The housing bubble must go on: 5,497,000 properties are still underwater. Number of equity rich properties grows as well.

The lap dogs of the housing industry are getting louder and louder as each day goes by. There is now a wide consensus that housing values only go up and the mania is losing all perspective. Crap shacks are still selling as beer belly cubicle slaves buy into the cult-like mentality and go against their common financial sense. “Well this area might gentrify soon and it might be the next Santa Monica!â€Â The notion that by you buying a crap shack you are living the dream is somewhat hilarious. No, you are not living in Bel Air just because you “own†real estate. There is so much “all hat and no cattle†in Southern California that it is hard to believe. Yet this housing mania is nationwide. So it is hard to fathom that you have over 5,497,000+ that are underwater right now with a good number seriously underwater. And this is in a hyper-crazy market. You also have a large number of equity rich owners but they need to sell to uncork that wealth.

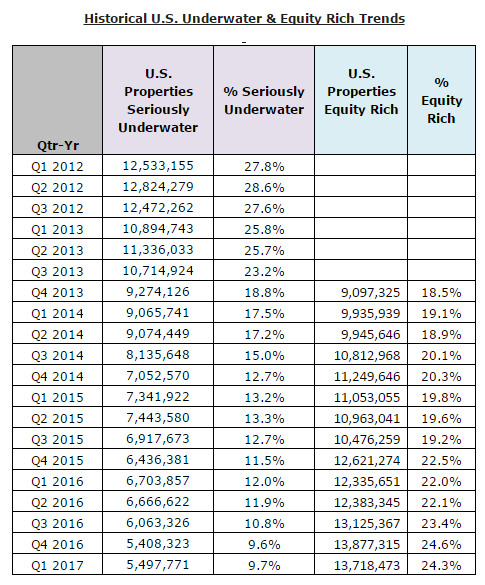

Seriously underwater property owners

The housing market has recovered nearly in tandem with the stock market. The stock market has been on a virtual nonstop bull run since early 2009. So people have forgotten about our recent financial history. While stock market investors and traders seem to be a bit more sophisticated, house humpers tend to live by the HGTV school of economics.

Back in 2012 you had 12.5 million underwater properties. That number has fallen to 5.49 million today. But that is the thing, you still have a large number of people that overpaid and yet somehow, Kool-Aid drinkers are trying to convince people to buy at the peak when there is clear evidence of those that over paid still out there today!

Take a look at this chart:

Source:Â Attom Data

This is really interesting. While the number of underwater homes has decreased dramatically as property values have increased, you wouldn’t know that we still have 5.49 million underwater homeowners today based on the rhetoric we are now seeing. There is now this near uniform chanting that “housing is great†yet this is coming from those that perceive luck as investing acumen.

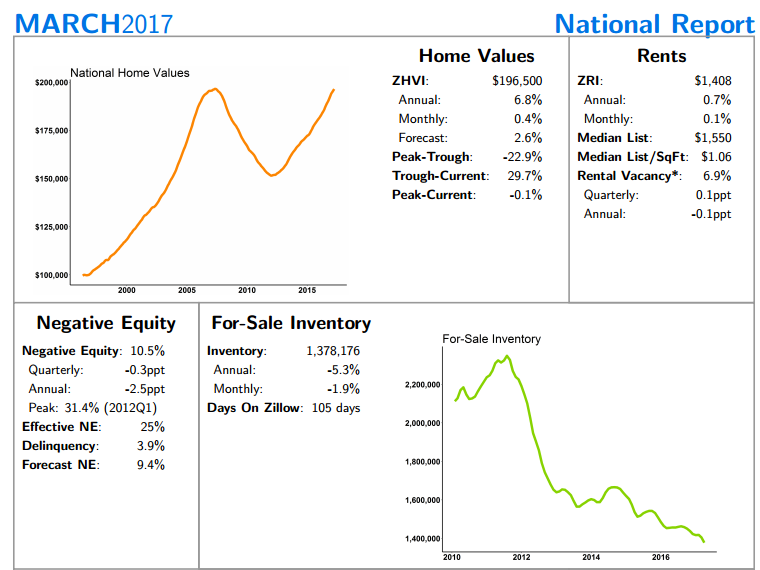

By far a big reason for this has to do with the lack of inventory:

Nationwide prices are at peak levels yet look at that massive drop in inventory. There is still very little inventory on the market. So if you want to buy a home, you may only be left with crap shacks as options. People get extremely house horny especially when they are in the family planning stage. But we’ve talked about how Millennials are bucking the trend in home buying compared to Baby Boomers.

So what to make of this? We have yet to see any stock market correction. Given the current uncertainty in D.C. you see what happens when people now assume tax cuts are off the table because you will need bilateral support to make that happen. This is being driven by hot money at the top (i.e., investors, Wall Street, etc). And ultimately, people need to be confident long-term before they dive into a 30-year mortgage commitment.

You would think that home builders would be building in mass but they are focused on building out multi-unit buildings to cater to a less affluent younger generation. Also, we are living in a major trend to renting in California and nationwide. What happens when the majority of your area rents when it comes to voting?

So the underwater inventory may add some additional information to why we have low inventory even in this market. A lot of people are still underwater. And those that have equity will need to pay inflated prices to go from crap shack #1 to crap shack #2 with hardwood floors.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

179 Responses to “The housing bubble must go on: 5,497,000 properties are still underwater. Number of equity rich properties grows as well.”

“You also have a large number of equity rich owners but they need to sell to uncork that wealth.”

If they sell, then what? Downsize? Move to a crappier area? Move out of state, (if they can manage it). No, best to stay put and tread water and be grateful they’re not homeless. This is the new normal, folks.

That’s always been my issue with magically becoming house rich. Unless you are selling a secondary home. If you sell your primary in an up market, most of that wealth will get dumped right back into an up market to downsize or make a lateral purchase.

Unless of course you leave the state.if you plan to stay put in an area like California moving makes almost zero sense. You could downsize into a higher tax burden here easily if you owned a large property for 30 years. Cali is almost setup to punish you for downsizing a long held property.

Under Prop 13, if you sell your house, then buy a house in the same county, of similar or lesser value, and you’re age 55 or older, you can transfer your low Prop 13 tax rates from the old house to the new.

In some cases, you can even transfer your low tax rates to a new house in another county.

I’m planning the leave state option. It used to be that you could cash out to the IE, but LA/OC insanity has already pushed the theoretically commutable ranges of the IE into the stratosphere. Upland for example is over $530k in median home value. Pomona and Ontario are rising too even with Compton-style crapshackery.

Now it’s basically stay put and chip away at the mortgage or ride that equity hot air balloon into a paid-off house in flyover country.

“If they sell, then what?”

They are NOT selling, they are taking out reverse mortgages in droves. A friend manages the It department at one such place and they have gone from 20 employees to over 400 in the last 5 years.

This is going to be a huge issue in the future IMHO…..

The banks defaulting on the homeowners would be a poetic twist.

We are seriously considering selling our house in nice part of San Dimas, CA and moving to Huntsville, Alabama, where we would both have jobs as engineers and our family would have a better quality of lifeach (much less traffic, nicer family place, not liberal, etc.). We’do be able to save so much faster and retire much sooner.

What do you think of the options? Our goal is to retire fast.

1) Sell California house and take equity there and buy house in Alabama and be debt free fast. Then save fast to retire.

2) Keep California house for a while, in case we want to come back. Or, if we wanna keep it until one day it is paid off and very inflated in price.

3) Sell California house and use the cash to buy an apartment building in a red state that is good for being a landlord….still live in Huntsville and save lots fast and retire.

Thanks…

From experience I would keep the CA house and rent it out.

You are most likely gong to be in Alabama for 1 year and then want to move back.

Better schools? LOL

In the event you love Alabama ( I give that less than a 10% chance moving from CA) you can sell your house in a year.

Buddy of mine did it 8 years ago. His parents even relocated with him and his family to be near the grandkids. They were all over what San Diego had become and got a pretty penny for their home. It is a hotbed of tech/engineering in AL, but if I were you I might rent out your cali home while you try on your new life and if it suits you after a year or two, sell it, otherwise go back. You may find you dont like AL but also that you dont particularly miss CA and want to just travel or something, so maybe its best to keep your options open.

Thanks for suggestions. My husband and I are considering them.our mortgage is a bit below $1500 a month so we can keep the house. Rent would be more than that. Our property taxes though are high.

Maybe we could afford private schools in AL…I don’t know…good point. Our baby is too young for school yet.

I’m contemplating moving back to the east coast. I bought in 2005. If I sell now I’ll see 2.5% CAGR for 11 years. Whoops I guess it’s been 12 years, but you get the idea.

Housing To Tank Hard Soon !!

After seeing this for years I realise it’s foolish wishful tikingking. In that time property values for the same home in my area, went from $700 to 1.1M. And today there is nothing to pick from. Keep calling a tank. You have to be right at some point. But the last 5 years you failed.

Be ready for a spectacular Fall

I remember some sand-in-the-head friends telling me back in ’07 that real estate in OC could only increase in value. They were literally bankrupt within 18 months. Cycles are a fact of life; maybe you get lucky, maybe you don’t. You can plat Russian Roulette to your heart’s desire, but don’t act like there are no downside consequences when (not if) the tide turns. Different rant — these prices are strictly and ONLY a function of unbelievable flawed Fed policy.

As you can see, from 1970 to 1990, we had two decades with the highest average Fed Funds rates. And wouldn’t you know it… at the same time, stocks had their lowest average P/E ratios.

These were times when investors could easily find yields outside the stock market. Much greater yields, in fact.

We need to consider this relationship when looking at our current situation and beyond.

When rates were lower in the ‘60s, ‘90s and 2000s, P/E was significantly higher. And today, we have a Fed Funds rate below 1%.

This means a current P/E ratio of 19.98 on the S&P is not only “normal,” but may even be a little low.

Going forward, as the Zero Economy marches on, money will continue to go where it is treated best. It’s a strong indicator that the bull market in U.S. stocks has plenty of room to run.

Um, have you ever actually met any Fed governors? They are, as Nassim Taleb so eloquently puts it, “Intellectuals Yet Idiots.” They will increase rates — they will have to at some point to control the very bubbles they have created — and that will be that. EVERYONE goes through the window shield when the Fed hits the brakes. How quickly we forget crisis periods — 1997, 2001, 2008. And yet, the Fed’s attempted rescues only resulted in excesses that resulted in more spectacular failures. Keep going around that mountain . . . .

Haven’t been on in years. I see Jim is still trolling. Good.

These are indeed uncharted, uncertain waters… Regardless of your party affiliation, the current Commander in Chief is indeed a true wildcard (maybe that was part of his appeal for many of his supporters). Either way, things are going to be shaken-up in DC and our economy in unpredictable ways for the next 4-8 years. Things may get better, or this unprecedented, 2nd-longest Bull Run in history may end very messily for a great many people. The operational word right now is “unforeseeable” for a great many factors. I, for one, would prefer slow, sustained growth and calm stability- not only in our markets, but in our political leadership as well.

I couldn’t agree more. Well said!!!

The Stock Market and RE tend to rise or fall together. Trump is not only unpredictable, but is also a loose cannon. If a domestic conflict doesn’t shake things up, an international will.

I know that it’s not about “timing the market” but rather “time in the market,” I prefer to sit it out (both Stock Market and RE purchase” until at least the 2018 election (unless something catastrophic occurs). I am an older millennial and have a household income of above 200k. Go figure, huh?

How are you guys playing this whole thing?

The market went down a ton between 2000 and 2003 and housing did well because interest rates went down. I think until interest rates move up above 5% or higher, you have a continuation of this nonsense. That doesn’t mean huge price gains but it does mean no declines. And that would be an equilibrium rate at best.

“I am an older millennial and have a household income of above 200k.”

I have yet to read about anyone on the internets making less then that and have yet to meet anyone in real life who does.

It’s weird how that works like that

33 years old. Husband makes 200K a year. 350K in savings (not including retirement). Two young kids and desperate to own a home with a nice backyard. We won’t buy until a recession hits. It is so hard to wait, but I know we will be happy we did. .

I’m 37 married, both State workers and we have saved 20% of our max house price. No way we buy until market drops. We’ll just keep renting paying less than market prices. Lately have wondered if waiting will matter, next correction will be bigger than 08. Fed doesn’t have many tools in the tool box left if any at all, might be a run on the banks. It could get really ugly.

@interesting

I bought in the IE with annual gross household income of ~$80k in Q1 2015. I too wonder where all these $200k plus types are. When I lived in LA/OC even with my wife working we never sniffed that.

I know a lot of those couples. Engineer + cardiac surgeon, lead engineer at Northrop Grumman + nurse, a very successful real estate agent who does it right (buys and holds RE), a software developer who also does it right (buys and holds RE), a police detective + accountant. They’re all over the place, even in the IE, but you’re more likely to know them if they’re relatives, a friend of a friend, or through your kids’ private school functions. Our meeting new well-off couples stopped the moment our kids left Montessori.

John D,

I’ve yet to meet a 33 year old cardiac surgeon. And I have customers that own engineering companies that don’t pay themselves $200K.

just sayin.

“I make $350k a year”

If i made that I would have no problem what so ever affording a nice home almost anywhere. At this point in the cycle I would still wait but who the fuck knows. The government manipulates RE so heavily it’s anything BUT CAPITALISM.

“I make $350k a yearâ€

I don’t believe anyone on this thread said that. Regardless, literally millions of individuals in this state alone make $100k+ (common for a software developer at a largish company and public workers doing virtually anything – an entry level project management IT position working for a city government in the IE will get you $70-80k, and there are two guys in their 20’s in my department who make that), and it isn’t a stretch to imagine some of those people will meet each other and marry. Both of the police officers I know, with their spouses, have combined incomes well into the 200’s and are in their 30’s. The engineer + cardiac surgeon make 400+ and are in their 40’s. There’s also a golf equipment salesman + dental hygienist in our group who are close to 200 if not over. Except for the Northrop engineer, these are all IE people. Like I said, they’re everywhere. The same work will pay wildly different amounts depending on the company, so if you’re in the private sector, job hopping every 2-3 years is key. Don’t believe that people don’t make $100k for the same work you do for $50k.

“I make $350k a yearâ€

“I don’t believe anyone on this thread said that”

read further John D., Bubble boy said it but the comments don’t nest for shit on this site. And i dental hygienist making bank?…..really dude?

“The median wage in 2016 for Dental Hygienists in California was $98,010 annually.”

Source: edd.ca.gov

I think we can all agree that stability is ideal, but the corruption in DC has been going on for too long on both sides. I hate to say it but its time for change, if its mean uncertainty then so be it; its the price we pay to drain the swamp of corruption.

I agree. The status quo equates to ongoing transfer and consolidation of wealth and power by the elite .0001%. unfortunately, I doubt that Trump’s vested interests will allow any substantial reforms to proceed and truly drain the swamp.

The establishment Republicans are proving they are completely worthless when it comes to governing. In fact I think they hate being in power, would rather be our bloviating about liberals and using their underdog status to get fundraising, than actually doing any work.

As far as I’m concerned, they want Trump to fail and to lose the House so they can get back to their swamp like ways.

I’m still not sure why both political parties seem to loathe Americans.

Certainly neither party has a monopoly on lying or corruption and both may stand for things you don’t like, but to say they are equivalent is simply incorrect. Look at the decisions by Supreme Court justices appointed by Republicans vs. Democrats. There is a stark difference and this is a better representative of the true philosophies of the two parties than any sound bite coming out of Congressmen or Presidents looking to the next election. You have every right to decide you like one more than the other, but just because they both stand for preserving some aspects of our status quo doesn’t make them anything close to equivalent.

32 year old millennial here. I make $350k a year and have $550k in savings. Can’t find anything in it price range for sale in LA or the IE. Waiting for the market to crash. Triplets on the way, in desperate need to find a house fast!

IMHO, (and Jim Taylor’s), it is time to take the money and run, The example from the Dr’s last post is the poor Santa Monica homeowner who was debating whether to sell for $2M based on the 20% capital gains tax they’d have to pay on the $1.6M gains. The buyer was a trust fundian. Trust funds are ALMOST always in the stock market. The stock market has also reached dizzying heights today. This poor trust fundian probably had a poor grandma who liked her Apple Mac and put 15K into Apple stock in 2003. Little did grandma know that the Apple stock is now worth $3M! How can this not be a bubble in the stock market also? I rode the 2001 tech bubble up and down where Lucent( The famous Bell Labs) rose from $3 to $120 before deflating back to $8. Apple has a far greater swing. Just take the money and run before Apple deflates back down to $10 (from the 2003 $1) and the buyer only has $150K left.

Yep, we have 2 insane bubbles running together at the same time. To be fair, the dot com bubble of the late 90s drove up RE in Cali, especially the bay area and housing bubble 1.0 drove up the stocks of companies involved in home building, furniture, etc. But now we have to beasts that on their own are ginormous and poised to destroy much of the economy when they go down.

I would take the $ but that poster you’re referring to was under the illusion that everyone thinks SM living is one notch below heaven. So where can she go? as Jed pointed out. But yeah, worrying about a $320k tax bill when you’re pocketing $1.6m seems to me to be greed personified. + isn’t the CG tax 15%?

No one in their right mind would set up a rust fund and put everything into stocks, let alone one specific stock. You know that.

As for selling the house, let’s look at some facts: Inventory in SM is low; prices, while slowing yoy, are still increasing; the house had no improvements; an unsolicited buyer is offering 2M cash, 20-day close.

In this case, the homeowner holds all the cards. She can hold on to the property and her tax base and keep collecting rent; she can make improvements, go to market, and ask 2.3 (depending on location and improvements, potentially more); or she can “take the money and run.” But where will she run with 1.7ish? Buy another property worth less that would yield less rent, up her tax obligations, and interrupt her cash flow? Put it in the stock market that you stated is due to correct soon? Or would she put it all in a savings account and lose to inflation?

Its a delicate balancing act but stating that she should take that money and run because one random person offered her 2M is shortsighted. There is still potential for growth or at least negotiating a higher price. Which leaves me with the advice to never accept the first offer from someone who wants/needs something you have.

I agree with you all above. And LATer On, most Trust funds I’ve seen are stock equities when the owner is younger. Most mutual funds hold a high stake of Apple. Nobody would put it all in one stock except for certain older generations that bought stocks they believed in.

The point of my comment is that for most of us, if someone offered us $2M today for one item we possessed, it would seem wise to take the money. Especially if you think the market for that item is in a bubble.

The excellent question is: What do you do with the $2M?

There are many commenters on this blog who are waiting with cash on the sidelines for a correction. What do they do? Hopefully not stocks. Some have said CD’s.

Any other options?

Funny. Everyone I know who owns a property has made money, and in some cases, millions. I don’t know anyone who lost money. It would take a low IQ to lose money in real estate.

Methinks thou dost protest too much.

You apparently don’t know the millions of people who were foreclosed after 2008, nor do you know any of the billion people who lost a huge chunk of their investments/savings as a direct result of the real estate crash of 2008. So you either don’t leave the house much, or you just turned 9.

“Everyone I know who owns a property has made money, and in some cases, millions. I don’t know anyone who lost money.”

Uh, you should broaden your circle a bit and make friends with people who bought in 2005/2006…

I do know people that purchased in 05/06, and they have modest to decent profits. They were down for a while, but no more.

JT, I doubt you ever made money from RE. Your comments remind me a lot of the twitter tweets from our clown president. Nothing but bs.

I know someone who lost money in Manhattan real estate. A co-op, specifically. It happens.

LOL…….your trolls are getting better……the “low IQ” was perfect!!!!

BTW that’s my X, she bought a house in 2006 (against my suggestion but RE never drops AND I WAS THE LOW IQ fool…. so….) for $415K and just sold it in 2016 for $385K.

so there you go.

Ha! Everyone I know who goes to Vegas comes back a winner also. I think many on this blog wouldn’t admit to losing. I have admitted to breaking even on a past sale after digging deep in the file cabinet for all of the capital improvements I put in (and enjoyed) over 10 years of ownership.

jt..As many know on this site I have done very well in RE except for one time where now I stand to lose approx. $175k on a second home. Yes I can afford such a hit, but the statement you can’t lose on property only counts if you are willing to wait it out for years in many cases even if paid off.

Up keep of a second property or even owning more investment homes can become burdensome and downright tough on your nerves.

My mistake which I never made in investing before, like when I played baseball, take your eye off the ball, only bad things happen.

I misread a wonderful location and felt it was a can’t miss investment, but foreign buyers stop coming and most Americans are in trouble, I over paid for the home because the area always had shown to be recession proof, I figure a min of 250k profit in 2 to 3 years, instead the property lost value every six months no buyers.

The ones interested couldn’t make the 20% down that was a huge mistake by me misreading the market.

Now all I get is investors, at the moment a $175k loss looks good, I probably will take it, afraid going forward in another 6 months I will lose at least another 50k Oh well. take care

You don’t know many people, do you?

U.S. households now have as much debt as they had in 2008 at $12.73T:

http://www.marketwatch.com/story/us-households-will-soon-have-as-much-debt-as-they-had-in-2008-2017-04-03

$1T in Credit Card debt. he number of subprime auto loans that have fallen into delinquency hit their highest level since 2010 during December 2016. That is similar consumer behavior to what was seen just before the 2007 – 2009 recession, experts said.

Meanwhile, the Dow fell 372 points because #fakepresident keeps putting his foot in his mouth. #maga = make America gag again.

The key word in this article is “nationwide” bubble. I would say it is a “global” RE bubble because of all central “committee” I mean “banks”, who decreased the unit of measurement we call “dollar” or euro or yen (at least in the industrialized nations). And that despite people here who think that because of their business investment acumen (investing in particular SoCal city) they’ve got an increase in house price. Those from Vancouver, London, Toronto, Seattle, Denver and Sidney (and on and on) think the same. Regardless of the weather, each one think that their place is special for one reason or another. Even prices in flyover country went berserk. In reality? Massive increase in money supply – smaller units, higher prices.

People are not richer but poorer because decrease in purchasing power. That is reflected in the wage purchasing power and quality of life.

In the previous post someone was trying to connect the impeding collapse in stocks and RE to Trump. Of course, PE of 35 to 55 (check BP) on blue chip stocks and bubble RE prices do not have anything to do with market conditions and insanity, it has only to do with the WH. It was Trump who printed 10 trillions in 8 years and created this insanity in the market. And for sure, who occupied the WH for the last 8 years does not have anything to do with the insanity in the market!?!….

I don’t even accounted for the bank derivatives exceeding 600 trillion (with a T) dollars. Of course, after this insanity, market will have a small correction (10% in SoCal and 5% in your choice city) after which it will resume the 20% increase year after year. I am just curious how the borrowers will service the debt on these insanely priced crap shacks year after year for the next 30 – no layoffs, no sickness and no divorces.

Simple. $10 bread slices, and $150 jam jars. Green Ink is cheap. But these calamities will only occur to renters because owners will magically be protected from the ravages of debt and inflation.

If this is true, then wouldn’t it benefit the homeowners with a fixed low rate/payment bc they could pay the constant with ever increasing currency units, basically inflating away the mortgage?

@Dan

The type of inflation I’m portraying would be so dire that being a homeowner would the least of your concerns. Labor and material costs to fix house damage would be so egregious that homeowner’s insurance would increase several fold. You also would have to make the choice between putting food on the table, being medically insured, paying your monthly utilities, or keeping up with property taxes.

Dan,

If our dollar bills become even more worthless than they already are, everything will be more dollar bills…daily food and gas and such. Mortgage payment might eventually be equal to 2 weeks of grocery bills, but the problem is that our wages don’t keep up with any of this. We all are getting poorer and poorer, except for the people who profit from all this.

Reminds me of that episode of DuckTales when people carry a big cart full of money to buy gum or something.

Oh boy, not looking so good for the economy….they will blame the crash on Trumpi. Poor Donald, poor housing cheerleaders, poor realtards. Cant wait for the collapse!

https://moneyish.com/hoard/rents-in-san-francisco-and-these-4-other-cities-are-getting-slashed-like-crazy/

OMG Run for the hills – rents are down 2.9%.

SF is still over 4K – and rentals are crap shacks too. Good luck finding anything nice unless you have a lot more to spend.

Rates falling back again, gonna add more fuel to this dumpster fire. Still think a blow off in prices to come. Money is so cheap.

It’s very possible to have recessions during periods of low interest rates — as in the past. Eventually, the credit cycle will run its course as borrowing risks inevitably outweight the potential profits for lending institution.

I agree. I think the FED is trying to play every possible scenario with interest rates just to create an event or marker in the economy. We are slowly becoming Japan by then. Low interest rates and no real recovery for a long time.

I suspect some day the good Doctor will tell us how many homebuyers are buying crapshacks with 50-year mortgages….an inevitable consequence after ‘ housing tanks hard ‘ !!

http://blog.credit.com/2017/03/is-a-50-year-mortgage-a-good-move-168596/

50 year mortgages are back? We had that option with our first house back in 1988. 30 year fixed loans were 12% so it was being used to lower monthly payments. The rates on a 50 year loan at the time were higher so we didn’t take it.

That’s BS, o I’ve seen a couple portfolio lenders with 40yr terms but no one offering 50. I suppose it’s possible but not likely.

Time to sell and buy a tiny house. Oh wait, those are going for $150k now …..

Most of the mortgage risk has been transferred from the banks to the taxpayers. They can allow housing to fall now and the banks will mostly be fine, as far a survival. The taxpayers on the other hand???

Look for a massive transfer of wealth to the top 1% and get used to a socialistic society. Sad 🙁

Strong movements to begin this fall.

Um, what on earth do you fancy the word “socialism” to mean?

We can thank our government for making it very difficult to get the approvals to build new homes. When the beaurocrats see the constrained housing supply and the law of supply and demand run housing expenses up they think a new rent control regime of laws and a beaurocracy will solve the problem. Instead it gets worse.

The jobs are under pressure from foreign plants, call centers and corporations. The salaries and pay are under pressure from foreigners here, legal or otherwise, willing to do our jobs for less. At the same time technology is simplifying jobs so a less educated (and cheaper) person can do it or outright doing the whole job putting people out of work.

It’s a brave new world and we need to rethink how we can be productively working on our nest egg, getting out of the rental cycle and helping with growing our communities.

As long as the population of California is growing fast it will be hard to keep up.

I suspect the communities within 30 minutes of the ocean have a gentrification potential. Add bonus points for access to rail lines. It sounds shocking, I know, but some down and out infested communities might come out of the gate and surprise us. I’m looking at Compton, Gardena, North Long Beach, San Pedro. Remember 30 years ago Venice was an infested slum.

The problem with this RE mania is not due to lack of supply but rather due to far too risky asset speculation (due to unprecedented rate suppression). Asset inflationary practices by the Fed and government pushed land prices higher. To make a profit after overpaying for the land, builders were forced to cater almost exclusively to the luxury market. Instantly, the vast majority of potential buyers is instantly priced or forced to take on excessive debt.

That’s an amazing statement. You don’t happen to have any facts to back it up do you?

There was asset speculation from 2002 until 2007 and there were plenty of guilty. Bernanke did provide cheap money hoping to lift the economy but the chief culprit was the Community Redevelopment Act by Congressman Barney Frank and Senator Chris Dodd which mandated home offerings to subprime applicants. This supercharged the demand side without a supply side increase. What do you think would happen? The banks started creating products to find money and move them out. The products were full of these subprime loans and almost guaranteed to fail. The subprime purchasers were subprime for a reason. They didn’t have the income or money management skills. All this demand pushed prices into heights that would have kept going but the MBS products started failing and that was the beginning of the end.

I live in the Bay Area at the moment and there is virtually no supply. Houses go on the market and are rarely there for 2 weeks. We were renting for 5 years when our landlord said they wanted us out because their kid couldn’t find a house. We scrambled to find something. All the rentals were much higher. Our $1800 now looked like $2500 and the landlords were very picky – no pets, no smoking, approved kids, FICO over 750. We saw nothing we liked and were able to buy a place finally rather than rent but it isn’t a perfect place either. There are very very few new places being built and there are a lot of new families in the area. The grape harvest requires thousands of pickers until they get mechanized and they have to live somewhere.

To recap, there are millions more people in the state and very little getting built. We have a supply problem. Maybe you should ask the government to force those greedy builders to build more houses?

@FensterLips

There’s something pretty useful that I’d recommend: Google. Let me give you a small demonstration of its capabilities:

http://www.bizjournals.com/sanfrancisco/news/2017/03/27/san-francisco-house-prices-sales-falling.html

http://blog.sfgate.com/ontheblock/2016/04/19/more-sf-homes-sit-unsold-as-inventory-grows/

I have no idea why you continue to blame subprime when it’s been established that the vast majority of defaults from the last downturn were prime borrowers. In fact, subprime was almost exclusively an American phenomenon amidst a worldwide RE bubble.

Supply problems is a myth perpetuated by the sale side to rationalize relatively weak sales and high prices. If the market was so hot, why do lenders continually attempt to lower lending standards?

Look up Logan Mohtashami’s statements about the inventory actually being higher during the current cycle than during the last one.

@Prince of Heck: You stated, “it’s been established that the vast majority of defaults from the last downturn were prime borrowers.”

It has? According to Wikipedia, the vast majority of defaults in the mortgage crisis were subprime loans. Only around 5% or so were prime non-adjustable rate loans. I’m all for a real estate crash, and I hope one happens sooner than later. But unless I’m misunderstanding something here, your assertion that “the vast majority of defaults from the last downturn were prime borrowers” is completely false.

@Responder

Wikipedia needs to be updated, and so does people’s misconceptions. The bubble has and always will be in high prices:

“while foreclosure activity started first in the subprime market, the foreclosure activity in the prime market quickly outnumbered the number of subprime foreclosures…the data shown above suggest that the foreclosure crisis would have happened even in the absence of such risky lending.”

http://fortune.com/2015/06/17/subprime-mortgage-recession/

You may be correct. I’ve read a lot of people that formerly occupied coastal Cali have been pushed east – Stockton in the north, inland empire in the south. Compton would be a prime area to transform. Look at the prices for Eagle Rock – unthinkable 20 years ago. That said, this bubble will take everything down and we just dont know how the aftermath will play out. A lot will be a function of this countrys political landscape.

Only nuts would move to Stockton from East Bay…..The commute will kill you…..or the gangs will…

I’m not talking about the working middle class, I’m talking about the people that go to Walmart in their pajamas. They’ll feel right at home in Stockton, and theyve been getting pushed out of the bay area and all of coastal CA for a while. Commute? They have no concept of that word, aside from it applying to a relative in prison. I know, I grew up there many years ago and had family still there up until about 2 years ago. The ghetto is creeping in on all sides there.

With Californians just being hit with a $5 billion plus gas and car tax and with any new tax reform in Washington likely to reduce the deduction of state income and property taxes the ability of many to afford a mortgage is reduced. The money has to come from somewhere and home buyers like camels can only carry so much.

Looking ahead long term, funding California’s public employee pensions implies a steady stream of state and local tax increases and government service cutbacks that will impact property values. Then as the number of renters increase relative to homeowners so will their political power. With the only large pool of immovable capital in the state being real property it is reasonable to assume measures such as property transfer or wealth taxes will be implemented to capture some of this real property wealth to fund government.

“What happens when the majority of your area rents when it comes to voting?”

Possibly they will vote in favor of projects or candidates that promote more inventory. More inventory = potentially more places to rent etc. = less rent hikes

Or vote to strengthen laws against short term rentals which reduce the opportunities for long term rentals

And yes renters do vote.

I for one think that renters should pay more state taxes. I do not think it is fair that property owners are responsible for the majority of state taxes while renters use the same schools and municipal services as property owners. If renters were responsible for their fair share of state taxes I assume they would vote differently and not always vote to increase taxes on property owners and introduce new school bonds which they don’t directly have to pay for. Who knows, maybe rents would go down? As it stands now one reason rents go up is because taxes go up. So if you are renter remember the next time you vote for a new tax you are more then likely going to pay for it one way or another.

You’re delusional if you think renters don’t pay property taxes. They just don’t pay it directly to the county tax man, their landlord does.

@ JJ: you pay nothing near what the owner of an equivalent condo or house would pay for all those bond obligations. If you think that you are the delusional one.

Uh, go fuck yourself yourself, getting rich off of someone else’s labor.

1. Renters absolutely pay property taxes through their rent, it’s completely ridiculous to say otherwise.

2. Unfortunately the renters don’t benefit from the tax deduction of those property taxes the way owners do

3. Long term landlords pay LOWER property taxes via prop 13 and can pocket the difference in marker rents

renters need to get more tax breaks. Landlords should be taxed higher. And we need rent control and an end to Prop 13. Problem fixed. If you vote for R’s you get clowns like Trump and unfair policies.

Fascinating how so many people either didn’t read my post past the 1st sentence or just simply didn’t understand and found it appropriate to use foul language.

” So if you are renter remember the next time you vote for a new tax you are more then likely going to pay for it one way or another.”

Renters DO pay property taxes – they just don’t write the check directly the municipality. The taxes are paid for by their rent payments.

“renters need to get more tax breaks. Landlords should be taxed higher. And we need rent control and an end to Prop 13. Problem fixed. If you vote for R’s you get clowns like Trump and unfair policies.”

Found the renter. You’ll only feel this way until you’re a homeowner – then Prop 13 will be your best friend. I would, however, be fine with seeing it changed to eliminate benefits for investment properties, IF California would reduce some of the other taxes they’re hitting us with.

Most economists agree that rent control doesn’t work. It drives up housing costs and causes the controlled neighborhoods to deteriorate.

As for Prop 13 – it was approved by the people, 62% to 34%, so blame them, not “R’s”. Many democrats happily voted for it (mostly homeowners). Like Gov Moonbeam’s ridiculous high speed rail, they didn’t carefully consider the consequences, or pay much attention to detail.

However, it being the law, take advantage of it. When prices are more reasonable, anyway.

I’ve been renting this past cycle – super cheap too, less than 10% of my income. Anyway, after almost 8 years my rent went up a whole $50/mo this year. Why? Property taxes went up. So yes, renters pay it too. My rent is so cheap that I didnt find any compelling properties worth buying near my work so I sat it out and stockpiled cash. Next downturn I’ll probably buy and retire, before age 50.

@young fellow:

You need an education regarding Prop 13. As was mentioned, it was passed overwhelmingly by THE PEOPLE, not by Ds or Rs. It seemed like a great idea at the time, people vote with their wallets…they rarely think about all intended or unintended consequences decades later. As I have said many times, Prop 13 limits natural turnover in many markets (especially desirable coast CA) and this drives up prices. And what majority owns (and benefits from Prop 13) in these desirable coastal CA area? Ds by a long shot!

Instead of trying to fight the system (complaining about unfair tax benefits from owning, Prop 13, etc). Why don’t you go out and buy and take advantage of these things. Homeowners will generally always get favored in this society, don’t fight it.

i never said R’s are the reason for prop 13. I said Prop 13 needs to go (because renters dont benefit from it and prop13 benefits the rich that dont need more). I also said, if you vote for R’s you get a clown like Trump an unfair policies. R’s are known for giving the rich a tax cut, horrible health care policies, education/Betsy D….you can go on and on. The only good thing is we can blame the next crash on R’s and Trump.

“The only good thing is we can blame the next crash on R’s and Trump.”…….even if Trump does not have anything to do with the 20 TRILLION in debt he has to service, the over trillion dollar deficit year after year and the subsequent crash which is going to come. However, I agree that the whole MSM and liberals will blame it on Trump – the scapegoat for the FED policies and spending happy politicians.

If he wants to cut from the higher and higher “SPEED” of INCREASE in spending, the whole MSM says that he is cutting spending even if he is INCREASING spending at a lower speed. That is the distorted view the MSM is selling even if the current course is TOTALLY unsustainable from the mathematical point of view.

The corporations don’t need cuts in taxes because they can move overseas; the workers need those so they can still find employment besides McDonald jobs. The globalists want to move all companies overseas. Trump, the populists, wants to slow down that process and everyone screams against him for being protectionist and against free trade. When I say everyone, that means R and Ds. Therefore it is doom on him either way, regardless of what he is doing. I would hate being in his place.

Possibly they will vote in favor of projects or candidates that promote more inventory. More inventory = potentially more places to rent etc. = less rent hikes

History has shown that renters don’t think in terms of supply & demand. They don’t want more inventory that will “potentially” lower rents. They want lower rents, period. In their minds, that means rent control.

Couldn’t agree more. People just want what they want, they don’t think about the ramifications.

Unless you have owned a property you don’t understand the costs and work involved: taxes, mortgages, contracts, maintenance, recordkeeping, insurance, advertising, inspections, evictions, etc. Most renters think that landlords take all the rent money home spread it out and roll around in it while having a good laugh. They have no idea what is actually involved.

Homeowners can easy pay more taxes. We need to repeal prop13. Homeowners need to pay their fair share. If property taxes rise tremendously we can easily build more affordable housing, balance the budget and forgive student loans. Its about time that millennials take over and get policies in place that benefit them and not these wealthy boomers who want it all.

We personally LOVE our landlord. Our rent is $2K for a 5 bedroom 2 story house in Simi Valley, which is about 50 min. from Los Angeles. Our landlord is kind and we have been renting from her for 8 years now (2 diff houses). She has only raised our rent $50 in the last 4 years. I know that we are VERY fortunate because here in our valley, normal 3+2 are going for $2,500 and up depending where it is. So, my point is, there are some renters out there who TRULY appreciate landlords who are not gouging just because they can. Believe me, there are some peeps trying to get $3K for a shack. By the way, a “fixer” here, you cannot touch under $450K. We are waiting for the housing to “Crash” or we are happy to be content where we are. We don’t ask too much of our landlord and she has been gracious to us. =D For the record, I do not like rent control…. free market all the way baby!!!!

How property taxes are calculated differs from one locale to the next, but I was absolutely paying more property taxes as a renter than I did as a condo owner here in Chicago. I looked up the taxes for the nice rental I occupied and was appalled at the taxes. My unit’s share was twice what i paid as a condo owner of a larger and better unit. Large apartment buildings (over 4 units) are taxed at the commercial rate in Chicago, which is 3X the rate assessed for SF homes and condos. This cost is of course passed on to the tenants, else the landlord could not afford to own rental property.

You should really consider getting off the Democrat’s high taxation Chicagoland plantation and move to a state like Florida that has no state income tax and property tax rates rank at or below national averages.

No way- my condo taxes AND insurance are very cheap in Chicago. Florida has too many “hidden” costs, such as sky high home insurance rates (even with massive federal subsidies for flood insurance), just for starters, in addition to steep condo prices for desirable areas and unbearable heat April though November. I highly value living in a city with 24/7 public transportation that is stuffed with some of the world’s greatest architecture, and first-class cultural and entertainment venues. As for Chicago’s highly- publicized problem with gang shootings, 97% take place in areas I’m unlikely to be in and couldn’t even easily reach without going 15-20 miles out of my way.

I hate it when the good doctor hits too close to home, especially the beer belly cubicle slave who bought at the top of the market portion of the blog

Google the bubble of 2013. That’s right. Despite thousands of headlines and fear mongering it didn’t happen. I sold my house in fear. I made money, but shame on me. It is worth 3 times what I sold it for today. Right now there is huge demand and little supply. All this despite rising rates and no reasonable financing for most. No way is it a bubble.

Free up lending for 2-3 (no doc/no down) years then stand back and watch the pent up frustration of millions who’ve been denied the opportunity to be a part of the RE boom finally have that opportunity. $2M for an E Bay fixer? As long as they can get financing bring it on. Then there will be a bubble to rival 06 and subsequent explosion.

Graph stock increases from their lowest point last crash to today. Do the same for RE. If there is any correlation between the 2 markets then RE will need to triple current prices to equal the stock bubble. Don’t measure housing based on 06/07 peak. That’s like measuring stocks now against their pre crash highs. Stocks tripled. Housing hasn’t tripled, doubled or even reached their pre crash highs.

You sold in 2013? why? that’s when it just started to pick up….you need to educate yourself on economic cycles. RE moves in 7-10 year cycles….right now we have a peak and the next bottom will probably much lower than in 2009-2012. The last crash in 08 was a minor correction. They quickly pumped money into the system and bailed out the banksters. Next crash will be the big one.

You didn’t ask when I bought. What if I bought in 03 for 200k, saw comps for 300k in 06 and comps for 100k in 08 and sold in 2013 for 225K? Imagine the roller coaster and mindset when (in Calif) people were screaming we’re in a new bubble get out in 2013?

“Don’t measure housing based on 06/07 peak”

I measure housing based on incomes and based on incomes this is pure fucking insanity………AND based on incomes Americans make less then they did in 06/07…….2013 was a great year for me….great meaning I made as much as i did in 1997.

exactly, DTI and PTI are horrible….

Low rates will never end as the fringe economy is dead, the US govt. will be broke with 5% Fed funds rate. Watch for the unwinding of the fed balance sheet to get the rock rolling….

Mortgage interest has to be removed from federal taxes for long term sustainability of the system….it will happen and throw in a war to boot..

The fed has failed at creating inflation, so have all the worlds Central bankers….the experiment will not end well….it just takes time…

“No reasonable financing for most”? That’s a joke right?

I write loans all day, and while income verification is a requirement, conventional and fha financing is very “reasonable”. Trust me.

Might you work for Quicken Loans? Those who still claim that lending standards are strict must not be paying attention to the Rocket mortgage commercials.

Feel free to buy as many properties as you can possibly get a loan for if you are haunted by seller’s remorse (or more likely greed).

“Nobody ever lost money taking a profit.” — Bernard Baruch

Quicken is a joke and so is their “rocket mortgage” platform. I close many quicken fall out deals b/c their loan officers are refi order takers in a boiler room type setting; not, the equivalent of a real broker.

In any case; I am both broker and correspondent (“direct lender”) and my point is that for someone that has income and not terrible credit, financing is available. Little money down as well.

Here is a guide:

3.5% down FHA up to $636k loan amount

3% down conventional up to $424k loan amount

5% down conventional up to $636k loan amount

*Some CA counties are different in loan amount max but you get the idea.

“3.5% down FHA up to $636k loan amount

3% down conventional up to $424k loan amount

5% down conventional up to $636k loan amount”

If you cant come up with 20-25% downpayment you should not buy. Wasting money on PMI and interest is extremely dumb. If you dont have 20% you should rent. In fact, it should be prohibited by law to buy with less than 20%.

Jenny,

“If you cant come up with 20-25% downpayment you should not buy. Wasting money on PMI and interest is extremely dumb.”

It depends on when you buy. In 2009, I knew I was getting in at a good time, even if prices hadn’t dropped anywhere near previous lows. I did put 20% down, but if I hadn’t had that much, I would have begged and borrowed to come up with 3.5% and it would have paid off in spades – as it did with 20% down. $30k in PMI and extra interest over 7 years for a $120k profit and very little being risked? I’ll take it. Even if there had been no bubble, I’d still have a lower payment than equivalent rentals.

Sorry to hear that you sold in 2013, maybe you were listening to Jim “The Tankman” Taylor. Selling in 2013 was a major mistake simply based on rental parity calculations. The price of owning most homes was very close to the equivalent rental cost. In my opinion, that is the best measure of when to buy or sell.

Live and learn. Hopefully you are saving money and can get back into the market soon after it tanks by 50 to 70% as some here have said.

San Francisco appears to be at a peak according to paragon’s latest report. 2 Million for an East Bay Area home; it depends on where. I still believe the X factor hear are the Chinese. At these prices, they are the only ones with the dough keeping this ship afloat. PRC have capital controls as of January. Job market is cooling down. Hasn’t slowed the RE market one bit. My money is on bitcoin and other crypto-currencies; when those start to crash then we are very close.

Many are selling now,then renting for a while, until the market gets backs to a more normal time, but many are too weak to make those changes..as aww their gal will not like it.

One of the realtors I work with, sold his house in January thinking we were topping out, took his proceeds and stashed in the bank and is now renting.

Saw him the other day, and he was amazed that it wasn’t the top with it still trending up up up…..

Unusual for a realtor. Looks like he is one of the smart ones. Selling during the peak year and renting is the smartest thing one can do. It does not really matter if it crashes in January, February or December. As long as you cash in before it crashes down, you are winning.

Some would argue the opposite. While I did sell in November, some of the most successful people I know are those who never do. They just keep collecting properties over decades, with most of those properties bought during a low, but some bought at peak as well. They tell me the key is to not sell, ever. The idea being that rentals will bring in far more money in 20-30 years than selling after a short rocket ride from trough to peak. The math does check out.

@John D

“They tell me the key is to not sell, ever. The idea being that rentals will bring in far more money in 20-30 years than selling after a short rocket ride from trough to peak. The math does check out.”

Speaking of math….buying now means negative cash flow when renting the property out. I would love to see a mathematical example in which you can buy during this time and rent it out for a profit without putting down at least 20%. (in case of cash heavy buyers you need to consider the opportunity costs).

The strategy of riding out a monthly loss and hoping for the tables to turn in your favor seems highly risky/unlikely. Recessions, economic cycles, housing bubble crashes to name a few risks on the horizon. But, don’t let me discourage you….obviously you should follow what seems the best way to your success. Why not buy again and give it a try?

Where did I say anything about buying at the peak being the path to success? I said most were bought during a low. In cases where these people did buy at a peak, the purchases were intended to be the primary residence, but when it did become time to upsize or downsize, they held on to them instead of selling. “Buy and hold” is a very long-term strategy – a lifetime. If you actually did the math, you would see that (depending on the area) you likely would in fact profit in 20-30 years when buying at a peak, although there are smarter ways to invest.

I actually did buy again, in January. 4,100sf for $634k, with comps currently in the $680’s. It’s our primary and the perfect place for us for the next 20 years, so price (and market fluctuation) doesn’t matter. Future investment properties will be bought only after a significant drop. When this one is paid off in 20 years, it will be a $4,000/month (today’s dollars) ATM for our retirement.

Many going to other states where the buck and taxes are a lot better.

No wonder there are financial locusts from big cities to mid-sized cities with a plenty of IT jobs, driving rents and house prices up, pushing old residents out of the cities.

All asset classes are currently in bubble of distorted prices. Prices are distorted because risk is distorted. The Chinese buy anything because anything on Main St USA is safer than Main St, China. California buyers see commercials everyday promising mortgage relief to underwater buyers…Keep Your Home California it is called. The world is awash in a massive sea of liquidity pumped out by central banks in US, EU, and China. That money by nature must flow proportionally to every risk asset class and then spill over eventually to assets of every kind. The Bernanke put has expanded to the entire world. Until the music stops…party on.

The question is, which are we in the dawn or the twilight of the party? Considering that the Fed is on the path to tightening despite the mediocre state of the economy (8+ years of emergency measures), the latter is more likely.

exactly, risk pricing is a joke….the sheeple always get sheared…..

they will keep pumping as this is the final push higher…..

The chart that the Doctor posted is interesting on the underwater side, but seriously lacking information on the “Equity Rich” side. How do you define that? I could still be ‘equity rich’ if all my properties dropped by 90% in assessed value. I might even get a break in my taxes. After all, someone who owes a million on a house that has spiraled up to 2 million would be in the deep fat fryer if the property dropped by 60 percent. It is not just debt to equity that is important, but rather debt to income that determined whether someone lost their shirt in the crash. Big drops in income flooded the market with short sales. Some folks with income but unprofitable positions in real estate added to the pile with strategic defaults.

Areas with high percentages of paid off properties (and in a way, reverse mortgages during the early years of the cycle act like paid off properties!) should see no major bubble pop, since the owners are not under duress to sell. Rich areas with high numbers of cash purchases should be just fine in the next bubble pop (if indeed we have a bubble pop). Property bubbles do not act like collectable bubbles (beanie babies, tulips, etc) because there is underlying value in holding it. You do not see repeat bubbles in a collectible once the bubble pops (my favorite is Thomas Kincade… his stuff will continue to depreciate through the next ice age!).

The bubble is not so much in the property as it is in the finance instruments that allow crazed individuals to indulge in overconsumption. From hedged financing to speculative financing to Ponzi financing; the classic Minsky financial cycle plays out inexorably. So areas where Ponzi financing (requiring capital appreciation to break even or profit) is not a big factor will not crash hard, just as we saw in the first housing bubble. Billionaire and Millionaire neighborhoods are safe (or at least safer) this time again. Although in the great Depression, some wealthy neighborhoods did drop hard because the source of the wealth crashed all around. Those who owned without debt didn’t lose anything except on paper, but those who were inveterate real estate speculators got taken to the cleaners.

The only people who honestly post housing is going to drop are trolling.

Supply Low & Demand High = Increasing Prices

This time isn’t different. It’s the same. Prices rise over time, they are going up again. Deal with it. The only think that will drop prices is a HUGE crisis. Trump isn’t a crisis – he has everyone thinking things are getting better which increases demand.

I feel high housing prices hurt the economy and having a place to live should be reasonable. Being a slave to your home sucks. But looking at the number above – less people are under water and people have more equity. Whatever the numbers may be, they are getting better. Thus, EXPECT much higher prices.

Bookmark this post – come back in a year and see who is right. This time next year – housing prices will be up 10-15% or MORE. No way they will lose value.

“The only think that will drop prices is a HUGE crisis. Trump isn’t a crisis – he has everyone thinking things are getting better which increases demand.”

The realization of Empty promises can work the other way. What’s really boosting prices are the policies

Of the past 8+ years. But look out, lending is drying up as defaults pile up. But the media won’t report it until after the fact.

“I feel high housing prices hurt the economy and having a place to live should be reasonable. Being a slave to your home sucks. But looking at the number above – less people are under water and people have more equity.”

There’s the crisis you claim doesn’t exist: inflation without the accompanying economic growth. Thus, paying back the huge amount of debt accumulated during the current cycle is becoming precarious (household debt is higher than nearly 10 years ago). Whag does having equity do for a household, allow them to take on more debt?

Looks to me like a “huge crisis” might be setting up right now, while Trump bumbles his way through his first foreign tour, and making this country even more of an international laughing stock than it already was.

It is impossible to gauge the effect that the increasing unpopularity of our president, the latest revelations concerning improprieties he and his associates may have committed, and the possibility that he may be hounded out of office, will have on the asset markets and the economy, because the central banks are firmly in the saddle. But there is no doubt that the uncertainty is giving investors the jitters, and interest rate repression and asset inflation may have gone as far as they can.

@Laura

IMO. Unless Trump starts a war, the crisis of the presidency will be minor compared to the economic crisis that globalist (central banks and Western governments) policies have been setting up for the past 8+ years. Absolutely they’ve used up their ammo to little or no effect for the greater good. With the global economy drowning in bad debt, they’ve firmly placed their respective economies behind the eight-ball when the next recession hits.

“Trump isn’t a crisis – he has everyone thinking things are getting better which increases demand.”

I’ll have what you’re smoking.

After the next crash prices will be 50-70% below today’s market prices. You can bookmark that as well.

I have been seeing now that some owner’s mortgages are being handed over to Fannie Mae and maybe Freddie Mac. I ask myself why are they doing this or is the banks that originally had the loan on the books giving it away? Do they know something we don’t and they don’t want the burden if there is another crash? Yet I see the announcement about giving mortgage power back to small regional banks again. Other articles mention big banks maybe getting out of the house lending all together to avoid the last bubble. Seems like maybe that is the plan to prevent big banks from tanking again they will let the government have the burden or hmmm…the tax payer, but we won’t be bailing out TBTF banks when the next crisis hits in my opinion.

Not sure what you mean by “handing over”; but, most loans written today (conventional, FHA and VA) are sold on secondary market by lenders to larger investors and a lot of time end up on the books of Fannie/Freddie.

These lenders and investors often times will retain servicing rights even though they no longer own the loan. That is why a borrower may still be writing a check to ABC mortgage every month, when, in fact the loan is owned by Fannie/Freddie.

Great business model…..you loan money, charge fees and sell that loan (risk) to Freddie and Fannie. In case of job-loss recession/defaults the tax payer is bailing out Freddie and Fannie. Not much risk in that business….in theory, the interest rate should reflect the risk you take but not in our world. Rigged system/bullshit market. The only hope is a complete economic meltdown and a revolution. Burn down the banks and this corrupt system.

The only reason Fannie Mae & Freddie Mac even exist, is to create a secondary market for mortgages. These are GSEs (government-sponsored enterprises) founded in the 1930s to buy mortgages from lenders. Without them, it is not likely that the 30 year mortgage would even exist. Most mortgages are sold to Fannie (SF homes & condos) and Freddie (Multifamily), and the mortgages are bundled into CMOs(collateralized mortgage obligations) to investors- mostly institutional investors, as these instruments are rather too complex for most individual investors.

GNMA, or Ginnie Mae is the Government National Mortgage Association, which provides liquidity for FHA and VA home loans, and RHA (Rural Housing Administration) loans.

One wonders just how easy it would be to obtain home financing, especially 30-year mortgages, without government sponsored enterprises and other government programs, and we also have to wonder just how much government involvement in the housing market has driven house price inflation and worked to make housing less affordable, not more.

Simply put, without government (and Fed) backing, RE would not be the hot commodity that speculators and investors flock to. Force lending institutions to keep loans on their books coupled with normalized rates would anchor prices to local incomes.

This was a nice explanation and to answer your question; if the aforementioned entities did not exist then bank jumbo guidelines would apply, those being:

10% down minimum

720+ fico

43% debt to income ratio

Yes, indeed the market would tank in a heart beat if those were applied across the board.

Don’t forget Fannie and Freddie are still in receivership and supposed to be wound down, or how about mark to market FASB rule 157-8 hasn’t been reinstated….

any homeowner whom thinks this market is real is delusional……

I own a home but could care less what its worth…..even in San Francisco

More than 80% of the residential mortgages are sold to Fennie and feddie . These loads are initially issued by private banks but then sold..

The public aka the tax payers assumes the risk..

https://www.redfin.com/CA/Newport-Beach/442-Redlands-Ave-92663/home/3241848

Here is a money maker. Along the way, someone poured about 500K in a remodel and expansion. But, it sold for less than 200K a little more than 25 years ago. Now, closed at 2.7M. Just an empty lot is worth about 1.75M

I would wait until after the crash. You probably will get it 50-70% off from current prices. During a bubble everything you can find on the MLS is a rip off.

“You would think that home builders would be building in mass but they are focused on building out multi-unit buildings to cater to a less affluent younger generation.”

Wait, what? Builders are building multi-unit apartments affordable to the less affluent younger generation? Where? Would love to find a three bedroom in los angeles under 2800 a month that isn’t somewhere we’d be dodging bullets, where the schools aren’t rated 2, and we don’t have to drive 1.5 hours to and from work. Where are these buildings? All the new ones have rents for two bedrooms anywhere from 2800-7000. Three bedrooms? Nothing less than 3800.

Nothing built new in LA will be “affordable”. The costs of land are just too high, not to mention all the red tape and permits. There is no money in building “affordable” housing in LA.

A couple of observations … I am convinced that many homeowners and RE junkies are oblivious to one of the biggest risks to their precious assets, their state house, city hall, and local utilities! Everyone is talking about economy, stock, and real estate crashes, no one seems to remember last years drought, rolling power outages in L.A., or water mains badly in need of repair, or the growing unfunded pension liabilities! The drought for the southern 1/2 of the state was a warning shot that will go unheeded, just like many other things. California has some serious issues and without significant tax increases or utility bill increases will grow worse and worse until they have direct impact on the quality of life and the value of those precious real estate prices!

The economy is doing great. People are buying houses and cars left and right. Must be due to the enormous yearly wage increases.

http://www.cnbc.com/2017/05/17/household-debt-levels-higher-than-2008-debt-levels.html

Oh wait. Household debt levels are higher than in 08? Nevermind.

Yeah in a monetorist /neoliberal run economy one can’t simply give workers enough wages to buy stuff. No instead offer them debt that they’ll repay ‘somehow’

Or the enormous yearly wage increases from the cash-rich Chinese speculators and investors. Oh wait, they too are up to their eyeballs in debt.

From the article:

Mortgage debt has fallen from 73 percent to 68 percent of total debt since the peak. That has come along with a rise in auto- and student-loan debt as a percent of the average American’s liabilities.

So, actually mortgage debt is the lowest it has been in awhile.

Debt is debt. The more personal debt one carries, the less likely one will be able to borrow to “buy” a house.

There are more than enough taxes in CA. But until we have this kind of government, it never be enough. Having more communism and corruption than USSR ever had (I know what I’m talking about, I came from this country) we will have problems forever.

Trump just triggered a surge in SoCal housing prices. The hundreds of billions in defense equipment sold to Saudi Arabia means a lot, and I mean a lot, of SoCal high paying jobs. In a matter of months, the impact of these high paying defense jobs will mean lots of multiple offers on lots of homes. This is going to be fun.

Selling real estate one property at a time! What a true master! Fantastic, fantastic job.

This is interesting; hadn’t thought of this angle.

nothing a matter with “all hat and no cattle” if you have “Texas Tea”, like I do. Concerning the Trump tax proposals, he proposed to raise the standard deduction so high that interest and property tax deductions are effectively eliminated for most people. But that will never happen due to the power of the real estate industry. The “baby boomers” are staying put(it was forecasted that they would sell and downsize, but what do economists know about human nature).

Yeah, why sell/downsize when your home is most likely paid off and you’re locked into super low Prop 13 tax rates, assuming most boomers bought 25-30+ years ago.

Kinky Friedman, Kinky Friedman. C’mon Tex, say it!

You always drop his name on all your posts.

Wow, they still don’t know why there was a housing bust!

How Tales of ‘Flippers’ Led to a Housing Bubble

Economic View

By ROBERT J. SHILLER MAY 18, 2017

There is still no consensus on why the last housing boom and bust happened. That is troubling, because that violent housing cycle helped to produce the Great Recession and financial crisis of 2007 to 2009. We need to understand it all if we are going to be able to avoid ordeals like that in the future.

But the explanations for what happened in housing are not, I think, to be found in the conventional data favored by economists but rather in sociologically important narratives — like tales of getting rich through “flipping†houses and shares of initial public offerings — that constitute the shifting mentality of the era.

https://www.nytimes.com/2017/05/18/upshot/how-tales-of-flippers-led-to-a-housing-bubble.html?mabReward=CTM&recp=7&action=click&pgtype=Homepage®ion=CColumn&module=Recommendation&src=rechp&WT.nav=RecEngine

I think the important take here is “Real home prices rose 75 percent from February 1997 to December 2005, according to the S&P/Case-Shiller National Home Price Index, corrected for inflation by the Consumer Price Index. And then, from 2005 to 2012, real prices reversed course, falling to just 12 percent above their 1997 level. In the years since 2012, they have climbed 29 percent, about halfway back to their 2005 peak. This is a roller coaster in national home prices — it has been even scarier in some more volatile cities”

So nationally we are only 30% of the way back from Dec. 2005. Which means there is a different kind of a housing bubble at play today than ten years ago. Since the average Joe or Jane is all tapped out from the last housing bubble, the all cash, deep pocket investor has stepped in to pump up RE primarily in big city housing markets throughout the country. US houses are now a global commodity marketed in places like China by the likes of Warren Buffet.

Whoever made the debt comment is off by a lot. You need to look at debt service. That’s what these oppressive rates have done to savers. The government picked winners. Surely not the renter class.

https://assets.bwbx.io/images/users/iqjWHBFdfxIU/ickjEWP80Sv4/v2/800x-1.png

I just posted a link to this exact same chart/graphic. I cannot fathom how we could be at decades’ lows in debt to income ratios with so many people leveraged out on mortgages, cars, credit cards……?

Seems like housing might finally be reaching a peak. Rents seem to be hitting a blow off top now.

I’ve been watching the OC rental market for a few years now because we would like to upgrade at some point, but prices are just beyond absurd. SFR landlords seem to be getting exceptionally greedy lately. Is this a sign of the top? Case in point: a nice home on a ridge in Anaheim Hills overlooking the canyon was listed for rent at $2900/month at the end of last year. Now I’m seeing SFRs in the older flat areas of Santa Ana, Anaheim, Garden Grove, etc., listed for $3200 to $3400. Sometimes they’re modestly upgraded, but nothing exceptional.

A month ago I saw a 3/2 rental in Anaheim that was a complete garbage heap listed for $2695/month. The place looked circa 1970 and the listing agent didn’t even bother to pick up the trash off the floor before taking the pics (another example of Dr. HB’s “trash can photography”?).

It seems to be me that we’ve hit peak mania even in the rental market now. I’m not saying this is “the” top, but it sure seems we’re getting close. How many people out there can afford $3000+/month for a modest rental home?

Just read an article illustrating the fact that total US debt to income ratio is the lowest it’s been in quite a while. This certainly flies in the face of the over-leveraged argument and was curious at everyone’s thoughts:

https://fred.stlouisfed.org/series/TDSP

First Americans defaulted on their mortgage…..now the car debt bubble is about to explode…..

http://www.zerohedge.com/news/2017-05-22/santander-skipped-income-verification-92-auto-loans-abs-deals

whats next? Soon Americans need to get a loan to buy groceries?

Housing to skyrocket! Lol

They already have financing for a mattress – the bed you sleep on! This will not end well.

Got to be stupid to buy an expensive or newer car, In 10 or 15 years, self driving cars will be everywhere. You will not own a vehicle. Instead, it will be an UBER type arrangement

Exactly! Instead f buying a newer car buy a beater with 10 mpg on a 5 year loan and get another loan for to cover repairs! One more loan is needed to pay for the gas and you are all set! Brilliant! And housing will go up and up! All we need is more debt!

In 10-15 years, the car you buy will pay for itself by ubering people around while you sleep.

Here is a nice explanation for why the FED can not print money to infinity to back up ever increasing house prices and why we can not have the same percent increase from the PAST 20 years into the next 20 years. Sorry JT, trees don’t grow all the way to the sky!

Going up in interest rate is not the same as going from 20% to 3%. Even if the interest stays the same (no increase), the prices would still collapse because the interest is never created, only the principal. Otherwise, all the money in the economy will be sucked up by banks one way or the other (in interest), till there are no money circulating (100% FIRE economy and nothing for the Main Street). The money “printing” (debt expansion) has to continue to accommodate the compounding interest or the Wall Street has to agree (willingly) to change the money system we have (debt based money “printing”). Good luck with that! When the pigs will fly. However, they will be forced by the market. The market can be distorted by the FED only for so long. There could be lots of different causes which will stop the FED in their tracks.

http://charleshughsmith.blogspot.com/2017/05/tinas-legacy-free-money-bread-and.html

For all who think they will wait until prices drop, consider the recent past…. people did not have to sell their homes because the banks let them remain in them for yrs without making payments. Some even moved out but rented out the property — free income on a property they didn’t own. The bleeding heart politicos will likely do the same again so don’t expect there to be much to pick from. Even if they do make them move out, it is the big cronies who will pick up the goods ones — don’t forget what BO did to us last fall. He made it so the big companies are backstopped for their rents — not only were they allowed to cherry pick thru the foreclosures and get them for pennies on the dollar but now that they found out it isn’t so easy to be a landlord to thousands, they get a pass and the govt guarantees their rents.

Have you tried to read Flyover’s TINA article, which warns about the consequences of prolonging “this time is truly different” practices? The next time will truly be different — whether you rent or own.

Exactly Clady. I know a few people personally who made out like bandits. I have one friend who owned a primary residence and an investment property. I think he didn’t pay his mortgages for almost 3 years while living in one property (no payments) and collecting rental income on his other property. Finally the bank modified the loan to some ridiculously low rate and slashed the principle. He saved so much money over that time period he used his mom as a straw borrower to buy another foreclosure property at the bottom of the market. So now it’s been 7 years and his credit is perfect again and owns three homes.