Living the California dream in Compton: In a competition to find the smallest “home†we visit a 378 square foot property.

One gut check that you need to do when markets reach this fever pitch in mania, is simply look at the product. People get fully disconnected from value and simply assume that every crap shack is going to sell because every single second a sucker is bred into our economy. There is now a blind consensus that prices will not drop. And if they drop, it will be a tiny drop. What is telling however is that virtually all large US metros are seeing price increases. This is a nationwide trend despite house humping beer belly cheerleaders acting as if it is only happening in their tiny niche market. So the euphoria is running rampant across all areas. This brings back the idea of decoupling. The markets are as coupled as an old Taco Tuesday baby boomer couple that is building up heart disease on a massive cruise ship. There is too much bubble psychology in the current environment. Have people already forgotten that the unexpected tends to happen (just look at our President!). Yet people just forget about Black Swans and keep on trucking forward taking on mega risk. Let me show you what is happening in Compton.

Straight Outta Compton

At one point in our Real Homes of Genius series, we were attempting to find the smallest house possible in Southern California. A reader sent this example in and I think we have a new winner:

558 W Compton Blvd

Compton, CA 90220

1 bedroom, 1 bath, 378 square feet

“OPPORTUNITY KNOCKS !!! NEED CASH OFFER. .. .ONE BEDROOM HOME. .. . NEED TLC, ,. .. INVESTORS !!! BRING YOUR CONTRACTORS AND HANDYMAN . .. . SOLD “AS IS “. .. .. .. .. .â€

Now I know you are itching to purchase this place. “Dr. Housing Bubble, I’m calling my agent right now! This place with 20% down is totally making sense via my rental parity calculations and Taco Tuesday logic.â€Â This place is 378 square feet and just look at the beauty here. The ad is very subtle with saying “need TLC†and that you should bring your contractor and handyman. How much for this place? $179,000. In Detroit you can get something like this for $1,000:

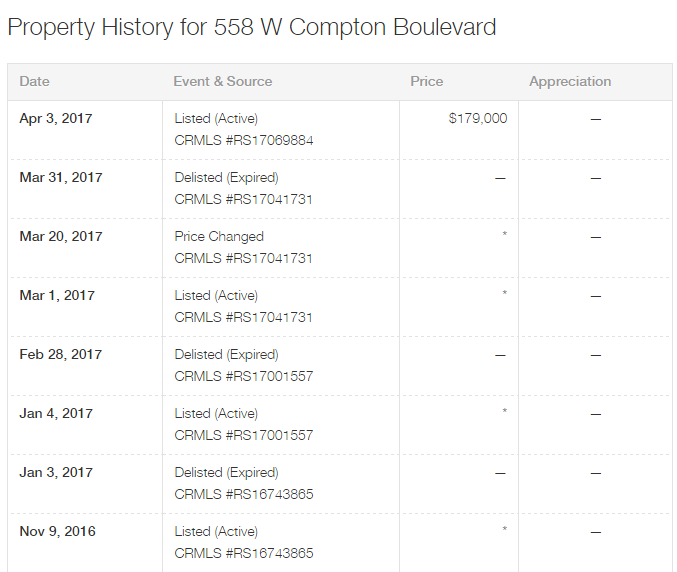

So far, there hasn’t been someone diving in on the Compton home:

Someone has had the interest in selling this place since November of last year. I pulled up the Google Street View and you flat out have a cop car in the picture:

Yes, looks like the area is definitely in gentrification mode. All this needs is a Whole Foods and you are suddenly able to talk like a house horny pitch person. And by the way, that Google Street View is from December of 2016.

People are absolutely delusional at this point. They assume that they can lock in for the next 30 years as if change isn’t accelerating.  And many work in industries that are one step away from being automated out or cut completely. Yet they have a crystal ball that allows them to buy a crap shack and assume the past is a perfect road map to the future. But if you are really honest, the recent past shows a mega housing bubble bursting because people paid too much for homes and took on too much debt – and again, most of the foreclosures came from traditional 30-year fixed rate mortgages.

Who is ready to turn this place into a hipster flip?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

178 Responses to “Living the California dream in Compton: In a competition to find the smallest “home†we visit a 378 square foot property.”

I think you are correct in your assessment. It seems like prices continue to climb. I’m not sure how much longer these high prices can sustain.

Housing To Tank Hard Soon!

I will be very happy if the housing prices tank hard soon Jim. Bless You.

Wang bu did u put peepee in my coke?

The sooner, the better.

Jim,

When did you first post this mantra? And how much have prices gone up since then?

He will eventually be right tho 🙂

I remember Jim Taylor starting his “tank hard soon” rant back in December of 2012.

At that time he should have been buying as many crap shacks as he could.

The market remains hot.

If the planets align, we could get a correction to spring 2016 prices. Wouldn’t that be wonderful ?

All clocks are right at least once a day… eventually, you’ll get that “tank” after all of these years of hoping….

Go Jim! After 5 years of being a denier, it looks like I am your new biggest fan. Times change and outrageous prices become completely ridiculous.

What goes up must come down

Spinnin’ wheel got to go ’round

Talkin’ ’bout your troubles it’s a cryin’ sin

Ride a painted pony let the spinnin’ wheel spin

You got no money and you got no home

Spinnin’ wheel all alone

Talkin’ ’bout your troubles and you, you never learn

Ride a painted pony let the spinnin’ wheel turn

— Blood Sweat And Tears

However, I still believe the cycles will continue. As long as you buy now and hold and enjoy your house for at least 10 years, you will make money.

Lot may make it worth close to its asking. According to the assessor, this home is worth $194,00:

“The tax assessment in 2015 was $194,000, an increase of 68.7% over the previous year.”

Depending upon the land’s zoning, it may have value future commercial development. It might be a good place to build a taco stand. I think it will eventually sell for at least $125,000.

This place is probably worth 100-200 bucks. Well, 200 only on a really good day.

Compton’s murder rate tripled in 2016.

http://www.complex.com/life/2016/05/compton-murder-rate-tripled-2016

Zoned “SFR” (R-1) by LA County Assessor Office

City of Compton “Land Use Element Map” from 2007:

Zoned “Medium Density” & “Mixed-Use” (duplex or Live/Work)

Property located within the City’s “Redevelopment Project Area”

Property located within the dam inundation “flood zone”

LA County Dept of Mental Health building adjacent to property

Westside Palmer Block Compton Crips (W/S PBCC) gang has beef with Tree Top Pirus

Google Maps “Street View” shows 3 Hood’rats jus’ chillin’ between the Tobacco/Smoke Shop and the Mental Health Build’g….ahhh….Gangsta’s Paradise

I was in downtown LA visiting some art gallery in Little Tokyo a couple of weeks ago and I was surprised at how high the real estate is nowadays. $2k+ rent for a 1 bed room apartment, 800k+ rehabbed lofts springing up all over the place. Every one is driving around in a new $50k beamer.

LA/OC isn’t really an area known for high wages/salaries so what are all these people doing where they afford this kind of stuff? I thought I was doing decently with my 90k job but no way I could afford to live in Downtown LA. Are there really that many jobs paying 200k+ per year where you can actually afford all this stuff or are a lot of people living way beyond their means?

You don’t know who’s swimming naked until the tide goes out.

“You don’t know who’s swimming naked until the tide goes out.”

I do. 99% of the buyers in SoCal swim naked. Jus wait for the wave to retract.

I find this interesting as well so i looked up the stats.

Top 25%: $98,300

Top 10%: $159,008

Some people do really well, but they have worked very hard and are usually older. Some people are married and have no kids so prices are not as big of an issue. If I was married and my wife made the same as me an $800K condo would not be an issue (without kids).

NOW, from what I see… most people rent and have roommates and still live paycheck to paycheck. Most of my friends live paycheck to paycheck. They complain about “its hard to save money in LA.” And then they turn around and order $16 shots and a $15 burger. Or go buy a $50K Audi. There are wolves and there are sheep.

Oh a beauty! I like the Fence made of ISO9001 certified Shipping Container Steel. Bullets will Ricochet off that baby without leaving a dent. Great upgrade and strategically well placed.

Chicom money is here since Vancouver and B.C. kicked them out. Canada went populist.

Actually, that’s a good point. Those folks who have been pursuaded not to buy in Vancouver – how many of them are shopping in SF and/or LA now? No way to know, but there has to be at least a few of them.

They are not kicked out. 15% is nothing to a millionaire. The Chinese remain in Hongcouver, unfortunately, yet largely seem unable to adopt an appreciation for the existing cultural norms, in my experience. Canada should subsidize good housing for locals like the Netherlands does. It solves the problem that America has, the stigma of section 8 being ghetto.

I’m moving to Detroit to be one of those All-Cash buyers that I’ve been hearing so much about. Will the RE agent call me sir? I may have to give up Starbucks for a month to afford it.

Like any business venture, a risk! On-the-other-hand, becoming a real estate mogul in Detroit now, may pay off in the long run! Twenty years from now, you could be sitting on your yacht whereas those house-poor slobs in L.A., are still sitting looking at the cracked stucco, bars on windows, and trash cans!

As someone from the Midwest, you might want to retract that statement. That $1,000 house sounds like a fire sale, because it is. Youngsters burned down the whole block on Halloween (as is Detroit tradition) and that house was the only one still standing.

What is is like living on a desolate block in the middle of the city? It is where all the homeless drug addicts and gang members live and party 24/7/365. Even if you fixed up the house they would not leave. That is their territory and you are late to the game. Call the cops all day long its Detroit and they will laugh at you and your $30-40 a year property taxes.

The neighborhood has been pre-demo’d? And no extra fees? Sounds like a gentrification dream area.

And soon you will see property for sale with an upscale dog house included.

The real estate market is so hot, it is difficult to get a great property. Great properties are getting multiple offers. To win, it takes both a very large down payment and a high price. You need to protect yourself. If you decide to buy now, only bid on quality locations. Since you need to overpay, only a quality location can protect you in the long term. Pass on marginal locations.

Housing bubble burst is around the corner….if someone decides to buy now….oh boy. That’s gonna hurt.

People are oblivious! The next recession/financial crisis is already brewing and it involves the every growing and staggering liabilities faced by government entities like the State of California, and local entities like L.A.! People investing and living in high density population centers like L.A. or S.F., are clueless to future impacts … the reality that pensions will not be funded, water and sewer repairs will not happen, and police and fire may not respond when you need them! You already have recurring power outages!

Jnj, I sure hope not! With interest rates so low, a recession happening now would certainly mean negative FED interest rates! What do you think a 700k “crap shack” at 4 percent 30 year rates would go for at 1.75 percent 30 year rates?

Trump tax plan eliminating the need for Mtg interest deduction?

http://thehill.com/policy/finance/330801-realtors-builders-worried-mortgage-interest-deduction-at-risk-in-trump-tax

I’m more worried that Trump will eliminate the property tax deduction. Not every homeowner pays mortgage interest, but every homeowner pays property taxes. For many people with multiple properties raising the standard deduction to 12K would not offset the loss of deducting property taxes. IMO, it is not fair for people to be double taxed. I assume that landlords will still be able to deduct property taxes on rental property, since that could be considered a business expense.

http://www.businessinsider.com/trump-tax-cut-plan-eliminated-itemized-tax-deductions-2017-4

http://www.nj.com/politics/index.ssf/2017/04/trump_tax_plan_would_eliminate_tax_deduction_benef.html

Loosing the property tax deduction is not double taxation. It is just loosing a deduction.

Losing a deduction is not the same as being “double taxed”. Is it fair to give homeowners a break the renters- who usually pay MORE property taxes through their rent than homeowners do for comparable properties_ that tenants do not get?

To be “fair” all homeowner gifts and incentives should be eliminated. They are not only unfair to renters, who are the majority in L.A. and many other major metro areas as well, but to lower-income owners of cheaper properties, whose deductions for taxes & mortgage interest are less than the standard deduction, and therefore only help inflate prices on houses while delivering no benefit in return. ALL government-sponsored housing “help” and incentives, from Section 8 rental vouchers, to FHA low-down-payment loans, to Fannie Mae & Freddie Mac, to all the housing help programs- TARP, mortgage mods, REO-to-Rental, and all the rest- only help inflate prices beyond affordability, endangering buyers financially and preventing those starting out (or starting all over) from buying while raising costs for everyone.

If you’re paying property taxes and then your federally taxed on that outgoing money, is that not like being double taxed?

Regardless, I don’t think Trump will get this through. He is going to have a hell of a time getting these tax revisions through congress. I hope he is able to reduce the corporate tax rate, if not the market will correct BIGLY.

I wish they would eliminate the tax deduction and increase interest rates to a more reasonable 6-7%. Home prices would come back to earth with a big thud. Realistically, I doubt #FakePresident will be able to get any of this through. NAR is going to fight him tooth and nail and they wield a ton of lobbying power.

What isn’t double taxation? I pay tax on my wages and then pay sales tax on food I buy. Capital gains is unearned income. Rent as income is discouraged in countries like Germany through high taxation and their economy is booming.

Housing to spike hard soon! Buy now or be priced out forever!

lol, thats funny. Its going to be biggest crash in history. I give it a few more month.

“I give it a few more months.”

LOL. That’s what Jim Taylor has been preaching since 2012.

Jed,

“That’s what Jim Taylor has been preaching since 2012.”

And Jim Taylor is right on the money….crash is around the corner….

2001, 2008 & 2017? see a pattern here?

So June or July? haha

2001-2008 7 Years

2008-2017 11 years

7-11! It’s all making sense…go long Slurpees

2001-2008 = 7 Years

2008-2017 = 9 years (not 11 years)

Home Capital Group, Canada largest lender, cratered by over 60%, its biggest drop on record. I guess, for those who didn’t see any black swans on the horizon, the black swan is here. In our global, interdependent economy/banking system, every domino will push another.

http://www.zerohedge.com/news/2017-04-26/canadas-housing-bubble-explodes-its-biggest-mortgage-lender-crashes-most-history

In short, the Canadian mortgage bubble has finally burst. I know, gravity does not apply to our elevated bubble. This time is different. Keep buying!

The London, New York, and San Francisco RE markets have already started their fall. Obviously, So Cal is immune in such a way that other regions couldn’t possibly fathom. It must truly be different this time, right?

Wait, it gets even better….They were bailed out by the Ontario Health Care Workers Pension to the tune of 1.5 billion.

That was not a typo… they were not rescued by the Banks or the gov but the brilliant management of the civil service pension. “What no one in the business of lending money wants to help you out…well let me do it I am an expert at seeing a great deal.”

It’s getting even better: the pension plan will charge about 23% in interest on 1.5 billion. At that interest this is a sure bankruptcy. They kicked the can down the road for few more months.

For all the bulls out there, is this a viable business model to borrow at 23% and lend it to 3-4%????….

Meanwhile the auto lending is subprime and bound to fall, commercial lending is almost frozen with very fast increasing vacancies. Student loans defaults are mounting year by year. There were more retail and restaurant bankruptcies in the first quarter of this year than the whole 2016 combined. Credit card default is one of the highest. Meanwhile the GDP is close to zero, and that because of the fake CPI. Using the correct CPI like in normal times, the GDP is in contraction – that is recession. It smells a lot like 2008. Keep on buying all the houses in Compton! This time it is different.

I got my offer in! Payments are only $900 on a 30 year conventional. Suck on that you slaves to the rental gods. I’m going to be living it up in 378 sq ft of pure ownership bliss in the home of NWA. Feel free to stop by, but remember BYOG (Bring Your Own Gun).

Trump tax plan, no state income tax and property tax deduction. Another incentive to move to Nevada for the wealthy.

No state income tax deduction, no local property tax deduction and no personal exemptions would just about eliminate the filing of all itemized tax forms and result in higher income taxes for most middle class tax payers. My taxes would increase significantly. There is something immoral about paying taxes on income that you never receive because it has already been taxed away by another governmental body. Real estate would definitely be hurt by the proposed tax changes. Luckily, they are not likely to ever be enacted.

“No state income tax deduction, no local property tax deduction and no personal exemptions would just about eliminate the filing of all itemized tax forms and result in higher income taxes for most middle class tax payers”

These tax deductions benefit the rich not the middle class. What would help the middle class is getting rid of these tax deductions, increase mortgage interest rates to pressure prices on housing and taxing the rich to pay for tuition free colleges and affordable healthcare. A housing and stock market crash will help the middle class to purchase affordable housing and buy stocks at a lower price.

The plan that Mnuchin and Cohn unveiled Wednesday does allude to one major revenue-raiser: It would scrap the federal-income tax deduction that individuals can claim for the state and local taxes they’ve paid. Repealing that deduction would be worth as much as $1.3 trillion over the next decade, based on an analysis by the Urban-Brookings Tax Policy Center, a Washington policy group.

The deduction mostly benefits high earners in high-tax states that tend to vote Democratic; the largest beneficiaries are California, New York and New Jersey — all relatively high-tax “blue†states. Conservatives favor eliminating the deduction, which they’ve called a federal subsidy for high taxes at the state and local levels.

It is made up with your standard deduction going to 24k, so stop your whining. You still get to keep your personal exemption.

@Millenial,

The rich don’t need tax breaks, they own most things free and clear. And the MID is only good for 1.1M. The middle class in expensive areas like socal will be the ones who get hurt the most. Maybe this tax plan will pass and maybe it won’t. Until changes are made, home ownership enjoys tremendous tax advantages compared to renting and people have gotten rich from this.

@Lord,

“The rich don’t need tax breaks, they own most things free and clear. And the MID is only good for 1.1M. The middle class in expensive areas like socal will be the ones who get hurt the most. Maybe this tax plan will pass and maybe it won’t. Until changes are made, home ownership enjoys tremendous tax advantages compared to renting and people have gotten rich from this.”

Again, if you would look at the actual numbers (spreadsheets) you would easily see that the MID does not even make a dent for the middle class. Nobody would ever get rich by paying taxes and getting a fraction back. Due to the bubble the houses are being sold for triple for what they are worth. The property taxes are based on the inflated prices. Easy example, a person who inherited a beach house that is worth millions might only pay a couple thousand bucks per year in property tax because he will inherit the locked in property taxes as well (Prop 13). If a millennial decides to buy an overpriced shitty condo today, the property tax is 1,2 % of the sales price and therefore he pays more then the guy sitting on a multi million dollar property. We need to repeal Prop 13 and get rid of the MID. The MID is just a cheap sales pitch to sucker people in to buy an overpriced crap shack.

Not really. Trump’s plan also raises the standard deduction by A LOT which for most people would rule out the need to itemize anyway.

This is already happening to renters, who pay more real estate taxes through their rent, than they would if they owned, since “investment” property is generally taxed at a higher rate than owner-occupied residential property. Additionally we all pay sales tax, which could also be considered “double taxation”.

Again, I see no reason to grant homeowners a privileged status over renters.

@Millenial:

You are very wrong that MID doesn’t benefit the middle class, because it definitely does in high cost areas like socal. A middle class working stiff couple who each make 60K per year can buy a 500K crapshack in socal. They are definitely relying on the MID to make the numbers work for their purchase. Itemized deductions will be mortgage interest, property taxes and state income taxes…these will be much greater than the standard deduction for a married couple.

I hate Prop 13 myself. It was sold as we don’t want to tax granny out of her house, fine then it only should apply to primary residences after the owner reaches federal retirement age. However, we all know it applies to commercial properties, investment properties and the tax benefits can be passed down to heirs…WTF. I think your chances of buying a winning lottery ticket will be greater than Prop 13 being repealed. There are simply way too many special interests, corporations, homeowners, landlords, lobbyists and ultra rich that would fight this tooth and nail. They would bring orders of magnitude more money and influence to the table compared to the “repeal Prop 13” crowd.

Some things in life aren’t worth fighting, learn to profit from it.

Lord B., I agree to a point regarding Prop. 13. However, you can reach a point of critical mass where there are so many renters (as %) that a rich opportunist will try to capitalize on this – something like Trump did.

That opportunist can realize that he has far more to benefit being in a position of power than the amount he saves on his Prop 13. This is the history of humankind. Changes in power always come from those at the top by taking advantage of an extreme situation caused by the greed of those in power. Everyone wants to be number one and there are are plenty of type A male leaders at the top fighting for the top spot. I talk from experience. I lived under communism and I thought that they can never fail based on the power they had. However, it failed from within based on power struggle. If you are an alfa male general taking orders from another guy day in and day out, you thought all the time is how to grab that power for yourself. Prop 13 can fall under the same dynamics.

Lord,

“You are very wrong that MID doesn’t benefit the middle class, because it definitely does in high cost areas like socal. A middle class working stiff couple who each make 60K per year can buy a 500K crapshack in socal. They are definitely relying on the MID to make the numbers work for their purchase. Itemized deductions will be mortgage interest, property taxes and state income taxes…these will be much greater than the standard deduction for a married couple.”

To run the numbers we need to agree on a bit more than purchase price and income. Of course, it mostly depends on location. I am going to assume that the 500k crapshack is a 3b, 2b. The lucky buyer put 3% down, 30y conventional, 4% interest rate, 100 bucks HOA per month and 5K per year for PMI/home owner insurance (1% of purchase price), marginal tax rate 25%. To rent this crap shack the renter has to pay 2,3k per month? Closing costs for the buyer are about 2% of the purchase price? Does this example sound reasonable to you? Let me know what you need me to adjust.

Nobody who makes $60K a year should even think of buying a property $500,000 unless he has a 55% down payment. Even after the deductions for mortgage interest and property taxes, the only way he can make that price “work” is if he lives on a diet of raman noodles and peanut butter sandwiches while living so close to the edge of his means that one week out of work or a car breakdown is enough to topple him into poverty. In any case, someone making that moderate income must have a massive stack of deductions to surpass the standard deduction for himself and family members, which most people don’t.

The tax favored status of home ownership is only one more factor inflating house prices, to no one’s benefit but lenders and the taxing authority. The home buyers would be better off with lower prices and smaller loans

@Millenial,

You can assume whatever down you want. I generally advise people not to buy unless you have 20% down minimum. This results in no PMI and much lower monthly payment and you have a cushion if a price decline comes. For 500K, you can get very nice houses in the IE. You can forget about any of the desirable areas.

@Laura,

I specifically stated a couple making 60K EACH, so 120K combined family income. This is plenty to buy a 500K crapshack. You need to rethink your stance on homeowner tax benefits. Relative to renting where there are ZERO tax benefits, the tax benefits to owning a home for most people (especially in high cost areas) are substantial.

@Lord,

“You can assume whatever down you want. I generally advise people not to buy unless you have 20% down minimum. This results in no PMI and much lower monthly payment and you have a cushion if a price decline comes. For 500K, you can get very nice houses in the IE. You can forget about any of the desirable areas.”

Works for me. 20% down and our buyer purchases a nice house in IE. No PMI. Since you did not address the other factors I assume you are fine with them. Since we are talking IE I can adjust the rent for a 3b, 2b down to 2k per month, agreed? Annual maintenance for a house is typically 1% of house price but in your favor we call it .5% (2,5k annually).

Looking at the numbers on the buyer side: 100K downpayment plus closing costs, 1,9K mortgage (1,333k interest, 570 principal), 83 home owner insurance, 100 HOA’s, 208 maintenance, 521 property tax, and -464 income savings from deducting interest and property taxes. Cash outflow in buy scenario is about 2,3k. Do you agree with that so far?

I want to get down to the cash situation in a buy versus rent scenario. As soon as we agree on these numbers we can look at assumed annual appreciation, general inflation, assumed rental price inflation & assumed annual (after tax) return on cash. Sound good?

@Millenial,

Your numbers sound reasonable. Do yourself a favor if you are buying an SFR, don’t buy in a community with an HOA. Nothing but a waste of money and headaches if you ask me. Subtract out the HOA and you are at $2200 per month cash outlay. And don’t forget that you are paying almost $600/month principal. This is money you get back if you ever sell or eventually you will own the place free and clear if you pay off all your principal. Principal must be treated differently! An equivalent rental comparison would be to spend $1600/month (2200-600) on rent and be forced to put $600/month in a savings account…your monthly outlays would be the identical.

All the things you listed (future home appreciation, rental appreciation, inflation, etc) are all guesses and nobody knows the answer. Do a buy vs. rent comparison at TODAY’s prices, this is the only information you have. If the numbers are close, your best bet is to buy. And then there are always what if…you could use that 100K downpayment to buy stocks, gold, etc. And this gets back to guessing, who knows where the stock market will be in the future.

This isn’t really that difficult. It’s simple math most people can’t do. Good luck.

Thanks Lord Blankfein for your answers and input!

“Subtract out the HOA and you are at $2200 per month cash outlay. And don’t forget that you are paying almost $600/month principal. This is money you get back if you ever sell or eventually you will own the place free and clear if you pay off all your principal. Principal must be treated differently! An equivalent rental comparison would be to spend $1600/month (2200-600) on rent and be forced to put $600/month in a savings account…your monthly outlays would be the identical. (…)

This isn’t really that difficult. It’s simple math most people can’t do. Good luck.”

Yes, I agree that the principal is your equity if the market keeps being stable and does not tank. But there is still an elephant in the room. According to google the income per capita in Riverside is 23k, The median household income is 56k. So, our buyer couple makes more than double compared to the median household in the Riverside area and saved a 100K in cash plus closing costs. In that scenario they are able to buy a house that is 9 times the median household in that area. Needless to say that this couple does not represent your typical couple in Riverside. And even with that much cash invested we can only get close to rental parity. Yes, we can argue that the principal should be treated differently but I would not go that far to say its equal for what the renter has in his bank account/saves monthly. I much rather have the cash in the bank then have it tied up in a house that is 9 times the median household income in my area. Also, in a job-loss recession scenario the renter is much more flexible to move without losing equity. In my mind, it makes only sense to buy (invest) in a home if the 20% down payment brings me well below rental parity. If that couple has to move for what ever reason, they would have to chose between losing a significant money by selling (transaction costs) or losing monthly by renting it out and not be able to cover their expenses.

@Millennial,

Home prices relative to median incomes is worthless statistic. You should ask yourself what are median incomes of TODAY’S buyers in Riverside, something tells me it will be much higher than 56K. I said 500K gets you a very nice house in the IE, most places can be had for much cheaper…especially a starter house. I think you already convinced yourself that it’s better to keep renting. Nothing wrong with that. Just be sure to do your due diligence when performing these buy vs. rent scenarios. People had your same arguments 5 years ago, I sure hope they ended up buying. Good luck.

Lord,

“Home prices relative to median incomes is worthless statistic. You should ask yourself what are median incomes of TODAY’S buyers in Riverside, something tells me it will be much higher than 56K.”

We have no way of knowing what today’s buyers incomes are. I would not be surprised if these buyers leverage the heck out of themselves. Lenders who give out these risky loans don’t carry the risk and pass it on to Fannie Mae and Freddie Mac. At the end the taxpayer will be bailing them out again.

“People had your same arguments 5 years ago, I sure hope they ended up buying. Good luck.” I was just about to start my career 5 years ago. I had little interest in buying real estate. Now, that I am in good financial shape I started looking into buying….that’s when i found this blog….opened my eyes about the bubble and this rigged market and prevented me from making a huge mistake! I’ll wait until the end of this bubble and after the collapse. It will be easy to tell….as long as you need 100k down payment plus closing costs to get close to rental parity you want to stay far away from buying. I noticed you keep wishing me good luck. By now you noticed I am a numbers guy and “luck” is not part of my equation. Thanks anyways.

That picture with the cop car, definitely tops all the prior pics of homes for sale with trash cans in front that no one could bother to move out of the way.

Anyone who finds a picture of a home for sale with a SWAT team armored vehicle in the view should get a prize! Shouldnt take much effort given the tension in South LA these days.

All us who were told we were knife catchers for buying in 2010-2012 are sitting on some good equity now. What ever happened to that dead-cat bounce and 10,000 boomers per day who were retiring and going to sell their homes? a crash in home prices is years away my friends.

This is better: https://www.zillow.com/homes/for_sale/house,condo,apartment_duplex,townhouse_type/25201940_zpid/33.815951,-117.936774,33.678211,-118.057623_rect/12_zm/

It’s not even a house! They didn’t even finish building it! $550k in Westminster!

I don’t blame the builders; why actually build the house if some sucker is going to pay more than half a million dollars for a pile of two by fours?

It’s already in escrow!!!…

the big deal coming up is the trump tax plan that will impact itemized deductions for many western coastal state home owners. why is nobody talking about this. if all you guys are waiting for some sort of crash this is the one thing that could clearly impact values to the downside

because 1. There’s no way the tax plan as it looks now is getting passed and 2. the standard deduction will increase which means many middle-class families (potential home owners) will not be affected. If anything, their taxes will decrease.

I think a large part of the cost of this property has to be the land it’s sitting on. Even though it’s in a bad neighborhood, you can put a house on it. Maybe?

Or a bunker.

That almost sounds like you are trying to justify the price for this pile of ****. Who in their right mind would sign up for this place even if it were free of charge? You would have to pay me money to even set a foot in this neighborhood. I would be afraid to get shot or catch something deadly.

The house is right there, Rich. Have you no vision ???? TLC, granite and stainless, a quick tape and rape grey on trend exterior re-spray and you’ll be the envy of the hood.

Yes, it is great to be the envy of the hood. So when you are at work they rob you blind and laugh all the way to the bank.

Never flash your money, especially in the hood.

You have a point, I recall in the 90s mobile homes going for nearly half a million in the Florida Keys. Why? The land. No one cared about a double wide. It was the location.

Well it is “just a few miles” from Manhattan Beach and Beverly Hills. Compton Blvd. used to go to Manhattan Beach, but they decided they did not like to be reminded of how close they are to Compton, so they renamed it to Marine Ave. I suppose there may be some value in the land, if you can keep up one wall, you can do a remodel and save some $60,000 for a new sewer connection. Anybody know they exact fee amount?

At least with these properties, it should be obvious what you are getting/or not getting, but how many people make real estate decisions with ‘eyes wide open’?! Here’s a cautionary tale … I sold the family home with the view in RPV in 2014. I was sorely tempted to keep the house but didnt’. My Brother-in-law kept a similarly aged home and now has drained his savings. Every time he took on a home improvement project, he was faced with bringing the structure up to code … new electrical, new plumbing, asbestos removal, and on and on … he is now ‘house poor’! While he lives in expensive real estate, he will have to work well into retirement just to put food on the table and pay his other bills! I made a sizable cash deposit after the sale of the family home and am enjoying retirement!

Its real value is you can park a fleet of landscaping trucks inside that gate. I’m pretty sure it is commercially zoned, Compton (AKA Marine Ave) is a main street. If the mortgage is cheaper than “storage” rates for 8 trucks, then it makes sense to the grass-cutting entrepreneur.

Can I just say…I love this blog! The Dr. Housing bubble articles are informative and hilarious, but reading the comments afterwards is just as entertaining!

Welcome to the nuthouse 🙂

Is that an earthquake fault line running through the yard?

You forget to mention the past sales price history of the Detroit home and only have the LA home.

Your are to buy in the bad areas for large gains,so this one could actually be good.

Millennials are such a bunch of uninformed losers. While they delve into their social and political pursuits, foreigners mostly Asians, are eating their lunch in the job market right here in America. Most of the “degrees” these millennials get in college are useless in the real world. After they leave college many can’t even get a job that pays for their school loans. Its time to go live with mommy and daddy and whine-whine-whine. Yes, go for this 378 sq ft. house! After all, its going to be gentrified! Whatever the hell that is all about.

You seem a little bitter Curti. Where does you anger come from? Are you one of these realtors who cant find clients? I think one of the reasons why Millennials refuse to get suckered into buying overpriced crap shacks is that they have access to information. If you google housing bubble you find a million website describing the rigged market. That’s a great advantage that past generations did not have.

Yep it was a huge advantage indeed to those reading bubble blogs back in 2012… and not buying a home… NOT

J Taylor’s Son,

they were un-affordable in 2012 too…..now it’s only worse.

Homes were well WELL below rental parity from 2010-2012.

If you couldn’t afford then you will never be able to afford unless your income goes up considerably.

If Millennials have all of this information, I’m quite surprised that they haven’t all moved to low-cost-of-living areas, cut back on Starbucks and BMW payments, and put the money into a house payment.

To each their own I suppose.

Jeff,

If Millennials have the knowledge about the housing bubble why would they put money into a house payment??? Your post makes little sense….maybe re-think that one. Or maybe that’s boomer logic….we are in a housing bubble!! What? really?? lets buy a house!!!

“If you couldn’t afford then you will never be able to afford unless your income goes up considerably.”

….Dude….no offense but not everyone on this blog is as old as you are….students and newly grads tend to have little interest in becoming a debt slave and buying houses without income.

“Homes were well WELL below rental parity from 2010-2012”

not even close, not on my planet and I don’t care if you capitalize the whole sentence it still will not be true. Renting for me WAS IS AND HAS BEEN far far far cheaper than buying….especially since I don’t spend my weekends doing yard work.

Curt you are a terrible human being but what you said are true, kudos to you for telling the truth.

Not sure what millennials have to do with overpriced garbage. There are suckers in every generation.

Curt – You forgot to tell Millennials to stay off your lawn too.

Housing bubble? Of course not. If you are renting, better sit down before clicking this link.

http://www.latimes.com/business/la-fi-spring-market-20170425-htmlstory.html

Of course not. So Cal is far more special than London, New York, and San Francisco are. Prices never fall in the land of palm trees and sunshine.

BTW, I’ve seeing more hand-made “RE investor seeing more apprentices” signs floating around my neck of the woods. Looks like quite a few generous people are looking to pass on their “expertise” to a lucky few. More money must be flowing out of their pockets than they know what to do with.

That’s why we’re still renting up here in Portland. We moved here from LA a couple of years ago with the plan to buy after a few years, but the prices have gone up so much that it would cost us nearly $1K more per month to buy the house we’re renting (not to mention the down payment.) Rents are flattening here in Portland, too.

The market in Portland behaves like the one in IE in SoCal – when it crashes it crashes with a thud. The market in Seattle behaves like OC along the coast. There are lots of factors contributing to that; that is just my conclusion after studying those markets for decades. Take that into consideration if you are new to the Pacific NW.

The PNW has lots going for it, water and jobs mainly, but the affordability is an issue and so is traffic. The 1-5 is still 2 lanes and so is the 26 and the 217 in Portland in many areas. But Tigard and Beaverton are still fairly affordable for affluent suburbs. In Portland stay west of the Willamette, the east side has good hipster food but it is not a safe environment. In Seattle you have to go north for the deals. The drive up to Vancouver is filled with nice little towns, on the water and 1/2 the price of anything in King County. When the bubble bursts there should be some good deals in these areas. Good luck with your plan.

Now that’s what I call a crapshack! My guess is that crapshack was once a moonlighting shop in the backyard of someone who lived there. That would be way back in the pre-1960 days or before when Duke Snider was still in high school or Pete Rozelle was football coach at Compton College.

“Our show “Flip or Flop” has just been renewed for 20 new episodes starting this December…Quick, call the broker!”

Tarek and Christina should buy the above Compton home. They can turn anything into a hot selling item. They never get into trouble even if they overbuild for the neighborhood or buy a home next to a freeway. If they spent $200,000 fixing of the above Compton house, they would get it all back plus at least a $100,000 profit. I don’t why the show is called “flip or flop” since they never have a flop. My guess is that if they bought the Compton home for $150,000 and spent $200,000 fixing it up, they could sell it for at least $450,000.

Can someone please forward this comment to the show’s producers? They would likely gladly accept the challenge since flipping is profitable 100% of the time.

I guess their divorce is not going to slow down their partnership. Not as long as there’s homes to flip and money to make. Since Jim Taylor predicted the end of the world, this couple has flipped over a hundred homes and made millions of bucks. Nice call Jim.

In the 1960s and early 1970s Compton was a nice, middle class area with mostly whites living there. I have home movies taken at a Compton high school around 1970 and there were few non-whites to be seen. What caused Compton to change? Was it white flight?

As far as the real estate market goes, I believe that the real estate bubble will continue as long as the stock market bubble continues. They both feed on the same speculation, and neither shows any signs of a top at the moment. I suspect that both will top out this year, but it could happen next year. In ether case, it is definitely too late to buy real estate.

Yep, blacks moved in, started robbing, raping and killing and white people fled. Same story everywhere they go. Detroit, Oakland, Stockton, Atlanta, DC, etc etc. Nonviolent blacks try and get as far away from their own as they can, but there arent many of them. Oh hey, NFL draft is on!

@Junior

Is it inherent in African Americans? Or is it inherent in the empire that enslaved them physically and mentally, which still under-serves them and persecutes them statistically?

Been outside ‘Murica? Your provincial race theory is easily refuted if you travel internationally and read history…

Your provincial race theory is easily refuted if you travel internationally and read history…

Well, no. Those Somali refugees are quite a bit of raping in Europe. And Africa itself is no paradise — though I guess you’d blame that on colonialism (despite its ending over 50 years ago).

And there goes the neighborhood….

LOL! I dont even live in ‘murica. Anyone with an average IQ of ~75 is incapable of building or even maintaining a modern civilization (proof? Look anywhere in the world and the entirety of history) and they inevitably get enslaved or bred out of existence. No impulse control, illiterate, prone to addiction, violent and incapable of understanding abstract concepts is a bad recipe. But keep believing otherwise from the safety of your lily white gated community and huffing your “smug” a la south park with coexist stickers plastered all over your hybrid as you putter to the local whole foods if it makes you feel better.

The same Yellen bucks that fueled Wall Street also fueled RE. Many buying RE because of paper gains in their stock portfolios. Many hedge funds borrowing billions to invest in RE tracts at heavy discounts. The stock market and RE are closely intertwined.

Housing price increases are a global trend. Most decent cities on the planet are seeing home price increases. Personally, I think the global recession strikes and stops these price increases in a little more than 3 years. Some analysts think we are only 1/2 way through this price increase cycle, meaning 5 to 6 years of price increases are ahead. Either way, this is a dangerous game for those buying their first home. Good luck.

“Housing price increases are a global trend. Most decent cities on the planet are seeing home price increases.”

OK, you finally got to me. how do I write you a check to take your real estate investor courses?

Since US middle class can not afford either rent or buying a house, unless they live homeless, they buy RVs (nomads).

http://www.zerohedge.com/news/2017-04-28/what-americans-spent-most-money-first-quarter

Without RV spending, this is the lowest spending since the Great Recession (2008).

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered…. I believe that banking institutions are more dangerous to our liberties than standing armies…. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.” – Thomas Jefferson

Jefferson was speaking from personal experience. He lived heavily in debt throughout his life.

+2…..for the timing of that quote. People still argue about democrats vs. republicans because that is how they were indoctrinated so they don’t see the man behind the curtain – the banker. We don’t have 2 parties; we have one – the party by the bankers and for the bankers – the OLIGARCHY. Some call it the FED, a banking cartel. Trump called it a “swamp” and promised to drain it. Instead of draining it, he was swallowed up alive. That is not a one man job. If he intended to drain the swamp or not I will never know – your guess is as good as mine. Fact is he was no match.

@Flyover

You often give credence to the analysis of Tim Backshall (zerohedge), but it tacitly also aligns with a set of ideas. I acknowledge some are worthy, yet others are alt-right. Demographics are shifting in the US, which unnerves the immigrants of European descent who have enjoyed and become accustomed to a (artificially petrodollar subsidized) high standard of living. As it drops, they largely resent the Other, mostly Mexicans, Blacks and Muslims. The communities that the empire has oppressed. Not the fault of contemporary whites, but acknowledgment is necessary to resolve sentiments. As years of nefarious foreign policy reap terrorism, refugee crises and the need for mass migration, anti-Islamic fervor rises. Trump is easily explained by these factors. I appreciate your analysis and comments. But the slant to the posts can only be accepted by a WASP or a minority with lacking education or an inferiority complex. This set of ideas, in my opinion, alienates a large majority of people who would support fiscally conservative/ anti-FED globalism, family-values type of governance otherwise – oppressed minorities – who instead join the communist party for what you call “free handouts”, but in reality it’s where they find safe spaces. As people continually shack up in trailers the enmity will only exacerbate. Do you acknowledge the latent ideology of zerohedge affects the economic analysis is cranks out?

https://www.bloomberg.com/news/articles/2016-04-29/unmasking-the-men-behind-zero-hedge-wall-street-s-renegade-blog

Eckspat, I do not care who publishes what!!…. I read all over the place from left to the right and I am loyal to no party. All I care about, is the content. Sometimes is true and sometimes is not. I have the right to decide on that, as much as you do. I don’t need a government agency to tell me what to believe. I had enough government agencies and propaganda to last me a lifetime – to tell me what to believe. I was born and raised under communism. For that, I developed a certain thought process, for which some call me a cynic. I like to believe that I am a realist. Some call me a pessimist, based on my comments. Personally, for various reasons, I call myself an optimist and my optimism does not have anything to do with the economy, human nature or politics. In general I am content and happy.

For me all politicians are power hungry, there to serve their interests only. I knew Trump is there first and foremost for himself, but I was hoping he will do some things which are right even if done for the wrong reasons. I did not vote for Trump, I am happy Hillary lost and for me Bernie sounds like a communist like those I grew under. I like Ron Paul; I think he is a statesman, not just a politician – he speaks way above the electorate who doesn’t understand what he is saying; most people like short simple sentences because that is the way media conditioned them. I dislike Progressives and neocons alike. For education I have a master in business and a technical BS.

I am happy Trump brought in the political discourse the issues of illegals in this country because that policy of bringing more slaves on the plantation of the bankers is very detrimental to the middle class. It does not help the poor and it does not help the middle class. I am happy with his Supreme Court nominee and I am happy for him supporting the 2nd amendment. For the rest, he is is pretty much sold to the globalists same like Obama, Bush, Clinton and McCain. I don’t agree with him trying to escalate wars and tensions throughout the world. But who am I!!!???…a guy with no influence. Even Trump can not do too much by himself.

Eckspat, all media is biased one way or another. Every single one of them has an agenda. I read Bloomberg fully aware that it is a globalist mouthpiece. I read from Jay Sekulow (from ACLJ), I agree with him on many points but I don’t agree with him on everything. He has an agenda, too. I even read from the Communist National Network (CNN) fully aware of who’s interests they promote. Sometimes I even listen to the National Proletariat Radio (NPR) fully aware of their agenda and propaganda. I put Fox News on the same level with Bloomberg, because they both pursue the globalists agenda.

I don’t have my “objective” media or I would forward you to it :-))) (LOL)

Nice try eckspat, but Flyover is too far gone. He’s apparently made so much money in real estate that he has time to post here all day long trying to manufacture more Zero”head”ge converts. Buyer beware.

@Flyover,

Ok so we agree, they all push agendas, but not all are equally toxic as you know if you come from a place where government went too far left. I too read Bloomberg, which is as you describe it, but the bias is easy to detect. Zerohedge is alarmist and pretty racist if you scan the comments section; that doesn’t fly with me. Progressives are generally incoherent ideologically, although many are nice folks, so I don’t get into the minutiae. Ron Paul was overall pretty solid when he ran for POTUS, but I never fully understood why he became such a gold bug. I read some of his writings from the 1980s on the topic, and I too have purchased gold as a hedge over the years, but to return to a gold standard? Gold is deflationary, which means lots of human suffering that can be abated by a fiat system. Not a fiat interest/debt system; a fiat system, but I’m sure you know that as I saw you debating someone last week trying to educate him on the private nature of the FED….probably a waste of time, he posted something from the government website as proof it was ‘official’!!

Eckspat, it is true that there are degrees of bias in media. However, since there is no “objective” media, we have to live with what we have.

Another thing I totally dislike and avoid at all cost is media with no comments section. For me, that is total propaganda. The author of the article and media should allow feedback if they are not afraid that what they wrote is full of holes in the rational. Any democratic society should have a free press and total freedom of speech. The so called “hate speech” is a code word for censorship and I hate censorship of any kind. A society can not fully develop and be balanced without free speech and by employing censorship because tyrants will use that to stifle criticism.

That being said, the author of an article is not responsible for the comments from the readers. If you don’t like them, you don’t read them or skip them. Do you think I like all the comments from this blog? I’ve been insulted countless times and I don’t care and I don’t hold the doctor responsible for the comments. He is only responsible for what he posts. If I don’t like the comments, it is not his fault.

Without this comments section I would probably not come here to often. Some are outright insulting, some are good and some are bad. It is the same with the media and all the comments sections. I think that everyone has a right to post regardless of how stupid the comment is. I don’t read all articles on Zerohedge and I have even less time for the comments. I never posted anything there. However, some articles are good and informative. Some news is posted there right away and CNN posts 3 days later the same information after it clears all the censorship. I don’t need the media comments. I need the news and I need it instantly if possible. I can interpret it myself; I don’t need the propaganda spin.

This (living in RV’s) is a new trend in the SF peninsula, specifically Redwood City and San Mateo. I see them parked all over the place and have chatted with a few of the people living in them. The common theme is, no one wants to pay $3k a month to live in an apartment.

Living in RV’s is a new trend in the SF peninsula, specifically Redwood City and San Mateo. I see them parked all over the place and have chatted with a few of the people living in them. The common feedback is, no one wants to pay $3k a month to live in an apartment.

Only way this makes sense is if someone Breaks Bad and turns this place into a meth lab. Great ROI!

I have been looking into home ownership. I checked out Riverside toured some homes and talked with a lot of different people.

Something that left a bad taste in my mouth:

A divorced dad at my work told me about his foreclosure in Canoga Park. It went divorce then foreclosure. That was when home prices tanked last. Unfortunately he told me he is looking to buy a home again. He told me that “housing will not crash like it did before, this time its different and it will just level off.” That comment sticks in my head every time I open up Redfin app or talk with my realtor. It is like a ghost, it haunts me.

Honestly I doubt the blog writer is a real doctor and these commentators are probably in no capacity to comment on home trends. Just be careful people, be very careful.

Success rest in the multitude of counselors. Read the opinion of others and process everything for yourself. EVERYONE knows and agrees that the bubble will bust. NOBODY knows WHEN. If they say that it is going to be in 3 months or 3 years, they lie. It is just their guess, as good as your guess.

Nobody has the same motivation to buy now. Some have the motivation to sell. I’m in the second camp.

I’d love to be able to sit this latest rampage out in a cheap rental, but the only way I could save any money by moving out of here, is to rent somewhere in the south or west Badlands of Chicago. During the Bubble of the 00s, you could chill out in a cheap rental and wait for the madness to run itself out, but now, rents are inflating as rapidly as purchase prices which is a very chilling thing for a person on the eve of retirement age. I had bought a beautiful condo very cheaply in 2013 in order to avoid the situation I find myself in now, but my fellow owners, mostly investors, couldn’t pass up a quick buck, so here I am, scrambling for a place that comes near what I had in beauty and quality, that can be had for the proceeds of my forced sale.

It doesn’t do us any good, either practically or emotionally, to dwell on how different the world would be if the Fed had not practiced extreme interest rate repression for 20 years, repealed Glass-Steagall, and pulled out every stop to rescue the credit & housing markets at our expense. My building would still be the fine owner-occupied building with moderately priced units, that it was in 1998, and there would be the usual predictable, stable turnover in houses and condos. Rentals and prices would still be moderate, at least off the coasts, and prices even in the toniest coastal precincts would be much lower, low enough that maybe, just maybe,an upper middle income professional could actually afford the kind of house a doctor or lawyer ought to live in. The Tech Wreck would never have happened because there would never have been an insane runup in tech stocks. And we wouldn’t now be about to hit the highest wall of corporate, personal, and government debt ever to be built

From the street view, it is close to all the necessities. Tobacco shop, pawn shop, barber, holy roller church, auto repair, health food store (!), dental clinic, OB clinic and DMH clinic (!!!).

This thing is obviously a backyard shed. It looks as though the main house once stood on top of all the mysterious craters (!!) in the yard, behind all that stylish concrete fencing.

“As Is” indeed! Was it a meth lab that blew up, or has the lot been sitting all bombed out since the crack days? (Maybe the new owners could contact the National Registry of Historic Places.)

In any event, no potential buyer should visit this site without donning hazmat gear. Whatever caused those scary stains on the ground will need to be bulldozed out and carted off to a toxic disposal site before anyone even imagines they can build afresh.

As people live longer and longer, more homes are needed. This is another reason home prices are rising. Many, if not most boomers will live into their 90s. And, most of them will stay in their homes. Supply will even become tighter.

No further need of the sales pitch. Where do I sign up for your real estate courses already (and join the cycle of debt that has perpetuated the price appreciation)?

No reason for classes. The formula is too simple. Buy a quality well located area at a fair price. Buy a few of them. Fast forward 20 or 25 years and it is likely you will be able to retire. The only problem with this is you need to be invested by your early to mid 30s if you hope to retire in your late 40s to mid 50s. This is no get rich quick scheme. You might find 5 or 7 years in, the investment might not look great since your rentals are negative ( payment higher then rent ). But, the strategy kicks in after that and you will be set for retirement, as long as you live long enough.

Back in the 90s, I knew a few old guys with a number of beach rentals. I listened to them and this is the formula. Smartest advise I ever received.

Yep I knew a lot of “jt”s in the 2000s. “Investors” they called themselves. Leveraged to the hilt buying beach adjacent rental properties.

Where are they now? Still down and out, bitter and broke, living off their memories of the good times …. 2002-07 …. when money flowed like the high dollar wine they downed every night out in their fancy designer clothes and cars.

Some of these “investors” will never recover. Many moved out of state. Some are no longer with us. Follow “jt” to Pleasure Island and don’t be surprised if you end up a donkey. Buyer beware.

“Back in the 90s, I knew a few old guys with a number of beach rentals. I listened to them and this is the formula. Smartest advise I ever received.”

OK, I get you. Where do I send my money order *wink* *wink*?

Absolutely!!! PLUS Chinese still make babies! More Chinese people = more housing demand in California! More demand = Housing to skyrocket!! Buy now!!! Median House Price in California will be 2 Million USD in 2020!!!!!! BUY NOW AND BE RICH SOON !!!!!!!

@jt,

The population of CA has increased by about 10M people in the last 25 years. It’s expected to increase by another 10M people in the next 25-30 years. Knowing these facts, buy in a quality area and you will make plenty of money over the long term. As you mentioned before, RE is not a short term get rich quick scheme. As times goes on, the desirable areas will become even more sought after.

“As you mentioned before, RE is not a short term get rich quick scheme. As times goes on, the desirable areas will become even more sought after.”

So are you suggesting that RE is a “long term” get rich quick scheme? That is contradictory, but the converse is redundant.

Since you’ve now changed your narrative to beach front and other luxury properties, you’re excluding practically 99% of the audience.

at POH:

I will change desirable to decent. I’ll let you figure out the definitions. If you buy a house TODAY in any decent area in socal, it will be worth MUCH more in 25 to 30 years. And if you are that confident that this won’t happen, you should approach your landlord today and sign the longest lease possible.

I could tell you the sky is blue and the sun rises in the east and you would still find ways to argue with me. It’s a beautiful day, go out and enjoy the weather!

“I will change desirable to decent. I’ll let you figure out the definitions.”

Yeah, I pretty much figured out your meme. Change the narrative to suit your arguments.

“If you buy a house TODAY in any decent area in socal, it will be worth MUCH more in 25 to 30 years. And if you are that confident that this won’t happen, you should approach your landlord today and sign the longest lease possible.”

I’ll do the latter if I shared your belief that there will never be a bust accompanying the current “boom”. However, I have this inconvenient tendency for evaluating the opportunity costs of participating in an speculative mania.

“I could tell you the sky is blue and the sun rises in the east and you would still find ways to argue with me. It’s a beautiful day, go out and enjoy the weather!”

Too funny. You’ve stuck in your own echo chamber for so long and recently started riding the coattails of one the worst trolls. But you accuse me of being out of touch?

California population grew a lot less than both Florida and Texas according to the US Census. In fact Ca by 2025 will lose about 500,000 since Immigration could do down a lot if Trump changes rules to legal immigration. Orange County grew less than 20,000 people in 2016 while Maricopia County in Arizona grew 85,000.

I really don’t think we’re going to be living longer, and in fact believe that we have passed Peak Lifespan. The book isn’t completely written on the Silent Generation that is now rapidly dying off (born 1924-43), let alone my own Baby Boom generation, but when we finally have the benefit of the rearview mirror, the GI Generation (1900-1924) will be the longest-lived generation ever, and we can expect lifespans to drop going forward. So far, the Silents seem to be dying younger, and subsequent generations still younger. More ominous, the death rate for white men ages 40-60 has climbed steeply. It looks very likely that Baby Boom and Gen X people will have much shorter lifespans than their parents, especially as more and more pension plans, devised when we thought the money would keep rolling in forever, fail, and social security benefits have to be reduced for the program to operate at all.

It’s easy to see why. The GI Gen and Silents came into their own at this country’s peak of prosperity 1945-1970. Even if you were not affluent, you had stability, and house prices and the prices of other necessities were very low relative to incomes- back in those days, the rule was to spend no more than 25% of your income on housing. Everything has been downhill since, and since the early 80s, 80% of the population has seen its fortunes and prospects dwindle as the wealth gap has gaped like the Grand Canyon, and the stable, high-wage jobs that every high school grad came to take for granted in the Post WW2 era began to disappear by the hundreds of thousands. Those jobs have been only partially replaced by low-wage service jobs, and somewhat by high-wage high tech jobs. As incomes fall, fewer people can afford decent health care, and life in general is more stressful in an era of unstable jobs and “gig” work. Add to that our dwindling resource base, increased global competition, and increasing population pressure here, and you have a much lower quality life at much greater cost.

When you look at graphs, you see a steady increase. Furthermore, cancer cures are closer every day. Once cancer is resolved, so many will live to old age .. that will put huge additional pressure on home prices. That is just the way it is.

Laura. No question ,stress and depression in this country is now like having a cold. Many Americans (90%) are stuck on a one way street. The prospects going forward no matter what party rules, the Cancer has taken this country to the brink of major collapse, I do believe.

A breaking point is around the corner, Americans just can’t get ahead and when hope fades so does this country?

Agreed, Laura. People who were born to the GI generation, if they survived all the childhood diseases, were healthier overall. They were the first generation to benefit, widely, from antibiotics and antibiotic resistance hadn’t yet entered the picture.

Environmental toxins, poor processed food diets and poor fitness (if not obesity) are at unprecedented levels today, in conjunction with the fact that fewer people work the land (or skilled trades) as opposed to sedentary desk jobs. Nowadays 1 in 2 men are expected to get cancer and 1 in 3 women. Can medical science prolong life? Yes. But “cure”? That’s really a misnomer. Cancer survivors are said to be in “remission” — “cured” is more of a layman’s term.

A study out in the early 2000s led to a voluntary agreement to withdraw Teflon from the market after it was found in infant cord blood samples taken across the country, even among mothers who claimed not to cook with nonstick cookware. Instead of going off the market by the agreed-upon phase-out date, however, Teflon is appearing in even more products, from paint to household cleaners.

Another story that made headlines in the ’90s yet was forgotten was the federal government’s allowance to dispose of low-level nuclear waste through dispersal, meaning it can be worked into consumer products from cookware to dental braces.

With the comparatively new science of epigenetics comes an appreciation that genes can be switched on/off depending on environmental conditions, stress, diet and other factors. These genetic changes can be passed on to one’s children. This may shed light on why we have witnessed an autism epidemic in this country. Much of this is probably tied to the fact that we live in a world that is infinitely more polluted in the wake of the NASA/Manhattan Project eras. The lifespans gains we were seeing are not going to hold. And that doesn’t just have implications for pension funds or health care costs but also for housing.

jt,

“And, most of them will stay in their homes”

yep, I know a couple of those and they are sucking the wealth out with a reverse mortgage. A friend was frothing at the thought of mom finally dying and him “getting the house” …..well she did die and unknown to him she had a reverse mortgage. They had to sell the house in 30 days or the bank took it over. He’s not a happy man as by the time the dust settled he was left with enough money to buy a used car.

serves him right, the dude was a bit of a loser and was coasting since forever cause he thought he’d have a house he wouldn’t have to pay for.

Well here goes, there is no talking to crazy…But for what its worth. Did anyone hear about the jobs going away, due to AI, that the good Dr. Mentioned at the beginning of this post? I work in an industry in which half my team works in the Philippines. Right now there is a retail melt down going on, at middle class stores, Sears, Target, J.C. Pennies, etc., closing stores some probably going out business…The middle class, is gone in this state, and without their tax money, the government cannot provide giveaways, to the under employed. If you think Detroit can’t happen to LA, you should drive around and look at all the business vacancy, signs…People in Los Angeles get by, day to day by going into debt, half the county is up to its eyeballs, i debt. The other way is through, drug dealing, prostitution, white collar crime, etc. When you see the murder rate go up like that Compton, you can bet its because, drug dealers are fighting for business. Where do people get a thousand dollars a day for a big drug jones? They steal it… The other problem is Fukushima. Anything on the coast is going to be unlivably contaminated within 10 years.

Th generational thing always emerges. The Silent, as Paul Simon points out were indeed born at the right time. But now it’s time to kill Prop 13, get rid of the property tax deduction etc. Personally I’m expecting the Millennials to start throwing haymakers at the Boomers. GenX certainly isn’t going to stop them.

Might wanna by a 1000 house in Detroit, flatten it, wait it out.

Here’s the facts:

-There’s not going to be a housing crash. Prices might stabilize but they won’t crash. The predicted crash never happened in NYC, Tokyo, Vancouver or SF. It’s not happening here.

-Rich people are going to live in cities. The rest of us are going to live in Palmdale and commute 3-ish hours a day. Priced out teachers, firefighters, police, retail workers etc. are going to have to commute in town. Traffic & congestion are going to get worse.

-Trump isn’t going anywhere. He’s not going to be impeached. He’s going to be in office for 8 years.

-Things are going to get way way worse for walking around folks.

-Might as well kill yourself cause you’re already dead.

“Here’s the facts”

The timing of your post could not have been better. Canada Housing bubble crashing before our eyes. US is next?

http://www.huffingtonpost.ca/2017/04/27/home-capital-stock-price-collapse-mortgage-canada_n_16293104.html

I think you are exaggerating this story. Yes it’s bad, but it seems to center around this one particular Canadian holding company. The question is whether or not mortgage fraud & liar loans are currently prevalent throughout the whole Canadian mortgage and banking industry. If so, then Canada has a big problem.

It is not just “another holding company”. It is the largest mortgage lender in Canada which is not a small country like Montenegro. It is the largest trading partner of US. The close proximity and the level of integration of these 2 economies is scary. The systemic effect in this house of cards we live under is even scarier.

This is going to raise lots of eyebrows with lots of investors about the health of other lenders in Canada and US. Hard to tell the effect in this mark to fantasy economy we live in.

Must be “alternative facts” day.

“Stabilize” is real estate jargon for “stagnating or falling”. As in, prices are now stabilizing after an (unsustainable and unnatural) 10% yearly increase for the past 5 years.

POH, I think I heard this language and word “stabilize” from Bernake 10 years ago. It’s getting scary similar.

@Flyover

Bernanke was George Orwell’s worst nightmare come true. He proliferated the doublethink necessary for a generation of fanatic RE investors into believing the omnipotence of “Big Brother” Fed.

Priced out teachers, firefighters, police, retail workers etc. are going to have to commute in town.

Retail workers, yes. But government employees — teachers, firefighters, police — will do very nicely.

Last year 105 Santa Monica city workers earned over $300,000 — https://blog.transparentcalifornia.com/2016/11/16/105-santa-monica-city-workers-cleared-over-300000-last-year/

8/10

not bad form, you got the already dead troll trigger in there. You got “rich people are better and the rest and you are losers” troll trigger as well.

i would have given a 10/10 but you couldn’t get a Nazi reference in the troll and that is essential for a 10.

BTW this is the 4th bubble I’ve seen in cali real-estate AND if there is no crash this will be a first.

It’s different this time. The “gentrifiers” have realized that there are no longer “bad” parts of town. What was once considered “bad” is now considered an untapped resource. It took 10 years to change the perception of Silverlake, once the domain of The Latin Kings, now the domain of Katy Perry; it took 10 months to change the perception of Highland Park, a part of town once known as the domain of Los Avenues gang. Abbot Kinney was ruled by the Shorline Crips; look at it now.

Urban lifestyle has been commodified. Used to be $1.7 meant you had an ocean view. Now it means you can walk to a coffee shop.

Boyle heights is next. Crenshaw is on the horizon.

I lived in SF in the 80’s. The 14th street projects were demolished. Think they’re coming back? No way.

Read this book: https://www.kirkusreviews.com/book-reviews/peter-moskowitz/how-to-kill-a-city/

Anaheim seems the next placed for lots of changed because of the colony. The problem is Disneyland attracts a lot of low skilled jobs but who knows.

No one here is going to convince someone who believes there is going to be crash that’s it’s not happening or vice versa. The real topic everyone should open their eyes to is inflation. Housing has been traditionally a storage of wealth and AT BEST, a hedge against inflation. If prices go up so do rents. If prices go down, rents may go lower or temporarily stabilize. Long term, both will increase. They have to! We need inflation… It’s how our economy works. The real question is why housing is not included in the inflation index. Maybe that crap shack isn’t really that expensive- maybe your money is worth less today (a lot less).

After the Great Recession, liquidity was pumped into the market to keep it going. It’s no secret the debt of millions of irresponsible people was merely diluted on the backs of every citizen in this country. We’ve demonstrated the “too big to fail” mentality and the wealthy know we’ll do it again. Why do you think the Chinese are bringing suitcases full of cash here? They have little faith in the Chinese government to bail out their economy but know the U.S. will have 90% of the people at the soup kitchen before they let financial Armageddon happen and zombies roaming the streets.

Foreign real estate investment is making up a couple percent of our GDP currently. It’s the only thing that’s keeping us “technically” not in a recession. The wealthy from all over the world will continue getting wealthier. If the market crashes, they’ll buy even more. Better to have 80% of their wealth evaporate than 100%. The wealthy will continue investing in LA, SF, NY, Vancouver and other metropolises. These areas may crash hard but they’ll rebound the quickest.

Even during the Great Depression, people flocked to the cities. Some people who were more self sufficient moved out to the country and lived off the land. The cities were expensive but there were jobs. It was a struggle and people lived day-to-day but it was better than starving. I see a lot of parallels today.

Everything you read and see on TV is merely a distraction. We have no money for healthcare but we have millions per missle to shoot at some fat kid in North Korea or a sand pit in Syria. Now let’s blame the illegal aliens for destroying America. Another distraction… We want those illegal aliens here. You think we really want to secure our border? Forget a wall.. Landmines are cheap.

The illegals also add to the GDP. The money we pay for their healthcare is merely passed on to insurance companies and hospitals who pass it on to you. If you ever end up in a hospital, just look at your itemized bill and scratch your head when you see $20.00 for one Advil. All the money we spend on illegals is a drop in the bucket compared to what we’ve spent on wars. The average person benefitted from wars back in the day when we actually built things. Someone is still benefitting today, it’s just not you or me.