Home equity loans in California still over $600 billion. Pasadena and the mid-tier correction starting. Short sale for 50 percent off and HELOC machine being sold at auction for 70 percent below the outstanding loan debt.

Pasadena is now starting to show cracks in it’s once thought of unbreakable real estate façade. Many of the mid-tier cities are now seeing sizeable price declines in 2011. What is interesting is that many major price cuts are going to come from home equity loan fiascos in California. We’ll show an example today of a home that refinanced to oblivion yet the actual housing ATM did not impact local area comps. This is another form of hidden problems in the California housing market. In many cases the HELOC was made by a different lender and there is really no incentive for the second note holder to agree on a sale that will effectively wipe them out. So these homes languish until foreclosure and then the inevitable happens. Since banks have lagged in California for 1 to 2 years (even 3 years in some cases), the pipeline is now ripe for the picking. We are now seeing actual sizeable price declines hitting in these markets. Before we examine a few homes in Pasadena, let us show the magnitude of the home equity problem in California.

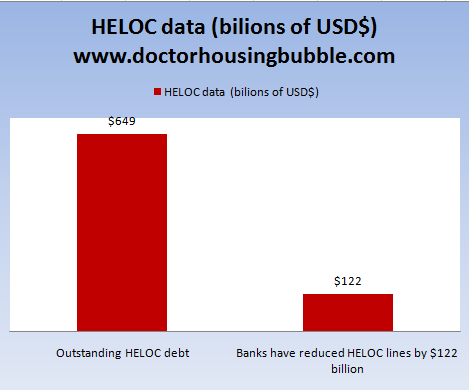

Home equity machine has run dry

Source:Â Equifax

California still has over $600 billion in HELOC debt outstanding. This money was largely used for absurd projects like adding in the stainless steel refrigerator or adding those now recognizable granite countertops. Banks have reduced access to HELOCs in the last year but a sizeable amount of this debt is lodged in the shadow inventory. How much of this debt is underwater? I would venture to say a giant part of it. As these hit the market they will push the local market comps lower because these homes never made it onto the comps in the first place. Take a home that sold for $119,000 in 1997 and suddenly had $452,000 in loans by 2008. Seems too extreme? Let us look at today’s first Pasadena example that is also going on auction today:

2424 WHITE STREET, Pasadena, CA 91107

Listed   07/13/10

Beds     3

Full Baths            2

Partial Baths      0

Property Type  SFR

Sq. Ft.  1,475

$/Sq. Ft.              $94

Lot Size 4,500 Sq. Ft.

Year Built            1922

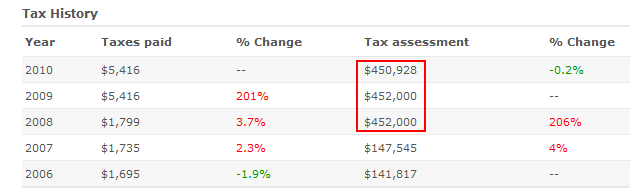

As we mentioned previously this home last sold in 1997 for $119,000. Suddenly in 2008 the place had at least $452,000 in loans attached. We see this through the tax records:

Someone believed in the home equity ATM fantasy. These folks didn’t get out in time. So now the home is bank owned and the current list price is $139,000. Here is the listing data since this place is going on auction today:

“Reo/bank owned ! this asset has been placed in auction and all auction terms and conditions apply. All auction properties are subject to a five percent buyer’s premium pursuant to the auction terms & conditions (minimums will apply). buyer responsible for pasadena city certificate of occupancy. . See agent remark for more details. when: sunday feb. 20, 2011 time: registration starts promptly at 8:00 am auction starts promptly at 9:30 am where: anaheim marriott – grand ballroom 700 west convention way, anaheim, ca 92802.â€

Don’t miss out on this gem and score a Pasadena home for 1997 price levels. I’m sure someone is going to overpay but nothing close to that $452,000 mark. In the end, this will depress local area comps and bring home values lower in mid-tier Pasadena. Round two of the California housing correction is now here.

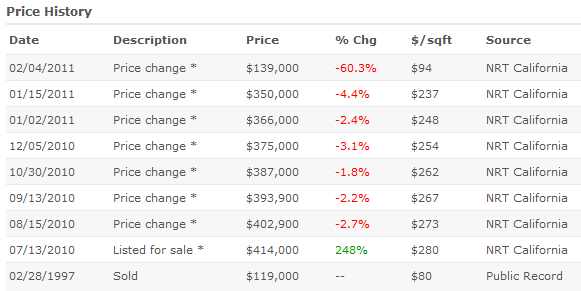

These folks tried to chase the market down as well:

As late as January of this year they were trying to unload the place at $350,000. Not going to happen. If anyone was at the auction we’d be curious for what occurred.

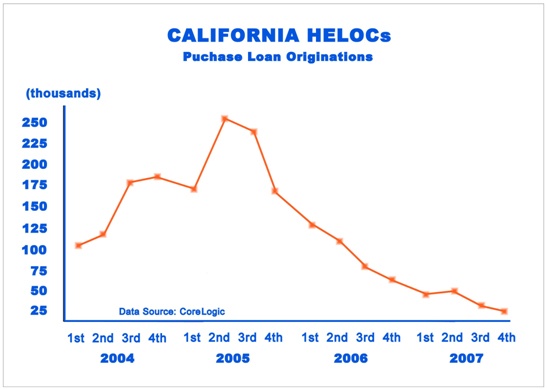

Home equity loans a blast from the past

Source: CoreLogic, Real Estate Channel

The HELOC game is largely game over in California. Banks have stopped doing these in any sizeable amount. Yet the amount of $600 billion is still outstanding. Similar to the shadow inventory problems these will cause market disruptions for years to come.

2011 is going to see more short sale action as banks realize the market is not coming back anytime soon. Let us look at a short sale in action:

50 QUIGLEY, Pasadena, CA 91107

(short sale)

Listed   02/15/11

Beds     2

Full Baths            1

Partial Baths      0

Property Type  SFR

Sq. Ft.  1,188

$/Sq. Ft.              $243

Lot Size N/A

Year Built            1930

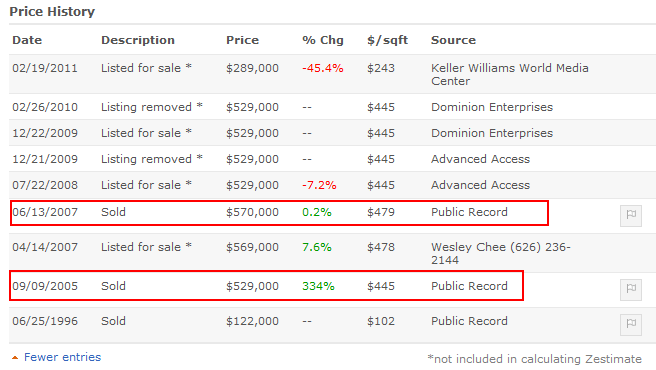

The above home is a perfect case of chasing the market lower. Let us look at the listing history here:

This home sold for $122,000 in 1996. It later sold for $529,000 in 2005 and this buyer lucked out when they found the apex buyer in 2007 for $570,000. These folks had immediate problems since they tried to sell the home for a lower price in 2008. They kept that price for two years naively thinking that California real estate was somehow different or immune to the global housing bubble popping. Today it appears the bank has agreed to a short sale at $289,000. This was listed only a few short days ago. In other words, banks are starting to get it.

Welcome to the 2011 housing correction. No need to rush out and buy a home with a 12.5 percent headline unemployment rate and a shadow inventory amount that would shatter the Hoover Dam.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

58 Responses to “Home equity loans in California still over $600 billion. Pasadena and the mid-tier correction starting. Short sale for 50 percent off and HELOC machine being sold at auction for 70 percent below the outstanding loan debt.”

This actually worked out pretty well for most of the buyers. If you bought a $500K home with no down, and pulled out maybe another $250K in HELOC loans, when the bank took it back, you would still have $250K in the bank.

Free money for those that were smart enough to take advantage of it.

Moral hazard. In the past year, we have looked at 2 houses that are the same model in a very desirable neighborhood. Both short sales. Both were purchased in 1999 to 2000 for around $200-250K. Now they are short sales because the re-financed loan are doubling the original purchase price. The first one scared us away, just by looking at the mess inside. It was finally sold at $420K. The second one appears much nicer condition, very clean inside. So we bid $400K and the bank approved after 2 months of pondering (during the holidays). Then we did home inspection: roof leaks, water damage, and termites. We backed out. Now it is pending again as someone else took the bait. The kitchen in both houses were in their 1987 original state. So where did the equity go? The first house seller did not even own a new car. The second house seller has 2 M-Benz parked in the garage. Either seller maintained their house in the past 10 years. They just used it as ATM machine. Now they will be able to re-build their credit in 3 years. Moral hazard.

I doubt anyone had taken out a HELOC to put in the bank to get foreclosed on. In order for that to happen, they would have had to have the foresight back in 2005 that there would be a financial meltdown and severe drops in prices. If they had that foresight, it would have been easier and far more profitable to short IndyMac. Maybe there were a handful of people among millions that did take out a HELOC with the intention of foreclosing, but that would be in the lines of organized crime. Otherwise, they would have been paying interest on a loan just to put that cash in the bank for less interest. More likely they spent that money on new cars, remodel, and to pay off their credit cards which they had used for a lot of consumer goods.

“remodel” – must mean plastic surgery since what I’m seeing in the marketplace indicates that most did not spend the HELOC funds on *home* remodeling.

~Misstrial

I forgot to mention, when a house gets foreclosed on, the HELOC doesn’t get wiped out. The debt is still carried because they are recourse loans unless it was taken out when the home was purchased.

Ex-neighbor that was foreclosed on called us in a panic last week. His HELOC, in 2nd position, was not wiped out in the foreclosure and was purchased by some entity that has placed it in collections. He just can’t understand why he would owe any money. I remember he was so happy with the home upgrades, new truck and landscaping business he started with the HELOC funds. I bet he won’t be so happy pretty soon.

That HELOC kitchen is tile…not granite. There’s no room for a fridge in the kitchen. There’s a window AC in the living room wall. The driveway is shot. There’s a quaint door to nowhere outside in the attic.

For some strange reason…the folks that robbed the bank for $295000 hung around to spend some coin on it before they booked.

I wish we could hear the owner’s story on how this happened.

Wow. Prices seem to be making sense. 139k for a house in Pasadena is not that bad-I don’t know the neighbourhood though??

I wonder if it will bottom out next year? The only problem is chronic unemployment. Will the economy ever pick up?

Perhaps they make sense. I imagine that house will go for 2.5 times at least what it is offered at for the auction. Bear in mind that it is an old house (recall Compass Rose’s comments in the last post). It is a high trafficked area next to the freeway that is commercial and industrial within a block of the house. Hardly a great location. Meanwhile in a good location of Pasadena/Alatadena is this listing:http://www.realtor.com/realestateandhomes-detail/600-Mcwilton-Pl_Altadena_CA_91001_M21531-01814.

Nearly $600,000.00 and when you read the listing you learn it was built in ’47. The listing states it has air conditioning but does not say central. My money would be on window unit(s) and wall heaters. This is like buying an 80’s car in today’s market. How much would you pay for an 80’s car? My money is that this house is worth in the $300 – $350,000 range. That’s a long way to fall from what they want. It may be positive or it may be negative that a search of Pasadena for homes from 598K t0 600K only brought up 18 homes. I saw this house the other day when I went hiking in the area. That street is heavily traveled and usually filled with hikers cars. For my $600K ( disclosure: I don’t have it) I would look elsewhere and be patient in a search for a better home. If it truly falls into the range I envision it would be a huge loss.

I hope someone can give feedback on how the house doc listed fares at the auction.

On the CNN show, “Your Money”, Nouriel Roubini (aka Dr. Doom) just moments ago, said there will be a double dip in housing. Ali Velshi, the host of the CNN show, disagreed.

I’ll go with Roubini, who has a track record of being “right.”

Beautiful ! After reading articles like these, as a 40 yr old renter with wife and a daughter my chest swells with pride knowing that I have not fallen under any spousal and peer pressure into buying my first home….

Neither are in the best areas of Pasadena, although not in the worst areas. Both are pretty close to the 210 fwy.

Dr. HBB, have you looked at all the empty condos in South Pasadena? Developers just keep building, and no one is buying. We have three mixed use buildings in foreclosure right now, and more are on track to be constructed. Why are they doing this?

Gays and other childless hipsters LOVE the faux-urban “mixed use” mid-rise developments, and will pay a premium for them. Planners and academics have been preaching them for decades, and if they sell better than anything else, they WILL get built.

I have quite a few examples here in Ft. Lauderdale area, most built during Duh Bubble, but there’s much I don’t know about how they’re marketed; e.g. I see some with many vacant shops on the street level, but fairly high occupancy in the residences above, then right down the street, just the opposite–shops 100% leased, but majority of residential flats above never sold (probably convert to rentals…)… curious.

I’m guessing the developers you’re pondering got a “deal” on the lot, have a huge amount of their own money on the line, and have a whole retinue of RE brokers and community cheerleaders convincing them that shoulder-bag carrying Whole Foods fans will be lined up ’round the block… and in PRCali, they may be right!

You’ve piqued my curiosity on “mixed use”, incl. how the HOA fees are split between shop owners and residents! =:O I’m going to tap some RE contacts for insights.

In fact, “mixed use” are so much the rage, and seen so strongly as a key ingredient in achieving The Holy Grail of an “Urban Village”, that these developers (whose actions seem puzzling) might well be getting $$ from city, county, state, and even federal gov’t sources to build these projects! Seriously.

Check the fine print on the sign in front of the mystery project for possible sponsors, check with the local building/development services dept.

Well, I’m a child-FREE hipster and I’m not buying it! 🙂

I stayed in a mixed use community for a bit. The homeowners there absolutely HATED it. The reason that I was given by a number of them was that the developer had retained control of the commercial area and there were two separate HOA’s that had to be paid by the condo owners. One HOA for just the residences and one for the “shared” areas. The owners felt that they were subsidizing the commercial and didn’t have a say in any of it. The half dozen that I spoke with regretted having bought there and said that if they had the chance, they wouldn’t do it again. I can’t say how it all actually worked but it didn’t sound appealing.

WRT Fort Lauderdale (I do check it out from time to time) I’m seeing A TON of shadow inventory. Especially the new stuff built in 2006-2009 such as 2501 Ocean Blvd, 2821 & 2831 Ocean (Sapphire Condominiums http://www.sapphirecondos.com ), The Il Lugano (where I stayed), and gobs more. It’s obvous that the banks are holding back on forclosing on the “good” stuff so they can dump all the crap at bargain basement prices. As soon as they start selling the better stuff for 50% off, it will show an increase in median price and the realtors will screech “RECOVERY!!!”. Very deceptive. Even some of the *cooler* older buildings such as the “Sea Tower” at 2840 Ocean aren’t selling as the debtors haven’t lowered their prices to reasonable levels.

Just my 2c

RE: Fort Lauderdale… EconE is probably correct on how the banksters are playing the macro-spreads, and manipulating Duh Stats.

1) An appraiser acquaintance in FLL, now a recovering alcoholic, admits that he LITERALLY never made a sober appraisal during the half-decade 2001-2006–i.e. Duh Banks paid him to play ball, and he reckons they KNEW he’d never be a credible witness and/or be a convenient fall-guy… if it ever came to that. =:O

Now sober, he calls the current market environment HIGH-larious. All the R-tor® cheerleaders and professional DENIAL-ists are hoping, praying, and burning Santeria sacrifices, in vain attempts to summon the MYTHICAL “wealthy South American buyers” who will swoop in and save us all… :rolleyes: I believe the “wealthy Chinese buyer” is an analogous article of faith in So-Cal, LOL.

2) Sea Tower ROCKS! “MiMo” = Mid-Century MODernist, and that place is a BENCHMARK for how MiMo is DONE! It’s the whole package, incl. that masterful plaza and mini-park leading out to the beach. The chemically-inert Marbleite coating never needs painting, yet has a higher albedo than today’s toxic high-tech “green/LEEDS” reflective coatings. It’s so funny to see that 55-year-old co-op outclassing most of the schlock that’s been put up since. There’s real value there for owners… but no doubt, it’s swept up in Duh Bubble-ized fiction in pricing.

Wait they are using Santeria? Doesn’t that reject materialism. The poor sods.

The American Dream has turned in to a nightmare!

Well, I am going to buy a house within the next three months. I agree with most here that there are going to be more sellers than qualified buyers in the upper-mid price range this spring forcing prices to drop. If I can’t get a deal in this market significantly below retail I deserve to be ripped-off by a smooth talking realtor!!! (I know that things will keep going down but the family {especially wife} are ready to move into a nice home so it is what it is.)

We sold our house in July and decided to rent which is turning out to be a very good thing. Watches prices drop has become my new hobby and I am going to miss it after we buy. I have talked to so many realtors at open houses that I have a large enough sample to rate their honesty. I would say that only 1 of 10 actually come close to telling it the way it is out there. The most honest realtor I met was one that told me she went to a meeting that had representatives from three of the larger banks. The first thing these bankers asked was if there was anybody in the room from the media. Once they were assured that they were safe to speak to the room full of realtors they basically went on to say that the market sucks and will be very bad for the next few years.

^^^sockpuppet

Middle east strife, state and local govt budget implosions and a world awash in debt it cant even roll-over anymore. Perhaps this is the year the chickens come home to roost?

LOL at CNN “Your Money”

It’s almost like a cartoon with Ali Velshi, his bald ass head, his over done suits, and their cadre of talknig head ..ahem…experts.

I will however take a minute with Christine Roman in the green room.

Although she wins no Mensa awards either.

I just have to laugh when seeing the cash out HELOC activities.

No one in their right mind could have thought that was going to end well.

But the government was right there, all along, aiding and abetting.

I for one remember all too clearly how these snake oil products were sold as the tax avoidance schemes to use if you wanted to – buy a car; finance an education, take a vacation, hell, you might even have a dollar or two left to put it in your house.

Another wonderful financial invention.

And so many people drank the koolaid in Jonestown, or in Pasadena. Wherever.

The smart people were probably the ones with non dischargeable student loans who HELOCed their house, paid off the student loans and then filed for bankruptcy.

EconE….The light bulb just turned on for me! You’re pure genuis.

Un_be_lievable. A two bedroom, one bath, 80 year old house of no special quality sold for over HALF A MILLION DOLLARS??!! ^&$”!*&%^ Gah, how is that possible?

And this same upscale hovel quadrupled in selling price in less than 10 years?!

I’m in disbelief. Gobsmacked. This is delirium. I wouldn’t give you more than $50,000 for it if it were in downtown Monte Carlo. Much less Pasadena……

Madness.

I found this blog in the midst of our house search. To say that it has given me pause

is an understatement. However, I’d still appreciate advice and/or opinions on the following. Thanks in advance.

How does one determine whether to buy now–when prices have somewhat corrected and interests rates are low–or wait for further corrections with the likelihood that interest rates will rise? Further inflation or hyperinflation also a factor?

My wife and I can do 20% down on a $450,000 purchase price (max). Been renting in the westside (not cheap), but looking to buy in the Valley ’cause that’s what we can afford. Our focus is having a home for us and our 1 1/2 year old son. I don’t view the home as an investment, but it does seem better to pay into something that at least might break even down the road as opposed to paying rent. Oh, and I need to stay in L.A. for work, so no getting out of CA.

Prices will go down, interest rates will remain artificially low and the value of the dollar will continue to decline with every quantitive easing Bennie Boy decides to implement at his own discretion and whims. We owe China way too much money so it is better to devalue the dollar to pay it back with cheap money. Not good for the American Citizens, but good for the cronies that own our money and government. My advice is don’t buy till you can get the house at prices from about 1989- 1992. Homes here in Las Vegas are selling in short sales and auctions around $30.00 to $50.00 per sq. ft. We have been victims to a giant criminal organization that transferred the wealth from the middle class. It was done purposefully and intentionally.

Read more Dr. before purchasing.

Have been a longtime reader (4+ years). 100% cash deals are the best deals today. If you can stand moving – you might want to consider a cheaper rental that satisfies the lifestyle you are looking for.

Stay on the fence for a while longer.

You can never really time the bottom because you won’t know the bottom ever occurred until prices start rising again. So, first target the Valley neighborhoods you like.

Wait to see two trends occur simultaneously during the next year:

If you see prices RISING continuously for similar-type homes in the neighborhoods you like, and, at the same time, you see the number of such homes for sale DECLINING, then that probably means that the bottom has already come and gone in that neighborhood. .

Yes, you may pay more then because you didn’t exactly time the bottom, but at least you would feel better knowing that things seem to be going up instead of down. If you buy now for $450,000, how would you feel if you saw prices continuously go down to, say, $350,000?

But, if you wait to see a decrease in supply and an increase in prices, yes, you may end up paying more, like $475,000, but you would not be facing a decline. Look for a continued rise in prices with a concurrent decline in supply…then get off the fence.

Well since you’re doing it for the child of course it’s ok to buy!

Read a little MISH before you spout the NAR inflation/hyperinflation scare tactic.

Unwinding credit = deflation in things that people use DEBT to buy.

If food and energy goes up you’ll have LESS to spend on housing.

Wages won’t go up like they did in the 70’s because we are a MUCH MORE globalized economy and have to compete with 3rd world countries.

Buying with low interest rates is for FOOLS. Smart money buys cheap assets with expensive money. Stupid people buy overpriced assets with cheap money because they are dumbfucks with a payment mentality.

A couple of weeks / months ago, DHB had an article about whether to buy while interest rates are low or high which pretty much summed it up in my opinion. Basically, the premise is that housing prices will gravitate towards the maximum possible price still sustainable by the pool of available money out there to buy them. If interest rates are high, then people can’t afford to borrow much and prices (have to) go down. If interest rates are low, then people can borrow more, maybe more than they should with an option-ARM, and prices go up.

Now, would you rather buy in at the high price, low interest time, or the low price, high interest rate time? The answer should be obvious here. You want to buy in at the high interest rate, low price time. The reason is that interest rates don’t stay high forever, and when they go down in a few years you can refinance your expensive loan on the low priced house into an inexpensive loan on a low priced house, and make out like a bandit. If you buy while interest rates are low, like they are now, then you are pretty much stuck with paying off an expensive house for the term of the loan. You also lock in an inflated valuation for tax purposes.

So, given that everyone thinks prices will go down, and interest rates have nowhere to go but up, you’ll likely be financially much better off finding a house to rent where the landlord will work with you on small projects to keep you content, like allowing you to plant a garden or repaint a room or two for the kids. Keep your eye out for the house you can’t live without, though.

The money spent on rent is not “lost”. You get to leverage your landlord’s undervaluation for tax purposes, thanks to Prop 13. He might be paying $0.10 on the dollar compared to what you’d have to pay if you bought the same house at market rates now. Your landlord is paying for the repairs for the most part. In the event that you switch jobs in the near term, you dodge the agony and expense having to sell the house in a dubious market. The mortgage deduction is not such a good deal. You only get to deduct the interest you pay, not the whole price of the house. Later on when you are finishing off paying for the house, the deduction wont be much, because you will mostly be paying down (a lot of!) principal. Also, if you lose your job, you lose the deduction, because you have no tax on no income to write off against! Then it’s double whammy time — paying the full cost of the mortgage without any income.

Disclosure: I own my own home outright. I used to rent. I needed to diversify my investments. The new home /is/ nicer.

Onthefence,

Having a 1 1/2 year old tells me this is the perfect time to rent a place. Then you won’t have to worry about upkeep and can focus on your growing family. You can also move to a home w/ a yard in an area and see how you like it, and the local schools, before deciding to live there for the very long term. If it’s a good fit, then you can take your time in buying a place nearby in a neighborhood you know intimately.

Are you worried about being ‘priced out forever if you don’t buy now’? Ha ha, what a joke that turned out to be. Keep us laughing, it reminds us of the glory housing blog days of 2006.

Buy it because you like it at the price you agree too. You are probably going to go underwater with it right away and will be lucky to ever break even if you sell in the next 15 to 20 years. So buy at a price that gets you under the equivalent rent.

Not sure who is buying homes with the job situation in California as it is. Funny how I rarely read stories about businesses expanding in California anymore…congrats AZ.

http://www.azcentral.com/business/articles/2011/02/18/20110218chandler-arizona-announces-new-Intel-facility.html

Dr. Could you provide more insight on how inflation is going to impact housing market?

Is it possible that inflation will keep housing inflated? Thanks

I imagine in a high-tech state like Cali, the results of this auction would be online by… Wednesday?

The housing market began to resemble the trucking market. Eager drivers put into the drivers seats by companies that promise them the world but secretly have other plans for them. They’re convinced they’re buying a truck but in the end they loose their asses. Interesting article by CH smith: Assets to bottom in 2014…. http://www.oftwominds.com/blogfeb11/2011-2016-2-11.html

I have done extensive researchj on this crime and from what I have uncovered I would say prices will go down, interest rates will remain artificially low and the value of the dollar will continue to decline with every quantative easing Bennie Boy decides to implement at his own discretion and whims. We owe China way too much money, so it is better to devalue the dollar to pay it back with cheap money. Not good for the American Citizens, but good for the cronies that own our money and government. My advice is don’t buy till you can get the house at prices from about 1989- 1992. Homes here in Las Vegas are selling in short sales and auctions around $30.00 to $50.00 per sq. ft. We have been victims to a giant criminal organization that transferred the wealth from the middle class. It was done purposefully and intentionally. Check out my website for more information and documentation on how they did, and by whom.

I’d prefer 93-97 prices as 89-91 was a bubble also.

http://www.zillow.com/homedetails/424-Marguerita-Ave-Santa-Monica-CA-90402/20486458_zpid/

Sold 1995: $1,837,500

Sold 2006: $4,500,000

Sold 11/19/2010: $262,500 (Amazing! Never seen anything like this before!)

No, there’s something else going on in the two examples that you are showing. That makes no sense at all.

HELOC holder foreclosing perhaps?

http://www.zillow.com/homedetails/407-Georgina-Ave-Santa-Monica-CA-90402/20486042_zpid/

Zestimate [Zillow source]: $3,082,500

Sold 05/26/2010: $484,000

Hella crazy! Just shows you how corrupt the RE industry is…

“My wife and I can do 20% down on a $450,000 purchase price (max). Been renting in the westside (not cheap), but looking to buy in the Valley ’cause that’s what we can afford. Our focus is having a home for us and our 1 1/2 year old son. I don’t view the home as an investment, but it does seem better to pay into something that at least might break even down the road as opposed to paying rent. Oh, and I need to stay in L.A. for work, so no getting out of CA.”

You’re throwing a whole mess of mixed stuff in here.

You’re renting on the westside and comparing it to buying in the valley, which features longer commutes and higher crime. And there is no comparison.

That said, to buy in the Valley right now you have to consider the following:

-Long commute.

-In your price range, likely Van Nuys or Reseda which means high crime and crap schools.

-That you may be able to save more for a down payment, countering the effects of a higher interest rate. You have 20% of $450K now…$90K. What happens if two years further on you have $120K, but prices correct 20% downward and now that house is $360K, and you have 30% down? Even at 9 or 10% your payment will be lower, you will have creater equity, and you can re-fi if and when interest rates come down.

Exactly. A lot of mixed factors and I grew up in LA, so trust me I know there’s no apple to apple comparison between W. LA and Van Nuys. I’m not happy about considering it at all (no offense to those that live there and like it).

The advice on prices, down payment, rates and future refinancing is helpful. Thanks.

I’ve been on the fence since 2005 when I sold. I can probably pay cash for a 4 bedroom home in my area by 2012 and will rent until I can pay CASH and get the cash price. Only then will I think of a refi, but will do so only if it cash flows as a rental because I expect prices to drop until about 2015 and bounce along a bottom for about 10 years. This has been the pattern with housing bubbles. Another part of the pattern is realtors predicting rising rates, inflation, etc., etc. If rates go up, prices drop very quickly. If there is inflation, there will be a lot more inventory in suburban (valley) areas as people end up renting closer to work. I hope nobody listens to the REIC spew.

Did ANYBODY attend the auction yesterday? If so, please post the sales results for the two properties in the story.

FYI, rents are also falling. If you do choose to stay on the fence, you can negotiate lower rents or move for lower rents. I’m changing rentals in the same area next month and discovered during my search that rents have fallen 10% during the last two years and incentives are everywhere. If you are going to buy a $450K house in 2011, be prepared to see its value fall by 1/3 during the next five years and stay there for ten years after that. If that’s okay with you (it would be okay with me ONLY if it cash flows as a rental for 15 years in case my job changes), then go ahead and buy before you spend another $80K in rent.

“How does one determine whether to buy now–when prices have somewhat corrected and interests rates are low–or wait for further corrections with the likelihood that interest rates will rise? Further inflation or hyperinflation also a factor?”

Rising interest rates would only drive prices sharply downward. Higher inflation, well, you have to determine the whole range of how that would impact you. Are you in a position to keep pace with it, income-wise? Businesses don’t all have that kind of pricing power, so their employees don’t get raises that keep up. What do you think that will do to housing prices?

What we know from the data is that wages are not rising with inflation. We can speculate on what would happen during a sustained period of sharply higher inflation. But I’m willing to bet that wages would still not rise on pace. Not for the population of most San Fernando Valley communities.

Hyperinflation? As a onetime student of Weimar Germany I can predict that if we have actual hyperinflation the last thing you or I or anyone else will be overly concerned with would be being upside down on a mortgage. Getting food before prices rise in the morning and our paychecks become worthless — that would be our daily concern.

Like everyone else with a finger on the housing trigger you should take a tough look at your overall situation. Job security? Ability of your employer to keep wages on pace with inflation? Whether the economic contiions you describe will make life unlivable in the SFV due to sharply higher crime and cutbacks in services?

Remember, there are much more stable housing markets elsewhere in this country. Where do you think employers would prefer to base? Horribly unaffordable places with dysfunctional, broke governments at all levels? Or places with stable housing at affordable prices and functioning, solvent state and local governments? Maybe your future will look completely different in a few years and you will be very, very glad you remained a renter. Hope it’s a bright future regardless and good luck!

Thanks Dr. for another great post. I rent in Burbank. The house I rent would need at least 50,000 in upgrade to be a great place to live. Zillow has it estimated at 479,000.

This seems to be the norm in Burbank. The houses in the mid 450,000 range need a whole lotta work. I worry the house I might want to buy in the future is being wholly neglected by some knuckelhead who bought it for 650,000 at peak and is now squatting. Do they care if the faucet in the bathroom is leaking into the 1938 wall and the floor will fall in in another year? Do they care that termites are eating the rest of the floor. When the roof leaked during the last rain they used the Sham-wow, and a bucket to deal with it, so now we have mold in the ceiling.

I’m afraid this is the norm with these properties. No more Mom and Pop selling due to empty nest after loving the home for 40 years.

My landlord only fixes something if it’s falling apart, otherwise he uses the cheapest material he can. My rent is cheap so I don’t complain, but if someone buys this place someday…

These Burbank “fixers” need to be in the very low 300K range so the buyer can afford the constant expense of fixing all the years of neglect!

Here’s what a home equity loan is: (a quick visual).

http://www.irvinehousingblog.com/images/uploads/20093early/ball-n-chain-guy_rubberball.jpg

Prices are correcting every day. WAIT, WAIT, WAIT!!! I am seeing six figure “price reductions” daily in my area and they still have to correct more. Too many homes over $500k and too few households with a 100k down payment and 132k in income. The math just doesn’t add up. Eventually many of these homes will have to go for less than $100 per ft. it’s the only way they will be able to move all the inventory. 31 houses on my street and 4 in some form of foreclosure (at least)!! There are probably another 4 that don’t show up yet, that’s 25% on one small street where the prices peaked in the 7 figures and will eventually go for less than 1/2 that amount. WAIT WAIT WAIT don’t buy now.

@Burbank….

Even with the price drops in the past few years, you realize the rest of the nation is LOL at 900sq ft cracker box priced at $500-600L, right?

It’s as if Burbank thinks it’s the Beverly Hills of the Valley. Prices are insane!

People just don’t factor in the price of maintaining a home beside the PITI. They don’t realize you need to have a few hundred bucks set aside each month for those inevitable repairs. How does Joe Blow do that when over 50% of his income is just trying to pay principle? They can’t. So when they default we get to see the neglect. So you get a neglected Cracker Jacks box for 500k. But… It’s the Beverly Hills of the Valley!

I recently started looking for a home, and the very first one I liked, once I knew how little they had paid for it ($116k) in the early 1990s and how much they owed ($390k), I understood that they had HELOCed a bunch of cash out. They did absolutely NO renovations to this house–had the original 40s kitchen and bathroom and unlandscaped yard. Needed a new roof; did not have full dual pane windows, or CH&A. Needed new ductwork, new electrical panel, new sewer pipe. I got a bit peeved finding all of this out after the inspections, and backed right out of that deal.

I can totally understand why a HELOC is not discharged in foreclosure or short sale–it’s “secured” but there is no guarantee the funds were used on the home (and most were not). Why should banks write off what is basically consumer debt? Why should they allow these families who did not put that money back into the home to profit from sending kids to college, buying cars, paying off other consumer debt, taking vacations, whatever. While I doubt folks get into homeownership solely in order to enjoy using their homes as ATMS (as they were encouraged to do of course), they did get the benefit of hundreds of thousands of dollars. Just blows me away…

In todays news “Paul Dales, a senior U.S. economist at Capital Economics, estimates there is an oversupply of 850,000 homes on the market, with another 4.5 million properties in the foreclosure pipeline.”

Leave a Reply to Roadtonowhere