Don’t believe calls for a quick housing bottom – Foreclosures increase as system is still clogged. Those calling for a 2011 California housing bottom are premature. 51 percent increase in REO inventory for California in latest month of data.

The calls for a bottom in 2011 for California housing do not coincide with the holistic data we are seeing for the state. When people talk about a housing bottom we take it to mean a nominal price bottom (as in what is the sticker price). This is what many are reporting through various articles on the current real estate market data for the state. I don’t buy this assertion first because the California foreclosure pipeline is spilling over and also the state budget is an absolute mess. Do we even need to talk about our unemployment situation? There is little reason to believe 2011 will be the absolute bottom in terms of price especially when recent trends are showing prices moving lower now that banks seem to be more realistic about moving over priced inventory. Let us first look at the overall foreclosure data for the state.

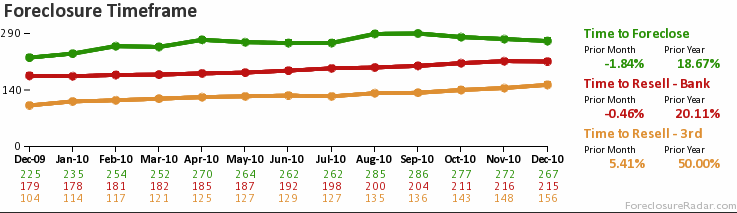

Foreclosure timeframe

The foreclosure timeline increased over the 2010 year. This is no surprise and that is why banks have clogged up their balance sheet with home owners that have flat out stopped paying on their mortgage. Instead of banks clearing out the market in 2010, many were waiting and hoping that somehow a second wave of delusion would have hit the state and prices would have subsequently gone up. As prices went up, banks would have unloaded the shadow inventory at elevated prices to newfound suckers. Of course this would only have created future foreclosures given the deeper employment problems in the state. But who cares at that point when you can shovel the loans off to Fannie Mae, Freddie Mac, or have FHA insure them? Waiting did not help since the overall market tanked and prices went nowhere and at the end of the year, started moving lower.

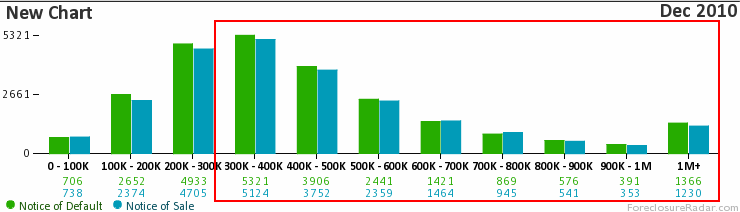

Giant mortgages in the shadows

The median home price for a home that sold in December of 2010 was $254,000 for the state of California. Just look at the above chart. The bulk of the backlog involves properties that are much higher than this. The market right now is being driven by the $200,000 home price range. Banks will need to cut prices lower and we have seen this happening in elite areas like Beverly Hills even. It doesn’t mean you will pick up a beach front home for one paycheck but banks are not going to get their inflated loan balance prices anytime soon. My assumption is that many banks are electing to sell these at lower prices before things get even worse. The bottom will not be this year. It will drag out. Make no mistake, when people try to pinpoint a bottom the underlying assumption is that you will need to jump in before prices rise yet again in some kind of perpetual bubble. No.  Prices will remain in a trough-like state for years to come. The only thing that will move prices up is an overall increase in wages for working Californians. Mortgage rates can’t go any lower. All you need is chump change for an FHA insured loan. Short of toxic mortgages that don’t verify income this is the future of California housing.

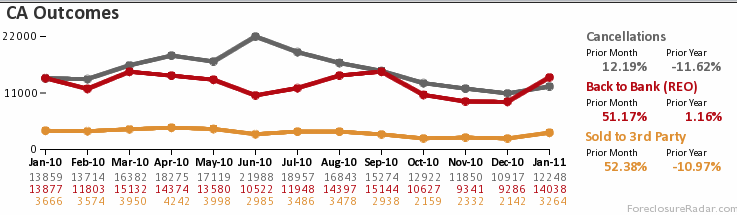

REOs increase over 50 percent in January 2011

The above chart pretty much solidifies the notion that banks are moving on shadow inventory. From December to January REO inventory shot up by 51 percent. We already know that Bank of America basically stopped foreclosure filings in December so of course the data became skewed. Banks are taking more of these homes back and we are seeing them filter onto the MLS. The bulk of these homes still reside in the shadow inventory and the public is unable to bid on these places. What this tells us is there is now movement on moving these larger loan balance foreclosures at discounted prices.

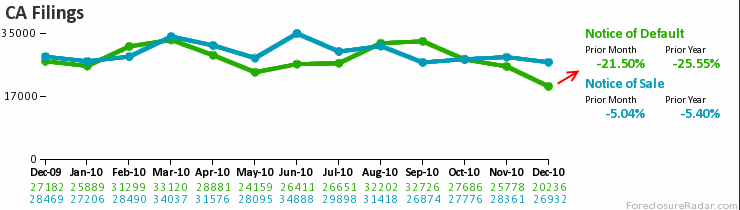

California foreclosure filings

This chart is deceptive because of all the gaming we have previously talked about. The paperwork fiasco put a wrench in the process last year and that is why we saw a dip in actual NODs being launched out to non-paying mortgage borrowers. At a certain point action was going to need to take place and for the last few years many have simply taken a free ride on the banking bailout crest. That can only go on so long. The latest data shows that 24,000 NODs were filed in California in the last month so that is why the red arrow is shown above. It looks like banks are now doing some action on this giant backlog of shadow inventory properties.

This is where I don’t understand the calls for a bottom. The clearing out process is in its infancy. The foreclosures that hit the MLS are underpriced by a significant amount from original loan balances. The way real estate is priced in local markets is typically through “comp sales†so if lower priced homes are hitting the market, wouldn’t you conclude that prices would move lower simply by how agents value properties? Of course this makes calls for bottoms premature.

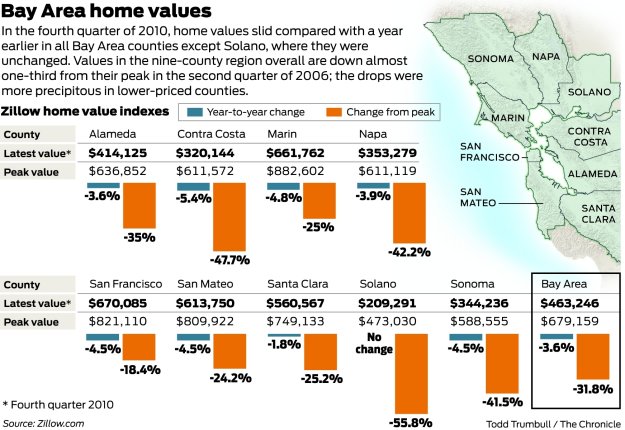

Take a look at the Bay Area:

Source:Â SF Chronicle

The logic that is being used is this:

“Well since prices have fallen so much they must be reaching some sort of bottom.â€

Every analysis of a housing bottom doesn’t even bother to look at local area incomes, or the potential of higher taxes given our budget, or even a mention that homes are still valued at bubble levels! If you bought AOL stock at the peak and kept on holding it all the way to the bottom you would have been better off selling even as prices were falling by double-digits. Some banks might be getting this and that is why some of the shadow inventory is being leaked out.

2011 will not be the bottom for California housing. The amount of shadow inventory, banking accounting games, and a troubled budget guarantees a tough year ahead. Don’t hold your breath and don’t worry about missing the bottom. It is likely that 2012 will be very similar to 2011. This isn’t 2002 or 2003 even though nominal prices in many California areas are back to those levels.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

67 Responses to “Don’t believe calls for a quick housing bottom – Foreclosures increase as system is still clogged. Those calling for a 2011 California housing bottom are premature. 51 percent increase in REO inventory for California in latest month of data.”

I really want to believe you, Doc. But in LA, prices are most certainly not dropping. In fact they’ve been the same for about 2 years.

nah fred, there have been big cuts in westside real estate, especially in the last 12 months. Condos are down 30%+ from their peak, in the best of the best areas.

I actually put in a bid today on an investment condo, haven’t looked at market seriously for years prior to this. In fact last time I looked in the this neighborhood was 2002, because after 2002 I thought prices were nuts.

I figure its always darkest before the light, I am going to purchase one investment condo every year from now until 2015, average in the 5 purchases.

Either I will be very smart or very stupid, time will be the judge of that, lol

I like that idea, Jason. Although I’m not a fan of condos due to the CC&R’s, HOAs etc. I’d be looking at multi-family units (preferably non-rent control) as the commercial market has been simply bludgeoned, although there is a long way for it to drop still.

What part of LA WestLA? Santa Monica? Torrance? Pasadena? Compton? every area is different. And the Doc has posted price decreases in each of those cities I mentioned. I would love to know an area that is immune to price decreases.

Fred is mistaken.

I only track the premier areas: Beverly hills north of olympic / west of doheny, and Brentwood north of San Vicente.

You cannot get better condo areas than that….. that is the best LA has to offer.

And both areas are down 30% from peak. And if the best areas are down 30%, then so is the rest of the market, if not more.

La Canada Flintridge

Foster City, CA. They seem to be immune to price increases. As a matter of fact, they have INCREASED since peak.

Not all areas are down. Some areas have dropped a lot already and are now bouncing along. Rents = mortgage payments. They might be at a bottom.

San Marino is in another level it has not gone down in price! On the contrary it has increased in price since 2008, all because of foreign investors.

G

Forgive me if I’m wrong here, but I was always under the impression that the general strategy being used right now is to pad the crash with airbags made of dollars. Rather, we inflate the hell out of everything until it matches the historical norm for housing. So we might see a small decrease, but the Fed probably wouldn’t let it go past 10-20% at the most.

…which, of course, is all fine only IF wages inflate along with it. Sure, responsible savers end up a casualty in this scenario, but why should we look out for responsible people? 😉

Petrin: That’s the strategy. However, it’s not going to work. The Fed’s entire game plan for over 10 years has been to blow a bubble, and then blow another one when the previous one starts to collapse. They are towards the end of what they can do, because it’s the Bond markets that rule the Fed and interest rates; and not the other way around.

The basic problem with this “recession” (I say Depression) is that it’s not a normal business cycle. It is explicitly credit driven, and not manufacturing driven (like the previous recessions of the past 40 years). The problem is excess credit. The only way to fix that is through credit/debt destruction. It notably can’t be fixed with more credit.

It’s sort of like trying to pay your underwater mortgage using credit cards. That trick never works; excess credit can’t be fixed with more credit.

But that is what the Fed is trying to do. It hasn’t worked. It won’t work. And consequently betting that inflation is going to cure the housing mess is a very bad bet.

I hope the big picture of what’s going on helps.

Yup – mortgage rates have already popped up 24 basis point this week, now o30 year fixed is 5.05%

I think I have to agree with you, at least in my area (Camarillo, CA) prices have been flat for about 2 years. According to Zillow my house has even gone up a little since the spring of 2009. All of the reasons given why houses should continue to drop make sense to me, but…

Try selling your house and then tell us about Zillow. Unless someone at Zillow knocks on your door today with a sweet offer in their pocket, you can probably forget about what they’re saying. What makes them so smart? The only data I trust is the recently sold prices, and, a real red flag to me is an area that has hundreds of homes for sale, and none or very little in the recently sold category.

“zillow” just doesn’t represent the true statistics for the Camarillo area. We have spent the past 9 years watching this market, doing our own record keeping and Zillow has been all over the place. The real Comps information takes some real investigation, Zillows computer generated results are a joke. There are far too many hands manipulating the real world statistics. Our own realtor has been caught juggling the statistics. Buyer Beware – it pays to do your Home work!

Prices have been kept fairly stable by two things, artificially low interest rates and banks holding back foreclosures in some areas.

Interest rates are rising and just the difference between the low of several months back and the rates of now is effectively a 10% drop in the price of every home. Something like 90% of people buy with a mortgage. But they’re not really spending X thousand dollars. They’re spending Z dollars a month. That’s what they really spend, the amount that they can make in payments. So, higher interest rates make that same payment equivalent to a smaller sales price on the home they just bought.

Between more of the shadow inventory coming out into the open and even very modest rises in interest rates housing prices *will* be declining.

Yeah, this doesn’t explain why Downey and some surrounding communities have jumped by 3% in like the last month or two. . .

You cannot pay attention to price fluctuations on a month to month basis, or even compare last year to this year. The trend is downwards for the next 5 years, although there will be some dead cat bounces in certain months and years in between that will make prices look like they are heading up; but believe me when I say they are not heading up. If you invest in anything, you will understand there are dead cat bounces. Homes are now viewed as an investment and they follow the same patterns.

A fool fall down from 13th floor. On his down passing the 10th floor, he says to himself, “So far so good”. You must be his relative.

Thank you, Dr. Housing Bubble, for your insights and analyses. I’ve just recently started posting to your fine blog, and would like to share my ideas (which have appeared in some other blogs but with no response) regarding the timing of a bottom.

You can never really time the bottom because you won’t know the bottom ever occurred until prices start rising again. So, before buying again, you have to research your wants/needs and target a particular area or two. Then, wait to see two trends occur over the same period of time — let’s say 6 months to one year.

If you see prices RISING continuously for similar-type homes and, at the same time, you see the number of homes for sale DECLINING, then that probably means that the bottom has already come and gone. Yes, you may pay more then because you didn’t exactly time the bottom, but at least you would feel better knowing that things seem to be going up instead of down.

And prices are still going down — even on the desirable westside of Los Angeles County. With unemployment still high and foreclosures increasing, I agree with you, Dr. Housing Bubble, that 2011 will not be pretty.

Typically you are correct. However, following that advice would have led one to believe last fall spring and summer was proof the bottom had been seen. I read it everywhere too.

Your advice PLUS a watchful eye on what Washington and the Banks are doing is imperative.

Washington fooled a lot of people, I don’t intend on being one.

It is just absolutely silly to try to time a market bottom or a market peak. Most successful investors that I’ve heard are delighted to be within 30% of an inflection point.

Which might lead some to believe that, hey, we must be within that for the bottom now. Personally, I think that’s unlikely. There are just too many downward pressures right now. I’m waiting for after the bottom. Wake me up when there’s upward pressure.

Ditto on the thanks, Dr. H. Especially appreciate the SF Bay Area stats. People up here are in such incredible denial and think that now is the time to buy. Or at least they were last fall, until prices started slipping again.

Time security markets and timing housing markets are two completely different things that operate on completely different time scales.

I talked to my grandfather and asked him what he paid for CA houses back in the 1940s-50s. He paid 2.5-3x his yearly income back then. Today, that model still holds, but sellers are asking 4-6x yearly income. No one in this state has that kind of money anymore. All of the good-paying blue collar and white collar jobs have been sent overseas or handed over to illegals.

I hope it will not be pretty. The loan reset charts show 2011 is the peak of opt-A and ARM reset. If people already can’t afford now, how about after the interest rate reset. They can’t re-finance if they bought in 2006 with a 5-year ARM loan, because 2006 was the peak and they have no equity left. Only more people to walk away and more houses get to be dumped into the shadow. Right now the REO homes are almost all dumps. Have to wait until the condition improves.

Exactly right about the resets. 2006 was the year the frenzy peaked in LA. Lots of pretenders watching the market soar couldn’t resist jumping in with hopes of hitting the jackpot. Unless they made a huge down payment (which is now gone) those people are hopelessly underwater – especially the condo loanowners…

One must remeber Japan. After the housing bubble crashed in 1989, prices are noweher near the peak even after two decades. We also have our very own Detroit as an example of what happens when outsourcing and job loss plague the economy.

One has to wait and see how long this drags on.

In OC, late 80’s to late 1990’s prices were basically flat-to-down for 10 years.

Don’t you love it when you hear (r)ealtors say somthing along the lines of…

“It’s impossible to lose money on California Real Estate if you hold it for a long time”

DOH!

http://www.redfin.com/CA/Beverly-Hills/9586-Shirley-Ln-90210/home/6834242

lol, interesting find EconE

well spotted, was really scratching my head at this one. Maybe back in 1989 when traffic was light compared to now, and gas was super cheap, living way up in the canyon like that may have been somewhat desirable?

at first I didn’t believe that 89 price, but after checking property taxes, it seems to match up

try something similar in the flats of Beverly hills (in other words south of sunset and north of olympic) that isn’t at least 2x to 3x its 1989 price.

I think you have proven the Realtor cliche here – location location location, unless you can find another one of these gems in beverly hills flats.

Originally, the whole west coast was “Location Location Location”.

Then, as Nevada and Arizona started to crumble, California was “Location, Location, Location”.

As Sacramento, Stockton, Fresno and Modesto started to crumble, Southern California was “Location, Location, Location”

As the Inland Empire started to crumble, Coastal Southern California was “Location, Location, Location.

So what you’re saying I guess is that everything other than the flats of Beverly Hills sucks?

LOL!

Shirley Lane is actually located in the city of Los Angeles just outside the city of Beverly Hills. You’ll be in the Los Angeles Unified School District, not the Beverly Hills system, and your police will be from the LAPD — that’s if they get up to you in time. The zip code for this property indeed is 90210 but this zip covers sections of both Los Angeles AND Beverly Hills. The zip codes totally within Beverly Hills are 90211 and 90212. Buyer beware, you may not be getting the amenities and services you’d expect.

the LAPD are awesome!

I live approx 1.5 miles from a police station, and right on a main road.

My alarm company called them 5 times to tell them someone was robbing my house. LAPD got there exactly 1 hr 57 minutes after the first call.

Burglars had been gone for exactly 1 hr 48 minutes.

But the good part about this story is LAPD are always there to write me a speeding ticket.

Maybe that’s why they are RE agents and not rocket scientists!!! DOH!

If you overlay an unemployment graph of CA with a real estate price graph, you will see a VERY strong correlation between the two stats. 7% unemployment is about the neutral position. Below 7% and prices start to rise. Above 7% and prices start to fall. At 12.5%, we’re a long way from a bottom yet.

The foreclosure timeline is insane. I’d love to see it broken down by lender. In particular I’d like to see what the timeline is for the countrywide toxic garbage that was bought up by Bank of America. I had one of those loans and I’m at 26 month with no-payment no foreclosure. I’ve tried short sale, deed in lieu and straight begging and still they won’t foreclose. I might add that I know a couple of other people that are 30+ months with no payment and no foreclosure. None of us are even trying to slow down the process. On the other hand my neighbor had Wells Fargo and he was out within a year of not paying. Within about 12 houses of mine only 1 hasn’t been through the foreclosure process and there is a house that has been foreclosed on twice within 3 years. Gotta love those neighborhoods built between 2005 and 2006.

Dr,

What is your take on New California bill to pay distressed homeowners $3000 a month, and up to $15000 to help them cover back pays?

It seems to be another ploy to put more money in bankers’ pocket.

This is outrageous. Just read about this news:

http://articles.latimes.com/2011/feb/10/business/la-fi-keep-your-home-20110210

The fund is from the federal gov. Why aren’t we not surprised? Secret bailout one after another. It says banks are reluctant to participate. How could they not to? According to the article, the gov. is going to match dollar by dollar on the principle deduction. How sick can this be? You know they paid their way to get the gov. to do this in Washington. But they had to play this little game and pretend they are forced into it, like it is against their interest.

Remember that interest rates can only go up and in this full income documentation loan origination environment that means prices must come down because people can’t just plug in a higher fake income number on their loan application to compensate. Those days are gone.

When rates go up prices must come down. I think there’s another 20% on the downside. In 2005 I told everyone who would listen there would be a 40% pull back from the highs due to the massive number of unqualified buyers being allowed to purchase homes. Now I think that was too optimistic. The pendulum will ultimately swing just as furiously to the downside as it did to the upside despite the government meddling that head faked hundreds of thousands more into plywood prisons.

Fellow Sufferers,

It is difficult to see housing prices even recovering to a long-term trend-adjusted ‘normal’ anytime soon, much less to the ‘bubble’ levels of recent years, until the macro economic conditions in the U.S. return to normal levels. Unemployment over 9% (and ‘underemployment’ over 19%) are antithetical to a robust housing market. Ditto for salaries/wages, which are essentially flat year-over-year unless you work on Wall Street. And the stock crash of 2008 wiped out trillions of dollars of family savings that have not been replaced by the recent market rally because this rally is mostly HFT-driven algorithmic trading and ‘dark pool’ trading done by the big Wall Street houses and hedge funds. Money actually invested the old fashioned way by humans has been flowing away from stocks almost continuously for 2 years. And, of course, banks have dramatically tightened lending standards (at least where I live) and forced banks to use appraisal methodologies that are borderline insane, especially with respect to conflict-of-interest provisions. And if all of this isn’t bad enough, we are also probably going to experience in a few years the same economic ‘stagflation’ we suffered thru in the late 70’s/early80’s after Fed Chairman Arthur Burns dramatically expanded the money supply and Fed debt, just as Bernanke and the Fed are now in the midst of doing.

Cheers,

Fast Eddie

Funny contrary to what one hears about the huge inventory of REOs, in the area I am interested to buy I have only encountered two REOs for the last year and half. Granted it’s an affluent suburb of San Diego but still… where are they all hiding or who is hiding them? Maybe there aren’t as many REOs as one is made to believe.

Go to realtytrac.com and map the zip code(s) you are interested in. You will get the numbers in those zip codes as to how many Notices of Defaults have been filed, NTS/Auctions set, and also REOs/Foreclosures. A LOT more than what’s actually on the market, that’s for damn sure.

Thank you. I will try that and be amazed perhaps.

People in Ca. although concerned, have a really hard time believing the facts, like Doc. has shown here. The only saving grace is the fact that almost 80% of the Population still think that owning a home is the best Investment that you can make. If and when lenders ease up on making loans. Buyers will come out of the woodwork, like you’ve never seen before. Of course my crystal ball is still a little cloudy as to when that will occur.

Excellent Point Questor: “There are just too many downward pressures right now.” Exactly. These fools calling a housing bottom seem to be clueless. There are just too many forces pulling prices downward. That, plus the fact that the housing bubble greatly inflated prices beyond what was reasonable/affordable.

Plus, it’s human nature that home sellers are greedy and want to get as much for their homes as possible, even if their asking prices are unrealistic. Sometimes, it is good to have a healthy sense of reality when it comes to selling a home.

Here’s a sad (but true) story! About 9 moths ago in California, I went to look at a house for sale. The real estate lady there was a very sweet elderly lady who was very kind and professional. Both she and her husband were real estate professionals. She told me of a house that she had in a big city in California that she was about to lose to the bank. They had the house for sale for a couple years and kept “chasing the market downwards.” It seems they were too unrealistic about their asking price. When all was said and done, they were going to lose the house! She told me “that is why I’m still working” and “that house was a big part of my and my husband’s retirement.”

I was flabbargasted then, and still am, by this story. How could two people who had long careers in real estate be outsmarted by a falling market and by their own greed? And she was so sweet! Had they priced their home attractively, they would have done well, but in not doing so, they lost everything!

Sad but ILLUSTRATIVE story… which reminds me of a particularly useful stat, which I haven’t seen since probably 1999, provided by some subscription RE data service here in So-Fla, which was basically the “guaranteed to sell in 45 days or less” price, aka the “fire sale” price, and THAT is what the sad/clueless need to key on, to avoid chasing the market down, esp. when you HAVE to sell (retirement, moving to better/solid job, etc.)…

I mean CRIKEY, if your house is on the internet (Zillow, Redfin, MLS), and you don’t get a single bona fide offer, even lowball, in 30 days, then DISCOUNT AGGRESSIVELY because you’re essentially priced outside the market… STOP listening to the soothing BS from Realtards. Pre-qual’d buyers w/ real down payments ARE the market. All else is wishing, denial, and fiction. Get your knife falling early, before the downpour.

The amount of Fed and Government intervention is disgusting. They do anything they can do reward the irresponsible while price fixing to ensure that those that actually pay their bills do so at artificial high prices.

Does anybody else find it ironic that the announcement that CA will subsidize $3,000 per month towards the home mortgage for unemployed came the same day Geithner et al bullshitted around about getting the Government out of the housing finance market…

cannot wait until the day the USD is no longer accepted in international trade. That will be the only way Americans will have to learn their lessons. Not wishing anybody anything bad but it’s pathetic how the irresponsible continue to get rewarded by those interventionist policies.

If the Government had not stepped in and “helped” with the housing issues, I think this would have been a 5 to 7 year event. But with the Government “helping”, I don’t see this being anything short of a 10 to 15 year event.

We are already three to four years into this event, and I too agree we are still a long way from seeing the bottom in terms of time and dollars. My guess, another 7 years and 20 to 30 % drop in price from these level, on average… again keepig in mind that real estate is local.

well people, after applying for a mortgage in 2011 (my last few purchases were all prior to 2005), I can safely say this market is going much lower.

it is unbelievable how strict the loan writers have become.

they are doing it by the book, with zero wiggle room, actually zero common sense.

Very few people are going to qualify for mortgages, the pool of buyers has shrunk hugely.

Therefore prices will go lower.

Noticed that too.

In 1999, with in assets we bought a house, financing 200K, but were told we could get up to 400K if we wanted, but we were much too conservative for that. And, I DID NOT Have A JOB!

Fast Forward. We have been looking recently so got prequalified. We both have jobs, 1 million in assets, but because of our actual work income, qualify for only a 150K mortgage.

Not a problem since we will be looking to pay cash when the time comes but others aren’t quite as lucky as I am. ( I only wanted to finance a portion because I think 4.5 for 30 years is a giveaway.)

And, I will not spend 500K for a house until I can get EVERYTHING I want for that price, not some fixer dump in the barrio.

Exactly. They don’t care at all anymore. they are doing it by the book.

your debt/income ratio cannot be over 45% and you need 20% down.

So basically, to buy a $620 000 home you need very little monthly debt, $120 000 down, and to be earning $150 000+ per annum

A $75 000 single earner family can now only afford $310 000 home with $60 000 down.

how many people really meet these qualifications, for an expensive area like Los Angeles?

I was buying a house in 2003 in LA.

I called a broker who I heard was good in NY. I gave him my name, not even my social security number. He sent a letter of approval for an up to $2 million dollar purchase to my Realtor and the sellers Realtors – with only my name, no social security or address even, no job details, no tax return, no credit check.

I used that letter to buy a house for 1.7 million dollars with 5% down.

now thats what im talking about! the good old days.

Well, my fixer dump in the barrio is only worth about $200k, and that’s coming from zillow. Plus, it’s a duplex. So don’t worry–you won’t have to spend $500k for some fixer dump in the barrio.

What you should worry about is how much rent you are wasting vs. your RE war chest while you savor the weakness of the real estate market.

Yes, I know rents are low these days–and maintenance standards are as well, accordingly, along with quality of life.

What we in my Borrego Springs barrio do have to recommnend for you is a fully permitted, wheels-on trailer house sitting on a fully legal 25′ frontage lot in the Imperial County metropolitan area of Niland/Calipatria, which will undoubtedly have EVERYTHING you want–for only $500k. Special deal for you!! 🙂

The Fed ‘QE-buying bonds at the auction’ would be any sane person’s idea of the end of the Super Ponzi Scheme of the last 50 years, but now it just rolls around like some normal financial strategy. Is it just me, or are things so insane right now that it is not possible to be troubled any more, or perhaps things are so troubling we have all gone insane and that’s the new normal. I’m sure there are lot’s of folks just waiting for housing to hit some pre-determined target and then jump in.

I agree that 2011 will look like the bottom to 2010, and the good old days in 2012.

BOTTOM! SCHMOTTOM!—–Globally magnetic north has shifted towards Alaska this year; the only BOTTOM we’ll be seeing is the Pacific sea bed and the tectonic plates by DECEMBER 2012!!!

If prices dropped in Arcadia or Temple City, I would be very impressed!

Ewww, I wouldn’t live in either of those cities.

I live on a small street, one side along a golf course the other not and a quick realitytrac check shows my next door neighbor hasn’t maid a payment since 8/2008 and is now just going to auction with over 1.4 million in loans, four houses away another is in “pre-foreclosure” with over 1 million in loans and a 3rd is in foreclosure with only about 800k in loans. That’s three houses out of 24 on the street that “show up”. How many others have stopped paying with no NOD filed yet? The mid to upper tier is about to explode!! Just keep renting and beeee patient.

I think you also have to take a look at demographics. Younger people encumbered with debt aren’t forming families with the same frequency as previous generations. The need for housing will not be as great. This happened to my old neighborhood in central CA. My old ‘hood was filled with kids, now, they are closing schools because enrollments are down. The neighborhood is all old people now and it’s really hard for me to imagine that thousands of homes of that size will be needed in the next 5-10 years as the older folks move on from those homes. But I see this all over the place. The neighborhood I used to live in LA – filled with older couples. When this huge inventory is unloaded onto the market, I doubt the younger set will have the #’s or $ to absorb this inventory.

Doc, id sure like to see a blog on Asian buyers in So Cal. The cities they have selected to immigrate to (most notably Arcadia and San Marino) seem to be immune to price drops. I sold my house in Arcadia in late 2004 for $840K and it recently re-sold at $1.1M. Is there a sub-current going on here?

Absolutely there is a sub-current going on. There are people from China paying all cash for houses in Arcadia and San Marino. That’s keeping the prices up for sure…I want to see some analysis on the effect of foreign money coming in and buying up our properties.

You you really want to fix housing????? Cut property taxes in half!!!!!!!

Are you retarded??!!

The housing collapse was coming with or without liar loans. The liar loans just made it worse. What we are all experiencing is a population collapse. A normal population growth would be shaped like an Xmas tree with ever greater numbers each year. Instead, the US population is shaped like Marilyn Monroe. The head (those 65+) = 45 million; the chest (boomers) = 79 million; the waist (Gen X) = 53 million; the hips (Gen Y) = 81 million. Boomer ‘demand’ drove the greatest expansion the world has seen, now we have the ‘great collapse’ into Gen X demand.

Bear in mind that the peak age for sales of housing, cars, and potato chips is 47 after which sales will decline, ever more so as you approach retirement. Of the 27% of homeowners ‘underwater’ on their loans I assume the majority are Gen Xers.

Do you want me to start on the fact that all SS and Medicare funds have been spent (Treasury IOUs–are only an ‘investment’ the holder, not the maker) and must now be borrowed to pay promised benefits. Arrrghhhh…

So 53 million strapped Gen Xers must pay to get the boomers to the end of life while finding a way to support 81 million students in the Gen Y. Good luck with that…

Thank you, CJ. Demographics are something folks just don’t want to face. Not only are the Gen Xers strapped, but I’ve been wondering how all the Baby Boomers with homes who are beginning to retire in droves now are going to sell them to the smaller in number Gen Xers behind them. The first Baby Boomers are just turning 65 this year, and, yes, some have already retired and downsized (those who were lucky to get out several years back), but there are still a lot more in the pipeline and who’s going to buy all these houses? For instance, you hear about cold-weather snowbirds who would like to leave their northern states for Florida, Arizona, So. California, etc. But how are they going to sell their homes in Detroit, Cleveland, etc? And for Angelenos who want to downsize and move, let’s say, to Palm Springs, who’s going to buy their homes? Somebody will eventually but the prices will have to come down more.

Perhaps there are fewer of us Gen Xers than Baby Boomers, but I have a feeling the future is all about divorce and singlehood and just plain living alone–so we may have fewer multi-person households and thus a need for more dwellings. As someone pointed out to me the other day, in this way, divorce is good for our economy & our country!

As always, an excellent analysis. But there is a sucker born every second, some people will never believe in laws of gravity, much less the your analysis. But don’t let them discourage you, keep posting your brilliant work.

Thank you HB.

Leave a Reply