The Good, the Bad, and the Ugly aspects of the American housing market: Key indicators of the 2013 real estate market.

The US housing market is massive. You would expect this from a nation of 315,000,000+ people spanning over 50 states. So it is important to understand the various dynamics occurring over many states. In regards to single family home buyers, in most of the United States home prices are very reasonable. This is hard for some in the coastal regions to digest or even comprehend. When you look at certain markets in high priced areas, many people have a hard time penciling out the financial details. Yet with such a large number of investors purchasing with cash, a new market has been created. But if we are to take the US market and make a wide-eyed observation, we will find some good, bad, and ugly aspects of the current housing market. Whereas in 2008 through 2010, the market was dominated by the bad, ugly, and grotesque. What can we say about the current US housing market?

The Good

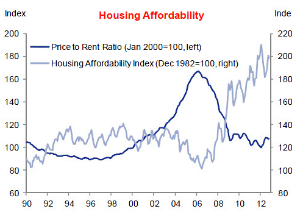

One good aspect of the market is overall, affordability is back in line to historical trends:

Price-to-rent ratios are back in line in many parts of the country. In fact, this is the big push from the all cash buyers in places like Arizona, Nevada, and Florida. The one thing I would be cautious about is in places like Arizona, you have over 50 percent of buyers coming from the investment bunch and when you look at rental prices, they are weak and vacancies are very common. But with such a high number of investors buying, you basically have investors selling to other investors thinking they will produce higher yields.  However, for non-investors in most US markets prices are now affordable thanks to the big drop in prices but also the Fed’s tantalizingly low interest rates. Sure, the Fed’s balance sheet is well over $3 trillion but that is an issue for another day.

If you follow the mainstream press and use this as a barometer of what most Americans see as their primary source of information, then the Federal Reserve might as well be nuclear physics because it is never discussed or even explained. So most people are driven by the monthly nut psychology. Low rates have boosted affordability dramatically. Americans are horrible savers. Something like 50 percent of Americans do not have a retirement account.

I was having a conversation with someone and their mentality is similar to many coastal folks. “Good luck finding a property in the US for less than $300,000 in a safe area!â€Â Of course, it is hard for some to understand that in many states, homes can be had for $100,000 in good areas and a $200,000 home will buy you a very nice spot. Heck, even in the Inland Empire in California you can find a great place for $300,000. Of course this person is obsessed with buying in prime Pasadena so good luck on that one when you have limited inventory and many other clones with similar thinking.

The Bad

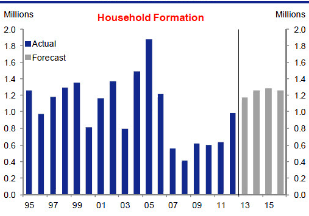

While not as good as it should be, household formation is now picking back up:

Funny how in 2005 when all you needed was a pulse for credit, household formation was up to a blistering 1.8 million per year. The crash brought on the “move in with mom, dad, or friends†trend and you can see this in 2008 where household formation was at a stunningly low 400,000. This is also another reason why the housing market is now picking up nationwide. From 2011 to 2012 household formation went from around 600,000 to a healthier 1,000,000. That is a big jump.

The one element I see getting in the way of this is the massive student debt in the market now above $1 trillion. Many younger Americans are still financially strapped so it is hard to see this improving anytime soon. Although we are nowhere close to the boom days, household formation does seem to be on an upward trend and this is a positive for housing in general.

The Ugly

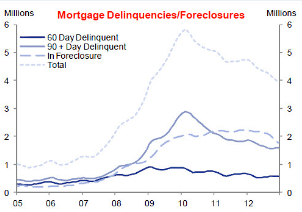

The housing market is still a mess when it comes to distressed properties:

Over 5,000,000+ Americans are in one of the following:

1,927,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

1,483,000 properties that are 90 or more days delinquent, but not in foreclosure.

1,694,000 loans in foreclosure process.

The market is full of bad loans but the number is going down. Many investors buying in bulk have connections that allow them to purchase many of these properties at auction before they even hit the MLS for the regular Joe and Jane. So the low inventory is simply a manifestation of banks leaking out properties at their own pace and to select individuals.

In most parts of the US, the housing market is fairly normal based on price and financing options. However, in places like California good luck buying a home when many in the industry think prices will keep going up and bidding wars are now fairly common. Get your PowerPoint presentation ready and your heart wrenching story (and wallet out) to make a bid in many prime markets. California is a boom and bust market and we’re currently in the boom phase. It is interesting how many e-mails I get where the person is actually sad and emotionally troubled that they got out bid on an $800,000 or even $1,000,000 home. Obviously you can only get so much from an e-mail but some people seem miserable because they can’t spend $1 million on a home! I got an e-mail like this from someone in San Francisco. You know what my recommendation was? Go ahead and buy because you seem absolutely miserable!

For most Americans, the decision to buy is fairly simple in today’s market. In other markets, there are definite manic like behaviors. We’re seeing some mania in California. Buying a home is a big decision yet some are willing to drop $700,000 (i.e., finance 80+ percent of the purchase) and treat this as if they were buying a car. Buying a home is a 30 year commitment for most. Many sell within 7 to 10 years but that is assuming prices keep going up. Some that bought in 2005 are still underwater today (8 years later). You want to know what was going on 30 years ago? Ronald Reagan was President, we were in the Cold War, The Red Hot Chili Peppers launched their first self-titled album, and a fixed rate mortgage was 13.4 percent.

There are good, bad, and ugly things in today’s housing market. The scope of each of these really depends on where you live in the US.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

56 Responses to “The Good, the Bad, and the Ugly aspects of the American housing market: Key indicators of the 2013 real estate market.”

gold has just gotten crushed. real estate is going to follow right behind it. MASSIVELY. i recommend buying a castle in Bavaria. That nation is actually running a surplus, has low unemployment, is annihilated all its neighbors so it has an infinitely cheap pool of skilled labor to cherry pick from…and still can destroy the value of “the general currency” by simply going back to the D-mark thus restoring competitiveness. they won’t have any problem “finding new bankers” either once they’ve done it. the USA on the other hand might be heading for the Zombie Apocalypse this time.

We are heading into a serious Deflationary Depression by the looks of the St Louis Fed April numbers which show a negative interest rate in the inflation protected bonds. Scariest chart I’ve seen since 2009. I would not buy ANYTHING right now since the chances are it’s going to get much much cheaper very soon as deflation sinks in deeper and we see lower prices, more job losses, and so on.

We’ve been on the sidelines since 2008. And I still feel uneasy about the housing market. I hear so much about how housing prices have bottomed and that prices are on the rise. So what? That doesn’t mean anything to me while interest rates continue to creep lower. I don’t think we can see the real value of a house until interest rates are at a normal level. And savers can again be rewarded for saving their money. I”VE Been looking at houses for sale on line. The mortgage calculator can say a house is worth $X at 3.5% interest. But if you raise the interest rate to 6%, the price of that house would have to come down significantly to match the same mortgage payment. Maybe I’m wrong, but this economy looks to me like it’s hanging on a thread. They need low interest rates to give the illusion that housing prices are rising. I’m assuming part of that is to support local governments in keeping housing taxes elevated. And also to prevent banks from being crushed again by a slew of new forclosures. We did just pay cash for a small rental. But on the one hand, I feel okay about doing that to put my money in a variety of investments –in case the banks do crash a few years down the line and we risk losing our money through a Cyrus style money grab. Thoughts anyone?

GD,

Fear not. Helicopter Ben I’m sure has more tricks up his sleeve… or not.

Karen there really is no true value on a home. It’s whatever people want to pay for it at the time of purchase. Having said that we don’t know when rates will go back to ‘normal.’ Low rates are not just for property taxes and potential foreclosures. Such rates also involve keeping in inventory values propped up so banks don’t get crushed on property value losses. Furthermore the rates are tied to the loan rates by which banks can borrow money to invest or loan out to people. The fed wants to keep Thx rates low until we reach a level of economic prosperity. That may not come for a long time. Until then you will have to either stay on the sidelines or bite the bullet on one of the many troughs that will occur in the market over the next few years (or decades). It’s up to you to determine whether your finances will ultimately support what really is an emotional investment and not so much a financial one. Times have changed. It’s time to think differently about what a home is really worth

I think it’s time for the regular people to take something back from these BANKSTERS. We should organize the homeless…people who have lost their jobs and need someplace to live.

All those empty homes that the banks refuse to put on the market, we teach the homeless how to do ADVERSE POSSESSION. California law provides allowances to legally do this. That will make the banks heads spin and help people who need help with at least a temporary place to live.

To successfully claim adverse possession, a squatter must occupy the land for an extended duration, which means that the land is essentially unused by the original landowner, and thus is being put to productive use, rather than sitting ignored.

Read more: Squatter’s Rights in California | eHow.com http://www.ehow.com/list_6822316_squatter_s-rights-california.html#ixzz2QVPRuHmH

Someone needs to make an app for that. And a TV show to go with it. Maybe it would get all that Canadian content off HGTV 😀

http://www.youtube.com/watch?v=7qi5d_1uodI

http://www.youtube.com/watch?v=N3OPfTlEEsw

There are news reports on people trying AP on homes stuck in foreclosure or abandoned, etc., secondary to the housing bubble. What usually happens is that neighbors get pissed off at some freeloader coming in (especially in neighborhoods where six figure salaries are common, and the person trying to take possession is not a high earner). Police are called. Banks find out, and kick the trespassers out. It doesn’t workout.

I am in the belly of the beast here in northern california. This mania is getting ahead of itself. Too much too fast. Investor selling to the next investor mainly, with a poor innocent sap in the mix who really wants a house to live in. This current round can’t have too much more room to run. As long as the fed punchbowl is flowing it probably will not collapse but shoud backfill soon. Banks still have plenty of inventory, but are holding back. Found several vacant houses sitting around for over a year, researched the property, found the lenders who own the properties, but they refuse to sell. That is part of the inventory problem, along with many homeowners underwater, and those who could not qualify for a new loan if they sold the home they are in. This is the new normal.

Here’s a question.

Aren’t you people outraged that banks are holding homes off the market like some sadistic game of keep-away?

I see Mr. Jimmy above pursued bank-owned property and they refused to put it on the market. Homes fall into the Big 3 category of “food, clothing and shelter.” Housing is a life-essential and the banks think its okay to play games with it hoping they can manipulate the market and force us to pay more for it than market dynamics dictate. ISN’T THIS WHAT ENRON DID WITH ELECTRICITY?

The American Public is behaving like a baby-harp seal in Canada; innocently waiting for the spike to turn them into something pretty to wear. Where’s the outrage?

Why do we not have emergency legislation to force any federally-related institution holding foreclosed residential property to sell that property back into the marketplace within 12 months of acquisition and giving owner-occupants purchasing priority – like with FHA repos; especially in markets that have low inventory levels?

Why can’t we find one representative to sponsor that bill and then pressure the hell out of the others to make it law. We are paying artificially high prices for housing. Are the banks better citizens than we are? Why are they the protected class of citizens? Why are their civil rights greater than ours? No more selling massive blocks of our homes to their insider-friends in their effort to never let a crisis go to waste.

Clearly, there was a coup in this country in August of 2008. What did Paulsen tell congress? Oh yeah, bail these guys out or it’s martial law. If those aren’t the words of a terrorist I need to repeat English class. Rise Up!

what you have just relayed is exactly what I believe, and why none of our representatives have done anything about it, tells me they are all in on it. and corrupt and they don’t want to stop the gravy train. vote them all out, and keep voting them all out. until they do right by the people their supposed to represent.

I’m angry, you’re angry and my hunch is that most folks trying to buy at angry. However, current homeowners watching their homes rise, artificial or not, may think otherwise. I woudnt be so shocked the govt is choosing current homeowners (who are likely wealthier than renters), especially when wages are down and we live in a consumption society, over renters. Savers eating a big bowl of sht right now. Plus the govt is suppressing gold prices (with the help of banks) so its buy some overpriced stocks, houses (or a car backed by the govt) or feel the slow burn of money printing to your bank account. No offense, but f everyone who buys stuff they cant afford and f the govt for incentivizing it. Weird that the values my mom taught me of saving, do onto others, personal responsibility and the golden rule, no longer seem to be the way to get ahead in the US.

Whaddy Think:

Right you are. Reason for such complacency, IMHO, is the “Bread and Circuses” effect.

@FTB: I’m a homeowner yet I’m angry. I’m very happy with my home I bought it at the bottom. I’m angry because I lost a decade waiting to buy this home , watching the deadbeats around me live like kings on vapor appreciation and HELOC and seeing those same deadbeats live mortgage free for years after deciding not to pay and then seeing those deadbeats re-buy those homes after shoring up enough cash (while living mortgage free) to outbid honest people who’ve been waiting to buy. Sick to my stomach.

I feel your outrage, and agree with your assessment.

I think 2008 is not the right year; it’s just the year in which we learned who Congress REALLY represents. The problems started in 1999 when some congresscritters were bought out by the banks and passed legislation to repeal Glass-Stegal.

We don’t live in a Democracy. At the national level, Congress is (and has been) for sale for a very long time; they’ve just been emboldened in their whoring because the average American is more interested in their gun, pot and Jesus to give a rat’s ass about the governance of the country. If you want change, buy a congressman.

Trying to buy a home in southern California for more than 3 months… a nightmare. Why? well.. simple: banks are holding back inventory to artificially manipulate the market and give the illusion that is going up. Now.. are banks really driving the prices up? NOT REALLY, at least not directly, they are letting us (regular buyers) fight like dogs while they watch and have fun!

Quick example: I bid for a condo that was listed at $260K, getting into a bid war in which the highest bidder offered $289K, that is $30K over the listing price!!!

The appraisal came down to $265K!!!!, meaning the bank will not lend you more than that for that property… What happened next? Did they negotiate the price? NO.. they won’t negotiate, they want the difference in cash. Of course, the deal fell out of escrow in the next 3 weeks, that was the logical thing to happen, the buyer backed up. What did the seller did next? They put back the property on sale at $289K, and they are very clear: THEY DO NOT ACCEPT LESS THAN THAT!! That is not the only time I have seen this to happen, it is happening daily, it’s the new “normal”.

Isn’t that an artificially and unethical way to drive the prices up? Is this a real housing bubble like some “experts” say? NOT at all. It won’t last more thane one year more. Our economy simply can not sustain it.

I suggest regular buyers that are already pre-approved and have the buying power, have patience and wait a little.

Let’s not be part of this game they want to play with us. it’s not a good investment to buy at those prices because they won’t really keep going up!

Bora Horza Gobochul: “We don’t live in a Democracy. At the national level, Congress is (and has been) for sale for a very long time; they’ve just been emboldened in their whoring because the average American is more interested in their gun, pot and Jesus to give a rat’s ass about the governance of the country. If you want change, buy a congressman.”

Perfect analysis! Well said!

Gold crushed all the way down to $1477/oz (price on APMEX today). Heck, my big screw up was telling my Wife to sell half of her gold coins back in 2007 for about $725/oz. I should’ve told her to sell half (or more) of her stocks.

Gold prices are based on worldwide demand, which is heavily weighted towards China and India, not the United States. When China and India have surplus dollars, they may spend them on gold or they may spend them on better food or cars or apartments. Some with dollars may even spend them on California Real Estate!

German real estate hasn’t always done well (it got crushed in WW II). But in the 1920s it was the basis of the nation climbing out of the hole that hyperinflation put it into. I don’t speak much German, so I think I’d rather have a castle in Corona Del Mar.

I agree with Dr Bubble that RE is definitely local, and that there are good, bad and ugly things in the RE market in the US. The same could be said of the stock market, the bond market, the currency market, the commodities market and the European Union.

Almost 2M homes have gone into the “30 to 90” days delinquent bucket?!?!

So, in the last 3 months approximately 2M households stopped paying their mortgage?

Finally, some data that seems in line with a work force participation rate at 1980 levels.

At least the stock market is making new highs. So everyone feels wealthier. Riiiigghhhht.

How many of those are houses that have been in the pipeline for years already? My understanding is that some of the worst can-kicking involves restarting the foreclosure process over again so as to avoid actual repossession.

“Pipeline”? These are mortgages that have been kept current in their payment up until 3 months ago. At least that’s how I understand it. Again, ~2M mortgages have just started down the path of default. That’s a pretty hefty hit for a 3 month period. And watch out if this is indicative of what may happen for the next 3 quarters of 2013!!!

@Windy City

You are correct. Delinquent payers apply for the mortgage modification program, get accepted then eventually redefault. Basically, these programs are a joke. Like you said, it’s kicking the can down the road. Almost everyone who goes into the mortgage mod program will eventually redefault.

This in effect is one reason why inventory is abysmally low in California, which is helping to fuel the current bubble in California home prices.

Oh, I see. Basically these mortgages have been in govt stall mode for years and are now back into the default system. Not new at all. Just regurgitated, kinda like most of the US economy.

The recent run-up in So Cal has flipped the rent vs buy affordability in a lot of zip codes. In less than 6 months, the flood of rentals and bidding wars on the for-sales is making is cheaper to rent again. Tack on the increase and permanency of FHA premiums and renting gets more attractive n the short term.

What does all of this mean? I have given up trying to guess…

I am a REALTOR here in California. It is really sad to see that regular home owners are getting out bidded by cash investor buyers. Some of these cash buyers have 30 million plus in their accounts for purchase and are buying at above market value. Also, the banks are holding property back. I go door knocking and see so many homes vacant. I talk to neighobrs to find out what is going on with the vacant homes and they tell us that some have been vacant 2-3 years. These homes don’t show in Foreclosure lists and bank is not on title. We have located some home owners for those vacant homes and they tell us, they got foreclosed on.

Prices are going up fast due to lack of inventory, but it is not going up because of regular consumers, they are going up by hedge fund investors. Builders are starting to build new homes and investors are competing with normal buyers. This housing market is controlled and manipulated by the stock market. In the meantime, can investors make money in California, yes, but it is hard to find a property. I placed a home for sale at $169,900 and sold it $20,000 abvoe to a investor, got 25 cash offers in 3 days.

Maybe housing is in recovery in California, but we need to get a hold of inflation. Just my 2 cents on this market. Since, I am in the field knocking doors and working with buyers.

If the fair market value is the price at which the property would change hands, between a willing buyer and a willing seller, then I think that the cash buyers are setting the true value of a property. It seems to be the purest form of transaction, without the influence of artificially set interest rates or opinions of appraisers.

You had expressed the definition of fair market value, that is true, that is always in play in every real estate transaction. But the question is why was this not in play in 2008 and 2009. I was selling 100 REO properties a year and there were investors wanting to buy, but not willing to pay $20,000 above list price, instead they were low balling properties. And, 2008 was just as a crazy market then as it is now. About 95% of all my REO properties that I had listed got mulitple offers.

Nothing like free money from the Fed. Basically, watch where it starts to go and get on its heels. Because, once they start buying, they have little to hold them back.

And once they start selling, it’s the same in reverse.

We are all human, emotional, and irrational. There is no such thing as fair market value. 2008-2009 was the time to buy when there are many sellers. This is the time to sell when there are many buyers. That’s market. But We do the opposite. We buy when everyone is buying, and we sell when everyone is selling.

The price that a willing seller sells to a willing buyer it is the market value, yes. But that does not mean it is the FAIR market value, big difference. And not because of the opinion of an appraiser, it is because the conditions in which the transaction were done are manipulated previously with an artificial “lack of inventory” in order to produce that response.

If the concept of a “fair market value” is that in which the price goes out of the reach of the one who needs shelter and is qualified to buy it, to go to the hands of the one who just wants to make money out of it, then it just becomes market value, not fair market value.

Wait a minute, Paul A. You left out the fact that supply is being constrained.

Your analysis is inaccurate. Try again.

Basically, what you are witnessing is the Federal Reserve blowing another bubble. By working to suppress interest rates, this causes investment funds (hedge funds, mutual funds, pension funds, etc.) to chase after yields.

Since there are zero yields in CD’s, money market, treasury bills and bonds, this is causing those investment funds to chase after real estate. Hence, we get the Federal Reserve blowing the 2nd bubble in real estate in less than 12 years. Like every other bubble the Federal Reserve has created, this will end even worse than the one before it.

Not specifically to ernst but in general –

Look, the whole reason all of this is going on and they are working this hard is because housing values are the American consumer’s (70% of the largest economy on the planet) largest store of wealth and have a levered effect on their balance sheets (i.e. financed with debt so feels great when it goes up and doom when it goes down). A real housing market such as what we have known in our lives isn’t in the cards right now. They are trying to hold values up and if you look at 2007-2009 you see what happened. There’s just not enough money and organic demand to hold it.

So what was done. Pancake interest rates. Right there you turn a given monthly payment from a $300K house to a $500K house. Now allow the banks to mark their assets to wherever and not realize losses, this stabilizes their balance sheets and allows them to take losses over a longer period of time. Then remove strict timelines on divesting properties and let the system move as slow as possible on defaults and delinquencies. This restricts supply and provides a giant cash bonus to those sitting in homes and not having to pay their mortgage (for the bad luck bunch okay but for the financial gamblers this is horrendous moral hazard indulgence). Now let the Fed finance bulk purchases via institutions as even with all of that and managed supply, incomes and balance sheets are just too ugly to take on more real estate debt from organic US based buyers (see baby boomers not pouncing on Florida properties for example).

The is massive market manipulation. Any other time and housing would be up 40-50% over 2 years (conjecture but probably not out of the realm as interest rates are nearly cut in half alone). The fact that it’s not massively up ought to be evidence of how rough it is. Hell even non-epicenter states have 2-3 year foreclosure timelines…really, like we couldn’t have solved or streamlined the judicial process in some states if we wanted too? Very simply, they feel that they need to hold this up and it is taking everything to do it.

Just look at post-war recovery charts vs. the 2008 to present record (everyone has seen these by now). It’s the worst recovery on record. That said, the amount of stimulus and firepower thrown at this one dwarfs by many magnitudes all the others on that chart and this one still sucks. What does that tell you? When combined with central bank activity (not their words), it tells you they continue to fight a battle against what they perceive as a potentially massive deflationary spiral (aka depression). End game…no idea, but life is moving on so far. Uncharted waters, just don’t mistake today’s “market” for any market you’ve ever known.

To summarize:

1. Affordability at a low point, about in line with historical averages, but going up.

2. Household formation which was previously at historical lows, but trending up.

3. Distressed properties very high, but trending down. Foreclosure starts lowest since 2006 in CA and trending down as well.

3a. Shadow inventory is really fading. Whatever impact distressed sales have had on the market the last few years, it’s getting smaller.

From 1/2013 Dataquick news feed: “While 1.1 million of California’s 8.7 million houses and condos have been involved in a foreclosure proceeding the past five years, 780,000 – less than ten percent, were actually lost to foreclosure. The other 320,000 were either sold, or the payments brought current.”

Realizing that some folks here from CA get quite annoyed when others come on and extol the virtues of moving to their much lower – cost – of – living states, nevertheless these recent data points seem instructive for much of CA right now:

http://www.forbes.com/sites/daviddavenport/2013/04/11/as-jerry-brown-touts-california-in-china-its-citizens-pack-their-bags/

You see similar demographic nightmare scenarios for many states with CA’s economic and taxation policies – in spite of great weather and the beaches, demography is ultimately destiny, and so far the future doesn’t look too swell right now for CA.

How many of those other states, that you’ve assessed, are equivalent to the 8th largest economy in the entire world? None. Therefore, your assessment is completely full of sh1t.

Thank you for your reasoned and logical response – no doubt the editors at Forbes would welcome an intellectual discussion pertaining to the points you’ve made. Please start a correspondence with them and let us know their response.

Additionally, “I” didn’t assess anything, the author of the article linked to did – did you even bother to read the article before opening your blowhole?

If California has the world’s eight largest economy, Texas has the tenth largest.

I truly think most people don’t care about what’s going on in the state. They care about what happens in their life, and when a Black Swan event occurs (in their life), they leave.

I mean, it’s pretty simple. My example, for example, was recruitment out of college. As long as I’m paid, fine. No job? No more CA. This has already been demonstrated by others at my Fortune 100 co. as massive layoffs have dominated the last few years. The co has made it clear downsizing in CA is here to stay, so some people did end up finding jobs here but most left.

“In other markets, there are definite manic like behaviors. We’re seeing some mania in California.” Yes, outside of California and a few other unmentioned areas, California is looked at as being full of crazy people. No argument from most of the country on this one.

Housing has become like diamonds! It’s the way, I forget what country, they used land to back thier currency. Its being done now with homes in the usa and will eventually become our backing to the usd! for what i think.

The Germans used land to back the currency after the Weimar hyperinflation blow-up the previous currency.

People look to buy in coastal regions and expensive areas because thats where the work is. If there were more good paying jobs in affordable areas buyers would flood those areas. And home prices once affordable would become out of reach.

The price of gas and time involved in commuting needs to be figured in as well.

Prices are crazy in Los Angeles and it certainly resembles boom times. Keep seeing ads for ARMs. During the boom before 2008 I remember hearing almost every week about some friend or co worker’s story of their new home purchase. Don’t hear those stories now though.

Gael,

Always glad to see you on here. I feel the same way. There are lot’s of job in Baltimore, MD. But would you want to live there? I’m not so sure.

I just found a part of the country that I love. I can afford it. I got the “Burger King” mortgage last week and we move into our house this weekend. First time buyers. I figured if I want the So Cal life, I could always visit. But, what I want is the day to day everyday life.

Do I want to sit in 2 hours of traffic each way to work?

Do I want to learn another language?

Do I want to wait 30 minutes to buy something in a grocerty store?

No thanks! I did that down South and it got me no where. I’ll stay put.

Another market manipulation factor that may keep inventory low – Obamas HARP ReFi program extended 2 more years.

More than 2.2 million borrowers with little or no home equity have refinanced using the 4-year-old HARP, and consumer advocates and lenders welcomed the news of the extension.

About 2.7 million underwater homeowners remain eligible for HARP loans, according to online lender Quicken Loans, which said the average savings from a HARP refinance is around $200 a month with an average rate reduction of 1.75 percentage points.

http://www.latimes.com/business/money/la-fi-mo-harp-refinance-program-extended-20130411,0,1791267.story?track=rss

Eff Obama and HARP. 200 dollars a month for folks in California who are underwater isn’t going to change anything but kick the bucket down a few years.

the end is inevitably in the buyers favor, just hold out. the shit is already hitting the fan in the market precursors to housing disaster. QE doesn’t work.

I have been home shopping in Southern California for over 1 year. The last 3-4 months heavily looking, making offers, and being outbid. Now, the current trend is to not only make offers above asking, but to waive the Appraisal Contingency. So when you make that ridiculous offer of 700k for a 649k home, and the home appraises for 640k for example…YOU have to come up with the difference or walk away from your deposit. Buyers are literally giving up all their rights to win a bid. I am actually a loan officer myself, and I see the Purchase deals falling thru because the appraisal is not matching the offer price, and the buyer backs out. I also see the local real estate agents adding fuel to the fire. They create a mass hysteria with uninformed buyers who are willing to waive their 1st born to get a home. The prices are matching 2006 levels, with offers for a 900 sq foot home in Burbank starting at 535k. I dont think anyone should try to pick a top or bottom of a market, but this looks really scary right now…tread lightly.

As all-ways, superb article !!

Thanks so much

Oscar

From what I understand reading the comments is that

most of the sales are done by hedge-funds and other

cash-investors. Okay. So, what are these people doing

with these properties? Renting them out? To whom?

Since unemployment is getting worse and most people’s

incomes hasn’t risen, who can afford to pay the rent

equivalent to a mortgage payment on these houses?

Are these cash-buyers so wealthy they don’t need to

rent them out? I don’t understand?

Ben Bernanke has two choices: submit to deflation and watch himself and all his rich friends lose their money as asset values decline; or blow bubbles, and try to suggest that bubbles and ‘economic growth’ are at least related.

Ben is panicking. All his trillions of dollars of debt have gone to his friends the bankers. He thought it would trick the economy too — but it hasn’t. His job, afterall, is to protect the banks. It never was his intention to protect the unemployed or average Americans.

I think Ben should be impeached for misreading the nature of the crisis and prescribing the opposite drug from what we need. We have a debt crisis, and Ben has been prescribing at along more debt, more debt. We need to destroy debt, not create MORE DEBT.

As bad, Ben has been funneling billions, trillions of dollars to his friends in the banks, forcing interest rates down — even though rates want to go up, which might make junk bonds out of US TBonds — so he can lend to the banks for nothing and guarantee their profit in government treasuries which he is manipulating so they won’t lose money. He is guaranteeing their investment. Impeachment? Prison perhaps? Is this type of manipulation of the investment environment legal? And who loses when he decides he’s had enough, when he lets the TBond bubble burst? And then who gets to bail out the new losers when this happens? The taxpayers again? American savers?

This is one of the most shameful periods of American history — there have been many — but I don’t remember a period of groveling before America’s rich by the government that even comes close to this. Murdering the American Indians; the slave trade; racism and legislated inequality…these are all part of the high-hand of the rich dominating government for their own interest. But this current massive theft (still on-going) is repulsive and compares with America’s worst behaviors. With 0% interest rates robbing America’s savers, rewarding America’s crooks and gamblers who made a bad bet, lost, and now are being bailed out by whom, by America’s savers….

If a revolution doesn’t break out over this, then Americans should be ashamed of themselves. The last time we threw out the rich bums we sent them to Canada. Where should we send them this time? I hear Haiti has good weather this time of year. Maybe they could use a housing bubble there too.

You are a wise, thoughtful individual. Very well written.

Yup. You want to know what the Fed will be “buying” next? Just look at the big member banks and see what total crap is on their balance sheets. And that’s what uncle Ben will be buying next. All his talk about the unemployment rate and the economy is total crap. Everything he’s done is to help his owners. There’s barely been a trickle down from a the $Trillions he’s created from thin air and given to his friends.

Couldn’t agree more. We need more voices like this. I think unfortunately a lot of our anger stems from the fact that deep down we know the likelihood of things changing how they should be and not robbing savers for risktakers, banksters, richie riches, etc is slim to none, especially when the media seems in on it too.

Absolutely correct on all counts, except that Ben is merely acting on his boss’s orders, not the other way around. He serves at the pleasure of this WH and this Congress, who in turn are in thrall to the bankers, who contribute money to their re – election campaigns. Until some new candidates emerge to challenge this status quo and attempt to repeal and/or reinstate some of the more onerous laws (they could start with Glass – Steagall), I’m afraid that this current state of affairs will continue.

Leave a Reply