Following the herd of foreign money into US real estate markets – foreign money and global capital flows. Are Americans moving out in larger numbers from high cost states?

Foreign money is flowing heavily into US real estate markets. Now some think that foreign money is going to prop up the entire market but this is simply not the case. The money flowing in from abroad is going specifically into targeted markets. This isn’t necessarily a US trend only. Canada is experiencing a massive housing bubble from money flowing in from China in particular. Here in Southern California many cities are seeing solid money flowing in from Asian countries. You have this occurring while big fund domestic investors are buying up low priced real estate cross the country as investments. What occurs then is the crowding out of your typical home buyer. I get e-mails from local families looking to buy saying they were outbid by $50,000 or $100,000 for properties that had nothing special. Even after the crash, why does it seem hard for domestic buyers to purchase a home?

Higher net worth group jumping ahead while middle and lower class grows in size

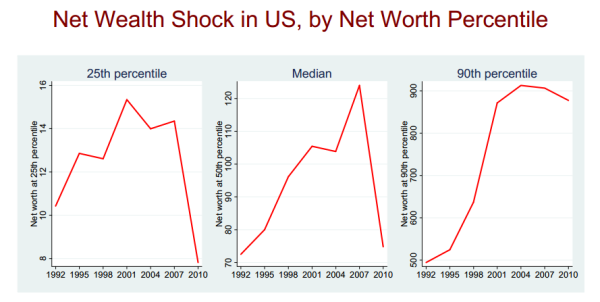

The below chart is an interesting look at net worth by percentiles:

Most Americans are still in a worse economic condition than they were over a decade ago. The numbers in terms of net worth, the true measure of wealth, highlight this very clearly. There are two primary drivers for this:

-90 percent of households have negligible holdings of actual stocks

-Most households derive their wealth from real estate

This explains why after the near non-stop run-up of the stock market since early 2009, most families are still in a tight financial pinch. High net-worth households with higher stock holdings rode this boom and bust much nicer. Part of this has to do with the fact that real estate is a small part of their portfolio and the massive stock market run has aided in boosting net worth back up.

This has implications on purchasing homes. Those in SoCal making $100,000+ think they should reasonably afford a “nice†home in a prime city. Well those are the places currently being targeted heavily by flippers, investors, and foreign money. This group is part of the net worth group that is in much better shape relative to the other 90 percent of households. So in essence, what was once viewed as affordable just doesn’t match anymore in a more uneven market of wealth.

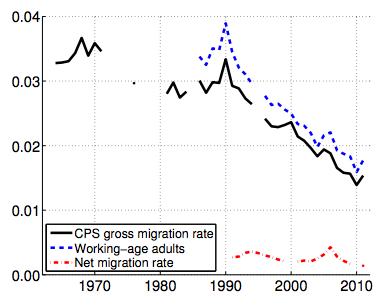

People talk about simply picking up and leaving yet this trend is tiny.

“(The Atlantic) There’s a connection between certain places and certain jobs. Silicon Valley is to tech what New York is to finance what Detroit is to cars. Call it the Synecdoche Economy. It’s what Paul Krugman dubbed the new economics of geography: small differences beget more differences that become big differences. Regions specialize — or do they still?

Maybe not quite as much. Silicon Valley still does computers, New York still does trading, and Detroit still does automobiles, but all of us do a whole lot less of one big thing — moving. Consider that gross interstate migration has halved in just the past two decades, as the chart below shows.”

Overall, people for the most part tend to stay where they are. Our cities copy one another so there no longer is the one city hub of say automobiles (i.e., Detroit) so you have tech jobs in Austin, Silicon Valley, or even Utah. In California, those trying to cope and stay are simply using up the easy money from the Federal Reserve and going into massive debt. These families typically also have large auto loans and other luxury expenses that they consider essential. This is why many are willing to take out a $500,000 mortgage for a shack. All debt and no cattle.

Japan and CRE bubble

In the late 1980s and early 1990s money was flowing into Hawaii and California heavily from Japan. This was during their real estate and stock bubble. Back then the fears were similar and that somehow, all of California was going to go to Japanese investors. That bubble was mostly focused on commercial real estate however. Of course that bubble ended and Japan finds itself in a stagnation of over two decades.

China is experiencing a massive real estate bubble. We recently discussed how Hong Kong instituted a 15 percent tax on foreign investors to cool the market down. Yet these actions are merely methods of slowing down the inevitable. People forget that money is flowing here because it largely wants to opt out or hedge against internal risks. Think about this clearly. If things were so fantastic domestically why is so much money eagerly looking to get out? Don’t you think that these local investors in China know what is going on domestically more than some Bloomberg report from New York? Whenever I see money escaping a country with a passion I think of two things:

-1. Domestic investments are looking weak

-2. Long-term growth is slowing down which is likely to bring economic and political instability

Just look at global stock markets since the lows in 2009:

While the S&P 500 is only off by 5.86 percent from its peak, the Shanghai index is off by a whopping 40 percent. The Hang Seng index is off by 14 percent. Even the Nikkei is off another 22 percent from its recent high. Again, when you see money flowing out of a country in epic fashion you have to ask what is going on internally. You don’t see European investors coming over with suitcases looking to buy properties in large droves. Yet you see this literally happening in California and Canada.

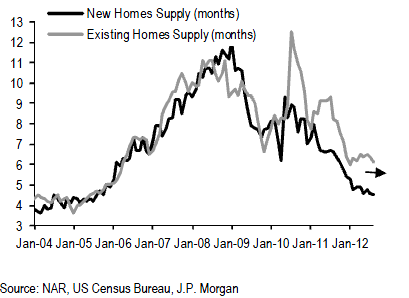

Supply is low

So you have this flood of money coming in competing with the Federal Reserve pushing interest rates to record lows. Add to the mix record low inventory and you can see why prices are jumping in some areas:

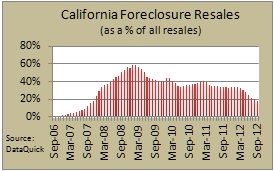

It isn’t that sales are back to bubble day levels. Not even close. Yet what is happening is inventory is incredibly low and the mix of foreign money, big domestic funds, and folks moving off the fence is causing some markets to move up in price. Take California for example. The share of foreclosure re-sales are moving lower and lower:

Foreclosure resales as a share of all sales is now back to levels last seen in 2007. So the sales that do occur, non-distressed sales are pushing the median price up giving the impression that we are in some sort of large appreciation movement. This is why the median price of a California home is now up 15 percent from last year even though incomes are stagnant.

I’m always weary about home prices rising so fast while incomes remain stagnant. This is a hot money scenario. Congress is likely to do nothing substantive this year but we have some major challenges in 2013. $16+ trillion in national debt is enormous and bigger than our actual GDP. As we have stated before, something needs to give and something will need to be done. The public of course is now accustomed to low interest rates, high levels of services, and a political machine that runs more like a corporation with large advertising arms. Those thinking they can buy homes in certain markets at rock bottom prices are now contending with the above trends. Hey, you can still get deals in probably 40+ states of the nation or even in places like the Central Valley or Inland Empire in California. Yet most want to live where the foreign and big money is. Following the herd is usually not a good long-term investment strategy.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

48 Responses to “Following the herd of foreign money into US real estate markets – foreign money and global capital flows. Are Americans moving out in larger numbers from high cost states?”

It would appear that the majority of US citizens just voted for much more of the same – easy monetary policy with no brakes on domestic spending. Yet eventually you run out of everyone else’s money, meaning the dwindling population of actual taxpayers. And what of the coming supermajority rule in CA for 2013? The melt – down will indeed be one of epic proportions, and I feel terrible for those on the receiving end of such irresponsibility. But if that’s what the voters want, that’s exactly what they’ll get – all of it.

Obviously this blog isn’t about politics but since you went there, voters voted AGAINST social hatred and rights infringement. The GOP chose to ignore fiscal issues and make this election about religion, maybe you should blame that party for not bringing serious issues to the voters, not the voters for choosing to opt out of theocracy. Im not fiscally irresponsible and I don’t think our country should be but if you don’t give me reasonable options in the voting booth then I cannot make much of a difference. Time for the right to start opening their eyes and recharging the fiscal conservatism that made them. A strong opponent way back in history…until then we will have more of the same fiscally so we don’t end up with a social structure like Iran.

[i]… social hatred and rights infringement. The GOP… theocracy… end up with a social structure like Iran.[/i]

Well, at least you don’t see the USA through alarmist-hyperbolic glasses… lulz.

So what exactly did the voters wind up voting for instead, Candace? Please be specific in your answers.

Are you A CA voter? Did you vote YES on 30? How does extorting & skimming more of citizens property follow your fiscally conservative logic?

Interesting perspective.

So the Republicans have demonstrated fiscal responsibility? The two greatest housing bubbles in history happened during a GOP watch: S&L crisis with Reagan and of course, GWB. Most American’s voted against starting another war and further concentrating wealth in the hands of speculators and stock-option whores; which is crowding out the vast majority from housing, health insurance, food and fuel. When the last election turned, we weren’t’ concerned that we could keep our pseudo-wealth insulated from our inability to compete in the world market–we were afraid the world financial system was collapsing and WW3 was just around the corner. Things are not good for some, but considering a generation of pot heads, sex-maniacs, alcohol abusers, and TV sentinels are doing as well as we are is amazing. All we ask from government is to not run the ship aground, and we’ll be lucky if we get that. “Stay the course, 1000 points of light…”

“Things are not good for some, but considering a generation of pot heads, sex-maniacs, alcohol abusers, and TV sentinels are doing as well as we are is amazing.”

Ummm, what? I don’t know who’s more incoherent in their responses, it’s a close tie between you and Candace.

Gramm-Leach-Bliley, the bill that overturned Glass-Steagall and created the conditions which spawned the new millenium’s epic housing bubble, was signed into law by Bill Clinton. He was long-gone by the time the unintended consequences came home to roost. The really sad thing is, where we get statements from people like Chris Dodds and Barney Franks claiming those consequences were totally unforeseeable, it is a matter of public record that the exact outcome we’ve experienced was predicted by the fiscally sensible few who voted against it. (Noteably, Ron Paul’s statements before passage of the bill explaining that it wasn’t de-regulation but rather re-regulation in a haphazard way, and later, in 2001, his statements that acts of congress had brought about a housing bubble that would end in ruin).

Now the really sad part is that Gramm-Leach-Bliley was a largely bi-partisan effort. It was a corrupt effort designed to pull in votes from the poorer demographics, and as is always the case when fiscal equality becomes the goal of government, that equalization necessarily manifests not through the uplifting of the downtrodden, but by the binding of upward mobility. This is the moral hazard that was so predominant an issue in 2010, and it is truly unfortunate that it has been forgotten in the interim. Every Republican that voted to nominate Mitt Romney should be ashamed of themselves. He never represented the ideals of small government. The only aspect of his character that represented Ronald Reagan was his speaking voice. But the GOP has a serious problem in keeping dim-witts out of the limelight and suppressing the real mantra of conservatism. So, as a result, as we have seen in California, those of us who truly value small government, low taxes, and minimal invasion of personal liberty are left completely disenchanted.

Republicans are under an illusion that they are the party of fiscal conservatism but the reality is that Repub presidents blow the deficit up like a balloon. Dick Cheney said on many, many occasions “The National Debt does not matter” when he was asked about the fact that he and Bush had turned Clinton’s almost balanced budget into a trillion dollar a year deficit. Look it up – it can be researched in minutes on the internet. Then stop lecturing Democrats about how good things would have been under Romney.

Timmah displays the usual rantings of the always – reliable playbook from the far left, titled “yeah, but Booooosh did it, too!” This is yet another favorite strawman argument for those not in possession (or caring) of the facts. The deficit did increase during the last two years of Bush’s tenure, with programs like Medicare Part B and others. However, the last four years have seen in increase of the federal debt to four times that of the entire 8 years of Bush’s term in office. That comes from the CBO, Timmah – hey, you could look it up.

90% of households don’t hold stocks? That may be true in the literal sense, but I’d say that the pension funds and other retirement related funds are holding equities that these household are part of.

People are not moving because the grass (jobs) is not greener anywhere else.

Well, fine. But, hardly anyone has a private traditional defined benefit pension, so, we can’t be talking about them. And, the public pensions systems hardly cover a large part of the population. Just the lucky ones. And, of course, those pension plans are now giant liabilities on 90% of the population, not productive assets.

And, most people aren’t moving because they’re underwater on an expensive mortgage (including the high moving costs).

State and local govt employ a lot of people and the Feds and many private sector jobs have 401K plans that are mostly in the stock market. 90% has to be way off the mark.

The history of the US is all about moving for opportunity. There’s none worth mentioning at this point regardless of your mortgage position.

CAE, here’s some facts.

The average Boomer savings account, to be generous, is about $50,000. And, since the Boomers own 80% of assets that are individually owned, that doesn’t say much for the younger set. The average net worth of a 65 year is about $210,000, most of which, if not all, is the equity, if any, in their home. (One third of 65 year olds have mortgage debt. One third! At that age!) One half of Boomers have nothing saved. Zip. If they decide to “retire” or, lose their jobs, the only cash flow they will have is Social Security.

It is a myth perpetrated by the financial industry that many own stocks and many have a lot of financial assets to churn. Hell, after ’08, whatever is left of that 50 grand that Boomers have saved are mostly in safe instruments, like bonds, and, even CDs and bank accounts. Up to just yesterday, trillions have been leaving stock funds for other, safer places, as it should be, because older people can’t afford to lose again in the casino. The market may be flirting with 14000 over and over recently, but volume is abysmal, relative to the 90s, and most of the trading is computers talking to each other.

Yes, most of the stocks that the industry wants you to think are “privately” owned are in the giant government pension funds. Calpers probably owns about ten percent of all that. Ironically, as I said above, those pension funds are actually huge liabilities to the citizenry, not assets to be used for survival in old age, because they are so poorly managed and underfunded. Already, some cities and towns in America are paying more for retiree costs than present costs, like education and, well, the police and fireman who are actually working, along with day to day expenses. This situation will rapidly get worse very quickly.

Don’t be fooled that we are all so comfortable. Hell, if the Boomers had any money, why are their children (and the parents, by co signing) in debt for a trillion dollars for their education? They couldn’t even afford to send their kids to school!

Nobody has any money. Really. Expect levels of senior poverty over the next decade or two that will rival the 30s. Greece right now is a precursor, with elder pensions being cut to the bone. Imagine that, your meager $20,000 a year from Social Security actually being reduced. It may very well happen.

That’s right. I was in the park the other day listening to two people argue about how capital gains increases will kill them. They were in their 40’s but NEVER had any capital gains in their lives. Way to go…argue for people who don’t give two shits about you! People have pensions? LOL! Pensions are disappearing…401k’s, the miracle of Reagan years, is a complete FAILURE. They manipulate your portfolio while they have insider information. Stocks go up and down, but somehow, you lose money when they go back to the same value they had before…….keep voting for the same two party system, the results do not change. Hoping for different results from the same experiment is insanity. wait…let’s lok aroun d for someone to blame and call evil….maybe it’s the commie pinko homosexual islamic socialists! yea, it’s them!

The good times will continue with Obama and easy money Ben. The Republicans went into hidding.

Something has to give.

Perhaps the USA’s credit rating will be downgraded again, as Fitch has already threatened.

@curiosity

Something has to give.

Perhaps the USA’s credit rating will be downgraded again, as Fitch has already threatened.

Will interest rates go down again like after the first downgrade? These are the same ratings agencies that were paid by the banks to rate all that cdo dreck as triple A right?

Good times ? Really? Oh wait , You got your Obama phone. Now I get it.

Well, during the bubble Orange County was losing about 20,000 white per year ,so yes people will go where its cheaper. Gas is higher and not everyone wants to communte right now.

“Whenever I see money escaping a country with a passion I think of two things:

-1. Domestic investments are looking weak

-2. Long-term growth is slowing down which is likely to bring economic and political instability”

I think of a third: Many are investing in their futures in case the political atmosphere back home becomes chaotic. So the foreign home becomes both a financial, and, literally, a physical refuge. If they can leave.

How about a forth? Gross devaluation of the currency by the central bank.

The american people sdeserve everything they get. The system is corrupt because WE vote corrupt individuals in. There is little to no difference between Romney and Obama, they both serve the same master…mammon. This heated dicsussion that occurs on the American Titanic every 4 years boggles my mind how people I consider to be intelligent, lose perspective and actually believe what the TV impregnates in them. I didn’t want to condone evil, so I didn’t choose either candidate. Until peopl wake-up and stop pointing the finger and realize THEY are the stupid one, there will be no change. Suck up the austerity, the rich will nto share, there is no “trickle down”. The monetary policies of the corrupt have failed and much siffering will entail. Good luck to all.

Incredibly, many posters, as well as the doctor himself, seem to believe erroneous economic policies will bring profits back to the country. A few illusions promoted here:

1. Any country with a sovereign, fiat currency (like the U.S., not like the eurozone) can run out of money. Bizarre. They’ll run out of money when the Bureau of Weights and Measures runs out of inches. Not possible. Ever.

Therefore, U.S. solvency is completely unassailable. Even S&P’s “downgrade” was premised on the R’s willful threat to default on debt, not because the U.S. was insolvent, but because the political opposition was willing to hold a gun to the head of the nation.

The markets understand the distinction clearly, too. Like the U.S, Japan can still raise money at very low interest rates even though it’s “debt” to GDP ratio is higher than even Greece’s. Greece, on the other hand, does not have a sovereign currency. It has to beg the ECB for funds, so rates are skyrocketing, and default is a real issue.

2. In the U.S, taxes and borrowing do not fund government. The government is the monopoly producer of dollars, which it can produce at will in literally infinite amounts, without cost. Why would it need either taxes or borrowing? (and where did those Chinese people get their dollars?). The truth: Taxes make the money valuable; they do not provision government.

It’s obvious, and logical that the government must spend dollars into the economy *before* it can ask to retrieve them in taxes. Where else would people get the dollars to pay the taxes with?

3. Government “debt” is therefore completely unlike household debt. When Treasury wants to spend $10,000, it instructs the Fed (the U.S. Central Bank) to put the money in its checking account (electronically, the Fed “types” the dollars on its computer keyboards, it doesn’t print but 3% of the dollars issued). The Fed also makes a $10K bond (an IOU) to balance the $10K credit to Treasury’s account.

So when government retrieves dollars from the economy in taxes or fees, if it retrieves a “balance” or surplus, it deprives the non-government sector of financial assets, creating deflation. Government “debt” in such circumstances is simply an indication of the amount of financial assets in the private sector.

Here’s from UMKC professor Randall Wray: “With one brief exception, the federal government has been in debt every year since 1776. In January 1835, for the first and only time in U.S. history, the public debt was retired, and a budget surplus was maintained for the next two years in order to accumulate what Treasury Secretary Levi Woodbury called “a fund to meet future deficits.†In 1837 the economy collapsed into a deep depression that drove the budget into deficit, and the federal government has been in debt ever since. Since 1776 there have been exactly seven periods of substantial budget surpluses and significant reduction of the debt. From 1817 to 1821 the national debt fell by 29 percent; from 1823 to 1836 it was eliminated (Jackson’s efforts); from 1852 to 1857 it fell by 59 percent, from 1867 to 1873 by 27 percent, from 1880 to 1893 by more than 50 percent, and from 1920 to 1930 by about a third. Of course, the last time we ran a budget surplus was during the Clinton years. I do not know any household that has been able to run budget deficits for approximately 190 out of the past 230-odd years, and to accumulate debt virtually nonstop since 1837.

“…The United States has also experienced six periods of depression. The depressions began in 1819, 1837, 1857, 1873, 1893, and 1929. (Do you see any pattern? Take a look at the dates listed above.) With the exception of the Clinton surpluses, every significant reduction of the outstanding debt has been followed by a depression, and every depression has been preceded by significant debt reduction. The Clinton surplus was followed by the Bush recession, a speculative euphoria, and then the collapse in which we now find ourselves. The jury is still out on whether we might manage to work this up to yet another great depression. While we cannot rule out coincidences, seven surpluses followed by six and a half depressions (with some possibility for making it the perfect seven) should raise some eyebrows. And, by the way, our less serious downturns have almost always been preceded by reductions of federal budget deficits. I don’t know of any case of a national depression caused by a household budget surplus.”

Read more at http://www.nakedcapitalism.com/2010/02/wray-the-federal-budget-is-not-like-a-household-budget-%e2%80%93-here%e2%80%99s-why.html#D43JwYPCqjh3hL0W.99

Please stop promoting delusional economics. It’s what got us into the housing bubble in the first place. The government needs to have a *bigger* debt so households will have enough money to repay their mortgages and generally deleverage. The sham of “fiscal responsibility” (i.e. paying off government “debt”) will only prolong our current great depression.

Oh yes, and for those who believe I said “print infinite money,” … oh no I didn’t. And for the inflationistas (“but keeping government spending high would be inflationary!”)… According to its recent audit, the Fed issued $16 – $29 trillion in loans of up to two years in 2007 to cure the financial sector whose frauds crashed the economy and stole 40% of U.S.’ net worth…. That was five years ago. Where’s the inflation? (QE manages *deflation*, remember)

The truth is that inflation concerns are ginned up about social safety net programs and state revenue sharing (ever wonder why college costs have increased 300% in the last decade? Take a look at revenue sharing for the culprit)… and all of the demands of such programs are much more modest than say the $3 – $7 trillion for the Iraq war, or the bankster bailout.

See…the Pentagon can spend six times more than our nearest military rival (China) without complaint, bu Social Security recipients have to suck wind. That’s what’s going on here. And until the likes of grandma with her Social Security gets some of those trillions, we’re going to be bumping along the bottom.

@ Adam Eran

Just a few comments of your gross mischaracterization of economics.

1. If this were true, Zimbabwe would be the Switzerland of Africa.

2. The United State government was only able to produce money at will in literally infinite amounts after FDR and Nixon took us off the gold standard and destroyed the currency. The earlier historical depressions you describe occurred under the gold standard and were caused by much more complex factors than government surplus.

3. Your example of government debt is beyond ridiculous. The QE programs, swaps, mortgage purchases,twist were all done by PRINTING MONEY, 16 trillion worth. Your example of the bond sale has no relevance to QE. With regard to lack of inflation, no one believes this joke. The prices of all commodities have increased dramatically since the Fed intervention. Look at gasoline, grains, gold, copper, some of these have tripled in the last four years. The basket used by the government to state inflation is a joke, and the same goes for th BLS and the unemployment rate.

Most disconcerting of all is your glib discussion of how moneytary policy is carried out by the Federal Reserve using policies that have never been used by any country. The truth of the matter is that the Fed has no idea how they are going to get out of the debt they have created. I assume you think interest rates will never go up again. The treasury rates under Reagan reached 20%. How would that work with today’s debt?

I think it is even more fundamentally wrong. The long-run aggregate demand curve is a fixed quantity because a given economy can only produce so many goods and services. If the quantity is fixed, then increasing the money supply cannot increase the goods and services an economy produces. The end result is more dollars chasing the same number of goods and services. Printing money will never increase wealth in the long term. You cannot print your way to prosperity. Printing can only create devalued currency in the long term.

I think the misconception is that the past 10 – 20 years has been the full potential of the economy. I believe the reality is that the short term effect of monitory and fiscal policy has overshot the real long term potential of the economy.

@Jeff Beckman

Zimbabwe destroyed a large chunk of it’s economy before it started printing money not the other way around:

Zimbabwe for hyperventilators – http://bilbo.economicoutlook.net/blog/?p=3773

HYPERINFLATION – IT’S MORE THAN JUST A MONETARY PHENOMENON – http://pragcap.com/hyperinflation-its-more-than-just-a-monetary-phenomenon

The treasury rates under Reagan reached 20%. How would that work with today’s debt?

How would it work? Well interest payments are made by the government to the private sector. If the private sector saved the additional interest payments then nothing really changes in the economy. If the extra private sector income was spent then sales would go up and unemployment would go down, yeah conditions would be horrible!

@ Rumble

How would it work? Well interest payments are made by the government to the private sector. If the private sector saved the additional interest payments then nothing really changes in the economy. If the extra private sector income was spent then sales would go up and unemployment would go down, yeah conditions would be horrible!

You cannot be that crazy. Treasury are tied to private sector rates. That is what Ben’s deal is all about. A 20% rate would kill the economy and the government. It would also bankrupt every corporation in America as they have all borrowed like mad men and would have to roll over their debt at 20%. The problem is debt and it is not solved by more debt. And, even less by blind printing of money.

@Jeff Beckman

Are these the corporations that have borrowed like “mad men”?

from the Wall Street Journal:

U.S. companies are holding more cash in the bank than at any point on record, underscoring persistent worries about financial markets and about the sustainability of the economic recovery.

The Federal Reserve reported Thursday that nonfinancial companies had socked away $1.84 trillion in cash and other liquid assets as of the end of March, up 26% from a year earlier and the largest-ever increase in records going back to 1952. Cash made up about 7% of all company assets, including factories and financial investments, the highest level since 1963.

Corporations are sitting on ever growing piles of money waiting for consumer demand to increase. It’s not happening because 99% of the consumers are tapped out. If consumers don’t have the money to purchase goods and services why would companies invest in plants, equipment and additional employees?

You appear to be treating federal government debt and private debt as the same thing. It is not. The federal debt never gets “paid back”. In order to pay back the Federal debt, the government would have to seize all net financial savings of the private sector.

Value is scarcity. If taxes make dollars more valuable, then taxes destroy money. Or as it was stated above, taxes deflate private holdings. But the other end of the government’s big stick is to create new money to lend out directly. So while may just be deflating one money supply and inflating another, there is net movement of wealth. It moves from tax payers to welfare recipients (and I don’t mean to invoke the term in reference to the tired strawman example of inner city crack babies. I am talking about lending institutions and foreign nations, whose payouts VASTLY exceed any domestic poverty relief programs). It would stand to reason that careful balancing could minimize the need perform the shell game implied by the above premise, and the constitutional directive of personal sovereignty and property rights should dictate it as an imperative of just governance.

During WWII, the military consumed 43% of GDP.

In the 1950’s and 1960’s, the military consumed 9-14% of GDP.

Military expenditures shrank to 4.8% under Carter and expanded to 5.9% under Reagan.

In the 1990’s, a shrinkage to 3% was the driving factor in the “Clinton surpluses”. It almost equalled out “dot bomb” revenues.

Both were much more important than genius Clinton tax ideas like the Luxury Boat Tax.

Military expenditures have made a small reboud into the 4-4.5% range.

Yet somehow the one expenditure allowable and assigned by the Constitution to the federal gov’t……that has gone from 43% to 4%………… is the cause of the inevitable fiscal disaster.

It’s alot harder to find solutions with idiots who can’t identify the problem.

A transfer of wealth (assets=private properties, public infrastructure, pensions) ??

from the USA to overseas markets and global investors through trade deficits, QE1, 2,3

to be in turn used to buy back those defunct assets for pennies on the dollar.

I.E. global investor(s) and 3rd. world country scenario.

Instead of migrating from the Mid-West to California.. . It will now be a jumbo

jet to the Pacific Rim.

Dr. HousingBubble once again hits the nail on the head with this article. Another factor driving housing up (at least in Toronto, Canada), is the quality of immigrants. We are getting very smart, educated immigrants who have excellent work experience in their home countries. These immigrants are are landing very high level jobs. I’m not talking about jobs that pay $100,000/yr but rather 3-4x that much. So in addition to the ‘hot’ international money, demand from these high net worth/highly educated immigrants who see Canada and particularly Toronto as a safe, stable place to set down roots have driven up property prices to the point where locals making $100,000/yr are easily priced out of the market. These high paid immigrants do realize that Toronto is a very expensive city to live in – let’s see how long they are willing to fork over almost 50% of their earnings to the government in the form of income taxes. Not to mention massive tax on alcohol and gasoline, high property tax and sales taxes on all goods and services. Those in the top tax bracket are easily paying in excess of 60% of our income in taxes here in Ontario. Also, MPAC (Municipal Property Assessment Corp.) has recently sent out letters to many Toronto households advising of the new, much higher, value of their properties. No doubt, Toronto city hall will use this as an excuse to increase our property taxes even more – regardless of the fact that they are not providing any additional services. So just because people out there are willing to pay sky-high values for a property, now all of us as homeowners will suffer through increased property taxes. Property taxes based on market values make absolutely no sense especially when incomes have remained flat over the last 10 years. So where does all our tax money go? It goes to make sure all gov’t workers – teachers, policemen, firefighters, politicians and all other civil servants, etc. get their regular pay increases and rich pension plans. They stay comfortable and get even richer at our expense…while we get poorer. We are now at a point where the public is working for the public servants and not the other way around like it should be.

All very true. Still, you have the acknowledge the irony of you, a woman, pointing out this NON-sustainable Nanny State train wreck scenario, which is CONSISTENTLY voted for–and entirely enabled by–(*wait for it… *) FEMALE VOTERS!

Think about it. Hard to swallow, I know.

OH please. Enzo you post a number of valid ideas but this comes across as pure emotional misogyny. You do know that Elizabeth is in Canada and not Ohio. Canada did not participate in the election of Obama nor as far as I know is it overrun with tea bag Republican evangelicals. This reply is in no way intended to support Elizabeth’s rant against public sector workers.

“We are now at a point where the public is working for the public servants and not the other way around like it should be”

What is the percentage of public servants of all workforce?

Something like 20%? (I don’t know but I doubt it is significant.)

Here in EU we have several countries were public sector is almost half of working force and at that point public is working to pay these people, nothing to their own pockets.

On the long run totally unsustainable which the eurocrises clearly show.

This is exactly what has happened in California. The public employees, their families and retirees are now running the show through the voting booth. The Assembly and Senate now have a bulletproof two-thirds majority ( meaning tax and spend to infinity ). Top it off with a Governator who is the Dali Lama and Founding Father of the public unions.

This long time Californian has seen enough. It’s time to git while the gittin is still good.

Unlike Kah-lee-faux-nya, there have never been many Asian faces here in So-Fla… ’til recently. [eek]

The public of course is now accustomed to low interest rates, high levels of services, and a political machine that runs more like a corporation with large advertising arms.

ZING! DrHB–always seeing the Big Pic, and laying it down in cogent terms! Kudos.

You haven’t seen notin yet,wait until Wall Street gets its green Obama Mama light now and dip its fingers one last time from whatever is left of the Social Security money.Damn the Boomers,who cares…They don’t need big houses anymore.Look around and see the excitement-the all new cage like low income apartment blocks springing up everywhere around America.This is the future folks, in black & white -oh, and stop bitching about the GMO loaded supermarkets and the expensive pain pills for your back.

Not so much Kudos for the Enxenophobic MoMisogynist.

And, no need for phonetic spelling for all to know what a complete joke of a state is your Florida. Eek and zing indeed.

As for foreign markets and cash buyers they tend to favor parts of La, Orange mainly has chinese foreign buyers in Irvine or parts of Newport Coast. South County market is hotter but it fits more the image of native born whites with some native born hispanics and asians buying the houses and South county according to the Register rose and south of Irvine rose.

Hi guys,

I was considering purchasing a home in San Diego when I stumbled upon this website. Bear in mind–I’m just an average joe, I’m not a finance guy so I don’t really follow all of the terms being thrown around.

But what I have gathered from reading some of these articles is that the banks are not releasing a significant number of foreclosed properties back into the market… I suppose this is for accounting reasons, i.e., they won’t have to report these toxic mortgages as a loss. Thus, the SoCal real estate market has become grossly distorted because we have an abnormally low level of homes available for purchase, when there actually should be a flood of homes on the market right now, which would drive the price of homes significantly lower.

I have a couple questions for anyone willing to answer. #1.) How long will I have to wait before the market operates normally again and the banks have to finally release the properties they are hoarding back into the market? #2.) I hear lots of talk on the radio about the prospect of hyper-inflation. I have a fair amount of money in the bank now and don’t want its value destroyed due to hyper-inflation. Is the threat of hyper-inflation real? I was initially considering real estate as a way to mitigate against inflation, but it doesn’t sound like it is a good move anymore. Gold is hellishly expensive now… anyone have any other ideas?

Thanks in advance

Good questions Patrick.. However, they are very difficult to answer.

In regards to #1, the banks are holding property but thanks to the the support of the Federal Reserve they are in no hurry to dispose of it and take a huge loss. They will continue to mitigate their losses as they repair their balance sheets. If housing inflates beyond the recent peak then perhaps they will release more properties.

In regards to #2, the threat of hyper-inflation is real in every economy. If the US economy takes off and we see a big jump in GDP and employment the Federal Reserve will have to tighten their current policy. If they don’t we would most likely experience hyper-inflation.

I highly suggest reading Ben Bernanke’s speech to Japan in 2002. I think you’ll find it very interesting regarding his current policy. Basically, he’s trying to convince you not to save money.

It may seem a bit insane, but I believe holding cash is not a bad idea. Good luck!

we are in a period of severe deflation.. take a look at the bond market.. there is no sign of inflation.. there is absolutely no demand, excess capacity and lots of debt.

Japan has been money printing for over 20 years with near zero interests rates. you need to worry about deflation a hell of lot more than inflation.

btw.. for everyone who talks about gas, food prices going up.. that’s true and a lot has to do with the money printing.. but the overwhelming driver is deflation and that’s what the Bernanke is most worried about.

so with asset prices deflating. (real estate) and commodity prices going up because of money printing.. the middle class in America is in the process of getting wiped out.

I have these same questions. On one hand I think it’s better to have debt (like a mortgage). On the other savings. I have concluded that it is impossible to know what is going to happen. So, I have a bit of both, plus working towards self-sufficiency (food, energy), to hedge my bets.

As an example, I could pretty much pay off my mortgage, but with the low interest rate, I think I should wait and see if savings rates skyrocket, like after the S&L crisis. At the same time, I am making extra payments towards the mortgage.

I do think that there are many toxic assets and that banks are holding them, since, because of newer rules, they essentially can until it’s a “good time” to put some of them on the market. I think the reason the Fed is doing QE3 is to keep everything from total collapse, meaning I don’t think it will make any market improvements – it’s just necessary to keep up the ruse of good times.

I think we’re in a game of sorts. One where the rules change constantly and it’s more like a casino game than a board game.

As for your first question, I think we should see more foreclosures put on the market this coming year. Why? 1) Because it’s been more than 5 years since many defaulted and 5 years is the timeframe to put an REO on the market, 2) Now is a good time for banks because they will be kept stable with QE3. I think though that this will only slightly drop prices.

Overall, I think it will take seeing what happens this year to see where we might be trending. If it doesn’t go down, I think a decision to buy is a matter of thining how you will feel and fare financially if your purchase drops dramatically, as this is a likely scenario, versus how you will feel and fare if prices go up a small percentage annually. At least this is what I keep telling myself.

Bottom line is the rich dont spend their money, it sits in the bank. All the rest of us are consumers and spend our money which makes the economy expand over time. For at least 30 yrs. the top have taken what should have been distributed among the majority in the form of higher earnings. The average worker in the US probably should earn 110k instead of 50k. We could afford to buy houses, cars, education, etc. So instead have to borrow from the rich to have the same living standard, and cant afford the debt payments. We are back to the days of the robber barons.

@la2mia2la

Agreed.

From Bill Mitchell:

In this blog – The origins of the economic crisis – I note that one of the underlying causes of the current crisis was the growing inequality in incomes in the advanced nations created, in part, by legislative support for real wages growth to lag behind productivity growth.

The redistribution of national income to capital (away from labour) created two separate dynamics: (a) it provided the real income for the growing financial sector to speculate with; and (b) it created a need for credit by the household sector to maintain strong consumption growth as the real wage lagged. It meant that with tighter fiscal policy positions being driven by neo-liberal fervour, economic growth was continued (temporarily as we saw) via the growing indebtedness of the non-government sector.

Gramm-Leach-Bliley, the bill that overturned Glass-Steagall and created the conditions which spawned the new millenium’s epic housing bubble, was signed into law by Bill Clinton.

Which the Senate passed 90 to 1. Clinton could have vetoed it and it would still have passed.

Leave a Reply to Rick Price