Financially dreaming in California – 50 percent of California households with a mortgage cannot afford the home they are living in. The lingering effects of Alt-A mortgages and negative equity.

Debt is not a source of income. I have on occasion watched a few budget makeover shows where a family that spends more than they earn suddenly gets an epiphany that debt is not part of your household income. Many American families have been conditioned via Pavlovian methods to assume that home equity and credit cards are some kind of El Dorado of hidden money. On these shows many of the guests just assume the access to debt will never run out. They have found the perpetual oil well and it is conveniently located in the home or via plastic in their wallets. Of course some of these shows are reruns because as we all know that home equity has gone up in smoke in many parts of the country. The bottom line amounts to people being told they have to live within their means. People hate hearing that like being told that eating broccoli is good for you. Very few states in the country have people living beyond their means to the extravagant extent of California families. It is the case that 50 percent of Californians living in mortgaged homes cannot afford the place they live in. If these people went on one of the budget makeover shows they would be told to downsize their housing cost.

50 percent of Californians cannot afford their mortgaged home

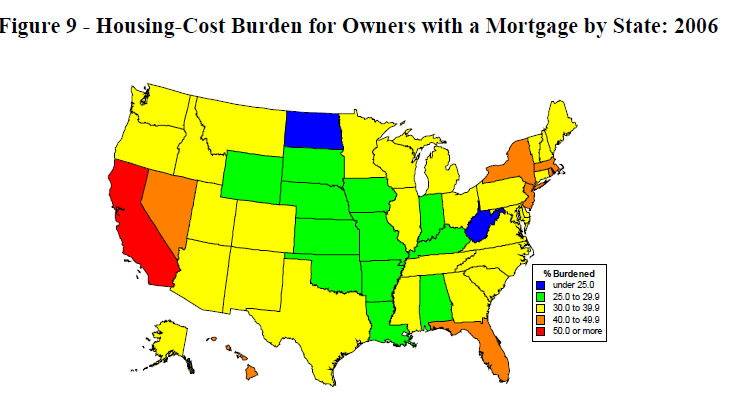

Being able to buy a home is not the equivalent of being able to afford a home. There is a big distinction and a large number of people still have a hard time understanding the contrast between being able to buy something and being able to afford it. The proliferation of Alt-A and option ARMs in the state allowed for maximum leverage and allowed many people to purchase homes they could not afford. California is in a world of its own when it comes to housing costs for those with a mortgage:

Source:Â Census

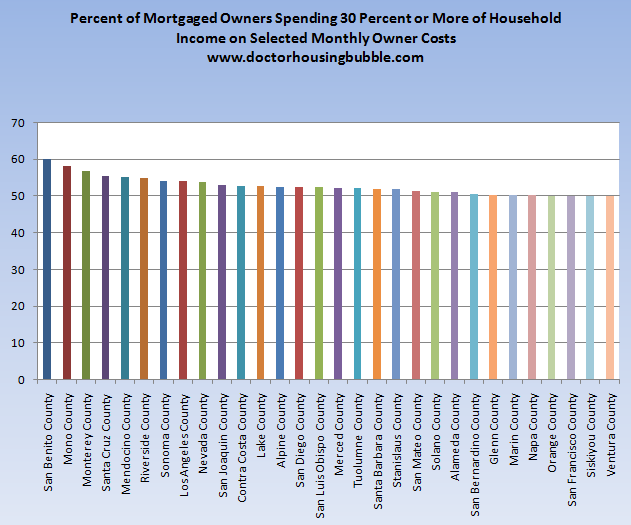

Over half of Californians with a mortgage spend more than 30 percent of their income on housing costs. By prudent standards this is spending too much on housing. Of course housing pundits would like you to believe that this is somehow okay and justified but the massive amount of people unable to pay their mortgages in the state tells you that many are unable to support their current home (aka they cannot afford their home). If we look at more recent Census data we realize that in many counties the 50 percent benchmark is solidly breached:

Source:Â Census

Even in high priced counties like Orange and Marin for example those with a mortgage are dumping more than 30 percent of their income into their housing costs. In fact 42 percent of Californians spend more than 35 percent of their household income on housing costs. The Census caps out at this level since it is rather obvious that going beyond this point is going to put your financial future in peril.

Some interesting data from the recent Census (data going up until the end of 2009) shows that the median housing cost for Californians with a mortgage is $2,317 although the typical mortgage payment committed to by California buyers in the latest monthly data, December 2010 is $1,010. In other words tens of thousands of Californians are living in homes they cannot afford if they were to buy today.

This inability to pay on an inflated asset is manifesting itself in a variety of ways. Many are losing their home through foreclosure. In fact over 546,000 California homes (1 out of 10) in 2010 had a foreclosure filing. Another way this is showing up is through the large number of people who have stopped making payments on their mortgage.

Over 30 percent of mortgaged California homes are underwater

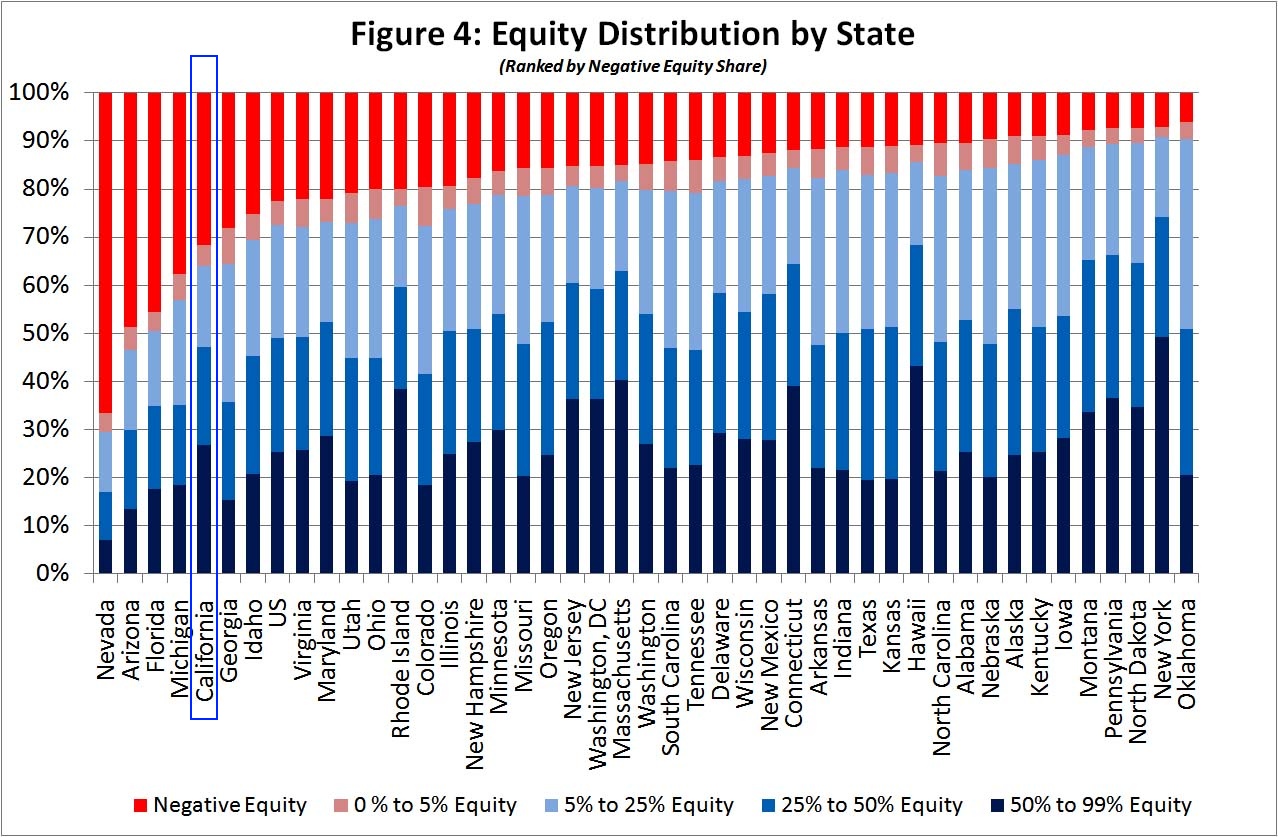

The correction is occurring because California housing is unaffordable. The only reason it appeared to be affordable is because of junk mortgages that allowed people to speculate in real estate as if they were some kind of late night infomercial guru. Now with the toxic mortgage market imploded and investment banks moving onto another area to pilfer with tax payer money, new buyers have to contend with 30 year conventional and government backed mortgages. Verifying income and meeting debt-to-income criteria may be an issue with 23 percent of Californians unemployed or underemployed. It also does not help that over 30 percent of mortgaged homes in the state are still underwater:

Source:Â Core Logic

Keep in mind the above chart rolls out until Q3 of 2010. When the data was pulled 1 out of 3 homes in the state with a mortgage was sitting underwater. The biggest contributing factor to a potential foreclosure or strategic default is negative equity. After all, if you had equity and could sell you would simply do it (if you refused a bank would simply foreclose and sell the home at market rate). Yet there are many people pinching pennies to make the mortgage payment in hopes that bubble-day California home prices are only around the corner. They are not. The amount people are committing to with new mortgages should tell you everything you need to know about the current state of the market.

Where are all those Alt-A and option ARMs?

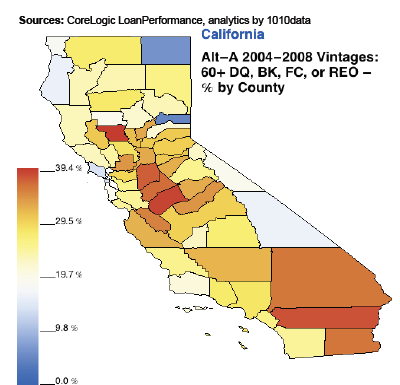

The national media has seemed to forget about the Alt-A and option ARM mess largely because it is relegated to a handful of states. California is option ARM central and many of those loans are still wrecking havoc on the market:

Source:Â American Securitization Forum

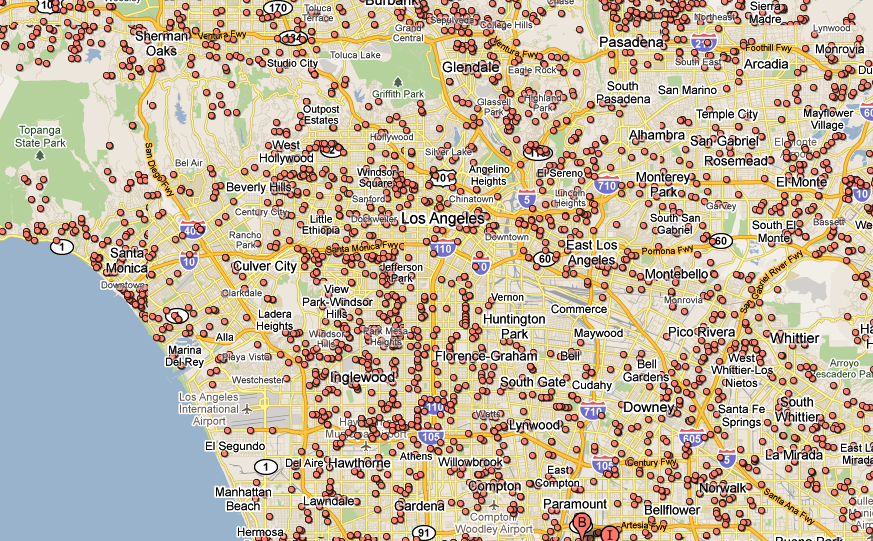

These loans have default rates surpassing subprime loans in many cases. If you think we are out of the woods just look at this map showing only a handful of foreclosures:

It looks like California home prices are correcting through the sales of foreclosures. Even with that said I would bet that half of those with mortgages would like to think that they can afford their home even though the overall market data tells us otherwise.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

58 Responses to “Financially dreaming in California – 50 percent of California households with a mortgage cannot afford the home they are living in. The lingering effects of Alt-A mortgages and negative equity.”

Being able to buy a home is not the equivalent of being able to afford a home.

.

Similarly, most cannot separate NEED vs WANT.

On the Home Front In 2011

http://www.cnbc.com/id/15840232?play=1&video=1715385720

I can’t live in California. I GTFO in 2009. I expect California to become the most exclusive subdivision in the country. The elite and the people who serve them. Eventually anyone in the strata between elite and servant will have to bail. With Governor Moonbat calling for a vote on the greatest tax hike ever and Blue Shield asking for a 59% rate increase- I think the Democratic mecca has just about priced themselves out completely. Current demographics show 80k people fleeing California annually. Health insurance will soon cost more than a mortgage. At some point, weather and the beach are simply no longer worth it. That point has arrived.

I have not personally vetted Browns tax proposal but my understanding from the press is that he wants to extend what is already in place. You write, in conjunction with your name calling, as tho he is generating an all new plan. You become even more suspect with your 80k leaving annually. You may want to take a math class to know that that is about .002 percent of the states population. Will you cry over a 2 thousandth drop in your annual income. None of this is to belittle the tremendous crises we face in Cali in budget deficit, job loss and underwater housing but c’mon man – you seem to be speaking with pre-conceived notions of reality and bias.

The way I understand it, CA last year added a 10% withholding increase as a purely emergency measure to borrow money from taxpayers in advance. Now, Gov. Brown wants to make that amount an actual increase, and will not be repayed to the taxpayer. Sounds like an increase to me. But I knew once CA got that revenue stream, they would fight like hell to keep it and never give it up; it’s not the status quo, it’s a tax increase, and I wager it will fail at the polls.

Perhaps Wydeeyed is the one that needs a math class:

80,000 / 37,000,000 * 100 = 0.216%

With your math skills, it is no wonder that everything is upside in California.

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2011/01/15/INEI1H55SI.DTL

brown wants to extend the sales tax increases from 09 as well as maintain vehicle license fees. however, he also wants to increase personal income tax. so it’s sort of both an extension and an increase. it’s just a matter of which tax policy you are talking about.

I think the poster’s point is not so much the percentage of peeps FLEEING PRKali, but rather that almost all of them are the skilled PRODUCTIVE, CONTRIBUTING middle class (engineers, physicians, contractors, etc.) and essential small-medium biz owners… while what remains behind is a thin layer of elites with money coming from OUTside the reach of Cali’s tax collectors, and a burgeoning welfare class making further claims on a shrinking state budget… THAT is UNsustainable.

PS: Err, umm, YOU need a math refresher too:

First, while 80k/30M does = .0026666… , i.e. 2.6 parts per thousand, that’s .26 perCENT (literally, per CENTum, i.e. HUNDRED), NOT .002% ;^)

Second, you rounded DOWN, when every amount > .250000… should be rounded UP, thus we’re talking 0.3%… now let’s talk about the SECOND DERIVATIVE of this trend, i.e. the rate of ACCELERATION of peeps FLEEing the failed Nanny State.

Again, secondary, even tertiary, to the DEMOgraphic profile of those leaving Cali, vs. those “showing up” to… I dunno… drop an “anchor baby”? =:O

The (net) 80k that are leaving are not going back to Mexico. The gross amount leaving is over 500,000, but most of it is made up by the immigrants coming here from Mexico(with no money and demand much public services). The people leaving are taking their money with them. California has the highest tax burden in the nation. This is a turn off to those who actually pay taxes here. Texas is the Promised Land.

Perhaps snot nose I do need a math class, however perhaps the real reason we are in an economic crises is that so many of you can look at a number like .2 and see two hundredths when in reality that is 20 percent. It is fourth grade decimal education that teaches us that whole numbers are to the left of the decimal and fractions to the right. .1 is tenths, .01 is hundredths and .001 is thousandths. Enzo is correct of course and I knew that it should be rounded up resulting in even less people leaving as a percentage. However I rounded the other direction in a foolish attempt to avoid the common internet backlash. My mistake. I otherwise stand by my use of decimals and zeros. I am not a fan of the shorthand method of showing percent. I find it confusing. Ever since I was a kid .2 was 20 percent. My point is that at .00266 thousandths of a percent leaving the state on a constant basis it would take 462 and a half years for California to be devoid of people. This is not like the exodus from New Orleans following Katrina.

As to the anecdotal claim that all the people net leaving are high earners I say hog wash. I just moved from an area in So Cal where houses between $550,000 and $900,000 sell regularly. These are actually very nice homes not the overpriced crap showing up in LA. If you re-read my comments you will see I did not say the state is all upside. Snotnose you should work on reading comprehension.

I work for a college & just my medical cap is more than my mortgage. The coverage exposes me to $6k worth of up-front medical costs.

$6k deductible/out-of-pocket for office visits is not bad, considering what a REAL medical “event” will cost.

Would be VERY INFORMATIVE to know whether your college is private/county/state?

Thanks in advance.

you took the words right out of my mouth sir! I think there are thousands of californians thinking the same thoughts and scenarios. there comes a point when we will have no choice but to finally throw in the towel and relocate elsewhere.

Just remember that the Corelogic “heatmap” doesnt include 2 categories of housedebtors.

1. The OptionARMs that haven’t recasted yet and the owners are still making teaser payments that are 1/3 of what they should be.

2. The plethora of homes that aren’t making payments yet no NOD has been filed.

The whole storyline behind “Real Estate Intervention” on HGTV, is that a person or couple is trying to sell their house, but they have it listed too high. So a real estate “pro” comes over looks at it, shows them the comps of the neighborhood, takes them to a listing or two that has more to offer than their house, at a lower price. In the last segment of the show, the couple agrees, reluctantly, to drop their list price, and learn to live within their means. Happens every time….

Nothing like negative amortization loans to put people into even more debt they can’t afford. What a fabulous invention by the banks. I am picturing all of the bank execs who made 6 and 7 figure bonuses by handing these out as no doc loans. What a joke.

I, for one, have been renting since 2005 and waiting for the Alt-A and Option ARM implosion to occur so I could jump back into the Westside at much more affordable/realistic rates and we’re not there yet. Make no mistake about it – the resets are just beginning and the next 2 years will create a whole new problem for medium and high-priced homes in SoCal. CA has 58% of all Alt-A and Option ARM mortgage issued in the US and the day of reckoning is slowly making its way through CA over the next 2 years. If you think prices have come down in medium and high-tier prices already then you haven’t seen anything yet. This is going to be a whole new ballgame and I am looking forward to watching the dominoes fall from the sidelines, as I have patiently waited 6 years for this year to come. And don’t forget that this will still take a while to play out. If banks to continue to wait 1-2 years to foreclose on these then we’ll have to wait until 2013-2014 before they are foreclosed and then are eventually released by the banks (which could take another 1-2 years!). Patience will clearly pay off. In the meantime, enjoy these years for what they are – an opportunity to build equity while renting in anticipation of buying when the timing is right.

And I apologize to anyone who thinks that I sound like I am vulture waiting to prey on others. The simple fact is that my wife and I were conservative and refused to take on a no doc loan like the Alt-A and Option ARM holders did because it was more than obvious that it was offer to overextend ourselves. Do I feel bad for people holding Subprime loans who bit off more than they could chew? Definitely, as I am sure there were some innocent people who got lured into things. But Alt-A and Option ARM loans, by design, allowed people to double-down and make a “bet” they couldn’t afford. So it’s hard for me to feel bad for someone who signed on the dotted line of an Alt-A or Option ARM loan. While I do feel bad that it will drastically affect their lives, I am very sorry but I really can’t feel that bad for them – as they clearly took on too much debt with the understanding that they were doing so at the time (at least for most).

In the meantime, be careful if you’re looking to buy in mid or high-end areas this year. What looks “cheap” today will probably look very overpriced in the next couple of years thanks to these ticking time bomb loans.

I welcome any comments/perspectives that are different just to hear if others agree or disagree.

Good luck to everyone.

One thing to keep in mind is that the massive influx of delinquencies/NOD’s won’t be as huge as the option ARMS graph released by Amherst (I think Dr. HB has used this graph several times on this blog already). People won’t start defaulting around the time of reset. They’re already defaulting now as people are walking away from their homes, realizing they are underwater and it’s not worth paying the minimal payments if they’re gonna lose the home anyways.

It’s possible that the most difficult challenge for banks will come sooner than later, and if they are able to weather the storm with help from big brother Fed, home prices may ‘stabilize’ as soon as 2013. I quote stabilize because the banks, having faced the worst, will by then sort out another artificial strategy to keep home prices from falling off another cliff (and maintain a minimal loss in home values).

My personal outlook is another 10~20% falloff between now and q4 of 2012 before further decreases become marginal. i think there’s lots of room for home prices to dip lower than 20%, but Fed/bank intervention has me wondering about a total meltdown in home prices.

Agreed. While I feel bad for some people, I don’t feel so bad for people with these timebomb loans. They’re structured so you either sell the property before it recasts, or you somehow triple your personal income in five years and can afford the new payment. Obviously, the intent is the former – to buy big, and sell at a profit. It’s a gambler’s loan.

While their credit might be ruined, and life disrupted, you can’t overlook the fact that they did have a roof over their heads, and the house was more than they could normally afford, so it was nicer than what they could have rented. Five years in a house is not nothing – it’s living. People less inclined to take these risks were living in more modest homes, probably in higher-crime areas.

Think of it as an extended vacation, or a sabbatical from reality, and it was being rented from the bank, and now Uncle Sam.

The people I feel sorry about are the ones who had regular loans, and had been paying it for a decade or more, but found themselves out of work, and are now losing their homes. These are the people who really need bailing out. The banks look at those properties, which are NOT underwater, and want to pounce on them because they aren’t going to hurt the books. The loans were profitable. The sale price will still exceed the previous sale price. Get them to bankruptcy court pronto.

“Five years in a house is not nothing – it’s living. People less inclined to take these risks were living in more modest homes, probably in higher-crime areas.”

Burbank, CA next to Disney does not look to me as Higher-crime area.

1300$ – two bedroom – house (not condo…)

I keep renting for now…

Yes some of us have been waitting, and prudent, knowing what we could afford, and not buy into all the hype that was being passed around.

I for one have taken Dr. H.B. advice about the 3 times your salary, as to what one could afford, I had never knew about that, but it sure makes sense.

I’m waitting to buy in Orange County, around the Tustin area, still way overpriced for what I will be looking for. I will wait as well, especially to see what the economy looks like this summer and as my son graduates high school, so I can think of other cities I may want to think of.

By then we shall see also what’s going on with government with the new players at hand. Will we all benefit somehow, every American, or will things still be the same, and only banks and wall street continue to come out ahead. Also with shadow inventory, always a great mystery.

You must remember we are operating in a very rigged market. The fed will keep it rigged longer than anyone can imagine (unless some outside event occurs that is unknown now). They will do what it takes to protect the banks including continuance of phony asset values on their books, allowing them to hold REO at phony marks on their books until they sell, off loading the bad paper onto the fed if necessary (rest assured we will see the fed purchasing crap MBS again soon as another bank bailout) and allowing banks to leave delinquent owners in their hose so they can keep spending to boost the economy. They are managing prices with all the above and more to bide time. At the same time they are causing inflation out the ying yang. Unless they totally loose control of long term interest rates, I don’t think you get the price depreciation you envission.

Nail on the head!

But….I have great memories of the 70s and know first hand things can go the wrong way for the FED for a long time.

Many are conditioned to believe the FED always gets what it wants. Many are in for a surprise when that “unknown” financial event occurs.

I understand your situation completely. Don’t feel bad though. I tried in vain to warn several friends before the storm hit. They resented my advice and never seem to have forgiven me — as if the whole housing crash was my fault. This was a pretty powerful dose of groupthink that drove housing to such staggering heights. I think it was less about sheer greed and more about what people thought was going to be the new reality. They really didn’t consider that they were creating this new, soaring price reality, by borrowing way more than they ever could afford.

There’s nothing wrong with being smart and using your common sense. If more folks had done that, we wouldn’t be so deep in the mire.

Yep, Ricardo, the entire housing bubble and prolonged crash WAS ALL YOUR FAULT. If you had simply bought in and drank the Kool-Aid like all the good little sheep, none of this would have happened. That house you didn’t purchase was the one that tipped things and broke the camel’s back. It’s all your fault. LOL. Seriously, your friends were caught up in the mania like the majority of the population – this was classic, typical bubble mania, and it pretty much always ends the same way. Usually quickly, sometimes it takes longer. Your friends will hopefully realize one day what a good friend you are for trying to steer them back to reality and keep them from harm. But also remember, ignorance is bliss…

Investor J….. You couldn’t be more correct. I could sign my name to this letter and not change one word. Good for you! Hope many read this and take heed…. J

Once again thank you always DHB and rest of the fellow readers who always comments! Keep up the great work 🙂

What is wrong with broccoli?

Investor J, we got lucky and sold our house on July 3rd. We thought we were going to just look for a home and life would go on. However, I started reading this site and doing some homework and we decided to rent and watch the market. We still want to buy within the next 6 months but my entire outlook has changed. We will only try and get a house way below CURRENT market value and if our offer is not accepted we will wait for the next one. Homes in the area we are interested in are sitting for a long, long, long time and are going no where but down. This renting is going to be the luckiest thing we ever did.

Dear Renter, As you’ve already made the move, I would consider 18 months rather than 6. It’s taking a long time to get this market back to reality. No doubt the government have more tricks up their sleave to keep prices inflated. It’s coming down, especially in the mid to upper tier — but you may have to be more patient than you like.

Doctor Doctor spare me this news…

Alt-A interest rates are higher when one signs up.

Adjustable-rates havent gone higher with the Fed stealing our money.

Those in these categories can keep on keeping on until their loans re-adjust when interest rates finally adjust higher… right?

Nothing to see here folks, move along. Just don’t move to Nevada. We are fed up with your calipornia ways.

It’s *not* about the interest rate adjusting upwards. It’s about the recast that is involved with a neg-am loan where the debtor has to start paying back the principal. They couldn’t afford to pay the principal in the first place (hence the need for a negAM loan) and not only that, many were given teaser rates that were far lower than the low low rates that we see today. Mix the negAM aspect with an overinflated stated income (aka liars loan) and the debtor is scrooooowed.

There isn’t a loan mod out there that can save a negAM (liars) loan.

Alt-A recast is not the same as adjustable resetting. The vast majority chose minimum payment, which is negative amortorization, so they are underwater already and have no hope of refi. Their future is foreclosure, in almost every case.

I guess “in English” they’re talking about two special deals you could get with some of these loans. One was that the borrower could make an ultra-low payment that was *less* than the interest on the loan, so that the total loan amount would increase. Some people are paying only this minimal payment — you can assume these people intend to walk away from the loans.

Second are teaser rates that were near 3%. Those loans will see their rates jump to above 5%. Some loans were made based on the borrower being able to afford the payments at the teaser rate, rather than at the higher rate. So, maybe they could afford $1,500 a month – they could get a loan for a huge house.

While people like to spread the blame between banks and borrowers, and some bankers like to blame the borrowers, my inclination is to blame the banks.

If you had a money to lend, would you lend it to someone who earned 40k a year so they could buy a $400k house? Well, that’s what the banks did.

Now, I know the consensus was that house prices would not drop. Or so they say. I know that wasn’t the case in my family. There were always people saying things like “oh, these houses are just too expensive,” and “I guess we’ll just have to move in together into so-and-so’s house.” We weren’t bankers. We were not rich. In fact, I’m sure some people would have said we were lower-middle-class or working class, and we’re a little stupid back then. I had more than a few garrulous people tell me they wanted to get me into a mortgage. They’d just gotten into real estate, was their usual story.

I had to wonder if these middle aged salespeople, my peers, even remembered enough high-school algebra to do the math on these loans. I could barely recall it. Maybe I could do it with a spreadsheet and a cheat-sheet. I wouldn’t be surprised if these folks still use printed amortization tables.

You have a few banks originating loans. You have hundreds of sales people, generally the guys who didn’t make it to calculus class, because I don’t remember seeing them in calculus, selling these products. And you have tens of thousands of people getting into these loans.

So, really, who is to blame here?

To become a mortgage broker requires no training. To become a realtor you take an eight week course — and I don’t think you need even a high school diploma. The mistake people made is taking their life savings and trusting the advice of people who basically knew nothing about economics. All they saw was their commision.

I love CA and never plan to leave….

It is beautiful, behold the view of citrus trees against the backdrop of the mountains and shining sun in January. But if you are caught up in the mindset of the necessity of owning what the culture says you must own then yea, it is NOT affordable. If your not though, maybe stay around, actually work to improve your community, stay and fight for a good life right here where you are, with or without “ownership”.

Amen!!!

With gas prices higher lately, this will be another body blow to the property owner.

Great post..but I notice no one seems to talk about what effect the coming surge in food, energy and clothing prices will have on the economy and housing in particular..what happens when people who can’t afford their homes also have to contend with $4 gas and food costs that are now only starting to rise. My guess is the coming “sticker shock” will cause another downturn in the economy and the stock market . and then….

are charts readily available for california homeowners who’s arm’s are recasting AND readjusting? meaning do we have two separate charts to look at those 2 pieces of data? i would like to see them. my $.02 – the recasting will squeeze homeowners out of homes as it’s been doing, but i think the bigger squeeze is when the rates eventually begin to rise. am i in the park?

I think a more important chart would be how many option arm mortgages are currently delinquent or in default. If a majority of the option arms are already delinquent or in default, it won’t matter that they recast a year or a year and a half from now.

Don’t apologize for being a vulture, but you should think three times before jumping back in. In parts of the country the first wave of vultures who thought they were getting a deal is already starting to roll over and go belly up as their flips have flopped. Better to wait and be a vulture of vultures, where the real deals will be found in several years (or more)

Now we have :

Zombie Banks

Zombie Homes

Zombie Jobs

The greatest transfer of wealth in all history. Keep an eye out for you and your family members…. Zombieland is headed for the Westside.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

that google maps “foreclosure” image is not just foreclosures.

it includes NODs, NOTs as well as foreclosures.

Housing tracker just released lastest asking house and condo prices in Los Angeles. In Los Angeles, the decline in asking prices for 25th, median, and 75th percentile properties is accelerating…

http://www.housingtracker.net/asking-prices/los-angeles-california/

An interesting factoid I came across was that in 1860 Vicksburg, Mississippi was the wealthiest city in America. 5 years later it was all ‘gone with the wind’. The economic model that Mississippi had relied on, cotton and slave labor, was busted never to return.

They were left with a ( rapid increasing) population of former slaves, bankrupt plantations ( their capital was human) and little know how in the industrial arts then becoming ascendant in America. Mississippi has since brought up the rear in state rankings nationally. I mention this because California maybe facing a similiar tipping point. Having given up its balanced economy that was the envy of the nation it became overly reliant on a FIRE economy that, for awhile, generated outsized profits based on an unsustainable credit bubble. It now has a large and growing proletariat brought in to service the FIRE economy but without the education or skills necessary to adapt to a changed economic circumstance. Has California tipped over into a new Mississippi?

No.

O Puleeze. That is ridiculous

“Has California tipped over into a new Mississippi?”

I think it would be accurate to say it’ll tip into the new South East Asia. Here in Southern CA I’m noticing increasing instances of people arriving from China and South East Asia to buy RE. They don’t even haggle the asking price. I know of one luxury condo in Irvine that was visited & subsequently purchased by an asian gentlemen straight off the airplane from nearby John Wayne airport.

Fullerton, a beautiful city in Orange County, has entire neighborhood tracts that are occupied overwhelmingly by Koreans who tend to buy up local businesses in order to open stores that cater specifically to their culture. Even the signs go up in Korean, with barely a few bothering to add an English translation.

Hey, THIS is the “change you can believe in” everyone. ENJOY IT!

And now if you’ll excuse me, I’m late for my Mandarin class.

You conveniently forgot that the city of Vicksburg had a visit from General Ulysses S. Grant and his troops a few years after 1860.

“An interesting factoid I came across was that in 1860 Vicksburg, Mississippi was the wealthiest city in America. 5 years later it was all ‘gone with the wind’. The economic model that Mississippi had relied on, cotton and slave labor, was busted never to return. …

… Has California tipped over into a new Mississippi?”

Only if the entertainment industry is abolished.

Hey – nothing is impossible.

Moss

“Debt is not a source of income.”

It’s hard to get the average schmoe to understand that very simple, basic concept when the U.S. federal government itself shows NO SIGNS of understanding it either.

Failure to abide by sane financial policies, coupled with massive institutionalized control fraud (as defined by Willian K Black) are the main reasons why China is on the RISE on almost every front while America whirls circling ever faster down the proverbial toilet bowl.

America is FUBAR.

Excellent article…! There was ONE sentence that implies much much more than was stated. I fully support the ideas in this article AND I would like to point out some inconsistencies that MOST of us miss when trying to understand what is really going on. I have spent considerable time studying the issues involved and learned that among even the most devout housing “whistlelblowers” we still miss the MAIN issue…but it is rarely if never discussed directly. If we carefully define this issue …..all other cards will fall into line…and the solutions will look very simple!

If anyone out there is interested in honestly exploring these ideas please email me or post here. This is not a “same old road” you may have seen before, but an entirely new way to look at the definitions we use.

Broadly it concerns our definitions concerning the intrinsic value of a house. I’ll start by saying that if you loo at the class of all man-made things, you will quickly realize that with few exceptions including: collectables, heirlooms, old photos, artwork, sculpture, that the overwhelming numbers of manmade objects LOSE VALUE over time….except “houses”. Look around and try this exercise. Now ask your self what is so important about a collection of wood, nails, shingles and construction materials makes it so valuable? There is NONE…other than emotion and human psychological conditioning. Once we accept this as FACT, you will soon realize that arguments concerning the value of the house because of its component materials also evaporates. I have noticed that some bankers and Realtors haven’t even caught on to the scam. They believe their own lies.

Lets look at a house built in 1938 —or ANY year…and assess what happened to its structure from initial construction to present time:

1) The land was paid for… ALL concerned were paid UP FRONT.

2) Utilities —all of the supply lines were paid for IN ADVANCE.

3) Building fees and permits…these were already paid for.

4) Local taxes…Paid for.

5) Building marterials — PAID

6) The most expensive portion – LABOR friom architect to engineer to laborer PAID.

7) If muliple houses were bullt—most commonly known as TRACTS. All price costs were reduced because of the economy of scale.

The Developer extratcted additional profit form the economy of scale.

Now look at the costs of buying the house…the house “value” increases a small amount most every year… WHILE AT THE SAME TIME the house slowly disintegrates and costs more money to keep it from “rotting in the rain”. But why do we have this perception…that somehow a house INCREASES in value…when the structure of the house deteriorates?

Ask why the laborers WHO BUILD THE HOUSE…can not afford to but what THEY BUILT? But the REALTORS, bankers and middlemen…make all the profits beyond the initial sale. It sounds so simple….and it is….but can we distill this to what sounds like the impossible? I think so! The laborers who built the house should share in the initial value of theior labor…NO ! These are the people the Developers and General Contcators despise…they want them to work for free.

How do we buy a house? PAY large DOWN PAYMENTS…ON LOWER PRICED HOUSES…at the same size and function. Once the time value of money is eliminated from the formula…house prices will go down!

I am a renter—why should ANYONE pay more for a house than the cost to build it.

Even the NAHB puffs up the cost of building a house…to make it appear that current “low” selling prices are “reasonable…when they are STILL BLOATED on new houses. When a car manufacturer buld a car— DO THEY PAY RETAIL for every nut and bolt? NO! Then why do homebuilders whine about building costs when they really buy under wholesale and turn around and show retail costs–as though they were the REAL costs…?

.

Then why do homebuilders whine about building costs when they really buy under wholesale and turn around and show retail costs–as though they were the REAL costs…?

@ L.D. – curious at to what your point of reference is with regards to your above statement? I would seem that with all the different components that go into the sales price of NEW home, ie. land cost, hard costs, financing, builder P&O, RE commission, etc. that ultimately the cost of purchasing any home – new or existing – ultimately comes down to its PERCEIVED VALUE at any given point in time. Nothing more, nothing less.

1. Wow. I been looking to buy since last May and still have not been able to buy a nice size home in a good area because it’s still overpriced. I’m stressed out big time and now with the home loans rates rising to almost 5% it doesn’t seem like the home prices will drop. I’m still renting it’s been 17yrs, dreaming of finally owning a home should I wait ? Based on the past in spring the prices of homes go up then in summer much higher then it falls in Fall. I’ve been my own agent driving after work and on weekends.. Agents showing homes I can’t afford.. and everyone thinks about the commission and not the customer… any advice?

I’m in CA, want to stay in North Hollywood but I may not have a choice but to go further . Granada Hills? Simi Valley

@tina you should wait and couple more years. The prices will drop. Also, you are always going to get a better deal if you move further away. North Hollywood is not going to drop a lot unless the Studios close down (too many high paid people in that area, plus people who catch the train to downtown). Toluca Lake is dropping a little, so it Burbank, but is still too high. Thus, people are pushing their way into Noho so if you can’t afford it now, I doubt it will drop a lot that you will be able to afford it later. Other parts of the valley are going to be way more affordable soon, especially as the interest rates rise.

Tina and II, please go to the LA times web site and look at the crime stats for NoHO. Not pretty!

Tina,

Most definately, WAIT to purchase!! The value of houses today will lose 20 to 40 % in the next five years, and interest rates will begin to rise. Would you rather purchase a house today for 375K with 5 % interest or the same house in a few years for 225 – 250 K with 7.5% interest???

You live in the epicenter of Bubble Central. Do not listen to realtors, mortgage lenders, or commercials hyping up great deals on the American dream.

Go walk the neighborhoods of forclosed properties, if the folks will talk to you and be honest about their situations, you will find you do not now or ever want to be walking in their shoes…

I know, I lived in SoCal for 13 years. I left before the bubble, but my old house, on Connelll Ave in Simi Valley would still list for over 400K. When houses in that neighborhood are in the 250K range again, that will be the time to get back in.

Good luck!!

Leave a Reply to Latesummer2009