The financial allure of renting – How the real estate industry silences the voice of one third of Americans. Homeownership back to 1998 levels because owning a home requires income and affordability. $650 billion in real estate wealth evaporated in the last quarter of housing data.

One third of Americans do it. There is no heavy handed lobby for this large group. We are talking about renting. The United States is built around homeownership and the marketing machine that pushes it through the system has no regard for the renting group. However renting makes a lot of sense for a lot of people. No one really owns a home until they pay off the bank note completely. You always see on the housing shows a dreamlike state of a person buying their first home. The camera zooms in on the happy couple in HDTV and they give each other a Hollywood glance and say, “we are now homeowners!â€Â Well, you actually own the property as long as you pay your mortgage on time to the bank. Owning isn’t the financially smart thing for many Americans yet there is no group pushing for this because there is little money to be made on telling people to not buy. Money is made selling the sizzle not on avoiding boneheaded financial decisions. Our consumer driven culture is pummeled with advertising from the real estate industry to buy like a boxer knocking out an opponent. Once you buy, you need to buy more junk to stuff in your home. Empty garage? Fill it up with a leased car. It is one giant debt scheme to get people to spend. Let us try to give a voice to the one third of Americans that rent.

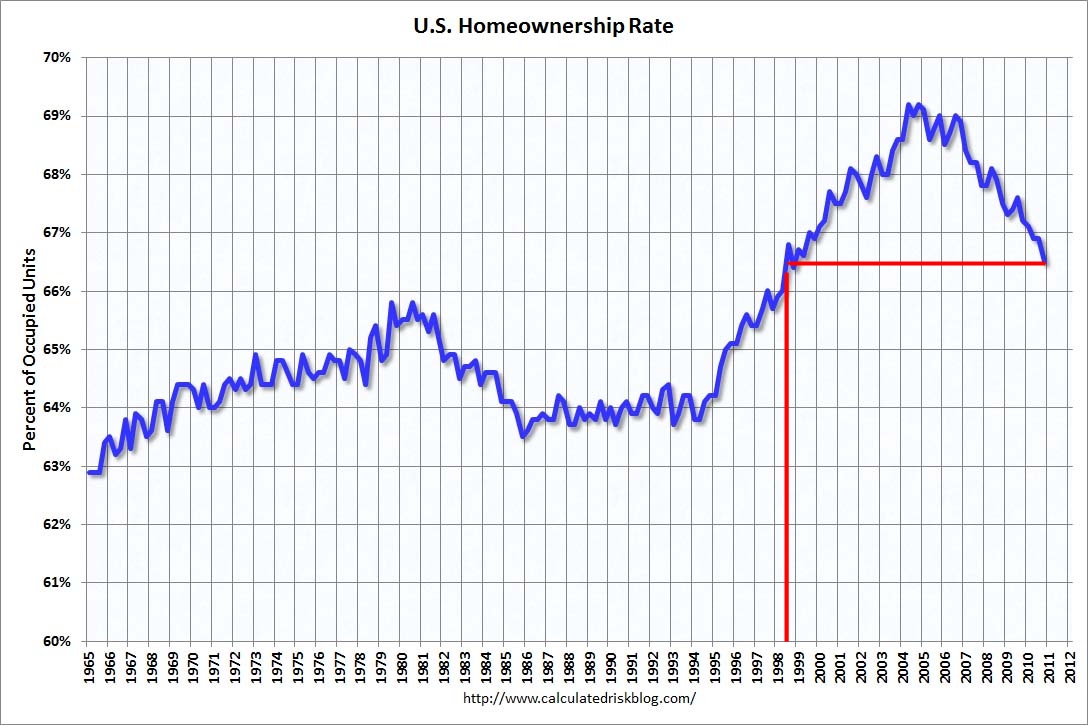

Homeownership back to 1998 levels

Source:Â Calculated Risk

The experiment on getting every person into a home to call their own was largely a dynamic and epic failure. Sure the mortgage industry enjoyed the massive sums made on churning out loans and Wall Street reveled in the speculation brought on by new and fancy financial instruments but who really won here? After all was said and done Americans are back to homeownership levels last seen in 1998. Not everyone deserves or can financially own a home. This seems to be a shocking revelation and all our government policy, which is ushered in with a Wall Street blessing, is guided and designed to get every single person into a home even if their financial situation is sketchy at best. This is like saying every American should be married just because it is the thing to do. It is nice to have a cookie cutter response to every person but life is more subtle than giving every person a no-doc no-money down payment loan.

But what about the schools and the children?

I always hear this argument about people willing to overpay simply because of a good school district. Did good schools not exist in 1998 or 1970 or 1950? Why all of a sudden a premium for good schools? This is again right from the real estate agent propaganda handbook. Nothing is precluding you from sending your kids to a private school and renting in a neighborhood you really like with an affordable mortgage. In fact you can rent in a solid neighborhood and send your kids to school just like everyone else. Of course, you’ll be living in a neighborhood where it is likely that everyone has a leased foreign car and is spending beyond their means. Can you resist keeping up with the Joneses? Most people that buy in these areas fall into the herd mentality and simply go into debt just like everyone else. But the argument about schools is so powerful because of the family emotional component. Who can put a price on that? Well apparently the real estate industry since they are trying to scam people into believing home prices are still worth inflated values especially in California because of random amenities that tug at the heart.

I’ve also seen people say “I am willing to buy this crap home that is the size of a dog house to send my kid to the great school in this neighborhood.â€Â This argument emerged mostly during the housing bubble. In the past people did buy in good neighborhoods and it was assumed you had good schools as a perk for buying an actual nice home. The last decade saw people buying absolute junk homes simply because of the schools in the area. It was a delusional financial move. What these people are saying is they are willing to live anywhere and pay the price for a good school. We see this nonsense permeating even in people going into massive college debt just because they need a degree. To these people I would say why not use the money you would save from renting and send your kids to a private school? The propaganda from the real estate industry has screwed up the psychology of many and it still lingers in California even after the housing bubble has imploded. If you can afford the payment then go for it. Don’t spend more than one-third of your net income on your home payment. If you can’t swing that, then you can’t afford it.

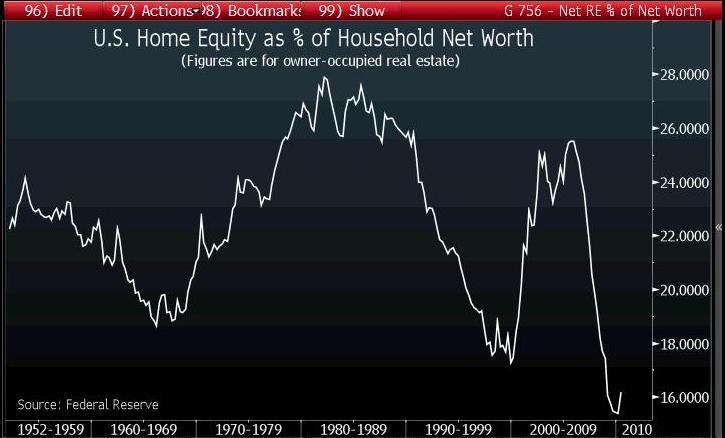

Housing is where the wealth is…or used to be

During the bubble days people were arguing that a drop in housing values would have a little impact because of the wealth effect. They were pointing to absurd charts like the above. First, you can see that most of the home equity gains during the bubble were largely all inflated to begin with. Many of these folks argued that people would be fine because of their stock wealth. This is a flat out lie. Half of all U.S. households have less than $50,000 in stocks or mutual funds so the net worth charts are skewed by the extremely wealthy that have billion dollar stock portfolios. So a 10 percent jump or fall in the stock market does nothing for the quality of life of most Americans and it certainly doesn’t make them feel like being on the Forbes 400 list. Home equity was and continues to be where most Americans keep their wealth. And with nationwide home values falling by over 30 percent from their peak according to the Case-Shiller Index many Americans have lost trillions of dollars in perceived wealth.

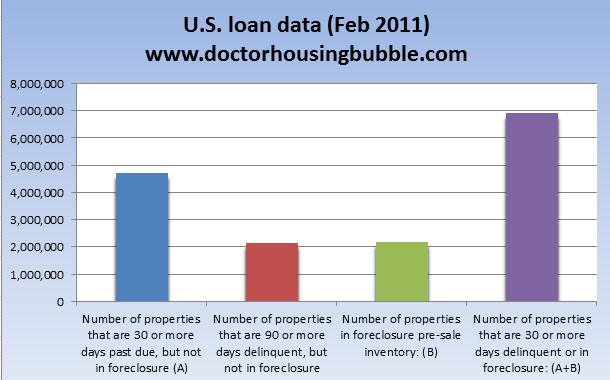

Renting doesn’t seem like a bad idea when the number one asset in the country has fallen by 30 percent from the peak. And keep in mind this is leveraged. So say you bought into the delusion and bought in 2007 in California with a nothing down Alt-A loan and paid $600,000 for your shack. As it turns out, the home is now worth $400,000 and you are underwater by $200,000. You are now in worse shape than a renter that simply lived in a home and socked money away in an emergency fund. Leverage cuts both ways and that is why having a significant down payment, upwards of 10 percent is so important. This is why we have a housing market flooded with problem loans:

Source:Â LPS

In the US nearly 7 million homes are either in foreclosure or have missed at least one mortgage payment. Even if we suddenly had no more foreclosures (not happening in 2011) the pipeline is spilling over with homes that will drag prices lower. Since many can still purchase with FHA insured loans with low down payments you are likely to lose all of your down payment in the correction that is coming. In other words, it makes sense to rent simply as a hedge. There is little incentive to buy today.

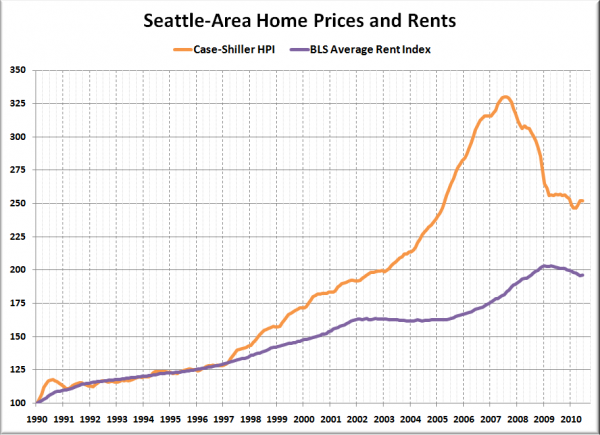

California isn’t the only place where this happened and you can see this when comparing market rents to actual home prices in other areas:

Source:Â Seattle Bubble

This chart reappears for Los Angeles, San Francisco, New York, Chicago, and many other bubble cities. Home prices are still too high relative to actual market rents.

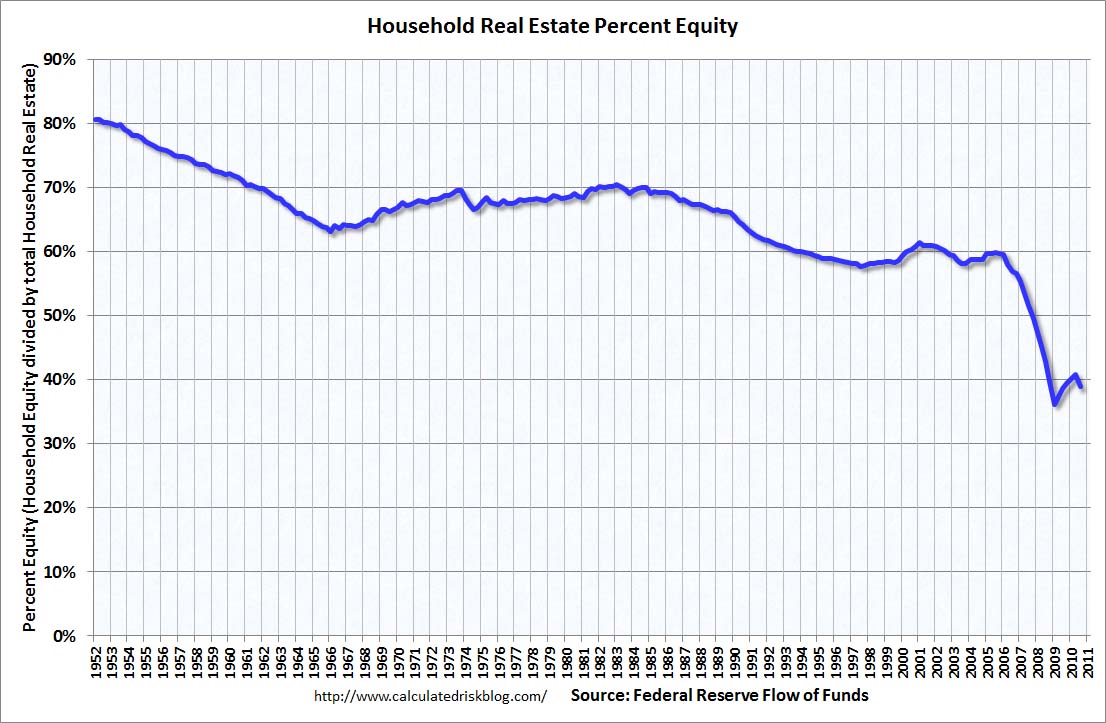

Equity declining yet again

Source:Â Calculated Risk

This is probably the most insidious chart of all. Even during the grand housing bubble the amount of equity in homes continued to fall. So think about this carefully. As home prices grew at levels never seen in the United States somehow the amount of equity in homes continued to fall! What happened? Well you had people that suddenly saw their home as an ATM and refinanced and yanked out cash from their home. This money was not free. It was a loan secured by an inflated asset. California was notorious in home equity withdrawals. You also had the advent of low to nothing down purchases. We are heading back to breaking the record low of equity Americans have in their homes.   In the third quarter of 2010 in the latest Federal Reserve report household percent of equity in household real estate declined by 38.8 percent and the value of real estate fell by $650 billion in one quarter. Renting is a viable option and home buying is obviously not a risk-free investment.

Why the bad press for renting?

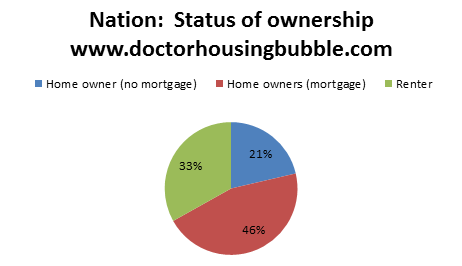

Here is the complete bird’s eye view of housing for the United States:

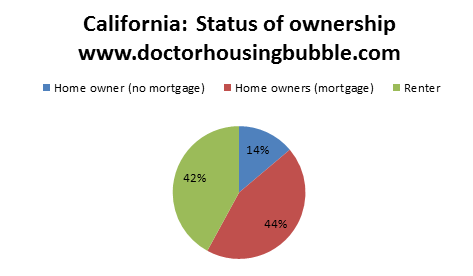

Nationwide one third of households rent. Another 21 percent own their home free and clear. 46 percent of households carry a mortgage. But when we look at California the numbers show how leveraged this state is:

Only 14 percent of California households carry no mortgage and 44 percent of home owners carry a mortgage. 42 percent of Californians rent. So in California nearly half of households fall in this renting category especially in high priced counties.

Renting gets a bad reputation because there is no visible lobby or big marketing budgets. You hear absurd mantras like “renting is throwing money away†or “you can’t do anything to your place until you own†as if these were reasons to overpay on a house and put yourself into massive debt. Buying a home does make sense in many circumstances. But right now given our economic malaise it absolutely does not make sense. Many investors are buying cheap homes betting they’ll be able to rent the places out. They obviously believe in a rental market. In the end we as a society have to have affordable housing relative to local area incomes or suffer what went on in Japan where the real estate bubble burst and created two lost decades of housing obsession and bank protection. Instead of focusing banking and capital resources to creating a better and more innovative economy we are plowing money into housing so people can sell drywall boxes to one another and pretend that this is somehow the key to a vibrant economy.

Renting is a great hedge in this current market of uncertainty. In place like California renting is the only economic option that makes sense although many will buy because the siren call is too loud.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

122 Responses to “The financial allure of renting – How the real estate industry silences the voice of one third of Americans. Homeownership back to 1998 levels because owning a home requires income and affordability. $650 billion in real estate wealth evaporated in the last quarter of housing data.”

No! I will not rent.

When Americans realize that owning a small affordable house that they can pay for is better than owning no house at all things will start to smooth out. Renting is like squatting you payout forever and end up with nothing.

Oh plesae, you real-turd (or is that real-tard?)! Renting is not throwing money away. Overpaying for a bubble priced, over-inflated asset i.e. real estate is throwing money away!

What will these home “owners” (home DEBTORS in reality) have after 5, 10, or even 20+ years of throwing money away on interest, maintenance, property tax etc. (assuming they don’t lose or walk away from their severely underwater properties…underwater to the tune of hundreds of thousands of dollars) – they will have what they have in Japan. Multi-generational mortgages on properties worth anywhere from ONE HALF to ONE TENTH what they paid for those properties 20-25 years ago!

So you can go run tell that, homeboy!

“you end up with nothing…” As in no maintenance, no taxes, no depreciation, no crappy neighbors you HAVE to live with, ect. I LOVE RENTING! In the summer I play with my family EVERY weekend at Silverwood. In the winter, I snowborad EVERY weekend. How do I do it? I RENT. All I have to do is mow the yard & rake or shovel the snow. That is it. Nothing more or less.

The OWNER is responsible for such items as (these actually happened in the last 3 years): The pump to the forced hot water heater needed replacing, one of the huge trees in the backyard was ravaged by woodpeckers & had to be removed, the fridge broke, the kitchen sink cloged twice, the automatic garage door opener broke, some service lines under the sink blew in the bathroom (glad I was there or it would have flooded the house), electrical panel fuses went (x2), etc, etc ,etc.

I LOVE RENTING- I play every weekend. Darn near bar none.

So go ahead and buy and fix, and maintain, and edge, and paint, and, and, and, be a slave to the bank and your plastic/asphalt coated drywall box.

I’m with Foolio and Shizo, and I OWN rental property (by inheritance) I will never buy a house, if we ever decide to sell this place, I will turn around and rent!

Renting is throwing money away???? I did not buy during the bubble becuase the price we could pay for even a small home, 1400 sqft was $700k in our neighborhood and would have doubled our rent and we would not have been “moving up” if you will into a 1400 sqft fixer, even in a nice safe neighborhood. We rented a small house for less than $2k/month for the past five years and still lived very well going on vacation and buying new cars and are in the best school district in our neighborhood. Now that prices are back down, we have saved a stash of cash and can afford 20% down on whatever we want. We both work remote and have made the decision to just move to TX where we can put almost 50% down with what we have saved. RENTING does make sense for many. I feel bad for all of my friends that had to buy 5 or 7 years ago, took out loans to remodel the kitchen, owe $800k on a peice of crap and now see why I waited. I’ll have a lovely home, pay for my kids college in cash, have no mortage in less than 10 years and retire sooner. yeah, renting doesn’t make sense.

In California, only 14% are actual “Owners”. The rest are ALL actually renters. Many are just renting from the bank at a high premium (Interest). That would be alright, IF, your asset was appreciating at a decent rate. Right now it is’nt, and doesn’t appear to be for at least a few years, at best. Renting is a no-brainer, if you can get past the emotional aspect of it. If you can’t, just think how “emotional” it will be when, your upside down, the down payment has evaporated and on the verge of a short-sale or foreclosure.

Why stress, when you can still rent for about half the price?

http://www.westsideremeltdown.blogspot.com

So, only 14% have paid off their mortgage? Not saying I don’t believe you, but WOW!

Lest we ooze over into the kind of closed-minded categorical thinking that DHB has tried for years to encourage people out of…

…I’ve had the experience of both renting (20+ years) and owning (10) years. Each choice had its consequences, and each fit with what I was doing at that time in my life.

I am 52 and came of age during the era of 18% mortgages. In my extreme youth I was engaged to someone who absolutely had to buy as soon was we both got out of college. It was impossible to become partners for life without a mortgage somehow. I knew too much about numbers even at 23 to strap myself to that sort of debt slavery. In my view it was better to save until I could afford at least a 30% down payment. (Cash outright would have been better, but that rapidly got less likely as the Baby Boomers so inflated the price of housing, wages fell behind, and prices kept going up, no matter how worker productivity increased, or how hard/how many jobs I worked.)

It was a major factor in my parting with that person–who went on to buy a place with an 18% mortgage, pay on that for 6 years, then move from mortgage to mortgage. And today is in a house worth less (even in a crashing market) and not nearly as nice as the one I live in. But I’m sure that person is constantly preaching the gospel of home ownership, coming from a family where that is tantamount to a religious belief.

The other thing? Over the past 30 years **I didn’t pay such a huge portion of my wages to banks’ interest.*** What this means is that when it made sense for me to buy–arithmetically–I had a much bigger down payment in savings, even with my life choice to work for small organizations and middle class people, rather than giant corporations.

Home ownership isn’t something you do like buying a toaster–once, and it’s over. It has consequences for many years, and isn’t as easy to get out from under as renting. At the same time, once someone knows they are willing and able to root in a community, and it can make financial sense, by all means, go for it.

Either way, it’s not the stuff of categorical thinking. It’s an economic decision. It should not be a religious/ideological one. And that, I think, is what DHB has been trying to say all along. People are entitled to their religious/ideological beliefs, such as “I will never rent.” The question is, what that will cost them. And lately, what it has cost the rest of us in hard cash and opportunities lost to an exploded bubble.

You are right that *now* we are paying for defaulted homeowners, but that is because all of our corrupt politicans (yes even the repugnantcan ones) are BOUGHT and SOLD when they run for office. It’s a scam, and when OUR politicans end up dead from the revolution, they will deserve it. ALL of them.

Your headline above says “….because owning a home requires income and affordability.” Ha! How right you are, but California today offers joblessness and sky high, rip off real estate prices. I smell a meltdown coming!

Coming? We’ve been living *IN* it for the last 3-4 years.

Just a thought – I wonder about the US homeownership chart above, which suggests that there is 66.5% “homeownership” in this country. First of all, I think this 66.5% number is a bunch of bull. 66.5% of the people? or 66.% of adults? And of the total number who do “own” their homes right now, how many have minimal equity, ZERO equity, or are even upside down (negative equity)? How many of this 66.5% number include all the squatters who have not made a payment in 6 months, 1 year, or 2 years?

I bet a revised chart showing $10,000 or less equity, zero equity or negative equity would be drastically different, maybe horrifyingly so.

It’s not just California where renting makes sense. I owned a house in the midwest and I can say one thing for sure…maintenance isn’t cheap. Not by a long shot. Homes here in California may do better because of a more temperate climate but if you look around closely, you’ll see that there is no shortage of homes falling into disrepair. Have you ever stopped to ask yourself…if RE is such a great investment, why are there so many crap homes out there?

The home and debt selling industries will prey on your emotional weaknesses. The biggest load of crap is what you need to do “for the children”. This is where they start aiming their marketing at the women such as the “Suzanne Researched It” commercial. Come on ladies….wake the f*** up and realize that you’re being bamboozled my marketing.

@Petrin from the last thread.

No, I wasn’t referring to you directly WRT the “where do I invest my down payment” questions that are presented with disturbing regularity. Why would you want investment advice from anonymous people on a blog? Nobody here will be able to tell you what the “next hot thing” will be. It’s understandable that everybody has the desire to have their dollars somehow give birth to extra dollars. Everything out there seems to be a casino these days. My own personal opinion is that Americans need to kick their gambling mentalities to the curb and learn to be happy with just saving.

@ Foolio…

Yeah…tons of shennanigans in Hancock Park. That house at 754 Highland has been sitting on the market forever. My guess is that approximately 10-15% of the houses on Highland from Olympic to Melrose have been foreclosed on. I notice the Crescent Heights glut also. I myself won’t ever be able to afford Hancock Park but being that I grew up here, it’s fun to watch the games that the banks play. The king of funkiness belongs to the house at 652 N. Cahuenga.

http://www.redfin.com/CA/Los-Angeles/652-N-Cahuenga-Blvd-90004/home/7099833

Nice, EconE. And just reading the first few lines of this latest Dr HB article, I also immediately jumped to thoughts of the “Suzanne Researched This” commercial…what a winner that one was and is, but for all the wrong reasons!

Again I post a link to it because it really is must see TV, and should be mandatory viewing by potential homedebtors:

http://www.youtube.com/watch?v=Ubsd-tWYmZw

BTW Dr. HB – regarding buying into the schools and the rhetorical question of “are the schools better than they were in the 90s, 80s, 70s etc.” – the answer to that is a resounding HELL NO, in fact more often than not they are far WORSE!!! So not only are you paying a huge premium for buying into these “elite” areas, but you are getting crappier schools with crappier fellow “students” for your children!

Put them in private schools or home school them! Or send them to public school (aka pre-prisons) with criminals-in-training and minimum-wage-slaves-in-the-making. That’s ALL the vast majority of the public schools in the LAUSD and even other schools districts in LA County produce now – the common criminal and the menial labor beast of burden!

What a frightening ad. Put yourself in debt on a declining asset. And, do it for the kids! Great post.

I will feel sorry for those who own only when the price of homes returns to a reasonable level…let’s say, 3x what the pre capita income is. Until that time, I don’t care if taxes on property go to 15%. CA is dead in the water, but as long as crony capitalism and injustice is the name of the game, prices will not come down. Hell, let’s just import all the RICH from China and other countries to keep the price of homes up, to hell with americans who were born here, they are ignorant and lazy from entitlements and a crappy edumication system run by corrupt gangster unions.

Break the unions that control the cops, fireman, and teachers and that will be a beginning. The entire state is a joke and rewards those whom produce nothing but welfare children. Way to go CA!!!!!

WOW, that Cahuenga one is UBER sketchy. Reminds me of the one a few blocks to the west, again on Highland, just south of Melrose (on the other side of that EZ Lube or Jiffy Lube or whatever that’s at the southeast corner of Melrose and Highland). A rehab/McMansionization on a lot too small for it, years of off again/on again work, and listed/delisted/relisted etc. games. And NEXT TO A QUICK OIL CHANGE PLACE, YUCK!

LOL… I say again: ZONING is too important to be left to low-IQ publik skewel graduates. Say what you will about the 19th Century “robber-barron” industrialists, at least the cities they built in the Northeast had rhyme, reason, and great public GREEN spaces… LA-LA is a shameful horror in that regard. Flori-DUH is somewhere in between.

I’ve been a home owner in the midwest since ’97, and I don’t really understand the high “maintenance” costs that supposedly come with owning. This hasn’t been my experience at all. Maybe I just take better care of my property than the average renter does? And do you think your landlord is not paying for the taxes and other expenses out of your rent? Maintenance is not free for a renter either. Now from what I’ve seen, California prices are just insane, and renting is a good choice there. But here, the cost of owning vs. renting is much more comparable, and arguments about supposed maintenance costs don’t sway me much, based on my experience.

As an owner, I cared more about the home I owned than I would have cared about it as a renter or even as a landlord had I been renting it out.

When I repainted the exterior (that was peeling) I stripped the T-111 siding down to bare wood. It would have been cheaper to just replace it with new T-111 but the new stuff is crap compared to what was made in the early 60’s. The same went for refinishing the deck. There were drainage issues that I took care of as an owner that the previous owner who used the house as a rental never addressed. The list goes on and on and on.

The homes that were 60,000-80,000 in 2001 when I moved there are now asking 120,000 to 160,000. Just because the prices didn’t triple, quadruple or quintuple into the insane-o-sphere doesn’t mean that the increase was justified in any way shape or form. Rents haven’t risen nearly as much in that time.

I sold my house in 2005. My neighbor put his on the market in 2007 and it still hasn’t sold. There are tons of homes listed that have been for sale for years and years so IMHO, that has to be taken into consideration. Sure, the gap between renting and owning is much narrower but one also needs to understand that if you buy a house in the midwest there is a good chance that you’ll own it FOREVER.

You must not have replaced the roof, water heater, furnace, air handling unit, a/c compressor, backflow prevention valve, leaky sewer line, extermination issues, paint eaves soffit and window trim every 5 years, mow grass, remove leaves, replace carpet, re-tile master shower, update electric panel, replace fence, new range, new Bosch dishwasher, repair the icemaker, have chandelier cleaned, I could go on

^^^ LOL! Excellent! That is exactly what I remember owning a home to be like in the Midwest. Always something to fix and why do all the roofs leak!

In the last 6 years, I’ve repaired my forced air heater, electric oven, ice maker, dishwasher (twice), and toilet fill valves (3 times). Total cost, maybe $700 for parts plus 6 hours of my time. I can’t imagine hiring out such simple repair jobs. I mow my own 1/3 acre lawn with my $300 lawn mower. Wow, yeah I’m just buried in maintenance expenses here. No need to paint anything, as siding and windows are vinyl. I don’t totally buy the “older is better” mantra.

I guess the thing that confuses me most about this whole line of discussion, Chris (and I’m mostly with you), is that life is about maintenance. It’s about getting up and doing what needs to be done, learning new skills, and doing something because it is fun and makes larger sense, rather than spending another afternoon consuming like a parasite.

But that’s me. I never feel quite right unless there is some new skill to learn. I never viewed any of the maintenance of life as an onerous burden. Relationships need maintenance, families need maintenance, kids need maintenance, pets need maintenance, livestock needs maintenance, gardens and orchards need maintenance, yo need maintenance and I do too…so what’s the big problem with material reality needing maintenance?

And if I’m installing the new Bosch dishwasher (as last week), or cleaning the frozen snow out of the gutters, what am I missing? The chance to throw money at the local yacht club’s martini party and listen to shallow people honk at each other about how superior they are? (Most of them are sorry-ass sailors to boot.) The chance to go to my rifle club and kill more paper circles? (Admittedly, that’s way up in the list of stupid but fun things I love to do–Loud Zen.)

There are people who are producers and people who are consumers. The latter view everything in life as impinging on the Far More Important stuff they could be doing, like watching TV or playing video games or going to some corporate sports event. In my view a huge proportion of this whole housing mess is offering my nation a chance for self examination, around what is really important in life. Also I must say that if a person lacks a fun partner or family, just about anything you do won’t be fun, and with those people in your life, even turning the compost or scrubbing mildew off the north garage wall can be a cause for celebration.

+1 Compass Rose. I have to maintain my car and boat too. If I didn’t want or need those things, I’d sell them and save the maintenance expense. It just so happens that I get a whole lot of use out of my house. The maintenance is just a part of life.

Thanks, EconE, and I agree with you completely.

I also agree with the premise of this post. Especially where I live (Sonoma/Napa Valley), buying doesn’t make a whole lot of sense. Parts of Sonoma, in particular, have been hit pretty hard and the price decline is in full creep. My sister, who owns a house in Calistoga (bought in 2006), lectures me repeatedly on how she is immune, thanks to the wine industry, but even wine, with all its antioxidants, cannot stave off this infection. Apparently she lives in a “desirable neighborhood,” and is “special.” (How many times have you heard that one?) Unfortunately, it’s already hit, and she either doesn’t see it or refuses to accept the truth.

So she loses money on it every month while I happily rent at an insane deal for $450/month and stash the leftovers, patiently waiting for the right day to strike…

More “fringe” Hancock Park funkiness. Yet another (severely) location challenged home.

http://www.redfin.com/CA/Los-Angeles/6307-Melrose-Ave-90038/home/7100980

Because you just know that everybody that used their home as an ATM lived on the busiest streets in whatever hood their in!

Wow, 950 feet on a 2000 sq ft lot! Gotta love those homes on those TINY half lots on Clinton, Rosewood, and some of the other east/west streets all around the city.

$800K asking price for this one – barely over 3K sq ft lot:

http://www.redfin.com/CA/Los-Angeles/8009-Clinton-St-90048/home/7103648

But I see your Melrose micro-shitbox and your Cahuenga shennanegans mcmansion and raise you Miss Cleo’s psychic storefront:

http://www.redfin.com/CA/Los-Angeles/625-N-Highland-Ave-90036/home/7101112

Be sure and check out the google street view to look at the sign in front of the place…

Do you think that Clinton listing is gonna turn into a foreclosure? I’ll have to check back with that one. 2006 purchase price + 5 years for the standard ARM reset/recast puts it right in the “I gotta get this sold QUICKLY!!” territory.

And WTF is the deal with the Psychics on Highland? There’s another one on the NW corner of Beverly & Highland.

I walked by this foreclosed pile of HELOC goodness today…

$68,500 purchase…$801,000 auction price.

http://www.redfin.com/CA/Los-Angeles/207-N-Arden-Blvd-90004/home/7095799

It was “bought” by a company owned by the former CEO of a now defunct mortgage lender. Wouldn’t doubt that they were the original lender. They had a crew of immigrant laborers doing a FULL BLOWN reno-flip with a sign out front saying “Coming Soon”.

So many questions, so few answers.

Wow, nice! There are also a bunch of “psychics” on Olympic. That and fleabag motels. Meanwhile the asking prices are anywhere from $750K on up to well over a million. NONSENSE!!!

How come his/her psychic power wasn’t able to predict the perfect time and price to sell it?

LOL Will! Give ’em a $20 bill and I’m sure they’ll tell you.

My wife and I pull in about $250k/yr and we’ve been renting a 1bed1bath apt in Los Angeles area for the past 3 years. We didn’t look into buying back in 07-08 because we knew there was a bubble going on and we knew the housing market will come down eventually despite how numerous Realtors told us the good old “renting is throwing money away!” or “buy a house so you can have some tax write off.”

Fast forward to 2011, we are still renting at the same place. The rent actually came down quite a bit for us from 2400/month in 2007 to 1950/month now. We’ve saved up quite a bit for our down payment and we have no debt whatsoever with excellent credit.

We looked into a house for around 550k in Temple City early last year. The realtor asked us how we were planning on paying for the place and when we told him that we were thinking of doing the traditional 20 down 80 financed, he told us that we gotta do better than that since most of the other interested buyers were all doing all cash. There was no way that my wife and I in our late 20s will be able to save up all 550k cash to compete with these other buyers. So again, we put off buying and went back to renting. We figured that if the two of us with perfect credit, no debt, 20% saved up and with somewhat decent income can’t afford to buy a 550k house, who else can?!

Lease is coming up again in 6 months for us and we are still considering rent over buy because we believe that this housing market is still going to face another big correction. I have other friends who are in the exact same boat as us financially and they are also considering rent over buy.

Great for you and your wife! Read this blog long enough and you will come to the inescapable and pretty simple conclusion that overpaying for any asset is absurd. You wouldn’t lay out 25k for a car that is only worth 20K. Why would you take on 750k of debt for a property that will eventually be worth 550K or less. Ludicrous. As for the realtor telling you to go home with only 20%. That does not pass the sniff test.

You were being played. At the same time my friend who is a realtor in Washington told me, “I’ll be honest, there are no buyers”. (Yes I admit it, one of my firends is a realtor.) Hard to imagine hordes of cash buyers in California snapping up real estate in Callifornia with all the houses for sale.

I am seeing sales in the lower cost markets but still plenty of stuff sitting in the beach areas. Was looking at getting mom to relocate. She has paid off house in another state and would like the family to be close.

Just trying to remember that a lot of the all cash buyers are REIT… will eventually become rental inventory.

Waiting to get back to historical norms where renting is more expensive than owning.

Yeah, glisten…but those California buyers who come up to WA State with the fistfuls of money they’ve skimmed out of their local economies sure do us all a huge service when they overpay for houses/land here, and drive the rest of us toward poverty.

Happily we’ve seen a lot of those types get burned in the run-up around here. We’re all just sitting tight, living as we always have, and as it sounds like Will is doing. “This is working fine, don’t need to lust after anything else.”

Further down someone talks about the people desperate to get renters to cover their bad buying decisions. There are a LOT of people in our neck of the (literal) woods doing this. They came here for a few years, paid way too much figuring they could always flip at profit, left in two or three years for whatever reason (often, the realization that living here is not easy, and that bling doesn’t talk here as it does in California)…and now are refusing to cut prices to unload their big shingled waterfront bubbles. So they rent, or the place just sits empty. It’s amazing to watch people who are supposedly in the comfortable class pile one bad decision atop another…and still end up on top. While complaining about poor people and workers who can’t make ends meet.

When the lease comes up insist on a month to month, they will give it to you, also that all cash buyer is occasional, in 6 months that house’s comp willo be 30=50k less. This thing just rolled over the hill top, watch the momentum now, think staregic defaults and rate chasing, the perfect storm.

The listing agent is required to tender any earnest offer to the seller. Whether he likes your 20% down is not a point for discussion. If he fails to tender your offer he is in violation of the CA real estate law, pure and simple, and you should have no qualms whatsoever about reporting him to the DRE (and to the Realtors’ association for good measure.) Threaten his license and livelihood– that tends to get results. It may be true that the seller may not be interested in your offer, but it is not up to the agent to determine whether to present it or not. EVER. In fact, you (or your buyer’s agent– and if you are shopping without an exclusive buyer’s agent you are making a big mistake) are entitled to present your offer directly to the seller if the listing agent won’t. In fact, just letting the listing agent know that you know your rights will force him to grudgingly present it. Even better though is if your buyer’s agent actually does present it directly because this lets the seller know in no uncertain terms how the listing agent is a) in violation of the real estate law, thus not a reputable practitioner, and more importantly b) in breach of his contractual fiduciary duties to the seller as per their listing agreement. The lying creep of an agent could then lose the listing at the very least, and ultimately have action taken against their license by the DRE if you– or even the seller, who may now be aggrieved!– press your complaint hard enough.

I was an exclusive buyer’s agent in the SD market for the booming first half of the decade and had some interesting experiences playing this brand of hardball with some of these bastards. It won’t make you (or your agent) any friends at the local Board of Realtors but what do you care? It may get you some vindictive satisfaction at a personal level however, and that’s enough reason to do it right there.

Of course all of this is moot if you’re going to sensibly sit on the sidelines a while longer as you indicate you are likely to do, but if you are going to play, think outside the box into which some of these criminals are going to try to cram you.

You and your wife pull in $250k/year and only manage to save 20%? What in the world are you two spending on? And you two are only in your late 20s? You both must be investment bankers.

Very true. Example: my parents “drank the cool-aid” and bought a house they couldn’t afford to maintain (the big cost factor no commission-driven agent will EVER discuss with you!) and years of re-financing later, only their government pensions are keeping them from moving into my sister’s garage. While a family I knew growing up RENTED in much high status areas than us, their daughter went to the same high-status gifted school program I did, only when SHE graduated High school, her folks could afford the tuition for her to go away and attend an excellent University, while my folks told me flatly that I’d better look no farther than the local mid-tier university that I could afford to live at home and work my way through.

Her folks, after years of saving carefully, bought a lovely home in a great neighborhood and plan on retiring soon. My parents are still desperately working to service their debt and living in the big house…now falling apart after years of their being unable to afford repairs.

I have my moments of feeling sorry for myself because our spruce one-bedroom apartment isn’t large enough to host family holidays…but we’re not in debt and have financial reserves exactly because we refuse to buy over-priced real estate when we can rent in a nicer area than we can afford to buy in.

Susan wrote:

” I have my moments of feeling sorry for myself because our spruce one-bedroom apartment isn’t large enough to host family holidays…”

Not having the family home for the holidays… is sometimes a good thing 🙂

In Ventura county, where I live, it seems that rents on houses (I don’t know about apartments) are going sky high, even as house prices refuse to fall by much. I don’t know if it’s speculators trying to get rich renting out their new income properties, in-trouble owners who can’t sell and are trying to rent out their houses, or what, but I’ve noticed that small nothing houses and townhouses are now renting for more than $3000 a month in this area.

Any insights on this trend, assuming it is one?

Paula, are those $3K plus the ASKING PRICES, or are those the ACTUAL, SIGNED RENTAL CONTRACT MONTHLY RENTS. HUGE difference between the two. Sounds like a lot of desperate underwater homedebtors desperate to stay afloat, so they are looking to go into the landlord business and get suckers to save them with high rents.

Won’t help them, as those sky high asking prices will ensure their rentals remain empty.

Good point, Foolio. I don’t know the answer to your question. I do know that there seem to be a lot fewer house rentals available in the Conejo Valley (Thousand Oaks, Newbury Park, Westlake Village, etc.) than in other areas, so maybe the scarcity is helping to keep rental prices up there. But yes, maybe the landlords aren’t actually *getting* those prices.

Foolio nailed this one.

It’s a combination of desparate homeowners trying to rent their homes out at a dream price in order to cover their upcoming ARM reset/recast PLUS sketchy realtors who will list them at crazy asking prices to try to claim “rental parity” with all the overpriced “for sale” listings.

This is because the ones that remain are overpriced, as Foolio points out.

I watched this closely here in San Diego when I moved here for my current position. At the time, everyone at the office was telling me to buy, before they became out of reach forever, often repeating the “renting is throwing money away” line. I looked at the numbers and couldn’t make them work (I can’t live on what would have remained, house prices were already out of range). Even at double the median income for the area, I couldn’t afford the mortgage payments on even the cheapest crap-shacks in the worst parts of town I could fathom living in. Therefore, I searched for rentals. Anything cheap that wasn’t utter crap was gone fast, and the average listed price of what didn’t go fast was astronomical. I ended up with an overpriced place in a funky part of town that was infested with termites. The owners used it as a mortgage ATM, basically mortgaging it to the limit of the rent payments. Lived there for a year, as I wanted to free up more of my income and with time it was easier to find a reasonably-priced place that better fit my lifestyle (SFHs are for fools that want to waste their lives on maintenance, that’s the main lesson I learned from living in one my father/grandfather didn’t maintain. The place also lost ~20k a month in value for the year I lived there). I still somewhat overpay on the condo I live in, but my landlady is /awesome/ with maintenance, the building is nice and well-maintained (with astronomical HOA fees that makes up the difference between my rent and the rent on a crappy apartment), I don’t need to worry about security when I take vacations, and it’s month-to-month, so I could move any time…

Between these two experiences finding rental housing, I noticed that asking prices were regularly astronomical, but that’s because that was all that was left after the good listings were rented. From talking with many landlords, all prices at least one standard deviation above what would be expected based on area incomes fell into one of three categories: 1) They had a mortgage and wanted to wait out this “short term downturn”, needed to move but couldn’t find a buyer, etc, 2) The property was built during the boom and never sold (prices are based on rental comps in better parts of town and bumped by 20-30% for property management fees), or 3) Reviewing current listings, they believed comparable was going for more (that is, they were based on what didn’t rent quickly)… I expect you’ll find these just about everywhere overpriced in CA. Be careful of those wily under-65 property owners, too. Devious over-leveraged and untrustworthy characters. Landpeople hate it, but you really need to review them thoroughly before signing.

Consider the following scenario:

House price $450,000.

FHA loan (down payment 3.5%) = $16,000 and $4,500 for fees [Assume very good credit score.]

30 year fixed mortgage = $2,156/month

Let us further assume that the buyer pays the mortgage for a year ($26,000) and after a year cannot afford it anymore because he/she is now unemployed.

after one year out of pocket = 16,000 + 4,500 + 26,000 = 46,500 + 4,000 (insurance, maintenance, etc.) = $50,500

It looks like it takes 3 to 4 years for the foreclosure process (let’s say three years):

$50,500 paid / 1 year of paying mortgage + 3 years of living for not paying mortgage = $1,052 rent per month.

There are no houses [450k] for rent for $1,050 per month.

So, one may purchase a house, don’t pay the mortgage for 3 years ($2,156 x 36 = $77,616.)

From the ECONOMIC point of view only, purchasing a home and not paying the mortgage still would be cheaper than renting.

Therefore, it appears that the 20% rule (as the doctor suggested and as even FDIC chairman supported) OR at a minimum at least four years worth of mortgage on a 30 year mortgage (2.5 years for a 15 year mortgage), is placed as a down payment whichever is higher is essential for a healthy real estate industry.

LOL so now housing bulls want to argue that buying at the bare minimum just to get foreclosed on is still better than renting? LOLOLOL too funny. Especially since the government doesn’t wait around like the banks do. Default on one of those FHA backed mortgages and they will punt you by the shorthairs a LOT sooner than 3-4 years…probably not much over 3-4 months of default or “free housing”.

Betcha $(insert any amount of money here) that the bank would toss you out and resell your house post haste. They’d be able to sell the house and stick the taxpayers with the bill. Gotta love FHA.

My guess is that the people who are supposedly living “rent free” are the ones that did a cash out refinance and now have recoursable debt. Do you really think that the banks aren’t tacking on the missed payments + penalties + fees for these people when they finally come after them for the money owed?

Let’s look at a scenario.

2 buyers in the same situation hoping to milk their foreclosure for all it’s worth.

1 is a (insert occupation here) with little hope of income security in the future due to outsourcing.

1 is a MD.

If you were the bank, who would you let the tab run up on with “free” rent?

Right – live rent free for 3 years and have the bank look the other way. Well, a few problems with that the scenario. One of the bigger problems: California and Federal debt forgiveness laws related to foreclosures expire on or before December 2012. So there will be tax consequences on top of everything else. This has not been factored into your scenario and is significant.

I rent a veryyyyy nice home in a great neighborhood. 3400 sq. ft 4 bedroom 3 1/2 bath…… My rent is 17% of my net income, if I were to buy the home my ratios would be OK, 27% of my net income, but then I get to ride the market the rest of the way down. Makes no sense to me. Keep renting!! 🙂

My brother and I recently inherited my mom’s rental property in South Pasadena. If we ever sell it (not for many years), I will not buy my own property. Property ownership is a headache! I’ve been taking care of this property for over twenty years…I would love to rent and not have to be the one that takes care of the maintenance!

Renting will always be 2nd choice for most except young people who’s lifestyle is to move around and explore. There’s an emotional element that will probably stick in the mind of most Americans for at least another generation or two.

I beg to disagree w/ you that “renting will always be 2nd choice…” We decided to rent after owning (a loan!) for the last 30 years because we it costs us less than 1/2 what it would to buy at current asking prices – especially with higher end properties.

It’s important to remember that asking prices for rentals are very negotiable – especially for those with excellent credit and reliable income. More times than not, the asking prices are simply what the home “loaners” owe on their note(s). Don’t get suckered into paying off other folks’ debts!

Do a credit check on your landlord and verify their financial solvency so you don’t risk losing your security deposit.

Thank-you Dr. HB for educating us all! YOU ROCK!!!

Great point, me gf just payed her upscale, good location home off recently, She loves having and improving the home, like an expression of herself. Without kids I recently explained the concept of reverse mortgage to her, she was blown away, her family is very long lived, the simple math was easy, no payment less taxes and upkeep and a nice stipend till the end, bank get the asset, sweet deal, do that with a rental?

i may have given the wrong impression. this is what i meant to say:

everyone wants to own their own home. most people in today’s market have no option but to take whats 2nd best. your handle is’ waiting to buy’, in other words, ownership is still your primary choice. circumstances have caused you to choose plan B, which is to wait it out until conditions get better.

in the grander scheme, people will prefer ownership over renting. economic factors are the predominant motivating factor for renting, but it doesn’t change the big picture.

That’s crazy talk Doc. Americans thinking for themselves and making intelligent financial choices–not going to happen. We do whatever Manhattan tells us to do. What, me worry?

Wow check out the shennanegans on this one that just sold according to public records:

http://www.redfin.com/CA/West-Hollywood/1232-N-Kings-Rd-90069/home/7118138

From $1.335 mil (and that was in 2004, well before the peak!) to $750K in “prime” Sunset Strip West Hollywood. 44% loss = -8% annual return! As Borat would say, VERY NIIIIICE!!!

Another one of those homes with a compromised location. Why would you want to buy a SFR on a street that’s FULL of apartments? It’s the worst of both worlds. Not only are you most likely deep in debt, you’re surrounded by a bunch of filthy renters.

I’m sure the sucker who bought in 2004 for 1.35 mil thought they were going to tear down the existing home and put up apartments/condos like the rest of the street. Probably ran into money trouble or problems getting the permits from the city of WeHo. Now the property has gone from weak to stronger hands…probably a developer who will put up apartments on the lot. Not saying the new buyer got a good deal, but 50% off of the peak price is far better than the moron from 2004!

I rent now, following a divorce. Ex still lives in the 1900 sq. ft. ranch. I estimate that maintenance on the house ran about $4 k a year out-of-pocket. I performed mowing, leaf removal, and general property chores probably worth $3k a year at least. Taxes were about $3600. That’s great when it was appreciating $40K/yr which happened for several years. Otherwise pure pain. Plus utilities were higher thn for my smaller apt. I’d love to buy, but can’t take the financial pain in this market (central NC) which is probably depreciating at the rate of 8% per year.

Any halfway decent house here is $300K. That means taking a $24K annual pummeling on principal, plus the aforementioned maintenance and taxes. The average person just cannot take but a year or two of that before they’re ruined.

I just hope we have a capitulation within the next decade so thay my kids can live in a world that justifies rational investment decisions.

tarheel, your economic thinking strikes me as soundly structured. My only problem is with you using in one phrase the words “rational,” “investment,” and “decisions.”

The expectation that any of us can get something for nothing, through the magical operation of time passing by, is not rational. Yet how much of our economy is built on just that? We have corporations with bigger profits than ever before…because their profit formula has existed of driving more and more working and middle class people into poverty. A better GDP would measure the misery and options of the productive classes, not just the engineered Baloney Numbers of the corporate overlords.

What we seem to have forgotten about fiat currency/bankster capital is that it is effectively useless unless it’s spent. The corollary of that is, if it does anything useful, other than sitting there and ganging up on itself like a constipated colon, it’s going to get smaller, or run out, eventually, depending on a wide range of conditions and scenarios. Yet the view of “the economy” is some tot board in the sky where the numbers just keep going up. Watch pixels and win.

There is an odd…belief…afoot that somehow we’re all supposed to not only get more and more money all the time for doing nothing, but when we die, there’s supposed to be more of it than ever before. The entirety of corporate law and policy is built on that religious belief, and on the political praxis of assembling whatever types and amounts of power are required to sustain that religious belief.

It used to be that people, organizations, and institutions saved in order to spend. That by definition meant that eventually, the money would be gone, or less, but it would have purchased something the person couldn’t have had otherwise. The notion that things must always go up, never down–that’s a cancerous sickness. Yet it drives much economic and policy activity…and seems to have infected many individuals as well.

I’m also flashing to an Onion piece:

http://www.theonion.com/articles/us-economy-grinds-to-halt-as-nation-realizes-money,2912/

I’d love to see a chart going back 50 years, of % of population that own their own homes with no mortgage, instead of that meaningless 6x% figure that mixes free & clear with people who have heavy debt.

Not too many good public schools here in California. private schools keep charging more because they can. My out of state rentals are renting quicker these days but property taxes keep going up sometimes as high as 10% in a year. Hard to win.

Until the powers to be in this country want the better jobs here, I do not see things improving for the majority of us….

Daryl, YOU have the power to teach your kids all they need to know. Schooling was engineered over the past 60 years as a consumerist industry just as housing was. Schooling should be a supplemental enterprise, not the main event. It was supposed to fill in parents’ and families’ limits of experience and skill, not replace it. I’m retired from the Ed Biz, and none too happy about the direction it took in my lifetime. Replacing one form of Schooling Uber Alles with another won’t solve anything. Schooling was supposed to prepare people to teach themselves, and learn always. Instead it became a factory of dependency.

Compass, Right On!! That’s why I send my son to a private school where they teach by the Socratic (Classical) method. Public schools are designed to produce “worker bees”. A classical school is designed to produce shepherds to lead the worker bees. That is not to say that some of us weren’t able to escape, but why do you think most teachers and politicians send there kids to private school?

Renters get no respect from RE agents. They pressure you to buy, or act super nice thinking, “one day, they will buy and that’s when I’ll make my money on them.” You have to bow and scrape and give all your personal financial info to potential future landlords when applying, and then they get insulted when you ask about their finances, when all you are doing is just to make sure you don’t move in to a future foreclosure. The process of house renting in CA sucks, but the Dr is right. It’s the only way to go these days.

I get your point Dr. I am a Physician making a great income but have 4 kids and will only buy in an area with great schools. If I buy in an area with not good schools I would have to pay for private school. Do you know how much that costs??? That is 15k per child and it would be 60k a yr x 12 yrs ?? That would be 720k. I rather buy in a prime area with great public schools!!

GMan … you have a logical point. Plus, if you are going to stay in the area while your kids go to these schools you are going to be ahead by buying vs. renting in the time your kids go from K – 12. Also, you don’t have to worry about your kids building great friendships but having to move because the landlord decides to sell the house. What a hassle! Let’s be real here too … with an excellent income you can afford a dip in home value but in the long run of 10 plus years you are going to be ahead by buying instead of paying for someone else’s house for them. Last thing, people that make good livings want their places to look like they want them and have the money to remodel … it is the advantage of making a good living in our society. I know the many landlords that pose as posters just giving advice on this site will disagree because they want to encourage renting but it is what it is.

Not as bad as the NAR/CAR shill realturds/realtards posing as renters!

Rent-turd wrote:

“if you are going to stay in the area while your kids go to these schools you are going to be ahead by buying vs. renting in the time your kids go from K – 12. Also, you don’t have to worry about your kids building great friendships but having to move because the landlord decides to sell the house. What a hassle! Let’s be real here too … with an excellent income you can afford a dip in home value but in the long run of 10 plus years you are going to be ahead by buying instead of paying for someone else’s house for them.”

LOOK AT JAPAN, GENIUS. Property prices are at the same level they were back in 1981. That’s three full decades of 0 appreciation. 30 years! And unlike the US, they actually net positive export and produce goods, and their currency hasn’t been devalued anywhere near where the US dollar has.

And let’s look at any Japanese that bought anywhere from 1987-1992 (peak was ’89/90)…instead of 0 appreciation they’ve had severe depreciation of their property…to the tune of a 50-90% loss of its purchase price! 10 plus years, hell K-12 (or even newborn through 12th grade – 18 years) means little in a prolonged asset bubble deflation. We are only 3-4 years from peak, with extend and pretend dragging this out to the bitter end and delaying the necessary deflation. Only making matter even worse!

LOL

Nice to see you not only address GMans post but also add a few extra fuzzy NAR talking points.

“If you hold for the long term you’ll do fine” NAR stroking

“You can customize your home to your liking” More NAR stroking

“Your landlord might sell the place” NAR fear pumping.

And you wonder why we laugh at your sockpuppetry!

Go ahead…give me another angry realtor reply!

Group Hug!

it’s a no brainer:

save your money and “inter/intra district transfer” to better-performing schools under NCLB rule

Why are not all public schools equal in there ability to teach. Maybe you should ask the teachers union. This country is starting to disintegrate into islands of discontent with walls around the affluent to keep the have nots at bay. I moved to the country and built a wall of woods and pasture between me and the have nots. 8 years ago bought 50 acres with a 3 acre lake ,fenced and with a house for 75000.00$. Maybe it is time to move out of the high rent district. If it takes most of what you earn just to keep a roof over your head it may be time to reassess your life style

Housing in prime areas essentially capitalize education costs. High income individuals are already paying the equivalent of a private education through state taxation, so you might as well benefit from the expense. Another benefit of an excellent school district is that your neighbors are generally more family oriented and financially responsible. Sure, you can buy a better house in a bad neighborhood, but then you have to live there!

My wife and I are in the same situation. We have chosen to rent less house than we need in a nice area, at least until the prices stabilize a little bit more (circa late 2011-2013). The key to renting in prime areas in California is to find a landlord that bought decades ago and has little or no carrying costs (Prop13), and therefore can charge lower rent. A high renter-credit-score and good job history is what landlords want more than slightly higher rent. This is because a landlord’s worst fear is not getting that monthly check and having to evict and re-list the property.

My advice would be to rent in a prime area with excellent schools, parks, shopping, etc. and keep looking for Prime REO at substantial discount to market. When opportunity knocks, put in a low bid and see what happens. The banks need to sell the houses a lot more than we need to buy them.

With financial reform kicking in this year, 20% down will effectively be required since Qualified Residential Mortgages (QRMs) can only be sold to the government agencies if the buyer puts down 20%. Otherwise the banks must retain 5% of the risk of default. This will result in few buyers qualifying for higher priced prime areas. Less competition and lower selling prices will then occur.

In my estimation, housing has a minimum of 5 more years of headwinds before prices begin to appreciate in real terms. Rising interest rates, higher taxes, government budget reform, mortgage interest subsidy reform, and cost-push inflation will severely limit buyer purchasing power in the coming years. At some point the pendulum will swing back the other way and instead of it being stupid to buy, it will be stupid not to.

My best guess is that the new housing norm will be here by 2020. At that time Frannie will be out of the mortgage business, and banks will be making responsible lending decision based on the federal mandate risk retention guidelines. Employment will be back in the 6-7% range. The excess boom-years construction workers will be retrained in viable industries. The first wave of baby boomers will have downsized. Most importantly, 10 years of wage inflation will make nominal home prices much more affordable in real terms. If you can stand it, wait until 2015 to buy. If you can’t, buy REO today at 2015 prices (20% off standard sale prices).

Thank you for the unbiased analysis. Well said.

GMan,

Of course, everyone’s situation is different, so it might make sense for you, but I think Dr. HB’s point was that you could choose to RENT instead of BUY in the exact same area/zip code and send your kids to the exact same school. Often in CA, even in high-priced areas, renting is MUCH cheaper than buying when you factor in maintenance, taxes, insurances, etc…

It seems as though most people don’t usually consider the alternative of renting a home in a nicer area for some reason, as most people automatically compare buying in a nice area vs. renting in a less nice area and paying for private school. But it’s definitely viable if you can find the right house at the right price – and take advantage of having someone else cover all of the costs in a currently depreciating asset while your net worth continues to climb. One thing is for sure: Renting in a nice area makes more sense right now vs buying if you’re currently renting and considering buying simply because you’ll be holding the bag on a depreciating asset in the near-term (and possibly beyond).

Good luck to everyone,

Investor J

I think the point that he is making is that if the purchase of a home does not finanicially make sense, ie it is overpriced and undersized, being in a good school district should not cause you to throw away that financial assesment.

You’ve already assessed the cost of private schools and found that it is clearly not possible for you to buy somewhere cheaper and use the savings for tuition. That’s fine. But what about renting? Have you weighed the cost of renting for a few years while the market settles out?

I think the bottom line to the message here is that people should throw away the negative stereotypes our country has built towards renting and make an honest assessment as to whether buying really make sense in the area they want to live in. Don’t let the emotional need to buy push you into a bad financial decision.

“No one really owns a home until they pay off the bank note completely.” – Dr. HB

Wrong Doc, no one really owns the land their home is on because of the way this country is set up. You own the house, but not the land. Unless you have allodial title that is. Nevada and Texas have provisions that allude to it, but it is rare. So basically, we are ALL renters.

Jim, I couldn’t agree more.

Just imagine my home state of New Jersey, esp. in Bergen County, where property taxes run as high as 3% of the value. Do the math on a 720K home. Paying almost 2K a month for as long as you “own” the home is atrocious.

And New Jersey wonders why certain, not all, union members and Wall Street psychos need so much income. Some of those homes cost 5-7K with everything wrapped in the payment. At that price, you are talking 200K+ a year salary. Yeah, no wonder it takes two incomes or a very sweet deal of a job!!!!!

While I concur with the frustration of paying property taxes ad infinitem exacerbated with rising fees due to inflation I see your post as implying that you are paying for the land with those taxes. Not true. Homeowners are paying for services; schools, roads, sewers, (I’d like to say utilities but this only applies in certain districts), fire, police and to some extent the local govt structure. Bear in mind that we pay taxes ad infinitem in both sales and income (again some states and municipalities). We are in my opinion over taxed. I believe it is because so much is given away to corporations by governments allowing to avoid a fair share of taxes. In any event I am getting off the topic of the blog. I appreciate Dr HB’s work and have a comment about renting below vs buying below.

I was not implying that taxes paid for the land, I was saying that home “owners” do not own the land their house sits on. The government ultimately owns all land, and we are just renting it from the government to put houses on.

The idea that renting is throwing away money is a falacy. Most people have a choice: rent a home or rent the money (aka, mortgage). Buying outright isn’t an option for most people.

My wife and I choose to rent our home and invest the money we save every month, rather than rent the “money” to buy a house and rely on real estate as our only investment. So far it has worked out well for us.

When the cost of owning comes within range of the cost of renting we may change our decision, but until then, we see buying as throwing away money.

What an excellent way of putting it. Will use that in discussions with my “Must own” friends.

This topic is quite salient for me, as my wife and I have been renting since we got married in 2005 (even though we could afford to buy). I convinced my wife back then that we were going to see a huge crash and, luckily for me, it turned out as planned. My wife is the type of person who “wants her own home so we won’t have to share walls with anyone”. Of course, I respect her opinion so I have been doing my best to “hold her off” during these deflationary times (in housing at least!) by literally renting new construction condos that just couldn’t sell due to market conditions. You have to love the irony of that!

Anyhow, given that my wife is growing a little impatient after 6 years, our next move is probably going to be to rent a home to give her the feeling of at least being in a home – ownership aside. As a full-time investor who spends all day trying to maximize my net worth, there is NO WAY I am going to buy during this 2nd wave of Alt-A/Option ARM recasts and resets. So, in the meantime, we’ll continue to rent and enjoy all of the nice home improvements that were made with bank money (ie. granite, nice showers, nice floors, etc) that is now ironically being paid for via all of our taxes thanks to our transfer of debt to the public.

To everyone – DO NOT forget that housing usually declines for a couple of years during the down cycle and then STABILIZES for about 5 years in CA. So, there absolutely NO NEED to rush in here at any time. Wait until the markets finally stabilize and then consider buying. Of course, if you find a particularly compelling deal then it can always make sense as an anomaly. But the general rule is that catching a falling sword is NOT a good idea for your financial well-being.

Good luck to everyone,

Investor J

i think over half the homes from the arms loans are already delinquent or received their NoD. Right now, it’s more a matter of banks taking on the burden of its shadow inventory against the current economic climate. Delinquencies/NoDs will be on the decline sometime this year (next year at latest), and foreclosure velocity may decline soon after. It really depends on how fast/slow banks act on defaults.

Also, I’m not sure if the 2 year down cycle really applies right now. seems we’re heading into a double dip. i dont think we’ll get our 5 years of stabilization before this dip gets into full force. If you meant we may see 5 years of stabilization after the next 2 years, I think that’s reasonable. But if you look back to 2007~2009, we should be into year 3 of the stabilization process, but it looks short lived. the fundamentals won’t support it.

Great responses, Shawn and Investor J.

Ed,

I definitely agree with you. The typical cycle has a 2 year quick decline followed by years (typically 5) of flat prices. What’s clearly happened this time around is the banks have stretched out the decline itself by a factor or 2 or 3. What the could mean is that the flat part of the cycle (after the decline in prices stops) could end up being less than your typical 5 years, if only because the decline was extended for so long.

Of course, it’s hard to know or predict due to fact that this time is really different (I hate to say that, because I believe in applying history to understand what will likely happen in the future, but the mark-to-market accounting changes are what really makes this different). It’s still hard to believe how many people are squatting in houses for 2-3 years before finally being foreclosed. You just have to love the bank execs and their bonuses…

Good to luck everyone,

Investor J

People just don’t get it that we are still in a world of hurt, and the financial headwinds are growing stronger daily. Oil is going up, and will put pressure on the economy for some time to come. California is in financial straits, and when the people reject higher taxes on a ballot initiative this June there are going to be big cuts. Your government employed neighbor will be out of work and foreclosed on. China has a severe bubble, and when it pops they might not be able to continue to absorb our massive debt. Then what is boom boom Bernake gonna do. Back to the printing press. Get a wheelbarrel so you can get your cash to the store to buy a loaf of bread. We are in a world of hurt and the shell game is on it’s last breath. But hey go head and buy a McMansion watch your flat screen and sing Happy Days Are Here Again. Ignorance is bliss!

CC,

Well said – I couldn’t agree more. We’ll be at 100% Debt:GDP sometime this Summer and Bernanke shot his last bullet with QE2. The game is over – there are no bullets left. It is going to be VERY ugly by the Fall, as the we’ll lose control over interest rates going up once the rest of the world opens their eyes to our Debt:GDP ratio and starts demanding higher rates. Meanwhile, if oil shoots up (watch out for the Saudi protests on March 11th) then the stock market will TANK and will take down job openings and the economy a la 2008. I could go on and on about how State budget cuts will eat away at our upcoming GDP, more people will be underwater within the next 6 months as home prices fall, etc, etc, but I think everyone gets the point. Watch out – by the end of 2011 things won’t be pretty.

Good luck to everyone,

Investor J

We rent a nice large place with big yards in a hood with good schools. We’re month-to-month so we can move whenever we want. We don’t pay for water, gardeners, repairs or maintenance. Outside of rent our only housing expenses are gas, electricity, cable/internet, trash pick-up and renters insurance. When the plumbing goes we call our landlord and it’s his headache/expense to deal with. We’ve decorated the place to our taste using easily removable wall decals and other temporary yet very attractive decor. We garden, host parties and BBQ’s all summer long and send our kids to a top rated elementary school just 5 blocks away. Plus our rent is almost half of what it would cost to pay for a similar place on our block so we save thousands every month. Our friends who own are constantly talking about their home repairs, renovations and other costly time-consuming endeavors that simply do not apply to us. Seems like a decent way to live out this madness to me…

Amen

You are wise!

My BF and I do the same thing in Brooklyn, NY. We rent, and as a result, we go on vacations when we want, and are saving our money towards the eventual change in the market or our retirement (we are in our early 40s.) Everyone here who bought and drank the RE Kool-Aid is seeking debt settlement, foreclosure relief or bankruptcy. I will be thinking about them this summer as I hang from my hammock I recently bought from one of my trips to the Caribbean. Oh yeah, and those homeowners I know here in NYC don’t even have a backyard.

During the last few years most of our friends who were waiting for lower prices to buy jumped in and bought and we almost did the same. But after crunching the numbers and looking at the reality we decided to rent a home instead. We have a lovely large house that had been remodeled and large yard and a pool. The landlord pays for the yard a pool maintenance as well as the repairs. Our friends who bought have been struggling with there maintenance costs remodeling expenses and taxes. They are stressed worried and thinking about all the money they have to spend to make there affordable fixer-upper their dream home. All of this while the prices are still dropping. Most of them are jealous of us and how happy we are. I am relaxed and not worried about what happens to the home prices it is not my problem, major repairs like pluming leaks which we had shortly after we moved in, not my problem. I honesty thought I would feel bad not owning, not being part of the”club” now I feel great i am not part of that club, and honestly am not sure I ever want to buy a home. This is too much fun, Oh and yes due to much lower costs than if we had bought we save money every month and that big chunk o cash we saved for our down payment still in our pocket wisely invested and earning interests and dividends. No mortgage interest for me!!!!

The big advantage to owning is that it may actually become paid-off some day and then you’d pay no rent. But there’s always maintenance and taxes to be paid no matter what. As a home is usually the biggest leverage and investment that most people will make in their lives, realtors have to strive for as much emotional impact as possible.

But schools can make a difference if your family is loaded with kids. The more kids one has, the more they are using publicly paid resources to their advantage.

We owned for 10 years in Florida. We’ve rented since 2002. I have my husband back on the evenings and weekends. No more, “I’ll go run to Home Depot while you mow the lawn”! Don’t even miss it.

We had to move in a hurry for a job 2 years ago. My husband got the job because we didn’t have a home to sell and could move quickly. He’s an Engineer in the defense industry. Layoffs come quickly and often. Luckily we’re flexible enough to go where the spirit or job moves us. Owning a home again would quickly (as we very well know) stunt our freedom, flexibility and quality time together.

But we could get a dog again; and that would be lovely 🙂

With the insane level of vacancies all across the country I’d be willing to bet that a dog won’t be an issue when push comes to shove as more and more landlords will cave in just to get a warm body in their place. Not only does an empty rental mean “no check” it also starts to have mold issues as the heater and air conditioning go unused.

The following titled article appeared in LA Times last month. I don’t have the link.

Homeownership loses its luster

Economic uncertainty, unstable prices and simple math have given Americans less incentive to buy. By Alana Semuels, Los Angeles Times 2/18/11

Here are the last two paragraphs ;

”

“There’s a zillion reasons why people aren’t buying, but honestly, they would if they could,” said Jane Peters, a real estate agent in Beverly Hills.

As for Peters? She leases. Her rent is so low, she says, that buying just doesn’t make sense.”

So this real estate pro admits the truth of the market in her lifestyle while she works to get people into homes. Makes me think of the lyric from by Bob Segar “Running against the wind”.

Two points.

1.) School district doesn’t matter. In most of LA, one can rent an equivalent property in an excellent school district for much less than it would cost to buy. That means if SFR 3bd/2ba 2000 sq ft in Cerritos or Irvine costs $750K, the same place would rent for less than what the mortgage would be to buy the same property.

2.) If the above is true and renting is cheaper than buying, then the paid off argument is also invalid since the renter would be able to save the difference during that 30 years and invest it. At the end of the 30 years, rent could be paid from the extra money amassed and likely also pay for a few vacations a year as well.

I dunno why people keep pounding out axioms that aren’t truthful.

Two reasons.

1. Bad math skills

2. Incentives (real estate industry)

Renting? How about when the landlord turns out to be a fraud and you lose your deposit when the REAL owner shows up and kicks you out….or what about the landlord who kicks you out because his kid needs a free place to stay. Nobody pays you to move all your crap.

If you’re living with a carload of stuff then maybe renting is OK but most people have a lot of stuff and moving is terrifically difficult physically, emotionally, and financially. It costs $$$$1000’s to move.