FHA Loans the Choice of Housing Comrades. How Government Backed Loans are creating Another Problem for the Housing Market.

Bless our real estate addicted society. You would think that a housing crash unlike anything seen since the Great Depression would teach us some lessons. It has been two years since the recession started and a decade long housing bubble. The first thing you would probably remove from the market is the toxic mortgage sector. Somehow in the mind of the politicos and Wall Street, the idea of allowing low down payment mortgages is still part of the turbo capitalist psyche. Recent data from FHA loans is abysmal. In fact, we are seeing subprime like trends. Recent data is suggesting that it is only a matter of time before the FHA goes to the American people for a bailout.

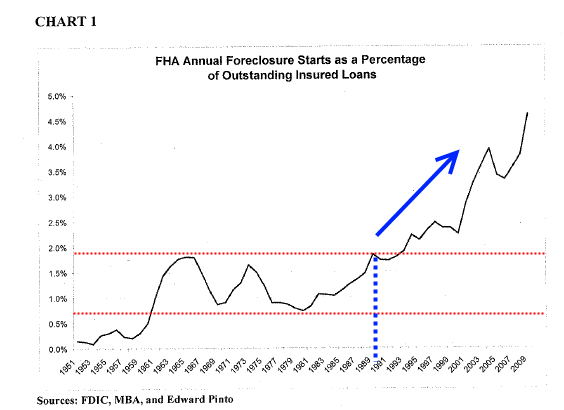

What is troubling is that instead of stopping the problem, lenders are ramping up their FHA backed loans since banks are hoarding money like packrats. On Thursday Edward Pinto, a financial services consultant and also a former chief credit officer of Fannie Mae (1987 – 1989) gave testimony to the U.S. House of Representative Housing and Community Opportunity Subcommittee. So Mr. Pinto must know something about credit risk. The first chart presented is absolutely astounding:

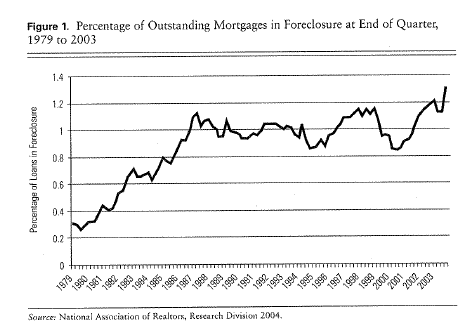

From 1951 to about 1990, FHA annual foreclosure starts stayed below 2 percent. The range was tight. However, from 1990 to our current bust the FHA annual foreclosure rate has doubled and shows no signs of stopping. You would think that with Alt-A loans and option ARMs we realized how bad it was to give people loans with little or no money down or having Warren Buffet as a co-signer when you work at Wal-Mart. Precaution unfortunately is not being taken. In fact, the government is basically stepping in to make up for the lack of toxic mortgage lenders instead of creating a more stable mortgage system.

Both the FHA and Veterans Administration now make up over 90% of all high loan to value mortgages. The vast majority of these loans have LTV over 96% which is smart if you enjoy driving off economic cliffs. Keep in mind that the government is now insuring loans even though the housing market has not stabilized. In the report issued on Thursday another risk highlighted was the ability for people to use the $8,000 tax credit and apply that to the downpayment requirement. So you have one government program screwing with another. Think of someone buying a $200,000 home. For a FHA loan, you would only need roughly 5 percent for a downpayment, or $10,000. Use the tax credit and you are buying a home for one month of rent! Can you say zero down?

FHA is basically eating up the slack from imploded toxic mortgage lenders. FHA insured loans are now up four times in volume from their 2006 pace. They will constitute some 10% of all outstanding loans by the end of the year. And in some areas, these new low money down loans are making up a big chunk of new sales:

“(DQ News) At the same time, a common form of financing used by first-time home buyers in more affordable neighborhoods remains near record levels. Government-insured, FHA mortgages made up 37.4 percent of all purchase loans in August, up from 37.0 percent in July and 27.1 percent in August last year.â€

Did you get that? In some regions nearly 4 out of 10 home purchases came from these little money down loans. This isn’t some low priced region. This is high priced Southern California. And this brings us to another risk brought by these loans. The loan cap is now up to $729,750. Now why do you need such a high cap when the median home price across the U.S. is less than $200,000? Of course, this is basically allowing major bubble HGTV addicted areas like California and Florida to use up these loans to create basically another housing bubble. As we realize, even if you have a high income, if you don’t have skin in the game you will walk. Those Alt-A and option ARM borrowers in California are strategically defaulting even before the 2010 recast wave hits next year. It is naïve to think people won’t walk away from these loans either. The only difference now is you have to document your income. Is that the only lesson we have learned!? Talk about lack of analysis.

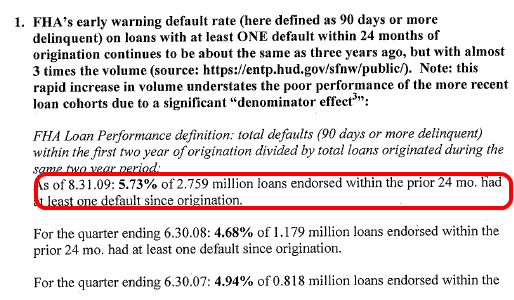

The FHA also has a long history of fraud which is perfect since most defunct toxic mortgage factories were full of fraud as well. These are basically toxic mortgage-lites and now we can rest assured that since they are looking at two years of income, all is well in Candyland. And loans are getting crappier and crappier:

If things are getting better in the housing market why are these loans imploding? This isn’t linked to option ARMs but is linked to poor lending philosophy. There was also recent legislation requiring lenders to increase net worth requirements on September 18, 2009. Yet this is a joke since four lenders make up 85 percent of all FHA loans:

(1)Â Wells Fargo

(2)Â Bank of America

(3)Â Chase Home Finance

(4)Â CitiMortgage

The too big to fail otherwise known as the Larry, Moe and Curly of lending are now government fronts pumping out near zero down mortgages. Make no mistake that FHA is now growing in this environment because the government and Wall Street are determined to recreate the ecology that caused this housing bubble in the first place. Yet it won’t work and it is putting the country at risk. If the dollar tanking isn’t warning enough, we are going to get a wakeup call next year with commercial real estate and the Alt-A and option ARM tsunami.

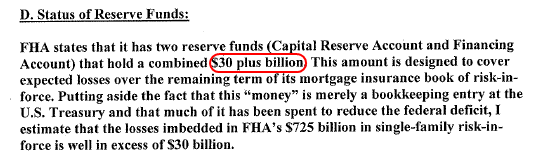

Another shocking yet not surprising highlight in the report is the ever diminishing fund for losses with the FHA:

Just like the FDIC DIF going to zero a few days ago, we can expect this fund to do the same thing. But guess what? We are on the hook for these loans since they are government backed! Instead of heeding the warning from that first chart above, FHA insured loans are being pumped out in mass because crony banks don’t mind gambling with your money while keeping reserves hiked up for the losses they know are coming down the pipeline. What did TARP do? It allowed toxic banks to survive courtesy of taxpayer charity. As I predicted when TARP was put in place over a year ago, the American people have gotten nothing in return.

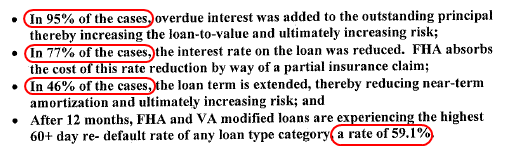

And while people are pumping their fist in the air for victory because of loan modifications, does anyone even bother to look at the details of what constitutes a loan mod? Loan modifications are glamorous versions of rearranging the deckchairs on the Titanic and a waste of money. Let us look at some details:

If you want to sum up the above it is extend and pretend. First, overdue interest is capitalized into the actual mortgage increasing LTV thus increasing risk. This is negative amortization-lite by the way and one key problem with option ARMs. Another smart move is basically extending the term on the loan up to 40 years! Good times in the government mortgage sausage factory. They took the ideas of the sewage industry, otherwise known as subprime and Alt-A mortgage brokers and made them government policy. If you need any more support how pathetic the success rate is, just look at the 59.1% re-default rate.

Want a simple solution? Instead of giving these loan servicers $1,000 per modification, how about you give $1,000 to the owner so they can use the money for a rental deposit? Isn’t that more efficient in the long run anyway? They clearly cannot afford to live in their home and that is okay! Owning a home isn’t a right by the way. Why not give out a rental tax break? Rental vacancies are now sky high and this will add pressure to commercial real estate. Then again, we are asking for some logic here from Wall Street and our government and they have proven to us that government, Wall Street, and housing simply do not mix like drinking and driving.

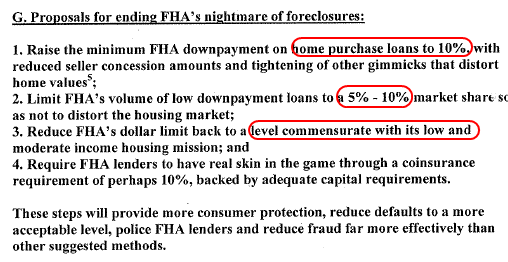

We get some excellent suggestions regarding FHA insured loans in the testimony:

Yes, yes, yes, and yes! 10 percent should be an absolute minimum and no, you can’t use any tax breaks for the downpayment. This is money that you save. Not a damn nationwide subsidy. And one point that is absolutely obvious is how in the world is a $729,000+ loan a low to moderate home price? This is nuts! Lower the cap to national median prices. The Federal government subsidizes this so it only makes sense. You want a $400,000 loan? Then let Bank of America hold the loan on their book with no government backing. We can rest assured they’ll be doing better due diligence. Keep on pumping out FHA insured loans and what do these banks care? These are the same toxic banks that were responsible for the housing bubble so we can rest assured we are in good hands.

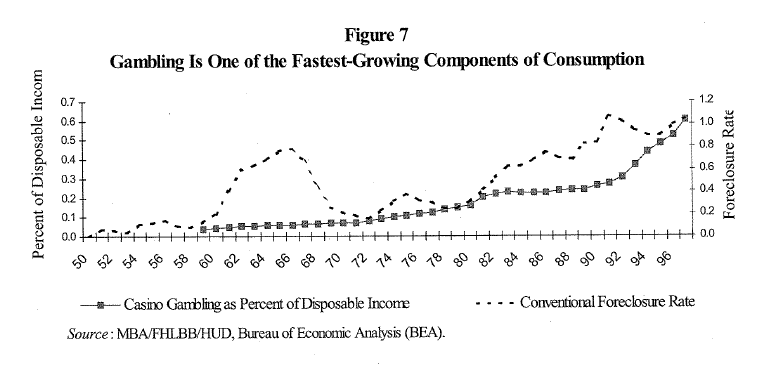

I love in the attachments Mr. Pinto includes an article showing the problems going on with the FHA. But this chart just cracks me up:

So it is true! The perfect correlation is increased disposable income in gambling tying in with higher gambling with toxic mortgages. What is so maddening about these reports is that it was showing clear cases of where the risk was in the system. Take a look at this report by Fannie Mae in 2006:

And of course this chart is only worse today. So it isn’t that no one saw this entire mess coming. What really occurred is no one in a position of power had the fortitude to act. That is the issue. The system was flooded with plutocrats listening to their lobbying masters and these Cassandra’s were merely pushed down the funnel of oblivion. Until we can reform the governing system, we can expect more crap to fly. That is why the tax credit is being championed by the real estate industry shills even though the cost to taxpayers is counterproductive and such an utter waste of money. Yet these shills kick money down to our beloved Congress. And that is why even though we have hard data showing the train that is coming down the rails with FHA instead of applying the brakes, the government is greasing the track! Then you have the real estate industry cronies jumping up and down at the prospect of the credit being removed. Most credible analysts and economists do not stand behind the tax credit. It is a waste of money.

You can download the full report with attachments here. It is worth a read. Too bad the plutocrats will continue to sleep with their lobbyist and FHA is merely another problem for another day. FHA is the loan of choice for fellow comrades.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

26 Responses to “FHA Loans the Choice of Housing Comrades. How Government Backed Loans are creating Another Problem for the Housing Market.”

This is a quote from the NY Times: “F.H.A. has stepped into the void left by the private market,†Representative Maxine Waters, Democrat from California, said at the hearing. “Let’s be clear; without F.H.A., there would be no mortgage market right now.â€

Yeah, without the government there would be no toxic mortgage market right now. Do these politicians ever ask themselves why there is a void in the mortgage market? Maybe there is a good reason.

This is a quote from the NY Times: “F.H.A. has stepped into the void left by the private market,†Representative Maxine Waters, Democrat from California, said at the hearing. “Let’s be clear; without F.H.A., there would be no mortgage market right now.â€

Yeah, without the government there would be no toxic mortgage market right now. Do these politicians ever ask themselves why there is a void in the mortgage market? Maybe there is a good reason.

Sorry… forgot to say great post – can’t wait to read your next one!

Great article! I read the report too, and it’s dead on. It’s refreshing to see that there’s people out there who are in positions of authority and influence that actually care about making the right decision instead of the one that makes the most money for those in power. Unfortunately I’m sure this report will fall on deaf ears, but maybe it’s a sign of better things to come.

Here’s to optimism at least…

I want to agree with you but I think that you’re looking at this very one sided. It’s not easy to save a lot of money in this past bubble economy if you have a family, weren’t a part of the real estate industry (to gain from the boom). I think that FHA 3.5% is a great idea to allow people a chance to get into their homes, but should ONLY be used for that reason. It should have legal mandates that require proof of owner occupancy and should ONLY be for FIRST TIME EvER buyers, not for frauds who try to work the system by buying a house every 2 years and flipping it and buying a new one under FHA. They should do everything they can to ensure these FHA homes are for families who really need a chance to get into their first home. The older generation had their chance and blew it. The new generation trying to get into homes that are at minimum 400% of their income, thanks to the last generation inflating the hell out of real estate prices, need a break.

Right again, Doc. Gov knows, but has capitulated that there is no other viable option. Like Paulson handing the keys to the Treasury over to Goldmember. When the choice is sink or swim, you gotta keep swimming. Nixon made this choice back in 1971 and every time the choice was do the right thing, endure the pain and move on, or kick the can down the road and party on Garth, we did the latter. Volker tried to fix it, but Reagan found pain to be unpopular, so he kicked the can a few more times, railed on big government, raised SS and Income tax, told us it was a tax cut and the rest is misery. Party on Wayne.

now we are blaming the older generation for the crap hole this country is in. now i know why no heads rolled on wall street,the big ponzi banks,the big ponzi insurance companys, and BIG PONZI govt. its all those old folks that did it. lets all get together and string up anybody over 30 years old. trouble is that when the new generation fha loans go tanko in a year, gramps and granma wont be around with dough for the bailout. but then again, the olds are broke because of the pizza delivery boy appraisers and loan officers. BRING BACK THE DRAFT!!!!!!!!!

If you can’t save at least 10% of the home’s value you want to buy then you can’t afford it. People just don’t get it when it comes to the importance of a down payment. It all comes down to skin in the game. The more you have the less likely you will default. The government is doing everything in it’s power to prop up home prices. I have a feeling that by 2012 all avenues will be exhausted and they will have not choice but to let the chips fall where they may.

FHAnot bad said “FHA homes are for families who really need a chance to get into their first home.”

Can you explain this? If you don’t earn enough at your job, or do not have the financial discipline to save for a reasonable down payment why do you really “need a chance to get into a home”? What is wrong with renting? At the end of the day what you and your family need is a roof over your head. Keep reading DHB, among other good sites, and hopefully you’ll eventually get it. Some day owning a home might make sense for you, but just don’t get caugt up in the casino hype that homeownership is the panacea to building wealth. The whole point is that home prices are being propped up at unaffordable levels, don’t let yourself become a debt slave just so you can say you ‘own’ a home. With no DP you don’t, and won’t, ‘own’ any of it for a loong time, which would make you…….a renter. A renter that chose to pay interest on their rent and take on all responsibility for the carrying costs (home repair, taxes, insurance, etc.) and a great deal of risk. Unfortunately the get rich quick by selling homes to greater fool theory has deeply penetrated the psyche of a lot of folks. Don’t buy the hype!

@ dimwit: STFU. No draft. I’m not sending my kids off to war because you’re worried how your generation is perceived.

Hey, FHAnotbad, have you been paying attention? Obviously you noticed that the only houses available to people are 400%+ of their annual income. Your solution to that problem is to use govt. subsidies to let people get into those homes so that they “Have a chance at owning a home?” How about this: If people can’t afford the houses at those prices, maybe those pricese are too high? If instead of finding ways to shoehorn people into houses they can’t afford, how about we go back to sane lending standards, the kind we had (more or less) say 15 years ago? If people can’t afford that, then prices will come down (the “correction” DHB and everyone is talking about) and people will be able to afford the houses (for real, on a 30 year fixed mortgage with 20% down, not with zero down and liar’s loans.) Will that cause some pain? Yes it will, to the homeowners who paid too much for their houses because they were afraid they’d be left behind, to the speculators who got caught with their pants down when the music stopped, and to the banks that underwrote all this crap. I say F* ’em, they bet the farm that real estate would go up forever, which is obviously unsustainable. The reality is they they’re not really that screwed at all. Underwater homeowners can walk away and rent (yes, they might have a foreclosure on their record, which is a mere slap on the wrist in reality) Same with speculators, and they won’t even lose their primary residences. Banks can write it all off as losses. If the bank was too reckless, they’ll go out of business and their assets will be sold off to the highest bidder. You know who won’t be screwed? The guy that bought his house in 1970 and paid it off 10 years ago. Yes, he’s not sitting on as big a “goldmine” as he was 2 years ago, but he also probably has a house valued at $300k that only cost him $25k in 1970. On paper he’s a big loser, but in reality he’s made a nice (sustainable) return on that house. I just don’t get how anyone can read this blog and propose that the problem with the govt. response is that they’re not doing enough to sustain the bubble prices and/or cause the next bubble.

It really is this simple: If the median house costs more than 300% of the median income for an area, prices are too high and either A.) prices will come down, or B.) incomes will go up to restore equilibrium. Anything else is just gimmicks that might work for a while, but will end up F*ing everyone in the end.

To ” FHAnotbad:” Why must you buy a house? There are plenty of perfectly good houses for rent in good areas for far less than you’d pay for a house you can’t afford anyway. If a house runs 4 times your income, you can’t afford it even with zero down, let alone 3%. And even if you could lie your way into the house (a practice you apparently pine for,) what would be the point? The money would be flushed anyway since you’d never realize any equity. So renting makes the most sense today. You’ll still get a house you like and pay less to live there.

The worst most one sided article I’ve ever seen written about FHA mortgages.

Concerns Grow About Another Mortgage Giant – Series – NYTimes.com

Chaz Fullenkamp, an automotive technician in Columbus, Ohio, got an F.H.A. loan even though he was living on the financial edge. “If I got unemployed, I’d be wiped out in a month or two,†he says. Thanks to the F.H.A., however, he is better off than he used to be.

Mr. Fullenkamp used F.H.A. insurance to buy a house this spring for $179,000. The eager seller paid the closing costs and also gave Mr. Fullenkamp $2,500 in cash. He immediately applied for the $8,000 tax rebate. Even taking his down payment into account, he came out ahead.

“I knew in my heart I could not really afford the house, but they gave it to me anyway,†said Mr. Fullenkamp, 22. “I thought, ‘Wow, I’m surprised I pulled that off.’ â€

As the number of loans has soared, random quality control checks have decreased sharply, F.H.A. staff members say. Mr. Donohue, the inspector general, cited numerous examples of organized fraud in testimony to Congress earlier this year.

“They need to stop taking bad loans in the door,†he said in an interview. “They’re taking on all this volume, they have to have very active underwriting standards.â€

And now Doc’s carefully framed and researched discussion of an issue of interest to populists of all politics degenerates into poor-people-bashing.

~

Look. The problem is that back to the early 1970s, wages were not keeping pace with the cost of living.

~

To make up the difference, our banking and finance and political masters–gazillionaires–gave us debt instead. Debt upon debt, debt packaged as products and commodities, debt debt debty debt. Numbers games.

~

Now the debt bomb is exploding.

~

Those of you who claim that housing should only go to the winners in the corporate new world order–the scum that rises to the top of a nonproductive casino society based on “consulting” and “management” and “leveraging” and “value add” and “fully scaleable end-to-end e-customer solutions” and similar PowerPoint tripe–are hootin through yer tailpipes in yer cube farms. In my always obviously humble opinion.

~

Don’t take DHB’s statistics out of context like this. His/her whole point is that this is the sort of crap that results from the refusal to build an economy based on productive labor and productive workers, and refusing to pay productive workers decent wages. An economy that seeks to skim and scam, rather than produce.

~

DHB’s whole point all along has been that the FIRE economy is toxic, and in the end will take down even the very rich and upscale, who thought they could skim the fat forever and let poor people suffer and stay insulated in Beverly Hills.

~

As for FHA, I personally have always adhered to financial fundamentals in all my choices. This is why I couldn’t afford a house till my mid-40s, and then went with a 50% down payment. I frakkin HATE debt. And then 16 weeks after I closed couldn’t have afforded to buy because of the bubble mania in my area exploded prices.

~

But I completely understand why working class and working households turned to FHA, so they could stop paying the frakkin landlord class in their own communities. I’m betting that most of you slamming FHA have never lived in a modest or poor community where landlords are scum, rather than good people. (I’ve known both kinds.)

~

As for killing everyone over 30, good luck. Most twentysomethings I know (admittedly I live in a liberal arts college town) wouldn’t know how to keep the cooties out of their hair and pubes if their elders weren’t running major public health campaigns and holding everybody’s hand and personally volunteering to comb them out. Never mind accomplish more productive goals. All you born since Reagan took office, who revile the working class, this means you. You were born into a shallow consumerist casino lifestyle. It’s all you’ve ever known. But even in your own generation are countless millions who are paying the price not for the fact that your neighbor got a house s/he couldn’t afford without creative financing. You’re paying the price because those with the most don’t want to give anything up. In my view that’s a lot worse than people with a little giving way more than their share.

~

And all you under 30 who voted for Mr. Obama, hope you enjoy your share of the trillions in debt that your Nobelista gave you.

~

rose

(wearing an onion on the belt)

i only thought that bringing back the draft would give the little morons something else to think about instead of their satchel ass pants, purple hair, beads and s–t stuck in their faces, and trying to look like some badass , just out of priz jerkoff, with a desire to look like a coloring book with tats. guess thats what they do, till they can afford a camero to dismantle in their front yard.

compassrose: good response. Although, the only point I wanted to question you on is blaming Obama. I didn’t vote for him either but if I remember correctly, Bush is the one that approved TARP. TARP accounts for the 3 trillion+ bulk of bailouts. Even if it weren’t Bush, and suppose that McCain had won, do you think it would’ve turned out any different? They all serve the same master: Wall St.

The number of comments seem to be decreasing…more people may be writing off Dr HBB as a fringe loon, since they are seeing some stabilization in ther low end? My feeling is: Someday, the high end “must” capitulate and those “million dollar homes” must drop to 750k or less to find a buyer. That kind of drop HAS TO create downward pressure down the entire food chain, certainly causing 300k homes to fall to 200k, more like what they’re worth. That’s what I think anyway.

Well written article. I touched on this topic this week as well and came to most of the same conclusions.

The worst part of this is that the next bubble has already been created and I don’t anticipate it taking long for this one to crash. Private insurers aren’t dumb enough to continue this model unless they have government guarantees behind them, so when the FHA inevitably caves in and raises standards we’re going to see a huge exodus from housing with shadow inventory sitting idle until prices drop 25+%.

@Rose–fine writing and great perspective.

@Imbuyinrealestate–I think you showed your hand in your losername…

Interesting piece by Dylan R., formerly of the cnbc noise factory. He evidently could see through the slop he was asked to feed the nation and couldn’t do the acrid cheerleading anymore. I guess we’re cutting too close to the truth now and the dam may be getting ready to break, flooding the Children of the Hoover-Damned and their casino economy.

Can’t blame the kids. They know what they know. This is my first Depression, so this is all I know, except what I’ve read about the other ones. I can stand the loss of false wealth, but depressions usually end in war and we can’t survive a real one now that there are nukes.

Housing is just one symptom of a once-great nation in the late stages of demise. I didn’t vote for Obama, but I didn’t expect Ron Paul to win either. Obama doesn’t have any easy choices, and the Health Care and Finance industries are in total control. We have probably taken on too much water to stay afloat for ever. We’ve been throwing fuel and motors (industry and productive workers) overboard for years to try to stay bouyant. There may not be a way out.

They thought I was a kook about Iran and the petrodollar until the news broke last week that China and the others are replacing the dollar as the world’s reserve currency. They know–everyone knows; they’re just trying to device a plan while mitigating the damage. I’d rather have been a wrong kook that an accurate doomsayer.

So go get a jumbo FHA and buy that 700k RHG, heck it’s such a good deal, buy a couple. The subprime problem is over, and its back to business as usual. I don’t know about you, but S/HE’s buyin(g) real estate. As screwed up as things are, maybe s/he’s right.

I think the vast majority of everyone who thinks the bottom is in and itching to buy and can buy, has.

I mean, if you think it is all up from here you’d be a nut not to take the plunge if you could.

What happens now that the panic to buy is tapering off?

All of these FHA loans are fully documented loans, unlike many of the ALT-A and option ARMs. While I do not support the high lending limits now possible with these loans, I think the larger factor impacting default rates at this time is employment and jobs Iincome) rather then increased risk due to low down payment. Even prime borrowers with good credit profiles, fully document loans and 20% down are defaulting.

@dimwit – from the de-industrialization of America to global warming and peak oil, could you honestly say that this country and the world is better since the boomers had control? The younger generations now have to clean up the elders mess but still have to wait for you to die off and get out the way. Complete selfishness and ‘something for nothing’ attitudes on a society wide scale are not good for that society. We’ll survive the ‘Me’ generation but just barely, with a lot of hard work and working together for the common good. Never trust anyone over 30 is finally starting sense (but make it over 45 and except for those over about 70). Does it seem telling that one generation has had problems with all the others and those other generations don’t have problems with each other?

@Deadbeat

The boomers started out with the Kenedy’s and MLK being shot, the Vietnam war and we just wanted to stop the hatred and killing. Then we were bombarded with advertisement to consume and parents with the means to give us all the things they never had. Your generation would have done the exact same things we did because we are all running the same firmware. When I was in college in the 70’s I was idealistic that the world could be a better place and dreamed of a day when that would happen. Some things are better, they really are, but of course many are worse. It takes a lot of reading to understand what is going on. You won’t find the truth on a 1080p digital display any more than we found it on a black and white CRT. I wish your generation the best–my son, nephews, neices are all of your generation. But be prepared for the worst. If you think just because you have a vote that somehow you can change the world, better think again. All the votes in your state might not sway an election one bit, so that doesn’t work. To rage against the machine you have to become part of the machine without being reprogrammed by the machine. Don’t hate the generation–we’re not in power. We just do what our mind masters tell us. Why do you think your generation all has tatoo’s and earrings? Did you all simultaneuosly think that was a good idea or did you just do what the machine told you—honestly. Good luck.

@Kid – sorry, ‘we just do what our mind masters tell us.’ isn’t a very good excuse. I don’t mean to imply the sins are equivalent but it does sound a bit like what some Germans said a few decades ago. It’s not my generation I’m concerned with, it’s the younger and future generations. The main problem I have with boomers is their overwhelming concern for their immediate satisfaction even when it indirectly hurts everyone else (hey, hey – live for today). So your parents did it to you? You were all spoiled brats that never grew up? I already knew this much. I only wish they finally would grow up now. At some point, in order to be a full human being, you need to become more than the sum of your genetics and upbringing. And mind control only works on weak minds. So the establishment told us to get tattoos and piercings? Weird, kind of seems like the opposite happened. The establishment did tell both generations to consume above all else – that is true. Unfortunately, your generation IS in control by the virtue of the number of your votes. When that is no longer true, we may be able to move forward. We are preparing for the worst in hopes of still being around when that day comes.

@ imbuyinrealestate –

How are facts one-sided? It was only a couple of years ago that Fannie Mae and Freddie Mac were making the same tired arguments – “nothing-down loans are good for people”. Both crashed and burned. FHA has the same problems, and you want everyone to put their head in the sand and ignore a pending disaster.

Grow up. Attitudes like yours are the reason why we had a global financial meltdown.

So much for another problem. This is really getting on my nerve. It’s really hard to avoid the global financial crisis because of ourselves and our attitude.

Leave a Reply to Kid Charlemagne