FHA has become the new toxic lender of first resort – 4 out of 10 loans made in expensive Southern California are FHA backed. FHA now backing apartments in Manhattan with a price tag of $820,000 to $3 million with a 3.5 percent down payment.

The Federal Housing Administration (FHA) was created in 1934 during the Great Depression to give low to moderate income Americans a chance at pursuing the American dream of homeownership. Even in the best of times, the FHA was only a small fraction of the mortgage market as it was never intended to be a big player. Today the FHA now backs 30 percent of all loans outstanding and is quickly burning through its reserves. You would think that the FHA would try going back to its core mission of helping those it initially set out to help. Instead, it is now being used as a backend tool to fund absurd mortgages that don’t fit into any other current government loan programs.

In Southern California, where the median home price is $300,000, 4 out of 10 loans made since May of 2009 have been backed by FHA loans. This is happening in a market that is 65 percent more expensive than the nationwide median home price. Think this is bad enough? Now the FHA will be funding loans for apartments out in Manhattan that have market rates of $820,000 to $3 million. That FHA sure knows how to stick to their mission statement:

“(Bloomberg) The Federal Housing Administration agreed in March to insure mortgages for apartments at the 98-unit Gramercy Park development, known as Tempo. That enables buyers to make a down payment of as little as 3.5 percent in a building where apartments are listed at $820,000 to $3 million.

“It’s a government seal of approval,†said Gollinger, a director at the Developments Group of New York-based brokerage Prudential Douglas Elliman Real Estate. “We need as many sales tools as we can have these days, and it’s one more tool.â€

This kind of lending is patently absurd just like option ARMs and other no document loans. Just because you are putting 3.5 percent down is no reason for making you a solid financial bet moving forward. The predatory nature of Wall Street banks seeks to exploit the weakest link in the current financial system. FHA is the perfect target. Is it any wonder why FHA loans defaults are flying off the charts?

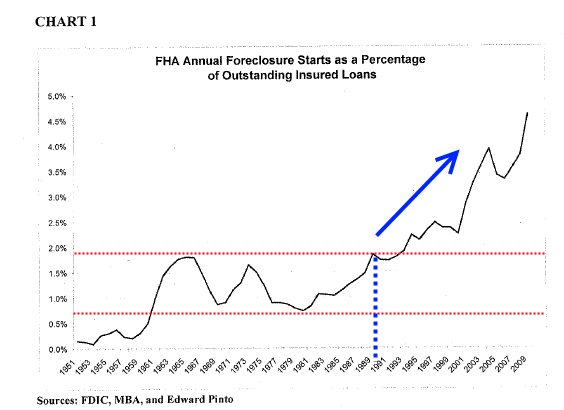

If we look at 60 years of data, we find that FHA foreclosure starts as a percentage of all mortgages hovered in a tight range. This range was from 0.75 to 2 percent. But starting in the 1990s it broke out to 2.5 percent. Why? First, the FHA only backed a small proportion of loans relative to the size of the mortgage market. But starting in 2000 things simply went haywire. FHA foreclosures went exponential during the housing bubble and now are flying off the charts. If we slice the data further, we can see that FHA loans are performing much more poorly than the headlines will show:

Source:Â HUD

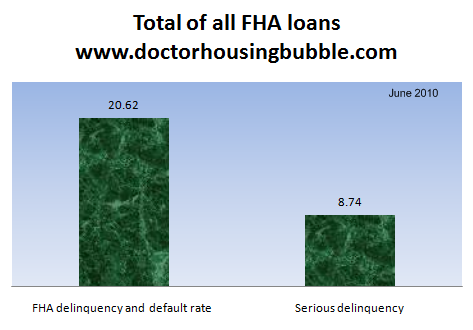

All the mainstream headlines have missed the most important point above. What they quote is the “serious delinquency†rate which has decreased slightly over the last few months. This is good right? Only if you have no sense of what is going on and believe in mark to market fantasies. The only reason the rate has fallen is because the FHA has been insuring large volume in recent months so these loans of course are current! But just give them a few months or even another year and just wait. If we look at the bigger picture, at least 1 out of 5 FHA insured loans is already behind by one payment. And now the FHA is going to fund loans on insanely expensive Manhattan apartments? The FHA is simply stepping in to fill the void of the now defunct toxic mortgage lenders.

Low volume to replacing toxic lenders

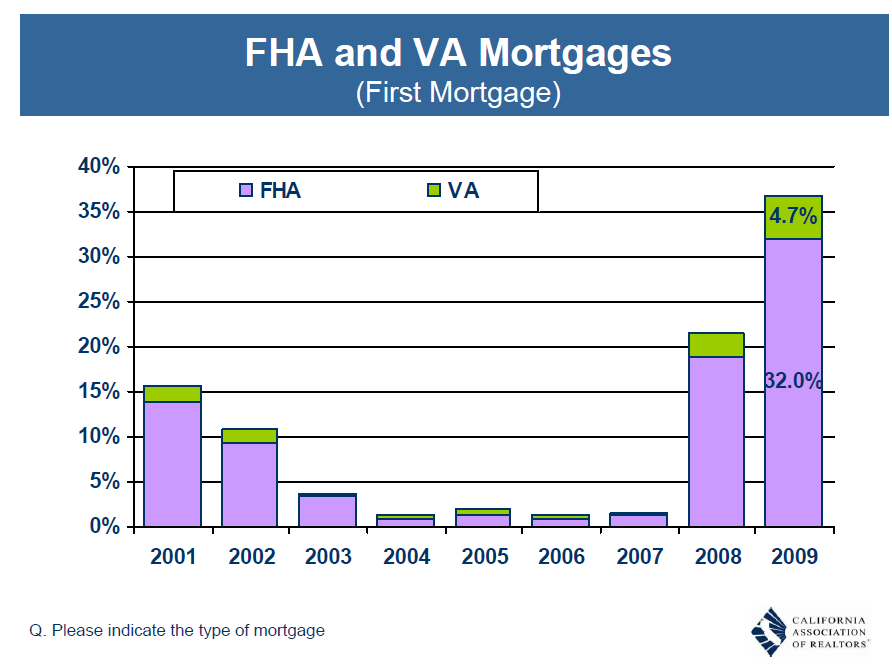

The FHA was never a giant player in the mortgage market and it was never intended to play such a role. The mission for most of its history was to help a small segment of the home buying population that might have been too risky for conventional banks. But now, the FHA is being used as a tool for some of the most expensive markets:

Source:Â CAR

Looking at this data it is becoming obvious that the FHA is now functioning as a conduit to bridge the market that was lost when the toxic lenders failed. The FHA backing those highly expensive apartments in Manhattan is merely another way average Americans are subsidizing the speculation of real estate in bubble areas. Say you were a wealthy investor or someone merely with a 3.5 percent down payment. Why not buy the $1 million apartment and hope it inflates in the next few years? If it does, you can enjoy the benefit of using other people’s money leverage and cash out. If prices drop even by 5 percent, you are now underwater. And as we all now know, those that are underwater are more likely to walk away. Those with higher mortgages have an even higher incentive to walk away. These kind of ideas and practices show how screwed up the housing market remains especially when it comes to the FHA.

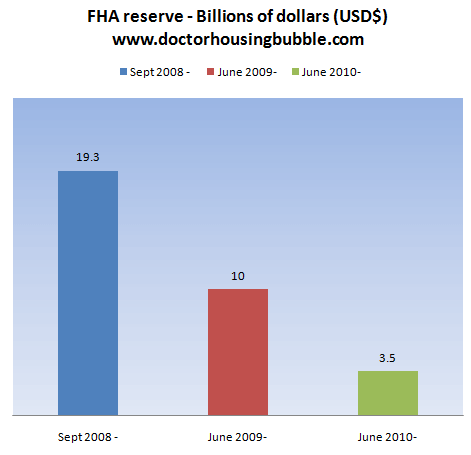

Bailout in the making

If you believe that the FHA will require no bailout then you probably also fall into the camp that believed that somehow Fannie Mae and Freddie Mac were going to turn us a profit. Of course now that we own Fannie and Freddie completely, the losses are rolling in like you wouldn’t believe. Billion dollar quarterly losses are common. The FHA will be the next big bailout and with current actions like those mentioned above, it is only a matter of time. Just take a look at the reserve fund to see if you can spot the trend:

The fact that 4 out of 10 loans here in Southern California are FHA backed simply highlights that the FHA is backing loans in markets that are still in housing bubbles. California and New York still have inflated prices in many areas yet the FHA is becoming the lender of first resort in these areas. What will happen if the markets correct further in these areas?

FHA will implode just like Fannie Mae and Freddie Mac

The FHA is merely taking on too much risk and much of this is at the request of bankers and the real estate industry. What do they care if the loans implode down the road? They will get their commission cut and will be gone before problems hit just like all the option ARM and Alt-A lenders. It is a market of perverse incentives and without any reforms with teeth, the crony capitalism continues. In fact, we found out after toxic lender superstar WaMu imploded that they had a blacklist of appraisers that actually were get this, honest. That is right; if you came in too conservative with your appraisal you were blackballed. So basically WaMu would tell you what price they would expect and voila, it happened. Appraisers that met the target received more business while those that did their jobs lost out. What happens in this kind of market is incredibly bad behavior is rewarded and all risk is shifted to the taxpayer.

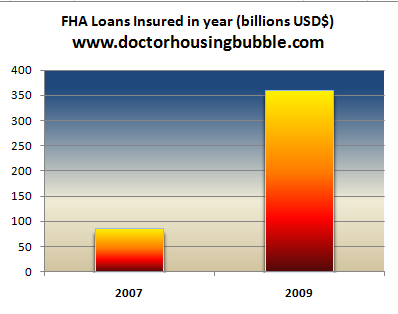

The FHA insured $71.4 billion in loans in Q2 of 2010 alone. In 2007, the FHA insured $79.5 billion in loans for the entire year. Here is some perspective:

Start insuring those high priced apartments and the nominal value of mortgages insured by the FHA just increases substantially. Who wins here? I have no problem with banks using their own money to lend on these apartments or on other highly expensive real estate. But what a stunner that over 95 percent of the current mortgage market is government backed (i.e., FHA, Fannie Mae, Freddie Mac, etc). So the Federal Reserve also steps in to buy more mortgage backed securities to keep rates artificially low. The market is completely and utterly broken.

So what is the solution? Banks need to be treated as utilities. Those that want to gamble and operate like hedge funds can do so but with zero government support. If they fail they go down with no taxpayer support. In other words, break the big banks up so they are not systemically destructive. This is the absolutely right thing to do. Right now the stewards of the mortgage market are the too big to fail banks. Basically Bank of America, Wells Fargo, JP Morgan Chase, and the other players operate as middlemen to push out these government backed products. It doesn’t take a genius to underwrite a government backed loan. So why not cut them out completely and basically pass on the savings to Americans? Of course this would be very difficult to happen given the cozy relationship between Wall Street banks and our government. I’m amazed by how many people still believe in the banks and say, “well if we let them fail, then god knows what will happen.â€Â Look at our current economy. It is a royal mess outside of Wall Street so we already know what happens. Basically what our current strategy relies on is continuing to believe in the housing Ponzi scheme. Bernard Madoff went to prison for that yet big banks get more taxpayer money.

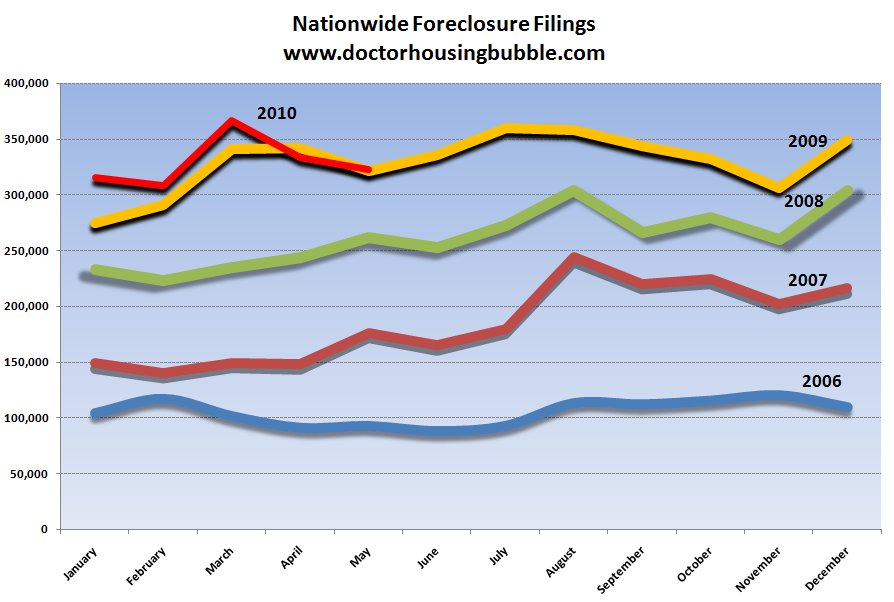

You think the foreclosure situation is getting better?

We are basically tracking the peak of monthly foreclosure filings. The FHA has stepped in and filled the void of the toxic mortgage operators. 3.5 percent down is just as bad as going in with nothing down and a strong FICO score. If you add in the tax credits, many people were buying basically with nothing down after the tax benefits were included. This is housing bubble 2.0 except with one major difference; home prices are stagnant and all the risk is now shifted to the government. The market is desperately trying to correct in many regions because local families can’t afford homes without taking on risky mortgages. Just because the government backs a loan doesn’t mean it is safe. FHA insured loans are helping the truly low income buyer needing that million dollar Manhattan apartment or the overly priced Southern California real estate. Is this really the new mission for government backed mortgages?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

31 Responses to “FHA has become the new toxic lender of first resort – 4 out of 10 loans made in expensive Southern California are FHA backed. FHA now backing apartments in Manhattan with a price tag of $820,000 to $3 million with a 3.5 percent down payment.”

Follow the money. Who are the beneficiaries of the FHA backing of million dollar Manhattan condo mortgages?

They still have to prop up the market somehow.

Banks are not going to make ultra reckless mortgages, they are only doing medium to super reckless mortgages, so FHA have to do the ultra reckless ones.

With the banking oligarchy essentially broke (take away TARP, 0% overnight rates, mark to market trickery, etc.) and hoarding money (well documented on DHB), where would the RE underwriting come from without the constellation of gvmt programs propping up RE, including FHA?

The financial system was on the brink of complete collapse just weeks piror to to the Obama administration. We can argue that both parties were equally complicit in the greed and malfeasance leading up to the crash, along with bankers and insurers and their gvmt co-conspirators/enablers.

So, the gvmt is coming to the rescue, when the private sector is essentially incapable, trying to keep the economy and consumer confidence afloat until confidence returns to the global financial system. With home ownership at 60%, there would have been real danger of depression (mostly a psychological condition) if the market were left to clean up the RE mess.

There is no polititian on earth, Democrate, Republican, British, Argentinian, who would want his/her legacy to be to allow an economic collapse on his watch, even if the cleansing would be a benevolent force. Political adversaries would jump on such “failure” with verocity it would make one”s head spin. And we all know that the victors write the history, so the opposing party would gladly take credit for “correcting” its predecessor’s “failure.”

Well that is the problem ………….. what is the solution. There is no political will!!! How does the greatest economy on the plant make the difficult and necessary decisions?

Now it looks like if you paid your mortgage on time and have any equity, your essentially penalized because of doing so.

“So, the gvmt is coming to the rescue, when the private sector is essentially incapable, trying to keep the economy and consumer afloat…” – Dfresh

In other words, the gov’t is coming to the rescue, to solve a problem largely caused by gov’t intervention, until consumer confidence and the economy recovers, which we’ll pretend is a foregone conclusion.

There really isn’t a private sector anymore. All of us are directly or indirectly employed by the government at some level. The company I work for does work for military, higher (priced) education, and the pharmacuetical industry. Some lawyers still got money too. I believe if you trace the money back, almost everyone is somehow getting their bread from the master baker, Uncle Sam. We have more government influence than Red China, I read a few years back–before all the fhit hit the san.

You have to admit the weather is quite good in so cal these days. This is pretty much all we have to brag about. No thanks to the government though. It is so frustrating to read the facts in this article. So much for “change”. There has been no change on the government behaviors. Wait, it has, it has gotten worse.

Jared Diamond’s ‘Collapse’ is a must read for everyone. The abuse of power by the privilaged is the downfall over every civilization, and we are going there too. In Greenland they survived by ships coming from Norway. Instead of survival provisions, the Bishops (doing God’s work…heard that one?) would instead have the boats loaded with finery, clothing, stained glass windows, crap for their churches; meanwhile, a bad winter and people die. Eventually a 450 year old civilization collpases because instead of preparing for hard times, the privilaged adorn themselves with guady oppulence. I’m sure those bastards would have had stainless appliances and granite coutnertops if they were available.

So which is more likely now: V-shaped recovery or the next Dark Age?

Note to self…

exchange more fiat for Gold

Cheers!

Gold may not fare as well either-check the prices during the deflation.

I think the govt propped everything up, assuming when the recession ended, the “up” cycle would pick up demand and so the stimulus and other measures were meant to be more of a hold mechanism to prevent everything from collapsing.

But the problem is much more severe. The jobs have all gone overseas. I know of at least 25 people who lost their jobs-all to other countries. These are people in their 40s and 50s who have worked hard and built their lives and now are looking at financial ruin and no way to claw back up. The republicans seem to think they are lazy, drunk and need to be drug tested. But the jobs are not there-at least for people at that age and experience level.

We do have a major problem. I am still looking for an answer. Now the last time they tried protectionism in the great depression-it didn’t go so well. But we were almost like China back then-we made and exported stuff and were a creditor. Now the tables have turned and we are the biggest debtor and the biggest importer in the world. So this time it might be different?

i don’t know the answer. I see the pain all around. I don’t see any sense in the republican plan-even more free trade, even more deregulation, even less taxes on the ones that are shipping our jobs overseas. Ain’t gonna work. But I see no plan from the democrats either.

Lets just see what happens.

Deflation? Did you not read what the government is doing?

Here is some help:

FOA wrote back in April of 2001,

“My friend, debt is the very essence of fiat. As debt defaults, fiat is destroyed. This is where all these deflationists get their direction. Not seeing that hyperinflation is the process of saving debt at all costs, even buying it outright for cash. Deflation is impossible in today’s dollar terms because policy will allow the printing of cash, if necessary, to cover every last bit of debt and dumping it on your front lawn! Worthless dollars, of course, but no deflation in dollar terms!”

There is much more going on than simply real estate on the world financial/monetary stage.

Hey Doc:

Great stuff as usual but I don’t think you’re clued in to the peas HUD is hiding under that big leaf of lettuce in their portfolio.

Brace yourself, HUD loan modifications are up 74.7% over last year’s same YTD period. HUD is tossing delinquent loans back into the “current” category, with 40,000 more loans modified than last year at this time. While HUD doesn’t break this down, nor does HUD’s Inspector General, I’m sure many of those loans are repeat offenders – double and triple defaulters. HUD allows them to be modified to be taken out of the “delinquent” statistics. They need to be called out on this crap.

An absolute volcano of defaults is brewing in the FHA portfolio. Notice how HUD NEVER talks about the toxic waste they are counting as “current” in the loan mod hideout. This is going to be the Mount St. Helens of default catastrophes.

Yes there is much going on than real estate/finance. The govt can print dollars up the wazoo, but there is no demand locally. They have esentially reduced their interbank rate to zero-I think for a while our yield was even less than the yen-which by the way is at multi decade highs.

For hyperinflation to happen, we need a lot of factors to come together. China needs to collapse first or at least their reliance on us erode. Then they can stop buying our debt. We are superbuilt in terms of housing, most of us already have a car or two and in terms of resources-we already use more than any country in the world. We are a mature economy. We already have our highways and dams and airports etc.

Where is the demand going to come from in the absence of jobs and incomes? The fed can pump all they want and the FHA is guaranteeing toxic loans that the banks used to cut up and sell overseas. Maybe the Fed might print another trillion and buy up the FHA loans too. But so what? The current mortgage rates are some of the lowest in history and demand is still going down. There is not much demand -it is not like China and India where billions are trying to come out of the pre industrial era.

Most people I know are slowly downsizing-not just housing, but in many aspects of life. Even those with jobs. Unless the economy improves markedly or the dollar collapses-hyperinflation is a distant possibility. Deflation looks more likely.

The economy’s greatest threat – deflation

“When the financial crisis of 2008 caused the credit markets to seize up, the Federal Reserve responded by pumping money into the economy.

The institution slashed interest rates, which had already been low for about a decade, to near zero. Through a variety of strategies, it injected about $1.5 trillion into the economy.

*The first thing that happened was a recovery that wasn’t really a recovery.

*National unemployment continues to hover at 9.5 percent, and a fuller picture of unemployment and underemployment shows a full 16.5 percent of the workforce in need of a paycheck.

*Inflation isn’t possible when people don’t have any money to spend.

*Banks haven’t been willing to lend and companies haven’t been willing to spend.

*In June, core inflation (overall prices excepting food and energy) was up just 0.9 percent, the slowest increase in 44 years.

*Once deflation starts, it’s hard to stop it.

*Unfortunately, the only solution to deflation is increased employment, investment and spending.

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2010/08/14/EDO61EFPIF.DTL#ixzz0wmHjLBDx

“*Inflation isn’t possible when people don’t have any money to spend.”

That must be why Zimbabwe, Weimar Germany, and Argentina experienced such severe inflation – their citizens had soooo much money to spend…yeah, right, that’s it…nothing to do with utterly corrupt (mis)management of their respective currencies…move along, nothing to ponder here, back to thinking inside the box…

When you and others I read and follow online state what needs to be done to correct the situation we’re in, and raise questions like – “Where are the cops?!”, I have to ask, what makes you think anything will be done to correct the situation we’re in?

Here’s the thing, we dove headfirst into the crapper a long time ago and no one in authority is either capable, or willing to do ANYTHING to get us out. In fact, they seem hellbent on making things worse through incompetence or deliberate fraud.

So when people complain, and moan, and demand action, I have to wonder what they’re doing? Is it just cathartic to yell and hope that you’re heard? Seriously, stop demanding change that is NOT coming and talk about what to do in the reality that we live in. These are not the days of the government that listens to it’s citizens. I don’t know how much clearer that could be. If you have money you have influence to get past the velvet rope and affect change. If not, then not except in some token gesture to get a blurb on CNN and appear to be doing something.

So, in a world where laws and regulations are ignored by people, companies and our government during this massive economic failure what do we do? How do we conduct our financial life to take this into account? I’m not expecting the government to suddenly act responsibly, or suddenly grow a pair and stand up for me. So what do I do to compensate for this new reality? Coulda, shoulda, woulda doesn’t help me.

To put it in very basic terms we all can relate to:

Hyperinflation: That $700K cracker box in Santa Monica is going to be worth $5 million debased, toilet paper dollars.

Deflation: That That $700K cracker box in Santa Monica is going to be worth a lot less.

Which scenario is most likely? If it’s hyperinflation, then you better buy now or be priced out forever…

If that crap box in Santa Monica goes from 700K to 5M due to hyperinflation, my 150K yearly salary should go to 1M. Either way, buying inflated real estate now is extremely risky. When you look a the big picture regarding jobs and the economic health of this country or god forbid this state, things don’t look that rosey.

You’ve got it. Wages need to go up to match. That’s the issue for real estate right now, wages never moved, savings rate was already poor, so those housing price increases came from….lowered credit standards and increased risk taking. All of a sudden that unsustainable push to gone, wages are the same but employment is worse, and it’s a s**t storm.

I don’t necessarily think a bet on inflation is a bad thing. Say I had $10m liquid and a $2m paid off house. I’d leverage the hell out of it and see what happens. Point being…if I get it wrong and I lose 50% of the value of my home, I lose less than 10% of my total wealth (a portion of which would also be set for deflation anyway).

The reality is that most people’s savings and incomes are dwarfed by their homes’ values. It’s too big a bet as you are either a big winner or ruined. Binary outcomes are what got people into this mess and pushed prices up. I don’t see the appetite for risk anymore. Not for people, not for banks. If incomes don’t go up, it’s just a matter of time before housing gets to parity.

Bane- your comment is completely stupid. No job equals who gives a $^%& what prices go to or infalte to… You must be a RE agent.

The government might listen to the people, but I think it would take mass civil disobedience at this point for that to happen.

Keep up the good work doctor, I’m not sure how you’ve stayed so committed to this issue for all these years. I, like many other prudent renters during this bubble, have waited for prices to come back to reality; however, due to the market manipulation by the banks/gov’t, we don’t see any sanity here in the SF Bay Area. With the worldwide economic uncertainty, sovereign debt crisis, currency manipulation, QE, wars, etc, etc, etc. this is not a safe time to be indebted. I’ll happily rent for the next 5 years and see where all this plays out.

US will be Japanese style economy, deflation and economy sinking……..Good luck US

It’s becoming increasingly clear that US govt debt is the final, great bubble. When it finally hits a point where no one trusts the US$ any longer…….

No worries: We are too big to fail. Rest of the world has to keep up the charade. Mutually Assurred Destruction. Aren’t you proud to be American right about now?

I wish it was deflation. But that’s not going to happen. A worthless dollar with no productivity = hyperinflation and depression. It will be a slow crushing depression right into the ground. Look at the big picture. We’ll be just like any other quasi-socialist country like Argentina or Brazil. Tiny pockets of nice housing surrounded by huge poverty-stricken areas. It’s already happening, just like the bloggers stated in earlier blogs referring to the housing value disparity in Burbank. Just look at at the garbage crowded shacks on Franklin Av., and the multi-million dollar homes up the street in the Hollywood Hills. There will be just more housing value disparity.

Maybe they can give some mortgages to Cambria, CA or Carmel-By-the-Sea. These former hot spots of second home purchases each show about 250 properties for sale. July sales for Cambria? 1. July sales for Carmel? 1. YTD sales for Cambria? 9. YTD sales for Carmel? 9. Months of supply? Approximately 250.

Will a 20% decline even make a dent?

Another perfect example of sticky prices at the high end. The rich can afford to stick it out for years hoping for recovery or at least inflation.

My apologies. Zillow says that 12 properties closed in Carmel in July. So at present there is only a two-year supply. However, it’s not exactly a sign of a healthy market.

All I can say is that nobody has mentioned religion? We are all going to be on our knees asking for forgivness from the Muslims at Ground Zero. WOW!!!

Get your facts straight, it’s not going to be at Ground Zero…..

Leave a Reply to turd ferguson