A modern day feudal system for real estate – Wall Street and large real estate investors crowding out entry level buyers to hike up rents and outbidding buyers.

There is an interesting dynamic unfolding in the housing market. Real estate agents in places like California are arguing that there is a lack of inventory and are also generally against the government unloading blocks of properties to big investors. Why? There has been bulk selling and buying to the investor class and a large amount of crowding out has occurred. This brings about an interesting set of problems for your average buyer in the current market. They are competing with swaths of big investors but also local flippers trying to make a quick buck once again courtesy of low interest rates and another mania in some markets. SoCal is now in a mania again as you will see with some of the patterns occurring. This is also happening in many other states as well. A new feudal system has emerged. The banks were bailed out by the Fed, were allowed to circumvent accounting standards, and now deep pocket investors in the financial class are buying up these places either to increase prices on flips or to hike up rents. In the end, if you want to compete in today’s market you need to bow down to the Fed, put on a football helmet and go head-to-head with big investors, flippers, suckers, and take on a massive mortgage.

Seeking out your own fiefdom

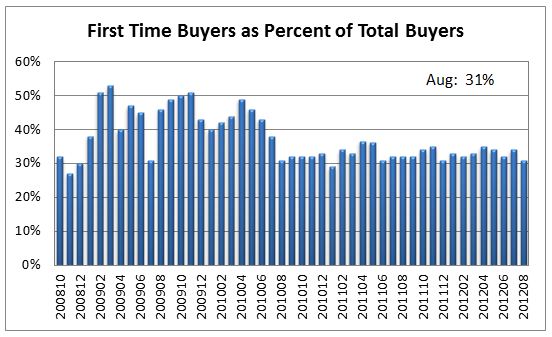

The Los Angeles Times highlighted the declining inventory for entry level homes with a stunning graphic:

“(LA Times) Rogers said he has gone into escrow twice and lost out both times, as other buyers have been willing to pay more. He has been shocked by competing investors paying $75,000 to $100,000 more than what he has estimated some homes to be worth.

The big speculators have pooled all their money; they invest and they bid them up,” he said. “It’s crazy. Some of them, they pay pretty close to what it’s actually probably worth fixed up, but then by the time they put money into it, they are going to be $50,000 to $60,000 over.”

First some analysis of the chart. The drop in inventory in various metro areas is stunning. Keep in mind the demographics of your entry buyer. They are younger Americans that are less affluent and very likely to be in student debt already. Many markets in California are being crowded out from top-tier San Francisco to places like Fresno. It is worse for places like Phoenix Arizona where a whopping 40 percent of all purchases were done with all cash. The chase for yield has caused prices to surge in an area that is economically depressed and carries lower household wages:

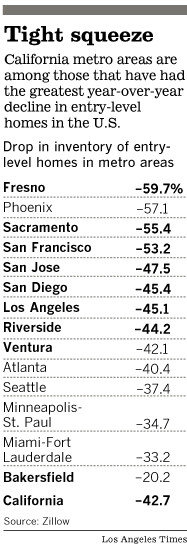

Source:Â DataQuick

The median price in Phoenix is up over 30 percent year over year. You read correctly, the year over year median price is up by 30 percent. Did incomes go up by this much? Of course not. For years you have nearly half of all properties being bought in this market going to investors. Rent prices have surged while banks leisurely leak out inventory while shelling out the best deals to other financial institutions with deep wallets. In other words all the bailouts were to create another bubble and crowd out the typical buyer and also, squeeze the wallets of many renters who probably are not able to buy.

Going back to the paragraphs above, the fact that investors are bidding prices up by $75,000 to $100,000 over market valuations in this current economy is very reminiscent to a mania. If you view the world through the lens of a hammer everything looks like a nail. These bulk investors are diving in head first here and entry level buyers are competing against large funds. This bubble is different. During the early 2000s you were basically competing against anyone with a pulse. Today you are competing with big pocket investors, hedge funds, flippers, and large real estate investment funds.

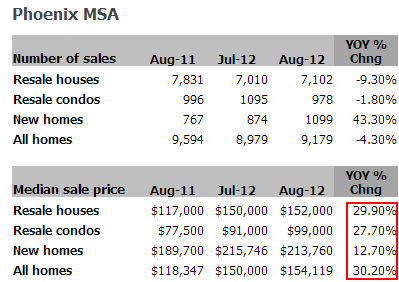

Hot money will go to many areas. For example, the Canadian housing bubble is seeing a good portion of money leaking out into the Florida market:

Nearly 75 percent of foreign buyers in Miami come from Canada. I wish we had figures like this for California but I would venture to guess that most of the foreign money coming in is from China (that is experiencing a housing bubble even bigger than the one we lived through).

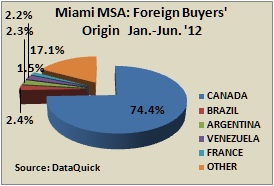

All this action has made it tougher for first time home buyers who need to over-bid or take on massive loans with the sticker price of low interest rates. You would think that first time buying would be high but it is not:

Source:Â NAR

The Federal Reserve is largely helping big financial institutions with QE3. Those that own and can refinance lower save some bucks but this is merely an afterthought of the Fed action. Big money is being made by the banking system right now. You saw this week Wells Fargo announced stellar profits even in the midst of being sued for their FHA insured loan practices. What is Wells Fargo being accused of?

“(SF Gate) Yet another major bank has engaged in a long-standing and reckless trifecta of deficient training, deficient underwriting and deficient disclosure, all while relying on the convenient backstop of government insurance,” said Preet Bharara, U.S. attorney for the Southern District of New York, where the suit was filed.â€

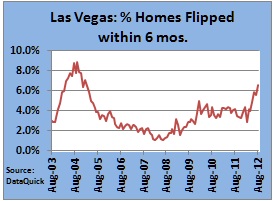

Why in the world would the Fed and government setup programs to bulk sell to investors when there is a clear demand from buyers? We’ve already noted the amount of flippers entering the Southern California market. Las Vegas is seeing an increase in flipping activity as well:

Just because money is cheap does not mean it is going to boost the economy. Take a look at Japan and their multi-decade policy of quantitative easing. We are juicing markets up in many areas and conditioning the overall economy to negative interest rates. The crowding out is creating a new kind of landlord:

“Renting out foreclosed homes has increasingly emerged as an investment opportunity for Wall Street.

Financiers are busily studying ways to take the single-family home rental business, for years mostly a mom-and-pop affair, and make it a bigger industry. That has made it difficult for first-time shoppers to compete.â€

So now you have to compete with Wall Street that receives favorable treatment from the government and Fed just to purchase an entry level home. This is becoming a closed loop system. The same financiers that made billions upon billions of dollars shelling out fraudulent loans and toxic waste are now gaining favorable treatment in locking up blocks of properties to jack up prices. The California median price is up 12.9 percent year over year while incomes remain stagnant. In Phoenix it is up a stunning 30 percent. Las Vegas? Up 18 percent year over year. These gains are on par with the peak years of the bubble. This mania is being caused by stringent control on distressed inventory and absurdly low rates courtesy of a Fed with a nearly $3 trillion balance sheet that is set to grow with QE3.

One of the quotes in the above article sums it up:

“Don’t sell to regular people — just sell to us,” Monks said these investors have told him.â€

Meet the new boss, same as the old boss.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

77 Responses to “A modern day feudal system for real estate – Wall Street and large real estate investors crowding out entry level buyers to hike up rents and outbidding buyers.”

Thank you Mr. Obama.

Oh please people wake up and stop the political blame game! Has anyone heard either candidate mention one peep about the Fed or our monetary policies?? I am no Obama supporter but please don’t think for one second that Romney will do anything different. Oh wait there is one thing Romney and Ryan ard working to change they will end the mortgage deduction. Welcome to the United States of Austerity. I study this and warned people of this happening 4 years ago via my website. Economicsurvivalguide.org the giant equity stripping ponzi scheme was done purposefully to transfer the wealth and assets and wipe out the middle class the end goal IS a Fuedal society. That is the goal and hence monetary policies support the NWO agenda. Simple and elegant really from the view from the top. People are too busy to really even pay attention to who what why and how. It’s like watching Atlanta burn and being helpless to stop it. I have tried but most people don’t want to know the truth.

Jeez Lynn. I wanna say you sound like a conspiracy theorist, but I can’t. What you say smacks of truth. I do NOT think that Romney/Ryan have the middle class in their best interest.

Jeff

Trying to hold on to optimism 🙂

If the mortgage deduction is eliminated, it will be for mortgages over $500k. So your average home buyer isn’t going to see a difference. As for the big companies buying up homes, that’s good for the home owners, isn’t it? The price now is back to pre-bubble and the only people that should be concerned are the vultures hoping that home owners lose even more equity. In SoCal, all the buying has driven up pricess something like 5 to 10 percent. BFD. You can still buy a small house right now for 20-30 percent of the bubble price.

Well put, this one.

Future doesn’t look too bright for anybody outside of the ruling class.

Romney will do worse. He will repeal Dodd FRank and get the securitization train running again. Then main street will be raped by this feudal system yet another way.

We are in the bull trap of a bubble right before the bottom falls out…look out below…

So…Another post containing indignation …Are wel really software surprises the system is corrupt? Still.

?

Software surprises!

So surprised

As always, the question is “Why aren’t the bastards in jail?”

Buying the guys who write the laws has always been the best investment big money can make.

Democracy is designed to resist that but there isn’t real democracy anywhere anymore, except maybe in Iceland. (They let the banks go bankrupt and bought the remains to the state: Nothing changed from the oridinary people point of view but speculators lost their money: More capitalistic than anything I’ve seen anywhere.)

Bought government doesn’t apply only to US but EU and almost everywhere else, too.

EU has a “comission” whose power is equal to good old Soviet Union era Central Committee (the Parliament is a puppet: Commission can and will walk over them whenever necessary) and bribing a Commissioner isn’t even a crime. Also there’re no crimes defined which could be a reason to fire a Commissioner. Nicely rigged system from the start.

So a Comissioner can build personal fortune as much as he wants by selling directives and that’s perfectly legal.

And oh boy, does that happen: Most of the directives are the ones Parliament sees first time _after_ Comission has approved them, absolutely no changes nor no discussion allowed at that point, only vote for accept/no accept.

Nice trickle up economics at work. Here is the recipe. It is not a secret, just that no one

in the mainstream media wants you to know how it works. Since you (the common person) is on the menu. The big bankers are the diners.

Recipe:

1. First bubble created by Greenspan by encouraging, NINJA, ARMS, OPTION-ARMS etc.

2. Then bust the bubble by increasing interest rates and gasoline prices.

3. Once the bust is done save the banks from their own fraudulent activity, by printing money.

4. Then banks buy the inventory by lending to hedge-funds and other investors. While doing this hold the shadow inventory on the books with mark-to-model (shall we say fantasy instead of model).

5. Slowly trickle out the shadow inventory.

6. In the process basically strip the equity of the common person and pocket it with free money from the banking cartel called the Fed. It is neither Federal nor a Reserve. It creates money from thin air for its constituents — the bankers.

Voila! Eat delicious working slaves who will toil for you with high rents for

the rest of their life. For entertainment have some side show of elections and debates,

football, hockey, basket-ball, baseball, soft porn with reality shows, while money printing is done outside of any public audit or scrutiny. For extra zing add $1T of student loans on the youth to prevent revolution.

For true connoisseurs do QE3 to QE-infinity. Hyperinflation will nicely keep those moronic slaves in their place (err on the dish) and will not escape your bite.

For desserts attack faraway lands and send some able bodied young men to die or to be maimed. No chance of a revolution then.

Enjoy the dish oh yea masters of the universe, the great bankers who only do God’s work!

Excellent synopsis of the biggest financial theft in history. I would only add the total rape of retirees with negative interest rates by the Fed. This plays an important part in the overall theft. But, “fortunately”, we only have at least three more years of the Fed’s negative interest policy. If the American people could only understand what is going on we might have a chance. The MSM will never expose the system. During the debates, how much have we heard about Fed policy, ZERO?

Thevquestion is, how do we get out? Is there a place a guy with a couple hundred grand can emigrate to that doesn’t have these problems?

RE: JiminSF

take all that 1’s and 0’s to the bank, have them cash it out in small notes of pristine quality, new colorful version of bills only 5/10/20/50 NO old 1’s or 100’s

Move to Myanmar live like a king. Sleep with one eye open.

http://www.dailyreckoning.com.au/monetary-mayhem-from-myanmar/2012/10/15/?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+dailyreckoningaus+%28The+Daily+Reckoning+Australia%29&utm_content=Google+Reader

Great way to put it! Keep in mind they will only keep up the entertainment and illusion of normalcy so ong as it is profitable,

I thought I’d finally be able to purchase a home after all these years and now this is happening? Shoot me now!

EV, I feel your pain

It’s funny, but back in 2007 a mortgage broker friend of mine said this exact scenario would play out over the coming years. Must be nice to be friends with the people that make the money!

Most people in the US don’t even know the Fed is a private institution.

Those guys know from preindustrial history that the best position to hold when nothing else in the economy is working good is that of a lord of a manner.

Those same investment banks, hedge funds, etc. are buying up arable land (and the water that goes with it) all over the world (Egypt, Africa, etc..), as they are quite aware of the water shortage (and thus food shortage) that is growing hastily.

Ok, back to serf-ing the internet…..

manor, not manner

Nice save, but there’s no way to edit the material after it posts….

While everyone is waiting for the next DHB article to post, here’s a game I found, where you’re given a picture of a house that’s either in Canada, or somewhere else in the world, and you have to guess if it’s a Canadian mansion or a non-Canadian ‘crack shack’. Pretty funny….

http://www.crackshackormansion.com/

We are seeing it here where we live, in the past 6 months, we have offered on 8 different properties and we have lost out to all cash offers. Not only that, prices literally have jumped up 30,000-40,000….in 6 months!!! We live in Vacaville, Ca. sandwiched in between SF and Sac. We don’t want some mini mansion, just a decent sized home in a nice neighborhood. We are comfortable with paying between 280-300 but anything decent is beyond our comfort level. I refuse to be house poor knowing what’s coming. Food and gas are only going to get more ridiculous and we are raising 3 kids…My husband and I make pretty good

money

with no debt and we can’t understand how people are paying for these houses?? Because we certainly can’t shell out 380-400 for a house and still eat?

Thank DHB! It is depressing, but Ev put that gun down…..this is simply not sustainable. Stagnant incomes, huge student debt, few move up buyers, retiring baby boomers, and high unemployment. This bubble will pop too. It is simply a matter of time. I look to after the election…….

The banker lendith, then the banker taketh away. Counterfeiting money is sweet.

It’s funny because it shows all of the Non-Profits and Community organizations around the country that their openly supported candidate, Obama, is actively hurting their asset building and housing efforts through bulk sales, the fhfa’s push for rentals etc. All the while organizational websites like United Way and many others state that they need inventory. Of course I called them the other day to channel discounted inventory to them and they did not know what to do so maybe they have bigger issues. Either way the end home buyers are certainly being “crowded out”.

A second to this is that this push for a “REO Bulk to Rental” program is by design. It is not coincedence that the FHFA RFP followed a mass of trial balloons and news reports about approaching the bulk problrme with a rental solution. It is no wonder the market submitted their proposals as Bulk-To-Rental given the administrations clear direction from the previous months’ news. I checked via Google restricted search and the news fit perfectly to the RFP due dates.

Its all unfortunate because in the end there are a great number of very affordable homes across the country that can be had by entry level and lower income people and families. Not in SoCal, save for parts of the IE, but nationwide. Countless people missing out on 30 year $200/mo payments as they are paying $700 rent. Its a shame laid at the feet of the current administration.

Needs to be a 75% cap gains tax on flippers with proceeds going to reduce rates for owner occupied loans in years five through ten of the loan. There is no other way to wrench this market from the jaws of speculators and support housing as well housing.

Dave, what you’re suggesting requires legislation, or here in California, a Proposition on the ballot. Where’s your constituency? Educated savers who don’t want to overpay for a home and disgruntled renters (this is less than the majority, undereducated as a group and poor in resources). The forces against such a policy are vast and influential (existing homeowners, investors, home-builders, hedge-funds, FIRE economy).

The object isn’t to dream of impossible solutions to end the game. The object is to find viable solutions to get in on the game.

This is California. Just use the standard class warfare pitch and claim it’s for the children and no matter how economically suicidal it is, it’ll pass. Welcome to the Golden State.

The problem is not the “Flippers” especially in lower end markets because typically they do add value and quality of life to the new owner. I have taken countless houses as REO. Homes that were bought in horrible condition during the boom for outrageous prices because “that’s all there was”. We have taken these homes and renewed them upgrading electrical for modern day appliances, re-insulating, adding vinyl windows and even central heating and air so owners no longer have floor heaters that are turned on and off with a “key”.

The new owners, often short on cash as we all know, but a home with a single payment and no pending repairs. This is good for them and saves them from the other trap of buying a home and then spending money on credit cards etc to fix a place oftentimes overpaying for each fix as they are not experts in the field.

I could easily look around areas like the IE and even Compton and point out that the flipped home is just that in many cases, a true “home” with modern conveniences and energy savings.

During the boom flippers did not have to do this work. They could buy, paint, re-sell giving the end buyer a lower standard of living.

Flippers are not all bad and they are not the problem.

I generally agree but flipped houses should be approached with a caveat emptor attitude. Between HGTV housingporn shows and my own friends’ experiences, I’ve come to the belief that flipper houses require more thorough inspection than the non-“upgraded” competition. It makes sense, too. Repairs don’t raise the asking price. There is economic incentive to try to remain ignorant of potential problems, or perhaps even to hide them with the ‘flipper’ upgrades.

Meanwhile as this housing bubble reinflates to extremes, 20/20 had the nurve to air rediculous stories on going to extremes but in another way. http://www.abcnews.com/20/20. So much for legit news. I mean one story was on plastic sergery & another story was on something called waste training where you wear a corset for long stretches of time to lose weight.

There are such large issues in the global econemy that cant be ignored & yet the average american is being fed such garbage like this, it’s pathetic.

Everyone involved in 20/20 and the MSM in general is a member of, or directly dependent on, the 1 percent. Why wouldn’t they produce “news” (or choose to allocate advertising dollars on) that which only had the purpose of sedating us, entertaining us, distracting us, or appealing to our most base instincts and desires as human animals? True education, discovery and enlightenment is NOT in their self-interests.

It’s amazing how the legislation limiting the number and types of media content that any corporate entity (I forgot what legislation it was), was allowed to be stricken down by the very same interests who benefit from the consolidation of such media outlets.

We have fewer and fewer mass media choices in how to get educated.

A free and independent press was seen as pivotal by the Founding Fathers for a vibrant Democracy.

I think it’s about time everyone accept the fact that banks and government are one and the same. As much as Americans abhor a government run anything now they have just that, except its officially not the case. They are the same entity, same people so why not just throw in the towel and accept that we have government banking and treat it accordingly?

Roger Arnold:

“Revolution never comes from the bottom up or the top down. Revolution comes from the 9% becoming disillusioned with the top 1% and identifying more closely with the bottom 90%.”

This is an educated blog. I’d bet that the medium household income here is within that sweet spot of the top 9%. We’re pissed off at what’s going on, but totally unrepresented by our elected representatives or corporate vote-buyers.

We are the silent, responsible, smart, hard-working, independent, resilient, curious.

It is the 10% that eventually will rise up, inspire and change the game.

The Tea Party was highjacked by The Koch Brothers.

OWS was just a flash-point with no 10% representation (or acceptance) to sustain.

It will be interesting to see when and how the 10% chooses to act.

At the risk of sounding like a conspiracy theorist, I personally believe the banks held back inventory during this election year to make the market look better (ie. higher prices) so the “wealth effect” increases for the average voter in an attempt to re-elect the current administration. We’ll know for sure next year, as I’m guessing supply will kick back up to last year’s levels. You’ll see from my numbers below that this is more of an “educated guess” on my part than a conspiracy theory…

To be clear, everyone can talk about the Hedge Funds buying all of the inventory but they DID NOT buy the balance of the 40-50% reduction in CA properties. The LARGEST hedge fund buying homes is targeting 10,000 home purchases by mid-2013. And I know literally because a very good friend of mine works in their acquisitions department! And there are only a handful of hedge funds that have the pockets to buy 5,000+. If you’re generous in your assumptions then you’ll arrive at perhaps 50k-75k homes purchases by the Hedge Funds or larger bulk buyers this year this year, while inventory is down FAR more than that (by multiple times). To put it in perspective, a friend of mine runs a Fund that owns roughly $40M properties in CA as a rental pool. If you assume he paid $100k TOTAL (including rehab costs) for the average home, which is likely too low, then he only owns 400 homes for his $40M!!! Think about that in the context of the numbers I mentioned above and you’ll quickly realize that the Hedge Funds don’t own very many homes relative to the shadow inventory…

Do the math and you’ll quickly see that the Hedge Funds didn’t just buy up the balance this year – something else is clearly going on that I personally believe is artificial. There are still over 5M homes in the banks’ shadow inventory while pre-2007 levels (ie. “normal” level) are 1M or less. If you think the Hedge Funds will have enough $$ to buy 40% of the 5M homes you are way off. The Hedge Funds will probably only buy 1-1.5% of the shadow inventory this year – that’s right – 1-1.5%.

Things that make you go hmmm…

All I can say is brace for an inevitable recession in the US in the next 24 months. Historically a leverage-causing recessions results in 2 recessions within the next 10 years. It’s already been almost 5 years and we haven’t had one yet thanks to the money printing. But the globalization of the world is already causing the economic dominoes to fall in Europe and China, with Canada falling next year. We won’t be spared. Between another recession and the possibility of more inventory coming back online next year all I can say is – be careful if you’re considering buying a home right now! You might be better off at least waiting for the recession to hit 🙂

Good Luck To Everyone,

Investor J

http://www.meetup.com/FIBICashFlowInvestors/

http://www.meetup.com/investing-363/

I tend to agree with you but……….

We are still watching the FED react like a mad man from a recession several years old. I wonder in what form they would “double down” should we go back into recession? Whatever plans you have to be a smart, prudent individual to not only protect yourself but further yourself from the coming recession, you can be assured that the FED will throw a 1000 pound anchor on your plans and will take you down.

I want to give an affirmative second in support of your post.

I have been guilty of throwing into the discussion the purchasing of the funds even selling to them, but in the end as with everything else it is a small piece of the overall market. Though funds are still buying a lot of homes in the $30K range also nationwide.

I too believe there has been election year manipulation though it is difficult for me to find others that are with me to the point I was doubting myself recently. Thank you for your post, now I know there are others out there.

coal mines have been shuttered and gasoline prices have soared in California. to 40 dollars a gallon? who needs a conspiracy when you have free money? of course Dr Housing Bubble says “buy, buy, buy.” but that would be madness as simple arable land is such immense value right now “that’s where the real money has been and is being made.” but that’s just for starters: once the debt markets implode you’ll have a recipe for social chaos. you want to own single family homes in LA when that happens? hahahahahaha. good luck!

http://www.youtube.com/watch?v=eQSGw0hMd_I

This is whats now unfolding from low interest rates and QE3

http://qz.com/on/low-interest-rates/

Since the crash banks have become very conservative with lending. Given these new dynamics, if they loosen up on lending standards the retail buyer will become more of the mix. Home prices are going up, thats what the gov wants. And of course the side affect from all the QE’s is increased money supply leading to inflation and speculation in commodities. So prices in everything else will also be going up. So where does that leave us?

Rich – can/will pay inflated prices, no problem. Will get richer since invested $ in real estate and stock market will go up. Will complain about paying more taxes on their riches

Mid class – Need to count on pay raises to keep up with inflation otherwise falling behind and must play the game with RE and stocks to get ahead. Will muddle through

Poor – Will get poorer, everything they need will cost more. Gov will keep feeding them more to keep contained

Retired – Will spend their capital just to keep up if they follow old model of investing. Must go out on risk curve to keep up.

This will be the muddle through, stagflation. Where you are depends on the decisions you make in the new norm. A crash isn’t coming, gov will print at all cost. Try to stay ahead.

Not a conspiracy…ZH covered it…http://www.zerohedge.com/news/2012-10-11/charting-housing-recovery-subsidy-foreclosures-slide-five-year-lows

I try to avoid the conspiracy theory thing too but I’ll tell you, this is purposely manipulated (supply and financing controlled). I can see the banks acting in their own best interest to keep up prices and create the illusion of a market recovery to get better pricing on short sales (call it write offs) as the last 5 years of waiting hasn’t worked.

That said the media started it’s recovery blitz back in January 2012 right at the beginning of the year. Seemed really odd without any real data but if you wanted to get ahead of the spring season you’d start pushing early. This seems to be a two prong coordination.

I’m not saying this was done only for the election but it’s a coincidence that absolutely can’t be ruled out and if I had to guess someone was pushing hard to get this done to boost the economy and make it look better this particular year. Unfortunately – things are truly bad and slowing all over so all the manipulation in the world won’t paper over the reality of slow GDP and unemployment.

When we look back at history, hasn’t this type of corruption been punished. ? What will it take for people to stand up in this country? Apparently, NOTHING.

Outstanding article, so clearly exposing the dynamics of rigged market cannibalism and naked crony capitalism. This perfectly explains the strange, centrally-planned housing market, which is classic depression-facilitated concentration of wealth and consolidation of power. I would only revise that last line from The Who:

“Meet the new boss, [worse than] the old boss.”

This administration has served the plutocracy/kleptocracy far more effectively thru secrecy and disguise than any naked predator. The class-war was won and the Shock Doctrine coup is now all but complete.

The good news is that such imperial hubris is always ultimately unsustainable, and it too shall pass.

Agreed.

“Meet the new boss, [worse than] the old boss.â€

Moneytalks – Social Darwinism from AC/DC.

FKNA

It’s like a big-a$$ MONOPOLY Game. The sly banksters hold all the “Get Out Of Jail Free” cards while the working-class stiffs habitually pass “GO”, and collect their measily $200 of “stagnant income” & now must pay them “rent”. Unfortunately. all b/c the Administration strategically implemented economic polices just so they can win the end game: the upcoming election…

The problem is all the banksters, insurance companies and financial companies are now interconnected worldwide. If one of them gets caught with their hand in the cookie jar, they all go down. Think Long Term Capital Mgmt or Bear Stearns. But now with debt piling up like it has, is the public going to put up with the next financial crisis? Unfortunately we will have to just wait and see. After the presidential election and before Jan 1st (fiscal cliff) ought to be very interesting.

http://Www.westsideremeltdown.blogspot.com

How will it be interesting? The FIRE economy OWNS the government and the courts! We have two parties! How difficult is it for the FIRE economy to switch their allegiance and influence from party A to party B? Answer: freaking easy.

And Doug Terpstra above thinks we have plutocracy/kleptocracy issues with Obama? Think about when Hedge Fund Romney gets in there! Unbelievable!

And the fiscal cliff? THAT will be interesting? Ha! It’s nothing but a political football each side is using to gain leverage over the other.

The name itself was “invented” to illicit fear and subordination of the masses to their Master, who in terms serves The Master.

The same R and D elected officials who invented the “fiscal” cliff are the ones responsible for avoiding going over the “fiscal cliff.” And, they’re the ones most at risk for losing their jobs, prestige, influence and future lobbying money if the country goes over said “cliff.”

It. Will. Never. Happen.

What is the “FIRE” economy?

A FIRE economy is any economy based primarily on the Finance, Insurance, and Real Estate sectors.

FIRE = Finance, Insurance and Real Estate. Pretty much Wall St. and other PTB that own our puppet politicians.

This is nothing new. We went through bidding war buying our first home in 2009. We missed out on a lot of homes when our offer was $30k-50k higher than listing price only to find out the house got sold to a cash investor at lower than asking price and see that house back on the market renovated with $100k – 150k higher than what they bought it for. The investors go after entry level homes because they can always find a buyer or renter.

This was my experience trying to buy a condo in south Orange County. I tried to buy several condos only to be beat out with over list cash offers and way over list with anyone with a loan. The first day on the MLS, there were at least 5 offers. Second day, three or four more. Third day, the last one or two offers were let in the door. Day four cash offers are countered. Day five an offer is accepted and escrow is opened.

If you try to over bid and you are a regular buyer who has waited this market out to finally buy you don’t have a chance. If you over bid to get your offer noticed, it will be used to bring up/counter cash buyers. They don’t want your over bid offer because it’s a risk to them having to have that offer appraise. They love the loan people trying to up the ante because it enables them to counter the cash buyers. This drives prices up. This is especially competitive at entry level condos which I have been trying to buy and finally opened escrow on one.

Where to put you money?Stock market is at all time highs and housing on the lower end of what may or may not be a bottom. Regardless supply and demand tells you that for every one condo listed that there are 9 other buyers who did not get the deal who wanted one and this will drive the prices further up. Rents will always be high.

Rents have always been artificially high in Orange County with little variation because of the the rent lord known as the Irvine company. It is crazy that the requirements for renting one of their artificially high apartments is 50% of gross income. They just want your money and have loose rent / income ratios. I have seen as high as 75% gross going towards rent. Pretty much if you have decent credit and you were willing to pay the majority of your paycheck towards rent, you are in. This was my primary field for over ten years. I have worked in many major markets and it always blew my mind how much people spend on rents verses income here. I did not think that it could be done long term but I was proved wrong and believe me people do it and it is the norm in the California rental market. Things are different here. People want to live here and will pay to live here.

You only have to look at all the people who follow this blog to see the wiliness to pay top dollar to live in an average home where you could elsewhere like a king. They are trying to time their purchase. Even with good timing buying a house in California is never a good deal compared to a great house in say Greenville South Carolina…I just went there and was amazed how beautiful it was. A great home cost 250,00 to 350,000. California is different and the people continue to pay what it takes to live here.

Any surf in Greenville?

i don’t know, with these hedge funds buying up the housing for rentals all i see is a lot of ghettos popping up and that can’t be good for home values.

I just saw in san diego, from a new home development, up to $477,000 loan with $0 down, for VA qualified. Wasn’t this the problem in the first place. So th esurge is built on financing like this?

i feel out of any loan programs, VA is the only one were as zero down is some what acceptable, defualt rate very low. 1. value asessment of the asset is usalley more realistic. 2. VA looks at residual house hold income 3. inculdes childcare expense into qualifing. 3. usalley more reserve debt to income ratios. if builders and RE agent hate VA loans, usalley means more consertivie financing. if you have fear of loan program, FHA and FHA high cost, CALHFA, CHADAP, USDA (used to be consertive now, not so much) are the one to look into. I feel FHA HIGH COST is the loan program that will causes FHA to require bailout. that program alone has prop’ed up all high cost markets. National Assoc of Realtors fought really hard to keep high cost FHA, why? it supports demand and demand prop’s up bubble sectors high cost markets. which mean money for thier agents, who care if the buyers get screwed, default, the unit will just be new inventory as short sale or FC.

http://www.youtube.com/watch?v=WHj2GaPuEhY

Here’s a Noam Chomsky lecture that touches a bunch on the history of wealthy institutions’ market manipulations over the last half of the 20th century. There’s even some ‘savings and loan’ history and the idea of how the public covering the wealthy’s bad debts only influences them to make more bad (riskier) decisions leading to more bad debt.

You know Bernanke said that he was going to keep QE3 going until unemployment hits 6%. Well, based on the way the BLS calculates unemployment, we may get to 6% in about a year. More and more people just quit participating and voila, we hit 6%.

You may be right.

Did anyone else think it was halarious that when Unemployment dropped to 7.8% Jack Welch, FOX News and other Republicans claimed the number must have been fixed? When they should have been harping about how the number doesn’t mean anything and is especially meaningless during periods of chronic unemployment.

Rather than putting the spot light on the flaws of the statistic they came out looking like idiots.

Try not to ever say the words “missed out”. Think about it. It only feeds into the game, as we are conditioned to think about it.

Crowding out is exactly what is happening, and why it’s so enraging.

Tho the Fed did successfully save housing. By saving housing, the Fed forced the interest rate to be near zero for the next few years. Interest cannot be raised with a 10+ trillion deficit unless US plan to default on it’s debt.

Many argue hyperinflation, but w/ Fed buying MBS, i don’t see hyperinflation happening.

If the Fed prints 40B every month and hands that str8 to the people, then yes, that would cause inflation, as that devalues the currency asset class. But by buying MBS, lowering mortgage rates, it causes inflation in real estate, not in currency.

It’s hard to explain but this is the way i see it.

Almost all money supply held at banks are in the form of: checking(savings)/CD/brokerage (equity)/mortgage/401k accounts.

Let’s say the average american has the following asset distribution profile:

20% checking

20% CD

20% equity

20% 401k

20% mortgage

If Fed’s QE causes that profile to change to:

28% checking

18% CD

18% equity

18% 401k

18% mortgage

Then, yes, i would expect inflation in various consumer products, foods, etc, as the money supply in liquid checking accounts increased, thus more money to spend.

But, if Fed’s QE causes the average american asset profile to change to:

18% checking

18% CD

18% equity

18% 401k

28% mortgage

Then, the money supply actually decreases, with people having less money to buy things, as now they’re paying mortgages, thus, no hyperinflation.

Also, i made this argument before, with CD’s at near 0 yield, the Fed essentially destroyed that particular financial instrument. Thus, assuming top example, the avg american now liquidates the 20% held in CD’s. Let’s say they split half to equity, half to mortgage, becoming:

20% checking

30% equity

20% 401k

30% mortgage

This may offer an explanation why the recent inflation in equity and real estate asset class.

Hyperanything does not begin with the peasantry. We’re usually the last one to get the memo. Didn’t 2008 teach you that? Hyperwhatever will begin in the Repo and Swap markets. Anything electronic will probably get locked out in order to keep the velocity of money in check. However, commodities will probably go into permanent backwardation Overseas And tada! The mother of all global financial crises will be here.

This may be a little off topic but it gets to the heart of the matter. For those of you who think Obama is a “black man” follow the money. Obama’s mother, Stanley A. Dunham, worked for Tim Giether’s Father Peter Geither at the Ford Foundation. Tim Giether and Obama’s other buddies are the quintessential NE banking oligarchy . How many guys in Watts have that pedigree. Now, do you get the picture? There is only one political party, and you are not a member.

head is beginning to spin rapidly at the madness that is brewing again, found this place today, $485k, beat down house in a ghetto neighborhood next to barrio http://www.redfin.com/CA/Orange/459-N-Christine-St-92869/home/4379614?utm_medium=email&utm_source=myredfin&utm_campaign=listings_update What the hell is unfolding?

Wish I knew CG. Personally we short sold back in 2008 and started renting. Got my personal debt paid off and for the first time in my life I’ve been able to save money consistently.

Until the cost of housing makes sense, I’m staying a renter. This newsletter speaks the truth and I am very thankful for it.

Massive mortgage for most = serfdom.

Nail on the head.

Thank you Real American Geniuses at the Fed!

Except serfs only had to work 3 days per week to satisfy their contract with their lord. The other 4 days, they were free to work for themselves. Or in other words, about 42 percent of their labor went towards land and housing ‘payment’. Granted there weren’t many days off, but even if you were a lazy serf that only liked to work 6 days per week, only 50% of your labor went to land and housing.

How many Californians out there spend 50% of their gross income on housing?

Starve the beast people…there is NO other way.

Why can’t it be as simple as this. Do what is right. Transparency. Be fair and honest.

question for the good Dr. or other with opinons. i have family in Russia who lived thru USSR collaspe. during one point of the collaspe, the people were rushing to trade rubles for assets, food, vechicals, land, homes, gold, silver. could this massive influx of cash into the RE market be the same actions. In my eyes, over paying 10-50% is not much when your liquid cash will devalue by a greater precentage or crash. if so, what do they know or have been told inadvance.

DFresh You da maan, whuurd-up!

I understand all of the posters’ indignation about SoCal housing prices (esp. OC), but face it, OC has and always will be a speculators paradise/proving ground.

We live in Sierra Madre, CA,. If there is a home that is under 500K we are always beat by an all cash buyer. Our landlord rents out 2 additional units on the property that don’t have building permits. Our property is not zoned for multifamily. He bought the house next door CASH 450K (it was a DUMP!) flipped it and it sold for 860K in 1 week of listing it. What about all the landlords that illegally rent out living spaces so they can leverage another investment property. It’s because of his renters this jackass can get away with buying more property.

When you’re in the money printing business you have to spend it on something so you appear to be working. In other circles it’s known as ‘money laundering’.

Leave a Reply to Milton Bradley