The Future of American Housing – McMansion withdrawal, rethinking commutes, designing housing with lower incomes in mind, and the impact of a fully subsidized mortgage market.

It is still amazing how few people realize how subsidized the housing market really is. I have talked to people that walked into a too big to fail bank, received a government-backed mortgage yet assume this is somehow the “free market†at work. Even after pulling up their loan on a public Fannie Mae database they still want to believe they are participating in a free-market. Why? Ultimately it is a direct benefit to their bottom line. The housing market lost any free-market label post-Great Depression. Plus, that bank is only able to function courtesy of rewriting accounting rules and trillions of dollars in emergency loans. For over a generation the loans that were made were conservative, required a large down payment, and came at a time when household incomes were rising. We can argue the merits of government-banking intervention (i.e., the Fed with QE3, mortgage interest deduction, etc) yet the market is now fully addicted on all these external factors. A Pandora’s Box has been opened and now every action that is taken is more extreme and more permanent. Yet the housing market of today is nothing like the one many baby boomers grew up in and eventually purchased. Demographics and stagnant incomes will create different variables for the housing market going forward.

Affordability the driving force

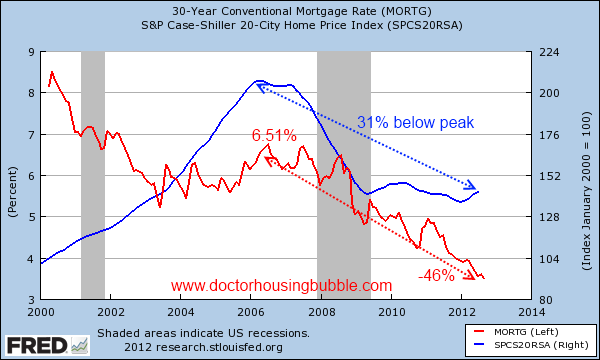

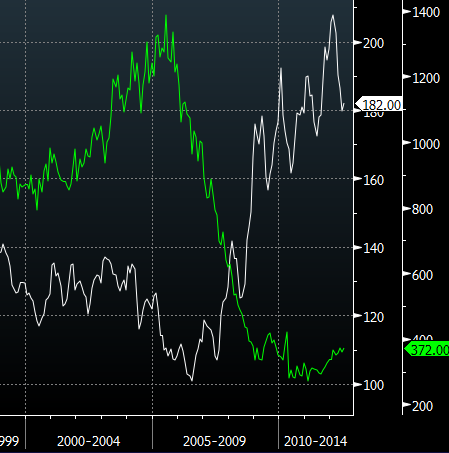

The Case Shiller Index is showing a positive move up in prices for 2012. However this needs to be put into context here. Let us take a look at the Case Shiller Index and the 30-year fixed mortgage rate:

This is important to understand because it explains why home prices are moving up and is also a major reason why the Federal Reserve did not hesitate in going all-in with an open invitation of QE3. Home prices have fallen 31 percent from their peak but interest rates are down a stunning 46 percent from this same point in time.

It might help to run some numbers to see what is occurring:

2006 Peak

Home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $200,000

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $20,000 (10%)

Mortgage:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $180,000 @ 6.51 percent

Principal and Interest:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,138

Now assume this house fell by the standard 31 percent from the peak price. What are the numbers for purchasing this home today?

2012

Home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $138,000

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $13,800 (10%)

Mortgage:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $124,200 @ 3.5 percent

Principal and interest:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $557

And you wonder why home prices are going up with limited inventory? The median household income in the US is $50,000. So this kind of extra money goes a very long way. First, you realize that the amount needed for a down payment dropped by a sizeable amount meaning people can dive in much quicker (let us not even discuss the 3.5 percent down payment of FHA insured loans). Next, you realize that the monthly principal and interest payment fell by over half from $1,138 to $557. Household incomes are back to levels last seen in the 1990s adjusted for inflation but this kind of massive boost is why you are seeing prices rise. There is also a savings from a lower tax assessment and very likely lower insurance rates based on price. It is important to understand this for states with modest home prices but also for hipster neighborhoods in California.

Now you would think that existing home sales would be off the charts:

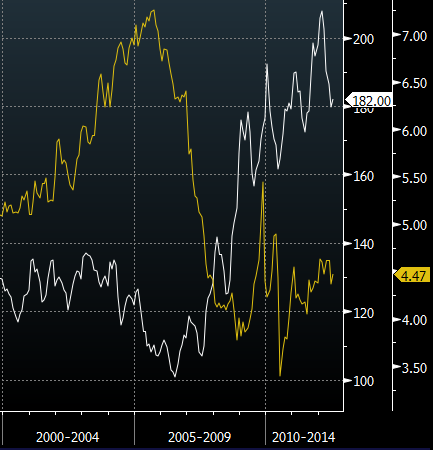

Affordability Index: White; Existing Home Sales: Yellow (Bloomberg) – Source: Soberlook.com

You can see that affordability has bounced back significantly. With prices rising it has fallen but lower interest rates and the crash has increased affordability. You have a couple of ways of increasing affordability:

-1. Lower home prices

-2. Higher incomes

-3. Lower mortgage rates

After the crash, the increase came from lower home prices. Today, the focus is largely on lower mortgage rates. Higher incomes are stagnant so it is not coming from this crucial segment. If the Fed truly believed that the housing market ramping up would somehow increase household incomes then why go with QE3? As we highlight above, higher incomes would have increased housing affordability. The reality of course is the Fed understands global wage compression and with stagnant household incomes for well over a decade, you have option 1 or 3 to work on. Since the Fed is vested on inflating housing prices for their banking friends, option 3 was the only road.

How much is injected into the economy from lower rates?

Some tend to think that lower rates are the solution to everything. There is a deep seated entitlement mentality when it comes to housing. 20 percent down mortgages are too high? How about a 3.5 percent down FHA insured loan. 6.5 percent too high for a 30-year fixed rate mortgage? How about a 3.5 percent mortgage. Need help with that tax bill? The more expensive your mortgage the more you can write-off. This is the system that is now in place. So now we have folks thinking that the Fed with a near $3 trillion portfolio has a mystical power to lower rates even further but we are already seeing dislocations in other parts of the economy (i.e., college education, healthcare, energy, food, etc). Easy money needs to find a home. Plus, this little move is coming on the back of nearly $500 billion in MBS purchases.

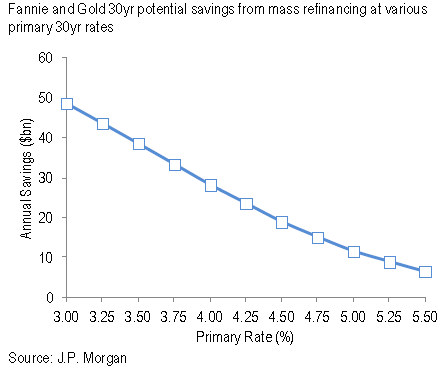

So when we look at the figures a few more basis points shaved off is not going to do much:

Basically each 25 basis point drop injects $5 billion into the pockets of US consumers. So a 50 basis point drop would inject $10 billion more (as a reference point, US consumers spend somewhere near $11 trillion per year). So those thinking this is somehow a panacea are missing the point and are simply addicted to the command-control housing market. Plus you pander to the majority of US households even if it is bad economic policy in the long-run.

The question of inventory

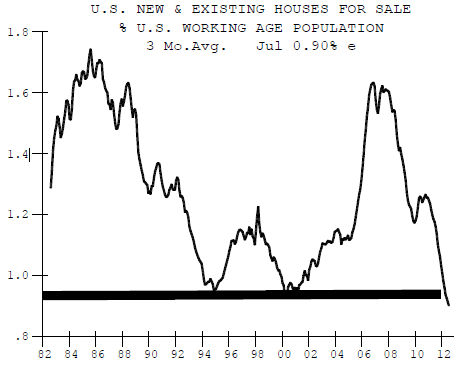

Without a doubt available inventory for sale in the US is low:

Keep in mind however that there are roughly, 5,400,000 homes in the distressed pipeline. Some are on the MLS but many are simply in the foreclosure process. So you would think that new home sales would be flying off the charts:

Affordability Index: White; New Home Sales: Green (Bloomberg)

What is going on here? New home sales have moved up a bit but certainly not reflective of the insane drop in mortgage rates. New homes carry a higher cost and demand right now is for affordable homes. This affordability is being driven by lower interest rates. It is an interesting trend yet we now have many baby boomers retiring and the McMansion style of living is no longer desired by many younger less affluent Americans with smaller families. Look at the Inland Empire in Southern California. Take a look at many of the arteries running into LA and OC during the weekday and you realize many people drive into LA and OC to work. Gas prices are now over $5 in many California areas reaching record levels.

Assume someone drives in from Corona to downtown LA:

Drive each way:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 49 miles (total roundtrip 98 miles)

5 days of week of driving:Â Â Â Â Â 490 miles

Let us assume this person drives in with a mid-sized SUV like a Ford Escape getting 32 miles per gallon. Total cost at $5 per gallon:

$76.56 per week on gas (assuming no weekend driving)

Over 50 weeks this comes out to $3,828. And this is for one person when you may have two people commuting in. What about home heating and cooling? Does this model of living sound sustainable? Let us not even discuss the psychological and physical impact of sitting in traffic for hours a day. Even looking 10 years back gas was around $1.80 per gallon. This puts a major dent in a household balance sheet.

So you have many variables now that make housing different from the boomer generation:

-1. You have a giant older population that is retiring. Will many sell? Downsize?

-2. A younger and less affluent generation. We’ve discussed the lower income prospects and the massive student debt many carry right out of school.

-3. Rising cost of living and stagnant household incomes. Is your grocery bill getting cheaper? Does it cost less to fuel up? How about sending your kids to school? Have you looked at your medical insurance bill recently?

This is why we have seen new home sales not really “boom†even though there is clear population demand for housing. Yet the key of course is affordability. And the mega McMansions built out in places like the Inland Empire, Las Vegas, or Florida may have a harder time when budgets are constrained by so many other factors. High density housing is more appealing to many younger Americans for a variety of reasons but probably the biggest one is economic. They simply cannot afford the white picket fence vision of housing that reigned supreme during the baby boomer era.

The fact that the Fed has moved so aggressively with QE3 tells me they simply do not believe US household incomes will rise. From their perspective, as long as Americans can go into massive debt and actually “purchase†the home, iPad, car, or vacation then people will keep on trucking. It is troubling to see so much energy and resources focused on housing as the apex of our growth. This goes all the way back to Alan Greenspan.

A rising standard of living is probably the better measure. And many indicators show this is simply not playing out. We live in a world of economic dichotomies at this point. We have access to virtually every book ever written with great minds talking about better living practices yet half of our population is overweight. We have all these technological devices to save time and help us become more efficient yet we become less efficient and some are tethered to work 24/7. Automotive advances allow virtually any consumer to have a complex piece of machinery that can drive through all kinds of conditions and many simply idle on by on cramped highways. We have home prices once again going back up in the face of stagnant household incomes. For all these reasons to assume we are going to have a “steady†housing market or a boom coming up is simply ignoring the fact that Black Swans are almost embedded into the system. This is not your parent’s housing market.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

81 Responses to “The Future of American Housing – McMansion withdrawal, rethinking commutes, designing housing with lower incomes in mind, and the impact of a fully subsidized mortgage market.”

“Investment guru Jeremy Siegel, finance professor at the University of Pennsylvania’s Wharton School, says stock prices could fall as much as 20 percent by year-end if Congress does nothing to keep the economy from falling over the fiscal cliff.”

-1. You have a giant older population that is retiring. Will many sell? Downsize?

http://housingperspectives.blogspot.com/2012/09/over-next-two-decades-baby-boomers-will.html

Over the Next Two Decades, Baby Boomers will Age in Place

“…the vast majority of baby boom household dissolution won’t occur until after 2030. Only about 15 percent of the 46+ million units baby boomers now occupy will be turned back to the market between now and 2030, assuming cohort household dissolution rates held constant at 2000-2010 levels. This works out to about 1 million total baby boomer housing units returned to the market between 2010 and 2020, and another 6.2 million between 2020 and 2030. For owner-occupied housing, these numbers are 165,000 during 2010-2020 and 5.2 million between 2020 and 2030. If baby boomers are healthier and live longer than their immediate predecessors, these numbers should be even lower.

If more than 85 percent of baby boomers will continue to occupy housing as household heads for the next two decades, can we say anything with confidence about how they will affect housing markets? Housing analysts have mostly focused on housing adjustments that aging boomers will likely make by moving – to smaller or one-story homes (perhaps in communities that are scaled to be less automobile dependent); to retirement destinations that are warmer, have lower taxes, or are “senior oriented†in terms of services and leisure opportunities; or to locations closer to kids and grandkids. Eventually, some will find themselves moving to assisted living. While during the next two decades many boomers will do all of these things, the majority of boomers will almost certainly not do any of them. The majority of baby boom homeowners over the next two decades will simply age in place.”

Thanks for that link.

I always point to Florida as a gauge of Boomer activity. You would think that, with the Boomers turning 65 at the rate of 10,000 a day (since 01/01/11, and continuing until 2031, totaling 73.5 million souls), that the Sunshine State would be witnessing bidding wars for the incredibly cheap RE available right now. Isn’t happening. Most Boomers should be moving down there out of necessity, to take advantage of no income taxes, low property taxes, minimal clothing and energy costs, and, of course, the warm winters. They can’t, because they’re stuck up north in unsellable homes and with no savings.

Florida has low property taxes? I beg to differ. It depends if the property in an given area has passed the thirty year cycle. I have sene properties in the Miami metro in the high 100’s with a tax rate of over 4% when the actual tax rate is around 2.3%. This is due to the asessments being performed in 2007 & not being updated with current home values.

Look at the listings in coastal areas like Miami Beach through West Palm as an example. there are hundreds of listings that would be considered afordable pricewise, but may never sell do to the overinflated tax bill.

Whoops, my bad. Still better than NY metro or a lot of the northeast. Every now and then I check out prices in upstate NY, beautiful farm country with cheap homes, but get hit in the face with the property taxes.

Amazing how much inventory there is, still, in S. Florida. Zillow will only show you twenty pages of product for your search, and a lot of times all twenty pages are filled with foreclosures.

florida is a cesspool; bugs, heat, humidity, crime – no thanks. I hope to head to the farthest corner away from there, Washington State.

I think this is a good point and the numbers support that many can try to go this route. The one thing that isn’t looked at is the boomer balance sheets.

Many at one time thought to retire to FL and other warm climates. Logically with solid balance sheets, super low prices, and ultra low rates wouldn’t many boomers have pounced on the vacation home (now) and retirement home (later) idea? I’m not a boomer, and fairly conservative, but I would have accelerated the move given the circumstance. And yet no one really did, you saw a lot more of it in the 2003-2006 period. Knowing plenty of boomers and having an idea of the financial picture, my conclusion is that a huge group of this cohort are not prepared for retirement and aren’t sitting on a decent balance sheet.

I think when the market popped @2000, boomers running too much risk there started piling money into their homes thinking it was going to be their retirement asset. A lot of them up sized, remodeled, or bought second homes in the coming years (peak earnings years for many). This is another serious hit and I think a huge number need access to their housing wealth (from 2-4 purchases at parabolic prices courtesy of interest rates falling from 1980-now). Maybe this will be reverse mortgages or something but this whole group seems to have been too heavily levered and illiquid.

Long point being – the other side to those numbers is ability to hold. A larger percentage of them may not be able to hold on to those homes given increased costs of living and inability to stay employed at peak income. From my limited sample I know plenty more who fall into the insufficient funds category than don’t.

“A larger percentage of them may not be able to hold on to those homes given increased costs of living and inability to stay employed at peak income.”

I wish this translated into a crash in ski condo values out west, but, I don’t see it yet, and leaves me scratching my head. Talk about a frivolous possession most could liquify for expenses, but, the market has barely budged in some places I’d love to retire to. It has stopped going up, which is encouraging, I suppose. Maybe it’s still Wile E Coyote floating in the air, but, I’m getting tired of waiting for him to drop.

BTW, the ski condo market is home to what I would say is some of the most absurd valuations that occurred during the bubble – $250,000 quarter share time shares. Usually ski in/ski out prime property with amenities galore. You can find people tying to dump these things on Zillow. What were they thinking? I’ll bet the down payments can be directly traced back to HELOC loans. Dumb.

When I sold my home in 2004 in one of the mid-tier areas of SoCal, the place was on the market for 2 days and I had eight offers. 7 of the 8 offers were 100% financing. The one offer with a down payment was: you guessed it, 3.5% down (i.e. FHA).

There is no demand for housing because most people have no savings and do not have a FICO of 720+ that is required to get a non-FHA loan (i.e. 70% of the loans originated). If you drop the FICO requirement to 640 *and* down payment to 0%, home sales would explode and the housing bubble of the 2000s would be back tomorrow.

by the way, you can get a conventional loan with 5% down with a 660 credit score so you might wan to check your facts. You can also get a conventional loan with 3%% down but it is a little more expensive

The bubble is re-forming as we type, banks are lowering standards.

” If you drop the FICO requirement to 640 *and* down payment to 0%, home sales would explode and the housing bubble of the 2000s would be back tomorrow.”

One thing you don’t mention, though. Most of those loans were sliced and diced and sold as securities to investors all around the world, with the assurances of an AAA rating stamped on them by our esteemed ratings agencies. That really got the market going, treating even the Germans as rubes to be taken as fools, let alone the emerging market customers who were babes in the woods, ready to be fleeced. I can’t see that happening for another, maybe, thirty years, when memories no longer recall it all, and there’s a new bunch of kids who think that this time it’s different.

Doctor, your blog is superb. I have recommended it to anyone who cares to listen. Your last paragraph is possibly the most insightful of all. I grew up with dreams of being a scientist. Back then it was inevitable that the age of science would make life wonderful for all. We would live on the moon, cure cancer, end wars all through science. That was the dream.

And what has the science bought us? Sure computers and iphones are fun. Cars are astoundingly safer and more capable than before. Nearly the entire compendium of human knowledge is now online.

But all that science has not made us more healthy, more happy, or more caring for each other. Those evolutions will take more time and more heart.

Science sure has made out lives better. Definitely healthwise. My wife and I are in our 60’s and our parents are still around. Statins prevent heart attacks. Pacemakers and stents keep you going into your 90s. I can sit at home and do my banking, pay my bills, adjust my portfolio, and take a class.

The medical industry doesn’t make any money off dead people. Keeping old folk alive while sucking them dry of their savings and retirement is a great plan. So our lives are “better”, because we’re kept alive, all while being distracted with worthless electronic gadgets that consume our lives and attention. It works out pretty well.

Statins do not prevent heart attacks. Statins lower blood cholesterol, that is the only thing they have ever been proven to do, and unfortunately, there is not one single study that proves that reducing blood cholesterol reduces heart attacks. Don’t believe it? Go on Medline and search the studies. Your doctor is selling you Statins because the pharm companies have sent your doctor to fun “educational” cruises and convinced him to prescribe it. Statins are side effect city, and no reduction in actual heart attacks.

Technological advances may keep people alive longer, but there is no evidence at all that is has made people healthier (mentally or physically) — in fact, I would say the opposite is true.

Science is a tool. Just like a hammer. Or a gun. Or money. It is neutral. What it does for you depends on what you do with it. It is too easy in our society to sit back, be lazy, and expect the world to come to us. We spend a considerable amount of time chasing leisure and escapism. And that will not further the march of science, except to march it straight out of our borders toward other nations more willing to embrace the notion of a constant pursuit of improvement. It is silly to lament what it has or has not brought to us. We brought things. We made them. Inventions are made by people. Discoveries are the result of curiosity and passion. Seemingly and sadly, these days, our culture and system seem to quash those critical feelings.

From what I have seen of the “20 somethings”, this should be called the slacker generation. They think that updating their facebook account 3 times a day, and waiting in line for the latest phone, is productive work.

If they spent as much time working on their career, that could afford that house.

I’ll guess many will eventually get houses, with massive govt financial assistance, $ gift from Mom/Dad, or somebody dies, they inherit. Especially in Cali, a Magical Land where the Cool, Hip, Cultured, Enlightened People Live.

FWIW, Corona has two metrolink stations. If you worked near a metrolink stop such as Downtown LA, you could get to work in just over an hour on it and it’ll cost you ~$250 a monthly pass with unlimited bus transfers. That’s what I used to do when I had to commute to work but now I just sit at home. From Rancho Cucamonga it’s even better. They have an express train that only stops once so you’ll be in DTLA less than 45 minutes.

Another thing to consider about weighing the gas cost of commuting vs a higher sticker priced home without the commute.. let’s say $300k Corona vs $700k South Bay. Sure, you’ll pay more in transportation in the short term but a $300k loan w/ 20% down = ~$1400 a month. The possibility of doubling up on that mortgage payment is more realistic than had you bought a $700k+ home. Doubling up on payments means you could pay it off in only 7 years vs being stuck in a $700k+ 30 year mortgage. 7 years and then financial freedom vs $700k 30 year indentured debt service. It all depends on what path you want to take. For me I think they both do, depending on what short term and long term sacrifices you’d rather take.

@sigma

Corona is a million degrees, and the air is filthy inland as compared to the beach.

Using public transport in Corona you still need a car to drive to the metro link because it is always hot and who can walk to the station, get sweaty, and then go into the office? I can’t go to the office all sweaty. So a person must keep the a car, which has substantial fixed costs.

45 minutes one way to commute? Is this supposed to be desirable? And what about the bus to the station from your office? So 2 hours a day spent commuting?

No thanks, we rent 5 miles from the office, 20 minute round trip commute and less than two tanks of gas a month for all our driving. Our time is worth much more than “pride of ownership” in Corona.

OMG what is this ‘career’ thing you speak of? LOL

20 somethings don’t have a lot to be excited about. There is no carrot out there for them. You sound like an old timer where a guy delivering Rainbow bread could buy a house and have a family. I know because this was my dad. A job that these 20 somethings get does not even get them out of their parents homes much less buying their own home and starting a family. You boomers are heartless towards the plight of the 20 somethings. Remember your generation was able to work their way through college. The average job a college student gets barely pays for food and transportation…no housing in that equation. Honestly there is not to live for or look forward to. They are not able to get out on their own and launch their own careers that leads to a better life. They are forced to take out huge loans only to compete for a job at Starbucks. Not everyone is cut out to be an engineer, doctor or scientist. If you don’t get a degree in one of the highly sought STEM fields future employment is a crap shoot. You can be pretty damn smart but there are no jobs for you. Education is the way up the ladder but that has been cut off unless your parents pay or you sell your soul to the devil for those dreaded college loans. Things just are not the same for young people starting out as it was 30-40 years ago. Any idiot 30-40 years ago could make a decent life for themselves with sub standard education/intelligence. High school diploma along with hard work was a gateway to the American dream and a college degree was the icing on the cake. I know you must say to yourself “I’m an idiot and I made it”. The bar is much higher for these 20 somethings gramps.

The successful kids I am starting to see these days are the one’s who start their own businesses. They figured out that the corporate ladder is no more.

Christie,

Very well spoken. I especially loved the “gramps” ending. I really do think that many of the “boomers” are clueless and want to stay that way. They don’t want to see how difficult it is for this generation so that they can continue to practice their culture of “consumerism” without having to look at the truth of it all. I can rarely address anything having to do with the economic reality of my life with my father without him looking at me as if I was just some whining baby. Meanwhile, he was paying 35¢ a gallon for gas and $250 a month for a mortgage on a 3-bedroom, 2 bath home while raising four kids with a wife at home and making it. I’d have liked that deal. As a father of three, it is nearly impossible to get past my cynicism to see a bright future for my children. God knows, I hope I’m wrong. I’ll finish by saying that there’s this amazing lyric by the late Kevin Gilbert in his song Goodness Gracious that goes like this, “Goodness Gracious of apathy I sing, the baby boomers had it all and wasted everything. Now recess is almost over, and they won’t get off the swing.” The writing was already on the wall as he wrote this in 1994.

Its funny, I read Roberts post and I saw it coming from someone in there 30’s or early 40’s who “made it” so thinks everyone else could too.

I am 49 and everyone I know in my age or older knows full well things have changed for the worse for everyone. At least I had a chance to get a nest egg going before everything went to hell. I can’t imagine how disheartening it must be for the young today.

The one group I think that is in la la land are those retired who have a nest egg, get a pension along with social security. I know a few of them from Sun City West Arizona and I guess that explains why they overwhelmingly vote Republican.

I am a Gen-Xer, almost 40, but I am totally sympathetic to the 20 somethings. I just don’t understand why they are only NOW seeing that the “American Dream” is a big sham, because it already seemed that way when I was 20 and things have only gotten worse since them.

That’s why I didn’t spend the last 20 years worrying about running the rat race, buying a McMansion, and building up my “career”. Good move, in retrospect.

Please, the good ol’ days argument. Let’s not forget hundreds of thousands American dead in WW2, 50k in Korea, 50K in Vietnam…all teenagers or twenty somethings. Women totally dependent on men. No central air, black and white TV with 7 stations, one car per household, cars with lap belts only, the thrill of one’s labor at the mill for 10 hours a day, rampant alcoholism and smoking, tolerated domestic violence, pollution, nuclear war…the list goes on and on.

Twenty somethings have the world as comfortable as ever.

Is it easy for the young now? Probably not, but has it ever been?

Great Observation Christie. I have 3 twenty somethings who are frugal and work hard, and haven’t complained that their college degrees aren’t a golden ticket but a an opportunity. We reared them that way. at 51, I knew plenty of lazy flakes in my generation. Our kids are stuck in their historical demographic and circumstance. I see lots of nice young people around who aren’t as selfish as middle age and older folks. My sons volunteer more than I ever did at their age. And we are conservative, not lefty complainers that expect the gov’n to do everything.

I work as a middle manager in technology. We can’t find enough American kids to hire. These are good paying jobs. I don’t understand why more kids do not take the effort to get a degree in a field with high demand. My own daughter is in college and wants to study Liberal Arts. She is very smart … just not interested in science, engineering, etc… We tell here that she is studying to be a future Starbucks barista. I grew up in a family of 6 and never expected handouts. I didn’t think about what my “passion” was when choosing a career, mostly just what was practical. I guess our kids just haven’t had to go door to door, mowing lawns for spending money much less experienced or witnessed the poverty that Indians and other recent immigrants who are taking the technical jobs have.

Ignorant comment considering 20 something’s are carrying non dischargable student loans and can not get meaningful employment and if they do they are paid substandard wages with devalued fiat federal reserve notes! It’s like blaming the maitre di for the restaurants bad food. Like the economic woes are because of the slacker generation. Lol funny. P.S. I am 50 something but have educated myself to our monetary policies that are basically legalized fraud. That is why things are the way they are. It is being done on purpose. That’s why you won’t hear the puppet politicians discuss anything substative. Enjoy the dog and pony show as our economy is flushed down the toilet so the banksters end up owning it all!

Don’t think it is that simple Robert.

The fact is, I bought a starter house in 1986 with a 10.00 an hour job and 10% interest for 38,000.. I still have the appraisal and it blows my mind.

That same house sits within 4 miles of downtown Portland in the Hawthorn district, a district that was popular way back in 1986 and that house now is worth around 320K. That same factory job I had, now pays 18.00 an hour and people working there today could never hope to buy that same house.

There has been a fundamental change and that change is our industrial base has been shipped to China and we have a FED who thinks that a never ending mania in housing can some how replace it.

You are right in that if some put their life into their work, they can afford that dream house. When I bought that house in 1986, all I needed was my self, a high school education and a job. Today I would most likely a college education (and the debt that comes with it) and a second income (working spouse or two jobs) and the two jobs to afford that same house.

martin, I lived in Portland back in the 80s and know several people there. There are a few factors that have changed prices. 1st low interest rates caused mainly by the USG bias towards the FIRE industry. Your same loan payment of $335.00 for 10% buys more than double the price so lets raise the original price you asked from 38,000 to 80,000 on this factor alone. So now let take 80,000 times a wage factor of 2x (per BLS stats) = 160,000. So that is the baseline we are working with. The second factor is zoning laws and construction regulation in general. Portland is attempting to make itself a high-density city which makes new construction prohibitively expensive. The Hawthorne district is close-in and a desirable neighborhood. I think it is fair to say that prices in there been impacted by these regulations by as much as doubling their price. After all, it is still possible to get a starter home if you commute from outside the Portland limits for $160k.

Trolltastic, Robert; 8.5/10

Robert, times have changed my friend. The 20 something crowd may seem detached from reality, but they are utterly screwed. There are very few jobs for new college graduates, don’t even dare trying to make it with just a high school diploma today. One of my co-workers had his son graduate from Cal Poly Pomona earlier in the year with an engineering degree…no job prospects yet. Nothing, nada, zilch! He is slowly realizing that moving out of California will be a reality very soon.

So let’s see what the 20 somethings inherited from the previous generations: an economy with little if any living wage jobs, mountains of student loans, an industrial base that has been outsourced and will never come back, $4 plus per gallon gas, high home and rent prices, high healthcare costs, 16T national debt, entitlement programs that are beyond repair that they need to keep funding so retirees can live it up. As you can see, they got a real shitty deal. I feel real sorry for these kids, they will need all the help they can get in the future.

Re: Robert

Updating a Facebook page 3x daily takes maybe 15 minutes total. New iPhones come out about once a year. If you can show me a career open to twentysomethings that takes 15 minutes a day and a once-a-year overnighter that will enable the purchase of a house, you must be a Nigerian prince with a Hotmail account.

Whenever I meet people with this level of You Kids Get Off My Lawn economic smugness they’re almost always retired, with an ample defined-benefit pension (almost nonexistent for today’s workforce), usually from a government or government-contractor job (aerospace, military-industrial, etc.), i.e. their lives are underwritten by the taxpayer while they spout Tea Party rhetoric; or they inherited from family a primo house and/or substantial wealth.

I work on a college campus and realize today’s generation have it tougher economically than I did two decades ago — higher tuition, higher costs of living relative to potential income and diminished job prospects.

Wow, from what I’ve seen with the 20 somethings I work with the millennial generation, despite being constantly crapped upon and derided as being lazy in all too many incredibly stupid articles printed in the vapid echo chamber that is the mass media, has a great work ethic. Now if you want to look at some useless, good-for-nothing massively entitled douchebags look no further than the Baby Boomers, a generation that had everything given to them on a silver platter and who then proceeded to screw it up for everyone else and who continue to screw it up for everyone else.

Your post is nothing more than hostile rhetoric. You are spouting nonsense. The average American has always worked hard. Now if you want to slam a boomer start with Romney who really only follows Reagan and the trickle down wealth entitlement club. It’s not the boomers per se but the banksters and corporate raiders who sold the whole country down the drain. Before Walmart made China the new emperor your average American was a working guy who loathed Communists and worked at a manufacturing job. Most boomers bled American blue and never saw the scam coming.

Taken in the context of lemmings undergoing a biosystem collapse is it any wonder that there are burrows in a state of disarray?

Well, in California student debt is not the real factor of lower income for youing people, the young are more hispanic and less white, and hispanics as a group finished both high school and college less than Whites or Asians. In La county under 30 population about 53 percent hispanic. One bright spot is hispanic birth rates are dropping so hispanic families on average that have less money will have less kids to strench that money and Mexico’s birthrate has sropped as well, many less low skilled and poor people emigrating into California in the next deacde or so, its alrady slowed down with the current Recession.

Personality, I think the Inland Empire will still grow as mention above a greater hispanic population and evetually more jobs in the area particulary Riverside. The in the city mainly appeals to uppity whites. La County though sometimes has lower cost housing in the hispanic areas, so some will stay. Gas might be cheaper in 5 years, it goes in cycles. The problem County is Orange which is pretty expensive except in some of the Mexican areas like West Anaheim or Santa Ana which might keep some of the 2nd generation MExicans closed to home instead of going out to the Inland Emire.

Do you really base your findings on fewer Mexicans?

Dr Housing Bubble,

Can you discuss how the China/Russia deal to sell oil and trade in Yuan is going to affect the housing market? Devaluing the dollar along with the US Government…

If mortgage rates head down again, this will boost real estate prices yet again….the amount of delinquent homes being processed by the banks is still at a dribble. There’s no reason for them to change this.

I told a friend whose been underwater for the last 3 years that her opportunity to get out is quickly approaching and should not be missed.

In your example of 2006 to 2012 costs, you neglected to mention the price to rent that same house in 2006 compared to 2012. I think you’ll find that another huge motivator is rent parity. At $500 or $600/month mortgage payment, their mortgage may well be cheaper than their rent.

Excellent post! Something to consider regarding McMansions is the doubling up of households. In my case we live with my mother so we bought a very large house (near the coast though and I suppose it could be considered a McMansion) because we are accommodating more people. Families are doubling up and living together which makes demand increase for large properties with mother in law suites, in my opinion. Affordability is key but that depends on how many wage earners contribute to the mortgage, which my mother does. FYI – we were 10% down and over 750 fico for conventional loan, maybe we aren’t the norm.

Did you get the 750 by adding up each families score! Just pile everybody in a SFH it’s great for the neighborhood.

Great Article! I so enjoy knowing that there are others out there that know what is really going on! Thank you and keep up with send the truth out.

32 mpg in an SUV during commuter traffic?? Hahahahahahahaaaa!

Yeah, I was going to say….

I can get much above 38 mpg on the hwy in my Prius, with the only advantage being if the traffic comes to a complete halt, the engine shuts off.

“A rising standard of living is probably the better measure”. I have lived in So Cal my whole life. When I was a kid in the 60’s and 70’s, everyone on my block owned, (mortgaged),their house and all the moms stayed home. All of this on a blue collar salary. By the time I was ready to buy my first home in the early 80’s, it took two good salaries to buy a home, (and this was a condo in La Habra!). It seems to me then, that housing prices had expanded to take advantage of the jump in income that occurred when women not only were employed, but employed professionally and full time. Prior to then when a women worked, it was not considered, “permanent”, as she could quit at any time if she became pregnant or wanted to stay home. (not making a value judgement about stay at home caretakers, that is up to the individual families, just stating how it was). I think that somewhere in the 70’s and 80’s the standard of living took a nose dive and we really didn’t notice. It simply cannot be possible anymore in So Cal for a blue collar worker to buy a house and his/her partner stay home, and certainly not whole neighborhoods. Everyone has to work, which means that almost everyone has to drive. So. Cal. real estate pricing is founded on cars, cheap gas, and a desire to be in traffic for over an hour. What will happen to the outlying areas now that gas is not cheap? How can any of this be pointing to a recovery? A rising standard of living?…..not in America.

What happened was a devaluation of the U.S. Dollar, inflation, caused by the Federal Reserve. Good old boy banksters that stole our wealth and standard of living these past 40 years. Wages did not keep up with true cost of living increase. Also there has been this anti-union sentiment amongst many people which I think the media parroted. Two income families were required just to maintain a decent standard of living. In the 90’s credit card usage exploded, student loan debt, car loans, etc. We have been living in an illusion of sorts these past 40 years.

Question: why do most of the OC middle class live south of Irvine? Why are they willing to drive the extra miles? One answer could be that they don’t like dense living. They prefer the demographics of being with like minded people. They like to be with their ‘own crowd’.

Why do people live in the inland empire with their mc mansions and the 3 hour commutes and $5 gas? …maybe they don’t like the OC crowd or OC lifestyle at all, and maybe to a point, maybe even anti-social depending on your perspective.

Maybe someone can present some metrics about the apartment vacancy rates are in central OC but it should show a decrease because those people that can’t afford the IE commute will move closer to their work location… leaving those that can afford it, to stay with 3 hour commutes and their mc mansions.

So with perspective, this essentially transforms the central OC crowd to a higher blend of the IE folks, which is the same reason that make people chose to live south of Irvine or now Chino and the rest of the IE. It is the same reason that people chose to get out of LA back in the days when Cerritos was a dairy farm and downtown Santa Ana was only mall in town.

This tranformation is not anything that Greenspan or Bernanke did, nor did mortgage rates or subsidized housing did.

I see the OC more like the “haves” & “the have nots”.

OC Beach communities (Newps, CDM, & Laguna, are typically much older towns, with old money (e.g. long-time, former “executive”, upper-income homeowners with no mortgage & typically have middle-aged children). And the newer South County towns like Aliso Viejo, RSM, or Ladera Ranch are typically average middle-class, 30-40 somethings (e.g. two income wage-earners with college-age or young children.) And then you have many downscale neighborhoods in central OC Cities (e.g. Stabba Ana, Anacrime, & Garbage Grove) which typically have the lowest-income, multiple wage-earners with multiple children of various ages which help support the “OC Lifestyle” of these two other classes. I’m sure many nannies, cleaning ladies, and gardeners from Central OC relish their time in these cleaner & safer communities where they work on a daily basis. That is what the OC is all about…

“I’m sure many nannies, cleaning ladies, and gardeners from Central OC relish their time in these cleaner & safer communities where they work on a daily basis. That is what the OC is all about…”

Do the nannies, cleaning ladies, and gardeners who commute from East/South LA relish their time in the cleaner and safer communities of WestLA, Beverly Hills, etc. where they work on a daily basis? Or domestic staff that rides the train in from Bronx to Manhattan to work, are they different? Doesn’t this type of thing happen in pretty much every large metropolitan area in the US, or is OC uniquely different? I’m confused….

What a bizarre set of comments above.

We have a few complaining of student loan debt and lack of opportunity outside of a few concentrations of study. Maybe that student should see that even a vocational school education could have produced a career path. These students also do not see a career path. I graduated college, started working at $6.86/hr and within 8 years was making $180K/yr. Though in hindsight maybe I should have stayed with that job, but that’s a different story.

These students expect to walk out of college and instantly have a house, car, cell phone and everything else. After all they had so much good stuff while in college blowing their student loan money on these goodies.

These students and former students should also take this as a lesson in economics. Why do you think education costs are skyrocketing? Because the students can pay with loans any tuition required – just like with housing in previous years they get stated income no assets student loans. Take away the student loan programs and colleges would quickly adapt lowering prices. It’s the students that borrowed money and over paid for something that was not going to deliver what they expected.

I personally like the cocooning available from a McMansion. Simply buy a 50mpg car and take advantage of alternate energy resources (innovations to make more affordable occurring all the time) on your home, but that’s me.

Students should stop complaining and start working. It’s funny how the OWS students, with all of their education, do not just get together and develop a new type of solar panel, or air powered car, or solve any number of societies problems which as a result would propel them to the 1%. Instead everyone is stuck on stupid expectations.

Read Atlas Shrugged and change your life.

Really. Just make your life fit the mold of a novel? And a damned bizarre take on reality at that. Make an air powered car? And enter the one percent? Enter the delusional poster. Put down the Rand, the Faux news and get a clue. Please.

Hear hear!

I may be delusional because I believe that the students and even the OWS types of today are oftentimes very smart and very well educated but fail to understand how to apply that knowledge. They are waiting for a job instead of creating one. I thought a book like Atlas Shrugged could open their minds to the possibility. It is one of the novels most often referenced as having a life changing affect on some of the most powerful and influential people around.

As for the air powered car. It was an example of what brilliant minds could do while waiting for someone to “give them” a job. I do not care if it is a car or whatever. The idea is to invent something that is in line with their values. As for their being an air powered car, I just read about one that goes 42MPH for 62 mile range on an air “fill up” that takes one minute. Their is no doubt amongst the OWS types and unemployed students a lot of scientists, engineers, etc. Their is an incredible amount of unchanelled potential that is waiting for a leader when in fact they should lead themselves and then, yes, enter the 1 %. After all if the Big Bird actress is almost a 1%’r, anyone has a chance.

Back to housing.

“These students expect to walk out of college and instantly have a house, car, cell phone and everything else.”

Yes, like their parents did. That is somehow wrong?

Dr. DHB,

One of the most insightful paragraphs written lately. DHB has listed problems

without even considering the effects of peak oil and other peak resources.

If you include those matters are much worse for the new generation.

See energybulletin.net, theoildrum.com. Read for a few weeks and you will

get the picture. Also, see chrismartenson.com, oftwominds.com blog by Charles Hugh Smith and also James Quinn’s theburningplatform.com.

Many of the new homes being built are not SFR they are multiple-units.

Also, lot of them are in cities where you can walk to most places not commute.

From 2007 to 2012 the drop in gasoline use by 18-34 year group is an astounding 25%. Do an anecdotal survey of these folks near you and you will find that many

of them walk, bike, car-pool or do not even have a car!

So suburban landscape is dead!

Keep up the good work DHB. We need more data driven sites like yours

instead of the shallow rhetoric hot air spewed by the election ads lately.

Incredible article Dr. HB. The concept of housing has changed and we have dinosaurs running the FED. Their actions will invariably sink the real US economy at the benefit of their bankster friends. Pathetic.

http://Www.westsideremeltdown.blogspot.com

When will people like us who read this blog stand up and say enough and demand the system to change. That is what it is going to take, is this country worth saving? It has worked before, women’s rights, civil rights, ending slavery and so on. When will we grab the power back from the Bankers?!!!

I find it surprising that no one here has mentioned the incredible lack of skilled tradesmen/tradeswomen that are desperately needed in many areas of our industry right now, and that excellent jobs often go begging. There are desperate employers across the country trying in vain to convince HS graduates to forgo the traditional college degree in favor of a much more viable vocational education, one in which the student goes to community college while also earning income from a potential long – term employer along the way. Why do so many of these jobs go unfulfilled? The younger generations have been indoctrinated for years about how a college degree is the only way to get ahead, and that anything associated with industrial output is dirty, not cool, and often something to be ashamed about. I went to a community college before matriculating to a four – year university, and my community college had a full – fledged vocational program at that time (circa 1979). Additionally, many of these positions are located in those awful, hayseed, backward rural communities – located in states that no self – respecting hipster doofus would even think of living in. I have a friend who runs a foundry in a town located a few miles south of Peoria, IL – and he has three openings for equipment operators who have the right vocational degrees, and each job pays over $60K for the first full year alone, with additional benefits and bonuses (depending on the entire factory’s output for the year). In that area that kind of salary gets you a 3 – bedroom, 2 – bath home in an excellent neighborhood for less than $200K. So while I certainly understand the plight of so many 20 – somethings with their college degrees, let’s not assume that they can’t rejigger their expectations and at least try to focus on things that might be more feasible in this economy. next

Great. That’s called immediate gratification, and not thinking ahead. What happens when that manufacturing job is offshored to Vietnam in a few years? Will this “skilled tradesman” get a sweet severance package that will cushion his or her fall from middle class status until he or she can find a new job? Probably not, and, of course, that worker cannot expect to have a union behind them to help negotiate such a cushion, because unions don’t even exist anymore, outside of the public realm in our country.

I graduated college in 1975, and, even at that time, I could have scored a nice union gig at a local Ford plant, making a nice, middle class wage with assured increases built in over the next decade, as long as I kept my mouth shut and worked hard. Look how that turned out. Glad I saw a little writing on the wall. And, a lot of those people had wonderful skills that were supposedly “marketable”. Problem was, they would have had to move to Japan to get their old jobs back. Now, it’s China or Vietnam.

And, to think that we may elect a president who’s business specialty was figuring out how to screw the American working man out of his job so that he could make untold millions and hide it from the IRS. How in the world could you tell some kid to try to establish a working life in the trades with that kind of tide against him? Me, I’d take my chances in finance or law, or both. That’s where you can mint money these days. Not working for it.

Try to keep your political opinions to yourself in the future – you just gave off a massive tell with that comment. Strike as non – responsive, your honor.

Dmac, drop the sanctimony. Your comment is equally both political and a massive tell.

@Dmac

Political? Sure, but, let’s get real here. If I were to advise a young person as to his or her career path, it certainly wouldn’t be in an area that our politicians have allowed and will allow to vanish form our economy. Kind of tragic to watch a lot of kids work toward a mirage of healthy middle class status, and have the money changers take it all away for immense profit.

I don’t think I’ll be calling an electrician or a plumber from China to do a housecall any time soon

Hi Kyle – please explain your statement here, and please give examples of support.

Although I agree with the majority of Dr. HB’s points, I do not agrre with the notion that a lower property assessment correlates to higher affordibilty. Case in point: although my property assessment decreased aprox. 25% in the past three years my property/school tax liability increased 115% in addition to increased water/sewer and sanitation fees. As well, my home insurance premium is based on “rebuild” costs, which according to the insurance matrix, has inflated inspite of decreasing values.

Further consideration, my local utilty has recently been “marking/mapping” the streets of the underground utilities for monitoring. My municipality’s infrastructure, like many older cities, is over a century old. Coincidently, a major sewer line recently broke spilling3- 5 mil. gallons of raw sewage into the Hudson river (in August a town up river had a similar incident). Although the municipality is eligible to be covered under a Federal loan program for future repairs, the city must still finance the inevitable rebuild of this and all its aging infrastructure. This will most certainly be done through the issuance of bonds pay backed via increased taxes. Who’s going to buy these muni-bonds? Pension funds looking for yields? The Feds? We will all be on the hook one way or another.

Speaking of skilled tradesman. Last weekend I went into SouthCentral LA to take a drive down memory lane…. Gage Avenue. My father didnt finish high school, but ended up a union worker (glassworkers union) at a glass factory which was at 702 E. Gage avenue. [The factory is gone and it is now a cheap import furniture shop with steel covered windows and grafitti galore]. He worked there for 30 years and was able to buy a house in Westchester, owned 2 cars, his wife didnt need to work and put all 3 of his kids in private school. Isnt that amazing, a blue collar worker in SouthCentral LA with a home, 3 kids in private school, 2 cars, vacations, and a stay-at-home wife and I recall good medical and dental coverage… those were the days ! As I recall, most of my neighbors (in Westchester) were also the children of blue collar workers in the various aerospace, airport and real manufacturing jobs in LA. The house he bought in Westchester is now gone, one of the dozens of blocks of homes forced to leave through eminent domain of LA airport expansion… anyway, those were the days when a single blue collar salary could afford all that!!!!

My father was a union printer and my mother worked. We lived in a fairly small apartment with one bathroom but considered ourselves fortunate because my brother and I had our own rooms, unlike some of my friends who shared with siblings, including those of the opposite sex. When we had a car, it was an old clunker. My parents’ only vacations were driving through the nearby countryside and staying in cheap motels. We had a lot of second-hand furniture. For Christmas and birthdays we got maybe two or three small items and some new pajamas. I had very little clothing. I had roller skates, a bike, a few dolls, jacks and maybe four board games. We went out for Chinese food maybe once a month at most, otherwise we ate at home and packed our own lunches. We had one tv and one phone. We had one radio and one record player and maybe a dozen record albums in the house until I got a transistor radio of my own when I was 14, which was a big deal.

Yes, there were lots of white men with well paid union jobs, but it’s a myth that everyone was living the good life on one wage. One of my best friends was the daughter of a postal worker, and the family of four lived in a one-bedroom apartment. Remember the Honeymooners? He was a bus driver and they lived in a two-room dump with no phone or tv.

And let’s not forget that those good jobs were only available to white men – and a lot of them were only available to sons and nephews of members.

QE 3 will succeed in reflating the housing bubble because that is exactly what it was designed to do.

The original housing bubble was created because of the lenders ability to re-sell loans into a secondary market at a profit.

When it became apparent that these loans were not of the quality that they were supposed to be, secondary market demand fell and the housing boom collapsed.

QE3 simply replaces the bond market with open ended mortgage purchases by the FED. This creates a market for mortgages regardless of quality and gives the lenders every incentive to begin writing new mortgages. This of course requires inflation in home values to give purchasers incentive to invest, and so you will soon see much in the media concerning increasing property values.

As demand for housing increases, so too will demand for goods and services to rehab neglected homes.

This will help to relieve unemployment and give the impression that the economy is improving giving confidence to investors.

While I do not think this strategy is stable long term, I do believe there is both the desire and incentive for people making policy to create one more bubble.

For the small investor your only choice is to jump on a train destined to crash, or get run over by it.

The low rate $500k buy in crap bubble is back. Will it ever pop?

http://www.redfin.com/CA/Costa-Mesa/862-Senate-St-92627/home/4564290

Half a million – really? 6 days on redfin and it is going. 3% down maybe for a $485K loan. Thing sold for $365K a month ago! Can’t imagine this real home of genius going higher. Stranger things have happened as we continue to witness.

Science is good but unfortunately the way we are using it produce more harm than good.We don’t use it to solve the needs we have like provide housing and food for everybody because if we do that we would kill the economy.We have to technology to do all that but monetary system would colapse because it needs the gap betwenn the rich and poor so that is the very reason why two bedroom in Torrance sell for $700 000

So the more we waste the better the economy.We don’t produce for our needs we fill up warehouses most of the time with useless product and than brain was the population to buy it.If someone is in real needs it will have to wait because there is no money to be made.just the idea that housing prices are going up so many people will not be able to afford it and we call it ” Housing recovery “

This is wild, what happens that hispanic birthrates keep dropping to1.9 inMexico,its now2.2

and in the 2020’s you have to do your own housework or hire the kids of the immirgants or all the maids are from central america. I think Brazil is now at the 1.9 and Mexico could be since even in the states we are seeing a drop from2.9 to 2.3 and maybe near2.0 at the end of the decade.

Very interesting post; pretty thorough. I’m someone who always believes that people should be able to afford a house before they buy one, and that reducing things too much so they can own homes is risky in many ways.

With that said, I also believe that 20% down payments are too high and truthfully, banks don’t want that kind of payment because it means they’ll make less money in the long run, even if they might feel some of their money is guaranteed up front. It doesn’t bode well for the housing industry across the board if fewer people qualify to buy homes.

Leave a Reply