The façade of a recovering housing market: New home sales collapse and supply of inventory finally reaches six months.

New home sales had a horrible reading in the latest set of data. Hard to blame the polar vortex on this one since the only area in the country that saw a jump in sales was in the frigid Northeast but what of the other areas? Of course what the press fails to recognize is that Americans for the most part are too broke to afford homes at current investor inflated prices. Since more than 30 percent of all sales since 2008 were going to the investor class, this group pulling back is showing how solvent most households truly are. Some people assume that millions of holed up Millennials will emerge from their parent’s basement only to flood the market with an unrelenting appetite to purchase homes. First, many of these young adults don’t even have the incomes to cover rents in more expensive zip codes forget about purchasing a home. So it is no surprise that new home sales fully collapsed last month. The West had the second biggest monthly decline and we are flat out in a drought! Definitely can’t blame the weather here. What you can blame is affordability and with investors slowly pulling back, we will now find out the ability of the housing market to stand on its own two feet with more traditional buyers.

New home sales hit a wall

New home sales plunged dramatically on the latest sales report. It should be obvious that affordability is a big problem even with juiced up interest rates that have turned on those house horny investors. Yet even hormones can’t justify prices in many markets and we are seeing a pullback. It is becoming harder and harder to justify current prices in many markets. Sure, people are still paying high prices but the lemmings are slowly waking up and inventory is growing. Builders need to think long-term and they are certainly not taking a big dive after this report.

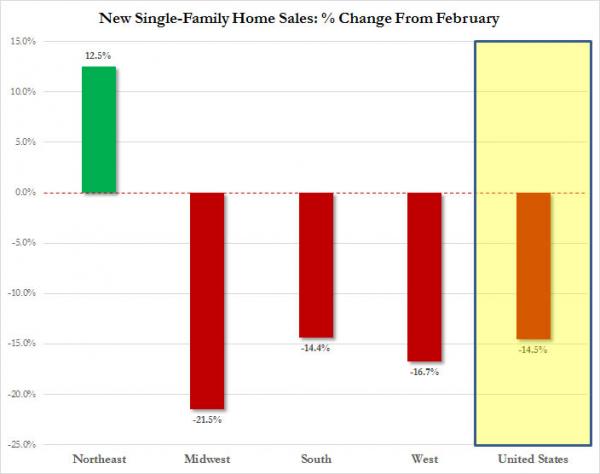

First, take a look at how deep the dive was in new home sales:

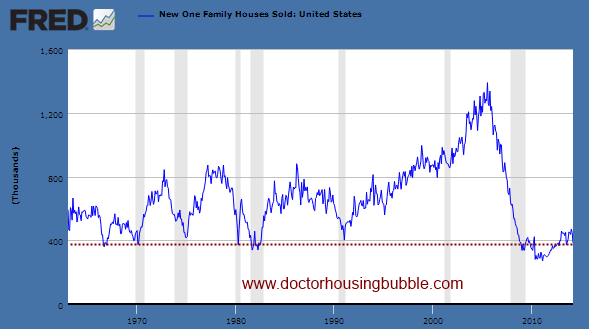

So much for the weather being an excuse. New home sales fell 14.5 percent nationwide. Prices are simply too high for many traditional buyers across the country. To put this into context you also have to see how pathetically low new home sales have been:

Where is the housing recovery? This chart is indicative of the massive demand investors have for lower priced foreclosures and distressed homes. You know, the graveyard of 7,000,000 foreclosures that all of a sudden people have forgotten? New homes are more expensive and tend to rely on traditional home buyers. As we have said, with incomes going stagnant this is a big deal. You rarely find flippers or investors buying up new homes. The chart above highlights this trend and reflects the massive demand from investors for existing home sales. They have crowded out regular buyers since 2008 and are largely responsible for the big rise in prices last year.

Inventory creeping back up

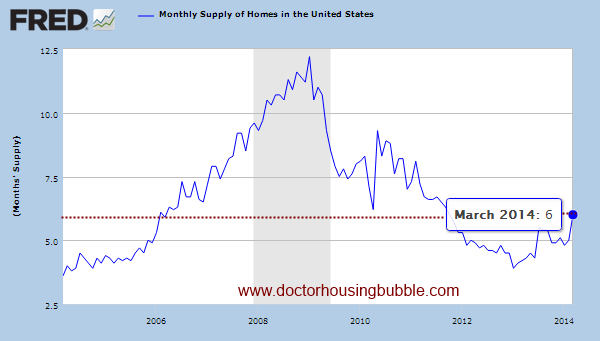

Since investors are pulling back and many households are priced out of the market, inventory is slowly creeping back. We have now reached a 6 month of supply in the housing market (6 months tends to be the “normal†balance point between buyers and sellers but good luck trying to claim this market as normal):

The last time we had 6 months of supply was back in 2011. People are still house horny and would like to purchase a champagne house on a beer budget. I doubt people really run the numbers that carefully when making a big purchase. Most will take the max a bank will give them. Thankfully today, we actually have some due diligence in the market. Investors circumvent this process with their large pools of money but it is clear that many are starting to pullback.

The recovery was largely driven by artificially low interest rates (Fed members are seeing higher rates shortly), low inventory (creeping back up), and investors (demand is waning). These are the three big groups pushing prices up since the housing crash hit. People assume pent up demand is going to flood the market and fill the gap left by investors. Where is this demand? Millennials? Doesn’t seem like it since many are also in debt up to their eyeballs in student debt and their incomes are not so hot. Typically rising prices in housing would lead to a healthy response by builders to add more supply. Instead, many builders have been building multi-family rental housing. This is a new trend just like the sustained flood of big money in single family homes, or the Fed’s uncharted QE adventure, or the pricing out of the middle class from the bedrock of their wealth, housing. The collapse of new home sales and the rise in existing supply should be expected given the weak growth in household incomes.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

149 Responses to “The façade of a recovering housing market: New home sales collapse and supply of inventory finally reaches six months.”

Aggression in Las Vegas!

New home builders are offering 4% commission for my buyers. Standing Inventory is back, dozens, AND they’re for rent.

1% down on Stated Income! What a combination, was that available in ’04-’06?

1/2% down FHA with 600 FICO, AND 103% loan. That’s straight out of the rabbit’s hat.

“They” are trying everything to sell houses at inflated prices.

There are no “deals” in Las Vegas.

Unfortunately, buyers that CAN afford a house in a great community don’t understand what the built-ins are for. They don’t fit anything. It’s because the builders created these oh-so-popular-at-the-time TV cubbies for the newest 48″ TV’s that nobody remembers. I can’t even explain them to Buyers, they just say, “hmm, what do we do with this space?”

As this BS continues, these dated, desert tract homes are becoming less attractive, and most young Buyers don’t even know what to do with the unexplainable floor plans. Nor do I.

I live in Utah and know what you mean about strange floor plans. Have been looking at houses here and they basically are “barracks with a kitchen”. Tons of postage-stamp sized bedrooms and a very small kitchen.

Pack as many people/extended family into as small a space on a small lot as they can. More builder profits, more property tax per sq. acre.

Welcome to the lowering of the quality of life of American citizens! While the third worlders’ i.e. “developing” nations quality of life improves, the quality of life of the average U.S. citizen will continue to decline. The H1B Visas are used to living 10 to a bedroom and 100+ to a tiny shitbox hovel, whether consisting of (very) extended family or strangers, same with the other end of the immigration spectrum, the noble illegal alien migrant workers et al.

Either way, these third worlders from where ever have no problem getting packed into tiny rooms, sharing said rooms like the flop houses of 1900s America or like a can of sardines…and if it’s good enough for them, it will be good enough for the U.S. citizen and his/her offspring as far as the multinational corporations running the show are concerned.

Taco, You could greatly abbreviate your xenophobic rant by just screaming “America for Americans!” and be done with it. It’s red-blooded American greed that made this mess.

You don’t have to be a TBM Utard in Zion to get the stamp sized rabbit warren floor plan. There are lots of 1500 square foot 4 crackerbox bedroom popcorn ceiling tracts all over north OC built in the 60s. Everytime I walk through one I get the same feeling….ugggh. One mans trash…I could get two bunks in each room and a crib in the master for my ever growing tax deduction brood.

Most of the people don’t know what they want – they claim they don’t want/need McMansions but that is exactly what they want. You can’t have small house with large rooms. For most of the buyers (I know there are few exceptions) a 3 car garage (at least) is a must, very large master bedrooms, closets, living rooms, kitchen and dining rooms, bathrooms, all are a must.

I know this because I make a living building houses. For me I learned to build based on how they vote with their money not based on what they say. I learned to built based on what they are willing to pay for not what they want – they don’t even know what they want and if they do, it is usually that they want a castle for $5. What the buyers want and what they pay for there are 2 TOTALY different things, usually with no relationship between them.

Also there are differences between what the wife and the husband want. As a builder I always ignore the husband because in 99% of the cases it is the wife with the final say. If I build something the wife likes I have a sale, if not, no sale.

Another two hyper overpriced houses on market:

http://www.redfin.com/CA/South-Pasadena/1912-Alhambra-Rd-91030/home/7008392

http://www.redfin.com/CA/San-Gabriel/241-Rosemont-Blvd-91775/home/7033749

OMG I don’t know which one of those DUMPS is worse. The first shack “Light and Airy”. Jeez…. Total gut job.

The second one in San Gabriel takes the cake: “Many possibilities”. Did you notice the huge crack in the living room wall? And the ghetto “addition”.

Realtard speak at its best.

Upper $600’s for these? Just blows me away. Forget it.

“they’re for rent.”

Can you expand on this? The builders are renting out the standing inventory or ?

“1% down on Stated Income! What a combination, was that available in ’04-’06?

1/2% down FHA with 600 FICO, AND 103% loan.”

Is this through the builders’ captive lending arms or other mortgage banks/brokers?

How-zing to go up fo-eh-vah!!!

On handle hijacking, I think it is very important to harass and respond to every comment made with your hijacked handle. I find they let up sooner or later…

Housing to Tank Hard in May 2014!!!!!!

It’s halfway thru 2014…housing isn’t going to TANK this year. Housing will pullback some this fall if interest rates don’t fall back below 4% for a 30 year fixed. People are listing WISHFUL prices in my neighborhood.. so any appraisals based on current listing price comps… (Zillow anyone!?) are getting pushed upward.

One $35K price decrease in my neighborhood is evidence that wishful asking prices won’t hold up this summer. But it is a great time to get an appraisal and say goodbye to PMI if you still got it.

Prices will still remain higher than 2013 though. Just not much higher.

Halfway through 2014? Are you a product of the LAUSD? There are still 12 months in a year, and we are a little over the halfway point of the 4th month. There are still over 8 full months left in 2014, meaning we are less than a third of the way through the year.

Back to remedial math for you, smokey bear…

I believe Jim has explained previously that by “tank” he does not refer to asking prices. I was not in Cali at the time, but in early 2009 during the meltdown, the sellers where I lived were still asking 2007 prices and proclaiming it was different there. The only sales were from people who saw what was happening and priced their houses ahead of the market. Right now, sellers are still in dreamland, but buyers are in watchful waiting mode.

GenXer has it right. Jim has in the past inferred that by “tank”, he means events to be set in motion.

By the way, the real Jim Taylor wouldn’t have made that top post with a month specified. Someone obviously used his handle. Seems to be a trend around here as of late.

Doc, does wordpress have some sort of a plugin or feature you can use that will lock-out the anonymous use of registered comment forum handles? Something not case-sensitive.

So here’s what is going on in my neck of the woods: Over 320 homes listed for sale currently (population 39,000). This time last year only 140 listings. Getting multiple new listings emailed to me daily, and at least 5 price reduction updates emails daily.

We went to a new home builder “grand opening” 4 wks ago. Tiny little cluster homes with zero lot lines on one side, on 3000 sq ft lots. HOA and high mello roos fees add to the carrying costs. The entire tract of 90 houses backs on to a high voltage power line easyway.

Before they opened the community to sales, they were advertising on the radio “from the 480’s”. Opening weekend the price had jumped to starting at $510,000. Within a week “starting from the $530’s”.

A month later, I got an email from them today – new prices: “Starting at $483,000”.

Guess they got greedy and house horney buyers weren’t biting.

@ Calgirl it would be helpful for us to know where ??? thanks

She posts here often, believe from the Sacramento area.

QE: Sacramento Eastern Suburbs: Folsom/El Dorado Hills.

Are you really a buyer or a complainer? I suspect you are the typical, “can’t afford a home” so you go to all the open houses, waste folks time and knock them. Look lady people are not in the business of getting you into their home so some day you can over price it and make a killing?

Did I offend you because I’m a sceptic that doesn’t buy into the hype? I’m a buyer, but at the right price. The writing is on the wall in my opinion. I must admit I get a kick out of listenting to the RE agents never ending speel “buy now or else”. I’m perfectly content continuing to rent my nice house until it makes sense to buy.

The new homes I referenced – the builder has now posted 8 of them “currently in construction, ready in June” on the MLS. Along with the $30k+ price drops.

Inventory piling up on these overpriced homes. That is what this post was about, wasn’t it?

Congratulations, robert. That was a fantastic example of an ad hominem attack. When you can’t dispute the message, distract the debate by diverting focus to be on the messenger. Call into the question something irrelevant to the original claim by way of a personal charge.

Someone did not get the memo… It clearly stated that no responses shall be made hence forth to anyone with a handle that includes “r” “o” “b” “e” “r” “t”. Sorry for spelling it out but we would like to keep this hush hush if you know what I mean…

Little “r”obert is upset because he’s facing the reality that in addition to his job as a realtor, he’s going to have to do some handyman work in the neighborhood to make ends meet.

Great post! I wish there were more of these types of postings on this blog. Excellent work.

I bought several homes in Simi Valley many moons ago, Indian Hills,The Groves,Bridal Path,Stone gate. I always thought Simi got a bad rap, the location for you folks who don’t know, Simi is ideal weather except it can get windy in fall a , very nice town of I think about 100k now.Tucked away in a valley of mountains.

Take care John, don’t think badly of me, these boards are classic internet, take with a grain of salt that includes me.

Enjoy your life in Simi Valley stay healthy.

I’m curious… show of hands… who here rents and who owns? Who rents that wants to own and who owns that would rather rent?

I own rather than rent. I live in Houston, TX. I bought much less than I could afford and am happy I did. Back in July 2012, I bought a 3 bedroom, 2.5 bath townhouse for $93k or so. We were the first owners, new construction. I bought because the monthly cost including taxes, HOA, insurance, etc. was substantially lower than rent. We’ve had a bit of a property boom in Houston lately, and this has pushed the paper value of the place to around $120k or so. I make about $100k a year right now, so I could definitely afforded something better.

The great thing about buying so cheap is that I’ve been able to make some massive extra principal payments. I currently plan to have the mortgaged completely paid off sometime in 2015. I’ll be 28 then.

Tanya, you are smart. My wife and I are both 45 now. We bought early in life too. We also bought cheaper homes we could afford, independently before we met and married. after we married when we were 36 years old, we sold her condo to pay off my house. Not having a mortgage gave us financial freedom to save about 60% of our combined monthly income. We eventually “traded up” to a much more affluent neighborhood and paid cash for our current home. It didn’t stop there. In 2011 we bought second home to rent. The mortgage on that one is $1905 and the rental income is $3100. We will never carry a mortgage on the home we live in again. We haven’t had a mortgage on our primary home since 2005. The financial freedom is too valuable. In the race for financial success, the tortoise will beat the hare every time. Just be patient and diligent and you will have financial freedom sooner than you think. Drive old Hondas that last forever and drive them to no less than 200,000 miles. NEVER EVER lease a car. No matter what financial advisers or tax people tell you, it’s a lie. Leasing is bad. Live within your means, prepare for the rainy day and save save save. You are on the right path and you have the right idea. You’ll get there for sure.

You’re probably too young to remember Houston’s oil crash back in the 80’s. Point is, things don’t always move up. Fortunately you didn’t purchase above your head which is what most people in SoCal do. Then again, that’s what most people in SoCal must do these days if they are to get their foot in the property door. That’s why this blog is here. The realities of Texas don’t apply much, other than a lot of people are leaving SoCal and moving to Texas.

On another note, what would be even smarter would be not to make additional principal payments and instead put that money toward investments earning a higher rate of return than the mortgage rate. Currently she is simply saving the rate of the mortgage, which in ’12 wasn’t much.

Tanya, you got a great deal for new construction.

I now own- last year, purchased a very sweet Chicago 5 room 3 bed 1930 vintage for $67,000, far below my means. It was in “move in” condition, though with the usual old building issues, which you expect if you are a vintage-lover. Nice kitchen with newer appliances, beautiful dark wood floors, large rooms, two huge bay windows, vintage details intact.

I’m glad I bought last year, but I’m REALLY glad that I couldn’t buy in 2005 because all my “low ball” offers were rejected for places that had half the space and amenity of this one, but were priced at $140K or higher. They are lucky to fetch $50K now.

If you are buying well within your means, at rent parity or not much above, and you like the place and the area it’s in, you are most likely doing the right thing for yourself. But if you are stretching to buy, have no savings, “chasing” the market to buy a place that is priced at a ludicrous premium over rent parity, you are going to shed many, many tears.

John S, the tortoise will beat the hare — provided he lives long enough.

I knew a high-powered yuppie couple in New York City. Husband had three degrees, including law and MBA. Wife was a VP at Citibank. They made big bucks, having studied and worked long hours all their lives. They bought a luxury co-op in Manhattan’s East 80s, with 24/7 doormen.

Their future was bright, but only a few years after their co-op purchase, the wife died of cancer in her early 40s.

So while many hares end up in in poverty in their old age, having saved nothing, there are also tortoises who die long before collecting their prize.

You should plan for the future, but also live for today. A difficult balancing act.

I have to agree with Son of a Landlord here. I’m an example of being a total Tortoise. Started looking for a move up home a full 10 years ago and for various reasons never decided the time was right. Now a year or two from retirement I’m realizing I never will get that move up home and instead probably just buy a place out of state to retire to.

So by waiting I’ve essentially denied me and my family a 10-15 years of nicer living. In a purely financial sense this may have still been the right choice, but life is finite and sooner or later we all just run out of time. Make your choices accordingly.

good on you Tanya! that just how my wife and i retired at age 45.

Own, in Houston.

Currently spend about 19 or 20% of pretax income on PITI for our house. 15-year mortgage at 2.875%. “McMansion” on tiny urban lot. Spend more than 11% of pretax income on private school, because local elementary not great, middle school so-so. Ouch.

But no state income tax, easy commute, climate tolerable for 1/2 the year.

@own=owe’n

Sold my condo in Culver City. Currently renting walking distance to the beach. Rent, gas, electricity, cable, internet, trash, etc, comes out to about 12% of my gross income. I have no desire to buy in my neighborhood as that would mean PITI of about 30% to 35% versus my current living expenses of about 12%.

I own a condo in Santa Monica. Wish I owned a house. Preferably in Santa Monica, north of Montana. I know that won’t ever happen. Only houses I can afford in Santa Monica are in the Pico district, near the 10 freeway.

I’ve looked at houses I can afford in Culver City, Pasadena, Tarzana, and Studio City. They were okay, but not worth the asking price, and since I’m not in love with those areas, why overpay?

I’ve also looked at houses in Seattle, and may soon fly up there again. They say it’s expensive, but really, houses are a bargain compared to L.A. And I love rainy weather — and no state income tax!

If it weren’t for Seattle on my mind, I’d likely have bought a house in Pasadena or Studio City by now.

I am loser renter and feel shame. I can not get a date until I own property. I someday hope to be winner owner then I will have a shot at a date and then I will hold my head up in pride of ownership of the greatest “investment” of all…

you crack me up

I can assure you most on this site rent, they are bitter they never bought a house when they had the chance. These people are procrastinators, I have come across them all my life, while I was buying and selling they were asking why, today I live in a top 100 zip code, can afford anything I want.

I also just yesterday because of the news of new sales down started to visit new homes because you buy on bad news always?

Bought my first house in 1986. Became a renter mid 2004.

When the sale of a modest house is enough to fully fund a modest retirement, prices are out of whack!

Enjoy your house and I will enjoy my money.

robert,

I can assure you nobody on this site is envious of you. You chose the snake oil sales profession. Deal with it.

Martin, curious in this ZIRP world how you are enjoying your $400k?

* Bouncing between 0.5% and 1% savings accounts

* Investing in facebook and watching them spend $15 billion on some app nobody heard of

* bonds, James Bonds

* put in on a pallet and do a reverse swan-dive on it Breaking Bad style

* speaking of BB, investing in an RV and going into biz with a disgruntled ex-high school chemistry teacher

*

“I can assure you most on this site rent, they are bitter they never bought a house when they had the chance. These people are procrastinators”

Either you are a troll or an idiot. I’m not sure which one but anyone who can count, _won’t buy a house_. At least in this so called “market”.

But hyenas feed on other people’s failed investments and lie anything to get something to eat, not being able to kill anyone by themselves.

Thomas, robert [sic] is our resident housing cheerleader du mois. We tend to get these folks on a somewhat rotating basis who make it their duty to label non-members of the housing industry cabal as “bitter renters.” This is just part of their play book.

Always gives me a good private chuckle, since I’ve been a homeowner for going on two decades. What’s that old phrase, don’t cut off your nose to spite your face…. Yeah, that applies to us home “owners” as well.

Own, but open to renting. We bought a 2,070sf 4/2 in Temecula in 2009 with 20% down (50% equity in today’s market, LOL). Refied to 3.66% a while back. It backs to a beautiful private park and we spent oodles of money upgrading in non-trendy ways (NO granite, for example). Needless to say, this will be a major cash cow for us in the future. Dual white collar income, and we live within our means – newer paid-for mid-$20k Japanese cars, no debt other than the mortgage, which is $885/month. I’m only cheap where it really makes a difference – I mow my own lawn and do my own brakes. Decent nest egg. Great school district and people who are very noticeably friendlier than those on the San Diego coast, where I spent many years as a renter. Downside is the 1-hour commute, but the early retirement (and eventual swim-up bar and 4-car man cave) will make up for it.

Next on the list is to buy a 3/2 for the inlaws in 1-2 years, and we’ll charge them a couple hundred less than market in exchange for ten years of stable rent.

I hope to buy a few more rentals, pay off the current primary, and upgrade to something with a guest house, all in the next 10-12 years. With timing dependent on what the market does, of course. I have goals with hard times in mind – the first being the ability to survive on a single minimum wage income, if it comes to that. The second is to have enough passive income to cover the primary PITI and utilities (even if it’s a $1m house). We’re also prepared to go several weeks without water, gas, or power. Ultimately, in the big house, I’ll install solar and drill a well.

I live in the Bay Area, and as much as I want to believe what Dr. Housing Bubble states, I just keep seeing prices go up, up, and up. Inventory does not seem to be growing at all…def not 6 month supply. 3Bd/2ba 1,500 sq foot houses that were built in the 60s and 70s are going between $800k and $1MM in Fremont by Indian families or Chinese investors. These houses were between $600k and $800k a year and a half ago.

What is a realistic outlook on a pull back? I am house horny primarily because I’m a potential first time home buyer with a young family and would like to settle down, but I can’t imagine sinking in my life savings and $3.5k monthly mortgage on a “starter home”

I think I’m doing well (I make nearly $200k), but I feel extremely poor living here.

“I want to believe what Dr. Housing Bubble states”

What is Doc stating that you don’t believe? He’s pointing out that it’s nucking futs and doesn’t make good sense, especially where you live. Everything else you wrote indicates that you agree with that premise.

“outlook on a pull back” – who the fuck knows? We keep repeating over and over that there’s no crystal ball.

Good grief, you have to purchase a home to “settle down” – what does “settle down” mean?

Don’t mean to be hard on you but come on, man, the state of things are telling you everything you need to know.

By settle down, I mean to stay at my job for the long term, own a house that my kids can grow up in, and update a house to my wife’s liking. We’re currently renting, and we don’t feel settled because our landlord can raise rent yearly and we can’t update the house up to the standard we want to.

We wanted to buy a few years back, but we didn’t have anywhere close to the down payment we needed, and now we’re ready to buy, but we’re priced out.

Every pull back has a trigger, and I’m not sure what that is. Yes, I get that pricing is out of whack, investors are slowly getting out, and houses are staying on the market longer, but that doesn’t solve the inventory problem. Without shadow inventory being unlocked because the govt is allowing homeowners who are not making mortgage payments live in their houses for what appears to be forever, what could cause inventories to increase? From what I hear current homeowners in the bay area are not selling because they don’t know where they can move to. The situation is totally f’d.

My plan is to stay on the sidelines until this is resolved, but just asking the community what’s the trigger for change?

An increase in interest rates or the correction in the stock market . . . or an earthquake. Would be interested to hear what others think about how the troubled Chinese economy will affect SF and LA/OC housing.

“We keep repeating over and over that there’s no crystal ball.”

Actually Only Son of Landlord purports to have one but won’t share. “I see…”

What, I never claimed to have a crystal ball.

You merely assumed I did. You must have, because you asked to borrow it.

SOL – and yet here we are…

@GenXer

In trying to gauge Chinese investors, keep an eye on the Dollar/Yuan exchange rate. The Chinese currency is dropping again versus the dollar which is catching many investors off guard. In the past few months the Yuan has dropped about 3% or so. Thus, the Chinese investor can add 3% to the price of an American home.

Canadian investors (very active in Phoenix) have seen their currency drop 8% or so . They’ve slowed their purchases to say the least. If the Chinese currency continues to drop they too will slow their purchases.

JQ – You are completely wrong!!! Rich “Red” Chinese have bottomless suitcases full of money. Translation shmanslation, nobody cares about currency when it comes to “Red” (God I miss blert, I hope he is ok…) China. They wipe their backside with gold leaf toilet paper. They would never be caught using useless currency to wipe. The “Red” Chinese will have bottomless cash fo-eh-vah and fo-eh-vah!!!

Canadians are “Red” Chinese in Peter Sellers like comedic disguises. They don’t fool me, they have the same bottomless suitcases of money that will never run dry. Ne-vah e-vah!!!

How-zing to go up fo-eh-vah!!!

@What

You watch too many movies.

Speaking of movies, I just fixed my flat panel tv by replacing 4 2200uf capacitors! I read that they put under powered caps to make the tv go bad in a couple of years. I replace the 10 volts with 16 as suggested so I won’t have to replace them again… Take that you rich “Red” Chinese slave worker! One less tv to be sold this week… That should slow these rich “Red” Chinese from taken over Merica!!!

Johnny Utah, if those Indian and Chinese families want to pay the fool’s price for those far out Fremont shitboxes and be left holding the bag, fuck ’em.

Would you really enjoy living amongst them as the lone stranger and odd neighbor anyway? Really think about that. I shudder at the thought of the odors wafting through and saturating said neighborhoods in the coming years…

I’m happy to hear those H1Bs are throwing their money away overpaying on those 50 year old shitboxes – they say a sucker is born every minute and given the populations of India and China, both countries are chock full of suckers no doubt about it.

It’s great that the American middle class families are cashing in and selling out to these greater fools from across the Pacific; let these foreigners be caught holding the bag while their money is soon departed.

These last two replies, which discovered what the U is in my handle was, were hilarious! I agree with the statements, but Fremont is a nice central location to Silicon Valley and SF. Also, the schools are highly rated. Obviously, if I didn’t have a family, I wouldn’t want to live here.

All jokes aside, what I’ve described is not only occurring in Fremont, but other suburbs in the Bay Area – Sunnyvale, Santa Clara, etc.

I grew up here in the Bay Area and have gone to great lengths to get back here after a lot of education, and I feel like I’m being driven out by “H1B visa folks” and investors. I never considered leaving the area after getting back here, but now it’s just down right ridiculous.

I’m sure there are many folks in the LA/Irvine/San Diego areas that feel this same pain. Not looking to live the high life, but a reasonable life within my means.

Any insight from folks on what could cause a trigger for a pull back? At least here in the Bay Area, it would have to be another dotcom bust and all the new folks who have come to the Bay Area over the last couple of years would essentially get let go and move away…

RE: H1b Visas. Let’s abolish them. Sign the petition.

http://www.petition2congress.com/7637/abolish-h1b-visa-program/

The Bay Area hasn’t had a major crash in some time. New developments are in short supply unless you travel far from city centers. Lots of prop 13 folks too. Interest rates would have to sky rocket and the Nasdaq would have to tumble for a real meltdown to occur. I grew up there as well and the place has changed dramatically. It’s well on its way to becoming like L.A. Sad but true.

“It’s great that the American middle class families are cashing in and selling out to these greater fools from across the Pacific; let these foreigners be caught holding the bag while their money is soon departed.”

I’ve long wondered if that isn’t part of the design. Arb cheap labor and goods from the certain parts of the third world by giving them dollars, set up events which convince them to return those dollars in exchange for “assets” and then pull the rug out from under them by tanking the market for said assets. It would be fucking brill if it were to work while minimizing collateral damage to folks such as Johnny U.

About 30% of sales are all cash buyers. I’ve heard from several sources (agents, actors, lawyers, etc) that these are rich business men from China and Korea looking to park money for their heirs.

If threes

@Johnny U – I grew up in Irvine and am just looking for something small, because I don’t want to leave my hometown. My only consolation is that this weird pricing has happened before here and that it’s probably just a matter of time until the cycle repeats itself.

Over the next 5 years or so you will see a big number of houses coming onto market as older Boomers leave. Older Gen X’ers will also leave the area when their kids graduate high school – too expensive to stay in places like Fremont.

I live in the SoCal beach community of Corona Del Mar. Also, prices here just keep rising … now, 2 Mill gets you a tiny teardown from the 40s or 50s. That same place was about 1.3 Mill about 18 months ago. However, if you go way way inland, things do not look that rosy. In fact, way in there, it appears prices are stable to just slightly rising.

You must be a movie star……..

Johnny, you can do what we did – live in a house for 5 years while the kids finished school in a great school district. Not one rent increase in 5 years (great landlord). So the costs were controlled and we lived in an area we could not afford to buy in. It was plenty stable. Not perfect, not as “stable” as owning. But better than picking a house to buy where the schools aren’t good.

And I don’t see any signs of a pullback any time soon. Go look at the best schools, pick a few areas to target for a rental, and find one with a good landlord or management copmpany and find out if you can stay a few years. There are some decent rentals down near Pali and Gunn in Palo Alto, if that is the type of HS you want. Honestly, it can be done without buying. And then you won’t have bought at a peak. But a house in a “decent” area, those are the first to take a dive in value when the musical chairs music stops.

Please review the data, your position on “decent” areas does not jive with recent events. For example, Irvine low end housing dropped around 30%, the peak to trough in some areas of Irvine was only 18% on the last cycle. Then take nearby Lake Forest, peak to trough was at a minimum of 30% and in the mid end neighborhoods it was more like 45%. Also, Irvine had a delayed reaction to the bust relative to places like riverside. So, in fact, during the last cycle, decent areas held their value better and held their value longer before dropping.

Were you the guy talking about confirmation bias?

“Of course what the press fails to recognize is that Americans for the most part are too broke to afford homes…”

Don’t be silly, Dr. HB! Of course the press recognizes Americans are too broke. But they have their marching orders to tow the line and report what the powers that be want them to report – nothing but propaganda aka lie through their teeth.

Speaking of the press. I was very worried when I heard on NPR this morning that sales for existing housing is way down. I was then reassured to hear that the cold weather was to blame and that builders/NAr are very optimistic that next month will be much better. They also said that more good news was that the median house price is now at all time highs.

How-zing to go up fo-eh-vah!!!!

The media’s continuing reliance on NAR mouthpieces as the voice of authority is annoying.

For the NAR, it’s always a great time to buy and they get free advertising. Prices up? You should buy now before they go up more. Prices down? You should still buy now.

I rent rather than own in San Diego. I’m 25 and have $110k saved up towards a downpayment and zero debt with a $100k plus career. Prices here in San Diego are definitely “wishful” these days, with a meteoric 20%+ rise in prices over the last year. At this point an under 1000 square foot fixer in a decent neighborhood goes for over $500k. I just can’t justify these prices and prefer to rent.

I currently pay $900 all included to live 1/2 block from the beach in a rich area and enjoy my extra savings. I hope that the market returns to normal in the next several years, but who knows? If prices recede 15-20% I will feel more comfortable buying. I don’t expect a 50% drop or any other doomsday prophecies. Time will tell if my waiting was worthwhile, or if prices will continue ever higher.

This makes sense, but prices here in Santa Barbara are going up as well. supposedly, March had the biggest increase in prices and sales! So are investors buying these million dollar homes? Rent is going up, too. We make good money, like the family in San Francisco, yet I don’t feel I can afford to buy. I am just not seeing what this article is saying.

First up, last down.

That would be LIFO. Last in, first out accounting… 🙂

Low affordability during a period of record low interest rates is alarming.

For most of the country, low rates have driven affordability today to be on-par with the past 25 years (NAHB/Wells Fargo Housing Opportunity Index (HOI) @ 65%.

California really is the outlier. Re: major metro centers, San Francisco-San Mateo-Redwood City, has the lowest spot among major markets on the affordability chart (14.1 percent were affordable @ median income of $101,200).

Other major metros at the bottom of the affordability chart included Santa Ana-Anaheim-Irvine, Calif.; Los Angeles-Long Beach-Glendale, Calif.; New York-White Plains-Wayne, N.Y.-N.J.; and San Jose-Sunnyvale-Santa Clara, Calif.; in descending order.

All of the five least affordable small housing markets were in California. At the very bottom of the affordability chart was Santa Cruz-Watsonville, where 18.6 percent of all new and existing homes sold were affordable to families earning the area’s median income of $73,800. Other small markets at the lowest end of the affordability scale included Salinas, San Luis Obispo-Paso Robles, Napa, and Santa Rosa-Petaluma, respectively.

Housing is always going to be less affordable in nice areas of California. To many people and not enough housing in the economic centers. Your options are to rent at an outragous price, buy at an outragous price or move to a cheaper area. I don’t see this changing any time soon.

Always!

Fo-eh-vah!!!

Yes, the California delta versus the rest of the Republic has been there since the ’70’s. However, it’s common knowledge that Ca is boom-bust state…so, are we in period of normal “sunshine” delta or is it full-blown speculation?

Survey says….

Ghost – of course you mean that the non “prime” areas are boom and bust because we all know that “prime” areas like Culver City, Sun Valley, South Central, Inglewatts only go up.

Yes, and home prices in California, especially SoCal will continue to go up by 25% a year, every year, forever!!!!!!!! Let us ignore that most of SoCal resembles third world cities like Tijuana, not first rate cities like London, Paris, etc.

Please also ignore the fact that wages in SoCal have been largely flat since 2007 in absolute terms, but declining when adjusting for “official” inflation of 3% per year.

flipping is alive and well in OC. this flipper is going to make a nice profit on this deal

729 East Hoover Ave Orange, CA 92867 – I had a chance to buy it for $435K too, but I passed on it, I thought ARV was $625,000 so I passed because it was too skinny….boy was I wrong

purchased for $435K cash, probably spent $100K on rehab did a very nice job, now it’s pending for …..drumroll …… $725K. After commissions paid, I bet this seller pockets $110-$120K in 90 days.

but looking at this sales price of $725K I have no idea how it will appraise, the highest comp in the area is $650K

Status: Pending Sale

ML#: OC14064995

APN: 37517106

Orig. List Price: $724,900

HOUSING TO TANK SUPER DUPER MEGA HARD IN NOV. 2013!! OR MAYBE APRIL 2014….OR MAYBE JUNE 2032. YOU’RE GONNA BE RIGHT SOONER OR LATER JIMMY

There’s a sucker born everyday. From PENDING to ACTIVE in the next 2 weeks.

Housing is booming in West Hollywood. Check out the profit this seller made in 4 years; $800k. http://www.redfin.com/CA/West-Hollywood/410-N-Alfred-St-90048/home/7095163

This isn’t a flip. I don’t think they did anthing but upgrade the kitchen. The buyer just bought and sold at the right time.

The price history on this place is incredible too.

This isn’t the best neighborhood either. There have been several murders in the area within the past few years, there are a lot of homeless people that gather on Beverly Blvd just down the street, and the ghetto bird makes almost a nightly appearance. I lived a few blocks away and know the area well. If I had $1.9m to spend, I wouldn’t buy here. I’d do the cheaper areas of Beverly Hills or Westwood, where you can get almost as much house for the same price.

man, wish I had bought that in the ’90s. Or in the early 2000s, or in 2005, or in 2010.

But this time is different. What a fool.

2005? Really?

Ghost – the year really does not matter if you buy in “prime” areas because they will always go up.

buyers paid $1.9M cash for 410 Alfred, wow talk about a payday for the seller….but he put $400000 down when he bought it in 2010. So he already had some $.

But $800K profit…sheeesh I think I’d buy myself a Lambo as a gift

That house on Alfred is a very sweet house, but not worth anything like $1.9M. I would think more like $700K, and then only because it’s in coastal CA.

If you can bear the thought of living in the midwest, here is what you can get in Chicago, in a very quiet, safe, north lakefront neighborhood, Peterson Woods (W Rogers Park area). It’s about a mile from the lake and train, and the neighborhood is very safe and beautiful, just very dull and distinctly not trendy.

http://www.redfin.com/IL/Chicago/3007-W-Hollywood-Ave-60659/home/13519261

For a fraction of that house, on the dry/sunny part of Washington state, in the wine country of Walla Walla, this is a brand new house you can buy with views to the mountains on top of that and very mild winters

http://www.wallawallarealestate.com/residential/269coyoteridge/269coyote.html

Trouble is, that house in Walla Walla is a charmless tract house with ordinary appointments and no architectural distinction, while the Chicago house is a miniature palace, with wonderful architecture and exquisite details, in addition to 4 beds, 5 antique baths in perfect condition, and even its own little creek on an ample lot.

Sure, the climate here sucks, but we have beautiful springs, summers, and falls, and the place is in a very safe, calm upper middle class neighborhood within walking distance of stores, professional offices, schools, buses, and fairly close to the commuter trains and the lake. Great combination of suburban feel and urban amenity, in a slightly out-of-the way neighborhood where houses are priced at half what comparable houses would cost in the pricey inner city nabes just outside downtown. You can easily access the north shore suburbs of Evanston, Lincolnwood ( a few blocks west), Skokie, Niles, and further north.

And it’s a good 15- 25 miles away from the locus of most of Chicago’s violent crime on the south and west sides.

Most of the buyers perceive value in price per sq. ft. not charm/character. I agree with you that some look for character. If that is a factor, here is another listing with character

http://www.wallawallarealestate.com/residential/2620wainwright/2620wainwright.html

Actually, the whole town has character. The house is still a fraction of the cost, built with reinforced concrete not card box, creek on the property and area of $800,000 homes (average). Winters are like Spring in Illinois and unlike CA or IL there is no income tax and low property taxes.

Ghetto birds. The official bird of Los Angeles which has an unmistakable mating call. There’s nothing quite like being slowly awakened from a midnight summer sleep to the droning yet jarring sound of a police helicopter hovering overhead, oscillating between far and near. Every city has its unique soundscape. The ghetto bird belongs to Los Angeles.

The upper class neighborhoods have the mating call of the blower moose. Loud 2 stroke engines with the mufflers removed to ensure that all mates will hear the call within a 10 mile radius. Yes, I too miss the peaceful sounds of paradise…

I don’t mind the helicopters and leaf-blowers. Once I was walking late at night in Santa Monica. There was a police incident. Lots of copters and cop cars. They were apparently looking for a burglar. One police copter shined a spotlight on me for 10 or 15 seconds, then moved on. It’s nothing. Just part of living in L.A.

I’ve a friend in Manhattan. When I visit him in his lower Eastside co-op, I hear sirens whizzing by outside on a regular basis. It’s nothing. Just part of nighttime Manhattan.

Copters in L.A. and garbage stench in Manhattan. Sirens and homeless and traffic in both cities. These are trifles. There’s still much to recommend L.A. and NY. Lots of events happening, things to do, places open, day and night. I wouldn’t mind the drawbacks if only these cities were cheaper. If only one could afford a decent house (not a townhouse) in a nice neighborhood, with a yard and privacy and some respite from the city chaos.

This wind to happen with the high unemployment rate and stagnant wages. Except for tiny pockets of growth (like Houston, if your an experienced engineer), most areas are beginning to look depressing.

“most areas are beginning to look depressing.”

Try squinting… I have found that it makes things look better… Sometimes…

I can tell you the latest 90 day MLS in a top zip code was 89 listings over $750k and 38 sold. 4 sales were not listed, owners wanted them exempt from MLS. This is not bad and certainly it should tell you people have money and are still buying, no matter what you read.

The lady doth protest too much.

I’m not sure what you believe you’ll accomplish on here. Shouldn’t u be out there raking in all that doe from ur RE sales?

3,000ft building envelop? Now that is a project I must see even in San Diego county you get at least 6,000ft and that is very, very over priced locations.

Economists “Stunned” by Housing Fade:

http://www.zerohedge.com/news/2014-04-24/schadenfreude-economists-stunned-housing-fade

One commenter sums it up pretty well.

“Economists “stunned” to find that water is wet.”

This so called “housing recovery” is a SCAM created by the Big Banks and The Fed.

This is all going to end very, very badly and you must be a complete fool or a sucker to fall for this scam. There is no reason to believe that the echo bubble is any more stable than its predecessor, as it largely depends on all sorts of government interventions, with the Fed’s money printing and interest rate manipulation the most important.

Wall Street firms buying up homes in REO-to-rental schemes don’t represent organic demand, and in fact only serve to price out potential first time buyers.

The Fed and the Real Estate TALIBANS are trying to reestablish what is essentially an unsustainable charade. As the middle class continues to compress and lose real purchasing power, so too the housing market in 90% of zip codes languishes in a depression.

Young adult underemployment and unemployment is at levels that causes family formation to be delayed by years and the labor force participation rate for all potential workers is at 35 year lows.

Â

As goes the middle class, so goes housing.

Unless you are really “house horny” and want to fund someone’s else retirement with your hard earned savings go ahead and buy today.

So…. you are saying to buy now or forever be priced out?

Has this home ever not been for sale?

Come on cash investors, its trendy Silverlake!

Look at that price history. Just list that baby in the Bejing newspapers man.

http://www.redfin.com/CA/Los-Angeles/1329-Silver-Lake-Blvd-90026/home/7059130

My friend in Munich… After renting for 2 decades, he has 0 savings. Home ownership can be seen as a forced savings account. He would have some equity and at 45, we will not be able to afford Munich prices when he retires…

OTOH, in Thailand, where I live (making a bit less than $ 1,000 as high school teacher while renting apartments often for about $ 50) home ownership often makes no financial sense. But folks are crazy about it.

Friend A, she spent $ 50,000 on a weirdest small 1 BR apartment with a 2 story floor plan and about 33 m2 or <300 ft2. She could have rented the place for maybe $ 225. HOA fees? Paid by a LL. The bedroom was upstairs and there was either space for a table or a couch, not both. Forget the usual closets and space to store stuff… I should have yelled at her, but she bought it "for her daughter" who was then 13.

Fast forward a few years and they have moved. It was clear the daughter might study somewhere else…

#B. A town house in NAN costs $ 55,000 or it can be rented for < $ 180. what would you prefer?!?

#C, i saw a villa costing $ 6xx,000 for rent @ < $ 1,500. What would you choose?!?

Well, folks can build wealth by hanging in there and making those payments.

Way too much math. First you have the metric system and the “English” system (which England no longer uses) and I have to translate dollars, baht and euros. But hey what if they bought not baht it before the euro? We have to include mark or was it deutschmark or dachshund…

“After renting for 2 decades, he has 0 savings. ”

If he has zero savings after 2 decades of renting, where do you think he’ll get the 20% downpayment? Tens of thousands. Or how can he pay the loan back if he can’t save anything?

Obvious “no loan” from bank. And there’s nothing this guy can do it, he obviously doesn’t earn enough to pay a mortgage, it’s stupid to even offer him one.

The Observer…I don’t post to make anyone feel inferior, envy is a terrible trait it only brings a person down. I want people to know for every bad graph and story there is opportunity out in the world.

Just two days ago I visited a new housing development, I looked on the board chose the house with a good lot and 3bed 3 bath added 4th garage for value. Asked what incentives because of the downturn, of course they always say what downturn?

I responded, look at your board lot of red stickers very little blue, how about I turn lot 11 into blue with a offer. He said, I’m a temp today, so now I know the decision maker was the young lady in the leather chair listening and pretending she was busy.

I ask her can I make a offer on the total package lot premium and house with a incentive for up grades, they never want to discount the house fine but the lot premium it is always up for negotiation

I don’t know she said, I told her you are the manager right and can present a offer to the builder making her feel very important. She smiles, yes let’s write a offer, I submitted a price reduction on lot, upgraded kitchen package,floor allowlance, elevation #2 more stone, and paver driveway.

This home is at $181ft, the location within two miles Resales at 268ft avg. If I get this home I must put in curb appeal landscape, pool and window coverings.To make this deal I can’t concide anything to the bulider.

Well he comes back early this morning this tells me they need a deal and concedes very little, of coursev

“I want people to know for every bad graph and story there is opportunity out in the world.”

The prophet of housing is here, we will all be saved. The church of housing ladder day saints is now in session.

Of course, we need a sermon because we’re all too stupid to know that when we smell shit, there’s a rose bush to be found around some corner.

TO continue they want a back and forth, I ask for my check back and the lot11 stays red

They have my phone number, so don’t envy me because like you all I want a deal when times show a new housing drop of 14%. The builder could easily have made out my offer, but they are not business people I guess so the join the ranks of a unsold new house?

Go back in a month’s time to see how rejecting your offer worked out for them. Tell them your offer is still on the table, LESS 5%

Calgirl….Keep looking no problem, but I have years in real estate, landlord,auto business. These are all people oriented, almost everybody I ever dealt with loan apps,sells ,buying etc. were not renters?

This is not to say nobody should rent, that is crazy, but overall the vast majority of people should own something in life, no better feeling then opening your door to your house and not somebo

I remember GW pushing an “ownership society” around ten years ago. Man, that worked out so fantastic for all of those who got foreclosed on! Imagine the feeling of opening the front door of “your” house to see the face of a process server! What a wonderful feeling!

Those sleepless nights wondering how one is going to make the payments and the constant harassment by phone and mail – no better feeling in the world than that! It’s totally worth it though, because “the vast majority of people should own something in life.”

i can block numbers pretty easy on my IPHONE.. do it all the time.

Right, because ignoring their calls will keep the judge and sheriff away.

I couldn’t agree more – but at the right price. I witnessed the madness back in 05-06, people camping out overnight to enter new home “lotteries”. I couldn’t believe what I was seeing. A lot of these people buying these inflated McMansions were blue collar workers leveraging themselves to the hilt on ARMs and negative amortization loans. I thought they’ve all gone nuts. 3 yrs later their “home” had lost 40% of its value, their ARM loan had adjusted and the downward spiral was well underway.

I have 15 yrs in Investment Banking experience under my belt. I watched markets for a living. I know what drives supply and demand. It frightens me right now because for the first time in my professional life I can’t see the underlying fundamentals due to massive monetary manipulation by the feds and the collusion between investors and the banks.

I’d love to own but I will not dig my own grave financially. Until the right time rolls around and the numbers make sense and are sustainable, I’ll continue to own my fully funded pension, 401k, good amount of cash in CD’s (pathetic return ..) my paid-off 4 yo car and pay my landlord relatively little for a seriously nice 8 yo home in one of the best neighborhoods in the Sacramento region. I’m biding my time.

“I have 15 yrs in Investment Banking experience under my belt. I watched markets for a living. I know what drives supply and demand. It frightens me right now because for the first time in my professional life I can’t see the underlying fundamentals due to massive monetary manipulation by the feds and the collusion between investors and the banks.”

I am sorry but I keep entering this statement into the computer and keep returning a “fatal error” message code. I went online and looked up the fatal error code and it appears to be a conflict with “15 yrs†and “for the first time in my professional life I can’t see the underlying fundamentalsâ€. I read further on this and it appears that there is a known bug with 2014 minus 15 equaling 1999. The problem is that there are two events in this numeric sequence (1999 – 2014) that includes 2000 and 2007. We are still waiting for a fix for this bug and the current workaround will be to replace 15yrs with 7 yrs. The vendor states that they are sorry for any inconvenience this issue may have caused and are feverously working for a permanent resolution which will be available in the next patch update.

Again ito continue …not someone’s else property. Take care, try every avenue to buy, the future in America is for upward movement, a country likes this never gets stale.

Never!

To Builder…Excellent post, the little women is in control for sure, also no question the buyers still want all the rooms they can get.

2125 Vallejo – Thar she sits. Still waiting. On something. To happen. Man, this flipper is gonna get rich off of this! Perhaps buy a lambo with the profits.

http://www.redfin.com/CA/Los-Angeles/2125-Vallejo-St-90031/home/6945511

4431 Don Ricardo Dr #18 – Condo flipping is here, folks! Get in before you’re priced out forever!

http://www.redfin.com/CA/Los-Angeles/4431-Don-Ricardo-Dr-90008/unit-18/home/6878708

I will go you one better. Came across a MLS sale at $2.4m told it was all cash. ( no appraisal needed). I thought I knew this house but couldn’t relate to sale with this home. I drove over to find it was the fully option to the hilt production house from Toll Brothers. The price of this glorified custom according to records was for $887 including landscape -pool package. It was purchased 9 months ago.

Can you imagine this neighborhood now with a comp like that. Previously the highest closed price was $1.258m.

Of course the obvious question, can you find another Phi Beta Cappa dummy to pay $2.4m cash for a total production house, the answer I’m sad to say is probably yes.

Bit suspicious it wasn’t just a way to launder a sizable wad of money.

You have to either assume someone with 2.4m in cash is a total maroon (possible), or that they know something we don’t.

My brother in law said the same thing, cash for that house, sounds like a few deals are going down in that house, and money will fly over to another country.

By far the best way to launder money is through real estate…

No question about it, all the bank says “is there a paper trail ” typical question they must ask. Cash is sweet music for a deal to happen quickly.

How will SoCal prices go down if inventory doesn’t loosen up?

1) Prop 13 lottery winners aren’t going anywhere

2) Weak hands from 2000-2007 have been shaken out

3) Very little new construction

4) People who refinanced aren’t going anywhere

5) Few move-up buyers to create churn

6) Cal’s illegal immigrants are staying put knowing amnesty is coming soon

7) 30% or so still have no or little equity

8) Rising rates won’t impact inventory

9) Prop 13 allows transfer of golden sarcophagus to offspring

10) As America’s 99% continue to slide, pessimism will continue to keep people locked in fear and staying put as long as they can

This is a excellent common sense post. The ultimate standoff, buyers wait and wait, sellers really can’t list, in the end housing recovery will be at a standstill for now and then decline, not good for the economy.

Please bring back the good paying jobs and security , American’s love to spend and be secure at the same time, heck the mass majority pay their taxes, they aren’t asking for much Wash DC. The American worker is the best investment in the world, help them.

Things change and most of those points are a guess as good as any. It would have been just as easy back in 2006 or so to come up with a ten point list of reasons why prices weren’t gonna go down due to x.

Specifically on point number two, I’m not sure about that. Anecdotally, I know people in SoCal who are still living in their homes after not paying their mortgage for years. I’d say they qualify as “weak hands.”

– Falling rents and increasing vacancies, plus massive over building of apartment complexes happening now. The herd that when crazy last year moves on to better investments.

– Increasing interest rates and fear of being underwater for a very long time.

– Boomers cash out and move to cheaper areas or their kids cash out inheritance.

– “Cash Buyers” turned out to be non-traditional home loans. Or properties were purchased cash to secure deal and lower price, then financed and another property was bought (repeat as many times as possible). Maybe throw in rental backed securities while you’re at it.

– Property tax increases to offset budget deficits.

– Removal of mortgage interest deduction.

– China’s economy crashes.

– Values in neighborhoods fall due to high amounts of poorly maintained Wall Street managed rental properties.

– Increasing unemployment or decreasing wages.

– Low household formation and student loan debt.

– Banks finish unloading their inventory and bad loans or allowed time expires for them to hold foreclosed properties.

There are plenty of reasons here too.

These are all side effects of the Polar Vortex. We should be good to go now. All signs point to up!!!

and last but not least…

– a real estate agent (robert) agrees with you!

Owner here in highland park Los Angeles. Bought amidst the hype in ’05 for 420k- A 1909 craftsman that needed A LOT of work. Did all the work to the tune of about 150k…didn’t know what I was getting into! Ugh..But it’s in great shape now. Watched in dismay while the crash happened but looks as if we’re back to the bubblicious prices attained in ’06 and ’07..I know the doc is referring to certain areas that are slowing down/flattening..but highland park? Was just looking through Redfin and saw 42 sales in the last month. Seems to still be hot from what I can see..maybe we should sell before the bottom drops out huh?? Probably won’t though. Only owe 350k on it which makes PITI quite manageable at 4.75%..it’s 1800 square feet 4 bed 2 bath..it’s more expensive to rent that size house in a decent neighborhood in LA..

“maybe we should sell before the bottom drops out huh??”

Nooooooooo!!!!

You bought at a peak. You need to sell the next valley to make it work. You know, buy high sell low. Somebody forgot their thinking cap… The good news is that your “prime” area will only go up fo-eh-vah!!!

Enjoy that house, sounds like you did a nice redo and you are satisfied. Unless sellers have a strategy in place or really need to move, please stay put, once you sale you are now out looking in?

Highland Park will be just fine. It’s going the same route as silverLake, Echo Park and Eagle Park. Good job.

“it’s more expensive to rent that size house in a decent neighborhood in LA..”

Probably wouldn’t drop $150K on the rental. Makes the comparison somewhat awkward.

Curious as to what qualifies as a “decent” nabe. By my standards, there are parts of HP that wouldn’t. Maybe someday. I’ve lived there and visit relatives there on occasion, so I do have perspective.

I love it, this person “What” says in a memo please shut out anybody with the name Robert? This is great, please don’t do business with minorities, non Christian’s, Middle East, (Remember gang a few weeks ago those “Indian Hindus folks are running it for us all”).

Love the American spirit, when you can’t cope you deny, no matter what a person post I defend their right unless it is pure racism or total profanity.

If What or anybody else thinks you are running me off forget it, I played hard ball in my life and got paid for it.

Grew up on the tough streets of Chicago, I given out a beating, I taken a beating many, many times but I don’t run.

My coal miner grandfather served time in jail to stand up to non-union thugs, they also wanted to shut him up?

In his honor I always defend the rights to express your thoughts and right of free passage for myself, family, and close friends, always have, always will.

So I say to this character What, don’t ever reply to me or anyone you deem not worthy,

You are the Pipe Piper of this blog, all will follow you, all but me?

Well this admintration continues on a no growth, no job platform. Keystone pipeline is

the perfect example to me. Anytime I see hard hats on men and women I smile, they are back to work and building something.

Politics I try not to get into, but I would gesture, no matter who you

support, how does one defend a handout society the last several years?

Anti business ,with no productive growth agenda means just that, stale ecomony and a

restless nation.

Keystone is not about the environment. If approved it will make a huge dent in the oil boom in the U.S. Canada can undercut U.S. oil. Fracking is by no means cheap when it comes to oil extraction.

look at this sale in burbank who is buying at this price

http://www.redfin.com/CA/Burbank/1426-N-Avon-St-91505/home/5321430?utm_medium=email&utm_content=home_image&utm_campaign=instant24_listings_update&utm_source=myredfin

This is LA, LA, LAnd and Burbank is a favorite place for people in the entertainment industry given its short drive to Hollywood.

As a life long resident of LA, I am no longer in ‘awe’ about home prices (in places like Pasadena, San Marino, South Pasadena and everything West of LaCienega) but rather in ‘awe’ of the amount of people that have so much money.

New REO for sale! Don’t miss the opportunity to get this charming freeway-adjacent home before somebody else does: http://www.redfin.com/CA/Los-Angeles/2447-Granville-Ave-90064/home/6756562

It has mature trees and is in a great community too, if you can deal with the noise and car exhaust fallout.

Leave a Reply