Economic Punch Drunk Love: 3 Fascinating Financial Stories Captivating the Market: CEO Being Punched, Bank of America Past Comes Back, and the Politics of the Bailout Plan.

What does getting punched at the gym, being forced to modify a large number of loans, and screwing over the American people have in common? It is all just another day at a comfortable and secure mahogany desk job for Wall Street and our politicians.

While a large number of Americans fret over a full blown economic collapse, the crony capitalist are doing everything to maintain their stranglehold on the casino which is otherwise known as the global financial system. This weekend a survey by the Wall Street Journal found that 6 out of 10 Americans felt another Depression was possible. That is a Depression with a capital “D”, not recession as in the mythical Great Depression which apparently most of Wall Street has forgotten since they fail to examine any historical context.

Some try to argue that there is little in common with our current system as the circumstances that plagued the 1930s. Actually there are many things in common:

(1)Â The Florida Real Estate Boom and Bust during the 1920s captivated a large part of the country.

(2) The roaring 20s saw a decade of decadence and keeping up with the Joneses. Think of all the people driving around in leased luxury foreign cars and taking second mortgages out to upgrade the kitchen with the latest granite countertop.

(3)Â A laissez faire free market President in Calvin Coolidge who pretty much allowed the stock market to do anything with little oversight during the 1920s.

(4) A Wall Street who gambled on risky investments and leveraged the world to make a quick profit. Margin accounts then. Credit Default Swaps and Mortgage Backed Securities today.

(5) Too much debt. Mortgages and foreclosures where a big issue back then as well. In 1933 the Home Owners’ Loan Corporation (HOLC) was created to give folks longer term mortgages to keep them in their homes. The program helped about a million people and put them in longer (20 to 25 years) fully amortized loans and the program was essentially spent out by 1935. When the program ended in 1951, 18 full years later it had turned a slight profit.

(6) An election driven by an unpopular President in Hoover presiding over an economic collapse ushering a massive uprising against the current administration. The economy was the number one issue as well in 1932.

Aside from these comparisons, you should take the time to read some of the Great Depression articles I have put together, usually from people in their own words of how things played out during that time. You’ll be surprised how similar things are because human nature with greed rarely changes. We can talk about moneychangers in Rome to Wall Street today, the core modus operandi rarely changes.

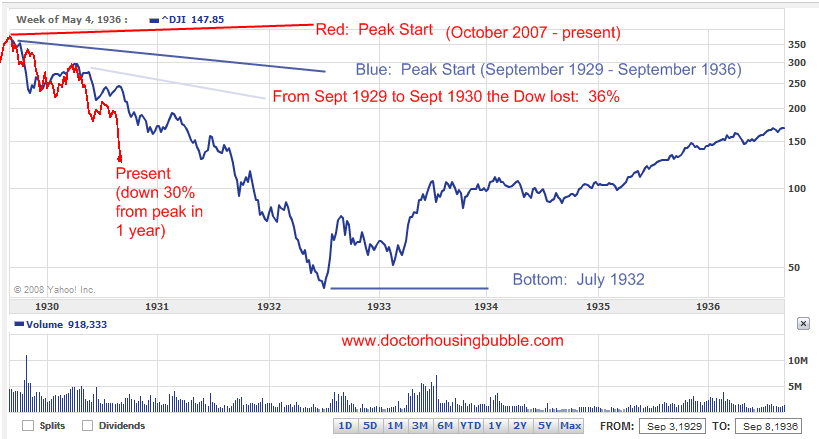

Before I move on to the 3 fascinating stories, let us look at a chart comparing a 7 year window during the peak in September of 1929 through September of 1936 and overlay our current peak reached in October of 2007. First, the important thing to note about this chart is that they are both on a 7 year scale but the percent change will not be reflected exactly on this graph, only the market patterns and timeframe:

*Click to enlarge

There is an eerie similarity here. The “Great Crash” of 1929 started when the peak was reached in September of 1929. If we are to look at the DOW one year later in September of 1930 we would see the following:

September 1929 – September 1930:Â Â Â Â Â Â Â Â Â Â -36% decline

October 2007 – October 2008:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â -31% decline

This is absolutely crucial in understanding the velocity of the current decline. First, housing is actually declining faster than it did during the Great Depression. Stocks are only trailing slightly as you can see from the chart above. In addition, you need to remember that with the removal of A.I.G. recently from the DOW and the addition of Kraft Foods, the DOW isn’t really reflecting the overall pain. Since the DOW is composed of 30 selected companies, this one move does skew the data. The DOW also includes companies such as Bank of America, JP Morgan Chase, Home Depot, and General Motors who all have been hit hard during the current economic collapse. The S & P 500 which may be a better indicator of the health of the market is actually down even more from the peak reached last year. The S & P 500 is currently down 35%.

When we examined the $810 billion bailout bill that was recently passed, all the bill does is create a dumping zone for toxic mortgages with little effort given to shoring up the fundamentals of the economy which at the nucleus is the middle class and sustainable employment. If you feel left out in the cold it is because the mainstream media, current politicians, and Wall Street care little about you.

With that said, let us move on to 3 stories that may be getting lost in all this market craziness.

Story #1 – Lehman CEO Richard Fuld Golden Parachute Includes a Punch

As the former Lehman CEO Richard Fuld was testifying to Congress on Monday, CNBC reported that Richard was punched in the face during a workout at the Lehman Brothers gym. The reason for the Ultimate Fighting Championship like move was the firm’s bankruptcy. From the reports being issued we get the following:

“From two very senior sources – one incredibly senior source – that he went to the gym after … Lehman was announced as going under. He was on a treadmill with a heart monitor on. Someone was in the corner, pumping iron and he walked over and he knocked him out cold. And frankly after having watched this, I’d have done the same too.”

Even though Congress may be waxing and waning poetically without doing a damn thing, some other folks have other ideas of what would constitute a matter of “equity” in these cases. I find it fascinating that when a desperate and poor person robs a bank and gets away with say $50,000 [if that much if the dye doesn’t explode and ruin the money] they have the book thrown at them. Here, we have people stealing much more than that amount and costing the jobs of thousands of people and leaving many others in financial ruin, yet their punishment is simply a public verbal spanking. Is that really justice? I now keep hearing people [mostly those who have much to gain from bailouts and covering their tracks] that we shouldn’t be pointing fingers. Of course we should! Let us go back to the bank robber again. Does the bank robber have the ability to say:

Bank robber: “Hey there officer! Sorry about robbing this bank. I just lost my job and got pretty desperate. If it wasn’t for my job loss, I wouldn’t have done this.”

Bank robber: “Hey there officer! Sorry about robbing this bank. I just lost my job and got pretty desperate. If it wasn’t for my job loss, I wouldn’t have done this.”

Police officer:Â “Put your hands behind your back before I zap you.”

Police officer:Â “Put your hands behind your back before I zap you.”

Bank robber: “Hey buddy. This is not a time to point fingers. Let us sit back and examine the overall picture. We should blame my company for driving me to do this. It is their fault. What you say we have a drink and chat about this?”

Bank robber: “Hey buddy. This is not a time to point fingers. Let us sit back and examine the overall picture. We should blame my company for driving me to do this. It is their fault. What you say we have a drink and chat about this?”

Police officer:Â [handcuffs on] “Get in the car and you have the right to remain silent…”

Police officer:Â [handcuffs on] “Get in the car and you have the right to remain silent…”

I am fascinated by history since it can serve as a guide for a better tomorrow. From 1900 to 1920, I remember an author saying, there was very little crime on Wall Street since everything was practically legal. Without any laws or regulations what they did was completely fair game. And who made these laws? Their corporate lawyers or what we now call lobbyist. He who writes the laws makes the rules. Given that logic, the $810 billion bailout bill has Wall Street written all over it.

Story #2 – BofA Faces the Ghost of Countrywide Past

When it was announced last year that Bank of America was going to get involved with Countrywide Financial, the uber toxic mortgage sausage maker I think most people really were wondering if it was worth putting the BofA brand on the line for this move. Something had to give. The initial bet was the market would recover and the bottom wasn’t too far away. When all was said in done, BofA would be the largest mortgage player in the market. Well as it turns out, things are much worse than once expected as Murphy’s Law would have it.

First in after hours, Bank of America announced a third quarter earnings result of $1.18 billion. This is horrific given the company has assets of $1.7 trillion. What compounded the problem even further is a settlement that would require Bank of America to modify many of the toxic trash Countrywide was peddling for years. Those $500 billion in Pay Option ARMs and other NINJA loans that were the bread and butter of the California market are some of the loans in question. Recent estimates put the cost being at $8.6 billion for the multiple state loan modification program.

Now think about this for one second. Your company just made $1.18 billion in the third quarter, an annualized rate of $4.72 billion and you have a settlement with an estimated price tag of $8.6 billion. You essentially have mortgaged two years of earnings for the horrid decision of buying Countrywide Financial! Not a good move and the market is giving Bank of America a high five for this move:

So the market has wiped out about 50% of the market cap of Bank of America in one year. So over $120 billion has evaporated into thin air and of course, bad moves have a lot to do with it.

Story #3 – Got Equity? Lobbyist Saw AIG and want Nothing of it

Okay, for this next story I’m going to have to ask you to put on your white collar crime thinking cap on. I think the problem with most Americans is that you do not have the greed gene that many Wall Street folks have. In fact, many have bought into the concept that if you work hard and do the right thing, you most likely will have a middle class life. In a nutshell, isn’t that the American Dream? If you work hard and live prudently you can rest assured that you will have a fighting chance at some stability in your life. This current irresponsible corrupt bank robbery [yes, pointing fingers] is putting that dream on the line. This is a battle to keep what is left of the dream from being annihilated altogether. The public had it right:

(a) The public had it right that the $810 billion bailout was nothing more than a Wall Street bailout. The purpose was to stop the bleeding. Well guess what? The bill had a shelf life of 2 freaking hours before the market went lower on Friday. On Monday, we had an 800 point intraday loss, the biggest ever before the market ended down “only” by 360+ points.

(b) The public is also perceiving that we are near a depression. 6 out of 10 feel this. Of course the pundits won’t admit this but refer to item (a) above and look at the market action to see how accurate they are. Amazingly, it would seem that the majority of Americans are diametrically opposed to what Wall Street, politicians, and the mainstream media are pushing.

So with that said, why didn’t we actually make a bailout plan were we took major equity stakes in many of these firms similar to AIG? First we have a bunch of hardcore trickle down no tax politicians that still somehow believe we are living in a free market. They are nothing more than crony capitalist that love social welfare checks so long as they are sent to a Lehman Brothers mailbox or other toxic firm. Lobbyist saw what happened with AIG and wanted nothing from it. Why? The government is now involved and any upside [if there is any] will be shared with the public. Remember, you need to think like a greedy criminal here, why would you want to share any of these profits even though you are asking for a fat handout from taxpayers? You don’t. Hence the bill has a tiny drop of this and a whole lot of free exchanges for toxic mortgages with little oversight.

The lobbyist write these bills. Therefore it isn’t a “crime” since our representatives choose to consciously not define what is occurring as a crime. If we redefined bank robbery as “stealing from a bank only with a gun” you would have many trying to rob a bank with a knife. Bottom-line it is still a robbery. So these lobbyist in cahoots with politicians have drafted a bill that has legalized corporate high level bank robbery. Who is really running this country?

Today we also get the announcement that the Fed is going to purchase commercial paper to ease the credit crunch. What isn’t the Fed doing? Everything being done is to help fellow cronies. In fact, at this point why not do a work creating initiative like in green energy? I was watching a talking head last night with some tool bag politician that was totally behind the $810 billion bailout but when someone mentioned the government creating jobs he stated, “no way! No taxes and keep the government out.” I nearly fell over laughing. This guy had some serious cognitive dissonance. It is like the extremely religious person having to reconcile his hidden habit of [gambling, drugs, sex, etc] from his public persona. Basically what we are witnessing is a massive amount of people who simply do not live congruent lives. Sort of like spending more than you make. Having a Lexus when you can only afford a used Civic. Everyone wants the finest Rhone wine but probably needs to chill with a Bud Light. I’m sure many of you saw Jim Cramer yesterday telling people to take a good portion of their money out of the stock market:

*Click to Watch Clip:Â Today Show:Â October 6, 2008

What was he singing in March of this year?

*Click to Watch Excellent Call:Â March 11, 2008

Or let us see his 10 predictions for 2008 from his article in the New Yorker from December of 2007:

1. Prediction: Goldman Sachs to finish year at $300 a share. Reality: Currently trading at $115. STRIKE ONE

2. Prediction: $125 barrel oil and $5 a gallon gas.   Reality: $90 a barrel and nowhere near $5 a gallon. STRIKE TWO

3. Prediction: Fed helping Citi directly. Reality: Citi is down 45% since that prediction was made. FOUL BALL

4. Prediction: “Throw in Verizon’s growing cell-phone business and growth accelerates dramatically, making VZ the best-performing stock in the Dow Jones averages.” Reality: Verizon is now down 32% since the year started. In addition, Comcast who he states will hit a low is actually only down 3% for the year. FOUL BALL

5. Prediction: Cerebrus bailout. Fails bid on Chrysler. Reality: Cerebrus still kicking and in fact, still looking to buy Chrysler. BALL

6. Prediction: Google to become in top 3 U.S. market cap companies. Reality: Google currently has the 26th biggest market cap at $110 billion. STRIKE THREE! YOUR OUT

7. Prediction: “European companies, eyeing the weak dollar, snap up New York real estate, and offer to buy Merrill Lynch and JPMorgan. John Thain and Jamie Dimon, the companies’ respective CEOs, agree to the bids.” Reality: Decoupling delusion here! Europe having their own serious problems. Merrill goes to BofA and JPMorgan isn’t selling to anyone…yet. STRIKE ONE

8. Prediction: Apple goes to $300. Reality: Apple currently selling at $92. STRIKE TWO

9. Prediction: New York Times drops to $10 before being helped out pushing stock back to $20. Reality: New York Times at $12 and not sold. SINGLE

10. Prediction: “An Army of the Foreclosed marches on the White House, then launches a siege at the Federal Reserve, before camping out in front of the Washington Monument. The army demands relief from eviction. Bernanke, recognizing that he did nothing to regulate the mortgage mess in 2006 and then did not cut rates fast enough in ’07, resigns. The siege ends, the new guy slashes rates, and the market takes off.” Reality: Bwahahaha! Bernanke is still there doing random pointless initiatives to help his cronies while a large portion of the population is fixated on irrelevant events. Rates are still at record lows and in fact, the Fed and the U.S. Treasury have gone beyond these limited items and the market is clearly not taking off. STRIKE THREE AGAIN!

Cognitive dissonance? Oh yes indeed. If this guy is a “financial guru” I must be Nostradamus.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

17 Responses to “Economic Punch Drunk Love: 3 Fascinating Financial Stories Captivating the Market: CEO Being Punched, Bank of America Past Comes Back, and the Politics of the Bailout Plan.”

Hi Doc,

Been asked a lot why I opposed the bailout. Responded, “band-aid on a shotgun blast.”

Also sent out this Red Cross link to lots of people I know:

http://www.redcross.org/services/disaster/0,1082,0_601_,00.html

Think of it as getting your earthquake plan in order.

Plenty of website out there with survivalist bents; hopefully we’ll remember to pull together instead of apart as the seams begin to rip more visibly.

Doc- thanks for the posts.

I was starting to think that there were no positve indicators in the market at all. If Cramer is calling for further declines though, I think we must consider whether this could be the bottom! He has not fared well in this market. To be fair though I think that his much maligned Bear Stearns comments related to deposits. The language he used was ambiguous but I think he was responding to a question about an account at Bear Stearns not Bear Stearns stock.

I’m just a layman without any personal investments, but as soon as I heard about this stuff on the news my immediate thoughts were the same as in this post.

Not enough governmental control, uncommonly pleasant boom preceding it, and in the end the people hit hardest is the little guy.

Odd how history has a habit of repeating itself, without anyone making connections before its too late.

At least this time *some* of the fat cats at the top are among the casualties.

IE – The big banks that closed up shop recently.

Say it ain’t so comrades! The biggest rip-off in US history has just occurred and the public is in some kind of zombie state. Has Wall Street conspired with Big Drug to sedate us long enough to pick our pocket? Where are the mass protests? Wars have been started over less. Empires have been toppled over less. We are staring into the abyss and the only way to keep from falling in is through strenuous push back. Because I like quotes, here’s another one:

“We are making great progress, but we are going in the wrong direction.†– Ogden Nash

“Bernanke, recognizing that he did nothing to regulate the mortgage mess in 2006 and then did not cut rates fast enough in ‘07…”

He still thinks the situation was salvageable in 2006 and that rate cuts would have made a difference in 2007. He never recognized the bubble as it grew, he never saw the bubble’s burst coming, so why should anyone listen to him on this.

Hey Doc, all this talk is making me sad. Couldn’t we have a nice, uplifting real homes of genius post? 🙂

I agree with you. I think it’s funny when I hear commentators talking about up or down movements in the market today as if any uptick has any meaning to where the markets will be next year. I was recently talking to my father in law, who has been a long time investor. He has this mentality that the market always goes up, and any dip is a buying opportunity. My own parents were WWII survivors and what I learned from them is that peace and safety is never secure. Good times don’t last forever. And we’ve had an incredibly long stretch of good times —which has been artificially boosted by the overavailibility of credit. I’ve always looked at the really long period of prosperity and good times in America as an exeption in history, not the rule. The markets have tanked, but aside from a few layoffs the full effects have not been realized on main street yet. Just like some of our parents told us stories about hardships, many of us will be telling our kids about a time when things were easy and plentiful, and our poor were some of the fattest people in the world.

The Depression hasn’t even hit main street yet. When it does, a lot of retailers are not going to be able to survive.

I wanted to add, too, when I was a kid in the 70s I remember how women used to fight over clothes in the Weinstock’s bargain bins. I wouldn’t say we’ve hit bottom until we see people desperately fighting over sales items, and we see a lot of familiar retailers shut their doors.

Interesting how the DOW dipped -850 on Monday (10/06/08), only to close down at -360. Could it be that the missing -500 from Monday’s losses was booked into yesterdays losses (DOW being down -508 on Tuesday 10/07/08) to stave off a crash on Monday??

Great post Doc, many thanks for your insights. I’ve been thinking for sometime about this whole mess, looking for some kind of explanation as to why apparently rational, sentient human beings fail to learn from past mistakes and history in general. As a qualified humanistic counsellor I think I might know why:

Assertion 1 – About 1% of the world are incurable sociopaths (formerly known as psychopaths) – as identifed by the military in their assessments

Assertion 2 – About 1% of the world own 40% of the wealth (world stats)

I wonder if there is a connection here?

Funny how the markets dropped while Hanky Panky Paulson spoke today. The DOW lost 316 points durring that time. Even his Wall Street buddies cant take him anymore than the rest of America, so much for the bailout, oh I mean rescue plan. What we all need right now is a rescue plan from paulson & his crackpots.

I think when WAMU was taken over, Chase wrote off 20% of the option ARM.

I wonder what happen to Fannie and Freddie CDS. It was settled on Monday but I think payment was not due till next Monday. Lehman settlement date is this Friday. Could this be one of the big reason for the market going bad the last ten days. Billions and Billions must be sold to come up with the settlement.

PIMCO poised to become the Federal Reserve’s PIMP-CO

So it looks like the $1.7BB paid to shut up Bill Gross also bought his “free†services – Oh, aren’t we lucky! The incestuous relationships between business and Government have escalated to orgy-like proportions!

http://tinyurl.com/4a9h7m

Nostradamus, Doc? Or Red Barber?

~

Backboarding this case study of Reverse Robin Hood and the thievery of the rich:

~

A number of comments have opined in other threads that CRA/Bill Clinton and Fannie/Freddie and poor/minority buyers bear the responsibility for the subprime meltdown. I’ve responded to that in those threads, and wanted to share this piece in Slate today:

~

http://www.slate.com/id/2201641/pagenum/all

~

It well makes the point that this fiasco needs to be laid at the door of the super-rich or wanna-be-rich speculators and the “culture of debt.”

~

More detail may be found in the Big Picture essay by Barry Ritholtz to which Daniel Gross refers in the Slate piece.

http://bigpicture.typepad.com/comments/2008/10/misunderstandin.html

~

Peter, I’ve often thought about the connection that you make above, in my dealings with sociopathic, narcissistic, and bullying individuals or power cliques. I.e., that qualifications for wealth and leadership in a force-based, winner-take-most system include, hone, and richly reward the sociopathic personality.

~

I think it was Sean who noted within the past week that Jim Cramer’s behavior would qualify as sociopathic, rather than oracular, if observed on Main Street rather than TV. That’s an accurate key to this whole mess. If this were a different sort of forum, I’d love to discuss this, the most compelling and concerning topic of my own experience of working intensively with people.

~

Instead, let The Onion oraculate for us:

~

Tenth Circle Added to Rapidly Growing Hell

http://www.theonion.com/content/node/28898

~

rose

FACT: 8-12 YEARS EACH UP OR DOWN CYCLE IN CALIFORNIA!

FACT: SAME REGARDLESS OF GOVT. INTERVENTION SINCE 1950s.

FACT: BOTTOMS ARE ALWAYS 50% OR LESS OF HOME COST ($100/FT)

FACT: WE WILL BEAT $50/FT FOR HOMES UNDER 10YRS. 2008-2009

RESEARCH: 20+ Auctions attended in 2008, I bid up to $40/ft and homes under 10 years old have sold for under $50 a foot in Southern California.

ESTIMATED BOTTOM: 2012-2014 OR 3.5 TO 5.5 YEARS TO ROCK BOTTOM!

ESTIMATED LOWEST: $25-35 per Sq. Foot homes less than 10 years new!

Batting Average=Been a repo investor since 1975 (high school).

This decade=198 deals sold averaged 11.65 to 1 profit in California Real Estate!

Watch & enjoy, avoid Realtors, and go to auctions to “laugh & learn”.

$25-35 a foot is your real purchase price if you sit and enjoy!

Good luck, Southern Californians! Yours truly,

John=66 countries visited & researched/law/economics & 5 passports filled

Rose

Many thanks for the link…wonderful article, wonderful site, quite unique in my experience and most relevant for me. Will enjoy many hours exploring and learning.

Go well good spirit.

Rose,

You rock!

Leave a Reply to karen