Are we seeing an echo housing bubble in California? The low inventory low interest rate mania. The psychology of buying in a perpetual bubble machine.

I want to start this article by first stating that I enjoy living in Southern California. This is my home. I’m sure it is home to many of you as well. When I started writing this blog, it was as an attempt to figure out what was going on in the market. Prices simply did not make sense and the loans that were being made were comically outrageous. This is also why the full title of the site is “Dr. Housing Bubble – How I Learned to Love SoCal and Forget the Housing Bubble.â€Â I get the distinct impression that many people are not fully “happy†until they own a home. So this second round mania is suddenly making people feel as if happiness is getting further out of their reach. Yet we all know this is a choice. If you really want to buy and you have a deep void because of this, go for it! Heck, all you need is a 3.5 percent down payment and you’ll get a low rate mortgage as well. Yet make no mistake, prices in many SoCal cities are demonstrating mania like behavior. As you will see, you are essentially stepping into another mania in SoCal where inventory is being driven into the floor. Ultimately the question then becomes, how badly do you want to own a home?

The disappearing inventory

SoCal home prices are up a solid 12.5 percent year-over-year. With incomes being stagnant you need to ask where this jump in price is coming from. Two main places:

-1. Low inventory selection (also decline of distressed inventory as percent of sales)

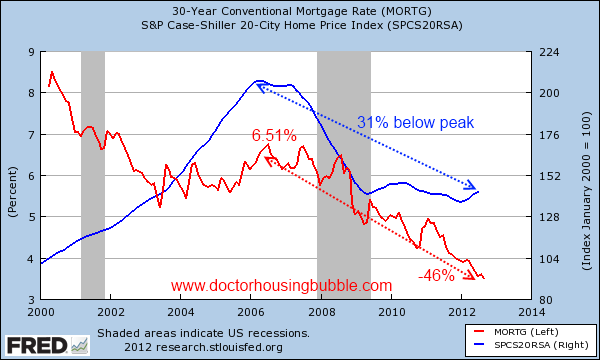

-2. Incredibly low interest rates

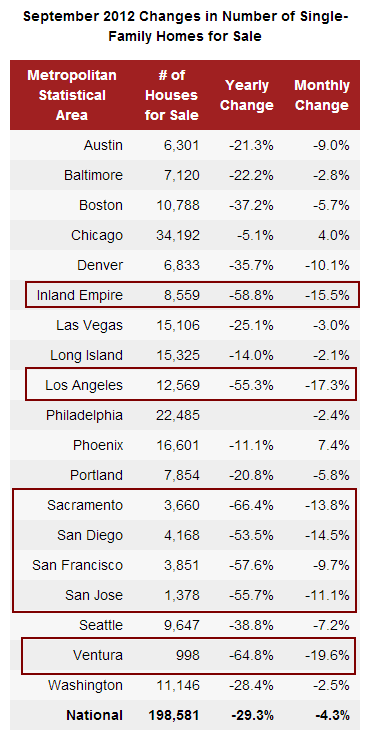

This is also a nationwide trend but inventory in California has virtually disappeared:

Source:Â Redfin

How crazy is this? Nationwide inventory is down 29 percent but in some places like Ventura County it is down a whopping 64 percent! Constrain supply like this and it is no surprise why prices are rising. Those willing to buy are dealing with a small selection of properties but also competing with Wall Street for these homes. California inventory is down from 53 to 66 percent year-over-year depending on what metro area you are looking at. This is dramatic. Compare this to say Chicago where the number of homes for sale is virtually flat year-over-year.

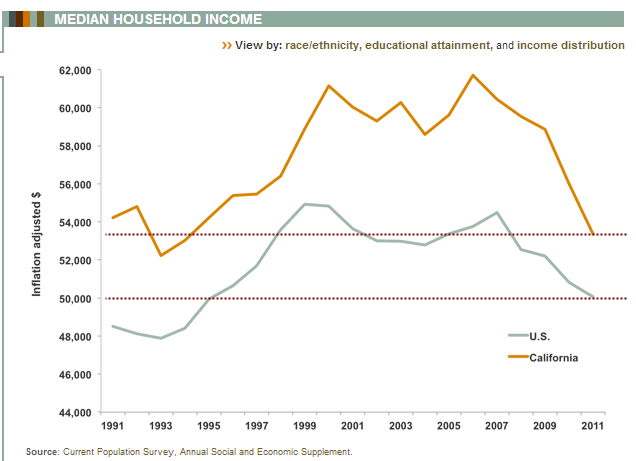

With that said, let us take a look at household income in the state:

California household incomes adjusted for inflation are back to levels last seen in 1993. This trend is a nationwide issue. Logically all of this makes sense to people. Many even understand the complicated motivations of the Fed with QE3 and understand that this market is completely controlled. Yet housing plugs into a very deep psychological need for belonging and many people feel a deep need to set their roots. For some, a mortgage is prerequisite for feeling established. I’ve gotten a few e-mails that go along these lines especially over the summer:

“Dr. HB. We’ve been waiting many years on the sidelines waiting for the right time to buy. It is absolutely frustrating that prices in [insert hipster/mania neighborhood] are going out of control again! Prices are near peak levels again and I simply cannot wait any longer.â€

Cognitive dissonance is a tough pill to swallow. Markets are largely irrational and it is hard to even say that our real estate market is operating in a market system:

-Federal Reserve pushing rates into negative territory (QEI, QEII, QEIII, TARP, Operation Twist etc)

-FHA insured loans

-Fannie Mae and Freddie Mac

-Mortgage interest deduction

I can understand the frustration but if you feel this strongly that you need to own then why not buy?   The Fed is actually betting that you will. Yet for a place like SoCal especially in many prime areas the pickings are slim and the prices are outrageous. It is interesting because it is now even becoming competitive in more select locations in the Inland Empire to buy.

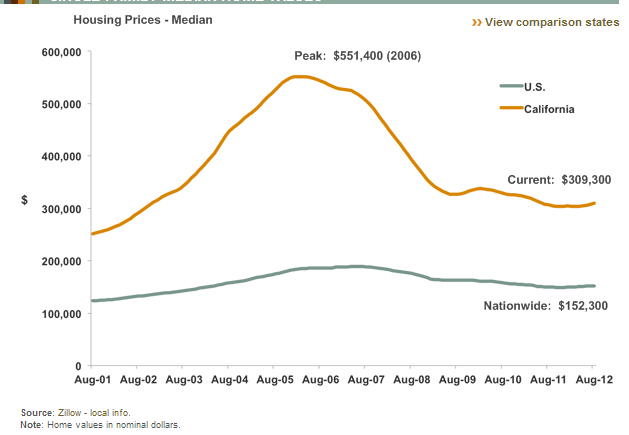

Let us take a look at overall home prices in the state:

Not bad especially in many regions. Yet many that have solid incomes want to buy in areas experiencing manias. It is an interesting experience getting to see another mania unfolding. We saw a little bit of this with the first time home buyer tax credit but that certainly did not have the impact of the current environment:

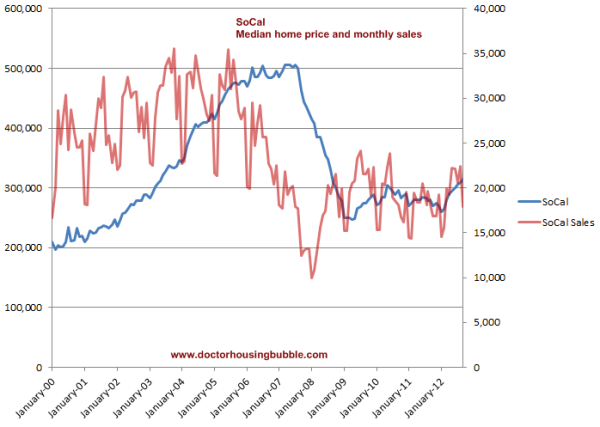

When we look at the overall market however for SoCal, we see sales are up but nothing that would signify a rise of 12.5 percent in median price over the year:

This is another interesting dynamic. Last month, 16 percent of SoCal sales were foreclosure resales. This is way down from the peak of 56 percent. So this is also tilting the median price much higher. So what you have is a market with limited inventory, big demand from investors, and incredibly low interest rates. All three of these are perfect recipes to push prices higher in the short-term. Is this sustainable long-term? It is hard to see this being sustainable unless wages keep pace. For the time being it is no surprise that the Fed is back to setting the stage for another housing bubble. The fact that home prices are up 12.5 percent in SoCal over the last year should tell you something.

So bringing all of this together, it is no surprise to me that many of those actively in the market to buy today must feel like we are reigniting another housing bubble. The frustration is clear but it is also coming from groups like real estate agents that have limited inventory to sell. Some key figures do stand out from last month for SoCal:

FHA insured buyers:Â Â Â Â Â Â 25 percent

All cash buyers:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 31 percent

Over half the market is driven by low down payment buyers squeezing in and another 31 percent are investors (big cash especially for California). The rate of flipping is also increasing. For those looking to buy, this is the market you are heading into. Does it make economic sense? Of course not and most of this is behaviorally driven but this is part of living in an area prone to boom and bust (for those that remember the late 1980s and early 1990s and 2000s). Understanding this may help you to learn to love SoCal just a little bit more.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

82 Responses to “Are we seeing an echo housing bubble in California? The low inventory low interest rate mania. The psychology of buying in a perpetual bubble machine.”

Why doesnt anyone ask the president why this inequity of access into the property market is allowed to occur . Otherwise it would make for a great 60 minute special on how Wall street is stealing from the poor again.

Because the President is a moron. Nobody thinks he has any serious answer to this. Uh…tax the rich? Regulate something — anything! Invest! Win The Future! Uh…hey! Look over there! A rich Republican squirrel paid a lower tax rate than his secretary!

Factor 1. Seasonality

How much of this is due to seasonality?

i.e. the typical upswing in spring/summer and consequent downswing in fall/winter?

Factor 2. Election year

How much of this is due to 2012 being an election year?

Will things change after Nov. 6?

Investor J

October 13, 2012 at 10:46 am

“At the risk of sounding like a conspiracy theorist, I personally believe the banks held back inventory during this election year to make the market look better (ie. higher prices) so the “wealth effect†increases for the average voter in an attempt to re-elect the current administration. We’ll know for sure next year, as I’m guessing supply will kick back up to last year’s levels. You’ll see from my numbers below that this is more of an “educated guess†on my part than a conspiracy theory…

To be clear, everyone can talk about the Hedge Funds buying all of the inventory but they DID NOT buy the balance of the 40-50% reduction in CA properties…”

Factor 3. Financial Cliff + Debt Ceiling

“Investment guru Jeremy Siegel, finance professor at the University of Pennsylvania’s Wharton School, says stock prices could fall as much as 20 percent by year-end if Congress does nothing to keep the economy from falling over the fiscal cliff.â€

Will the coming Financial Cliff + Debt Ceiling throw a wet blanket on the housing market?

75 days from now, will we be looking at a major shift in housing sentiment?

Fiscal Cliff date will be moved further into 2013. Will not be a problem Jan 1. This will just kick the can.

Ahem… the only issue with your educated guess is that 70% of all the election campaign money is going to the Republicans. Also, many of the elite bankers are openly backing and financing Romney.

It’s crazy that metro Los Angeles has defied any logical sense. People are tired of waiting and jumping in. I too think about it, but talk myself out of it constantly. Because I feel like I deserve better and I will wait for the right place at the right price. I wish everyone felt that way too. I’ve gone back and clicked on that link “History of a Housing Bubble – LA Times Archive From Previous Housing Bubble” a few times and sometimes go back to this article:

http://www.nytimes.com/1984/12/08/opinion/the-day-los-angeles-s-bubble-burst.html

It’s hard to believe that there was a time when not everyone was obsessed with real estate and people bought when they were ready to settle down. Or that there was an actual time after a bubble burst that people real estate became so toxic that people stayed away and an actual bottom was reached. This time the bubble didn’t quite burst here, but just let out some air and was quickly patched up…lol…

Great find in that NTY article, Forever_Sidelined.

“but talk myself out of it constantly”

not me, i simply can NOT afford to buy in socal…..yet i’m stuck here. any minute now the rest of my industry can be boxed up and sent to China to save a penny a part. going into debt to the tune of $500K isn’t even possible……and never will be.

I’m in a very similar boat. I can’t afford to leave and can’t afford to stay.

If you’ve experienced better then you know that there’s a lot to be disenchanted about in regard to living in SoCal. At the very least, one with a decent job would like to be able to afford something better than the junk around here.

I’m not willing to take the risk of leveraging up and settling for some overpriced piece of junk.

3.5% mortgage rates and a severely restricted inventory….what’s not to love? Talk about market manipulation!! The govt allowed the banks to sit on bad mortgages and then the Fed drives down the interest rate. Ever get the feeling you’re being played!?

When you’re not sure who the sucker at the table is, it’s you.

The market manipulation became official on April 5, 2012 when the Federal Reserve issued a policy statement that banks are now allowed to rent out REO’s: http://www.federalreserve.gov/newsevents/press/bcreg/bcreg20120405a1.pdf

By renting out REO’s, banks are no longer under pressure to sell distressed inventory as they now have cash flow from renting out the foreclosure.

Before April 5, 2012, banks were forbidden from renting out REO’s. It was either sell and take a financial hit or keep the REO on the books and bleed money from deadbeat mortgages.

Federal law: 12 U.S.C. § 29, (http://www.gpo.gov/fdsys/pkg/USCODE-2011-title12/html/USCODE-2011-title12-chap2-subchapI-sec29.htm), allows banks to hold foreclosures up to 5 years. If banks show “good faith”, they can extend the holding period for another 5 years. In effect, withholding inventory for up to 10 years, which is what we are seeing now.

With the Fed’s ZIRP program and the REO-to-rental policy, there is no reason for banks to release shadow inventory. This leads to the low inventory we are seeing now in certain markets.

Wouldn’t the banks still have to pay the property taxes based on inflated mid-2000s appraisals?

He who forgets the past is condemned to relive it…

“Bubbles with a goal — enslavement and control…

Rolling global serial bubbles blown by XtrÄ“vilism’s maestros — Greenspan, Bernanke, and others… Bubbles anyone? Dot com bubble? Housing bubble? Commodities bubble? Want a starvation global high food price bubble? No problem! Its now a simple process formula; roll out the cheap money supply, buy the politicians and deregulate or eliminate any laws in the way, create an array of bogus over leveraged financial products (more cheap money and virtually counterfeit), give them all a misleading stamp of approval with corrupt ratings agencies, and then use the XtrÄ“vilism global propaganda machine to blow events out of proportion — that are far beyond supply-and-demand fundamentals — thus creating speculative environments for the benefit of large institutional corporate investors. In essence it is casino speculative betting with the ‘gamblers’ whipped into a frenzy by the global propaganda machine that drives prices to the moon. XtrÄ“vilism’s big happy to play the game complicit banks profit on the fee churns while XtrÄ“vilism central planning gets its desired herd thinning. This is immoral economic warfare on roids folks! Yes! Immoral warfare! Immorality against morality! XtrÄ“vilism against Fairism!

The core problem in banking — with corruption, control of propaganda and its lying corporate jargonized phony baloney set aside — is that debt creation is in the hands of the few. The financial system is run by bankers for the benefit of bankers. Keep that in mind when considering remedial measures.

But also keep in mind that the problems are systemic and affect all facets of life and are not limited to just finance; Too Big To Fail — intentionally scaled up to mega size corporations used to crush and eliminate competition and create complicit dependency — exist in agriculture, commerce, defense, transportation, manufacturing, etc., and that it is this XtrÄ“vilist anti-American mega size corporate structure and control of the global propaganda machine that are at the heart of all of our ills. These rogue mega corporations, controlled by the aberrant, morally depraved, self anointed elite, function as secessionist and traitorous radical terrorist gangster states. They function in reality as shadowy secretive terrorist gangs that have stolen our commons, our right to opportunity, and our freedoms! This global crisis is not just about deficit finance. It is about deficit morality!”

More here…

http://www.boxthefox.com/articles/premiere%20article.html

Deception is the strongest political force on the planet.

Market manipulation has been going on forever. The U.S. bigwigs always have had protectionist agendas to minimize market risk for themselves, while screwing everyone else. In the past they spent their time screwing other countries over, and the U.S. middle class got to benefit from that, as a side effect.

Now, in the face of globalization, climate change, chronic slowing of the economy, and peak cheap energy, they’re battening down the hatches and stealing anything they can get their hands on, regardless of where it comes from, that they may ride off into the sunset with champagne and caviar. Fear of the decimation of their dynasties is what keeps the working man in his chains…

If you want a chance at blackening at least one of their multitude of eyes, push for clean, renewable energy, provided by a constellation of sources – the more the merrier, and the freer the market.

I’m sorry to say this , but we’ve seen the bubble rise in this down turn before.

The first time was during the first 2009 $8,000 tax credit. As soon as the tax credit disappeared the market dipped again. The government resurrected the tax credit for a second time and the market went up again. In addition because of the state government mandated foreclosure moratorium’s that were enacted in Sacramento all the inventory shrank to record lows. I remember a realtor in my neighborhood in the fall of summer of 2009 was passing out flyers proclaiming that properties were rising 1% per month, and it was true, that is until the housing credit ended in mid 2010 and prices started to dip again.

2011 had the biggest price dips in California since the initial crash in 2008. 2011 also had no foreclosure moratoriums, and no tax credits for purchasing during that time.

I think it’s extremely important to be totally aware of the extreme lack of inventory and the insanely low interest rates when trying to understand this market.

The housing credit ended around mid 2010 and if you look at most graphs you will see definite rises and dips exactly matching the start and end of the tax credits.

It’s obvious to all this is more government controlled bubble making, so buyers be ware.

One thing that I’ve learned in this five year long real estate down turn is if you want to buy watch the inventory closely, and you get the best deals only when the inventory is high. Furthermore even in a housing bust, the bust doesn’t go down in a straight line, their are many ups in the overall down turn.

“I think it’s extremely important to be totally aware of the extreme lack of inventory and the insanely low interest rates when trying to understand this market.”

But, does this set the stage for another dip?

Everyone is on the same page as you. It’s even hitting the MSM. But, unlike the tax credit programs, we have policies, and rules in place now (QE3, 12 U.S.C. § 29, etc.) that can promote buying demand and support prices for years and years.

The strategic decision was made to patch holes in the popping of the real estate bubble. That strategy is working! Romney and Obama haven’t said a peep about the Fed or the housing market….they like what they see and won’t change a thing.

But,

There is ZERO trade-up market.

This is significant, because when you extract transaction costs, even a 10% rise in the value of your home will barely make you whole if you want to sell.

The buying panic now is about “lifestyle” (I want a place to call home) and not about getting rich, or even as an investment vehicle.

So, we’re in the early stages of an unusual metamorphosis in psychological mindset about the whole nature of home ownership in Southern California (just as DRB underscored).

What sort of impact with this change in psychology have longer-term on prices and price:income ratio’s?

“There is ZERO trade-up market.”

True, and I think this is a big factor in the current low-levels of inventory. People that have refi’d into a lower rate won’t be selling anytime soon.

“The buying panic now is about “lifestyle†(I want a place to call home) and not about getting rich, or even as an investment vehicle. ”

Given that rental-parity has been reached in many areas, I think financials are pushing many people to buy rather than emotions. Furthermore, the large number of cash-buyers shows that many people are buying as an investment, most likely to hold as long-time rentals.

Greg, all those tax credit programs had specific end dates so everybody knew what would happen afterwards. The Fed has signalled “unlimited” support for housing. As much as I hate to say it, they can keep rates and inventory low longer than most people are willing to wait this market out. That is exactly what we are seeing now with the frenzy going on. If you can get into a place at or less than rental parity, in might make sense buying.

I finally threw in the towel recently and bought. I see no end in sight to Fed manipulation and I was not prepared to wait another 5 years in HOPES of lower prices and normalcy returning. My monthly payment for a 3 bed/2 bath SFR was lower than renting a 1 bedroom apartment…wating for me just didn’t make sense anymore. Who knows what the future holds, but Fed manipulation needs to be in everybody’s buy/rent equation.

Lord and Fresh,

You get what is going on with low inventory and ultra low interest rates, but I don’t thing the majority of buyer do. I truly believe a lot of buyers panic when they see prices increase and they just purchase with out much real analysis.

Back when we had the $8k tax credit I thought to my self “who’s going to get all excited about $8k” when properties cost $350K – $500K?

Well a lot of people did get excited over the $8K, and it sparked a new mini bubble.

Even an observant bubble watcher like myself almost panicked, because I didn’t really understand what was happening, it didn’t make sense to me.

As always it’s not about what I think and want it’s about what others think.

Lord and Fresh your not alone in you dilemma about buying or renting, it’s stressful and risky. I bought recently as well as you Lord. My situation really was not stable for my family. I was suing my old land lord for keeping too much of my security deposit, ( We left that rental because the landlord increased the rent). The new rental that we moved into was going into foreclosure. Other rentals were going up in price!

We’re a single income family and it was hard enough to pay $1900 per month on rent, I needed to reduce my house payments.

I swore I wasn’t going to another landlord, non of them were trustworthy.

I have friends that are in their second rental that is going into foreclosure. It’s really pretty awful to find a stable rental out there right now.

If you do have a stable rental right now, then you’re probably in a pretty good situation.

Bottom line in my opinion were all being forced by the Fed and Government to make risky purchases because it suits their needs, not ours. Unfortunately were only alive for so long.

Guy’s don’t worry too much though, I can tell that your all pretty intelligent, and I think that you’ll be one of the smart ones that will find an opportunity somewhere.

I think I found an opportunity in my purchase, and if I can do it I think you can to.

Greg, the Fed forced my hand into buying also. I would have likely remained a renter if the housing market were allowed to return to normal. Obviously the market has been and is highly distorted…the announcement of QE3 was the final nail in the coffin. The Fed directly said they will do everything in their power to keep nominal home prices from falling and interest rates low, crushing renter and savers along the way. Like you mentioned buying offers stability. My rent was increasing $100 per year like clockwork. Most landlords don’t care if you are the best tenant in the world, their goal is to squeeze the most rent out of you possible without you leaving. And everybody knows that securing another place and moving is a royal pain. There is none of this with owning.

I agree that your average buyer isn’t financially aware as most people on this blog. What the average buyer looks at is monthly payment, the monthly payment for many houses now is below rental parity. Case closed, that is all you need to know.

Where the heck can you mortgage a 3/2 SFR for less than a 1-bedroom apt? I find this extremely hard to believe.

Or are you talking about a 3/2 SFR out in Whittier vs. the cost of a 1-bed apt in Santa Monica? That’s the only way I see it making sense.

Lord I don’t think the real estate market will ever be a free market. It’s been manipulated by FHA, Fanny MAE, and VA loans before we were even adults.

The bubble was created by the Federal Government and the Fed. and when it went bust the government was out there to stall and help and refinance all those who bought during the bubble.

They are setting up another trap and if and when it fails they will be there again to help bail-out, refinance and stall foreclosure once again.

It’s obvious to me that it’s going to keep going this way maybe forever, unless there is some huge collapse and the powers in Washington are totally unable to assist the market.

A, I went though this math before. Buying a 500K house with 20% down is cheaper than renting a 1 bedroom apartment for $1600 per month. I won’t go into the details but the math works when you account for principal payments and writing off mortgage interest and property taxes. This equation obviously doesn’t work in super prime areas like Santa Monica, but it works in many other decent areas. This is one of the main reasons you are seeing the frenzy today. Case closed.

Congratulations on your house purchase Lord.

I’m glad that you’ve got one, It feels good having a place that you can settle down in. I hope that you have many happy years there.

It’s possible for that math to work, but of all the places I look, wherever a 1-bed apartment costs $1600, houses most certainly cost a lot more than $500k. Are you saying that you can find the two within, say, ten miles of each other? And in similar neighborhoods with similar schools? If not, you are comparing apples to oranges and it’s irrelevant how the math ‘works’.

I most certainly cannot find this setup within a 45 minute commute to Santa Monica, unless of course, again – the house is in a neighborhood that requires bars in the windows. And wherever those houses are, a 1-bed certainly is way less than $1600. So this is why I ask, what area(s)?

A, your question is what areas can you buy a 500K SFR and rent a 1 bedroom for about $1600/month. Here is a list for you: Torrance, Lomita, Huntington Beach, Costa Mesa, Irvine, Tustin, Fountain Valley, Laguna Hills, Mission Viejo, Laguna Niguel, Aliso Viejo, many parts of the valley, etc. These are all decent areas for the most part.

Sounds like you are stuck commuting to Santa Monica, unfortunately we all know the Westside defies gravity when it comes to home prices so my math example unfortunately doesn’t work in these ultra prime areas (like I mentioned before). You have two options when it comes to affordable housing: commute or change jobs.

Lord,

I have crunched the #s also and say that the 500k versus 1600 rent scenario only works out under the most optimistic of scenarios. If you account for investing the 100k dwnpmt and also the ~500 $/mnth difference between the rent and after tax mnthly pmt (PITI+170 for maint, garbage, water), the net profit is very dependent on invst rate and infl rate.

for example using 90 yr avg 3.4% infl/appr, the after tax total payment does not balance the rent payment for 17 years.

Then, if you assume anything over 6.5% investment rate (not accounting for tax benefits of dumping this money into retirement accounts), the net profit curve turns concave, meaning you break even in 5 years, but the rental investment at 6.5% catches up in 30 years. If you assume a small, like -15% decrease in value or a 7 years of flat appreciation, net profit never actually gets above zero. assuming 7, 8% investment return and things become even worse. I don’t know about other people but i expect atleast 7% return in my retirement accounts over the long term.

calculations are too complex to put here, but if anyone is interested i posted link to fileshare with my xls, which is a pretty awesome rentvsown investment calculator, if i must say so myself (this is what people with applied math and engineering degrees do when looking at houses). any other potential buyers are welcome to take a look also.

http://ge.tt/8jmJEnP?c

@gte: remember my example clearly stated “monthly payment” between buying and renting. When you start playing with the “I could invest my downpayment funds..,” things get murky real quick. If these funds will truly be used as a future downpayment, it can not be put into risky investments (i.e. stock market, gold, etc). That doesn’t leave you with a whole lot of return then.

The 20% down payment is the former gold standard, that is why I used that number. I am an engineer also and have crunched many of these numbers. Here is another question you need to ask yourself, what is it worth having my “own” 3 bedroom/2 bathroom/2 car garage/backyard/no sharing walls/monthly payment locked in for 30 years home compared to renting a 1 bedroom apartment where future rent increases and apartment living “bonuses” are big unknowns. I’m not sure about you, but that counts for something for most people.

I didn’t look at your buy vs. own calculator. Many people compare the total PITI to rent. You can NOT do that. Paying $1 in principal is definitely not equal to paying $1 dollar in rent. When you take that into account and the other tax write offs, buying from my exapmle makes sense on a purely monthly basis. That monthly payment is what 90% of Americans care about….that is one of the reasons you are seeing such a frenzy right now.

Zero Hedge has a pretty concise evaluation of what’s really going on:

http://www.zerohedge.com/news/2012-10-15/us-households-are-not-deleveraing-they-are-simply-defaulting-bulk

Stock market soars to new highs, real estate bubble inflating nicely. Boomerang buyers foreclosed in 2008, losses eaten by banks, bailed out by taxpayers, fast forward to 2012, same people now buying another house with FHA loan, tiny down payment, the great American Mulligan! Keep printing Ben. What’s real anymore?

It’s like the American Beauty ideal…she was once a virtuous, beautiful woman, proud, strong, smart; nowadays the American Beauty is a surgically enhanced wh*re with hair extensions and fake eyelashes, hawking a leaked sex tape, hustling to get a reality show.

I lean more bearish on the housing market (and stock market) than bullish but I ended up buying a house in 2010 despite these views. I looked at comparable rents in my area and found that my monthly out of pocket mortgage payment would be very close to what i would pay in rent and I did not take into account end of the year tax rebates since I am much more concerned with monthly cash flow. I am fully aware of the fact that prices could come down, and likely should come down in the future as more inventory comes online and rates ultimately go up. After sitting on the sidelines since 2006 and being frustrated by all of the government intervention and policies that puffed up the bubble and rewarded the reckless, I tried to sift through the madness and find a metric that worked for me and that was comparable rent. Two years later I have since refinanced to a sub 4 fixed rate and I am very happy with the neighborhood and roots/stability that my family has. Like I said earlier, I lean bearish on housing overall and think that prices could likely go down, but after weighing the pros and cons, I am still happy 2 years later with my decision to buy. The 4+ years of bitterness towards the housing market was not worth holding on to and I can’t imagine how bitter I would be today now that prices are actually going up. You will never pick the top or the bottom in buying a house so you have to pick a metric that makes sense and just go for it when you are ready. I have no regrets and I also know that I would be paying the same for rent right now anyway. I hope this helps for those of you who are on the fence.

I would not be surprised if this spurs on building new homes. If demand is that great, it should come naturally.

I think builders are starting to eye-ball new projects as it’s becoming clear that this current real estate situation can go on a long time. Shadow inventory will stay in the shadows while mortgage rates stay in the basement. Everyone talks about how interest rates have to go up….and they’ve been saying this for years now…and all rates have done is go down. This is the new normal. I bet it lasts a lot longer than most think it will.

I think you’re right.

I wouldn’t refer to it as “natural” this is pure GMO stuff. Manufactured demand induced by strangling the shadow market into a comma. If they succeed in strangling the flow of resales to buyers they will invent a false demand for new housing starts. They tricked everyone into a false belief of a stabilized resale market, now on to new housing starts fabrication. And they will convince the “general public” recovery on hand.

I just moved into a house in the I.E., I still have all my search filters running on Redfin/Zillow/Trulia. For the same criteria of rooms floor area lot area and price range the list of offerings has dropped off and the prices have gone above what I paid for mine. Not saying there is a bottom here, just that the firm grip of the bankers has nearly touched fingers around the neck of housing in So Cal for retail buyers. If you are out there still looking, it seems that deliberate despair has been inflicted upon you by the 1%. No tin foil hat but, maybe after a tuesday in Nov maybe perchance they open up again, who kudda’ known.

To build on what Greg In LA said earlier this feels like another crash waiting to happen.

Another fact that I rarely see mentioned is the impact of the appraisal rules on this market. We have done numerous flips and investors I work with have done the same where Buyer’s were willing to buy for an even higher price than we could get an appraisal.

In fact many “flippers” have begun doing less to the homes because they know they can get a “maximum price” given the current appraisal rules without doing as much as they normally would to a property.

When fixing a house we constantly evaluate actions to determine if we have already maxed out the property relative to what we can get as an appraisal. In other words this new mini-bubble is being substantially, and that is not an understatement, by the appraisal rules. Without them and you would see large price increases, much more than DHB has documented. Especially in the entry level markets and the IE.

So are you saying that the appraisers are holding the market from going higher by being conservative in their valuations. Buyers are willing to pay more but the appraisal is putting a check on prices.

If that’s the case I would say that for now the appraisal industry is taking it’s job more seriously than it was during the last bubble.

This was true in my case. Because I strategically defaulted I had to buy a home from a flipper using a private loan(I put 60% down). I actually ended up getting the price reduced signifigantly because the appraisal came in low.

I live in one of the “mania” Bay Area communities. Here, in 2012 prices have regained most of what they lost in 2008-2011. Volume, of course, is much lower than the bubble years. And there is a huge backlog of future foreclosures that’s trickling through the pipeline.

I think the bigger picture is that the Fed / Govt / Financial Sector manipulation that’s going on is driving us toward a currency crisis. Once it occurs, there’s going to be hell to pay in lots of areas.

Gonzalo Lira (http://gonzalolira.blogspot.com/2010/08/hyperinflation-part-ii-what-it-will.html) talks about what happened when currency crises occurred in Chile and Argentina. One of the results was that mortgages became unattainable. This resulted in housing prices collapsing–at the same time that prices of consumer goods and commodities were exploding.

Unless something changes radically with respect to our government’s skyrocketing debt levels and increasing reliance on money printing, it’s hard for me to see how we’re not going to hit that point within the next five years.

Just a note, DRB for the first time refers to the low rates as “incredible” instead of past references as “ridiculous.”

Capitulation?

He strikes me as the same kind of tired many people covering many issues for about a decade are. They had hopes that things were an anomaly and that eventually we’d return to normal, but then there is the resignation that we never will. This is the new normal. It doesn’t make sense, it isn’t right or fair or for the long term good, but it’s the new normal nontheless.

Echo bubble round 3 – low interest/inventory = doomsday machine.

Slim Pickens in the market these days.

Guess I won’t own – ever. Purchase prices, not rates will be the impetus.

1) Don’t want 97% leveraged home that loses value when rates do go up in 5-10 years.

2) Don’t wanna be no slave (to debt).

3) “House poor” doesn’t have the same cache it used to have.

History shows that home values go up when interest rates go up:

April, 1971 – 30 year fixed rate = 7.31%

April, 1980 – 30 year fixed rate = 16.32% (a 223% increase)

Median home values in California unadjusted:

1970 = $23,100

1980 = $84,500 (a 366% increase)

Equally, home values level off or go down when interest rates go down:

April, 1990 – 30 year = 10.37%

April, 2000 – 30 year = 8.15%

Home values unadjusted in California:

$195,500 in 1990 to $211,500 in 2000

In the last 4/5 years home values and interest rates have been going down. If interest rates stay at current levels for years to come I suspect home values to remain generally flat, but I’m not a fortune teller.

Whoops, I meant a 123% and 266% increase or 2.23x and 3.66x increase.

“April, 1971 – 30 year fixed rate = 7.31%

April, 1980 – 30 year fixed rate = 16.32% (a 223% increase)

Median home values in California unadjusted:

1970 = $23,100

1980 = $84,500 (a 366% increase)”

Track those same time periods to the unemployment number and you’ll get a much higher correlation to housing prices. When unemployment was 6% or less, housing went up in CA. Regardless of the mortgage interest rate.

Watch those numbers – incomes were rising during that point as was inflation and very positive demographics as boomers nested down with children. Also, valuations were not nearly as stretched as they are now at the starting point. Be very careful about extrapolating that one period forward, I’d guarantee it doesn’t play out like that again.

Back in the 70’s wages were increasing in par with inflation. Inflation was accurately calculated and reported. As time went on in the 80’s and 90’s, inflation formulas were revised and no longer reported the reality of cost of living. Wage increases did not keep up and resulted in many two-income families, and then massive credit card debt to make ends meet.

Now in 2012, inflation is reported at about 2-3% while true inflation is about 6 to 8% per shadowstats. Most people are not getting wage increases or if they are it is about 2%. So every year you lose about 4 to 6% of your purchasing power.

The real villian here is the federal reserve. We have a fiat system, not backed by anything tangible.

Being “house poor” indeed had cache and being leveraged to the gills on a mortgage has been the smartest investment choice anyone living in So Cal could have made for the past 40-odd years (save for ’06 to ’08).

But, without a move-up market, people will really, finally be stuck.

Instead of “appreciation” the new buyers are clinging to the siren call “rental parity.”

But, rental parity can still exist with your 3.5% 30 year note AND have your home decrease in value 15-20% when interest rates come back someday to historical (5 years?).

It will be very, very interesting what happens to psychology then. When psychology turns, it will mean that prices aren’t far behind. And, I have a sneaky suspicion that all of Los Angeles won’t have turned out to be a gentrified pre/present/post hipster utopia by then.

Maybe Papa will buy then. Save, Papa, Save!!!

Hi CMclimber. I told a friend of mine last night that ‘I am ready to buy’ and he said: ‘no, you are ready to look at homes’. He bought 3 yrs ago in Playa Del Rey but only after getting the run around by brokers not knowing the area well and investors with all cash buying up the best homes and crappy home inspectors, etc. But now 3 yrs later and prices in his area are rising again and he refinanced. He said he is very happy being a homeowner.

Anyway, I am preparing myself mentally for the process of looking at homes, submitting offers, getting counter offers, then inspections, loan process etc. but that beats the hell out of renting for the next 3-4 yrs HOPING for a better time to buy. Seems there are lots of doomsdayers on this website who all promised house prices by 2012 will be half of what they were in 2008 in LA. Now these same people in 2012 are now say ‘just wait until this that or the other thing happens’…by 2014, bla, bla, bla. Not me, I am going for it! Taxes deductions for being a homeowner alone are about 40% of my current rent. I plan to buy a duplex, live in one small home, rent the other one out, so at least I have my property working for me as well. Good luck to all the potential buyers out there. I will keep you posted. I am looking at mid cities LA and some WLA

Daniel, your friend is right, you need to look first and educate yourself on what is really going on here in the La La Land real estate. Our view is different, we grew up in LA in the 1950’s & 60’s when it was a beautiful place, owned properties and most likely will never buy here again, makes no financial sense. Jobs/incomes don’t support the cost of housing and living unless you live outside of the city. Besides the worst construction on the planet, most homes on the market today are either “damaged” or get into multiple offers the second they hit the market, then the bidding wars. We are not waiting for the market to change, we are looking other places that make sense, even though this is our home. Good luck in your search and buy based on the financials not emotions.

Doomsday was probably hyperbole. But if you don’t see the incomes being out of whack with housing, you might be overestimating the health of the current housing market and its long term trajectory.

The renewed sentiment claiming the soundness of a current housing purchase based on low rates, historic housing appreciation, and the idea that low volume supply will cause buyers to quickly be priced out of a shinking market expressed on this site smells a bit like 2002-2010 IMO.

Obviously there are a multitude of buyers who bought low during the forementioned timeframe and didn’t HELOC theirvhouses into the red. Conversly, there were a lot of nitwits who did – squatted, walked away, didn’t pay, saved, and basically did anything but honor the mortgaged they took on but couldn’t afford.

I wish you the best of luck in your Income Bearing property purchase. It probably will be a smart play from you in your local market. I am not as sanguine about the future values of mid tier (what currently goes for half a mil) Souther Cal property.

http://www.scpr.org/news/2012/10/16/34587/fewer-homes-sale-southern-california-has-caused-fe/

What do you think of this article n KPCC about the “constraints” in the housing market in San Gabriel Valley?

I’m in So. Pasadena and I had a realtor call me out of the blue to ask if I wanted to buy a house! Or, do any of my friends want to buy in So. Pas. I said, sorry, I am not wealthy nor or my friends and then I hung up. She also said inventory was low here….whatever. Inventory is always low here, it’s a small town and a lot of people want to buy here.

DHB, could you speak to the issue of the current pool of eligible buyers. Is there a way to track how many eligible buyers there are now, compared to the bubble? If the following are not in the pool to buy a home……..

1. Those who have been foreclosed on in the last few years

2. Baby boomers who need to sell and don’t necessarily want to buy.

3. Low new family formation and huge student loan burden

4. Financial consequences of divorce

5. Unemployment

6. Employed but future not secure enough to take on a 30 year mortgage.

7. Stagnant or decreasing incomes

8. People who bought recently

9. Those who are underwater

10. Those that can’t even come up with 3.5%

10. What have I missed?

How many real potential buyers are left today? Isn’t there a time when a critical number will be reached?

At some point isn’t the shrinking pool of available buyers something the fed can’t control? Or can they?

Love your blog! Thanks for all you do!

There is one small problem with the Fed’s manipulation of the supply, what about the demand side? You can limit the supply to zero but if there are no buyers, then what? Economic growth, and consequent wealth, is NEVER created by artificially limiting supply. That is straight out of central planning 101. Welcome to one very sick, feeble system thrashing in the last phase of its existence.

“Economic growth, and consequent wealth, is NEVER created by artificially limiting supply. ”

Yes it is. What do you think OPEC is for? Every one of them is not just ultra rich, but rich beyond anything imaginable.

Limit supply to half, thus raising the price 10-fold and increase profit 5-fold, just like that, overnight.

Oil, rice, wheat, iron, what ever; same formula works always when you are trading with something “essential” and in a modern society there’s a lot of “essential” goods: Oil, electricity and food being primary examples.

But other reasons exist, too.

There is 100* more loose money around the globe than stuff to buy with that, thanks to our bankster overlords and that shows clearly here: 2004 speculation for commodities was allowed and what happened:

http://www.indexmundi.com/commodities/?commodity=iron-ore&months=240

Price of iron increased 2000% in 7years, i.e. 20-fold. Real consumption didn’t change much. Speculators running wild like with oil since 70s.

By the way, if we were talking about any other product, Ben would be in jail for price fixing. Collusion on pricing is illegal. But, not when it comes to the 1%.

The postwar California boom was courtesy of the Cold War and the growth of the military-industrial complex, of which so-called Silicon Valley is but one instance. California is the platform from which the United States projects its imperialist aims into the Pacific Ocean and across that puddle onto the rising world powers of Asia. The federal government brought water to Southern California in the 1920s and turned worthless desert into developable real estate; but even Northern California is dependent on 4 other states for its drinking water. Without the federal government’s largesse and imperial ambitions, California would revert to what it was before the arrival of Europeans, the burned-out edge of a continent that even the native Americans mostly avoided: they preferred the naturally fertile North American steppes in the center of the continent. But the American empire is in decline barely more than half a century after it began. Whoever dominates world trade runs the show and the crafty Chinese own the electronics trade and that seems unlikely to change any time soon. California is a high-tax, high-cost of business and living environment and that is the one sure recipe for failure on the playing field of world trade. if high-cost residential real estate was a model for economic development, the most-imitates country on the planet would be Monaco!

Did I forget to mention demographics? Thirty years ago, the median age in San Francisco was 35; today it’s 65: the city by the Bay has become a retirement home for same-sex couples who bring their lifetime savings and buy a place to hole up in while they wait for the arrival of the Grim Reaper. Frankly, that scenario seems to be about the best the Golden State can hope for. Young people go where living is cheap and free: they already have all they need for a good time, youth and other youths. But a high cost of living kills that idea. California is full of private-corporation-owned so-called schools of higher learning, the reality of which gives all those categories a bad name. But the feds are about to end that game when they exit the educational lending market. By way of example, “Swinging London” in the 1960s was caused by the cheap British pound, favorable tax laws regarding film production, and a city full of empty buildings for rent cheap to aimless youth: see the 1966 film “Blow Up” for a vivid record of the era.

You did not mention Southern California, which by whim of demographics is slowly becoming Caracas north. I did not allude to Mexico City because it does have a small semblance of middle-class. The middle-class of Caracas is mainly in Miami today. Same thing is happening to Southern California with many heading to Texas. Drive around the “middle-class” neighborhoods in the evening and see how many cars are parked out front. On average, four or five, that is the number of low incomes it takes to carry the cheapest mortgage.

I would also add that the Spaniards and early Mexicans avoided California like the plague for many of the same reasons you mentioned. Wild “savages” and no water, has not changed much.

“Thirty years ago, the median age in San Francisco was 35; today it’s 65: the city by the Bay has become a retirement home for same-sex couples”

Really!?!?

I’d like a fact-check on SF’s median age.

The Census site tells me it’s 38.3

I think my point still stands!

It helps to include the relevant link:

http://www.sfgate.com/news/article/Census-shows-Calif-median-age-at-record-SF-older-2372237.php

I’m not sure what your point was exactly since your link states the median age of SF is 38.5

There’s a huge difference between a median age of 38.5 and 65. And obviously a city with a median age of 38 is not a city that “has become a retirement home for same-sex couplesâ€

Life expectancy in 1980 was 73. In 2010 its 78. Median age should go up.

You are correct. No way is the median age of SF 65. Old people tend to leave the expensive inner cities for lower cost suburban or sunbelt retirement areas.

This blog and associated comments are filled with references to the bank/gov’t conspiracy to limit housing inventory and thus reinflate the bubble. This ignores the elephant in the room – the vanishing non-distressed inventory over which the banks have little to no control.

In normal housing markets most sales are “organic” – owner/occupants simply decide to sell. This normal sales process has ground to a halt for several reasons: massive equity reductions leaving many with too little equity to sell at a profit, general nervousness about current economic conditions and a domino effect of limited inventory resulting in fewer options for sellers to subsequently buy. This effect has curtailed inventory far more dramatically than the bankers’ conspiracy.

Ironically the very bubble reinflation that all here decry will ultimately serve to correct this effect. Get enough underwater homeowners back into positive equity and they may finally become willing to sell. This has the potential to reverse the inventory shortage, whatever the banks are doing with their REOs. Maybe, just maybe, this is part of Bernanke’s plan after all.

I think you are going to have wait a bit longer than you imagine for your bubble to allow underwater homeowners to be able to sell (see link below). If the hedge funds cannot make the rental market work with free money, then who can. More demand eliminated and inventory increased.

http://www.zerohedge.com/news/2012-10-17/och-ziff-calls-top-reo-rental-exit-landlord-business

OH GOD, this idiot makes me want to STOP using REDFIN:

Howdy Redfinnians!

Welcome to another action-packed newsletter filled with facts, figures and bold predictions about the U.S. real estate market!

First, the Facts

First, the blatantly self-serving but absolutely true facts. Redfin commissioned a study comparing thousands of listings on local brokerage sites like Redfin.com to national portals like Zillow and Trulia. The study found that Redfin has 20% more agent-listed homes for sale, and gets new listings 7 – 9 days faster; nearly 2 out of 5 homes that appear on the national portals as active listings actually have already sold. To see for yourself, just compare search results for your neighborhood.

Percent of Agent-Listed Homes Appearing on Different Websites

Moving Up from the Bottom

That’s the Redfin news, but what’s going on in the U.S. housing market? You may remember back in February, Redfin was one of the first to call the bottom of the U.S. housing market, even as others were still revising their 2012 forecasts further downward. Who was right?

Well, even the sometimes-bearish Goldman Sachs just predicted that home prices will increase 2.0 percent over the next 12 months, rising another 2.8% in the following 12 months. JPMorgan CEO Jamie Dimon said on Friday that housing has turned the corner.

Only 11% of consumers now expect home prices to decline. U.S. home prices jumped 5.4% in September over last year. Over that same time, inventory declined 29%.

The Number of Homes for Sale in 2012 Is Way, Way Down

Many Buyers, Few Sellers

And from here on out, the inventory crunch will only get worse. With less than eight weeks before Thanksgiving, few sellers will jump into the market now, so supply will keep falling.

But demand so far has shown little sign of slacking off; in September, when back-to-school usually slows buyers, 3.5% more Redfin home-buyers toured U.S. homes for sale and 4.5% more wrote offers to buy them. Mortgage applications for home purchases hit the highest level since June, though we expect that to slow starting this week.

Shadow Inventory, Shadow Demand

The market just now feels like the last day of summer camp, when everyone tries to hook up; most campers end the ride home staring out the window of Mom’s station wagon. Home-buyers are headed into the holidays feeling the same frustration.

The result is a relatively new phenomenon. Just as economists have long worried about shadow inventory — the reserve of foreclosures banks haven’t yet put on the market — we now see shadow demand, with hundreds of thousands of would-be home-buyers from 2012 going into 2013 still looking for a place.

The Conspiracy Theories and the Truth

But hold up, you say, what about that shadow inventory? For months now, we’ve been duking it out with suspicious readers about whether the banks have been conspiring with one another to dump more foreclosures on the market once prices rise. But every month it has become more clear that the conspiracies are canards.

True, foreclosures are continuing to rise in the judicial-foreclosure states, where a court runs the foreclosure process. It turns out that foreclosures can be fair or fast, but not both. The states that are fast, like Arizona, mostly shrugged when a resident lost his home in a rigged foreclosure, but now Arizona will recover three years ahead of the states that were fair, like Florida. Nationwide, foreclosures hit a five-year low.

The Rise of Short Sales

Short sales, where the bank lets a home-owner sell the place for less than he owes on the mortgage, have been the safety valve. As we predicted more than a year ago, in the most distressed parts of the country there are now three times more short sales than foreclosures. These sales are far better for local real estate prices than a foreclosure, mostly because the home hasn’t been left for dead over 18 months.

It’s making a big difference: shadow inventory has declined over the past year more than 10 percent. For underwater home-owners who want to stay where they are but just need a lower rate, government programs are finally helping too, as people are now paying off their old mortgages at a rate not seen since 2005.

Interest Rates Keep Falling

And interest rates keep falling. One area where we were dead wrong, partly out of some misguided political conviction, was about how long the government could keep rates down. As economists like Paul Krugman never tire of noticing, it turns out the government can keep rates low for a long, long time:

Interest Rates Are At Historical Lows

Our Bold Prediction: The Empire Strikes Back

So if real estate is doing so great, when will it help the rest of the economy? U.S. banks have already benefited, with the two biggest just reporting record profits. Finally, inventory has started to increase in at least one market, Phoenix, as higher prices induce owners to put their homes on the market, which will in turn increase sales volume.

We think this trend will broaden in 2013. Next year will be the first year in the last seven to begin with a wide consensus that home prices are rising. Given the backlog of people who have wanted to move for years but couldn’t, we think there will be a flood of new listings after the SuperBowl, which will create far more sales and far more jobs in the real estate industry. Already, Redfin is hiring like mad.

Construction will pick up too. The Federal Reserve just reported not just strengthening home sales but more construction across most of the country. Jobless claims declined sharply last week; consumer confidence still isn’t strong, but posted a five-year high. Political commentators have wondered whether the much-improved unemployment numbers are a statistical fluke or a political conspiracy, but there is a third possible rationale: it’s real estate, stupid.

Real estate will never grow to the proportions it had at the height of the Bush-era bubble, when it was two and a half times larger than it is today. But it is why things will get better. In fact, it’s why they already have. Life is full of ups and downs, but after four years of bad news from the real estate industry, a few ups are ahead.

Questions, comments, quibbles? Just visit the online version of this newsletter and fire away! Thanks as always for your Redfin support.

Best, Glenn

Glenn Kelman | CEO, Redfin

Thanks for the self-serving “analysis”. Just a few things you left out. The fiscal cliff and coming reduction in government spending across the board, local, state and federal. Not to mention that we are due for a recession within the next two years if one follows statistics over the last 60 years or so. Your type of glibness serves no purpose other than to misinform the public. I think they have had enough of that for a while. You may also with to look at real wages and effect of default on the consumer spending. Defaulting is not the same as deleveraging. The US and world economy has a long way to go. The Fed’s total panic should tell you what they think.

If you bother to read the article I linked above you will see that that the average time to foreclousre in California is over 1,000 days. I assume that is not one of your “fast” states.

Wow, enough to make one lose their lunch.

I think the housing market is really, really bad. Why else would the Fed be pumping $40 billion a month into mortgage backed securities? Just like the Fed trying too hard, so is the article.

Im a Realtor and I can confidently say this article is swill on so many levels.

Second opinion! “Who Killed California?”

http://www.nationalaffairs.com/publications/detail/who-killed-california

I expected better of this blog than to quote MEDIAN house prices as an indication of risking house prices. Median prices are a function of mix, nothing more.

While it is true that house price indices in parts of CA are rising, they are rising at nothing like a 12.5% rate.

High 5 to Lord Blankfein. I did what you did 6 months ago and purchased a home. I’m not sure if you have a mortgage or paid with cash the point is we’re now homeowners and that feels awesome. Even if my home depreciates I will make that back in several ways, ie: knowing It’s my home with no threat of increasing rent, no a-hole landlords to deal with, the feeling of throwing money out the window and not owning anything for it is over, being able to upgrade MY home to my satisfaction and not losing the money in upgrades if I ever decide to move, no roaches or pesticides, and the list goes on. My townhouse was 250k in 2006. I paid $43.5k (REO). Rent in my neighborhood for a comparable 2 bed 2 bath unit is $1200 a month if you’re lucky. I figure it will pay for itself in 3 more years. Not to mention the value of the unit has gone up approximately %10+ in the last 6 months, %22+ y-o-y. Many investors probably wanted to buy my property but according to hoa rules they were going to have to occupy the unit for 12 months before being put on a waiting list to rent out the unit. And, from what I hear, that waiting list is at least 5 years long. I’ll be going on the waiting list in 6 more months and plan on just enjoying living there til the day comes when or if I ever decide to rent it out In the end, I feel lucky and I’m glad I made the move. PS. my property tax was reassessed and the city actually sent me a refund check. The tax is now $576 a year : )

About 32 percent of Americans own their homes free and clear. Many of those are Baby Boomers, the oldest of whom turned 65 in 2011, and they are now retiring at the rate of about 10,000 per month (there were about 80 million Baby Boomers born between 1946 and 1964). Generation X that came after the boomers was about half as large.

I had thought that inventory would rise as boomers retired and wondered who would buy all those houses. Yet, now inventory is very low. What happened? Are the free and clear Baby Boomers just not selling or downsizing?

Facts and Feelings, in reply to your question “Are the free and clear Baby Boomers just not selling or downsizing?” I can give you one answer from personal experience. We live in a modest, middle class neighborhood in the valley. Homes in our area sell for between 300k-500k. Our next door baby-boomer neighbors just paid their house off a few months ago. Since then, they have been doing non-stop improvements: new paint, windows, landscaping, remodeling. At first we thought they would be selling, but so far, it just looks like they are digging in their heels and staying put. It makes sense to me.

The state that gave America the two most reactionary presidents of the 20th century , Richard Nixon and Ronald Reagan, and currently employs another moron for governor, peaked in 1966 at the height of its postwar boom. Since then, its citizens have sloughed on peddling real estate to each and engaging in assorted other low-skilled, nonexportable undertakings. World leadership is currently being transferred to Asia just as at the end of the 19th century world leadership was transferred from the UK to the US. But a currency is only as strong as the things it can purchase. The mortgage-bundling game was created for one reason only: to recapture trillions of expatriated dollars that departed the country over the past 20 years or so: Currencies must ultimately find their way to the country of origin. The US is overinvested in the housing sector whcih keeps low-skilled and no-skilled people employed and their customers perenially in debt. But the world has no use for the output from this sector and consequently the US has nothing to balance its trade deficit which leaves it begging the world for indulgence. Deflation is a long, slow process because those capitalized at the inflated level can’t reorganize at the new reality due to their debt service; thus, the process is years and decades of individual bankrupticies which are currently projected to end in 2032 or so. By then, housing prices should have returned to 1955 levels and the US economy reorganized around more exportable output from the rising low-cost areas of the South and Midwest.

Dr. HB,

Could it be the politicos & banks are intentionally holding down inventory in California in order to raise prices because they have so much inventory on their own books? Some ploy to make their inventory more valuable before year end accounting? And selling off to institutional investors?

Quote: >> I ended up buying a house in 2010 despite these views. I looked at comparable rents in my area and found that my monthly out of pocket mortgage payment would be very close to what i would pay in rent and I did not take into account end of the year tax rebates since I am much more concerned with monthly cash flow. I am fully aware of the fact that prices could come down, and likely should come down in the future as more inventory comes online and rates ultimately go up. After sitting on the sidelines since 2006 and being frustrated by all of the government intervention and policies that puffed up the bubble and rewarded the reckless, I tried to sift through the madness and find a metric that worked for me and that was comparable rent. <<

= What is often overlooked with a Mortgage is that you have to pay interest on top of the amount borrowed. Even based at a low interest rate of 4% this would effectively double over a 25 year period. i.e to keep things simple, if you borrowed $250,000 @ 4% over 25 years you would pay back $500,000.

So whilst you slag off renting, the patient renter can gain multiple advantages waiting for lower prices. You calculate rent and mortgage payments about the same.. so better off buying with a mortgage? That's fool's math player.

I’m a young CPA and lawyer and I am a renter for now because I haven’t decided where I would like to settle down yet. Compared with cities like Mckinney, TX, housing price in Torrance is outrageous. I’m living here now because of my husband’s job with Honda, and I am not impressed because Torrance is right next to Carson and surrounded by other scary looking neighborhoods. If crimes from these areas overflow into Torrance, which they will eventually, it will cost more to live in Torrance because we will need more police. The pension and health benefits for retired city employees right now are big portion of the city budget, and the current payroll for current city employees are also very high. I just don’t want to own a home in a city that has such huge financial burden, where I have to pay huge amount of property tax (on high housing price in Torrance) even though some of it will be reduced when we file our taxes. Prop 13 is also making housing expensive and property tax outrageous for first time home buyers. One of my clients live in a house in LB that is worth around $800+K based on recent sales. She is only paying around $2500 property taxes because she bought the house many decades ago and her property tax is protected by Prop. 13. She is a multi-millionaire though. Prop 13 creates shortage in houses in CA too cause who would want to sell their houses if they are paying dirt cheap property taxes.

If they ever remove Prop 13, housing price will drop, it will be good for people like me, but not so good for the people who bought houses in the peak price when inventory was tight and Prop 13 was in place. The democrats are constantly trying to take it away…. So another uncertain that keeps me from buying in Torrance.

Anyway, with the alternative minimum tax that hits us year after year, we actually won’t get to deduct much of any property tax or mortgage interest even if we own a home. Tax deduction for property tax and interest is overrated and it’s a scam that enriches the real estate developers. If you are retired and have a low income bracket, you won’t get much of it. The extra amount people end up paying on property tax and interest is way more than the deduction itself, not worth it. If you are making an average income in the South Bay like us, you are considered to be rich by the government standard and are hit with AMT which may add back all deductions as property tax and mortgage interest claimed on regular tax, to arrive at AMT taxable income to calculate the extra AMT tax that is added back to the regular tax calculated at the regular tax rates. The AMT system is an additional second tax system to add more tax in addition to the tax system that is in place. Most people think it only affects the rich people but with inflation, yes, decades ago it did. But with inflation that raise the amount of average income, it’s hitting people like myself. As a lawyer and CPA, I would rather own a home in a city that is safe, has good growth potential for jobs, and that has affordable housing. Any city that has huge financial burden will not provide good future growth for jobs, cause businesses will move to cut cost. It will be a matter of time when Toyota and Honda relocate to other cities in other states or may be Rancho Cugamonga or Fontana to cut cost. Then more regular folks will flee, leaving Torrance to become more like Inglewood, Hawthorne and Carson… As a lawyer and CPA, I will move my family to Texas in a heartbeat because we can buy a 5 bedroom 3 bath house there with cash and we won’t have to pay income tax to the state. This alone is going to save us a lot of money. But so far my husband has a good job here with Honda and we are able to make the cashflow work for our rent using the growth of our stock investments, a couple of our stocks are Google and Apple. If only we spent that money in a house in 2010 instead of on Google and other stocks, we would have less net worth now. The bottom line of owning a home vs not owning a home is cash flows and its ultimate impact on net worth for the family. Total Assets – Total Debt. For us, we are better off now we are renting than if we buy a house. We have no debt, out assets are in good stocks and mutual funds. We save money on upkeep and repairs and house insurance. We have total flexibility to move to anywhere that offers us better income than what we are having now. My landlord is nice and he hasn’t raised our rents for the last 4 years, making our rent cheaper than mortgage payment we will pay if we buy a house of the same size and in the same nice neighborhood. He bought the house we are renting dirt cheap in the 50s, so he can afford to rent it to use for cheap since we are good tenants who won’t trash his house. But I am sure to a lot of people, they are better off owning their own homes in Torrance. But for us, Torrance is going to be one of the last places in America we want to buy a house in, because the state income tax alone is the factor that assures us that we will not want to be in California for good. We will be here as long as our disposable incomes are still the same as if we are to move to Mckinney TX. Any higher in tax rates and higher cost of living as a result of another inflationary real estate bubble created by the subsidies and artificial low interest rates of the government, we will move out of Torrance immediately.

My take on the rising MEDIAN price in SoCal is that we now have more high-end homes being released to the market. The loan recast of all the Option-ARM, Alt-A have mostly came due between late 2009 till now. Most of these loans, I imagine, are in the high-end area like Irvine. So with more high-end homes being sold to the market, that does have a positive impact on the MEDIAN price, but not necessarily means home price has risen due to higher demand.

Have just put an offer of 370K ( 15% ) above asking house for a fixer upper that was worth $200K 12 years ago. There were 80 offers and apparently it went well over 400. Of course there is no housing bubble, cough…

Leave a Reply to LindaRNnLA