Real Homes of Genius: A search for small homes in Culver City. High prices for 700 and 800 square feet of stucco box joy.

Southern California is truly a unique place. Once the family planning part of life takes place, people go into house lusting mode overdrive. The Viagra of house hunting is all those remodeling and house flipping shows. I’m sure many of you saw a recent study that showed the cost of raising one child to be somewhere close to $250,000. This is important because many people are paying sky-high housing costs to own a home in areas with crappy or mediocre schools. They will need to send their kids to private school if they want to provide them an education that a $700,000 crap shack would entail. Maybe they’ll take a class on economic history and how following the herd is rarely a sound foundation. Also, with the cost of attending college setting new records, what will it cost when those young kids of today go to college in 17 or 18 years? They rarely factor in these future costs when they purchase a home. Why think about that when squeezing every last nickel into a mortgage payment is the dream of many SoCal residents? Screw retirement planning or focusing on the true cost of raising a family, the ultimate goal is own that prime location home. You better make sure you have extra room for when those kids boomerang back onto your Taco Tuesdays and Karaoke Fridays. Set a nice seat and plate for the Fancy Feast weekends. Let us go shopping for some homes in Culver City!

The small and the restless

I love it when I post some of the current examples of homes in Southern California and get e-mails from folks outside of the region. “Are you people insane?†or “I can’t believe people are willing to pay this price for THAT!†But people do. Boom and bust folks. The past never happened. Those millions that got screwed in the last bust are like the failed Hollywood movie of yesterday. People are eager to be part of this new Blockbuster! Of course the housing market has slowed down and sales are dropping while prices are stagnating during the hot and steamy summer months.

Let us take a look at a couple of homes on the market in Culver City:

4205 Irving Pl, Culver City, CA 90232

2 beds, 1 bath, 780 square feet

Plenty of room for two but what about the new family member? Most that buy are couples with the mentality of expanding their family. 780 square feet isn’t exactly a big place. Let us look at the ad:

“Gorgeous 1923 Spanish Bungalow in downtown Culver City! This fully remodeled jewel box has it all: ornate tiled fireplace with built-in cabinets, French windows opening to the front patio, hardwood floors, remodeled kitchen with tiled counters, stainless steel appliances, garden window & breakfast bar, central air & heat, remodeled bathroom with marble floors & marble counters, and a detached office/workshop.â€

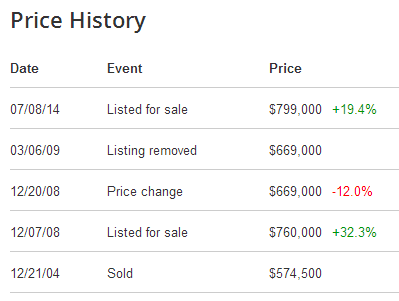

The place is almost 100 years old! Do you think things will go wrong in the future given the age of the place? Probably. Homes cost money to maintain, especially older homes. Have you ever paid for a roof replacement? AC replacement? Pipes? Many wide eyed future buyers are going to get a rude awakening. This place is currently listed at $799,000:

$800,000 for 780 square feet and 1 bathroom. Dive right on in. With a $160,000 down payment (20%) your PITI will be close to $4,000 with current mortgage rates. A fabulous deal. Onto our next home:

9016 Poinsettia Ct, Culver City, CA 90232

2 beds, 1 bath, 853 square feet

I love how the bush covers nearly one-fourth of the home. Let us look at the first line of the ad:

“Rare opportunity to own a single family home in a prime Culver City location at condo prices.â€

Single family home for condo prices. Is this place priced in the $400k range since that is what you can get a condo of this size for in Culver City?

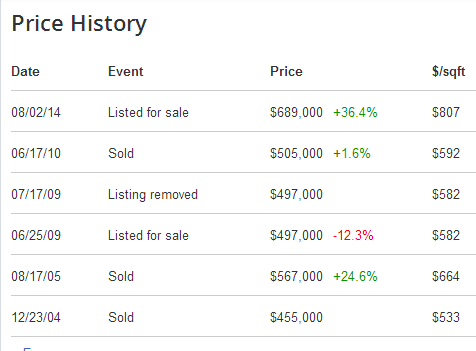

Hmmm. $689,000 certainly is a long way away from $400,000. Then again, you are living in 853 square feet of luxury and opulence. This home was built in 1922 or a year when Babe Ruth was suspended for one day and fined $200 for throwing dirt on an umpire. A couple of years prior, women got the right to vote. Good times. Each month you send in the $4,000 mortgage payment you can remember those milestones as you read your kids stories of history from the bottom bunk bed.

Pick up the phone and call your agent! Aren’t you eager to drop close to $700k and $800k on 700 and 800 square feet of beautiful real estate in Culver City? The investors are pulling back now so the forum is all open to the regular buyers now.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

108 Responses to “Real Homes of Genius: A search for small homes in Culver City. High prices for 700 and 800 square feet of stucco box joy.”

The game’s been upped, yo! Marble is the new granite!

And, may I present a new term for What? to lavish over…

Condo-equivalent!

I prefer condom-equivalent…

I would just continue to rent mine for a half of the mortgage payment, besides, I also keep the DP, which I would invest in PMs (to make sure I don’t collect 0% interest), the second half of the saved monthly payment i would invest in my own business (not rental business, of course)…

I remember reading an article last year that said it takes more than $300,000 to raise one child in middle class America up to age 18 without spending on college if that child was born in 2013. Or more than $400,000 for the same child in a high rent area like SF or LA or DC or NY. If you don’t care about your kids future you can spend less of course. If you are a single guy you don’t have to pay for a good school district real estate prices and just live in a relatively safe lower middle class hood like Gardena . Guys don’t need a fancy nest

How much does it cost me to raise a child on welfare? I mean $300k is for my child and $300k moar for someone else child…

http://money.cnn.com/2013/08/14/pf/cost-children/

a link for how much it costs to raise a middle class child. upper middle class child costs more

i must be doing something wrong or I’m just really poor? i see Hispanic family after Hispanic family with 4-5 kids all the time, hell i saw one family interviewed with 10 kids so I’m confused on how it takes $250K to raise a kid? that group certainly doesn’t seem to have the financial difficulties raising kids that i seemed to have. 2 kids just about broke me.

And I quote: “Redfin is unable to take you out on tour to see this home because the sellers have accepted an offer and the property is now pending or under contract.”

Hahahaha…this is ridiculous.

In my surroundings it takes two to three months to remove sold signs from the side walks. I wonder if they left on place to create impression of high selling activity in the area…

Actually, these prices are not as ridiculous as 2007 home prices. Crap shack shoe boxes like these were selling for $750K in Culver City in July 2007. On an inflation and interest rate adjusted basis, these shoe box crap shacks would need to approach $1 million to nominally match the previous bubble’s market top. Interest rates on a 30 year fixed mortgage was 6.75% in July 2007.

You forget to mention the income in 2007 and employment rate and many other thins. The current economy is waaaaay weaker than it was 5-6 years ago. The household incomes declined, why housing shouldn’t. In my area, the housing prices has already beat 2007 peaks and at all times high again. Look out below, everything is all time high, housing, stocks, unemployment, rich, etc… and the interest rates at all time lows…

true, but the vast majority were buying with nothing down and selecting the 1% teaser rate…..million dollar loans had a monthly payment of around $1800. But you are right, we will see what happens. I spoke with a friend who owns 5,000 SFR’s and he thinks prices for all of So. Cal are going past the highs of 05-06. Cities like Arcadia and large parts of West LA are already WAY past the peak prices of 05-06. The only difference now is a huge portion of the buyers are paying cash in the good areas. Prices are leveling out all over the place. Without better paying jobs it’s going to make it hard for prices in mid/low tier areas to keep climbing. Either we need better paying jobs or the banks need to bring back liar loans, that’s the only 2 things that will keep prices increasing…

Using the CPI basket of inflation for comparison purposes only tells part of the story. We’ve been seeing deflation in other areas such as wages. I get why general price inflation is used as a yardstick but it’s really a blunt tool, at best. And then there’s the issue of comparing previous peak to current vs leading average to current.

Considering with these low interest rate mortgages and tight supply you can see homes are coming out pretty quickly now. As an example on Zillow in Monterey County all the low end homes are being snatched over the ones that exceed $400k. That tells me this is the banks at the work trying to siphon off delinquent homes and and now sending out foreclosure notices to owners who have been under warranty for a while. I guess with these price increases they are unloading while they can before interest rates head up likely next year. Doesn’t seem like the new buyers figured out what really is going on now. Low interest rates wont’ save them this time if prices drop when interest rates increase. also with the changes in the bankruptcy law I am curious if this could have repercussions on those who are taking out loans now if prices did go back down again?

Tired,

I understand your point about CPI calculation brought to housing. Short term you might be right. However, long term, those higher prices for building will put a damp on construction. Due to building at 1/3 historical norm for year after year, at the same time you have new births and immigration, long term you are not going to see lower NOMINAL prices. The building at this point is at replacement only.

You can cram only so many people in the same housing stock. That pressure will keep the NOMINAL prices if not increasing at least flat. I agree that quality of life in SoCal will drop significantly for most average people. Those in search of quality of life will forget about climate and the so called “soffisticated diversity lifestyle” and will look for better pastures.

Homerun,

Interest is not going to increase. You’ll see. I suspect they will go lower. The FED is not setting the interest on 30 yr mtg. It is the treasury and bond market. Due to global conditions you’ll see more and more capital flying to US for safety. That will keep rates the same or lower, regardless of what the FED is doing.

If you don’t believe me, wait and see. I am 100% confident.

Builder

Yet at the same time we are seeing price drops with dropping interest rates. I think we hit a short term inflection point with this buying. Not to say it will stop but I think buyers are looking for bargains again based on what I am seeing. Maybe rates will go lower but if they did drop back to 3% I would guess the banks are probably saying we need more time…please keep it down a bit longer until we can dump the rest of the properties? I think the game is up in my opinion. I am being realist as well.

I never understands the attractions of LA. Mediocre school for the price you pay. Traffic is horrendous. Many people are rude. Gangs. Smog (thought this has improved). Maybe you’re closer to the fake lips and boobs, downtown, the beach, and can pound your chest to everyone that you’re an LA’er. But that about it. Heck there is not even one NLF team in LA, we ran two of them out of town many moons ago.

Whenever I hear that the city that I am living in is trying to attract *another* sports team, I get down on my hands and knees and pray to God that it won’t happen. The trend of sports team locating to already dense urban downtowns drives me to lunacy. It’s as if city planners were actually deciding on ways to make traffic worse in what are normally the worst places for traffic. Like in LA, Sunday is normally a low traffic day, but I am convinced there are a bunch of people sitting around thinking, “You know what? If we get a football team here, we can screw up traffic on one more day of the week. That’ll be awesome!”

closer to the fake lips and boobs, downtown, the beach, and can pound your chest to everyone that you’re an LA’er

Ben when you live in very depressing cities and towns with lousy weather every 3 to 4 days you don’t care where you live in So Cal. It is all about sunshine and a life style that many folks still dream of.

Lol I live in the OC. But LA is too overpriced for what it offers. I don’t give a f*ck about being close to celebrity, beaches, etc.. even though I’m living 15-20 min from the beach as well and some of the baggages that LA has. It’s too crowded for my taste.

It’s all about weather, isn’t it? It is special down there (down there from Seattle :))…

Seattle. All I can say is my father gave up a huge business in Chicago in the 1950’s, when our family arrived in Jan and the temp was 74 degrees, I remember very well even at a very young age, he said “money or no money I did the right thing for us.”

It’s not 1950 anymore so that’s a misleading anecdote.

Climate change will make PDX/Seattle the new LA weather wise. LOL!!!

Oddly enough, my wife and I prefer overcast and cold, and, after 15 years in L.A., we’re probably going to move up to Portland in the next year or two. Outside of family and friends, I honestly can’t think of much that I’d miss about L.A., so it is pretty hilarious to me that I overspend so much to live here. Granted, if I made seven figures per year and lived somewhere like Beverly Hills or the Palisades, it might be different.

@GH – please consider your move to Portland (or anywhere in the PNW carefully). I lived there 5 years. Owned a home at 33rd and Broadway. I was asking myself if life was worth living during the 5th winter. The weather isn’t for everyone. The constant nagging drizzle. The never ending stretch of gray cloudy days (6 weeks straight with no sun in winter #3). 70% of the populous on meds. Shut down close to the vest people (by product of the gray and rain). Countryside drained of color during the winter. I sold my home at a loss because I just knew I had to get back to SoCal where people are outgoing, willing to goof and play, and are of an entrepreneurial mindset that embraces people of different color and cultures. I am white and I got sick of looking at white people. There isn’t any diversity there. If you’ve lived in NYC, SF, and LA like I have diversity seeps into your blood. Portland ain’t no utopia. It’s a place with the highest suicide rate in the country. There I’ve been of service.

Many moons ago after 18 years of snow on the east coast I had to decide where to go to college. I spent a weekend in late April visiting one of my top choices up in Boston. On my last day, May 1st, it snowed. I sent in my acceptance letter to my other top choice in SoCal the next day – and I’ve lived here ever since.

As I near retirement I too think of migrating to Oregon, but while Portland is indeed too gray for a confirmed sun worshiper, head about 50-75 miles east to the other side of the Cascades and things brighten up considerably.

Apolitical, tolucatom

It is true that the coast of Oregon and Washington are depressing in terms of overcast and rain. However, east of the mountain range is beautiful, sunny and dry. The views are excellent and the winters very mild.

My first choice for Oregon is Bend.

My first choice for Washington is Walla Walla wine country. It reminds me of Tuscany, Italy. Mild winters, very dry and sunny and beautiful scenery. Lots of restaurants and the town is historical with lots of character. Clean air year round and no traffic bumper to bumper.

“Isn’t 1950 anymore” from BS…don’t matter does it, 1950 or 2014 the mountains, the sea, the desert, the sunshine are still there,and not going away anytime soon.

SOUTHERN CALIFORNIA

=================

Home sales will continue to decline — because the very high home prices are too high for people’s current INCOME to support. INCOME DICTATES EVERYTHING.

Because House Inventory is very tight and quantities continue to be low, the Real Estate Industry by which I am referring to Real Estate Brokers/Agents have ONLY A FEW HOMES they can represent. Since they need to earn a living on a COMMISSION basis – they will attempt to keep their listing prices high to obtain as much COMMISSION AS POSSIBLE FROM EACH AND EVERY SALE.

After all – they don’t know when they might earn commission again, or get another listing again. MANY REAL ESTATE PROFESSIONALS ARE “STARVING” FOR COMMISSION.

What will surely happen is that :

(1) Listing Agents’ will get ‘desperate’ and nag and nag their listing clients (home owners) …… TO DROP THEIR ASKING PRICE …… PLEASE, PLEASE DROP YOUR ASKING PRICE.

(2) What these Agents are NOT telling their customers is that they need to make a commission ….. because they are STARVING for money.

Even Real Estate Agents have bills to pay.

(3) This will cause the NEEDED DOWNWARD PRESSURE IN ASKING PRICES.

This has happened before .. in the early 1990’s

(4) In many ways – it is possible to say that the MARKET DOES NOT SET THE ASKING PRICES for property .. IT IS THE AGENTS AND BROKERS WHO ACTUALLY SET THE ASKING PRICE …DEPENDING ON WHETHER THEY ARE MAKING “SUFFICIENT” MONEY FROM THEIR COMMISSION during that period in time.

(5) Another side-effect of this , is that many many Agents and Brokers will begin to break many laws , Real Estate Laws, breach contract laws, break criminal statutes …..just so they can MAKE THEIR COMMISSION.

REAL ESTATE FRAUD WILL INCREASE RAPIDLY …. Since these guys are DESPERATE TO MAKE THEIR COMMISSION … Or they CANNOT SURVIVE.

The were many Criminal Arrests of Licensed Real Estate Agents/Brokers in the Mid-1990’s … when the SO.CAL real estate market was in a DEEP DEPRESSION.

What did happened to the Mortgage Brokerage Industry (during this latest Real Estate Disaster) will soon happen to the Real Estate Sales Industry. These prosecutions don’t always get media coverage — BUT THE INVESTIGATIONS do lead to license revocations and sometimes to Agents being arrested for criminal violations.

HISTORY REPEATS ITSELF.

*** All the RED FLAGS are there. ***

Keep dreaming. High prices are nothing new in SoCal. They have always been high compared to the rest of the country.

The new norm is multi generations in the home. Either cultural or kids not moving out. This will keep turnover low and demand will only grow as the 2nd wave of legal kids (born in he us) are able to buy with the cash from the illegal parents.

Realtors have always played games I won’t hold my breath on anything being done about it or a complete collapse of the system because of it.

Southern California is not like the rest of the country. The demographic is completely different. And that is making all of the difference.

The rest of the country has cheap homes, they just don’t know it.

In other words, this place is different. You may also enjoy similar hits such as this time is different. Brought to you by: always and never brand crystal balls.

Define “high.” It’s too broad of a stroke to reach anything conclusive. There’s “high” and then there’s unsustainably high. The devil is in the details and so far, we ain’t got none.

” Reply to Sean1 ‘ :

===================

Please go back and re-read my post;

also you sound like a Real Estate Agent ? (are you an Agent?)

Sorry – you missed the point and much of what you say is historically INCORRECT;

except one thing …. So.Cal is one of the most expensive markets in the USA.

The supply of homes is selalble small – therefore R.E. Agents must make their commissions on fewer transactions. That is the CURRENT state …. it has NOT been the historical norm.

We have HIT THE WALL — The prices for what were middle-class level homes are TOO EXPENSIVE — Buyers do NOT have the Income- So they STOP BUYING. R.E.Agents become DESPERATE and they have to make a living somehow , so they can either take a part-time job at WalMart ….

…… OR these R.E. Agents can force their Sellers to drop asking prices to attract at least some qualified buyers; to make this happen many R.E. Agents will almost say anything to make a deal.

R.E. Agents in California are Fiduciaries to their Clients … misrepresentation, forgeries, lying and other illegal behavior leads to losing their licenses or worse getting prosecuted for their behavior.

** Take a look back at 1991 to 1998 (approx), at the number of R.E. Agents that either lost their licensing, quit the real estate industry or got prosecuted.

As I said :

….. History repeats itself , yet again.

“The Viagra of house hunting is all those remodeling and house flipping shows.” I Love this analogy doc! It’s both funny and true.

Less is more…

It is in the USSA wonderland… BTW, as much as I enjoy the silly What?, I like the real one moar!!!

you mean shilly What? of course…

Less What? is more…

So we have gone from big “S” to little “s”, interesting…

I am currently in the process of buying 20 acres of vacant land in Palmdale. It’s located near a landfill/dump so I got a great deal. I also purchased 120 empty storage containers from the shipyards in Long Beach. They weren’t in the best of shape so I sand-blasted them using walnut shells so as not to cause damage. The good news, they’re ready to live in now. I will divide up the acreage and place a single storage container on each small parcel, which I shall auction off in the fall of 2016.

Finally, a chance for every new family, or those with outstanding student-debt, to afford to own their own home in sunny California. But only 120 people can get in on this. Do you qualify? If so, don’t delay. I’ll be taking orders shortly. Okay, who’s in?

I want the reality TV rights. What’s your price?

Oh, contingent on the aforementioned walnut shells being certifiably organic.

Container/land prices start at 350K, depending if you’re plot is upwind of the landfill. Reality TV rights are negotiable. Make an offer.

From humanely raised, free range walnuts. Don’t forget to add the guitar in the background when staging the units.

Check out the third photo in this listing!

http://www.realtor.com/realestateandhomes-detail/7-Wellstone-Dr_Portland_ME_04103_M47224-53847?row=5

That’s actually not a bad idea. These strong steel containers are earthquake proof and you’ll have a more intimate time with your family as the steel walls will block all cell phone / wifi signals.

Lol I love it. I’ll take two and then I’ll flip them. I can already see where I’m going to put the granite counters. lol

Stock market at all time high again, no tank on the horizon, sorry Jim Tank, but the tank is not happening, just yet. Lets see what 2016 will bring us 😉

Don’t agree with that one! Already coming down. I think people are tired of pretending their eating steak as they stuff a can of beans in their belly.

“Stock market all time high again” so you’re saying long as stock market is all time high housing prices will keep going up because people will have more money from stocks to buy homes?

2016 seems awfully far out for me. I like 2014 better 😉

@Jim Tank, as much as I want the prices to correct and to start reflecting the underlying fundamentals (household income and debt, employment, etc), as I said on many occasions there will be no housing correction. There would be some dips and ups, but for real correction to occurs we would need to encounter bigger correction in bonds and equities’. This time is different in the way that this bubble is driven by the wall street. Stocks, bonds and housing are in the same boat, if it sinks, everything will. If you believe we will have the economy collapse by the end of 2014, then yes, the housing will tank, otherwise, the Fed will “save” us 😉

I find it funny and maybe some strategy by the FED where they get comments from one group about interest rates need to change and then swing back the chief on this. Seems like they are trying to scare people into buying before they jack up your rates?

All motivated and then mention of loosening of lending is just icing on the cake which I feel is going to lead us to a 2006-2007 scenario all over again. all in my opinion

I totally agree. This is a new housing bull market. Just last night, I watched Million Dollar Listing: Los Angeles (these homes almost qualify!), and it’s clear from that show’s anecdotes that both the economy and housing market is strong throughout So Cal. While I don’t recall actually seeing a buyer or seller on the show who was actually is having to earn a paycheck, I am sure that the show is indicative of the strength of the entertainment, aerospace, and automotive industries that have historically underpinned So Cal’s economy. Why else would anyone be paying $1k/square foot for such charming and cozy residences?

A nod to What? For changing my houzing tune.

Fwiw, don’t forget that the show you’re watching now was likely filmed at least six months ago, if not more.

Josh Flagg, Josh Altman and two douches from London. What a show! They seem to have lost Madison and his low-key Malibu lifestyle, in favor of the two douches from London. But you’re right, at the highest echelons of property transactions in LA, Brentwood and B.H. times are still good, even though inventory is low and ‘sellers’ are interviewing lots of agents before they get the listing. That one seller interviewed 12 different agents before giving the Altman the listing.

I’d imagine the average buyer doesn’t have much of a stock portfolio outside a retirement account.

First the $250K to raise a kid is complete BS! Do you honestly believe this? If this is the case then why in some poor neighborhoods I see people pushing their 6 kids down the street in a Food4Less shopping cart? Do they secretly have 1.5MM set aside to raise the 6 kids? Or is government assistance is going to pay out 1.5MM over the next 22 years to that family of 8?

That $250K number is complete crap.

As for these small homes. These 2BR homes will accommodate the family of 8 above, their parents, and some other cousins. Each bedroom holds 3 kids, the living room for the grandparents, and the dining room for the parents. The garage could be two more bedrooms and will be a rental unit. Collectively they will work tax free and have enough to cover the rent. This my housing bubble friends is how we roll in LA.

Did someone really think this was a starter home? What middle class family of 3.5 earning the avg $80K is going to be able to afford this?

California Dreaming!

@Sean1

a friend of mine is a social worker with LA County and the stories of the multiple generation families of 6 or 8 people living in a 1 or 2 bedroom apartment or home are spot-on. Especially in ELA, Bell Gardens, Cudahy, Huntington Park, Maywood, Bell, Southgate…But you forgot to include Top Valu market and Food4Less !

The harsh reality that this living condition is 100x better then their alternative. In many of their home countries they are not safe, the schools are worse or non existent, they power doesn’t stay on 24 hours a day, and the homes are shacks.

It’s all a matter of perspective. To many living in that home it’s the middle class dream and they could not be happier. The safety of their family, food, and shelter are much more important than the BMW and impressing the neighbors.

As I understand the 250k is a mean, not a median. So it can be skewed upwards by a small percent of big spenders.

And in your example with 6 kids, there is some ‘economy of scale,’ particularly when it comes to things that can be reused (like clothes) off a single purchase, or goods (like food) that are cheaper on a per head basis, at least if you actually cook. But the average family is not so large – you’ll get some savings on the second, but not a deep discount.

In terms of a single child, if you look at diapers + clothes + shoes + marginal housing costs for larger space + childcare + healthcare/insurance, etc. it can run into the six figures pretty quickly.

So I wouldn’t say the number is ‘crap’ albeit it certainly has flaws as a single metric. It’s a very rough gauge of the real fact that kids ain’ t cheap, particularly if you strive to give them anything more than the bare minimum, but it certainly doesn’t indicate that each and every child costs that precise amount.

I am seeing more and more price reductions almost daily now. Housing to Tank Hard in 2014!!

since you’re a youngster it’s in your best interest for housing to tank. i can’t say the same for someone like lord b

Lord Blankfein here. I’m actually rooting for Jim Taylor here. I would prefer housing to tank in the 2016 timeframe. My 200K down payment will then be ready to scoop up a beach close rental property. If Jim’s prediction of 30% plus correction occurs, today’s 800K house should be around 550K…count me in. Housing to tank HARD soon! 🙂

Oh boy I just can’t wait for 2014!!!

Not happening in 2014, told ya already 😉

Sleepless – are you telling me that 2014 will not happen until 2016? I love this new math!

It is new math in USSA wonderland, like 4 + 4 = 5, if you can describe how you came to this conclusion (common whore), now 2014 is 2016 as we keep kicking the can down the road. I have a crystal ball, BTW, if someone wonders 😉

This feels more like floating on a bunch of low interest HOT AIR rates provided by the FED. Can’t see how this bubble will last. Considering how the political time line is set maybe we might see some kind of leveling off since the FED has already been announcing hints of possible rate increases. We’ll see. Just thinking that whatever happens at the political level may determine what will happen with this bubble. could it deflate faster based on who gets in office or will it be gradual or nothing?

Then this happened: http://www.hgtv.com/the-jennie-garth-project/show/index.html

I wish she would marry Garth Brooks. Her name would be Garth Garth.

No, it wouldn’t. It would be Jennie Brooks. If Garth Brooks assumed Jenny Garth’s last name, then his name would be Garth Garth.

I forgot what my predictions for 2014 were but I stand by them non the less…

I believe these were your calls.

“howzing to go up 30″ in 2014”

or

“Howzing to go up Forever”

We have an older in-ground pool, 16 x 50 = 800 sq ft. Just sayin…

Speaking of multi-generational households, click the below Pasadena house that just went pending — then view it on Google Satellite. Go north two houses, and east one house. The backyard appears to have SEVEN cars.

http://www.redfin.com/CA/Pasadena/716-N-Catalina-Ave-91104/home/7194839

Multigen household is a new normal now…

It has been that way in SoCal for a few generations. But now the next generation is needing to move up into a bigger home. So the buying continues.

Saves on daycare, less meals out, cleaning, etc.

Sorry, no housing tank in 2014 or ever. 10-20% correction in time, but there isn’t going to be a fire sale where houses are half. So if that 1,000,000 home comes down to 900,000 is everyone ready to pull the trigger? Probably not, they will just wish it will come down more until it’s selling for 1.5MM.

No, I’m not a realtor. I am realist.

Continuing the realistic part — 10-20% even for lower price homes would be $40 -$120K. That’s a sizable chunk of change even at the low end. House prices are coming down in SoCal. I am tracking 45 homes — all on market for months, pulled from market and relisted, or reduced. 5 properties have offer. All 5 are nice and were priced right. Organic sellers are putting their worn properties on the market thinking they’re going to get last years prices for the flips and flippers are running out of properties to flip that they can buy at 350K and add the usual 40$ margin. I don’t think we’ll ever see 2010 again and those of us who missed out should give up hoping but even if we see a 20% correction — I’d take that and higher interest rates over an overpriced property and low interest rates.

“Multigen household is a new normal now…”

I’ve been saying this all along. You will cram only so many in the same existing housing stock. Eventually, two things will happen:

1. Many will say forget SoCal and move to flyover country for better quality of life

2. Rents will go higher. Those higher rates will provide incentive for investors to bid prices higher. The stock of housing stays almost the same. Whatever is newly built barely covers replacement for demolished structures.

It is a sad course and if you don’t see it you are just in denial.

“Sorry, no housing tank in 2014 or ever. 10-20% correction in time, but there isn’t going to be a fire sale where houses are half. So if that 1,000,000 home comes down to 900,000 is everyone ready to pull the trigger? Probably not, they will just wish it will come down more until it’s selling for 1.5MM.

No, I’m not a realtor. I am realist.”

Good observation Sean! I am a realist, too. I don’t like what I see but I don’t like to pull the blinders and pretend it doesn’t exist. If I would be in denial, I would be the only one to loose. Lord b. tried many times to say the same thing and nobody listed to him. He was not a housing shill but was treated like one just for trying to be realist. He sounded as pessimistic as me, but acted based on logic and not feelings. He admitted that is a crooked world, that things should be different but he didn’t live in denial of the real conditions.

The best barometer of where the Real Estate market is “heading” … (not where we are at now) …. are PRICE CUTS. R.E. Market declines do not happen in a matter of days or months … but when the decline happens it is DRAMATIC how values deflate .

People who bought in 2011 to 2014 (or 2015) and want to sell in three/four years from now will realize they can’t break even – to get out they have to take a LOSS.

> Price Cuts are accelerated by R.E. Agents/Brokers who demand lower asking prices from Sellers … because they just can’t move that property.

> So … now it becomes a “race to the bottom”

> It does NOT matter how low the mortgage interest rates are , the question is

can a Buyer actually afford the Seller’s Asking Price …. The ANSWER IS “NO” .. NOT TODAY.

The DECLINE in sales of Existing Homes will continue….as we saw in July-2014.

I’m a Realtor in Orange County which is just south of LA County. Our inventory has almost doubled since January and prices are not going up anymore. Buyers in Orange County are not willing to pay more than the most recent similar sale because housing is becoming unaffordable to the average person. Homes that are priced right still sell in a matter of days but overpriced homes are just siting on the market. Real estate is local so the multi million dollar market in LA or Orange county is different from the $500,000 (average home price) market. If interest rates go up to 5 or 6%, I’m sure prices will come down again. The market never keeps going up forever, just like the stock market, it goes up and down over time.

Orange County is one of the most OVER PRICED So.Cal local markets.

Every time, I come in contact with the R.E. Industry (Agent/brokers/etc),

it seems like they are all reading from the same Powerpoint presentation,

and the same repetitive mantra:

” …. Homes that are priced right still sell … ” ; That statement really means NOTHING.

There is no such thing as “PRICED RIGHT”….. No metric exists to say what is RIGHT.

I think what the R.E. Industry wants to say is, if we can locate and convince enough

new buyers, desperate buyers or just some “suckers” ….. We can price the properties

as high as their Financing Pre-Approvals will allow.

“$500,000 (average home price) ” is NOT a price that an AVERAGE HOME BUYER CAN AFFORD …. So – we have HIT THE WALL. Once the R.E. Agents get desperate and are screaming to make their Commissions – but CAN’T- They will DEMAND THAT SELLERS LOWER THEIR ASKING PRICES; that’s when the so-called Average Home Price will drop to AFFORDABLE PRICE LEVELS — Based on each BUYER’S AVAILABLE INCOME.

** INCOME DICTATES EVERYTHING** …Just a Fact of Life

( My name is also Paul – I AM NOT A REALTOR and not in the R.E. Industry, but I have lived in So.Cal for over 40 years and bought and sold properties and seen the tactics of our so-called “‘good natured R.E. Agents”. They all do the same things, regrettably.)

“I think what the R.E. Industry wants to say is, if we can locate and convince enough

new buyers, desperate buyers or just some “suckers†….. We can price the properties

as high as their Financing Pre-Approvals will allow.”

Now that’s someone who can label himself a realist.

Inventory is rising and like you say homes priced correctly sell reasonably quickly. This leads me to believe that we are finding a top here based on buyer demand. The banks are still unloading some homes at near or above the original foreclosure prices. Seen many homes just sit.

WOW. That makes me feel a little better about San Diego prices, where, for $800K a buyer can still get around 2000SF in a great school district and near employment centers.

I realize LA is a different animal–but those prices are still shocking to live like that.

Yup economy is great that’s why Sears , Kmart , Staples, JCPenny, HP, Microsoft and the rather long list goes on are closing hundreds of stores and laying off thousands cutting payrolls buying back stocks in billions to meet estimates and to show 0.001 profit margins. Almost forgot, Ford is celebrating the great US economic recovery buy offering 72 months 0 interest on all Ford models. Have more cool aid comrades!

” Almost forgot, Ford is celebrating the great US economic recovery buy offering 72 months 0 interest on all Ford models. Have more cool aid comrades”

……” KingLG” … Hit the nail on the head.

If there were sufficient INCOME in the hands of the Consumer, why then offer

0% Financing for 72 months …. ????

To sell things, where INCOME HAS DECREASED …

. PRICES ON GOODS AND SERVICES MUST THEN DROP —

…. Or we have a SURPLUS SUPPLY of the same Goods and Services

Thanks Paul. It’s comforting to know there are others that see what’s been really happening.

If you google GMs total domestic sales in 2007 vs 2013 you’ll be in for a shock , 4 million vs 8 million!

That puts GM with 2500 less dealerships since 07! Recovery?

I call this recession! From the macro and “real jobless” statistics I believe we are entering another recession. I live in one of the prime SoCal beach towns and the 15 to 70 k price drops have begun on 700-800k homes. I believe the US consumer is tapped out.

This guy is right it’s all based on income. If interest rates go up since everyone has to borrow to afford higher borrowing costs means the less they can afford and will put downward pressure on prices. Borrowing to pay for something is the definition of something being unaffordable.

I also agree with the members talking about people congregating. It is the only way to afford these insane prices. Adding multiple low incomes together is the only way to afford!

Rates are going lower – global growth has stalled and they will keep them low until organic growth returns (if it ever does)

Even if rates go higher, prices won’t go that much lower because once everything gets ‘low enough,’ you’re going to start seeing houses get bid up again by the legion of renters out there

If houses go multigenerational, then you’re going to see 3-4 cosigners on 30Y fixed mortgages because housing is still part of the American Dream, like it or not

California is boom and bust but the FED changed the entire game in 2008

If we don’t see inflation in goods we’re going to see it in wages and that’ll keep prices high too

And if inflation really does rear it’s ugly head, you’re going to wish you had bought while prices were low and your $ was worth something

I’ve been on this site for a really long time and most of what is being said here is 100% spot on

But if you’re sitting on a shit load of $ just waiting for the next ‘crash,’ unless you’re playing real estate like stocks, you’re wasting your time

Once it makes fiscal sense to you to buy, based on your monthly inflows + outflows + ability to come up with a downpayment, if a house is something you really want, you should probably just pull the trigger

Real estate should be logical and rational

Even hoping for a crash is emotional

I can see how there will be a flattening out or small decrease but the prior crash was greatly influenced by the millions of NINJA loans…. without any NINJA loans for the past 5 years, it is hard to comprehend that a ‘crash’ is forthcoming.

I dont hear much on this site about how the disappearance of NINJA loans factors into future prices.

Lets see rates are going lower by a little bit By how many basis points you think the FED will go? I think we will likely bounce along this area for a bit. Not that it may dip further but the idea about supporting this FED policy is not good.

Do you believe the FED is suggesting to all of us that everything will be massively expensive 5 – 10 years from now? I sincerely hope it does not happen but the only way out of this is deflation. Bring prices back in line with REAL rates of growth instead of this tightly controlled inventory that we see today.

Homerun,

The FED does not have anything to do with the 30 yr rate. That is established by the global bond market. The FED is not in the business to establish the 30 yr rate.

The FED is by the banks and for the banks. At any given moment all the decisions are taking in such a way to benefit the bank the most. Some actions might seem to affect bank in a negative way. However, if the action is benefiting the banks more than they loose, they will decide that way.

The largest banks can win or loose in multiple ways at any given moment. They are also the shareholders of the FED. The FED will decide only for whatever benefit their shareholders the most. They can affect the 30 yr rate only marginally in an indirect way.

At this time, the rates are low because the banks can not find qualified buyers. The number of applications plummeted. At the same time you have massive influx of foreign money into the treasuries due to global instability. If the present dynamic changes, the rates could go up regardless of the FED action. Also if the present conditions continue, the rates will stay low or lower regardless of what the FED is doing. All the money printed stay at the FED, 100%. That is the reason you don’t see wage increases and the economy stays soft. The money are just for the largest banks to have reserves to prop up the largest banks (their shareholders) from collapse. This way, the financial market doesn’t freezes like in 2008.

The guy from Seattle understands some of this and that is why he is saying watch the bond market and the treasuries. The global bond market is far bigger than the FED. The FED through their actions affects some players in a positive way and some in a negative way. How the players in the market are affected is not their business (everyone for himself). They have ONLY one goal – take actions which benefit the largest banks. If you understand this, it is going to help you the whole life in all decisions – buying, selling RE or stocks. The FED my help you or hurt you, but not on purpose. It is just pure coincidence based on their actions to benefit the largest banks.

great question – in a word, i don’t think so. if we look at this from a very practical/almost game theorist’s perspective, the FED can’t raise rates or lower them by all that much because of america’s _brand_: reserve currency, democratic, freedom seekers, etc. so we can’t have hyperinflation or deflation – we are the global safehaven and if we can’t make it work, nobody is going to be able to.

i otherwise think you’re 100% spot on: i think we’ll bounce around here for a while until the eurozone gets their shit together. and if all the FED/ECB does is keep rates low or negative for 5-10 more years, then of course whatever is left of the middle class is going to have ‘deleveraged’ to the point where purchasing actually makes sense.. they’ll have saved enough period, if they can show some fiscal responsibility in the next 2 years (and prior 6-7)

blackrock purchased a ton of property to keep inventory low, boa/wells/chase are keeping ‘shadow’ inventory off until they can unload it in the next 2 years..

if i had to make a prediction, it’d look something like this: toyota is leaving torrance in 2 years which will cause a surge in inventory, and suddenly a change to the FICO algorithm/methology is announced – with 2 years being the forgiveness period. that brings forward demand, for everyone who was screwed in 2008-2009 (+7 years/credit damage absolvement = 2015-2016) and i don’t think it’s a coincidence: +2 years (when unpaid debts stop hurting credit scores) is also in 2016

if we don’t crash before 2016, we don’t crash ever. you’re going to have a ton of buyers suddenly qualify in 2016 and a lot more inventory. whatever you do, you’re making a bet, and i’m betting on a US recovery.

if you’re sitting on your hands, betting on a US crash/reversion to the gold standard, why the hell are you still working for USDs? you’re here because you think the US has the most power + opportunity – i’m here for those same reasons

if you need more evidence, look at paris, london, china – the biggest problem is overpopulation and a lack of space. either cities get more dense (multifamily permits up currently but communities will fight it for quality of life) to keep prices low or prices just keep getting higher. the other option is just more sprawl, which we could all do without..

TLDR;

this is just a really long winded way of saying: IMO i would buy downtown, sell suburbs. sprawl is always available but your track home’s value is tied to your neighbors. downtown/neighborhoods that are block by block are entirely different

“The FED is by the banks and for the banks.”

Ok. So either way their decisions do have a lot of influence on the direction of the market wouldn’t you agree?

This is why you do not keep your $$$ in bank at 0% interest and buy PMs…

disagree, man. the US took their stand decades ago: we are off this gold standard and insofar as the USA is still a global powerhouse, gold is a sentiment trade. as people slowly understand digital currency is here to stay ( by way of efficiency if nothing else ) i think gold will go by the wayside (although luxury markets could keep gold propped up) silver is different – it actually has practical applications but there’s a glut of that too; if it’s about efficiency with your $’s, PMs can’t be it – at least not for the long term

if you live here and you are trying to build your wealth in this country, you’re going to have to be a market timer with gold. and that’s fine because gold’s time might be soon.. or never. and in that way, you have way too little control – just like with equities. they’ll crash it when they want to and the insiders will make their $. they always have.

what you can control is your own personal outflows and inflows, and if you don’t think in 30Y you can’t get value out of your home in NOMIMAL terms, you cannot be playing the long game or at least not 100%

a lot of people max out their contributions to ira/401k and make prudent long term decisions but when it comes to housing it becomes something entirely different. i get it: it’s emotional. but you have to find a way to disassociate your emotions from what has probably been a series of very serious, un-passionate decisions about your finances

why are corporations borrowing like crazy? rates are LOW. if your corporation ISNT borrowing as much $ as they can get their hands on then your company doesn’t think they can pay that back in NOMINAL terms over the next 30 years. and that’s frankly embrassing.

just my 02c; i’m fucking 27 so take what i say as just another data point

Are you assuming a banana republic scenario? When? After elections or 30 years from now?

“Southern California is truly a unique place.”

Or, “This place is different.”

But, it’s moar like, “This place (SoCal) has officially joined the likes Manhattan, London, Berlin and Tokyo as elite globally desirable urban centers whose real estate markets are uniquely different from the rest of the world.”

That’s funny. You compared a few cities to SoCal as a whole. Apples and oranges. LA prime areas make sense in your analogy, though even they will adjust once the current mania ends. But I’m seeing 800,000$ asking prices in Upland. For 2700SQFT track homes. Rancho Cucamonga is not middle class OC yet its asking prices are. There is no mathematical basis for the specuvestor prices we’ve seen post 2011. Even the prime areas are at risk as the Hyper Credit Bubble hae destroyed price discovery in EVERY asset and commodity. Being rich and living in SoCal Prime is great, until you aren’t and can’t.

Savings will be back in vogue.

DFresh, you are absolutely correct regarding “socal really is different.” Many of the bears are in denial about this. Do you guys honestly think your average socal house price will revert to flyover country home prices?

Crack houses in Compton sell for 250K. Houses in marginal areas (Gardena, Carson, Hawthorne, Lawndale, etc) are seeing 500K asking prices and are being sold. One of the two Culver City shitboxes featured in this article is already “sale pending.” The truly prime areas (Malibu, Manhattan Beach, Newport, Westside, etc) are seeing all time high prices and fierce competition for the low inventory. Prime socal is a much sought after destination for the global elite.

You can go to almost any flyover destination and get a nice, new house for cheap. There is an increasing population here, no more buildable land, anti growth measures, and much desire to live here (how ever you define that). Add all these things up and it truly is different here regarding home prices.

I’m getting my ducks in a row to purchase a beach close rental property when the price is right. I have full confidence that prime coastal socal will NOT turn into Detroit. Any financial advisor worth his salt will recommend a diversified portfolio, RE is definitely part of the equation.

Lord B: ” ‘socal really is different.’ Many of the bears are in denial about this. Do you guys honestly think your average socal house price will revert to flyover country home prices?”

I see some reasons why SoCal home prices MIGHT drop, even in prime areas, over the next decade or two:

* DROUGHT. How bad is it, really? I’ve driven through Santa Monica, Pasadena, Woodland Hills, other parts. Everywhere … trees, lawns, greenery. All of it thirsty. All of it thriving in an irrigated desert. What if the water dries up and the desert reclaims SoCal?

* GOVT FINANCIAL CRISIS. The state, counties, cities are obligated to pay huge pension and health benefits over the years. Meanwhile, the tax base is eroding. Wages down. Benefits recipients up. The middle class and wealthy will shoulder ever higher taxes, some will flee, the remnants will be taxed still higher, still more will flee, and the cycle continues. How much higher can taxes go? What happens to mid-tier cities as services are cut?

* The BIG ONE. How bad will the quake be? If it happens in a dry, drought-stricken summer/fall, will fire spread from the Hollywood Hills clear through to Topanga and Malibu? What if many of SoCal’s eroding water pipes break, and the fire trucks have no water to fight the blazes? And rioting and looting break out? What will SoCal look like after such a perfect storm of earthquake, drought, fire, rioting?

NO CAL earthquake, we have discuss what effects mother nature can have especially in a sensitive state to mother nature like Cal.

Will this soften the blazing house prices and sales in San Jose-SF bay area?

Seems places like this selling in the same matter are fronts. Fronts for laundering.

>> Doc: All you need to do is look at the tiny old homes that you can buy for inflated price tags to ground you a bit. <<

I can't bring myself to post this on the latest entry….

4205 Irving Pl, Culver City, CA 90232

Stomach churning ill-feeling here. I'm not an expert with US Real Estate websites/listings… but it appears to have sold for a very stupid price. I hope it is just about the last of the dumb money. Ponzi markets imo.

_____

Sold On: Sep 5, 2014

Status: Closed

Last Sold Price: $875,000

https://www.redfin.com/CA/Culver-City/4205-Irving-Pl-90232/home/6722266

Leave a Reply to San Diegan