Conditioning the housing market to unsustainable policies – 5 charts highlighting the current landscape of the manipulated housing market.

The US housing market is one of the most heavily subsidized and controlled sectors of our economy. Where Fannie Mae and Freddie Mac had an implicit guarantee for decades, until we took them over, the FHA insured loan segment of the market is fully backed by the government and consequently, the public. Increasingly high default rates with FHA loans is now problematic since this is one of the key financing tools used to keep the market afloat since the bubble popped. It is good to take an elevated view of the housing market across the country and also look at the California market to get a sense of where things stand today. Is the market fully recovering? Are we near a bottom? Have lower rates really spurred home sales? We’ll try to examine all these questions.

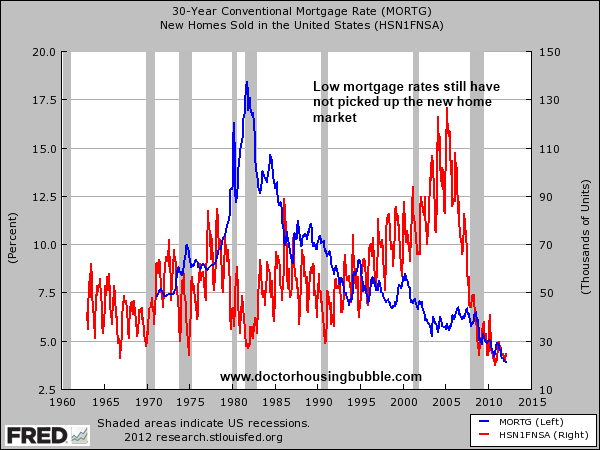

Chart 1 – new home sales and mortgage rates

Mortgage rates are at historically low levels. But as you can see from the chart above, this has done very little to help the new home market. Low rates have largely helped many to refinance and for others to stretch into homes they otherwise could not afford. The Federal Reserve over the last few years has grown its own balance sheet to nearly $3 trillion in a mix-mash of items including other mortgage backed securities. No one in the open market is willing to finance these loan products including the too big to fail banks. We are seeing fractures in this already. The Fed has slowed down with MBS purchases and FHA loans will become more expensive because of staggering default rates.

Low rates, lower prices, and still new home sales are at historically low levels. If we simply look at the chart above lower interest rates did not aid the new home sales market.

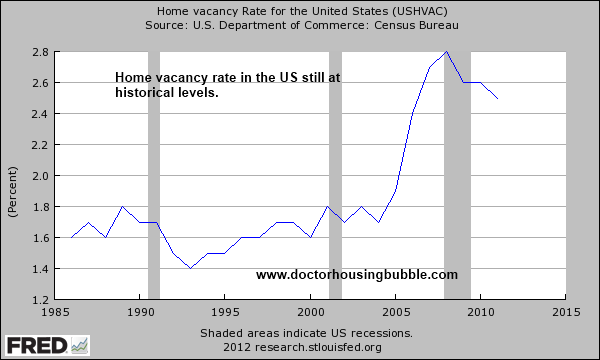

Chart 2 – home vacancy rate

The US still has a large number of vacant homes. It will take years to get back down to a more normal vacancy rate. Part of this comes with the shadow inventory. The vacancy rate is being artificially boosted up because the market has been controlled by the Fed, government, and banks. The demand right now from the public with their incomes is for lower priced homes. New home sales, with higher price tags, are not selling as the first chart highlights. People would buy if prices made sense based on their household incomes. The risk of subsidizing the market with the ballooning Fed balance sheet and subsidizing the housing market is we misplace our focus on other competitive parts of our economy. Are we really going to be that much stronger of an economy with trillions of dollars pushed into the housing market simply to bailout the too big to fail banks? Certainly it did not help to keep home prices at peak levels but we will find out in the years to come because this is the exact policy we have engaged in.

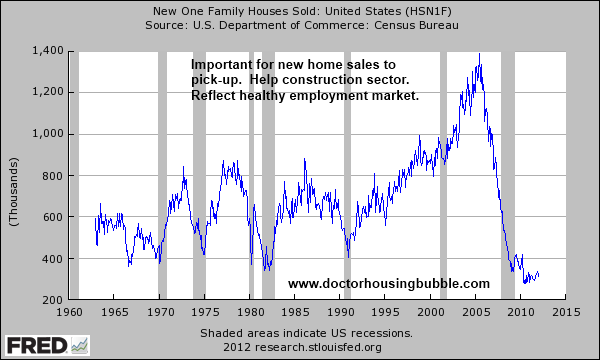

Chart 3 – construction and new home sales

I think it is important to examine how bad things are in the new home sales market. We keep hearing how little inventory there is on the market and some preach this as if it were a gospel and don’t bother to point out the obvious. But realize that low inventory is completely artificial. Why? First, big home builders are in the market to make money. They are quick to respond to market trends. Don’t you think that new home construction would be rising if this were the actual case? Low inventory would be like a siren call for new home builders. Yet housing starts are still near record low levels.

The low inventory comes from the shadow inventory and suspension of mark-to-market accounting.  So in truth, the bailouts were about giving too big to fail banks full control of manipulating the market and stunting market forces. That seems to be rather clear. Yet this full control has failed to help home prices rise or more importantly, help household incomes rise. To get sales overall to increase the tactic has been artificially lower rates, questionable mortgages via FHA insured loans, and severely restricting inventory. Funny how the banking “capitalists†suddenly become U.S.S.R. wannabes when it comes to their own balance sheets.

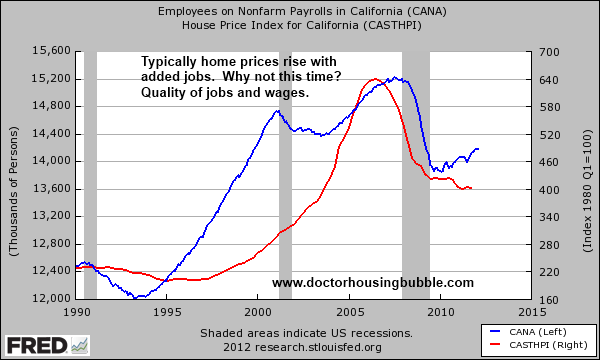

Chart 4 – California home prices and jobs

California home values are now in a lost decade. The above chart highlights total nonfarm employment and home price growth. You’ll notice the early 1990s bubble which looks like a tiny blip on the radar compared to the current bubble. Employment fell and so did home prices. In 1995 employment started picking up and home prices followed. Keep in mind all the high paying tech jobs that were added during this time as well. In the 2000s there were many high paying jobs tied to the housing market. The bubble burst first and employment followed. California has been adding jobs now but home prices still are moving lower. Why is this different today?

I think a couple of reasons are playing out. First, many of the added jobs today are in lower paying fields. Second, there is the shadow inventory steadily dripping out a stream of distressed properties. The tech bubble and housing bubble have provided high paying jobs to many for two decades. There is no bubble anymore in any large enough sector to sop up this lag in employment. Many of the jobs being added today come in the lower wage fields. So this is why we are seeing home prices trickle lower and employment slowly moving up.

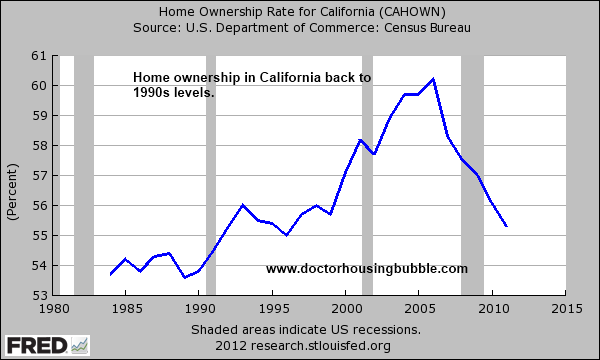

Chart 5 – California home ownership rate

The California home ownership rate is now back to early 1990s levels. It is important to note that the market is still heavily subsidized via FHA insured loans that make up roughly 1 out of 3 home purchases in California. New guidelines starting this month will make FHA insured loans much more expensive through mortgage insurance and premiums that need to be added because of rising defaults. So this main entry point is going to get more expensive and incomes are still stagnant.

Buying a home is not a simple decision. When it turned into a decision like purchasing a banana people started diving in with little thought. A low down payment with current loans is going to cause additional problems and likely, another bailout. I’m not sure if people realize all this has long-term consequences for our nation. Diverting incredible amounts of money to protect the financial sector is costing us in many profound ways and more importantly, will hit us down the road. After all, low interest rates are a product of the Fed buying up trillions of dollars in MBS and now that the market is conditioned to low rates, will they continue to do this forever? Their balance sheet is already approaching $3 trillion when in normal times, it didn’t even crack $1 trillion (and the assets they had before were typically high quality US Treasuries).

Housing nationwide with a median home price of $160,000 is much more reasonable. And maybe that is the point. Stabilize the nationwide housing market and allow a methodical price decline in mid-tier markets across the country as we are seeing here in Southern California. The mid-tier markets are heavily dependent on the low interest rates and manipulated inventory. We have seen signs in the last couple of months that this is changing. Ironically, these small markets will not even make a dent in the nationwide stats if housing throughout the country picks up.

Spring and summer are the big selling seasons so we’ll see how things begin to trend out shortly. What are you seeing in your local markets?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

73 Responses to “Conditioning the housing market to unsustainable policies – 5 charts highlighting the current landscape of the manipulated housing market.”

Once again, I have to wonder why in the world the mortgage holders would start to foreclose and sell all their delinquent homes when it would just about guarantee that they would go out of business?? Anyone?

I think that given the CA employment market and the need for banks to very slowly release their bad loan homes means that the CA residential real estate market will slowly grind down hill for years to come.

In response to your statement, I am a rabbid progressive. However, the welfare and entitlement queens should stop sucking us tax payers dry. That means the banking and Wall Street community should follow their drum beat of un-controlled capitalizm…….and fail! Foreclosiing and re-setting the real estate market is natural economics. After all it worked on tulips. Why not here in this generation?

What capitalism? Our money is private property right? If that is right then how can the government manipulate the value of it? And since they do what they desire with our fiat currency, then they are not so much protecting and defending the rights and property of individuals are they? And the fractional banking system is so leveraged as to be able to create many trillions of dollars of debt. This would be impossible in a capitalistic economy. Letting banks fail now would just turn the American economy on it’s very thick head. Much better to slash into “entitlement” spending including tax funded pensions and tax funded benefits across the board. And that must be done now if we want to avoid total collapse. Why are precious metals being manipulated by government? You should know the answer. The danger lights are flashing faster and faster.

I can only speak regarding the condo market here in Chicago proper, since we recently sold our 3 – bedroom unit after three price reductions over the span of roughly six months. We had an agent who was quite familiar with the north side of the city (been through two booms and busts), and she priced our place reasonably well, considering the reams of condo sales data that we all reviewed before making our final decision on the initial listing. In less than three month’s time from our first listing, the market supply of condos increased dramatically, leading to the price reductions. It has only gotten worse since then, so from our narrow vantage point the shadow inventory is finally beginning to be realized.

Very well thought out. You mentioned that low down payments with current loans will likely result in another bailout. So, would the answer be to raise the down payment required?

There have been talks in the past, and still today even, that the FHA should increase the down payment requirement. Obviously increasing the down payment requirement would prevent some people from being able to purchase a home, unless they go for the lower priced homes. An increase in demand for lower priced homes, means we can expect to see an increase in price. So the prices of these homes rise and the price of the more expensive home falls, like you said a decline in mid-tier markets.

However for folks that are taking lower wage jobs, which is spurring the job growth in CA, will home ownership ever be attainable? Is that really the answer here? This is also a long-term consequence on the society of our nation.

Homeownership was attainable to anyone with a heartbeat 7 years ago. I suspect you mean a different type of attainable.

Eliminate the subsidies and it will become truly attainable for many more people. Contrary to how its sold, the FHA does not exist to help people who can’t save for a downpayment. It exists to benefit lenders, the housing industry and bureaucrats.

“Eliminate the subsidies and it will become truly attainable for many more people. Contrary to how its sold, the FHA does not exist to help people who can’t save for a downpayment. It exists to benefit lenders, the housing industry and bureaucrats.”

It has become a tool to function as a part of the semi-controlled crash landing being put on at the expense of the tax payers. One of the tricks to remain somewhat buoyant, when it should be a complete free fall.

PS: Here’s an interesting piece of info that very few have mentioned or even noticed.

It seems that banks are actually PAYING THE DELINQUENT PROPERTY TAXES on defaulted mortgage loans! I discovered this fact after doing a public records search on my next door neighbors property, whom I happen to know hasn’t made a single mortgage payment for over 4 years. He paid $570K for his house at the peak of the market on his DAY LABORER’S salary and is currently unemployed. Meanwhile, he accumulated over $40K in back taxes and was just about to hit the 5th year of non-payment (at which point the city usually steps-in to exercise its first-lien rights) when SUDDENLY and out of nowhere the entire debt was PAID OFF!

Fast forward 3 months and he’s behind AGAIN!

The RIP-OFF works like this: our deadbeat government bails-out the deadbeat banksters with free money, which the deadbeat banksters then use to bail-out the deadbeat borrowers so that the deadbeat city authorities won’t exercise their first-lien rights by selling the delinquent properties at tax-auctions.

The entire U.S. economy is a WALKING ZOMBIE!

Zombie is fairly succinct, but I think we’ve moved from giant parasite (exchanging paper for finished goods and commodities) to predator, to pariah. The melting pot experiment has not gone that well because no one group in US cares about any other, so those in power are domesticating the rest of us, and have us hooked up to mortgage milking machines.

Fed has had the peddle to the medal for four years now and has only managed to keep the house of cards intact for a little while longer. Hoping that things will return to normal is just not realistic. The only way we stay in the game is to keep bluffing and raising, cuz we’re holding a pair of jokers and everyone knows it.

The pedal to the metal, but now the clutch is slipping.

Thanks for sharing!

I bought a duplex and found that some national bank failed to pay their property taxes. I’m current and they are not getting bothered by collections efforts by the deadbeat county.

Letting folks who could keep paying stay for free and then not come after them increases moral hazard. Others observe and will want a piece of the action, too. Save on your mortgage, lease a BMW convertible with the money you save!

I bet his mattress is full of cash, probably squirreling away every cent. I would.. What a effin joke this is!!!

I stumbled across a lady that was in a strategic default when I first moved to Vegas. She was saving very cent and still working on a refi bailout. This scum bag was dragging it out as long as possible and staying in the house without paying a cent. She had been doing this for over a year.

In Ventura county, we are seeing quite a few homes for sale coming on the market. Crazily enough, some of these are priced at 2006 peak levels. Shorts and Foreclosures have started to appear and these are getting attention. Some crazy price wars have started, which are insane as properties are still quite overpriced. Most wares are between Investors and wanna-be homeowners. The good news is that many of the investors have fixed up the rentals and A LOT of rentals have come on the market. This increase in supply is putting downward pressure on rents which have been trending downwards since January. I anticipate that rents will drop A LOT over the summer because of the oversupply of rentals. Some of the investors are going to be in deep-you-know-what by next year.

Agreed. Add to that: Many people are also buying homes under $400K because the monthly payment is less than rent. They dont care or dont know that home prices are going to keep heading down. Rents have been going down in this area and will continue for the next few years.

In Santa Barbara County a lot more foreclosures are coming onto the market. The banks smell a wave of investor and frustrated buyer interest (“We’ve waited long enough through the recession, I don’t care, time to buy something”) and sense an opportunity to unload.

These buyers will carry the next leg downward of the housing market. Rents will soften and prices will drop, negating their optimistic investor math.

We are also actively looking for a primary (cash and final home) in east Ventura County. I completely agree with Patiently Waiting. What the CAR & NAR gansters are telling agents to say is that the $350K-$550K market (love the macro range lol)has 5 offers per home, but what they aren’t letting out of the bag is most of those are FHA borrowers on oxygen, and they are going to the bottom of the offers. Regardless if the future defaulters offer $25K above list. Sellers want to see at least 10% down. They don’t want a buyer that if one hiccup happens, the escrow clock starts again.I am tracking the MLS and see fall outs after 60+ days escrows. I would presume that is a sign of weak borrowers, not other contingencies.

Housing in our area is in a mini bubble, still way out of whack to incomes. It’s insane here. For Patiently Waiting and us, this is a mixed bag market. Contrary to the syndicates “it’s a seller’s market”, there are few qualified buyers. I don’t believe for a second, the market is flush with cash buyers, or even 10%-20% downers.

I also want to add that I’VE BEEN TO R E OFFICE MEETINGS, AND ASSOCIATION MEETINGS. Don’t think for a minute that an agent doesn’t have an agenda, or hasn’t read or been told a script to follow. If you find one that knows you know what’s going on, and is a straight shooter, you have a rare one. But then again Caveat Emptor. They don’t do the practice playing agent groups for nothing. Agree with the buyer, throw in some new info, and create urgency and fear. That was my take away from my experience. One of the Brokers I hung my license with (in & out quickly) was a former Produce Manager, who hated to read. (Yikes)

Ventura county does not make any sense in my eyes, too. I have been working there as an Expat from Germany between the beginning of 2006 and the end of 2009 and fell in love with the place. As a German who rented a house there I couldn’t figure out how my landlord (even wih 40% down) could afford a $890k house which he bought literally at the top of the market as a fireman. He tried to sell the place and even went down to $640k but ended up renting it out because he couldn’t find a buyer. I am still dreaming of returning to VTA county one day and therefore monitor the Ojai prices very closely but prices are still far from affordable even when now $29k mobile homes hit the market regularly. If people cannot make their payments on these homes but 3BR are still close to $400k, what exactly is going on there? I can only assume that the shadow inventory must be GIGANTIC (DHB wrote that 75% of home in VC are in distress) so that banks cannot just flood the market. As I want to return there in about 10 years from now I will enjoy watching the market go further down until I get my chance to buy my dream home there 🙂

I’ve seen a couple houses come on to the market recently with 05-07 peak bubble wishing prices. Anybody who is dumb enough to pay peak bubble prices today will get what they deserve. The only way this deal is going thru is if you are a cash buyer. There is no way in hell a lender will value any house today at peak bubble price and put themselves and their money at risk.

It’s going to be real interesting to see how the current low inventory plays out. I just don’t see low inventory like this being the new normal. If it truly is, then record low home sales will be the new normal. Record low inventory = not many houses being sold. As I said before, the market isn’t going anywhere anytime soon!

Lord, that’s just it. Banks are not risking their money, they’re risking the taxpayers money.

I’m seeing pretty much the same thing in east Malibu and Topanga. A LOT of stuff seems to be being bought by investors, and pretty much any half-way reasonably priced property is the subject of multiple bids and bidding wars.

Almost all the realtors we speak to at open houses tell us the same thing: this spring a ton more people are looking to buy than were in previous years.

Which is sort of disheartening to us, as it look as if – in this micro-market at least – prices aren’t going anywhere but sideways.

Everything you write makes perfect sense Doc. But I still can’t find a decent place to live at an affordable price in LA. Maybe next life…

House prices have gone down from insanely ridiculous to just plain ridiculous in West Los Angeles.Doc, you can speak the truth to death but explain to me why houses prices are still so high in Los Angeles? Inventory is very low and there are multiple bids on houses over asking price.

Yes I would like to know why the banks seem to be manipulating Los Angeles worst of all. Inventory shortage. Rents going up. Bidding wars on junky homes. Flipping still going on. Insane prices still.

Matt,

I left Los Angeles County in 1985 and moved to Oregon. I’m a Realtor here. I warned my forst Buyer about the housing bubble in 2003! She said I was the only person who considered the market to be in a bubble. What was clear to me and very much more clear later was that wages were not going up. It was the lending regulations which were going down. Here’s the problem now: Our national debt bubble together with Bernanke and kid a Treasury crossing their fingers together with the illusion of recovery together with the oncoming wave of new inventory from the most motivated sellers in the market (Fannie and Freddie) and so on, means that oh, I’ll say, maybe 18 months from now we will realize that the bottom we thought we experienced was merely a ledge. And the deeper we fall, the more structural damage to our whole social fabric. Our economic leaders are stupid to think there’s substantive difference between micro economics (consider how you must pay your bills) and macro economics (the collective of people like you.) Keynesian theory has urged economists to experiment with very sloppy theory. If they’re wrong, we’re toast. Are you feeling the heat?

@Matt & Gary,

Just read this blog, it’s all a fraud.. There won’t be a fairly priced house in years.

The master plan by the smartest guys in the room is working perfectly in the Canejo Valley. Prices have slowly crept down and just when you thought the $450k barrier would be busted, the inventory dried up and the price wars started up. You cannot underestimate the lengths to which the government will go to protect their 3 trillion (as Dr. Pointed out) dollar investment. Crazy thing is, every voting American is complicit. So stop your fretting, and jump on board! “With rates at all time lows and housing more affordable than ever, there has never been a better time to buy”. I know because the National Association. Of Realtors told me.

Numbers, I’m taking the plunge and buying a short sale. It took 3 months to get the bank approval. I just can’t rent anymore.

Renting is getting so dicey because so many of the rental properties are going into default, stable rental properties are getting hard to find, and a lot of landlords are getting greedy.

I refuse to put my money in the stock market and I am getting .75% interest in the bank, and I truely believe the government will fight tooth and nail to keep interest rates from rising.

I’m paying cash for a house that I like ( I have been looking for 7 years). My plan now is to live cheaply in this house with no mortgage and keep what I use to pay in rent . I think I am getting a good deal, (I wouldn’t be buying if I wasn’t).

I don’t think the banks will ever allow the market to be flooded with too many properties, I believe the plan is to let the inventory trickle onto the market for years to come.

That is what I am looking to do, with my 550Kish in cash. But with current prices, a house that I like would be 650 to 700K (if i could find one ) so my PITI would be about 1500 a month, plus maintenance. On the other hand, my rent is 2100 minus what little interest I am earning on my cash ( 1.5% on a 5 year cd with a 6 month interest penalty). So actually I am kind of in the same situation weather I rent or buy.

I also agree the FED will do whatever it takes to keep interest rates low until the economy improves, which means rates will be low for more than 5 years, if not longer.

It is pretty much a case study that easy money created the bubble in the first place, I don’t think it is a stretch to say easy money will prevent it from deflating AS MUCH AS IT SHOULD in coastal Ca.

Greg in la

Congrats on the purchase of your mortgage free home. I wish you happiness and healthy memories in it. So, when is the Bar-B-Q?

Want to share any inisights regarding the nightmare of short sales? (If not, I understand, not to worry.)

Hmmmm. Banks holding back properties to prop up prices? If they do not sell them soon they will end up with tear downs on their hands. The structure will continue to depreciate and they will still owe property taxes. Not sure what their end game is.

Canejo Valley=Conejo Valley. I think you made a boo boo.

Good post!

Mad, thanks for the kind wishes.

I have a few tips:

One: buy a short sale and not a foreclosure. Foreclosures get swarmed with buyers, shortsales are more difficult so they get less interest and that translates into lower prices.

Two: When the bank does their appraisal, have your realitor meet the appraiser and have the realitor give them a written estimate of all the obvious repairs that need to be done and greatly over price all the repair costs. The appraiser will deduct that amount from their appraised estimate. We did that and it worked.

Also find all the comps and give the appraiser the lowest ones.

Three: Make offers in October – January. Less compitition then.

Four: Buy a property that needs just a little fixing. In my case the kitchen sink and stove was disconnected , the dish washer was missing, and the pool is all green. It couldn’t go FHA. FHA buyers have good income but absolutly no savings to put down, cash buyers looking for a deal can’t compete with them. Fha buyers will always out bid you.

We made our offer in January, and it took three months to get the bank approval. I offered $240K cash which was $60k lower than it was listed for. I heard the appraisal came in at $240K, but the bank countered us at $250K because there were all cash back up offers for more,(I was told $260K).

The sellers bought the property in 2004 for $470K and then borrowed $100K more and put in a pool/ jacusi and a master bed and bath addition, new roof, heating and airconditioning, and restuccoed in 2008-9. There debt was $570K I’m buying it for $250K. Zillow shows that it was sold in 2001 for $250K, but that was before the 500+ sqft. addition and pool.

Previous blogs that I read have said don’t buy until it is 50% off of peak price and at 2000 price levels, and I subscribe to that rule. By my calculations this is a little over 55% off of the peak price, and lower than the 2001 sale price if you add in the expanded sqft. and new pool.

I truely hope this info helps you Mad. Best wishes to you also.

Greg in la

I did read your very well thought out and interesting reply to my SS inquiry. THANK YOU SO MUCH. I was thinking the loan(s) balance was more of a factor than the BPO, until I read otherwise in your post. Thanks for the data points.

You hired a fairly good agent, that knew what the heck they were doing. Not many out there like that. Buyers pick same like agents (intelligence to intelligence, snake to snake), and Sellers aways pick the marketing- image types, imho. THANK YOU, again.

Mad , I think your comment about buyers picking agents of like intelegence is very interesting. I never thought about that, but I think that you are on to something.

With me, I find trust a crutial factor. I am a not a very trusting person and I am always on the look-out for being manipulated.

I’m not saying I had a great realitor, but I’m not saying the realitor was bad either. Choosing this person was a shot in the dark, I had no Idea what I was going to get with them. I felt that I needed to try though. I guess she did pass the “I’m not dealing with a crook test”.

This Is the first house I have ever bought in California, and the most expensive by $35k, and I am still pretty nervous about it. I should close on in a couple of weeks.

Mad my compliments to you, I think that you are a very gracious person.

DHB,

I have a question. In two of your charts the units of housing sales in thousands do not make sense. What gives? HSN1F sales are about 300K. HSN1FNSA is only 15K. The latter should be bigger than the former, should it not? It is a subset of the total the way I read their descriptions. Could you explain. I must be missing some definition.

Thanks.

Inventory is low not just in LA. Look up Murrieta, CA. That’s in the IE, supposedly with lost of foreclosures. But the number of house for sale has gone down from 797 in 2010 to 279 now. Go to redfin and look it up. I have no particular reason to pick Murrieta, just to show even the hard hit IE has inventory drying up. What happened to the other 420 houses? I am sure there is no significant job growth there to absorb the houses. The tich Asians are not buying in the middle of desert either. Something fishy is going on here.

Inventory is obscenely low in Culver City as well. I drive past at least a dozen empty houses every day in CC. There is no “For Sale” or “For Rent” sign on these SFR’s. These were listed on the MLS as being in the first stage of foreclosure about two years ago. These houses are dark at night, there are no cars in the driveway but interestingly enough, the banks are keeping up with the landscaping.

The only way banks are going to release this shadow inventory is if there is a sudden liquidity crunch, ala October 2008, and they need to raise cash to cover their liquidity shortage. That isn’t going to happen any time soon because the Federal Reserve has been running the printing presses like mad men in an insane asylum and injecting liquidity (borrow money) in to these zombie banks.

I’ve been wondering the same thing everybody else has on this blog with regard to the stubbornness of prices and low inventory in LA so here’s a theory… In the cases where no payments are being made could it be that the bank is borrowing from the Fed at 0.25% and paying off the MBS lien holders with this cheap money? Effectively reducing their costs to a trivial amount.

Agreed! Saw Geitner on Meet the Press. Couln’t watch for fear of throwing up breakfast. He and Boom Boom helicopter Ben are destroying our countries middle class. I’m sure they will have a great job on some board after government. Making millions in kickbacks while sitting on their fat asses doing nothing but saying “If it wasn’t fur us it would have been worse. ” Hogwash!

@Swampoholic,

Your theory is valid. Google “Operation Twist”. The Federal Reserve buys garbage MBS’s from zombie banks. The banks pay off the bond holders with the funds from the Fed. These zombie banks no longer are under pressure to raise capital which would force them to sell the REOs, so they pay the property taxes and hire a gardener to keep up the property. By constricting the available inventory, these banks hope to keep home prices artificially elevated.

By running the printing presses like maniacal lunatics, the Federal Reserve in the short term keeps zombie banks alive. In the long term, the Fed is setting the stage for hyperinflation.

In my subdivision in Michigan, the number of houses for sale is very low. Back in 2005 to 2008, it seemed like, at any given moment in time, 10% to 15% of the houses were for sale.

Now it is !5 or 2%. Don’t really know what’s up. I suspect that no one has much equity, and therefore cannot sell without bringing money to the table.

One thing that is critically important is that, at least here in Michigan, the seller is expected to help the buyer with a portion of the closing costs. If you pay a realtor 6%, plus give the buyer another 2% for closing costs, you have to an 8% cushion over the seller price, just to break even!!!! And who wants to sell, just to break even and walk away with ZERO dollars in your pocket?

I imagine the story is pretty much the same everywhere, except where there are a lot of short sales.

The banks will release inventory later in early summer for the real estate buying season. Then as late Fall approaches, they will start constricting the supply. Rinse and repeat.

Anyone else see this pattern for the last couple of years? Now I see that the banks are actually paying the property taxes or at least keeping them current on delinquent mortgages!!! This has all the hall marks of a controlled market.

CAE , Ditto.

A realitor friend of mine from Chicago, raised that same point to me.

Chicago has sky high property taxes, ( a $350k home will have a tax bill of $8-$10k per year).

Every year Cook county would sell the deeds to properties of thousands of delinquent owners at auction.

Now I hear that those tax sales are all but history, all the property taxes are paid and current… by the banks.

The government bails out the banks and the banks bail out the local governments. Thats what is going on.

Inventory is insanely low in irvine also….prices have started going up…rents are high too….its crazy over here…

Where do you find all your data? I am looking for some kind of “affordability Index”

From what I can tell pricing in our area is approaching 2002yr levels. Most properties in the low $400’s is sold fast. I never imagined paying 1/2 million for a home.

Thanks for the article.

As discussed in the “media”, rents will be going up some 5-10% in the coming months and a year or so.

It appears that people will be encouraged more and more to purchase real estate and/or maybe bank owned properties will be rented so that elevated house prices may remain in place for a few more years.

Doc. has stated and mentioned so many times that it all depends on the income and the reasonable 3:1 formula (Income:mortgage ratio). Will people be able to afford additional rent increases? Or, will we see more and more people to share and occupy one and two bedrooms apartments together? And two and maybe even three families share and rent a bank owned property together?

What do you think?

Rents HAD been going up. They are in a slow tailspin now. Supply of rentals is increasing as demand goes down. People are buying homes now, seduced by a false bottom and low monthly payments. New “investor” landlords are going to feel the pain soon as they make less than expected. Witness the “newly reduced” signs on rental property ads on craigslist.org and realtor.com.

On the Westside of Los Angeles we have a bifurcated market. Inventory is low due to the manipulation of shadow inventory released by banks and only a few people are actually able to sell because they are not upside down. The banks are doling out the most overvalued lower-end properties like short sale crumbs. For the few who can actually purchase better located properties, their are properties to bid on as most are in no position to sell. Those are the choices in this artificial market we have here on the Westside. This drags on for another 5-10 years here in my opinion. Why should the banks take a chance on making a large loan at 4% on a risky investment, when they are assured 2.5 – 3.0% borrowing and buying guarenteed US treasuries and mark to market no longer exists? Answer – They aren’t and they won’t, until inflation finally catches up to the declining highest-end properties and they are fat and happy from feasting on treasuries. Next thing is they will try to foreclose and turn “owners” into “renters”. Newsflash: most with a motrgage are already renters, as prices on The Westside continue dropping and more and more approach, or cross into negative equity.

Check prices for yourself, as you can check all the rolling weekly or monthly sales for each area on The Westside at:

http://Www.westsideremeltdown.blogspot.com

We are not getting inflation. They may never sell those houses. They could turn into tear downs and the land will have to be liquidated for pennies. I think we will see more deflation and failed banks in the next 2 to 3 years.

Just finished reading the final of those 3 books you recommended by Frederick Lewis Allen. Wow the similarities of what happened back in the great depression and today and frightening to say the least. Why haven’t we learned from history. We are in a story that has already been written. Government bailouts, high unemployment, under employment. I think that there is still plenty more bad news to come out. YIKES !!!

I have discovered that large corporations have been buying up large portfolios of homes at a large discount, sometimes sitting on them or fixing them up and quick turn. A house down the street sold over night to a corporation. Less than two months later, the house was cleaned up and put on the market for a 100K mark up. Most of up are not privy to these deals.

I have applied for a HARP 2.0 refinance loan. I don’t know if I’ll get it, but I’m hopeful. Currently, I have 25 years remaining on a 30 year fixed loan. If I get the Harp-2, our payments will go up slightly, but we’ll be in 15 yr fixed.

In a 15 yr fixed, you are building up equity rapidly, assuming housing prices stay flat. Seems like a good program to me. I don’t understand the program entirely, but in some cases you can borrow more than 100% of the home’s current value. I’m in a different sector, where you can borrow up to 95%.

There is one draw back though. You can’t have been late with a house payment in 6 months, and not been late more than once in a year.

I’m FURIOUS that the money men and flippers are keeping the prices elevated. I’d like to put all of them in vats of acid.

Can somebody please explain this to me?

http://www.vcstar.com/news/2012/mar/24/high-demand-low-supply-make-apartments-to/

A quick check on CL shows a lot of free rentals, why would there be a low supply? I can only guess that a lot of would be home owners now move back into smaller appartments which they can afford but did you check rental prices for 3BR and 4BR houses in Ventura city? They look like it’s still 2006! Seriously people, do you really think that a renter will pay your whole mortgage? E.g. http://ventura.craigslist.org/apa/2935434329.html

Unfortunately I know the guy who lives there, he was my neighbor and is a good man but…seriously???

The landlords just have to find ONE sucker. Most renters are now asking for reductions in rent in eastern Ventura County.

I think a lot people thought they’d sell their house during the bubble, make half a million on the sale, wait out the housing bubble for a few years as renters; then, once things petered-out, jump back in and pay cash for an even better property than what they sold with money left over. The endgame seems to have turned out quite differently than most probably expected.

As for my market — I live in Austin. Everyone here wears Kool-Aid goggles. Homes in and around the central urban core are anywhere from 3-450K per square foot. Buy now or be priced out forever. We didn’t have a housing bubble here, blah blah blah.

Nothing much seems to have changed. I’m just waiting for some contemporary iteration of sub-prime lending to re-emerge.

There will be just enough inventory “leaked” out this Spring/Summer to keep inflated prices where they are. The orchestration of this fiasco is superb. The only ones suffering are homebuyers and taxpayers, but who cares about them anyway.

CC- Unfortunately, I think you’re right.

We wish we would have bought our perfect floor plan/too big a pool home last April. It had an adobe thing going for curb appeal, and my husband thought it was pretty fugly. The interior of the house was perfect, but adding $10K -$15K to make the pool smaller seemed insane at the time. It took up 90% of the small yard. Looking in the rearview mirror, we screwed up. An FHA buyer, who even financed his closing costs bought it. Man, talk about squeezing in.

I hear you loud and clear. As a cash & primary buyer, we feel the betrayal of our nefarious govt. We’re not buying an investment. It’s a home.

So many homes in Burbank are like that. After the addition to the house, they put in a pool, and end up with a concrete jungle…

I really hope OWS gets a second wind..

That’s a nice thought…but I gotta tell ya…OWS does not, in any way, represent the savers of the world. I’m sorry, but it just doesn’t. Much the mindset with this bunch is complete mortgage debt forgiveness for even the most leveraged-up speculator who got caught holding a hot potato. Matters of moral hazard or the guy who lived beneath his means? TFB. Note the sentiment in the comments section. No sympathy for anyone who didn’t bite.

http://sherriequestioningall.blogspot.com/2012/04/iceland-forgives-mortgage-debt-for.html

Went house dreaming today. Went into 3 houses, one a great deal , two way over priced. Interestingly, the one that was the best deal was nearly 800K. It was once 1.2 million. The other two, in the 500 to 600K range were both about 20% below peak price.

Anyway, all three of the agents made a point of how the inventory was so low. Some of the comments are as follows………

“This house is priced aggressively but with the low inventory, the seller will get what they are asking, it may just take a little longer.” I heard this from the agent at a poorly done flip.

At another house I made a comment about the housing collapse. The agent said, “The housing collapse is history, prices are going up in San Diego, especially with hardly any inventory.” This was said by an agent in a Prime Neighborhood on a house that has been on the market now for 2 weeks at 700K and has no offers. The house itself was decent.

The third agent, I can’t recall, but they were babbling something about the low inventory too.

Here in SD, we were losing 20 to 50 houses in inventory each and every Saturday and Sunday for months and now it just seems to have stopped. Inventory has actually turned up for the last week, it may be too early to get excited about a trend change but it is a positive.

Low inventory aside, there may be a decent amount of people out there who can afford up to 600K, but there isn’t many who can afford over 700K and it is beginning to show.

Martin,

Your comment regarding the 700K mark, the jumbo conforming loan limits is 729K for certain prime areas. Anything above this requires much more stringent financing. That’s why the mid tier market (especially under 500K) is hot right now. Anything above the 729K limit is dead money, this is really true the higher you go. Those highend areas are still coming down and will for some time. I’m not sure about the mid tier, it depends on a lot of variables.

One thing is for certain, there won’t be any noticeable appreciation for years to come. Don’t believe the standard realturd spiel…you will be priced out forever…not gonna happen.

hello from australia…interesting blog here…seems like there’s a mexican standoff between buyers and sellers in cal….for mine, if i didn’t HAVE to buy now, i wouldn’t

Mate, in Oz, you’re mad to buy now.

Prices there are at the very top of the curve. They could easilly lose a good 25% within a year or two, and no-one, but no-one, is expecting them to rise.

I’m doing my very BEST to help lower home prices for all you prospective buyers. It’s been 3 months since I last paid the corrupt House of Morgan, they were dutiful on the N.O.D. so let’s hope they hurry up and foreclose on me so I can be out of the house before the end of the year. THEN someone else can buy the home for what it is currently selling for rather than what I owe (whic is considerably more). Just say NO, to the bansters and their scheme to bury us all in life long debt.

From this point forward I pay CASH, hide my savings, and do not use the corrupt institutions that run the country. THAT will help the system collapse because I barter, buy cash, and pay little to no new taxes. Yankee frugality is back!

Trickledown economics finally hits Morgan Stanley.

Blowback’s a bitch!

“Funny how the banking “capitalists†suddenly become U.S.S.R. wannabes when it comes to their own balance sheets.”

The banksters may have been spoon-fed Friedman and suckled on Rand’s mother’s milk, but when the shit his the FIRE fan they were first to get in the bread line.

It isn’t a controlled economy, but the banks will have controlled the inventory for at least half a decade and I predict they will double that timeframe going forward.

Free-Market with caveats and safety nets for sure.

The idealogic hyporcisy is bad, but the Dr.’s point is serious. The long term effects of banks holding this overvalued shite on their BS will burden the home owning public and therefore the U.S. economy for years if not decades.

Todays Real estate market is just like the diamond market, it is controlled to keep prices at a certain range by controlling inventory. The government and bankers are working togehter. The government because they understand that they want to get relected and avoid the 80%er’s from revolting since 99% of there wealth is in their houses. But, bottom line if your a first time buyer, just like a first time person who is going to get married, you buy the ring because Debeers will protect its market and so you can sleep well first time buyers the Market Makers will protect the housing market so your investment will not go completely bust unless our great nation does. But before that happens we will declare war on someone and rise out of the ashes as we did in WWII

Thing is diamonds are forever, but houses depreciate and the taxes have to be paid.

With the governments blessing the banks are controlling the amount of shadow inventory being released into the market. Why? because this lack of inventory will encourage people to buy overpriced new construction. This is not in the best interests of most homebuyers but it does give a lift to employment numbers. Once again buying a new home which is priced 30% above a similar existing home may be good for the economy but not the individual homebuyer

Leave a Reply to Randy