California November home sales slowest since November 2007: Year-over-year sales are down 8 percent and market grinds to low volume as year closes.

Apparently home buyers didn’t get the memo about buying California real estate. November home sales tumbled to their lowest November showing dating back to 2007. When real estate markets turn, you will always see sales volume dry up first before any price changes. We are already seeing marginal areas throwing out some properties with lower prices. The drop in sales volume was to be expected given that investors are largely pulling away from California and regular families simply do not have the income to support current prices. If buying real estate was a no brainer you would expect that sales volume would be running at a healthy clip. It isn’t. In fact, this was the slowest November going back to 2007. Not a lot of good things were happening in 2007 but sales were dropping year-over-year yet year-over-year home prices were up.

The tumble in home sales

The drop in California home sales is sharp and reflects a market that is having a tough time weaning itself from years of investor buying. You have many sellers delusional about their own crap shacks and many buyers are shopping with beer budgets and champagne tastes. Speculation is running rampant and what we can learn from current markets is that “experts†don’t always get things right. It was assumed that we would have oil hovering around $100 per barrel and nothing less for years to come. Obviously that is not the case.

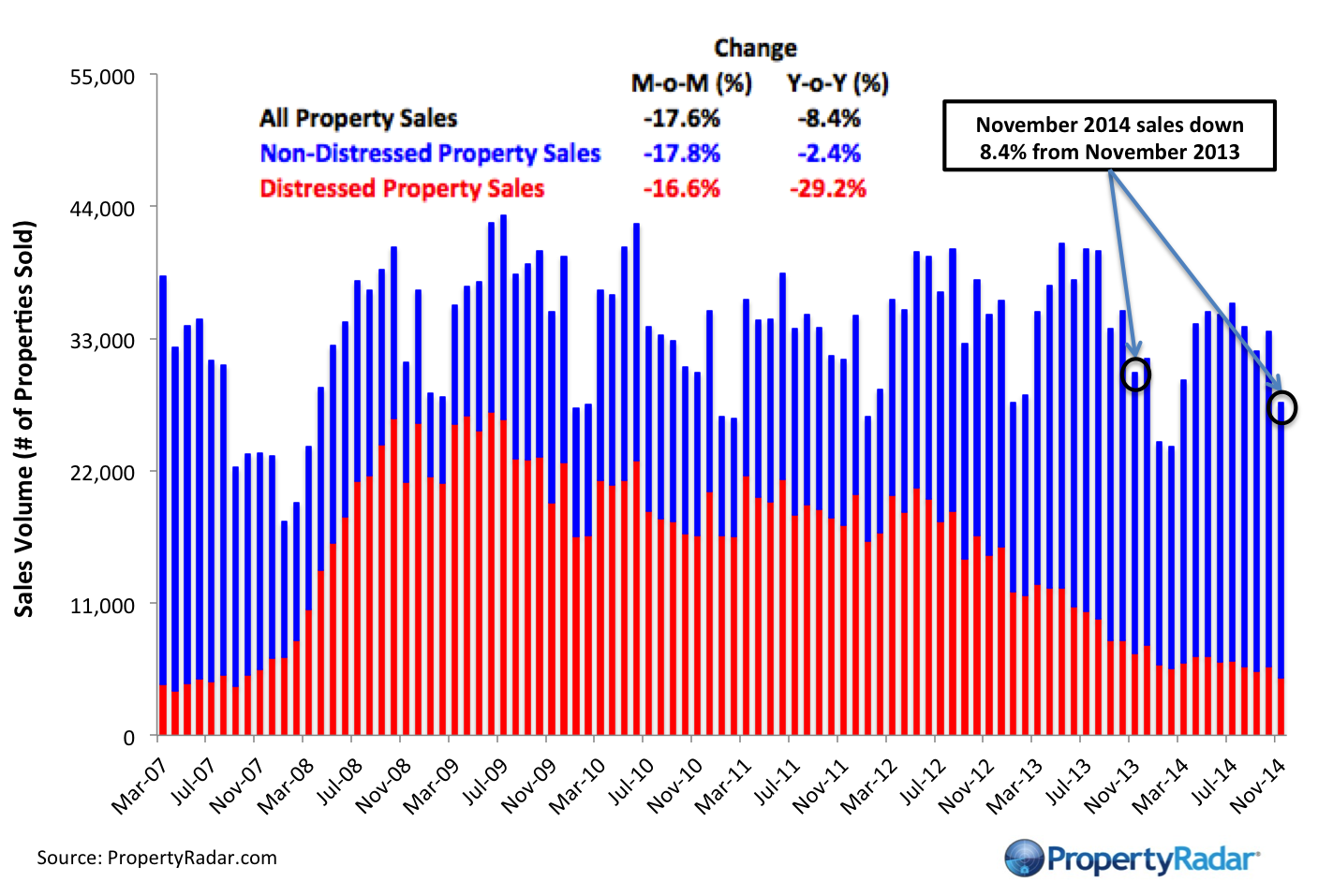

Take a look at California home sales:

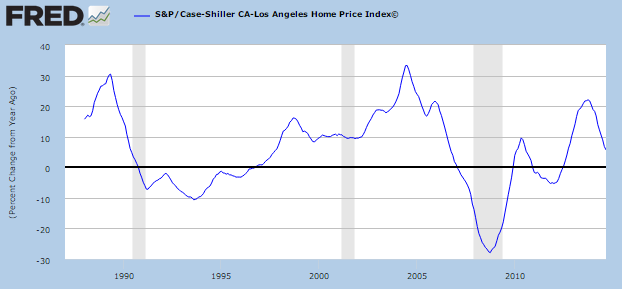

The drop in sales volume is rather dramatic. What is important to also note is that mortgage rates are still hovering near historic lows. The main reason for this drop in sales volume is investor demand pulling back but also the speed in which prices rose in 2013:

Prices were pushed up largely by investors, a group that is now pulling back from the market. In 2013 year-over-year price increases were in the 20+ percent range far outstripping stagnant incomes. Now that investors have pulled back, regular families are left having to stretch their budgets to squeeze into the crap shacks that litter the market.

The above chart reflects the LA/OC metro areas. You can clearly see that SoCal (and California) is built on a boom and bust model of real estate. These cycles take years to unfold. External events can accelerate corrections like the mortgage market collapsing or certain industries pulling away. What is causing this sales volume plunge is merely big investors deciding that California no longer has many good deals. Rental yields lost their attraction late in 2013 for many big players.

If you look at mortgage applications, you will find that volume is back to 20 year lows as well:

Even for a home priced at $200,000 nationwide most families will need to leverage up with a mortgage. This is also why the FHFA is dropping down payments to a paltry 3 percent because most Americans have very little saved up in terms of a housing down payment. A big part of the sales volume since 2007 has come from big investors.

The drop in sales reflects your typical boom and bust cycle in California. These things take years to unfold but if this low volume trend continues expect prices to wane in 2015. Just look at what $700,000 can buy you and decide if this is worth mortgaging 30 years of your life. Based on sales volume and mortgage applications, many people are saying the answer to that question is no.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

79 Responses to “California November home sales slowest since November 2007: Year-over-year sales are down 8 percent and market grinds to low volume as year closes.”

Swiss central bank introduces negative interest rates:

http://www.marketwatch.com/story/swiss-central-bank-introduces-negative-interest-rates-2014-12-18-71032631

Oops, part of my post got cut off. Here’s the rest.

From the article:

In June, the European Central Bank introduced negative interest rates on deposits with it, a move designed to encourage banks to lend rather than park money. The central bank of Denmark, which isn’t part of the eurozone, has also used negative interest rates.

The Russians are coming, the Russians are coming. We are going to be rich again.

People are to busy spending their millions on Christmas gifts!

Sarc

With the amount of appreciation investors have enjoyed, and the looming possibility of higher interest rates, it is possible many investors will head for the exit in 2015:

“Home Price Appreciation Gives Institutional Investors Incentive to ‘Cash Out’”

http://tinyurl.com/moo3c6b

Let’s hope it develops into a full blown stampede. 🙂

Not seeing the dramatic drop according to chart above. It looks like normal cyclical activity. The problem is low inventory because older folks don’t move until they absolutely are forced to by their worried kids. Most plan to die in their beds and only leave their homes feet first

With only a 70 to 80% increase in apartment rents since 1987 to present the renters are screaming foul bloody murder, and yet the 500% increase in housing prices from 1987 to present leaves the resiliency of house prices is undaunted. What does that tell you?

85% of statistics are made up on the spot.

http://www.areavibes.com/library/rent-vs-ownership/

Sex Panther – “60% of the time, it works every time”

It’s sort of a sad statement that you no longer can present your opinion without resorting to using someone else’s screen handle.

It means that times were better for the middle class back then. 500% markup on real estate based on speculation and dollar inflation rather than income growth will hurt future generations.

What are you smoking? Rents have risen far more than 85% since 1987. My first apartment in 2004 went from $1450 a month for a 2 bed/2bath.. to the current occupied price of $2450 a month for the same exact non-updated unit. Sure they repaint the walls and put in cheap new carpet. But it’s the SAME unit will cost you a cool GRAND more in 10 years. That’s a 70% increase in just 10 years… I’m sure it rent for far less in 1987… 17 years prior.

The guy who can qualify for $700,000 loan now, should know what to do.If not the he deserve it

Don’t have to worry about him

“In fact, this was the slowest November going back to 2007”; And that’s what this feels like, the end of 2007. I doubt FHA’s lower down payment requirements (3%) is going to rescue this market. The enthusiasm for real estate has faded.

The only recent non specuvestor enthusiasm in RE was the 2010-2011 period where inventory was not constrained and mortgage purchasers we’re on fairly equal footing with cash buyers. Once this run up began in 2012 the proletariat have shown to have a better memory than TPTB give them credit for. Every Joe 6pac I have talked to about RE in the last year anticipates a downward adjustment if not a crash. The lessons of 2008 stuck for many. However the specuvestors have no end game other than finding the Greater Fool. That’s what will likely add greater velocity to the coming bust. There will be very few home “owners” desperately holding on to the dream. It will be a wave of liquidations and strategic defaults with no drawn out mortgage foreclosure process as this house of cards is built on private equity.

As an aside, my girlfriend is from Laguna Niguel and I visit there from the SGV semi regularly. If one of the older, smaller, nonHOA, 1970s homes was available in the low 400K range I’d seriously consider buying. The topography of South OC is beautiful. That said OC could be sticky and low 400k would be a small overshoot of the 2010 trough. As you mentioned about the 6 adults in a condo with all new cars, OC is incredibly hard to gauge as people will do ANYTHING to keep up appearances. I suspect the OC either adjust more modestly than expected, or significantly worse. When playing with that much leverage, high income being directly tied to whatever the bubble dujour is, either you make a good bet and keep winning or you lose everything.

nzero, this is off this topic, but in your view is the specuvestor phenomenon due to the fed and twist lowering treasury bonds to below 4% or so and billions of dollars then chasing a higher yield in RE?

You might like the hills in the South Orange County area, but the area is relatively remote. It’s a long drive (as you probably know), often in traffic, to do anything in central/north OC, LA or San Diego. For that reason, I will be happy buying a halfway decent condo in Newport Beach.

This one attracted my attention, but $560k is a lot to pay for a >1,300sf condo, especially given the prospect of a future crash. That 3-car garage is really tempting, though (I pretty much never see that in a condo)!

https://www.redfin.com/CA/Newport-Beach/4218-Spindrift-Rd-92663/home/4591877

Oops, I meant <1,300 sf

The specuvestors were out in large numbers in 2011 in northern Calif., I tried to buy for a year and it was virtually impossible with a mortgage, every place I bid on went to a 100% cash flipper or specuvestor. At that time the asking prices amounted to about 10 years rent and made sense for me financially…but they are up 60% since then. May try buying again if prices drop back to 2011 levels but wonder if there will be another wave of flipper/specuvestor locusts that shut out ordinary buyers (i.e. they are buying a house TO LIVE IN IT)

@ Responder

I’m a detached buyer. Wouldn’t buy a condo to live in it under any circumstance. As for distance, I’m an independent IT contractor that specializes in small biz. I work from home a lot and I’ve got the motorcycle for the times I need to battle traffic. That said, I haven’t decided where I’m going to settle. I’m considering the hill communities of Riverside just for the price per SQFT and development possibilities of the ranch sized lots. Either way I think were a good 2 years from a bottom so I’m stacking down payment $$$ in the mean time 😉

@ gordon

I think it’s painfully obvious that Housing Bubble 2.o was enfineered by the FED through all their tools and with the suspension of Mark to Market accounting. This was all about clearing inventory from the big banks by any means necessary. The specuvestors who got in early were useful tools for the FED’s agenda. They flipped, went public with REITs, and did everything else possible to move the inventory into the hands of greater fools and knife catcher come-latelys. Mission accomplished I’d say…

Bluto: We had some luck in 2011/2012 in dealing directly with the listing agent and not having our own agent (we could have realistically purchased one of three separate places, each of which we ultimately and stupidly passed up). We also worked with a buyer’s agent a few times during that same period, our offers were pretty much ignored.

If there is another significant downturn, I think we are just going to offer a sufficient amount above asking price (and only work directly with the seller’s agent) so that the seller/ seller’s agent have an incentive to select our offer instead of cash offers. I can’t think of any other strategy available to buyers who are getting a mortgage when competing with cash offers.

I probably will try that next time, a coworker did OK that way (dealing directly w/ the sellers agent) and in general the less realtors I have to deal with the better. I bought once before in a normal market in 1997, had a good agent, looked at about 10 houses…made two offers, one was rejected and the other was accepted. In 2011 I very naively thought it would be that easy and straightforward again, in retrospect I should have dealt directly with the sellers agents. I am aware of the dangers in that but as has been said here all realtors are working for their commission, NOT for you.

Exactly, I don’t think there are any dangers you would encounter working directly with the seller’s agent that you wouldn’t encounter having a buyer’s agent. Both agents only want a commission and really don’t care about you beyond that. Get a good inspection done, look at historical building permit records, and that might be the best chance you have of identifying any significant problems.

@ Bluto

I’m certain we’ll get back to 2011 levels and overshoot that if rates are higher. The 2010 monthly nut is my baseline. Sometime between 2016 and 2018 Price+InterestRate=2010MonthlyNut…

I hope you are right, am also convinced that Bubble 2.0 will pop within a year or so, partly based on what I read here, also at thehousingbubbleblog and oftwominds. Have been following them since well before Bubble 1.0 popped and thanks to that in Spring 2007 was (correctly) convinced that it was time to sell, both predicted the pop quite accurately.

FWIW in 2011 I had enough cash to pay up to about 50% down but that made no difference when competing with 100% cash buyers…but had I dealt directly with the listing agent as suggested it might have helped.

For most of the ultra-bears on this blog, 2010 was supposed to be just the beginning of the downturn and the dead cat bounce was on its way… in 2011, 2012, 2013, 2014,

“I’m going to get out my popcorn and watch prices crater” “Dont buy now, when the cat hits bottom, prices will decline another 20% -30%”. “Only a fool would buy now…”

“look at all these knife catchers” bla, bla, bla.

Home prices will fluctuate around a mean minimal increase year over year. In order for prices to crash, there will need to be a job-loss recession. The Fed and Calamity Janet will continue to do everything from letting a job-loss recession happen. In other words there will not be another crash due to mortgage fraud like there was in 08. (I’m not saying there is no fraud, just not as rampant as it was). The other possibility for a price crash is if all the investors (a specuvester is still simply an investor) were to suddenly flood the market with home sales, but would they shoot themselves in the foot with massive sell-offs of homes that are earning them good ROI?

For the ultra-bears who are now praying for a crash – you really think you will somehow win if there is a crash? think about your own job security and think of investors coming out of the woodwork again….

My premise: It is not a good time to buy now and prices will drop (fluctuate) and this time is no different than other cycles but hoping for a crash as a solution to being a renter seems shortsighted.

@QE “The Fed and Calamity Janet will continue to do everything from letting a job-loss recession happen. In other words there will not be another crash due to mortgage fraud like there was in 08.”

The FED can’t stop the eventual job loss recession no more than they could stop the last one. You guys worship the central planners far to devoutly. As for mortgage fraud, the MASSIVELY leveraged specuvestors are infinitely more dangerous than Joe6Pac with the no doc cash out refi. All the specuvestor activity is with other people’s money borrowed at unsustainable rates to support rentals/flips with unacheivable cap rates/returns.

You “Ultra Bears” are living in LaLa Land thinking these post 2011 gains are sustainable at a macro level. A RE crash doesn’t necessarily mean a job loss recession either. In the funny money world we live in your Central Planner heroes can keep the stock market juiced with liquidity while RE tanks. Stocks have non of the holding costs or utility that RE does. With properties someone HAS to rent or buy the asset. Price discovery of some sort is inevitable.

@Nzero:

I think you need to adjust your thinking regarding the Fed and PTB. You state that you fully expect a 2010 monthly nut. That would be on the order of a 25 to 30% decline from today’s prices. Without another crisis of some sort, the chances of this happening is virtually nil. The Fed went on record last week saying higher interest rates are coming, but it will be gradual, orderly increases over the long term. And the Fed can always lower rates again if need be.

You can bet on the Fed losing control or PTB, politicians, Wall St., banks, etc turning their backs on RE. I will not take that bet. Everybody here realizes that in order to have a healthy economy, you can not have cratering home prices. You are predicting cratering home prices with your 2010 monthly nut. I have to agree with QE Abyss, without some external trigger…housing is likely in a trading pattern (+/-5% from here).

From your posts, you are obviously interesting in becoming a homeowner and you have given timelines when you think prices will go down. I don’t need to tell you, but almost everybody’s predictions have been flatout wrong. What happens if your timeline is off by 5 years, 7 years, 10 years?

@QE Abyss

““I’m going to get out my popcorn and watch prices crater†“Dont buy now, when the cat hits bottom, prices will decline another 20% -30%â€. “Only a fool would buy now…â€

“look at all these knife catchers†bla, bla, bla.

Home prices will fluctuate around a mean minimal increase year over year.”

You all are the same. Making predictions about the future although nobody knows for sure. If you had enough certainty about what will happen you wouldn’t be visiting this blog. There’s a line between making claims about what will happen and voicing skepticism about what might happen.

“The Fed and Calamity Janet will continue to do everything from letting a job-loss recession happen.”

Because “this time is different.” Where was the Fed during all of the job-loss recessions going back decades on their watch? Will this finally be the moment when the Fed walks on water and cancels the invisible hand?

“In other words there will not be another crash due to mortgage fraud like there was in 08.”

I don’t think there has been a relative amount of people claiming that we have the levels of mortgage fraud as there was before 2008, so that point seems like a bit of a non-sequitur.

“The other possibility for a price crash is if all the investors (a specuvester is still simply an investor) were to suddenly flood the market with home sales, but would they shoot themselves in the foot with massive sell-offs of homes that are earning them good ROI?”

While all investment is speculative, there exists different categories of investment strategies. Specuvesting relies on transitory momentum to bid up the marketplace and times a quick exit. Investing in its traditional definition relies on long-term value creation.

Of course they don’t expect to “shoot themselves in the foot” because each of them plans to be the first out of the door.

“hoping for a crash as a solution to being a renter seems shortsighted.”

I think most of the skeptics here simply want to avoid getting screwed and not all are renters. It could just as easily be said that hoping for there not to be a crash as validation for buying a house seems shortsighted.

Dennis…Love your statement, buyers have lost a need or as you said enthusiasm to even look let alone buy. This is not to say there will be a bounce in early 2015 with relax loans and short sale buyers back in, but overall many atre just tired of the game playing by agents, sellers, and the overall economy, they want a break from the craziness.

3% down FHA will accomplish Jack in SoCal. With the current cost of PMI and asking prices still at full retard, the monthly nut is completely out of reach. Clearing the relatively miniscule inventory available is impossible unless we get significant price drops of 15-20%. If that happens rental and rental prices track, the bust takes off. Conversely if rental prices drop as the REO to Rent model continues to struggle and in general rental inventory builds, listing prices have lower to stay within some rational semblance of rental parity. We are about to enter the inevitable negative feedback loop. The FED knows this and is telegraphing IR raises more clearly than ever. You can’t lower rates that are at zero. The FED is preparing for the post bust timetable. Much like the early 90s I expect a modest stock pullback when Housing Bubble 2.0 pops, followed by another bull run. RE crashes and then runs flat in real terms but modest rises nominally as some wage inflation finally takes hold. $12 an hour or more minimum wage in CA by 2018. It’s the surest way to keep the “system” from imploding, and the “system” of fiat and unearned wealth by the financialization class is all TPTB care about protecting.

“current cost of PMI”… Bingo! We’ve stepped back from making several offers on places when we get back how much our monthly costs would be. Even with over 10% down, PMI was costing almost $400/mo. That’s $400 a month for the life of the loan and not tax-deductible. Given our current cheap rent, why would do that?!? We could avoid that by having 20% down, but it took us YEARS just to save 10%, so we’ll keep saving and sitting on the sidelines. No thanks, don’t want to be a homeowner THAT bad.

Pat: I agree, PMI for the life of the loan is a pretty egregious stipulation for a buyer with less than 20% down. I think charging the borrower PMI should be illegal altogether. If the lender is sufficiently concerned that a buyer will default, then they should not issue the loan. Alternatively, if the lender wants to issue the loan but is still concerned about default, then the borrower should pay PMI. Of course, this will never happen since the politicians who make policy are obviously paid for by the banks, and are complicit in the scam.

PMI is not for the life of the loan if you put 10% on a conventional loan. Plenty of those still exist. We bought in 2011 with 10% down and about $200 PMI… we had it lowered to $125 when we refinanced later than year… and then dropped completely with an appraisal in 2014. We had the benefit of buying at the bottom of this real estate cycle so we lucked out . Our mortgage with taxes in quite a bit less than a 2 bedroom apartment shared with friends when i first moved to CA.

3% down is now available conventional. If you have good credit the MI factor is .65% which is about half of what FHA monthly MI is and the MMI automatically falls off at 78% LTV.

Buyers are only going FHA if they are credit criminals or you have a short sale or foreclosure that is not 4 years removed. FHA or hard $ is the only route for borrowers with a short sale or foreclosure only 2 years removed. Once the derogatory event is 4 years removed you can go conventional.

PropertyRadar’s chart is trippy on my eyes, with colors. Or to be more precise, I think:- ‘Chromostereopsis: Red and blue wavelengths focused at different points, leading to misperception of depth.’

I had to hold a ruler across that chart, on my computer screen, and it does indeed seem to be ‘the slowest November going back to 2007’.

>Doc: Just look at what $700,000 can buy you and decide if this is worth mortgaging 30 years of your life. Based on sales volume and mortgage applications, many people are saying the answer to that question is no.

Here I am, answering that question; Do you want a mortgage to buy a $700,000 crapshack?

https://www.youtube.com/watch?v=0z_Qqnq8pI8

The run up in the last year was entirely uncalled for. NOTHING supports it. Here in Laguna Niguel, I noticed SELLING prices start to drop dramatically at the end of September. I have a ton of friends who have been laid off or are taking pay cuts. Nothing at all justifies these prices. We will be on a downhill slide from here. I wouldn’t be surprised to see prices in south OC down 20% by this time next year.

Close your eyes, click your heels together three times and say “this place really is different.”

Maybe you’ll end up under the rainbow at the Sony lot.

I am also in Laguna Niguel… in Hidden Hills Condominiums (which are rentals with delusions of grandeur). It is not just the “home owners” that are taking a dive, here in the poor-neighborhood, people are doubled up at an alarming rate. I am not talking the usual immigrant families but white, middle-class people living 6+ people in a 900 sqf, 2 bedroom. Of course, they all still drive new cars! They stay in California because there are jobs but does anyone truly think this is sustainable? THE RENT IS TOO DAMN HIGH (let alone the house prices).

You hit on one of the key issues right there, WHY IS THE RENT SO DAMN HIGH? Instead of the pissing and moaning about high home prices, high rent prices need to be discussed on this blog. Is it a conspiracy of some type, the fed, collusion amongst landlords, mythical supply and demand, etc? As long as rent prices are high, corresponding home prices will be too.

The people you mentioned (can’t rub two dimes together, doubling or tripling up, driving nice cars, enjoying life, etc) have been prevalent in socal for a few decades and this will not change. Given the chance, these people will also buy houses as we saw 10 years ago. I may not like these people, but I need them. They keep the local economy, keep tax coffers filled and will pay off my mortgage on my rental.

So why are rent prices so damn high and will they come crashing down soon?

The Rent is high in the good school districts because that’s what the Asians and whites are willing to pay to stay out of the ghetto….. Supply and demand

The rent is too high compared to what? Monthly carrying costs on an equal house in so-called desirable coastal areas? I don’t think so. A comparable rental has a lower monthly cost burden.

Let’s see:

1. Low to no down payments (check)

2. Refi’s with cash out (check)

3. Flipping shows on TV and Radio (check)

4. Appraisal fraud (check)

Yes it is 2007 again.

Great article but what’s missing is the number of properties that are available for sale in comparison to previous dates mentioned.

Sales for SFR homes in Las Vegas for November was down 7.7% year over year but total inventory available was also down 5.8%. Throw in that the median list price of homes available for sale in November was 19.3% higher when the median sold price has gone up 10.4% over the same time period and it’s pretty obvious that many homes that are available are overpriced.

Yes.. sales are down because investors have backed off due to the increase in prices but other factors could be because of lower inventory and asking prices that are too high. That’s certainly the case in Las Vegas. Can’t tell if that’s really the case in California with this article.

No worries. The stock market went up 700 points in the last 2 days. We’re back baby, we’re back!

Party on Wayne!

Party on Garth!

Yes! I agree!

In April, Yellen will again change the wording, and instead of “patience” it will be “Ctrl+P”

Then 20 years from now, still on this blog, the beat goes on… ♪♪♪

Me thinks you missed the sarcasm.

Crash baby Crash!!! crash hard and I hope investors take a loss for driving up the real estate market

The slow down in sales and pricing isn’t surprising. Keep in mind that California is notorious for it’s boom and bust cycles in housing. And, you haven’t actually made money off your home, unless you sell it and are holding cash in your hands!

It’s all testament to the tenacity of the residents of CA, and their inherent drive to keep appearances going by ANY means necessary.

This place is all about the eyes only. That being said…

Prices are higher now than they were before. Over a period of years, that principle is not going to change. Buying a home in CA is the best thing you can do in your career, then sell it and retire somewhere else with the profit.

Why would you want to retire somewhere else if this is the weather and entertainment capital of the world?

Because it’s for the young producers, in a lifestyle that caters toward them. The old takers move on because they have had their fun and the new entertainment they desire at an older age is in other cities/states. Like Texas or Florida.

Ok, glad we’ve cleared that up. SoCal is the bestest place in the world to live, except if you’re over a certain age. Got it. Any other exceptions or buts that have not yet been covered or should we just wait until you make them up as we go?

Boom and bust weather. Boom and bust topography. Boom and bust water. It’s a boom and bust place that attracts boom and bust types of people, I guess.

There’s no market sense anymore. After the last bust the banks took control of the RE market and they’re not going to screw themselves.

I’ve been looking of a home for four months now in the LA area. They sell in a week or two above asking price and theres always a bidding war. I’ve already lost 3 houses this way. So I dont know what the hell this article is saying.

For what and where are you looking? In L.A. and O.C. there many properties listed across all price levels and in established along with so-called “up and coming” areas that have been riding down the price reduction wave for months.

Sure is interesting to see the same houses keep coming back for more pain. From $160K to $400K and back to $160K again. Lots of laughs.

https://www.redfin.com/CA/Los-Angeles/10336-Lou-Dillon-Ave-90002/home/7312700

Because if you paint it lime green, it’s worth twice as much two years later.

https://www.redfin.com/CA/Los-Angeles/10517-Weigand-Ave-90002/home/7312769

If worse comes to worse, you could always sell frozen yogurt out of it.

In my hood, 92116, it can be spotty. There is a huge stock of housing, most 1000 sq feet or less, 92116 between elcajon and university, where daily buzzing from police helicopters is a huge nuisance.

I quite often will walk through this area on walks and It seems that whenever one of these dumps gets flipped, usually in the mid 500k to 600k range, I will see a car with out of state plates in the drive way.

For whatever that’s worth!

That’s worth something. Which states?

oil crash, texas economy crash. all those californians that left for something better in texas are gonna be scrambling soon

everything crash, socal RE crash.. but not much else

big picture, US exports culture and NY/CA is US culture

wealth preserves wealth.. opportunity lies where the $ is

and the $ is in cali

Would that be the same big picture culture exporting machine which created The Interview? Would that also be the same US culture that still doesn’t afford LA an NFL team?

Will all of those Californians that moved to Texas as a part of the corporate relocations for Toyota, Charles Schwab, and Raytheon also be scrambling? But what does that matter since the US isn’t involved in the exportation of autos, financial services, or defense systems.

L.A. will never get an NFL team because it’s Roger Goodell’s leverage machine. “Build a new stadium or I’m moving this team to L.A.”

And how do you know about Raytheon moving it’s manufacturing to TX? The high level engineers are staying in CA though, they don’t want to move.

This is going to be a very interesting market from Jan to late May. 3% down, 620 credit score, 3.8% mortgage, and a decent job gets you a house. I know this, many will go shopping and sit down and see if this is going to happen for them. If the house payment is anywhere near the rent then the sellers are back in the saddle?

I say prices go up 7% by July 4th

Ok I used mortgage calculator. A 500k home with 10% down 50k and taxes 1.25% has a mortgage of approx $2,634 for 30y @ 3.9%. But with mortgage and property tax deduction of approx (17,000+ 6200)*.34 = $7,900 or a savings of $650 per month. Subtract maybe $300 for maintenance per month than the actual cost is $2,300. That is very close to rental parity (maybe a little high) right there even with 10% down. PMI is temporary so I’ll wont add here. On top of it, this price is fixed (for the next 30y except for taxes+maintenance) and you have equity.

I would have to say that buying make sense if it’s within 15% of rental parity (we are probably about 5-10% above rental parity now or just about depending on location on average). I can see some solid middle class areas in LA and OC with prices around 500k for a 3bd/4bd 2bth single family home like Anaheim, Garden Grove, Lakewood West Covina, Whittier, etc…If you want to save money, you can always do some of the fixes/maintenance yourself. Nothing wrong with that.

It’s still beat plowing snow, paying 6-700 hundred dollar heat bill during late fall/winter and 3-400 dollar ac during summer which is 60% of the year. Also salaries tends to be higher on the west coast.

I’m sure a lot is doing this this math which make buying, even now, make sense. These are real not pie in the sky numbers. Even during the last crash, rent either stays flat or drop little compare to drop in house prices. But than you can’t even buy if you really want to if there isn’t anyone (not many) who is willing to lend when the economy crashes. Cash buyers wins again.

.34 is the combined state/Fed tax bracket of 25% & 9% for income up to 90k (people who makes 100k contributes to their pension/401k so it might drops their income into the 90k tax bracket).

“buying make sense if it’s within 15% of rental parity”

And the hits just keep on coming’… Now we have a rental parrot telling us it’s all good up to a 15% margin.

– You don’t have to put 10% down to rent. That 10% can be put to other use.

– If rents go down for a year or so, then the basis for the original rental parroty projection is skewed.

– Equity means little unless one sells and books a profit. Sure, go ahead and borrow against said equity and “invest” the borrowings. In the case of putting 10% down, how amazing does that sound to be charged fees and interest to borrow back what was one’s own money.

– When one does sell and we assume they are able to book a profit in real terms, then what? Are they going to buy back into the same market at the same price level which afforded them a profit?

“If you want to save money, you can always do some of the fixes/maintenance yourself.”

Sure, go ahead and climb up there and put on a new roof and while you’re at it, go ahead and trench out that main pipe to the sewer. There’s always time left in the day between commuting and running the kids between appointments.

“It’s still beat plowing snow, paying 6-700 hundred dollar heat bill during late fall/winter and 3-400 dollar ac during summer which is 60% of the year. Also salaries tends to be higher on the west coast.”

Higher heating costs combined with lower housing costs means there is a net nothing comparative advantage in regard to heating costs.

A lot of SoCal gets hot about half of the year and people run the A/C so cooling costs don’t escape us either.

Much in the way people in SoCal pay “gardeners” to tend to their lawns, many people in cold weather regions pay others to clear sidewalks and driveways. That’s different than plowing snow, which is usually done by people in it for the money or who, gasp, actually have fun doing it.

“.34 is the combined state/Fed tax bracket of 25% & 9% for income up to 90k (people who makes 100k contributes to their pension/401k so it might drops their income into the 90k tax bracket).”

With a tax code as complex as what we have here in the U.S., it’s impossible to apply a generic scenario across the board. Aside from that, anyone who has been paying income taxes long enough can remember that tax shelters constantly get changed. It’s foolish to rely on mutable inputs when one is at the margins of 15% rental parroty.

Benshalom, you put a tear to my eye with your rental parity post. Don’t mind the hater, he doesn’t even like LA to boot. This rental parity equation should have been big news on all the housing blogs back in 2011 and 2012, but it wasn’t…the sky would continue to fall. As I have stated time and again, if you are anywhere close to rental parity in socal, you need to buy. The reason I say this: “show me just ONE example of buying at rental parity that didn’t work out?”

I would personally not buy today; however, it may be different for others. Picking the correct area to buy in is obviously the most important part of the equation. Do your homework and you’ll get rewarded!

“Don’t mind the hater”

When you’ve got nothing else, focus on and label the messenger.

“the sky would continue to fall”

Also repeat hyperbolic accounts of the past.

“anywhere close to rental parity”

And use vague definitions to hedge being called out in the future.

Well my post has struck a nerve somewhere. Show me how the 10% down is put to better use beside splurging on new toys like a new beemer or all those expensive trips and items. Investing? Think you can beat wall street? Not many can.

The haters will hate but living in your own home still have a different feeling than renting. Yes it can be overrated at times but there are still pride of ownership. Many here never really talk about the effects of low interest rates which make the homes 15-20% cheaper even though the prices might look bubbly [not really since the dollar is worth less than 9 years ago, hello stagflation]. In reality today’s prices might be 30-40% lower than 10 years ago due to lower rates and inflation [yes wages haven’t gone up much but we’re in a stagflation period]. Investors doesn’t buy because they can’t make money flipping/renting (after the fees) but home buyers [to live in] should look at it from a different perspective if they have a longer horizon.

I don’t think now is the best time to buy but it ain’t the worse either. What we have is a neutral market outside of a few places were foreign/investment money run amok but that’s nothing new. Just look at places like Hong Kong, Tokyo or New York. LA is not there yet but it’s heading in that direction. If billionaire developer like Sam Zell is betting on the revival of the urban core than do you think he got it dead wrong? I for once don’t think he make his billion being an idiot.

I can cite some research/observations about urban trends but what I will get is just the same old no one can predict the future and the research is biased meme.

2014 will come and go and I still see no crash nor higher rates in sight yet. If prices go up another 10% in the next couple of years and drop 20% due to higher rates/debt bubble crash. I still think that those who buy today is still okay especially if they’re locked in to a lower monthly payment.

Best of luck to everyone, bulls and bears.

I like Siggy.

“Well my post has struck a nerve somewhere.”

Who’s upset?

“Show me how the 10% down is put to better use beside splurging on new toys like a new beemer or all those expensive trips and items. Investing? Think you can beat wall street? Not many can.”

No one is claiming savings are better used on cars and trips, that’s nonsense. There are options aside from putting it into a down payment on property. For example, it could have been invested into peer to peer lending and achieved north of 10% returns. Or it could have been set aside for a rainy day. As for wall street, I don’t advocate throwing it all in there although having it in an S&P or DJIA index fund the past few years would have resulted in a tidy return.

“The haters will hate but living in your own home still have a different feeling than renting.”

There one of you goes again with the “haters” label. Feelings don’t pay the bills.

“Yes it can be overrated at times but there are still pride of ownership.”

Pride can be felt in any decision one chooses to make, including pride of freedom from debt or pride of mobility. Someone can rent a house and take pride in it and the neighborhood. Pride of ownership is a marketing tool pushed by the real estate industry.

“Many here never really talk about the effects of low interest rates which make the homes 15-20% cheaper even though the prices might look bubbly [not really since the dollar is worth less than 9 years ago, hello stagflation]. In reality today’s prices might be 30-40% lower than 10 years ago due to lower rates and inflation [yes wages haven’t gone up much but we’re in a stagflation period].”

We have discussed the effect of low rates. Namely that the low rates push up sale prices. Anyway, I think you’re claiming that homes are 15-20% cheaper on a monthly payment basis? If that’s the case, check out point #5 at http://mhanson.com/archives/1594

“I can cite some research/observations about urban trends but what I will get is just the same old no one can predict the future and the research is biased meme.”

Is it not prudent to be skeptical about any claims as to what hasn’t yet happened?

A tumble in sale price and a spike in prices?

from 2008

http://www.doctorhousingbubble.com/there-will-be-housing-how-weve-returned-to-selective-market-ignorance/

SEAN

February 26, 2008 at 5:58 pm

This whole story gets more out of hand every day. My dad read a story that stated prices for housing PRICES went up in NYC, White Plains & northern NJ. WOW!

I’ve made a mistake, a tumble in home SALES

> BSB: ‘The haters will hate but living in your own home still have a different feeling than renting. Yes it can be overrated at times but there are still pride of ownership.’

I will buy when the prices make more sense. There is also pride in having fat savings accounts, as a non-owning renting tenant, with options open to move, especially when you still have belief in a real estate price crash, and even rental price softening.

Just the other day, Howard Marks, the super rich guy (who I’m not particularly keen on because of their investments into real estate into the early QE years) got something right with this theory, I do believe. Higher prices suck in more people, and get used to it being new normal… but things can change suddenly.

___

MARKS: There was an economic philosopher, Rudiger Dornbusch, who said it takes a lot longer for things to happen than you think that it can, but then they happen much faster than you thought they would. And that’s the way things go in the investment world.

MARKS: I’d say we should start getting interested in the asset class. Declines are not a reason to get worried. Declines are a reason to get excited. The investing public like things better at high prices than at low prices. The professionals like things better at low prices than at high prices.

RUHLE: Hold on, one more time. Say that one more time because it’s such a good point.

MARKS: Well the public, people who and who don’t understand how investing works like things, feel better at things when they’re at high prices, and lose confidence as the price falls. Warren Buffett says, I like hamburgers and I eat more of them when they go on sale. The investment professional who understands the intrinsic value of the things he’s looking at, hopefully, likes things better when the price converges to or falls below the intrinsic value.

http://www.marketoracle.co.uk/Article48681.html

Leave a Reply to A