California Rental Armageddon: Nearly half of Los Angeles adults doubling up, working class moving out, or you have the option of simply living in poverty.

California like the rest of nation has gained a large number of rental households. Many of these households were formed from the ashes of the 1 million completed foreclosures. Over the last ten years the nation has lost 1 million net homeowner households and has gained a whopping 10 million rental households. L.A. County with roughly 10 million residents is predominately a renter county. Over the last ten years the large gain in California households has come in the form of rentals. Maybe you find living with roommates deep into your 30s and 40s as awesome or maybe you enjoy living a Spartan lifestyle just so you can pay your monthly rent while hearing helicopters overhead in your hipster neighborhood. Every piece of research simply shows that people are being pushed into spending more money on housing. Some say move out. Well guess what? Many middle class Californians are doing just that. The rental and housing market has gone into full on financial Armageddon mode yet in typical California fashion, the sun keeps glowing brightly. Ironically over time people think it is normal to dump every nickel you have into housing. Let us look at three trends impacting the rental market in California.

Moving out

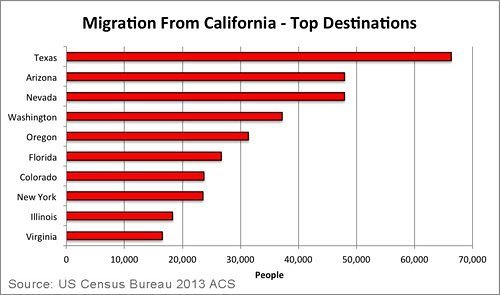

The urge to buy real estate is a deeply rooted American concept, although Millennials might be changing their tune. For the majority of the country, buying a home is a simple endeavor. With your typical house costing $200,000 and with low interest rates, simply having the median household income is good enough to not have your home consume every penny of your income. But in California, we have $700,000 crap shacks that look as if a two-year old developed it in their first art experiments. In the last couple of years, there is a vocal group saying “hey, if you can’t make it in California get out!â€Â Apparently some people are listening to this:

Based on Census data on state-to-state migration, nearly a quarter million more workers left California between 2007 and 2013 than arrived. Nearly all of those leaving made less than $50,000 a year. Then you have your low six-figure income crowd buying crappy properties and pretending that somehow they are part of the Malibu or Newport crowd. The gap is widening and even with rentals, more money is being consumed in housing. But maybe leaving is not an option. How about finding a roomie or moving in with mama and papa?

Doubling up and living with parents

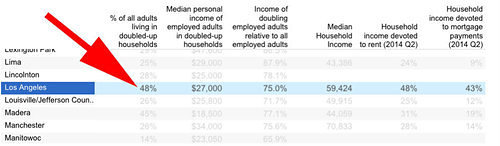

In Los Angeles nearly half of adults are living with roommates and this isn’t your spouse or partner:

Source:Â Zillow

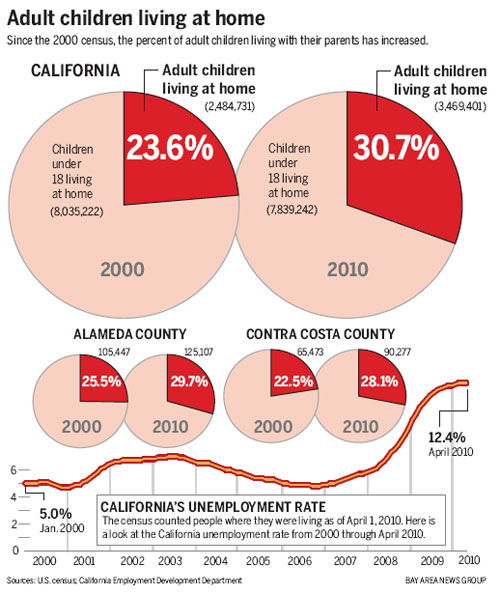

This is defined by Zillow as at least two working-age, unmarried or un-partnered adults living together. So how can someone afford a $4,000 apartment in Santa Monica? Easy, just have two other people living with you and the rent then becomes “affordable†or at least that is the pitch. For many, even finding a roommate is too expensive. Many adults are moving back home:

Over 3.4 million adult “children†live at home in California. The vast majority are living at home because of economic reasons. They are not making big bucks saving their income to buy that $700,000 crap shack. Many in this group can’t even afford a home with a roommate. So how are others making it? Another option is simply living in flat out poverty.

Living in poverty

Based on Census figures nearly a quarter of Angelenos lived in poverty during the last few years. The poverty rate varies across states but the Census gives us an example of a five-member household with three adults and for this household to be categorized as being in poverty, household income would need to be $28,087 per year or lower. Good freaking luck getting by in L.A. on that income. You can drive around any lower income neighborhood and you will see multiple cars parked in front reflecting this dynamic of multiple income streams under one roof. In fact, in the last article we highlighted one of the benefits of buying the home included additional “parking†spaces almost understanding this deeper trend. Yet somehow these are the areas that will gentrify into the next Pasadena. Not going to happen and certainly is not going to happen while you are still young and thinking that Taco Tuesday is a hip thing to do.

While the economy pushes along, many are feeling an apocalypse on their pocketbooks largely driven by real estate. You have the option of buying from the limited inventory out in the market and locking into a 30 year crap shack matrimony or continue getting it from every way with rentals. This is California baby! This is boom and bust central. What did you expect from the land of make believe and fairy tales?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

160 Responses to “California Rental Armageddon: Nearly half of Los Angeles adults doubling up, working class moving out, or you have the option of simply living in poverty.”

Love the description on this one: https://www.redfin.com/CA/Compton/2622-W-Claude-St-90220/home/7340564

“Location! Location! Location! This home is located in a highly desired area of Compton.”

I didn’t know Compton had a “highly desired area.”

“Just perfect for that growing family.”

TWO bedrooms, ONE bathroom, only 1030 sq ft. How is that “perfect” for a “growing family”?

Is the area with the crocodile-infested moat?

“…This home is located in a highly desired area of Compton…”

May I pass on some Compton Insider info?

(complements of RealEstateOnlyGoesUp)

Some areas in Compton are desirable because:

1) Gangsters in desirable areas are polite.

They only shoot people they don’t like.

2) Gangsters in desirable areas use silencers on their guns.

3) Gangsters in desirable areas don’t rob people, carjack or

have shootouts on Sunday mornings, whenever feasible.

4) Gangsters in desirable areas have become more gentrified.

5) In desirable areas, your car will not be stolen when visiting a open house.

“complements of RealEstateOnlyGoesUp”

It’s “compliments” and not “complements.”

compliment — praise, offered as a gift or courtesy. “He complimented the house’s curb appeal.” “The realtor offered me a complimentary pen.”

complement — to complete, to make perfect. “The hipster fence complemented the red door and Buddha shrine.”

This is one of the best entries the Dr. has given us.

With 48% adults living with roommates and 25% of the population living at poverty level, LA is truly turning into a 3rd world county. Brush up on your Spanish.

You must be new. It is a third word city.

Is there such a thing as 4th world? 3rd world would be a step up.

More and more business that serve working people will continue to struggle. RE is DESTROYING spending power for many in SoCal. Those business that serve the hipster crowd shouldn’t feel safe either. NASDAQ 5000 is just as unsustainable as before. Total house of cards… Hope the OC goes bankrupt again like in ’94. I would really enjoy seeing the Newport Beach crowd frustrated LOL.

For those of you saying a relatively speedy correction is impossible. These roommate shackled debt slaves are your backstop. Inventory is low, but the amount of qualified buyers after this investor exit is even LOWER. If you can have a rapid price ascent on miniscule volume, so can you have a rapid decline. 2011 prices in all but coastal prime within 3 years tops. I’ll gladly offer a humble mea culpa if I’m wrong 🙂

“2011 prices in all but coastal prime within 3 years tops”

which is still way way WAY to high

@interesting

To high based on market interest rates and lending? Of course. But we’re not going back to that anytime soon. 2011 was relatively specuvestor free and the monthly nut was within range of historical averages. I think parity with 2011 payments is a reasonable prognostication given a moderate increase in inventory over the next 3 years and a complete absence of specuvestors as there will be no momentum to sell into for sometime. Many areas are already down 5% plus from peak and the action hasn’t really started yet. 25% to go means we only need 8% drops over the next 3 years. 6% per year if it takes 4. Looking at the economy and the world I don’t think that’s a radical proposition at all.

2011 prices don’t mean a thing to most on this site. They didn’t buy in 2011, did they? My prediction – IF we see 2011 prices again, the perma-fence-sitters once again will not buy, but instead complain that prices are still too high. I ask these people over and over “why didn’t you buy when prices went down” and there is never a response. They are just frozen and have left a ton of equity on the table over the past 4-5 years by not getting in the game. I see no reason to think they will get in if prices revert.

“2011 prices don’t mean a thing to most on this site. They didn’t buy in 2011, did they? My prediction – IF we see 2011 prices again, the perma-fence-sitters once again will not buy, but instead complain that prices are still too high.”

I think your painting with a pretty broad brush there. Some were close to buying like myself (just missed on two properties in 2011 and 2012) and before they new it Housing Bubble 2.0 exploded. As for the missed out equity gains, I’d say it’s even harder to timea market top as a seller than it is a bottom as a buyer. Sell to early and your rushing to find a rental and wait to get back in. Sell to late, and those “gains” can rapidly diminish.

Since the onset of Housing Bubble 1.0 we’ve had maybe 2 years of normalcy in SoCal RE. Late 2010 – Late 2012. 2 years out of 12. Just because some of us couldn’t close the deal in that window and refuse to participate in the mania does not make for perma-bears all.

Turd world state more like it …… The 5% are doing just fine

No, not really. The 4-5% struggle with education costs.

Teresa.. the 5% net worth well over 2 million dollars and up, thus college cost are not a concern.

@Robert, Wasn’t thinking of college costs, actually. Was thinking about the $20k-$30k per year per child cost for private school for K-12. Also, are you sure about assets for 5%? I haven’t looked them up in the last year so perhaps they’ve changed.

SIMPLE:

….. It is GOOD to be RICH

….. It is NOT Good to be POOR

ALSO – The Real Estate Agents are hitting the ANXIETY BUTTON

and have REACHED THE DESPERATION POINT .. They are NOT

making any MONEY … They will NOW FORCE PRICES DOWN TO MAKE THAT SALE …

PAY ME .. PAY ME…PAY ME … YOUR DAMN HOUSE IS NOT WORTH THAT MUCH

JUST “PAY ME ” DAMMIT … OK ??? Screw your damn house ..

*** I’ve seen this before — 1991 to 1995***

I’m sure many of us are familiar with the statistical data made popular in Freakonomics that shows that Realtors on average wait longer and sell their own houses by (as I recall) around 5% higher than they counsel their clients to do. (Just sell. I don’t think you’ll get a better offer and the market won’t bear your asking price). Also they buy their houses cheaper than they counsel their clients they should do. (You should offer $75,000 more or you won’t get the house)

Just another reason why by and large Realtors are objectively weasels, liars and hucksters. (to which you should not listen in real life and of course in these blogs)

Paul – ( not a Realtor )..Excellent post and so very true! I have dealt with them all my life, you lower your price many thousands of dollars and they take a small hit on commission. Flat rate buying like flat rate taxes would eliminate a lot of anxiety in life.

Basically a house should bring at most 3.5% commission the agents then pay the broker .5% each. That leaves 1.25% profit for each agent, the 1% is pure profit the .25% goes to there expenses if they incur any. A agent in a not so expensive market could sell 11 to 12 houses a year and make about 80K, luxury about double to $125k, not bad for getting a license and where a college degree is not needed and on your own time?

I post this CAUTIOUSLY :

When I make Offers on property and I am forced to deal with a Licensed R.E. Agent,

I have a TACTIC that I use to SHORT CIRCUIT their GAME PLAYING & repetitive LYING.

Featuring benefits such as multi parking, guest quarters, extra bathrooms, etc. showing up outside SoCal as well likely to appeal to the large family/multifamily/renting out rooms demographic. Check out this listing on Redfin in Phoenix…

https://www.redfin.com/AZ/Phoenix/2814-W-Mariposa-St-85017/home/27936805

“Very Special property because of the Block Garage workshop 35 X 21 (appox) PLUS a bathroom with shower (IDEAL FOR QUEST QUARTERS) or Office & room for 7 cars behind your fence!!!!! Main house is 3 bedroom 1 bath Plus 1 bath in workshop!!”

This is being offered for $69K. Will work for somebody who can fix it up. Wonder what a comp property in comp neighborhood in LA area would list at? (insert laugh track).

Article in yesterday’s edition of the local fish wrap: “Flood of home sales may indicate millenials diving in”. Their site is pure shit, so qouting below:

—–

More Millennials and boomerang buyers appear to be hopping off the fence and stepping into their own houses.

Home sales across metro Phoenix are on track to jump more than 30 percent during the next few months, potentially signaling the restart of the area’s stalled housing recovery, according to a new report released Friday.

The number of Valley houses under contract to sell started to surge in early February, a special report from Arizona State University’s W.P. Carey School of Business indicated.

The biggest increases in pending sales were for houses priced from $150,000 to $250,000 and from $250,000 to $400,000. That could signal more first-time buyers and that former homeowners who lost houses to foreclosure are purchasing again.

“It’s really encouraging for the housing market to see home sales climb the most at the lower end of the market,” said Mike Orr, director of the Center for Real Estate Theory and Practice at W.P. Carey. “Millennials and boomerang buyers are likely behind much of the increase in sales.”

Real-estate agent Matthew Coates of Chandler-based West USA Realty Revelation said he has sold four Valley houses in the past 10 days. He said he is now working with three buyers, including a first-timer.

Less-stringent lending standards and the federally mandated cut to Federal Housing Administration mortgage insurance may be attracting new buyers, especially Millennials, experts said.

An FHA loan appeals to Jacqueline Moore, a 30-year-old single mom who is ready to buy her first house. She’s looking in central Phoenix because it’s near her office in the Biltmore area.

“Renting is so convenient but definitely expensive,” said Moore, who currently lives with her son, Noah, in a downtown Phoenix high-rise. “I am ready to invest my money in a house, but I want something low maintenance.”

She said she is considering an FHA mortgage because of the low down payment required, 3.5 percent or less. She also appreciates the recent cut to the mortgage insurance required on the loans. President Barack Obama announced the cut in Phoenix last month.

Valley home sales fell 14 percent last year. Housing-market watchers have said since the market started slowing in early 2014 that it would take less-stringent lending requirements and more Millennials and boomerang buyers to push home sales back up.

The trend appears to be national, as pending home sales in the U.S. reached an 18-month high in January, according to the National Association of Realtors.

“Millennials have realized interest rates are going to tick up, and that’s scaring them into buying,” said HomeSmart real-estate agent Mike D’Elena, who is working with Moore to find a home. “Based on the increased demand from buyers I am seeing, the Valley could have a seller’s market by summer.”

He isn’t seeing the same increased demand from boomerang buyers in the Valley yet.

Most potential boomerang buyers, people who went through foreclosures or short sales during the crash, have been required by lenders to wait seven years before than can qualify for a loan again. Many people who lost houses in 2008 are eligible to buy again this year.

The rising demand from younger buyers also appears to be helping Phoenix’s new-home market. During the past two months, contracts to buy new houses in the region have climbed 12 percent, according to Belfiore Real Estate Consulting.

“Consumers, relegated to window shopping for a new home as the economy has recovered over the last 24 months, are just starting to show their purchasing might,” Arizona real-estate analyst Jim Belfiore said.

Contracts signed to purchase a house usually become sales within six to eight weeks, so Phoenix-area home sales should begin to jump in March.

Orr saw the spike in home-sale contracts through his regular research of Arizona Regional Multiple Listing Service data. Pending home sales, or contracts, aren’t public record until they close and are recorded.

He said it will take a few months for higher home sales to translate into rising prices.

“There is no doubt we will see home-price increases coming in the next several months,” Coates said.

Anyone who wants to avoid problems knows better to stay away from the gangland hoods of west and south Phoenix.

So does it still make sense to buy? What you think? There is a condo in Tarzana, which was bought $140,000 in April, 2012. Now they are selling for $240,000 without doing any upgrades to the property. Is prices still going to increase or it is time bubble to burst?!

In 2012, my wife and and I wanted to live on the Westside but were facing rents of +/-$2500 per month in Rancho Park for a 2bedroom 1 bath. Rents in the shabby part of Pasadena were about $2,000 per month for a 3bedroom 1 bath. So faced with $2K per month for shabby 3bd in Pasadena or $2.5K per month for 2bd in WLA, in 2012, we decided to buy a 4bedroom 2 bath on 7,000 sqft in Baldwin Hills (sale price was $470K). Our PITI is $2,600 per month. Based on where rental rates are today, I think we made a good decision, but time will tell.

Yes, what you did in 2012 made perfect sense. By the middle of 2013 it made no sense. I can rent houses in areas like Westwood, WLA, Toluca Lake, Brentwood, etc that I could never afford the monthly mortgage for.

Baldwin Hills is called the “Black Beverly Hills” and we don’t want any crackers moving here. The crackers belong in the cracker jack box little crap shacks for $700k in Pasadena or where ever.

tyrone, us crackers don’t want to live near you either, stinky. COMPTON KING

It might be black but it’s no Beverly Hills. Just checked the LA Times crime map and it’s laughable how preyed on the suckers in this area are. Burglaries, Thefts and Robberies abound! Enjoy that Tyrone! Probably a bunch of “crackers” ripping you off, right BRO? Hahahahahahahahahahaha!

“This is California baby! This is boom and bust central. ”

But…but…but..this is the “entertainment capital of the world” The whole world is dreaming of renting a crapshack of 600sf with 3 other families; the more, the better the cudling.

The helicopter above and the shots in the street are part of the entertainment….like in action movie. DHB does not understand the thrill attracting those young people to the “action”. That’s what gives the adrenalin rush…:-))))

Exactly flyover. Yesterdays story in the LA Times was all the proof needed to justify SoCal home prices. It said 70% of the population is so drawn to living here, that housing and traffic were non-factors. They are annoying, but just the price to be paid for paradise.

Despite some nightmares, poll finds voters still California Dreamin’

When pollsters asked California voters whether they would rather live here or somewhere else, more than seven in 10 picked California.

http://www.latimes.com/local/politics/la-me-pol-poll-california-dream-20150301-story.html#page=1

I love the responses why people loved California…it’s so accepting, the arts, etc.

LA Times demographic…illegals (oops “undocumented immigrants), Dusty Liberals clutching recycled shopping bags rambling on about “DOING THEIR PART”, bought RE decades ago, state pension or living in rent controlled apartments, or trust fund babies…CA life is grand, even though many of their kids/grandkids struggle, can’t make ends meet. People whose priorities are art, acceptance, and weather. Who needs a solid economy/good jobs when there is a weekly farmers market, art show, etc?

Doc, you could not have picked a better day to publish your post. Did anyone see the LA Times front page story today? 70% of Califonians specifically cite housing and traffic as problems, but WOULD RATHER be here rather than anywhere else. Reasons being – weather, entertainment, diversity, open culture, art, and creativity. This is as much proof as anyone would need on the extreme draw of Cali and how cool it is. There is just no place better.

I am glad you brought this up Nachos.

I moved to Dallas, unfortunately for a year. “All” the businesses on the planet are there, so prices are becoming competitive (rent-wise), not to mention condos and apartments going up by the minute everywhere. While living there, I had a very low paying job, however, give me all the money I needed, and I still wouldn’t’ be happy there. It’s true that the geographic location can make a huge difference on your livelihood.

No where to go but down from here. Wait until at least 2018. They always time the recessions to start at the beginning of a new presidential administration. It’s coming.

Agree 100%!!

It is nice to buy during a recession… if you have a job. Most recessions, however, are followed by a significant unemployment growth. Like I said, it doesn’t matter if the home is now 50% cheaper if you earn 50% less, or have no income at all. Be careful what you wish for, after all, it may actually come true and you wouldn’t like it…

“Like I said, it doesn’t matter if the home is now 50% cheaper if you earn 50% less”

Actually it does.

First: When the depression ends your salary raises to old level but the price you paid is still only 50% and it’s taxed accordingly.

Second: The value of the house is more unlikely to drop even more if it’s already 50% off from previous peak price.

Third: The amount of money you pay to bank as interest drops much more than 50% if you can shorten the mortgage period by 10 years (from 30) even if the amount of loan is 50%. Shouldn’t be hard if and when the depression is over and salaries rise again. Buying on top and becoming unemployed means you lose the house, whole investment: A significant risk.

Fourth: Buying at the top means the value of the house goes only down. Either fast or slow along the inflation. But it can’t go up as it is already at the top.

Thomas you forgot:

Fifth: If your income gets slashed FIFTY PERCENT you are going to be FREAKING OUT and wisely questioning your future employment and income prospects (if you even manage to stay gainfully employed in a bad recession) and therefore YOU AIN’T BUYING ANYTHING.

Go google ‘rental property backed bonds’ – you’ll see why rents are so high, and why property prices are so high.

Many of the lower income people from cali that chose to buy homes early in the heights,west u,bellaire,montrose and other popular hoods close in,are sitting on a couple hundred grand of home equity.since oil is down there is going to be a $30 billion dollar petro chemical boom in Houston.those companies benefit from low gas and oil and need engineers,construction workers,etc.houston has the world’s biggest medical facilities,the medical center.more doctors,nurses and other medical staff is needed.houston does have some tech firms too.the panama canal venture is going to boom.i have family in California,i wished i would of bought real estate a couple years ago.many rich people from overseas are buying up properties in houston and other cities in Texas.i keepreading reports affordable real estate in Texas will soon be a thing of the past.its already happening in close in hoods here.east austin has become expensive.

I just left E. Austin TX because could not afford property taxes. My home was valued at $80000 3 years ago but with influx of these dang Cali idiots my home value shot up to $200000 we sold and moved 30 min out of Austin Lower taxes less populated I just hope the bubble will burst before the idiot start moving my way again. Austin TX is now so overpopulated its no longer fun place to live its a giant headache.

It’s all relative – it is good you in Austin are already making a fuss about this. In Australian cities, and in Auckland NZ, as in Vancouver and some California cities, it is impossible to buy ANY house, even a dilapidated one or a remote exurban one, for as little as $300,000. The people in your position where your property has inflated to $200,000, are facing an inflation to $1,000,000.

Americans living in cities that are actually systemically affordable definitely need to stay vigilant because you ain’t seen nothing yet, about what utopian planning idiots can do to property markets!

Phil, things are free (or subsidized) in Au and NZ that are not here. Eg. cost of healthcare and college education. Can’t compare. Americans have less extensible income.

Yep. Been in the Houston area since 95. Two rentals plus my primary home. I live near the Exxon Mobile campus that is slated to open later this year. I miss the weather but everything else I can get here. Plus its nothing to fly back a few times a year.

Yep. We recently moved from Orange County to Florida, after our landlord in Mission Viejo told us that we had 60 days to move out because the landlords were moving back in.

We looked for another place to rent in OC and were shocked to find that we couldn’t even get a single return phone call on the any listings that we looked at. Apparently decent rentals are gone the first day that they come on the market! We looked into paying $1000 more than are last rental and still came up empty handed.

So we said “F*ck It!” and the wife and I both decided to quit our well paying jobs and take early retirement. We couldn’t afford to retire in CA, so we moved to Florida where we can get a decent home for $200,000. We paid cash so we don’t have to worry about monthly payments anymore.

Based on my experience, good rentals go within the first couple hours they are listed on Craigslist.

Doc, many thanks for continuing to point out how crazy SoCal has become.

As my nick indicates, I’m down in San Diego, near Mission Bay. I’ve lived here for decades, and I bought my current place back in the mid 1990’s. No way could I do it again. My income (as a software professional) peaked around 2000 and has been falling ever since. Meanwhile housing prices have tripled.

Between the crazy housing prices, the lousy infrastructure, the massive overcrowding (both current and future), and the super high cost of living, I am done with California. I am winding down my business affairs and I will be out of here soon. I will miss my friends and the weather but that is all.

To all of you that think you are locked out of reasonably priced housing forever, be patient. During the mid 1990’s, there were hard times in SoCal and there were a ton of foreclosures that sat on the market for a long time. Hard times in San Diego were triggered by the cutbacks in Federal Government spending.

It will happen again, if you can be patient enough. But I gotta say, for me it ain’t worth it anymore.

More people are leaving LA …. yet rent is going up.

More people are living with parents … yet rent is going up.

More people are unemployed … yet rent is going up.

More people are poor … yet rent is going up.

More people are living with roommates…. yet rent is going up.

Are the 10 million new rental households the result of immigration or population growth? Are they rich people from other states?

With the economy the way it is…. why aren’t prices going down? Will they? Or will they go up more? A crystal ball anyone?

Prices are going up because there is not enough housing in SoCal, so the double and triple up into properties = more income for landlords to charge rent on. And while certain demographics are leaving LA, as a whole the population is still growing.

heh. what, you think prices are market-driven?

the dollar is a fiat debt ponzi scheme. the system – in this view property owners – needs ever-increasing money to service the ever-increasing debt, or everyone fails and everyone goes bankrupt and the asset seizures begin. they’re getting YOU, all of YOU, to work harder and harder and pay more and more to stave this off for THEM for as long as possible. that’s all. that’s all there is to it. this process will drain every last speck of wealth out of everyone in the area, then it will all fold up and look like a tijuana slum because there will be nothing left.

Nothing has done more to diminish the quality of life for the middle class through higher housing (land) costs, competition for jobs, greater poverty, mortgage fraud, medicare fraud, crime, cost of public schools, cost of college, depletion of resources, burden on the taxpayer and overall congestion than the increase of and change in population since 1965, driven almost entirely by immigration.

Because we are overpopulated, millions of young people graduating this year will never be able to buy a home in the town where they were born. What sort of person wishes for that?

The high price of housing is a major factor in poorer quality of life for the middle class and the poor. Population density is the main driver of the price of land, and thus the price (and quality) of housing. High immigration is the main driver of population density.

See, for example, Immigration and the revival of American Cities by Jacob L. Vigdor for the Americas Society/Council of the Americas and the Partnership for a New American Economy, in which he claims that more than 40 million immigrants currently in the united states have increased housing prices nationwide by $3.7 trillion. Or, get the population and housing price data for 1900 to 2010 from the Bureau of the Census and do your own analysis. Don’t forget that change in population leads change in price by ten or twenty years. (You won’t find many studies on this politically incorrect subject).

“What sort of person wishes for that?”

ErikK,

The answer is “a psychopath ”

I think we both know a very popular hero who recently said he has a pen and he intends to use to legalize millions and millions more of “undocumented workers” who will push the wages even lower for most people who voted for him. However, those low wages workers clapped their hands and were so happy to get additional downward pressure on their wages from over 10 million additional illegals

Hey, at least someone is happy…!!!!

What really puzzles me is that his base formed of greens (i.e. Sierra Club) and other environmental “conscientious ” individuals who are against population increase, they really support their hero who increases the legal population in this country by tens of millions on top of over a million per year who come here legally. They must have their logic, but I don’t see it.

Immigration is population

You do need to net things out according to demographics in your existing population too. There is a ridiculous narrative in New Zealand, for example, that “immigration is causing house prices to go up”, but in fact New Zealanders leaving, and demographic declines, mean that the immigration is largely compensating for what would otherwise be a population decline.

You should address your question to the policy makers in WA DC and the FED… I will give you a hint – 0% forevar interest rates, .gov backed mortgages, QE to infinity…

“More people are leaving LA …. yet rent is going up.

More people are living with parents … yet rent is going up.

More people are unemployed … yet rent is going up.

More people are poor … yet rent is going up.

More people are living with roommates…. yet rent is going up.”

Leftover T.,

The summary to your statements is – MASSIVE DECREASE IN STANDARD OF LIVING.

What you said is true. Those millions of new households come from Mexico where having a low standard of living is the norm.

If you don’t have a much higher income than the combined income of 3 families living in a house, then you have to live the same way they do.

But, be happy you live in the “entertainment capital of the world” where clown houses are on every corner. If you don’t have enough room to rent a house with 3 families, at least be happy that outside is warm. Remember? People are attracted to the warm weather.

Liverpool in the UK has lost people almost as fast as Detroit over a time frame of several decades, is like a rust belt city, has major unemployment especially among youth, has ghastly weather – and rents are high, especially per unit of space – density is still high even after all the population loss. Its latest Demographia median multiple is 7.5!

This issue is ALL ABOUT markets with distorted supply, like liquor under prohibition.

The Fed must raise interest rates. Savers can earn interest, and it will help curtail this ridiculous bubble blowing in CA real estate.

It is a wishful thinking… The FED will never raise rates without bringing the house of cards down… Remember, the FED has two main mandates – sound currency and low unemployment. In the current environment you can have either one, but not both. If the FED raises the rates substantially, the unemployment will skyrocket.

Now what have I been saying, L.A. county folks are coming to Texas and to Kerrville, the home of Big Tex, and Kinky Friedman. I get to ranch here(not so in the big city of Dallas, that home owner association didn’t not like me anymore than I liked them) and raise free range, organic grass fed happy cows and make a powerful chili. You all come on over and we can have a BBQ. Yes, L.A. county is not for regular folks.

Having Lived in Culver City most of my life, I never thought it would become unreachable to purchase a place given a reasonable “good-paying” job. Now, making just shy of 6-figures, and constant talk about shuttering of jobs in my industry – as a millennial, I can’t stomach buying a place in SoCal given the current conditions. I have a sizable amount of money I saved for a downpayment, but I’ve seen what happened before and it seems that history is about to repeat with our economy going through another downturn. Even the jobs the media claims is “recession proof” or even is set to have unprecedented job ops because of baby boomer retirement is a lie. The truth is, most Engineers in So Cal in their 50’s or 60’s continue to work becuase they took some damage during the recent downturn, and they now need to work to get back to even. Still, many have “kids” that aren’t even as fortunate as me, and are still “finding themselves” or going back to school in their thirties and mid twenties. The one thing I’ve seen in places like Del Rey (where I’m from) is a influx of new tech from up north which is buoying housing prices even though most younger new workers can’t afford the prices. I know of several colleagues my age making about as much as I do (~ 6 figs) who are throwing in the towel because its too hard to live out here with traffic, cost of living and threats of layoffs. Why deal with it ? On my list is Charlotte, Asheville, Portland or some other place to get away from this place where competition can be suffocating.

“On my list is Charlotte, Asheville, Portland or some other place”

doesn’t matter where you go. the same dollar fiat debt ponzi process operating in socal is operating everywhere else too. your wealth will be drained wherever you go.

That point of view is really missing something. Texas and quite a few other US States have housing supply that is so elastic (actually it is the supply of land that you are allowed to build houses on that is crucial) that no amount of money-supply boosting makes house prices go up any more than it makes the price of cars or TV’s or IPads go up. There are all sorts of beneficial effects to being a non-property Ponzi local economy embedded in a national economy where the property Ponzi local economies are being pumped up to oblivion by the monetary suicide.

The $1,000,000 that a property owner in CA sells up for, might be illusory wealth in one sense, but it is very real wealth if you take it to Texas or Georgia or the Carolinas. You can actually buy stuff with it, not just trade properties on a zero-sum basis (at the expense of the first time buyer).

The shift in population and jobs that is underway is a massive economic secret weapon in the USA, other nations like the UK and Australia that have the same Ponzi as California, simply have nowhere for people and businesses to go, the whole country is unaffordable. Even in Canada, the affordable Plains cities are starting to act like Canada’s Texas in taking foregone growth from unaffordable Vancouver and Toronto.

gman…been to all those towns, either a weather issue, narrow minded folks, prejudice, boredom,take your pick, or better yet get a new list?

We used to live in Portland, Oregon. It has horrendous traffic, dismal weather, high home prices in desirable areas, and the city is home to some to the most radical white anarchist leftists that you would ever want to meet. However, the scenery is nice, the air is usually clean, and there is plenty of water.

Similar boat here, earning well north of six figs, moved back in with my mom on the westside last year. Would rather kiss goodbye to all privacy and romantic prospects than enslave myself to market rents or exile myself to the exurbs. I’m quite happy to pile into savings and investments for as many years as it takes for housing costs to realign with median incomes.

I don’t know w..wat are talking about doc?I just bough me Zenvo last week and I’m cruising around the hood…so if the workin class is movin…. out, let em move.They aint workin anyway.They are collectin bro.Its a dream and somebody got to dream it man.

Let’s say an adult child lives with parents in a crapshack which could fetch $700K today but which is assessed at a much lower Proposition 13 tax rate because the parents bought it decades ago. With the additional benefits of Proposition 58, the parents can then pass on the shack to the adult child who will acquire the lower property tax basis the parents had.

I’m sure many of these adult children will be happy to stay in their low property tax crapshack, thus holding even more inventory off the market and causing prices to increase for others who want to buy. For some, it’s good to have gotten to California earlier than later, and those Props sure do help a lot! But, of course, these Props have also caused a huge erosion in resources available for schools and services.

Two years after passage of Prop 13 the schools were pulling in more money that prior to it becoming law. 48% of the CA budget is earmarked for schools, by law. If the resources are unavailable it’s mismanagement and bloated levels of bureaucracy thats keeping it from getting to the schools themselves.

Every time a home is sold at a higher price the valuation for property taxes is re-set. If that higher amount is squandered by the state it’s hardly some passive aggressive move by the so called “Friskies eating baby boomer” set.

Yes.

I make 80k and am still with mom and pop paying off debt…. either I buy a house in the IE and drive 3 hours a day round trip or pay 700k for a house built in the 1930s… what to do…

Go South-East, young man, go South-East…..

I’m quietly envious of those who can live with Mom and Dad in low-mid-high prime (although I would like to think you are paying a healthy sum towards the household and your living costs). I know some, perhaps like Cal-Girl, think those doing so are missing out on life experiences… but at least they should have far more disposable income to spend on having good experiences, and for saving.

In your position I would keep saving, and focus on buying in prime, when prices fall. I’m not settling for anything less than prime.

i would simply call it ‘Armageddon’! Housing affordability is but the tip of the iceberg of California’s growing problems. For example, an op-ed piece last week claimed 2/3 of tax revenue go toward paying for public services already rendered including pensions and benefits. Government at all levels in California are failing at delivering services … more money going in, less service coming back to taxpayers. Today, we found out from the American Cities Survey that a bit over 11% of L.A.’s households earn over $150k. If you enter that into the LA Times ‘where can I live’ calculator, it shows that in the entire L.A. basin, it is cheaper to rent than own, even with a substantial down payment! Only, the ‘Inland Empire’ came up as affordable! So, 90% of L.A. can’t afford to buy a home. The story is worse in San Diego, San Jose, and San Francisco!

Prices continue to rise to ridiculous levels in the Eastern suburbs of Sacramento. YES SACRAMENTO = median income a huge $48,401 per year.

In my neighborhood there’s one street that backs onto a trailer park. There have been 2 homes 4 doors apart listed for sale for about 6 weeks. Both went pending last week. One for $420,000 the other for $419,000. 1700 sq ft, 15 years old and both need updating. Same floors plans BTW and similar to the home I rent. Both of these pending sales back directly to a trailer park with full view of the single wides.

I pay $1,650 a mth rent. To purchase one of these with 10% down my monthly carrying costs would be $2,350 PLUS maintenance/repairs.

Does that make sense? Who is insane enough to get into hock that much for an outdated 3 bed in a crap location? BTW my place is on a fab street, no trailer parks… I’m talking Sacramento not So Cal. I don’t get how this inflated market is being sustained.

Its not just California – the UK has been like this for decades, Australia is like it now, parts of Canada, New Zealand; Paris; Sweden; most of Scandinavia…

Even in the crashed countries, Ireland and Spain, my money would be on systematically extractive housing and rental markets in perpetuity; the odd crash does not change this.

You can look at a blog called “bubblebubbledotcom” for some charts of all the house price trends in numerous countries. This is a global problem.

The sole causative factor in all cases, is new forms of constraint on the supply of land that is allowed to be developed for housing. Mostly this is explicit “compact city” urban planning, but there are exceptions where the policy is not an explicit one but ends up having the same effect. For example, rural municipalities with their own strict rural zoning might as well be a growth boundary. Or National Park land that is not for sale.

It is hard to deny that there has been a global mania for “saving the planet from urban sprawl”, that correlates with the globally synchronised house price inflations. Other factors are very unfortunately providing red herrings to divert attention away from the real cause. For example, there have been episodes of easy credit before in many countries, that did not cause house prices to bubble, in fact it got more houses built at a constant affordable price, just as still happens in Texas. For just one example, see Prof Nicholas Crafts essay “Escaping Liquidity Traps: Lessons from the UK’s 1930’s Escape”

It is cited in this essay of mine that includes more examples and argument:

http://www.voxeu.org/comment/105237#comment-105237

The US has plenty of land available for housing. Look at the Ca, Arizona and Texas deserts. We can build molten salt solar plant and sea water desalination plants. Plenty of solar power and land to build new communities.

Agenda 21

Exactly! The fact that there is an Agenda 21 is evidence that the global causative factor of all these problems might be in urban planning, not the theories about everything else like monetary expansion and easy credit and globalisation. In fact there are counter-examples and disproofs of all the other theories; it is the urban planning one that actually works for all examples. For example, the same monetary and credit conditions as in CA does not make TX house prices bubble. If you try and argue that this is because of “desirability”, why does the UK have hell-hole cities that are unaffordable, why are Australian cities with horrid climates expensive, and why did Phoenix house prices morph from TX levels to CA levels in record time, 2002 – 2007? It suddenly got a better climate?

I’m in the Oakland Area….and it is equally baffling. My landlord is in discussion with a management company because she doesn’t have time to deal with “finding a handyman that won’t screw her over”…but she told me that the 2k in rent doesn’t cover the mortgage. So I know a rent increase is coming…and I’ll in turn file all the “fixes” I have let go unfixed and she’s lose out…badly.

I guess my point is that I don’t understand buying houses for 400K-600K when you can only rent them for 2,000 – 2,700/month range. Zillow says she paid 366K in ’06 (when she claims is wrong)…and Zillow says she can rent it for 3,200/month…good luck.

I really am starting to see a leveling off in rents…there just are not that many people making enough to pay 2,000+ a month for a 2bd house in below average parts of east Oakland. Even the new apartment building in Emeryville and North Oakland/Berkeley border area are 2,700/month for a studio…I just don’t see or having that many friends (I’m mid-30s) that can pull that off…I know a few couples that got into luxury apartments early and are still there…but not many.

I realize a bit of ramble…but rents seem to have leveled off a bit the last few months in the Berkeley to San Leandro corridor.

I agree. My landlord paid $440k at the height of the market in 2005 for this place, then she put another $35k in, in the form of granite, nice back yard, electrical upgrades etc.

Luckily she has paid it down to $295k – I checked at the county recorder’s office before I leased it. She refied in 2013 to a lower rate.

But still… all the $$$ my landlord and her husband has sunk into the place, and they get $1,650 a month rent. Plus they still have to pay property taxes, insurance, pest control and repairs and maintenance.

To date, they have lost hundreds of thousands of dollars on their “investment”.

Sounds like a REAL BAD investment to me 🙂

Calgirl – don’t forget that YOU are the one paying for most of their investment at this point. Even though they overpayed, it will likely still be an ATM machine for them in retirement (depending on their age), spitting out cash until they die. I’m not saying it was a good investment – it wasn’t – but if they’re still middle-aged or younger, do the math, and you’ll see that the money they eventually pull out of it will far exceed what they personally put into it. In retirement, I’d rather have a paid-for rental that I paid bubble prices for than no house at all. Luckily I’m smart enough not to pay bubble prices.

And all that maintenance is deductible.

*overpaid

Sheesh.

I agree with the commenter above who said this is one of the Doctor’s best posts ever.

I would just like to point out that all this stuff has happened already in the UK and there they are probably one cycle ahead of California. Google the term “generation rent” and you will see articles on the UK thick and fast in the search results.

The cause of this, is the 1947 Town and Country Planning Act. There has been a series of papers from Paul Cheshire (London School of Economics) and various colleagues over the years, tracking the difference in urban land prices per square foot, between UK cities and benchmark US cities of similar population only with no growth constraints. In 1984 the difference was a factor of at least 120, and a factor of 320 in some places. By 1998 the upper factor was 700, and last year it was 900.

There is simply no amount of “trading down in living space” that can make housing costs sustainable to everyone, when this kind of inflation in the cost of space is happening. In fact, the more people you cram in, the higher the rents for space get. It is a lie that upzoning and building up and intensifying will restore affordability, as the advocates of “save the planet” urban planning in Vancouver and Portland and California and Australia and everywhere claim. All it does is deliver ever-fatter gains to the landlords, land owners, and mortgage financiers.

And following the UK and California (and Vancouver), exactly the same trends are starting to show in all Australia’s major cities and in Auckland New Zealand. It could also be said to be a similar problem in many European and Scandinavian cities. Young Californians at least have the luck that they can easily flee to Texas. Where do young Australians go? Or young British?

“Where do young Australians go?”

The outback?

Just a minute there, we don’t want a bunch of Yankees coming here and change our culture anymore than Israel will give a right of return to the Palestinians, we are not fools. You stay in your loser liberal diversity cities and bring about change. “Yes you can”. Leave Texas for the people who have a Texas type of mindset, as Gov. Perry would say. We are expanding our ports to take your west coast port traffic away because you can’t run them properly and the shippers want to come to Houston. We already got Toyota, more will be coming.

I completely sympathise with that point of view. Somehow you have to mostly let in the people who genuinely want in because they truly believe in your culture, and encourage the rest to stay in their liberal utopias.

I always enjoy your posts, Phil. You have an interesting perspective on the issues. How does the rampant immigration to England compare to the flood of foreigners to places like California? Do the people there take the same head in the sand approach to it? In CA the governor goes down to Mexico and tells them California is the other Mexico and he will make room for all of them. This during an already unmitigated epic flood that has clearly been arranged through some nefarious preparation and funding of it. 50,000 kids don’t all just wake up one day and decide to leave their families, hike through foreign countries, and find the exact correct American owned freight train to ride to the border. The reality is the status quo is attacking the middle but the middle doesn’t seem to care.

I’m reading a book about the Weimar inflation and it is interesting that they note the middle didn’t really seem to care then either or at least not until they were eating dog food. In CA you can move 70,000 middle easterners in next door, raise taxes any time you want, and no price is ever too high for the middle to go along with. It’s really odd. Even on this forum you can see how they all go along with it. I’m curious if it is a similar phenomenon in the U.K.

Thanks, IPFreely

I think there is a similar phenomenon re immigration into the UK. It is an article of faith in Political Correctness, that if someone is opposed to immigration, they are a racist. Political parties that emerge to try and oppose immigration because the mainstream parties won’t, are immediately portrayed by the mainstream media as the modern day second coming of Adolf Hitler.

It is typical of political correctness, that it requires people to embrace intellectual positions like: there is no more room in Britain to allow urban growth on greenfields; but it is racist to want less immigration.

It does make one more open to theories of actual malevolence on the part of the political Left – that they hate their own civilisational heritage and want to destroy it. Among other things, by swamping the natural balance in the population, of conservative voters and liberal socialist voters, with immigrants.

It is a dirty little secret about the much-lauded increases in urban density in western cities pursuing policies of intensification to save the planet, that a significant factor in it is overcrowded immigrant populations. Of course they are used to living that way where they came from. In fact historically “high population density” correlates far more with overcrowding than with vertical floor space. Cities like Dhaka and Lagos are at the top of the density stats today and do they have skyscrapers? The densest ever recorded human settlement was Kowloon Walled City, and that was around 5 stories high at the most. Google it for some truly horrific images.

I have little hope that things are ending well in the UK. The combination of stresses building up in society and the economy are too obvious an outcome of policies that seem to be untouchable, or at least too late to do anything about. If I was young and lived there I would definitely get out.

I agree with Phil on “political correctness”, it’s a cancer which has already spread through political field.

“It does make one more open to theories of actual malevolence on the part of the political Left – that they hate their own civilisational heritage and want to destroy it. Among other things, by swamping the natural balance in the population, of conservative voters and liberal socialist voters, with immigrants. ”

But this is only a half-truth: The rich, mostly Conservatives, know that flood of immigrants are cheap work force and keep the housing prices high, i.e. a good thing.

Those also are paid mostly by taxes rich people aren’t paying anyway, so who cares?

They, as the real rulers, also know that nothing important will ever change by voting so an influx of new voters doesn’t mean a thing.

Political correctness-cancer is as bad as in left.

In a real democracy majority, i.e. the poor, could vote for an law ordering _all property_ to be equalized, just like that. Can you see that would happen anywhere in current voting systems?

I can’t and therefore we don’t live in a democracy, which means voting basically is irrelevant. Money rules everything and we are back in 15th century.

Good point, Thomas. In the UK, the Conservatives are the ones linked to the big rentiers in property and finance anyway, anything like free markets in urban property aren’t really politically represented by anyone. So the Conservatives leave the urban planning system intact to please their one-percenter mates (eg most of the land in the centre of London has been owned by the same 4 families since the 1600’s) and Labour leaves it intact because they honestly believe that central planning “works” in spite of 6 decades of contrary evidence.

In the US things are a bit different, you have the Republican Establishment who are as bad as the Democrats, but the Democrats are heavily linked to the big rentiers unlike Labour in the UK, where it is the Conservatives who overwhelmingly have that. And at least in parts of the US, you have a strong libertarian streak including in the local Republicans, which is the reason you have so many cities with truly affordable housing. Joel Kotkin’s article “America’s Red State Growth Corridors” is still a definitive classic on the different USA’s that exist. No other country has anything like those Red State Growth Corridors and you need to cling to that exceptionalism.

My grandfather bought a house for $6,000 back in 1962. Sheesh when is this bubble going to burst and prices come down to reality? I’ve been waiting over 50 years already!

Just something to think about…. 🙂

And he probably earned more than $6,000 a year in 1962.

Just something else to think about!

There is a logical reason that “Real Estate” gives a return on investment ahead of inflation and income growth over the long term. This is simply because cities are growing, and your property gradually becomes more and more “efficiently located” relative to the new fringe. Urban land rent curves all start at about the same level (as long as growth boundaries and zoning don’t mess it up) and rise from there towards the centre. So your fringe Levittown home in 1960 is now in a “mature suburb close to the CBD” where the land rent curve is somewhat higher now than the fringe in 1960, which is what it was then.

But this is not bubble Real Estate price inflation, which is not justified by any fundamentals at all, unless you regard supply of land turned into a racket by central planners as a “fundamental”.

“Sheesh when is this bubble going to burst and prices come down to reality?”

when the boomers begin retiring and/or dying off in serious numbers.

Baby boomers already are retiring in serious numbers: 10,000 per DAY.

And they’re not selling up their homes and downsizing or moving to retirement villages, they are staying put in their prop 13 “nest eggs”.

They have to actually die and even then, the bum kids with no real job gets the house.

@Calgirl, you are correct about retirees not selling in California. They are not selling because they have been conditioned into thinking 10%, 20%, 30% year-over-year home price increases are normal. They ignore the deflating bust years of 1982-1985, 1991-1996, 2008-2011.

Home prices have been stagnant in SoCal since May 2014. It would take another 3 to 4 years of flat year-over-year home prices before these retirees would even consider cashing out of their golden sarcophagus’s.

All one has to do is drive around Mar Vista-Palms-Culver City-Cheviot Hills-Marina Del Rey-Westchester and eyeball the massive volume of grey haired drivers slumped over the steering wheel of their cars to know there is a massive supply of houses that are not and will not be able available for sale anytime soon because these retirees ain’t going nowhere.

Look if CA. had affordable prices, fair property taxes, great zoning laws, better schools, what do you think the population would be by now 60. 70, 100 million? In other words by now they would have had to build a wall to keep everybody out. Wall Street would have moved there, most of the IVY school grads would have moved there, anybody with some money would move there Utopia for all, they powers to be had to make it expensive and don’t create the Disneyland life, basically everybody East of St Louis would be jamming route 66 to get there everyday. They had to ruin it, to make it unattractive, to expensive, crime, bad freeways, 1/2 of America was at stake?

Ah yes the old ‘screw all those flyover people, keep them out’ attitude. Isn’t it ironic how virulently you will rail against your own domestic neighbors while adamantly championing every 3rd world immigrant you can find? I find it amusing that your zoning laws don’t apply to them. CA is going to burn.

Someone has to cook and clean…. Im not

Even Denver has the housing shortage/affordability problem, although no where near California’s housing price extremes. Apartment complexes going up everywhere with few condo projects because developers are complaining about a state quality of construction law passed last year. Developers don’t want to construct condos because in their opinion the quality of construction standards and legal recourse given to buyers is too stringent and generous legally for the buyer or owner. In other words, developers want to throw up any kind of structure, sell it and move on, free and clear of any liability in what they’ve built and sold thus leaving the buyer to deal with any structural or design problems. This is having an effect on developing high density real estate around light rail stations which according to the dreamers is the future. The real estate promoters as well construction industry is downtown at the statehouse I’m sure with $$$ in hand to change some minds. They’ll probably succeed.

Do you live in CO? I do, and I observe the same things. We tried to purchase our first home last year and it didn’t work out so well for us. We rent a condo in the ‘burbs and the owner is selling it because he can make a bundle, since as you pointed out — there are very few condos being built. We are considering a move to either Idaho or New Mexico. Even beautiful Santa Fe seems more affordable than Denver. We like Albuquerque and Boise as well. Denver is getting very expensive and very, very crowded. Not to the degree that California has reached, but still very congested and pricey nonetheless.

I hear New Mexico has even worse drought problems than does California.

Good Point, Boise ID gets a lot of Californians and Texans that moved there when they retired to get away from the rat race. This blog is always so pro-Texas if current rates of growth hold up for Texas it could be 54 million by 2040 and maybe larger than California with the right controlling Texas now it will lacked the infrastructure for such a European side population. New Mexico is also go but in the rural areas you have to go to El Paso for hospital. In fact Texas housing is more the national average now with the high grown. A stae of 54 million means its rents and housing will be as expensive as California.

some people complain about illegals bringing down the neighborhood that the poor people are mixed in with the nice neighborhoods but yet we want our cheap labor, nice homes and schools.where do you think they are going to live? public transportation is impossible so they need to live close to your business.so what is the solution? where do you lay down the proverbial train tracks to separate these neighborhoods?

You don’t separate them. You pass laws that state they have to build x amount of low income housing for x amount of luxury while you completely ignore the middle. Over time you are left with nice low income housing that the savages have trashed, the middle has moved on, and you’re slowly getting more and more anxious in your luxury digs as the ‘cheap labor’ gets restless around you. Think Detroit. That is what is occurring but it is a multidecade process. Gotta have that diversity tho, right? 🙂

Reading that was the most fun I’ve had on the Internet in weeks.

Everyone keeps referring to Texas as the optimum place to relocate. Well, I was born in that state, however, I did not grow up there. I had to return to Houston to take care of my father back in 2003 and had thought I’d spend what’s left of my life there ( I was near 70). His home was in a community called Inwood Pines (which by the way does have sidewalks, curbs and drainage). My dad lived to be 98 in 2007. Though I hate to say it, but I thought he’d never die so I could get the heck away from that place.

Texas has its pluses and minuses. Generally, I observed that decent housing, at that time, was affordable for the different classes of people. However, all other costs was about like every other place and I have lived in WA state (West & East), CA (North & South), UT, CO, LA, KS, MA and Texas (SE, Central and West).

To me, Texas is a very depressing looking place. Whenever I have visited the place — the closer I get to my destination the more depressed I become. At the age I was when I returned to care for my father (he was 93 at the time) I thought it would not matter where I lived till my death. As it turned out I preferred death to living there.

Following is the perception of TX when my son was about 9 y.o. He went to visit relatives in Houston. Upon arrival he called to tell me that he had arrived safely. Then asked me why I didn’t tell him that he was going to the boonies. He was taken aback due to the abundance of trees and lack of sidewalks and curbs. Then years later one of my young grandson’s (about 10 y.o.) had the same shock concerning so many trees and his younger brother inquired about the ‘water’ (perspiration) on his skin when they visited Houston in the nineties. They were able to related to West TX, but the deeper they got into TX the more numerous the trees which to them (coming from CA) looked like a jungle. Needless to say none of my children, grand and great grandchildren like the place, even though the cost of living is better.

The hot sticky weather, thunder and lightening storms, flooding, long electrical outages due to storms, hurricanes, insects (all kinds of flying and creeping insects) etc., helps make it such a depressing place. Almost every holiday it rains. It is too hot and sticky to have BBQs. Many neighborhoods within city limits do not have curbs and have ditches for drainage. I could go on but it would take a book to list all the negatives about that part of the country. Needless to say when my dad finally passed I fled back to the to earthquake prone SoCal. I have experienced many earthquakes in my 50 year history in CA and in Japan, but earthquakes do not happen on an annual basis like horrible storms. All natural disasters are frightening, but I’ll take a once in a blue moon earthquake over constant stormy weather any day.

So all of you who want Texas and other places, be my guest. I have lots of relatives who swear by TX and I swear at it. Different strokes for different folks. I have never had a desire to visit the southeastern states. Any place with weather worst than Texas and Louisiana has never appealed to me.

It doesn’t make sense that so many comments on Texas are on this board.

I’ve lived in 6 states, scattered all around this country, inluding in coastal Cali. I can tell you many areas in various states that rival Socal in scenery, attitudes, culture, and that are far better than any part of Texas I’ve experienced. The areas I mention may not have perfect weather, but they aren’t gloomy coastal Oregon either.

Shees people, start reading about places other then the few that “people you know ended up in”. Bunch of sheep on this board. City-data.com is one site that provides comparitive info on political, cultural, climate, many other factors comparing thousands of areas and cities with each other. Try doing a little research.

You should come to Kerrville and have a BBQ with me and Kinky Freidman. I raise grass fed, free range, organic cattle and make a powerful chili. Yes, we have trees(not like the Marin County redwoods, but the people I met there were crazy) and apparently you live now in a dry climate in SoCal. My spoiled daughter, Ashley, lives on the bluffs over looking Zuma(I come out there sometimes). Her perspective is nothing east of the 405. I made money in the oil business. Used to live in the little town of Westlake, north of Fort Worth, but they complained about my attempt to raise some cattle, so we parted our ways, and now I am in Kerrville.

I have lived for extended periods in CA, AZ, TX and LA. In terms of “economic” opportunity, CA is bad for most right now (opportunity = cost/benefit). If you have “social/cultural” needs that limit you to CA, that’s fine, you will never justify moving.

CA has the highest percentage of poor people in the US, when you adjust for cost of living. (I posted earlier on this blog- it’s a US Gov reference). AZ is not far behind. LA has a lower percentage.

I have spent wonderful years in CA, and have good friends and family still there. For me it’s not even close any more. I wouldn’t recommend for the “general person” to go there to live. I have relatives who are definitely struggling in CA (lifelong residents). It’s a banana republic in most senses of the terminology.

Your take the words out of my mouth. I am left California 2yrs ago for Houston and now I am moving back because all you said above.

MOAR “folks” come to the WA state. BTW, the trees and flowers started to bloom in the mid of February here. Soon, we will have “all that nice weather” that everyone’s looking for. Just wait a couple more years and we will be the new SoCal. Another BTW, the state becomes one of those libtarded states like California. I kind of start to wonder if libtardestness of the state matters. After all, the WA state is the most libtarded, second to california only.

Sleepless,

WA is liberal only on the coast. That is about 3.5 mil. out of 7 mil. The east side of Cascades is conservative and balances out things in Olympia. WA has places for everyone – liberal or conservative. The conservative side is helping with keeping prop. taxes way lower than TX and unlike CA, no income tax. CA and TX are not balanced. One is blue all the way and the other is red all the way. That is why I moved out of liberal CA but didn’t move to TX. Oregon is liberal even more than CA. Those politicians in OR are completely loonies. There is no room for ecesses in WA because the liberals sometimes win with few hundred votes. Because of that they have to step on eggshells in their policies. The local politicians in cities usually have the majority on way or another and care less to avoid extreems.

Being in Bellevue gives you a skewed perspective on the state as whole. I used to live there till I’ve got enough of the “hope and change” delivered by the liberals. Then I moved over the mountains and I like it. The best thing I ever did. Sun, dry, clean air, no traffic and no looney politicians.

I personally know 36 yo gal, who lives with her parents in the parent’s home. She works for $15 at RiteAde and drives $35K brand new Infinity. I am not surprised those “Millennials” have no money to event rent, let alone buying. The people are broke, nevertheless everyone needs a new car and the new iPhone every years. I know many people who spend on “toys” and clothing 5 time more than I do, while earning 5 times less than me…

Why am I even bringing this up? Because most of the people are broke because of their own bad choices and lack of education and skills.

Your argument has repeatedly been disproven here. People making 80,000 per year, with real careers who don’t work “at Rite Aid”, and who make wise financial choices instead of driving “a brand new Infinity”, still cannot buy a house in most of Socal.

I smell someone who bought 20+ years ago and is sitting there smirking.

Me too Steve. Obviously some do live with parents and spend every penny, but many on good money who can’t afford to buy, or choose not to buy… waiting for better value where they want to buy.

There’s a great little pic-poster that sums up the chronic positions of the older property-winners….

http://oi59.tinypic.com/2mfeqf4.jpg

_____

Generation

LOST

Losers, who live with mon and

dad. They can’t buy a house or

get a job, becasue they buy Ipods.

You may have to click twice on the image link… sometimes it doesn’t show on first click.

My wife and I are both working professionals making way more than $15/hr. We rent, drive older cars, use android phones, don’t even have aniPad, have a good amount saved up, but choose not to buy because it just DOESN’T MAKE SENSE! Oh, and we are millenials.

Cali will ALWAYS have ups and downs, but the weather persists in awesomeness….I rent an ocean-view studio/loft in the South Bay for 2K per month. I get by just fine, alone. Those of you who can’t, or won’t, please leave….frees up the streets for the rest of us.

not one comment on the elephant in the room that apparently has been forgotten……EARTHQUAKES!!

it’s been quiet for far too long and when the next swarm hits that will thin the herd a bit, from 1987 (the Whittier quake) till 1994 (the northridge quake) there’s was a earthquake almost every 6 months or so….when the yucca valley quake hit we had a 6 pointer 3 hours later in big bear….

and make no mistake the next swarm is coming, it’s only a matter of time and it could last for 7+ years….just an FYI.

Quakes are bad for homeowners. Good for home buyers.

Earthquakes are a worry, but the bigger worry is DROUGHT.

I remember the ’94 quake. Santa Monica was hit hard. Many buildings were damaged, but no loss of life. Even so, we can rebound from quakes. But a serious drought that lasts for years, even decades, would be far more devastating.

If earthquake is an elephant in the room, then drought is a woolly mammoth.

And for those looking to Seattle, they’ve been expecting a 9.0 or bigger for a while now.

The Sylmar quake had some loss of life, but it was mostly the one hospital that collapsed in Sylmar that caused the majority of loss of life. I find it surprising that there is so much fear of quakes yet the death count it quite low for the size of earthquakes we get (so far) in LA, LA, LAnd. Knock on wood.

Despite adding 6500 rental units las year, LA, Ca’s vacancy rate plummeted to 3.3%. How come? A large part of it is the 5600 + of vacant foreclosure units which sit empty. Entire families were forced out of there homes.

For those considering purchasing a home in LA, Ca. consider this. Real Estate prices are driven by three factors demand, affordibility and interest rates. Demand demographically, is decreasing. Boomers are downsizing and dying-and they will be vacating units over the 20 years. Affordibility: incomes are largely stagnant so homes won’t have a basis for appreciation. Interest rates are at historic lows, as they rise, affordibility goes down -more of the mortgage payment goes to interest and less to principal -this caps and lowers house prices. Buying real estate right now and expecting appreciation is a gamble. Buy if you plan to be in the area long term and have a family. If you are mobile and can relocated to another area with a lower cost of living and about the same wages that is the smart move.

You forgot the forth factor, the Wall Street, seeking higher yields in low interest rates environments…

A few years ago i asked these two well known real estate brokers on a radio show,since houston is the fastest growing city when will home values in the inner loop would be as expensive as the home values in Brentwood or Beverley hills.they both said houston has alot of land,but a year later home values inside the loop has been going up a hundred grand or more in the last few years.last year i read an article in the local paper the value of my house has gone up 332% in a two year period.and the same broker is saying the builders cant keep up with all this growth.the out skirts such as the woodlands is going up 50 grand per year and is starting to become a place for people who are upper class or rich.

Alot of people who bought homes in houston have made a killing when it comes to appreciation.its pretty cool making a hundred plus grand a year without breaking a sweat.thats the great thing about owning real estate,of course a person with that type of equity would have to sell or get a home equity loan to get the money.thats why i dont understand why people would want to rent,even in cali the popular hoods may be to expensive for you then move to the outskirts or a booming place such as houston and become equity rich.the hoods in los angeles some of you want to live in but can’t afford to buy means you waited to long to buy,when u thought prices were gonna go down further more a few years ago.now those hoods have become a place for the rich foreigners to live in.and the lil cheaper hoods have become a place for the upper class.

So many people talk about the financial advantage of leaving Cali. But a move to another state is not solely a financial decision. One of the main things keeping me in Cali is that I have friends and acquaintances here. Stores, church, dentists, service providers that I’ve been going to for decades. I’m known to people and know them. I have roots in the community.

It would make financial sense for me to move. I’m financially mobile. But I’m socially rooted in SoCal. So there’s the conundrum.

This was my issue, but you can and will make friends at your new location, and can go back and visit friends – Cali is much much better place to visit than to live for most people. Took my 6 figure income and 7 figure net worth to an infinitely better state over 8 years ago and couldn’t be happier. And no, I’m not going to tell you where I went!

One thing you forget to mention is that all the “sweet equity” only matters if sell at the right time. It doesn’t matter how much equity you have or had a few days ago, if you cannot get your money out, it is all worthless. Same with the stocks. Lots of people enjoyed equity in stocks and real estate in 2007, until they didn’t. It doesn’t matter what you have NOW, it will only matter when you sell it, when you actually need that money and might not be able to “retrieve” it.

We need a massive prime HPC. We need a market event to utterly strangle out this new peak in complacency and entitlement evidenced above.

Plus, New Mexico is a poor state.

And as beautiful as Santa Fe is, it also has a high crime problem, particularly with burglaries and car thefts.

I thought this was an interesting article about the crazy real estate in the UK….maybe we are seeing some of this sort of action in LA and the OC… http://www.bloomberg.com/news/articles/2015-03-02/kazakh-billionaire-s-london-home-sale-reveals-underside-of-real-estate-secrecy

Since many current and former pro athletes live in Houston or the outskirts and upper class and rich people from other parts of the United states and different countries are moving here,then a middle income person who is priced out of the popular hoods in cali can move to Houston too.buying a house inside the loop would be like buying a house like in California,but Houston has much cheaper home prices in other areas.the problem is so many people are moving here you have to compete with the other home buyers or investors.since houston,dallas and austin is booming buying a house here would be a smart investment.

Houston is heading for a bit of a real estate price crash, imo.

_____