The Frenzy is back: Low inventory creates bidding wars and mania for California real estate. Low inventory shifting buyer psychology. Video of mania in action.

The housing mania is definitely back in California. Low interest rates are one thing but those that are out in the market to buy are finding it tougher and tougher to contend with all cash buyers and people that are simply willing to go with large above sticker price offers. The low inventory environment has shifted how people now perceive the market. One of the craziest stats I saw was that last month, over 35 percent of Southern California purchases came from all cash buyers. This is an all-time record. FHA insured loans made up another 25 percent of all purchases. Given the higher mortgage insurance premium costs, there is little reason to go this way instead of a conventional mortgage. Yet you have two groups; those that are investors with all cash and those that can barely get a down payment together. Yet low inventory is pushing prices up to record levels. The psychology has definitely shifted and you can see this from various examples.

San Diego mania

A reader sent over this video:

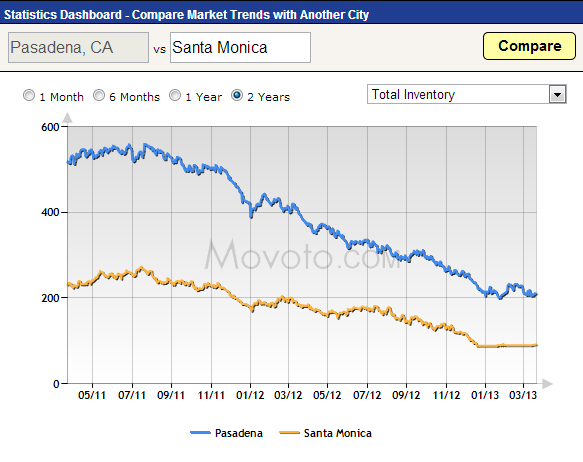

Offer without looking at property in person. 10 offers. People flowing in like a herd. Welcome to the California housing market. The dynamics are different this time but low inventory has shifted buying behavior. A survey conducted by Redfin also highlights this change:

The biggest jumps occurred in:

-People ready to pay more (this is a big jump in simply one quarter)

-People looking at new areas

-People looking for unlisted homes

Taking a break? No way! Time to go shopping for a home and join the herd above. You do not want to miss out in this current mania. The current momentum is clearly unsustainable and anyone looking to buy in a somewhat desirable neighborhood today without a big down payment or solid amounts of cash is simply looking for a dragged out headache. Are you willing to make an offer without even looking at the property? Are you willing to go way over asking price? These are things you may need to do if you want to purchase in this current market in California.

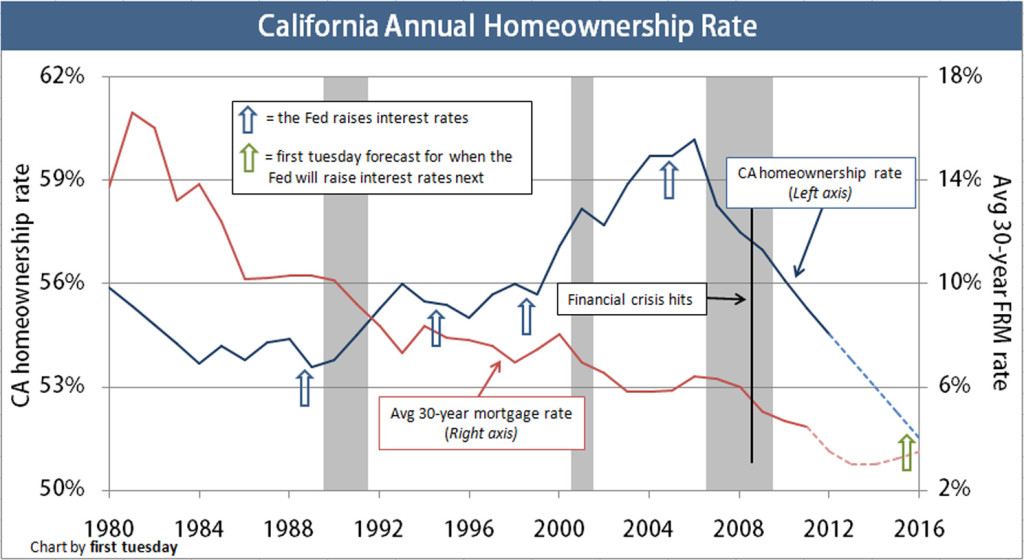

What is interesting is that even with all this renewed buying, the homeownership rate really isn’t going up:

Why? First, you have a giant amount of investor buying. Some may not even be in the state. So in places like the Inland Empire you have many would-be owner occupied homes converting into rentals pushing the rental rate up. As we discussed in a previous article, the rate isn’t going up because you simply have owner-occupied going to owner-occupied (i.e., Beverly Hills with no population growth). The first time buyer is probably the most impacted here.

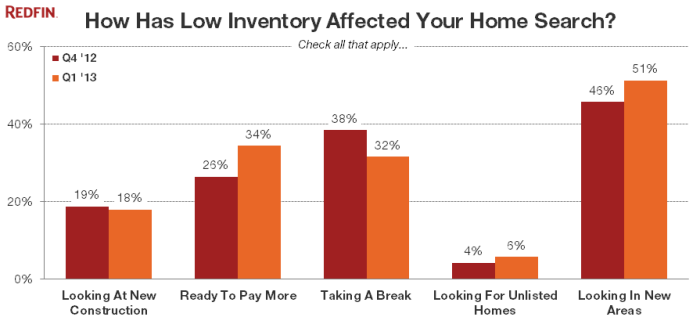

Take a look at inventory levels in Santa Monica and Pasadena:

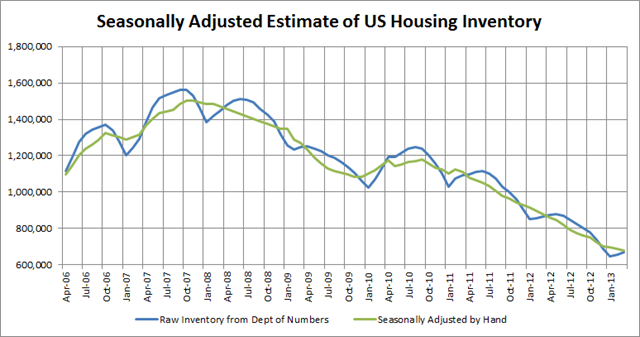

Pasadena inventory is down nearly 60 percent in the last two years. The median list price has gone up from $559,000 to $738,000 which reflects what sellers are expecting to get. The trend seems to be playing out nationwide:

Anyone out there braving this current market and looking to purchase? The attitude seems to be that it is only going to get more expensive and inventory is going to get even more constrained.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

109 Responses to “The Frenzy is back: Low inventory creates bidding wars and mania for California real estate. Low inventory shifting buyer psychology. Video of mania in action.”

Some things never change.

http://www.redfin.com/CA/Palos-Verdes-Estates/1316-Vuelta-Pl-90274/home/7727084

Three months and up over a million. Insane.

But the remodel most have cost $100K. That only leaves $900K in profit.

Haha!!!! A great example of the hysteria running throughout the Socal real estate market. Herd mentality.

Hey Dr.

Love the blog as always, but just a heads up that video link isn’t working.

Thanks!

Tried to watch the video on my iPhone and it just opened in a new window as a picture

I’m seeing rents drop 10%. Must be a mania toward buying.

My analysis suggests that there will be too much rental inventory which will actually cause rents to go down which will in turn lighten investor interest and more homes will eventually be back on the market. Don’t forget the banksters are manipulating this again and monetizing rent rolls. Same scam as with mortgages but instead with lease agreements. Hedge funds are buying en bulk and must keep the homes as rentals for min. 5 years with option to extend additional 5 years. Its just bubbleilicious!

Rents dropping is directly attributable to shadow inventory being converted from foreclosures to rentals. (see below).

#1: From April 5, 2012: http://www.federalreserve.gov/newsevents/press/bcreg/20120405a.htm

“…in light of the extraordinary market conditions that currently prevail, the policy statement explains that banking organizations may rent residential OREO properties within legal holding-period limits without demonstrating continuous active marketing of the property for sale…â€

Summary: Banks are now allowed to become landlords. The old policy forbade banks from renting out foreclosures. Banks do not have to list foreclosures for sale.

#2: The legal holding-period limits (referenced in #1) are defined by: Federal 12 U.S.C. § 29

http://www.gpo.gov/fdsys/pkg/USCODE-2011-title12/html/USCODE-2011-title12-chap2-subchapI-sec29.htm

“…the title and possession…of any such real estate by such association for a period longer than five years, but not to exceed an additional five years, if (1) the association has made a good faith attempt to dispose of the real estate within the five-year period, or (2) disposal within the five-year period would be detrimental to the association.â€

Summary: Banks are allowed to hold on to foreclosures for 5 years, and up to 10 years if selling the property would harm them in any way.

Ernst – I think this explains a lot. That and your QE3 comment later on. I’ve come to a similar summary of why low inventory and high prices are happening.

Just kills me that they have that caveat of an extra 5 years – “if it would cause harm”. I agree that it essentially means they have 10 years. So, they will trickle out properties. No sense in trickling out properties now with the QE3 buying the toxic assets.

I think I’ve given up on buying a different house. Only reason I wanted it is to have more productive space (garden, chickens). I can’t do it all in my current home, but I can do some of it. It’s not worth several hundred thousand more to have the yard space (I think).

Link is fixed above. Here is the direct YouTube link as well.

http://www.youtube.com/watch?feature=player_embedded&v=U277xZiCvl4

I priced up a $650K home in Irvine.

The homes comes with these VERY nice extras!!!

Prop tax: 20K year

AD Tax: 3K year

CFD Tax: 2K year

Association dues: $4K year

Total = 29K year = $2416 month! That does not include the home price or interest.

I have a friend who had been scouring the pasadena area for 3 years. They’ve had no luck. They either get priced out by all-cash offers or just a sheer massive amount of offers for one home had become too discouraging. One home they looked at had over 40 offers. The frenzy is definitely alive and well.

Buyer agents have also resorted to unethical tactics such as asking their clients to give selling agents an extra 1% of the listing price. This money is pocketed by listing agents. As a return, the listing agent will put that offer at the top of the list to be accepted. These things are going on more and more now. Also heard things like silent auction bids are becoming more frequent. This stuff is happening in the San Gabriel Valley area. Everyone has gone mad.

Cheapest money in the history of the country and inventory at lows. It was bound to catch fire. I’m hearing similar stories. Real estate in a vibrant and safe country. What could possibly go wrong?

The time – honored axiom is that which cannot go on forever, won’t. Once the gov’t runs out of everyone else’s money, the game of musical chairs ends.

http://www.marketwatch.com/story/bond-crash-dead-ahead-tick-tick-boom-2013-03-20?link=MW_story_popular

Not so fast Stopthemadness, my wife works for a major bank and it’s buyers are mostly Chinese investors with 50-60% down and still a cool million in the bank. So no government money there, and we already are Mexico by our living standards.

Thanks for the article. I’m also enjoying several other articles by the same author.

You mention “history.” How about:

* Only asset bubble in history that didn’t shoot past the mean on the correction

* First global real estate bubble in history (2000-2006)

* Highest percentage of FHA buyers in U.S. history (?)

Well if they buy it and it crashes, they get to squat in it for years without paying a dime. While the rest of us will be tossed out if can’t pay rent.

So, what’s the best long-term play here?

Are we all thinking bubble & crash back to 2011 lows?

Or frenzy, push up for a bit then settle down again to where we were in 03-04, pre-bubble?

arm chair economizing here, probably somewhere in between. but id love to hear thoughts from others and the doctor himself.

i mean another horsemen of the apocalypse on this one is that a house in my neighborhood just got listed for 750,000 staring at a freeway. the last time that happened was pre bubble/bubble period.

The FHA buyers are the most hilarious. The vast majority are once again likely overextending themselves on houses they can’t afford.

Explain what is funny about making homes unaffordable to people that actually want to buy a home but have to pay bubblicious prices becauses of investor demand? I am not referring to a mom and pop investor because they can get burned badly too. Rather the large hedge fund investments from the likes of criminal banksters like Golman Sachs, JPMorgan et sl.

Do we remember what happened in the last bubble? Banks made a lot loans to drive all housing price up to levels unsustainable by income. After crash, typical loans will lose about 70-80%. Almost all banks were insolvent at that point. Here came our Fed Reserve, they bought everything at the face value with freshly minted cash. Banks immediately felt sexy again, like nothing happened. Those assets were supported by Fed, and banks don’t need to fire sell any of them. In fact, the banks can let them just sit there without doing a damn thing. Now everything seems fine, people still need a roof to make a baby, and people start to buy houses again.

There are currently a lot of money in the wrong places, looking for assets. Much of he country is still fairly depressed. So Cal is an exception. But the crash price, fire sale price are long gone by now in anywhere.

Ha, ha – you gotta buy in the dips.

So can we start taking bets at when the bottom will fall out? I have my money on the second half of 2014.

June of 2015, approx.

I agree, middle of 2015. Question is are we at the start of the bubble 2.0 and pricing will go up 20-40% from here, not a bad investment for short term hold (2 yrs, no cap gains!).

We sold in 2012

Good neighborhood, great schools K-12 Bay Area, 3/2 1800 sq ft, small lot, no view

Listed $900k, immaculate property but 1930’s sconstruction

17 offers over asking, sold without contingencies, other than 24 hours for inspection, for 33% over list, clean back up offer, one open house completely mobbed, scaring neighbors

Market is same again this year based on neighbor’s sale last week od similar house, same street,

curious, where did you move (to a new market?) and how much did you pay?

Sudden Rise in Home Demand Takes Builders by Surprise

SACRAMENTO — After six years of waiting on the sidelines, newly eager home buyers across the country are discovering that there are not enough houses for sale to accommodate the recent flush of demand.

“In my 27 years I’ve never seen inventories this low,†said Kurt K. Colgan, a broker with Lyon Real Estate in the Sacramento metropolitan area, where the share of homes on the market has plummeted by one of the largest amounts in the nation. “I’ve also never seen a market turn so quickly.â€

We may partially thank QE3 for low inventories. The Federal Reserve’s QE3 is $40 billion a month.

Assuming the median mortgage price of $300K, and assuming the Fed is buying non-performing assets from member banks, this means that the Federal Reserve is effectively pulling 135,000 units off of the market every month via QE3. This has a way bigger effect than REITs and Wall Street investment firms coming into the market.

We were up against 5 other buyers in late Sept 2012. Yeah we were cash, but some offers were nosebleed higher. I think we got picked for dual reasons, the seller and us “connected” (she’s a doll), and secondly, our agents were in 3 other deals together at the time. They worked well together. And of course, any FHA buyers mean a lower net. “As is” and we agreed.

Take Away= It isn’t just about the money.

I gave up 3 weeks ago after putting an offer 50K above asking price on a shitty fixer and finding out there were 80 offers and 5 of them cash.

betty

What a bummer. We gave up as well, but here’s an angle. Our hardscape guy saw a guy put a FSBO sign on his lawn, stopped the car, and built up a nice conversation. He closed yesterday. I feel so bad for all you guys/gals. We too, lost a decade of our lives. This inventory manipulation sucks.

After being outbid by all cash on almost 15 houses in Nor cal, we were losing hope! A friend of mine (our kids go to gymnastics together) and her husband were getting orders to another state. They were wanting to do a FSB0, they bought in 2010, put 10,000 into the backyard and were looking to break even. Needless to say, we jumped on it, offered asking and closing and closed in Feb. 2000 square feet 4,3 built in 2010, 359,000. I feel really blessed/fortunate considering the current market.

Lost a decade of your lives?

Ridiculous hyperbole.

That sort of thinking is exactly why there are 50 other morons willing to pay over list on some shitty fixer.

Joe

Excuse me, sir. We sold our 4,000 sq ft McMansion n 2002, and then as we we looking for our modest home, prices were jumping $20,000 a month in east Ventura County. Hyperbole, my arse. We lived it. We had to wait for a re-entry point. We rented an apt and waited it out. And we had a great broker, who got us $ off, even with our competition. A decade of our lives were derailed. Not hyperbole, but the God honest truth.

You don’t get it.

It is hyperbolic to claim that living in a rental as opposed to something mortgaged is equivilent to losing a decade of one’s life. What did you do, put everything in your life on hold because you didn’t have a land deed?

So you rented while waiting, big effin deal.

That mentality forms the basis of people making stupid buying decisions.

I wonder if this is depression part deux. The depression had a furious Dow rally, though don’t know about real estate. If this goes bust, does the FED have much left in its arsenal-short of printing money and throwing it in the streets everyday??

I’d say the Real Estate Market has been trading like stocks since 2003. This is mainly due to easy access to credit.

350,000 stopped looking for work last month, bring down the “unemployment rate”

Brave New World, indeed.

not really. the fed is out of tricks this time around. i dont know how many more favors the government is going to toss the banks and the people who made terrible decisions during the bust. we are reliving it again today. over asking bids on a house as common place? give me a break.

basic economic principals are not fueling this “recovery” when the merry go round stops again we might as well be mexico.

Yes, but you don’t understand the new micro economy at work here, the population’s increased two – fold in SoCa while the number of homes available has remained stagnant, and since everyone only wants to live in the most desirable zip codes, etc. – presto, justifiable bubble. Every time a bubble happens there’s always a new and previously – undiscovered factor that’s used as an intellectual underpinning of the RE hype in overdrive.

right, but again, like all bubbles, it eventually pops when things reach critical mass and things come crashing down.

Joe

We paid cash and remolded all cash. No mortgage, car pymts, or CC debt.

We are saving $30K a yr. Glaucoma changed our lives. Had to reduced out financial bleed for life. The lucrative career is over. Just the average one is left, and I’m not getting any younger.

This will end badly for those buying now. If this isn’t a bubble, I don’t know what is. About a month or two ago, the news showed people camping out overnight in an attempt to purchase new houses being offered in Huntington Beach. This reminded me of what I saw in Ladera Ranch during the housing bubble. People lining up overnight hoping to get picked to buy an overpriced town home. I think prices may crash much sooner than the 2 year out time frame most are looking at.

My take is that we’re seeing a lot of investment/foreign cash flow into home purchases right now, and is entirely different than the ’02-’08 bubble propelled by single-family (some sub-prime) mortgages. As others have noted, in order to purchase a home today you have to be fairly liquid and ready to negotiate up, not down.

When this hits the fan I think we’ll see one giant corp file BK and finally expose their portfolio to the world; right now we honestly have no idea who is holding what (but the numbers floating around are staggering).

Why will they go belly up? Because their end game is a bulk sale and not a long-term hold. When someone finally goes through the books they’ll figure out it doesn’t pencil (and probably run in the other direction).

What happens then? Entire neighborhoods go on the block in a very public manner without the drawn-out foreclosure process to soften the blow. Renters will be displaced and long-term, otherwise solid homeowners will find themselves next door to a fire-sale. Maybe this happens in 2015 or 2020, but I think the writing is on the wall.

totally agree, ladera ranch says hello!

im wondering what the retards at the RMV corporation are going to do when RMV opens. Hopefully they learned their lesson that a 2% property tax and hundreds of dollars in HOA a month to take care of a 10 sq ft lawn screwed their neighborhood.

The biggest culprit isn’t so much foreigners and/or investors. It is the Federal Reserve. QE3 is $40 billion a month. If you use the national median home price of $175K and annual sales of 5MM units, the Federal Reserve via QE3 is involved in over 50% of all residential real estate transactions.

Here is another one.

http://www.redfin.com/CA/Manhattan-Beach/1409-Pine-Ave-90266/home/6706139

“House prices never go down.”

So what happens with the next severe downturn? We get to bail out all these buyers….again?!

Many of these buyers are the new short sale sellers from two to three years ago who got bailed out and are going to do it all over again. Definition of insanity? You guessed it doing the same thing over and expecting a different outcome.

Just closed on a house on the market three days in Oxnard in Ventura County that had multiple offers and was priced at $574,000 and closed at $611,000 all cash.

CJ

Yeah, I am seeing that as well. Some of our neighbors walked from over refi’d underwater homes, and 2-3 years later went FHA 3.5% down on our street. (WE just bought in Sept 2012). Now they are in a serious remodel mode, after stiffing the bank and the taxpayer. Not people I can respect. I hope they are sinking their own cash into this remodel.

All around our neighborhood it’s going on. Naturally, us working stiffs who did without, rented for years, and did a regular sale lived modestly (at or below our level) and these arrogant a-holes walk when the sun goes doen on prices.

Don’t get me started. Locked out of housing 10 years because of our timing and because we’re honest.

sun goes down on prices….sorry. typing in the dark.

Don’t hate the player….hate the game

These people have learned that it just isn’t that bad to go through foreclosure. You get another go at it in a few years. No fear. Just do it.

We put our house on the market in 2006 as there was talk about the market heading down. That really terrified me. I thought that it was really really serious to end up in a position where you had to foreclose. I’ve learned that isn’t the case. I was also worried that we’d be stuck if the value fell too far and couldn’t afford to get out. Now I know you just walk away. Now after years of having to move from rental to rental I think we probably made the wrong decision. Maybe there are lots of people around like us who have been through a ‘purgatory’ period not being able to own, but only because they thought they were doing the responsible thing. There is no responsible thing anymore.

Bag on the FHA borrowers all you want, but they have nothing to lose if the market heads south. They have ‘protection’ in their numbers. And they have no skin to lose. Those who put down 20% + have a lot of skin to lose. Ideally you’d put 5% down and get conventional and if prices go up refinance to get out of PMI or if prices crash you haven’t lost as much as the cash buyers.

I’m leaning towards no big crash though. I think prices are peaking. In the lower end. I have no clue about anything over $500k. I think prices are just going to back off from rising and hang where they are for some time. And eventually sellers will think the top has been reached and see we’ll a slow increase in inventory. There was a good Trulia blog post about inventory I saw the other day. I’ll try and find it.

I think this was it. Don’t have time to check it, going out to look at properties :p

http://trends.truliablog.com/2013/03/trulia-price-rent-monitors-feb-2013/

tapis volant

You nailed it. Doing the moral thing is bad housing business. I hear you loud and clear. Yeah, in retrospect, we should have bought, done the stiff thing, and went FHA

for tihs home (although FHA would have no financed it-shape). But we wanted to pay cash for a modest home and be done w/ it. My other half was diagnosed with Glaucoma 8 years ago. 5 surgeries later, our lives are a big question mark.

That crystal ball of ours needs recalibrating.

Exuberant hubris abound AGAIN. Its definitely not a buyers market and unless you’re going to hold your property for some time, it’s hard to justify a purchase now. No one has a crystal ball, but the forecast looks like at the very least severe headwinds or another giant storm on the horizon. As the most recent news in Cyprus indicates, the dyke filling keeps happening and the worst may yet to have been revealed and if not Cyprus, somewhere else next week/month. until then, more hubris…

Well it looks to me as if the huge economic growth the first world saw starting 100 or so years ago secondary to cheap oil, cheap electricity and the popularization of debt as a means of purchasing things like cars, fridges, toasters, ovens, etc. is over. Imagine a virgin consumer market for fridges!

So we see lots of economic growth happening up until the 1970’s or 1980’s, when we start seeing oil price spikes, and there are no more virgin markets – every one already has a fridge; now all they’re are doing is replacing their old fridge with a new one, when they buy. There’s still lots of economic activity, but all the hardcore growth has come to a halt, as has the cheap energy that made it happen.

So what happens to keep subsidizing economic growth? Remember this level of economic growth is something modern, not something that is a normal part of the history of civilization. So the answer to keeping the game alive is that more and more debt starts piling up from the 1980’s to 2008. Meanwhile cheap oil peaks, and we reach a limit to debt.

We see Big Banks and hedge funds not only in the RE game, but buying up farmland, and the water that comes with it. We see (or some of us see) the exaggerations the oil/gas industry are putting out there about the future of production (see the IEA report that came out a few months ago that got circulated in the MSM about how America will be energy independent in x amount of years ).

It might therefore, be at least somewhat probable, that by the 2020’s, oil price spiking will get more and more inflamed secondary to us surfing down the tail of the Hubbard curve while demand in China and India increases. By that point wind and solar will have become cost competitive for lots more first world areas, but we haven’t invested heavily enough in them up front to offset the possible oil production loss.

If such a scenario plays out, even partly, I think these Banks and hedge funds are going to have more incentive to keep hold of their RE purchases, because the best position to be in, in a low or no growth economy is that of a land owner, or lord.

Watching oil production fall will screw the equities market. Resilience will take the place of economic efficiency, and as a result, the first priority of a corporation will no longer be to its shareholders.

Go to Seeking Alpha (dot com) and do searches for investing in food or agriculture. You will find articles by financial consultants that recommend that you buy farmland if you can.

I saw the herd mentality up close when I sold my house just over the California line in Reno during the housing bubble. People were bidding on it and we held an open house . The people were practically drooling and frothing at the mouth. It was so shameful to watch the way they acted!! I felt like I saw what greed really looks like. A flipper/investor eventually bidded the highest and won out over a family who had sent us a personal letter begging us for the house.

@Mel

“It was so shameful to watch the way they acted!! I felt like I saw what greed really looks like. A flipper/investor eventually bidded the highest and won out over a family who had sent us a personal letter begging us for the house”

Hilarious.

Did you end up selling to the ‘greedy’ flipper or the family?

Does this investor still own the house? How much value did it lose during the crash?

Way to go then, selling to that upstanding investor/flipper instead of the “greedy” and “frothing at the mouth” family that had the audacity to write you a personal letter.

Sick.

how much more did the fliipper/investor offer you that you decided to sell to them instead of the family?

curious why you didn’t give it to the family. no judgment, just curious.

DMac,

california’s population grew by 10,000,000 since the 1980…..AND, the kicker, tax filings increased by 100,000 over the same period or put another way california gained 9,900,000 freeloaders.

I really take issue with that. It is a bunch of right wing bull!

Everyone pays taxes, EVERYONE! Some years I pay Ca income tax, some I don’t.

But every month I pay rent and the landlord takes a portion of that to pay property tax. Essentially, I am the true payer of the property tax. Virtually every cent I spend other than rent has some sort of tax associated with it, if not sales tax for consumer goods, or some excise tax or user tax for a utility.

It is the total tax that counts, not the line item called CALIFORNIA INCOME TAX. If anyone should know that it is the TOTAL tax that counts, it is a Republican!

Stop letting FOX think for you and think for yourself.

martin,

WOW, damn dude, you are brainwashed…..anyone who starts in with this right vs. left meme is a sheep.

This might be part of it.

http://go.bloomberg.com/market-now/2013/03/19/so-what-happened-to-all-the-people/

March 14th, 2013 was my 1 year anniversary since I bought my townhouse for 43.5k (REO). Today my neighbors have theirs up for sale for 75k and 80k respectively. Same sq. footage as mine, but mine is nicer. I expect it to go to 125k – 150k in about another year to 18 months. Thinking about selling, but a home is to live in and what if the predicted bubble doesn’t happen for another 10 years? Besides I remodeled my place to where I want it and I love it. It would have to go to its 2007 asking price of almost 250k before I’d seriously consider selling.

Bubbles never end well…if your missed the lows you are better off waiting this out…another three to five years and all hell will be breaking loose once again. I know it’s hard to wait but look at what happened to people who bought in the last bubble. They got annihilated! History repeats itself and you don’t have to look back very far to see where this one is going.

This time not only is housing in a bubble (certain areas of California) but we have a debt bubble and a stock market bubble…when those pop it will make 2008, 2009 look like a walk in the park.

The dollar is losing value every day, inflation is happening now. Buy some gold and silver, hedge your bets. Don’t get crazy, just make a few good decisions. Watch the market…we are due for a correction…move some 401k money/investments into cash and gold/silver. Just don’t have all your eggs in one basket. Don’t sink all your money into housing either just to get that home in that bubble area.

How can you be so sure that housing and stocks are in a bubble, but gold and silver are not?

So we should not buy now and watch price gains for the next three to five years? That doesn’t make sense. I should buy now and jump in two to four years then. Anyone who bought in 2002/3 and got out in 2006/7 probably made some tidy cash.

“I know it’s hard to wait but look at what happened to people who bought in the last bubble. They got annihilated!”

But Christie, that’s just it – many of those same buyers didn’t get “annihilated” at all – in fact, many stopped paying their mortgages, pocketed the savings over the next few years and are now back in the market, looking to buy again. The underlying moral hazard that’s supposed to be inherent in a free market was obliterated by the Fed, so making an assumption such as yours in highly improbable.

…”is highly improbable.”

“I know it’s hard to wait but look at what happened to people who bought in the last bubble. They got annihilated!â€

I got annihilated because I put 20% down on my place in 2005, then put another 20% down in prepayments. If i would have just done the no down payment, interest only thing, then defaulted, and lived for free for a few years, I’d be well off, with an extra couple hundred thousand in the bank. It would have paid really well to be irresponsible.

Bottom will NOT fall off.

Fed will print money to infinity as a result asset inflation will be infinity.

Especially when Fed openly and loudly tell everyone that. But people choose not to listen to the Fed and act their own way.

And why would all these other nations want to continue purchasing debt, spiraling out of control, for infinity?

Do you know what the biggest “too big to fail” is? America. And when it does fail, which it will short of a “black swan” event of some kind, I’m not talking Great Depression; I’m talking post-apocalyptic sci-fi film with nomads in a vast wasteland, trading scraps of metal. Insane arrogance, blindness and entitlement never end well.

The interesting thing about this blog is people can see through the scams to a certain degree but no farther. They think the options are either inflation, or that the Fed will stretch this out continually… Well, major inflation would crash the country, causing riots and unrest. The thing about the Weimar Republic, is they had almost 100% employment, we do not. We cannot weather that storm. And the Fed stretching things out just buys a bit more time, while making our inevitable demise even worse.

But if you were a rich dude whose options were around five more years to live, or one more year, which would you choose? That is pretty much all it comes down to. The greedsters who have built this system, which is inherently doomed, are just blowing hot air desperately trying to keep it going.

I have watched the California market from afar for 25 years. My wife’s family lives in Mision Viejo. Here are my observations:

Desireable areas in California will never be cheap, or “affordable”, ever again. Rising interest rates may shave 20% off home prices, but prices WILL rebound to new highs yet again. Why? Because California has the jobs, the weather and the lifestyle / culture that makes people want to live there. Sure, the traffic almost ruins it all totally, but barring that nagging little aspect, California beats living in Kansas, North Dakota, the humid south, or many the cold cites of the East Coast (which are as expensive as Cal. but COLD.)

I live in Utah, my home was cheap, my lifestyle is cheap and my property taxes almost don’t exist. Here’s the rub: today, our family will probably hunker down inside watching T.V. because the thermometer is hovering at freezing. We ski, but I loathe cold weather, so skiing is a miniscule trade-off for freezing five months of the year. In addition, pay is low here, and then there is the homogeneous religious culture that is down right stifling.

There is a reason that California property prices are high, and why other places are less so. I definitely empathize with and understand the frustration of those home owners looking for the right place at the right price. But if you are waiting for a “crash” you may be renting for the rest of your life. You can either afford a place or you can’t. If you can afford it, buy it and let time work out the rest.

my .03 cents

Tyler, you are absolutely correct. As time goes on, the premium areas in Socal will get even more desirable. I was one of the naive people who thought, “when prices really crash, I can just waltz right in and buy a house in a premium area for a decent price with little competition.” We all saw how that worked out. There is an endless supply of people and money chasing properties in these desirable areas. With foreign money, Prop 13, wealthy boomers helping their kids out and people who will literally do anything to “own” in a certain ZIP, the competition is absoultely ruthless.

What has the housing bubble taught us? Certain areas will be protected at all cost by the Fed, government, PTB. Prices in these areas will always be maintained…here in the South Bay I am seeing places selling for near peak bubble prices. Being a renter today absolutely sucks too, you are at the mercy of greedy land lords. If prices crash again, the latest crop of buyers can at least live free for a few years or get a principal reduction…people need to adjust to the new unwritten rules of the game. Good luck everybody, we are truly living in interesting times.

I think you have the right idea. Also, since the folks in these areas have more stable finances, they are not as susceptible to foreclosure. They can wait out issues and taking a loss or being underwater is not going to force them out of their home. People will also do more to retain a home in a good area — they’ll empty out a bank or retirement account — take out an unsecured loan — sell another less desirable home — but they will hold on tooth and nail to a home in a desirable area.

My dreaming friend, there is nothing stable about this economy. As more jobs are outsourced, and as no new booms come to pick up the slack, jobs are lost. This means less people going out, less people shopping. With less people going out and eating and shopping, this means more places closing. This means more jobs being lost. See how it works? Like an economic melanoma of the worst kind.

Yes, correct, while this is going on, there will be an attempt at ultra-gentrification, but the seeping rot will get them too. No place is safe. It’s like a zombie film. I come from Manhattan Beach, it is right next to Inglewood. You are better off somewhere in the Midwest when the bomb drops, or Montana. People are still so trendy and so incredibly blind it is pitiful to see.

Here’s .02 more to get ya a nickel.

Never say never. An age old truth that works every time.

There are more than traffic issues that almost ruin it totally. When you live or have lived here, then you’ll have some perspective.

Define “afford”.

Crash happened, and passed. There were times when 1500 properties were on auction block one weekend 3-4 years ago. Those warm fuzzy feeling has come back. Did you see those people in the video above? They are really happy to put 10 offers on the spot to buy.

Buy now and ride the wave. Sell in the summer of 2014. Ride out the next crash as a renter and wait for the Fed to drive mortgage interest rates into the 1% zone. If Japan can do it, so can we. With a pile of cash and a mortgage for 1.5%, you should be able to live in a place with very little exposure to economic disruptions.

If your timing happens to be off, just stop paying the mortgage and live for free in the house. This is now the MO for home buyers. GO with it.

probably going to get some hate, but here’s where i’m at…

after finally saving a solid down payment, my wife and i have been in the market for about 6 months in LA. Our preferred areas are ((bring on the hate people). : silverlake, echo park, beachwood, hollywood hills, los feliz, mt washington, after my wife and i finally saved up a solid down payment. we make 300-500k a year (a little over 500k in 2012) so it seems like we should be able to score something decent in the dumb hipster areas we like.

yesterday we got word that we lost to an all cash offer in Silverlake:

3+2, 1800 sq ft. with a nice garage to studio conversion. great backyard and landscaping. turnkey, very very nice but not in a “prime” part of silverlake (if you agre that there is one. i do.) — not in ivanhoe school district.

asking was $879k. we ended up at $910k. they took the all cash offer.

oh btw, the current owner bought the house last year for 770k in the condition it’s in now (no substantial improvements or upgrades since then).

granted, we are a bit pickier than most people aesthetically, but it is seriously slim pickin’s out there.

i keep looking at the stuff that sold last year and kicking myself for not buying, but we didn’t have the down payment.

anywho, that’s my story so far.

Trash Face, with your solid income you won’t have any problems buying. This little rally can only go on for so long before the pendulumn swings again. I’m sure you have all your ducks lined up in a row, you’ll get get your house.

In hindsight, the time to buy was 2011. I remember seeing nice places languishing on the market for literally months. Rates were about 4.5%. Those places today have gone up 10 to 20% (area dependent) and people have refied into low 3% rates.

I ended up buying 6 months ago in the South Bay. Regardless of what happens in the future I don’t ever intend on selling this place. It will either be my primary residence, a rental or passed down to family members. Good luck with your future purchase.

The time to buy may actually be 2016. U.S. banking laws limits the number of years a bank can hold on to a foreclosure to 10 years maximum. The first wave of bad loans started in 2005. So starting in 2015 banks will be forced to unload foreclosures from 2005, no more REO-to-rental as we have now.

You make 300-500k a year and “finally” saved a solid down payment on a 900k house?

Are you buying fresh “his & hers” Bentley convertibles every six months? Where exactly does your money go?

Chris, we’ve only been making that money for about 4 years. weren’t making 500k the first couple — more like 250. had to pay down a lot of debt those first couple years. we had a kid (expensive), had to build a studio for work, pay taxes, pay management… etc etc.. we’re not the most frugal people in the world, but we don’t have fancy cars and stuff, we just live in LA, it’s hard to save 200k.

Gotcha- I might have jumped the gun as you didn’t mention re-investing in your company or the (always expensive) kid.

As an LA native I can definitely sympathize but I also know that a good chunk of that 250k+ crowd is 90 days from BK.

In my area, we saw prices drop to about 2001-2002 levels. I would say that the price increases until about 2004 were sustainable — they weren’t comfortable, but they were still barely affordable, after that (2005) it was sheer lunacy and that turned everything else upside down.

So there is room for our prices to go up, although I would say that the overall economy and job situation is worse than 2004, so maybe there is not room to go even that far anymore but it is foreseeable that with a real recovery to status quo that 2004 prices could come back — but I would like to see it a heck of a lot slower than it is happening. I’m so tired of living Bubble to Bubble. But, there is some room to go up. Prices went down sooooo low.

Everyone thinks they will be able to time the low, but most people are looking in the rear view when they call it. If you missed the boat in my area that means you had a FOUR YEAR window to act. I’m not feeling your pain. I do feel sorry for the folks that are just naturally lumbering up to the housing market (just got their first job, just having their first baby and now it makes sense to buy) and have to get involved in this chaos. But for those who just sat on the sidelines and waited trying to call the low… oh well, you rolled the dice — now get in there and bid!

It can be like jumping from one merry-go-round to another. My Wife is working with our Daughter to help them jump from their town house with Mello-Roos & HOA fees to a house near us that is 1000 sq ft bigger. The taxes will be about the same if you include HOA and Mello-Roos. They were waiting to jump until the price of their town house came up to even with what they paid. They may have to decide if the problems with the older house found in the inspection report make the deal worth it if the owner won’t make repairs.

Bought my first place (a condo) in Simi Valley in 2002. Sold in 2005, and rolled the money into a down payment on a house in Simi. Sold short in 2009 (owed 500k, sold for 320k) 3 months after getting married. Rented for 3 years, saved up 20% down, and bought another house here in Simi Valley for 640k (we now have a 17 month old) 4/3 2300 square feet with almost 2/3 acre and a pool. Had do do an FHA, couldn’t get a conventional with the short sale on my credit, even with 20% down. Still having to pay PMI for 5 years. Isn’t ideal, but we are 30 and our family has started. Sometimes a home become more than shelter (both from the elements and taxes) and we decided to jump in. Sucks to be paying an extra $500+ a month (for 5 years), but at some point in the last few years (been reading this blog for 5 years or so) my priorities changed. I work in public safety, am counting on a pension, and I feel like this was the right decision.

Having said that, we were looking from Sept. to Dec. of last year, and the amount of all competition was pretty crazy. I couldn’t believe how much people were offering above asking, and all within seemingly hours of the listing! Maybe people (like us) are just losing patience.

trash face…..what the F do you do that could possibly be worth making $200K a year? i’ve been self employed for my entire adult life and NONE of the business owners i work with pay themselves that much money?? WTF?

If you’re selling services only and have a good client base, such as consulting in a field for a couple hundred an hour, you can make $200K.

“a couple hundred an hour”

WTF……i have to compete with a chinese guy on the other side of the planet who make $100 a week……i’ve lowered prices every year for a decade and only since last year have i stopped digging the hole……i just wish the world would blow up as i never thought i’d be this old and work this hard for so little….AND i’m in engineering.

can’t afford, i make music for TV. i have no idea how to make money in other ways — i’m totally useless!

You’re one of the ‘lucky ones’ then. Talk about an over-saturated market. How many a 1990’s TV composer converted into an early 2000 RE agent once computer tech made it cheap enough for some kid that couldn’t even read music to be able to publish a ‘descent’ tv score in his parent’s basement, the dedicated music production libraries started selling tracks to TV producers for 0.00 dollars in hopes of ASCAP/BMI lottery money, and upfront compensation started falling.

I write classical music.

I’ve scored a few crappy movies, years ago, that probably got thrown in the trash after festival. But the music for TV and film is one of the most polarized industries I can think of, where you have a handful of 1%er’s on top, making descent money, and everybody else in the 99% fighting over tiny scraps of nothing, and willing to work for free for years just to get a credits list, whilst middle men and employers (ASCAP et al., suites, music supervisors, other composers, etc.) corruptly take advantage of the deep oversupply of composers. The middle class composer died out in the early 2000’s. What there is now is a disparity so large, it’s pretty much the same as Medieval England, where there are a few nobles that own all the land and everybody else is a peasant farmer.

When too many people worry about bust, I can safely say that the bust is not going to happen anytime soon. A bull market peak by definition happens when everybody and their granny/nanny has already bought and no more buyers.

The current situation is far from that. I see people paying with cash. Many people are bringing in hefty downpayments of 100K and above. we are a solid 2-3 years from a top. Living in Southern Califonia, I thought the brand new house I bought in 2010 would take 5-10 yrs to appreciate in value if I”m lucky. Apparently, it took less than 3 yrs and now I can make a profit renting the place out.

These are the same equations going on in the heads of a million people.

Hilarious, another real estate shill! Peaks can happen (like now) when sellers outnumber buyers. There aren’t THAT many buyers, just a constrained inventory (artificially, thanks banks). In my Nor Cal hood which has had extremely low inventory, I have seen 5 pop up in the last week alone…where there were three now there are EIGHT. And it’s only March! Wait until full throttle April and May hit, and there will be way more sellers than buyers…and prices will drop accordingly. Just watch and learn my friend. People buying now are gonna get hosed. And with the world economy in the crapper (hello Cyprus, Greece, Spain, Italy…the whole eurozone really), wages declining, prices on things we need going sky high (health care, gas, food, education), the bubble is on the verge of busting again. If the stock market peaking doesn’t scream “bust coming” to you, then you just can’t see the signals.

I’m going to make a totally unscientific prediction by going slightly off-topic.

The last economic meltdown occurred in 2008-2009, also the (supposedly) final season of Jay Leno’s “Tonight Show”. If the NY Times is to be believed, 2013-2014 will be Leno’s final season (again), making way for Jimmy Fallon.

Another market meltdown coming?

Even going back to the 1992-93 fight for Carson’s job, which coincided with a pretty severe recession in Socal.

Either way, this bubble will pop. But as others here have pointed out, the desirable areas will always be overpriced, and will only drop so much because of a downturn.

Or you could just watch for oil price spikes. Every time one of those happens, it screws the economy.

any bold predictions on what’s going to happen in the next months of 2013?

I think it really depends. The market right now is hanging by a thread from a few factors in the bubble direction, if folks start to put their homes on the market in April/May and prices level or dive more people may panic and the spiral will begin.

If inventory stays at this artificially low bullshit rate, we are in the status quo and I still see prices leveling off. If things get any higher than where they are now, the repeat of the bust will be equivalent if not worse than last time.

When we get hyperinflation(contagion from Japan), people will not be able to afford to buy the homes. Look at what happened in the Argentine. This is a suckers market.

I see many people buying homes in 2008 when gov’t was giving out tax incentive to first-time home buyers and now they are on short-sale…. Whoever who are buying now at these insane prices will be on short-sale in the future. Many of the people who are buying don’t make enough income and don’t have job security…. As a CPA, I see many people paying too much mortgage and they don’t get much tax deduction of prop tax or mortgage interest because their effective income tax rate is only 20%. These people don’t realize the 80% extra cash they have to spend on prop tax and mortgage interest alone (not talking about the portion of the mortgage principal) can add up to be just like rent expense because of the high housing price they pay…. Meanwhile, their job situation is extremely fragile…. So sad to see so many people who can’t think. For these people their situation is like renting a home from the bank and the government by paying a huge initial cash deposit and also continuous monthly cash deposit…..

[i]Yet you have two groups; those that are investors with all cash and those that can barely get a down payment together. [/i]

And *there* it is–destruction of The Middle Class–captured in another DrHB money-shot. Bankster/NAR pressure on Fed.gov creates the FHA Bubble, while Bankster/NAR pressure at state.gov level greases the skids for all-cash investment bloc buying. GRRrrr 😡

I’m trying to buy a house in South Florida. We put forth 10 offers, all declined. Even with our budget of 450k all cash, we keep getting beat. We’re not talking mansions here either, just a regular 2,000 sq ft home, zero lot. I guess I’m going back to renting 🙁

Leave a Reply to MB