California homeowners are getting older and taking homes into the grave. Property turnover has fallen substantially since 2000.

California homeowners are entering into their geriatric phase. The share of homes owned by older Californians has grown substantially since 2000. The Taco Tuesday baby boomer crowd is dominating the ranks of homeowners. This trend is new and because of key items like Prop 13 and Millennials living with parents, very few homes are turning over. The first time home buyer in California is simply getting older and older contrary to the house humping cheerleaders talking about the days of “sucking it up†and having to save to buy a home. Of course many were not contending with hot global money, limited inventory, artificially low interest rates, and a delusion of crap shack grandeur.  Now some yell from their beer belly exposed guts and a savory carne asada taco in the other hand that people should move out if they don’t like it here (and many are). The economics of course are more subtle.

California old folks home

The old dominate the homeownership ranks in California. Fewer properties are turning over because many older homeowners are now having their grown adult children moving back in. Which makes sense since many bought because they were itching to pop out offspring. Now their offspring is itching to pop out offspring but many are hesitant to do that when a “starter home†is $700,000 and many times is in an area with bad schools.

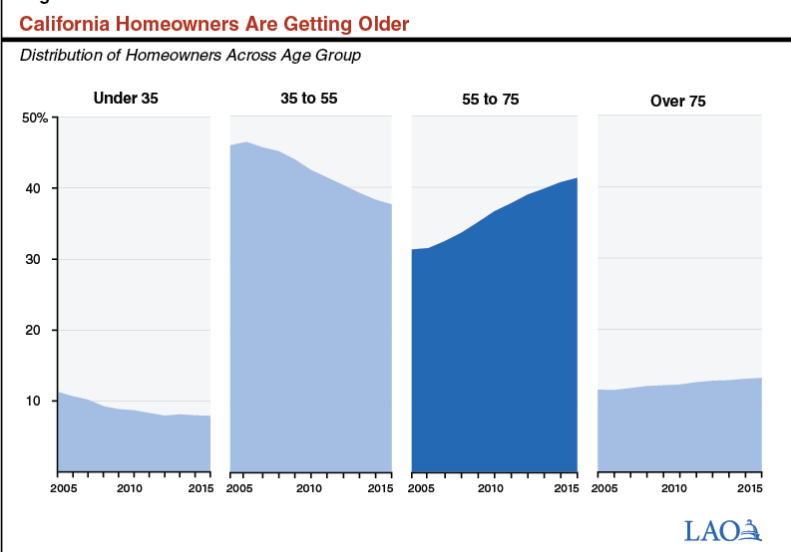

Take a look at this chart of homeownership based on age cohorts:

Source:Â California LAO

The chart is interesting for the two groups in the middle. You can see the homeownership percentage of all homes owned by the 35 to 55 age group decline as it is overtaken by the 55 to 75 age group. In 2005 the 35 to 55 group dominated and now it is the 55 to 75 age group. But that group, your typical Taco Tuesday baby boomer, is now seeing many of their adult children moving back home.

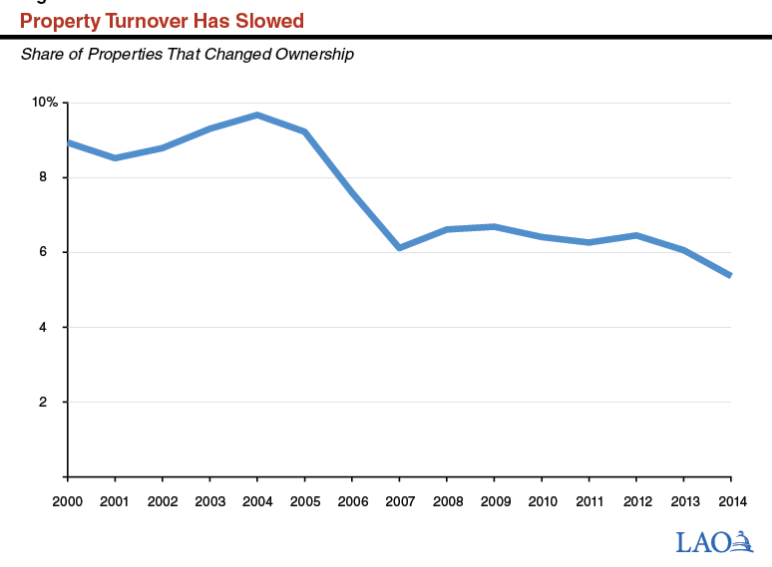

This is keeping property turnover very low:

Why are people not selling if the market is so blistering hot? The demographics should explain a lot of this change. Older homeowners are now stuck in their stucco sarcophagus. If they sell, many metro areas across the country are also expensive. The only time they would maximize their wealth is if they left to a lower cost of living country. Many will not do that – they even hesitate going to lower cost states. They would rather shop at the 99 Cents Store and live in a million dollar crap shack than unlock that sweet tasting equity.

That is one reason but another is the fact that their kids now live at home once again. 2.3 million grown adults live at home with their parents in California. Don’t think this is common as some are preaching as if suddenly California is Italy. This is uncommon. It is happening because people are broke after paying the monthly bills and even rents eat up a ridiculous amount of income.

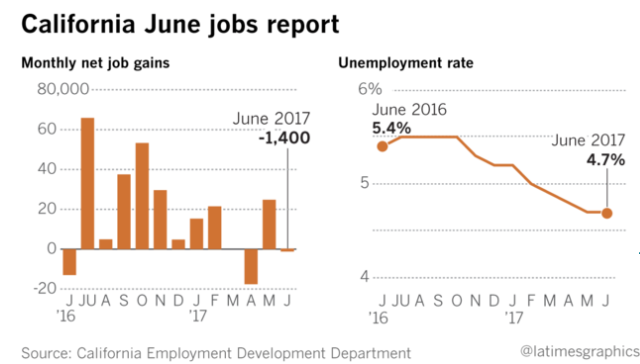

Also remember that we’ve been in a hot market for 8 years now. The business cycle is bound to rear its ugly head:

The employment market is already looking a little softer. This can only mean that more adult children are going to be moving back home and of course this means home prices are going to go up forever because that is simply how things go in California where the tacos never run out on Tuesdays.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

279 Responses to “California homeowners are getting older and taking homes into the grave. Property turnover has fallen substantially since 2000.”

housing to tank in 2018!

Tanking to Begin Soon!!

Yawn

I was in Pacific Palisades yesterday. I was stunned by how many Open House/For Sale signs there were. Maybe a couple of dozen along Sunset Blvd. alone. Many lined up next to each other. If the “smart” money is looking to sell — what does that mean? I think it means top of market.

So many people have multiple homes. Instead of selling and moving up, they are taking a home equity loan to purchase a move up property, then rent out their old home. Frequently, people in their 50s have three homes, while people in their 40s have two. None of these are being sold. That is their retirement plan.

jt, I have known several people who have done this. A cash out refi is taken on the starter 1000 sq ft Torrance box and magically people have hundreds of thousands to use for a down payment for the Palos Verdes move up home. The Torrance box is turned into a rental and gets $2800/month rent and is cash flow positive. That’s how the game is played here. This is another reason why owning property in desirable socal locations is so highly sought after. When that Torrance box is paid off, that will be a nice monthly chunk of change in retirement. Or the house will be left to offspring.

Don’t fight the system. Learn how to play the game!

Cap rates in CA are terrible. The only RE investing play in CA is the appreciation.

If you want cash flow with returns double that in CA, look to the Midwest.

The cap rate argument is correct. But, when the economy hits a recession, you will find that it is nearly impossible to rent many midwest properties, whereas in a decent Cal location, you reduce your rents and you can fill. So, it is true cap rates are higher in the midwest, but you take that higher rate knowing you are taking the risk of no rental income in a decent recession.

LOL…unfortunately this strategy ignores RISK. What a dangerous and moronic game to play. I’ll feel bad for these people when it all comes crashing down and they are exposed.

@Never Goes Down

Exactly. Stretching themselves thin on debt when prices are high is one of the primary reasons why investors fail. The current cycle represents the biggest debt binge in modern history.

“LOL…unfortunately this strategy ignores RISK. What a dangerous and moronic game to play. I’ll feel bad for these people when it all comes crashing down and they are exposed.”

What risk exists when it comes to owning (and renting out) desirable socal RE for the long term? Unlike home prices that gyrate wildly, rents in socal are pretty steady…the long term trend has and always will be UP. Is socal going to have a mass exodus where we lose millions of residents? This is not rocket science, the renter pays off the owner’s mortgage. The owner gets any appreciation moving forward. Eventually the home is payed off and it’s all gravy.

Is socal going to have a mass exodus where we lose millions of residents? It might happen considering that SoCal is prone to major earthquakes and fresh water and food must be brought in from hundreds of miles away…

Prop 13 is evil

Proposition 13 is evil? No, big government bureaucrats taxing property owners out of their homes is evil.

@samantha let me guess, you benefit from Prop 13 and pay way less in property taxes than your neighbors. Funny how that works…things are fair when you personally benefit, but unfair when you don’t.

How about this…everyone pays a flat fee in property taxes based on the size of your lot, not on the value of the property. Would you go for that?

Throbert Girth: How about this…everyone pays a flat fee in property taxes based on the size of your lot, not on the value of the property.

That’s not a property tax. You’re describing a parcel tax. And parcel taxes already exist in addition to property taxes in Santa Monica.

Some local jurisdictions add parcel taxes to their property taxes, others do not.

If you’re suggesting that we abolish property taxes, and rely exclusively on parcel taxes, I’d be fine with that.

honestly it not a bad strategy Jt, it is part of my retirement plan as well, i have a few other ideas,, but that seems to figure prominently into most peoples retirement plan ,,making your hard earned money work for you , the american dream right?? as long as people love the weather in ca, owning rentals here is probably a good thing but i am moving to cheaper hunting grounds or at least ones with weather i like better norcal is kinda cold in summer..

that might be a good plan, assuming you have great tenants. Many landlords have problem tenants who only pay what they want, and understand the law protects them even if they don’t pay at all. There are many tenants out there who don’t pay at all after their security deposit because they understand how long the eviction process actually takes, and how difficult it is to sue someone with virtually no assets.

is that different in California?

Only stupid landlords have those tenants. Finding good tenants isn’t rockets science. Good credit, high income, long term steady employment. People who have all 3 pay the rent and don’t trash the place. Nobody with a 750 fico score will destroy their credit score in order to get a few months of free rent.

If you overcharge for rent, that’s the experience you’ll have. Very few tenants with families responsible enough to have a 750+ fico and ten years on the job are going to go into it with the plan of getting kicked out in 3-4 months, or however long it takes to evict them. Lower rents get you higher quality tenants. Before you say “if they’re that qualified they would own”, look at the people on this blog. A lot of people are waiting, and some are life-long renters.

Ask the people who know. Biggerpockets.com.

There it is again…Mr. Landlord at his finest: “Only stupid landlords have those tenants.”

If you happen to have a renter that doesn’t pay you are stupid! This wise guy said the same about the 7 Mio foreclosed homes. The people who lost their homes were not smart! According to Mr. Landlord, if these people would have been smart they would have simple held on to their RE!

His reasoning is simple: “It’s really, really hard to lose money in RE”.

Yess Millie. If you are dumb enough to rent to undesirable, you will lose money. It’s not rocket science. And yes if you foreclosed in 2010 and walked away from a money making machine, you were a fool as well. That house is worth 100% more today in some markets. People make stupid decisions all the time, not sure why it offends you when I point it out?

“That is their retirement plan”

And the next part of that plan is to sell to whom? The Walmart worker making $11 an hour? The gardener? The flood of illegals?

OR is the plan selling to some rich Chinese “investor”

the people they are planing to sell all these homes to, on average, make shit money so how are the going to afford that $1.1 million house?

I don’t think people understand how little most Americans earn……half the people I know don’t even have jobs and live off the government

Man, you need to Branch out into different circles of people got run with.

Doctors (almost any medical related profession)

Lawyers

Sales people

Money managers

RE people

IT guys

HR/admin

All of those are examples of people making 6 figures easy.

They don’t plan to sell, they plan to rent it out. That’s the point.

Agreed Dan.

I’m so sick and tired of hearing how EVERYONE is broke and/or working for $10/hr. Sure there are those people. But there have always been poor people. Judging from some of the comments here you’d think that up until 2000, everyone was a millionaire in this country, lighting cigars with $100 bills or something.

There are millions and millions of people making 6 figures who live comfortable, financially secure lives. It’s not all doom and gloom out there.

In the nice neighborhoods of San Diego average household incomes are somewhere between $120k-$150k a year. Which is generally enough to get you into a $500k-$700k place depending on how little you want to save.

People who make less generally are renting sometimes still in the nicer areas if they find deal. The bottom middle income earners are just stuck renting apartments, many times section 8, instead of small homes and nicer condos.

Its not uncommon to hit $120k given that almost every family in San Diego in the nice areas are dual income earners, or high single earner. Avg engineering job with a big company is paying $100-$120k base with experience, sometimes with very little for tech work.

But the real key is the dual income. Makes it a bit harder on families that actually want a parent to have time to raise their young kids, but it is what it is. Even dual income teachers with master degrees are getting $60 in the public school system. More at a college. Between employers like Qualcomm, UCSD, SDSU, General Atomic, the Navy, Air-force , Salk, all the high end medical facilities, biotech and the list goes on there are thousands of jobs beating the $60k mark to bring a 2 income family up to $120k and also many of those reaching above $100k for single earners.

@Mr. Landlord

“I’m so sick and tired of hearing how EVERYONE is broke and/or working for $10/hr.”

Almost everyone is effectively broke and makes far less than the $350K/yr needed to afford (assuming no other debt) a $1.1 million house. Only around 2-3% of all Americans make that much or more money per year.

Even in CA where there will be a higher concentration of wealthy types than other parts of the US there will be very few who can afford a $1.1 million home or any home at all really.

“Judging from some of the comments here you’d think that up until 2000, everyone was a millionaire in this country, lighting cigars with $100 bills or something.”

Hyperbolic strawman. However back then wealth inequality was much less pronounced than now so economically it was unquestionably better. A college degree was generally still a reliable pathway to a middle class income or at least a job that would grow into that back then.

“There are millions and millions of people making 6 figures who live comfortable, financially secure lives.”

There are over 300 million people in the US though. The vast majority earn a fraction of even $250K a year much less $350K.

If a relatively tiny few are doing well but everyone else is getting screwed hard is that the sign of a good economic system?

tts, you need to expand your horizons. Seriously. Virtually everyone in my circle of friends/family my age (early 40s) makes good money and owns a home. Many have a vacation home or ski condo or what have you as well. A friend of mine just bought a sailboat (not my thing, but whatever makes you happy).

And enough of this woe be me garbage. Buck up and make something happen for yourself instead of whining.

As a point of reference I bought my 1st house when I was 28. I was making $63K a year. Cost of the house was $299K with 10% down. Bbbbut bbbbut how could this be? ***EVERYONE**** knows that the most you should spend on a house is 3X income. Well I guess I performed a miracle, because I owned that hosue for 3 years, never missed a mortgage payment and I don’t believe I ever had Tacos on a Tuesday either.

Meant to add…

If I could easily afford $300K on $63K salary, then a dual income family each making $100K+ (which is quite common in coastal CA), should have zero problem affording a $1M house. Now, that’s not to say the SHOULD buy. But if they wanted to buy $1M worth of house on $200K they’d have no problem.

Many states and counties have a Prop13 type of thing for people 60 and older. My county has a program that is a combination of age and income. If income is below a certain number ($50K I think) and the owner is over 60, property tax is greatly reduced and it’s frozen as well. It’s also a good incentive to get retirees to move to the county. And as everyone knows retirees are the best residents…..they have money to pay property tax, but have no kids to send to public schools, which is one of the (if not the) biggest expense item for most municipalities.

There are alternatives to Prop13, if the goal is keeping grandma in her house.

No joke. Your circle of friends are not representative of all buyers.

Just met with and pre-approved 3 sets of buyers this week. 2 Indian and 1 Hispanic.

All with good jobs (6 figures), bringing 20% down, good credit and virtually no debt.

Definitely far from 11 bucks n hour at Walmart.

Yep, that’s my back up plan > to inherit the homes from my parents/in-laws.

I know….the RE cheerleaders are quick to respond and tell me that wont happen because of inverse-mortgage blah blah blah. Lol

So here it is:

Plan A invest all the cash i saved over the years and buy when prices are low after the next crash.

Plan B: If plan A does not work out, perfect….keep renting/saving money and wait for the next crash. The end-game would be I inherit all the real estate from my family eventually.

What I will never do is buy an overpriced house. Reading about the bubble and it’s beneficiaries I just cannot find any justification for paying a high markup to benefit the older generation just because they got lucky and bought when houses where dirt cheap (compared to nowadays). Millennials haven’t had that opportunity yet.

Ya ya we get it, you want to wait till there’s a 70% crash and are willing to wait 100 yrs. You repeat this same theme on every post. Got anything constructive?

winning doesn’t get old.

At least now he has his Plan B strategy:

Inherit real estate

So whether it’s 100 years.. or inheriting real estate at age 60 to start life.. he has his bases covered.

Inherit as a strategy? What could go wrong?

“or inheriting real estate at age 60 to start life”

Because….you cannot start a life unless you “own” a home.

That’s great! Will add that to the list:

1. Buy now or be priced out forever!

2. Buy now or start your life with the age of 60!

3. ….

“Inherit as a strategy? What could go wrong?”

Not sure….you tell me? I am eager to hear it.

I’m confused. Why would Mille want to inherit r/e? It’s the worst thing in the world to own, or so he says.

It’s funny how Mr Real Estate is Evil, is planning on inheriting r/e as his retirement plan.

Dude either you are trolling harder than anyone online, or you have some serious issues.

Millenial,

What could go wrong counting on inheriance?

To put it bluntly:

Everything

Tank in sight,

“To put it bluntly:

Everything”

Nice. Than it should be easy for you to name one or two for me?

Inheritance can go to zero for a myriad of reasons

Are you so dense you need me to sight the infinite reasons inheritance goes to zero?

OK… since you are counting on inheritance as a “strategy” I will give you the heavy hitters:

1. You find out you aren’t in the will or to the extent you thought

2. Healthcare eats it all, which is becoming very VERY common… and the trend is getting worse.

3. Your parents screw up their investments, ball game over

4. The market tanks 50-70%, they sell because they need the money

Entitled hope is certainly no startegy

Thanks Tank in sight!

If these are the heavy hitters I should be fine. Both my parents are getting government pensions and great healthcare. Sure, they could decide to start being alcoholics and gamblers and lose it all in a high risk game of poker or they could decide to be converted to Islam and donate everything in their possession to the next mosque. But these events have a probability of happening of less than 1% in my mind. If you think of anything else let me know.

Well said

Being a real Millenial, there. Expecting parents to help by inheriting.

I’m a millenial and I got my parents to buy in 2012 so that their rent wouldn’t keep going up when they get older and have less income. I’ll help them when they are old, if they need it. My husband and I bought a house and we are selling it now to move out of state and kinda have a paid off house, better life, really focus on retirement planning and raising our family too.

“Being a real Millenial, there. Expecting parents to help by inheriting.”

You make it sound like its a bad thing.

As I mentioned, my first choice is waiting for a nice, beautiful crash to pick up a house at 50-70% lower price (that would reflect the true value of the house and you would have rental parity). But, you always should have a backup plan because you never know, right?

Some on this blog said we have Trump now and therefore housing will skyrocket since he is a real estate guy. Also, illegals will disappear and our GDP will increase tremendously (tax cuts and import tariffs). Some even believe that we will have enormous growth by legalizing pot. They call it a pot boom. While I give all this fantasy nonsense a 1% chance for materializing i give an upcoming crash a 99% chance. However, its always good to be prepared for the worst case scenario (That would mean no economic crash).

Time helps build wealth, so the more time you spend doing, the more you have at the end.

I agree a crash will happen. It’s the cycles created by the Fed. Unless somehow we get to audit the Fed and get rid of it, the cycles will keep happening. I don’t know why some people think it will never crash. Because of the Fed, we have bunch of bubbles right now: housing, credit cards, car loans, student loans, etc. and because of the Fed, they will all burst.

I like this idea. in the Southeast, instead of my in-laws renting, I helped my in-laws buy a house and they made all the payments, taxes, etc. at their reduced rates. when they died, it passed on to us and now we rent it out making a 4-5K/yr. we are now taking our savings and able to purchase a couple more rentals and we will pass all this on to the kids. My side of the family in SoCal has several RE rental properties and own it all outright. (old folks don’t see RE as some type of bank account, they live within their means.) So we will have several opportunities to rent out, pass on this to our next generation or live in multiple areas of the country. Thanks Mom and Dad. We will be doing the same for our kids, looking to get a couple vacation props that are rentable while we pay lower taxes and pay those off too before we die. Building wealth is easy if you are conservative, take your time and are willing to look outside your market. Live beneath your means, everyone works, save what you can, don’t buy new cars, don’t get cable….but hardly anyone wants to really sacrifice.

Mr Landlord,

“I’m confused. Why would Mille want to inherit r/e? It’s the worst thing in the world to own, or so he says.”

Yeah, I can see the confusion 🙂 Its not uncommon. For most RE cheerleaders only two doors exist when it comes to real estate. Door 1: BUY NOW. Door 2: RENT FOREVER.

As soon as you mention door 3: RENTING, SAVING AND WAITING FOR A CRASH they have issues comprehending this strategy and/or are confused (like in your case). But the vast majority of RE cheerleaders respond to the strategy of waiting for a crash with the wildest theories and predictions:

“You are an Anti-American Perma Bear” (probably my favorite), “If you don’t buy soon you will never own a home”, “You wont start life until your are 60”, “you will wait a 100 years”….to mention a few. Over the years the list grows and grows. Quite the entertainment.

What would be confusing. You can buy outside your market. It is easy to see the upcoming markets. Look at the Southeast (SC, NC, GA, Dallas area of TX, growing areas of AZ, retirement areas where you would like to live, or vacation areas. You can stay renting in SoCal, get a beach rental in Charleston or Myrtle Beach, SC or a rental property or three in Irving/Dallas TX. Move your retired folks there and have them pay the payments and taxes while they are old and taxes are reduced. Rent out their current home, so they are living rent free. Work together as a family…when you work together options are far more manageable, family is more trustworthy. numerous Property companies to help manage anything you want to do.

35-55 and 55-75 are pretty big ranges. Could be the big change has gone from a lot of 50 year olds owning in 2000 to a lot of 60 year olds owning today. The fact under 35 and over 75 is steady, leads me to believe the change is at the 55 line, going from just under 55 to just over 55, but since the range is so big, the charts look scary.

Also, the entire population has aged so it makes sense that the average age of home owners has increased as well. Plus people are living longer and the retirement age has been steadily increased from 65 to 70. Which means all else being equal, people will work for 5 more years, so they will hold off on selling the house and moving to an apartment or retirement community 5 years.

As for the employment picture, this can’t be. I was assured by very smart liberals that increasing the minimum wage to $15, and turning the whole state into an illegals’ paradise was a recipe for economic success. You don’t mean to imply they are wrong, do you?

@Mr. Landlord

“35-55 and 55-75 are pretty big ranges.”

Lines up approximately with what could be considered a generation (ie. Boomer, Silent, GenX, etc) by some, so ~20yr. Given all the generational talk that goes on all the time regarding the housing market and Millenials you can’t claim numbers skewing is going on there. Its quite relevent.

“Could be,,,,,,,,,,,, but since the range is so big, the charts look scary.”

That is some serious mental gymnastics you’re attempting there. Doesn’t even line up with reality since the under 35 chart is declining not steady. It just isn’t declining as fast as the 35-55 chart. You can’t handwave away a 10yr trend like that, that is a timeline that get approaches a little to closely with what went on with Great Depression.

“Also, the entire population has aged so it makes sense that the average age of home owners has increased as well.”

Millenials surpassed the Boomers as the largest generation in the US back in 2016. So all other things being equal (they’re not) Millennials should have higher or equal home ownership numbers to the Boomers. Instead they’re still declining and are at current historical lows.

“Plus people are living longer and the retirement age has been steadily increased from 65 to 70. Which means all else being equal, people will work for 5 more years”

Living longer doesn’t mean they’re fit to work. Or at least to hold the job they used too. Old people don’t like to admit it but its not just the joints or back that wears out. The brain does too with time.

“As for the employment picture, this can’t be. I was assured by very smart liberals that increasing the minimum wage to $15, and turning the whole state into an illegals’ paradise was a recipe for economic success.”

Most areas that voted for $15/hr voted to have it scaled in over a period of 3yr or more around a year or so ago. It’ll take 3-5yr for the full economic benefits to be felt. And very few areas voted for $15/hr wages. Its not a national min. wage.

Its also a farcical strawman to claim that any attept was made to make the US a “illegal’s paradise” or that $15/hr wage alone was supposed to fix the economy period for wage earners. Its a good start but it won’t fix everything. Lots more has to be done. $15/hr min. wage won’t fix housing prices for starters. That requires price controls of some sort.

“It’ll take 3-5yr for the full economic benefits to be felt.”

The economic downfalls as well. A $15/hour minimum wage will help more than it hurts only in areas where the local economy can support a $15/hour minimum wage. Just slapping it on a city because it’s a nice round number is pretty moronic.

There may be a few areas that could support a $20 minimum wage. Most cannot, just as most cannot support $15.

There should be no government intervention in the minimum wage. There are ONLY negatives and no positives, like all other government interventions. In expensive areas like SF, Seattle and NY which can support a high minimum wage, there is no point to set a minimum wage. The free markets would accomplish the same thing or businesses would not be able to attract anyone for those jobs in a high cost of living. No need of government intervention. If it is a lower cost of living and the government sets too high of a minimum wage both, the businesses and the employees will suffer. The businesses will suffer bankruptcy and employees unemployment. It is Econ 101. Only morons who never took a course in economics and never run a business would set minimum wages or think that they know better than the free markets where that minimum should be set. Bureaucrats just set an arbitrary amount with no relationship to the free markets.

If $15 is better than $10, why not $25 or $50? For sure it would produce more “good” (sarc. off).

The ONLY beneficiaries of minimum wage set higher and higher are the TBTF banks who own the FED. All the population loses and the poor more than anybody else. For those who do not understand why, they should start with a course in Econ 101, and then they will understand – pretty basic.

@John D

“The economic downfalls as well.”

Except according to the $15/hr min. wage detractors it was supposed to start a economic calamity almost immediately. Yet that hasn’t happened.

“A $15/hour minimum wage will help more than it hurts only in areas where the local economy can support a $15/hour minimum wage. Just slapping it on a city because it’s a nice round number is pretty moronic.”

$15/hr min. wage was chosen for solid economic reasons, not just because it was a nice round number, which it isn’t even that. None of the reasons were moronic.

Its also not even where the min. wage should be BTW. If you take a 70’s/early 80’s min. wage and adjust it for inflation as well productivity increases you’d end up with closer to $20/hr.

“There may be a few areas that could support a $20 minimum wage. Most cannot, just as most cannot support $15.”

And yet many other countries, some quite a bit poorer than the US and all with a much smaller economy, have had no issues instituting a min. wage of $15/hr or even higher for years.

If it was a matter of economics as you seem to think none of those countries could be doing that.

Disclaimer: I’m socially liberal.

“Its also not even where the min. wage should be BTW. If you take a 70’s/early 80’s min. wage and adjust it for inflation as well productivity increases you’d end up with closer to $20/hr.”

This is not the 70’s, and our minimum wage shouldn’t be based on what the 70’s minimum wage was. They didn’t have the Internet, or looming automation, or the other things that make ours a different world. In many areas of the southland, rental living expenses are actually MORE affordable now at $10/hour than they were in the early 90’s at $4.25/hour.

https://www.nytimes.com/2017/06/26/business/economy/seattle-minimum-wage.html

The long and short of it is, we don’t have enough data to prove the effects either way. Funny how the liberal media will only show one side of it, though – check out the Washington Post’s articles on the subject for a laugh.

However, common sense will tell you that most small business owners have a low-to-middle class income, labor is one of their biggest expenses, and a 50% labor increase is devastating, period. Imagine you own a bar or large gift shop, and your biggest expense (even more than rent) is your $10k/month labor cost. You make a pretty comfortable $100k income but work 60 hours a week for it. Suddenly (3-5 years is plenty sudden) your labor costs are $15k/month, knocking $60k off your income. You’ve invested hundreds of thousands in this business and probably took out loans as well, and suddenly you’re not making much more than your workers (and probably even less hourly). You try raising the price of an IPA to $10/pint, but that only flies in the downtown clubs, where the $15/hour crowd generally doesn’t go, and besides, a downtown liquor license is $500k+. So you lay someone off and work more hours. Maybe close your doors earlier on some days. Your revenue drops further. Eventually you realize it isn’t worth it when you could work in an office for someone else for double the money and half the hours. No one is going to take your place, because they ran the numbers and saw that small, low-wage, labor-intensive businesses simply don’t pencil out or are too risky to attempt. Try it yourself – start a day care center (or whatever) on paper. Be sure to do ALL of the math – in a TYPICAL area of the city (i.e., not a downtown high rise), and take your typical customer’s salaries into account. In other words, be realistic. At $10/hour you might even get excited at the prospects. At $15, forget it.

“But the money will go back into the economy!” Yes, it will – into the economies of China and South Korea, and Japanese car companies, and the pockets of auto workers in far away states, and Amazon, and the landlord’s checking account, and probably a few loans to a roommate who lost her job at the gift shop. They still won’t be paying $6 for a Big Mac – but they will be paying $4 for one made by a robot.

“And yet many other countries, some quite a bit poorer than the US and all with a much smaller economy, have had no issues instituting a min. wage of $15/hr or even higher for years.”

I hope you’re not saying that second and third world countries have been setting their minimum wage at $15 U.S. (they haven’t), but I am genuinely curious which countries have increased it substantially, and what the real results are, so I’ll look into it.

A UBI would be more fair and far more manageable. The jury’s still out on that one – I need to see it in practice on a very large scale.

“like all other government interventions.”

…such as contract enforcement and building codes. Yawn.

“Its also not even where the min. wage should be BTW. If you take a 70’s/early 80’s min. wage and adjust it for inflation as well productivity increases you’d end up with closer to $20/hr.”

100% false!

Minimum wage in 1975 was $2.10. Using the BLS inflation calculator that is $9.87 today.

In 1981 it was $3.30 which is the equivalent of $8.75 today.

Here’s what happened in Seattle when it went to $15/hr

http://money.cnn.com/2017/06/26/news/seattle-minimum-wage-15/index.html

“Researchers at the University of Washington, who were commissioned by the city, found that when wages went up to $13 in 2016, low-wage workers saw their hours drop by 9%.

Workers ultimately made $125 less each month, on average, the report found.

“For every $1 worth of increased wages, we are seeing $3 worth of lost employment opportunities,” said Jacob Vigdor, one of the study’s authors.”

Ooops! And this is only at $13. I can only imagine the carnage at $15.

WA state also raised the min. wage this year. I know of two local effects this had.

1. A small pottery store than my wife and kids frequented closed down. The owner said at the new min. wage, it just wasn’t worth the effort to keep the business going.

2. A county park couldn’t afford to hire life guards. So not only did several teen agers not have a job for the summer, but swimmers at the lake were put in more danger.

So min wage earners make less, business close and teens no longer have summer jobs. Thank you Democrats.

I have a friend in Mar Vista. She is about 70yrs old. Bought a 1930’s craftsman back in the 80’s near Washington Blvd and Glencoe. She lives off social security. has no cell phone, her car breaks down often (which she cant afford to fix) so she takes the bus until she can save money to fix her car. She cant afford internet so she uses her computer at the local library…. her house is worth clearly over $1Million. Her friends (me included) have suggested to her she sell her home, but a condo for half that amount somewhere else (even as close as WLA) and at least pocket a half million $ but she refuses… she likes where she lives… So Doc, she is one of the people you will see at the 99cent store. Real Estate rich, cash poor. LOTS are doing it. But many are simply renting out a room or two for $600-$800 per month, while many others are AirBnB their rooms.

There is a guy in my neighborhood who owns two houses a couple of doors apart. He used to rent one to some relative of his girlfriend/wife. But now he has it on Air BNB. Must be fairly pricey since the Air BNB clients look nice. It’s pretty much the same size as my place. We’re about 6 miles from D-land. He doesn’t need to have people living with him in the same house so it is a bit different than renting a room out.

But but but… I hear the millenials crying that she destroyed their world with her huge carbon foot print.

LOL

JT – that is so true…. people in their 50s … to have homes as their retirement plan. Investing in actual retirement plans with those voulchers from Wall Street is not such a good idea. the series Billons in HBO has opened my eyes trememdously.

Too bad there is no equality when it comes to owning a home. Middle class people who work really hard also deserve to have an opportunity to live and own a home.

And yes, as I near my mid 70’s life is good , two pensions , two social security checks ,

one military disability check from agent orange , and the rental income from four paid off rental homes. The guys I worked with always living from paycheck to paycheck, and they laughed when they saw us working weekends and evenings. But now their money is running short, and they are having trouble paying bills, but they still have their memories of Vegas on the weekends and once a year two week vacations to the mountains or the seashore. We are now spending more on cruises and long weeks at the recreational areas than my old friends make during the year. Have a good time in your younger years, but plan for the retirement years because if you are lucky you too may live to an old age with your great-grandkids enriching your life.

You sound very much like my parents. Growing up I never understood why my parents didn’t live it up. They made decent money. But they drove Hondas and Toyotas while all my friends’ parents drove Volvos and BMWs. Well, my parents ended up saving well into 7 figures. And for the last 10ish years since they are both retired, they’ve been living a terrific life, traveling all over the world, spooling their grandkids rotten. And yes my mom bought herself a Mercedes just because.

My parents are both in good health and (knock on wood) have many years to go and they will never have to worry about money again.

I knew a yuppie couple in Manhattan. Husband an attorney, wife a bank executive. Both worked long, hard hours. Wife died of cancer in her early 40s.

Some people enjoy their youth, and suffer an impoverished old age.

Others spend their youth working 60 hour weeks, and die before they reach 50.

Do you live for today, because tomorrow might never come? Or forego immediate pleasures and save for retirement? I’ve had friends who’ve died in their 30s, 40s, and 50s. You just never know.

My 2 cents:

Focus on the things that make you truly happy… mostly those are not material items.

If you have money to save after that, great… get a dog named spot and the rest is history.

I think California needs to repeal grandfathering the property tax assessment when houses are passed to children/family members. The whole point of Prop 13 was to insure old folks aren’t priced out of their own homes. Why do the children reap this reward?

Yeah. I know someone who got a $1.2 million house out of an estate at the time of the great recession (estate closed in mid 2008). Had to pay the Bro & Sis off with a $400-500K loan and the remainder of the estate. Got Prop 13 taxes from the beginning of Prop 13 … that’s 2% per year since the ’70s. Taxes are lower than mine on a house I bought in ’89 for less than $200K.

This law is so flawed, but it won’t be fixed anytime soon. It’s just wishful thinking.

“The whole point of Prop 13 was to insure old folks aren’t priced out of their own homes. Why do the children reap this reward?”

And you believed it? If you did, you missed the whole point. The liberal politicians in Sacramento are good at lying. The point was that the very rich who own very expensive properties and lots of commercial RE will pay less in taxes so they would not have to sell. Ask Warren Buffet. On a 22 million dollar, waterfront home in OC he is paying a little over $2000 per year. Does he need that property tax break???…Why ? So he is not kicked to the curb???….

In a way, I don’t think the politicians should charge property taxes. That being said, if they do want to steal the money from the people they should steal the same % from everyone. But then, how can they pay for the millions of illegals? Don’t they want to make the whole state a sanctuary state? Why do they want to bring millions more? So they can protect the environment. Don’t they say they care about the environment while the GOP doesn’t? The more people they bring in CA, the more it benefits the environment, or so the logic of those who elect those in Sacramento goes – progressives/liberals are green.

Hey here’s a crazy idea: instead of taxing property more, how about the govt spends less?

WHOA. Mind. Blown. Right?

The answer to fiscal issues is always tax more, and never spend less. Let’s try spending less and see what happens. Keeping more of my money is not a crime, nor is it unfair.

Howard Jarvis was a liberal politician? Politics must be even redder than I thought out in Flyover-land.

The founders of Prop 13 were the original Tea Party members. Very conservative legislatures who wanted government out of our lives. Prop 13 slashed property taxes by nearly 60% at the time for both homeowners and businesses.

Previously, the tax rate in CA was at 3% and it was rolled back to 1% in 1978(of the property value 3 years before the passing of the law). The other part of it that we are seeing today is the limit of 2% per year on the increase in taxes per year. That is how older homeowners and their heirs are able to pay a fraction of the taxes their new neighbors pay.

One of the liberal reasons for it was “Poor grandmas and small business are being forced out of their homes due to high taxes.” I agree, taxes were forcing out fixed income residents and shutting down small businesses while at 3%. However, locking in property taxes for a 25 year old new homeowner at the start of their career, was shortsighted. Many states lock in property taxes for those over 65.

As far as the heirs, how else can these move-back-home Millennials afford to continue to live at home after their parents depart his world? The heirs to homeowners in CA have it really good.

The new basis on the property is reset at the time of death if they decide to sell. If they sell the house mom bought in 1975 for $60K immediately after her death for $1.2M, they likely will be able to declare a tax loss on the sale due to RE commissions and closing costs. There isn’t a CA Estate Tax and the Fed Estate Tax starts at $5.4M. The heirs “win” $1.2M and get to write off over $60K in losses against their own taxes. No wonder the State and Feds have a budget shortfall.

If the heirs decide to stay, the Prop 13 property taxes are maintained so they are extremely low and they can continue to live in the basement.

The heirs are either instant millionaires or they own a cheap house on the beach for the rest of their lives.

“legislators” not “legislatures”

Another way to look at it is from an elderly parent’s point of view.

1) If you bought your house in the 1970’s, your property taxes and insurance are likely $2k-$3K per year. Easily affordable on Social Security. If you didn’t own a house, your rent would likely exceed this per month.

2) If you decide to cash out your $60K house for $1.2M, you will not be a millionaire. You may owe CA and the Feds likely nearly $300K in taxes (after the 250K deduction) that your kids will never see.

The morals of the story if you have kids you care about is:

1) Buy early and stay as long as possible.

2) Buy in CA with Prop 13 to keep your taxes low.

Given that, I know many 80+ year olds selling their houses and moving to these $6K per month retirement communities. These communities transition to assisted-living as you need them when you reach 90+. Historically, at 90+, you would be invited into your child’s home. However, if you child has a 2 bedroom small rental house that won’t allow you to move in without sleeping on the sofa, you as a parent should live the life you earned and go live on a land-locked Cruise Ship by the sea. It’s your money.

And this is why Prop 13 is good. The 2% escalator per year let’s someone who’s held onto their house and paid off the mortgage and been responsible for ~30 years stay in their home on Social Security. I think that’s a great thing. Of course there are all kinds of side effects from a government policy, shocking… But can you imagine if this property tax was not locked in and millions of people that are relying on Social Security had to make their property tax payments??? The Prop 13 creators did a great thing for millions of people that were told Social Security would be there for them in retirement. As someone who is younger I know that not to be the case, but that’s another story…

Prop 13 had plenty of intended and unintended consequences. For the first 20 or so years after Prop 13 passed, everybody was happy. Now many people are realizing that their offspring may not be able to afford housing in the towns they grew up in and Prop 13 is a major factor to this. Read the comments on this blog from millennials, they all echo “we’ve been sold down the river by the boomers (your parents).”

I don’t like Prop 13, but it isn’t going anywhere soon!

I get both sides of the Prop 13 argument and how people feel locked out of the market because of high prices because of prop 13. I really think (only my opinion) that if there was no prop 13 the property prices would be relatively similar in coastal big cities, that’s where money flows. The bigger problem would be government constantly coming to property for more taxes/revenue. There only seems to be one solution for our CA government for all their fiscal issues, and that’s revenue/income. It’s crazy. In my business we look at the income side and EXPENSE side. It’s funny how the expense side never really seems to come up… Drives me crazy. I like how prop 13 limits their seemingly unending hunger for revenue for their ridiculous projects. I’m willing to pay a little more for a house in exchange for handcuffing the govt’s revenue stream.

“The morals of the story if you have kids you care about is:

1) Buy early and stay as long as possible.

2) Buy in CA with Prop 13 to keep your taxes low.”

This describes our situation perfectly. And for all the other reasons you listed, we’re not going anywhere anytime soon – modest house, great neighbors and neighborhood, manageable overhead costs, etc. More importantly, we’ve looked at a lot of the “best places to retire” – Florida, Texas, Costa Rica, you name it and no thanks – we’re good.

LA and California have their problems, but so does everywhere else, just different problems. We’ll keep getting the $2 Tuesday tacos at the Hot Red Bus in Alhambra and the $3 killer ice cream sandwiches at Baker Bear in La Canada. And seriously, who REALLY needs a zillion square feet in So. Cal. when you can live outdoors comfortably 9 months out of the year?

People are being quite rational. It’s easy to pull out equity to pick up a new place and turn around and rent out the old home. If you sell, where do you put the cash? The market isn’t that strong and renting is a leveraged return. That’s hard to beat and when an “emergency” comes up you still have the house you can sell.

No slow down in SoCal in the <2 mil range. Check out this gem:

redfin dot com/CA/San-Diego/621-Rushville-St-92037/home/4914494

Last Sold April 15th, 1975 – $50,500

Listed Now- $1,375,000

They'll probably get it too, a 2/1 just 2 streets overs recently sold for $1.55 mil

Call me when we actually institute serious taxes on foreign buyers and raise interest rates. Until then I'm not even looking at buying again seriously.

Vancouver instituted a 15% tax on foreigners and sales fell off a cliff MOMENTARILY, now, sales are back on very strong.

I think only a 50% tax would stop the relentless appetite by these foreigners

Little anecdote, in the 80’s the Japanese investors were on a buying spree in California. Remember the eighties? I don’t, I was just born but the doom and gloom news still remember it:

http://articles.latimes.com/1992-02-21/news/mn-2588_1_japanese-real-estate

http://www.businessinsider.com/japans-eighties-america-buying-spree-2014-9

Apparently, people were dumb back than because they were all convinced the Japanese would buy America. well, it’s easy to say that now isn’t it? after the fact that the Japanese lost their shirt? Fast forward a few decades and switch Japanese with Chinese and your find yourself in 2017. Once again people are convinced foreign investors will own it all and suggest buy now or be priced out forever. For my part, I’ll sit back and enjoy the show.

Up and until the boomers can no longer afford their tacos on Tuesdays, expect more of the same.

Also, people are planning to live longer and retire later. I’m in my mid ’60s with no immediate retirement plans. My Dad died at 84 with bad war wounds and smoking for 40+ years (he quit at 78). My Mom died at 96 (with a rough upbringing without good food or medical care always). I’m inside the recommended weight limits for my height and I’m fairly active. No one in my recent ancestry died of cancer. My modest suburban house is fine for us. (We’re looking into fixing it up this year, but not to sell.) We do have an adult child living with us, but they’re not the marrying kind. The choice is our house or an assisted living group home. And the government benefits they get pay for the care. So downsizing from 1500 sq ft isn’t an option. With no debt, nice neighbors, a good job within 25 miles and the California sunshine, why would I sell? Not every boomer is living for taco Tuesday and living with grown children who can’t go out on their own because of the economy. But there are some I know who might somewhat fit that bill; they are not particularly unhappy either.

My Stepmom died February. The caregivers have been squatting the house in Southern California since. I cannot enter the house, cannot check the mail, cannot go through personal belongings, they objected to me becoming Executor of the Will to prolong the process another 6 weeks. It has been an unbelievably frustrating process. Their time is almost run out, just waiting to get the Letters of Authority, but then I still have to give them a 30 day notice. All you can do is wait it out.

That is the reason is not worth buying a rental property in CA. What you get (in most cases a losing proposition) on the paper is different than what you get in reality. Those who talk about rentals in CA talk ONLY about theory. In practice, it doesn’t pencil out for most of the Landlords. For the most part, the rentals are very old houses, with lots of deferred maintenance in really bad shape. By the time you subtract ALL the maintenance cost, legal cost (@$250-300/hour) for dealing with squatters, unpaid rent you are already in a big hole even if you bought the place long time ago. Buying today, is a losing proposition from the start, due to high PMI and property taxes. After subtracting ALL the loses, year after year, selling cost, even that nominal increase on paper turns into a losing proposition.

I disagree. I have some late paying tenants, and have been stiffed. Just part of the business.

But you can avoid a lot of those headaches by renting to good tenants. I always price my rentals a bit below market and get to pick from a long list of applicants. My criteria is good credit, high income and steady employment. I said this before and I will say it again, nobody with a 750 fico score is going to blow their credit in order to get a few months of free rent. And someone who is responsible financially is extremely likely to be a responsible tenant as well.

I’d rather let a unit go empty than rent it out to a $30K millionaire type or someone with a bankruptcy in the past or anything like that.

I agree.

I would only invest in rental in a landlord friendly state in the mid-west.

There you will find more limited appreciation, but, strong cap rates/cash flow and laws that favor the owner. Buy/invest in a blue state and you’ll have high taxes (although many red states do as well) and have to spend thousands for months to get the deadbeats out.

“it doesn’t pencil out for most of the Landlords”

Right, that’s why no one’s doing it. This is about the dumbest thing I’ve ever seen you say.

I disagree, if the rental is not mortgaged, this is like printing money. There is not a whole lot of maintenance on a Stucco Crapshack, we don’t have weather.

Jed, if you read my previous posts you will know that I am a landlord and I’ve been a landlord for decades on many properties and in many different states.

Not only I have been and still am a landlord on many properties, after years of experience I accomplish what very few landlords accomplish – a clean (NET) profit of at least 12% per year with NO deferred maintenance. That is almost unheard in the industry. Of course it took me a long time to get a “gut feeling” for the type of property and type of tenants I am looking for – what Mr. Landlord already explained (he is correct).

You took my words out of context with the specific purpose to make it sound dumb (that is what most “journalists” from MSM writing fake news do all the time). If you read it again “slowly”, you will see that my comment was referring to rentals in most of SoCal due to a combination of factors which are very detrimental to landlords: bad legal system protecting the squaters at the expense of the owner of the property, very high prices to start with, and very old housing stock with lots of deferred maintenance. All these create a very pour ROI. I think I was very clear and you can not deny that.

JT, again, generalized the midwest with one big brush. Every single city is different, it is a distinct market with very specific factors influencing the rental market. Even at the bottom of the last recession I was able to do excellent on my rentals (temporarily down to 11% per year). Sometimes, the market varies from one zip code to the next and JT characterized the whole midwest with one sentence.

You can tell that Mr. Landlord is an actual landlord because he understands what tenants to look for – Costco demographics.

Slumlord: There is not a whole lot of maintenance on a Stucco Crapshack, we don’t have weather.

The primary cause for roof damage is not rain or snow, but sunlight.

Google “roof damage and sunlight.” Many articles on the subject.

The majority of the US population is renting. CA has more renters than the rest of the US. I agree that screening out bad tenants with a credit check is a good idea.

They should even be charged the nominal fee for the credit check at the time they are applying. No one with a good credit history who is responsible will destroy their entire credit record by squatting or refusing to pay rent.

With our one rental our tenant pays on time every month., However, I do see the tenant adding more people to cover the rent. That is indicative of the times when one person cannot cover the entire rent and that is more wear and tear on the property. I ask less than the average rate, but there are a lot of people who still can’t afford it., I don’t think a standard lease can forbid “guests” ie girlfriends, boyfriends from sleeping over on a regular basis. Or from older children of the tenants parking their cars on the street.

If wages were higher, these extra tenants would likely find a place of their own. Except the girlfriend/boyfriend who wouldn’t live there but would have a place to call home if they desired.

Flyover, you can’t honestly slam real journalists, yet fall for a propaganda site like Zero Hedge all the time?

I mean, this article was written well before the current Russia thing was in the public’s eye. Zero Hedge is awful: http://www.smh.com.au/business/media-and-marketing/unmasking-the-men-behind-zero-hedge-wall-streets-renegade-blog-20160429-goit31.html

GH, I don’t care who is behind every journal/site. All I care is the article and content.

Let me ask you now – who is behind CNN, MSNBC, NBC, Huffington Post, Washington Post, and NY Times? Regardless of who is, they are propaganda means for the globalists and I care less what they say. If you enjoy them, continue reading them. I am not going to stop you. As for me, I am not going to lose my time with propaganda rags.

Like I said before, in the first part of my life I heard enough propaganda to last me a lifetime. Also for me, the communists and NWO globalists are the same in goals and practice. You can never convince me to like them – I suffered enough for few decades under communism. I am talking about what the NWO/globalists themselves say.

That really sucks. I’m surprised squatting isn’t more of an issue yet with all of the luxury homes available nowadays. Maybe it will pick up soon?

If the fractional reserve bank system prints up on avrrage 38 debt dollars for every dollar borrowed and they compete equally with and bid agaibst every dollar of savings in housibg, minus the government, and press propaganda kickbacks, then housing, but for the banksters slave owning desires and governments control of the masses desires, houses are a number Times 30 ovrrpriced, or freedom was lost to fascists…divided by 30 is freedom

There are capital controls in place since 2016 january that puts a tax equivalent to 35 percent on everything an expatriot expat has, aof the highedt rate of evaluation or assessment the property properties ever reached…fascist prison state Usa

Plus 6 percent commIssion..?…plus 3 percent obama fees, plus 3 percent fees..=== and any other rentier bloodsuckibg looters take likely gone…ye haw…leave….50 percent poorer to avoid pOVerty..

And therefor the hiuse us 68 percent again price raised to profit….sucker….

If they only own one property and not multiple like jt is talking about than many boomers are stuck due to property tax reasons. Prop 13 is keeping many older people in their homes. My mom has a lot of equity in her house here in CA because she bought low but moving would increase her taxes to unaffordable levels for her income level. Current high prices increase the taxes and many flyover areas have 2-3 times the property taxes of CA so that is not always and affordable option, plus many people don’t want to move when they are older, they need to stay near to their family and familiar comforts.

Lucky for her I have never moved backed in with her during my adult life but I do always remind her how lucky boomers are to be able to own something. For us millenials it is largely hopeless. I did a mortgage calculator on the average house in my Bay Area town and the average crapshack is $850k. That would take around $200k cash for the down payment and closing costs and then with the mortgage, taxes, insurance and average utility costs it would be $5,000 a month and then you have maintenance costs on top of that and the random tax adjustments which could raise that payment even higher over the next 30 years. I make decent money and that is so beyond affordable it ridiculous! And that is just for the average 60s crapshack with a tiny yard, anything nice here is $1mil plus which would cost way more!

Back in the early ’60s our family stayed in a cabin for a vacation that belonged to a friend of my Dad in rural N. California. The water was from a diverted creek that ran past the place. Milk came from a cow on the property. There was an outhouse. It was Summer so we weren’t cold, but I’ll bet that place is cold in the Winter! That… is a crapshack. A ’60s tract house would be a veritable palace compared to that place. I doubt you really need a McMansion so suck it up or move on.

This is a good comment and the numbers are accurate. Older people are comfortable, get the SS checks and have a paid off house with about 750-900 k equity. Moving when you’re 70 is traumatic and describes my parents to a T

Now imagine the 5k + family expenses with a couple of kids. So unaffordable and feels like it’s unfair, but, that’s the market. Beyond frustrating.

Thank you Dan for the sanity conformation. Everyone else makes me feel like a whiny crazy person. I’m just stating facts. Most boomers couldn’t afford their houses at today’s prices and certainly couldn’t afford multiple rental properties. These delusional comments on here from certain people just confirm the trust fund mindset of most of California these days, where people can’t understand that normal working people with decent jobs have limited income! I for one am for Prop 13, I wouldn’t want to see my Mom on the streets after paying for her house for 30 years and working 50 hour weeks to pay for it and then have some trust fund investor creep or tech asshole from Iowa in his sexy new Audi buy her house for $700k. I am glad to have her locked into an affordable tax base and I am glad to inherit that tax base which will probably finally give me an affordable place to retire when I am her age in our family house because rents then will be like $20,000 a month for a ghetto apartment and what middle class of retired person can pay that!?

If Prop 13 was altered or removed it should be for commercial property which would help out the tax base for the state and makes sense since businesses are always growing and changing with the times. I don’t want to see older hard working people out out of their homes by deuchbags and I think Prop 13 and the property tax % is one of the best thing that CA has going for it.

PS. I apologize for spelling errors, apparently my iPhone likes to change words with spell check to the wrong words a lot.

Priced out,

You have a valid point about Prop 13. I think it is good and ideally people should not pay any taxes on their property (they already paid taxes on the money they buy with).

That being said, it is evil to tax a young couple trying to raise a family 10 times what Warren Buffet pays on 22 million property. The old property taxes should be used as a reference and tax the new buyers more or less like the old buyers (use a Board of Equalization). After all, all people use the same roads, libraries, schools and fire stations more or less the same.

Those who bought 30 or 40 years ago are also the wealthiest today. Why should the poor who buy today pay so much more in taxes? That is the most REGRESSIVE form of taxation. It is enough the young couples have to pay a million for a house which 30 years ago they would have paid $100k. Do they have to pay prop. taxes ten times more?

Again, to avoid any confusion, I am against property taxes, period. If the government thieves want to steal, at least they should steal in a fair way based on comparative value of the property (use a Board of Equalization). But do we ever see honest/fair thieves???…

” For us millenials it is largely hopeless.”

Are you serious? Every generation faces the same struggles. But, being young is everything. I am retired in my 40s. But, I would give up all material items, but keep the wife and kids, to be 20s again. Time is everything. So is an optimistic attitude.

Lol,bwahahahahaa!!!!!! Are you serious? Older generations had it waaaay easier buying property. I don’t know any boomers making $200-300k and even boomer I know owns a house or two and maybe a vacation house in Tahoe or some lake somewhere. I work my ass off 6 days a week and make over $100k and I only qualify for a $450-550k house which would cost me a big chunk of my income and the cheapest house in my area is $3-400k more than that, so I would need to make another $100 plus thousand a year to buy here. In cheaper housing areas of CA I would t make as much $ so it would balance out even if I was willing to move, I’ve looked at jobs elsewhere and have seen the numbers.

Honestly I can’t believe that people think it’s that easy to put $200k down on a house, or including savings for retirement, average backup/solid saving plus living expenses.

The truth that jt obviously doesn’t get is that most millenials are being forced to pay super high rents and either can’t save any money or their saving could get them an average priced $200-400k house but those don’t exist here anymore!!!!!

PricedOut,

the last buying opportunity was between 2009-2012. That was only 5-8 years ago. Since 2013 prices have surged due to manipulation/market distortion and you have no rental parity meaning its much smarter to rent and wait for the next downturn. RE cycles are within the 10 year range. As we all know the crash is coming. So, by 2019-2022 we should have another buying opportunity. That’s great news for people on the sidelines. 2-5 years more of saving lots of cash while enjoying flexibility as a renter. It’s much less stressful to rent from a private landlord long term at a highly discounted rate than trying to buy a house during a bubble. The way I see it, my landlord is giving me a huge gift. You need to have the glass is half full mind set and abandon the California drive-thru mentality and instant gratification need. This situation/market has nothing to do with fairness…you cannot expect fairness from the world. You need to look at yourself and have some discipline and be thankful for what you already have. If you put your happiness in temporary things, your happiness will be temporary. On the other hand, there are people who really suffer in California and cant live with their parents….for those people its probably better to move on to greener pastures somewhere else. And there are some millennials I know that struggle financially but have the opportunity to live with their parents. These kids tend to not leave California or might give it a shot to live in another state but decide to come back to Mom’s hotel.

Millennial, I agree that the market is at a peak but currently the extreme lack of inventory isn’t too promising that it will crash anytime soon. I am grateful for what I have but I feel the point of this blog is the ridiculousness of this current housing situation, so I don’t mean to come off as negative but just putting the steaming pile of bullshit into real and basic terms. The truth for our generation is that we have to make the inflationary equivalent of 5 times out parents to buy a house today and for most without family money that is impossible and/or imporabable at these ridiculous prices and with what 90% of real jobs and careers actually pay. Let me ask you, do you have $200k cash for a house down payment? Could you pay $4-6k a month for a house for 30 years? If your answer is yes then is your place of employment hiring? I’m supposed to be in he too 10% of America or something with my income and here in the Bay Area I am working/lower class in the current economic climate.

Priced Out, I made this statement many times on this blog – it doesn’t matter how much you make. What counts is what can you buy after ALL the taxes you pay.

In Zimbabwe everyone is a billionaire. That doesn’t mean they can a afford a good standard of living. In SF you need at least $500,000 per year to afford a decent standard of living. If you earn a lot, you pay top % in taxes. If you earn a lot, most likely you live in a high cost of living where you can not save anything. If you do your homework well and know math, you may discover places in flyover country which can give you a far better standard of living even if you earn less than $100,000. I am not saying that can happen everywhere. You have to search each individual city which offers employment in your field and compare.

It’s not hopeless.. if you want to own check out other parts of the US.

@PricedOut

I hate to burst your bubble (pun intended) but making a $100K a year is not that much money (especially in the Bay Area). My dad made that in the 80s. It was good money then, maybe even in the early 90s.

My first min wage job was $4.25. Based on 2080hrs a year that’s $8840. Now you have baristas making $15/HR X 2080 (40hrs/wk X 5 days) making $31,200 a year. So how does it feel to make 100k working 6 days a week? It should make you feel pissed.

I don’t want to brag because I’m certainly not considered wealthy here in LA but I’m making just over $200K year for working around 12-14 days a month. Pension is gone but company puts 16% of my pay into 401K (maxes out and contributes the rest on Jan 1). We have excellent healthcare. My pay will increase to over 300K within the next 10 years or so. My wife also works a regular job and makes about $90k plus bonus. Life is good. I’m also not a boomer. I paid my dues for years though.

I’m thankful for our union negotiation. I look at these tech guys working for say Google making mid six figures. Meanwhile Google made nearly double my companies revenue ($90Billion) yet their average employee pay is less. That’s what you get without a labor contract.

I have a few friends who work for the port authority. Something I also considered once. Average pay is $150K plus another 35K in benefits. Two brothers I went to high school with (that barely graduated) are easily pulling down $200K plus. Mind you these are not doctors, lawyers, not very educated people.

I know it doesn’t seem like it but there are plenty of people making a lot more money than you. They are just not in your circle. There are 13,500 of us in our labor group at my company and I know what everyone is making based on seniority. There are no games. There are no favorites for promotion. You are a number based on date of hire The longer you put in the more you make while working less hours.

And the more you make the more everyone else has to pay. That’s why unions are dead outside of govt and a industries like airlines.

That’s why I work for the airlines. 😉

Burbank is a wonderful place to live and retire. The only people that move out are in a box. Once they come, they never leave any other way. Burbank homes are just the right size. Too small for many people to live in, e.g. 1,450 is average size, unlike the suburbs where the occupancy is so high which brings noise and undesirables, if you know what I mean.

A couple of comments … as homeowners age in place, the maintenance and upkeep of those homes begins to become a lower and lower priority. Having gone through this with 2 set of parents, I can assure you that this happens even to those who have the means to keep up with things! We sold my Mom’s house in So. Cal. as is for 7 figures. My Wife’s brother kept their folks home and has spent down much of his savings in the proverbial ‘money pit’! I’d be safe in saying that as these Californians age in place, there will be many homes that will simply need to be bulldozed! Second comment, as we travel extensively, and this ‘age in place because I can’t afford to move’ phenomena is common up and down the west coast based on people we talk to. But, I do see more young people and more vibrant urban cores in places like Seattle, Denver, and Portland, than I’ve ever seen in L.A. … makes me wonder if the young smart ones are fleeing places like So. Cal.

I visited an open house in Santa Monica for a 1920s craftsman house offered at $2.6 million.

Inside, it looked like a slum dwelling. Decades old carpet. Kitchen at least a half century old. Decades old linoleum tiles. Sagging paneled walls from the 1970s.

The realtor confirmed that it was a tear down.

A HUGE lot in Santa Monica’s northeast area, north of Wilshire. Hence the huge price tag for a slum dwelling.

I suppose the Taco Tuesday owner finally died, and his/her heirs are cashing in.

@son of landlord…you still looking for property in SM? Whats your idea on this? It seems to be wayyy overvalued to me. Im looking at picking up another piece of property but Santa Monica seems cray prices. Shed some light on your thoughts…

I wasn’t considering that house. I live in Santa Monica and was passing by. An open house happened to be in progress, so I went in out of curiosity.

Yet not matter how highly priced, prices still seem to be rising even more crazily. This $1.7 million townhouse just went pending: https://www.redfin.com/CA/Santa-Monica/846-21st-St-90403/unit-3/home/8113402

I can’t believe how much people are paying for mere townhouses.

So the argument of cheap credit, business cycle, recession would not apply to these retired house rich boomers who intend on sitting in their million dollar free and clear house until they die (my parents included) AND the Chinese millionaire buying cash.

So, low supply and strong foreign demand; where/how will this crash occur? This is a serious question, and not just RE cheerleading; however, I would like some further analysis than the typical Yellen/zerohedge/nobody has a decent job argument.

Dude, there are endless reasons why the crash is coming. You think old farts sitting on RE make a difference? The only acceptable question in this context is WHEN will the crash happen. For that, you need a crystal ball or simply some patience.

Well did you actually read the article? Turnover is extremely low and those “old farts” are going to sit in their paid off houses b/c a recession will not matter to them since they are all on fixed incomes.

Looks to me like they are not planning on selling any time soon and yes that does affect the market b/c it limits the already tight inventory.

If you are in your 20’s and stacking cashola, then it doesn’t matter that much. But, if you are in your 30’s, 40’s, 50’s and have a family and want to buy to settle, then ya it does.

One word, Heathcare.

The whole industry is focused around milking as much life savings and wealth from the boomers final years.

Retirees may not cash out now because life is good and the tacos are cheap, but when their age catches up and they are no longer able to wipe their own asses, the priorities will change. They will need cash to pay for home health care or nursing facilities, and their over extended dual income children will not have the time or money to help. They will sell, or reverse mortgages their way out of the mess.

There will be no house or wealth to inherit, just an old ass to wipe.

Been thinking about this recently.

I think reverse mortgages will be on the uptick in the next few years as they will allow these boomers to remain in their homes.

Reverses are pretty expensive, but, seems boomers will have no choice.

The fact that you still assume that investors are buying with cash tells me that you’re not seriously considering to any opposing point of view. Why would RE investors not take advantage of the largest expansion of cheap debt in modern history? Do explain how an ordinary Chinese investor would be sneaking out millions of dollars when the Chinese government only allows $50K per year.

I absolutely consider all points of view and constantly have an evolving opinion. I would say you (and millennial) are the ones too stubborn and blinded by articles on doomer sites to consider opposing views.

And yes, there are still cash investors I see it every day in the industry. As a lender/ broker who pre-approves buyers, that report back after a couple months of bidding on properties and as a buyer that has wrote offers on several properties; I can assure you with certainty that Chinese cash investors still exist.

I also don’t think it’s so easy for a govt to keep track of 1 million millionaires and 1.2 billion people.

As a prospective buyer I would love nothing more than to see a pull back in the market (crash),however, to ignore many of the realties affecting and distorting the market is nieve. I cannot speak for the rest of the country, but, for CA demand is strong and supply is extremely tight and to deny these basic facts means you are not serious or open about debate.

What makes me a doom and gloomer?

What doom and gloom sites have I cited?

The Chinese government has a restriction of 50k/year per person that can be transferred overseas. How are they buying millions in real estate without borrowing it?

Prince,

It’s cute that you think a “law” in a communist country means anything. These laws are nothing but a way for bureaucrats to make extra income via bribes. I thought everyone knew that.

POH,

You often cite zerohedge (which I read daily) however I believe contains way to much fear porn n Doom and gloom content. That is what I was referencing below.

Furthermore, just bc it’s illegal to immigrate to the US doesn’t mean people don’t find ways to do it (easily). That is a response to your 50k Chinese limit.

Lastly, interesting article: https://www.mingtiandi.com/real-estate/outbound-investment/us-still-tops-the-list-for-migrating-chinese-millionaires/

Part of the article seems to support your thesis that Chinese cash is drying up due to capital controls or becoming “increasingly challenging” to get money overseas. But, also think about the raw numbers, according to the same article there are 800,000 MILLIONAIRES in China that want to emigrate aka buy property in English speaking countries with popular cities on the west coast of the US being a favorite Target. 800k!!! Even if only 1% are looking at CA and can get their money out, that’s still a big number!

In filtering for 5 cities with my criteria there were probably 100 total houses on the market.

Think about that supply versus demand (of only Chinese buyers).

Another interesting article (from one of your favorite sources) http://www.zerohedge.com/news/2017-07-26/spot-outlier-seattle-home-prices-go-vertical-laundered-chinese-money-flows

Looks like these guys are finding ways around that 50k cap

@Dan