Where did the California foreclosures go? Level of foreclosures sales dramatically down. Foreclosure legislation and bank processing. Subsidizing investor purchases via HAFA.

Foreclosure sales usually come at a deeper discount than non-distressed home sales. For many years, the mixture of foreclosure sales and non-distressed sales was distorted especially in California where the housing market faced a deep correction. The peak occurred in early 2009 when 58 percent of sales were foreclosure re-sales (today it is down at 13 percent). This past year or so, foreclosure re-sales became a tiny portion of total sales so the median price reflects a much higher price because of this shfit. For example, the median price is up 28 percent according to the California Association of Realtors or 22 percent according to DataQuick. The Case Shiller, a better measure has price up over 10+ percent which is still very strong. This is an unbelievable pace and is clearly unsupportable. I think that goes without saying but what will be interesting moving forward is how year-over-year data will be impacted as the shift in the selling mixture will start to emerge. So where did all the foreclosures go?

Foreclosures

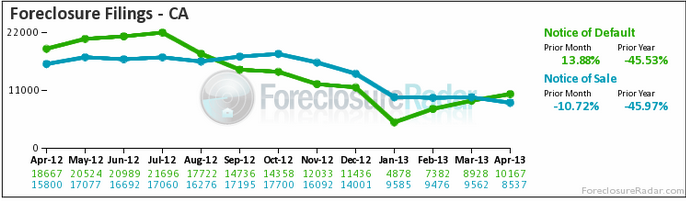

In California foreclosure filings are down 45 percent year-over-year but are up 13 percent over the last month:

The notice of default is the first stage of the process. This is usually sent out after three missed payments but in California with the California Homeowner Bill of Rights, this process might be delayed even further. In California the time to foreclose is about 300 days (almost one full year).

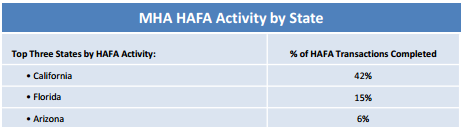

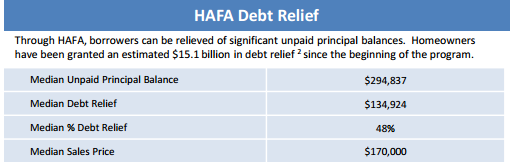

The bailout of the banking industry was under the pretense that it would help the average homeowner. What is interesting, is that we are now subsidizing the foreclosure process for many of these homes to be sold to investors. In California, roughly one-third of home sales for the last couple of years have gone to investors. HAFA (Home Affordable Alternative Program) has made the process of selling distressed homes much easier via short-sales and deed-in-lieu of foreclosure. Take a look at where most of this has occurred:

42 percent of all HAFA activity has occurred in California. This has not come at a low price:

What is troubling about this is that many regular homeowners would like to buy these homes if they were actually on the market. In fact, many would pay fair market value if these homes made it to inventory in a more normal fashion instead of going through the labyrinth of government programs and bank alternative-accounting standards. Instead, these large cuts in balances are feeding into the investor frenzy. The end result is a dragged out foreclosure process and the market suffers with a lack of inventory.

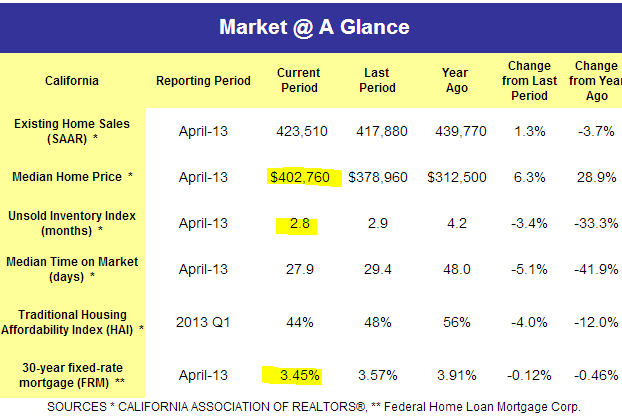

You don’t think inventory is low? Take a look at this:

California only has 2.8 months of inventory. This is incredibly low. The median price according to CAR is now over $400,000 and the current 30-year fixed rate mortgage is hovering around 3.45 percent. A healthier market would have six months of inventory. Anything below and you are in a seller’s market and anything above and you are in a buyer’s market. Anyone shopping for a home today can clearly tell that this is a seller’s market.

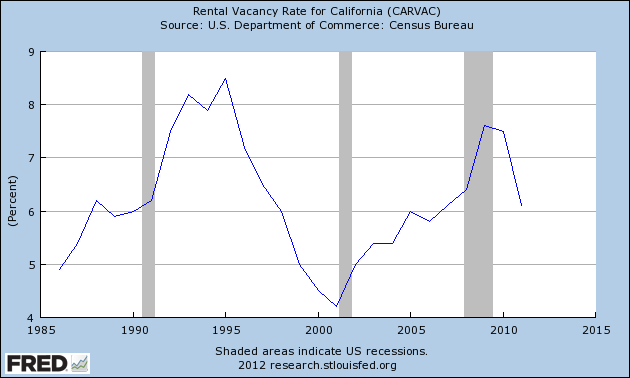

The massive price gains are coming because of low inventory, low interest rates, and high investor demand. California has added about http://www.doctorhousingbubble.com/renting-generation-homeownership-rates-by-age-ownership-rates-renters/1 million more renters since the peak in the housing bubble and rental supply has increased in places like Sacramento and the Inland Empire. Take a look at the rental vacancy rate:

Affordability isn’t all that great when home prices are going up 20+ percent each and every year with no subsequent gains in household incomes. Unless mortgage rates can go into the 0 to 1 percent range, we might be tapping out on this for leverage. With inflation at about 3 percent and mortgage rates at around 3.45 percent, this is virtually free money. The Fed wants you to spend and they want you to spend it on housing. With the amount of inventory on the market and investor demand, get those personalized letters ready and keep those family photos handy because sellers are in the driver’s seat in today’s market.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

18 Responses to “Where did the California foreclosures go? Level of foreclosures sales dramatically down. Foreclosure legislation and bank processing. Subsidizing investor purchases via HAFA.”

The “smart money”, i.e. hedge funds, sold out months ago after having bought in when there was blood in the water. As long as Joe six-pack’s income isn’t rising, real estate valuations and rental costs will hit a ceiling. Just as the stock markets are by majority traded between a few, flipping shares shares back and forth, I get the feeling that the current “buyers” of real estate are playing a similar game. These rising markets built on faux foundations may tumble. Pay attention to the cracks.

Who will be left holding the hot potato when the music stops?

Why, taxpayers will be left holding the bag, again, of course.

Sacramento update: Inventory is starting to build at all price levels. The foreclosures that are being released are overpriced with no opportunity for a fix and flip, so after a few weeks banks are having to reduce their price. Opportunity for the long term owner occupied with low interest rates is still attractive. The big price run up from the last year has made the cash flow for renting not very attractive. I think the most optimistic scenario would be a consolidation phase now. I think appreciation has run its course for this cycle. Hopefully, prices will not start declining.

Why on earth do you hope that prices won’t be declining? Seems like a market correction in long overdue, at least if you want would – be homeowners to have a chance at actually buying a home to live in for the long – term.

This fast price run-up is making people suspicious. The crash is still fresh enough in memory to make people wary when things move too fast. I’ve noticed the homes in the $1M range have a lot of lookers, but very cautious buyers.

When you see incentives for renters Such as free rent, 250 dollar gift cards etc. You know the rental market is soft but the large institutional investors must hold the foreclosure houses for 5 years so they can’t sell which means we will have a glut of homes eventually again. The house prices are unsustainable they over sold these tulips and there is no way around it.

Rental Market soft? Where do you live, Vegas? Arizona? Maybe one of the neighborhoods about 90 minutes from L.A. ending in “ville”, “lanto”, or “dale”?

Why do hedgefunds have to hold for 5 years? I think they will flip as they realize CAP yield goes down and prices up.

PS. There just isn’t enough reality on the planet to pay back all the debt. Unless we start selling RE on Mars? Except that debt will also be monetized. … hmmmmm Such a Wagner.

There’s plenty of reality in MY life, enough to pay off the debt of a dozen countries. My mom has Alzheimer’s, I can’t find a job, and my ticker is misfiring. What a Wagner is right! The Ride of the Valkyries!

Who sets the prices for the banks when they off load houses in 90064? Last month some bank offered a foreclosure to a select group of cash bidders on my street. The winning bid was 515. After two weeks, this flipper listed and sold the house for 580. Are these banks really that disconnected from reality? The house was bought by a neighbor on the next street over and is now being rehabed as a keeper. All the above commentary on the rental market is a joke. Houses in this neighborhood rent for premium rates as soon as they are listed.

$515 in 90064? Is that a 1bd condo or something else?

Quick flips are still happening often. I looked at a house in Encino today that was purchased for $715k a few weeks ago and was just listed for $799. It needs to be completely remodeled. It was bought by an investor who is going to easily make $80k+ profit in less than 2 months.

515k in 90064 3bdr 1 bath. Look it up on Zillow. As I say, the bank mispriced it. They have no clue as to the actual market any more than the academic commentators on this site have as to rental pricing and demand in my area. The more drivel I read on this site, the more I am convinced of it’s overall worthlessness.

Dr. HB asks: “Where did the California foreclosures go?”

Answer: They are now rentals, courtesy of the Federal Reserve, as of 4-5-2012. Which means that member banks (i.e. Bank of America, Wells Fargo, U.S. Bank, Goldman Sachs, etc), were petitioning the Federal Reserve to allow this at least a year prior, say April 2011.

(read below, have fun)

http://www.federalreserve.gov/bankinforeg/srletters/sr1205.htm

“In light of the current extraordinary conditions in housing markets, the policy statement indicates that banking organizations may rent one- to four-family residential OREO properties without having to demonstrate continuous active marketing of the properties, provided suitable policies and procedures are followed.”

For those with reading comprehension issues regarding Fed speak, this means that banks became the largest landlords in the U.S. on April 5, 2012.

Sheeple have short term memories! This bubble is just another in a long line of bubbles but this time no backstop and price fixing by the govt, treasury and fed will help. The sheeple buy homes but forget about everything that it entails. With rates shooting up a full pt this past week and more of that to come, this is setting up to another blow up and again I will enjoy it from the sidelines. Trying to make so few whole by sacrificing the rest of the sheeple will cause some huge problems now starting to surface..

Debtpushers are worse than drug pushers…the tax write off for that home is gone….this is a suckers game and it’s almost filled…

Holy short sale, Batman! I’m more confused than ever! I am looking to buy outside the Sacramento are and am a bit spooked now. It’s seems like a feeding frenzy out there. Realtors are telling me to buy anything I can or I will miss out. Rents are higher than hell and yet they are snapped up as soon as they are listed. I could use the Tax deduction on a home, but don’t want to expose myself to the 2005 type scenario.

I guess I’ll just move to one of the shelters…. (sigh)

Leave a Reply to FTH@