California big purchase sentiment at bubble levels: The psychology behind house lust.

You would have a hard time believing it but California’s homeownership rate is near a generational low but the good news is that hipster pants couldn’t get any tighter without turning into spandex. A large part of the state is now fully praying at the altar of real estate mania lighting incense for the HGTV gods to bring granite countertops alongside host with upgraded body parts. It is an odd sort of Hollywood herd mentality but this is how we do things here in California. While the majority of L.A. County lives in rental Armageddon you have geriatric house humpers salivating at the Botox stretched mouth when a crap shack hits the market. “This makes total sense with a 20 percent down payment! They don’t make land anymore!â€Â They also don’t make more time and life is too short chasing crap shacks. But for some, the crap shack is the ultimate dream like sipping hard liquor in the Caribbean. The culmination of all financial success is being in debt for a beat up house and this is the race many are trying to run.

Housing mania running wild

It is understandable the wish to own a home but $700,000 for a shoddy drywall reinforced shack? And many people will lock into this and take out a 30 year mortgage and then endure the health destroying commutes of Southern California just to keep the “nest†paid while the weight packs on and heart arteries clog up. But damn it feels good to own a home! People deep down know something is off. This is why the public still inquires and debates. If the decision to buy were so clear cut, housing cheerleaders would be out in the market buying every property they could get their hands on assuming they actually fully believed in their thesis. But they don’t fully believe in it. They don’t want to admit in that fleeting thing called luck. And that is the rub of delusion and mania.

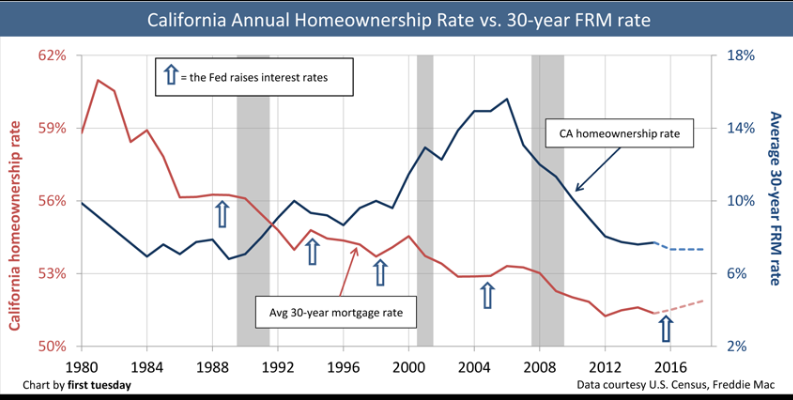

Housing mania is running at full force. But what is different this time in California is that instead of the homeownership going up with the mania, the homeownership rate went down yet mania went up. Is this because marijuana is now legal that things are surreal? No, it just means fewer hands are owning property and big investors have turned many homes into single family rentals.

As it turns out, even the whiff of housing lust is enough to get people to go nuts like cats near catnip.

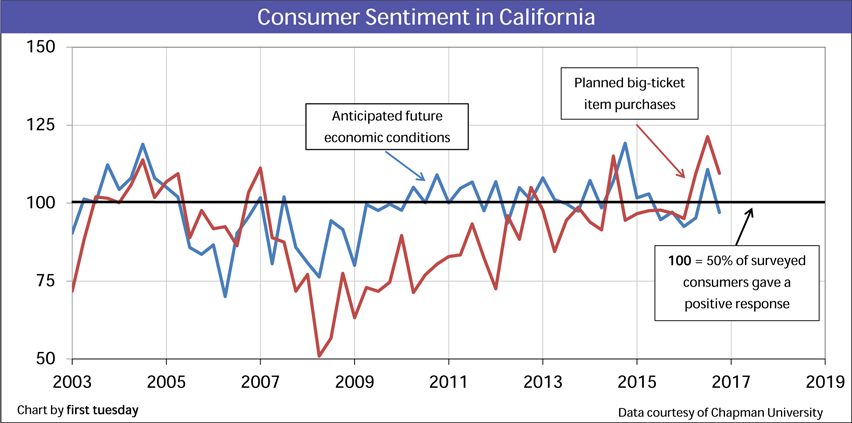

The market is seeing some manic pricing. And consumer sentiment in California is near the levels last seen during the last bubble. People are itching to spend and crap shacks (or cars, refrigerators, TVs, iPhones, etc) are at the top of their list:

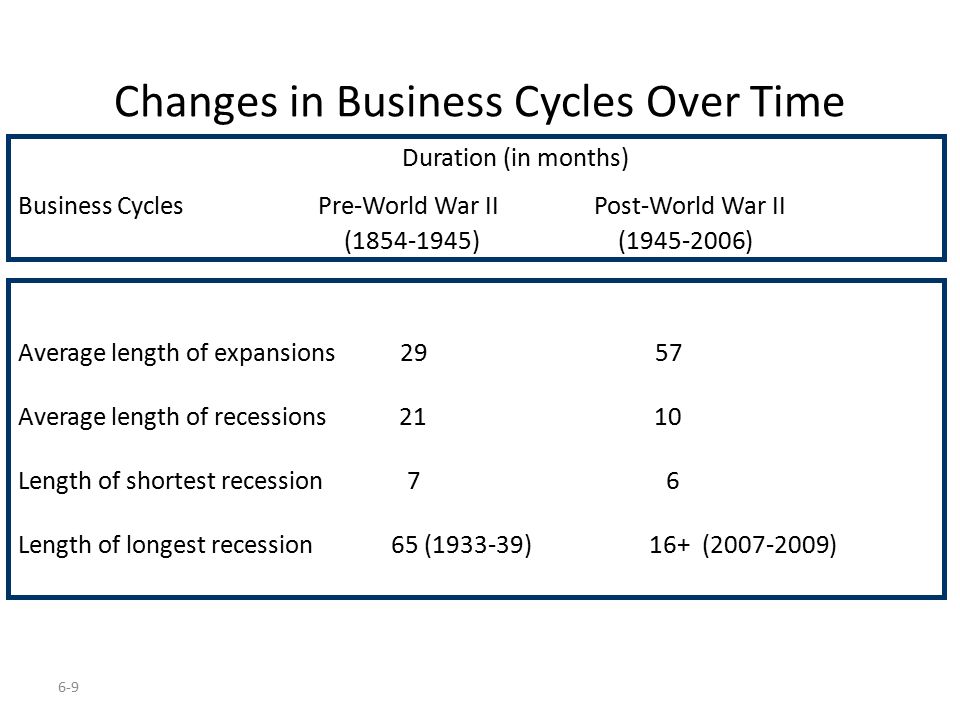

People assume that things only go up. They forget about a thing called the business cycle. The last recession officially ended in the summer of 2009. So here we are going into year eight of the recovery. Keep in mind this is an epic recovery based on historical data:

Even in the post-World War II era the average length of an expansion is 57 months. We’ve blown right past that. This June we will hit 84 months of expansion. What is interesting is that our last Great Recession only lasted 16 months which wasn’t all that much more compared to the historical average of 10 months. Of course the magnitude was much more profound. Have people forgotten that recessions are a typical part of the business cycle? It is also important to note that the Great Recession was the worst recession since the Great Depression in terms of economic impact, and it only lasted officially 16 months. Welcome to La La Land.

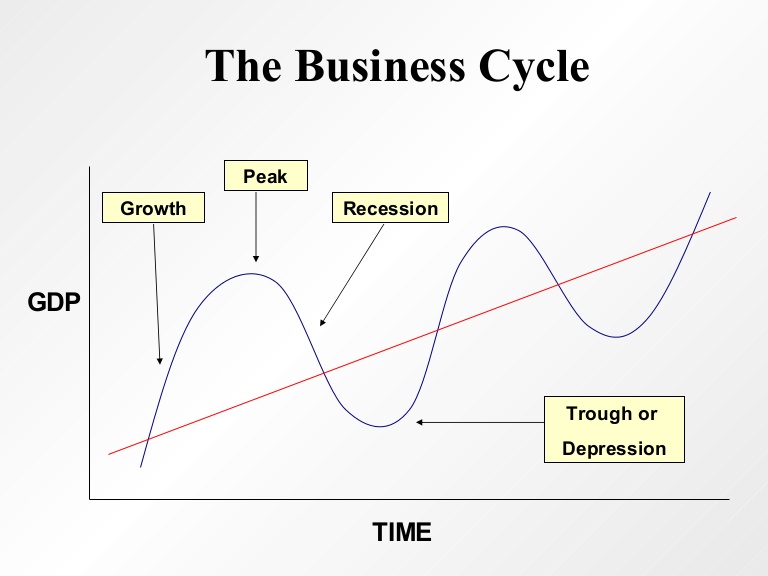

Taking a pulse on sentiment and you would think all is well and we’re in for epic good times. Black Swans by definition are unpredictable but what we can comfortably predict is that the business cycle will show up again and probably sooner rather than later. This is something that is well studied in economics:

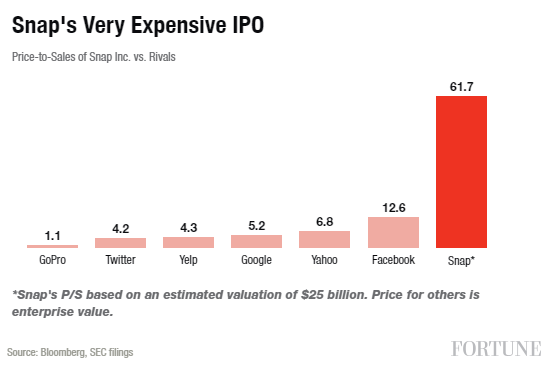

You can only call a peak once a bust has started. So by definition, these are hard to predict. But just look at all the absurd crap shacks out in the market like million dollar shacks in the Bay Area. And valuations are all out of whack in real estate and tech companies. Just look at the potential Snapchat IPO:

Funny that the ticker symbol will be SNAP (which coincidentally is also the nation’s food stamp program). Mania’s have a weird way of playing with people. It takes living through a couple of housing bubbles and business cycles to understand that while history doesn’t repeat, it does auto-tune and rhyme.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

167 Responses to “California big purchase sentiment at bubble levels: The psychology behind house lust.”

This zany rocket ship ride will crash spectacularly sooner than later. But look at the bright side. There’s never been a better time to have The KING OF DEBT occupying the Oval Office.

In the history books, the King of Debt will be known as Barrack Hussein Obama.

Dude ran up more debt than everybody before him combined. Yes, he was dealt a bad hand but did NOTHING to reel in the absurd spending that future generations will be on the hook for. So sad!

I always find this odd that this is never talked about because he was so in bed with the media.

Sources, please.

Blaming Obama for our national debt makes as much sense as me forcing you to buy a house that is $10 trillion underwater… And has ARM balloon payments due every year… And you aren’t allowed to sell the house.

He actually managed to pay the bills on time and actually cut down the yearly deficit. Other than ACA care… Name a single expensive program he initiated. Trump is about to build a useless wall.

Maru, you need sources for the claim that Obama increased debt astronomically? Even Democrats agree on that. Their only point of disagreement is that they’ll claim it was a good thing that Obama “invested” so much in “public spending.”

Maru,

sources for which? Obingo in bed with the media or the debt?

but here’s a good example, do you know that the best way to remember which countries are on the Trump not really a ban list? Take the 5 that Obingo bombed to smithereens and add Sudan and Iran…..the press doesn’t talk about how many bombs Obingo dropped in the middle east, why?

does the number 26,171 mean anything to you….3 an hour every hour of every day? Well if that was how many bombs Trump dropped I’ll bet you it sure would……BTW that was Obingo’s 2016 total…and the media……crickets…..but then the media gets on it’s soap box and tells us that the Trump BAN is going to empower ISIS……..as if 26,171 bombs didn’t or won’t.

“if don’t read the news you are uninformed, if you do read the news you are misinformed”

@Maru,

I’m not going to waste my time referencing sources for my statements. Do some research yourself if you don’t believe me.

You seriously must not have been paying attention to what was going on the last 8 years. Bush spent like a drunken sailor, Obama took it to a whole different level. That is a fact. (Source: Lord Blankfein, 2017)

AnthonyRingo – we have a lot of Taco Tuesday baby boomers here who are right-wing loons. So, don’t say anything about the Kenyan communist Muslim lizard-man sent to rule us by the IMF, mKay? You’ll just trigger paragraphs and paragraphs of stuff copied from Infowars.

I’m not an Obama fan, but let’s get some facts into this. The deficit consistently grew smaller under him.

Click below and see the chart called “Federal surplus or deficit by quarter”.

It never ceases to amaze me how ignorant Americans are when it comes to debt and deficit.

I don’t think anyone ever exploded our debt on a percentage basis more than Reagan.

https://www.washingtonpost.com/news/the-fix/wp/2015/01/07/the-story-behind-obama-and-the-national-debt-in-7-charts/?utm_term=.0330ce46c0a6

Mike: The deficit consistently grew smaller under [Obama]. … I don’t think anyone ever exploded our debt on a percentage basis more than Reagan.

Deficit and debt are two different items. You’re comparing the deficit under Obama to the debt under Regan, which is meaningless.

People here are saying that debt grew under Obama. This is a fact. Your citing the deficit under Obama does not refute this fact.

Mike,

Debt grew under Obama per your article from $10B to $18B.

The GDP grew so people like to point to debt as a % of GDP… GDP can be wiped out in an instant…. but never forget, debt grew astronomically under Obama.

While GDP can be eroded, that debt will still be there.

The deficit was reduced by taxing more, not by spending less.

When you tax more, you take more from the private sector and increase the government bureaucracy. The government taxation is a drain on main street economy. The government is a cancer/tumor on the private sector and takes out the life from the producers. The government never produces wealth; they consume wealth and kill the host.

@Flyover

I agree, but it’s not limited to governments, and not all governments are created equally. Some have sovereign wealth funds, which completely change the concepts most Americans understand. We need to nationalize things like our oil and gas, or all of are minerals. We already have the government entities that could do it, BLM, MMS, IRS to name a few.

For instance, I am from Alaska, and most people have probably heard of the Permanent Fund Dividend, created around 1980, and operating like a SWF, dishing out about $1-2k per person, per year. Imagine if all the mineral rights to our nations resources were not just leased at auction, but if we just had the government have corporations bid on contracts to do the EPC (like Haliburton, Schlumberger, etc..) and they / investors get paid, but the bulk of the profit from the rest of the oil, gold, natural gas, etc.. goes to the national treasury to fund things are tax dollars are currently funding.

You know it’s a novel idea when it upsets capitalists enough for them to assassinate democratically elected officials from countries we did business with before, and after.

Mike,

Sounds like somebody needs a lesson between debt and deficit. Your article you linked was over two years old. That debt has since grown by several more Trillion.

Obama spent like a drunken sailor. That is a fact.

Future generations will be saddled with this debt. That is a fact.

Both Ds and Rs are to blame for this mess. That is a fact.

It seems fashionable to throw around the statement future generations are saddled with our explosion of the debt with each exiting administration. But government debt is not like personal debt. There are certainly risks and probably breaking points but in our current global economy every country runs wit a permanent and sizable debt to GDP ratio that we will never pay off, because that is the current system.

The actual debt value in a vacuum is meaningless. Until that system changes we could in theory sustain many lifetimes of exploding debt as we continue to balance that number against all the other numbers that put it in context and make the globally economy work.

Could we have recovered faster if Obama didn’t bail out the banks and buy out all their shit assets, maybe, we will never know for certain. The argument on how fast to grow the debt or whether we should consider shrinking it under certain circumstances is an open and difficult question that involves a lot of guesswork. It is not black and white win like telling a person pay off their high interest student loans.

I bet that the Snapchat IPO alone will drive home prices higher in Venice which is where their HQ is located. They say lots of employees will become overnight-millionaires. And I am sure they will want to live in walking distance or short drive of the office.

http://la.curbed.com/2016/12/20/14031404/snapchat-venice-employees-ipo-homes-real-estate

http://www.hollywoodreporter.com/news/la-hood-snapchat-millionaires-will-snap-up-houses-post-ipo-957063

for them, WHO CARES about a recession.

Those employees should take the long-term share prices of Twitter and Groupon into consideration:

“In 2016, Snap Inc. reported revenues of $404.4 million, but it lost an enormous $515.6 million through the same period”

http://www.techspot.com/news/68016-snapchat-loses-way-more-money-than-makes.html

Aaaaaand this is why I have a personal theory that the internet and everything associated with it is a big social-welfare program, as a backdoor way to pump money into the economy because I can’t figure out how anyone’s really made a thin dime from the thing.

I mean, I don’t pay Google, or Wikipedia, or Craig’s List, or anything involving the internet. Yet somehow they’re making money?? Except a lot of ’em aren’t, really, when someone does the math. Hence, I’m sure they’re a slightly more subtle way to “toss dollar bills out of a helicopter”. Not that I have any problem with this.

Alex, seriously? You can’t understand how Google makes money? They’re the largest advertising company in the world by far. Everyone pays them so that when people search certain adwords, their company sits at the top.

Craigslist is even better. Their site is generic as all hell. But go look at how many job listings there are… and consider all the cities. Now consider $75 per listing.

Wikipedia doesn’t make a lot of money. That’s why they’re always seeking donations.

You dumb Americans, the housing market has gone global. There are plenty of rich people worldwide, who want protection from fiat currencies. And with interest rates still near historic lows, all the smart people have only started gobbling up LA homes.

Why aren’t you buying properties hand over fist instead of wasting your time here?

Lead by example, Vlad-de-dah. Get off your dead ass and buy a house!

^^^ Ding ding ding we have a winner! Americans are not driving up the price of homes in SoCal….Foreigners are. Chinese own Orange country now, so they will own the rest of So Cal. Just look at the new housing buildings being constructed in LA. Remind you of anything? Look at down town Hong Kong.

Yes people have absolutely forgot about the last recession. They can’t even remember what was on the news last month (probably not even last week) let alone 8-9 years ago!

The main concern of the average person is “who just ate a salad in Santa Monica” and “look at that new viral video, cash me outside!” This isn’t that new but social media exaggerates it.

I will never understand the obsessive Facebook users (my mom is one of them), they act like it is some sort of narcotic. They get withdrawals and can not last more than 50 minutes without opening their phone to scroll the posts.

They see their friends buying homes or new cars or fancy Caribbean vacations so they join in. I would call them sheeple but they are more like zombies.

Housing prices will continue to rise for a few years but they will crash again. Thanks to the internet this is how we live now. In america if you can’t afford it, you buy it anyways and write it off as “tomorrow’s problem.”

Hey, Dumbo, housing markets always go up and go down, but always go higher long term. And, it’s always location, location, with RE….there is never a wrong time to buy quality, just good, better and best. Only dopes buy non quality and deserve to lose.

So Vlad, are you aware of what the average annual appreciate rate is over the long term? And what kind of trend would you predict over the next few years when looking at what’s happened in the last few years versus the long term average?

Is it different this time?

I would call them sheeple but they are more like zombies.

Sounds like the zombies in this satirical piece: http://www.cracked.com/article_19402_6-mind-blowing-ways-zombies-vampires-explain-america.html

It argues that Liberals Are Vampires and Conservatives Are Zombies. (At least, as seen by their opponents.)

The train wreck that is coming is being prepped for as we speak. States know they will have to hoover up cash from whereever they can – raising taxes, fees, etc. all the while legalizing gambling and maybe even prostitution to keep the bureaucrats from burning the system down – that they robbed.

I saw something about legalizing prostitution in Hawaii – a situation that was in place before WWII – which up until recently was legal if you were a cop there. Their incredibly corrupt police force had a “rule” that before busting a “professional” lady, it was OK for the cop to utilize her services.

I agree that real estate like everything else runs in cycles. It will decline again, we just don’t know when! It is very presumptuous to think your income security will last, that home prices will continue to rise, and that the story always has a happy ending. You must not have been paying attention over the last dozen or so years! Unless your bank statement shows that $500k profit from selling your home, or you’ve cashed that several thousand dollar check for each rental unit you own, nothing is guaranteed!

“Funny that the ticker symbol will be SNAP (which coincidentally is also the nation’s food stamp program)”. SNAP is also what this house of cards economy will do pretty soon. But then, of course, it will be Trump’s fault.

Or have we now reached a “Permanent high plateau”? According to some bloggers here, we did.

The mythical new paradigm has finally been achieved. Cats and dogs living together. Unicorns roaming prairies.

What goes up, must continue to go up, or pay dividends. I mean, where else are you going to put your $$$ /sarcasm

Dare ye cite the business cycle and downturns ye bearish Dr!

They ain’t making more land and historical data has no relevance in the new economy.

I scoff at your downturns. UP UP AND AWAY!

Besides RE has nothing to do with stock prices, employment, or cash moving from equities to bonds. RE is discrete and uninfluenced by the macro economy or the Australian species of black swan.

“Surprising” news in regard to HSBC sub-prime mortgage defaults:

“This is a material negative surprise for HSBC,” said John-Paul Crutchley, an analyst at Merrill Lynch.

Foreclosures jumped 35% in December versus a year earlier, according to recent data from RealtyTrac. For the fifth straight month, more than 100,000 properties entered foreclosure because the owner couldn’t keep up with their loan payments, the firm noted.

For its part, HSBC said its overall charge will be about $10.56 billion, about 20% higher than the average analyst forecast of $8.8 billion.

In explaining the outcome, the bank said its own risk projections had failed to predict how many borrowers would fall behind on mortgages as interest rates climbed and saddled them with higher monthly payments.

HSBC’s warning comes just weeks ahead of its planned report of annual results and follows a December trading update that was already bearish on U.S. mortgage debt.

The problem is with HSBC’s portfolio of sub-prime mortgages, which it snapped up in 2005 and 2006, before the U.S. housing slowdown began to bite. Sub-prime loans are sold to home buyers who fail to meet the strictest lending standards.

Housing to continue to increase in prices for the next 3 years :-)) Keep on buying!

Where did you read this “surprising news” from HSBC? I’d love if you posted a link to your source, because I’ve been searching since I read your comment, and find only articles a few years old, which are of course outdated.

I have read here and there that foreclosures are spiking a little because so many home equity loans written a decade back are recasting, with payments doubling or tripling, which means many people who leveraged clear to the top of their borrowing power are caught in the lurch. But I had not read of any massive jump, or any particular problem at HSBC.

Sorry for not clarifying – it is an example of an older news when everyone thought that nothing was wrong with housing till it collapsed.

The one bellow is today’s news:

http://www.cnbc.com/2017/02/07/houses-are-the-least-affordable-theyve-been-in-seven-years-heres-why.html

Flyover, it’s a bit disingenuous to leave out the first four words of the article you copied (and didn’t properly cite): “10 years ago today…”

From http://www.zerohedge.com/news/2017-02-07/10-years-ago-today-financial-crisis-started-announcement-hsbc

But we share the same sentiments about this whole mess.

Jeff,

I agree. You are right and I am wrong. My apologies. I was in a hurry and didn’t pay attention. But I agree with you.

That is interesting but looking over at Zillow might tell you if the house was already an REO and the bank/lender waits until prices are back to bubble levels to sell the foreclosure. And the property is listed as a foreclosure.

We were one of the millions who bought in 2006 and paid dearly for it. All and all we are blessed in many other ways, so I guess timing the housing market just isn’t our kind of luck. But 4 states and 4 rental houses later, we are able to purchase again. Fast forward 10 years and housing is at the top of the cycle, ugh, missed the best years to purchase again! I know we can sit and wait for the down side, but I have 2 kids in elementary school that have moved 4 times and I would like to put down some roots for them before they grow up completely. We are in the Temecula, CA area and prices are surely among the best in SoCal but thats what you get for living far away from everything. My head says wait it out but my heart says don’t wait for another landlord to tell you he’s selling the house and you have to move the kids aaaaagain. We have 20% saved and we could buy but do I sit around and wait and wait and wait for a market correction in 2017 or 2018 or 2019 or just own up to the fact that housing is a poor investment right now and buy. Trying to find this balance between what has happened to the family in the past and managing your family’s future life is often very polarizing. There is something to be said for just making a decision and moving on with life, wish I didn’t analyze things 10 ways from Tuesday.

Anyone in a similar situation or have thoughts on the matter ? Thanks for listening.

StuckInLimbo

We moved back to CA in 2013, right as prices started to take off again. Have been waiting it out as well, and definitely tired of moving like you. A house we almost bought near Temecula then for ~$350K recently sold again for $600K (no updates). A huge windfall for someone else.

That said, you are doing well financially just to have saved up 20%. I personally think the timing is bad, but I apparently left >$200K on the table in 2013, so what do I know? No one knows the future, and maybe housing prices won’t drop for another 20 years. Or maybe they are already dropping. In the end, money in hand means having more options, debt restricts options. More options in an uncertain future, or a house with a large debt load? For us, the choice is clearly on the side of more options, even though we really want our own place.

At least once it’s been observed here that you could do pretty well just buying and selling the same house, timing the booms and crashes.

Hi Stuck – I normally don’t advise people to buy now, but you described exactly the situation in which it may be a good idea, IF you find exactly the house you want, in exactly the school boundaries you want, and in which you’re sure you’ll be happy staying (and can afford to stay in) for 10+ years. We’re in Temecula as well, have two kids, love it there (transplants from the San Diego coast), and recently sold our 2009 purchase and went all in on the perfect (for us) new construction McMansion.

I tend to think in the very long term. Waiting is smarter if you can live on the cheap in the meantime, but if you have a family, you’re looking at a minimum rent of $1,400/month, and that’s for an apartment. $1,800+ for a 3-bedroom house. The question is, would you rather hold onto that down payment and hope other investments will pan out in the next few years (keeping in mind the stock market could very well tank along with the housing market), or trade it (and probably watch ALL of it disappear in the short term) for stability and happiness? I can tell you I’m a lot less stressed being an owner regardless of the price I’ve paid, and I’ve bought at both the bottom and the top.

The market will come back, and so will your home’s value.

We are in a similar boat. We are in Vegas currently looking to make the move back to San Diego late summer after leaving in ’12. We have lots saved up for a down payment but I feel exactly like you do. Our plan, unless prices crash this year is to pick a community and just rent until it does. If we get booted at some point, we’ll plan on renting in the same district. Hopefully it won’t take 3-4 years and we’ll be able to catch it after this bubble bursts! It’s tough when you have school age kids and don’t want to jerk them around to different schools every year.

@StuckInLimbo I share your pain.We have been waiting since June 2016 because some of the houses available did not make sense at all to even put an offer….as this blog says ..they were outright ‘crapshacks’ which told us to RUN as far as possible.We have just entered the market with the strategy that the house should have enough square footage and yardage so if the market does tank after our purchase we can always do a room addition or add a pool to increase equity and have an exit route that way.Finding a house and not making a hasty decision with 2 kids around is not easy..Good luck !

We were in the same boat a couple years back. We rented for 6 years here in West Corona. Finally started making real good money and we bought a house. Kids didn’t even change schools. We have a good house we can stay in for awhile.

That being said, traffic is horrible over here…so it still ain’t perfect.

Personally, I hate parting with my money. So if you have the down payment and some extra to spare, go ahead and buy. That’s what we did.

I just had to remember this isn’t our parents world anymore. So stuff is expensive and we can’t expect to live in a house forever.

Yes Limbo I feel you, I live in the SD area and would like to own but fortunately with no family to worry about. According to a previous post, the IE is not as far into the cycle as coastal areas so you are probably not at the top there. Otherwise there are landlords that want super long term tenants (mine is one of them) so maybe you can find one if it comes to that again?

Personally I feel the housing prices in Temecula/Murrieta area still a decent value when compared to much of S. California. You can still find a very decent place in a good school district for around 300K. Crime is low, but the traffic and summer heat is brutal. Also I see future prices possibly being much higher with all the growth in new and expanding businesses, wineries, Kaiser and the proposed bullet train stop at Murrieta on the way to San Diego. The future of that area is very bright. I think it’s the jewel of Riverside county.

Seems the bargain now is in Puerto Rico. In the US, a tax haven, warm weather, homes near beaches as low as $100k…..

http://money.cnn.com/2016/02/21/investing/puerto-rico-foreclosure-crisis/

I feel your pain, for a different cause. I just HATE this over-inflated housing market. This is a horrible time to buy, but here I am viewing condos that have jumped 20% in price in just the past few months, finding little that I can even stand the thought of renting. But rents are inflating even faster and I need a rent hedge, that simple.

In my case, I was forced to sell my beloved 20s vintage Chicago condo because 7 of 9 of our building’s owners voted to “de-convert” my building from condo to rental and sell it to an investor. There has been a monster wave of these ‘deconversions’ as owners in heavily investor-owned buildings, including high rises downtown that are almost big enough to have their own zip codes, see a chance to sell their units at substantial premiums over what the unit would fetch if sold as an individual. In IL, 75% of owners must approve the conversion, but that is no problem when 75% of your owners are investors, to whom the place is just a cash machine.

The rental property stampede was triggered by the same thing driving up house prices in general, which is of course an endless flood of E-Z low interest money available to large investors, and home buyers alike. And I do not expect the new administration to improve things. In fact, Trump thinks it’s too difficult to get loans and shows every intention of opening the spigots wider, and demolishing even the weakest regulatory barriers to a return of the insane lending practice of the 00s. If I do manage to score a place I like for a half-reasonable price, my fear will be that the return of fog-a-mirror loans will result in my building’s units totally turning over and ending up in the hands of people who have borrowed way past their ability to repay in order to afford hyper-inflated prices, and a flood of subsequent foreclosures that wrecks the association financially and creates yet another distressed condo building. And, while I could not bring myself to support Trump, I very much feared that Clinton would do whatever she could to keep the party going. Now it looks that Trump, whose fortunes are very closely tied to the value of his real estate holdings, will do even worse, will do everything possible to drive asset inflation, while removing whatever weak protections remain against lender malfeasance and fraud.

I knew that we would be well and truly screwed whoever won, and that as long as our government and its chartered agencies control the money supply and interest rates, we will never have an honest free market economy.

At least you didn’t drink the kool-aid that subprime and toxic loans, rather than cheap and easy credit, were the culprits. I do have hope for some changes under Trump:

– His Treasury Secretary nominee wants to spin off Freddie and Fannie from federal conservatorship — no more unlimited funding.

– In the past, he recommended profiting from the inevitable RE meltdown.

– He admitted that the current economy is smoke and mirrors due to Fed manipulation. Hence, his populist platform.

Stuckinlimbo, a lot of people are in this boat. You, me, and hundreds of thousands.

All I can say is, error on the side of saving more $$$, and spending less $$$.

The old adage “live beneath your means” holds true here.

Good luck with whatever you decide. I’m not sure either, but I’m leaning towards NOT taking on more debt.

I didn’t buy in the last bubble but I empathize with your frustration. We’re just a regular family and trying to get our kid settled. I feel like we suddenly woke up and realized that California is completely inhospitable to regular (even upper-middle class) young families.

My son is disabled and stability is key to his future. I feel the same itch to buy – it is like it will alleviate some of the anxiety of our unknown future. But in this school district, there is nothing appropriate under $550k. It is crazy! Our requirements are so basic (3 bedrooms, away from busy roads since he wanders, no pool, and on the bottom floor if it is a condo) and yet things are priced so high. There are a few luxury townhomes around $600k with HOA and Mello Roos tacking on like $600 extra a month. Redfin just alerted me that 2 of my saved Condo options just RAISED their prices.

I empathize with everyone in this situation. We were in this situation 30 years ago. One baby on the way and we eventually wanted 2 more. We could rent a similar house for about 2/3 of a mortgage or buy. We bought even though prices and rents were at an all-time high. It was a fixer-upper and we devoted our labor during the 6 years we owned it. It prevented us from buying extravagant things and going on vacations and turned our vacation time into fix-the-house time. After 6 years, we sold at about a 15% profit which after commissions was more like 9%. And after considering the money we could have saved by just paying rent, we probably broke even. The positive side was that we had the security knowing nobody would evict us or raise our monthly payments. The other positive side was the principal paid during those 6 years was forced savings that we didn’t spend on extravagances so we did have a nice downpayment for the next house. If we would have kept the house for 10 years, we would have likely made a nice profit. IMHO, I wouldn’t buy anything unless you are planning on staying there for at least 10 years.

I would never offer you advice on a decision of this magnitude but I wonder how many people are waiting on the sidelines for the correction to occur. Now what if it turns out these people number in the millions or at least in the hundreds of thousands, and what if a 10% correction occurred and many, if not all these people waiting on the sidelines decide to dive in. Wouldn’t that either stabilize prices or even cause the prices to re-adjust back upwards? We just don’t know the number of house-horny people who are, like you, waiting for some kind of a correction. Could be more than anybody realizes.

History doesn’t pan this theory out. The last downturn took prices down far more than 10%. It took unprecedented actions by the government and Fed, not organic buyers, to slow it down. Buyers weren’t going to risk catching a falling knife.

Even the king of subprime, Angelo R. Mozilo, admitted that he has never seen a soft landing.

“my heart says don’t wait for another landlord to tell you he’s selling the house and you have to move the kids aaaaagain”

It is better to hear that from the landlord than from the bank; at least you get to keep the 20% with you. In the second case you say bye to that. Temecula is part of IE. Prices there could drop more than 50% while on the coast maybe 30%. Prices drop first in IE and later on the coast. Prices rebound first on the coast and later in IE.

Ultimately only you can decide.

Some sense, emanating from flyover country?? WwwwwOOOoooOOOooo…. Yes, in the IE it can certainly go down 50% and yep, “hearing it” from the landlord is much better than hearing it from the bank.

Realistically, it should be possible to time the booms and crashes. I mean, in 2009 and 2010, no one wanted to buy a house and there was very nice places, house on a few acres, in nicer areas than Temecula. There should be a way to easily chart, say, house price vs. median income, or something, and make a nice graph, showing up and down peaks and valleys, and have a sort of straight line through them, or an averaged line, and then just be a buyer during times the house prices are below the line, and lay in wait or rent through the times the house price is above the line.

But then I’m talking to an awful lot of people who don’t remember 2008…

Similiar -recently married, the wife and I bought in 2006 in the Bay Area with a zero down, thinking it was what married people do – but we stretched to do it. Crash, 300K under water, we walked after careful consideration – had never defaulted on anything ever. Figured we’d pay our dues and sit out until we could ‘responsibly’ purchase with a 20% DP and modest mortgage. Been in 2 rentals in the 8 years since – almost bought the first in 2012 before FHA was about to change the MI rules – but thought why rush, hindsight. 3 kids later and we’d like some more room but current rental is fine, we always treat where we live as our home and a decent landlord respects that which keeps rent raises below market. Frankly I like not being on the hook for major repairs, higher taxes, the constant HGTV pressure to upgrade every damn thing. Buying stopped making sense financially a couple years ago vs rent, for us anyway. Besides, you rent the money or the house, it’s nearly all the same. I like having a cash cushion, no debt, and diversifying into other areas. There’s enough anecdotal evidence in our social groups to see people are stretching again (equity withdrawals, risky debt levels, job instability). It’s just not for us and we’re at peace with that. We’ll likely buy again, but once we stopped worrying about a house purchase, life improved. Plus, I’m not about to hand a seller a 250K lottery ticket just because they ‘timed’ the market right – but good for them. Do what you think is best for your family in the end. Just my 2 cents.

iMO, if you can afford it and can see yourself living there for 10 years if necessary, then there is never a bad time to buy a principal residencs. Investment property is a whole other story.

Wow, thanks to everyone who took the time to reply, really appreciate it. The comments did a great job of verbalizing the Pros and Cons of our situation. We have worked hard to save for the down payment. It’s not a nest egg I want to leave up to the whims of today’s RE market but I want the stability for my kids that I had growing up in the 70’s & 80’s. We are old school parents who take pride in values like taking the kids to church every week, packing their school lunches, saying grace before meals, reading books before bed, teaching the kids to say “May I” & “Thank You”, holding the door open for others, having respect for your elders, etc. But sometimes, especially when it comes to RE, you get tired of always doing the right thing (saving 20%) and being patient while the rest of the world seems perfectly happy throwing caution to the wind. This world places no value on the family, the jobs those families need to survive or the housing in which they reside. OK, I’m heading towards a “what’s it all for” moment.

Maybe there are tons of families like us waiting for the right moment, I suppose the trick is to forget about that stable house you grew up in for 20 years and the 2 houses you bought and sold successfully up until 2006. Since this world only cares about the here and now, perhaps I need to find a way to be happy Stuck In Limbo.

““my heart says don’t wait for another landlord to tell you he’s selling the house and you have to move the kids aaaaagainâ€

Don’t follow your heart – “the heart is deceitful above all things and….”

In making financial decision use your cool level head. Emotions cloud your thinking. Also get very well informed in making the biggest financial decision of your life. There are times when fear gets in the way of taking advantage of an opportunity – also an emotion. It takes time to sort out between emotions and what is the logical think to do.

These are decisions with major impact for the rest of your life and the quality of life for the whole family. Only you can make those decisions. Take the advise from others ONLY as inputs – nobody knows the future.

Hi Limbo,

We’re on the West Side and don’t have anything close to 20% for a house in these parts. Plus, the mortgage would be outrageous.

Our longterm goal is to save up in CA… and then take what we have to Dallas, Phoenix, Oregon, or maybe the Southeast. I think it’s the only way to do it.

We like Temecula too, but feel like, if we’re going to live there, we may as well do Phoenix, weather wise. What do you think?

Temecula, or Phoenix, really? How many other ways do you want to be told to go to hell?

Mike: Phoenix is not remotely comparable to Temecula. Temecula averages mid to high 90’s in the summer, and cools down at night – no AC needed, windows open all night. That’s in late summer/early fall. Meanwhile, Phoenix is a furnace. Leave your windows open at night there and you’ll cook.

Look at your numbers. Can you afford the mortgage payments (principle and interest, pmi if applicable, HOA, insurance, taxes)? They recommend your payments to be less than 30% of your household income. Are you looking to stay put in the house for more than 7 years? Are you happy with the school district? Do you have job security/income security/anticipated annual inflation adjusting raises? It’s best to buy for the long term, where fluctuations dont matter as much, so long as you can comfortably afford the payments and maintenance… but if you can’t afford it, don’t buy. there will be consequences for poor math skills…

I have been reading this blog since at least 2011. Many people said real estate wouldn’t go up again yet it did. I just cracked and bought. Its the right time in life. Praying I don’t get burned. Good luck. I found that in my area you get a small crap shack for 600,000 but a palace for 750,000 (If you search). The 750,000 range has only appreciated less than 20% from the lows. Compared to the stock market more than tripling from the lows it seemed sort of reasonable.

Housing to Tank Hard Q2 2017!

Nice! Tank it Baby!!

Dad?

This time is different

The real estate prices in ca would never collapse…..

There’s now an AP news video available of the new $250 million Bel Air mansion: https://www.yahoo.com/news/250m-los-angeles-home-most-expensive-listed-us-064744920.html

I suppose the asking price is intentionally inflated, so as to get all this free publicity.

Was Blert correct? Do mega-mansions like these forebode the imminent popping of the bubble?

At this moment contractors are in my back yard digging holes to install foundation anchors so we can arrest the subsidence wreaking havoc on our paid for OC crap shack. Yes, crap shack ownership can be fulfilling (as in raising a family) if you can ride out the windows, the roof, the water heaters, the carpets, and on and on and on. In the course of 30 years you can take these things in stride, but major structural repairs or additions or remodels are not for the faint of heart.

When you pay so much for so little you better be confident that your income will increase significantly to span all those sundry expenses as well as recessions and popped bubbles and other black swans.

We survived it, so far. It was expensive, but we were never upside down. The crash set us back income-wise and we are nowhere near where we thought we be in, say 2005. Now, we face years of upkeep (keeping lipstick on the pig). The last bathroom upgrade will have to wait a little longer as a result of the repairs and unless we sell out and leave California it is all just a number. A Chimera. A trip to Vegas. Life is a gamble.

This time has already proven to be different. We have foreign money in homes purchased with cash saved for the next generation – so those homes won’t be sold. Then we have a glut of people who have saved cash for the past 10 years waiting to bid up anything that shows up in a good area.

This won’t end anytime soon. There just isn’t enough inventory for sale.

And I used to think – how do fireman – police – and other locals afford this market. Until I looked online to see that many police and fireman in the SGV make 200K year. With others making strong 6 figure salaries.

See the link for Alhambra.

http://transparentcalifornia.com/salaries/alhambra/

Rather than raw salary and benefit numbers, the figure that really caught my eye comes in another page on the transparentCA site for Alhambra:

Median pay for full time city workers: $81,623

Median pay for full time private workers: $38,276

If that doesn’t represent a two-tiered society nothing does.

BART Janitor’s 270k Pay Raises Questions…

http://www.ktvu.com/news/2-investigates/234011066-story

Apolitical – that median pay for private fulltime workers is scary. Sure I make about 13.5k a year but I’m only working half time if that, and living very modestly. And I chose a very low-paying field; electronics. Janitors and felons on work programs putting together trays of snack foods for company break rooms and dish-washers for hospitals make more than I do per hour – in fact it’s possible to match the magnificent $16 an hour I do, doing a whole lot of things.

Supposedly there are a whole lot of people making over $20 an hour, but that median wage seems to argue otherwise.

I wonder how much the BART police are making w/ overtime, and benefits. I know the police in Irvine are making bank in OT, some of them are claiming 20 hours of OT a week (on average / over 1000 hours of OT in a year) to make an additional $75k on base pay of $97k;

http://transparentcalifornia.com/salaries/2015/irvine/

POLICE OFFICER

Irvine, 2015

Regular pay Overtime pay Other pay Benefits Total pay

$97,332.80 $76,156.63 $26,693.46 $64,907.54 $265,090.43

I remember working 4-5 hundred hours of OT a few different times in my life and it was not pleasant. But I guess if you can nap in your squad car while getting paid time, and a half….

My dad* used to say that one way to get a good paying job is to do something that needs to be done but no one else wants to do. And they don’t want to do it to the extent that they’ll pay well for someone to do it. And it checks out: Cops, sanitation workers, the guy who’s always got a clothespin on his nose down at the water treatment plant … Really, think about it, would *you* want to be a cop? Dealing with the portion of society who does not play well with others, seeing the worst side of things? There’s a reason jobs like that pay well.

*My dad’s advice was not always golden though, he actually believed there was good money in programming computers, which there is not, and that you can make money in real estate, which you can’t.

Alex: Cops, sanitation workers, the guy who’s always got a clothespin on his nose down at the water treatment plant … There’s a reason jobs like that pay well.

Sure there is. Public employee unions bride liberal politicians, who then capitulate in contract talks, rather than hard-bargaining for the taxpayer, as they should.

My dad … actually believed there was good money in programming computers, which there is not, and that you can make money in real estate, which you can’t.

Computer programming and real estate are not guaranteed money-makers because they’re not government jobs.

The takeaway is not to “do something that needs to be done, that nobody wants to do it.” The takeaway is that, in a socialist economy, government workers make out like bandits.

Government paper pushers also make much money, and great benefits, but how hard is their work? Lots of people want to do it, and it still pays well.

@Alex,

I’m taking it you have never been to Irvine. My first question upon arrival was what do they do with the homeless people, the second question, is where are any black people…

https://legacy.cityofirvine.org/about/demographics.asp

It usually ranks in the top 10 safest cities, although we have had a few murders this year. Most crime here is white collar, like the jobs

Jon – I have indeed been to Irvine, and it’s the City Of Lego People, said Lego People varying in shade from pale pink to pale yellow ….

I guess what you’re saying is Irvine cops have it pretty easy. Point taken.

And I agree with all, and have always said, the gold standard for a job is (a) government and (b) unionized.

“My dad’s advice was not always golden though, he actually believed there was good money in programming computers, which there is not…”

Alex, I’ve been working in software for 25 years at four different companies, and I have never known a developer who made less than $80k.

I think there are two very different worlds when it comes to west coast real estate! There are certainly wealthy buyers, especially if you include foreigners, who can sustain prices in certain desirable areas! But, I think it is foolish not to think that there isn’t a breaking point for a significant segment of the population especially along the west coast, and especially L.A., which is the most expensive city in the nation relative to median income! And, since a large majority of Americans who own homes have the lions share of their wealth tied up in their homes, there is a significant risk of ‘all or most of my eggs being in one basket’!

don’t be surprised if all that down payment cash you saved up ends up going for survival cause when the next housing correction arrives so does a recession……along with job loss, wage reductions…etc etc.

Chinese money moving from Vancouver to Seattle: https://www.wsj.com/articles/for-chinese-home-buyers-seattle-is-the-new-vancouver-1486500393

I hope we start taxing the shit out of them.

Foreign money comes and goes. China is going into a big crisis and everyone there with money knows it, so the money leaves. But we’ll have our crisis too, and so will 20 other countries that are over-leveraged. The whole world has been roiding up financially since the early 80’s.

Now our economies are hulking ripped monsters with massive organ failure under the surface from years of roid abuse. You could say that the American economy is as healthy as Lyle Alzado circa ’88. Looks healthy to me.

Honestly, we all debate here on this blog because deep in side we truly have doubts about the fundamentals and strength of this market: housing bulls and bears alike. I don’t care which position anyone takes or says. If we didn’t think there was an underlying problem we wouldn’t waste our time here. We’d shut up and either run out and buy crap-shacks with cash without a second thought, or we would simply rent and forget about it.

Here here… I assumed the 2008 collapse would look more like the great depression, where the majority of the declines happened a few years after the panic of ’29. Guess I should have know the central banks would stop at nothing to prevent a systemic collapse, and prop up housing at all costs.

A good article below about RE in Australia:

https://mishtalk.com/2017/02/08/time-to-panic-in-australia/

It shows that the problem with RE in SoCal is not a regional problem because of sun and weather. It is due to extraordinary monetary policies in the whole developed world due to DEBT. British Columbia, London, New York and Seattle do no have sun and mediterranean weather and they struggle with the same phenomena in respect to prices. The cause is super easy money policies (low interest among others). Can these conditions continue in the face of inflation rising in the whole western world???!!!!…. You can answer this question putting your money where your mouth is. Bellow is the conclusion:

“The #1 rule of panic is simple: Panic before everyone else does.

Those thinking of buying a house in Australia now are out of their freaking minds. Yes, I have been saying this for quite some time. And many can point to profits. But those profits are all on paper. Try selling. It’s impossible for everyone to cash out.

Those who place their homes on the market now, with aggressive below-market pricing, will likely be able to find suckers. Those who think it’s too early to panic will likely to be trapped down the road.

Homes are illiquid. It’s seldom too early to panic.

When selling real estate, it’s a catastrophe to panic after the panic has already started.”

Yep. Economic manias have and always will be based on cheap and easy credit. Subprime and other toxic loans, which represent a small manifestation of this mania, are U.S.-centric. But the housing bubble is international in scope.

http://www.zillow.com/homedetails/1617-Silverwood-Dr-Los-Angeles-CA-90041/20767907_zpid/

For those of you looking in Los Angeles, not sure if this is a doable location; but, this looks like an interesting house in Eagle Rock, Los Angeles. Seems like a good price by today’s standards for the square footage, views.

That looks like an awesome deal. At $2,632/mo mortgage and nearly $1,000/mo going into your principal piggy bank at today’s interest rates, that means you are only paying $1700/mo for an upgraded house with an awesome view. Unless it is sliding down a hill, I’d buy it!

It looks like it is on a north facing slope (or at the top facing the north). I grew up on a hill in nearby Highland Park, and the areas that were moving that I know about were on north facing slopes.Don’t buy without an INDEPENDENT geologist’s report!! The geologist who did the report on my Folk’s south facing house told me about that.

All I know is it seems like the housing market can only go up from here! Which means it will probably be hitting its cyclical peak, if it hasn’t already. I saw a short sale for the first time in awhile. The price history is the most interesting part-

https://www.redfin.com/CA/Irvine/10-Cornwallis-92620/home/4794989

It apparently has an open house this weekend, but had a short sale graphic in its place, but still has “This is a short sale subject to lender approval.” in the description

I still come across some short sales in the IE, but prices there still haven’t reached the previous peak. Short sales today are at least market value. I remember in 2012 when the entire MLS was heavily dotted with discounted short sales and selling agents would call begging for offers after the supra notified them of a viewing…. ahhhhhh the good ol days. I miss the buyer’s market.

Just a nonrelated aside, but most of the Internet is down right now but for some reason, this site is still up. Yet another reason I think anyone who thinks they can make a living on the Internet is a damned fool.

A) The internet is global, but your, or your ISP’s connection to other providers isn’t

B) They’ve gotten really good with analytics used for marketing, to generate ad revenue

Whether those ads are effective, or worth what they are paying is a completely different story. In my opinion there will be a collapse in ad prices, and ad revenue soon, as cheap money finishes working its way through the system. I think people will look back on the past 8-10 years and realized that it was different this time, with QE and stock buy packs driving most growth

Google’s ad revenues should also decline because web browsers are getting better at blocking ads, not to mention people are getting better at ignoring ads.

It’s sort of an arms races. People ignore banner ads, so web developers create ever more annoying pop-up, animated, and video ads, floating across your screen. Then newer web browsers find ways to block the newer ads.

Sometimes I go to a site and there’s so much video, animated, floating crap, I turn off the java script and reboot the page. That usually gets rid of most ads. Then I keep the java turned off until I come to a page that requires it.

Yes, like most things it’s on a pendulum, and right now it seems to be swung in the favor of content owners/distributors. I see more and more sights that will not allow you to view the article you are reading until you give them money via a paid subscription model, or shut off your ad blocker. Where it will get more interesting is when SOPA, PIPA or whatever they call the de-regulated internet bill once they destroy what is left of the concept of net neutrality (DirecTV and AT&T anyone)

I remember an article about a regional ISP/cellular provider on an island in the Caribbean if I recall, that had so many people using VOIP apps on their smartphones (FB messenger, Skype, WhatsApp, etc..) that they started to hijack the ads via DNS spoofing to recover the revenue. At some point we are going to cross the rubicon with some sort of awesome sounding ‘transformational’ app that just guts the existing economy. My guess is AI will hit us first, then autonomous vehicles, then who knows…

Has anyone looked at the actual Federal Funds Rate chart-

https://fred.stlouisfed.org/series/FEDFUNDS

Almost the entire Obama (not partisan, just saying) presidency, and ONLY during his term were rates held below 20 basis points, until 2016, where they have started to trend upwards. Does anyone think that this time is different, in that last time it was a housing bubble caused largely by everything from sub-prime to HELOC’s to MBS/CDO insanity, and this time it’s just low interest rates that drove housing ‘affordability’ down, and prices up?

Anyone disagree that as rates go up, prices will invariably go down in areas where the median home prices are almost identical to the FHA loan limits?

Historically there has been little correlation between interest rates and housing prices. In the past, they move independently of one another. You would think higher interest rates would drive down home prices, but it just has not been the case. I contribute some of this to banks willing to take on more risk and introducing more creative lending products to entice would-be homebuyers as rates rise.

I think interest rates have a dampening effect on house prices, but if the stock market keeps going up (where many large down payments come from), or inflation rises, it may counter it. Also, there is still foreign money pouring into the US after Canada and Australia slapped high taxes on foreign buyers. I know. I recently bought a house with stock market gains and sold a house to a foreign buyer for cash.

Did home prices drop in southern CA from 1960 to 1980 when interest rates sky rocketed…. or did home prices rise over 300%?

In ECON 101, they teach you the correlation between 2 variables, “all other things being equal”. The problem is that in REAL life, “all other things are NEVER equal”. Therefore, for each period you have to look at the whole picture and come up with a decision based on your “gut feeling” about which factors are more important in the grand scheme of things. For example, a VERY important factor is the consumer psychology. How can you quantify the cumulative effect of how people think???!!!

For this reason, it is vary rare to find two economists agreeing on the future course.

However, “all other things being equal”, when interest go up, the prices go down (absent other compensatory factors.)

Did household incomes stagnate like they are now? Did prices require a household income multiplier as high as now?

There are always people that will have to sell and those that want to buy no matter what the rates are. People have become addicted to the low rates we have been experiencing for the past years. If you look back over the past 50 years the current low rates are more of a abnormality then of a norm. I wouldn’t be surprised to see rates hitting 5% later this year and 5.5-6% in 2018. That may seem like a lot to people buying homes for $500K+ in S. Cali, but the median US home price is around $190K which comes out to approximately $200 more a month for 2 percentage points.

Yes, in 1988 when we bought our first house, both interest rates (10.5%) and housing prices were both rising. Inflation was rising at the same rate at that time.

Exactly, people on this blog have very myopic views.

This president will do everything he can to drive inflation… will it work? Who knows, but understand that 1960-1980 is possible yet again.

This president will do everything he can to drive inflation… will it work? Who knows, but understand that 1960-1980 is possible yet again.”

Doubtful. Fed policies and increased family incomes drove inflation. These days, globalization and technology has muted income gains. Without strong income growth and the corresponding consumer demand, the asset inflation created by central bank policies has no long-term support.

Well it looks like the dump may have started:

http://www.cnbc.com/2017/01/31/invitation-homes-raises-154-billion-in-ipo-source.html

I wonder this will how much they bought the foreclosed home for considering what they are trying to get out of the IPO.? I will feel sorry for anyone who considers buying this because it will likely fail if the economy heads south again. My guess is this will be the Big Short in secularized rents this time. Maybe it will different. Maybe it will be a longer duration. Who knows.

This site has made me suspicious of REITs.

Meanwhile, the KFI-AM team — Bill Handel, John & Ken, Tim Conway Jr. — are all advertising for “Rich Uncles,” another REIT company. Selling their own voices and reputations to promote Rich Uncles.

son of a landlord – Yep those “Rich Uncles” ads were all over our major AM station, KGO, months ago. Now you’ve got ’em. We’ve got “get rich flipping houses” ads now.

I believe a REIT can buy up houses and rent ’em out. There’s money in being a slumlord!

I disagree, the major investment firms and stock buyers who gobbled up this stock are betting that homeownership will continue to be unattainable for most and renting is where the money is at. Is it profitable to maintain and manage 50,000 SFH rentals spread out throughout the US? That I don’t know.

I think what could undermine this REIt is if people find new jobs in areas that are not owned by these Wall street Landlords. How do you think they will resolve that problem then? Also companies may decide to relocate to cheaper areas. Hence less rentals needed in overpriced areas.

Oh there always will be a market for rentals — but not at the outrageous prices that those REITs are charging. Another big REIT, Equity Residential, has been selling their stakes for over a year because rents in many traditionally expensive markets are hitting a wall.

In my firm, some jobs are being cut. I have noticed that many being cut are late 40s through mid 50s.

Those that bought homes decades ago are OK with the layoff. They are getting severance and their payment is very low relative to rents.

But, the ones being cut who rent or recently bought their first home are in a total panic. They are in financial trouble.

Bottom line is the ones who smartly purchased when they were young are financially OK. Some even welcome the early forced retirement. But the renters are in a hurried job search. They are very worried. It is important you get situated into a good home early in your work career.

Excellent advice. I wish I’d taken it when I was younger.

My sister and I, both retirement age, are telling her children that while they hope they aren’t forced to retire at age 50, they should position themselves now to be able to retire at that age, because getting re-employed at a decent salary at that age is almost impossible. The days when you could count on being able to retire from the job you took in your 20s, have been over since the 90s at least. That’s when millions of baby boomers in their forties were laid off from high-paying jobs and forced to scramble for jobs that paid half as well, if even. Worse, many fell for the retraining hustle and signed themselves into major debt to retrain for something else, just to find that most employers don’t want to hire people over age 40, and certainly not age 50. Nowadays, the suicide rate among Gen X white men has climbed alarmingly, and job loss at the age at which you are most likely to have the largest expense in supporting your family and helping your kids through college while trying to save for retirement, is likely a major cause.

I hope young people get the benefit of the dreadful examples of their elders, and become very frugal and wise. Unfortunately, they’re getting lessons that almost nobody can financially survive in the form of college debt they signed on at ages where you really aren’t capable of making sound financial decisions, and they’re stuck with the consequences for life.

Laura your post is solid gold!

I’m 54, will be 55 in about 6 months, and I’m making about 20% more than I was right out of high school, in absolute dollars. There was talk of my pay ramping up to something like $30k a year, but I can see it’s going to be pretty much level at the $13k or $14k level. At least it comes with a place to live, or I’d just go hold a sign at an onramp; that pays better.

Wise indeed to advise people to set themselves up to retire at 50, because indeed they may be “retired” whether they like it or not. That means, jobs like greeter at Wal-Mart or something. Minimum wage or not far above it.

Many would consider me as being in the youngest cohort of Boomers, but I’m actually in the oldest cohort of X’ers. The difference is stark: My older sis, a true Boomer, got to go to a fancy private school with Obama, had show cats, at a young age had a governess who called her “Missy”, a nickname it took years for her to live down, etc. She, of course, married a “hereditary lawyer” who went to the same elite school, and now she sits in her multi-million dollar house, feeds stray cats so they can kill of native birds better, and looks right down her nose at anyone who didn’t “work hard and make it” like she did.

My older bro, and the rest of us, had the quintessential X’er upbringing. Dad had stopped coming home by the time we were teens, and he pretty much only cared about older sis. We were scrounging for food, fishing and foraging, sometimes stealing here and there (my youngest sis was adept at this, while I suckered into the working thing) and we were often lucky to have one T-shirt without too many holes in it and one presentable pair of pants. Public schools, and shitty ones, for us.

Us X’ers still had a chance, though. If we either went into the trades, got a government, unionized job, or married someone who did these things, we’d be OK. Some of us got suckered into the college/hi-tech scam, and yeah, we’re sure collecting our punishment. Many of us were smart enough to not have kids, but some of us did have kids, of course, and between us and the kids we’ve brought into this shitty economy, we’re a population of leftover-eaters and string-savers and “A stitch in time saves nine” and whatever other Great Depression sayings you care to tote out, because we love ’em all.

A good number of us look at homeownership/homeslavemanship with a VERY jaundiced eye.

Alex, you’re a tail end Boomer, same as me. If you were born in 1964 or before, you’re a Boomer. If born in 1965 or after, an Xer. Those have always been the cutoff years.

You might identify with Xers. Your economic plight might not fit the Boomer stereotype you paint. But many Boomers don’t fit that stereotype.

I’m mid 40s, my job “transitioned” to consultant as contracts dried up last year, luckily I was able to find another job (in the office next door to my old company, woohoo!). I’ve been stacking for 20+ years, packing lunch, living modestly because I saw the tech industry (or any industry) was not kind to the older worker. Add in H1-Bs (Im in tech) and I knew things could get tough 20 years ago. Yeah, living modestly doesnt get you much “respect” from the how much a month crowd but those people are clowns anyway.

I planned and saved so that I should only have to do a couple more years of work. I could probably retire now but I want to build up more and at least SOME of the work is interesting. One thing I found as a consultant with a lot of free time on my hands is that I like to keep my mind engaged. I dont necessarily like working 40 hours a week, but every company seems to want to own your soul rather than let you cruise part time. Hopefully the younger generation will have better opportunities but I think a lot of them are pretty weak (some are great), so we shall see.

Son of a landlord – Nope, the Boomer/X’er cutoff is about 1960.

Again: My older sis, 5 years older than myself and 4 years older than my older bro, had the governess, Persian show cats with a wall full of ribbons, one of the most elite private schools in the country, the whole Boomer package. Us younger kids had Top Ramen if we were lucky, one good shirt/pants and if we were lucky, a very cheap pair of shoes for the school year (barefoot over summer) etc.

I think you’ll find this strong demarcation is pretty universal.

The 1960 cutoff is “pretty universal”?

Wikipedia has the cutoff at 1964/65: https://en.wikipedia.org/wiki/Baby_boomers

I’ve been seeing that cutoff everywhere, for decades.

Laura, I am in my 40s, and I am fortunate I saved and bought homes when I was in my 20s. Now that layoffs are hitting my firm, I am OK if I get cut and need to take a new job with a huge pay cut. But, this was not my plan. Instead, I was never attracted to the material things ( cars, vacations, expensive partying ) so I landed up with savings I rolled into fixer beach houses. But, in my 20s and 30s, if I had bought a few new BNWs instead of used Toyotas, and did a few vacations, that would have eliminated the down payments I used for the beach houses I have as rentals, and I would be in the same dire situation others are in when a layoff hit. So close … just a few new cars and vacations when I was young would have ruined me.

There is one thing that losing a job is like losing your life eventually and another where it is considered just a part of doing business. Unfortunately with the high rents these people may have very little options but to move further away from the area just to make ends meet.

I wonder if moving further away makes your personal network connections a lot harder to come by since the travel will be a lot longer where it used to be a short drive. I think that alone scares more people than anything else when you feel powerless.

The only reason I can see to “settle down” in an area and buy a house and assume it’s going to sit and appreciate year over year, which takes a “bet” of 10 years and preferably something like 30, is if you’re self-employed in something where being “established” pays. You learn plumbing, start out on your own in a town, and over the decades you built up a loyal clientele. The same goes if you’re a dentist, a veterinarian, a carpenter, etc. Hell even a barber, things you can go to a vo-tech school, what’s left of ’em, for a year or less to learn to do.

I’m kind of surprised the term “ronin” hasn’t come into vogue for today’s workers, especially tech workers. Ronin were rogue samurai, who’d serve whoever needed them and could pay. No real loyalty, just hired guns, and if no one needed ’em for a while, they’d just get by as they could. Many a great Japanese tale of hardship and derring-do comes from this.

In Japan, a lot of workers are “freeters” which is a contraction of “free” and “arbeiters” or “free workers” which means, you work however you can get it, if you need to move, you move, if you need to sweep floors because it’s all you can get, and sleep in a cyber cafe, you do.

That’s how it is for a lot of workers now in the US. You have to be willing to move, cross-country, anywhere, if that’s where the work is. Even down at the minimum-wage level. If you’re going to make the same $12 an hour working for CostCo, does it make sense to work at a CostCo in a California coastal town, or one in Tennessee? You’re not going to have time to go to the beach anyway, but in Tennessee you might be able to afford to raise a kid on that pay. So you have to be willing to move.

There are a lot of types of workers who are mobile now. And the older folks are getting with it too, retirees living in RV’s and doing work here and there, they have the RV to live in and that $10 or $12 an hour is fine with ’em because they’re retired, and they’re not working at a given job forever, just a few weeks or days, months at most.

I wonder if the whole “American Dream” thing of owning a house is a carryover from the old “40 acres and a mule” days? If you had a farm, of course you had a house, even though you might have had to build it yourself.

So I imagine lots of big box stores welcome motor homes. Sleep in parking lot and go work at the store. Seems plausible to do that now? No rent and your not letting a parking lot sit idle.

In other words, the fortunate buyers were born and working during a strong, diversified economy and when RE prices were reasonable and not the subject of a global mania. Buying over-priced properties by over-leveraging yourself, regardless of the stage of your career, can lead to severe financial stress.

I can tell you of young workers who were never laid off but found themselves in dire real estate straits during the previous downturn because they felt pressured into joining a real estate mania in the first place.

JT, you could not be more wrong. Renters who get laid off collect the severance, move and just rent closer to wherever their next job will be. They celebrate that they did not buy the overprice crapshack. If you recently bought and got laid off you are screwed. You cant rent it out because the rent would not even cover the expenses (inflated mortgage, interest, property tax, mortgage insurance, repairs, maintenance, realtor fees, loan fees, appraisal fees & other fees). You cant sell without making a loss. It takes many years until the appreciation makes up for all the high transaction costs and 6% realtor commission. Congratulations, you got laid off and are stuck with an overpriced crapshack. At least, you can run around and tell the world you bought the american dream. But dont tell the world that the term “buying” means you are renting from the bank and it helps to keep the bubble going. Mainly brainwashed Boomers believe in that american dream of renting an overpriced crapshack from the bank and call it buying. I have never heard this is the Norwegian Dream….yet the Norwegians are supposedly the happiest people on this earth. Some US boomer really needs to tell the Norwegians that they need a housing bubble, 7 Mio foreclosures, flipper shows and overpriced crapshacks. Or, as some guy on this blog mentioned before….you can only find true wealth by buying real estate….lol. Eat that you happy Norwegians!

It takes many years until the appreciation makes up for all the high transaction costs and 6% realtor commission.

It needn’t be a 6% commission.

1. Redfin charges 4.5%

2. ALL commissions are negotiable. I recently received some junk mail from a realtor offering to sell anyone’s property for 3.5% commission. With this low inventory, I guess many realtors are getting desperate for listings.

3. You needn’t even use a realtor. You can list your own property, hire an attorney to handle your end of the paperwork, and refuse to pay the buyer’s agent’s commission. Tell the buyer to either hire his own attorney, or pay his own agent’s commission.

You know what’s sad, being in your seventies and still having to work to afford rent on a crappy apartment.

“You know what’s sad, being in your seventies and still having to work to afford rent on a crappy apartment.”

As opposed to resorting to reverse mortgages at that same age? Or finding yourself in debt because you decided to take a HELOC to pay the bills or buy luxury items?

@Son of

“It needn’t be a 6% commission.”

Of course not. A realtor does not deserve more than 0.5% commission in my mind. The avg Joe will pay 6%.

@WheelinDealin

Can you explain what the connection is between my post and your response? Or do you just like to list sad life situations?

You know what is sad? If a family decides to buy an overpriced crapshack and lives in a truck after the foreclosure.

You know what is sad as well? If a pet is being abandoned by its owner and has to fight for survival until in ends up in a rescue shelter.

Wheelin, if you want to be a bit more subtle about this approach, choose a selling agent that will work for a discount. (I found one that did it for a flat $800 in Salt Lake City, but couldn’t find one a few years ago when I sold in Santa Clara.) Then in the listing’s notes that only the agents can see, you can say, “full commission for a sale at or over asking, 2% if under.

Worked for me.

@Millenial Your young (I assume) and think you have all the answers. What I was trying to point out is that many people see purchasing a home as retirement security. Knowing that you have a place to live at a fixed cost or an asset to sell when you’re up in years and on a fixed income is comforting to most people. I don’t think anyone wants to be in their golden years still struggling to pay rent and make ends meet. And there is nothing wrong with a reverse mortgage. Millennial, you seem to be very bitter.

Being a child homebuyer in the late 80’s when mortgage rates were 11% and CD’s were paying 9%, and inflation was 8%, I am very hesitant to pay off my 3.75% mortgage. I think we may get there again. My parents benefited greatly by having a 5% mortgage and a 9% CD.

Tough call. Inflationary and deflationary scenarios both seem credible. If we go deflationary ala Japan then paying off your mortgage may be wise. If, as some of our more alarmist fellow posters suggest, we go the inflationary Weimar/Zimbabwe route then that 3.75% mortgage is money in the bank. FWIW I gave up on waiting for the 2nd scenario a few years ago and paid mine off. We’ll see in another 5-10 years whether that was a good move or not.

If we go deflationary… just like Japan… Mortgage rates will be 1.5%… just like Japan.

Every try buying a condo in Tokyo? Deflation doesn’t look quite like it sounds.

Came across this – Miami, FL housing market boom, courtesy of foreign buyers:

https://www.youtube.com/watch?v=Q0wRpHzDehc

You mean construction boom, not buying boom:

Miami’s Condo Frenzy Ends With Inventory Piling Up in New Towers

https://www.bloomberg.com/news/articles/2016-05-27/miami-s-condo-frenzy-ends-with-inventory-piling-up-in-new-towers

Good.

Sounds like the Immigration enforcement might be having its effect?

@Homerun

Might have had an effect, but the laws of economics played a much bigger influence.

Granted prices are crazy. But I have posted on the wb many times. We put $20,000 down on a duplex in Manhattan beach in like 1985. The loan was 90% LTV, ARM with 11.375% start rate and 5% cap, so it could have gone to 16.375%. By 2004 it was worth over $900,000; today, +/-32 years later, it would be worth $1.5MM to $1.6MM..

Watch the psychology. In the next dump, the virtues of renting will be extolled – that will be the time to start looking to buy.

and to the side track – we live our lives in 1/3rds… 25 years to prepare, 25 years to accumulate and 25 years to live off what you accumulate. You want to be where you wanted to be by 40yo.

The next trend, which is picking up steam now, is expat living for retirees.