The middle class migration out of California: While domestic migration is up, foreign migration is filling the gap.

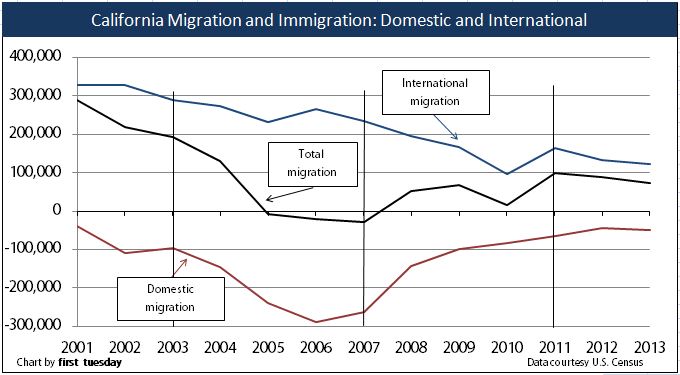

People look at population growth in California and see nothing that stands out. Digging into the numbers you find some interesting figures. First, the main reason California is actually growing is because of international migration.  California for well over a decade is losing domestic residents. That is, “domestic†Californians on a net basis are heading out of the state. On a more micro level, you are seeing the middle class either being phased out of the state or being pushed into lower priced inland regions. It is an interesting trend that is also happening in the tech hungry Bay Area. Housing continues to be an important topic because the vast majority of income is spent on housing. California has one of the highest percentage of families spending half or more of their monthly income on either rent or housing payments. In places like Los Angeles the main international migration is coming from Asia. You also see this driving up real estate values in certain areas and this contributes to domestic out migration. The migration numbers are interesting and shed light on this global trend.

California is a dramatically changing place

California is dramatically changing. It was telling to see the housing protests in the Bay Area where tech buses were stopped by anti-gentrification protesters because of crazy housing costs. It is odd to single out the tech industry which is highly progressive as some kind of aggressive capitalist juggernaut. But NIMBY policies, antiquated tax laws, and employment centers are shifting demographics. Many in the tech industry are progressive socially but are fiercely free market when it comes to ideas. So when it comes to housing, it is open season and many original residents can no longer compete with current prices. Hence the out migration.

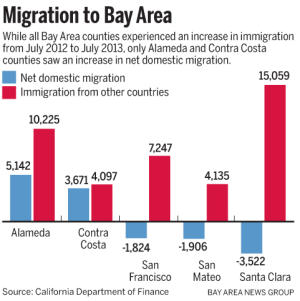

Take a look at migration patterns in the Bay Area first:

In a global market, talent will come from all over the place. This is how you can have million dollar crap shacks in San Francisco selling with multiple bids. Of course, we are currently in a big bull market and the tech sector is blistering hot (and many companies are looking extremely frothy).

California is growing because of international migration and natural births. Domestic migration has been trending out for well over a decade:

During 2006 and 2007 California was losing over 200,000+ people that were originally Californians to other states. But internally, you are seeing some other shifts occurring because of economics as well:

“(SacBee) Between 2007 and 2011, as a severe recession hit California, Southern California counties were the nation’s most active in terms of human movement.

The nearly 42,000 people who moved from Los Angeles County to adjacent San Bernardino County during the period was the largest county-to-county migration in the country. It was followed by the nearly 41,000 who moved from Los Angeles to Orange County and, interestingly, the more than 35,000 who moved to Los Angeles from Asia, the nearly 31,000 who moved from Orange to Los Angeles, and the more than 27,000 who moved from Los Angeles to Riverside County.â€

Many have transplanted from high cost Los Angeles to lower priced San Bernardino. You have a similar pattern of people moving from Orange County to Riverside. But you also have a large number of foreign migration from Asia.

“While Los Angeles was a net loser in the migration of residents to other nearby counties and other states, it was a net gainer in foreign immigration, particularly from Asia. It also attracted a high percentage of domestic and foreign migrants with advanced degrees, but was among the leaders in losing highly educated residents to other locales.â€

All of this of course impacts real estate. In the bigger picture California may become more volatile as industries reflect the whims of the market (tech is currently very hot). With the markets hot, excess cash is flowing into real estate. As we mentioned in a previous article, the money isn’t flowing all over the region blindly. It is laser focused on certain areas. California in higher priced markets is becoming more renting centric because of current costs. In San Francisco, only 36 percent actually own their homes. The vast majority rent. San Francisco is an interesting market because of the tech sector wealth being created. SoCal on the other hand is seeing prices being pushed up but more of it coming from all hat and no cattle living. In other words, simply more net income is being funneled into housing from domestic buyers. International funds and investors make up the rest.

It is interesting to hear of people using their homes in good areas as AirBnB “hotels†for extra cash. For example, I’ve noticed some people in Santa Monica renting out rooms or garages at fairly hefty prices:

*Sample AirBnB locations in Santa Monica

But like any business, I think some of these people are underestimating the liability potential. As most landlords know, you can have one bad tenant and this will eat deep into profits so careful management is absolutely vital. Yet this also unlocks a hidden stream of income from your home. Given current rates, you can make a nice stream of income from doing this.

To bring all of this back home, you are seeing that the room for the middle class in California is largely disappearing. And people are voting with their wallets. For many others, the only option is to rent.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

76 Responses to “The middle class migration out of California: While domestic migration is up, foreign migration is filling the gap.”

Just moved from Torrance ($700K, 1500 sq ft, $4,000 mortgage) to Round Rock, TX ($200K, 2000 sq ft, $1,200 mortgage). Couldn’t be happier. Feel like we got out while the getting was good.

WOW!!

Carl, you’re my hero!

“got out while the getting was good.”

You and Toyota.

But what does Toyota know? It’s not like they have a successful track record or anything. Don’t they realize they’re missing out on top talent that only wants to live in prime coastal California?

@ A , what does Toyota knows? Labor laws in Commifornia are nuts and 75% of LA is Latino.

Toyota is in to making profit unlike the president handing out social benefits!

Gary North in one of his essays a few years ago, related a story of someone who sold their bubble-value CA house at the right time, moved to Atlanta and bought 7 houses with the money; lived in one and rented out the other 6, enabling a life of semi-retirement.

Similar move – Santa Clara – 1650 sq ft, $900k to Montana – 1650 sq ft garage, 2300 sq ft house, 1300 sq ft basement $500k. The winters can be crazy cold, but I’ll be retiring in 12 months rather than 15+ years due to putting cash into rental properties. OK, it’s semi-retiring if I’m going to become a property manager. But I’ll trade 50 hr corporate weeks for < 5 hrs of carrying a crescent wrench.

RR donuts, Rudy’s, The Saltlick. Go up to Walburg for some German food and beer. Congrats on the move. I moved to Georgetown in April, just bought a home in Waco. Careful though, Texas has water that falls from the sky, they call it rain………

Congrats, very happy for you. I wish I could do the same, but I would miss So Cal too much. Pretty much the best weather anywhere in the world, and a ton of stuff to do. I’ve visited Austin a few times in May and August, and the heat/humidity there is a lot to bear. Unfortunately, even being reasonably successful, we can’t even afford a single family in Newport Beach! Maybe someday…

Some people aren’t quite cut out to handle the changes that more dynamic climates offer so it’s understandable that they might find a more boring and less challenging climate to be considered best.

Sure is a good thing that varied climates are contributing to offering people a ton of things to do in most parts of the world.

Try Westside Costa Mesa for an affordable beach close location. The City Planning Commission is approving hundreds of new units to revitalize this older area of town. Most new projects are 1900 sq ft townhomes with 3rd story decks with some amazing views of Newps. Also, most of the new projects include “live/work” loft space dedicated to a first floor work area/home office too. Currently, CM is in the middle of a renaissance on the dilapitated Westside to accomodate a more upscale residents from the pending Banning Ranch project PCH/ River Jetties. Volcom even partnered to build homes off 18th St/Whittier Ave. to help some of their employees live close to work & the beach! Forget the 909 when you can get a beach close bargain in the 949!

One of the things I hate most about living in SoCal is this lousy weather. No seasons. No crisp, cool fall. No snow in winter. Always hot during the day, every day.

The summers aren’t as bad as in NYC, which has humid summers. But SoCal is pretty bad.

Last year I visited Seattle in December. Loved the gray clouds and soft rain. It felt more like Christmas than it ever does in SoCal.

One year I visited Salt Lake City in late March. It snowed! In March! Lovely, beautiful, spring snow. Can’t beat spring in SLC.

SoCal has much to recommend it. Not everyone agrees that weather is one of them.

Responder, always remember that how much you make is irrelevant. The most important think is what can you buy with what you make. For an extreme case, to make my point, those in Zimbabwe were all millionairs and billionairs but could not buy a loaf of bread.

If you earn more, they tax you more, not only in absolute value, but percentage wise.

If you can’t buy a house where you live, you are a poor man, regardless your of income. You have money but no purchasing power. If you save them, you might give them value by moving to a lower cost of living area. SE states are not the only place where you can move; in the Summer they are hot and humid.

Anywhere west of Colorado climate is relatively dry. As you get closer to Pacific, winters are very mild, too.

@A and son of a landlord: Perhaps my assertion that So Cal has the “best†weather was somewhat presumptuous. A better description might be that I find it to be the best weather. It’s virtually indisputable, however, that the weather near the beach is among the mildest in the world year round. I like that I can drive to areas of more “dynamic†climate (mountains) for the day or weekend, but then I can leave and go back to enjoying 70°-80° F pretty much all year!

@ Costamazing Opportunities: We’ve looked at the development I believe you’re talking about (Level 1 by Taylor Morrison). They were nice, but not worth the money in my opinion. The rooftop decks are nice, but I can also see them being a problem, given they are perfect for partying. You might like to go to bed at 11:00 on weeknights, but your neighbors (renters or owners) might like to party until 2:00am. I work from home and am flexible, but not to that extent. Plus, my kid needs sleep. The walls are also too short on the rooftop decks between units, so hermits like me would always have to interact with their neighbors should I choose to be out on the deck at the same time as them. No thanks! Lastly, the schools throughout Costa Mesa are pretty bad (with very few exceptions). All in all, not the place for us, though the location is nice.

@ Flyover: Agreed, it’s all relative. And as most here seem to think, a slight (or better) correction might not be too far off in the future, making things interesting… Btw, we can easily afford a house in OC (and we have one). We just can’t afford one in the most expensive OC city.

From what I have read, the middle class has been shrinking for decades. That coupled with middle class migration from California really puts its existence in jeopardy. Third world countries don’t have a middle class. Not good.

Don’t you all worry Fuhrer Obama just gave Chinese business a citizens ten year yes 10 year visas!

That should work out well for housing and wages!

Rip USA.

Interesting piece that confirms my own observations. I migrated to California in 1985, settling in Santa Monica from 88 to 94 and shortly after I got the “Asian fever.” I wanted to date only Asian women and found Santa Monica something of a wasteland, even though everybody said it was paradise for singles I found the women there rather boring and went east to date and eventually marry. However now I am single again and end up having to go to the west side to date Asian women. Interestingly the biggest source of contention when I date women from the west side is that they all bought real estate at $400 to 800 per square foot, watch nonsense on HGTV and think that real estate at any price is a ‘great investment.’ I predict many will go back to China when the 2006 housing bubble ultimately deflates or when the China bubble implodes. I think both events will occur during the next decade and Google cars will eventually eliminate the opportunity cost of driving, opening up more areas for development by 2025 than roads and automobiles opened up from 1890 to 1940 when nominal inflation adjusted housing prices declined across the board over a period of 50 years. there is a lot of manipulation of ignorant foreigners to keep bubble price is going now.Indeed, In the longer term the only way to keep bubble prices going will be manipulations of public policy which we are seeing now.

The woman in the first home buyer couples who are fodder for the sub-prime racket, is often the problem, regardless of race. Their man is a “loser” if he can’t own a home for the family they are going to have.

It is not just a coincidence that tax cuts for the rich have preceded both the 1929 and 2007 depressions. The Revenue acts of 1926 and 1928 worked exactly as the Republican Congresses that pushed them through promised. The dramatic reductions in taxes on the upper income brackets and estates of the wealthy did indeed result in increases in savings and investment. However, overinvestment (by 1929 there were over 600 automobile manufacturing companies in the USA) caused the depression that made the rich, and most everyone else, ultimately much poorer.

Since 1969 there has been a tremendous shift in the tax burdens away from the rich on onto the middle class. Corporate income tax receipts, whose incidence falls entirely on the owners of corporations, were 4% of GDP then and are now less than 1%. During that same period, payroll tax rates as percent of GDP have increased dramatically. The overinvestment problem caused by the reduction in taxes on the wealthy is exacerbated by the increased tax burden on the middle class. While overinvestment creates more factories, housing and shopping centers; higher payroll taxes reduces the purchasing power of middle-class consumers. …”

http://seekingalpha.com/article/1543642

thank you. More people need understand how much monetary policy affects each and every one of us. Another huge factor that was not mentioned in this article was the fact that the Fed is giving visas to any foreigner that spends $500,000 dollars or more on realestate in the U.S. That policy was put in place in 2010. They’re killing the goose that lays the golden eggs, the middle class. When they can no longer receive enough tax revenues from the depleted middle class whom do the rich think they will turn to to get their money? Get in line. Your next.. the .001 % will gladly take it from the 1% and the 1% will gladly take it from the 10%. There in lies the rub. One for all, All for one!

Thanks to Obama the .1% can now get their money from the 5 million new green card holding illegals from their payroll taxes

Housing To Tank Hard in 2014!

no it wont

@Jim Taylor, nope. Not enough time, maybe 2015?

Most escrows take 45 to 60 days to close. So a home that went pending today isn’t going to show up until January 2015’s sales data, if there are snags then a home that went into escrow today may not show up until February 2015’s sales data.

I know the weather is nice in So Cal and if like myself you like to surf, well it is impossible to duplicate inland (Texas). That said, I am honestly surprised there has not been a greater migration from Coastal CA, where prices have gone full retarded again. If my wife didn’t have 6 years left in her teaching career to retirement, I would have left by now, as I do not understand paying so much more for the nicer weather.

O and as a landlord, I love the “Eviction Free” photo. WTF???? So they want it so landlords can not evict people that don’t pay their rent now, in the socialist city of San Francisco? This state is going bongers.

Jim, that signed is aimed directly at landlords that are restricted from raising rents due to rent control. The landlords are pushing every possible option to get their rents up to current market rates. Of course the tenants still paying rates from the 1980s don’t want to see that happen. If I recall correctly, there was talk of limiting the ability to evict a tenant even when the property is sold to a new owner.

It was more a reference the “Mello-Roos-ing” of SF that is happening…I believe the Dr. has covered that in past articles.

I sold a home in Rancho Palos Verdes in April. While I hadn’t lived there for years, it seemed the right time to sell and severe ties with So. Cal. I believe that cashing out of high priced California real estate while you can may be a good decision, and that buying in such a high priced market may carry significant risks! I think everyone can agree that we no longer are living in the ‘boom tines’ and that both the housing market and economy can turn on a dime … as we have seen!

We moved from Ventura County to Sonoma County in a career move around 6 years ago. We watched the market continue to go up but then bottom out in 2010. Since we had sold our place in Ventura County the “show” was interesting but not concerning – too much. We rented because there was such a nice choice of affordable and decent sized houses available for less than $2000 a month.

Now, in 2014 we are forced to move by a landlord that wants to rent the house to their kid ( this is the worst part of renting – capricious landlords giving the boot at the worst time).

Well, how times change. There is little rental stock to choose from now. Every rental open house is attended by 10 to 20 families desperate to get the nod. There is little for less than $2300. We ended up having to raid the piggy bank (at least we have one) and jump into the purchase market on a reasonably modest home. The monthly cash flow for P&I plus taxes and insurance is less than a similar rental. Of course there is the risk as well as the down payment money tied up. There are also the sales costs.

We figure that if we move in a few years there might be half decent rental market remaining up here that is cash flow positive. A couple pluses include a less than 5% unemployment rate and a commuter train to the SF area due to inaugurate around the end of 2016 increasing commute possibilities to the greater Bay Area. I guess we’ll see.

FWIW I’m in Sonoma Co. too and have been renting since selling a house in Mendocino Co. in 2007, fortunately I like my current place and the rent is OK at $1500 and has never been raised (YET) Tried to buy in Santa Rosa in 2011/2012 and it was virtually impossible with a mortgage, every place I bid on went to a 100% cash flipper or speculator. Am waiting for Bubble 2.0 to pop, buying now makes no sense for me when mediocre 3/2 houses are $400K…the same type of houses were $250K in 2011. May try again if prices drop back to somewhere near that level…but am wondering if there will be another wave of flipper and specuvestor locusts. Have retired in the meantime and can pay cash if need be when the time comes but would rather not, the tax hit would be considerable.

Santa Rosa is prime for a bubble pop…I moved from there last year (I lived near the Safeway on 4th, nice walking distance to Russian River Brewery).

It is not part of the Bay Area tech boom at all…and doesn’t have the jobs support those rental prices. Nothing new is being built as far as condo, houses or apartments. The few that commute to core Bay Area have the Novato Narrows (which won’t be 3 lanes til after 2017) traffic jam that adds an hour to what should be a reasonable drive.

I could go on and on about that place…I hated it…I took a job in Walnut Creek and moved to Alameda. Found a better paying job and better commute and a rent a nice house a few bus stops from the BART in downtown Oakland and only pay $2000 a month.

Santa Rosa will be crushed and soon….can’t stand that place.

In Santa Monica it is illegal to rent out a private residence, or even a room or garage of a private residence, for a period of less than 30 days.

Santa Monica has a compliance officer tasked with monitoring AirB&B and similar sites for illegal rentals. The Santa Monica Daily Press did an article on SM’s code compliance dept: http://smdp_backissues.s3.amazonaws.com/112013.pdf

From the article, page 10:

“A new staff assistant, one gain from the 2013-14 budget, is surfing the web for illegal short-term vacation rentals and helping to reorganize the way Code Compliance tracks

violations.”

Yes, I thought that article was such a classic piece of “Soviet Monica” culture that I bookmarked it.

Hello Son of Landlord. Yes, it is illegal in Santa Monica but plenty of people are doing it.

Just like plenty of people in LA with garages in their backyard converted them to rentals but left the old wooden door on the garage to give the impression that it is still a garage.

In the UK, where they have the worst problem with housing shortages and unaffordability due to the Town and Country Planning Act 1947, some Councils actually have light aircraft flying around at night taking thermal image photographs, which enforcement officers then overlay on maps to try and pick from the heat signatures, where people are living in structures that are not authorised as dwellings. This includes garden sheds and garages.

Create enough laws and everyone’s a criminal.

One of the features that has been noted by authors like Saskia Sassen, regarding “global cities” (which is a term I think she coined), is that they are increasingly comprised of a divided society, with very wealthy people on the one hand (both locally born wealthy and cosmopolitans), and on the other, lower-income recent immigrants from developing countries where they are accustomed to housing hardship (high rent per square foot and overcrowding). Locally born non-wealthy people are less tolerant of the housing hardship required to be able to live in the area at all, especially if there are other regions they can re-locate to.

The most advanced example of this is London, UK where fully 50% of the population is now foreign-born. This has grave implications for the preservation of western culture, period, in a culturally important city.

It is also a question how stable the politics will be in the long term, with severe inequality and a kind of “serf” class performing the unskilled work for a kind of oligopoly class. The serf class and indeed the great majority of locally-born voters nationally are never well-informed enough to understand that the underlying problem is regulatory distortions regarding housing development. It is all very well to have strong “Anglo” traditions of property rights and secure title and freedoms from “regulatory takings”, but the modern era’s system of rationing of overall land supply for urban development represents a massive “regulatory giving” to all incumbent land owners.

It is not necessarily “growth boundaries” that are responsible – it can be adjacent municipalities with strong “rural” density zoning, against which a city’s growth has run up.

If we are unwilling to break the impasse in these situations, then we need to understand that combining this with traditional strong property rights is a toxic mixture that will ruin our economy and society with its unintended consequences. I am in favour of free market solutions, but if there is an unbreakable political consensus that we must not allow urban sprawl, even if to keep housing systemically affordable, then pragmatic revisions of our dedication to property rights would be intelligent. No-one regards Japan as a raving Marxist nation and yet they have strong government direct operation in the urban land market and compulsory acquisitions (eminent domain) to enforce urban planning without creating unearned value for property owners. Same with the Netherlands. Of course both those countries have to be pragmatic due to sheer lack of actual total land supply relative to their population. If they were not pragmatic, and had untouchable Anglo systems of property rights, they would have had bubbles and crashes worse than California every 10 to 15 years. Sure, Japan has had ONE bubble followed by a long slow melt which is still going on. But they must be doing something right if they have avoided the short and repeated cycle of every Anglo market that starts to constrain its urban growth (the UK started this in 1947). How long did San Francisco’s property prices “unwind” for, did they ever reach “affordable”, and who knows where and when they will top out again now? Tokyo is more affordable now than any UK city, any major city in Canada, Australia or New Zealand, and more affordable than the USA’s bubble cities most of the time.

Germany is another country with interesting combinations of policies that have had a similar result to Japan’s in terms of an absence of short-cycle volatility. I will say more in another comment addressing the peculiarities of markets with more renting than owning.

It’s only a matter of time before the serfs come after the oligarchs with pitchforks. It’s not if, but when. it has been repeated throughout history and there is no place or point in history where there has been a great disparity between the rich and the poor in which this did not happen. They better smarten up pretty quick. Because the poor will eat the rich. how many houses yachts plain food clothing can the rich really consume? I’ve heard stories of people burying billions of dollars in the ground in their backyards because they obtained it in some nefarious way, and so cannot even spend it. So rather than giving it away they bury it. How disgustingly gross, greedy, slothy, Parisitey (new word), disgusting can one get?

But we the serfs have 500 channels and food stamps

Lynn Chase: “I’ve heard stories of people burying billions of dollars in the ground in their backyards…”

Have you really?

Billions? Not merely millions, but billions of dollars. Buried in a backyard. And you actually “heard stories” of this? Not just a story, but stories.

And since these billions of dollars are buried in someone’s private backyard, how did you come to learn of it?

Do some more research Lynn, then get your shovel out.

It’s only a matter of time before the serfs come after the oligarchs with pitchforks. It’s not if, but when. it has been repeated throughout history and there is no place or point in history where there has been a great disparity between the rich and the poor in which this did not happen. They better smarten up pretty quick. Because the poor will eat the rich. how many houses, yachts, planes, foods, clothing, can the rich really consume? I’ve heard stories of people burying billions of dollars in the ground in their backyards because they obtained it in some nefarious way, and so cannot even spend it. So rather than giving it away they bury it. How disgustingly gross, greedy, slothy, Parisitey (new word), disgusting can one get?

“I’ve heard stories of people burying billions of dollars in the ground in their backyards because they obtained it in some nefarious way, and so cannot even spend it. So rather than giving it away they bury it.”

Oh yeah… I remember that episode of Breaking Bad. That was a good one.

When you have an unusually high proportion of renting of homes rather than ownership, there is more than one differing cause of this.

It can be because the property market is one with inelastic supply (regulatory distortions), and is dominated by investors leading the market, buying most of the property that comes on the market in anticipation of capital gains. Private first home buyers tend to be priced out. But the investors cannot cover the costs of the property they have bought, with rental income – the reason they still bought is because of the anticipation of capital gains.

This is like the price/earnings ratio in shares – the share market price is often completely disconnected from actual share earnings potential, being dominated by speculators seeing who can make the most money out of “greater suckers” before reversion to mean occurs. It is morally repugnant to have housing affected by this phenomenon though.

The rational young person making housing decisions will rent because it is cheaper than buying with a mortgage in most cases.

Another cause of a high level of renting in a market, is that people are really only there for the employment and income potential and have no intention of staying permanently. Once they have made what they regard as a satisfactory amount of money, they will move on to somewhere where the stress level (and often the housing cost as well) is lower. This can be the case for not just a high-housing-cost market with good local economic conditions, but also for a low-housing-cost, high-opportunity city like Houston. Yes, the proportion of renting is high in Houston.

The third reason I am aware of for a high proportion of renting in a market, is typical of a country like Germany. Rental housing is heavily subsidised on the “supply” side, including with tax breaks for landlords, and strongly controlled in allowable rents and rights of tenure – making it an attractive accommodation option. The “rent controls” actually do not have the perverse incentive of reducing the supply of rental housing (like in New York) because investors are enticed into rental property by the subsidies.

Germany also has a perplexingly beneficial mixture of policies that I am still trying to understand, that keeps their urban land surprisingly affordable in spite of their economy being so strong. Not as affordable as Houston, but far more affordable than most Anglo cities that have limitations on sprawl. Yet Germany’s cities also have their sprawl strictly rationed. Among the factors that might be working to keep their urban land prices affordable, are: the incentivisation of renting, reducing pressures of “ownership at all costs” that tend to afflict Anglo nations; the existence of powers of compulsory acquisition that although used sparingly, tend to limit the greed of owners of greenfields sites and the “holdout” phenomenon that plagues Anglo cities with a growth boundary; the fact that most “rural” land surrounding German cities are small holdings that are numerous in quantity, meaning less greenfields-land-owner oligopoly effect than in Anglo countries where farms are traditionally very large; and lastly, the Autobahn effect – when you can travel by car in multiple directions from a city, at 100+ miles per hour, there are quite a lot of cheap rural towns property markets that are still a practical option of location. Bear in mind that the amount of land functionally added to a property market with a given centre, increases exponentially in quantity the more of it can be accessed in every direction. Fast trains, though, only ever provide access to a few locations (at each stop) on a single ribbon route.

Germany may also have strict prohibitions on foreign investment in their urban property markets – capital flight from China is currently swamping many Anglo nation cities property markets.

This is a nice synopsis of the issues we are facing, clearly you spend a lot of time researching. Have you ever considered seeking out historical price data for Detroit or other rust belt cities? I have a suspicion if we had accurate price data for Detroit starting from the late 1800’s we would see some interesting parallels. At one time everything was named Grand This and Grand That, I bet prices became quite grand as well. Perhaps that is what really caused things to unravel as opposed to the reasons usually given. It’s important to keep in mind that Detroit was not built by the auto industry as most people assume. Detroit was built by industrial revolution money from before cars really became dominant. The auto industry is more like a Detroit 2.0 kind of thing. Similar to how the chip business (now on foreign shores) was Bay Area 1.0 and silly dot coms are Bay Area 2.0.

I think a very similar process is occurring, in fact the population charts posted on this article show a similar replacement of the domestic population just like happened in Detroit. I imagine a very strong case could be made that the same mistakes are being repeated. Perhaps London being 50% foreign born is also a similar red flag. That number seems like it should be alarming. Call me what you will but I fail to see the long term benefit of allowing this to occur.

AirBnB is a lawsuit waiting to happen. Wait until someone gets bit by a dog or slips and falls in your garage/guesthouse. Good luck getting your homeowners policy to cover the claim caused by your unlawful rental. Might as well just give them the keys and title to your house. Even the AirBnB website warns of this. And AirBnB does not offer ANY liability coverage, only property damage. How many people using AirBnB to list rooms actually have shirt-term rental insurance coverage?

INTL migration from Asia is just a small portion of the people coming into CA, the majority is made up by the illegal kind. No need to worry about them, they are just renting anyway.

asians come here on tourist visas and stay too. they have very little money but who cares

Doc: [23 Mar, 2014] ‘Those buying today seem to be part of the fickle investor cohort and when prices stall or go negative year-over-year, let us see if things will continue. The Fed now seems to be on it for tapering and if you think they care about SoCal real estate you are incredibly mistaken.’

_____

This is just about my final hope, having been so crushed by house price inflation. I go back to that point time over when I’m feeling the attrition.

Doc is so smart in repeatedly sourcing and scrutinizing different data/themes which impinges on the market, including this latest look into migration / international migration. I still hold SoCal might see a fall-away in both holidaymakers and investors from UK/Europe.

Which reminds me… I know an English girl who has very recently returned to UK with her US husband – after he lost his job in SoCal (and I believe he had some role in real estate) – where they had been renting for the past few years. They’ve gone to live with her parents in a leafy/rainy part of UK… although at least it means bedrooms in that house will finally be dusted off. Way too many older owners in their 60s living alone in 5 bed houses in UK, complacent in belief values can’t fall from crazy heights.

There may be a great migration of middle class moving out of Ca. but I can assure they are not buying property in Nev. or Az. The markets in both states would like Ca. buyers but it isn’t happening.

As one agent told me CA. Folks are not realtistic when house , they think they can walk in and a steal a home at any price. sellers in these who states are willing to deal but not give the farm away. Sellers become buyers where do they go?

All in all nobody feels sorry for Ca. Buyers if they can’t afford the Golden State then they have to suck it up and buy where homes are a better bargain buy not a steal.

If you like the country life, and dislike the crowded polluted cities, move to the land of clean air, the “Emerald Triangle” and become a farmer, doing God’s work for the masses. Humboldt county is the place you would like to be. We even have a State University. This is God’s country, a real paradise on earth. As always, I(and Forest Lady) am a farm advisor, helping farmers with the highest quality product which puts $ billions into the California economy, the largest cash crop in the state. I switched them over to drip irrigation to conserve water(preserve the creeks).

California born and raised. Rented in SoCal for nearly 30 years, coastal OC for last 15. Could not stomach paying inflated prices for stucco, aluminum and sheetrock shacks built on top of your neighbors’. Over the summer, moved to N.E. and bought an old wood and plaster house in great shape on a couple of acres for less that a condo costs back home. At my age, it’s a permanent move. There is no going back. I’ll miss you, 405… 😢

If you could have found a way to stomach prices 30 years ago just imagine what could have happened. I stomached prices in ’92, ’96 and ’05 and thank god I did. Perhaps there is a lesson here for the young’uns.

Farmer John, hopefully CA passes prop 420 in 2016 and we have a legal west coast marijuana growing zone. Nothing would make me happier than to get out of my profession and move on to farming.

Been wondering lately about all those comments not too long ago which claimed that the Fed’s QE would go on forever or at the very least, a really long time. Now that the Fed has put that meme to bed, have any of the former doubters adjusted their related positions?

QE is still going on in the form of central banks propping up stock markets by buying treasuries and futures! Thus every asset is 3 to 19 x over priced!

Until its not!

The higher dollar, lower interest and lower oil prices are also a form of QE. Puts money in the pockets of consumers to spend them…for now!!!

@flyover, I will disagree with you about lower oil prices stimulating the economy. Gas coming down $1 a gallon is a great conservation topic. But for myself, this equates to about $20 per month in real savings. The average SoCal’er lives 10 miles from work so this comes out to about $30 per month in savings for them. Again, great for a conversation topic but irrelevant to financial well-being.

ernst, lower energy costs have major cumulative impact beyond just what you’re putting in your tank. Most people don’t realize how much energy costs are built-in to just about everything we consume.

Ernst,

I agree with you if you look at price of gas ONLY.

My point is that we have a combination of 3 factors. ALL COMBINED are a form of stimulus (not just one): lower interest, stronger dollar and price of gas.

‘When we look at anything closely enough, we find it connected to everything else in the universe.’ Don’t be too quick to celebrate lower oil prices (although I welcome it) without consequence elsewhere.

_____

A drop in oil to the $50s or lower – Just another $20 drop in oil would cause tremendous pain in the entire energy sector and would quickly spread to the financial sector levered to higher prices.

@Brain Of England, also oil is a global commodity. Declining oil prices usually signify the world economy is softening, and since the U.S. and China are the two leading consumers of oil, one can infer the economies of the U.S. and China are slowing.

Chinese energy usage is down 3% year-over-year, yet the Red Chinese government claims their economy is growing at +7%. Something is not right here. The delta on energy usage in the U.S. appears to be going to zero or negative for 2014.

I use oil prices as one recession indicator.

Unfortunately, ZIRP and the threat of a QE revival remain. The former is allowing the “orderly” unwinding of real estate investments. The latter is still levitating an wildly overvalued stock market.

“The higher dollar, lower interest and lower oil prices are also a form of QE. Puts money in the pockets of consumers to spend them…for now!!!”

A higher dollar is not a form of QE because, at worse, it lowers the “official” inflation index and foils the Fed’s inflation target. It would also eat into the profits of American multinationals. It could be used as an excuse by the Fed to keep rates low for a longer amount of time.

I hate to tell you this but Houston Texas got the most diverse city in the US. It has about double the number of afro-americans that las has and has lots of foreign born as well. A for Plano where Toyota relocated a lot of the schools have indians and whites or afro-americans and Hispanics. Both Orange County and San Diego are less diverse than Houston and Dallas County Texas. In fact most of the domestic immigration to Texas is 2nd and 3rd generation latinos and afro-americans not whirtes as much and Texas actaully is getitng more doemstic and international while Claifnria in ORnag eand San DIeog is getting less foreign born than Houstn and Dallas Texas.

HOUSTON — On Wright Road, near the cellphone parking lot at George Bush Intercontinental Airport, sits an enormous rectangular warehouse and parking lot stippled taxicab yellow. Sedans and SUVs imprinted with the blocky names of car companies line up headlight to taillight in countless rows. Drivers of every nationality, age and background — nearly all men — wait hours to be dispatched to the airport terminal with the promise of a $53 fare.

They huddle around TVs, lift weights, gossip, pray and eat in a rundown concrete shelter that once served as a detention facility and is now Houston’s main taxi depot. There’s a circle of North Africans watching Arabic-language news, a lively pingpong game, a chess match and a lone Pakistani leaning back in a plush armchair. In the only air-conditioned part of the structure, not far from the two food trucks parked outside, drivers nuke their lunches in microwaves stacked on the floor, and part-time students read and surf the Web.

taxi

From left: Houston taxi drivers Mohammed, 49, who uses one name; Ali Sayed, 55; and Sam Arnick, 63, at the airport depot. E. Tammy Kim / Al Jazeera America

Ebrahim Ulu, an affable, round-faced man with a broken gait, begins a sultry 14-hour shift in July. A teacher and public-health worker in Ethiopia, he went to Houston in 2007 on a diversity visa, a certain number of which go to countries with historically low rates of immigration to the United States. “For six months, I slept in the car in order to buy a car and bring my family from Africa,†he said. Life today is much improved: After a long day of driving and waiting for customers, he returns home to his two young children and pregnant wife. He owns the car he drives but must lease the right to operate a taxi in the form of a costly $170-per-week medallion.

The burden of having to rent the medallion from a middleman moved Ulu and his fellow drivers to form an unofficial union, the United Houstonian Taxi Drivers Association, in 2011. It’s the eighth org

Houston is multicultural, in part because of its many academic institutions and strong industries as well as being a major port city. Over 90 languages are spoken in the city.[79] It has among the youngest populations in the nation,[80][81][82] partly due to an influx of immigrants into Texas.[83] An estimated 400,000 undocumented people reside in the Houston area.[84]

According to the 2010 Census, whites made up 51% of Houston’s population; 26% of the total population were non-Hispanic whites. Blacks or African Americans made up 24% of Houston’s population. American Indians made up 0.7% of the population. Asians made up 6% (1.7% Vietnamese, 1.3% Chinese, 1.3% Indian, 0.9% Pakistani, 0.4% Filipino, 0.3% Korean, 0.1% Japanese), while Pacific Islanders made up 0.1%. Individuals from some other race made up 15.2% of the city’s population, of which 0.2% were non-Hispanic. Individuals from two or more races made up 3.3% of the city. People of Hispanic origin, regardless of race, made up 44% of Houston’s population.[85]

At the 2000 Census, there were 1,953,631 people and the population density was 3,371.7 people per square mile (1,301.8/km²). The racial makeup of the city was 49.3% White, 25.3% African American, 5.3% Asian, 0.4% American Indian, 0.1% Pacific Islander, 16.5% from some other race, and 3.1% from two or more races. In addition, Hispanics made up 37.4% of Houston’s population while non-Hispanic whites made up 30.8%,[86] down from 62.4% in 1970.[24]

The median income for a household in the city was $37,000, and the median income for a family was $40,000. Males had a median income of $32,000 versus $27,000 for females. The per capita income was $20,000. Nineteen percent of the population and 16% of families were below the poverty l

Big cities are big cities. Go to the suburbs. In Houston, live in The Woodlands. In Dallas, go to Westlake, Greenway Parks, or Westover Hills. I use to live in Westlake, but I wanted to live in Kerrville, God’s country. But Westlake is nice, Glenn Beck lives there. The westside folks would like that place. The westside people don’t like diversity, according to Ashley anymore than the folks in Westlake. Yes Houston does have diversity, like Compton. Houston is a big area, the same for L.A. In real estate, Bubba told me, it is location, location, and location. Westside people who never go east of the 405 never get to see the diversity. Zuma to LAX, you do not see much diversity.

Yes but Plano TExas and Sugarland have really grown in minority populations. There are schools in Plano that are over 20 percent Asian mainly Indian and Sugarland is about 33 percent Asian. It isn’t as white as you say I read the stats. In fact South Orange County is more white than many cities or towns in Texas and Texas is getting more minporityesty since its a lot cheapre than California. Arizona has had increase of Blacks and Asians. The woodlands in Texas has seen a more rapid growth in Latinos than south Orange County. There are schools in the most white parts of Texas that are 50 percent Latino.

Hispanic 59% 22%

White, non-Hispanic 37% 74%

Multiracial 2% %

Native American or Native Alaskan 0.5% 0.4%

Asian 0.5% %

Black, non-Hispanic 0.2% 3%

Asian/Pacific Islander 0.2% 0.8%

Native Hawaiian or Other Pacific Islander 0% % This is in Magnolia. Its like South Orange County the Woodlands and the other places you mention the nice part of town the schools are white and the bad part of town its latino. This is not Houston or Dallas its out in the burbs and is from Zillow on school enrollment.

Madisonville Intermediate School is a public elementary school in Madisonville. The principal of Madisonville Intermediate School is Mr Marc Hodges and can be contacted at mhodges@madisonvillecisd.org. 470 students attend Madisonville Intermediate School and identify as White, non-Hispanic; Hispanic; and Black, non-Hispanic. 15% of the Madisonville Intermediate School students have “limited English proficiency.” 65% of the 470 students here are classified as “economically disadvantaged”, and 70% are paying reduced lunch prices.The class size at Madisonville Intermediate School is 23, and the student to teacher ratio is 15:1. Madisonville Elementary School is one of the nearest elementary schools.

Student Ethnicities

ETHNICITY SCHOOL DISTRICT

White, non-Hispanic 50% 48%

Hispanic 29% 28%

Black, non-Hispanic 19% 23%

Asian/Pacific Islander 1.0% 0.7%

Multiracial 0.8% %

Native American or Native Alaskan 0.6% 0.3%

Asian 0.4% %

Native Hawaiian or Other Pacific Islander 0% % Poor whites at this schools in the woodlands. Free and reduce lunch levels in La or OC which would be for Latinos or poor Asians or blacks in LA. Granted, its cheaper to get a house but Texas has the white poverty problems in some places like Arizona.

Most of the above paints the picture of a powder keg. Resentment of newbie residents, racial overtones throughout Barak Obama’s presidency, etc., all useful tools for manipulating the mob. Stability plays well. Instability and fear plays sensationally.

The government hands out VISA’s to chinese nationals that buy a home for $700,000 CASH. I have worked in Irvine since 1986 and this is by FAR the worst I have ever seen of this type of rampant corruption. The elite rich like Donald Duck Bren, buy elected officials votes, so the law of the land reflects the ability for the rich to get even richer while the current sharecopping service workers provide for the families of the 1% moving into California, displacing the sharecroppers to the inland empire. The problem is, the sharecroppers hate when you tell them the truth and they vote against their own interests according to their masters media and educational instructions.

When will America rise up against these parasites called politicans and the dirt bags that protect them called the police?

half the people don’t vote, they know the game is fixed. not voting is a legitimate protest. We need a parliamentary system like Europe. Look at California, the two parties conspired to kill the third parties, now we have a one party state, just like Texas(but the “bad party” is there).

The reason the THIRD party died is because Al Gore lost to George W. Bush. It was widely viewed that Ralph Nader voters would have voted for Gore and pushed him over the top.

Since then… voting for a third party candidate is viewed as a wasted vote because your intended candidate has NO SHOT IN HELL. And your 2nd choice candidate might lose and your stuck with your 3rd choice.

Doc – interesting article in the FT, perhaps for a future topic if you rejig the theories to the US perspective. None of the info in the article will be any news to you, but so many often forget, or don’t consider the variables involved, as they rush to get as much debt as possible, with teaser low mortgage rates, to meet very high house prices.

Unfortunately I can not quote any of it here, for the FT has very strict rules regarding its articles, under copyright policy, being quoted elsewhere on the internet. It’s behind the paywall but FT usually allows viewers to click in from a google search for a couple of articles a month, and I have most success getting in to read articles with Google Chrome browser.

FT.com

November 21, 2014 3:49 pm

Why a house-price bubble means trouble

California has become like Mexico and Central and South South America with a corrupt leftist ruling elite (Democrat Party) that controls the wealth, a middle class that’s shrinking, and a huge population of poor people that continues to grow. Go inland from California’s coastal cities and it looks more like a third world ghetto. The lack of water in California is only going to make things much worse for the millions who live here.

Leave a Reply