The mass exodus of middle class households continues from California: One-third of Bay Area residents would like to leave sometime soon.

The cost of California housing in the form of mortgages and rents is forcing many families to pack up and leave. And many others are seriously contemplating the decision. A recent survey by the Bay Area Council found that one-third of respondents would like to leave the area sometime soon. Recently I purchased an item from an independent seller and he couldn’t help telling me how he was moving to Nevada and how SoCal prices were “insane†and he couldn’t get ahead even with a good income. Most of time you get some Taco Tuesday baby boomers yelling from their gut that “you should move then!†to most people examining high home prices in California. And guess what? Net migration out of the state is high. In terms of domestic net-migration, 63,300 more people fled the state than entered. This was the highest level since 2011. People are voting with their wallets.

The blueprint for migration

People realize the insanity of their choices if they want to stay in California. Some people that I know decide on ridiculous commutes that not only are likely to shorten your lifespan, but will also send your quality of life into the toilet. “I get home and everyone is asleep.â€Â Okay. But hey, they “own†a home even though their commute into work is mentally destructive and they have minimal interaction with their family for most of the week. Many people are simply doing the analysis and are bolting out of the state.

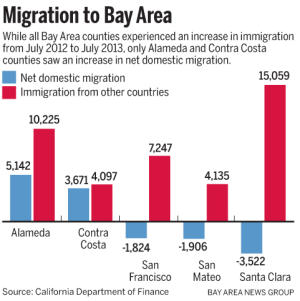

Take a look at some net migration for the Bay Area:

Southern California housing is equally ridiculous. But you’ll notice above that in every category, foreign immigration is outpacing domestic migration. And in San Francisco, San Mateo, and Santa Clara you actually have net outward domestic migration. Meaning families are leaving, like this family:

“(Mercury News) You can’t get ahead,” Eaton said. “It’s more than the cost of living; it’s the high taxes.”

Eaton and her sister had a $724,000 house in The Villages in South San Jose that they sold before moving to Ohio. Their mortgage payments were $2,200 a month, plus $1,000 for association fees in the gated community. They were able to pay $300,000 in cash for their new home in Ohio.â€

And there is the kicker. This is a family that owned a $724,000 shack and decided to get out. And most house humping cheerleaders only look at principal and interest when running their math. What about taxes? Insurance? Or in this case the $1,000 ridiculous association fee for a gated community. If every area of California is so “baller†why the need for a gated community? Who are you trying to keep out? So they sell their home and use the cash proceeds to buy a “new†home in cash in Ohio. No mortgage and probably no insane association fee. The biggest expense is basically eliminated in one move. Others would rather slog away on clogged up freeways so they can get to their crap shacks so they can rinse and repeat for 30 years. And yes, long commutes are bad for you.

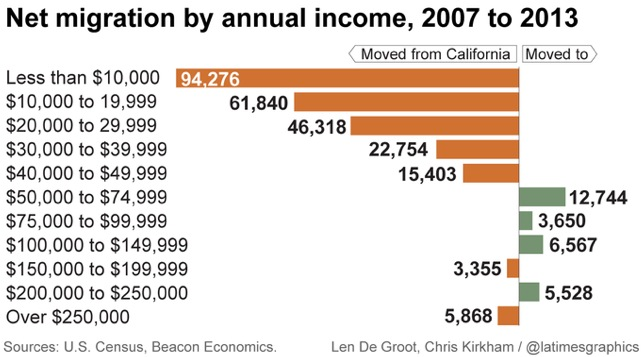

The middle class is clearly leaving California:

Those that stay are getting milked by high rents and high priced crap shacks. Only a couple of groups are seeing a positive net domestic migration pattern. But I find it funny that those making over $250,000 are also opting to leave – for this group it is largely the high taxes in the state.

Here is an example of a high income household bolting:

“Living in UC San Francisco housing, the couple pays $2,100 a month in rent. And they have to cough up $1,900 a month for child care.

“My husband’s salary would be in the six figures, but six figures is not enough to cover the rent, day care (and) food prices,” Govindarajan said. “It all starts to add up.”

Govindarajan said she figures they can put down 20 percent on a nice house in North Carolina and have a monthly payment of $1,800 — which would include the mortgage, property taxes and insurance.â€

And this is another point that is typically missed on the house humping shows and from the lips of horny housing cheerleaders. Many people buy because of the pressure of “having a family†and forget about the cost of having a child. Your budget gets blown out of the water when kids are factored in especially with dual-income households. This family had rent of $2,100 and childcare costs of $1,900 a month! This is typical in California and especially in the real estate nutty Bay Area. And those costs are going to last until they enter public school. And many crap shacks are in hoods where schools suck. So add on private school costs as well.

The bottom line is that people are voting with their wallets. And many Taco Tuesday baby boomers are seeing their kids moving back home and guess what? The kids can’t afford rent or even to buy a home in their area and then you hear the bellyaching from these people yet much of the NIMBYism policy was brought on by their myopic views. Why not turn large parts of big cities into high density housing? People are having smaller families for the most part.

Expect this trend to continue but you do have a choice. The idea of an insane commute is enough to make people leave. By the time you pay off your 30 year mortgage your health will be so bad that you’ll be lucky to be alive and not have heart disease brought on by stress and a sedentary lifestyle. Then again, you have a home to leave to your family and maybe that is the goal.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

165 Responses to “The mass exodus of middle class households continues from California: One-third of Bay Area residents would like to leave sometime soon.”

I have a hard time believing they can’t find anything cheaper than $1,900 a month for child care. They are probably taking the kids to an elite daycare school and they are probably living in a real nice area. You can live within your needs in these cities (hell, any city) but most people feel the need for the house, cars, big screen TV, upscale restaurants for date night etc.

Childcare IS expensive. I live in LA and where I live the average daycare costs is $1250-$1600/month for one infant. I pay around $1800/month for 2 kids for my work daycare which is subsidized and thus less than the surrounding area. And I live in a decent area, not elite at all, a lot of my neighbors have those iron bars on the windows if that gives you a sense. And since most daycares and preschools have waitlists, if you can’t find one with an opening, then nannies are $15-$25/hour.

Would you like to be raised by strangers and not your mother? Why did you have kids?

Andy – do you not get it? Those kids are going to be raised by nannies, and they’re going to get into the right kindergarten then into the right elementary school, right high school, right prep school, then into Stanford or Harvard, and they’re going to make their parents look good, or else!

It’s like buying a race horse; that f*cker better win or it’s off to the glue factory.

Those kids will grow up with II or III after their name, if male; if female, they’ll be known as “buffy” or something and their actual real name will be almost forgotten.

And if they don’t play the game right, well, they can’t be sent off to “the pound” like an expensive pointer dog who insists on widdling on the antique Persian rug, so they’re turfed out and at best, they become “grey gardens” or “cello joe”

Andy

June 27, 2016 at 12:40 am

Would you like to be raised by strangers and not your mother? Why did you have kids?

Is this comment for real in 2016? maybe because women have other identities beyond being a mother and a care taker? because they may have spent years working hard and building a career that is important to them and they don’t want to give that up because they also want to have children? because if being raised by a parent is so important maybe the father could stay home as well? because different strokes for different folks? because in a state like CA where the cost of living is so astronomical you don’t even have a choice to live on a single income? there reasons are infinite and personal and that comment is incredibly narrow minded and dismissive.

Moe Bee, I understand your view. It’s just that maybe both parents working is not the best for a baby.

My husband and I are currently wondering what our plan will be for our future kids. We live in southern California, but we live outside of the very expensive areas with the “crap shacks.” Our big goal was to have low monthly expenses, so we bought a modest house in a very nice neighborhood in a small town called San Dimas (look it up…it was and it still is more affordable than many other areas). Our mortgage is $1480 per month and we don’t have any association fees or anything. Rent in most nice areas of SoCal is that or more. And we didn’t have a giant down payment or help from others. We saved.

Also, we live cheaply. We bought our older but very nice and reliable Toyota cars for around $5k each (certain year Toyotas and Hondas are the best) and we can fix cars most of the time. We also fix the things around the house ourselves. We are in our early 30’s but we work hard and believe in saving and not spending on ridiculous things like sunglasses, purses, shoes, and cellphones like a lot of other young people.

I work 20 minutes away (take streets all the way) and my husband hasn’t worked for a while but hopefully soon will work nearby. We believe in having a good quality of life and if it ever becomes hard to live well in SoCal, then we’ll move to another state.

I wish everyone good luck. The economy is tough these days.

I have a feeling that $1900 a month is pretty minimal for even a half-decent daycare center, based on the fees I see here in Chicago, if you are talking about care for more than one child.

At one time, over 25 years ago c. 1990, my sister had to place her 12-year old, her toddler boy, and her infant son in 3 different day care situations. There were the after-school activities for the eldest, conventional day care for the toddler but the place did not take infants, and a woman who cared for infants but in a setting my sister considered sub-standard but couldn’t find anything better. The cost was $375 per week for sub-elite care. In 1990. In St. Louis, MO. The truly fine day care centers were out of her bracket.

I checked at the place near me, which is used mostly by lower-middle-income working women. It’s a very friendly place run by caring women who love children and are very dedicated, but it is absolutely sub-standard by upper middle class standards. It costs nearly $200 a week for each child. Meanwhile, the really beautiful center I saw in Evanston that made me wish I was a kid again, costs $300 a week.

You might ask why the customers, who are marginal earners, just don’t stay home, but the fact is that even the $30 a week or so they clear after taxes, transportation, assorted work expenses, and day care, helps out in their houses.

Laura Lauzader – the lower-middle-income place sounds great but it’s death for upper-middle-income kids. The kids might acquire the wrong accents – I remember extensive drilling and correcting when I was little because we’d learned to say “aigs” and “laigs” for “eggs” and “legs” from, apparently, some kids of the wrong class in the neighborhood, maybe even actual descendants of Okies! We were drilled and corrected on other words, expressions, etc also.

And those kids might not grow up knowing the “right” other little kids; being able to say you used to play in the sandbox with Bill Gates is worth millions, after all.

Class becoming all-important in the US is becoming the dominant idea, very fast. About all someone can do is snob it up faster than everyone else is snobbing it up.

Exactly. I would want a better day care center for my own kids. High quality day care, like the wonderful place in Evanston, is exorbitant in cost, but I would personally want nothing less for my child. I’d make a lot of sacrifice in other areas to provide high quality care and education for my child- it’s worth it to live in a smaller dwelling and drive an old, cheap car, to get your children off to a good start in life. My point is that day care of any quality is absolutely stratospheric just about everywhere, so a monthly cost of $1900 in a high-cost region does not surprise me, especially if it is of good quality. I can see why- just maintaining the level of sanitation necessary to prevent contagious illnesses has got to be very challenging, never mind the cost of toys and educational materials that have to be replaced constantly, or the personnel needed to provide proper supervision. The only way you can get a break is to use the church-run facilities, which provide quality care at steeply lower rates. Many women who aren’t especially religious join churches just to have access to these.

That’s exactly the point. They’re making six figures, so of course they expect good child care, a nice house, a nice TV, etc…and that is why they moved away from California. We did the same thing last year.

$100k + doesn’t get you very far in America these days. When I say doesn’t get you very far, sure you are better off than A LOT of Americans but if you compare the value of the dollar, cost of real estate, education , health insurance, gas, etc. compared to generations ago….it’s a joke. The average American family of 4 makes what? $45K? That’s poverty level in America. This country is on a downward spiral of third world status. Truly……the middle class is blowing up into the upper class and everyone else trying to keep up. Everybody is in debt up to their eyeballs, even the wealthy. Most upper middle class people and professionals like lawyers, doctors, etc. are in just as much debt as anyone else. All we seem to be able to do is kick the can down the street and pile on more debt and more financial chaos for future generations to deal with, that’s the saddest part of all this.

Nick – Imagine a ladder that’s pulling apart, but the stretchy part is in the middle – so the rungs in the middle are further and further apart, but they’re close together at the top and at the bottom. So if you’re on the middle part of the ladder, you’d better have some way to gallop upward past the now-far-apart rungs, and up into the close-together rungs at the top, or you’ll fall down toward the close-together rungs at the bottom, and that’s where you’ll be.

This is how it is now.

What amazes me is how few couples ever consider that it usually makes economic sense for the mother to stay home with the kids and even homeschool instead of paying strangers to raise and “educate” them. Much less need to overpay for a house in an expensive “good” school district too. Easier to move with only one corporate job to consider too.

Totally. The human animal is the worst. What it does to its children.

I’m not sure I agree about homeschooling, but I do agree about one of the parents raising the children. I’m very thankful that my wife decided to leave her job and raise our son.

Wow. You do realize this is a Southern California housing blog?

Given today’s average salary vs. average rent, the average worker can barely afford to put food on the table for 1 person, let alone a non-working spouse AND a child.

If you bother to read this blog, this shouldn’t be new information.

I stay at home with my children and have been homeschooling for 15 years. My children surpass the average for standardized testing and are also involved with several social programs and church activities. In other words they are smart and social. It has been much easier for us to live on one income than try to deal with two jobs. There are still affordable places to live in California, but it can be tough to do that if you are needing to manage child care, public or private school and two jobs. Our life is simple and beautiful.

“need for the house, cars, big screen TV, upscale restaurants for date night etc”

isn’t that also known as having a life? How did we get to this point where having a few nice things is a bad thing? Now we’re supposed to live like paupers for some insane reason.

interesting – you’d get along well with my employers.

They have to run like mad to stay in one place, and the latest is, the guy’s going to take a job on the east coast and fly back and forth to hopefully be home here on weekends. No problem, no health repercussions, when you’re 27 woops nope the guy’s 67.

When those things are way overpriced, it makes sense to do without. My beef is with the rising cost of our needs – health care, housing, and education to benefit the vampires running this country into the ground. Also transportation – all this phony luxury junk going into cars nowadays is a joke, I just rented a new subaru (I have a 2012) and as is typical they had to fix a bunch of stuff that wasn’t broken – added a stupid touch screen which is hard to see and completely unintuitive. How much has a car stereo and AC changed in the last 20-30 years? Not one damn bit, but they have to screw around with the layout making it a pain in the a55 to figure out without going through the owners manual. All these electronic gizmos just add to the cost and when they break its a fortune to fix. Don’t even get me started on the so called luxury sports car segment, some of my friends who got sucked into that vortex lost small fortunes on that nonsense.

You can have a life without these things. Del Taco is great and cheap. Instead of going to see U2 go to the beach with a Bluetooth speaker and watch the waves. Instead of going out drinking with friends, have a party at your place. Volunteering is free and helps everyone out plus you can meet new people. Sounds to me like you let the TV teach you about life. Life is relationships, not about what kind of cruelty steak you just ate at Boa.

In light of recent events, I predict a new run on US real estate as more foreign money will seek relative safety in US assets as currencies throughout Europe and Asia continue to fall compared to the dollar.

Bexit = Higher US RE

http://fortune.com/2016/06/24/brexit-home-prices/

PROPAGANDA!!!

Isn’t it funny that the main stream American media is always bullish. They take bits and pieces of the news and then slant it as “news” when it is actually their opinion piece.

Oh yeah, you better by real estate and stocks right now because of the Brexit vote.

Nimesh – if you read US newspapers from the dailies to the free weeklies, you know how much of their advertising is for real estate. So no wonder the papers are all bullish on RE.

Yep…or it could mean the first real piece of the Jenga tower has fallen, and our economy will go with it.

If Brexit causes the US economy to go kaboom, then we might have a chance at reasonable home prices.

http://www.nexthousingbubble.com/2016/06/brexit-and-us-housing-bubble.html

I have read that Brexit will raise real estate prices in major cities also, but I am not sure I agree. Our dollar is a lot stronger against their money now which will make it more expensive for them to purchase our real estate. Plus luxury housing sales have already slowed in major cities. Add to that all of the layoffs they have already started announcing and we have no idea how much farther down stocks will go adding more layoffs. I think my man big Jim Taylor may soon be proven correct. Housing to tank hard soon

Our dollar is a lot stronger against their money now? No, the U.S. dollar is worth less than both the Euro and the British Pound Sterling.

http://finance.yahoo.com/currency-converter/?amt=1&from=USD&to=GBP&submit=Convert#from=USD;to=EUR;amt=1

http://gbp.fx-exchange.com/

I think that Ms Tammy meant that the long term trend has seen the dollar gaining against both the Euro and the Pound.

Seismic1

Then we are killing it against the yen. I don’t think it’s works that way. If the values of currency are equal it’s not one to one.

The faster this happens, the better. An asset bubble bursts once it has sucked in all possible victi…er buyers.

BTW, gotta hand it to you for distorting a rejection of globalism and central bankers into something to the contrary. Many voted for britexit because they were disgusted by the wholesale accumulation of English properties by foreign buyers.

Prince, UK may have rejected globalism, but unfortunately the US has not. At least not yet. With that being said it just makes sense that foreign wealth would flee to the relative safety of US RE when the option is unstable UK and European countries.

I am all for a downturn in RE. but I just don’t think Brexit is the catalyst everyone is waiting for. It may in fact cause the opposite. Maybe I am wrong.

Don’t forget that in the aftermath of Brexit it is highly doubtful that the feds will raise rates any time this year. Which translates to more cheap money and interest and mortgage rates remaining at all time lows.

I’m not contradicting your initial claim. I wouldn’t be surprised if those foreign investors accelerated their plans and pulled demand forward ahead of schedule. However, I don’t believe that it’s any more sustainable than before, especially if properties become pricier just by the virtue of a strengthening dollar.

BTW, low interest rates are not going to prevent the next recession nor the pricking of the bubble. The Fed and other central banks are playing with fire keeping rates so low while the world is oversatured with debt and very little demand.

The headline should be some people are moving out, but there are still plenty of others lined up to take their place and even pay more for the privilege of doing so.

Take a look at who is moving in: the super rich and the super poor.

The best part is how those left behind think this is not going to be a problem for them.

Take a look at who is moving in: the super rich and the super poor–mostly from other countries.

U.S. citizens are being pushed out of their own country thanks to globalist politicians and their open borders.

Siesmic1 – and the globalists are very foolish if they think there will be no backlash. The Weimar economy is not working for the vast mass of the people.

“63,300 more people fled the state than entered.”

So what? this is a typical crowd size at a Dodger game. It would take decades of this to make any meaningful impact.

Just was in socal for a week – the thought that came to mind is that its like a million vultures fighting over some scraps of carrion. Crowded, polluted, traffic like a video game, corrupt government taxing you at every turn. All that for a bit of warm sunshine. Fresh water is so foul there, its disgusting to drink or bathe in it. Good luck with parking anywhere near someplace you have to go that is half way nice. I would like to see a CalExit in the future, in the hopes that it doesn’t drag down the rest of the country into its third world abyss.

I’m for CalExit too! But that is because we send more money to the US General Fund than any other state. Unlike those TAKER states of Florida, Kansas, Wisconsin….

The Red Staters who pride themselves on self-sufficiency are all taking more than they pay. In other words, except for Texas, the Red Staters are on welfare. Texas pumps money right out of the ground, so this keeps them off the list, not any astute business or government practices. Texas also brags about all the new jobs they created. They are burger flipping jobs. As the number of new jobs surged, the median household income in Texas dropped.

Thanks for seeing it my way, Cali has it so good and is so economically strong that it doesn’t deserve to be dragged down by the rest of lowly backwards unenlightened states in the US and therefore should become its own nation. Quit whining and start petitioning for a divorce! I and millions of others are already working on our David Spade-ish “buh-byes”. We’ll miss you, we promise!

As far as states deriving income from stuff in the ground – life must suck to be that stupid. Modern civilization runs on oil. All the tech crap that clowns slobber over runs on materials that come out of some pit in a desert somewhere and most of those pits aren’t in Cali. But I guess failing freshman econ inevitably results in people thinking Cali is actually financially sound – kind of like those who invest in Tesla!

After Cali becomes its own country, it can upgrade its flag – replacing the bear with a unicorn.

Hey Roddy, take a look at your precious blue states, as they rank near the bottom for fiscal condition. Next time use actual facts to support your position instead of your opinion.

http://mercatus.org/statefiscalrankings

The bipartisan Legislative Analysts’ Office annonunced that California’s 2015-16 personal income tax collection has fallen from a huge surplus to a $147 million deficit. The cause appears to be plummeting Silicon Valley capital gains and weakening tech employment.

California politicians used to spend windfalls on the middle class. But since Brown was elected in 2010, the state’s middle class has shrunk from 46.7 to 43.5 percent of the population. Average incomes by 2013 had fallen by $5,255, and those spending at least 30 percent of income on housing leaped by 20 percent to 44 percent of state residents.

The quick reversal of fortunes for the state budget is disturbing, since the California State Controller reported that personal income tax collections through December had been at a $1.276 billion surplus.

With a hot tech stock market through June of last year, California realized about $4 billion in “extra†one-time capital gains tax revenues for the 2014-15 fiscal year.

With a “structural deficit†relying on capital gains taxes to balance the budget, California will be as broke as Greece if the stock market ever tanks again…

http://www.breitbart.com/california/2016/02/05/california-state-moves-to-deficit-as-silicon-valley-begins-to-crumble/

Haha AMEN brother/sister!

I wouldn’t wish too many bad things on CA. Earlier this month, CA surpassed France to become the world’s sixth largest economy. With Britain leaving the EU, it will likely become the fifth largest economy in the world. As CA goes, so goes the rest of the country. There is a reason highly desirable locations in CA command a large premium if you want to live there (own or rent).

Exactly, who cares what the cost of a house in Cali, as long as people have the money to buy them and buy them they will. I would love to live in sunny southern cali but simply can’t afford it year round but to winter in Palm Springs area is great. Canadians come there in the the droves, they know a good thing when they see it, and many bought during the great times when Dr. Housing moron was telling us not to buy. Well they have made out like fat cats!

No kidding. We’ve been in Oregon almost 2 years now, and we’re dreading the trip home to LA next week.

Oregon is pretty high tax too, no?

Yes, I know, no sales tax. But still, a high income tax. High property taxes. Isn’t that so?

Cumulatively, it’s still one of the lesser taxed states. Plus, although home prices are also in a bubble here in Portland, they are considerably cheaper than equivalent homes in Los Angeles, which is why so many Californians are moving here. The house we’re in up here would easily be 3x more expensive in an equivalent neighborhood in LA.

That being said, we’re still renting (at only about 12% of our income) until the next downturn.

Love you folks with your smarmy Oregon posts. I lived there 5 years and couldn’t wait to get back to Cali. Stop taking the meds, smoking the weed, and drinking the microbrews. Just wait until you get 8 weeks of constant gray and drizzle with no light at all. Just charcoal gray everywhere. Stop trying to sound superior until you’ve really spent time there. Met a man bragged about how much house he got in Oregon compared to terrible Cali and his wife confided she wanted to kill her self every day since she moved there.

Overheard a lady at an airport complain about California being expensive and overrated, and would leave except her family’s in SoCal. I’d do the same but our jobs are too specialized.

I must admit, I have been enjoying a little distance from the family members in LA. If that doesn’t sound appealing, it can be more difficult to make the move.

Yeah well… that’s just like your opinion.. man

If you call hard working Americans vultures then add me to the list of vultures!

California is for people who have the skills and talent to compete. Oregon was originally populated by the people who quit on the Oregon Trail — they didn’t have the right stuff to make it to California — so they decided Oregon is good enough. Texas and the Red States are for people who need their houses to be priced at $50,000. Texas is for people who need to carry guns as compensation for lack of certain physical endowments. Texans remember the Alamo yet it’s where the Mexicans kicked Texan butt. What kind of people make a myth out of getting their butts kicked. California is rich in diversity. Texas, well, it’s the gene pool that has given us Rick Perry and the current governor.

I have left California before and always return, yet here I am again considering my options. I make more than the median wage in South OC and my living habits are not extravagant… but I am one more rent increase from homelessness. People love to blame the taxes in California for the cost of living, but it’s really the cost of housing that drives people away. BTW… “Homeowners Association” is just a very, very local tax.

And yet Janet Yellen doesn’t count home price or rent increases in their inflation calculations to derive inflation. Cost of housing is astronomical in SoCal, and cannot be ignored as being part of our cost of living.

It’s the taxes AND the cost of housing. Why do you so flippantly discount the effect of our extremely high state taxes on people’s budgets? Because you’re a bleeding liberal who has to defend everything that government does no matter how wasteful or egregious? This state is out of control and it’s no wonder people are leaving in higher numbers than they are coming.

If I didn’t work in the industry I do I’d take my family and leave tomorrow. No amount of sunshine is worth heavy handed government we have here now. And it’s only going to get worse…

Calexit, love the lingo! We “calexited” in 2015 after retiring in 2013. Tried making a go of retirement in California, and have to say it didn’t work because of the low desert heat and the high cost of living. Now I can say we are a part of the 61,000 Californians who left and have found a greener pastures. http://www.mercurynews.com/business/ci_30037774/greener-pastures-beckon-some-beleaguered-residents.

I can’t say I miss Los Angeles much. Great place for young people, with skills, talent and drive, but “its no county for old men.” and their retired track dogs.

Plenty of country waiting for us seniors, just head east, cross the Colorado River and keep going until you find the right place for you.

Good Luck!

I think the chart would make more sense if it showed how long the residents had actually lived in California before the left. My guess is that a high percentage of the poor leaving are recent immigrants who come to California because they have friends or family here, and they need to get some help when they first arrive. Then they look for the best employment/housing opportunity and leave when they find it. I certainly see no mass exodus of poor people leaving inland San Diego County. I see lots of newly arrived immigrants coming at a steady rate, and the ones leaving for other states just get replaced by new immigrants.

Anecdotally, I can’t believe how many physicians we’ve met in Portland who’ve cashed out their Cali homes and transferred up here. Those who have jobs that allow relocation are making the move.

Charles Hugh Smith hits another home run.

http://charleshughsmith.blogspot.com/2016/06/please-dont-pop-my-bubble.html

He succinctly pinpoints the motivation and fear of the “I got mine (I hope), and will step on others while they’re down or waiting” sort of comments which so desperately attempt to convince us that skeptical thoughts regarding house prices are unfounded.

You know, the global coastal everyone wants to live here sort of nonsense.

Anyone confident enough that our skeptical views are unwarranted wouldn’t be reading this blog in the first place, much less need to tell those of us questioning how we should ignore our instincts that perhaps this place isn’t so great.

“…beneath the euphoric confidence that valuations can only drift higher forever and ever is the latent fear that something could stick a pin in “my bubble”– that is, whatever bubblicious asset we happen to own and treasure as a source of our financial wealth could be popped, destroying not just our financial bubble but our psychological bubble of faith in permanent manias.”

“But the naive faith of asset owners cannot be restored to its pre-bubble virginal state. The nagging realization that all bubbles are temporary and irrational, and that bubblicious wealth is unearned and undeserved, lingers in the traumatized psyches of the former true believers.”

“This knowledge that all bubbles pop sooner or later generates a skittishness that finds voice in sell-offs. Once the skittish owners of a bubblicious asset sense the nail is pushing against the bubble and the inevitable popping is nigh, they sell sell sell.”

Spot on. All the pro-real estate rationale (stringent lending standards, rich foreigners, real estate as commodities, etc.) serve as nothing more than distractions from the core problems of this economic mania.

Leaving Bay Area in July, life-long resident. Bought a 4-bedroom house in north county San Diego (92010). Newer house, great schools, 3.5 miles to coast. Same house in Bay Area would be 2x or 3x the cost. Leaving the Bay Area was a no brainier for our family. Locking in a 3.5% fixed rate on great coastal real estate made sense.

Have been reading this blog for 8 years and will keep reading, love the posts. Good luck to everyone.

The Bay Area is in Northern California

he’s leaving the bay area….did you read the comment? heading to San Diego because of lower cost

I left the Bay Area after 31 years. I couldn’t wait to get out of that pit. Took my money and retirement check to Idaho. I would rather be dead than live in california.

Me too … after 25 years of Cali middle class ‘stranglenomics’, I moved to Idaho 3 years ago. It was like a half price sale … water, electricity, insurance, housing prices, etc. Now I’m beginning to meet a lot more CA refugees making their way here. Housing subdivisions are popping up all over west of Boise, and the schools and transportation infrastructure can’t keep up. To my old pals in Cali I’m fond of saying … ” Don’t come, you’ll hate it here.”

Idahoans have a healthy distrust of government at every level and I’m good with that.

There are no jobs in Idaho so you’d better be a retiree with a nice nest egg, have a location-independent income like some online business that you can operate from a remote place like Idaho, or resign yourself to a life of grinding poverty that would make living in a California culvert luxurious.

The Eagles may want to update their song ‘Hotel California’ because that is really what large parts have become. You can check in but, unless you are independently wealthy, you will be forced to leave at some point.

It would be interesting to see just how many people in San Francisco were born and raised there. They say you can’t go home again and that is especially true when the house you grew up in is now valued at several million dollars.

Living somewhere affordable is impossible when the job only exists here. The cost of housing, healthcare and education continues to skyrocket and pay raises don’t keep up.

Are there really so many people who can afford places like this:

http://www.zillow.com/homes/for_rent/Los-Angeles-CA/house,condo,apartment_duplex,mobile,townhouse_type/99445416_zpid/12447_rid/3-_beds/2-_baths/566409-1132819_price/2000-4000_mp/featured_sort/34.10054,-118.368716,34.018767,-118.445964_rect/13_zm/

http://www.zillow.com/homes/for_rent/house,condo,apartment_duplex,mobile,townhouse_type/20611174_zpid/3-_beds/2-_baths/566409-1132819_price/2000-4000_mp/featured_sort/34.103881,-118.296361,34.022111,-118.373609_rect/13_zm/

http://www.apartments.com/access-culver-city-culver-city-ca/mffrd0l/

http://www.apartments.com/the-palazzo-communities-los-angeles-ca/32ghtcd/

That’s when you change careers. There are places where a 50% reduction in salary still offers a better life than California.

Tell me, what is this job that “only exists here”? Or is that a bit of hyperbole? If it’s in IT, perhaps it also exists in Austin, Seattle, Boston, etc.

Those of you that have some equity but are scared to move, I’d suggest having a more open mind about it. If you’ve got 100 or 200k in equity, even that will go a very long ways in the less expensive parts of the country.

To oversimplify my recent history – I sold in Santa Clara 2 years ago, left the state, then used my 200k profit as a down payment on 4 rentals. The weather isn’t anywhere as good as CA, but cost of living, crime, pollution, noise, congestion, etc. all are better than CA. I’ll be retiring at 47 rather than 62…

I keep reading this blog looking for tidbits of what’s to come, and of course for a little entertainment.

There are a lot of technical people, like myself, that have (un?)fortunately made careers dealing regulations in California. I’m an employee at large subcontractor for PG&E and because of CEQA and other laws that exist only in California there are tens of thousands of monitors and compliance people. Lots of us were hired on after San Bruno….Almost all with at least a B.S. or M.S.

But huge portions of the construction folks come into the state from elsewhere and live in hotels during the summer season then head back to Idaho, Texas, Michigan and even Washington. But it should be noted…most of those guys are miserable, divorced and chain smokers.

Jeff, which state did you move to?

What I see is a lot of young families moving close to their parents so Grandma & Grandpa ca help with the kids. Case in point: a couple living in LB. Working Mom, stay at home Dad. Dad dies unexpectedly. Mom & kids move back to OC to be near Grandparents. Get orphan/widow benefits from Dad’s death, and actually have as much or more $$ but need childcare bargain to make it work.

My Wife is getting ready to leave to look after Grandkids… gotta go now…

Exodus is impractical if you are a grandparent and you want to see them grow up.

I’ve traveled around the States and have stayed long term for work but after a few weeks of working out of town, I still miss Cali but I miss it because family and close friends are near. I like to say I would leave this state if it wasn’t for them but who knows, maybe I’m addicted to the lifestyle here as well.

We left Southern California in 1987. It relieved all the financial pressure and gave us much more time with each other as a family. We moved to Southwest Missouri where it is much safer and the crime was almost nonexistent. The ridiculous commutes from Orange County into the Aerospace industry is just outrageous. Just move and get settled in an area where you can have a life. Oh and take your grandkids with you… Living in the Ozarks

I’m too addicted to city life to actually take up residence in the Ozarks, but I remember the beauty and ease of that place well. I grew up in St Louis, and the Lake of the Ozarks was our favorite vacation spot during my childhood. And when you get away from the crowds and expense of the resort area, you are in very beautiful territory, very green, moist, heavily forested and studded with caves and sites of interest. It’s a paradise for spelunkers, mineral collectors, entomologists, and other nature lovers and outdoors people.

Living in the Ozarks has got to be lovely, as long as you have savings to spend or an inheritance or trust fund. What jobs could possibly be out there? Minimum wage jobs at the local Wal-Mart? With 200 applicants, 100 of which are related to the HR manager? Seriously, it’s great if you can retire to the Ozarks, but there’s nothing there for the regular non-wealthy person unless they want to live in the woods like Huck Finn’s Pa.

Agree, Alex. I personally would not reside permanently in a place like the Ozarks because, in my own retirement, I want a high level of convenience in a walkable neighborhood; frequent and reliable public transit close to my door; a reasonable degree of personal safety; grocery stores that deliver; and an ample array of cultural and entertainment venues, for a reasonable cost. I will make sacrifices when it comes to the weather- I’m used to living in cold climates so winters don’t trouble me that much.

Well, for my people we are doing well. When the Anglo leaves, we take their place. Soon we will have a U.S. Senator. After old man Brown goes, we will also have the Governor. “Make California Mexican again.”

When the Anglo leaves, who pays for your food stamps?

Who pays for your hospital emergency room visits?

Who pays for your Section 8 housing?

Who pays for your K through 12 education? For your Dreamer college loans?

(I’m expecting a hilarious answer from this troll — and I can’t wait for Wang bu to chime in.)

The Federal Government will pay. But as California has Silicon Valley, which we will for many years to come, the taxes will keep coming. Taxes will also go up through propositions to raise the income taxes on the 1% and take away corporate welfare that is in the budget and tax laws. That is what my son says, who is in Junior College. You can’t stop demographics. I have been doing my part, 6 children.

Martha you need to read iSteve dot com, sure there are tons of Mexicans in California (and word to the wise, here, all Hispanics are “Mexicans”) but you’ll have a white ruling class.

How come there are so few Mexicans in IT and tech fields in general? Same reason there are so few black ppl in these areas, reading books just ain’t cool.

So you’ll be doing the same things you do now: Growing the crops, picking the fruit, landscaping, etc doing what the whites doing the thinking and planning tell you to, and that’s fine. It’s a system that works.

The only change I see coming is that the productive people are getting sick and tired of race-based quotas in education and hiring; whites no longer feel guilty for being hard workers and the ones who hit the books and invent stuff. So, about the only change I see is, less 4-year free rides for Jorge where he gets to drink mucho cerveza, buy a Pontiac Firebird with his Pell Grant Money, and then go to work for his uncle’s landscaping company. It will just be straight to the landscaping company.

California tax revenues down almost $1 Billion dollars!

http://www.zerohedge.com/news/2016-05-13/california-tax-revenues-miss-projections-1-billion-residents-flee-state

Sure, make California Mexican again. You’ve done such a great job with the land and people you have now. I can hardly wait to see how this would play out. Remember Tijuana and San Diego are only separated by a few miles. They have the same weather and are on the ocean. San Diego is one of the wealthier cities in the country and Tijuana is a nightmare. The government is the big difference. You want our land? Do a great job with what you have already and stop coveting something you sold to the US Government under James K Polk a 170 years ago in a bargained deal after the Mexican American War. The land in Mexico was taken from the indigenous people that were there first too so where do you draw the line? These kinds of things are never clear cut. It’s just not good to do a lousy job with what you have and then demand more from those that have done well. I will admit thought that that thought sounds a lot like what our government is doing these days.

I’ve met far too many people like “Martha”, who believe that the working taxpayers in this country exist for no other reason than to support every moron fuckup who can scam her or his way onto disability, or welfare….. or turn his business into a Subsidy Dumpster to suck up hundreds of millions to billions of dollars from the rest of us.

What happens when you run out of “givers”? What happens when the “givers” have given their last dime and have to close their failing businesses, or are laid off from same, and the tax revenues start shrinking while the supply of goods and services from food to shoes to gasoline, suddenly runs dry and the shelves are bare? Venezuela is a good test case, but I doubt that “Martha” or the tens of millions of other leeches in this country who suffer from a similar mental disorder are capable of digesting the lesson to be learned. But starvation is instructive, and so is the barrel of a gun shoved down your throat by someone who has been looted down to his last dime and isn’t going to hand you his last morsel of food just because you’ve been enabled in your sense of entitlement by our welfare state.

I’m glad that I left before I had to live in Northern Mexico…

But I do miss the tacos.

Martha, what do you think happens when the corporate taxes increase and the wealthy get taxed harder? They leave. Then you have nothing.

BTW, I don’t know where you get your news, but Kamala Harris will surely be CA’s next senator. She got more then double the votes then Sanchez in the primary.

I think it’s wonderful (sarcasm) that Mexican immigrants come to CA with the purpose of turning it into Mexico by attrition. But why not just stay in Mexico then?

we are already mobilizing for Sanchez. Our activists have plans when ever Harris wants to speak. They got training at the Trump rallies. Harris is anti Mexican and we will emphasize that point. As A.G. she put so many of our people in prison.

Martha – I voted for Harris in the primary and will be sure to vote for her in the general election.

She’s got a huge majority for a reason.

Laura – It sounds like Martha wants to play cowboys’n’indians/Mexicans again, because it went so well last time.

If trump won they will flush out all this illegal immigrant here and the Anglo will be very happy. Los Angeles will shine brighter and ghettonization Will not be happening in certain areas. California state will not be bankrupt. Only in this country where illegal immigrant has all the benefits compare to taxpaying hard working Americans. I know some people who lived in a section 8 housing, receiving food stamps, under the table salary and full coverage medical benefits what a crazy state

American pleas vote for Trump so America will be great again lol

I don’t thing Trump has a chance, but if he won he’d be a disaster. I think a large part of the disaster would be that there’s no track record of him having any consistency. He’s as predictable as a tornado. He won’t build a wall, he won’t keep us out of war if he *thinks* he can profit from a war, and so on. Trump will do, at any given moment, what he thinks will be the best thing – for Trump.

But Trump’s success is a result of what’s been going wrong with this country – working and middle class whites, the ones who went to school and kept their noses clean and buckled down and built things and won WWII and got us to the moon, etc have been told they’re worth less than non-citizen Chinese people who have more money, then brown/black people who just want to laze through life and through college on Whitey’s dime, and conniving criminals who profit by exporting solid jobs.

The Democrats could really sweep things by paying more attention to the people who are the backbone of the country (Hint: the Chinese didn’t build the intercontinental railroad, the Irish did; and there’s a reason high tech is so heavily white, it’s because when you’re white there are no excuses and a grade lower than an A is a disgrace) the backbone of the country will rally behind them.

The ‘transcontinental railroad’, Alex. An intercontinental railroad would be a real engineering feat, especially in the 1860’s.

Alex, you’re just a bitter anti-Asian racist. The Chinese built the tough western half of the transcontinental railroad. Whites built the easy eastern half. You got your butt whipped in Hawaii by sansei and you couldn’t compete.

Now you’re getting your sorry @ss beat by Chinese immigrants and Chinese Americans. So you spout racist b.s. America has a proud history of racism towards Asians–first against the Chinese and then the Japanese. Then there was 9066–or that little matter of American concentration camps. Look it up, hotshot.

My dad was in the 442nd and dumbasses like you make good Americans look bad. of course Americans laughed at the Japanese–Made in Japan was a joke, remember? Then when the Japanese killed the crap American cars and destroyed our consumer electronics industry, Americans started to hate the Japanese.

Now the Chinese are getting their revenge. And Americans are cranking up the racist attacks again. So too bad that the “Chinese” got money and the other whiners (like you) here are priced out of the market.

Americans and the west has always laughed at the Asians. Well we’ve got competition now and we just can’t compete. So just go away or learn Chinese! You do realize that without all of those good, smart and hard working Asians here in California, this state would just be a really big ghetto filled with gangbanging kids and illiterate trash.

Alex,

Hillary is the one with the history of being a war-monger, not Trump. And his rhetoric and campaign statements don’t show him to be the one most likely to start WWIII.

Hillary has publicly compared Putin to Hitler. Trump and Putin have displayed a certain level of respect for one another.

Now what do you think is the most likely event that could wipe humans off of SoCal and the rest of the planet? I’m going with mutually assured destruction. And who do you think is more likely to get us into such a predicament?

Want to see the middle class recover? Then vote for a candidate that’s for more protectionism and less globalism. I hope that you’ve figured out that globalism is bad for the US middle class and that neoliberals = globalism. For those that haven’t been paying attention, Hillary is 100% neoliberal and globalist.

Alex, I would have thought that you’d realize that your personal wages are under attack (indirectly I suppose) from people willing to work for less than minimum wage. Those folks are coming into the U.S. from outside of our borders. Wouldn’t curtailing these legal/illegal immigrants help your own working/financial situation?

Curtailing H1Bs would help folks in my line of work. I’m just astounded that there aren’t more complaints about foreigners coming to the U.S. and taking jobs from Americans – in my case these are high paying tech jobs.

Once big companies like J&J, Pfizer, and Roche figured out that the quality of work done in India was terrible (it took 10 – 20 years to figure out that poorer quality wasn’t offset by the lower cost), they realized – “Hey, we can bring those low paid workers to the U.S. on H1Bs and just closely supervise them. We’ll save a ton of money by laying off all of the front line and lower management U.S. workers.” I’ve seen this happen multiple times now – I’ve been in in drug research for 22 years.

Keep reaching for the smog filled clouds, Martha.

I’m pretty sure Martha is a Smart-ass Dude just being a smart-ass sarcastic comedian. Makes me laugh anyhow…

Next you’ll be telling me Wang Bu is a white guy, although Google Translate says it means “net”, which could be interpreted as having the function of a troll.

surf – I’m with you on Martha being a troll. Despite the imperfection of her grammar and spelling, it’s too good to be coming from a Mexican…

I’m voting for Trump just so he can deport Martha & Wang Bu.

I was fortunate. Left LA in 1998. But, I kept some beach homes that were only valued in the 300s to 400s at the time … as rentals.

Now, they are worth millions, and I am headed back for retirement at the SoCal beach.

This is my advice. Buy something decent, and turn it into a rental before you leave If you can get two, even better.

About 15 or 20 years later, you will have all the money you need.

You said it yourself. You were “fortunate.” The real estate market has changed quite a bit since the ’90s, so I’m not sure advice from that time is particularly great.

hard-work risk taking, planning….”fortunate” is minor driver in anyone’s success

Jt,

that makes total sense, take the last 20 years and extrapolate that forever into the future.

i suspect that the next 30 years are going to be the opposite of the last 30 years….

You wash your mouth! RE goes up forever!

You are indeed fortunate, jt.

My father bought a large tract home in Cerritos, CA (inland) for $100k in 1977 and the same model has sold for $1.1 million recently.

But can I really buy that 1.1 million home today, and in twenty years will it be worth $5 million dollars? In 40 years will it be worth $10 million dollars? Perhaps it will.

I’m betting it won’t. But I’ve been wrong before….

….And a toyota corolla will cost a mil.

In other words, it’s not different this time.

Excellent read from the OC Register: LA and OC are home to the nation’s most financially stressed homeowners.

http://www.ocregister.com/articles/percent-720592-housing-inland.html

There are some great bits in here why the housing market is in the position it is today.

Well, the OC Register supports low interest rates which caused the housing prices to be jack up, actually the year 2014 was a big price increase also because of the Chinese buying real estate. The only two politicians that opposed keeping the mortgage deduction was Mitt Romney in 2012 and Ted Cruz in 2016. If LA and OC didn’t have the mortgage deduction for housing over 300,000, housing would be about 100,000 to 150,000 dollar less now. People would have paid less if they couldn’t get a mortgage deduction. Low interest rates instead of making housing cheaper actually make them more expensive, all the big price increases in California and the rest of the US was during low interest rates periods for mortgage rates.

after reading the comments i only have one more thing to add.

it’s 2006 all over again.

I personally do not think this feels like 2006 for the housing market.

1. We have had a decade of inflation.

2. Rates were over 5% in 2006. Rates are 3.56% as of today!

3. Anybody who bought since 2010 was a qualified buyer and likely sits on quite a nice cushion.

4. Unlike 2006, rents have gotten extremely expensive.

5. Population and economic growth have outpaced new housing stock.

6. International money loves socal real estate.

7. Environmentalists and NIMBY movement alive and well squashing new construction.

Has this all plays out is anybody’s guess. In the RE world 2016 is not 2006.

In summary – It’s different this time, but the outcome may not be.

I feel like I’m repeating myself again debunking the notion that this is different.

>1. We have had a decade of inflation.

Nope. Real estate inflation has far outpaced the official rate of inflation. On the other hand, incomes of prospective organic buyers have stagnated and fallen far behind prices.

>2. Rates were over 5% in 2006. Rates are 3.56% as of today!

And the rate of credit of expansion and easy lending standards for investors and insiders has far outpaced those in 2006.

>3. Anybody who bought since 2010 was a qualified buyer and likely sits on quite a nice >cushion.

The majority of those who walked away during the last downturn were prime borrowers. See Morgan Stanley as one of the biggest strategic defaulters.

>4. Unlike 2006, rents have gotten extremely expensive.

Rents are in a bubble thanks to buy-to rent speculators from #2 who need to cover their costs. In overpriced cities, renters have to pay out close to 50% of their incomes in housing costs.

>5. Population and economic growth have outpaced new housing stock.

Irrelevant. Organic home ownership is at its lowest during the weakest recovery in decades where GDP growth is at best ~2%.

>6. International money loves socal real estate.

So did the Japanese in the 1980’s. Heck, international investors also love tech unicorns.

>7. Environmentalists and NIMBY movement alive and well squashing new construction.

Supply has been artificially curtailed by:

– hot investor money

– shadow inventory

– prospective sellers who are unable or unwilling to find a replacement house

– House builders dwell primarily in luxury housing, which very few organic buyers can afford.

@Prince

You seem to either misunderstand some of the statements LB made or are using a strawman argument and changing them.

1. Just because housing inflation outpaces overall inflation doesn’t mean now=2006. Some homes are selling for around the same as in 2006, so when you account for NORMAL rates of inflation they are actually CHEAPER than in 2006. I don’t see how this is hard to grasp.

2. So homes are CHEAPER than in 2006 when adjusting for inflation, WHILE interest rates are LOWER than in 2006 – making homes EVEN CHEAPER in actual price than in 2006 (since people can afford more with low rates thus driving prices up all other things being equal).

3. LB never talked about those who walked away. The opposite – he mentioned the ones who BOUGHT recently are sitting on a lot of equity so why would they walk away? They are not the same as the buyers of the last bubble.

LB is not saying things aren’t messed up, they are for many reasons. He’s simply saying it’s not quite 2006 again. It’s stupid, it’s annoying, it’s manipulated, but it’s not 2006. I think tech is in a bubble, I think RE is in a bubble, I think rents are in a bubble, and the stupidity is certainly reminiscent of 2006 but the actual details ARE different. For every idiot that was buying things they couldn’t afford in 2006 there’s a current one with ACTUAL cash and is highly qualified. And, from what I seem to gather when I speak to people or read this site, there’s another 5 waiting just as qualified with enough cash downpayment, that are just waiting because they foresee a drop. I’m sure there will be a drop, but I don’t think it’ll be as bad as the last one…

@A

You basically and LB are basically repeating the same thing that was mentioned prior to the last downturn: this time it’s truly different. You dwell on minute differences while ignoring the big picture. Unfortunately, it’s just the same economic mania based on record credit expansion and loose lending. And manias don’t tend to end well.

1. To use 2006 prices, the barometer for extreme speculation and price distortion, to justify current prices is simply setting the bar too low. The 2006 So Cal real estate median prices should have been about $257K based on 10 years of inflation. After 10 additional years of inflation, the price would have risen to $306K. Realize since the through in 2008, OC prices have risen over 174%. Using inflation to explain all of these data points is grasping at straws.

2. Again, comparing current prices to a year of extreme price distortion 2006 is far too easy.

3. My bad… What I should have said: those who bought in 2010-2011 were investors with inside connections and are actively selling, not buying. A correction as “shallow” as the last one will destroy the equity, if any, of recent buyers.

The term “all cash” sales is badly misrepresented. Insiders and big time investors used hard loans to buy their vast housing stocks. Even Chinese buyers take out loans to buy real estate. Even though they’re not mortgages, it’s still borrowed money. And those loans need to be paid back. And as I mentioned previously, more prime borrowing doesn’t make the market any more stable. Hence, the term strategic defaulting.

Why are big time investors currently selling instead of buying? Do they know something that retail investors, flippers, and buyers who line up to buy the next overpriced property don’t?

The last RE downturn didn’t reverse until the Fed and government took extreme measures. What additional actions would they be able to take in case of another downturn to restore buyer confidence? Keep in mind that we still have record low rates and record lending.

Prince of Heck,

My response was towards the blogger known as interested when he/she claimed “feels like 2006 all over again.”

I gave some very succinct points why 2016 is NOT 2006. How it plays out, nobody knows. But the circumstances regarding housing are MUCH different today than 2006. End of story.

@Prince

I think you’re still arguing with yourself. Neither of us are saying “this time is different” as in there won’t be a drop or there’s not a bubble. It’s just that simply saying it’s 2006 again is incorrect, as things in 2006 were much different. Current RE market is still dumb, irrational, and probably overvalued and in a bubble, but not the same as 2006…and it won’t pop for the same reasons and won’t pop as easily.

There are pockets where you can still buy for close to what the rent costs. Even at a low % down you end up barely above rent. If it goes down, ride it out. If it goes down a ton, just stop paying and live free a couple of years (if it goes down a lot you can bet the bank won’t be foreclosing quickly, like last time. If you can’t beat ’em, join ’em. Playing by the rules and saving has only screwed those who did so the last 10 years.

http://fortune.com/2016/06/27/fed-interest-rate-brexit/

With low rates going lower, buying power will go up and with demand and jobs staying the same, prices will then go up. I don’t see desirability/demand going down in the LA area. There aren’t millions of over-leveraged people out there due to the recent run up that are on ARMs with low income – they ALL had down payments and good incomes if they bought between 2011 and now. The government will simply not increase rates, too many people have skin in the game that don’t want to lose that equity. The government and banks are in cahoots and they are not in the business of making property prices drop. So the only thing left to pop this is a job loss recession. I don’t see another way out. Is it coming? Maybe…but if it happens again, guess who’s going to come roaring back to scoop the properties up at the lower prices?

An item that sells today for the same or more price than it did some number of years ago is not cheaper.

Cost and affordability are not the same.

In terms of adjusting for consumer inflation, affordability can be measured by the relative change in cost of other consumption items and income over time.

The housing component of consumer price inflation has been far outpacing other necessity components such as energy and groceries. In some cases, there has been price deflation in these other components, thereby making the affordability of housing even less so on a comparative basis.

Wage inflation also has not been keeping up, negatively impacting affordability relative to house price inflation, unless of course, incomes don’t matter.

Until we have negative ammort NINJA mortgages being handed out like candy, today’s leverage provides less monthly affordability than there was in 2006.

Funny enough, in 2006 the same could be said that anybody who had bought since 2000 was a qualified buyer and sat on a nice cushion. It’s a moot point.

@LB

My impression was that the original poster was seeing the forest for the trees regarding the current RE market. On the other hand, you are pointing at the trees (minor differences between 2006) to advocate a different type of vegetation (outcome).

@A

No, I think I’m talking to a brick wall. My point over and over again is to point out that things are generally NOT different from last time. Neither you nor LB can see the forest for the trees. The key point here is that the real estate market now, like back then, is living on far too much speculative debt.

There aren’t millions of over-leveraged buyers? What, do you think that record borrowing due to cheap and easy liquidity for 8+ years can’t go bad? The oil bust is proof #1: the house and rental markets in formerly high flying oil towns are crumbling.

Why harp on borrower qualification when the last downturn showed that it didn’t matter?

Sure the government and banks are in cahoots. But the government has basically used all its ammo by expanding its balance sheet to record levels. And banks won’t care so much since they’re offloading their portfolios onto Freddie and Fannie (taxpayers).

Low rates will not prevent or mitigate another downturn. Check out the historical price charts for Japanese real estate despite 20+ years of ZIRP and now NIRP.

Stop right there HC:

“Funny enough, in 2006 the same could be said that anybody who had bought since 2000 was a qualified buyer and sat on a nice cushion. It’s a moot point.:

Are you serious? In 2006, we were several years into giving out loans like candy with nothing down and no verification of income. THE SAME IS NOT TRUE TODAY! THIS CAN’T BE REFUTED!

I’m going to make this real simple since some of you guys just don’t get it.

2006: Buyer bought house A with zero down loan, stated income loan. Total monthly cost for home = $4000. Market collapsed and house A lost 40% of its value. Comparable rental to house A is only $2200/month. Buyer walks and rents…loses credit for a few years. Smart move.

2016: Homebuyer purchases house A and puts down 20%. Total monthly cost for home = $3000. Comparable rental for house A is $3000. Unless home prices AND rental prices drop DRASTICALLY, homebuyer will stay put at all costs.

Why is this so hard to understand? 2016 is NOT 2006 in the RE world in socal.

Prince, you might as well talk to a wall, since you keep just creating your own argument and not reading what people write.

Example: you state low rates won’t prevent a downturn…yet no one said that, I said IF low rates stick around the only likely cause of a downturn will be job loss recession (unless LA just becomes undesirable). Case in point, your oil town example. What drove down the price of housing in oil towns? A huge loss of oil jobs.

In the last 4 years everyone I’ve known that bought a place had the income and the cash for a downpayment. Many times more than 20%. And went through very stringent underwriting. In 2006, everyone I knew was buying more than they could afford, I knew two people who went for ARM interest only loans telling me I was dumb for renting (I knew better) and saw the places drop from like $250k to $170k in the downturn…they’ve now come up to about $200k (this is on the east coast).

Homes in LA are selling for around the same amounts than in 2006, but the rates are much lower. Combined with 10 years of inflation I can’t see how you could compare the market to 2006 when you really think about it. The stupidity is the same, no doubt about that, and it will likely downturn.

I just don’t think you’ll be able to pick up a SFR in, say, Mar Vista for $600k again, unless a TON of jobs are lost in which case, it’d be hard to get loans and most of those purchases would happen with cash. Like from investors with cash, but you know…I’m sure they wouldn’t jump on that deal, right? Not like they ever did before…

@LB

The bubble was in the price, not in the borrowing standards. It’s been documented over and over. In principle, when an industry becomes overheated, it tends to melt down. Servicing debt becomes too expensive, house poor owners no longer can support the economy, or the greater fool theory exhausting itself, etc. This is endemic of economic manias — subprime or not.

@A

Once again, you continue to concentrate on the trees and can’t see beyond the forest. My points simply fly over your head either by design or by accident. Once again, over-speculation through over-leveraging tends to lead to a bust.

Yes, you suggested that low interest would prevent a downturn, or at least one as severe as the last time:

>”With low rates going lower, buying power will go up and with demand and jobs staying the same, prices will then go up.”

>”The government will simply not increase rates, too many people have skin in the game that don’t want to lose that equity.” — Losing equity or “prevent/mitigate a downturn”?

>”Maybe…but if it happens again, guess who’s going to come roaring back to scoop the properties up at the lower prices” — A rescue by investors would require scooping large tracts using ultra-low borrowing rates.

What drove the huge loss of oil jobs? Over-speculation in the shale oil boom. Companies no longer being able to keep up with their debt obligations. Massive job losses just do not occur in a vacuum.

That’s great to know that your home-buying friends underwent rigid background checks. Not only do they represent the exception to the rule (very few organic have the

~90K minimum down payment), but they probably paid that much more because financial institutions and then private investors, through cheap and easy credit, drove prices up in the first place. Then buyers working in the bio, tech and oil sectors, which grew through cheap and easy credit, bid up prices again. But somehow, you believe that a market dominated by cheap credit and excessive speculation can’t suffer as badly as before just because 1) organic buyers find it hard to qualify and 2) the government will be able to mitigate it.

My belief is that credit will dry up for investors and many will default on their debt obligations and be forced to liquidate.. This would create a chain reaction that will affect the debt markets and even organic mortgages.

And then you bring up

You can’t discount the value of the Mediterranean weather in Coastal California – which is really what we’re discussing. People in Fresno have more in common with people in Amarillo than Mar Vista. There are 8 places on the planet with this temperate Summer Dry Climate and it does command a premium. Add to that the restrictive land use policies preventing much new from going up, a crazy government, an open border and low interest rates there’s no way the prices won’t climb and climb. It’s not the place it was as little as 20 years ago and I hang around for family mainly. The family that left are renting their houses here and making good money. Why would they sell? You can’t put money in the equities market and make this kind of money. I see it slowly turning into a state of renters with absentee landlords – either exiting and renting or hedge funds that see this as one of the few inflation hedges that turn out a 5% to 8% return. I wish I saw a downturn so I could buy more but the future recessions (or worse) will only make it worse.

People do discuss weather a lot when CA real estate prices come into the conversation. But look at London or NYC: The weather SUCKS in these cities and prices are just as insane! But give me a choice, yeah, I’d choose Cali anytime 🙂

Real estate prices caught up in a mania trump any economic fundamentals. Bubbles tend to collapse under its own sheer weight and the ever-increasing amount of money needed to fuel it.

I don’t know about you, but I have found the past few summers have been HOT in S. Cali. When I say hot, I mean 100+ degrees Sahara hot. And these summers have started sooner and lasted longer each year. Not exactly what I call ideal. Starting to remind me of Vegas or Phoenix.

Similarly, San Francisco gets cold and foggy, yet its RE is pricier than that of SoCal.

Rainy, foggy Seattle is also very expensive.

The appeal and financial impact of SoCal’s weather is over-stated.

I’m a SoCal native living in NYC the past 18 yrs. Last two NYC summers were remarkably mild, as has been the start of this summer. I often compare temps and dew points between LA and NYC and on many days LA’s weather is hotter and stickier than in NYC.

The weather is changing and so far, LA is getting the short end of the stick.

Translation – It’s all about the weather, but it’s different this time because of factors other than weather.

Fensterlips,

You are correct. Only 2% of the world’s land mass is in a Mediterranean climate. And California is in the U.S., very stable politically compared to the rest of the world. So it attracts investment from all over the world ( esp. China). I am a native Californian, ex pat and wish i still owned my primary residence there for future appreciation. I still have some interest there as my in laws will die someday and my wife and her siblings will need to figure out what to do with their SF Bay Area home. I love to visit California but I am glad to return to my adopted home in the Southeast where I live larger ( sans the spectacular weather) and much easier than I ever did in California.

CA Real Estate has crashed many times before and it’s gonna crash again.

No one knows when and how ..

I think it would be interesting to now whether previous housing crashes were all caused by job loss recessions or other causes. Wasn’t the crash of 08 in actuality a job loss recession ? (the collapse of financial markets caused massive layoffs?).

Methinks that anyone who is praying for a crash (08 style) in order to buy a home better think twice – you may not have a job and all cash buyers will swoop in again.

And those who believe that the religion of ZIRP and god Fed can usurp the economic cycle are in for a rude awakening. How many of those “cash” rich buyers will be willing to catch a knife?

every CA housing dip was caused by job loss / recession, even 2008….. that was far more than the cause than the toxic mortgages

IMHO 2008 was caused by the housing bubble via subprime mortgage bubble. I read stories of people who did not even have a job but made $50k to 100k a year just refinancing their home in California YOY.

The whole bubble burst when there were no more subprime borrowers (we almost hit 70% home owner) and the teaser rates reset from the 2% or 3% range to 8% to 10% range. People quit paying their mortgages. That started layoffs in the banking sector, mortgage sector, home builders sector, etc.

GREAT post! I used your graphics in a post of my own (with attribution of course). But I added a chart of SF home prices relative to median family income. Median family income in San Francisco in 2015 is the same as it was in 2009 while San Francisco home prices are up 90% since March 2009.

Wow.

https://anthonybsanders.wordpress.com/2016/06/28/escape-from-san-francisco-home-prices-congestion-taxes-driving-people-away/

except actual incomes for the slice of the Market that buys in SF are way WAY higher…. and have been going up at a fast rate since 2009

You mean you’re actually counting foreign money to perpetually power SF real estate?

According to the chart, the middle class (incomes from $50k to ~$150k) had net migration to CA whereas working/lower class ($250k) had net migration from CA (moved from CA).

I’m working/lower class, where’s my $250K? Did some conniving foreigner steal it?

They appear to have taken your decimal point but left you with the superfluous zero.

Same concern of mostly middle class where is the money

Interesting video and accompanying story about US having a rigged economy.

http://money.cnn.com/2016/06/28/news/economy/americans-believe-economy-is-rigged/index.html

Well this sort of explains some of the cash sales?

http://www.zerohedge.com/news/2016-06-28/crackdown-begins-chinese-bank-sues-seize-vancouver-real-estate-assets

According to the Globe and Mail, China CITIC Bank has filed a lawsuit in Canada to try to seize the assets of a Chinese citizen the bank claims took out a $10 million loan in China then fled to Canada.

The defendant, Shibiao Yan, owns three multimillion-dollar properties in a Vancouver suburb and lives in a $3-million Vancouver home owned by his wife, according to court documents, the Globe and Mail reports.

It is illegal to take out more than 50K out of the PRC. The Peoples Republic of China does have enforcement actions, not only in the country but also outside. Anybody who takes out more than 50K should have trouble sleeping at night because the PRC knows where you sleep.

$2100 for housing cost and $1900 for child care cost a month…..

that’s typical for any upper middle class area of the US

If I understand this article correctly,

the family unit has disintegrated into someone else raising your kid, who knows your kid better than you do;

the remaining 49 states will become ‘Californicated’ as Californian’s flee;

and California is being taken over by rich Asians, Indian H1-B workers, and lots and lots of low-skilled Hispanics who are doing all the manual labor jobs no one else will do, including cleaning the houses for all the rich arrivals!

The upside is your progeny will speak Ebonics and/or Spanglish. Fortunately they’ll be illiterate beyond 140 characters. Then you’ll pay for ESL courses, or their lifetime underachievement will be the penalty for your thrift, and you’ll end-up in a silo for neglected oldsters. You won’t know your grandchildren, and they won’t know you exist.

Then you’ll die alone.

There is an average

There is an average of 173 hours per month so $1900 for childcare averages out to about $11 per hour. That is cheap for many city areas.

Of course it’s different this time, it’s always different.