El California Housing Adjustment: 17 of California’s 26 largest counties posted a monthly price decline.

The housing market in California has hit a plateau in 2015. The latest figures show that 17 of California’s 26 largest counties posted monthly price declines. In many parts of the state home prices are well out of the reach for regular families. What has transpired is a massive move towards renting or for many adults to move in with their parents. Purina Dog Chow Taco Tuesdays are a way to save a few pennies for that down payment on your dream drywall junker. The latest figures of a tepid market will cause more people to pause and reflect on the insanity of the current situation. People have made it an art to justify the price of your typical crap shack. Junk is junk and people are in a fog overstretching their budgets once again. So it is no surprise when we find out that notice of defaults also jumped up by 8 percent in October. Whoops. And keep in mind this is happening at the top of a six year uptrend in the stock market, tech wealth overflowing, and lustful investors buying up real estate like hipsters chasing after the latest food truck phase. I’ve had a few e-mails from people saying that El Niño is somehow going to revive housing prices again! Do people even remember 1997 and 1998?

Weak sales and reality kicking in

No one is excited about stagnant growth in California real estate. We need to be booming or busting. There is no middle in the state unfortunately. And we’ve just had a healthy boom. You would assume that people would learn this pattern but memories are short in the Golden State.

Sales volume is low relative to the big price gains. At least in 2005 and 2006 prices were moving higher with higher sales volume as well. Sales volume isn’t all that hot:

As we mentioned, prices have also slowed down statewide:

April median price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $416,000

September median price:Â Â Â Â Â Â Â Â Â Â Â $407,000

October median price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $407,500

It does look like April was a short-term price peak. We are now entering the typically slower fall and winter selling seasons. If we do have some gnarly weather come January, I don’t see how heavy rains are going to inspire people to buy. It will however be a good thing if heavy rains and snow hits the northern part of California for things that are a bit more passé than granite countertops like staying alive and having water to grow crops. If only SoCal gets soaked, we might as well pour the water into the ocean since that is where most of it is going to go.

The press rarely shows examples of homes. The L.A. Times had an entertaining L.A. Land section that provided a surprisingly balanced view of the housing market during the last bubble:

That section only lasted a couple of years but did show actual homes and reflected on their prices. A large part of mainstream press on housing is full on cheerleading especially in places like San Francisco. So let us see what we can buy in the market today:

1933 Phillips Way,

Los Angeles, CA 90042

2 beds, 2 baths – 1,311 square feet

This is one of the more creative ads that I have seen:

“I’m gonna change you like a remix. Then I’ll raise you like a phoenix?” Fall Out Boy?uh huh? that’s exactly how it goes, and just in time for the holidays! Inspired by the natural light, views of hills, canyons and trees surrounding, 1933 Phillips Way was raised from the ashes, and a star was born. The open floor plan is such that all rooms are exposed to ample decks, both above and below, bringing the blue skies in, as a guest at your table. This home is all about chic simplicity, with best use of space,functionality, and light. Perhaps a kitchen that will delight the epicurean in you as you make a holiday feast to share with with your loverlies? Maybe warm large planked floors throughout? A downstairs master that has an en suite bathroom and walk-in closet? Boxes checked. This is a home where nature meets nurture…it’s all in the details. You can be home for the holidays!† Â

Delight in the epicurean? Fall Out Boy? Chic simplicity? Did I miss something on HGTV regarding flips?

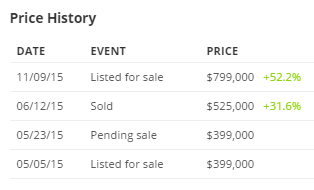

This place is flip central:

So it sold in June for $525,000 (someone had listed it at a low ball price). Now a few months later, someone is trying to offload the place for $799,000. Someone feels the work on this place is worth the $274,000 price increase. Not even El Niño can rectify the real estate mania that is in the market right now.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

92 Responses to “El California Housing Adjustment: 17 of California’s 26 largest counties posted a monthly price decline.”

How soon wee forget and believe it is always the new normal. The big fish will milk the upturn as long as possible, than crash the market, and pick up all the big crumbs on the bottom. Rinse, Wash and Repeat. The story is always the same with just new little fish to eat. “But this time it is different because of the __________ buyers” All you need to do is fill in the blank.

Prices are unsustainable for the long term and built on total speculation. Buying a house is so much fun now, you don’t have to even drive to the casino!

http://www.westsideremeltdown.blogspot.com

A new rental building is opening up in Manhattan, featuring micro-apartments. Some of the apartments are as small as 260 sq ft. : http://ny.curbed.com/archives/2015/11/21/nycs_first_microunit_listings_go_live_on_monday.php#more

The cheapest unit in the building is 265 sq ft and lists for $2,540 a month.

Manhattan makes prices in L.A. look cheap.

Obviously, these apartments are not intended for families. I guess they’re targeting young professionals who want to enjoy Manhattan night life, and maybe even walk to work. Young tenants who’ll move away to the outer boroughs or New Jersey after they get married.

I’d be happy with 260 square feet, I live in half that now. But how would I afford it? Deal coke?

Housing To Make a Spectacular Crash Soon!

http://www.marketwatch.com/story/san-francisco-real-estate-looking-like-it-did-before-dotcom-crash-in-2000-2015-11-20

this article says the SF real estate market is about to crash

Jim, the irony of your sentiment is the more that fears the market, the longer it’ll take for the crash to occur, if at all. So as you spread fear, you are actually delaying what you wish to occur, tho at a negligibly micro level. For a bubble to burst, capitulation needs to occur on a mass scale across a finite period of time, quickly purging the buyer pool. If there is a reasonable ratio between those on the side lines vs. those that bought (e.g 1 to 5), then as soon as the bubble deflates, the side liners, who’ve been waiting for too long, will pull the trigger. In other words, if capitulation is slow to occur, bubble will not burst. Despite economic downturns, there will always be side liners who have been saving for the past X years and are desperate to capitulate as soon as any indication that real estate is softening.

My goal is not to crash the market. My goal is to educate people so they don’t lose their shirt when it does.

Jason I remember the panicky feeling people had in the last bubble. It was “Better buy now while you can because prices will go up forever!”. People really felt, and acted, that way.

Another way in which New York City residents resemble those in L.A. … http://www.huffingtonpost.com/entry/new-york-city-rent-affordability_564f7751e4b0258edb3175d2

Most New Yorkers cannot afford NYC. They’re struggling to maintain a crappy lifestyle. Yet they refuse to move because they feel entitled to live in what they believe is “the greatest city in the world.”

Uh oh. The L. A. City Council is looking for ways to solve the homeless crisis. It looks like they’re gonna let the car dwellers “camp” on city lots overnight. I live right above Cabrillo Beach in San Peeedro. Cabrillo Beach has a giant city-run lot that recently converted from “pay an attendant at a gated kiosk” to “park and pay” where you feed your coins into an iron ranger and get a receipt to put on your dash. Fewer (expensive) employees means more riff raff. I’ve learned to step gingerly to avoid doggie doo when I jog the beach and cross through the parking lot. Human feces should be easier to detect and avoid because it’s usually accompanied by a wad of toilet paper. I shoulda passed on the house and bought an RV instead!

And those canyons and coves along Palos Verdes make good dwelling spots as well!

The SoCal beach town I lived in is loaded with 50+ y/o Dusty Liberal NIMBYs who bought houses years ago or inherited from parents and generally protest new development. They want to preserve trees/buildings even if it makes no sense, is costly or a rundown eyesore because “I worked there in High School” or “I met my wife there” or “I remember that house as a kid”. They’re generally supportive of the homeless; if something is stolen from the yard a neighbor might say be happy “the person who stole it needs it more than you do!”. It will be interesting as the homeless population rapidly swells how the Peace Yacht and Yoga crowd copes with more people sleeping in parks/on the beach, bums peeing/pooping in yards/on sidewalks, rusty RV’s parked in front of their houses, panhandlers, “street performers”, etc. Namaste.

pretty much

I honestly wish homeless, hoboes, bums, gramps, crusties, etc. knew how to piss or crap in field conditions. It’s easy, and if you’ve housebroken a puppy you can get the general idea.

First, piss. Piss is relatively easy to deal with and its just a matter of pissing where it will go into a storm drain, or into an area that will process it, such as a hedge, plants in general, pick places that are biologically active and not already overloaded with piss. In moderation, its fertilizer.

Poop gets more involved, but if you are healthy, just do your business like a puppy, on newspaper (free newspapers are everywhere) and wrap up and put in a dumpster etc. If this is are more…. liquid…. you have to get a bit more inventive. A plastic bag placed inside a coffee can, yoghurt tub, you get the idea. Then dispose of. Use baby wipes to clean up, but even water sprinkled on some fast food napkins will work.

Really, there ought to be flyers handed out about this stuff.

PS: I’m not sure what got autocorrected to gramps. We all know how he handles things: Depends.

Brazil, That is a very good perspective you have and reminded me of my time living in an ocean front high rise in long beach for 4 years. Almost everyday there was some being picked up by long beach police, lifeguards or beach patrol for sleeping on the sand, I’m the bushes next to the sand or on the street sidewalks after hours. Homeless will sleep anywhere, pee and shit anywhere too. They will leave their trash and filth where they spent the night prior despite having a public trash can a few paces away where that stuff can be disposed of. When this economy starts unraveling again soon we will see 2008 again and many many more homeless wandering the streets. Hope everyone is ready!

Homelessness is NOT causes by an “unraveling economy.” It is NOT caused by high rents or foreclosures.

Homelessness IS caused by mental illness, alcoholism, and drug abuse.

Normal people — when they are evicted due to high rents or foreclosures — normal people find cheaper housing. They might move in with family. Or they’ll find roommates. Or they’ll move to a cheaper neighborhood or state.

Were I faced with the choice of being homeless in Santa Monica (where I live) or move to a cheaper neighborhood or state … I’d move. I’d rather live in a proper home in flyover country than be homeless in any city. Any normal person would.

Yes, I know that a small number of normal people might become temporarily homeless, living in cars and such. But they’re the minority, and their situation doesn’t last. It’s the mentally abnormal who comprise the chronically homeless. They’re homeless in good times and bad. The economy has nothing to do with their situation.

SOAL –

if i was hopeless because of chronic unemployment i might become a methhead or an alcoholic or kill myself to escape

https://www.psychologytoday.com/blog/reading-between-the-headlines/201305/white-middle-age-suicide-in-america-skyrockets

SOAL – I agree; most homeless are mentally ill, drug addicted or both. Or just like living “naturally” without “the man” telling them what to do.

The Ohio Blvd. underpass for the 405 in Westwood/West LA has become a homeless camp; you cannot walk down the sidewalk (and barely drive down Ohio) without having to deal with their (literal) crap.

A few weeks ago, the city and cops stopped by and cleared the bums out. Men in hazmat suits disinfected the crap and carted it away. Within a week, the bums were back.

Maybe they want to claim that prime section of West LA RE – it IS freeway close!

That whole “most homeless people have a mental illness or drug addiction” is a myth.

Plenty of studies show only a quarter of the homeless have a mental illness, and a third have drug abuse issues (much of that is tied to the mental illness group also). Families with children are the fastest growing segment of the homeless population and this would indicate that homelessness is indeed tied to the economy. It’s real easy to say move to a cheaper state, much harder to do when you don’t have an emergency fund in place to fund the move. A large percentage of this country lives check to check, and when one or both parents get laid off it’s a real quick route to being homeless.

http://www.nationalhomeless.org/factsheets/Whois.pdf

SOAL – I’d choose being homeless in Santa Monica over being in a house in flyover country every time.

Let’s say I’ve lost my job etc and through some miracle I wake up one morning in a modest house in flyover country. Great, I think, I find the bills are paid for the month and the fridge and pantry are even stocked with a months worth of food.

OK, time to go out and find a job! Oops, its flyover country, those are extremely hard to get. I do find one, but it requires buying a car, and I don’t have the money. That job would not support me AND a car, anyway.

Winter’s coming, making it hard to go out and do odd jobs I find by riding a junk bicycle I found around my own ‘hood, which is the only workmi can scrounge up. Being the neighborhood low level handyman, weeder, rat killer etc is OK I guess, but it’s pretty hard work. It will feed me and just barely pay the bills but not for winter heat, so I’ve been collection g scrap wood and will have to build a rocket stove to keep warm with and only heat, and live in, the living room or the house. Fortunately, I’m also adept at small game hunting, so I can supplement my much needed winter calories with rabbit, squirrel, etc. I’m smart enough to use traps rather than any kind of fun, so this is stealth for quite some time, until some roaming kids come across one of my snares, worse, with a catch in it.

Some people get gossiping about this and that cat going missing, and of course it must be due to the outsider weirdo from California who does odd jobs and gets around by bike. The rumors get worse, and now the handyman works tapers way down. This is bad, because I need my winter shelter and calories… The weather here in Ohio can kills me.

I’m late on rent now, and on tbe electricity bill too. I can do without juice by using kerosene lamps and cooking using wood, but I can see the end coming. I sell all excess thisngs I can on Craig’s list, even unto stripping all the copper wiring and piping out of the house, buy some decent winter clothing and pemmican or c-rats for the road, and cash.

Whether by bus or thumb, I get my ass back to California, land of my birth. I land in Santa Monica, get a storage unit and a bike. I hang out on the beach and get busy with a sketch pad. I go from very basic caricatures skills to quite good, as I’m doing it all day and I don’t want to be career homeless. I meet tons of people, and after a while a few realize that I’m the kind of good egg they’d want to rent their garage to, because another person is another layer of security, I keep the leaves raked, and watch the place when they’re out on vacation too.

Eventually I’m an established caricature artist, or have gone from that to signs (signs are pretty fun) and have a resale number, business license, and am an established small biz. I save my money and wait and watch, and in the next crash buy a 2-bed 1-bath place, cheap because it’s not a mcmansion but its plenty fine for me.

And I thank myself for having the foresight to become homeless in Santa Monica.

Doc, good article! However, this statement is not correct:

“And we’ve just had a healthy boom. ”

The boom was anything but healthy and everyone knows why.

I think you are on to something! The real question … has there been enough improvement in the overall economy and households in general to sustain things like home prices or rents? From where I sit, I first saw big investors buy up blocks of homes at rock bottom prices. The smart money is now done buying. Next, those rich Chinese bought up all the choice homes as an assumed safer place then China to park their money! What I don’t see is a broad improvement in households at every rung of the ladder, which I thing would be necessary to make this sustainable. What we are seeing, is an increase in un-affordability, and households shelling out larger and larger percentages of their budget for housing! I don’t see that as sustainable!

I also don’t see is as being sustainable. Seems many who comment here would agree. Here in CO there are households paying a very large percentage (up to 50%) of their income on housing alone — and it applies to both renters and buyers. Sure we live in a desirable state. Colorado has great weather and boasts a pretty healthy local economy. (Or so they say.) But housing costs cannot outpace incomes forever.

You’re spot on! Everyone agrees

Alas, for all those praying for the ‘crash’…

what exactly do you think is going to happen?

Prices dropping 20% from where they are now… back to 2011 prices?

Anyone who thinks the ‘crash’ will mean they will get a better price than in 2010-2012 is dreaming. If prices go back to pre-2010 prices, the investors will swoop in and snake all the deals. And when will that better price be, 2017? 2018? how much money did you blow on rent in the meantime?

Dan – Totally agree. Any crash or correction will mean the all-cash crowd owns us, more than they already do.

Doc, you might as well go ahead and close up the blog. Dan over has just got back from the future.

Reply to Dan.

Yes you are correct, chances are we won’t see a crash similar to like 2010-2012. When prices are declining the government feels they need to intervene. When prices are heading higher and higher the government doesn’t intervene.

I would love to see a free market free of interference from different interest groups. But that is a pipe dream.

We shall see. There have been crashes where that hasn’t occurred, and in my view, a lot of foreign money is levered up…. banks have offloaded loads of junk to REITs and other investors…. and banks have a strong motive to allow the HPC to occur, so they can write new mortgages in volume.

All this forever cash-rich buyers is going to prove an utter fallacy imo. Yet keep telling yourself that in Wonderland. Just don’t come back and moan and whine that you regret not having sold at hyper-treble-peak, or blaming others for you now holding the view that housing wealth is super-protected (when it isn’t).

_________

Paul – ( not a Realtor )

October 4, 2014 at 4:18 pm

….EXACTLY CORRECT ….

This spike in escalating home prices was due to temporary lack of inventory,

but the prices and sales are declining slowly.

Once the reductions TAKE HOLD .. the price reductions will escalate …. WHY?????

Because the REAL ESTATE SALES PEOPLE (Agents/Brokers)

MUST MAKE A LIVING .. THEY WILL TELL THE SELLERS ANYTHING …

†Sorry — I can’t get you Top Dollar for your house… Sales are DECLININGâ€

What the R.E. Agent/Broker is really saying is :

†I really need to SELL SOMETHING, I have bills to pay and I need to make

a quick sale on your p.o.s. House — I need my money FIRST … You can take

your FANTASY PROFIT that we promised you when you signed the Listing Agreement

and just “eat your heart out†….. TOUGH LUCK FOR YOU…. I NEED MY COMMISSION,

IT’S TIME TO DISCOUNT YOUR damn PROPERTYâ€.

*** AND THAT IS EXACTLY HOW THIS WILL PLAY OUT.****

Just go back and take a look at 1991 to 1996 California R.E. Statistics,

I lived through it and bought a house at 75% discount. I saw how

desperate and hungry the Agents and Brokers were — THEY ONLY CARED

ABOUT THEIR COMMISSION….. REALITY RETURNS TO US AGAIN.

What exactly will the government do that it already isn’t doing to mitigate the next downturn?

Dan is absolutely right. There is so much pent up demand that even if there is a decline, all the people who have been waiting on the sidelines to buy will bid prices right back up. Meanwhile, there are people on who have been wishing for a crash for years, while prices have only gone up. Is it really considered a win if prices decline in 2017 to 2015 levels? I’m sure there are many people here who will say “I told you so”.

The last crash was generally attributed to toxic loans, robo-signing, people using their properties as personal piggy banks, and wall street encouraging and profiting from it all. Most all of these issues have been corrected and safety nets put up to prevent the same thing from happening again. Generally, anyone who got a mortgage in the past few years has the income and means to support it. It is not easy to get a mortgage today. I’m not saying that a housing correction can’t happen again, but there needs to be a different catalyst. Whether that be natural disaster, war, stock market correction, etc. who know? I believe that any correction in the housing market we may experience in the near future will be limited.

how about hedge funds selling 10,000 homes as fast as they can while prices are falling and then all those flipper mom and pop landlords seeing their paper wealth evaporate?

how about interest rates coming back to reality?

how about a nice big fat earthquake?

how about China trying to claw back the flood of money that left the country?

The pent up demand is just that, pent up demand. Basic economics, in lieu of exotic loans, prevail, at least for the little people like you and me. The last downturn didn’t end until the government and Fed — not ordinary buyers — stepped in with extraordinary and unprecedented measures. And not until prices fell by 30% in some areas.

Robo-signing caused the last crash? Robo-signing was an after effect of the crash. The basic cause of the last crash was simple: high prices. Let’s not over-dramatize it by scape-goating subprime or home equity loans. The majority of bad loans were from prime borrowers walked away or were foreclosed on due to job loss or the unwilingness to remain underwater.

What safe guards are you referring to? Real estate over-leveraging is alive and well. This time, it’s investors who are over-exposed. Sure, they may have more liquidity than end buyers to withstand a downturn. But why would they want to? Who in their right business mind wouldn’t cut their losses?

Who or what will limit the damage in the next downturn? The government and Fed have already expanded their ammo. Investors are already levered up and could face margin calls or redemptions. Prices in bubble markets are several multiples that local incomes can support.

“Generally, anyone who got a mortgage in the past few years has the income and means to support it.”

I disagree, just look at all the foreclosures in Socal. People are still leveraging themselves way to much., Real estate agents are still spewing their bullshit. Same old same old. If I wanted to I could get approved in L.A county tomorrow for $500K + and have plenty of agents that are ready to put me in a house. I can only afford $400K max and that would be tight. The only lesson the lemmings have learned is that they can buy a huge over priced home, stop paying their mortgage, save their money, foreclose, rent and repeat. The Socal housing market is nothing more then another stock market for the rich to play in. The average Joe better learn how to play this new game or get burned bad. (By in the dips, sell in the peaks)

“Generally, anyone who got a mortgage in the past few years has the income and means to support it. It is not easy to get a mortgage today. I’m not saying that a housing correction can’t happen again, but there needs to be a different catalyst.”

Isn’t wanting to cut your losses good enough of a reason?

“According to MLS listings, [Pharrell] Williams now wants $10.9 million for the three-floor, 10,000-square-foot crib. One drawback: Property taxes currently are about $60,000 a year….Williams bought the place at the height of the real estate boom for $12.9 million. He has been trying to unload the digs for more than two years…Williams bought the [penthouse] at the height of the real estate boom for $12.9 million. He has been trying to unload the digs for more than two years.â€

If a multi-millionaire worth ~$80M is willing to take a 15% loss at the height of a supposed real estate boom, imagine the magnitude of price reductions when the downturn is in full swing.

so what you’re saying is those big hedge funds that bought up thousands and thousands of homes are just going to sit on them when prices start falling and then buy even more?

did you happen to look at the post where the Doc showed us the make up of an old neighborhood in Torrance? The vast majority of homes were bought decades ago and they can sell at any price on the way down so if the government stays out of real estate manipulation i think you’d be surprised on how far prices can really fall…….and what “investor” is going to keep buying if prices are allowed to fall to the correct clearing level which is much much much lower than even a 30% correction.

AT SOME POINT WHAT PEOPLE EARN WILL MATTER AGAIN and, when i ask everyone i know, “which one of your kids could afford to buy the house you live in” i almost always get the same answer…..”i couldn’t afford to buy the house i live in on my current income”

and that’s the rub right there.

and p.s. notice that i left the interest rate question completely off the table.

Over the past couple of years on this comment forum, I’ve noticed a pattern of belief that the Wall Street landlords are in it for the long haul. I tend to wonder if this is related to the widely touted idea of buy and hold in the public mindset. Wall Street interests don’t buy and hold, they time the market. As of yet I’ve not read nor heard any compelling arguments as to why this particular asset class will not be treated in the same manner.

Incomes and wealth do matter. Statistically, about 0.7% of the world’s population are made up of individuals with net worth’s of over $1 million. In China, there are estimated to be 7 million millionaires, and around 10 million in the U.S.A. And only around 10 to 15% of households in America make upwards of $150k, probably the starting point for qualifying for a mortgage in many west coast locations. While those numbers are likely higher in California, and those Chinese millionaires are active in that market as well, those who can afford real estate at current prices is not without its limits! I’m not sure if this small/exlusive segment of the population can sustain the housing market indefinitely at current prices!

I guess the free market skeptics have never heard about “strategic defaults”:

“Morgan Stanley, for example, is a gigantic corporation. As of the second quarter, it boasted total capital of $213.2 billion (Q2 2009). It certainly has the ability to make good on obligations incurred by its many operating units. But earlier this month (12/2009) Morgan Stanley said it would turn over five San Francisco office buildings to lenders rather than pay the debt on them. Why? Morgan Stanley foolishly paid top dollar for the buildings in 2007, when prices were really high.”

JNS – being a millionà ire is not so special these days. The guy I work for is a millionà ire, and trust me he’s not rich.

I hate to see people thinking that those all-cash buyers are some sort of powerful flying beasts who are richer and smarter than the rest of us. They’re not – they’re hard money borrowers, many of whom probably don’t have two nickels to rub together. They’re the ones who buy when the lemmings say they should, on the way up, not when the smart money does. Downturns can be incredibly fast compared to artificially drawn out upturns, and (at least in my neck of the woods) in the year that it takes for the market to drop 20%, you’ll hear crickets at open houses just like the last time. Once prices flatline for a while, it will start to get competitive again. I’ll be going in before that, because 20% is enough for me.

Dan stated, “Anyone who thinks the ‘crash’ will mean they will get a better price than in 2010-2012 is dreaming. If prices go back to pre-2010 prices, the investors will swoop in and snake all the deals.â€

Whether anyone will get a better deal than 2010-2012 is total speculation. The dreamers and the naysayers probably have an equal chance of being right.

Also, I think it is absolutely ridiculous when people make the statement that “investors will swoop in and snake all the deals†in the event of a downturn. Of course the connected and all cash buyers will get the best deals. That is true in good times and bad, and there is nothing you can realistically do about it. However, if prepared, average folks could have purchased in 2009-2012 and made out really well. I bought in early 2009 and got a great deal (sitting at around 45% equity now). I also was poised to buy again in 2011-2012; I could have realistically purchased one of four different houses, but I chickened out and didn’t (oh well). A friend bought in late 2010 and also got a fantastic deal. I also know various other associates that bought in the 2009-2012 timeframe and have done quite well equity-wise. None of these people were well-connected or cash buyers.

I tend to say that I got lucky by purchasing a nice little bungalow a few blocks from the beach in 2011, but there was that little matter of having saved up more than $130K so I could take advantage of that opportunity when it came along. Saving that much was literally just a matter of saving $100, repeated 1300 times (though I scaled it up dramatically during the last two years).

Did you forget about the 30% crash in the market in the 90’s and the 40% correction we just had in 2006?

If the market goes up that far, then it can go down that far.

Case-Shiller graphs – they’ve been accurate for 500+ years – so it’s likely to come down. Of course we get some dead cat bounces along the way.

“Purina Dog Chow Taco Tuesdays”

I wanna put in a plug for cat food. It’s very cheap. My cat adores tuna and whitefish. I haven’t tried it yet.

For every housing crash comes new renters. Good For Landlords.

Something is likely to come along to punish the landlord classes, especially the levered landlord classes. BASEL III for one, and banks getting protective/stingy in terms of lending. Capital = number 1. In the UK many landlords are panicking against a new tax regime. Where they once could offset the mortgages, from 2017 they can’t and are taxed on turnover. Massive. UK Gov has decided to feast on the rentiers. Something similar has to occur US side.

I think it will come down to changes in our property tax structure. Single residence will be ok . However if you have a second home and then decide to rent it then it should classified as something else.

Agreed Homerun. That is such a ridiculous unfair situation. Although I would like to see Prop 13 radically changed. Shake things up. If it’s coming I suggest it will be done in a really crafty/sneaky way, and also astonish the smug vested-interests who think the future can’t change.

Homerun, that’s already law in some places. I lived in Salt Lake City in 2009 and property tax was discounted 40% if the home is your primary residence. That put the effective rate just under 1%. That’s by far the lowest property tax rate that I’ve ever had. (I’ve owned homes in WA, MN, Ontario Canada, ND, UT, CA, and now MT.) CA was the second lowest rate, of course with the high valuations the overall bill ended up as my largest.

I think you have to wait till spring/summer of 2016 to really know whats happening with the market. We all know fall/winter is the time when real estate slows down. Wages could possible increase next year with the minimum wage increases being phased in that might raise the pay of people that make more than minimum wage. I do think that prices need to come down a bit to a level that is more in tune to the money people actually make.

The problem is that the way our society is structured it is itself a ponzi no matter how we try to benefit every possible solution to any society there is going to be groups of individuals who have an education/trade background which will give them the privilege to own a home/rent some where near where they will work and live out their existence. On the other end the unfortunate individuals who cannot make the grade or have other issues are left very little choices. They would need assistance which our society provides. However, it will comes with special requirements. In any case trying to ask people to take a cut into their living conditions to accommodate for others is going to be a constant fight forever. Why should a person with a million dollar home even care what happens what happens with the unfortunate? is it their responsibility to see their home price lowered to meet their living conditions? With wealth comes options for some . For others No wealth no options. I think our society is and has been a tiered society and will likely remain this way going forward if unless we can change. -all imo

That’s not how it works. Every time the minimum is raised the people who worked their way to higher incomes through raises have their labor devalued by people just coming in the door. They get no corresponding raise.

Prime example is Wal Mart’s recent wage increase for new hires. No one that had been there longer, even 2 years, got an increase in their wages. Now the slob who just came through the door that day made as much as someone who’s been there for two years and proven themselves in that time. And it’s not just WalMart.

And there’s never been a raise or pay increase as a result of new minimums for the already employed workers in any job I’ve ever been in in the nearly forty years I’ve worked.

And yet the conventional wisdom I hear on talk radio says that when you increase the minimum wage, employers must increase wages for those already working. And that this is why unions support the minimum wage.

Liberals and conservatives seem to agree on this, though each sees it as an argument for their side.

Conservatives say the minimum wage is a great burden on employers, because it forces them to increase the wages of all workers, at every level.

Liberals say the minimum wage is a great boost to the economy, because it causes all wages to rise, spreading the benefits to all workers.

I read an article last year about some techy firm who had high ideals of equalising pay between directors/senior staff and just those pulling the 9-5 on the more basic stuff. They followed through on it, but it led to damaging splits and lower productivity and arguments. Senior staff began to get moody with it all, and leave. Their pay not as high as it could be (for more of the revenue being shared with lower level staff), despite senior staff having taken risks to get company off the ground, done the 13 hours days, their higher intellect and push to forward the company to make it prosper… downvalued in the name of ‘fairness’.

How does a McDonald’s worker making more money have any affect on someone with a real career?

The rise in minimum wage in large cities is interesting. Places like SF, NYC, and perhaps even LA are going through a boom so taxes, mandatory wages and the like are going up because TPTB think, “They can afford it.” What happens when things normalize and businesses have to stay afloat in a non-boom environment? You’re stuck with legally mandated $15 min wage, insane local taxes, personal health insurance mandates from when times were “good”. What small business owner can afford all this? Expect millions of small businesses going under.

Don’t forget Seattle. They started this $15 an hour minimum wage standard.

I don’t think there will be a “crash” in housing prices. Maybe in SF. But most banks now require a pretty thorough vetting before making a loan and a healthy down payment. The last bubble was built an extremely flimsy lending standards that do not exist anymore. I waited and waited during the great crash of 2008 to snatch up a bargain. You had to act fast because the sharps were circling like vultures and they got bought up real quick. And the banks held back foreclosed inventory, letting people live in their homes for a year not paying the mortgage, slowly dripping homes on the market to keep prices up. I not saying overpay or take on too much debt. But realize that the game is rigged to keep housing prices up.

Friend of mine is in escrow in the san gabriel valley on a home financed with FHA at either 3% or 5% down. He lost his last home in 2011 as a short sale. I told him that at least this time around he at least had the opportunity to walk away relatively unscathed when things go south. So no, all down payments are not “healthy’.

So banks are tightening lending criteria, and those wanting to buy have to put down ‘healthy’ chunk of money. Wow. You don’t get it do you? You’re describing a situation where banks are being picky and choosing about lending, and requiring the applicant to put down a chunk of hard money. Not particularly bullish for house prices I would have though.

That downpayment is chaining the buyer in (to repayments and price falls), whilst gifting the bank a chunk of money/security and added security to foreclose on house in the future if necessary. Or to have the ‘smart’ buyer strain to pay off the jumbo mortgage over the next 30 years.

_____

Hence you’d be looking at a situation where you thought the market was irrational (your property, in your estimation, was worth $1million, although nobody would pay you $1million for it). […] That is the heart of the aphorism; it’s about holding on to a leveraged investment position when the market turns against you.

You’ve got it all back to front. The bank demands the big deposit because they know that you are weak. Arguing that you are not weak because you’ve handed over a big deposit is an interesting way to look at things, but in my opinion, completely wrong headed.

You must not know many loan brokers… You can get a 10% down no doc loan with a good credit score. Beyond that you don’t have to have a wave of foreclosures (though there is one coming when the loan mods of the past several years reset) for a lower level price discovery. The recession has already started. The FED is irrelevant to the market psychology that is taking hold. The median has been skewed by high end purchases for at least a year. Even with that asking and closing prices are down. The illusion of the last 3 years is coming to an end. Hedge accordingly.

This is not accurate (I am a mtg broker).

With the passage of the ATR (ability to re-pay) rule; borrowers must exhibit an ability to repay (read: INCOME). Lenders must document this ability via tax returns/pay stubs/w2’s or bank statements. Yes, there are bank statement as income programs available; but, they are very strict with many sub-rules in place as investors/lenders are very cognizant of this ATR rule.

That being said; these programs are available and not impossible, just a very minute segment of the overall market.

FHA requires 3.5% down and conventional 3% down. Former will go down to 580 fico and latter will go down to 620. There are plenty of people who scrapped up enough just to get in the door and whose reserves are virtually nil; therefore if any loss of job or downturn in the economy would present itself these are foreclosures waiting to happen.

I myself have sat in bewilderment as prices have continued their upward climb. Just thought I would interject some info from the lending side.

RE:dan

“That being said; these programs are available and not impossible, just a very minute segment of the overall market.”

Then how is what I’m saying not accurate???

Last year when I was buying my house the lenders I went to all pushed me adjustable rate mortgages. Flashback to 2006, right!? I’m sure am arge number of ignorant people bougt into it. We will see what happens when they lose their jobs and interest rates adjust higher.

You are correct that this time is not like 2008, but that doesn’t mean prices can’t nosedive. What if all the Foreign, Cash buyers disappear? Then the market will be dependent upon a broader wage earners and their ability to qualify for and obtain a mortgage. That is a limited pool when the median wage is $60K-ish and the income needed to buy is $150K-ish. Even 2 median salaries don’t cover that nonsense.

True, LA/oc are agining faster than the State of Califonria since the housing is too expensive. In fact Mexicans are coming less often to the US than 10 years ago which means slower population growth to both counties. Also, a lot of the native born moved to other counties in Ca or out of state. Interest rates are going up a good 50,000 to 100,000 dropped to LA/Orange would be good it would move some of the houses and renters out. I predict that Orange County will move from 3 highest market to only 20th by 2020 since other places in the US like Virginia are picking up steam and an aging population means less people looking for houses.

There currently exists a trending perspective being fomented by housing interests and the media which posit that because subprime “unorthodox” credit is not involved to the same extent that it was in the last cycle, there should be no outcome of a significant price correction this time around. This is linked to another point of view widely held by the public which holds that the previous housing bubble was almost entirely fueled by unorthodox credit. The truth of the matter is that it was brought on by speculative sentiment where subprime credit and loose lending standards were two contributing catalysts out of many. There is evidence that a large cohort of buyers with decent credit, lured by the prospect of making a quick buck, snapped up investment properties to let and flip–in many cases flipping to other speculators within a matter of mere months without improvements made. New entrants whom bought during this period because they coincidentally also arrived at a life stage ready to buy a house to live in ended up being snared as collateral damage.

The argument can be made that the present market is also being mostly fueled by speculative activity, although just like last time, entrenched interests are abound with narratives as to why it’s plain old stable demand. To the extent that there is speculative buying, it matters less how the makeup and distribution of contributing factors are REALLY different this time. Speculative activity with its resultant deflationary wake still informs pricing on the margins and only once the cycle runs its course will we know for sure to what extreme.

To suggest that the game is rigged is to also accept the premise that there is a large preceding degree of well executed planning involved. The spectacular changing of the rules mid-game in 2008 suggest otherwise. America does not exist in a vacuum free from the effects of a volatile and uncontrollable world replete with competing interests. The legacy of the former era’s speculative excesses live on as government organizations at the helm kicked the can to where we now find ourselves. I’m not sure how anyone looking at historical precedent could have much confidence that these entities are any more in control than they were before and believe that capitulation is a sure bet.

Frankly I find the promotion of the ideas that price levels will remain affordable only for the few and everything’s rigged to be the worst form of fear mongering. Rebalancing is restorative and a positive sign of health.

HC; agreed for the most part. Only part I challenge you on is this = New entrants whom bought during this period because they coincidentally also arrived at a life stage ready to buy a house to live in ended up being snared as collateral damage.

We are in a market where individuals make their own decisions. I told my friends and B-I-L that I am not interested in their/the sentimental justifications (“we should have a house at our age”) to paying reckless-insane price for a house. If they were snared (become snared in future from over-stretching to buy hipster houses at crazy prices in this market) – quite frankly the buyers (whatever their age) are/were part of the problem. They are active market participants.

Everyone needs to take ownership of their own market decisions. If not, it leads to VI pointing at these ‘young people’ – so innocent…. ‘save them’ – “let’s begin QE and 0.5%” (‘which in process locks in our own hyper gains and gives us more ponzi HPI wealth’). To give them special passes is silly. ‘snared’ – it’s a competitive market and wouldn’t we all like a house. Take ownership of your own financial decisions to buy / rent etc, and allow markets to play out.

GB (Great Britain, ha!), I mentioned the ensnaring purely for technical purposes. Totally agree that the addicts are as much a part of the problem as are the dealers. In matters pertaining to real estate, the two are quite often the same person.

@HC

Great arguments as always. Calm, cool, and to the point.

Scape-goating subprime for the last crash is based on emotional bias — or in some cases hysterics and short-shortsightedness.

The question is when will it happen? Since everyone seems to be anticipating or expecting this monumental event to to occur how bad will it be? Will they quietly walk the housing market down before the tech companies crash or will be the tech companies lead the crash? Maybe the problem will be from abroad that will be the undoing of the tech and housing. Seems like there is going to be something else to blame for the crash this time around.

There’s always someone to blame or scapegoat.

——–

The Search For Scapegoats

Even recognizing a slump is underway is often beyond the vision of authorities. Consider that the 1973-75 recession began in November 1973, but, reported the Wall Street Journal, “as late as August 1974, Arthur F.Burns, the Federal Reserve chairman, was assuring Congress that the economy was still expanding.”

Widespread complacency is not the only parallel. A major confirmation of the onset of depression will be a concerted effort on the part of political authorities to locate scapegoats for the slump. Every slump and market crash in history has been blamed upon something other than a decline in economic prospects. The pattern is infallible. The blame is fixed partly on some technical factor: short-selling, margin abuse, etc.; and partly on some fraud or wicked manipulators. In 1720, it was Sir George Carswall and the Directors of the South Sea Company who were judged to have ruined the London Stock Market. The Panic of 1837 was blamed on Nicholas Biddle. The crash of 1873 was the work of Jay Cooke. In 1893 the blame fell on James M.Waterbury and “international bankers.” In 1929 the “international bankers” came in for another tarring, along with President Herbert Hoover, short-selling, and “unregulated securities markets.” The Brady Commission after the 1987 crash and the new high-tech villain: the computer. In the future the blame will fall on program trading and derivative instruments like options and futures, and foreigners in general.

The search for scapegoats is in many respects silly. But it unintentionally makes a point that you should take to heart. When the news is bad and apt to get worse you cannot draw your bearings about the economy or the market from channels of mass communications.

Can you imagine a major newspaper (much less the leaders of the country) saying that stocks fell because objective conditions no longer supported their further rise? Has it ever been recognised politically that a market has topped out? Or that an economy needed to go through a painful slump to facilitate a transition and shake out dead wood?

In every case which we know, politicians have continued to pretend that all was well long after events provided impressive evidence to the contrary. This is a game that President Hoover, in retirement, described as “sustaining the morale of the people.”

-J.D.Davidson

Has it ever been recognised politically that a market has topped out? Or that an economy needed to go through a painful slump to facilitate a transition and shake out dead wood?

Well, Chance Gardener had the courage to say so: https://www.youtube.com/watch?v=YgGvd1UPZ88

I thought that was Peter Sellers but had to do a search to make sure. Thanks for the clip.

If only it were that simple, Spring, Summer, Fall and Winter… to Spring… with short simple and relatively gentle seasons for economic flow/set-back/re-flow. Many VI think it’s just one ’30 year endless summer!’ in party-land for house prices, and believe global financial conditions can keep it so. We shall see.

Disturbances analogous to economic depressions are characteristic of many complex systems in nature. Paleo-ecologists for example, have established that spectacular forest fires in Yellowstone Part, in which vast numbers of acres are consumed, such as that in the summer of 1988, “occur every 200 or 300 years.” In effect there is a “long wave” of forest growth, followed by a major conflagration and a slow period of regeneration.

William H. Romme and Don G. Despain point out that forest systems evolve through various stages of succession. Growth is most luxuriant and varied immediately after a major fire. For quite logical reasons, the forest is not very flammable during the recovery period when a few widely spaced saplings and low-lying vegetation keep the forest floor moist.

Neither are major fires likely during the many decades when “the treetops rise too far above the the forest floor to be easily ignited from below.” But during the “climax stage,” when the understory of old-growth forests is littered with dead trees and rotting underbrush, a spectacular fire is almost inevitable. It is only a matter of time until lightning strikes in a dry season and the whole flammable mix explodes.*

The long cycle of economic life appears to be shorter than the long cycle of forest growth in Yellowstone Park, and we hope, less combustible. Yet both cycles may function in inheritantly similar ways. Just as it is impossible to prevent or suppress spectacular forest fires by putting out every small fire over time, so too, economic policies that aim to prevent depression by forestalling bankruptcies and enlarging debts may only increase the severity of the ultimate disturbance.

The mounds of debt paper issued by politicians in the leading countries, especially the United States, may merely be littering the understory of the economy with combustible material. When the spark is lit, it will produce a “mighty flame”.

Of course, many people no longer believe that the long cycle of boom and bust still operates. They imagine that the climax of the cycle – the period of credit collapse and deflation – is now impossible because politicians have determined to prevent it. The is not the place to go into an extensive analysis of why this view is mistaken. Suffice it to say that the populations of the leading industrial countries evidence a touching faith in the powers of politicians.

*The pattern of growth and conflagration is not unique to Yellowstone. Some Florida pine forests for example actually require fires in order to survive. The Florida pines have evolved so that their cones will not open to release their seeds unless they are heated to a high temperature by fire.

-J.D.Davidson

Galaxy Brain, have you seen Being There?

Peter Sellers plays this mentally challenged gardener, who is inadvertently accepted by the wealthy elite. They don’t know that Sellers is a gardener, or that he’s mentally challenged.

Sellers always speaks in literal terms. He has no idea who the President is, or what the President is asking him about. So Sellers, being a gardener, answers with the only information he has — he talks about gardening.

The President and those around him mistakenly think that Sellers is speaking metaphorically about the economy.

Throughout the film, Seller rises in society, because people mistake his simplicity for brilliance. When the Russian ambassador quotes Gogol in Russian, Sellers laughs because the Russian language sounds weird to him. The Russian ambassador mistakenly believes that Sellers understands fluent Russian and is laughing at Gogol’s wit. Thus the Russian ambassador is deeply impressed by Sellers’s expertise on Gogol in the original Russian.

Thanks SOAL. I didn’t know the movie but I will position to watch it in near future.

Sounds good. 🙂

I grew up down the street from that house. At which time the pavement stopped prior to that house and it was on a dirt road.

There was a guy living there who inherited the house from his mom, and he was an artist. All the neighborhood kids were welcome to come and hang out and see his latest art project. One time he built a machine he called the International Popeye Machine. The machine moved slowly down the street making funny noises and emitting smoke.

The only chairs to sit on in his house were barber chairs. And the interior of the house was filled with different items he made.

This article brought back wonderful memories

What a coincidence and that’s a cool story. Thanks for sharing.

It sounds like that guy was fun!

People hanging onto their lives by their fingernails don’t have time for fun and don’t dare anyway. It’s the new puritanism.

Yeah, sad really. The Bay Area has rapidly become a less artistic, less eccentric, less surprising place. Once the Grateful Dead and Jefferson Airplane, basically groups of friends who liked playing music together, could rent out a big Victorian house and make their noise, performance art- whatever. Now, our cities are just full of the millionaire elite, recent Stanford business grads quadruple bunking up in a 2-bedroom apt, or the desperate service/working-class, sweating bullets that they don’t get evicted. Not much time for art, culture, family or simply putting up a fun mural with your neighbors when you’re working 60 hrs a week just make the rent…

Doc; So it sold in June for $525,000 (someone had listed it at a low ball price). Now a few months later, someone is trying to offload the place for $799,000.

The latest listing description lol. Ab fab darling.

Is this the old listing? If so, looks like more than a lick of pain was required to modernize it.

http://www.movoto.com/los-angeles-ca/1933-phillips-way-los-angeles-ca-90042-204_15-902005/

pedro is a great town sure you got your growing pains but what town doesn’t? and if you got a town without such problems then i’m pretty sure its a place where you don’t ask “how much is that place?” or “bitch” about the price.

I get such a laugh when people blame real estate agents for declining prices. Most likely, they are the same ones who considered themselves to be brilliant investors when prices were going up. They certainly didn’t pass any credit the agents’ way. And they shouldn’t have.

The idea that agents control prices in one direction or the other is the biggest joke in the world! Anyone who believes that is terminally naive.

This is my new favorite listing:

https://www.redfin.com/CA/Los-Angeles/2216-S-Palm-Grove-Ave-90016/home/6899613

600K for a 1920’s 2/1 shoe-box without a garage that needs TLC. That neighborhood is straight-up ghetto. And it’s close enough to the 10 freeway to wave to the commuters as you develop black lung and suffer from lack of sleep. Make sure you save enough money for a firearm, or maybe they can work that into the closing costs if you ask nicely.

I might be in the minority here but I think that area has a lot of future potential, but it’s going to take a few cycles. That said, this seller is smoking crack with that ask, figuratively for sure and quite possibly literally.

I used to own property nearby and I can tell you from experience that the neighborhood is plagued with crime, drugs, poverty (lots of section 8), and a general lack of caring for the community. That being said, it will take MANY years for gentrification to take hold here.

Repeat flipping is back in style. Came across a few examples of 2012-2013 vintage flip buyers trying to cash out.

https://www.redfin.com/CA/Long-Beach/3335-Baltic-Ave-90810/home/7626863

https://www.redfin.com/CA/Los-Angeles/724-W-F-St-90744/home/7677077

https://www.redfin.com/CA/Los-Angeles/4717-Lomita-St-90019/home/6905810

https://www.redfin.com/CA/View-Park/5259-Angeles-Vista-Blvd-90043/home/6868484

Here are a couple of 2015 vintage ghetto crap shacks helping to demonstrate some of the ways in which this market really boils down to speculative fervor, just like the housing bubble in the run up to 2008.

https://www.redfin.com/CA/Los-Angeles/3767-Wellington-Rd-90016/home/6888718

https://www.redfin.com/CA/Los-Angeles/2136-W-83rd-St-90047/home/7293396

This sort of market action is the real test. But hey, everyone is qualified and the loans are solid this time so no worries!

Bonus – at what point can it no longer be described away as a “make me move” or a “marketing gimmick” price in Sillycon Beach? Redfin doesn’t display it, but this thing was originally listed at $3.4M and now asking $2M. After a little over a year sitting on the market and somewhere around 10 price changes later, the reduction sits at 42%. -$500K in just the last two months.

https://www.redfin.com/CA/Venice/424-Venice-Way-90291/home/6741608

Really no surprise as correction in anything means it comes down and takes longer to get a buyer. The question all ask, what will be the new norm for house prices. If it was listed for 950k, is a correction of 10% reduction enough to get it sold? The market is more than a % of price reduction. Location, future value, will dictate the movement of a house price reduction.

If the 950k home was bought it at a bargain price of $400k and the actual value is lets say 650k, than it can still be purchased for $650k and the seller still makes a profit.

Vice a versa, if the seller paid 950k and wants to dump it for 950k they have a problem Houston, and that is when the wheels come off. Every home purchase has a story, one size doesn’t fit all. always a buyer and a seller, it all comes down to what the value of the home is, was, and will be, and how much the seller will either escape even or smaller profit or lose their collective shirt?

“L.A. tops nation in chronic homeless population”

http://www.latimes.com/local/california/la-me-homeless-national-numbers-20151120-story.html

Californians best get ready to pay more taxes/fees/surcharges to manage/support the exploding homeless population, and get comfortable with more homeless taking up residence in their hoods, because more money will be needed to support them, and more laws are being relaxed/passed to benefit them. Perhaps a mattress or tent will be set up on a sidewalk/bridge near you, and probably there won’t be much you can do about it but enjoy the smells, increased crime, litter, people wandering aimlessly day and night, constantly picking through your trashcans? Good luck!

Good! I actually feel the homeless have not only a right, but a duty, to make the taxpayers pay and pay. When the financial bleeding gets bad enough, maybe the ruling class will wise up and adopt things like utah’s housing first model, treat substance addictions like illnesses rather than moral failings, and mental illness as illness, rather than sin and punishment from a vengeful God.

Leave a Reply to Nimesh