California Budget Recalled: The $24.3 Billion Budget Deficit. Missed Economic Projections and Financially Betting on a Recovery that Never Showed Up. 20 Years of Bubbles. From Tech to Real Estate.

There are many reasons why California finds itself at the financial edge. We are a state that heavily depends on personal income and sales taxes that fluctuate wildly during good and bad times. California also finds itself grappling with the reality that there may be no other bubble to save itself from the current harsh reality. During the 1990s, we had massive wealth gains with the technology bubble with areas such as Silicon Valley. After the bust, state revenues dropped quickly but without skipping a beat, we had the real estate bubble to pick up right where it had left off. Two decades of massive bubbles. There may be no other big bubble in the near future to get us out of this mess easily.

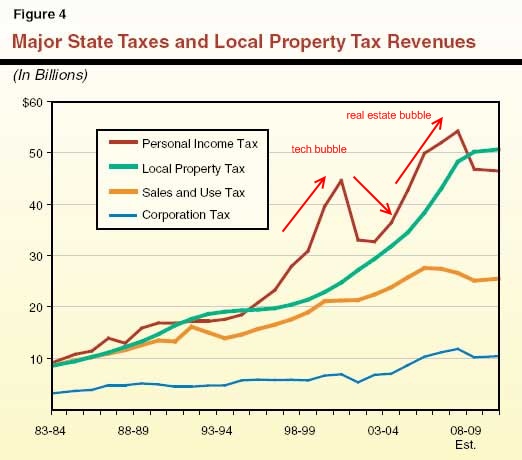

Let us set aside the Alt-A and Pay Option ARM tsunami that will depress housing prices further late in 2009 and will hit full force in 2010. How can state representatives miss so badly on the budget for the wealthiest state in the nation? First, it is important to look at the state like a household balance sheet. Let us first take a look at the last 30 years for revenues:

Source: Legislative Analyst’s Office

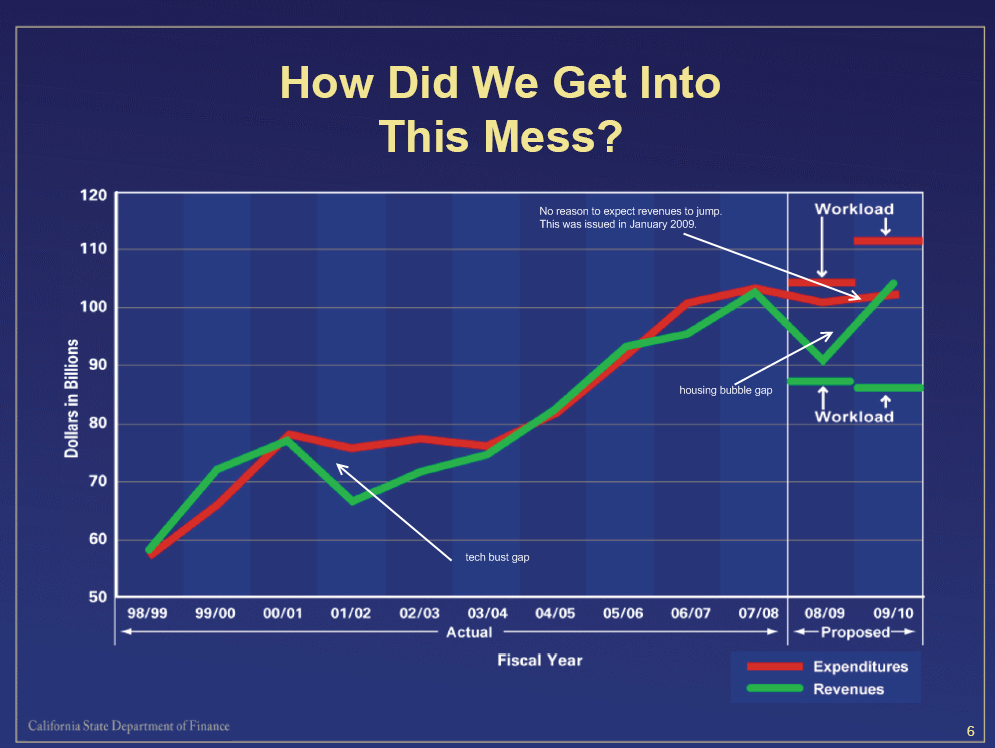

The first thing you will obviously notice is the incredible jump in personal income taxes during the tech era. That bubble burst and brought income tax revenues lower. As would logically follow, sales taxes also fell after that burst. But do you notice something else? Local property taxes kept on moving up during the tech bust! In fact, starting right about the time the tech bubble burst we had a major jump in local property tax collections. We transitioned with one bubble to another. This is why California is in a deeper mess than other states. For the past 20 years, we have drawn a large portion of our revenues from a bubble economy. Now this leads us to our next chart that was presented back in January of 2009. This chart comes from the Department of Finance and ironically is called, “How Did We Get Into This Mess” while giving us another reason why we are in the mess, overly optimistic projections:

Now if you recall, at the time we were trying to plug a $41.6 billion budget deficit. Now if you carefully look at the chart, you will realize that the major deficit is reflected by a drop in revenues yet somehow revenues miraculously go up for the next budget. You will also realize that expenditures do not move together with revenues. This again is because of our dependence on personal income tax and sales tax. What is fascinating from the chart of course is that much of the revenue produced in the last 20 years largely relied on bubble economics. Now with the real estate bubble bursting there may be no other bubble to pick us up. You will see that the state has had no problem spending more and more. This is problematic in normal times but realizing you are spending money from an income stream that is built on a bubble is troubling. Bernard Madoff made money in an elaborate Ponzi scheme in which he paid investors money with money that was coming in. Everyone was happy until the scam was uncovered. We are now realizing with the real estate bubble bursting that a large amount of revenues were simply a function of the bubble.

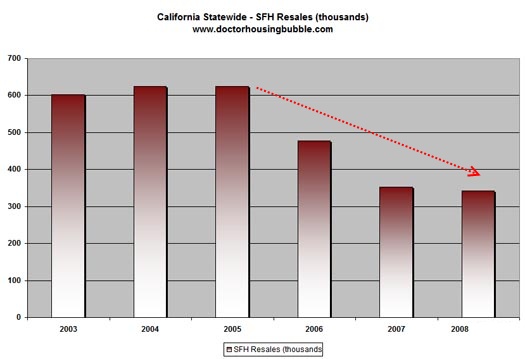

A simple way to think of this is to take into account the income of banks, mortgage brokers, or real estate agents. Each home that sold produced a commission, fees, and higher property taxes for the state. It was a win-win-win to infinity. And homes were selling over and over churning fees and money for all involved:

You go from having 600,000+ sales per year in California to 300,000+ sales per year. So even in 2007 when sales drastically slowed down the state should have started adjusting to this new reality but of course it did not. What did this translate to? Half the work was needed. Half the income was being produced. Yet the state kept on spending as if nothing had changed. Its number one source of growth for the decade housing was cut in half and it kept on going forward as if everything was the same!

37,967 homes sold in the state in April 2009.

36,215 in March

29,225 in February

29,458 in January

This puts us in a target range of 450,000 to 550,000 for the year given that spring and summer are the strongest selling months. Yet here is the new problem. The median price for a home sold in the state has fallen by half. So even though sales may be moving up prices are cut in half. This does very little for revenues especially when over half the homes that sell are foreclosure resales.

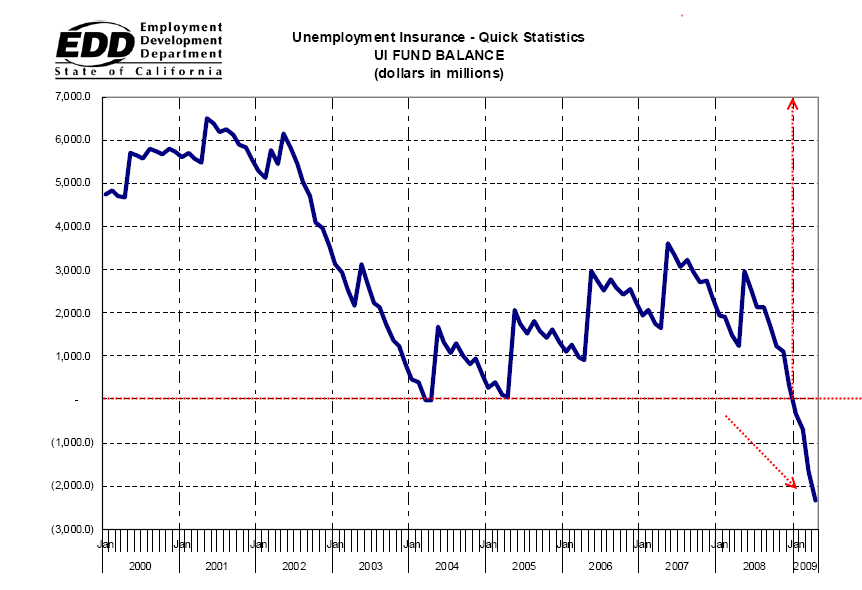

The new budget gap came only a few weeks after the $42 billion hole was patched up. The January chart should give you a few reasons why. Expectations where much too optimistic. In fact, in a September 2008 report the peak unemployment rate was put out at 9.4 percent for the state which would be reached in 2010. We are up to 11 percent already. Also, we are now blowing through the unemployment insurance fund:

We have been in the red for some time now. Of course, the reason to this is logical. Unemployment insurance is paid by working people and with such a high unemployment rate, less is collected while more people collect. You would think that the state would understand basic arithmetic but that is not the case:

“(SF Gate) Starting in 2002, the Democratic-controlled state Legislature enacted benefit increases that raised the maximum weekly payment from $230 to $450 – which they were able to do by a majority vote.

But Democrats lacked the two-thirds margin to change the 1985 formula under which employers are taxed on only the first $7,000 of each employee’s wages. Schwarzenegger’s proposal calls for taxing the first $10,500 in wages.

Marc Burgat, chief policy advocate for the California Chamber of Commerce, said the shortfall is the consequence of increasing benefits without increasing funding. He said California should study how other states handle unemployment and consider tightening up “some of the broadest criteria for eligibility” of any state.”

During boom times, many economic ills are hidden simply by the flood of money. No one goes thirsty. For two decades, California has had the luxury of two historic bubbles with unprecedented windfalls in revenues. The problem with unemployment insurance sinking into the red is a good litmus test of how things are done here. We nearly doubled benefits yet collected money into the fund at the same rate. Of course, it sounds nice to have bigger unemployment checks. Who doesn’t want that? But how are you going to pay for it? Therein lies the rub. All it took was a recession this deep to expose the semi-Ponzi scheme of the system. So much money is going out of the fund to 853,000 Californians that we will be $17.8 billion in the hole by the end of 2010.

The voting down of the propositions was a stand many took in the state. Yet many are now stunned of the deep cuts coming. Most Californians have never faced such a deep economic crisis. As I have discussed many times the only way for California to fix the situation is either gather more revenue or cut spending. With the propositions voted down (more revenue) the only option left was to cut.

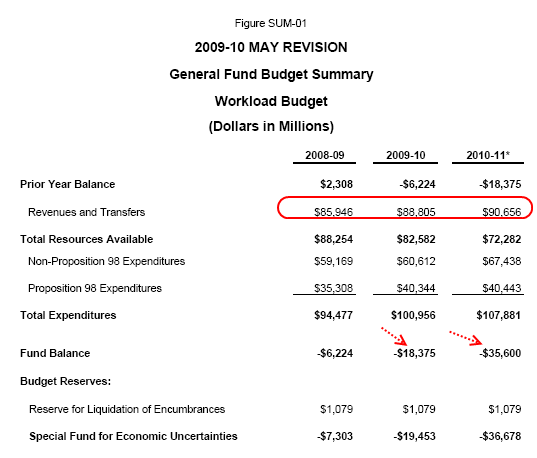

Remember the state revenue chart by the LAO above? Last week we had a new update for revenue projections:

Welcome to a lost decade of income. We are now back into 1990s territory in regards to how much revenue the state is pulling in. This should not be a surprise given the housing bubble was simply a bunch of smoke and mirrors fueled by toxic mortgages, many like the Alt-A and Pay Option ARM that are going to kick the mid to upper range of the housing market a few notches lower. That is why expecting a loss decade in housing prices isn’t out of reach. We’ve already reached that with the lower range and the mid range will be next.

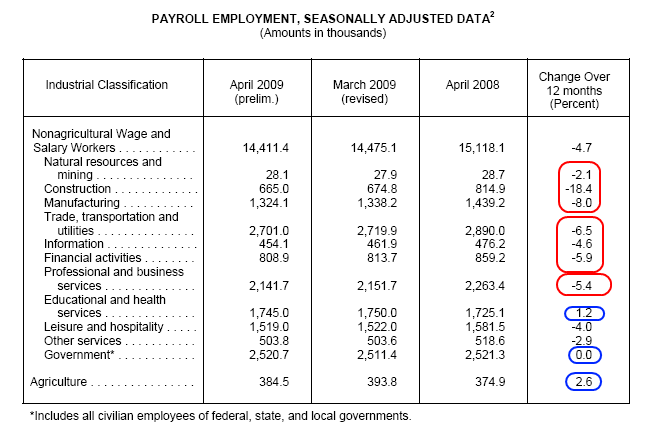

The above should be reason enough to believe there will be no housing bottom for a few more years. And many of the pundits fail to ask the next logical question. What happens after the bottom? Do prices shoot up again? Do they move sideways? I doubt we’ll see another bubble anytime soon in real estate. And when you look at what jobs are holding up in the state the picture does not get any better:

So what we have are good bubble paying jobs disappearing while lower paying jobs take their place. This is another reason for lower housing prices. Who is going to buy all those over priced homes in so-called “prime” areas? That is why in some California cities we are seeing a handful of sales while at the lower end, sales are moving along briskly. 50 to 60 percent discounts are working but not 15 to 20 percent in more prime areas. The Alt-A and Pay Option ARM debacle will move up the food chain later this year and into 2010.

Now people are asking why doesn’t the Federal government simply step in and bailout the state? Well for one thing, states are part of the country. Shocker, I know. This is like a snake eating its own tail. Also, if California receives assistance this sets up a precedent for all other states to follow. Either way, even if we were to receive a massive bailout this doesn’t remedy the balance sheet because those revenue streams from the bubble are long gone and will dry up after the first bailout. Unless, someone can find another bubble to give us another decade of so-called prosperity?  Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

44 Responses to “California Budget Recalled: The $24.3 Billion Budget Deficit. Missed Economic Projections and Financially Betting on a Recovery that Never Showed Up. 20 Years of Bubbles. From Tech to Real Estate.”

I’ve been trying to figure out what the “extra money” was spent on during the bubble years that we didn’t have back in the 90’s, before expenditures went through the roof. What did all those extra dollars go for?

You can depend on it, one of the first things we will hear is, “End Prop. 13.” We get in trouble when we depend on volatile sources of income. If we didn’t have Prop 13, property tax receipts would be in a death dive now. As it is they were still going up well after the bubble burst, and are holding pretty steady even under present circumstances. The chances of ending Prop 13 on residences is probably small, so the focus will be on ending it for “commercial property.” Already one of the most business unfriendly states in the nation, why not drive a stake through the heart of what is left? Why not kill the goose that lays the golden eggs? After all, we need golden eggs, right?

Is it possible that Proposition 13 has something to do with California’s problems?

Proposition 13 allows long-time residents to enjoy extremely low property taxes while placing an increased property tax burden on relatively new residents. In effect it is a way of subsidizing long-term residents by taxing new residents more heavily. The rational given for this subsidy is that people moving to California have the option have a choice; they don’t have to move there (and presumably long term residents would suffer under higher taxes because they don’t have any option to leave). Of course the choice of not moving to California is not always so easy. Many people who move to California do so because of job transfers and not moving would require them to find other employment.

When the economy of California turns south, this subsidy is surely a factor that encourages newer residents to leave the state in search of lower cost living; in turn this depresses the real estate market further than would be the case were it not for Proposition 13 tax descrimination.

I have the same question as J. Where did all this money go? What did the state spend it on? Obviously the state didn’t think of ooh maybe saving some of it, and got sucked into the mantra of homes will go up forever so spent spent spent. But on what to use up all that money? Has to be more than just the unemployment fund.

As for the mid-priced areas, yeah I’m still waiting for them to go down more. Some has reduced the asking price, but 10% off ridiculous is still ridiculous and people are still asking $600K+ for some shoebox by the freeway. Every place I see I think is worth about half of what the seller is asking. So maybe they can meet us half way and slash another 25% off already. After all that’s what’s predicted with the Alt-A Option Arm Reset Tour coming to town.

Although Californians already pay far too much tax, I personally think getting rid of Prop 13 would help keep a lid on real estate prices.

Als, it is simply not fair that a guy buying a 800k house pays 8K in taxes while his neighbor who bought 20years ago is paying 2K.

With the elimination of Prop 13 that difference would equalize.

In addition, all you need do is look to other states with high property tax rates. The high tax rates help put a lid on housing prices. So, you may pay more property tax without prop 13 but you would save probably more on housing costs.

I could never explain the intricacies of this in a post but there is plenty of reading out there on this subject. It is really quite interesting.

Again, I believe we pay way too much tax and I voted against the latest tax/funding ballots, but that doesn’t mean I throw my brain out the window.

California is in trouble because the government spends too much money, period. Revenues have gone up, but spending has gone up at a greater rate. The only solution is to reduce spending by cutting inefficient departments and policies.

First step, stop imprisoning people for consensual crimes. Every person imprisoned costs the state tens of thousands of dollars per year. Additionally, every prisoner is not working and thus not paying income or sales taxes. So each prisoner probably costs more than $100,000 per year in direct expenditures and lost revenues.

Additionally, every minute that police spend enforcing consensual laws is a minute they are not spending investigating and catching real criminals that perform property crimes and crimes of violence against the population. Property crimes and crimes of violence cost the state lost revenues and of course, are the only real reason that people justify expenditures on police departments. As long as there is even one unsolved property or violent crime, the police have no business enforcing consensual laws.

California needs to Legalize and regulate Marijuana. End the Marijuana prohibition and Tax the growers and sellers. Marijuana grown in Northern California due to abundant rainfall would be the equivalent to wine grown in France. Why let the illegal drug dealers make off with all the money? The war against drugs is a lost cause and California with taxes made from Marijuana would be in a surplus.

Gerald Celente recently echoed your predictions about real estate values.

“I predict continuing deflation of real estate, followed by extreme currency inflation — ultimately becoming worthless. This is why gold is the only honest money — the government can’t counterfeit it. Look for it to top at least $2000 an ounce”

“Our unemployment numbers are also bogus. For example, the construction industry is really above 20% , and the government is creating low-level jobs, not real jobs. The US total real unemployment is more like 16%. Before the crisis is over, it will reach 25% – great depression numbers.”

He also sees major cities like NY and LA having riots.

Doc, If we are lucky we will see the bottom in a few years as you predict.

http://www.totalinvestor.com

California,the-state-of-insanity.Driving-tax-paying-small-business-out

while-simultaneously-welcoming-40,000-illegal-aliens-in-each-day.

Hahahaha,Morons!

I voted against propositions because I was tried of being asked to do the legislatures job. How is the ordinary Californian supposed to be an expert on ways and means? If we are going to run the state government with referendum, voter initiative and recall then why have senators and assemblymen?

Those who say we spend too much money have to tell me what programs are going to be cut and by how much and how are the provisions of the state constitution are going to be met at the same time?

Raise the sale tax through the roof and eliminate the income tax altogether.

With millions and millions of illegals in this state, they will only pay if we switch to a sales-tax based system.

Income tax should be zero.

This article does a good job of looking at the revenue side of why we are in a mess, but does not examine the spending side. In the last decade spending increases have way outpaced inflation and population growth. To add insult to injury, much of the population growth has been from illegal immigration. 11% of people born in Mexico, for example, now live in the US. Many of them illegal, many of them in California. “The Governator” says he’s glad the illegals are here, and the four or five billion spent on them (perhaps a low estimate) is “a small part of the problem.” Well, four or five billion here, four or five billion there, it starts to add up! Obviously he still doesn’t get it. We are treated to the spectacle of a “public servant” charged with corruption but eligible for $600K a year in retirement. Thousands of “public safety” workers make $150-200K per year. Spending is out of control. Don’t talk to me about Prop 13 until spending is under control. If we had increased spending by inflation plus the increase in legal population over the last decade, we’d be doing OK now.

I’d like to ask an honest question…no judgement here…I really would like to know. I hear lots of talk about the costs that illegal aliens place on the state. If that is true then why don’t we see solid and aggressive actions to at least BEGIN the process of moving them out? Yes, I know the costs of moving them out will be huge and that politics plays a role in preserving the status quo. But if things are really so horrible and are obviously going to get much worse then how could California (or the entire country) not begin this process? It seems suicidal and just plain impossible to continue to pay millions of dollars in health care, schooling, housing, etc. for everyone who came and stayed illegally when we may no longer be able to provide some basic assistance to Americans in need. Or are they not the burden that some make them out to be?

I’m new to this blog, but find the comments provocative and accurate.

I have some comments to make about (1) the issue of where did the money go and (2) cost of illegal aliens

The issue of where the money went is actually pretty easy to know. Consider that the dollar has been devalued and the inflation numbers are artificial (the actual inflation rate is higher).

The question isn’t really where did the $$$ go, but to whom. One factor is that the taxes paid to State of California are only paid by 20% of the population.

Here’s my math:

About 40,000,000 people live in California.

Of the 40M people, about 15M are below the age of 18, therefore, ineligible for work.

That leaves about 25M people, split between men and women. If you have 20% unemployment (which I think is the real rate), you have about 5M people not working and another 20 M eligible to work or homemakers.

Consider that 50/50 gender split and the fact that many women are not routinely working anyway. Take 25M and call it 15,000,000 people in prime working years with 8M guys and 8M women, the rest are retired (10million over age 65?)

Notice, out of 45 million people, the about 10 M working people have 35 Million other people dragging down their productivity. No wonder the taxes are killing us.

Not only is the working guy paying for himself, he’s also paying for his family and FOUR OTHERS!!!!

So, do you really have any questions about where this money went?

OK… here’s more to swallow.

I have been reviewing the income to the hospitals in this state. The hospitals and healthcare insurers run these idiot ads saying “thrive”. Well, I got news for California… these hospitals and insurers are sucking the financial life out of this state.

Each hospital I’ve looked at is getting somewhere between $100,000,000 to $300,000,000 per facility from State PER YEAR!

In total, between the four facilities I’ve reviewed in Orange County, these facilities drain close to ONE BILLION a YEAR from the state. This is JUST for four hospitals in OC. Still wonder where the money went? I found one hospital with an off-shore insurance account in Bermuda (I guess that stopped a few years ago, but still in their tax returns).

Now, on the topic of where did the tax dollars go… If OC accounts for ONE BILLION PER YEAR in state hospital costs, care to guess what Alameda, San Mateo, Los Angeles, Riverside, San Bernardino, and San Diego cost???

Coming from the great state of Florida, a little example of what things are like on the east coast and why we are screwed. Tried to buy a townhome last week. Great job with long term solid income, 790 FICO, and looking to buy a home that was about 2.8 times my income. Offered to put 10% cash down and was declined. Good luck everyone.

why don’t we see solid and aggressive actions to at least BEGIN the process of moving them out?

Easy. The Globalist Banksters and their lackeys, the Dumbocans and Republicrats, worked for years to bring in those tens of millions of illegal aliens to help destroy the middle-class. They aren’t going to let you or me get rid of them. The Banksters want to turn this country into a third would banana republic like Mexico were a tiny elite own and run everything and a huge ineducable underclass works for peanuts and is kept docile by crude television, cheap drugs, and militarized, corrupt police. The American middle-class won’t be ruled over by tyrants so they imported an entire population will accept it and will also help destory the economic and social ability to resist tyranny.

You know what’s funny?

I read an editorial yesterday arguing with a straight face for increased taxation to pay for more government services.

The government is giving our money away to campaign donors, literally, just writing checks, now up into the trillions! And on Bloomberg this morning, there was an article about felony tax evaders vis-a-vis the UBS scandal, and a quote from some judge about how it’s our civic responsibility to pay our taxes. Say what? Why? How was anyone convinced that it was a moral responsibility to pay money to someone who puts a gun to your head (i.e., pay us or we’ll throw you in prison and kill you if you try to escape), so that they can they take it and do whatever they want with it, mostly paying off the people who keep them in power (e.g., writing hundred billion dollar checks to banks and others who fund campaigns)?

If there was ever a basis for a moral/civic duty argument to paying taxes, those days are long, long gone.

A good explanation for the continued state fiscal spending during 2007 is that the state budget lags behind current economic conditions. The state budget is “voted” on a year or so before the fiscal period begins. Therefore, the 2007 spending is dependent on budget forecasts which did not account for the housing sector tsunami.

However, the collapse of the housing sector should have been foreseen. Unfortunately, the greed and narrow mindedness of the state legislators led California into this mess.

The biggest problem the we have with the California budget is the lack of discretionary spending. Most of the budget is taken up with bond repayment and spending mandated by the all of the propositions we have passed over the years.

Ronin, how does the little guy turn this around? Were the tea parties a start? Who or what organization is big enough to make what must be done more than a conversation?

Strongsidejedi, were the recent elections a start in reigning in the enormous costs?

Sorry to be little more than a bunch of questions. I feel I get no real information from any news outlet anymore. Please bear with me.

If California is out of money then how do they continue their old ways? The taxpayers are tapped out…so how could it NOT stop? Is there a solution in repealing Prop 13?

How in their right mind could any party or group of people want to turn this country into a banana republic? The men and women in our military would never consent to serving if those were the goals. I do not mean to argue with you or anyone here. More than anything I want to know how we begin to turn this all around.

Comment by J

I’ve been trying to figure out what the “extra money†was spent on during the bubble years that we didn’t have back in the 90’s, before expenditures went through the roof. What did all those extra dollars go for?

>>

____

Actually J, the answer is quite simple. I read a breakdown on the increases in spending by the state gov’t the other day. The increases of the pst 15 -20 years came from 2 things and matched the increases of those 2 things exactly:

>

(1) Inflation in the cost of providing goods and services. What cost $100 in 1990, now takes $163 in 2009. That is a HUGE jump in costs – an increase of 63% in 19 years.

>>

(2) Increase in the population. The more people there are in the state, the more it takes to provide the same level of services. If you have 100 customers,you need X people to provide services to them. When you have 200 customers, you need 2X people to provide the same level of services. And that is the consequences of unrestricted growth.

>>>

The breakdown of the numbers in the study showed that increased government spending in CA over those 15-20 years matched the rates of inflation and population growth exactly. So the only way you are going back to the same amount of dollars being spent in 1990 is to kick a whole lot of people out of the state to reduce demand for services since you can’t undo the national rate of inflation.

__

BTW, another study comparing the total taxes and fees of all states also puts a lie to the endless whining that Californians “pay the most state taxes in the US” and/or “pay more in state taxes and fees than other states.”

>>

That is flat untrue. On a per capita basis, Calfornian ranks around 18th or 20th in terms of the state taxes and fees paid by its residents – both personal and business.

>>>

It isn’t the state tax levels that make it an unappealing state for business. It has been considered a lousy place to put a business for over 30 years. It is undesireable to businesses, not because of the taxes, but because of (1) the housing costs, (2) the congestion (3) the air pollution (4) self-righteous intolerance from the right and left, and all the other quality of life actors that make businesses’ employees refuse to move there. (And that is more than a happy guess. In 30 years of doing corporate and labor law, that is exactly what our very large business clients told us about why they wouldn’t have anything to do with CA.)

>>

Problem is that Calfornians want to have services and facilities that need a whole lot more money than they are really and truly willing to pay. This is the real world – not the movies – and there is no ending where someone finds the buried treasure. It is time to figure out stable revenue sources, increase the amount paid in and pay up —- or slide to a level that makes the backwoods of Alabama and Mississippi look urbane, civilized, sophisticated and compassionate.

>>

Proposition 13 always sturck those n the field of public administration and planning as nuts. If you want to protect seniors from loosing their homes because they can’t pay ever esclating property taxes, then you simple give them a very statutory tax credit. That is what other large states do and it works perfectly.

I forgot to add that Doc raises the issue of whether the rest of the US aka federal government should ‘bailout’ CA.

>>

To the rest of the US, that is just throwing good money after bad since Californians made it very clear in the special vote that they refuse to help themselves.

>>

And any state where the voters put on the ballot and pass a provision that sets a mandatory level of spending for extra-curricular school activities aka football, cheerleading, photography club etc – and doing it without figuring out where the money would come from – is not well thought of by the rest of the US. That kind of nonsense clearly lacks any smidgen of common sense, thought or planning.

>>

It smacks of ‘we want this, we want that, we want simply everything but we are not going to pay for it!” Kind of like the voters throwing themselves to the ground and having a screamng temper tantrum until they get what they want without deealing with the costs or consequences. And the list of that stuff continues with things like the ‘term limts’ idiocy which only lands you with inexperienced short-term employees (legislators) who don’t have a clue what they are doing and take years to figure out how legislation and government works but by then they are out of office. Running a government is not DIY proposition that can be learned by cramming over the weekend before taking office. CA got what it wanted – Prop 13, mandatory but unfunded spending, the highest per capita prison rate in the US, inexperienced officials……and now it has to deal with the mess created by the voters with their faddish ‘initiatives.” Mob rule has ugly and irrational results

I read an interesting article that said there is a growing population of permanent residents in KOA campgrounds. Some now have bus stops in front of them. I don’t have any firsthand knowledge of this but it is starting to sound like the modern version of Grapes of Wrath.

Be brave Comrades!

The comment above from “Lawn Care Tips” is absolutely dead on.

Over the years Californians, through the proposition process, have made THEMSELVES almost wholly responsible for the budget by progressively taking away the legislature’s control over it. But, as the recent vote showed, now that they’ve voted themselves the responsibility they also are unwilling to make the tough decisions it would take to balance the budget.

If you want to know where the largest portion of California budget goes just look at the largest expense. It is Payroll for all the State, municipal and city workers. The Sacred cow of pension costs and platinum health care for government workers is never even discussed as the easiest way to reduct expenses. All other expenses are trivial

>If there was ever a basis for a moral/civic duty argument to paying taxes, those days are long, long gone.

That’s true! It seems the moral duty to pay taxes orginated with some crazy guy who called himself “Jesus”.

Thank goodness none of his wacky followers seem to listen to a word he says anymore!

AnnS. I don’t know where you get your information from about inflation, population grow and tax ranking (if you getting this information from the LA Times than you are corrected). If base on Inflation (4% a year) and population (3%) grow since 2005 California budget will be good shape right now. Since Arnold took office our budget has grown from 75 Billion a year to 130 Billion dollar a year. I don’t think population grow or inflation grow that fast. Moreover, since 2006 we actually have less people enter California (California now has more native Californian).

Tax ranking we can rank from 2 to 8 to 19 depend how are you calculating the tax. Here is some of the break down. California has the highest personal income tax because personal income tax of 9.3 percent on all income over $38,000. Only two states have income tax higher that California are: Montana and Vermont. However; in Montana, which charges 11 percent but makes up for it by having no sales tax at all, and Vermont where a 9.5 percent rate doesn’t kick in until someone earns $308,000. That means every Californian with taxable income between $38,000 and $308,000 is paying the nation’s highest state income tax.

Sale Tax California are the highest Sale tax as well as a tax rate 7.25 percent (riddled with special interest exemptions, California manages the remarkable stunt of collecting a fairly low amount of sales tax revenue despite the nation’s highest state-level sales tax rate in the country), plus local options additional (i.e.: LA county will pay 9.75% sale tax in July). With higher sale tax are causing special pain to businesses. A few states have sales tax rates almost that high, like Tennessee’s 7 percent and Washington’s 6.5 percent, but those states have no income tax on wages and salaries. That’s a godsend to small businesses, most of whom who file their business tax returns not as corporations but on the individual side of the code as sole proprietors, partners or so-called S Corporations.

The main reason people claim that California’s tax burden is lower than other states is the justly famous Proposition 13, which has limited local property tax collections effectively enough to bring California down to 31st in property tax collections per capita. So I don’t know how people get California to be rank 19.

Regarding prop 13 the commercial property is the problem given the low turnover and various legal loopholes used to keep rates artificially low. The real issue is the state government along with cities and towns have had a pedal to metal attitude regarding growth. This has created a climate of corruption by government officials passing out large development projects such as state and university educational facilities based on growing rural cities rather then actual higher education needs.

The list of political corruption is long and endless but now the political establishment needs to face the financial reality which has always existed and curtail the political involvement with these special interest forces including local police and fire and create a state government that reflects the financial reality the state faces.

For those who want to revoke Prop 13 (which would require a popular vote):

Say you buy a starter home tomorrow at our current prices.

Good for you. The lower price houses are probably priced properly. Like the good Doctor you should wait for the mid and high level homes to fall…

Anyway, you like your house, you like your schools, you pay some of the highest income and sales tax in the nation. All is good.

Then a few years from now when property values are going back up Prop 13 is recinded. The price of your house doubles every ten years (note the resonable growth).

Can you pay the nations hightest income taxes (Texas has high property tax and no income tax), the nations highest sales taxes, and now pay the highest property taxes? Me think that a bit unfair. And, I must – absolutely must – question how our State gubmint grew spending by 36% in four years…

“…Snake eating its own tail” Excellent Metaphor, Doc; on numerous levels:)

@Doug – Time to think again Doug. Doc makes an exhaustive case for the two headed serpent of bubble-projections and crash-reality. The spending grew out of control because of the huge revenue stream. The bubbles and the desire of hyper-bulls and phsycho-liberals to throw projected revenue into long-term programs is the main culprit here. Reagan may have been right about big government being the problem, but he was too ignorant to realize military IS government. To this day everyone hates Carter for trying to be fiscally prudent in the face of runaway inflation and energy blackmail (they took Americans hostage, for God’s sake) and Reagan deemed an economic genius for figuring out you can simulate a recovery by vast military expenditures and negotiating with the people holding the hostages (don’t believe it, yeah, they really did it-google it). California Dreaming–sorry, but even Holy Cal has to obey the laws of physics, especially this one: The bigger they are, the harder they fall. BTW, I was actually born there, but don’t live there now.

Where does the money go? I live in an official “sanctuary city”: Los Angeles. Our mayor forbids the LAPD from asking about immigration status. The amounts spent on illegals here in California is staggering. If a penniless family with four children crosses our open borders and moves to LA (like five million other illegals have done), we immediately spend almost ten thousand dollars per child on educating these kids. A wonderful thing, certainly. But where is this money coming from? Do we have the money to be so incredibly generous with all the world’s poor? With kindhearted leaders like ours, why would any poverty-stricken family stay in Guatemala or El Salvador? No wonder we teeter on the edge of bancruptcy!

I have a great solution for our prisoners: outsorse them to China or Mexico and. They all will cost us 100.000, not one prisoner.

AnnS reports reading an article (it came from the LA Times) showing that the growth in spending exactly matched inflation plus population growth. Unfortunately the article used some bogus inflation factor no one has ever heard of, not the CPI that we all live with, and the population growth figures were simply wrong. Didn’t match census figures. The clown that wrote the article regularly publishes articles with faulty math and even more faulty logic. It seems like he decides what he wants to say and then invents the most absurd and dishonest statistics to “prove” it. His population growth figures are indisputably wrong. I canceled my LA Times subscription in protest of his dishonest editorial. Check it out. Maybe you’ll want to cancel too.

And since many of the posters to this blog and over 50% of the population of Los Angeles RENT (because even a 6 figure salary buys you a shack in the hood), there are a lot of people who aren’t feeling much benefit from Prop 13. But they are feeling the high income and sales taxes. So tell those people again how low taxes are in CA …..

The election, ah yea it made me sad that every single proposition went down but one of the major propositions consisted of borrowing from the lottery to finance the state. I mean when that kind of insanity is what is on the ballot, I’m on some level not even surprised that the whole election crashed and burned. Financing a state by borrowing from the lottery!!!!

I don’t think giving to charity can be equated to forcible taxation “Fraud Detector,” and I also don’t think Jesus can be credited with the ideas of either charity or taxes, both of which long predated him, although from the looks of your web site and your response here, it appears you think Obama SHOULD be taking from the rest of us to give to his campaign financiers at the banks and REIC.

Stan – the author to which you refer is not simply a clown; he’s a clown-tard, and a sociopathic one at that. Note that sociopathic clown-tards frequently distort all facts that contradict their preconceived opinions, in an attempt to lead others toward predetermined faulty conclusions. The sociopathic clown-tard believes that other individuals’ acceptance of sociopathic clown-tard “reasoning” validates the clown-tard’s presumption of such individuals’ inferiority, hence demonstrating and reinforcing the sociopathic clown-tard’s notions of superiority.

JS – hmm, financing a state by borrowing from the lottery..you might have just given the sociopathic clown-tards running the US government the seeds of their next big revenue generation idea: perhaps federally mandated US govt. “borrowings” from state lottery funds; a federal “temporary” tax on state lottery funds (a VST, or “Value Subtracted Tax”); and/or an official federal lottery itself (eventually to be followed by a “North American Lottery,” of course).

Associated political promises would abound, stating that any such lottery-related federal revenue would be used for a “good purpose,” for instance, funding universal health care “for the children.” In actuality, such revenue would be for a “noble purpose,” i.e., lining the pockets of Amerika’s nobility. None of the sheeple would pay much attention if a trillion or two in federal lottery-related funds periodically “went missing,” as long as the sheeple had their infinitesimally small chance at winning a slice of a lottery pie.

Didn’t match census figures. The clown that wrote the article regularly publishes articles with faulty math and even more faulty logic. It seems like he decides what he wants to say and then invents the most absurd and dishonest statistics to “prove†it. His population growth figures are indisputably wrong. I canceled my LA Times subscription in protest of his dishonest editorial. Check it out. Maybe you’ll want to cancel too.

Hi Jay, to answer your question, we were legally required to balance our budget until the early 90’s when a series of initiatives were passed that were backed by the state unions were voted in. When these initiatives passed, all requirements regarding balancing the budget were thrown out the window. This led to ever increasing personnel costs (state personnel now receive benefits that most people would sell their first born child to receive). Although payroll costs are not the only reason for this state’s financial straights, personnel costs are the state’s biggest expenditure.

I don’t think that raising taxes will help our situation, since we are already one of the highest taxed citizens of the country (California residents). Also take into considerateion that we in California recently received one of the largest tax increases in the history of the country and the budget is still out of whack. The recently failed ammendments were designed to continue these tax increases for an extra two years and to borrow more money to help postpone inevitable disaster. They were not actually adding any money to the coffers NOW.

Vin H,

Montana does not have the highest income tax rate in the US, they cap out at 6.9% at 15K in salary. They are mid-way between AZ and CA in state income tax. See http://www.bankrate.com/brm/itax/edit/state/profiles/state_tax_Mont.asp

Bankers do it again-speculating on oil futures (GS declares $85 target). Oil up to $70 / bbl despite low demand. Haven’t the bankers stolen enough? How can they be stopped? Triage, hedge funds, CDS, plant your man at the Treasury. We just can’t carry all the non-producers on our backs. We are at the breaking point, or probably past it. I hate to think we were on the wrong side in WWII but the way these bankers act, it may be true.

Price_out, you are right my bad on Montana. I got the wrong information but the two states that are higher state tax than California are Vermont (9.5) and Rhode Island (9.9) but only for those who make 357,000 and up. Don’t forget California had a Millionaire tax as well (those who make more than 1M will pay an extra 1%).

Look, it’s the 2/3s required for any kind of revenue to the state. This is the most ridiculous setup ever. No other state requires a 2/3s vote for this. That’s the basic source of the problem. It’s not the Democrats who “somehow” neglected to also raise the revenue, it’s the minority Republicans who have blindly blocked any sort of attempt at increasing revenue.

We’re also the only state that doesn’t tax, for example, the oil companies that extract oil from our state. Is this crazy or what?

For a better understanding of some of the politics and factors underlying this, may I suggest perusing through calitics.com? No affliations, I just read both these blogs.

Also, we are NOT one of the highest taxed residents! Where does this crap come from?

Source: http://www.taxfoundation.org/taxdata/show/228.html

Addressing the illegal immigrant problem. It costs much more than 5 Billion a year. The problem is our government doesn’t use accurate accounting practices when reporting this figure. They use “checks issued”, which is minimal to the actual cost. There are many more valid estimates that range from 10.5 billion a year to 15 billion a year, and still many of these estimates admit that they don’t consider other issues, such as the increased costs of our school systems (multi-billions) to educate the children of illegals, the free breakfasts and lunches given by schools to the poverty-level (which the highest numbers lie with the illegals, and lesser with their following generations), the increased costs incurred by individual taxpayers for auto insurance, due to carrying the load for all the non-insured illegals, the increased costs of medical premiums incurred on covered individuals, as a result of carrying the uninsured illegals, the bankrupt hospitals (for being required to provide emergency treatment to anyone), and the soon to come costs to the state, which will be further resolved by increased taxes, for saving our hospitals. There is a domino effect in all aspects, and the costs go much further than the ones briefly mentioned here. But, you get the idea.

Also, there are issues of valid inequalities in Social Services that add to the fuel of anti-illegal sentiment. Picture the cartoon of the Mexican couple, wife nine months pregnant, hurrying over the border, while the woman fights off labor pains, to get to a CA hospital, so that she can give birth in a state of the art facility, without having to pay a cent, while the hospital is stuck absorbing the bill, which inevitably comes out of the taxpayers pocket. Among the obvious incentive, there is a greater one. Because “anchor” babies, as they are termed, are given eighteen years of Welfare, while legal citizens are not. Legal poverty-level citizens are given minimal Welfare in comparison. CA’s response to the growing problem was to (ten years ago) supply the growing number of anchor babies with free medical (actually paid by the taxpayers, who resent the fact they are just providing more incentives for the illegals to come, and they do come to CA, at an estimated rate of 4000 per day).

Added to this is a cultural view that differs substantially from Americans in terms of poverty. Many illegals are quite happy living at what Americans term “poverty” levels, as these levels, in the US, are much higher than what is offered them in their countries. They consider their living conditions here (free advanced medical, food, Welfare, advanced education, subsidized housing, etc.) great. And they are right. Even those who live in what some Americans consider lowly apartments, in bad areas, are living much better than they did in their own countries. Many are quite happy to earn pay under the table, without paying taxes, and collect on all of our freebies. Only they aren’t really free. The taxpayers support them. And a main concern is that many of the second generation anchor babies continue their parents practice of taking all they can from CA freely. The fact that one-half of CA’s kids drop out of school, and the majority of them are the illegal South Americans, fuels the argument that they’ve no need to adapt to the American culture of rising above via education, and becoming productive. Many fear that the American culture of succeeding is dissipating, and being replaced with a third world country culture, who is furthering our decline, by draining our pockets, and soon nothing will be left, but the new culture, that won’t be able to pay for any services (third world poverty).

Also, less than one half of Californians pay State taxes, and this figure continues to decline (a huge red flag). The fact that one half of our population cannot afford to pay taxes, either due to poverty, working under the table, or other reasons, is alarming, and is a huge indicator that we have an unbalanced Welfare state. Viewed from a national perspective, the fact is that only 12% of us Californians are paying for 32% of all Welfare in the country. This is clearly unaffordable, and if continued, will financially ruin the State and remaining taxpayers. As a result of the deteriorating situation, continued increase in taxes, without actions to correct the problems, and only actions to promote further Welfare, there has been a dramatic increase of Taxpaying Californians, and businesses leaving the state, which only further worsens the situation, and speeds the decline.

Lastly, the societal effects of poverty are one of the main causes of the fleeing of California taxpayers. There are many factors, crime, gangs, etc. But, in a quantitative form, the number of taxpayers enrolling their children in Private and Charter schools is “off the charts” compared to all of California’s history. This added, back-breaking expense on the taxpayers, sufficiently adds to their decisions to leave.

Leave a Reply to rjr