California Budget and Housing Financial Escapades: $26.3 Billion Budget Deficit with State Issuing Monopoly Money. Housing Still Collapsing. Comprehensive look at Mortgages.

The state has officially run out of money. The state government unable to govern themselves out of a paper bag missed the fiscal year deadline (again) and here we are starting the second half in a massive deficit. The crony bailout continues with absurd ideas but the second half recovery pundits are out in full force. Since this is the bottom, the Governator with no re-election and nothing to lose decided to give 200,000 state employees another day off formalizing a 14 percent wage cut. As I discussed in a previous article we are in the midst of deflation created by demand destruction. California has relied on two gigantic bubbles with technology and now real estate over the span of two decades to spend beyond its means. Now, with no other bubble in the foreseeable future time has run out.

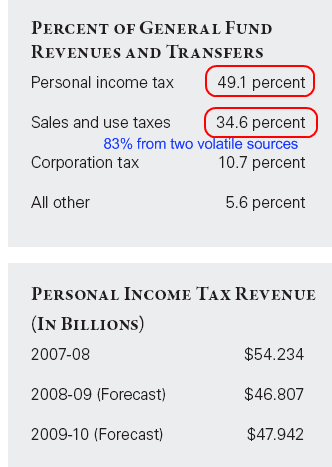

Why has the state run out of money? First, a large portion of money is pulled from personal income taxes and another large portion comes from sales and use tax:

Over 83 percent of the states revenue comes from two extremely volatile sources. This week I happened to get the wonderful news that Los Angeles County now has a 9.75 percent sales tax! So not only do you get taxed on your income, now you will get taxed when you go buy goods. And look at what kind of great government we have in Sacramento for this high tax rate. The best that IOU money can buy!

Here is a problem with the current system. No one has the ability to tell people in the state that we are flat broke! I’ve noticed the pundits are out in full force again with horrible ideas about buying toxic mortgages and bottom callers are out in mass again preaching to their housing gods.

Dumb and Dumber – I.O.U.

In another smart move worthy of a Noble Prize, the state has decided to offer IOUs:

“SACRAMENTO – In a move certain to draw national ridicule and exact financial hardship on business owners and taxpayers across the state, California is slated today to begin paying billions of dollars in bills with IOUs instead of cash.

Nearly 30,000 IOUs totaling more than $53 million are expected to be sent out by state Controller John Chiang this afternoon, the day after Gov. Arnold Schwarzenegger declared a fiscal emergency in the face of a staggering $24.3 billion deficit. The state Legislature remained in its familiar state of gridlock, raising the prospect of an extended standoff that further damages the state’s financial reputation.”

If you have noticed unlike the early 1990s not many banks have come out and stated publicly that they’ll honor these IOUs. It is likely that many will honor the IOUs but the banks are flat out broke too! We are going to give people monopoly money so they can go and deposit their funds into a bank that is broke so it can then lend it out to people with no money! This is the solution to the $26.3 billion shortfall.

But wasn’t it $24.3 billion on Tuesday night? Yes it was. So buy the end of the month people in jail will be getting legit get out of jail cards.

“CHICAGO, June 29 (Reuters) – Michigan has to close prisons to save money. California’s are bursting at the seams.

Both states are struggling with huge budget gaps.

Now, Michigan Governor Jennifer Granholm has offered California some of the state’s prisons that are slated to close at a yet-to-be-determined cost.”

Well I guess we’ve found one export we can depend on. The budget is in shambles because each year, we go through this song and dance and eventually, a budget does pass but it is basically a patchwork of delaying reality for another day. That day has come. Asking the Federal government to bail us out would be a nice form of beggar thy neighbor. Even though Bernard Madoff is getting 150 years in prison, there are far more corrupt things going on right now.

Two of those things involve California and National Housing.

OCC and OTS Show Country insane like State

Earlier this week the OCC and OTS released their first quarter results on the health of the mortgage market. As you may have guessed, lenders across the country are as blind as those in California. Some have thrown out the idea that the government should simply buy up all the toxic debt. When they say the government, they mean you and every other taxpayer. The public-private investment program, which ironically is anything but an investment and does not resemble a partnership, is one of these crony banking ideas. Yet that doesn’t resolve the fact that if you are unemployed or have a mega-mortgage then any housing payment is a burden that isn’t within your budget! These programs are to aid Wall Street and all lenders that are still living in their delusional crony world of housing bubble economics.

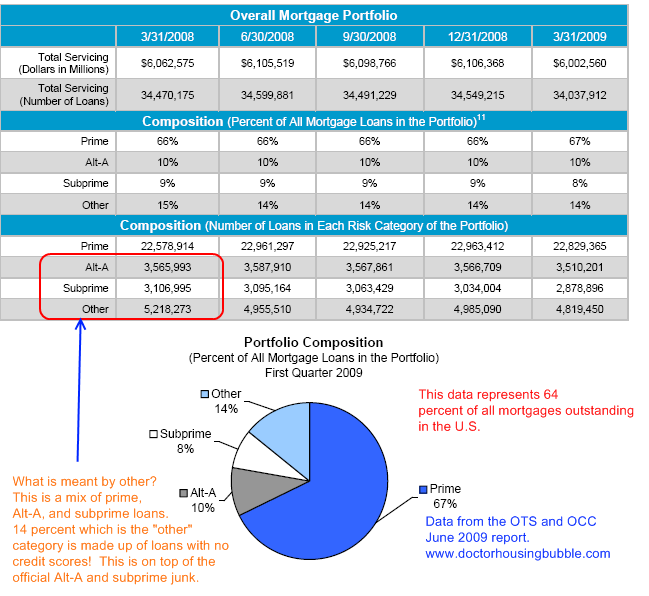

Yet some of the public are taking notice. During the Great Depression the word banker took on a negative connotation and I don’t see how it is avoided during our Great Recession. But let us look at those OCC and OTS stats:

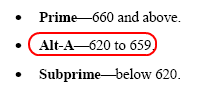

This is important information so let us spend some time here. This data covers approximately 64 percent of all first lien mortgages. In the data covered by the report, we have a sample of 34 million mortgages. Of these 34 million mortgages, we can say that 11.8 million loans (the Alt-A, subprime, and other) are questionable. Essentially 34 percent of the entire portfolio is made up of junk! Here is the breakdown of the loan categories:

This is junk! In fact, that “other” category is a mix of Alt-A, subprime, and prime but these are loans made with no credit scores or low documentation! Who in the world knows what this crap is. We have a better chance of guessing what is floating in the Los Angeles River. And those in the housing industry are eagerly waiting to unload this crap to the public. Let us just assume that the entire portfolio has mortgages with the same balance. 34 percent of $6 trillion is $2.04 trillion! As you all know 634,000 of those Alt-A loans are here in California with an average balance of $420,000+. According to data from the OCC and OTS, there are still 3.5 million Alt-A loans floating out there. But fear not, loan modifications are way up. Let us look at that data:

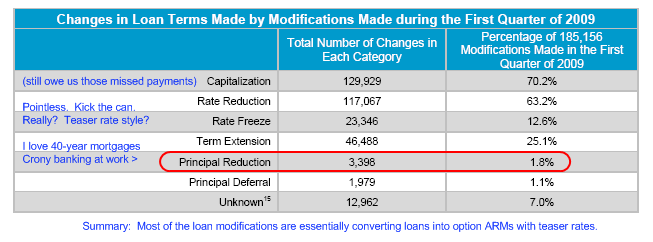

The crap California is doing is nationwide. That is, with loan modifications and workouts the main strategy is to convert loans into option ARM, low teaser rate, 40-year mortgages. Take a look at those principal reductions! Bwahahaha! Now you know why they ripped out all that cram-down legislation. With bankruptcies skyrocketing many of these loan modifications and workouts are basically converting people to renters and locking in the bubble price of the home.

Think of a situation in our current market. You buy a home at the peak for $500,000 and the home is now worth $300,000. Their idea of a workout is turning your loan into a 40-year mortgage with a teaser rate. But what happens when you want to sell? You can’t! Homeowners are now being swindled once again by the same banks that issued this toxic waste under the guise of “helping” you. Sort of like how Bernard Madoff helped all his investors; things look good until you read the fine print or dig deeper. The Alt-A and option ARM wave is going to hit California like a tsunami especially in the more so-called prime areas. Some of these people think they are insulated from the rest of the state economy in silos. They are going to find out the hard way in the next few months.

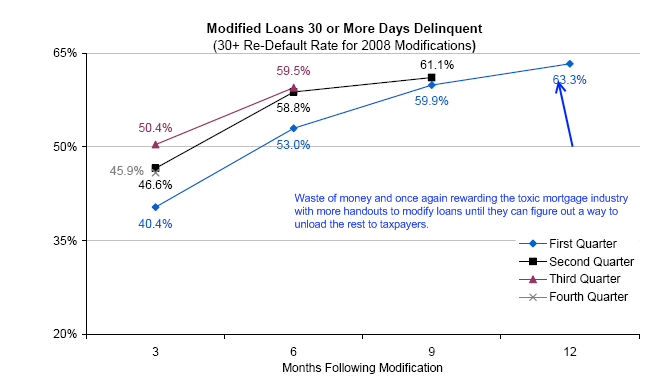

What the OCC and OTS data tells us is this problem goes beyond California. You can look at Florida, Nevada, and Arizona and these states are loaded as well with these toxic mortgages. Yet you will find the toxic waste in every state. And to show you how much a waste of time this is look at the re-default rates:

If we extend this out to another year and break the data out by Alt-A, subprime, and prime I bet you would see in some categories a 90 percent plus re-default rate. The data is telling us this is a waste of time. It seems like people are hell bound to repeat the lessons from Japan.

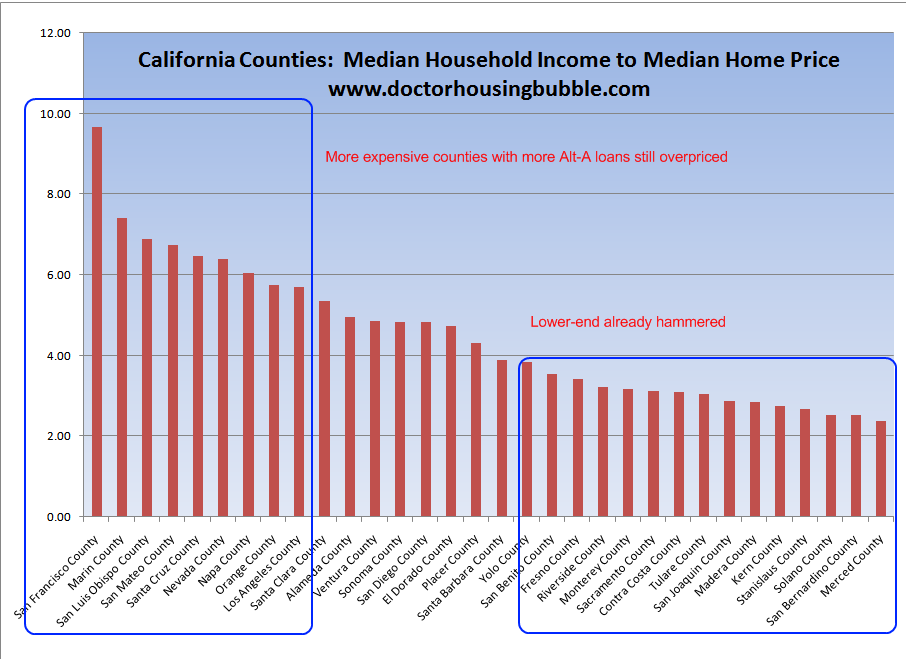

Some people have told me, “but California housing is now affordable. It is a good time to buy.” I have decided to compile a list of median household income and median home prices for all California counties to show you that we are still over priced in many regions:

The above chart sums up the California situation. What you have is the lower-end being pummeled and now having more modest price to income metrics. Yet those higher priced areas, those areas with the 643,000 Alt-A mortgages with a nice average sum of $420,000+ are going to take it on the chin next. These numbers are simply unsupportable. Bottom callers are drinking the Kool-Aid once again. Ironically, we may see the median price stabilize but this does not show the real story. The mid to upper range of the market will fall, creating more sales, and thus creating volume to shift the median price up. For example, say a place like Culver City has a $600,000 home that sits on the market for ages. The place has a nice Alt-A, the borrower walks away and the bank is forced to unload it. It goes for $400,000. The median price for L.A. County is $300,000 so this gives fuel to a higher median price but the place took a $200,000 hit. This will happen.

The state has an 11.5 percent unemployment rate (the highest in record keeping history), the state is slashing the wages of 200,000 employees, more layoffs are in the pipeline, the Alt-A and option ARM problem is not being addressed by delusional loan mods and workouts, and yet this is the bottom. What high paying industry is being created to give birth to the new era of suckers that will over pay for housing in those so-called prime areas? Maybe we can start buying homes with IOUs.

Orange County had a median price of $258,000 in 2000 and Los Angeles County had a median price of $192,000. Just think of that when you see the current median price for Orange County of $411,000 and $300,000 for Los Angeles. To describe the problem takes much analysis. Solution? Let these homes foreclose as quickly as possible and let banks fail. But too many people believe in the Angelo Mozilo school of, “homeownership is not a privilege but a right!”

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

37 Responses to “California Budget and Housing Financial Escapades: $26.3 Billion Budget Deficit with State Issuing Monopoly Money. Housing Still Collapsing. Comprehensive look at Mortgages.”

DHB, you have a free beer waiting for you if you ever find yourself in Santa Monica. This post is spot-on. The following quotes couldn’t have been written better:

>> say a place like Culver City has a $600,000 home that sits on the market for ages. The place has a nice Alt-A, the borrower walks away and the bank is forced to unload it. It goes for $400,000. The median price for L.A. County is $300,000 so this gives fuel to a higher median price but the place took a $200,000 hit.

>> Solution? Let these homes foreclose as quickly as possible and let banks fail. But too many people believe in the Angelo Mozilo school of, “homeownership is not a privilege but a right!â€

CA is getting hammered by people squatting, defaulting & not paying property taxes (not to mention the sales tax, rising unemployment, etc)

Anyway, CA — wanna know how to start collecting property tax again? Let that home that sold for $600K – the one that’s really worth $400K, the one that is 9-months delinquent with no property taxes being paid – let the damn thing foreclose, and let John & Marty Jane middle-fricking-class BUY THE DAMN HOME and give it some love & pay the damn taxes.

I swear, people in real estate & gubmint love to complicate a simple situation. There is a saying, “Water seeks its own level”. Same thing with housing prices, you can fight it, resist it, deny it, protest it, debate it, whine about it… but that damn $600K home is really a $400K home.

Deal with it, lick your wounds, you lost, move on and bear the pain of that injury for a while so that you don’t buy an irrationally overpriced home in a hype market (granite countertops?) again!!!

Great article, I wanted to ask when (in those higher prices counties) would be an indicator that the mid to high housing prices have dropped to a point where a first time buyer like myself should consider getting in?

CA issued IOU’s in the early 90’s. It seemed to work then. Assuming that the issuance of IOU’s doesn’t occur for months after month, why wouldn’t it work this time?

If CA gets too bad off, the Feds will come in and bail the place out. Obama loves bailouts. Bailing out CA would be brilliant politics. Not bailing out CA would be stupid politics. Obama does not do politically stupid things.

Let them all foreclose. Let’s unwind this mess as quickly as possible. 9.75% sales tax in LA County, on top of crazy high state income tax, no wonder people are leaving LA in droves. I see no reason why the housing prices in the county won’t drop to 1997-1999 levels… That’s when it’s time to swoop in and get that oceanfront!

I still think that killing some of the bad guys is the best solution. Mozillo should be the first one executed.

I am so sick of the politics in CA. I just come from point of view that there are a lot of government jobs we can do with out. I used to have a job where I had to deal with the State dept of alcohol and drugs. It took them so long to accomplish anything, and most of the people seemed to have a “pass the buck” attitude. And I remember one guy bragging about how they had this really expensive data base (they spent tens of thousands on this oracle database) but he had no idea how to use it. (Ironically I remember first hearing about Karen Bass during these years, because she got her political start in substance abuse.) There are some very useful state jobs, but there are also quite a few where state workers end up accomplishing about 1/4 of the work (or less) than the average competative business. And their paycheck is really just a glorified welfare check.

I would have some hope for the future of California if the state were capable of evaluating the usefulness of jobs every now and then, and could cut jobs that were no longer needed or were not functioning with the efficiency that they should. It really bothers me the state would rather raise my taxes to continue on so many pointless state jobs rather than cut off the things that are not working right.

We should pay every member of the legislature with an IOU, not a check.

They would solve the budget problem in one week.

Great post – I follow the housing market very closely but hadn’t seen the price/income graph by county ever before – it sums up the current situation very nicely – should be interesting to see as the high-end gets hit hard. If only there were a way to make money off the consensus (incorrect) view that the high-end will hold up. I am surrounded by people who cling to this view…

Kinda OT, but anyway–I’ve seen it various places, and I just don’t get the whole Cali-Michigan prisoner thing. If Cali is letting them go because they don’t have the money to jail them, then how is sending them to Michigan going to be possible? If Michigan is closing unused prisons already, then obviously keeping prisoners is not a profitable endeavor (at least at the government level). Who do they think would pay for keeping them in Michigan?…..

John – the simple answer would be that when the home you want is available for a price that will keep your total debt payments below about 40% of your gross income. Or, if you are living more or less debt-free, the mortgage+tax+insurance (home owner’s and PMI), should be below about 35% of your gross income. These are just general guidelines. It is a good idea to try to develop a reasonable estimate of the median income of the surrounding neighborhood, as well, to get an idea of where these guidelines would put the prices for the immediately local wages. A good equilibrium price will run 3-5 times the gross annual median wages.

Once again, a phenomenal post.

One comment on the last chart. I really don’t think this tells half the story. Sonoma County didn’t make upper third but it is because the median home price has been driven down by foreclosures on the low end of the market which makes the income/price ratio look better than it is. SF/Marin don’t have the tract homes we do to push the median down.

And according to BusinesWeek Sonoma County is second in the nation when it comes to Option-ARM issuance. We’re ground zero for the option-arm implosion, something the chart doesn’t reflect. The high end (and there are lots of $1 million plus homes in the county) hasn’t been hit… but it will and it will be hit hard.

There is no way this doesn’t crush the upper end of the market and continue to pummel the lower-end when the flood of NODs are upon us. The $1.5 million dollar homes will fall below $500,000 when all this is done (right now they are still sitting on the market at $1.4 million waitiing for a recovery) and the $500,000 tract homes that are now down to $250,000 will fall to $125,000.

Bank on it.

Dr. HB, the writing is on the wall for our great state. Perhaps we need a great calamity to wake up our politicians and the federal government. House prices need to fall by another 30% on the Westside to correct the last of bubblemania. Hopefully, your Culver City example will wake up some of the Westside that STILL is in denial. The longer they sleep, the worse the nightmare. By the end of summer, it should be apparent, the Westside in not immune.

http://www.westsideremeltdown.blogspot.com

2 years ago we had droves of people from CA coming to Az to buy anything and everything (housing) with their home equity loans! Now, everything collapsed hooray!! I held off buying because I couldn’t afford the mortgage by my own standards,not the banks! Now, I’m moving in with cash and buying a townhouse

for damn near nothing.Way to go californians! I’m laughin all the way to the bank!!

Based on the data here, The CAGR of the prices for OC and LA county homes from ’00 to ’09 is around about 5%. I’ve read here and elsewhere that 2000 is when the bubble began. Since the historical CAGR for home prices in Southern California is around 5% (my assumption), that would tell me we’d be close to the bottom if we were living in normal circumstances. However, the record and rising unemployment, coming alt-A tsunami in California and still-record low interest rates makes for abnormal conditions for RE, and we’ll probably whip to the downside past the 5% CAGR “norm” just as we whipped to the upside from ’00 to ’06 once unemployment peaks, exotic loans explode and interest rates get back to 6-8%. Watch for the Time, Newsweek or LA Times cover story about “The End of Real Estate,” then you’ll know it’s time to buy.

Dear JOHN (July 2nd, 7:10 AM):

How many times does Dr. Bubble have to state it?

The time to buy in any community is NOT BEFORE

numbers reach levels last seen back in 2000. Which is

also likely be be the price level that area’s homes sold

for in 1990.

You should be looking for a home that has not

appreciated a penny in 25 years. When you find

it… and you can afford it, it will be time to buy it.

Bill

??? so what if i buy a house now for $200,000. that was 450,000.in 05 . and now out of the next wave of homes that hit forclosure , a house that was 700,000. sells for 450,000. . will that push the value of the house i purchased for 200,000. down even lower ? especially if im able to purchase a larger home, sq feet , for the same price or lower per foot ?? anyone ????

im moving out of california ! im done with the crap !

I am envious of those leaving California. The climate is great, it is beautiful, but it has been made unlivable by our crooked political class, and government.

I love the “Dumb & Dumber — Empty Suitcase of Money” – can’t stop watching it – is so spot on! Keep up the great work!

I live in Ventura County (Oak Park/Westlake Village). We sold in 6/06 and have been renting for three years. Prices have gone done about 30%. Is it time to buy in our area or is there a ways to go?

Lived in California for over 30 years. Sold in 2005. Bought small farm in North west. Remember the 3 big “B”. Best advice ever. Get out of the Big cities, Get out of Big houses, and get out of Big debt.

That formerly 600,000 dollar house in Culver City going for four hundred thousand is still overpriced. Culver City might be close to Beverly Hills, but it’s a dumpy little spot. Homes there won’t be a deal until their more like 200,000 which they were in the 90s,

.

Prices have gone done about 30%. Is it time to buy in our area or is there a ways to go?

No, Yes.

.

Realities of the New Obama Refis

The snapshot of the ratio between mediun prices to income levels is interesting, but not particularly predictive about the future. I’d really like to see how that ratio looks historically. Also, I’d like to know did previous RE “busts” really hit all areas or were some spared the dramatic declines (eg, Santa Monica, Beverly Hills, South Bay beach areas).

Boom, Bust and Blame – The Inside Story of America’s Economic Crisis

I really like the idea of paying the pols in IOUs !! A great idea !!

We should do the same in the UK.Our Labour pols are even than worse than yours..they are completely corrupt liars and astoundinly incompetent.

Maybe if California was federalized, Prop 13 could be declared unconstitutional, or at least in violation of equal rights legislation.

Thanks for the Chart DHB. I have more ammo to use when arguing with overly optimistic housing bulls.

@dangermike: Your “3-5 times the gross annual median wages” rule is off. Anything over 3 times median income for median housing prices is too high. Historically, the rule has always been between either 2 – 3 or 2 1/2 – 3 times median household income in an area. In other words, as hard as it may be for many people to imagine, housing is still overpriced. You simply cannot afford to buy a house that’s priced over 3 times your household income. Just because you used to be able to lie your way into an pay-option ARM doesn’t mean your $50K/year job could produce a fully-amortized mortgage payment on that $750K McMansion.

A nation on overconfident-undereducated can be manipulated so easily. But the world is a macrocosm of US–who can I screw to get wealthy? We have become a race of cannibals that suck at math.

“Maybe if California was federalized, Prop 13 could be declared unconstitutional, or at least in violation of equal rights legislation.”

Prop. 13 is the least of CA’s problems. The tax structure isn’t perfect, but the spending structure is atrocious. The current spending levels in CA are so high that no tax structure could extract enough revenue to fund it.

We have been riveted to this blog ever since we began questioning our mortgage last July. We are in Santa Barbara and have seen the low end drop out while the upper end real estate holds value. Keep in mind that the entry level in Santa Barbara is quite high to start with.

We chose to stop making our payment in September and still haven’t recieved a NOD. We have heard many rumors surrounding how to negociate modifications during foreclosure, but would love to learn more. We are particularly curious if it is too late to modify after a NOD has been issued.

There is a guy named Alex Jones who is on Coast to Coast and is doing fear mongering, but some of the stuff appears to be at least partly true. He thinks the Federal Reserve, which is a private entity, is orchestrating the collapse in favor of a New World Order. (See prisonplanet.com)

One small thing he is right about, is that Citibank was giving out easy credit. I know they were, because I’m on Social Security Disability and did not own a home and yet they gave me five thousand dollars credit at Home Depot which was ludicrous. (I know this is not about housing specifically, but about the economy).

The State of California is harming their most vulnerable; elderly and disabled and blind on Social Security Supplemental income. It’s been cut twice this year, and rental housing assistance has not kept up at all for Californians in poverty. I am on Disability, and recently Social Security tried very hard to cut my $200 a month of SSI out, by being untruthful and very shady. I had to fight them with a lawyer. The employees act like they are going to save California by cutting out as many poor people as they possibly can.

Why are some areas still holding their own, such as nice areas of Long Beach? I grew up in an area there where houses have held at 1/2 mill. for many years.

First, California spending is not all that high – we’re the 17h highest taxed state. Given the high cost of goods, plus the large distances (requiring lots of road building and maintenance), state spending is not that bad. Could be better, but 17th highest is not that bad. We just have a stupid structure that undertaxes property, especially commercial property.

Big picture, policymakers are scrambling to treat the banking sector as the sick patient. As if the economy exists to serve banks, instead of the other way around. Ideally the best interests of the banking sector (and I include the “non-bank banks”, institutions like brokerages that essentially perform banking functions) would align with the interests of the wider economy (which is to say, the working populace).

But they don’t. Real estate liquidity is a prime example. The economy would benefit from maximum liquidity, minimum friction. Get the foreclosed homes sold, let prices reach levels where inventory moves, let pick-a-pays and alt-a loans fail if the borrower can’t afford them, clean out the detritus. If prices need to fall another 30,40,50% in some places, so be it.

But banks don’t want liquidity right now – those loans on their books would drop in value by several times their available capital – which means the banks themselves would go under. The foreclosed homes they already own and will own would be deflating assets. They want less liquidity, if not to let employment recover, then simply to stay in business, buying time since the alternative is to shutter the business.

So you get these “workouts”, ways to keep insolvent borrowers from defaulting, at a minimal hit on the bank’s books, and keep that house off the market. Locks people in to an investment that already has failed, and will continue to fail, locks up the house so it can’t be sold to someone who can afford it (at a better price) – its a classic misallocation of capital and assets.

Toss in Prop 13, which creates huge friction in the market – keeping people in houses they don’t want because of perverse tax incentives. You’re elderly, retired, your kids have long since moved out, but you keep a house that is three times the size you need, because selling and moving to a smaller place would send your property taxes skyrocketing. And property taxes on new buyers are ridiculously high because the bulk of owners are locked in to ridiculously low valuations.

So you get barriers to selling, depressing inventory, barriers to buying, depressing sales, keeping first time buyers locked out and existing owners locked in. Classic example of perverse tax incentives distorting a market in every bad way possible.

Which begets things like municipalities zoning for very little housing (lousy long term tax revenue) and far too much retail (easy sales tax money), further distorting the economy. Ugh, its a picture no economist could love, or even bear.

I’ve seen on several blogsites and even now realty reporter Diane Olick of CNBC has now commented the fact that banks are not only not putting out their REOs out to market on a timely basis, but they have not issued NODs on people who have been delinquent for over 6 mos to a year! Whether this is due to the pig in the python theory (too much volume for too few workers to process) or a concerted efforts by the crooked banks to put a “floor” on this market is up for debate, but this is the kind of games they can play now that the AICPA caved into the politicians on the mark -to-market issue. Now that banks don’t have to mark assets down to market levels, they don’t have incentive to move them off the books, thus kicking the can down the road by delaying price declines to their natural level and thus delaying ultimate economic recovery in housing.

Not only that but the govt. should not waste our tax dollars trying to keep people in overpriced homes. Their efforts should be focused on helping people in forclosure or bankrupcy get back on their feet, getting people who can afford to buy a fair market priced house to buy that house with reasonable financing, and to create jobs, which is what is ultimately going to get us back to growth. I mean I didn’t see Uncle Sam prop up Cisco stock when it plummeted from 80 to 50 on its way down to 11 a share or Pets.com or Webvan when they went to zero, why should we be doing it for another overpriced asset like housing?

Leave a Reply to John