Baby boomer home owners will hunker down in their California properties: What impact will a declining middle class have on younger home buyers?

I seem to hear a familiar story among baby boomers with college-age kids. “When I went to college, I was able to find a good job with mediocre grades and have a middle class lifestyle with one income.â€Â Their fears are that their kids will not have the same opportunity. The reality is that California in more desirable areas is no longer a place for middle class families. This may sound harsh but it is true. The boomers who in many cases won a lottery of timing in terms of affordable real estate prices, plentiful jobs, cheap education, healthy benefits, and a global economy that favored the US won out. Yet their kids face a harsh reality of global competition not only in jobs but also in terms of real estate. When I talk with these boomers many enjoying the juicy Prop 13 tax assessments, have no plans of leaving the state and cashing in on their big win. They complain and pound their fist in the sand that their kids are being “priced out†yet enjoy the major profits in their properties. California is a tough place for young families starting out. But for baby boomer home owners they are going to go down into the grave with their gold plated granite infused hardwood floor housing sarcophagus. To be buried like a pharaoh seems to be the modus operandi.

The crazy year for California home values

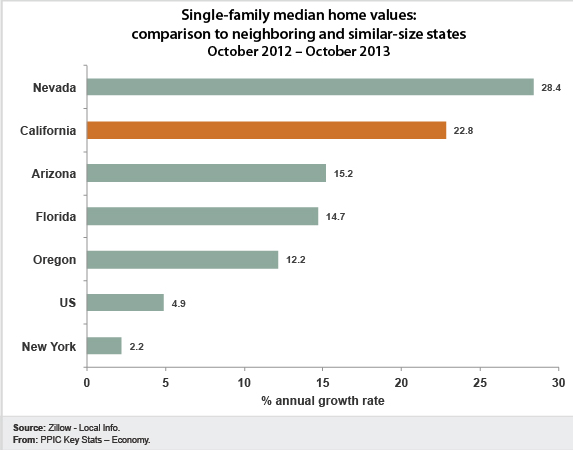

The Southwest had one of its best years on record when it comes to real estate:

According to Zillow, California home prices went up 22 percent. Other measures have the gains between 20 and 30 percent. Look at the top gaining states (the 4 horsemen of the sunny bubble apocalypse). I wrote an article a few years ago about the crazy Florida real estate bubble in the first half of the 20th century. Sunny states and real estate bubbles go together like gin and tonic.

The market is softening and we are seeing the market in California being held up by investors. Some boomers peer out of their 1970s windows to see a young professional couple moving in with the standard BMW and Mercedes and their newly minted 2013 tax assessment. These people are gentrifying the middle class out of many California markets. Many Californians have decided to embark on brutal commutes to keep the dream alive of being able to afford a McMansion.

For the most part, the idea that there was going to be a flood of properties as baby boomers “retire†was largely not based on psychology. First, many boomers are in no position to retire. However, many could cash in their California real estate lottery ticket and live their days out in financial security in many of the states in the US. Yet, they want to act like that young professional couple earning six-figures with multiple college degrees that just bought their home in the same neighborhood and complain that somehow, their kids can’t buy a home with a YMCA job like they did. That game is done. The Fed will see to it. The Fed has no interest in the US middle class but is looking out for the interests of the upper-crust. Ironically many boomers are seeing their kids move back home with newly minted diploma in hand and loads of debt.

The collapse in mortgage applications

Mortgage applications have collapsed in spite of a record year-over-year increase in prices:

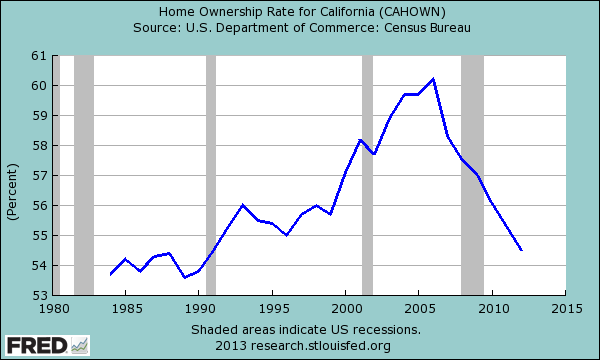

Who needs a mortgage when you can go in with cash or alternative sources of financing? This helps to explain why we have a burgeoning rentier class coming about and also is the reason for a drop in home ownership yet home prices going up.

The game is entirely rigged on lower mortgage rates. That is why even a tiny move from 3.5 to 4.5 percent in the mortgage markets stuck a fork in this current mania. The average holding period for a mortgage is something like 7.5 years highlighting that most Americans love the property ladder game. They try to make the home seem like a place for establishing roots but have turned it really into a commodity to be sold off to the highest bidder. When was the last time you went to a mortgage burning party especially in California?

Here are some stats on California:

54 percent own / 46 percent rentOf those who own, 74 percent carry a mortgage

30 percent moved into their current household after 2010

69 percent moved into their current household after 2000

California has become a state with a high number of renters and people move around a lot. The flood of investor buying explains the big drop in home ownership across the state:

Source:Â Census

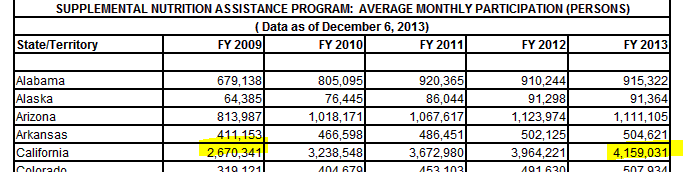

To highlight the case that more people have fallen off of the middle class bandwagon I also highlight the growth in food stamp usage. The recession officially ended in the summer of 2009, right? Well take a look at this:

Source:Â SNAP

Food stamp usage is up 55 percent since the recession ended (with over 4.1 million Californians on food stamps). Did these people magically appear from nowhere? Of course not. Many were probably on the edge of being middle class but have now been pushed into the lower rungs of income. The point being is this: non-middle class Californians are growing in large numbers while the top is getting even wealthier (yet this is a smaller group). This is why you have mortgage apps hitting lows while investors step in to purchase up 30 percent of all properties in California and nationwide even with low inventory overall. Boomers are not selling their Prop 13 locked lottery tickets. That is, the new rentier class doesn’t need cheap mortgages to stretch their weak household income growth.  Boomers are going to witness this in real time as they view their kids get left behind unless they have the skills and connections for the new competitive global landscape.

Many of these people can easily sell their homes and move their family and kids to another state and start off with two households with completely paid off homes. Imagine how great life would be if you could start off your working life with a paid off property? Instead, they will “live and die in LA†in their pre World War II shack and hem and haw about the challenges their kids face but will remain idle in their stucco sarcophagus. Many will also bemoan that it is so hard to get into Berkeley or UCLA and when they went a generation ago, they paid nearly nothing and got in with sub-par scores (today these are the schools with the highest number of applicants in the US and just look at what it takes to get in). This is a completely different ballgame.

I will end this article with some short-term trends:

Source:Â Quandl

After a big decline with inventory year-over-year, we did see the number of homes for sale go up in California for October and the number of homes for rent slightly went up. Given the small number of foreclosure re-sales if historical trends play out, we should see a pickup in inventory starting in early 2014 simply because of seasonal changes. All signs point to a Fed tapering (i.e., the recent jobs report) but the Fed IS the mortgage market so any tapering will pop this bubble instantly. You think the new Fed chief is going to take the punchbowl away on day one?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

119 Responses to “Baby boomer home owners will hunker down in their California properties: What impact will a declining middle class have on younger home buyers?”

Wage growth requires NEW small businesses — funded by Angel Investors — which are often blood relatives.

Such funding is impossible when the elderly investor cohort is denied proper money rent/ interest by ZIRP. They’re forced to pull in their horns.

So, quite simply thousands of new businesses are not started — all across America. The Fed is gifting that growth to foreign nationals — via devious means.

Read Hendry:

http://www.zerohedge.com/news/2013-12-06/hugh-hendry-throws-bearish-towel-his-full-must-read-letter

This failure to ignite new business formations is draining intangible wealth: human capital. Careers are not started on time, training is delayed, the working cohort ages: human capital within America is permitted to fade away.

This is the driving force behind the ramping misery of SNAP and Medicaid, even SSDI is amplified by zero growth and a ramping population.

H1-bs are crushing relative incomes of STEM professionals.

The absurd surge in law graduates is crushing that profession, too. They’re all ready to function as mandarin drones — but there are not enough hives to mind.

The narcotic effect of fiat spew is having its classic effect on the political class — and its rent seeking, parasitic, attendees.

The President appears, based upon his ideology, to be a force for a ‘dynastic end-game.’ For he is entirely comfortable with trimming America’s sails — far and wide.

When taken to its logical conclusion: then America would no longer export International Money — and would no longer dominate the global political scene.

Looking past politics and egos, such a world would require America to balance its books — and very quickly too. Back of the envelope calcs indicate that the Feds would have to trim 40-50% of current spending — overnight.

That’s EXACTLY what happened to Weimar Germany. And, it really did happen overnight. Pink slips were handed out by the million.

Russia did pretty much the same thing in 1998. Pensioners were cut off, de facto, as the Russian government simply did not budget new monies for them. Call it “Death Therapy” — See “What About Bob.”

His abandonment of the elderly is exampled by de-funding of LBJ’s pride and joy: Medicare. It now is to have the same (more or less) payouts as Medicaid!

When the physicians found out that 0-care was modelled entirely upon Medicaid… county by county… and that the payouts were going to mimic Medicaid… they blew a fuse. This is why about 7 out of 10 physicians are not contracted. They’re boycotting 0-care. So even having ‘insurance’ does not correlate with actually seeing a doctor. Indeed, the un-insured seem to have better odds of seeing a doctor! The government mandated payouts are so low that even time-payments from the uninsured seems a better bet — by far. (!)

===

We now have so much meddling in the economy that it must stumble.

During this travail I expect TPTB to try and paper over everything in sight — with fiat.

We may be entering Phase 3 of hyperinflation: when foreigners repatriate fiat monies at an astounding clip — to buy everything not bolted down — plus the real estate it sits on.

Faber calls such times: crack-up booms. Sounds right to me.

Keep your eyes peeled upon the twists and turns of 0-care. If the doctors boycott continues than 0-care must crash and burn — in 2014 — right in front of the off year elections.

Explains why Obama visits Hollywood so much. At least four times a year.

I call this the CGI Economic Recovery. Plenty of WOW if you’re sitting in the prime seats but if you peek behind the silver screen, there is nothing but air.

Strap in, kids. It’s going to be a bumpy ride.

I read ZH also. Obozocare will be disaster after disaster as time goes on and they attempt to put band aid after band aid on this not thought out social experiment. By the time the 2014 election comes around, folks will be praying for a Republican majority to defund Obozocare.

Blert, you’re back! I hear you on the pensions. I’m a Democrat, but I always tell my friends, “Yes, I love teachers, and I’m glad someone polices the streets; but that doesn’t entitle anyone to retire at 55 on anything more than they themselves have socked away.” And, you’re right, Obama has been too willing to right-size America’s ambitions. The 1% know they’ve milked the lower 99% for about all they can get. If we run up too much more debt, they might end up paying for it down the road. So, it’s time to trim the sails.

I’ll never forgive Obama for committing the worst of all political sins–throwing away a once-in-a-generation moment when he could have at least proposed fundamental reforms. If successful, he would have had what any American politician knows is the greatest of all honors: elementary schools named after him. Instead he settled for a Nobel prize. Oh, well.

Nice slam on teachers Chris D. Except the retirement age is 60 for older teachers and with reform in CA it’s now 62. It could be 55 if you have enough years in but there is a huge penalty that would leave one with such a paltry amount good luck retiring on that. Also..teachers here in CA put in 8% -more than the 7% other workers put in for Social security. Teachers basically don’t get social security. So until you or anyone else is willing to give up their social security upon retirement then deal with the fact that teachers have earned and deserve their pensions.

Dude, seriously, Obamacare is not what you make it out to be, the government doesn’t pay doctors except if it’s Medicaid. Even if doctors accepted Medicaid, which hardly any do, they go into it with eyes open with full knowledge of the low reimbursal rates. Obamacare is basically the same system we had before, but with the Federal government paying a portion of the premium based on the individual’s income. That’s it! Stop trying to make it out to be something that it’s not.

Medicare — for the elderly — has been DEFUNDED consequent to 0-care — and the payouts for Medicare are now being shifted down to the norms for MEDICAID, more or less.

Medicare Advantage has been cancelled. ‘Advantage’ topped up the Medicare system, making it MUCH more attractive to physicians. Now, not so much.

You are fulsomely incorrect on your other points: 0-care is STRUCTURED as if it were Medicaid — that is — county by county. That’s how the contracts are being set up — that’s reality.

Cross-county networks are being largely excluded. This reality has still not penetrated the public consciousness — to include you.

The doctors are boycotting 0-care because they’ve read the fine print. The terms of the deal require them to cram down their professional fees — something fierce. Said contract rates are based on the pre-existing terms long established by Medicaid and Medicare. That’s where the government is coming from.

It’s a MONOPSONY situation: 0-care is creating the same dynamics as single-payer by largely structuring all of the price negotiations around the pre-existing Medicaid/ Medicare structure. This is the direct consequence of making the playing field uniform.

In MANY counties, there are (currently) only one or two qualifying parties to ‘negotiate’ will on the ‘exchanges.’ This situation is known as either a monopoly or an oligopoly.

Famously, Hawaii (Barry’s old home state) has had only ONE HMO (Kaiser) and ONE classic insurance program (HMSA — shades of Blue Shield) One must jump into one pond or the other.

It is NEWS to most that this new scheme, in most cases, does NOT allow enrollees to cross county lines. In my case, the nearest hospitals and clinics are just across the county line. They are now excluded from my insurance coverage. Like most of America, I HAVE to stay within my county to be covered. Anything outside my county is on my own dime — with some exceptions.

By mid-year, everyone and his brother will have figured out the new system.

Due to the lack of contracting doctors, most Americans will find that they are, de facto, insured — but UNCOVERED. There is no actual health care that goes with 0-care insurance — for lack of talent signing on the line that is dotted.

It’s that simple.

Additionally: Medicaid is paid 100% by the various states — to the providers.

The states then, turn around and get reimbursed by the Federal Government — 90% — FOR A WHILE. That rate is scheduled to drop in the out-years.

Medicare is also picked up by the Federal Government; it’s bigger than Medicaid.

Financially, both are blowing up. Both have been cross-subsidized forever by the rest of the marketplace. The stipulated rates have been manipulated since day one.

And, to top it all off, the tempo of fraud committed against Medicare/ Medicaid is off the hook. The Feds, year in and year out, look the other way at fraud levels that would bankrupt any private insurer.

There is ONE taboo correlation in said frauds: they’re overwhelmingly committed by foreign born, foreign educated doctors who have immigrated to America. The correlation is astonishing. Naturally, it’s politically taboo to mention that green card holding medical practitioners are looting the system by the billions per year.

Ann Coulter wrote up just a smidgen of the scandal just the other week. The further you peek, the uglier it gets. Yes, yes, yes, it’s not politically correct.

Don’t blame me. I’m not the one who’s filing fake insurance claims against Medicaid.

Of course, these frauds have a direct impact on Medicaid budgets — and payout rates. Unable/ unwilling to prosecute fraudsters, the bureaucracy simply re-jiggers the payouts lower to make the figure fit the budget growth. It’s like bending your fuel gauge to make the gas tank fill up, same logic.

LAer says “Obamacare is basically the same system we had before, but with the Federal government paying a portion of the premium based on the individual’s income. That’s it! Stop trying to make it out to be something that it’s not.”

Dude, Obama and the government don’t pay for anything! It’s the young and healthy who are forced to buy insurance and pay higher insurance premiums to insure those who are without insurance coverage.

Obamacare’s “individual mandate†requires all Americans to purchase expensive government-controlled health insurance, even if they don’t want or need it. ObamaCare inflates the cost of insurance for young and healthy people so it can subsidize premiums for the older and sicker. It does so by not allowing insurance companies to charge the old more than three times what they charge the young, or to vary premiums based on health status. But ObamaCare goes further — providing hefty taxpayer subsidies for older people, but little for the young.

Obamacare’s “community rating†price controls force insurers to sell coverage to the sick far below cost, and to the healthy far above cost. In that environment, an insurer that provides the highest-quality care to the sick will attract all the sickest patients, and will quickly go bankrupt, as healthy people avoid that carrier’s higher premiums. In this way, the Act’s community-rating price controls literally punish health plans that provide the most attractive coverage to the sick. The Act thus forces health plans into a race to the bottom, where insurers compete to avoid, mistreat, and dump the most vulnerable patients.

Prior to Obamacare, my barebones Blue Cross insurance was $166 a month.

This January, it’s going up to $459 a month.

I don’t know what’s going on, except that it’s costing me a lot more.

Blert,

What do you think ought to be done? Ought we do enforce balancing the budget and handing out pink slips. We are not a reactionary country: it is a sacrifice that would similar to the civil war, but without blood, but a lot of hardship. But it would pay off. Would it not?

I’ll quibble with you on a couple of fine points.

As I am a Baby Boomer, I well remember how difficult it was to get into any college during the 60s and 70s. At no time ever did anybody ever get into the famously demanding UCLA, or God Forbid, Berkley, with sub-par grades and test scores. It was not a given that “everybody” would go to college in 1970, and the Baby Boom demographic bulge made college admissions very, very competitive from 1966 until the late 70s. If you weren’t in the top 10% of your class, the only schools available to you were small, uncompetitive private colleges that charged exorbitant tuition. If you wanted to get into an Ivy League school or the notoriously choosy U of California system, you had to be in the top 2% of your class, and if you wanted to get into any state university or fine private university or college, you had to be in the top 5% of your class.

Once the baby boom generation had passed its college years and the baby bust generation, known as generation X, came along, its cohorts had a much easier time getting admitted, though at this point, costs began to rise steeply thanks to the proliferation of college loans, which really did not make paying for college any easier, just stretched out the cost over time, like your entire life, while driving up tuitions steeply.

I tried to get into medical school in 1975. Affirmative Action blew me out. I went to UC Berkeley and studied Electronic Engineering instead. Competition was always VERY tough for us boomers. We were told we could have it all and we all went for it at the same time. However ALL was not big enough for ALL of us.

In 1979 I was admitted to UCLA. But I decided to stay in New York and went to NYU instead. In retrospect, I think it was a foolish choice.

Back then tuition at NYU was only a few thousand dollars a year. And since I lived at home in Queens, and commuted by subway, there were no housing costs.

” Imagine how great life would be if you could start off your working life with a paid off property?”

This might be the defining question of our age. I’ve long said that, if we could free up just 40% of the money that is being spent on overpriced housing, virtually all of America’s economic problems would go away. But, no. People have actually been trained to trip over each other in an effort to pay ever more money for ever lower quality housing. But, I don’t think it will end with an cataclysmic corrective bust. America will just become a society of renters–80/20 maybe–and the idea of “retiring” will fade into the mists of our collective memories.

Sounds like the Federal Government should have just paid off everyone’s mortgage and student loans during the Housing Crash instead of bailing out the Big Banks.

I don’t think a student loan payoff would have been in the works for a housing price collapse, but I get your point. Besides, a “bailout” of homeowners wasn’t needed. The fed should have bought bad mortgage debt for $0.40 on the dollar and then auctioned the individual mortgages to community banks within a 90 mile radius of the homes with bids starting at $0.40 on the dollar. The only requirement would be that the purchasing bank would have to adjust the mortgage to reflect the new, lower purchase price. Problem solved. Banking arms of investment houses go bust. Community banks boosted. Economy booming. No tax money required.

Fed would have to move lightening quick, though. A dawdler like Obama probably couldn’t pull it off. It’s the political equivalent of yanking the tablecloth out from underneath the tableware and then slinging a new one in right afterward.

Here is a thought- when boomers die they will leave homes worth hundreds of thousands of dollars or millions. With estate taxes children of boomers will have to sell their homes to pay the estate taxes. That might be a demographic/economic disruption.

Thoughts?

Inheritance is exempt from taxes for estate sales under $5 million.

Thanks Matt

Is that the California exemption?

I thought there was a change in the Federal law to make it closer to a $1 -1.5 million exemption

I was going to make that point also.

smaul- The gift tax exclusion amount is $5,340,000 in 2014. Per person. Estate taxes apply after that. They’re federal.

My gut tells me they’re going to go all-in on reverse mortgages. Those companies already have Henry Winkler, Sam Watterston, and Fred Thompson shilling for them.

You are right about the reverse mortgage. The older generation were big on borrowing money and living it up.(Just like the big government debt that the younger people will have to pay after the old folks are gone). The children of “baby boomers” are in for a big surprise when they get nothing from their broke parents. The parents spoiled them, but now they have no more money to spend, except to keep the party going with the reverse mortgage, just like the government’s out of control spending and borrowing.

FYI: California’s “Prop 13” status is transferrable (one time only) to a family member heir. So, one “Boomer”ang child gets to continue to keep the extremely low tax base which is like winning the Lottery!

“California’s “Prop 13″ status is transferrable (one time only) to a family member heir. ”

Reason # 64,937 to repeal Prop 13. It’s going to start happening, piece-by-piece. The entitled classes is going to end. The Millenials and newcomers won’t put up with it.

But only if the house is in a trust does the property tax bill stay the same. A will won’t cut it because the house gets revalued as it goes through probate. How many people do you know who have their house in a trust?

@ LAer

Hi LAer

My mother lives in a house that her parents bought in Santa Monica in 1955. It is worth over $2M as a tear down (North of Montana Avenue). I think anyone who has spent a half hour in front of a lawyer will tell you to put the house in a living trust, which my mother did so 15 years ago. I think living trusts are quite common these days.

I know many older boomers who have their homes in trusts. Another friend’s parents explained to me at a party that when they talked to their accountant about selling a rental condo they didn’t need anymore he told them it was worth more to them as a tax deduction so they now they will never sell it.

What I see is boomers in houses that while they may not be paid off have lower locked in monthly mortgages (sometimes 25% or less monthly than what can be charged in rent). Why sell when you can rent the home out when they move into assisted living or move on to the next property and make money at the same time. Why not cash out some of the 401k or take some savings and buy a new place while you cash flow on the last one? No one getting started today can do that, but plenty of boomers can. In my friend’s example the condo and the family home are now rentals, with the parents living in the new property. They can cash out the family home to pay for assisted living (or use the 4 +grand a month they can get in rental for it), and when they die they can leave each kid a rental property/condo tax free since the estate tax is exempt up to 5 million and with a trust they can keep the low property tax in CA. Boomers have no incentive tax or leverage wise to do otherwise.

What that means is that one couple can and will easily lock up three properties.

Welcome to the new landed gentry. Serfs, say hello to your new overlords.

I think could continue to get away with high housing costs if there were high-paying jobs. Example: Carmel Valley in San Diego, where you still have a fair number of two-income professional families happily smacking down $1 mil on a house in order to have a five-minute commute to their biotech or law firm.

But that is clearly an exception to the rule. I recently saw some 2,000ish sf house built in 1984 with no back yard in Redondo list for $825k. Who the heck buys that kind of place? What good kind of job still exists down there for even the upper middle class?

The state is so focused on economic equality that every business not part of a local industry hub (see: biotech) is realizing that the value proposition almost always justifies an out-of-state move. When you pursue economic equality as a social goal, all you end up doing is pushing down the middle class rather than raising up the poor.

Not true KR. After world war 2, economic equality became very important to the USA. Because of this, the 50s and 60s were excellent times for the middle class. Unions were strong, wages for ordinary workers were high, and the minimum wage was (in 2013 dollars) the equivalent of $17.85/hour. Big corporations pushed for and got international trade deals starting in the 80s that have continuously undermined unions, wages and therefore the middle class. All it would take to change things is to rip those agreements up – but the republocrats will never do that.

Pandora’s box has been opened. You’re not going to just seal it up. Raise the minimum wage to $17/hr and employers just aren’t going to hire people…. Those kinds of actions are only going to drive jobs elsewhere, as in all the way out of the USA. Or: robots!

“But that is clearly an exception to the rule. I recently saw some 2,000ish sf house built in 1984 with no back yard in Redondo list for $825k. Who the heck buys that kind of place? What good kind of job still exists down there for even the upper middle class?”

KR, Redondo is going through massive gentrification. South Redondo has always been desirable, North Redondo is undergoing massive changes. If you want the South Bay beach lifestyle on a budget, Redondo is where it’s at. Much cheaper than Manhattan and Hermosa and you still get to enjoy all the area amenities. Who is buying in these areas? Usually two income professionals each making 6 figures plus. This is definitely not a starter area so they are likely bringing money in from past RE sales. Regarding jobs, there are lots of high paying jobs in the vicinity (Chevron, Exxon Mobil, LAX, Boeing, Northrop Grumman, Raytheon, etc) and people are willing to drive to downtown, westside for work. Manhattan Beach is the town of choice for young medical professionals. There is very little supply and lots of demand. An 800K house on a small lot is nothing out of the ordinary.

The housing bulls like yourself keep talking about all this demand. At some pricing point, doesn’t demand have to tap out? Are there just endless strong two income families in the bulls heads saying for CA real estate at any price? People are stretching themselves about as far as they can go or farther. Interest rates can’t get much lower to help raise housing prices. Investors aren’t going to keep buying homes like the past few years. I get the lots of people WANT to go to CA. I think its quite a smaller number that still want to stay in CA after a few years and then I think it’s a much smaller number that want to stay, and want to buy a home and can afford to buy a home at ever increasing levels. There is always a point where people say this is too expensive.

To Ernst on a previous thread-you mention that a house goes from say 900k to much less when interest rates go up to historic norms of say 9%. Even assuming interest rates get that high and the inverse correlation is true (the history is fuzzy here at best), i dont think people that bought houses for 900k will just sell them for 400k or 500k bc interest rates are up and the ‘market’ says there house is now worth half. I’m a housing bear, but why would I sell my house again for such a huge loss? Of course its better to get houses at low prices and higher rates so you can pay down early. I just don’t know where all the supply will come from in such a scenario unless its distressed properties…and then who knows if non-insiders will get them.

FTB, I don’t think you are familiar with the areas I am talking about. RE prices for the beach cities in the South Bay have shot up big time in the last 20 years. Yes, there really is a supply and demand issue here. Go on redfin and do a search for properties under 1M…there are simply not many available. In my experience, if a property is priced accordingly it will go quick. Like I mentioned, this area is not for starter buyers. These are people with established careers and money in the bank, they aren’t going to settle for lesser areas where the quality of life, safety, schools, amenities are all subpar. If they need to squeeze the finances to get into the beach cities, they will. The alternative of living in Gardena, Hawthorne, Lawndale or Carson simply is not going to happen.

FTB – You missed the real fallacy of LB’s statement. “Manhattan Beach is the town of choice for young medical professionals.” Ahhhh… I have four words for you O Bam A Care. I lived through Romney care for the 9 years I lived in MA. Ask the doctors/medical providers how that worked out for them. Half of my family in MA worked in health care. Many of them left the field or the state. Not good…

LB-why choose 20 years to make your point? Did the last housing crash skip this area? You know the area better than me. Forget that it may or may not be higher than pre-crash/QE today. If it went down before, it can/will likely go down again. If it withstood the last crash completely, then it may survive again. Keep in mind rich areas went down in bubble 1.0 as i was looking at similar price points in 07-13 when i was looking to buy in CA (i actually bought something but the builder fell through n my money was refunded) and saw things first hand, albeit not in the exact spot you mentioned. also rich people stretch themselves too and have to sell at times (think traders who buy CA real estate when they’re up, lawyers (who are getting laid off still and/or not making partner at firms anymore as that bus model is in flux), etc. lawyers salaries have been absolutely flat for years (bonuses were just announced and they were same as last year), doctors salaries are next thanks to obamacare. Its not just lower classes or middle, its upper middle and upper. maybe their stocks have been up so they feel food, but that is temporary noise. salaries is what makes one feel confident long term and they seem to be trending one way at least medium term.

FTB, I chose 20 years to make my point because this was the last time housing in “most” desirable areas was even somewhat remotely affordable to the commoner. Anybody who is familiar with the South Bay beach cities can chime in here and will likely agree with me. This place has been undergoing massive gentrification. Back in the day it was mostly aerospace industry jobs that the economy was based on. Not anymore. Turn back the clock on areas like Malibu, Santa Monica, many Bay Area cities…the same gentrification happened. You are familiar with NYC, is Manhattan ever going to be affordable for the commoner? People need to accept the fact that the old normal is not returning to some of these areas. The rich have decided to call these places home and that is that.

LB-now youre talking about CA real estate being available to the ‘average commoner’ to try and justify your point. I thought, and tried to make clear through my comments, that we were talking about a downturn in what you appear to be claiming are almost bullet proof areas in real estate. Something can go down 20-40% and still be expensive to certain segments of society, but now much more affordable to another segment of society. This is especially true in many of the areas we are talking where a decrease of that size in a now inflated million dollar home becomes much more affordable to the couple making $150k. Ditto with the homes currently at $800k and so on. I, and I pretty much everyone on this board and on this planet gets it; you’re not gonna make an ‘average commonor’ wage with no other wealth and buy a home on the CA beach.

You seem to know a lot about CA real estate, especially in certain areas, and are clearly an intelligent person. Its odd to me that someone like you who has lived in CA through the last bubble, thinks it can’t or wont happen again less, equal or possibly worse than before. You seem to have this idea that this time is different, at least in select areas. I guess it comes down to that maybe and I guess that’s where we’ll have to differ.

On a sidenote, I know its not a beach right near LA, but San Clemente is a pretty nice little beach (albeit much further from LA or SD), and their housing absolutely tanked last bubble too. Chinese have been making money for more years than just the last few, btw. I guess they no likely San Clemente or CA real estate in general during the last bubble. Globalization isnt new nor is the trend for the death of the middle class. What’s changed is central banks distorting markets with liquidity and low rates causing people to make decisions they wouldn’t normally make. Take the central bank punchbowls away and we’ll see.

Good discussion, folks. LB wrote good points.

In the end, Prop 13 gives incentives to homeowners who bought long ago to postpone selling (everybody will sell eventually, within 100 years). Reduced supply leads to high prices. I bet this effect was known to whoever came up with Prop 13 idea, and was the main objective behind Prop 13.

FTB, I have never claimed that certain areas will be immune to another downturn. What I can claim is that cities like Manhattan Beach will weather the storm much better than almost any other area. Even the ultra bears will likely agree with me here.

I realize you lived in LA for a few years, but I still don’t think you understand the housing dynamic in certain areas. Comparing San Clemente to Manhattan Beach is comparing apples to watermelons. They are both on the socal coast, that’s where the similarities stop. San Clemente is a fringe town, it is literally the last city in OC when heading south. I am not aware of any big employers down there. The nearest job center is Irvine, which doesn’t even compare to DTLA, Westside, South Bay employment centers. San Clemente rightfully got smashed in the downturn. I think MB was down 15, maybe 20% from the peak. Many places in MB today are going for more than peak bubble prices.

There are certain areas in California which absolutely defy economic gravity (Malibu, Beverly Hills, Santa Barbara, Palos Verdes, Newport Beach, La Jolla, Palo Alto, parts of San Francisco, etc). And guess what, I’m going to add Manhattan Beach to that list. It’s that desirable. The rich are getting richer and buying desirable CA RE is on their radar. I would love to hear the bears refute this one.

Not sure if I’m not being clear or if you’re doing it on purpose or not, but you keep spinning what I’m saying I’m a little. I said on a sidenote and said its not LA or SD when talking about san clemente. I was just making a separate, “sidenote” point saying that beautiful weather plus coast plus limited space does not automatically equal immune from housing busts. Personally not for me, but after reading doc’s recent commute article, its not impossibly far from SD as people commute from the IE just as long all the time to work it seems. Also my old mortgage broker commuted from san clemente to LA. He just loved surfing every morning before work.

In terms of most of manhattan beach, malibu, bev hills and other prime areas of course they are relatively better than other CA real estate and other real estate in the world in general. I dont know what to say other than I agree and I think almost everyone else on planet earth does as well. Not sure why if one is not pro real estate, he automatically is tossed into the “prime real estate in the world has to go down 50%”pile. I would think a 20% decline in prices in those types of areas (most of which people here arent buying in) would make a lot of people feel better about buying homes there and its real money. I’d like to pay $800k for a house instead of a million, or 1.6mil instead of 2 mil, especially if im bev hills rich and cash/no mortgage is my game. not sure if doc has any stats, but id be curious how manhattan beach or some other other similar areas did during the last bubble.

FTB, all good points. I too would like to see a Manhattan Beach article by the Dr. HB. I personally would never live in MB because you can get much better bang for the buck a mile or two away. However, there seems to be plenty of people willing to spend a 1M plus for an old shitbox that is maybe 2 miles from the water. There is a blog called the Manhattan Beach Confidential is you are interested. It’s always good seeing things from a different perspective.

@FTB, interest rates do matter in setting the selling price of a home. When interest rates go up, selling prices go down, but the monthly nut does not change.

I bought a condo in Culver City in 1997 for $75,000. The prior owner bought it in 1991 at the height of Housing Bubble 1.0 for $160,000.

The effective interest rate was 11% (9% plus 200 basis points for the “condo penalty” due to all the condo foreclosures that happened in the late 1980s/early 1990s). The 200 basis point condo penalty drove the selling prices of condos into the ground however the monthly nut was close to rent parity for the area.

With the Federal Reserve keeping the Federal Funds rate at close to zero (ZIRP), this helps to keep inventory artificially low. The Federal Funds rate determines interest rates paid on deposits, savings accounts, CDs, money market accounts, variable interest rate mortgages and short term bonds/treasuries. With this rate at zero, investors who would normally be in CDs/MM/short term bonds were forced to chase after real estate in search of yields.

This also causes the golden handcuffed homeowners Dr. HB references. Since these golden cuffers have been seeing average annual home appreciation in the 7% range for the last 15 years, they are not going to sell because there is no where else to get this kind of risk-free yield. Both of these events which are directly linked to the Federal Funds rates, leads to the inventory depletion we are seeing.

What also leads to inventory shortages is that Federal law allows banks to keep foreclosures off of the market for up to 10 years. Again, ZIRP is a factor in this as well. If the Fed Fund interest rates were in the 5% range, banks would be unloading their foreclosures like radioactive nuclear waste. But with zero percent interest courtesy of the Federal Reserve, banks can sit by twiddling their thumbs and sit on their inventory for up to 10 years.

In any event, do not expect to see any meaningful inventory until a minimum of 2016. Most likely, inventory will not return to normal until many years later (perhaps 2018 to 2020) unless we run into another severe recession like 2008.

If home prices are flat in SoCal for the next 5 years this may cause some of the golden handcuffers to capitulate. During Housing Bubble 1.0 (1990) it took about five years before the 1990s equivalent of golden handcuffers threw in the towel and capitulated.

ernst-lots of good stuff in there that I agree with. Not sure about inventory coming on line in exactly what year yet as its hard to tell when govt intervention stops, market reaction, “home” investors reaction, especially lots with cash in the market, etc. Your caveat that unless we see a 2008 recession is the elephant in the room. Cant assign a % to it, but its in the realm of possibilities for sure…just as the govts of the world can get out of QE safely (everything has a %).

You would think rates and home prices are correlated as it makes sense on many levels. however, the stats show a little different picture:

http://www.calculatedriskblog.com/2013/06/house-prices-and-mortgage-rates.html

If you read online (google home prices and interest rate correlation), there are lots of articles talking about how its not likely really that true. It seems many think, its really about affordability, which is broader than interest rates. Rates are one big part of affordability, lesser so in a market (temporarily?) driven by cash. Wages and wealth are a big part of affordability too (which we can all disagree on if they are going to be flat, up or down, which segments are up or down, which segments matter for different locations, US salaries/wealth vs worldwide salaries/wealth, etc. Like you said, limits on supply (market or artificial) can also effect home prices beyond rates I would think as well.

“But that is clearly an exception to the rule. I recently saw some 2,000ish sf house built in 1984 with no back yard in Redondo list for $825k. Who the heck buys that kind of place? What good kind of job still exists down there for even the upper middle class?â€

Trade up buyers. Often boomers, but could also be Xers or others who bought pre 2000 or have paid off enough in the last decade to have some equity. If you can buy something, then sell it a decade later and double, triple, or quadruple your money you have a down payment that may be bigger than your common sense, allowing you to put 200k or more down to buy a $825K home with payments like a 625 k home. Hell, put down 400k and you have a payment equivelent to a 425 k house. Doesn’t mean it makes sense, but in an overleveraged consumer society that may explain the math.

While this is not achievable for millenials or those who didn’t hit the housing lottery, it explains a lot of the purchases we are seeing better than “those people just have REALLY high paying jobs.” Sure. some of them may, but the people with money are buying in the hills. The reality is I think we are seeing a lot of sales to people who have pulled out their 401ks or cashed out their starter homes courtesy of good timing and buying down the loan through years of payments.

Prop 13 is a disaster for CA. So fine, you don’t want people “taxed out of thier home”…well, then whatever the taxes are above what the person’s Prop 13 level is, should accumulate as a lien on the property…to be paid when the property is sold, or the owner dies. But nooo, there is now a new generation of people living in inherited homes, paying taxes equal to 1/10th of what their neighbor pays…for the same services. What a clusterf$&ck Prop 13 is. My parents just sold their overpriced mcmansion in North Tustin (aka Santa Ana) for almost $1.5 million….moved up here to live near me in the Pacific NW…and bought a much nicer, larger home than the one they left in CA for $400k. I’m glad they were smart enough to cash in their Prop 13 lottery ticket.

Tron, no problem with your move, but for others moving to another state has it’s own set of problems. I for one have been to the NorthWest many times, I have no interest in waking up in the NorthWest.

life is about choices, for those who still want the California life even if it means sacrificing to live there, I can understand it.

You need to hit the history books — especially WHY Prop 13 received such broad support during the first two Jerry Brown maladministrations.

Jerry simply grew state government like topsy.

Further, because property taxes are so highly correlated to school funding, run-away property tax funding caused wealthy districts to have insanely disproportionate funding versus the inner cities/ rural sticks.

In a very round-about way, shifting the education burden into the income tax/ general fund caused educational budgets to be re-equalized in about the only viable scheme I can think of.

Anyhow, it would seem that your own family massively benefited from Prop 13. For without it your parents would have been up a creek without a paddle. Something to consider.

Prop 13 is of a kind with Social Security and Medicare: protection for the elderly — who no longer have any defense against taxation. You can’t duck property taxes by filing an amended return with additional exemptions, etc. For most Americans, their paid off house is their most significant retirement asset.

Limitations on taxation, like CA’s Prop 13, would work if, and if only, there were corresponding limits on government spending….. and a vigilant, militant population willing to enforce those limits…. and willing to give up all the goodies a spendthrift government makes available.

I well remember the high income taxes of the 50s and 60s, even though I was only a child in those years and heard the adults discuss them. I also remember the signs that adorned the highways being laid allover the place that proclaimed YOUR TAX DOLLARS AT WORK. People didn’t mind so much committing everybody else’s money to massive projects and proliferating welfare programs because we were so rich as a nation in that era that it was widely thought, by people who should have known better, that we had achieved permanent affluence and would never again have to concern ourselves with scarcity. No one saw the resource scarcity and foreign competition looming on the horizon except outliers like M King Hubbert and the pro-business leaders who were working tirelessly on acquiring 3rd World slave labor havens to which to export those high-paying blue-collar jobs, which was really what our wars in Southeast Asia and Nixon’s “detente” with China were all about.

bert, there’s nothing wrong with the general motivation behind Prop 13 – but it was implemented very poorly – as usual the powerful cronies of our lawmakers got their way.

Why do business need to get this break? This increases the barrier to entry for new businesses!

Why do landlords need to get this break?

Why does it apply to multiple properties?

Why does it apply to millionaires?

And so on – if they wanted to protect the poor old people, why didn’t they write the law that way?

The Renter:

Prop 13 was aimed directly at JERRY BROWN.

It was designed to stop him from growing government like topsy.

But it was more than Jerry, it was aimed at the larger Progressive Movement.

Taxes were not just going up — they were growing like CANCER.

No-one, not even businesses, could handle the astounding ramps in property taxes that were occurring at that time.

So Prop 13 was drafted in simple, universal, construction: it was to apply to EVERYONE.

Consequently, it gained 66% Yes votes — a virtually unheard of approval vote for any Proposition. It was that popular — because the growth of state and local government was that out of hand.

The taxes not collected by the property levy pop up as INCOME – – of which the State of California has simply no end of trick taxes that apply to businesses only — and of which on other state levies!

It’s NOT true that California businesses get a free ride. The exact opposite occurs. This is why there is massive flight of those businesses that can flee.

This is not the place to go into all of the odd and unique taxes that Sacramento places on California business entities. I’d be writing a book.

BTW, the courts have already ruled against using property taxes to fund school systems. That scheme puts the rural sticks and the urban centers at at severe economic disadvantage. It’s another reason why Prop 13 flew through to approval.

Go to the Wiki on it. It’s worth your read.

The idea of a Prop 13 lottery ticket? How can the 1% tax be a lottery ticket when it benefits all who purchase a home. There are very few remaining original Prop 13 residents who are still in their homes. Many are older and could not afford to sell and rebuy a better home who benefit from what you are referring to. The problem today is the many investors who are buying up the homes for cash that should be being bought by first time home owners. If Prop 13 is replaced I am sure that the taxes will be MUCH higher and that is what the unions want in my opinion.

How can you call Prop 13 a lottery ticket when it benefits all who buy a home with a 1% tax? There are very few original Prop 13 people left who (mainly older) who could not afford to sell and rebuy. If Prop 13 is replaced the tax will be MUCH higher for everyone.

cb, Prop 13 has drastically distorted values in desirable areas of Ca. Forget about the 75 year old original owner. Anybody who bought prior to 2000 in the desirable areas is GREATLY benefitting from Prop 13. House prices have went up by a factor of 3 or more times for these areas and yearly tax increase is 2%! This is why pricing in the desirable areas is so sticky. People simply will not sell a gold mine where large nuggets are still be extracted. Not to mention you can collect top dollar rent, leave property to your heirs and still have Prop 13 protection.

Excellent take

This Boomer is glad she never had kids. #Childfree

Amen to that!

Reminds me of one of my favorite Simpson’s episodes…

Lisa: Mom! Maggie puked in your purse again.

Childfree Woman: Poor me. All my purse is full of is disposable income.

it’s pretty self-explanatory, how many existing home-owners (not recent), can afford to buy the same property today with their current income? that is the state of SoCal housing affairs…

Income is definitely one of the crucial issues. US incomes are toast and they aren’t coming back for the super majority of folks in the private sector….ever. So few jobs will be safe going forward in terms of income increases to beat real inflation, plus their interest expenses. Add in very few people being able to feel real job security and one would think it will effect people’s behavior immensely. People I speak to in all walks of life are just scared besides a very select few (like those at Google :)). Most are gen X and gen y/millennials. The boomers, relatives included, I speak with still only kinda get it when I speak with them. My buddy in sales at Thomson Reuters in NYC said this morning that they (of course with record (fake) profits) are firing between 3000-5000 right now just weeks before xmas. and thats sales, which often doesnt get cut until other admin jobs go. I get the whole natural gas possibility thing. From what I’ve read (and it could be wrong) that boom may not happen quite as expected and/or may last about 10 years as its already seeing diminishing returns on a high scale. I just dont see what all of a sudden brings us forward into higher salaries. Maybe you never do I guess. Who knows. Real estate home values aside, not a pretty picture, IMO.

The counter in real estate at least will be that we’ve gone global so its global, not US, salaries that matter going forward, especially in “internationally-desirable cities. Personally I think we have gone global and its bad. We’re now one big correlated clusterfck. like a closed tube of toothpaste. Squeeze one end and another part bulges. To me that means a global decline at some point and world salaries wont save pumped up real estate or assets in general. once again, all guesses. I do wish we’d get on with it already. Either lets start doing better or do worse and then try and do better. This middle shit is for the birds.

OK, the rich get their breaks from the FED, and the rest get their food stamps. So what is the problem? The rich complain about our food stamps and unemployment and etc(e.g. Romney) and we complain about the rich getting their government benefits, corporate welfare, tax breaks, and cheap interest(e.g. carry trade) and so on.

As a recently retired parent, I am thinking of moving to a place and buying about 5 acres and making a family compound. Kids can build houses there if they need to. That way they can avoid this Calif RE BS. Later they can subdivide and sell each house separately and each make a killing.

Make a killing? Where will these homes be located? Bumf@#% Egypt?

WHERE will you buy these 5 acres on the cheap, so that your kids can make a future “killing”?

Cheap land can be got in the Inland Empire or Nevada, but the cheaper the land, the farther from civilization, and the less likely people will ever pay high for a house there.

Empty lots of far less than 5 acres are very pricey in desirable areas. I recently saw a lot go for nearly 1.4 million in Santa Monica. It was on 7th Street, across from Lincoln Park. It had an old tear-down on it, built in 1909 or 1906, something like that.

Where is this cheap land on which you plan to make a future “killing”?

Doc wrote: “Instead, they will “live and die in LA†in their pre World War II shack and hem and haw about the challenges their kids face but will remain idle in their stucco sarcophagus.”

I agree most will, no matter how desirable or sensible an alternative might be. But humans tend to resist change, no matter how positive; especially older humans.

The prevailing argument I repeatedly hear is that these houses will never come to market, simply pass to boomers adult kids who will carry on. The problem…many “middle aged kids” won’t be able to afford to keep Mom/Dad’s house over the long haul, even with a well planned estate. Why? Many “stucco sarcophagus” are money pits with lots of deferred maintenance; old roofs, heat/air, windows, paint, plumbing, electrical issues, termite damage, etc. Also many seniors are perfectly content with a 1500 sq. house with functional 80’s era appliances, carpet, vinyl, formica, etc., dated exteriors, landscape. etc. Many of these houses will be gutted to keep up with the neighborhood; basic granite/stainless/hardwood upgrades can quickly mushroom into six figure Tuscan Fantasy remodels, especially if a bit of cash is inherited as well. I believe many Boomer Inheritors who have experienced job loss/reduced earnings/adult kids back home/credit card debt, etc., may find keeping the family home far more costly than they bargained for. They may eventually HAVE to sell, even if they don’t want to.

Also, some middle aged “inheritors” didn’t inherit their parents Depression Baby saving mentalities/frugal ways; many inheritors have incurred a mountain of debt maintaining The Lifestyle, with little job security/minimal savings. I have personally witnessed people blow through big inheritances within a few years.

Not to mention many a house/sarcophagus will be inherited by siblings that dislike each other; in many cases neither side has enough cash to buy the other out, can’t agree on what to do with the property and who should live there, etc. Selling becomes the sensible choice for all involved.

All excellent points. What I have seen from personal experience is the parents’ house ends up getting sold. I have seen immediate sales, I have also seen one kid move in for awhile and I have seen the property rented, but I cannot think of a case where the property was not sold eventually. In a couple of cases before parents’ death as they moved into assisted care.

I have friends living in a former 55+ community built in the 70’s where the age restriction was lifted about 15 years ago and now it is mostly younger families that have taken over the neighborhood, not renting but purchased from the estate. Most people have no desire to be landlords and those that give it a try find it to be too much of a pain, just dump the property and take the money.

Sure there are exceptions but I believe most of the boomer property will find its way to market.

drinks/falconator-I think you guys are right and many if these homes will find themselves on the market. I think y’all summed it up by saying its not about what people want to do. Its ultimately about what people have to do. My hunch is that the ‘have to sells (for whatever reason)’ + ‘want to sells’ outnumbers the ‘can and wants to keeps.’

There IS something worse than paying bubble prices for a house! That would be……Paying a bubble price on a house that home depot puked up on.

Unfortunately 95% of flips have the Home Depot puke job so even if I were to cave on the ridiculous pricing, the puke jobs usually stop me dead in my tracks.

Laura, it’s no easier now to get admitted to selective colleges…unless you are in a desireable group (star athlete, underrepresented minority, first in family to go to college, sob story, etc.), especially the UC. If you are the typical white male/female of the 60s and 70s now, your chances are pretty slim at the UC. And if you do get in and go, if your parents make more than 140K combined, you pay full freight (and subsidize the expenses of those “special” classes of admits who pay no tuition, which is about 50 percent of Cal Berkeley students, and some pay zero). Loans have been the biggest contributing factor to exploding costs of state schools in CA. Give them more, they spend more. And I agree, KR, who would pay 800K+ for that box in Redondo? Real estate prices are beyond the reach of most younger Californians. Only the double income professionals have easy access, but they aren’t buying the truly exceptional properties, they are driving their BMWs into so-so areas, because even those are pricey right now. One of the most obvious “fixes” is to repeal Prop. 13, but don’t tell that to those who have owned their houses for 30 years. In my Marin ‘hood, the only people moving in (it’s an average ‘hood with 3BR/2BA tract homes built in the 50s) have two nice new cars and they both work in the City. No single income folks moving in, and certainly no “older” folks like me (50s) with kids in college. And definitely no big families. There are a few houses that are just like that Redondo house sitting here for sale, 1.1MM and above…and no takers. Granted it’s winter, but what does the buyer look like who is willing to buy a small, used 60 YO house on a tiny lot for over 1.0MM, with a crappy high school too? I don’t know but it sure isn’t a young family. They would do better, much better, outside of CA.

I think it is very important to stay focused on the fact that this is a phenomenon that does not affect much of the rest of the country. I have seen many friends move away from or avoid ever moving to SoCal because of the high housing cost. I have friends in Vegas, Pheonix, Portland, Denver and Boise in the West, Austin, Dallas and Houston, KC, St. Louis, Charlotte, Raleigh and Minneapolis. Much much more affordable housing in all these places. Good for them. I also have many friends in SoCal and in SF, NYC and DC where housing is very expensive and they either have the earning power to live well or they live in small places in more affordable submarkets.

You are not entitled to afford real estate here and if you can’t get what you want, hit the bricks you have plenty of options.

The middle class is dead because they don’t want to live like middle class, they want all the bells and whistles and gadgets and lifestyle of upper middle class and they lived like it all on credit, living beyond their means, it was all a charade and a self-inflicted wound because they simply could not control themselves. Farewell middle class, maybe we will see you again if you decide you can survive in a smaller house without granite/stainless steel appliances/flat screen on every wall/leased cars/dinners out/Iphone-Ipad_Igadget for everyone/etc etc etc.

Some places are never going to be affordable again for the average Joe and coastal SoCal is one of them, if you can’t get what you want then find a way to make more money or get out now and get on with life.

Also a good take on the So Cal market. when the 2005-2006 takeoff occurred many areas of America wanted to get Cal prices, I can assure you buying a expensive home in the boom years in location’s that could never support it was the disaster that happen.

locations like coastal Cal will have some push back at times but overall they will be unaffordable for most, why attack to these folks if they can afford it let them be, and like the post said move on with your life?

Well said Falconator

>> I have seen many friends move away from or avoid ever moving to SoCal because of the high housing cost. <<

I have seen a related trend. Boomers, who were never able to afford a house in California, move away when their out-of-state parents die and leave them houses in other states.

I had a boomer friend who had lived in California since the 1970s, in apartments. In 2007 his last parent died and left him a house in Florida. So he moved into that house because it was cheaper than L.A., and he stayed there. Florida RE had tanked so selling it didn't make much sense, and he's decided he prefers his old home in Florida — same house as where he grew up — to apartment living in L.A.

I've another boomer friend, a longtime Californian, who returned to Wisconsin several years ago because his parents died and left him a house there.

Not all longtime California boomers own houses. And when their parents die and leave them houses in other states, some of them go home.

Here’s one more example. I have a boomer friend whose parents left him TWO houses — one in Culver City, one in Nevada.

In early 2006, he mortgaged his Culver City house to invest in a film. The film investment tanked, the RE bubble burst, and he was forced to sell his Culver City house and move into the Nevada house.

California is full of transients who arrive to make their fortune but fail. I wonder how many are slowly returning as their out-of-state parents are dying and leaving them out-of-state houses.

SOAL wrote: “California is full of transients who arrive to make their fortune but fail.”

California is also full of natives of all ages who were born here, fail, will never leave…California life is their birthright. This growing population will likely require ever increasing govt assistance. Also all the 45+y/o CaliDreamers with little/no savings, investments or job security who believe a comfortable retirement that includes beach close living, unlimited yoga/organic food is a realistic option. Their votes, combined with swelling working poor/low/no income, dusty wealthy liberals happy to pay increased taxes to do their part, idealistic youth whose parents pay the bills vote what feel/sounds good, will likely ensure a CA Democrat power base for years to come. It will be interesting to see if in this political climate Prop 13 survives over the long term.

WeDon’tMakeThoseDrinksNoMore –

I am a fourth generation Californian and I have never seen “California is also full of natives of all ages who were born here, fail, will never leave…†The key word being “fullâ€. My father (third generation) use to complain in the 1970’s about all the non-natives in California. I know that there are a lot of folks with Native bumper stickers who were born and raised in other states and still claim to be native. I know that it is hard for someone who was born in pre 1990’s California to leave and adjust to a different life-style. The real issue is that the Southern California I was born in no longer exists. None the less, more than half of my native and non-native childhood friends have left SoCal. The ones who stayed are very unhappy with the current state of the state.

my,my,my,so many who missed the boat.while tax rules were being changed to benefit the few and now in full effect you all are crying that your not rich enough to benefit from them.so now you go after what little tax breaks the middle class still enjoy, but i will fight to make the tax code fair for all. taxes will never go away but we can all pay our fair share and when we all pay our fair share those who succeed will be the ones with real know-how brains not high paid tax lawyers and overseas tax havens.

New FHA loan limits were announced this past Friday. They are dropping drastically, from 696K down to 546K in San Diego, similar in Los Angeles.

Seems like this will be impacting the 575K and up market quite a bit.

A reduction in the limit below $ 696K down to 546K can only be characterized as a good start. It needs to be shrunk to, like, $300K or less even in SoCal. It’s unfortunate that we have that much tax-payer risk at stake just so that brokers and agents can make commissions by putting wanna-be’s in overpriced housing.

Riverside County limits are headed to 355m, down from 500m this year. My wife and I are contemplating buying a house in Temecula but I want to hold out and see what happens in 2014.

Reverse Mortgages will give cash to the boomer and let them stay in their palace until they can no longer take care of themselves. This is a lock for those where they want to be until the end.

DHB – At the risk of blert telling me that I am wrong regardless what I say, I have two observations.

First, 74% of 54% is a little under 40%. I would think that there would be pressure to remove the tax deduction for mortgage interest. I would also think that as the renter portion increases there will be more and more pressure to eat away at prop 13.

Second, is the elephant in the room. Peak oil is becoming less and less a theory and more and more a reality. We are literally squeezing the sponge at this point with fracking. The Chinese and Indians remind of those folks who show up to a party at the end and they ready to get down but there is no more booze and the pretty girls have left and the band is playing the last encore. I don’t care how much money you print the current energy supply can’t support the populations of India, China, Brazil, etc. to live the live style of the US three decades ago. The party is over.

One more thought before blert blerts out… I heard on the radio today that more and more Americans are paying a higher and higher percentage of their stagnant income on housing. Doesn’t that mean that they are buying less and less cheep crap from China. I would think that this would lead to a slow down in Chinese exports to the US. We know that China needs to export to grow and the EU has been dying a slow death.

Funny. my posts talk of demand going down and fracking maybe not being ‘the answer’ for a variety of reasons (I wish it was) too. You’d think at some point with housing, healthcare, college debt repayments, etc up and wages not, less disposable income would be going to Chinese bought products. I don’t think the US rich are their savior as well as they don’t buy enough in general and also their ratio of Chinese goods vs higher quality goods is not the same as average joe. Its hard being a bear when assets are up and the MSM is selling the world is great for the most part. plus everyone hates a party pooper. Personally I wish I saw things as going up, up, up. Would probably make life more fun. 🙂

I don’t quite know what to make of fracking.

Tight gas — from fracking — is so super abundant that prices are depressed — yet they still punch holes. The implication is that it’s actually still very favorable, economically.

A century ago, the floatation-cell was new-wave technology. It’s the source of Hoover’s engineering wealth. It also revolutionized mining. It’s the reason why almost all hard rock minerals are now mined by open pit methods — using mega machines.

Until floatation-cells came along, the ‘experts’ were convinced that the planet was running out of viable hard mineral deposits. At this time, the world is extracting many, many multiples of that achieved a century ago. Because floatation-cells permit the rapid concentration of feeble ores the absolute size of said ore bodies has exponentiated away to the upside. One is no longer dependent upon geochemistry to concentrate minerals to amazing levels.

(In the beginning, man needed nature to concentrate metals to native gold, native copper, etc. Today, such rarities would be regarded as scarce as jewels, perhaps rarer, still.)

As for fracked oil, the Eagle Ford strata appears to have astounding potential. On current trends, Texas is going to pass right through its previous all-time-high — in 2014!

While it’s true that fracked deposits ‘decay’/ fade off like crazy — the total available strata to be attacked is MANY multiples of all prior formations known. California has one field that is purported to be three to four times the size of the Bakken. It’s right underneath currently productive pay zones — but going much, much, further afield, too.

The Bakken is now officially an Elephant, over 1,000,000 bbl/dy, with no limit yet in sight.

What might be reasonably expected is that the fracked wells decay like crazy — and then approach an asymptote — dictated by the porosity of the strata. Because of the depth and pressure, this residual production may well last many decades. In sum, the first jolt pays off the drilling crew — and the residium becomes an annuity for the producers.

I’ve seen accounts from Russia indicating that they’ve got a (theoretically) frackable oil strata that stretches from the Urals to the western border — and beyond — from Saint Petersburg down to Volgagrad — simply the largest zone on the planet. It’s been known for decades — but until fracking came along — was considered uneconomic. They claim that it holds about 1,000 times as much crude oil as KSA has on the books. I don’t know what to make of such claims.

The Majors have tried to duplicate the fracking success of the wildcatters. No luck! Apparently, there are trade secrets that the independents are keeping hidden from Chevron and Exxon Mobile.

I’ve also read that there has been the discovery of an entirely fresh new pay zone — deeper than previously known — underneath Ohio, Pennsylvania and New York. Until recent years, no-one had even punched an exploratory well that deep. The strata had been attacked generations ago, before really deep drilling was possible; all assumed that they’d found everything. Wrong.

There are tales of this strata being as big as any Elephant.

Considering the nature of wildcatting and the big talk that goes around — and the suppression of success — who knows?

I suspect that fracking will prove to be — on economic terms — a repeat of the floatation-cell. And that it expands the target resource strata by 1,000 times, perhaps more.

We’re still so early in, the trend lines are whipping all over the place.

And in other news: The strata that made KSA number one appear to extend straight down the coast through Yemen and off the edge of Somalia and Kenya.

Until truly deep water methods were well advanced, no-one made any attempt to wildcat in Kenyan waters. These days, just about every hole they punch is bringing in gushers. This is kind of freaking out the Saudis, for no-one has punched any wild cat wells off Somalia. With her frontage, Somalia may end up being as big as big oil can get!

All of these zones are virgin strata. They’re also indications that Hubbert got it wrong: POLITICS has blocked the normal progress of events. Most of the planet has been off limits to wild catting. We actually have NO IDEA of what oil might be down there — for most of the planet.

Russia and China prohibit Western Big Oil — always have. This means that Peak Oil may be correct — just not for our generation — nor that of our grand-children.

It’s all up in the air.

I think one of the most important points you appeared to gloss over is that the energy cost to extract these new finds are higher and higher making the net energy yield lower and lower. Oil sands, fracking and deep water drilling are yielding new supplies however the net energy of actually “punching holes” in the Saudi desert yielded $20 a barrel of oil and the Saudis got rich on that endeavor because the cost to manufacture the oil drum was higher than cost of the stuff inside. I heard estimates back in the day that the oil in the barrel cost less than two dollars to get out of the ground. Now, with the growth of the world population and with China and India’s (the two most populated nations) desire to live the life of the US middle class of the 1960’s. This increase in demand will surely will out pace all of these “wild cat” discoveries. I would guess that it is safe to say that the cost of fuel will surely rise.

Open pit mining, the necessary rock crushing and consequent floatation-cell separation, and all the rest – are fablulously more energy intensive, capital intensive than mining practices a century ago.

That has not stopped the price of metals from declining — severely — in real terms.

The low cost Saudi crude has to be balanced, in the modern era, with its Social Overhead. Namely, the King is COMPELLED to hand over lifetime annuities to the new born locals. This social contract makes the TRUE export nut over $80 per barrel!

The upshot: KSA can’t bear to have prices move much lower than current without having to tap into their rainy day fund. The native population is still growing exponentially — though not as fast as before.

===

On the other side of the equation: the consumers are embracing digital technology to trick more efficiency out of fuel burning devices — especially heat engines.

These ‘smart engines’ are more than negating the effect of increased drilling effort. The energy intensity of America’s GDP has shifted lower, going back two generations.

The very first oil, Drake 1859, was used with staggering inefficiency. Only animal labor was used to drill for it. The energy-in vs energy out equation was never more extreme. It’s been downhill, for the equation, ever since.

Yet, in all that time, drilling and consumption have never abated.

So far, I’d have to call it a wash. Energy consumption to produce the resource has been balanced — and then some — by energy efficiencies during ultimate consumption.

This extends to such things as drastically improved home insulation. You would not believe how many residences have no insulation at all. I once had an apartment that featured insulation only in every other stud bay! The builder simply cheated.

In older homes, (See: This Old House) insulation was not even on the schedule.

As long as such easy efficiencies can be had, the punishment at the well head can be offset in the larger economy.

BTW, for poor Energy-in vs Energy-out — check out solar cells. The manufacture of polysilicon is much more energy intensive than reducing aluminum! The Chinese are using massive amounts of dirty coal to fuel this export.

The soot of said power plants is the PRIMARY driver of melting Arctic ice sheets — since Chinese soot drifts into northern latitudes — and in scale, too.

Soot melts ice like crazy, of course. The connection is rarely made, of course.

blert – I am going to give a simple answer in hopes that I will lead by example and you will answer just one question…

Precious metals are really not that precious. All the metals mined since the beginning of time still exists. They are not consumed. All of the oil/gas/coal mined since the beginning of time does not exist with few exceptions (strategic oil reserve). Fuel is consumed and is permanently lost as kinetic energy, heat, etc. to the universe. For all intents and purposes neither is a renewable resource in human terms. Ergo, you are comparing watermelons with tornados…

A shocking fraction of hard rock minerals are permanently lost — in economic terms — as they end up in our land fills.

Silver is almost at the top of the list. When it’s used — say PV arrays — the actual amount, per item, is too small to justify recovery. It just ends up in a land fill.