7 charts exploring the U.S. housing market – Bank of America bad bank model and leaking out $1 trillion in mortgages over 3 years. 7 million loans non-current in U.S. Option ARMs winning prize for worst performing mortgage product ever.

America’s largest bank is now offering a hint at how long it will take to off load the shadow inventory. In a shockingly under reported story Bank of America announced plans that they will be splitting off 6.7 million mortgages with a face value of $1 trillion into a bad bank model. The aim at least from some reports is to sell the portfolio out over 3 years. Now on the back of this, we also received information from RealtyTrac that nationwide foreclosure activity plummeted in February. This is interesting given that there is little success in saving loans but speaks more to the new strategy banks will be undertaking in dealing with the large shadow inventory. The bad bank model might also be a reason why we’ve seen more action in the market with banks leaking out properties in a methodical effort. Could this be a way to test the water?

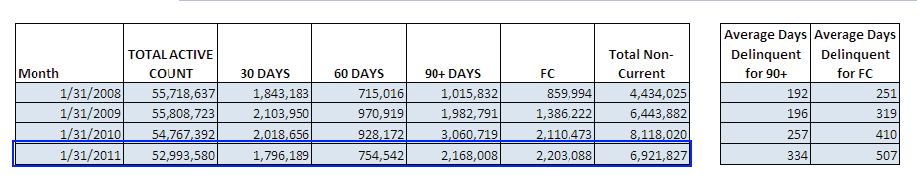

Exhibit #1 – Total distressed inventory

Source:Â Lender Processing Services, LPS

The foreclosure pipeline is full. At the end of January 2.2 million homes were in foreclosure. A total of 6.9 million homes were non-current. Although this is significantly lower than the 8.1 million in 2010 the actual number of foreclosures is peaking. Why? These are the properties moving through the shadow inventory pipeline. This is why we are seeing more and more homes hitting the market with lower prices as banks get more active reducing their inventory. The backlog is still too high.

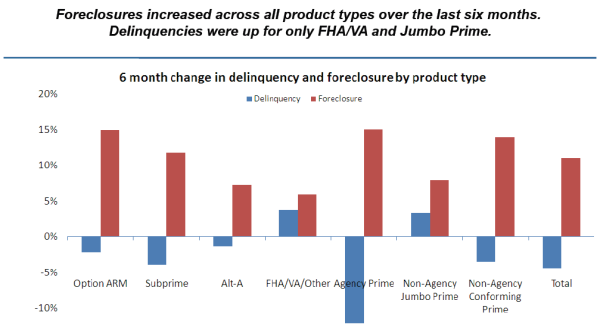

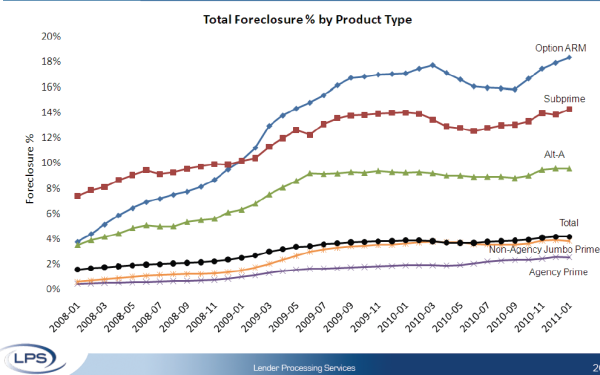

Exhibit #2 – Foreclosures increase across all loans

Source:Â LPS

Every single category of loan has seen a sizeable increase in actual foreclosures over the last six months. This pretty much coincides with the data we are seeing in the California housing market. What is troubling is the increase of both delinquency and foreclosures for FHA loans. What this means is the distressed inventory for these loans is increasing and these are incredibly popular in California.

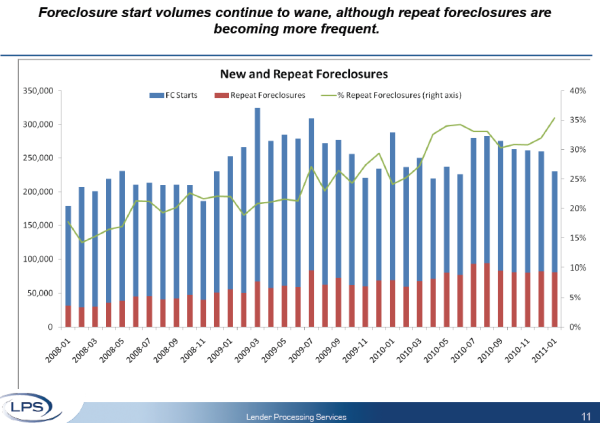

Exhibit #3 – Repeat foreclosures soar

The failures of HAMP and other modification programs are highlighted above. There is very little that can be done for someone who took out a $750,000 mortgage with a $75,000 annual income via an option ARM. Many of the homes that enter into modification programs usually end up re-defaulting. What this tells us is that the home price and mortgage balance is too high even after modifying the loan. The solution? Lower home prices and solid wages.

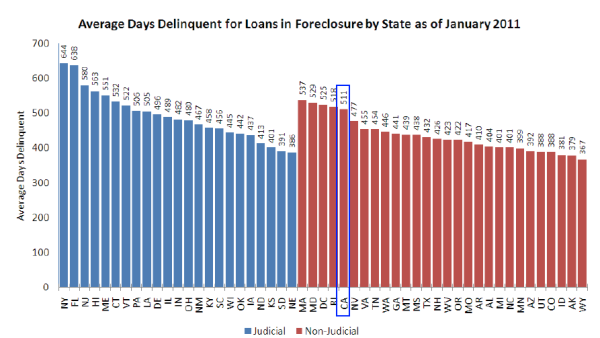

Exhibit #4 – Average days delinquent

This is a troubling chart. The average number of days a loan is delinquent in California is 511 (New York is up to a whopping 644 days!). The reason we are seeing the above is because of the massive Ponzi scheme banks were operating. Foreclosures usually follow a common pattern over a set number of months. Here we are looking at over 17 months before the process concludes on average so you know there are loans that are 2 years in the process.

Exhibit #5 – Total foreclosure by state

[total foreclosure by state]

The above chart is useful in telling us how many homes are in distress. Let us run the numbers for California:

Total mortgages:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 5,374,216Â (Source:Â U.S. Census)

Delinquent (9.3%)-Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 499,802

Foreclosure (3.5%) – Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 188,097

I ran a query for scheduled auctions and bank owned homes and found 195,189 so the figures seem to be aligning. More and more of the shadow inventory is coming out into the open. The bigger pipeline remains with the delinquent loans and with the bad bank model we may start seeing a more steady stream of these homes hitting the market.

Exhibit #6 – Option ARMs still causing havoc

As we speculated a few years ago the option ARM would end up being the worst performing loan on the market and that has come to fruition. The option ARM, with 50 percent of all outstanding loan volume in California, is by far the most toxic of the loans. According to the data roughly 1 million loans are categorized as option ARMs (out of 52+ million). So the question we should ask is how much of the current California shadow inventory includes higher balance option ARMs? Given the bad bank model and Countrywide Financial’s fascination with Pay Option ARMs the amount can be significant:

“(NY Post )Bank of America is ripping a page out of Citigroup’s playbook in an attempt to salvage its own mortgage fiasco.

The nation’s largest bank will separate some 6.7 million souring mortgages — many of which it inherited from the acquisition of Countrywide Financial — and place them in a “bad bank” with an eye towards selling them over the next three years.

The toxic loans, which have an outstanding principal balance of $1 trillion, represent about half of the bank’s 13.9 million mortgage portfolio.

BofA executive Terry Laughlin is expected to manage BofA’s so-called legacy assets, which consist of a mix of loans that are 60 days or more delinquent.â€

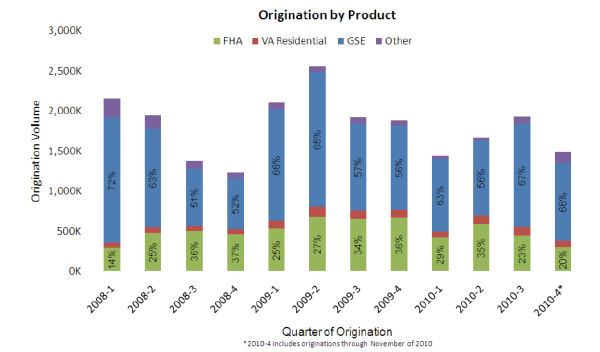

Exhibit #7 – Government owns the mortgage market

Source:Â LPS

The government by far is the biggest player in the mortgage market. Last quarter it stood at 86 percent of all loans originated. In Q2 of 2009 it was at 92 percent. Make no mistake, the government is the housing market right now. However with FHA insured loans defaulting in larger numbers guidelines will tighten up. We’re already seeing signs of that and the housing market is slowing down yet again.

What do the above charts combined with the bad bank model show us? The shadow inventory will be leaked out into the market over the next few years and prices are likely to move lower all along the way. At least that is the ideal plan while the quality of life deteriorates since this doesn’t happen for free. The Federal Reserve keeping rates artificially low and bailing out the banks has a longer term cost. We are seeing it creep out in many different arenas. An unforeseen crisis can throw a wrench into this slow housing deflation model and we are seeing problems hit again in Europe. Spain for example has recourse mortgages where people cannot walk away. It seems we have the opposite where anyone can walk away from any mortgage without a second thought. Maybe a middle of the road approach is better like asking for a 20 percent down payment and then you have the right to walk away.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

47 Responses to “7 charts exploring the U.S. housing market – Bank of America bad bank model and leaking out $1 trillion in mortgages over 3 years. 7 million loans non-current in U.S. Option ARMs winning prize for worst performing mortgage product ever.”

Good post.

Its the first time i see a big USA bank come forward in public wiht the real scale of this housing mess.

Basicly they say if we hold this on the books we bankrupt cause it would wipe out their capital base. Lets assume this toxic mess from 1 tril has a hidden loss in from 50%. Optimistic even cause till now they been hiding it under the market to fantasy rules. So thats 500 bil they should have to write down. Impossible ofcourse would take decades to clean and would destroy the bank overnight.

This bad bank idea might well save the good bank. Real question is who gonne pickup the loss and what will it mean for house prices when this surplus supply gonne hit the market.

With a USA gov that already has a 1,5+ tril deficit and no political will to balance that i not sure if they can support more extra QE to clean up the banking mess ( estimated between 3 and 5 tril needed just to save the banks). Addup the GSE mess running into a few tril too.

If they print all those dollars the dollar will fall like a rock -50% at least.

Leaves the next option let the investors take that loss. That means pensionfunds all over the world mostly and other investment funds.

Last option is just let the banks go bellyup and others will stepin and buy all this mess for whats it worth.

Either way this has to be resolved cause doing nothing is only gonne make things worse.

Anyways good things all is now out in the open.

For all their “honesty” about the mortgage loan situation, it is highly annoying (all I can say without bursting into an unrestrained profanity laced raging rampage) that now banks are going to be allowed to say “Oh, we are just going to put all our expenses over here. See, we are doing wonderful. Where are our bonuses?”

I would like to put my student loan in a Bad Marc. “Oh, sorry, you want payment on the student loan? Sorry, that is Bad Marc’s responsibility, I am Good Marc”

What drives me even more nuts is all the blind, foolish retards that talk about capitalism and free market. This economy is nothing like a free market or a capitalistic market. It’s a fraud wrapped in shiny capitalism and free market paper.

It is quite disconcerting how the goings on in our economy is essentially the same level of deception and fraud that was at the core and rotting away the Soviet economy.

Visions of Bruce Campbell in Army of Darkness….fighting himself….”I’m bad Ash”…..

Funny but sad.

lolol! A Bad Marc…that’s funny. Really. I wonder how long it will be before the market realizes that none of the issues of the last crash and the recession were resolved.

As a 16 year old kid in 1978, I was laying on a bed reading an issue of Time magazine about the Soviet Union. Although we certainly had inflation in 1978 of around 7%, it was much much worse in the Soviet Union.

The article made fun of the fact the Soviet situation was so bad that, to hide some of the inflation, food packaging was getting smaller to help hide the true amount of inflation.

At the time in 1978 it seemed insulting to everyone that anyone would try to hide from grown adults the effects of inflation by reducing packaging.

Times have changed. After all, we have a growing group of people, the “Tea Party”, who have voted in people who will protect the wealth of the top 1% at all costs, even at the cost of our children and our social fabric.

Times have indeed changed, today, what is the big deal about a little deception in packaging?

Martin, are you serious that the “tea party” is the evil that is protecting the wealth of the top 1%. Why don’t you look at the Democrats and Republicans, they have been at the helm for the last few decades while all this mess was brewing. And don’t forget who the biggest donor was for Obama…oh that’s right the evil Goldman Sachs corporation.

Face it, our current political parties are nothing but a bunch of whores who will sell this country down the river so they can get their moment of power in. You need to really open your eyes before going after the tea party. If anything, the tea party is trying to reel in the status quo in American politics.

Let’s see what the status quo has gotten us: a debt that can NEVER be repaid, a lower standard of living for future generations, deteriorating education system, sad values and morals, hell we can’t even put a human into orbit after the next shuttle flight. That awful tea party is the blame of it all. Man, wake up and smell the coffee!

True-Daat. For the dumb surfers (like Me)> Free-Market: see craiglist, free people making free choices= price efficiency. Highly regulated, corrupt cronyism= overpriced & inefficient.

Now the big banks have found away to unload mortgage junk a second time. Instead of slicing and dicing mortgages into deratives, they will sell large chunks of homes to investment groups. I wonder how they will figure out to hide the losses this time. As long as FHA is sucking in more people at 3.5% this game continues. The reason we are seeing all this BS is because the real estate market SUCKS, and it will for at leat another 3-5 years. Anyone buying now is just a fool.

http://www.westsideremeltdown.blogspot.com

The market conditions along with government lending polices continues to create underwater homeowners. A market segment ignored in Calif is the impact these lower property values will have on investor owned RE held for rental whether purchased for cash or leveraged. Most rental property is still negative cash flow in Calif and all investor buyers expect RE to rebound within a relatively short time span say 5 to 10 years yet the possibility exists that we could have deflating to flat home prices well beyond investor time horizons producing some very uncomfortable financial results.

1. Yet Another excellent encapsulation of the situ by Dr. HB;

2. While I am part of the small but growing chorus shouting the anti-NAR, anti-bankSter line, and bemoaning the artificial supports and slow leaking of the not-so-shadow inventory… can we discuss the *realpolitik* of why it *might* be positive to NOT ALLOW THE SUDDEN, FREE-MARKET DEFLATION/COLLAPSE of the residential (and commercial) RE markets?… why the current PTB manipulations *might* have some merit?

Given the staggering 10^12 $$$ amounts in play/peril, most employment sectors in my non-industrial area seem stable, esp. telecom and healthcare. Neglected, poorly-managed hotels/motels/apts. are moving from weak (hit-the-ATM) hands to stronger (refurbishing) hands… gradually. There’s CAUTION on the “street”, but not PANIC.

The economy can recover sooner if we allow the market forces to act freely. The sooner house prices fall back to normal prices the sooner we can recover. In fact, the cheaper housing is the more disposable income people will have to spend and regrow the economy. Slowly leaking out inventory will only prolong the housing downturn for years to come. Borrowing trillions of dollars by the Federal Government to prop up the economy will only bring USA closer to bankruptcy.

Don’t let the Banksters fool you thinking that

Yes, that’s certainly the conventional wisdom, but how BAD will things get during that “sooner rather than later” scenario? What metrics can be applied to DISRUPTION, i.e. RIOTS?

The Yalie Skull & Bones supercriminal banksters running the planet probably gauge these things all the time; see Egypt, Tunisia, Paris, etc.

@Enzo: The only positive thing is that it buys people a little more time, in the false hope that a miracle will occur and fix things. The basic fact is that you can’t fix excessive debt (especially bad debt) with more debt. Eventually the piper has to be paid. The problem is that, by kicking the can down the road, the problem gets worse. And the impact will be worse.

Had the Banks been Nationalized two years ago, we could’ve cleaned up this mess, and we’d be coming out of this by now. Instead, we’ve got more pain, for more people, for a longer period of time. And we haven’t gone through the worst of it yet.

I do hope people are making the best use of this time while they can. The key thing you can do is to get out of debt. And make sure you have plenty of food. Note how quickly stores can be cleaned out, as is happening in Japan.

@Dr HB. This is the best article that I’ve seen on the Bad Bank situation. Note that what the Fed will probably do this Summer is a “sneak QE” in perpetuity. It’s starting to dawn on people that the Fed is getting enough “income” from all of their obligations that QE can go on without purchasing Treasuries and Stocks via money conjured from thin air.

The only question remaining is how long the Bond Market will let them. Given that the world’s largest bond fund announced last week that they were completely out of long term T-bills, this isn’t looking good.

I dont know, what is better: Having cancer for one day then die. Being unemployed for one day, or being unemployed for several years? The fear that the world would end “if we didn’t do SOMETHING” or let the market function, is STUPID.

That bar-graph, by state, of avg. days “squatting”, is stunning, but actually understated in many ways. In my state (FL), I can tell you the more rural counties, and the few with “rocket dockets”, are keeping the avg. down to “only” 638 days; in the urban/glam areas, it’s more like 800+ days!

What’s educational for me about that bar graph is that there’s really no significant difference between the judicial vs. non-judicial states, which is further indication that it’s the BANKS that are foot-dragging, not the state.govs…

ALSO think about the artificial support the consumer economy is getting from all those squatters not paying rent/mortgage, and what happens to that when they finally have to pony up some monthly rent. There’s no squatting in a rental in FL–you can be evicted in 10 days, sometimes LESS.

I am amazed that there are only 3.5% foreclosures.

I expected about 50%

In California, I agree. 50% is probably close to the number of people who are deep under water. Maybe not so much in the rest of the country though.

Once the banks get a strong balance sheet, then they can unload the bad properties and take their losses. Remember who runs the place(the investment bankers, e.g. Goldman Sachs. )The Fed is working to help their member banks make big profits and strengthen their balance sheets. When the banks really unload the bad mortages-houses, that will be deflationary and good for first time home buyers.

As for the those jobs that went away. Home construction is about 1 million below normal. That is about 5 million jobs if you do the math, 5 people to build a house per year(got this from somebody in the industry). Of course a lot of these workers went back to Mexico(remember they came here to work). It’s funny that the crime rate went down during this depression.

you’re assuming equities will play nicely in the whole equation bank recovery equation. i think it’s more probable to continue to see a slow release than banks releasing larger quantity of homes due to bank prosperity

[i]It’s funny that the crime rate went down during this depression.[/i]

“Funny” indeed! If true, rather counter-intuitive… and good ammo for Strong Borders Party. ;’)

Might also lend to the *possible* wisdom of Duh Fed’s current slow-mo-zombie path, i.e. social stability in our post-moral age. =:O

“Once the banks get a strong balance sheet, then they can unload the bad properties and take their losses.”

Since the Banks are currently cooking their books with market-to-model accounting, and are currently insolvent if they used the standard mark-to-market accounting, when pray tell might they become solvent again? Or do you mean having a strong balance sheet by using fraudulent accounting?

It seems to me that they aren’t going to have strong balance sheets via honest accounting without the taxpayer forking over trillions more.

And you also need to consider that they’ve started gambling again, since they have learned that they are above the law and can have the taxpayers pay for their gambling losses.

In light of this, I really don’t see how anyone can believe that they are going to have real, honest strong balance sheets any time soon. I daresay it’s a delusional view.

In a free capitalist society like the U.S. (are we still one?), it has always been the case that one man’s loss is another man’s gain. While feeling sorry for the plight the homeowners suffer because some of them have their homes foreclosed on or some lost a lot of equity, I can’t help but feel happy for those who couldn’t afford and now can afford a home for their families. Any effort to manipulate the market is unfair to this group of people who need to have a voice in this housing debate.

I met with a guy at B of A and was told that all the public numbers are SEVERELY understated.

Just remember this…

There are far more people who AREN’T making payments that don’t show up in the 30-60-90 day late NOD figures as the banks haven’t issued a NOD for them yet. You won’t have any indication of them being “shadow inventory”

We’re not being shown even half of the “distressed” homes out there. I know of a few “distressed” borrowere that don’t show up at all in any of the so called “official” figures.

This party is just getting started.

foreclosure rate will be closer to linear than exponential. the party started a long time ago, and it’s in full effect now.

Can you back that up? In my state/locale (Miami-FtLaud-WPalmBeach), there’s typically a HUGE lag ‘twixt NOD and Lis Pendens, and YEARS ’til the actual foreclosure gavel slams down, but in all my nosing around, I haven’t uncovered a single case of the lender NOT sending at least one NastyGram (NOD), either Registered Mail, or tacked right to the front door!

The parallel UNreported story here (and elsewhere I’m sure) are the squatters who are NOT paying their mortgage, but ARE paying their property taxes! I guess the county tax collector isn’t particular about if the moo-lah comes from the escrow company or duh squatter… long as .gov gets theirs, a tax lien foreclosure–which happens much swifter than the bank kind–is one less thing prying duh Option ARM squatters from “their” home. ;’) Scrambling and gaming, zigging and zagging.

There’s no place I can point you to verify people that aren’t paying but haven’t received their NOD yet. I can only go off what people have told me about their own situations and what I heard from the personal banker/financial advisor at B of A wrt his clients in my neighborhood. He wouldn’t tell me who they were but stated that his clients were just a few of many. So, once again…no “proof” but from what I’ve been told it’s good enough info for me. I did find it suspect that none of the “services” had any NODs listed on non-arterial streets here in my neck of the woods in Los Angeles (Hancockl Park)

YMMV

And even if these people do get loan mods/principle reductions on their underwater homes, many of them will be liable for taxation on that forgiven debt. Only forgiven debt on money borrowed to purchase or improve a PRINCIPLE RESIDENCE is free of taxation. All the pretenders who bought multiple properties, cars, TVs, vacations, etc with their refis/helocs are going to have to pay tax on that forgiven debt as if it were regular income. Their struggles are far from over.

I thought only the loans that have never been refinned are eligible for principal reduction which is not subject to income tax until 2013.

If one felt like tracking the unemployment in Socal, they should have been tracking the amount of vacant seating inside Starbucks, over the past three years.

In the past year it’s been nearly impossible to get a table inside, between the hours of 9 am. through about 11. Every table is taken and people are waiting. I can only guess that this is the newly unemployed, who have no job to go to, time on their hands, having coffee in the morning. Since Starbucks is such a hot stock, I would argue that unemployment, benefits the coffee shops, whose business has really picked up in the mornings, which seems counter intuitive.

Umm, my observation re Starbucks is that the place is packed when the kids are in school. I used to spend a lot of time there using the wifi but stopped cuz I couldnt get a seat with all the kids doing their homework! So, personally, i dont really consider the SSI (Starbuck Seating Index) as a good indicator.

Dr., this site is amazing. I don’t know where you get all of this info, but I look forward to your posts. Too bad the people in government don’t have this kind of intelligence.

Did anyone catch B of A CEO on cable news Wednesday saying that the bottom has been reached …there is 8 months of inventory to get through and the market will start to normalize … While on another channel, a so call “Expert” said we have more than 60 months worth of inventory nation wide in all phases of the pipeline. Same day, same time, different channel, different motivations = B of A lies!

LOL/COL… SNAFU = Situation Normal-All Foozed UP! I’m still cracking up about Jim Cramer, Clueless Bombast of ‘Mad Money’ fame, back in the dark Lehman-tanking days of Sept. ’08, predicting TIME AND TIME AGAIN, that housing (prices) would bottom in July ’09!!!

Recourse mortgages are even worse stealing than that that happens in California: if you miss even one payment, for whatever reason, bank may take your house and auction it to anyone it likes, almost every time to itself by middleman.

So bank gets the house, your share of it and you’ll be in debt to bank for the major part of the price of the house. Forever. Add interest and other expenses and you’ll pay (if you ever can) twice the price of the house to that bank: Bank itself has no responsibility of to whom they loan and zero losses. Usually they profit a lot for this kind of operations.

An (quite real) example:

You’ve paid back 50% mortgage of $200 000, so you owe 100 grand. You’ll miss a payment (for whatever reason, a traffic accident is enough) and bank takes your house and auctions it for $10 000 , so you owe $90 000 more + expenses. (There’s never any announcements for these auctions, cash only, payment on the spot, so price is _always extremely low_: Bank really, _really doesn’t want anybody to come to these auctions_, it wants the property to itself, practically for free. Via a middle man of course because it’s illegal that bank buys it directly).

Already paid $100 000 is now your loss and on top of that you owe $90 000 + expenses + interest for a house you don’t have anymore.

Bank instead got a nice house worth of $200 000 with $10 000: Your $100 000 loss paid 50% of the house on spot and the resale price for the house brings another 150 000 cash in. That’s $40 000 profit. With zero risk. If you ever pay that $90k back, _it’s all profit with interest_ and that’s the icing on the cake. For the bank.

That’s a _profit_ of 130 000 for one mortgage of 200 000, not bad, isn’t it? Profit margin is whopping 65% (Remember that mortgage owner pays all expenses, so it’s all profit).

If that’s not stealing I don’t know what is. All hail banks, those semi-legal thieves.

All of this is totally legal which tells to me that laws are bought by big money and citizens have zero effect on them, no matter who you vote: Big money owns everyone who has name: They are all for sale, just price varies.

“It is quite disconcerting how the goings on in our economy is essentially the same level of deception and fraud that was at the core and rotting away the Soviet economy.”

Yes, oligarchy on the top and too big to fail industries are the same basic recipe which killed Soviet Union. It had been dying since 1970s, so it took 20 years. I don’t doubt that it will take at least as long with US. Unless China decides to dump its dollars, then dollar is finito in weeks and along that, the US.

“BOA mortgage holders may get help”

KIHEI – State Rep. George Fontaine is working with Bank of America to coordinate assistance to BOA mortgage holders.

Fontaine, who represents South Maui, will have access to an exclusive bank hot line on behalf of constituents and other Maui homeowners who are having difficulties with their mortgage payments. BOA’s goal is to establish contact with the customer within one business day, and to provide a response the legislator’s office and to the borrower within 20 business days on the specific issues of the inquiry.

While specific outcomes cannot be guaranteed, the goal is to have Bank of America develop a solution that allows the homeowner to keep a roof over his or her head.

Fontaine said, “I am glad to be able to offer this service to homeowners on Maui, and I am pleased that Bank of America is making a proactive effort to work with families in Hawaii to address their mortgage problems.”

Starting in April, Bank of America will have a team of representatives out in the community to meet one-on-one with homeowners. Fontaine’s office will facilitate arranging those meetings. Call Fontaine’s office at (808) 586-8525 or send e-mail to repfontaine@capitol.hawaii.gov. Homeowners will be asked to complete a simple one-page form.

All personal and financial information will be handled in a confidential manner.

“While specific outcomes cannot be guaranteed, the goal is to have Bank of America develop a solution that allows the homeowner to keep a roof over his or her head.”

Translation:

While it’s hard to tell how many debt slaves we will be able to create, the goal is to have Bank of America develop a solution that allows the homeowner to remain financially shackled to the roof over his or her head.

Here’s my comprehensive chart of the housing market’s outlook, formulated after much exhausting research.

http://jimmy8wong.com/wp-content/uploads/2010/01/line-graph-down.jpg

Here is an absolutely excellent article about public sector pensions and how the public sector workers are going to have to wake up and smell the coffee in the realization that they will have to take pay and benefit cuts. They have been promised too much for too long by irresponsible governmental agencies.

The article states:

Public sector workers everywhere will need to accept the reality of:

lower incomes,

lower pensions,

lower benefits and

lower living standards.

These new realities are coming our way in the near future. They cannot be circumvented.

I think of how many jobs will be affected by our national financial crisis. Think of all the “governmental” workers (federal, state, local level):

federal government workers, military, state government employees, teachers, postal workers, city government employees, policemen, firemen, garbage disposal workers, prison guards and workers, county workers (who really work for the state), etc…. This is big! Real big.

So all of these (millions of) people working for lower wages, and lower benefits will reduce the standard of living in this country, and will certainly drag down housing prices.

http://financialsense.com/contributors/arnold-bock/day-of-gold

Very good short article – well worth reading!

I wonder who is behind your “article”. It certainly is not a mainstream news article. It does smell of propaganda to me. Just the way it is written. It is disingenuous to bemoan that small govt can’t print money while the feds can. Printing money is one cause of the Federal Govt’s problems in the crises. That is referenced by many posters here and many respected economists. The articles line of “union muscle” is pure and simple fear mongering. It is no more valid than “corporate muscle”. Unions, by the way exist because individual workers are powerless before giant companies. Finally, in light of how the wealth in this country has migrated to the wealthy and uber wealthy. Check the charts in this article: http://motherjones.com/politics/2011/02/income-inequality-in-america-chart-graph Your article has the stink of a Koch brothers agenda.

All this said, the middle class losing money in these ways will have or should have an effect of lowering the price of housing. Destroying unions will have a greater price – turning America into a third world nation. You (nor I) will like that if and when it happens.

I can attest to the no notice of default. My husband and I are CA teachers who were stupid enough to buy a home in 2006. We put 20% down and had a fixed rate. Since then we have had two pay cuts, and have had a son diagnosed with Autism (Autism is expensive). Wells Fargo is our servicer but we are owned by a private security. They told us they will not modify as our payment is still onlyl 41% of our income and they consider our sons therapy a “lifestyle choice”. Let me tell you it was not a hard decision at that point, our son’s future or a house that is underwater 200k. We stopped paying in Oct and havent heard a thing except that they were honoring our request to be removed from the short sale program. (We were never in it). Our next door neighbors are in trouble due to an ARM reset and they too have recieved no Notice as well as 5 other neighbors in similar straights for various reasons. This is No Cal.

Thank Ann. Very interesting.

Thanks Anne.

I sure wish more homeowners in your position would “go public” with that information. It’s amazing how much information the banks are hiding from everybody.

Ann,

Wish you and your spouse strength, hope and faith grows as your son grows.

Ann -I think housing is absolutely HOPELESS. Your story and that of your neighbors seems to confirm that! When the cow poop hits the fan, it will be a DISASTER. Think tsunami. Think A-bomb. Think Armageddon (in the housing sector).

Thanks Dr. HB, this is the most interesting website on the web. How else are you going to figure out why consumer spending seems to be increasing when debt levels are so high, and the real direction of the US economy. Thanks Ann for sharing, that is anecdotal evidence, but seems to verify what I have been thinking. It is going to get much worse, it will be interesting what happens when Japan starts investing in its own infrastructure and isn’t buying US treasuries. Will interest rates go up?

Provably Fair Gaming, 0.5% House Edge

https://crashdice.com

Leave a Reply to Polo