What happened to the traditional home buyer? California has the highest percentage of young adults living at home with parents. Existing home sales collapse.

Existing home sales continue to operate in an anemic range. The latest existing home sales figures show that sales volume is back to where it was in July of 2012. A large part of this is due to higher interest rates, investors crowding out regular buyers, and prices outpacing stagnant incomes. It is surprising that somehow people believe that prices can simply go up untethered to actual incomes especially in an environment that looks to have higher future interest rates. When we look at futures data the market is now pricing in a 100bps move in interest rates higher over the next year. The so-called traditional buyer has been a weak participant. The investor crowd is already showing signs of exhaustion and this may be a problem given that they are purchasing roughly 30 percent of all existing inventory in the market. The traditional buyer is tapped out. Mortgage gimmicks to hide stagnant incomes can only go so far. The drop in existing home sales is a reflection of shifting investor demand, stretched household budgets, and low inventory because of banking policy implemented after the Great Housing Crash of 2007. Will we see traditional home buyers again as the bread and butter of the housing market?

Existing home sales plummet

The latest existing sales figures show a very weak housing market. Existing sales registered their weakest month since July of 2012. When we look at sales since the crash we realize that the market has transformed into a different kind of beast.

First, let us take a look at existing home sales:

We had two euphoric housing trends since the crash. The first was courtesy of low prices and the tax credit incentive. This pulled forward demand for a brief period. Then, we had the low rate party and massive investor mania that pushed home sales to another short-term peak in the summer of 2013. So where do we go from here? It is rather clear that home prices at current levels with current rates are actually making it unaffordable for many first time home buyers to jump in. The bond markets are getting impatient with the Fed.

Young adults living at home

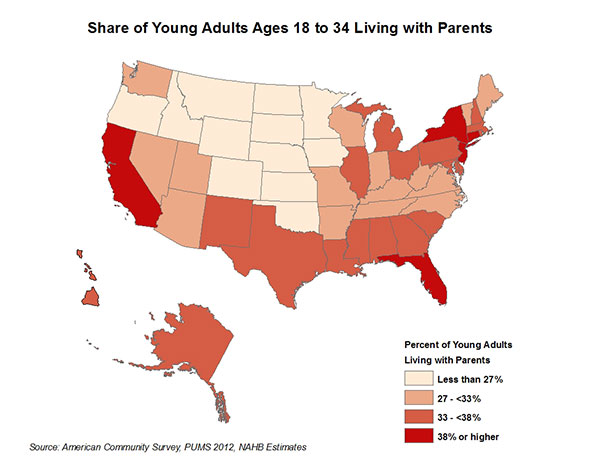

Where is the traditional home buyer? For many, they are living at home with parents. In fact, California has the highest number of young adults living at home:

This makes sense given the manic like market we are seeing across the state. In California, the market right now is being dominated by tight inventory, investors, flippers, and foreign money. In other words, the “traditional†buyer is really absent. You can see a similar pattern across the nation where states with higher priced housing tend to have a higher percentage of young adults living at home.

Smaller home size

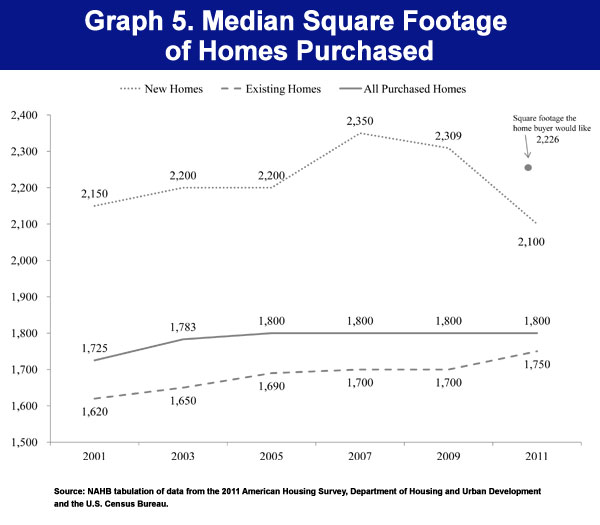

Another consequence of the Great Housing Crash is the size of McMansions. With smaller future households, why the need for a giant home? You can see this in the size of homes being purchased:

This dovetails with the lack of home building over the last few years. Why build if the demand has shifted? As we noted, younger households are less affluent and are struggling to buy a home even in a market where interest rates are historically low.

Many are shifting into a renter nation mentality. Also, of those 7,000,000 homes in the foreclosure graveyard how many are itching to dive back in? Never have we had such a deep and profound crisis in housing still very fresh in the memories of the country. The mindless nonsense of “you can never go wrong with housing†was completely shattered in this crash.

How long do people live in their home?

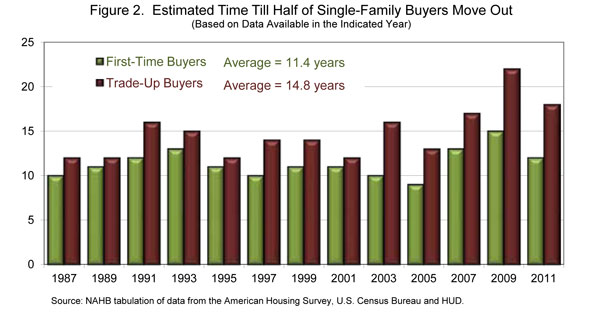

Contrary to the belief that people live in die in their first home, the average stay for a buyer is 13 years. This is even less for first-time buyers that stay on average 11.4 years in their first property:

This is why in manic California where crapshacks of 1,000 square feet are selling for $700,000 you have to wonder if people really believe they will stay put for 30 years? Deep down these people are actually planning for the property ladder game thinking that in 10 years, their initial purchase will now be worth $1 million and then they can buy the 1,800 square foot $1.2 million home with the equity that was created. This is carried out as virtual dogma to some.

The traditional buyer is largely out of the game in high priced states but this appears to be a nationwide trend as well. For states where investors are missing and “all cash†buying is rare you need your typical traditional buyer. The above statistics show a very weak market. In some markets, multi-year buying sprees of investors have made the “all cash†buyer the traditional buyer. The reason people are still looking deeply into housing is because something is amiss here.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

132 Responses to “What happened to the traditional home buyer? California has the highest percentage of young adults living at home with parents. Existing home sales collapse.”

Buy now or be priced out until Bubble 2.0 pops!

So you’re saying….”Buy now and be underwater for a decade!”

Underwater for a decade? Maybe longer…a LOT longer. Take a look at Japan. Prices/values back to early 1980s levels. That’s 3 decades plus of 0 price appreciation. FAR worse if you bought from the peak years, say around 1988-1992.

No question the traditional buyer is on the sidelines, they have money to buy but think 25 to 40% drop will happen again???

I can unequivocal tell you all this is never is gong to happen. Buyers and sellers need a meeting of the minds to hash out deals yes, but wholesale giveaways can’t happen because sellers have figured out eventually folks need a home and why should they leave money on the table, go rent or move in with relatives.

I look at it the same way as a car deal, if we have a profit left you get a car, if we make no money go walk and waste hours with another dealer, who pays the same price we do for the machine.

This is the most illogical post of recent times on this blog. Prices can, should, and will drop atleast 10%. Then become inverse to interest rates from there. Now 40%? Maybe not but not out of the realm of reality either, but the odds would be lower. Natural disaster, Fed blow up, etc etc…

But it is also NOTHING like a car deal. Wont even waste time picking that one apart, what a stupid analogy.

Little “r” – as usual, you are wrong. You need to study something that nobody likes to study, economic history. Every (with NO exception) boom has an equal and opposing bust. These micro transactions are just temporary background noise.

The Worldly Philosophers – not such a bad read. An oldy but goody.

http://www.amazon.com/The-Worldly-Philosophers-Economic-Thinkers/dp/068486214X

far from complete and doesn’t include much monetarist shite, but not a boring sketch of the history of economic thought.

BAHAHA, this clown lil r robert is hilarious! And he even compares selling homes to being a car salesman. That’s basically all a realtor/RE agent is.

And you really think it can’t happen?!? Believe me, there will be people who will be desperate enough to get whatever they can in a downturn just to get out. Can’t happen, IT DID HAPPEN ALL OF 3-5 YEARS AGO. 2009 and 2011 prices were down 25-40% in just about every single prime area, and MUCH more of a discount in shitty, ghetto and barrio areas.

CraigLister,

The biggest difference between 2010-2014 run up in prices and 2003-2006 run up in prices is that people lied about their incomes in the 2003-2006.. and no one checked or cared.

When your entire mortgage loan is based on a lie and you have nothing to lose… Why not walk away or sell for nothing! The BIG difference today is 70%+ of loans are 10%-20% down or all cash in the past few years. Sure the FED is still giving out 3.5% loans.. But they are still checking incomes and atleast being far stricter overall than 2003-2006.

Used house salesmen.

You are absolutely right. Prices can go up 25% but they can’t go down 25%. That is one of the fundamental laws of economics. Prices can only go up!!!!!

Yes that’s what everybody thought during the last bubble – prices can only go up! And if history teaches us anything… It is that it always repeats itself and we never learn… So yeah sure prices can only go up, go on with that and I hope it works out for ya!

And btw let’s see if your logic withholds during the next stock market crash which is just around the corner if you have been paying any attention. Come April/May 2014 and we are going to see the biggest crash yet… Let’s see whether it will be +25% or -25% for real estate… Adios amigos, I’ll be back in a few weeks so we can see where things are at and evaluate your illogical fallacy.

Fundamental laws of economics!!! LOOOL…would love to know what school of economics you attended! Too funny…

Buyers may or may not need to actually buy. Sellers may or may not need to actually sell.

You assume buyers need to buy but that sellers are never under any pressure to sell, which is erroneous. Though it’s certainly also not true that downward pressure on prices will necessary lead to sellers actually selling at lower prices. Some will certainly have the flex to wait it out and hope for another upturn in the market, and for those underwater even if they want to short sell, the bank may prevent it.

robert, there are to many unknowns out there, nobody can control the laws of supply and demand, they however can easily manipulate them as we have all seen over the last few years in our local and national markets.

You do have some good points and so does Longcat about the huge pent up demand, just remember if people see anything close to a 20% drop in prices due to one thing or another (rates up, inventory swelling & investors dumping) etc the panic kicks in and everyone starts to sell at the same time, even people who had no intension of selling jump on the selling band wagon, its heard mentality 101.

On the flip side if rates head south into the 3% range again which they might…the complete opposite will happen then the gloves are off in a big way and off we go again into bidding wars, ramapnt uncontrolled overpricing and crazy home buying euphoria. The only way that will come around is if the market gets artificially manipulated once again, so how long can this go on for?

Its going to be a very interesting 2nd quarter coming up, Logan Mohtashami just mentioned last week that the loan applications already in the pipeline for 2014 are adding up to be a very slow summer buying season.

http://loganmohtashami.com/2014/03/20/existing-home-sales-look-soft/

1- beware of anyone who tells you “unequivocally” what is going to happen

2- apples to cucumbers comparison

Hilarious! Dude, you have a ball and chain, I HAVE THE MONEY. I definitely don’t need to buy your crapshack! But unles you die with title, you need to sell that baby. And some of your ilk will need the money for retirement, some will get divorced and need to sell, some will get sick and need to sell…and some will lose jobs and need to sell. All the while, i NEVER need to buy. The sooner you figure out which way the balance is tipping, the better off financially you will be. As for me and my kind (those with the money to buy), we can wait you out. Capitulation may not be on the front of your mind, but it’s coming. I hope you realize that the music may stop sooner than you think and you will be chasing the market down. Meanwhile, I have what you might want and need, and I have no interest in paying top dollar.

I’m curious – by “wait you out” do you mean that eventually you ‘would’ want to buy?

That’s a lovely song to sing while we are making piles of cash in the stock markets. We must remember that our assets are much more liquid than a house. Houses are an emotional asset. So, while we pound our chest about where we’ve chosen to put our money we should be keenly aware that rapid price changes are not likely in housing, but a flash crash could wipe out our positions in a few hours.

There is also a floor in housing created by Mark to fantasy. Under water sellers, don’t sell. They foreclose, and foreclosed houses aren’t in the market for the price you want because banks have NO pressure to sell due to Mark to fantasy. Buyers that got good prices aren’t selling. In short, if demand at these prices sinks then my expectation is that supply will as well, at least in the thriving parts of the country. Prices went far below rental parity. Now they are essentially at rental parity.

What I am seeing from the “smart crowd” is that they have found a way to rent/live with reduced cost. Sweet deals from friends or living with parents or in crowds. They are saving their money, and want to buy. Their analysis is skewed because of their very low housing costs. They think hey, I’m paying $700 to live, and a decent house would be $2800 THAT’S CRAZY! However if they were renting a crappy 3/2 in Irvine for the going rate of $2500 it would not be a shock. In the mean time they just save, and in my opinion that’s a good thing, we need more savers.

“They think hey, I’m paying $700 to live, and a decent house would be $2800 THAT’S CRAZY! ”

Half-truth. With their income $2800 is crazy and that’s no “thinking”, but economical reality.

@Un qualified buyers no that I’d not what caused the hiding crash. That’s what you heard on tv caused the hiding crash but I guarantee you it wasn’t caused by people lying on their loans. That was not what caused or global financial crisis! It was the selling and reselling and reselling of the Notes the banks suckers borrowers info putting up the only thing the banks valued, The Notes. It was derivatives to a quadrillion. That’s not an exaggeration either. The banks took 30% of that up front the day the borrower closed escrow. It www a scam. It was a scam! Biggest heist in us history. Don’t blame the victims.

Sorry smart phone isn’t very smart and changes my words to what it thinks I want to say. Hope you can interpret my comment. lol.

Damn right Lynn. If I remember TARP or the first stimulus package was greater than the total of all active mortgage loans in America. This whole affair since 2001 has herb theft in broad daylight. We’re in the 14th year of an engineered recession who’s only purpose is to keep asset prices high and wages low to preserve the global power structure that the internet was going to deliver the death blow to. WW1/2 prevented mass production from destroying class divisions. Gotta destroy excess production instead of giving the serfs a rise in living standards. Eisenhower and Kennedy had us on the right track and were probably the last REAL (IE not corporate or banker puppet) presidents we had.

” No question the traditional buyer is on the sidelines, they have money to buy but think 25 to 40% drop will happen again??? I can unequivocal tell you all this is never is gong to happen.” (THIS IS COPIED FROM THE BLOG POSTER ABOVE)

———————————————————————————————

JUST A QUICK REALITY CHECK:

(1) Don’t forget the 1990’s Real Estate Bust that hit California very, very hard.

Properties remained unsold for a long time ..even though prices were 50% discounted from last sold prices. In some parts of San Gabriel Valley, every third house had a “for Sale sign” on the lawn …. and many homes were VACANT FOR YEARS.

EXAMPLE: I bought my Vacant house from a Bank … and I offered them $20K lower

than asking. The bank took a LOSS OF $200-K. ( True story )

(2) The 2008-2009 REAL ESTATE NATIONAL IMPLOSION is much, much worse … the difference is that Banks are being FORCED to DELAY FORECLOSURES. In the 1990’s the Banks just dumped all the properties rapidly — in large quantities.

(3) People must buy FOOD, must have clothes, must have temporary Shelter and they can stay with relatives and friends ….. BUT THEY DON’T HAVE TO “BUY” A HOUSE. Purchasing a house is a LUXURY and NOT a NECESSITY.

=========================

False paradigm. People don’t “need” houses. They need a place to live or shelter. People often buy houses to increase space (a three bedroom home for a family of 3 instead of sharing a single 1 bedroom apartment, for instance) or kids moving out of the parent’s home.

It’s similar to someone “needing” a car. You can ride the bus. It’s not luxury, but economic downturns mean less people “need” houses even as the number of people stays the same (or grows.)

Despite or perhaps because of tighter lending rules, the impending decline can still result in economic duress for owners and sellers who thought they could refinance in the next big boom (and are overleveraged) or bought investment properties that don’t “flip” or simply need to move. I’m already seeing some of the latter in the DC metro region as owners put up their long sitting homes for rent and the rental market expands. This drops rental prices and demand for housing creating a feedback loop effect.

They really should build 1200 to 1500 sq ft homes, why do they only build large ones? Even now I see new construction and it’s all large homes. You don’t need 2000 to 3000 sq ft. It’s nice if you have a good job and earn it, but generally and on average it’s too much.

As far as the kids go, I see it and agree. Even if you graduate college debt free, you still have to work and save up for a downpayment. Takes a long time in CA. I don’t know what the reruiting and hiring trends are these days, but the old days of South Bay mega corps bringing college recruits in are dying. Other than cyber-security, who’s hiring? Most jobs are going to McKinney TX, Mississippi, and Huntsville in aerospace.

In my market we see a similar phenomenon with apartments. The only apartments being built are on the high end, even though most of the demand is for affordable housing.

The reason seems to be that the desired margins are only achievable at the higher end, which for SFH is driven in part by square footage. You’d think there would be enough supply of labor that would be willing to build whatever was in demand, but the reality in CA is that land prices are so high that you need sizable cash to get in the game. Thus competition is (somewhat artificially) limited.

“They really should build 1200 to 1500 sq ft homes, why do they only build large ones?”

The value proposition goes down. First off, the cost per sq ft goes up the smaller the home (for obvious reasons), secondly, land costs stay mostly the same, and finally impact fees will be mostly the same. Eg., in Fontana CA before you even consider sq ft the impact fees can be as high as $50K-70K per home. So…. you end up with much less bang for the buck. End the end you might end up with a 1500 sqft home for $255,000 compared to $315,000 for a 2800 sqft home. That would be cost. For $60,000 more you’re getting a hell of a lot more sqft.

Fair enough but the PITI on $315k is $350/mo more than the smaller loan. That may be too much for a lot of people.

Hence the arrival of “white collar ghettos” in SoCal with homes taking up the entire lot and no room between houses. You get 2500+ in sq footage but you can also hear your neighbors arguing a house away due to close proximity.

You are so right Cranky CPA. The new “homes” are two story boxes. They have no class, hence the “Cracker Box” look, with no lines, just like the fat people that live in them.

Indeed, Cranky. No doubt many will be eventually converted to multifamily/multiunit, just as so many once stately mansions were converted west of the city center.

Too many big kids living at home with parents? Sounds like a lot of pent up demand.

The most misunderstood term “demand”. What is demand? It is funny how every Tom, Dick, and Harry use this term as if there is this magical economic truth called the demand curve. This is no different than saying there is a lot of weather on the sidelines… WETF that means…

Demand is best measured by spending. If you spend, you have demand. Its everyday thing. You have to live under a roof, regardless. That’s why there is a value under a roof.

Sometimes demand is a tough nut to crack. Take oil for instance: In a traditional oil consumption forecasting you presume oil demand is a function of GDP and that if the price becomes too high that OPEC will increase production and if the price becomes too low OPEC will reduce production, modulating the balance.

However if you approach demand from a supply constrained philosophy and realize that apparent demand (as calculated based on the presumption that it is a function of GDP) is less than inherent demand, and until there is enough supply (or enough increase in use efficiency) to allow those two to equal each other, the price of oil won’t go down. [And obviously there is a monopolistic price too, capping how high the price can go.]

Pete – you are very close to what demand is. If you call spending income + change in debt, you are right on the money. Now we know that income is flat to falling and debt is maxed, so how do we get increased demand again?

Income is down due to globalization, technology advances and loss of jobs. If you have a stable job, you don’t get a salary cut. We are lifting minimal wages, and all groceries are going up in price. Our way out is more debt, more productivity growth and more inflation. Our leaders are determined not to deflate. It’s written on the wall, and they keep telling you every month. It’s been that way for more than 5 years. You still don’t see it?

Pete – “Our way out is more debt, more productivity growth and more inflation.“

This is the problem. There is a point at which more debt actually slows GDP growth (around 250% of GDP) and I believe we passed that point some time ago. Productivity is a double edged sword. First, there is only so much you can get out of a single worker without leaps in technology. Second, more productivity actually puts downward pressure on employment which puts downward pressure on wage growth/inflation. Finally, in order to get inflation you need to have wage inflation which won’t happen because of globalization and the growing slack in the labor market. Inflation is a double edged sword as well because anticipated inflation is a component of the interest rate. With higher inflation we will get rising cost of money which we would expect to lead to slowed growth. The bond market will eventually force the cost of money to include the future anticipated devaluation of money. Sure in the short term you can play around with money and make it appear that things are improving but sooner or later the piper expects to get paid. And history proves that the piper always gets paid…

Some people confuse demand with desire. You may have a million people with the desire to buy a million dollar home. If they don’t have the ability to pay and all are poor, that is not demand or pent-up demand. Demand is desire + ability to pay.

“Too many big kids living at home with parents? Sounds like a lot of pent up demand.”

Or a lack or household formation and a shift to multigenerational households.

WTF??? It’s because they have no jobs, no money, and probably student debt. How out of touch are you?

I’ve had a lot of pent up demand for a Porsche all of my adult life. The way things are going, that ain’t going to happen, ever.

Gotta love the Porsche analogy!

You made a good argument for home prices going down. Forget the talk of staying up. When will we hit that iceberg and go down? I need to know so I can be the first in the lifeboat.

You are already too late if you are not already in a lifeboat…

I bought in 2011 not expecting any appreciation for the first few years. I bought close to or just below rental parity in my neighborhood. So, i made out as long as I stayed in the home for 5 years and didn’t do too many unnecessary upgrades to the home. Closing in on the 3rd year of our purchase feeling fairly lucky.

I think staying in a home 10-15 years is pretty safe bet… Even those that bought in over-priced areas in 2006 may be approaching break even by 2021.

I hardly think it’s “popular belief” that you live and die in your first home. I lived in 3 homes growing up… My parents are still in the 3rd home now and it is paid off. Definitely a different time.. i think their first home was like $40K… second was like $70K.. and third was purchased for $155K.

Thank you for replacing Lord Blankfein. We need to hear rental parity a couple times a week because we might forget…

What? is right, without “rental parity” in the mix, it’s just not a complete discussion. The fallacy of “parity” is so obvious yet lost on those that use it to make themselves feel better about buying. Ask all those who bought at the last peak in 2005-2006 about rental parity and see how that worked out for them. Rents aren’t bad right now but prices are out of whack. It’s a much better deal overall right now to rent, given the latest bubble. Who knows when it will pop, but I am not going to be caught holding the bag!

Bay Area Renter,

NOTHING was even close to rental parity from 2004-2006… NOTHING! What are you smoking? Every buyer in 2006 could rent for about 1/4 the cost of owning. Maybe not a house.. because they were being flipped like pancakes… But apartment rents were 1/4 what similar size homes were going for.

You guys are totally blind. When it’s all said and done this year, additional complexity aside, I will have spent 20k less than what I was spending on rent when I was renting. I put 160k down. Yeah, that’s all after taxes too. I bought at a good time, how did I know it was a good time? I used a rental parity calculation.

This place is turning into Patrick.net

If you put 160K down to get under rental parity within the last 2 years or so you’re in a bad way as soon as this market turns SAK. You’re taking a bigger gamble than the stock market. Might as well have put half in an S&P fund. A lot more liquid and you’d have banked some nice capital gains.

Prices were under rental parity when I bought had I only put 3.5 percent down. You are so occupied trying to prove your point that you make up random assertions/assumptions to prove it. You can’t read, you make the wrong assumptions, you missed the last dip. Why does anyone even respond to you? That is the question that is worth answering. I’ve made 7-13 percent tax free since I bought based on rent that I haven’t paid. The houses around mine appreciated are selling for 35% more than what I bought for, and you have the audacity to tell me that I made a bad choice? Really? Really? You know nothing.

SAK 7-13% rent savings doesn’t come close to what you’d have made on an S&P fund. And if prices are up 35% but rents aren’t, you’re talking bubblicious gains which don’t mean a thing if you don’t cash out. How much did 160k get you below rental parity? Factt is you could have turned that into a nice capital gains without chaining yourself to a mortgage. However let’s be real. The fact that you got so butthurt at criticism and don’t even mention your “up 35% location while touting your investment acumen tells me youra RE shill who’s here to make themselves feel better about themselves. Unemployed agent maybe? Broker fired you?

Rental parrot, rental parrot, rak rak…. polly want a rental! It’s the rental parrot! Rental parrot! Rental parrotty!

Wrong again, I’m a scientist. Wrong again, I’m gainfully employed. Wrong again, that was 7-13 percent on my down payment. Wrong, wrong, wrong. You don’t get much right when you have to think for yourself do you?

“I’ve made 7-13 percent tax free since I bought based on rent that I haven’t paid.”

That doesn’t jive with making a 7-13% return on your down. Two different things so obviously you’re not a scientist because you suck at math. Still haven’t told us the fabulous up 35% neighborhood you bought in 😉

“You LOSE! Good day sir!” – Willy Wonka

Also SAK you still would have made more in an S&P index fund even with rental parity. So once again, not showing yourself to be much of a scientist…

My math? OK. Let’s say I bought for 400k and the house is up to only 500k just 25 percent. Mortgage is $1700. House is too big. Taking a play out of your book (which you didn’t have the guts to execute) I have a roommate knocking my costs down to 1000. Comparable rent with one less bedroom is 2400. Then let’s say I’ve saved 16k per year in rent. I’ve made 132k, to sell costs me 30k. So, I’ve made 100k after taxes on a 160k investment. S&P was 1370 on the day I bought. It is 1885 now. You have to pay taxes on that gain. You lose lose lose. Your inability to do simple math is why you don’t make the right choices. I did not even factor the equity I’ve gained into the equation or the tax benefit from owning. If I liquidated right now, I will have destroyed the S&P by more than a factor of two because the numbers I’ve given you were conservative. That’s because when you buy at the right time you get a massive advantage from even small amounts of leverage. Your rage has blinded you to the truth, and your brain can’t comprehend what it doesn’t want to see. Talk about confirmation bias.

Never knock free rent! The State of California is now majority Latino and Asian! We don’t move out until we absolutely have too. Other cultures are the same way, it’s not the economy it’s in our cultural background!!!

Thank you, Luis, for pointing out that there aren’t any deadbeat crackers. Also, that “Hispanic” and “Asian” might as well be the same, as they don’t move out until they “have too.”

It is immigrants from traditional cultures. The women have to stay at home until they get married. If they move out before they get married, they are thought of as a “bad woman”(not a virgin) so the parents are upset because they think that no man will marry them. As a result of this old country idea of virgins for men, the women learn to lie and play all kinds of games with their parents and grand parents. I could go, on, but you get the idea.

“The women have to stay at home until they get married. If they move out before they get married, they are thought of as a “bad womanâ€(not a virgin) so the parents are upset ”

Hmmmm… waiting for the Southern Calfornia housing market to implode due to an explosion of virgins… All those Southern California virgins living at home. Hmmm….

Hi guys, long timer here. 9 years after selling the Valencia house, renting the entire time since, we are making the move to Texas. Sent our 2 kids to college over there, Baylor & TCU (peak market sell price made the payments easy). We have lived in a pool house in Hope Ranch, Santa Barbara and the Pine Mountain Club, keeping the rents low- $800/month in SB and $1500/month PMC. That and the stock market put our net worth at an all time high. My wife and I both work from home so we will continue that. Native Californian, at 55 it’s time to go. Kids have full time good paying jobs in Texas and the wife’s side of the family is from there. We have some farm land over there already. Renting a small home in Georgetown for a year and will look to buy a small home in a rural area during that time. California has been great and Texas will be another adventure for us. Keep an eye on me: https://www.youtube.com/user/canamrider07

Sounds like a terrific plan. Glad to read that there are still sensible and responsible people out there. It’s a shame that California’s economics drive out the middle class like you.

Sic ‘Em Bears!

Yes, are you going to be a dirt farmer like Perry was when he was small? I have a ranch near Kinky’s place,(raise grass fed organic beef) but it is not as big as the King Ranch. You are doing the right thing about moving from SoCal where there are so many whiners. I hear that the Pine Mountain Club is a nice place but the road(going east to Cuddy Valley) out of the little valley there can be hard in the winter with the ice, because it is steep. Most of Texas is flat, you tell your directions by the time and the position of the sun, not by where the mountains are located. It will take sometime to get use to it. In California, you are never far from a mountain range. It usually takes a Yankee a few years to adjust to the heat and humidity. Now don’t you go to whining once you get here about all the things that you miss in the “Golden State”.

Yea, PMC is a beautiful place, roads get a little icy but not this year. The RE up here really tanked, vacant homes , repoed lots sitting for at least 3.5 years all over the place. Can’t wait to move to Texas. In laws have land over by Richland Chambers Lake (Kerens). Like I said California was great but time to move on. Sic Em bears….vs Wisconsin tonight……….

Hey desmo,

How’s the water supply in Pine Mountain Club? I read that shortages are so severe one town over in Lake of the Woods that all the wells are dry, they’re trucking in water now and worried the taps may run dry by summer. Maybe you’re right about bailing for TX….

my sympathies – you sure won’t find a Hope Ranch in Texas

Back to the crux of DHB’s article, what did happen to the traditional buyer? The traditional buyer is priced the F out, that’s what. I happen to be a broker (not my only income source) that does not side with the herd and actually gives honest advice. Many realtors ARE real turds but there are some (admittedly few) that truly have their clients’ best interests in mind. I fit in the latter category so don’t start with the ad hominem attacks. I rarely comment and have been reading this blog since LB was more on the bearish side.

Now for some personal anecdotal evidence. I’m a Gen X’er. Bought in 03, sold at end of 05 at a large profit and rented until 08. Bought in Jan 08 (too soon junior!) and sold at a loss (after down payment and improvements) at end of 09 because the area was not where I ultimately wanted to be. Rented from 09-end of 12 and bought again 9/2012. I really got lucky even getting the home I bought because most of the good deals went to insiders. I went straight to the listing agent and let that moron double end on me. She never even showed me the home. Never even met her. Nice fiduciary duty. Sold it 5/2013 at a huge profit after fees/improvements (even took the hit on taxes) because I think we’ve passed the peak again and although I was happy with the area, the neighbors SUCKED. Probably one of the biggest X factors buyers fail to consider are neighbors.

Now happily renting again with a nice chunk of change in the bank and watching the areas I like, hoping for a real drubbing of values like NZ and many others. I only wish prices would tank like they should have been allowed to in the first place. Instead, we are still in a completely fake “market” manipulated by big banks and insiders. Joe Six Pack gets hosed again.

The cash buyers are still there but definitely not in the same manner as they were before. I only know this because I represent multiple sellers and they still hit me up as soon as I post a new listing. Not running into any buy to rent types because the numbers no longer pencil out in the markets I am in. The remaining few are flippers looking to unload the hot potato.

The $ on the sidelines thing is a load of crap. My generation and the latter is str8 brizzoke. There are some like myself that have a little money but we know there will not be any social safety net for us in the future so we’re not ready to go plop down $250K and still have a mortgage payment that is 20% higher than rent on an equivalent home. Single job career and a pension? Please. Not unless you work for .gov

This is a fake recovery. Everything is manipulated. BLS stats, CPI excludes food and energy, stock market up when labor force participation is at an all time low, etc. You name it, the numbers are being massaged. I really hope there is blood in the streets again so I can jump in with both feet. Hell, I’ll buy 2 or 3 this time. Now, I just hope we get a drop. I like to think there will be a trigger even that causes it. D

We are at or beyond the price peak and this feels dangerously close to 07 again. Unfortunately it is entirely possible that we end up in a Japan scenario and prices just stay flat. Don’t underestimate the ability of .gov to keep rates at or near zero. Everyone is talking rate increase like it’s a done deal, but who really knows what Old Yellen’s going to pull if the SHTF again?

Like the Dr has pointed out, the current environment has forced all who are interested in SoCal housing to be speculators. You give a balanced appraisal of the slings and arrows of speculating over the past 10 years or so. Whatever happens, you seem in good shape.

Great post, CAB.

I am a GenXer, never bought. When I was finally in a position to, life-wise, was right when the (previous) bubble was just getting underway. I sat it out because I could tell that things weren’t right. I remember my parents buying during a bubble in the 80s and so I knew that prices could, in fact, go down. I expected them to, and I figured I would buy after the crash when the market returned to sanity.

But history taught me the wrong lesson, because prices never really did go down like they should have. Sure there was a “crash” in 2008, but things never really returned to normal. Had I known the FED would keep ZIRP going forever, prop up a fake recovery like you mentioned, and that prices would never return to a traditional ratio with incomes, I would have just bought a decade ago.

I think we are long overdue for a reset but I honestly don’t believe it will happen. It’s Japan. Prices are going to stay unnaturally high, propped up by intervention. I missed the boat and I’m probably never going to own a house. It’s either buy and pay too much, or don’t buy and rent forever. Those are the only two choices. So be it.

“I think we are long overdue for a reset but I honestly don’t believe it will happen. It’s Japan. ”

Bub, in Japan prices dropped a lot from the peak. If it is Japan, then you are going to see continuing dropping prices for the next 3 decades.

Growing up in CA taught us that booms and busts were part of the deal. You’re right that 2008 was a scratch compared to earlier busts.

Hey Bub,

Don’t feel like you’ve missed the boat. Think of it as being on a somewhat unpredictable schedule. Another boat will come around soon. If it’s meant to be, you will own a home. If you do not end up buying keep in mind that a house is really just a roof over your head. So long as you can keep you and yours safe and sound whether you own it or are renting doesn’t matter much.

Really what it comes down to is security. That’s what money is for. If you feel secure renting and that security gives you happiness then that is a reason NOT to buy. There are multiple advantages to renting and I am pretty sure you are aware of them.

That being said, if you feel you must make a purchase, try out the buy v. rent calculator on msn. That one actually lets you adjust every input (including appreciation-you can even input a negative number haha). Once you calculate all the costs it may make sense for you to keep renting for X more years. I won’t take the plunge again unless I am certain it makes sense and that I feel secure about the purchase. Good luck and thanks for the nice words!

CAB,

this is probably the most rational post ive read on this site.

i’d like to comment on your posit re yellen: it seems very likely that, at some point, yellen and her fed ilk wont have any say in the matter and the bond market will take their ammunition away. already the 10-yr has gone from 1.5% or so last May to 2.8%; im very sure she and the fed are not happy about this. it’s a game of chicken with QE and the 10-yr (and most other treasuries i guess) and, eventually, they will lose and the bond market will take away the printing press.

full disclosure: most of my views are influenced by Bill Fleckenstein on this topic. he’s got a lot of interesting things to say about all of this.

The Washington Post recently highlighted the vital role played by young adults in housing. Not only are there fewer people in the age group; the cohort just isn’t that into houses. Demographer Chris Porter of John Burns Real Estate Consulting told the newspaper that Americans who were 30 years old to 34 years old in 2012 “had the lowest homeownership rate of any similarly aged group in recent decades,†at 48 percent. Baby boomers had a 57 percent ownership rate when they were that age.

Our young would probably be a lot more “into houses” if they also could win the jobs to save for a down payment and support a house, and weren’t so burdened by student loan debt. They’re far too occupied just trying to get the first foot on the economic ladder and handle their debt to think of anything but bare economic survival right now. I can’t think of a worse time in the past 80 years, for people just starting out in life, than the current era.

Well, I fit into that demographic and don’t own, even though I have the money. I’m married with a kid on the way. I have my eyes set on a specific school district, but have 6+ years until I have to think about that. So I’m just eyeing the market and waiting for a good deal. So, I am pent up demand… if there was a good deal, I would’ve bought already.

hear, hear

Housing to Tank Hard in 2014!!!!!!!@

Mr. Tank Hard, you said SHTF in March, right? Is April the new collapse date now?

Perhaps we’ll find out when the March numbers get released?

Housing to stay flat in 2014!

This is just anecdotal, but in the 3 town area that I monitor (Glendora, San Dimas, La Verne), it looks like there has been about a 28% increase in properties listed on the market over the last 2 weeks (for SFH under $500,000) compared to the number of listings in early March. Over the past few months, the mantra seemed to be that “sales are down but inventory is tight”. My perception of inventory in my area reflected that thinking. But, at least in my area, sellers may be starting to adopt Jim’s slogan. Or, it could just be people wanting to move during the Spring. Is anybody else seeing the beginnings of a similar shift in terms of inventory starting to swell in other So Cal areas?

My business is in Glendora so I check this area out as well (though ultimately I’m looking to buy in Upland) I think much like Orange County this little Caucasian enclave of the SGV is full of people trying to keep up appearances. Those who realize Bubble 2.0 is popping are listing and looking for greater fools. They may find some but with investor demand at these prices nowhere to be found I think they’re gonna hit a dead end. Foreclosure filings from early this year might start hitting the market early next year and the folks who “have” to sell will get hit with reality. There are no buyers for their shacks at half a million and on top of that mortgage rates will be at 5.5% or more and trending upward.

As I’ve said before Jim has it right in that the tanking is here. Closing prices are the LAST indicator to catch up to the market.

whatdoyouthink-

you are in my neck of the woods. correct that inventory is slightly ticking up but this is mostly cyclical. what is not cyclical for this time of year are the price drops associated with the uptick, and in my/our area those are starting to pop up more and more. i like to think they are cracks in the foundation that are the start of a correction of some sort. in addition to the price drops the ratio of closed to list prices is starting to decrease meaning you have less transactions closing at or over list price, and more transactions closing under list price. time to market has been steadily increasing as well, though only slightly.

Be super careful about Glendora,

It has a high chance of winning the gentrification lottery. It is one of the few places I would buy something even at these prices.

Not in the markets I watch. Under 500k in Ventura and Santa Barbara counties seems to have cratered. Initially it seemed like inventory was up, but try looking at Santa Barbara City, Ventura, even Santa Paula. Anything under 500k for a stand alone house has disappeared. Normally there aren’t that many, but where I used to see five in SB, now I see 1. Used to see 10-15 in the areas of Santa Paula I watch, now I see 3. I do see lots of horrendously overprices condos with $300-$400 HOA fees (you have to be kidding me).

The reality is that most people either got a great deal and are staying, or they are still underwater and know they can’t get what they paid and get into something new. There aren’t even many rentals right now in those same areas.

Gen Y wants to buy. We are just too broke, and prices are just too high.

RE:AK

Glendora winning the gentrification lottery??? Where? South Glendora is about as built out as can be and North Glendora is ALL residential. Glendora will probably drop less than 2008 crash only because it’s a white flight destination. Para Military grade police force and good schools keep the upper class white folks happy 🙂 That said when this systemic credit bubble deflates, even a little, it is going to hit upper middle class jobs hard. Everyone of my fellow biz owners in Glendora is concerned. They’ve never seen it take this long to bounce back from a crash. Of course they agree WI 4th key that the FED has never gone to these lengths to prop up RE and that is killing consumer spending. As someone posted earlier during the 90s bust prices were allowed to fall quickly and that recession was over rather quickly as the velocity of money quickly returned. The FED has frozen the entire economy for the sole purpose if saving the banks from nationalization. It really is disgusting…

If Yellen doesn’t end tapering this Fall and have an interest rate increase next Fall we are in for a wild ride. The dollar will take the hit hard and the Fed would get stuck buying treasuries at a fever pitch. Inflation would increase and the Fed would have to raise rates to kill it. Lets hope it doesn’t come to that.

Why are we reading housing blogs? Aren’t we supposed to be demonizing Putin and blaming him for the economy? Last time it was Europe, then it was weather. Maybe the blame game goes in full effect after he takes gas/oil purchase in currencies other than the dollar.

How was the SoCal market in the 70s?

First off – LOVE this board! 2ndly, I don’t really mean what I said in my handle – actually love SD, but I do hate the prices. Wife + kids were happy in our 3/2 PQ home, albeit it was a bit on the small side. But then we goes and gets preggo again. So during our search for more space, we quickly found that a contingent offer on the few reasonably priced Scripps Ranch homes wouldn’t go far. So we listed ours for 15k over comps and the sucker went pending in 3 days for 10k over asking price! Pretty much jives with what I’ve been reading – that clean, well upgraded homes that are priced within reason sell in a snap, while the drastically overpriced homes (pretty much 80% of the SD market right now) are sitting. The obvious dilemma for me – I’ve got a nice chunk of change ready to plow into the next ‘move-up’ property, plus an increasingly impatient and pregnant wife questioning me daily about why I’m pushing for the rental route for a year. There is one property that we like but it’s overpriced by at least 40k based on recent comps. Logic (& the likes of tells me to be patient, while the impulsive ADHD side is screaming to just bite the bullet and absorb the hit. We both make pretty decent salaries so I roughly estimate the tax hit to be about $6-9k or so if we were to rent for a year. My question is, am I expecting too much for prices in desirable areas like Scripps to fall enough in a year’s time to recoup that tax hit? It seems that there are plenty of sideline buyers waiting to strike in that neighborhood when the occasional non-lunatic seller pops into view. Your thoughts greatly appreciated!

Go F SD-

In your shoes I would rent for a bit (wait a minute…actually I am in your shoes and that’s what I’m doing). Easier said than done, but try and find a month to month or at most 6 month lease so you can pounce when you spot the one you want. Hopefully you don’t have dogs…

Tell the wife not to be overly picky about the rental as it will just be short term. Don’t force yourself into a purchase; bad decisions are often rushed and/or impulsive. $6-9K is a small number compared to a large percentage of a hefty down payment. Good luck in your search.

Why are you estimating a $6-9K hit on taxes, presumably from the sale of your home? You get a $250K exclusion on profit from the sale of your home for each of you, meaning as a married couple you get the first $500K of profit on the sale of your primary residence i.e. your home excluded from any capital gains tax. That of course also requires the caveat of having lived in the home for 2 of the past 5 years, but it prorates the amount excluded if you have lived there less than 2 years.

Pretty sure he’s referring to lack of mortgage interest deductions on his tax returns for next year, not capital gains. Deductible mortgage interest on a SFH in PQ could be in that range for a 2 income family.

That’s correct, I was indeed sweating the potential tax exposure without a mortgage interest deduction. But we actually met with our accountant today & it just so happens that our projected tax situation for this particular year shouldn’t be as painful as I imagined (maybe 2-4k). 2015 would be much worse, but we hope to be in better position to buy at that point. The other added benefit is that renting for a year gives us time to assess other options (like perhaps even moving out if the state).

I still don’t understand why people put so much value on the interest tax deduction when comparing to rent. In almost every case I’ve seen, the property tax on the home eats that interest deduction up…sometimes more, sometimes a little less. Renting you don’t take that property tax hit (of course some level of it is built into the rent, but not anywhere close to 100% of course).

“This is why in manic California where crapshacks of 1,000 square feet are selling for $700,000 you have to wonder if people really believe they will stay put for 30 years?”

Heh, heh…he said crapshacks.

“Mr. Tank Hard, you said SHTF in March, right? Is April the new collapse date now”?

What is going to make the market tank hard? Last time around it was an unprecedented 5 years worth of “Stated Income” loans, at 100% ltv, that had the disastrous effect on the economy and the RE markets.

There has been nothing like that going on over the last 5 years. Sure, the Fed and the Government have greatly expanded their deficits, but as long as the US dollar is #1, they can get away with deficits and printing money/buying their own treasuries.

While the points made on young people not being able to afford a home in coastal CA (within 25 miles of the ocean) are valid for a variety of reasons. I do not think that has any impact on values. All it means is sellers will realize there are less buyers and likely not sell as often as has been historically the case. That is why inventory is so low today. Your average seller sees what is going on in the over all economy and in many cases are scaling back, just fixing their present place up and sitting pat.

Unless the entire economy falls off a cliff, I do not see a 20% reduction in values in coastal CA. If the economy does tank that hard, few of you will have the courage to step in and buy when the future looks so bleak.

My 2 cents to the younger people. Look for better opportunities outside of CA. If you have the good fortune to do really well, you can always return down the road. In my beach town, a large part of the RE sales are to people from AZ that plan to retire here down the road.

“What is going to make the market tank hard? Last time around it was an unprecedented 5 years worth of “Stated Income†loans, at 100% ltv, that had the disastrous effect on the economy and the RE markets.”

That’s like the fat man claiming that the food made him fat. Stated income loans were only one section of an over-financialized house of cards. A symptom and a cause inside of a larger unsustainable system.

Jim’s 2 cents is worth about a negative $1,000,000. He’d have to pay me that to follow his advice. So coastal CA can’t fall 20%? Even though it did this in the 2008 crash… and the 1991 crash… and in the 1982 crash…

If you’re gonna troll or shill or masturbate to your confirmation bias posts at least TRY to sound objective. 3 paragraphs and outside of acquiescing that Jim’s thesis “could” happen in “some” areas all I read was NAR drivel.

if a seller stays pat and renovates his place, he also doesn’t become a buyer. This is a problem with most of the housing bulls, they try to violate the laws of thermodynamics by creating demand out of thin air.

Expect a low transactional volume as close-to-underwater owners and low-interest-rate-mortgage-holders become cuffed to their houses and can’t escape. If anything, the low transactional volume makes housing more prone to wild shifts.

As a best case scenario, CA is adding about 250,000 a year in population. This equals the need for about 150,000 new homes assuming historic household formation and the need to replace more units.

What’s scarier, California measurably, has a decreasing tax base, meaning whoever is moving in is unlikely to be in a position to buy except for a minority of foreign nationals with big cash reserves. What is not accounted for is also people who are moving into rental units, living with roommates and going multi-generational in their household. The supply-demand equation isn’t off as much as people think.

500 years of data have strongly correlated house prices with income and when they have diverged, they have reunited after not-too-long-a-period. I am not sure why people keep thinking it’s going to be different this time.

The current market is so far from “normal” that you have to wonder when it will run out of gas? 33% of all people in CA under the age of 34 are still living with their parents!! That’s an amazing number. 30% of all home purchases are cash?! Right now it’s an investor market as I have heard many say they were looking to park a large amount of cash somewhere besides a bank or the stock market. This is not organic nor sustainable.

It’s the land, not the house, that makes housing so expensive. And the land is expensive because the population is so large. And the population is so large because of excessive immigration.

If it weren’t for immigration we’d be at a negative population growth-rate in this country and in a deflationary death-spiral instead of the disinflationary zombie crawl we’re now in.

And, as far as the cost of flat expanses of dirt is concerned, you might find some delta’s when comparing 29 Palms with Manhattan Beach.

Negative population growth is good for so many reasons. Read Agenda 21 for starters. Prices will go down with negative population growth, same goes for pollution, and taxes. We will spend less taxpayer dollars on schools(teachers, plant, and equipment) and colleges. It will all be good. Mother nature says that we either reduce our population, or she will do it for us, and it will not be pretty.

…And the “excessive immigration” of dirt poor Hispanics have increased existing LA/ OC neighborhoods into some of the most undesirable, dilapidated, over-crowded per sqft properties in the U.S. (e.g East LA & Costa Mesa) And the “excessive immigration” of cash rich Asians is creating the demand for higher priced “upper-middle class” neighborhoods in CA Distinguished School/Blue Ribbon school districts” (e.g. Irvine)

Both of these events, as described in the Times, drove the white folk out. They went to Texas and Arizona. They left the state in the hands of “Shrimp Boy” and the Triad in the north, and of course, the Calderons, in the south. California is a one party state, like a third world country, in so many ways.

Jim-

Do you own coastal property purchased over a decade ago? I would venture to guess yes. Why do you mention only coastal CA as being unaffordable for “young people”? It is not only coastal areas that have become unaffordable based on incomes. Look at what has happened in the IE, SGV, and other areas that are not within 25 miles of the ocean. In 12 LA county areas we are 30% OVER the 07 bubble price and affordability levels measured by multiple sources are at all time lows. Inventory is down because it is being artificially MANIPULATED to keep prices up. If rates increase, how long can this dog and pony show continue? Price drops are already happening as sellers realize their inflated list prices are not going to happen. Buyers are starting to question the increases.

That being said Jim Taylor’s comment is probably only going to happen in some areas. Other more desirable areas (read Newport, Irvine) may only experience a slight drop or simply remain flat. RE is highly localized as most on this blog know. Coastal is only a small part of CA RE.

You can keep your 2 cents. “Look for better opportunities outside CA” is a nice way to tell the younger generation to beat it because they were not fortunate enough to be born at a time where property here was affordable relative to income. Easier said than done when you have roots here.

CAB >> “Look for better opportunities outside CA†is a nice way to tell the younger generation to beat it because they were not fortunate enough to be born at a time where property here was affordable relative to income. Easier said than done when you have roots here. <<

Whatever happened to America's Pioneer Spirit, its "rugged individualism"?

Young people have been "beating it" to these shores for centuries. America was built by young people who "beat it" from Europe and Asia, at a time when there were no phones or internet, a time when leaving your "roots" in Ireland or Italy or China meant you'd likely never see your relatives in the flesh again, never hear their voice, just an occasional letter."

My parents "beat it" from behind the Iron Curtain in the 1950s. I "beat it" from New York City in the 1980s, a much easier thing to do.

It's normal for young people to move for greener pastures, and easier than ever in this age of modern communications and rapid transit. Easier to leave, easier to stay in touch with friends back home, easier to return for visits.

Are Millennials really so much softer than previous generation? Have Americans morphed from pioneers into potted plants?

SOL-

I don’t see the relation of your comment to property values but I would like to respond nonetheless. America is far removed from its “pioneer spirit.†Wake up and take a look around at what American society has become. America is not in the midst of an industrial revolution and plentiful employment, unless you are drinking the BLS job creation data kool aid. Regardless of generation, as a whole America has become soft. Many old ideals such as saving and investing in your own future have been replaced by finance to get what you want now. Wants are mistakenly thought of as needs.

Rugged individualism has been replaced by displaying your individualism on facebook or some other electronic media. We are a consumer society where everything is based on credit and fiat money. The rugged America you mention has been replaced by corrupt corporate governance. Ponzi finance at its finest. We produce little of real value compared to what America used to produce. Look at how huge the FIRE sector has become for simple proof.

My parents, like yours and many others, migrated from another country. Potting plants has nothing to do with it. Being able to take care of your family is not facilitated by being thousands of miles away regardless of electronic media or “rapid transit.†Could you care for your sick parent through electronic media? Didn’t think so. Oh, just fly back every 2 days because your fantastic new job in another part of the country said it’s OK and you are loaded with cash to cover regular flights? Doubtful.

I love your idealism but the fact is Americans are not the same as they were then. Call it soft if you choose to but don’t point your finger at any specific generation; if there is anyone to blame such blame should be directed equally at all generations. The rugged individuals and pioneers from the 18th and 19th centuries would roll over in their graves if they know the depth to which our Constitution has been subverted.

Do you think those same rugged individualists would have allowed the unjust taxation of the ACA or the federal reserve act or the civil rights trampling patriot act or any of the other plethora of unconstitutional garbage that has been shoved down the throats of ALL Americans, not just “millennials� I highly doubt it, but you can’t blame the millennials alone for being soft. BTW I am not a millennial.

Yes, so sad. Today’s youth sucks. You, SOL, represent the last, true rugged iconic American individual. Wow. NY to LA. Without the internet or even a cell phone. Impressive. Wait, you said the 80’s…some of that sweet NY blow probably made the 4 day drive less monotonous.

Sorry above post could be misconstrued, should have said: In 12 cities in LA county we are as high as 30% OVER the 07 bubble price.

The Lost Decade is still in full swing. I don’t expect any real economic recovery until 2018.

Follow that flip – price reduction edition!

Our favorite Victorian charmer is still on the market, currently with a $118K haircut after five months sitting on the market. A 17% discount from original ask.

http://www.redfin.com/CA/Los-Angeles/2125-Vallejo-St-90031/home/6945511

Properties sitting on the market with price reductions are increasing. There is a filter on Trulia you can toggle to view.

As of today, the number of homes for sale in OC is up 33% vs last year, while the number sold is down 15%.

The number of homes for sale in LA county is up 10%, with the number sold down 17% YOY.

Tick tick…

Yup, sure does seem like the exit ramp is backing up.

That home looks nice now by itself, but its just a terrible location. Too close to the freeway, poorly rated public schools. Looks like street parking is required, so you’d have to worry about car break-ins, as well as other crime.

People that can afford $500K just aren’t going to want to live there. For $580K there are a ton of better options out there, with much better public school systems. The flipper should have done a better analysis before he sunk that much cash into that house. Just doing minimum work to make the home liveable again would have probably netted a higher profit.

sold home moved to get into a great school system.best move i ever made. the school system keeps home values up without breaking a sweat.that is the only thing that matters now with these crazy home prices.never understood the facts in how they price some of these homes that are in shitty school systems.

Berkeley for 1.0 MM. Are you kidding?! Talk about jumping the shark, this market has definitely peaked…4K lot, run down, not a quiet street, coved in algae…I wouldn’t even rent this place for 2K.

http://www.redfin.com/CA/Berkeley/1594-Scenic-Ave-94708/home/12352212

What a sad little house. You can tell the current owners are financially stretched just by looking at the sad furnishings. These people probably have an income well into six figures, yet they are living one VERY lower-middle-class lifestyle.

In fact, every lower-middle-income person I know here in Chicago lives with a lot more style and grace, in places that cost a fifth as much money.

What’s the use of earning $200K a year or more if you’re going to be financially overwhelmed maintaining a lifestyle that you could easily buy with money to spare on $60,000 a year in another part of the country?

Flippety flip to I hope a flippety flop. Check this out.

http://www.zillow.com/homedetails/23637-Via-Rancho-Dr-Diamond-Bar-CA-91765/21488021_zpid/

Sold by the original owner to a corp 12/31/13 for $435K. Hit market at $599900 mid Feb of this year. Closed 3/7/14 for $601K all cash. Now it’s listed @ $648K. The most recent all cash buyer is an individual. Gotta figure he is in it for at least $607K after title and escrow even on an all cash purchase.

After fees and taxes, how much is he really going to make? Even if he does not pay the listing agent he still has to pay the selling office $13K + $6 to title and escrow. If he sells at ask he barely grosses $20K.

Interesting times.

Just like old times.

Its the individuals you have to watch out for. At least the bigger businesses do proper accounting and value their time. The beauty of a market is that it can create $213K and destroy it in a couple of months.

I know some people that invest solely in the housing market (one comes to mind with 4 houses in SoCAL). It doesn’t mater their opportunity costs for other investments. They want to OWN a house. Kinda like goldbugs, but more proactive. Tell me why a boomer who may retire in 3-5 years would purchase at these house values. There is cash flow, but you tie so much in an illiquid market. Plus you gotta manage that crap. Some people are crazy?

Correlate cars and homes you can easily mate the two, they are both two of the most important decisions of ones financial portfolio and it is a must have.

The American dream, have a house and nice car, folks it isn’t ever going away, Americans will always buy into debt to achieve this dream.

If you really think housing is going back to 25 to 50% off and cars will be affordable again then you will always be in a rental with a rusted Chevy outside and if that is what you want as your dream no problem, but for most in this country it is a home, a new car, and a 60″ TV it is never going to change?

Yes, you are right! They are alike. From the day of purchase both start falling apart and as the years go by maintenance costs on both increase.

On key difference is due to the economic collapse the Government, Federal Reserve and the Banking industry have done everything humanly, legally and illegally, possible to elevate housing prices in the past 4 or 5 years.

The question one has to ask is can they continue this extraordinary amount of manipulation of a market forever? Perhaps a wiser investment is available with your hard earned cash than one that is being propped up?

Oh be quiet Robert. You must be hard up for a sale.

Homes in my area are decreasing everyday. And we’re talking 10-15 properties, daily!

Thank goodness.

these posts are a sure sign of a market top, we’ve been here before, more than once.

What happened to the traditional home buyer?

their job were sent to China, India and Mexico, free trade where only one side wins wasn’t such a good idea afterall huh? it can only get worse from here.

I am a 23 year who live with my parents. I graduated from colllege two years ago and I cannot find a job that pays a living wage. I would love to buy a house but until I find a better paying job I will be with my parents. In my neighborhood, I have seem that young couples are moving in and buying with FHA. Some said they never would of thought that they will purchase a house in Compton.

Leave a Reply to Joeknowit