The real estate gamble in Arizona: Inventory is up 35 percent from last year as cash investors begin to pull away from the market.

In many markets, investors were purchasing properties to rent out for a short period of time before they had any intention of selling. Many of the large investors have hinted at buying places and holding them for 5 to 7 years before selling them off. Since big money entered the market in 2008, we are already seeing that phase one is being completed and big money is certainly exiting the market. The impact of course is what you would expect. Take a look at Arizona for example. In the Greater Phoenix Area, cash buying now makes up “only†24.8 percent of all sales. This is the first time since 2008 that it has fallen under the 30 percent range. And what has happened because of this? Inventory has shot through the roof increasing 35 percent year-over-year. Because real estate trends move like molasses, the next phase will likely include pressure on prices (which we are already seeing). The Arizona market was hyper obsessed with big investors. As those investors pullback it is no surprise that inventory is shooting up. Yet the psychology of the market is always lagging because prices peak when inventory and sales are changing and this tends to be a better leading indicator. Arizona is an excellent example of a market where investors are now pulling away.

The gamble for cheap property

Investors were hungry for deals when the market imploded. We’re not talking about high priced areas here but overall markets like Nevada, Arizona, Florida, and more inland areas of California where good deals were to be found. Apparently investors are now pulling back as prices are making those good deals harder to find and cap rates are being severely compressed.

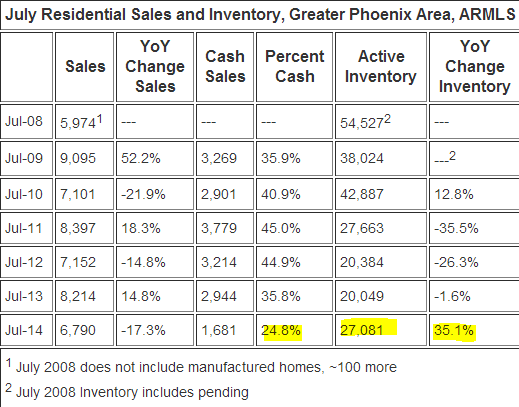

The Arizona market has been fully fueled by investor demand. Investors bought approximately 50 percent of all single family homes for close to half a decade. There is no parallel to this in history since single family home purchases were largely relegated to families looking to buy for a place to live. Now we get a taste of investor demand waning:

Source: CR, Arizona MLS

Can the market stand without investor demand? Not for very long at these prices and these income levels. Take a look at what has happened to inventory over the last year. Inventory has shot up by 35 percent while sales have fallen by 17 percent. Prices are still affordable, relatively speaking in the Phoenix area but regular households are having a tough time competing with current prices. Getting a loan still requires due diligence and when it comes to examining household finances, apparently many in the Greater Phoenix Area simply do not have the means to buy.

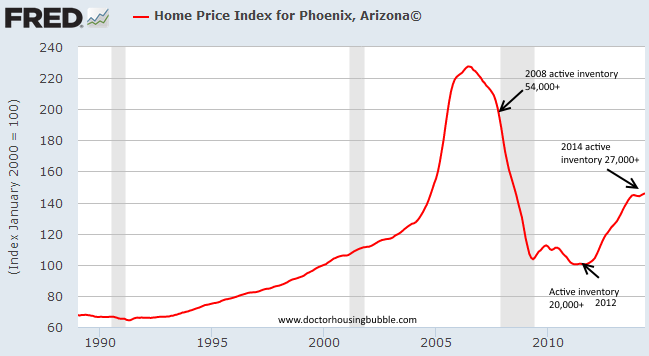

There is little doubt what investor buying has done in the last year to prices:

The massive growth in inventory is very telling. If you look at the chart above, sales cratered and inventory soared all the while home prices continued to make new highs. With inventory growing, crap shacks and junk is sitting longer while good homes priced right are still moving. This is why when markets turn, you usually see a plateau when it comes to price adjustments.

Many investors have a good buffer for profits here and many of the larger firms have mentioned that their goal was to hold for 5 to 7 years and then sell. If you look at the data above, the Home Price Index for Arizona is up 40 percent from the trough. Even if prices fall by 10 to 20 percent (or 30 percent) there is still a good profit here since some of these investors were renting out the homes for cash flow. Yet rents also take a hit when economies turn. If a contraction occurs or those inevitable recessions come, many will be unable to make their payments. In California, we have 2.3 million adults living at home because many simply cannot afford current market rents.

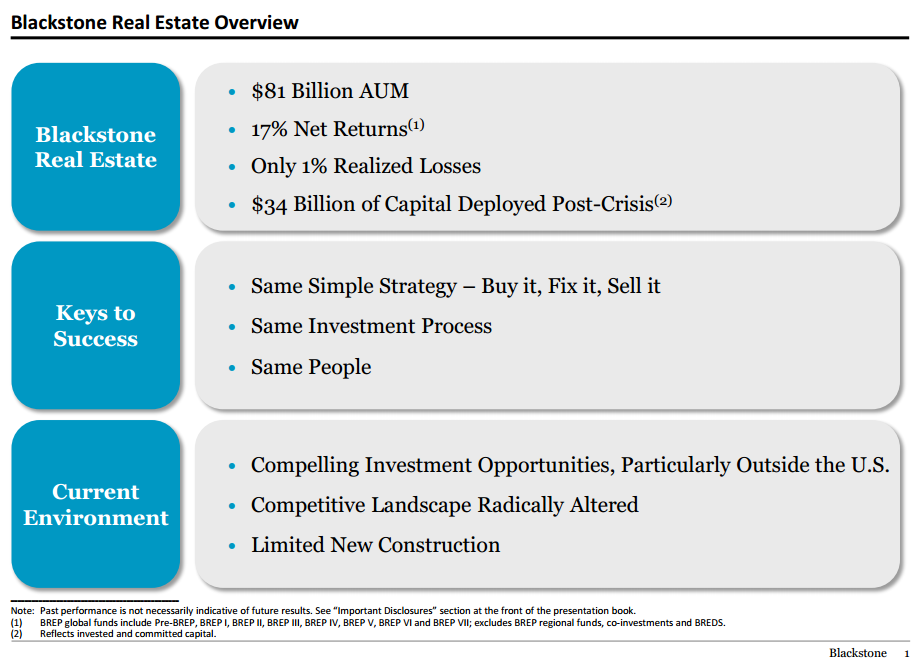

We’ll need a year of data to see what the impact of investors leaving a market will be but we already know that inventory is soaring and sales are falling. For Arizona, a market so dominated by investors, many will likely take their profits and shift into other areas. Take for example Blackstone. The big money is in financial instruments, not real estate. So it is surprising that some people think that these large firms will want to be landlords forever.

Instead of speculating, just take a look at what Blackstone had to say about their real estate holdings this year:

Buy it, fix it, sell it. Where do you see the buy and hold for eternity line? Investors have only started pulling away in earnest this year after a half decade of diving deep into real estate buying. Since places like Arizona will now need to rely on local families and their actual income earnings to boost sales, we will see how much true demand is out there.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

91 Responses to “The real estate gamble in Arizona: Inventory is up 35 percent from last year as cash investors begin to pull away from the market.”

Blert ….. Any chance of hyperinflation ?

I prefer Hypothecation over Hyperinflation…

There is a difference… I think…

Housing will NEVER go down!!! NEVER!!! The stock market will NEVER go down!!! NEVER!!! The bond market will NEVER go down!!! NEVER!!! The US will NEVER go into recession!!! NEVER!!! This will go on FOREVER!!!!!

This time is different, rich Chinese, Blackstone, the Fed, the crack whore on the corner of Lincoln and Rose won the lottery, dog ate my homework, blah, blah, blah…

10/10!!!!

As some of the real estate geniuses on this blog have said: local incomes do not matter, jobs do not matter, the economy does not matter, everything will gentrification, this time is different, recessions do not matter, interest rates do not matter, underemployment/unemployment does not matter, this attracts international money so economics do not apply.

I don’t even know why you’re allowed to post here. You’re a clown!

@Polo, I would disagree, I think, What? is one of the smartest guys on this blog. What he is posting is sarcasm or frustration from what is currently going on. The problem is that, unfortunately, 90% of the US population have no idea about what is happening in the country and in the whole world. So, all that remaining 10% can do is just “going nuts”… because there is nothing we can do to change anything… too many people don’t give a crap…

Polo, there are rolls and rolls of tin foil lying around here. Make yourself a hat.

@What ..you forgot the sarc tag.

I am sad to say that at this point nobody cares…

I would hope that a sarcasm tag would not be necessary for that post.

The best, most biting sarcasm has mostly truth to it.

This one qualifies.

Bubble pop and a guy from Seattle….when you think What? Is one of the smartest people on this blog..Both of you must be wearing tin foil hats along with What?

I find What?’s repetitive posts annoying and non-productive.

Polo, I agree with you 100%.

What? Does not even own any real estate and I’m sure his other investments won’t amount to a hill of beans after the next stock market crash.

How about you stick with posting your ideas Christie. So what if someone doesn’t own real estate. You seem to imply that just because What? doesn’t own real estate that he can’t comment on it? We know better than that.

I would be interested in hearing about what you are seeing for the market going forward since you do seem to own real estate in California.

Christie – shall we craft you a tinfoil hat as well? If you don’t like what?’s posts or anyone elsea, just ignore them like a big girl. I think what? Is on the right track. Open your mind and brace for the tanking.

Christie, I traded most of my stock certificates for hard assets. I am now cornering the world supply of tin foil. I believe I will soon have enough market share that can control the whole tin foil market. Tin foil today, tomorrow the WORLD!!!

Anon…I have posted strategies to home ownership in bubble markets. I’m about action and own real estate and I am experienced real estate buyer/investor and have only added more wealth to my portfolio with each dip.

I’m a day trader and eat the likes of What? For lunch. Yes, I am critical… It’s a housing blog not a renter blog. I give more weight to homeowners/investors than someone who has never done so.

I like lively debate so I enjoy much of What? posts. Sometimes what I post is in jest, it’s all good. 🙂

Renters like What? missed one of the best times to buy since the last crash…they could not recognize a deal if it fell on them. There are strategies to home ownership and it may include renting at times but give me a break there have been many buying opportunities in the last six years.

What I would tell renters wanting to buy now…is don’t, wait till the next turndown. Very simple or “simpleton” advise, lol! Next time around, if you can’t afford your dream home buy a rental property instead and get the cash flow and appreciation while you rent.

Hi Bubble Pop

Diversity of thoughts and opinions should be welcomed and challenged…this blog need not be propaganda where only people who share the same exact opinion should post.

Come on, why so serious?!

I think you need to put on your big girl panties and deal with it.

I’ll post whenever, whatever I want just as you do, that’s what big girls do!

Ok, ok, I will do something that will make you feel all warm and fuzzy inside…

“Housing will NEVER go down!!! NEVER!!! The stock market will NEVER go down!!! NEVER!!! The bond market will NEVER go down!!! NEVER!!! The US will NEVER go into recession!!! NEVER!!! This will go on FOREVER!!!!!”

@Christie s, with this market’s ups and downs and all the funny money manipulation there is no way to predict where the markets will go and how they will react. What? we have here is a casino where the fouls like you gamble with “dips”. The problem I see is that the folks who manipulate and speculate markets do not really add any value to the economy and the society. When you buy “low” and sell “high”, it is not earning money, since it doesn’t actually add any value to the economy. Whenever you sell high you always assume that someone on the other side loses money (by buying high) and whenever you sell low, again, you assume someone losing money on the other side (by selling low). For speculators to gain someone has to always lose. This is why I call it a casino because the wall street doesn’t actually produce any wealth, it transfers it from losers to winners. This is why people despite folks like you because they don’t create prosperity, but rather steal from the society. If the “investors” alike stop “investing” (aka speculating), the society as a whole will just benefit from it. Would have fewer distortions to the markets, we won’t have ups and downs, the markets would be more balanced. I wish some day the housing would be for living, not for investment. When people used to buy houses to live in, they were able to buy median home with median income, it is not the case anymore.. guess why… because we have too many “investors” in the places where they shouldn’t be.

Poor Christie Simpleton, You have never brought any insight to this blog other than NAR/CAR talking points. I am still waiting for you to actually have some insight. I am very patient! Still waiting…

a guy from Seattle…

If you have a 401k, retirement account, stock investments, real estate, stock piles of Friskies you are a speculator. Not too many people keep their money under a mattress like you.

Your frustration is mis-guided to who is responsible for this mess. I can tell you most definitely it is not the small investor.

Yes, speculators has changed the landscape but we are not the cause. You need to look towards banks, the Fed, government policy.

I too wish I had the life boomers so freely enjoyed….working their way through college, blue collar jobs buying homes, one income households, savings in banks that kept pace with inflation. I was not afforded those luxuries so it was more or less get on the bus or get run over.

I’m ready to go back to the days where teachers bought homes in coastal communities with the Beach Boys playing on the radio but that is no longer possible my friend.

@Christie s, what we have here is not an economy, it is ponzi scheme (fascism if you wish) where people, instead of making society better by creating wealth through investments and creation of new products and services, are riding the bubbles. The one thinks he or she can buy a house, sit on it and flip it at profit few years latter, this somehow should bring wealth to the society. What we really need is the government staying out of business trying to “make housing affordable” (college tuition, increase employment, etc, just pick your drug), let the capitalism decide, let the price discovery to take place. Most people want simple things, like buy/rent a home, raise their family, they don’t want speculators or investors looking for every single opportunity to take away their last penny. Housing should be a consumer product, like cars, closing… It should be affordable, it should be competitive, that’s the whole point. People are frustrated because they have to pay too much for housing, it is understandable why, housing is like food, you cannot get along without it, you have to live somewhere, it is a necessity. It saddens me when in used to be the greatest country in the world, median income family cannot afford median income housing (including rents), it is like median income family would not afford median quality food. If this goes forward the way it is, i wouldn’t be surprised to see median income families eating dog food for lunch in near future. The people are despised of investors because they make the necessity, such as putting roof over you head unaffordable. I am not saying the housing should be free, not at all, all I am saying is the affordability of housing vanishes every day…

Hi Christie, I am certainly glad you are here. I’ve been lurking on this site for years and I am glad to see a debate. That said, I agree with the frustration expressed by What? through his sarcasm. He reminds us that this whole market is rigged in favor of destructive long term forces.

Regarding teachers buying into coastal communities, it can happen again. It is just that we need to get off our couches and retake our democracy. Once we do that and we get campaign finance reform/Constitutional changes then our Representative democracy will have a Renaissance.

When we pass by the shambling homeless children of this society, we walk past our future. Christie, before you roll those eyes out of their sockets you have to ask yourself: Can the status quo go on and on? Can the downward spiral of income inequality be ignored for much longer?

No. This pot is set to boil over.

Why would be value investment and speculative success over work incomes when we are a society with 20% overcapacity to produce? Reforms to how capital gains and investment incomes are taxed are a small part of how we bring back the good times you mentioned.

Diversify your portfolio to include both tinfoil and ink

Inevitably either those paper checks with the Statue of Liberty embossed on them should become scarce along with ink

Housing to Tank Hard in 2014!!!!

Nope!!! Not in 2014 at least!!!

Try NEVER sleepless…

Common, guys (and gals :)), you know how it works. First, the rates should go up, second, the bond market should tank, then the stock market to follow, and only then housing, student debt bubble, sub-prime car loans bubble, etc. Not sooner. What?ch the bond market, this is what? the housing will look like in 1 – 2 years…

I once thought Jim was right, heck, may have even been saying that before he did, but am now seriously doubting it.

Will housing go up forever? No. Obviously this is untenable. However, let us not downplay the situation. Let us not underestimate the fact that many, many tenacious and probably stone-cold evil people all around the world, and many if not all nations, are now stuck in this confidence game — because that’s what it is — with no way out, and that their “wealth” and power entirely depend upon it. Do you really think they intend to just fade out?

Can it go on forever? I will tell you exactly how long it can go on — it can go on as long as people don’t get out the pitchforks and storm the castle. However, it cannot go on without impoverishing more and more people.

So how to stop any possible revolt? That is what this is really all about. Bread and circuses work pretty well, but only up to a point. After that point, what you need is TYRANNY. Now, keep your eye on Russia…

OutofCalifornia, absent a severe, paradigm-shifting crisis, housing prices should go up over the longterm. It may dip, sometimes sharply, but only temporarily. Longterm, housing prices go up because…

* Population is increasing,

* All those people have to live somewhere,

* Inflation, maybe even hyperinflation, makes owning hard assets (i.e., paid-off house) better than owning paper money.

I know people say wages are stagnant. But with hyperinflation, wages too will inflate. They have to. Otherwise, people can’t survive, and that would mean revolution and chaos. The .01% do not want that. They’ll buy off the angry mobs if they must.

Granted, these inflated wages won’t bring more earning power. At best they’ll keep up — barely — with rising prices.

Housing prices can only decrease permanently in a severe, paradigm-shifting crisis. Like a severe longterm drought. Or the end of an industry. The death of the Salton Sea killed Salton City as a resort. The decline of manufacturing killed much of the rust belt.

I don’t know if SoCal will undergo a severe, paradigm-shifting crisis. I do wonder about the drought. Is it only cyclical or longterm? If longterm, can it be fixed with desalination plants, “stealing” water from up north, or growing less thirsty crops?

What about our state and local budgetary crises? Can that be fixed by SoCal’s economic strengths — the high tech and entertainment industries, international money, etc?

Then there’s that Big Earthquake we’re supposedly long overdue for…

But absent a severe paradigm-shifting crisis, housing prices should go up longterm.

Slow of Landlord, unlike you I will use your EXACT quotes and respond in kind because I am a clown but I am actually being a clown on purpose…

“OutofCalifornia, absent a severe, paradigm-shifting crisis, housing prices should go up over the longterm. It may dip, sometimes sharply, but only temporarily. Longterm, housing prices go up because…

* Population is increasing,

* All those people have to live somewhere,

* Inflation, maybe even hyperinflation, makes owning hard assets (i.e., paid-off house) better than owning paper money.”

The real problem is that the current slow down in population growth cannot support the exponential growth curve we are seeing in “prices”. The population would need to continue to expand exponentially to support the entire ponzi scheme.

“I know people say wages are stagnant. But with hyperinflation, wages too will inflate. They have to. Otherwise, people can’t survive, and that would mean revolution and chaos. The .01% do not want that. They’ll buy off the angry mobs if they must.

Granted, these inflated wages won’t bring more earning power. At best they’ll keep up — barely — with rising prices.”

We would need to grow jobs at a faster rate than the world population growth rate to increase wages. Welcome to the new world order. There is no way to keep up with price increases regardless what TPTB want. They opened the can of worms and don’t know how to put the cork back in.

“Housing prices can only decrease permanently in a severe, paradigm-shifting crisis. Like a severe longterm drought. Or the end of an industry. The death of the Salton Sea killed Salton City as a resort. The decline of manufacturing killed much of the rust belt.”

It depends on what your definition of a “severe paradigm-shifting crisis” is. How about debt default? That is the most likely “severe paradigm-shifting crisis” that will impact our economy. Once those dominoes start to fall in our interconnected world, all bets are off…

“I don’t know if SoCal will undergo a severe, paradigm-shifting crisis. I do wonder about the drought. Is it only cyclical or longterm? If longterm, can it be fixed with desalination plants, “stealing†water from up north, or growing less thirsty crops?”

Focusing on the wrong “paradigm-shifting crisis”…

“What about our state and local budgetary crises? Can that be fixed by SoCal’s economic strengths — the high tech and entertainment industries, international money, etc?”

This is the biggest red herring of them all. First, anyone that has ever worked in the “entertainment industry” knows two things. One that they hide profits like no other and two they are moving to cheaper locals for much of the work. Almost nothing is actually shot in LA anymore. My guess is that the “high tech” bubble will burst and all the wealth will vanish over night…

“Then there’s that Big Earthquake we’re supposedly long overdue for…”

This would most likely help in the the local economies in the long term with massive construction projects.

“But absent a severe paradigm-shifting crisis, housing prices should go up longterm.”

That is yet to be seen. My guess is that all bubbles pop eventually…

Yes, a growing population means a demand for more housing. That doesn’t mean prices will keep going up if the money moves out and people who can’t afford the area move in or start moving in together en masse. When well paying jobs are fleeing the state and moving their HQ’s to Texas, it’s absurd to believe that prices go up when the fundamentals show this is unsustainable. You really think 250,000 new minimum wage residents are going to pay to live in crapshack houses sold at top dollar? They can’t.

Sure, investors buy properties and rent them out. Is it prudent to overpay for properties only to rent them out for far less than the parity to buying and tie up capital in a money intensive investment than won’t yield all that much? Not really. It residential landlording made that much money, there would be way more billionaires on this planet.

Yes, you can yield much more than just sticking the cash into a passbook savings account. The risk right now is so high – the reward is barely there. That Monopoly analogy is perfect – when a few people in this society have all the money, the game is over and it begins anew.

This “everyone wants to live there and will pay whatever the asking price to do so” mentality is exactly what will do SoCal in.

@What?,

We have not had wage inflation because the government has flooded the labor market with cheap foreign labor, both legal and illegal. Sure, prices go up, but labor costs have dropped or remained steady for a long time. With Obama’s pending unilateral amnesty for 5,000,000 illegal aliens, this trend will continue. It’s called squeezing the middle class until there is no more middle class. Despite the fact that there is a glut of programmers on the market, both major political parties want to substantially increase foreign work visas. The comprehensive immigration bill passed by the Senate had massive increases in foreign work visas. This was not widely reported. Thank goodness for the House of Representatives.

I hope so Jim, because I hate snow and want to move to Southern California!

I’m not as smart as some in regards to finances but even I know that psychology/emotion play a large part in any market. Once fear is out of the bag — it’s a paradigm shifting event. And it seems an increasing number of homeowners are fearful that they will miss out on cashing in their lottery ticket if they don’t act soon. Also, people seem to be pulling prices out of their asses. Case in point — house on Beverly Glen started at 699K several months ago — now at 549K. Drawback to the house? No driveway or garage. Still, 150K swing?

‘Panic Selling’ In London Drives Fear That The UK Housing Bubble Is About To Burst

Read more: http://www.businessinsider.com/panic-selling-in-london-and-uk-housing-bubble-2014-8#ixzz39iaVjRSC

Folks still don’t get it. If housing tanks hard, so will the rest of the economy. As I said before, it won’t matter if the prices fall by 50% because most probably so will do the job market. It doesn’t matter what housing rices are if you don’t have a job you wont buy a house at any price…

I certainly don’t WANT housing and the rest of the economy to tank. There’s just many strong indications that it will indeed implode soon.

“I certainly don’t WANT housing and the rest of the economy to tank. There’s just many strong indications that it will indeed implode soon.”

I agree with sleepless on the fact that the job market will tank along with incomes if/when the economy/housing “tanks”. I have a vested interest in the economy continuing at the current pace. The problem is that the math does not work and has not worked for some time and I fear that we will have some kind of “event” that will lead to the next recession anytime now. I hope I am wrong but I fear that I am not…

@What?, I believe your fear makes sense. As hard as I want the housing price to decline to affordable level, I am afraid it is not going to be an easy decline, most probably it will be a result of more fundamental issues, like severe recession/depression, which, in turn, will make housing still unaffordable. What? we really need is booming economy and the investors and the government to stay out of the housing. So, the people who earn enough could afford enough housing, I mean people with solid financial fundamentals, not 0% down clowns with interest only loans or other crap with 500+ credit scores. The government should spend money on infrastructure (new roads, bridges, utilities, etc) not military or foreign aid, which would allow builders to build in more rural areas and generally increase the supply of housing units. We have artificially low or restricted supplies combined with funny money policies that are supposed to “save” housing from collapsing. It makes everything just worse.

This market is running out of steam even with 4.25% mortgage rates. Everybody agrees rates will move higher over the next 18 months, probably to over 5%. If you look at the history of business cycles, we’re going to be due for a recession around this time as well. Shouldn’t be a surprise — recessions often come with new incoming presidents.

College kids are graduating with $29,500 average debt, people are under-employed, and wages are flat. Now that investors are pulling back and inventory is rising, I think I’m gonna wait this market out.

@wait wrote: “…If you look at the history of business cycles, we’re going to be due for a recession around this time…”

This is a correct observation. Recessions happen about every 5 years. The last recession ended in 2009 which means the next recession is due in 2014.

I predicted when interest rates went up by 100 basis points that the bidding wars would come to an end and the market would plateau until the supply of potential buyers is exhausted. This is exactly what is happening.

recession of 2007-2009 has never ended. We have been in depression since 2007…

@ a guy from Seattle

We have been in a depression since 9/11/2001. I could not buy a job for 2½ years beginning in October, 2001, and when I finally went back to work, I was earning between 40-60% of what I had previously been making on an hourly basis. This depression had its basis in the policies and actions of government under the Clinton Administration. The run-up in housing prices was caused by the Federal Reserve trying to stimulate the economy, and instead of helping the economy, it has prolonged our plight.

If you want to go back to the root of our monetary problems, they occurred under the Johnson Administration, when Lyndon Johnson demanded both guns and butter. This led to Nixon removing the peg to gold and the inflation in the 1970’s. Since labor contracts were pegged to the inflation rate, we had a wage-price spiral until those pegs were removed under the Reagan administration.

Two things contributed to the boom in the 1980s. The first was the breakup of AT&T, which led to major changes and increased employment opportunities in the telecommunications industry, and the emergence of personal computers, which revolutionized businesses. Back to telecommunications, AT&T used to charge much higher prices for long distance in order to support telephone service in remote locations. When competition in long distance began to occur, long distance prices dropped. This had an interesting effect on businesses. The reduction in long distance rates resulted in incentives to centralize business headquarters. It also made mergers and acquisitions more attractive. The effect of changes in telecommunications prices in our national and international economies is something that is rarely, if ever, noted or talked about, but is something that has had a profound effect on our society.

Christie Simpleton, please read the below quote from RM. This is what it looks like when someone brings NEW insight to the conversation. Regardless if it is right or wrong, it is both interesting and insightful. Take notes!!!

“Back to telecommunications, AT&T used to charge much higher prices for long distance in order to support telephone service in remote locations. When competition in long distance began to occur, long distance prices dropped. This had an interesting effect on businesses. The reduction in long distance rates resulted in incentives to centralize business headquarters. It also made mergers and acquisitions more attractive. The effect of changes in telecommunications prices in our national and international economies is something that is rarely, if ever, noted or talked about, but is something that has had a profound effect on our society.”

This time is different because of all the “bifucastration” in the air…

“bifucastration�

@wait – bi means two, fu@$ed means, well you know f’ed and finally castrated means to ummmm lose your man parts if you know what I mean… This world was the winner of the word of the week contest sometime back. I don’t remember who submitted the word but is was unanimous! Dfresh, do you remember who submitted bifucastrated?

What?

Bifucastrated was lightening in the bottle…and should be anointed to our dear departed “Drinks.”

Get the biggest mortgage you can! Prices only go up!!

Isn’t it odd how people don’t notice that ‘mortgage’ has the same root as ‘mortuary’? It happens to mean death contract yet in the modern age most people want the biggest one they can get. Another oddity is the fact that most people have played Monopoly at some point in their lives and even though everyone knows how the game ends, we just can’t help trying our luck.

The game Monopoly was specifically created to teach people what happens when the land becomes monopolized. She thought if the kids learned it at a young age they would know what NOT to do later on. For some reason this lesson has not been learned even though everyone knows what happens at the end of the game. There are two main lessons that the game is intended to show. Lesson number one is that most all of the players lose everything. Lesson number two is that even the winner loses because he no longer has anyone to ride his railroads or rent his properties.

A friend of mine told me when they were kids they would just print up more money so that no one had to stop playing, but that only stopped the tears for a while…

It’s not a very fun game when you think about it.

That is really a great analogy. Thank you for sharing.

The most telling passage in the Monopoly rule book is:

“The Bank “never goes broke.” If the Bank runs out of money, the Banker may issue as much as needed by writing on any ordinary paper.”

I never read the rules to the game. Now, I wish I did…

Wow that is even more incredible!

http://www.economist.com/blogs/buttonwood/2009/10/monopoly_money

Doc,

Thanks for the Arizona post! Long time reader, first time commenter. Being a Valley of the Foreclosure resident, I would like to share two anecdotes about the Phoenix market. First: two friends, a married couple with one child, were offered $100k by a grandparent to purchase a home in the spring of 2012. The two were in a frenzy to find a place, as they had lost out on a few properties due to large numbers of investors bidding on homes with straight cash, even though these two had $100k to drop on the table. Hubby isn’t the most motivated of individuals, so wifey was the driving factor in finding an investment (her words, not mine). Long story short, they purchased a 3bedroom fixer in an ok (sic) part of Chandler, AZ for $125k, they had to go back to gramps and ask for the extra cash because they were being out bid yet again. The couple is happy, the wife quit her job and stays at home watching Netflix or Hulu all day, while hubby works for his father and the kid is in grade school. They feel comfortable with one income because of the paper housing wealth they have ‘earned’ over the last two years. Second: a colleague of mine bought a BofA foreclosure in the heart of Tempe (about 4 miles from ASU) in 2011 for the paltry sum of $111k,she has been trying to unload the place for the last 3 months, starting at $250k,with price reductions all along the way. I asked if she would consider renting it out, her response was, ‘no, it is my house, i don’t want a stranger living in it’… I was shocked by that asking price, and then i heard that old canard, ‘but my realtor said that it was priced just right’. Supposedly one investor had taken a look, but no offer was forthcoming. Just wanted to let you know that LA is not the only place in Amurica where people are delusional about housing.BTW The comment that ‘only’ 24.8 percent of purchases in Arizona are from investors is spot on and quite hilarious. Disclosure time: I used to work for 2 TBTF banks in mortgage loss mitigation, needless to say, I ‘missed the boat’ on this current bubble. I am not sure if that is a good thing or a bad thing just yet…

Tededfred…Realtors are one reason (a big one by the way) for this housing in America lately. Most never do their homework, they are at least 6 months removed from knowing the real market.

They go on a listing and agree with everything the seller says then go ahead and over list the property in hopes of a stupid buyer showing up with a even dumber buyer’s agent.

Then all of a sudden 6 weeks later they tell the seller sorry, I was told by my broker the market is dead so the start the journey down in price reductions. the agent still has no clue of what the house might fetch all they know is the sign still bears their name???

Can someone lend me their little robbie decoder ring? I seem to have misplaced mine and I have no idea what little robbie is talking about…

‘Panic Selling’ In London Drives Fear That The UK Housing Bubble Is About To Burst

Read more: http://www.businessinsider.com/panic-selling-in-london-and-uk-housing-bubble-2014-8#ixzz39iaVjRSC

The flow of cheap money out there is unreal. My wife is giving her current car (10 year old Prius) to our 16 yo daughter, so she needs a replacement. We were just approved for an UNSECURED loan from Lightstream (Suntrust Bank) of $20,000 at 1.99% for 60 months. That is insane! They just wired the cash into my checking account. Now we just go use the money towards any car and no lein issues…We get the title. Granted, we have 800 fico scores and good income….but sheesh….that is a prime example of the Fed’s ZIRP in action when a bank can do unsecured loans at 1.99% for 5 years.

You are now an “all cash buyer”! This is exactly how the majority of “all cash buyers” do it in the housing market.

“The Next Default Title Wave”

Can anyone share any insight about the impact on the Heloc’s beginning to amortize through the next few years. Anyone have any data on California?

http://www.tucsonlanduselaw.com/2014/06/articles/foreclosure-topics/the-next-default-tidal-wave/

Amy Crews Cutts, chief economist at Equifax, recently told mortgage bankers that the coming increases to homeowners’ monthly payments on these home equity lines is a pending “wave of disaster. Peter Rudegair reported that more than $221 billion of HELOCs at the largest banks will amortize over the next four years, about 40 percent of the home equity lines of credit now outstanding. According to Rudegair’s Reuter’s article, in 2014, borrowers on $29 billion of these loans at the biggest banks will see their monthly payment jump, followed by $53 billion in 2015, $66 billion in 2016, and $73 billion in 2017.

Equifax’s Crews Cuts believes that in terms of loan losses, “What we’ve seen so far is the tip of the iceberg. It’s relatively low in relation to what’s coming.†By all accounts, absent a rapid improvement in home equity levels, 2015-2017 may well usher in a substantial wave of new defaults, causing notable pain to the largest banks’ balance sheets.

Doc…Not sure where this 35k number came from, I checked with ARMLS and Dept. of Numbers both reports inventory of homes and condos at just over 22k and falling?

I then called a top broker in Phoenix I know and he came back also at 22,417, he said a high volume of homes have drop off market the last 6 weeks. Some will wait to fall to see any upward movement others will wait 6 months to a year, which means low inventory this next 3 months or longer.

I also checked the very high end market in N Scottsdale who had inventory at 1.963 in April as of Aug 5th it stands at 1,377.

robert,

he showed 35.1% change year to year,Inventory 27,081 as of July 14.

Doc….BTW to clarify this number of lower inventory, by no means the Phoenix market isn’t in a slump it is for sure. Houses many of them sold for much lower prices and it looks like many couldn’t get their price so the let the listing expire, or canceled the listing.

In my neck of the woods, .75 baths is the new hotness! Now that I’ve seen these .75 bath properties, I don’t want to look at any homes with at least one full bath. I know I’ll probably have stretch to get into a .75 bath property, but housing is only going up, am I right?

Okay… I give up. Full bath is considered a can, a sink and some kind of bath/showery thingamabob. Half bath has a can and sink only. What does one expect when getting a three quarter of a bath? Do you get long hose from an outside spigot coming through the bathroom window with a drain in the floor and we call that a quarter of a bath?

A can and a sink is .50 baths. Throw in a shower and you get. 75 baths. I was coveting this wonderful mid-century modern .75 bath but it has already gone pending!

http://www.redfin.com/CA/Altadena/3562-Glenrose-Ave-91001/home/7253629

A 3/4 bath is a cramped full bath, basically you use the toilet and can lean on the shower door.

My mom always called her bathroom a 3/4 (1950s rambler)

I think there is a formal definition

1/2 bath is sink and turlet

3/4 bath is sink, turlet and shower

full bath is sink, turlet, shower AND bathtub.

Bidet?

Got it!

@Teresa,

$450,000.00 for a 678 sf closet on 5509 sf lot built in the era of Eisenhower? I am not good at geography but I think Altadena is not coastal CA. Is there an oil field under the house? Goldmine? Silver mine? Buried treasure? Was David Lee Roth born in the house?

What?, I know you and others on here like to consider all kinds of external factors like the bond market and so on when evaluating a house. As a result you are missing out on very important trend information. Micro-houses are in! Here’s another very nice .75 bath that I have my eye on:

http://www.redfin.com/CA/Pasadena/390-N-Sunnyslope-Ave-91107/home/7218264

The first property I pointed out does not need a silver or gold mine on it. It’s a picture perfect mid-century modern remodel, and that alone justifies the price! I particularly like the way the micro-house seems to mirror the car port in its design. It’s almost like the micro-house was once a car port.

You do not need a pit filled with some barbaric relic when you have this kind of style going for you.

Teresa, what you call “micro houses” are what some realtors call “condo alternatives.”

As in, sure, it’s not a great house, but it’s better than a condo. It’s about the size of a condo, you own it like a condo, but there are no shared walls.

People often see condos as a step between renting and a starter house. I suppose these “condo alternatives” are supposed to be a small step above condos, if you can’t yet afford a full “starter house.”

These are TRUE micro houses: http://www.tumbleweedhouses.com/pages/houses

http://thetinylife.com/tag/micro-house/

Some environmentalists ever consider the “tiny home movement” to be highly progressive — a way to lessen man’s carbon footprint.

I will need to find my old MICROscope to view your MICROhouse… Now explain to me why the MACROprice… Ohhhhh it will offset the MICROsavings and MICROpaycheck… Got it!

Teresa, that house was on the market 22 days, it on a dead end street, and is about $672 sq. ft. Santa Monica prices. I have 45 properties on property watch for 2 months — only 4 have gotten offers and gone pending. Another .75 bathroom house will come along soon — or maybe an even better one.

I can see my dry sense of humor does not come across well here. I will have to be more blunt about what I mean.

There may be more inventory on the market, but the quality is pretty abysmal–as evidenced by the .75 bath houses on the market asking for (and getting) top dollar.

There’s a lot of crappy inventory in L.A. Older “Kit” houses that were built, DIY fashion, from kits ordered from Sears Roebuck at the turn of the last century. Older homes with zero upkeep, still sporting the type of iron pipes that led to the recent flooding incident over at UCLA. It’s a scandal that these properties are selling at such high prices. I guess my message here is buyer beware.

I know some investors here think there are still lots of opportunities in housing to make money so everyone should buy, buy, buy. Who cares what the real value is? I’m personally not comfortable building an investment strategy around the “greater fool’ theory. This is a philosophical choice as much as it is a financial choice.

“I guess my message here is buyer beware.”

Okay now I am officially confused. I thought we were talking about “turlets”….

Doesn’t matter how much facts you have in front of you…this article below basically capture how the general feel about housing…if people are reading yahoo articles and following the “Advice” then go luck to them..

https://homes.yahoo.com/news/reasons-to-buy-a-home-now-064217521.html

Speaking of yahoo “news”…

http://finance.yahoo.com/news/the-economy-does-better-under-democratic-presidents–here-s-why-153217880.html

This is why we NEED to vote for the next donkey/ass they parade in front of us. Don’t get me wrong, I am politically agnostic and believe that there is no real difference but really?

I stopped reading after ‘yahoo’

seriously though, many of the comments were more intelligent than the article.

Its 100 degrees at 3am. Whats not to like?

Home Equity Loans are resetting:

http://www.marketwatch.com/story/the-home-equity-line-crisis-might-not-be-as-bad-as-some-fear-2014-08-07

Relevant parts of the article (note the line ““The sky is not falling here,†Becker said. “Seventy-nine billion in elevated risk is not a small number, and needs to be managedâ€):

…

Somewhere between $50 billion and $79 billion in balances on home-equity lines of credit could be at an elevated risk of defaulting in the next few years, the study found. That’s fewer than 20% of home-equity line balances; there was a total of $474 billion in HELOC balances outstanding as of Dec. 2013.

…

An earlier estimate from the Office of the Comptroller of the Currency suggested that $171 billion in home-equity lines held by the country’s biggest banks would reset between this year and the start of 2018, compared with $28 billion in the previous four years.

…

Many of them aren’t tiny loans, either: 52% of HELOC balances were greater than $100,000 at the end of last year, TransUnion found.

BLACKROCK: The US Deleveraging Story Is A Lie

Read more: http://www.blackrockblog.com/2014/08/07/great-deleveraging-happened-debt-problem/#ixzz39l7X423j

Hmmmm we have many of the stock indexes basically flat for YTD. Housing prices have slowed even in the summer rush. Where is the money that can support housing appreciation?

Maybe we are seeing the beginnings of a new consumer revolt. Didn’t think I’d just accept higher prices did you???

@Leaf Crusher wrote: “…stock indexes…flat for YTD. Housing prices have slowed …Where is the money that can support housing appreciation…”

Stop pissing on the perma bulls parade!

Everyone knows that:

1.) Housing prices never ever go down.

2.) Stocks prices may fall but stocks always end the year higher.

3.) The Red Chinese are honest.

Stocks are going back to the “all time highs”, no tank on the horizon, enjoy the bubble while it lasts 🙂

BTFD!!!!

The RE and rental market is on complete steroids in my area. 2006 peak prices, except in 2006 rent was cheap but housing prices were inflated.

Now rent is through the roof. I’m seeing 3 bed APARTMENTS rent for $2100 a month, exact same apartments were $1600 a year ago. Who would pay that for a crappy apartment. Remember I’m not in LA or Orange County. I’m outer Eastern suburbs of Sacramento.

For every house that sells, the next one/comp is priced 5% higher. Homes are going pending in under 3 days. I don’t get it. Who the hell is buying these places? And with what? It seems like a last ditch effort to “get in” before you are “priced out”.

People have lost their mind – again. The general public have such short memories. 8 years ago is apparently too long for their attention span.

a guy in Seattle…thanks for giving a little lady like me such and education. I have never heard such information before…thanks!

I never knew the reasons why the economy and markets are the way they are today. I thought black holes may have been the cause. That history stuff is so Funk & Wagnalls!

One day I was picking up my dry cleaning and next day I invented the Ponzi Scheme. Everyone has jumped on the band wagon and I have quite a following. I have more likes than Jesus. No one wants to play musical chairs anymore since the new age of Ponzi. I’m their leader. Forget juicing, I have taught everyone how to make Ponzi out of lemonade, it’s a derivative of lemmings…I mean lemons…oh crap shack, I must be house horney again!

If you want housing prices to stabilize and get the investment mentality out of this arena then you want:

Increased Capital Gains Taxation that collects profits from sales that net higher returns and grants tax breaks for losses on decreased sales values.

A responsible government would have made this happen a long time ago.

Let me fix that language!

If you want housing prices to stabilize and get the investment mentality out of this arena then you want:

Increased Capital Gains Taxation so that profits from sales reduce the actual gains. Likewise, capital losses for when homes drop in value take the pain out of price reductions. The goal of affordability should drive this bus.

A responsible government would have made this happen a long time ago.

Interesting considering Arizona took the path of clearing out their foreclosures instead of delaying out the foreclosure process like Nevada and California did…

Hmmmm….

From October of 2012 on a blog article that I did @ http://www.lasvegasrealestatehome.com/blog/nevada-ranks-second-in-percentage-of-homeowners-90-days-late-on-their-mortgages.html

“Also a big surprise is that Arizona has dropped off of the top 25 list for the percentage of delinquent home loans 90+ days late. It didn’t seem like it was too long ago that Arizona was competing with Nevada for the top spots in the number of foreclosure filings reported. Arizona took the path of dealing with distressed homeowners head on and not delaying out the foreclosure process resulting in now having a healthier real estate market with less distressed homes that will eventually hit the market as Bank Owned Properties or short sales who knows when. Currently, only 5.2% of Home Loans in Arizona are seriously delinquent 90+ days.”

Thanks for the great stats on Arizona and what is happening in a state where shadow inventory isn’t such a big “What If???” like it is in Nevada and California. Obviously easy to speculate on what is about to happen in states that did manipulate the market by dragging out the foreclosure process and inflating prices by creating a lack of inventory.

Leave a Reply to tolucatom