Alt-A Loans and Pesky Resistant Subprime Loans: The Lingering Mortgage Beast. $1.1 Trillion in Active Toxic Waste Mortgages. PennyMac Ready for Toxic Mortgages. What Happened to the Public-Private Investment Program?

It would seem that all the housing problems are now washed away in the ocean of government bailouts. Many readers after reading the Alt-A and option ARM tsunami report sent me a few articles showing how option ARMs are not going to be such a big problem. I disagree. If toxic mortgages and debt were not a problem why don’t we remove the additional $13.5 trillion being dished out to Wall Street? By the way, over $4 trillion of that commitment has already been used and spoken for. That $4 trillion was worth a 45 percent stock market rally (too bad it is on the back of taxpayers many who are losing their jobs in the real economy). The problem of course goes beyond the option ARM loan which is a monstrosity and a beast with no purpose in this financial universe. The Alt-A galaxy includes option ARMs but also includes: stated income, stated asset, no income verification, debt-to-income ratios that Fannie Mae and Freddie Mac wouldn’t touch which tells you something, weak credit history, and maximum loan to value ratios. Now how much of this Alt-A crap is outstanding today? Try $660,000,000,000.

And let us not forget about the $446 billion in subprime loans that are still out there floating in the abyss. The toxic mortgage problem is still largely present. Doubt it? On July 30th PennyMac (PMT), a real estate investment trust went public to buy up toxic mortgages. You would think that they would avoid the “Mac” in the title given IndyMac and Freddie Mac don’t exactly inspire public confidence. One of their goals is to buy and modify mortgages keeping buyers in their home before selling the loans once the value goes up. Does this crap sound familiar? It should. One of the top managers of PennyMac is none other than Stan Kurland, a former Countrywide Financial executive. The company had a weak performance on Thursday even though the stock market is flying high like an eagle strung out on drugs. If you were wondering what happened to the public-private investment program, here we are starting to see the inbred nature of bailing out those who actually were responsible for this crisis.

One thing the happy cheerleaders in the financial circuit fail to have is basic logic. Think of it this way. Why would we need all those trillions in backstops if we are now officially out of the recession? I’ll tell you why. These are the same people who led us to financial Armageddon and here they are promising the public once again that all is well yet quietly, they are developing methods to unload the remaining toxic mortgage waste so they can effectively be absolved from their massive financial sins. Who better to know what crap is on their balance sheets than the mortgage manure producers? This is certifiable insanity! Now wouldn’t you think it would be prudent to at least call in folks who were whistle-blowing before the crisis to buy up some of these mortgages at the right price or at the very least, didn’t produce the actual junk? Of course this isn’t going to happen because crony Wall Street knows that once we open up the books, we know what kind of toxic mortgage waste we are going to find in their Pandora ‘s Box. Their plan is to unload this mortgage chum to the U.S. taxpayer now that they are drunk on financial happy talk so once things sour again, the mortgages will now be fully on the taxpayer’s back. Whoops! Now it’s your problem.

Make no mistake, we are going to hit another wave of pain. The commercial real estate market with $3 trillion in debt has some of the most toxic debt in the world. Empty strip malls, vacant medical offices, and parking lots with no cars. We have barely scratched the surface in this market. Have you ever asked why we are up to $13.5 trillion in financial bailout commitments? What a convenient number to choose given that we have used up $4 trillion already. And don’t listen to the Wall Street crony capitalist. Remember when we were being told Fannie Mae and Freddie Mac were going to turn a profit? Bwahahaha! A few hundred billion in losses later, the story is a bit different.

But let us focus our attention on the Alt-A and subprime universe.

Alt-A and Subprime Still Toxic Waste

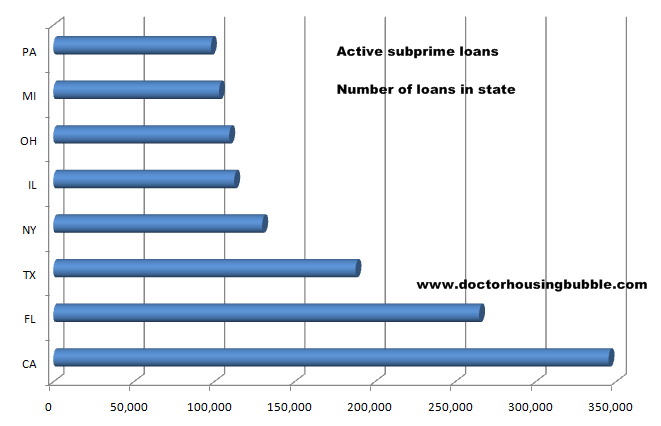

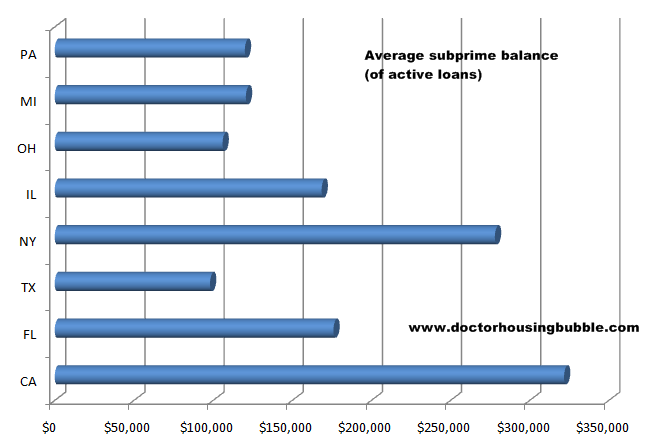

People want to forget about subprime like a crazy ex but there are still $440 billion in subprime mortgages active:

The average subprime loan balance is $180,000. There are some 2.4 million loans in the U.S. that carry the proud subprime label. The large majority of these loans have as much likelihood as making it a few more years as city sewage turning into gold. As you can see from the chart above, your typical epic failing housing markets are your largest guilty parties. California leads the parade followed by Florida and Texas. Notice how other states like Ohio make their way on to the list. Many of these loans will be epic fails. Calling PennyMac.

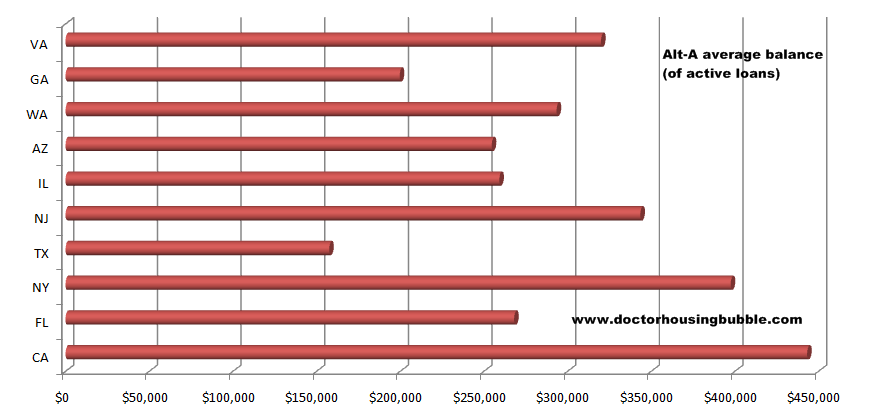

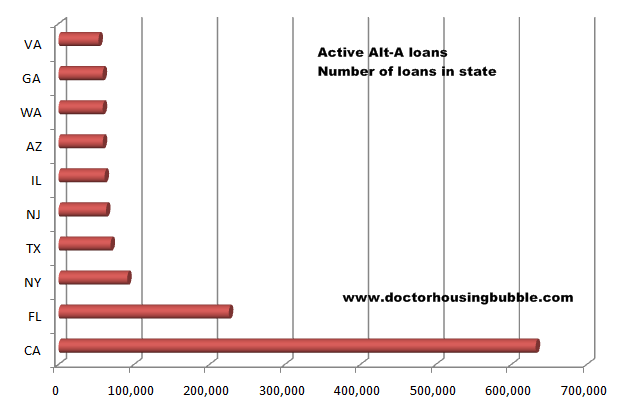

Yet the Alt-a crap flowing through the mortgage veins of our country is more ominous:

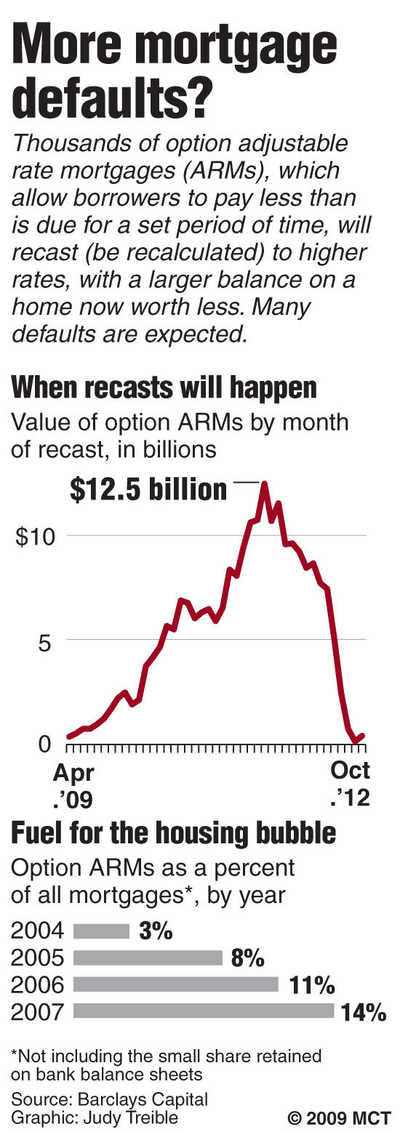

As you can see from above, this is by and large a California problem. How much of that $660 billion is here in California? $280 billion. So one state has over 40 percent of this crappy market and much of it is the option ARM variety. The Alt-A and option ARM tsunami will happen.  The only remaining question is what does this mean for the housing market? Not good news. Much of the doubt that I received in the last few weeks was based on new research conducted by Barclays Capital:

“(BusinessWeek)Â New Barclays Capital research from Sandeep Bordia and colleagues shows that the recasts in the next year or so are expected to be a minor event. But by mid-2011, these borrowers are forecast to see payments that are 50% to 80% higher than what they are grappling with now. (Many of these option ARMS are concentrated in former hot-spot real estate markets, such as California and Florida.)

Modification don’t seem to be working with these particularly noxious loans. In the face rising payments, borrowers don’t have an incentive to keep up with their current payments for homes that are already so horrendously under water, i.e. the loan amount is far above the current value of the property. Bordia says that many of the option ARM loans that do get modified turn delinquent soon after anyway. They’ve crunched some numbers and forecast that 95% of the loans that are slated for modification will eventually default. If you think that sounds bad, get this: They say that 80% of the option ARM loans out there that are ok and up-to-date as of right now will eventually default, too.”

My emphasis added but did you get that? This is the same logic that was used in California in 2007. Housing prices didn’t fall 50 percent…until they did. Here, the positive spin is 80 percent of these people are ok…until they are not. Sure, you are driving in your red convertible with no care in the world…until you fly off the cliff. And keep in mind we are only looking at the option ARM universe here. We had folks who went stated income on 30 year mortgages or went gangbusters on an interest only loans. Not option ARMs. In fact the amount of option ARMs outstanding is hard to gather but some figures put it at $230 billion. A subset of the $660 billion Alt-A pie. So the Alt-A universes goes beyond the option ARM. And most of those loans are crap as well. It is one gigantic feast of mortgage sludge blended with other waste. And as you noticed, the report isn’t stellar so I’m not sure why some were sending e-mails of relief from this data. So we don’t implode in 2010. Okay, so you are breathing a sigh of relief because we implode in 2011 (by the way that is when I predicted a bottom for the California housing market)? Their estimate is that 95 percent of option ARMs that are modified re-default. So you get the picture. This is a Godzilla like mortgage mess. This is the size of the subprime explosion and here we are, starring it in the face and everything is supposedly dandy.

Here is a new chart based on the data:

Source:Â McClatchy

Yet in an interesting find from Zero Hedge, some of the banks may be sidestepping the public-private investment program:

“Wells Covertly Offloading Subprime Loans

A relatively obscure piece in the Triangle Business Journal, referring to a piece in the National Mortgage News, demonstrates how some of the larger banks are bypassing the PPIP and going direct to willing toxic buyers in a very “under the radar” fashion. In this particular case, Wells Fargo has apparently offloaded $600 million in subprime loans to Arch Bay Capital at 35 cents, or double what other hedge funds had offered. While the price discrepancy alone is worth a follow up, the TBJ had this interesting tidbit to note about the transaction:

“No one involved in the recent sale is talking on the record, which may be a key reason lenders will look to private transactions to unload bad assets rather than turn to a government-sponsored program.”

It is very interesting how many other comparable portfolios Wells Fargo has been offloading without public notification, at what price, and how much of an MTM hit it has had to endure as a result. What is confusing from this development is that the bank would be willing to take a 65 cent hit (which on $600 million is not, or rather in the pre-taxpayer-guarantee-of-everything days, used to not be, peanuts), when it could keep the loans, even if massively non performing, and sell into the PPIP at what the FDIC would announce is a much higher and “fair” price. Is Wells admitting it realizes that PPIP is a failure and thus is pursuing private transactions even at a major loss? The discovery of comparable transactions by other banks would be useful to determine if this is indeed the case.”

Interesting observation. The lukewarm reception of PennyMac is telling you what we have been telling you for months. The public-private investment program is an outright sham and any initial movement and gaming will bring massive political consequences. The public can take a lot (obviously) but patience is wearing thin. The commercial real estate bust combined with the Alt-A and option ARM tsunami may be enough to give us our pitchfork tipping point followed by a Pecora investigation and hopefully some much needed justice.

I’ll leave you with this quote from inmate Bernard Madoff:

“No one bothered to ask simple questions. People foolishly – including accountants and regulators – never looked in the right places.”

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

11 Responses to “Alt-A Loans and Pesky Resistant Subprime Loans: The Lingering Mortgage Beast. $1.1 Trillion in Active Toxic Waste Mortgages. PennyMac Ready for Toxic Mortgages. What Happened to the Public-Private Investment Program?”

And remember, if the wave of Option-Arm and Subprime defaults all get foreclosed and flood the market with REO resales, prices will continue to slowly decline. That means that even homeowners who got Prime, gold-standard mortgages (30-year-fixed at less than 6% with 20%-down) before 2004 begin seeing all their equity wiped out and start going underwater. Going underwater is what pushes even people who would otherwise be able and willing to pay their mortgages to give up and walk away.

Now, there’s been a lot of talk about mortgage modifications, but in my judgment, we’re not going to see much meaningful activity on that front. This is mostly because (a) they don’t work for the banks and (b) it sets a precedent, and everyone and their mother will be constantly trying to rehaggle their mortgage terms forever.

Here’s my guesses as to why we haven’t, and we’ll never see many real mods:

1. Financial Intelligence – banks were holding back for enough time to conduct experiments with a small number of mods to see whether they make sense.

2. The results of those experiments probably prove they usually don’t.

3. If they start mods, millions of underwater homeowners will flood the banks with requests.

4. Banks don’t know how much to mod – too little and you get a redefault, too much and you lose money you wouldn’t have in an REO resale.

5. Foreclosure is useful for legal reasons – especially the automatic clearing of title, and wipe-out of subordinate liens

6. Mods could reset the statutory time period to conduct a foreclosure – so if the owner defaults again, it could take an even longer time in a falling market to foreclose – which risks larger losses.

7. If you mod once with an existing homeowner, and prices fall, he’s immediately back underwater and wants a new mod – and so do all the millions that already got a mod – and so do the millions more that just went underwater.

8. A loan modification leaves the bank with a buyer who has already burned them once (and is now seen to be a greater credit risk), and who also now probably has no equity since most defaults result from a buyer being underwater. The bank prefers a clean resale to just be rid of the problem – and if they offer financing to the new purchaser – they get a new customer with a higher credit score and 20% equity down.

This, by the way, is the reason the banks will probably get excited about lending again much earlier than “the bottom” – when prices are still 25% in excess of where they forecast the bottom to be, because they can

reallocate losses to the new buyers.

Remember folks – buying houses is all about leverage of at least 5-to-1. Leverage means high gain in an up market, and high loss in a down market. Let’s say you put 20% down and see what happens with a relatively small change in prices of 10%. If Prices go up 10% when you sell, you’ve made a 50% return on your equity! If Prices go down 10%, you’ve LOST 50% of your equity while the bank is still cushioned from any loss.

Banks are simply not going to get into the business of doing zero-equity modifications and expose themselves to even greater losses than they’ve experienced thus far.

Don’t forget that PennyMac isn’t a Mac at all. It’s a bunch of senior execs from Countrywide that got capital injections from BlackRock. The same Blackrock that recieved tarp money to stay afloat. There is a hell of a story in there if anyone has the b@lls to chase it.

The sub prime mortgage crisis has been triggered by a rise in the foreclosure and mortgage delinquencies in the US. The problem became apparent in the year 2007 when refinancing of these adjustable-rare mortgages became gradually difficult and has been one of the huge challenges which have led to the global financial economic crisis.

A study revealed that about 2 million people who took sub prime mortgages have slowly turned victims of foreclosure. The security corpus funds which were backing the sub prime mortgages gradually became less and less and a huge decline of the capital has been observed in big banks and federally sponsored enterprises complicating the problem further. Some of the sub prime lenders have shut down while some have filed bankruptcy. The whole vicious circle has been caused by the careless lending to borrowers who did not have adequate funds to repay and who were not sure of their affordability in the future. Investors never bothered to verify the strength of the portfolio of the borrowers before backing up the sub prime mortgage security funds. In order to qualify for loans, the borrowers had overstated their incomes. Another major factor was the low level of government oversight to the real estate bubble which was uncontrollably growing.

Read More: http://www.housingnewslive.com/articles/subprime-mortgage-myths.php

WOW! I just heard you on the Max Keiser show. You are officially an international superstar now! eat your heart out Madonna!

Let’s stop being so US centric. So Spain and other Euro countrtries don’t have worse mortgage problems ? Some of these strivers took out a mortgage in Swiss francs when in was in florins or whatever their local currency may have been. And have taken a 10-20% hair cut on currency There are more blowups to go to come.

If we all know about this coming Tsunami, then of course the Gov’t knows, and it is probably gearing up to do “whatever it takes” to keep the “flood of fairness” from happening as it should. Part of me says there’s nothing Obama & co. can do about it, but another part of me worries that they will indeed go thermonuclear on this bitch once the walk-aways and defaults really begin to pile on. Will the gov’t (us) simply end up with every bad loan? Will Obama allow millions to live rent-free for years on end, just to hide the facts? (How will that go over with the steady payers?) Will the white house just start paying mortgage payments directly? I think they will at least TRY everything under the sun, until the bail-ers get sick and tired of the bail-ees and revolt in some kind of way. If it was JUST the free market at work here, then the aftermath of the ten-year housing orgy would be very, very predictable. But with all the bank obscurity and scams and bailouts, and all the moral hazards being dished out, there’s no telling exactly how this will play out. I want to hear Dr. HBB’s absolute worst case scenario for Obama trying to put the brakes on the natural price declines that all the renters of the world like myself are waiting for.

The clock is ticking faster and louder now on these toxic loans. Throw in desperation in the stock market and we have a disaster in the works this Fall. Over leveraged Westside is going to take a beating and finally wash the last of the garbage loans out.

http://www.westsideremeltdown.blogspot.com

If Wells is privately unloading some of their worst junk at 35 cents, they must see that price as a heck of a deal. And that’s pretty scary. PPIP bids will come in much under that. If the bad paper is the worst of the worst, it’s probably not going to fetch more than two bits at best. That’s a heck of a big loss for the banks……or whoever holds the end paper…..nobody knows.

The banks really got a break with the suspension of mark-to-market ( M2M )rules by FASB in April ( with heavy government/bank “encouragement “). No way are the banks now carrying their junk on the balance sheet at 35 cents. And no mystery that zombie banks with no heartbeat got well after the change in M2M. Big, big losses became teeny-weeny losses on the balance sheet for the second quarter. And the banks suddenly announce magical profits . The bonus machine rolls on, baby !!

I now see that FASB realizes it screwed up with the M2M change after seeing the earnings reports. Now they’re trying to reverse the April decision and the banks are fighting them tooth and nail. This change resulted in a material overstatement of bank earnings in the second quarter and FASB is terrified that this tar baby will stick to the AUDITORS.

What a mess !!

I’ve been seeing people writing about how tax payers are the bad holder, and they are suckers at the mercy of the government and wall street gangsters. I am wondering if it has ever occurred to the authors that they are also tax payers. So don’t feel sorry for the tax payers but instead think of a way to shift the scale back a little bit.

Great comparison with the Great Depression. This very well could be worse as all the pieces are now put in place. Imagine what would happen if and when the stock market crashes again this Fall. Govt is pulling every trick in the book and still hasn’t helped. Trying to persuade public opinion and consumer confidence is all they have left. Pathetic….

So many on the Westside of LA are in denial, or don’t want to admit their mistakes. Once summer ends, housing will get crushed here.

http://www.westsideremeltdown.blogspot.com

@Indy…FRAUDCLOSURE DOES NOT CLEAR TITLE! ONLY THE SIGNATURE OF THE TITLE HOLDER CAN CLEAR TITLE AND THAT WOULD BE THE HOLDER OF THE DEEDS WHO ARE….THE U.S. TAXPAYERS…WE THE PEOPLE ARE WHO LENT, FUNDED AND PAID FOR EVERY SINGLE THING THESE CROOKS DID. THE BANKSTERS ARE THE DEBTORS. THE BANKSTERS OWE THE U.S. TAXPAYERS HUNDREDS OF TRILLIONS OF DOLLARS. THE BIG BANKS SHOULD BE SUED OUT OF EXISTENCE BY THE AMERICAN PEOPLE AND THE TRAITOR POLITICIANS WHO ALLOWED THIS, THE CEO’S, THE FED HEADS, AND THE HEADS OF THE U.S. TREASURY DEPT. PAST AND PRESENT SHOULD BE IN PRISON FOR STEALING THE WEALTH OF THE PEOPLE AND PLUNDERING IT BY COMMITTING $1.2 QUADRILLION DOLLARS OF FRAUD OFF OF OUR SIGNATURES.

Leave a Reply to infobuzz