The investor buying party in real estate: In last four years institutional investors have purchased over half a million homes. 2014 was a four year low in investor buying.

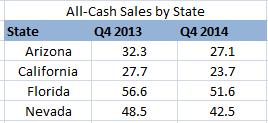

Investors continue to be a big percentage of home sales although overall home sales are rather low. Big investors started pulling back from the housing market late in 2013 and steadily into 2014. But even as that trend continues, we find some states heavily dominated by investors. In more “normal†markets all-cash buyers represent 10 to 15 percent of total sales. These sales in the past largely went in expensive markets rather than investors buying up single family homes to turn into rentals. Big investors have had a good share of activity over the last four years. In this period, institutional investors have bought up half a million homes in targeted markets. While this may be a small portion of overall sales, when this money is targeted in one specific area, rapid price increases can unfold. While California has a large share of all-cash buyers, we find Florida and Nevada leading the way.

All-cash buyers pulling back

It is important to understand that while the sheer number of cash buying is pulling back, all-cash buyers still make up a sizable portion of all home sales. In California, all-cash buyers continue to make one out of every four home sales. This is twice the historical rate in a market that still has very little inventory. But states like Florida and Nevada continue to see all-cash buying as the cornerstone fueling the market.

Take a look at this data:

Source:Â RealtyTrac

Cash buyers have pulled back in big numbers but continue to be a large portion of total home sales. In the last few years we have seen a massive number of households becoming renters. It is still clear that most people want to own across the country. This is a general perspective but the market with Millennials shows that 6 out of 10 would prefer renting.  Future home sales will need to come from younger buyers unless older people plan on trading houses to one another in an internal game of property ladder. Trade crap shack one for junk shack two. And in places like Florida or Nevada, it is highly doubtful your traditional buyer is paying all-cash for a $200,000 or $300,000 home. It is more likely it is an investor looking to flip or to turn a property into a rental.

So has this investor play been a good one? Absolutely:

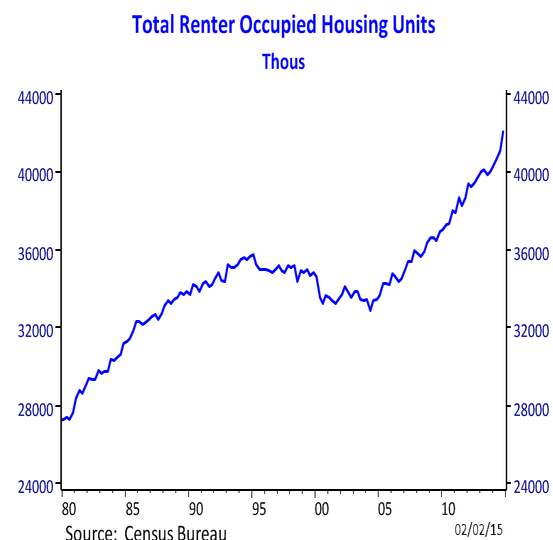

Over the last ten years, the number of homewoners has fallen by 1 million. During this same ten year period we have added 10 million renter households. Now the RealtyTrac data only tells us that in the last four years, half a million properties were bought by big investors. But heavy investor buying started in 2008. Also, the data is looking at institutional buyers. How many non-institutional investors bought properties as well? Given the volume of all-cash sales and absentee buyers, we know it was enormous. Plus, the homeownership rate has fallen dramatically suggesting one big buyer buying up multiple properties in many instances. For example Blackstone buying up thousands of homes.

Why are investors all of a sudden pulling back if the renting trend is so obvious? First of all, rents are a big function of local area incomes. You have little ability to use a mortgage to leverage your monthly rent payment. This has to come out of earned income in your bank account. So there is a limit as to how much landlords can increase rents. We are already seeing in LA/OC that people are doubling or even tripling up in units just to cover the rent. It is clear that some don’t understand the wear and tear that comes from having multiple tenants in units. Also, many in higher priced states are moving back home with parents since they simply cannot afford rents.

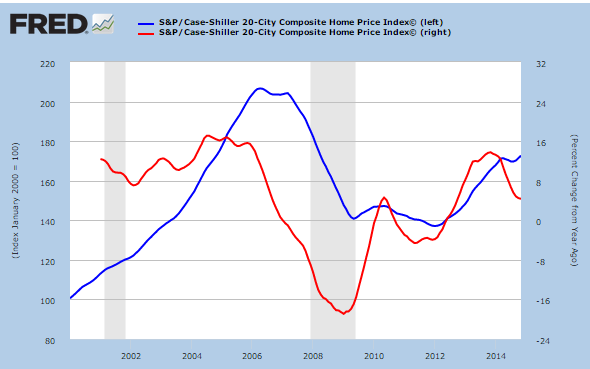

There are two main driving forces pulling investors away. The first is cap rates are not looking all that attractive. Next, prices have been driven up to a point where yields are looking inflated. You can see that price gains are coming off their lofty 2013 pace:

Nationwide home prices were going up 13 percent at some point in 2013. The latest point has them up by 4 percent. Investors are in it to make money. It should be telling that many pulled back dramatically in 2014.

One thing that is clear is that we are in a renting trend. 1 million fewer homeowner households and 10 million more renter households over the last ten years. That speaks volumes.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

137 Responses to “The investor buying party in real estate: In last four years institutional investors have purchased over half a million homes. 2014 was a four year low in investor buying.”

The L.A. Times maintains that it is cheaper to rent than to buy. Be a renter and be free and happy.

Rent for now and put your extra cash / down payment into precious metals. The good time to buy will come, make sure you money doesn’t lose value in the meantime…

there’s no question renting is cheaper. it’s not even close.

In this moment of time, perhaps yes but renting is not cheaper if you own the house (I almost do). Renting is not cheaper if there is an inflationary environment lile therewasin the 60’s and 70’s. Next, I know this could be considered a “black swan” event but if inflation was suddenly back in vogue, renting is definitely not cheaper and owning with a low mortgage rate would be a gift.

Renting is cheaper now because houses are extremely overpriced while at the same time wages and jobs have drifted downward. Plus, our population has traditionally been very mobile moving on the average every 4-5 years so it simply does not make sense to buy for most people, esp younger people. As one commenter said above. Consider putting your extra money into a hard asset that is presently undervalued like gold, for example. Oil seems to be undervalued also according to my financial adviser.

As stated in the other thread, the money does not come from 9 to 5ers. los Angeles has evolved past that. The money comes from technology and entrepreneurs, I got a guy today moving out from the Midwest. He’s a baller in Chicago, makes his own money on the internet. But he loves the culture here. He says he can’t get enough. He’s looking in Santa Monica, he doesn’t care the price he just wants to pay it and live here

I agree with what you’re saying. There’s a gentrification happening in California, and it’s not race based, it’s wealth based. The ultra rich will be the last man standing in single family homes. The rest of the worker class will be shacked up in ghetto multi family homes to provide just enough support for the ultra rich. FWIW, Chicago has a -10 windchill today.

The “gentrification of California” rationale seems to accompany every bubble reflation. Last time I hear was during the mid 2000’s. It only signaled that the emperor had no clothes.

Thank you for the anecdote!

Investors bought the low and continued to follow the trend up. Their pulling back signals the expected return is not worth the risk at these levels. With their demand pulling back the market can snap trend pretty fast. I don’t see a lot of 20-30 yr old famillys ready to make up the difference. Down we go.

The bull market is over, the bear market isn’t quite here yet. I don’t expect significant price increases for years to come, but neither I expect the prices to fall. They will do fall eventually, but not this years, nor the next one. We are entering a prolonged stagflation / depression environment. The money velocity is at record lows. The homes do not sell, but there is not much on the market either. The prices will fall, eventually, we just need more patience. But make sure when they do, you are prepared, well prepared. As I said before, no matter how much the prices will fall if you don’t have money or a job to buy a house.

Especially not when they are under-employed and over-indebted (school loans) …

All cash buying is money laundering of corruption, heroin and cocaine money.

The NAR lobbyied fast and hard to get real estate exempt from money laundering.

The people laundering money don’t care about making a profit or renting these out for a fair price.

i think rocky nails it with that one, now that the Government is going all in on bank accounts and actually stopping the big banks from doing the laundry the only place left is RE.

and i’ll bet they couldn’t care less if they lose half the cash if the market crashes, $250K of clean money is way better than $550K of dirty cash….IMHO anyway

The long term bullish trend in home values/ land values is being arrested by 0-care taxation.

The level of 0-care taxation is epic and MUST take out the bottom rungs of the classic property ladder.

This mega-reversal of trend (a trend that has run from 1935ish to 2015ish) will be a psychic shock to the financial world — and flood the academics with a rash of scholarly white papers explaining how a bull market is terminated when all of the sugar is taken away.

Barry, without knowing it, has diverted mortgage payment cash flows into ‘dollars for the medical/ pharma/ insurance/ attorney cartel — on a national scale.

This re-vectoring of fully 2-4% of the national income towards this hyper-cartel (a service only cartel) HAS to come at the expense of the bottom rungs of the real estate ladder.

Obviously, the top rungs don’t use mortgages, doh!

Like cancer, the effect starts slow — and the ‘patient’ lives in denial.

By the time its full import has been evident, governmental stasis should paralyze all political ‘resolution.’ (D.C. as ‘Hamlet’)

It’s an open bet whether the government will fall — like Greece — or whether a program of counter-insanity will be initiated.

Historically, such changes of heart occur only after extreme damage has been done — and the ship is plainly sinking.

When either time comes, epic, wholesale ‘restructurings’ will sweep across the MPIA cartel.

Long before then, the FIRE cartel will be laid low. (Finance, (asset) Insurance, Real Estate.

Of OVER ARCHING SIGNIFICANCE:

The FIRE cartel is THE engine of modern money creation.

By wholesale termination of mortgage originations the maladministration has torn up the national liquidity engine.

This is ANOTHER epic change in the market.

REMEMBER: ALL (first) mortgages amortize. (yes, there are weird exceptions — too trivial to affect the ‘money python.’ )

Hence, even a flat mortgage market is deflationary among a rising population.

The ALL CASH buyer does NOT create new money for the economy. (no debt)

&&&&&&&&&&&&

Since the average Joe is quite unaware of any of this — the dawning will come slow — with many bitter fruits.

In the fullness of time, the trend should utterly destroy the Democrat party — just as the FDR money creation engine brought it out of the depths of the post Civil War 70ish year march through the wilderness. 1861 – 1933! (Wilson slipped by during Republican-Bull Moose fratricide.)

[ It’s of not that FDR ran against Hoover — the liberal — for being TOO LIBERAL with Federal spending!

Then, in a reversal of epic scale — ran ALL of his administrations taking America as fast as he was able further left than Hoover — and packing his administrations with out and out Communists and Socialists — whose diaries and Moscow connections continue to bubble up — and astound all.

[ Paging the junior Senator from Wisconsin…]

FDR is the ONLY president to lie fulsomely and tirelessly during his 1932 campaign.

Even Barry fully admitted he was on the extreme left — and wanted MORE cowbell.

Farm land all the way. i don’t give a crap about surfing and sunshine beaches. The fertile farm land is what matters. You build a home there, you grow your own food there! I am long on farm land, gold (silver) and firearms (ammo)!

Yes, I raise grass fed, free range, organic, happy cows(until the jack hammer hits). I also make a powerful chili in Kerrville. Kinky Freidman said, “Money can buy you a fine dog, but only love can make him wag his tail.”‘

I agree with your general timeline, Blert. This is a slow-moving train wreck, playing out across decades. There will be no response to the average person’s distress. There may be some interesting moves as the fallout from consumer’s drop in income and appropriation of income starts to heavily impact entire industries.

I don’t agree with your political slant, which seems to point fingers at the Democrats. But I don’t defend the Democrats either. They’re all corrupt in my opinion, and the only principal they govern from is raw self-interest and pandering to the highest bidder.

“the only principal they govern from”

It’s “principle” and not “principal.”

Principle – an abstract concept or ideal.

Principal – primary, first in line. (As in the principal of a school, or when a film starts principal photography.)

My principal goal this year is to buy a house, because home ownership is a fundamental principle of the American Dream.

Good catch, Son of a Landlord.

Blert,

What kind of household income range would define the bottom rung of the home buyer ladder? What were their pre and post obolacare monthly health care costs? I have seen so many articles full of what look like hyperbole that I don’t really know what the actual numbers are.

Always good to see your posts, regardless of whether I fully understand or agree!

Cheers.

“What kind of household income range would define the bottom rung of the home buyer ladder? ”

Jeff, it depends a lot on location. It is diferent on the coast than IE.

Since the White House, itself, is CONSTANTLY re-writing the law (!) any attempt at calculation is largely futile.

And, this is not an accident.

It’s best to leave the turd unpolished, it will actually roll better.

Should any politician or expert pronounce upon the economic calamity — the rules can then be re-jiggered, yet again, (We’re well past 60 rejiggerings!) to impeach the claims and projections offered in rebuttal to this epic folly.

{ 0-care will prove to be even more epic than the Volstead Act — Prohibition. When a law is that horrific in impact — even a Constitutional amendment gets withdrawn.}

&&&&&&

Prior missives posted here have established that only a minor fraction of the readership comprehend that employers NEVER pay for the (so called) employer’s fraction of taxation.

All employers at all times and in all markets HAVE to calculate their cost of manpower. Now that modern computers are universally used for this figure – and a mere handful of commercial programs cover the market…

We can say with confidence that absolutely EVERY wage cost program backs in ALL of the MANDATED (by the various levels of government and its hangers on) {Think the Medical/ Pharma/ Insurance — as in “Health Plan” [double speak strikes again] / Attorney cartel} outlays to arrive at a total cost of a given employee’s man-hour.

(Man-hour is just an expression — men are absolutely equal to women in the land of math and accounting.)

When Congress PRE spends your wages — ‘above the line’ — then the subordinate employer has no choice but to re-rig ‘the line’ — lower, much lower, as it turns out, to get the total man-hour rate right back to where it was to begin with.

Be under absolutely no illusion: Congress can’t enact higher incomes — well, except for insiders, crony capitalists, and its organs.

EVERY time Congress spends more money it MUST come at the expense of the larger society — with the curious exception of the US Federal government.

Strangely, this unique beast is able to EXPORT its taxation across the globe — via its money printing — debt issuing — engine. (AKA the International Reserve Currency.)

This curious capacity has been traditionally used to ENTIRELY fund the US Department of Defense. AMERICA, not Europe, has been free riding on defense expenditures. It’s for this reason that Europeans — and Japan — and the rest of the ‘Anglo-Oriental economies’ — can’t find the money to expand their own military spending.

De facto, they are committed to purchasing the American defense ‘export’ — which doesn’t even show up in the accounts.

This reality eludes virtually ALL pundits — and accountants.

This tax export engine is being shut down by Barry Soetoro.

Grand Mal Incompetence in strategic and tactical defense and diplomacy is CRUSHING the marketability of US government bonds.

This weakness is being hidden from the general public — and the financial markets — by a fulsome purchase program by the US Federal Reserve special open market account.

(AKA SOMA)

Aldous Huxley would be chuckling on that term!

I’ve posted of the staggering risk involved in hyper-inflating the American money supply on this blog.

My missives must have caught eyes: the Bank of England issued a pdf white paper — by a committee of six ‘young turks’ formalizing my case.

{ Anyone who believes that a COMMITTEE would generate new theoretical notions on our money creation engines — has yet to escape the academic bubble. }

&&&&&&&&&&&

Directly ahead, and for years running, the MPIA cartel is going to suck the $$$$ out of the FIRE cartel.

And, to repeat the obvious, the FIRE cartel is almost entirely responsible for the expansion of the money supply in normal times. It’s contraction is ENTIRELY the cause of the deflation one sees — in American incomes.

It’s a complicated, interconnected, world we live in. So there are countless college educated fools who do not comprehend the above connections.

&&&&&&

If I were to write out ALL of the connections — ALL of the math — you’d choke.

And, no-one believes what they don’t want — or dare to believe.

&&&

Barry Soetoro’s love of Islam is over the top and in your face.

Yet the MSM still lives in fulsome denial — as do most pundits — to include the ‘right.’

Simply no-one wants to believe it.

I find it interesting that many bulls fail to comprehend that the specuvestors don’t have to sell for a relatively quick macro downturn there mere abcense from the market means that what inventory is for sale must be bought with real incomes and financing. A 25% run up happened on miniscule volume. 25% downturn is just as possible and in this case probable. If we look at the 2011 trough of what real incomes could support, every investor purchase since levitated the median. The inverse is not an investor sale, but simply the abcense of the purchase. We’re looking at the second weak spring selling season in a row. There will always be people that need to sell and though there are many of us waiting to buy, we surely aren’t buying at specuvestor prices. So I ask the bulls, what’s the backstop? If it’s not specuvestors all you have is us “smart money” guys and Joe6P who buys when the FHA tells him he qualifies. We’re supposed to keep prices levitating just because? There’s no more up this cycle, there’s never been a run up like this without a drop and a soft landing has N E V E R happened in SoCal RE. Newport, Santa Monica and Manhattan Beach are sure to remain elevated playgrounds for the well to do. But the suburbs and Inland Empire, where most people actually live are about to meet Mr. Price Discovery.

Look, I explained it before, but I would repeat myself. The “investors” don’t have to sell, they can just rent it out. Most of the big players, like black stone, borrow at 0% APR to buy homes. If they have positive cash flow, there is no reason to sell. The previous crash was caused buy the shortage of the money liquidity (the raised interest rates in 2006) and the inventory build up from the builders overbuilt as well as a flood of foreclosures from the NINJA loans. remember, lots of people bought with ARMs that were reset to much higher interest rates. Some bought with interest only loans and the principle kicked in. Also the collapse of the Lehmans caused the chain reaction via credit default swaps (someone had to pick up the slack) and the banks stopped lending – hence the hammered demand. The banks were trying to get rid of the toxic mortgages as well as the properties, so they flooded the market – hence, the significant supply increase. Now we have the opposite. We have a huge shortage, 1.5 – 2 month of supply, at least in Seattle metropolitan. I am pretty sure the SoCal is about the same. What will prick this bubble is the flood of the properties – the drastic supply increase. The demand is at historic lows at current valuations, but the supply is just as low. You can kill the demand with higher interest rates, but forget about it, not going to happen in the next 20 years.

@Sleepless

You seem like a smart fellow, but you miss the couter points to your arguments I already made in the post…

“What will prick this bubble is the flood of the properties – the drastic supply increase. The demand is at historic lows at current valuations, but the supply is just as low. You can kill the demand with higher interest rates, but forget about it, not going to happen in the next 20 years.”

What is pricking the Bubble 2.0 is the same as Bubble 1.0 (or any asset bubble for that matter), cratered demand. You can expand a bubble with either high supply (Bubble 1.0) or low supply (Bubble 2.0) but you can’t expand anything without sufficient demand. Lack of demand has and always will burst a bubble. So I will repeat since you missed it last comment:

SPECUVESTORS DO NOT HAVE TO SELL. THEIR MERE ABSENCE AS BUYERS IS ENOUGH TO FORCE DOWNWARD PRICE ACTION.

If you’d like to debate this point please do. And may I also, for the umpteenth time, challenge your little fallacy that Blackstone, etc can hold properties to rent. there is no such thing as long term investing amongst the Wall St crowd. The whole thing is a system of finding greater fools masquerading as real investment. The securities that the REITs created are based on impossible cap rates and are under performing. At some point you have your “margin call” and assets get liquidated. I have yet to see you make a cognizant argument to the contrary.

That said you do NOT have to have a great increase in inventory for downward price action nor a steep increase in mortgage rates. The exit of specuvestors as buyers and the resulting turn in market psychology has already begun the downturn in prices. It will be swifter than many here think, though maybe not to the depth that others here think.

@NihilistZerO, you fail to realize is that the market fundamentals and price discovery no longer exist. Regarding the absence of buyers. We already have one of the lowest demand in the history, the home ownership level is at multidecade low. The regular joe has not bought in the last housing “boom”, just like he doesn’t buy stawks. Everything is bought by financial institutions and investors that need to put their money somewhere and generate some returns. Bonds used to be the favorite thing for the investors – good returns, lower risks, but the FED screwed the bond markets by forever 0% interest rates. There is no really place left to put your money in. This is why the investors invested that much into the housing, there is just nothing else to invest into. The housing market will remain stagnant, so will be the stawck market. It is a big ponzy and the fundamentals no longer matter. You will see the housing crash when the 10 year T-bill will be at 6% and DOJ at $10,000. Yes, then you can expect the prices to go down. Housing market used to be not an artifact of the wall street and the .gov manipulation, not anymore. Hosing now, just like stawck, is an investment product. Via MBSs and RBSs (Rental Backed Securities) housing now is being bought with the retirement accounts and 401Ks.

@sleepless wrote “…The “investors†don’t have to sell, they can just rent it out. Most of the big players, like black stone, borrow at 0% APR to buy homes…”

You are technically right and wrong at the same time. Investors who paid 100% cash do not have to sell. Hedge funds and REITs who borrowed would be wiped out by:

1.) investor redemptions (they sold mortgage backed securities to underwrite the loan)

or

2.) a change in interest rates (carry trade on mortgage backed securities vs the interest on their loan)

In the case of #1, if enough redemptions take place, there are protocols in place for hedge funds to liquidate/close the fund and sell the assets (houses).

In the case of #2, most of the ZIRP loans are short duration which need to be rolled over on a continual and frequent basis. The MBS’s that back these loans are longer duration so any rapid rise in interest rates will cause their REITs to bleed money like a hemophiliac.

sleepless – I think you got it, a drastic over-supply will dictate the crash not the demand in so-cal real estate. What will kill demand today, raising rates or massive job loss. Could we be like japan and just carry zirp for years? Isn’t that unprecedented for the US but I am starting to think most likely for years to come. Even if half the investors exited the market to get to the historical norm of 12+/-% cash sales, that’s not enough to sway the demand for prices to drop 25% or so. Even of that 12%+/-, I question how many are flippers buying under-market or just parking their money at market rates. So-Cal has always been a high demand area and at 3%-4% mortgages, the qualified buyers will jump at even a 10% drop thinking this is there chance. The absence of these investors alone is not enough to make the market drop given the current supply. Even if it did drop, just nobody will sell, they will wait. The people that own now in the last few years are well-qualified buyers with job stability. They will continue to make the payments. Just like the investment groups will wait, timing is everything, their properties do cash-flow and we are now a nation of renters. Makes no sense for them to dump properties if values go down but they still cash-flow. Will rents go down if values plummet >20%?

@ernst blofeld

Good point about Blackstone and other big RE investment firms having to answer to their investors. These firms have found out that becoming landlords and managing illiquid asset isn’t as profitable as originally thought. Minimal return on investment isn’t something that shareholders will be too patient to stick around for.

Mr Sleepless isn’t a smart fellow – he’s basically a bot who repeats what he reads on zerohedge. Think for himself he does not. Regurgitate his pointless drivel in long winded posts he does. A lot.

@Seattle$$$Investor, you comment makes me thing you spend a lot of time on zerohedge, otherwise how do you know that I am “a bot who repeats what he reads on zerohedge”?

Why would you spend so much time there if everything they write is for the bots like me to troll the blogs?

NihilistZerO: Nooooo! Newport (condo) prices must trend downward 20%+, since that’s where I want to buy! You might be correct for $1M to $2M+ single family homes, but I’m guessing prices of lower-tier condos (say, less than $750k) will decrease quite a bit along with other areas. At least that’s what happened last time around. I’m not sure about Santa Monica, Manhattan Beach et al.

Another thing I find somewhat interesting is that Asians don’t seem to like Newport as much as Irvine (next city over). For instance, some of the better Newport schools are 80% white whereas some of the better Irvine schools are majority Asian. Wife and I were speculating there is cheaper multi-generational housing that meets their criteria in Irvine (big house, nice area, nice school). That’s good for us, since there might be a tad less competition when it comes time to buy an over-priced condo in Newport.

@Responder

The reason I always qualify my prognostications to exclude certain enclaves is that the bull’s arguments DO apply, even if not to the extent that full-retards believe. In these areas you have people of means seeking out what will always be relatively limited inventory even in the worst of times. Your argument for condos taking a larger hit makes total sense in that Newport condos are not typically purchased by the .01% and are much more susceptible to prevailing market forces. Same goes for homes in Irvine. They along with the condos you speak of are single A properties as opposed to AAA. Mr market will have his say on those valuations much more than the mansion set.

This cycle of hyper RE market manipulation is coming to an end. Communist China is showing that even the most manipulated of command economies eventually go bust.

The main reason Asians don’t like Newport is because of racism.

Not gonna happen. We are in a new normal this time, in a new evolutionary cycle for the SoCal area.

I was thinking the same in 2006 and 2011. Where are we now?

“Realist” is typical “What?” trying to get a reaction – sarc.

Good post NZ. Good good post, on another fine entry about market changes by Doc.

I really look forward to the day I am reading entries of patient renter-savers buying a much better value prices in low-mid-high prime SoCal.

Those days are within sight. I’m no perma-bear, and I narrowly missed out on an estate auction home in 2012. I’m merely patiently waiting for the inevitable price adjustment from the exit of specuvestors and the end of QE. As Mr Blofeld explained above the buy and hold cash investor model is a myth. Market forces are returning as we speak. The FED has successfully reduced the banks exposure to residential RE and is now focused like a laser on the stock market. Lower residential RE costs benefit Wall Street, it’s a detractor consumer spending stimulus. Look to the 90’s bull run in everything BUT housing as an example. Anyway, 2011 was the last time the market wasn’t hyper manipulated and that’s my call on where we’re headed back to in all but the most prime areas. Mind you, nominal 2011 prices would still be an increase juxtaposed against lower wages and slightly higher mortgages. I don’t think there’s anything radical about my prognostications. We’ll see what happens over the next couple of years…

Banks are in the lending business.

Playa Vista resident & renter here with $200K cash saved up looking to make the plunge on a town home (looking for only those with connected garages) around $800K

Problem is they are all around $900-$1M in playa vista now that there is all the Asian buyer tech hype surrounding the community.

Waiting for prices to correct back in the $375/sq ft range (HOAS avg around $700-800, FYI) but think it might be a couple years…

Anybody with experience in Playa Vista have any good takes on the timing? Runway is opening next month and this is prob gonna continue to drive up prices in the short term.

This is currently the lowest price per sq foot condo in Playa vista right now, and they been sitting on the market for a month… waiting patiently for price reductions:

https://www.redfin.com/CA/Playa-Vista/13173-Pacific-Promenade-90094/unit-128/home/8135891

https://www.redfin.com/CA/Playa-Vista/13173-Pacific-Promenade-90094/unit-120/home/8135882

I saw the second one at an open house a few weeks back… It was a nice asian lady trying to get lucky with her “888” price point… We really loved the layout and spaciousness, but for this price, have to have an attached garage/parking.

Nobody ever talks about playa vista on here, but since it is the new “hot spot”, I figure it will start to come up in convo more and more….

Playa Vista is a hotspot for high income singles/couples, but not so much for families with kids unless you’re sending the kiddos to private schools.

They have that brand new elementary school, so private schools after 5th grade

BUMP on Playa vista! Anybody know anything about this market?

They’ve had to have methane gas detectors installed in the basements and garages in Playa Vista due to PV being built on reclaimed wetlands.

If you are healthy, potentially breathing methane gas should not be a problem.

I wouldn’t want to live on top of the gas deposits in Playa, but I’m more cautious than most.

Did you check out the HOA fees? Over $700/month. You realize that it’s not tax deductible, right?

I pay over $700 a month for my condo’s HOA fees. But that includes all utilities — water, gas, electricity — sanitation pickup, earthquake insurance, cable TV and high-speed internet. Plus 24/7 doormen, three on-sight technicians (a super and two assistants), and a part-time on-sight manager.

Sure, if I moved into a house I wouldn’t have to pay a HOA fee. But a lot of that above stuff I’d have to pay for separately. I’d save money on the doormen, but without them my home would be less secure, especially when I travel.

Your HOA fees include electricity? Your neighbor could set his A/C at 60° and run it 24 hours a day, and someone else might rarely use the A/C. That is ridiculously inequitable. And a doorman? That would just be annoying having to interact with someone every time you come and go. I think I would pay money NOT to have a doorman!

A condo we rent out has shared water, and I hate it because this one douche washes multiple cars every day, wasting ridiculous amounts of water. Our HOA fees are likely higher because of him and other water wasters.

Responder, yes, I realize that one person can overuse the electricity. The building also has community washer/dryers (none in the units), which I hate. So a family of 5 uses far more water and electricity to wash clothes than I do, a single person.

OTOH, one person can’t overuse the AC. This is because the building only has AC during the summer months. Then it switches over to heat. It’s either/or for the entire building. So no one has AC except during the hotter months (usually June – September).

No one is allowed to purchase individual window AC units. The HOA believes that AC units are unsightly and would hurt property values.

We have underground parking. No one is allowed to wash their cars, or do any auto repair work, in the underground parking area. We must take our cars to a commercial car wash or auto repair shop. So no worries about some douche over-washing his car.

The doormen are convenient. They sign for packages while I’m away. So I don’t have to worry about the mailman leaving them on my doorstep and having them stolen.

I’m in escrow for one of the new homes being built in Playa Vista. Unfortunately, you probably missed the boat, at least on Phase II. They are selling like hot cakes and after the Google and Yahoo moves hit the newspapers I saw a bunch of folks show up at the sales centers and all the builders raised their prices. When I started looking early last year, the KB Skylar project was priced at between $1.1-$1.3 million. Now they are priced at $1.3-1.6 and they’ve completely sold out the first building and half of the second building. I think there is some standing inventory at the Camden project, which is a stacked flat product, but yeah, there is nothing less than $1 million in Phase II. I don’t see this changing either, because every day there is new leasing activity in the commercial section being announced, and mind you, this is BEFORE accounting for any of the new tech employees moving into the area. But I’m sure you know all this already since you live there. I think there is another batch of new product coming online later this year, so maybe you should wait and see what that pricing is like, but I would get on their wait lists if you are even considering it. I was on a wait list for 4-5 months before landing a unit, it felt like 2006. Trust me, no one likes the feeling of having to suck **** to buy an overpriced home, but all you have to do is look at the pricing in SM, MDR and Venice and you’ll quickly realize that Playa Vista prices are not a crazy as they look.

@dean. I know it sounds all good, doesn’t it? Until one looks deeper and discovers that FB revenue is generated through ad buys by startups that are part of the same VC incest circle and that the BRANDS that a company relies on for lasting revenue are pulling out of FB. Or that SnapChat and other over valued start ups have yet to make money and trust me the VC people will want to make money. Now it could be that a new way to create the illusion of revenue and profit could be invented (see the FB example) but I’m not counting on the tech industry growing. I got started in 1999 and I see much the same activity now I saw then e.g. cooked books, etc. Here is a really good read that makes sense and is not just naysayer BS. “Snapchat and the ‘T-Rex’ venture: why it all sounds like dotcom bubble 2.0”

http://www.theguardian.com/money/us-money-blog/2015/feb/22/snapchat-t-rex-ventures-dotcom-bubble

Dean – great reply.

Yes, I only want to spend $1M for that new skylar home or something similar in Tapestry or Icon. Sucks that I now gotta spend $1.3-1.6M

We could probably afford it but would be stretched very thin and just hate the feeling of blowing $300k extra just because of bubble inflation

‘Playa Vista’ translates to ‘Beach View’.

tolucatom – good post… ‘VC incest circle’ – ‘cooked books’ – there is a lot of coarsened complacency of late towards current prices and wealth.

The Wall Street casino is now festooned with giant deadweight losses waiting to happen.

http://davidstockmanscontracorner.com/tesla-bonfire-of-the-money-printers-vanities/

Dean – and there ya’ go. That is what the market is like and will be for awhile even when investors get back to historic numbers. Limited land, prime real estate, low rates, qualified buyers at current loan qualifications and DTI, stable job market, small phase releases, good for you. Congrats! You didn’t try to play the market now that we are at a “new normal” and wait and get left out in the cold. So now you and your family (if any), can enjoy your new home and build memories/roots.

I met a real estate agent about two years ago who owned home in Playa Vista. She bought it during the last bubble for just over $1M and sold it at the bottom of the market in about 2011 for less than $800k. I bet she regrets that now considering the current bubble brewing there.

@Galaxy Brain – it may well be that all of the California coast becomes silicone beach BUT I’m wary because of what I see as a person who has made a great living online since 1999. The ONLY way these companies propose to make money is to sell ads to companies that want to sell products to a diminishing middle class. Or they sell ads to companies that haven’t figured out how to make money from their apps, etc. Let’s look at Fab.com or Gilt Groupe – 2 huge darlings that are either gone or on the way out in 6 years or less. How does that affect Dean? Remember when law firms were paying 155K to new graduates. Amazon, Google, Yahoo, FB, and Snapchat can only afford to pay outrageous salaries for programmers in this environment. If this environment ends then there is no one to buy that condo. I assume the condo is a rung on the ladder so a profit is desirable quickly. Those close to the faucet are the real winners. Those downstream even if they can afford a condo in Playa should be careful imo. Just my .02. Snapchat partnering with Alibaba should scare people who are waiting for the IPO. The Chinese are experts at cooking the books.

I agree on the over-valuation of tech start-ups. Nice comments, Tolucatom.

Look, I wish everyone well. I think we are now pretty firmly planted in the digital era but even to a layman like me some of this enthusiasm is like being drunk. The people populating silicon beach are employees of Google (it’s search business is slowly but surely dying), Snapchat, (how to sell ads on an app that destroys messages after 10 seconds without destroying the very reason for it’s attraction), FB (look at the ads there — see many from the leading brands with deep pockets?), Instagram (where’s the revenue?), and so on. The tactic is to blow up valuations with marketing and an incestuous arrangement among the 1% and then take the company public so that the mom and pop investor can get burned. It’s a shell game. Fab.com burned through hundreds of millions of dollars selling heavily discounted items of niche appeal. Gilt was a flash deal site BUT how do make a profit when everything you sell is discounted 70%? Gilt was BIG. It was the new way to retail. It spawned countless imitators. It was the tech industry darling (just like Fab.com). Silicon Beach is built on companies like this — burning through VC capital while Tech Crunch, etc tout them as “amazing new start ups”. They don’t tell you that Tech Crunch, BI and other rags are owned by vc companies so they have a vested interest in pushing these amazing new companies. The hottest products online? Real time bidding and other ways to track and target end users so more ads can be delivered. See the fallacy there? Present more ads to the 99% who see wages stagnating. Doesn’t sound like a good foundation even to a moron like me. “Four years ago Gilt Groupe was the hottest startup in New York — Here’s what happened

Read more: http://www.businessinsider.com/gilt-groupe-story-2015-2#ixzz3SgSAKMAI

@tolucatom and Galaxy Brain: “silicone beach” Ha! I don’t know if that was a typo or not, but I like it! Don’t get me wrong, I agree with everything you say. But we’ve been wrong for too long about how this that I have the humility to consider maybe this time really is different! I know it sounds ridiculous, but I’ll admit something to you guys knowing you are strangers, I’ve been sitting in 100% cash in my retirement accounts for the past 7 years. So yes, I totally understand where you guys are coming from, I’m right there with you, the arguments are compelling, but the bear case, whether for stocks or real estate, simply hasn’t gone well for folks over the past 7 years and it has now come to a place where even if a catastrophic financial event were to take place, if you got in early enough, you are still pretty well insulated. I’m not sure what the counterargument to that is. I thought we would all be on the streets eating garbage, who knew 7 years later everyone who went back to risk taking would be eating caviar instead. If you can’t beat ’em, join ’em right?

@dean Not much to say. I get your logic Dean. You’re right. This could be the new permanent paradigm. I remember thinking Bitcoin couldn’t go over $500. It went to $1500 and I realized that maybe anything I thought I knew about valuations is industrial age stuff that is not applicable to the information age.

Good reading tolucatom. It’s not my sector, and you clearly have experiences to draw upon – good reading.

Also everything I thought I knew about values is out of balance too – prime real estate only softened a bit into 2007-10… so quickly recovered; along with what we see in financial markets and valuations which look… ambitious to me. Then again, I know that when markets do eventually turn (if it’s in my life time), they take down a lot who have invested or reinvested at the new-normal very high prices.

Assuming that only the less smart make poor investment decisions is a big mistake. Isaac Newton was famously burnt in the South Sea Bubble. He bought in early, saw his investment climb and sold out at a handsome profit. But then the price kept climbing and he couldn’t deal with seeing so many of his colleagues continuing to rack up huge paper gains, so he bought back in massively just before the peak and saw his savings wiped out in the crash. He remained furiously angry about his loss right up until his death. What defences should the government of the day have put in place to safeguard the cleverest man in England?

Good luck Dean. We make our own decisions.

@Galaxy Brain. Great story. Newton got burned. A frigging genius. Wow. I think you’re in UK, right? Not sure where but saw an article where Londoners are buying in Bath now. True?

Blert, you’re speaking in tongues.

For Blert you have to read between the lines :-)) Eventualy you get it. He has very good observations. His brain works well but his communication is not as good.

Ah. I think I understand what he’s saying. And I think I agree with most of his economic takes. And I think I don’t agree with his politics. But I really don’t know. 🙂

Yeah, we big time INVESTORS are dumb billionaires.

^this, 100x exactly. follow the money

walmart is going to raise wages to 10/hr, prompting others to do the same

if you don’t think this is inflationary -> will help put a floor on the current housing market, then go ahead and keep waiting

glta

I don’t think $10 an hour is going to do anything for California’s housing market, though it might help home sales in middle America

At $10/hr you couldn’t even afford an apt. on your own in so cal! LOL!

$10 minimum wage arrived in California at least 20 years too late. Firms paying already paying more than that aren’t going to fear that their employees will jump ship for the Wal Mart “gravy train”.

Existing home sales plunge in January …… biggest drop was in the Western U.S.A.

http://www.zerohedge.com/news/2015-02-23/existing-home-sales-plunge-and-dont-blame-weather

Yup, the homes are not selling as fast, we established that, but the prices don’t fall either. The inventory is too low, the builders need to build more. We have plenty of “buildable” land around here. The zoning is the problem. The local government doesn’t let the builders build. We also have plenty of space in the more rural areas available for construction. But those places need significant infrastructure investments (roads, bridges, power lines, etc). But instead of investing into the crumbling infrastructure, the .gov would rather start a new war in Iraq or Syria!

Wrong wrong wrong, Mr Sleepless. So now your wisdom to share with us is that ” government zoning” is the reason for lack of inventory nationwide? Really? Is that what you’re learning from the comments on Zero?

Instead of spewing random poorly conceived conjecture in every post (then insulting other commenters by claiming that you’ve “already established”… “facts”), please think a little harder before you post your verbal diarrhea. We’d all appreciate it.

@Seattle$$$Investor, your rant is really amusing. Unlike you, I DO SUPPORT my claims with the facts. Keep living in your dreamland, keep dreaming about getting out of your mom’s basement…

Sleepless, it’s called reading comprehension.

How do I know you read ZeroHedge? Because you post links to articles there. Duh.

Oh, and you repeat the same tired drivel anyone can read there day after day… after day.

I also remember when you posted under a different avatar whining all about how Seattle prices are so high, you can’t afford to buy there, blah blah blah.

At which point I told you repeatedly that Seattle prices ALWAYS follow SoCal by about 1-1.5 years.

How’s that panning out so far? Yep.

Facts. It’s what the big kids talk about.

Builders not building because of zoning, cost of land, nimby’s and greed. All builders never build for volume, they build for profits. Squeezing every last dime on small phase releases. They also know there are fewer qualified buyers out there because a lot are still recovering from the burn and renting.

In talking to several brokers here in my area; they all complain about ‘lack of inventory’ (e.g. lack of homes coming onto market). And see no immediate change in this pattern. Therefore, perhaps it is good to ask;

“where will the inventory come from”. It wont come from NINJA defaulters; nor will it come from move-up buyers; will owner/occupiers simply sell to make a profit… not unless they plan to relocate far away (and cheaper).

QE Abyss…You don’t need to talk with brokers check any for sale site plenty of homes, I just posted about a home in Simi Valley on the market 107 days reduced 160k and this is a very nice golf course home, agent says no buyers, nobody looking, prices are coming down not going up because of lack of inventory, buyers are in a “don’t know what to do mode” economy is weighing on their minds and if they will be able to turn a profit when they sell the home in 5 to 7 years.

NEA is very good at covering up stats, it is like the business that nobody comes into buy or eat, always a excuse the real reason lousy merchandise at high prices, or lousy food,service at high prices, it is that simple.

“Inventory is low!” yet days on market are climbing? That means either demand is slowing, prices are still too high or buyers are tapped out. Probably all three.

A severe housing price correction is coming very soon for most of California. This is just the beginning.

There’s no immediate change to this pattern as long as there are jobs. What’s the forecast looking like for Southern California?

I’m not trying to be sarcastic here. Right now it seems that all is good, at least in my circles. Sure there are a few people jumping around but overall there seem to be plenty of people with stable employment with decent compensation – maybe not enough to afford a home at current prices – but higher than average income that is more than enough to afford to keep their current homes.

If you’re in Southbay, you are near a job centers in El Segundo, and Santa Monica is within commuting distance, so I can see how your friends might be employed.

I do have the sense that there’s more hiring going on this year generally, but not at income levels that support buying. Also, many jobs labeled full-time permanent jobs are usually closer to contracts these day. The employment figure doesn’t reflect the fact that tenure has eroded in many highly paid professions.

All that is to say, does current employment support buying? No.

The builders don’t build enough. In the cities we need to build higher, also instead of single family homes we need to build more multifamily units like condominiums and town homes.

We also need to build more in the rural areas. And build decent homes already!!! All I see being built are 5+ BR 4000+ sq. ft. monsters. What about 2000 sq. ft. 3br homes? They no longer build those around here… It is too “unprofitable”, I guess…

In the event of some economic catastrophe (it’s debatable what that might be or what the catalyst might be), inventory would probably come from short sales and foreclosures from underwater owners just like last time. If everything stays the same in other aspects of the economy, then it would stand to reason that the current housing market would remain static, too.

Big investors will be protected, small investors not so much…

All good answers, lurkers should take note!

Well, somebody is still buying. I see these types of property being sold frequently.

https://www.redfin.com/CA/Downey/7840-Benares-St-90241/home/8119560?utm_source=myredfin&utm_medium=email&utm_campaign=instant24_listings_update&utm_content=home_image&riftinfo=ZXY9ZW1haWwmbD0zMjQxOTI5JnA9bGlzdGluZ191cGRhdGVzX2luc3RhbnRfMjQmdHM9MTQyNDY4NzYxMjQwNSZhPWNsaWNrJnM9c2F2ZWRfc2VhcmNoJnQ9aW1hZ2UmcG9zaXRpb25fbnVtYmVyPTAmbGlzdGluZ19pZD0yODQzMTI2MCZlbWFpbF9pZD0yNjY1MDktMzI0MTkyOQ==

Gerardo

People are definitely still buying in West L.A. I’m seeing an unbelievable amount of pending and solds in the zip codes I’m following: 90025, 90064, 90048, 90035, 90049 and Santa Monica. Much more than what I was seeing most of last year. I went to an open house at a condo in Westwood this weekend and 2 hours into it they had almost full 4 sheets of visitor sign ins. This was for a 1,300 sq ft condo priced at $700k. It will probably sell in a few days.

Dang! Really? Not familiar with LA but WOW! What I don’t doubt is that the loan for these homes are at least 20% down or cash. They cant be 100% financed, and the buyers have probably been qualified to meet standard DTI ratios of 28%/36%-45%. Basically pushing the limit of what they could afford at 45% but I guess owning is their dream.

Downey is the “Hispanic Beverly Hills”, and the schools aren’t all that bad in that area either. Not the best 10’s like beach cities, but not bad.

“Downey is the “Hispanic Beverly Hills†lol, ok

Okay, so home sales are down because of lack of inventory? If you believe that no way, open houses are sitting with few pulling up, new house traffic is very weak, it has nothing to do with inventory and all to do with prices ,loan qualifying and income.

I imagine those open houses are over-priced then given it’s location, location, location. One thing I also noticed is that today’s buyers are very picky. At today’s high prices, the typical buyer must be discerning given their high income to even own in so cal. Unless it looks like a home aired on HGTV and priced right, that will go in a heartbeat. The wives buy homes on emotion.

the open houses ive been to in the past couple of weeks in north and east pasadena have been well attended

I’ll guess SoCal RE inventory will remain low due to Boomers handcuffed to crapshacks because of Prop 13 and more “all hat and no cattle” kids/grandkids needing increased financial support and/or moving back home; the offspring can continue lifestyle UE, w/low paying jobs or “self employed” while their “living a dream” posts with beach workouts/vacations/selfie with a celebrity pics can continue getting “likes” from High School/College Facebook friends and family.

These houses may hit the market when offspring with poor money skills eventually inherit, then drain cash out of house to continue illusion of prosperity/pay bills.

Meanwhile most CA RE buyers will be Asian or Hispanic multigenerational. Far more people per residence. The “SoCal is loaded w/$150K annual professionals” is a fantasy on par with “SoCal is loaded with blonde surfers”. Those days are gone.

All of the above just my Humble Opinion.

Your humble opinion is wrong, and SoCal is loaded with professionals that make far more than $150k. That’s chump change.

Nope. The % of individuals making $150K+ annual income is small. The % of individuals in CA in low wage jobs, welfare, poverty, multigenerational housing, work PT, homeless, etc. is far higher, and growing. People live paycheck to paycheck to continue The Dream. The desirable neighborhoods are full of people who bought RE decades ago, could never buy at current prices and have kids/grandkids moving back home.

But that’s irrelevant. Go grab a taco, check out all the bikini babes and celebrities hanging at pristine local beaches. A 700K prewar charmer is a steal, international ballers are surely lining up to bid. Enjoy the CA gas tax and Vehicle Mileage Tax that’s on its way. Don’t forget recycled bags. Make minimum payment on credit cards so they’ll keep working, the illusion of true prosperity continues. Cheers!

It’s not an illusion if it’s happening, the specifics are irrelevant. Swipe, lend, work, borrow, sell, whatever. Keep the machine going and things always work out. Look at the BK filers, they are back now. The cycle continues.

@The Retardist, $150K is not enough to buy $800+ 2br 1nth crap shack. And we already know that only barely 5% in LA make $200K and above. 5% of the population is not the entire state, which means 95% of the residents cannot afford those prices. And even the 5% who make above $200K a year, most probably, are married families with children who have been in the industry for a while. The collage graduates do not make $200K a year, most of those are probably in their mid 30s who need more than just an $800K crap shack.

Not even close. Per capita median income in Orange County in 2013 was $34,057. Median household income was $75,422. You are saying that a large majority of the population make twice the median? LMAO! That’s downright ridiculous.

Infact, per the official statistics 13% of Orange County live under the poverty level. Data for the $150k/yr+ bracket is hard to find but extrapolating from various sources I am estimating it to be between 7-8% of households countywide. This is a very small fraction of people not the vast majority like you claim.

Source was offiical US census but were cross verified by this one from CSUF as well:

http://www.fullerton.edu/cdr/ocff.pdf

where is your source?

Kevin, sleepless, and Drinks…

What you forget is that “data” is irrelevant. The enigma of SoCal real estate is not tangible nor can it be put into words easily. A lot of people from around the world buy here. A lot of people that live here make money under the table, in side businesses, selling stuff on the internet, etc.

Household income data is completely worthless in this area. That only matters in places like Cleveland or Louisville.

Once the aging boomers and costly medical bills means that the RE will be sold on a massive scale soon. Keep an eye on Prop 13, its on its way to being changed or repealed.

Once that happens look out below for RE prices, because millions of people will need to pay more property taxes in CA (triple or more property taxes will force them to sell).

The 150k professional crowd is sick of footing the bill for the boomers. Add CA seeking more tax revenue, and changes to prop 13 are more then likely going to happen.

I think So Cal is loaded with $150k/year professionals, at least combined income. Problem is: 1) these people aren’t comfortable buying at current prices; 2) $150k doesn’t go far with kid(s), car payment(s), student loan(s), medical and other insurance, etc.

Obamacare subsidies go up to 400% above poverty line. I think for a family of four the subsidies top out at $104,000 a year, which should give an indication that $100k family income will not take you far in this area.

I don’t think it’s loaded, but there is definitely a lot compared to what’s offered for sale in the areas these high-income earners are looking for. I believe they are most likely dual-income for sure.

Since when did it become the norm for parents to enable their bum “children” to live off them forever more? They are not doing their kids any favors.

Unfortunately, I personally know a few “kids” (30s and 40s) who live with their parents, and have no intention of ever leaving. They are clearly sticking around to inherit the house. What a way to waste your life.

Existing-home sales slow to 9-month low in January:

http://www.marketwatch.com/story/existing-home-sales-slow-to-9-month-low-in-january-2015-02-23

oversea living looking better every year.

Lest we forget the 1.2 billion student loan debt. Buy now and hold on to your hat and plan to stay a while imo. No quick flip bucks to be made now I think.

“‘We won’t pay’: students in debt take on for-profit college institution”

http://www.theguardian.com/education/2015/feb/23/student-debt-for-profit-colleges

Low inventory on market – not helped by investors snapping up so much in recent years, but seemingly their appetite slowing now… is irritating.

It’s exactly the same thing in the UK – and to be honest, my previous understanding was that ever higher prices should tempt out more sellers – but that market dynamic appears to have been overwritten by a new law; ‘ultra-complacency’ at seriously high ‘bubble’ valuations in low-mid-high end prime – imo. It’s a phenomenon of $Trillions QE, ultra low base rates, and so many market participants looking for yield, despite painfully high asset purchase prices.

UK Chart: As House Prices Soar, Listings Plunge

http://oi60.tinypic.com/5nu8mw.jpg

I can only hope it’s going to be like a tsunami…. ever fewer listings on the market in recent times… a tide of listings disappearing as it has done.. but set for a huge flood of listings to come into the future, as and when markets turn.

No one seems to comment about the stock market. The stock market and real estate market is correlated , both are rise from global QE. If you get a good correction or bear market in stocks .. the housing market should come down as well. Alot of the money in stocks likely got leverage into real estate. There is alot of leverage in the global financial system. When stocks fall home prices should do the same as some leverage players will have to bail or may have to raise cash for liquidity.

The momentum in stocks has slowed significantly and same with real estate. Something should crack in the global financial system soon because the average recession is every 7 years. You can do the math, the last high was 2007. The shock may come from abroad but will be felt everywhere since banking is connected. There are a lot of foreign cash buyers in s cal real estate. There should be a deflation scare before we get more QE, i don’t think rates will rise until near the end of the decade when another few rounds of Global Qe finally rattles the markets.

I’m a real estate investor, inventory is low and prices are stagnant with a downward bias from what i’m seeing.

And in-the-meantime-in-between-time, people gotta keep living and ♪ on. I don’t see a RE decline happening in Los Angeles or SoCal, it’s too cool of a city. That’s like saying people don’t want to live in NYC. Yeah right.

I wouldn’t be surprised about a downward bias, but nothing dramatic like 20% and it would definitely depend on the area, like the working-class neighborhoods. Real estate pricing and demand is very local.

Email from RealtyTrac today: ZOMBIE FORECLOSURES: The Vacant Dead…. One in every 4 homes in the foreclosure process is sitting vacant, abandoned by the distressed homeowner and not yet repossessed by the bank. Magnets for vandalism, these zombie homes are dragging down the values of nearby homes in the neighborhood.

The rental I moved out of in Oct last year is a Zombie Foreclosure. They tried to sell it – at a insane listing price, of course not a single bite, then they tried to rent it again.

They found a tenant after it was empty for 2 mths, but then the tenant found out a Notice of Default had been filed on the property and the owners had not disclosed this fact when the lease was signed (now illegal practice). The tenant demanded cancellation of the lease and rent and deposit monies refunded immediately. I know this because the tenant was a school friend’s family of my son’s.

They are STILL trying to rent it out, its back on Craigslist with a lame “disclaimer” about the NOD being a “mistake” – a $23,000 mistake at that, they haven’t paid the mortgage in 9 months. They are intent on sucking every last penny they can from it. What a gall..

I would’ve done the same thing.Why bother. Just rent the shack out for whatever people are willing to pay. Collect the rent until the bank forecloses. Easy money 🙂

My question is why aren’t there more properties on the market? it would seem to me that all those boomers with homes in places like L.A. would want to cash out while they can and give themselves financial freedom and flexibility … downsize! As the author points out those nice homes are deceiving, when the occupants are living on fixed incomes eating dog food!

Most people/families buy a home to live in. Those people don’t people look at it like an investment to cash out. But as soon as they lose their job or reduced income, that home will come to market, hopefully not as a distressed sale.

Because the head over heels love affair of living in the weather and entertainment capital of the world is huge draw. Some people get that, some don’t.

@Realist. You are just another bullshit real estate huckster who spends half his days on this blog trying to hype sales. You’re worst than a used car salesman. This posting isn’t for you. It’s for others who might read this blog and think that your viewpoint is anything but bullshit snake oil sales. When I think of a realtor like you, my first image is of a loser living check to check but leasing an $80,000 car. That’s my guess for you.

That’s exactly the delusion that keeps people in LA. Now that I’m finally out, I hope it stays that way.

The dog foot eating boomer (like the stupid hipster) is another myth/meme that propagates on this site. The reality is that most boomers with a paid off house have it pretty good in SoCal. The main component of the local high cost of living is housing and, particularly with a favorable Prop 13 assessment, most of these folks can live quite comfortably around here on a modest income. They have no reason to sell any time soon.

We lost a home we were trying to purchase to a bid from an all cash buyer. Thing is I knew the person who owned it(my best friend’s stepmom) and I still lost it. Our bid was higher, but since there is less paperwork, inspection, etc, she went with the lower, all cash offer. Only upside is she is trying to buy in the same area we are, with our same budget, so she is pretty much screwed as well. Feel the burn….

The real estate market is awful. Been trying to buy for 3 years(Chicago suburbs) and there is nothing but garbage houses asking for way more than they are worth. Kill me.

same boat; sucks bad

The next time a listing pops up you are interested in, call the listing agent directly. If the agent thinks he can double-dip the commission on both sides, they are more likely to push that offer to the seller. Yeah, I know….conflict-of-interest, who’s interest are they really looking out for, etc….but do you want a good deal or not? It sucks, and depending upon the age of the home, there might not be that much risk. I mean c’mon, how much does the buyer’s agent really know about the home you are trying to buy anyway regrading infrastructure? Probably not more than you.

@Donna: Using the buyer’s broker is certainly one strategy, maybe the only strategy, that might work to get a halfway decent deal if you are not an all-cash buyer. Even with that approach, though, I’ve had mixed results. Some realtors are interested, some still wont even talk to you-I can only assume the realtors that ignore you are interested only in a cash offer.

Occasionally on this blog, there is discussion of rental rates in LA, LA, LAnd. This article outlines the mild to exorbitant rental rates, spanning from Florence area (Under $1K per month) to Santa Monica for $2,800 per month.

http://blog.zumper.com/2015/02/rent-changes-los-angeles-january/

From my recollection during the last housing bust, although home prices fell significantly, rental rates only fell by minor amounts.

Interesting map. Soooo glad I left Cali 8+ years ago. So much cheaper and waaaay better quality of life. Can’t even wrap my head around those rents, or paying 700K for a condo. This won’t end well!

Where did you move?

LOL. Not gonna give up the goods, I have it good here and don’t want any Cali locusts trying to ruin it! And while some could say I’m a Cali locust, the difference is I didn’t come here and try and change the local ways and turn it into the hell hole I left. One needs to accept the new culture and adapt or leave, simple as that.

Thanks for the reply, I guess. I don’t quite understand the reason for the clandestine mindset. I’m sure the vast majority of people here want to stay in So Cal; otherwise they’d likely be reading other blogs.

I’m sure you’ll be missing So Cal eventually. Maybe not today or tomorrow, but when you’re shoveling snow 5 months out of the year or sweating it out in 90% humidity for the 10th year in a row, you’ll probably wish you hadn’t left. I’m glad you did, though, the less demand for housing here, the better! So Cal isn’t perfect, but neither is anywhere else. As long as things aren’t perfect anyway, I’ll take the imperfections with nice weather!

Most investors have little patience, both bulls and bears…

We must be getting close to a top…

as the bears are growing tired, giving up or buying at the top….

Retail loses 95% of the time….patience always pay off…

Hey cd; I am patient… renting and waiting for value has been a long haul for me… massive credit crunch and prime values hardly tilted down (in my area), and now they’ve gone up 33%-100% (in UK-London). Waiting for better value in prime, for me, has been like that scene from Indiana Jones and the Last Crusade … where Donovan drinks out the false grail/goblet.

However I still hope for the correction so younger people, saver-renters, have opportunity to trade up/buy in decent areas, in a more genuine economy (I mean… all this QE and Zirp has just made for bubble on bubble imo). SOAL, younger people are always coming through… and they want what you’ve got.

_____

son of a landlord

February 21, 2015 at 8:27 pm

“Those of us who are patient renter-savers, have knives laid against and inside the body of a complacent, over-extended, worn-out home-owner enemy, just ready to cut…â€

Sure, you can be patient, and wait, and dream of your day of opportunity.

But a lot of people grow old and die while waiting.

I agree, when the flipper-investors pull-out then we must be close to the top. Good, because so-cal is pushing the limits and is almost out of hand and stability is better in the long run and more in-line with historical norms.

Again, those metrics are for “inland cities”. And I don’t mean I.E. inland, I mean Phoenix, Dallas, Atlanta, and all the places people live that can’t hack it in CA.

SoCal is not an area for the faint of heart.

LOL. Can’t “hack” it in LA. I own a business, probably make more money than you, and I couldn’t be happier to get the heck out of LA a few months ago. Most of LA is pretty crappy, especially for the price, and if you don’t make a million bucks per year, in order to live in some of the nice areas on the west side, you’re wasting your time in LA. My sister and her husband make hundreds of thousands of bucks a year, have a half million in savings, and live in a nice apartment right on the Santa Monica promenade, and they still don’t want to buy in LA, because it means moving to Westchester, or Playa, or whatever, since they still don’t make enough to buy a decent 2 million dollar house in Pac Pal, or Beverly Hills, or Santa Monica above Montana, etc., where it’s actually nice.

The Realist, I’d love to see your lifestyle and the LA estate that you’re living in, considering how much you brag about how great LA is. Granted, you mentioned that being near a taco place was a big advantage in one of the dr. hb listings recently, so I don’t have high expectations.

Buying is emotional? You can have all the passion to buy but in todays market and world cash and loan qualifying rule the day. Years ago relatives and close friends could help you with a down payment, or fudge those income numbers to get a house those days are gone, with much higher prices and requirements to buy.

Home sales are down about 7% in the West, I’m a trend, at look at the big picture guy, down the road type. I ‘m seeing steady downward trend, with all-time mortgage rates so low and builders or sellers willing to give and still most folks are not pulling the trigger, even if they can buy. I do believe in the next few months we will see a slight bump up just on the pure fact that interest rates may raise to 5% or more buy late year causing a lets buy now. but going forward into the future folks, uncertainty is very high among the G7 countries, American can’t even get a health care system web site to work, the fundamentals of capitalism are poor at best. I see a longer road then I expected last 1.5 years, I was the buy now guy, I’m the ultimate capitalist, but I see a storm brewing in the next to years.

Leave a Reply to sleepless