A tour of 3 million-dollar foreclosures in Southern California – Calabasas, Bel-Air, and Brentwood. A $2.2 million dollar rental? Brentwood lists 1 home as a foreclosure on the MLS but has 90 homes in the shadow inventory.

The core problem with the current housing market is that most of the current activity is being driven by distressed sales. When mortgage rates were lowered, instead of boosting new home buyer activity you really saw a large surge of refinancing activity from those who already own. Good news if you own a home but little use if you are trying to build up your income to purchase a home. The bulk of housing activity is being driven by three items; investors snatching up lower priced homes, refinancing activity, and FHA buyers purchasing lower priced homes. The overarching theme? The demand in the housing market is for cheaper real estate. So today, we are going to highlight three million dollar distressed properties here in Southern California. Since few bother to cover this niche, it is important to highlight that million dollar foreclosures are more common than most think.

Million dollar foreclosure number 1 – Calabasas

25648 QUEENSCLIFF COURT, Calabasas, CA 91302

4 bedroom, 5 bathroom, 1 partial bath, 5,819 square feet, SFR

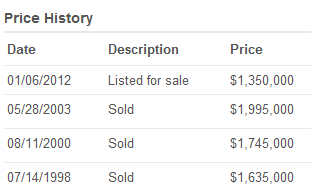

This home looks to be a recent addition to the MLS. The trend seems to be picking up where prime REOs are now making it to public view. In the next few months, there are some talks about major program changes with HARP and bulk sales of REOs to investors for turning them into rentals. In other words, the investment banks and government have a hard time admitting there is a massive amount of shadow inventory yet we are having targeted programs for this major issue. The above home has an interesting sales history:

The above home sold for nearly $2 million in 2003. The current list price is $1,350,000 but this is likely to generate interest. Let us look at the ad:

“All offers should be highest and best and must be submitted by cob on monday, january 16, 1012!!!!!! Limitless potential!!! Almost 6,000 square feet at the end of a magnificent cul-de-sac on a 57,120 square foot lot in mountain view!!! 4 bedrooms, 5.5 baths, tennis/basketball court, beautiful swimming pool and back yard. Please see remarks section before showing.â€

Million dollar foreclosure number 2 – Bel-Air

11730 GWYNNE LANE, Los Angeles, CA 90077

3 bedroom, 2 bathroom, 1 partial bath, 2,452 square feet, SFR

The next place takes us to the exclusive Bel-Air neighborhood. Let us take a look at the ad first:

“Well maintained two story home with three bedrooms and three bathrooms in a high demand gated community of bel air crest. Full amenities and located on a quiet cul de sac. Private yard. Two car attached garage. Close to freeways and schools and ideal for families.â€

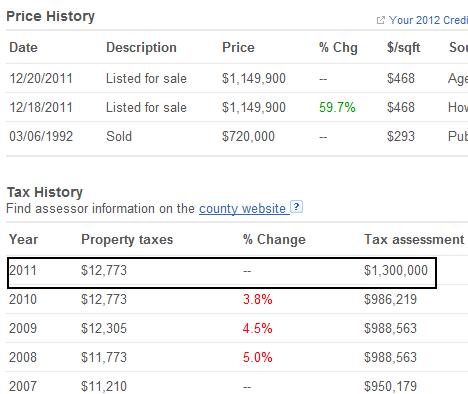

Nice place in a good Los Angeles area. Certainly a prime location so if housing activity is picking up these places should be selling like pancakes. Let us look at the pricing history here:

Interesting to see the tax assessment jump up in 2011. Typically a jump like this occurs from a refinance or an upgrade. The shadow inventory is definitely creeping out into the market in prime locations. Current list price is $1,149,000.

Million dollar foreclosure number 3 – Brentwood

11328 CHALON RD, Los Angeles, CA 90049

5 bedroom, 2 bathroom, 1 partial bath, 4,153 square feet, SFR

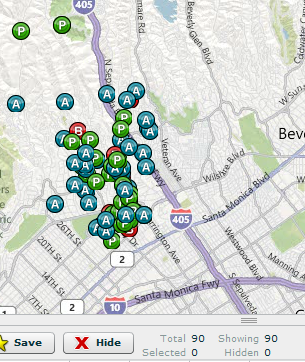

We finally end our journey in Brentwood. Only one SFR foreclosure is listed in the area and this is it. However if we look at the shadow inventory data we find the following:

90 properties sure looks like a lot more than the 1 listed on the MLS. And this is clearly a prime area in Los Angeles County. Let us take a look at the price history:

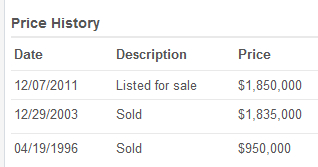

The current list price is $2,200,000. I love the ad for this place:

“REO, contemporary, custom home. Tenant occupied.â€

So this $2.2 million home is a rental? So much for all renters being poor. As you can see someone is getting serious about listing prime properties on the market. Little by little they are being leaked out but the shadow inventory is massively large. The new bulk REO programs seek to offload lower price homes but you think an investor is going to be purchasing million dollar homes in bulk as rentals? Highly doubtful. Welcome to the housing market circa 2012!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

32 Responses to “A tour of 3 million-dollar foreclosures in Southern California – Calabasas, Bel-Air, and Brentwood. A $2.2 million dollar rental? Brentwood lists 1 home as a foreclosure on the MLS but has 90 homes in the shadow inventory.”

Isn’t the Bel Aire property built on a landfill? Looking at the aerial view… you really have to like your neighbors, because these homes are pretty tightly packed together.

A shamless, low-class thief is posting on this site with my nick. Please ignore any posts using this nick with a space between the two words and know him for what a he is-A waste-of-skin, low-life punk.

I was just talking to someone about this in the morning. There is a house up the street in the Toll Brothers neighborhood that sold in 2004 for $1.4 million (when built) now REO asking a little over $1 million. I was thinking this will never be bundled to the investors and there is no one to buy because there is just so many million plus homes for sale. Can’t get FHA loan for these properties which means prices decline. Which will result in all prices for all properties going down. This is not going to end well and their new scheme of bulk selling to investors isn’t going to work, in that, these high end houses are going to come crashing down and take everything in its path (including the lower end homes).

I wouldn’t buy a Toll Brothers home for half the market value. I’m a civil engineer in Central Mass. I’ve talked to a few different home builders out here who were unanimously contemptuous of the materials and methods used in the construction of Toll Brothers homes. Lest you think that this was competitive enmity or envy, these guys have spoken to me openly and honestly about each other’s work, praising things quite often. They all said that they’d warn anyone they know to stay away from cheaply, poorly made Toll Brothers homes.

According to http://www.deptofnumbers.com/asking-prices/california/los-angeles/

the upper end houses, 75th percentile houses, price declines are acclerating these past several months.

I wonder how much the tenant is paying for rent on the third property? It would have to be 20 grand a month to make it a decent investment property at that price.

$20k a month sounds about right.

Not wanting to sound like a shill, but there IS still a market for high-end short-term rentals: many corporations will have good accommodation available for visiting Grand Poobahs to stay in.

And in the entertainment industry its fairly common for actors and other film people to rent a mansion for a few months while there’re shooting/whatever.

That being said… like most of these things, there’s only a few thousand renters a year with that kind of money, and anyone relying on their particular Underwater Mansion being one of the ones rented in this way is juggling chainsaws, financially.

But, looking at the DOM and the price tags on some of these Palaces (esp in Malibu, where some places have been listed for over 3 years) no one wants to admit that their property isn’t Speshul, nor that they made a horrible mistake betting on the Housing bubble going to infinity and beyond

Are you certain there is STILL a market for 20K/month rentals for visiting corporate Grand Poobahs to stay in places that look like they need the oil stains steam-cleaned from driveway, and a coat of paint on garage door?

I’m betting Grand Poobahs prefer to stay in $700/night hotels over that house any day. At least they get a free breakfast and clean towels and sheets every night. I know I would. Plus you are closer to the business centers.

Amazing Doc…that Calabasas place is $285,000 under it’s 1998 selling price…and the economy is NOT getting better, it is declining still…I am thinking California prices are still searching for that 1985 price before THAT bubble inflated. But, it is a very nice location, great looking home, huge lot….so who knows, maybe someone not looking at price, just living conditions, young family (wife and kids) scoops it up. Then accepts losing another $150,000-$250,000 in falling comps in area. Why do I say the 1985 price?

Because THAT was when Defense spending under Reagan peaked…and how many jobs have been lost since then? When manufacturing jobs decline…it isn’t only the blue collar folks getting smashed, it is the support engineers and execs getting hammered too….this looks like a top manager or lower lever VP-type house.

Follow up, see what the news is on these places in a couple of months…thanks for good article!

I wasn’t excusing it – I just know from experience (albeit a bit dated these days) that some corporations will put up Grand Poohbahs in expensive rented houses (with hot and cold running servants too) rather than hotel rooms, as it can actually be cheaper by the month to lease a short term rental than pay 5-star hotel bills.

But… my closing point was that the pool of companies (and, by default, Grand Poohbahs) was contracting – while the available stock of luxurious housing was expanding.

And that while every Underwater McMansion owner prays to the gods daily for someone to rent their palace for the price they think its worth, it isn’t likely to happen.

Though, I’m fairly sure you only replied to my post to give yourself the opportunity to write “Grand Poohbah” a couple of times. You’re welcome 😉

How much would anyone like to pay for the 1st one if you think it is the bottom?

I plan on submitting my offer by the Jan 16 deadline. I certainly don’t want to be late, as I’m sure that the typical calla-bass-assz buyer is prudent and plentiful. I hope my $100 offer is accepted, cuzz that is all i can afford. I don’t plan on moving there, the commute on the 101 sucks, and too far from winter surf for me. I’ll try to rent it out, maybe I can get $2500 a month? I might be able to go as high as $250K if i have to, in order for it to generate cashflow. Do you think there are suckers willing to outbid me??

My bid is $100.01. I also plan to rent as I live in Santa Cruz and my commute will be even worse than yours. However, I expect to get $6,000 a month as a corporate rental. Do you know any executives that might be interested?

BTW, that bid is cash money…

Pete,

I am thinking where it is listed (1.3M) is fair market, with a fair price/sq foot for the location. That number has to be an arbitrarilly picked (low) price point to generate interest and a bidding war. The properties surrounding this one are much smaller but have traded at higher price points.

If it does sell close to 1.3M it would be catastrophic to the owners in the neighborhood and would likely start a tsunami of “strategic defaults” in the area.

Your thoughts?

It will depend on how fast the house gets sold and at what price. 1.3 m is a reasonable price, if it can be sold at that price. a little less than 1m will be a real good deal, I think. If you build yourself, it will cost you more than 200/sq. Its not housing itself, its the bank. You cannot buy that house without financing from the bank (not many people can). The bank only wants to lend to people with enough down payment and steady income. But again, if the price is right, the property will be sold fast. if the property is on the market for a month without bidding, the price is not right.

See the bidding war above? That is the free market at work. Tract homes are a dime a dozen. The crazy fantasy prices for nothing more than shelter will eventually get shaken-out. $1/sq ft ratio…which one would you like to use? Do you know how much it costs to build? Material and labor? Sometimes cheaper to build yourself…and sometimes cheaper to buy one already done…the ignorant (potential buyers of this place for over a million) dont know either metric.

It is a lovely place, on cul-de-sac, huge lot, great location…I’d pay $885,000 for it right now…and hope like heck that is the bottom of the decline were are still in.

Got $884,000 to lend me, Uncle Freddie?? Aunt Fannie?

My sister bought a tiny small highrise apt. in the capital of one of the developed Asian countries for half million dollars. It only has one bed room one bath for about 600 sqft. (or even less). So I guess if I have enough money and the commute is not a big problem I’d pay for $800k. I’ll pay 1 million if the property tax in US is not that crazy though. But the bottom line is I cannot afford $800k mansion. I’d love to submit offer if it’s $600k.

Are you referring to Hong Kong? With there flat 16% income tax and ZERO capital gains tax? Or maybe Singapore with their maximum 20% income tax rate, and ZERO capital gains tax?

Big difference when you compare it to the US, with it’s local, state, federal, capital gains, AND sales tax. It’s amazing any of us have anything left to even buy a house.

Funny… 20K for a rental… We didn’t rent a 2.2M house, but the 1.4M house we last rented was for $2600.00 per month. You can extrapolate the math on that one, but I’m guessing it is renting for far below $20K/month.

People are just “hanging on” in hopes of a housing recovery.

By-the-way… we left that house, which last year went as a Short Sale for just under $800K.

http://realestate.msn.com/blogs/listedblogpost.aspx?post=2587d08b-efb6-4555-9cc5-c50419ac5eda&

This page is from MSNBC so a grain of salt might be recommended but realtors writing automatic price reductions vs. time on the market in the sales contract? And realtors refusing to list a house for sale because of owner’s asking price? How is a realtor going to make a sale if they don’t list the house (at any price)?

Some agents are writing price-reduction clauses into contracts with sellers, which authorize automatic price reductions if no action occurs in the first few weeks.

This is coming from the same network that called housing bottoms in 2008, 2009, 2010, 2011 and I heard the stock humper Kramer call 2012 the bottom last week. Happy New Year Kramerica!!!

Yes Cramer has started saying that the housing has bottomed and some dumb people will believe him…according to me housing MIGHT bottom in 2013-2014.

It might be possible to say that housing in some areas of Compton, and Palmdirt are near the bottom….when it costs more to keep it erected, you tear-it down, ala Detroit style.

We have a house in Malibu that is supposedly worth 1.6mm fair market but which we rent out for approx. 6K per month. There always seems to be a steady stream of willing renters becasue the school district location, and size are very attractive. It is always families with two or more kids so the place gets trashed.

Thankfully, the rent does cover the mortgage and operating expenses to withtin a few hundred bucks, but that is about it. If it were 100% financed, no way would rent come close to covering. It may come down some but it won’t very much – this is a 1% stronghold area. 99% need not apply I guess.

I wouldn’t be so sure.. in fact you are probably going to lose a lot of money on your property. My grandmother’s property in Tokyo Japan in a neighborhood that is known as the “Beverly Hills” of Tokyo went from over 20 million dollars in 1987 (probably more like 50 million in today’s dollars btw) to about 2.5 million today. The Japanese stock market is currently off 75% from the highs. real estate deflation is being felt in the 1% areas now… as DHB shows… and probably another 10-15 years of declining real estate values before we see a bottom. Fair market value is what someone is willing to pay in CASH these days for properties over a million.

We live in Brentwood and we are starting to see those foreclosure notices. Our next door neighbor was the first one, then we took a stroll in our neighborhood and saw another a block away. Because Brentwood, Beverly Hills and Bel Air have changed so much in the last two decades (not old LA money anymore), they are not as pretigious as before. Also, there has been so much demolition of old houses and all the enormous, obnoxious mediterranean McMansions went up that all look the same. We will never buy here, the neighborhoods are certainly not what they used to be, nor the neighbors.

btw.. check out the HGTV show selling LA… gives a really good perspective on the LA housing market. One takeaway I got from the show is that we are reaching a tipping point in the luxury market (homes in the 2 million and above range)… sellers continue to lease after getting no bids for their properties.. which all means property prices are about to crater. it will take another few years before sellers realize they should have taken what they “considered” low bids.. 2011 is going to be viewed as part of the good old days compared to what is about to happen to the real estate market going forward.

We are in dilemma right now whether to buy or keep renting. I’d like to know your opinions.

Some backgrounds of ours. Our incomes is around 170-180k. No debt. No loan. Renting a small house in an undesirable area with rent $1700 per month. We have a kid and would love to have at least one more in the near future. We’d love to move to a nicer area since we are about to send our kid to pre-school. The rental price in the area we’re interested ranges from $1800 for a 2 beds 2 baths apartment to $2800 for a clean 3 bedrooms house. We have 4 small dogs and I don’t think an apartment suits our needs. We are thinking if it’s a good idea to buy a fixer house in a better area (Temple City) for $400k or buy a living-condition condo in a nice area (Arcadia) for $420k+ or just stay in current rental house. Both of us are still paying the same tax amount as we were when single. We will be benefits from tax if we own a house (couple hundreds a month). So suppose we bought a $400k house, the mortgage plus tax benefits would probably similar to what we’re paying now.

My question is what would you do in our situation?

We certainly know it’s not a good time to buy right now. We have been waiting for 3 years but prices in those area are still holding strong even though I don’t think it’ll last forever. We don’t know if we should just buy a house and pay what we’re paying now or wait couple years more and hopefully we will be able to afford a $600k house in today’s $400k price. What do you think?

Put every dime of extra cash in the bank so that when prices drop in the mid-tier areas, you will be in good shape. Wait til the horrible spring selling season is over and see what gives. When sellers are made to realize that the $120,000 home they bought in 1977 is really not worth $750,000 like they thought it was in 2008, they will sell to you for $375,000. Watch further foreclosures through the year, and ride it like the big wave you are so stoked to find dude. Peace.

i would only consider buying a short sale or REO property… 40% of sales in LA right now fall into this camp. you don’t want to deal with delusional sellers. plus you have to factor in more depreciation… so only buy if it’s a great deal.. otherwise just sit in the driver’s seat.

Leave a Reply to pongpong