A History of the California Housing Gold Rush – The Financial Expansion of California Real Estate from 1850 to 2010.

California has gone through many boom and bust cycles. Since it became the 31st state in 1850 California has been home to many speculative manias. An enormous population boom in the 1800s was brought on by the California gold rush. Booms like this led to the rise of cities like San Francisco. Los Angeles in the early 1900s found its footing as an entertainment hub and this led to massive expansion. Since that time we have seen countless real estate booms and busts. The current housing boom and bust cycle is the largest and most widespread in the state’s 160 year history. As we look at historical data there is no lack of hyperbole when it comes to selling California real estate. It would seem that every year is a good year to buy. Of course as many are now finding out, timing is usually a bigger factor in determining housing success than investment savvy.

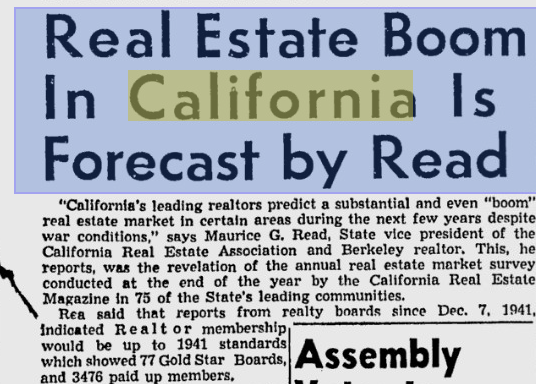

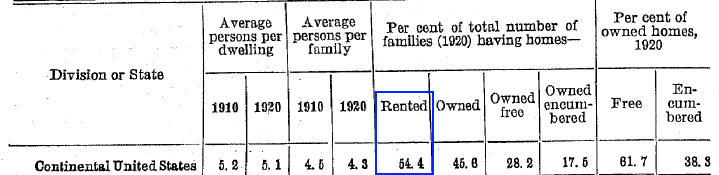

We first should look at the history of housing from a historical perspective because many old paradigms of housing have fallen. Let us first look at nationwide data from 1910 and 1920:

Source:Â Census Archives

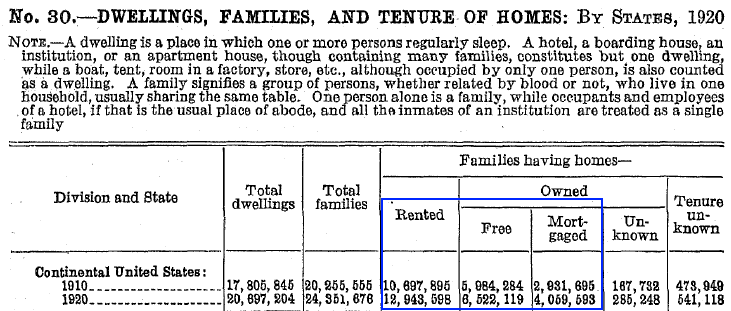

I decided to dig up some old Census data to show how dramatically housing has shifted over the years. Many in the housing industry assume that real estate has always been the way it currently is but forgetting about history can lead many into challenging situations. In 1910 and 1920 the majority of Americans rented their home. Of the 20 million dwellings in 1920 only 4 million were mortgaged. Today, the majority of American households own a home. The homeownership rate has fallen since the crisis started. California is not immune to this trend:

The nationwide homeownership rate stands at 67.3 percent down from the peak of 69.4 percent back in 2004. In less than a century the housing market completely transformed. We went from a country dominated by renters to one dominated by homeowners:

So how did we go from a large number of renters to a majority of homeowners? Much of the jump came because of government financing in the housing market:

Source:Â Hoover Institution

In the middle of the Great Depression the National Housing Act of 1934 was passed to bring on more affordable mortgages and also created the Federal Housing Administration (FHA) and the Federal Savings and Loans Corporation. The central reason for this was to stem the issues deep in the foreclosure crisis of that time. The FHA and the FSLIC created the network to allow steadier access to mortgages in the market. Some factors that came about from this was the push for suburban sprawl and also less focus on improving inner city housing.

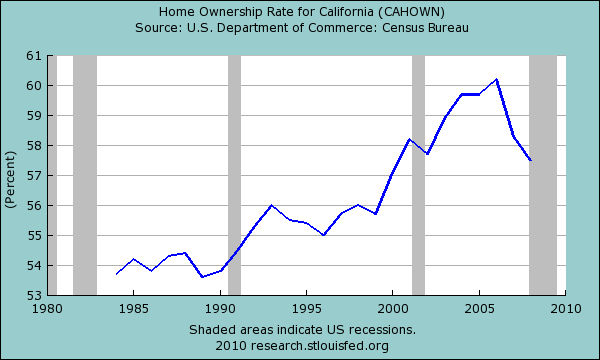

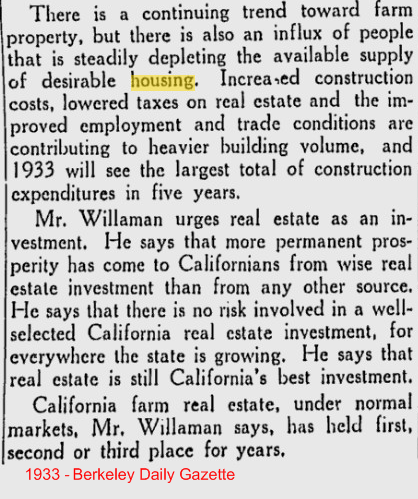

There have always been promoters of real estate. Even in the depths of the recession people were championing real estate in California:

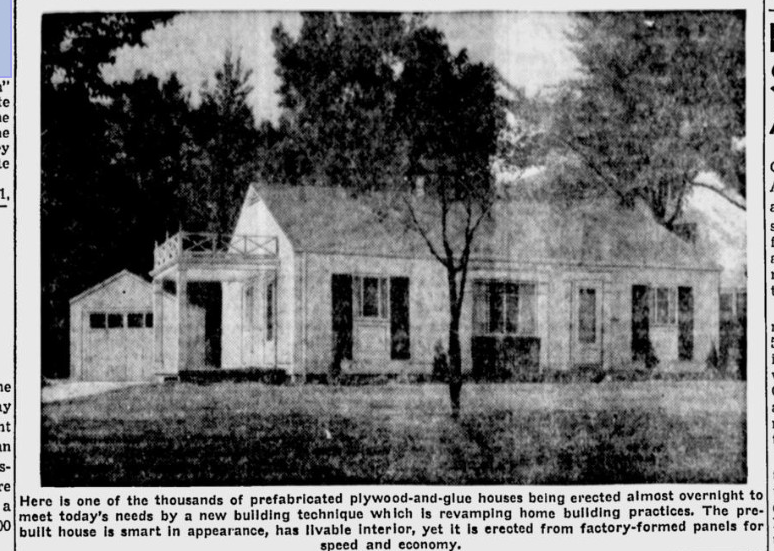

I found this piece from a 1933 California newspaper.  The cries of available supply, lower taxes, and benefits to the real estate industry were already loud and clear back in the 1930s. You would think that the Great Depression would at least dampen the spirits of housing promoters but that didn’t seem to stop many. If a Great Depression didn’t stop the promotion maybe a World War? Not even that could stop the hype:

The above comes from a 1942 newspaper spot. One thing is certain when it comes to California real estate. There is always a boom going on, it just depends who you ask. Timing is such an important factor in purchasing real estate. Many who bought in California from 2004 to 2007 took the brunt of this current housing bust. But the usage of highly toxic mortgages has created a long lasting legacy of problems that we are still working through. The problems are still embedded in the market and many mortgages sit in a financial state of suspension. This will continue at least throughout 2010.

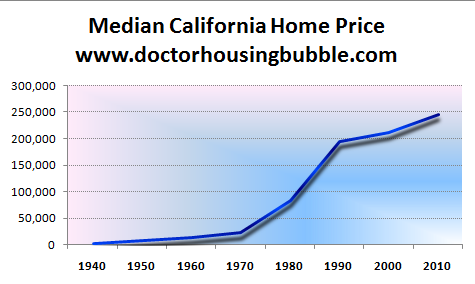

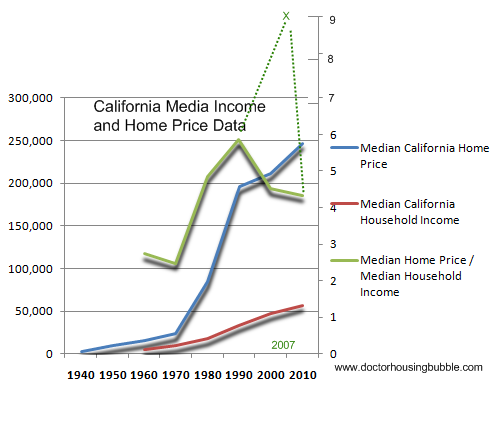

Let us look at California housing prices going back to 1940:

Source:Â Census

Home prices have gone up steadily since the 1940s. Some decades saw much higher price growth. The biggest jump came between 1970 and 1980 when home prices went from $23,100 to $84,500 increasing by a factor of 3.65. This decade has seen the slowest growth since the 1940s. In 2000 the median California home price came in at $211,500 and today the median home price is $247,000 (an increase of 16 percent while the state’s inflation rate is closer to 30 percent over this timeframe). So California real estate has now witnessed a lost decade adjusting for inflation. The likelihood of seeing a nominal lost decade in prices cannot be ruled out. Some areas in California like the Inland Empire are already seeing this happen.

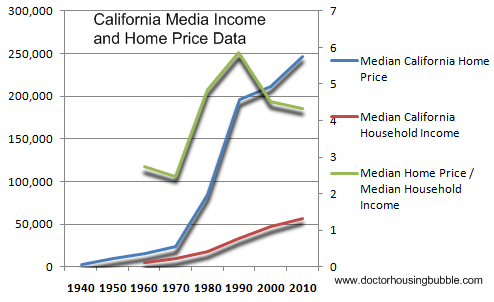

Yet what has really happened in California was the transformation of housing into a speculative commodity. This can be seen by how much income is eaten up by home prices:

It is tempting to look at the above chart and say that home prices are overall cheaper than they were in the 1980s if we factor in the median home price and household incomes. However home prices are still too expensive and if we look carefully above household incomes never really caught up after the massive inflation of the 1970s. Access to debt covered up much of this lost purchasing power. The current median home price in the state is also deceptive because of the massive amount of foreclosure re-sales in the last two years. Most of these have come from lower priced markets while mid to higher priced areas remain in bubbles. The above chart highlights the overall sales in lower priced markets and still comes out showing a very expensive market in California.

Much of the rise in home prices this past decade came because of maximum leverage mortgages that didn’t even take into account incomes that were falling further and further behind. Many of these mortgages didn’t even look at income. The above chart pulls points at each decade so we miss the 2007 peak in home prices. If we include that point the chart would look like this:

When you look at the peak price data, it shows how historical this bubble was. In places like Los Angeles and the Bay Area many homes that are still selling for peak prices were built back during the last home building craze in the prime counties. Take a look at this 1942 ad:

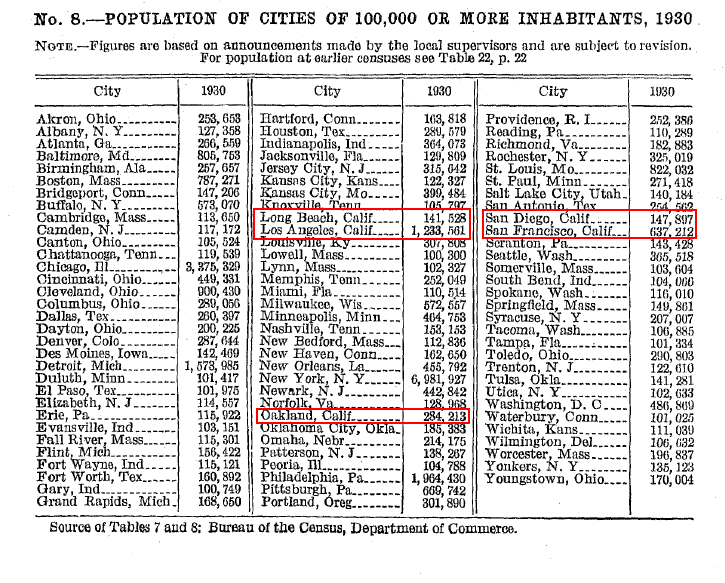

Much of this massive construction took place decades ago in some of California’s biggest and oldest cities:

Massive population centers are nothing new for the state. And a growing population will increase housing demand but not how most think:

Source:Â Legislative Analyst Office

California is still lacking in affordable housing. The days of cheap fuel will make it harder for other Inland Empires to sprout up from the ashes. People forget that California has an enormous amount of land that is similar to Arizona and Nevada. The Central Valley has plenty of room. Why don’t they build this out? For one, access to employment but also the cost of energy to keep these new cities up simply does not make economic sense. It is unlikely that we will see $1 gas again so fuel is going to impact the suburban sprawl dream that started back in the 1930s. New housing has to be smarter and more compact near city hubs. Look at places like Tokyo for example. We always hear the real estate building crowd that we need more friendly permits but then they go out and build sprawl just like they did back nearly 100 years ago. Is this really good for our longer term prosperity? Also, it might have reached its natural end. People can’t afford to commute from these outer regions.

There is no arguing that the population will grow in California over the next decades. Yet to assume that this will mean another real estate boom is incorrect. Look at China for example. They are now contending with mini bubbles in real estate and they have massive population centers throughout the country. The big issue in the coming decade is going to be smart and affordable housing. Ironically many of the current government programs are making housing unaffordable by propping up failed banks. It also keeps the current structure in place since so much money is involved. Yet that doesn’t mean it is smart policy going forward.

So what will we see in the next decade? It is very likely that the homeownership rate will dwindle lower in California. As more and more people are classified as “part-time†workers with no employment security, a large part of our population will need the mobility of renting or simply won’t have the income to purchase a home. When people purchase a home, it requires a level of security in their employment. If a large part of the population doesn’t have that, many will opt to rent, some by choice but many others because of economic reasons. City hubs will probably see bigger growth as people move closer to employment opportunities. This isn’t the 1920s when 1 out of 4 people were farmers. It will definitely be an interesting decade when it comes to California housing.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

19 Responses to “A History of the California Housing Gold Rush – The Financial Expansion of California Real Estate from 1850 to 2010.”

I think the big plan for Los Angeles is to build high density apartments near subway and other public transportation stations. If this plan is realized, there will probably be many population centers far away from downtown, because they will build more public transportation. I am talking about many years from now.

Excellent post Doctor. It’s always educational to view data presented over a longer time perspective. As financially wrenching as it would prove to be, I suspect median California home price to median California household income ratios will again need to return within the range of 2.5 – 3 found prior to the mid-1970’s and become more closely aligned with the rest of the country. The belief California can support much higher ratios of 4 – 5 forever may finally be coming to an end (even though this “experiment” lasted 35 – 40 years).

A recent paragraph summarizes the Japanese financial bubble of twenty years ago for another perspective.

Mises Daily: Friday, March 05, 2010 by William L. Anderson

http://mises.org/daily/4121 (excerpt):

For a brief moment in 1990, the Japanese stock market was bigger than the US market. The Nikkei-225 reached a peak of 38,916 in December of 1989 with a price-earnings ratio of around 80 times. At the bubble’s height, the capitalized value of the Tokyo Stock Exchange stood at 42 percent of the entire world’s stock-market value and Japanese real estate accounted for half the value of all land on earth, while only representing less than 3 percent of the total area. In 1989 all of Japan’s real estate was valued at US$24 trillion which was four times the value of all real estate in the United States, despite Japan having just half the population and 60 percent of US GDP.

Yes indeed, those Japanese real estate valuations were proven “sustainable”….. (600 square foot condos, at $600,000 outside Tokyo, requiring 100 year, three-generation mortgages). To “solve” the current California housing bust, just roll out the “California Special,” a newly developed 120 year, four-generation mortgage….. after all, whatever the Japanese can do, we can go them one better…. (the “Wall Street” way!)

I tend to agree with most of your blogs however, California seems to be at odds with urban development. If you go to CA dept of finance website you will see that the forecast for school children will actually shrink in the coming decade for Los Angeles and Orange County while Riverside will have some of the highest growth in the state. So Harvard studies predict the younger generation wants to live in urban centers yet the California school forecast contradicts this somewhat.

Another interesting thing I would like to see in one of your upcoming blogs is the not just where the younger families are going to buy homes but where the greying baby boomers are going to go. The aging population over 60 will be the fastest growing segment of our CA population as well. Are they going to stay put in their homes in LA and OC? If so, this might be why Riverside will be the beneficiary of young families unless urban development picks up.

I like the comparison to the past, as that is the only true gage of how the herd thinks and acts. Until the mindset changes to a sustainable social format, we will ignore reality and pursue individualistic, often irrational choices. This is the flip side of liberty–we have the choice to make both good and bad decisions for ourselves… Reality will prevail in the end though. Just as progression of farming productivity has made it impractical for the small farmer to survive, there is a functional limit to real estate as an ever-increasing economic juggernaught. It may be propped up a while longer, but logic seems to indicate a sea-change is underway. How this shakes out is only a matter of timing.

Three things (The Web) (High Speed Rail) (Personal Solar energy)

The web will allow far more people work remotely than ever,

(tell me tech workers, how many times has Webex and PC remote saved you from jumping on a plane !!!)

I am working from home as I write this with a system 3000 miles away.

High Speed rail will let people commute from places like Sacramento to San Jose with ease.

I know people in Japan who commute over 100 miles every day.

Solar energy will allow most everyone to become their own power company (it’s happening NOW !!!).

Lastly the recession will end someday, I heard this same thing that we will be going nowhere but down in every recession sence the 1970’s (America’s done) (1980 Japan will rule the world) the list goes on.

Yes, I do agree that Ca population will grow only because the hispanic population will out grow other nationalities…… White 15% Asian 15% Blacks 3.5% Others 1.5%….then rest will be all hispanics……Questions is (can they afford housing) , you bet they can, they live 7 to 10 families working and paying the one house. . But higher taxes and not many jobs would make people moved out from the states……Yes, this decade will be interesting to predict but it won’t be pretty in next decade…..If you know what I mean, it won’t be California, lets call it Mexifornia or Mexicali…….

“High Speed rail will let people commute from places like Sacramento to San Jose with ease.”

Oh boy I’m not a betting person, but who wants to take odds on which comes first: the state defaulting on it’s bonds or the high speed rail boondoogle actually being built?

I somewhat agree with Jonrent, but the rail isn’t likely to be completed until 2030. What do we do about the next 20 years?

Jonrent the two items you mentioned are disruptive technologies for our society (high speed rail and working remotely). It has far reaching implications for society. High speed rail can allow people to live very far away (50 to 100 miles away) and still have a short commute from point A to point B. Having a group of people work from their home can further deteriorate commercial real estate prices.

The federal government is the last bastion supporting high housing prices. The free market is doing what it naturally would do; based on either positive or negative inputs giving back the corresponding feedback. But the federal government is stepping in and supporting high housing prices. I look forward to the day when the government can no longer afford to do that and house prices reach a ratio of income to house price that benefits everyone.

There is no doubt in my mind that we are in and in for more of a deflationary debt spiral. The only conclusion is whether we have a deflationary collapse or end up like Japan- a long slow stagnated decline that lasts God knows how long.

I really enjoy this blog and have learned a lot. All the data points make a lot of sense, and I tend to agree with most of the Dr’s thoughts. However, despite all the massive shadow inventory, high rent/buy ratios, unemployment, etc, prices have not significantly come down where I live (Bay Area-San Mateo county), in fact they are flat to 10% up year-over-year on a per sqft basis. I wonder if there is something all of us are missing here. It would suck to one day find out that the theories presented in this blog were flawed for some reason. I would be interested in hearing from other readers if there are any potential flaws in the Dr’s arguments. What assumptions would one have to believe in to buy today vs. in 2-3 years.

California is still lacking in affordable housing. The days of cheap fuel will make it harder for other Inland Empires to sprout up from the ashes. People forget that California has an enormous amount of land that is similar to Arizona and Nevada. The Central Valley has plenty of room. Why don’t they build this out? For one, access to employment but also the cost of energy to keep these new cities up simply does not make economic sense. It is unlikely that we will see $1 gas again so fuel is going to impact the suburban sprawl dream that started back in the 1930s. New housing has to be smarter and more compact near city hubs. Look at places like Tokyo for example. We always hear the real estate building crowd that we need more friendly permits but then they go out and build sprawl just like they did back nearly 100 years ago. Is this really good for our longer term prosperity? Also, it might have reached its natural end. People can’t afford to commute from these outer regions

Well said DHB! Nick has it right also. The future of the housing market will be cities with strong transit networks & that are walkable. Not just in CA but nationwide.

wwwwalkscore.com is a good resource to understand how walking fits into the equation.

San Diego home prices during 1919 till 1940.

1919-3453

1920-4665

1925-5570

7-1926-5826

6-1927-4682

6-1928-4789

5-1929-5599

5-1930-4450

5-1931-4000

6-1932-3050

6-1933-3050

6-1934-2500 over 55% drop, data I have 2300 on 1-1929.

6-1935-4000 then gradually down again till 3250 in 1940.

Should would like to know the source of these historical San Diego home prices.

This is a Positive Rant, so pass if you are not in that frame of mind.

I love your site and have been following for 2+ years and though I agree there is much pain to come, but some how, some way, there are answers (the above suggestion of a 120 year AMO could be a method – but let’s say take it further and coupled with a waiver of estate taxes if these assets are deployed as a loan to new home buyers, or in the purchase of LEED certified homes located within the “Economic Zone of Efficient Frontiers” – yes, we will have wastelands…and so many people are and will be suffering…so help people first….but let’s turn the outer reaches back to farms – solar, ag, fish, ? populated by small efficient communities) – call it what you may, but there are answers and we must experiment and have the vision that we can go beyond the basic math (no math?) of SubP and Alt A, while not being idiots in terms of Wall Street idiots, Quant Theory and derivative/leverage destruction. And so with that:

First: California is two, three or five economies. Smart growth is not new, young urban’s usually become “close in” suburbanites (SF to Rockridge and Berkeley and then becomes Orinda/Moraga/Lafavette – why? great schools + BART + an urbanish life simulated or very close by; same SF to Palo Alto, Los Altos, Mt View – train; SF to Marin – ferries; throughout Los Angeles and San Diego as well). There is only one Tahoe, one Mammoth, one Harvard Square, one Santa Monica, one Sausalito. No offense to anyone, but many people will continue to live in X rather than Y for lifestyle choice, basic supply/demand, that will never change. Location is nothing new. I understand their is an argument otherwise, but look at the gentle-person who reflected the pre and post depreciation prices: they never went to zero….they severely retracted…and yes, the rule of 70 can still be applied, ultimately bad – even a long, long bad – will turn to good. Just be prepared – Three Pigs, Cub/Girl Scouts, your grandparents and parents. Pay attention. Second: California is strategically positioned to Asia and that will never change whether importing in or exporting out. Third: we can solve our problem here in California, but the most difficult will be this: municipal and state worker retirement programs et al and etc., eliminating the abuse (unused vacation accumulated to a bonus payout “collectively bargained” (Sic) and so way beyond absurd – yes for the cops, CHP and our fireman; but no dice for anyone else eg: city managers, whoever). Lastly: housing will continue to drop in value as described in the outland areas, but demand, family estate family transfer and motivation, both at the personal and changes in planning department density restrictions will provide and allow subdivision of in-burg single family homes. Sure, less space, but it will not be a million cubed box sitting on Treasure Island. There is so much inner space, if you look and allow. NIMBY will have to give way. Waterways can be utilized to a level that simply have not been studied. We need to be creative and courageous, but the answer is not mass hiatus. People can and need to change their circumstances, and really, think about it: there is no new frontier (said long ago, 40 years now…Hotel CA, Don Henley – Eagles). I am no liberal humanitarian (though at times I wish I were), but I am sure and confident that there are thousands of ideas and solutions to so much waste and inefficiency. So much.

The enrollment at LAUSD is declining due to rising house prices.

You have to understand that LA was super-cheap in the recent past. Look at the historical data for the 1990s. Good sized houses sold for $175k, and this is within a short distance of downtown. Middle class people were afraid to live in LA. Poor people were too, but they had little choice.

So, even with recent declines, the prices are higher than what working class people can afford, in all but some parts of South Central LA.

The much-publicized trend of younger people moving to urban areas is a little faulty. In my workplace, my co-workers are mostly 19-25 and unless they get a high-paying job in an urban area, they do not want to give up the comforts of suburban living. My generation, which grew up in suburbs and exurbs, got used to driving, malls, large homes, backyard swimming pools, does not really want the difficulty and expense of urban living. Most are content to work low-paying jobs close to where we grew up and enjoy low cost rentals and overall low stress life. Many of us have lived in big cities and were not able to get ahead financially, so we moved back to where we grew up and found life easier. For this reason, I do not expect the price of housing in urban areas to stay elevated. – little demand going forward. Why live in a tiny rat trap for $2000/month when you can rent a house for $700/month? I think the New York Times and other urban voices promoting this trend are trying to justify their urban bias.

As for the knowledge based/creative workforce preferring to live in cities, well, sure, but I know from experience that those types of jobs in those areas are very hard to come by these days and without jobs, housing demand goes down. Los Angeles area is hemorrhaging these types of jobs and rent/purchase prices of housing will come down because there is no next generation of buyers to soak up the supply coming down the pike.

Great entry Doc!!

old ahh comments

Leave a Reply to Nimesh