The Housing Metrics of Southern California – Seasonal Home Sales, Inflation Adjusted Home Prices, Tens of Thousands Living Rent Free, and the Japanese Experience.

People are realizing the problems in the housing market are simply a bigger reflection of the lingering issues in the overall economy. There have now been a few stories comparing California with the issues being experienced in troubled Greece. JP Morgan Chase CEO Jamie Dimon echoed his concerns regarding California. The markets seem to underestimate how profound the issues are in the California economy. What is more troubling is California is merely a reflection of other states. The Legislative Analyst Office projects deficits deep into 2014 and each year we experience a deficit will require higher taxes or deeper cuts. That is why focusing on jobs is such an important barometer for the improvement of the overall economy. Without one net added job in California people are already counting the next housing boom. The numbers simply do not reflect this assumption.

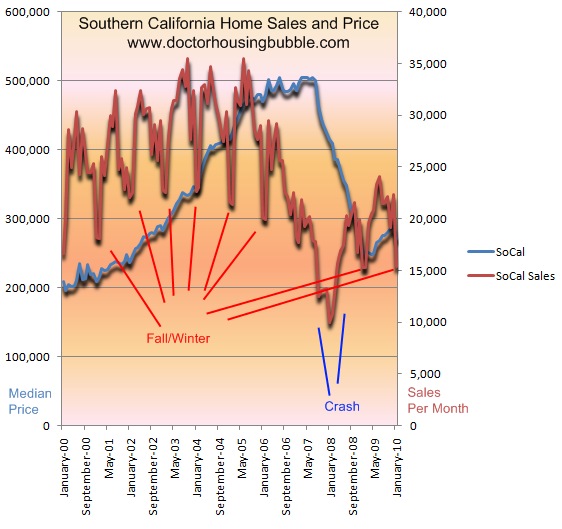

I want to examine some of the nuts and bolts of the market because this is where the real story is. We know that millions of foreclosures have flooded the market. We can understand how toxic option ARMs have become to the market even years after they were originated.  But what does this mean going forward? First, let us examine the median sale price and monthly sales of Southern California over the decade:

Source:Â DataQuick

This is a fascinating look at the market. Even during the boom we clearly see the seasonal pattern in sales. Each fall and winter sales drop as more people take inventory off the market. Spring and summer overall are bigger sale months because of school schedules, family commitments, and just a general acceptance that this is when more inventory enters the market. But you’ll notice in 2006 that the trend radically shifted. The crash hit and sales plummeted. An interesting phenomenon occurred where the median sale price didn’t peak until the middle of 2007 well into the monthly sale crash. So it would appear that sales would actually lead future prices. So the jump in sales would indicate much higher prices going forward right? Not necessarily. Even with the jump in sales, we are nowhere close to the average sales per month over the decade. I ran the monthly sales number for the past decade and the average monthly sale number for Southern California is:

24,604 Sales

This includes fall, winter, spring, and summer. In January we had 15,361 sales and the last time we had 24,604 sales or higher was back in August of 2006. Prices have come down but the bulk of the drag to the lower side has been in lower priced home sales. Much of this has been driven by foreclosure re-sales. But another important factor to look at is how much are families committing to their monthly mortgage payment? With Alt-A and option ARM products families were able to stretch their budget. Since the bulk of loans are now backed by the government lenders are now at the very least verifying income. Let us look at the monthly mortgage payment over this time:

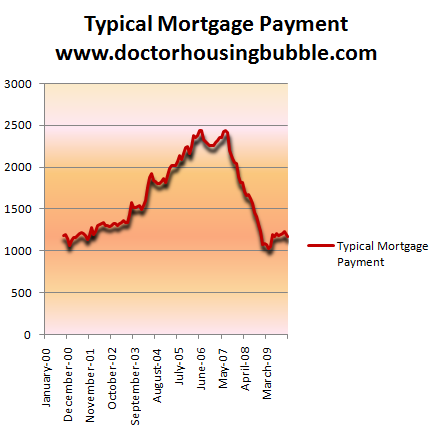

Source:Â DataQuick

The above tells you a lot. While the median home price in Southern California is down by 46 percent from the peak the typical monthly mortgage payment is down 52 percent from the peak. People are committing to half the monthly payment amount and this has more to do with the health of the economy. I know many would love to have a $1,170 monthly mortgage for a place in Southern California. This is already happening in many areas but not in higher priced regions like Culver City or other parts of the Westside.

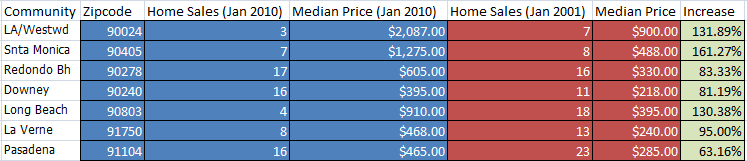

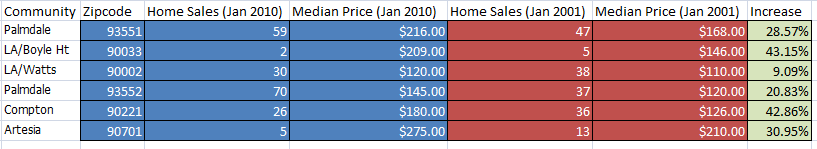

It helps to look at a handful of examples to highlight what is really happening. Let us look at pre-bubble prices in areas that have corrected versus areas that still seem elevated:

Source:Â DataQuick

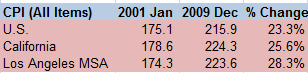

Now this data tells us a lot because over the past decade incomes went stagnant. The overall inflation rate for California was 25.6 percent:

So if wages don’t explain this rise in prices and inflation isn’t the reason, can it be that some areas are still in mini bubbles? This is very likely. And this doesn’t apply to the entire state of California. Some areas have corrected fiercely and prices seem to be more in line with inflation and wage increases:

You’ll also notice the difference in overall sale numbers. What on the surface may seem like an enormous crash actually looks like a correction to the inflation adjusted mean. I find it fascinating to see many communities heading back to the 25 to 30 percent inflation rate of California and are somehow finding a bottom in this range. But many areas are still over priced and this will need to adjust either with higher incomes coming from better job growth or further price corrections. Part of what is forgotten when examining the shadow inventory is the fact that these are properties in heavy distress. The L.A. Times ran a piece confirming what we have been talking about for over a year:

“(LA Times) It’s been 16 months since Eugene and Patricia Harrison last paid the mortgage on their Perris home. Eleven months since the notice got slapped on their front door, warning that it would be sold at auction.

A terse letter from a lawyer came eight months ago, telling them that their lender now owned the house. Three months later, the bank told them to pay up or get out by the end of the week.

Throughout the country, people continue to default on their home loans — but lenders have backed off on forced evictions, allowing many to remain in their homes, essentially rent-free.

Several factors are driving the trend, industry experts say, including government pressure on banks to modify loans and keep people in their homes.â€

Now this wouldn’t be such a big deal if it were a handful of mortgages. But just look at this mind blowing chart:

Source:Â LA Times

Mortgages that are 90 days late and a foreclosure hasn’t been filed are up to a record shattering 5.1 percent. Now think about that. How is this a sign that things are good? So we’ve reached a point where simply staying put in your home, rent-free is a strategy being used by banks to deal with the foreclosure crisis. The big losers are the prudent in this country. How many Americans are paying their mortgages diligently, probably needing to take a second job if there is one to be had, just to make sure they pay their bills? Wall Street has the luxury of making disastrous mistakes and yet they are bailed out to the tune of trillions of dollars and offer billion dollar bonuses. Those that over extended are then put in a lottery essentially where some can stay rent free for one and even two years before an eviction depending on when banks get to it.  Others are kicked out quickly. Some are put into HAMP. The big issue? No clear uniformity to what is going on. What is wrong with renting? Half of those living in giant Los Angeles County rent. There is this stigma attached to renting a home and massive subsidies for homeownership. This carefully orchestrated play is now being held up even though tens of thousands now are living rent free in over leveraged homes. Housing seemed to work well when it was a boring, track inflation play that if you were lucky after 30 years, you had a place over your head and no mortgage. Since when did it become a rule that every 5 to 7 years you had to “trade up†a “starter home†just so you can progress forward? This twisted logic seemed to make sense because how else were most families going to save $100,000 to $200,000 just for a down payment on a 1,000 square foot home in a decent area? Of course that broken trend is now unraveling.

So putting this altogether, why would anyone want to buy in this current climate? Transparency is really not to be found. What real reform have we gotten after these two agonizing years? Is this reason in itself to buy? The headline data seems to tell us things have stalled but if we look at a deeper analysis, foreclosure filings, those 90 days late and with no foreclosure pending, bankruptcies, and other in the trenches data we realize that the market really isn’t healthy. We have yet to add one net job since the recession started. How are home prices going to go up? So let us assume the next big play is to simply turn ourselves into Japan and go for our second lost decade by putting banks into a permanent zombie position and ignoring problems. Pretending someone in a home that isn’t paying their mortgage is somehow good is probably a clear example of turning our housing market into a zombie market. Yet how is this good for prices? The same arguments were made in Japan and prices went nowhere for over 20 years!

It is interesting that the flurry of buyers jumping into the market have tapered off in the last few months. There was a period of two months where the tax credit and uptick in sales seemed to move a large number of people off the fence. There was a good amount of e-mail during this time. This has now waned significantly. But guess what? Prices are still near the trough. Why? Because incomes are stagnant. Maximum leverage mortgages are gone. Unless you plan on staying put for 30 years and can cover your mortgage comfortably, that future buyer is only going to be able to afford what their household income can stretch with a government backed loan. And looking at that typical monthly mortgage payment for Southern California it isn’t jumping up quickly. In other words, know the metrics of where you’re buying before jumping in.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

33 Responses to “The Housing Metrics of Southern California – Seasonal Home Sales, Inflation Adjusted Home Prices, Tens of Thousands Living Rent Free, and the Japanese Experience.”

There is nothing wrong with renting, except that if you are 10 days late on your rent the landlord puts a nasty note in your mailbox. However, if you are 90 days late on your mortgage, you get 90 more days, and than maybe another 360 days. After a while you just might start liking it.

I have been watching this the San Diego Market for the past two years. There is a significant demand bifurcation between homes priced above median and those priced below median. For many the below median prices have come down to the point where a regular person can buy a condo or a smaller home on a median income. So when the lowest priced condos began pricing below $150/sqft, those people bagan to buy as they could afford it and it was cheaper or equivalent to rent. Investoprs also began to buy as they could cover payments with rent.

I have even observed bidding wars for smallish condos with starting prices between $100-125/sqft. The real problem is that alot of people thought that this meant the market was returning and put their sfrs on the market at over $250/sqft where there is very little traction. Your blog showing the same homes in the same neighborhood priced at drastically different prices in indicative of that problem and can be observed in many neighborhoods. Each time sales pick up I have noticed a lot of homes coming back on the market in hopes of getting a sale and disappearing once it is clear that the market has not changed for over $500k homes. So I agree with your idea about pent up supply continuing to come on the market as people get more and more frantic about getting out of their underwater homes. But the higher priced homes will take longer to clear because owners tend to have more resources to keep making payments even knowing the home is underwater.

The above median home market is still in deep trouble simply because the marginal buyer still can’t afford the payments.

FWIW, Chris

Love your blog, Doc. But I’ve heard all this before. It’s a Mexican stand-off between the buyers, sellers and the banks. No one wants to budge.

I currently rent in Newport Beach and am seeking to buy a home here in about 1 to 2 years. I have seen the most invaluable houses at the most insane prices sell. The median household income is currently around 112K and over 50% of houses here are selling for over 1 million. A house selling for 1 million will cost you around 5000$ a month including taxes, utilities etc (this is a low estimate not including possible HOA’s). So if you do choose to buy that 1 million dollar home and have two kids to feed, you will most likely be buying your food at CostCo and missing out on family vacations, especially if you choose to lease two Escalades. I am wondering if prices will ever go back to a sane level if people still prefer to eat crap before downsizing on their show time.

Is there really a possibility that myopic lawmakers are going to grant principal reductions to folks who overpaid, lied on loan apps and put nothing down, refinanced to pull out cash and spend it on cars and cruises instead of the actual mortgage payments? In that case I want a principal reduction too, do I have to stop paying my mortgage to get one? See what I mean, does this not create a nation of folks in default?

I wish you would report on the overlooked consequences of folks that are in homes for 24 months without a payment and without a Notice of Default from the lender. That is reported but the main issue is that these folks that are not paying the mortgage are not paying their property taxes (or insurance) either and in this state we have a $25,000,000,000 shortfall. How do moratoriums help close that gap? At least a bank that forecloses pays the property tax!

Given that my (current on my bills) tax dollars are being spent on bailouts to banks, bailouts to deadbeats am I also supposed to be overjoyed that I get far less for my property tax dollars now (57 kids in my daughters class, and it is one of the better schools in LA!!) road closures, cutbacks, potholes and every single Police officer in the County is now a meter maid writing tickets to save their jobs instead of tackling crime?!

There may be a fix for foreclosures but doing nothing for 24 months and then granting a do over principal reductions isn’t the answer. It is made all the more ridiculous as these folks are coming to Karate, T-ball, soccer classes and standing on the sidelines telling me they haven’t made a payment in 24 months hardee har har and meanwhile they have a new Escalade and boxes outside the house on trash day for gigantic flat screen TVs. MADNESS!

Foreclose. Foreclose already; new buyers remodel, buy furniture, appliances, pay property taxes-it STIMULATES the economy.

Thanks, keep up the good work, I try not to miss a column.

(PS a long time ago you told Mark Haines foreclosures were not listed in the MLS-they are. Not sure I heard a retraction.)

best article yet! (and you do set the bar high) printing this one, it is a keeper. great work!

Claudia,

It’s supply and demand. If there is no supply demand will stand firm. So don’t hold your breath. Remember that silly superman comic book last week selling for 1 million dollars. Limited supply means stiff demand. If you want to buy in one of those corporate packaged housing areas, where supply is high, prices will drop for quite a while……………

Hilarious and maddening story in Rolling Stone this month on the “Vampire Squid” that is the banking/real-estate industry.

http://www.rollingstone.com/politics/story/32255149/wall_streets_bailout_hustle

The government and the public have been scammed…and they continue to be scammed because they want to believe they haven’t been. Current Real Estate prices are merely a reflection of the once ever-increasing demand for mortgage-backed securities. Not low unemployment, Not thriving industry, Not magical California sunshine, Not hordes of “foreign investors,” Not great #’s of people making “Great Money.”……

re: the cops writing tickets!!!!!

Just was nailed for one going along Ventura Blvd in Woodland Hills. I see this cop EVERY DAY writing tickets. I cannot believe that I was nailed! I resent having to pay $275 plus on top of the $400 car repair two weeks ago due to a pothole!

What I would really like the cops to do, is catch the true criminals!

@ LA-Architect:

Is that where they are? Writing tickets? ‘Cause I called 911 a few weeks ago to report a burglary but no one answered.

I wish we would’ve stayed in our home when we stopped paying our mortgage…bought $4 million dollar house in 06…put $1 million down, full doc, made plenty of income, not a stretch at all…Taxes $44,000 year, Associatio dues $12,000 year, mortgage of $3 mil, husband loses job, gets severence for a year, spend a year paying that mortgage hoping for another job finally give up, decide to stop paying as severance was over and eating into any savings we had, couldn’t sell for 3 million, bought a small home cash…moved in Sept, house is still empty now, no auctions, nothing, been trying to do a short sale offer since Sept. for 2.5, no word. Stopped paying the taxes, kept up insurance, didn’t trash the property, maintained it for months, but now we still don’t have job so have to save all we have. We could’ve just stayed till we got kicked out, but didn’t want to traumatize the kids by not knowing when we would be homeless…

Dr. HB the first I’ve seen write about the free house lotto for squatters!! Doc on the cutting edge, as usual. How does this situation resolve itself? I sold at the top in late 2005, invested the money wisely (?) (5 year T-Bonds) and rent now. IF I had chosen or been forced to stay in my old house, I could have HELOC’ed the “equity,” been forgiven on the gift of the overage by the IRS, stopped making mortgage payments 2 years ago and be living “free” in “my” house with my yanked equity right now. I know people who are dropping health care coverage to make the rent. They have no choice. Lotto Squattersâ„¢ might have that choice. I know a couple of them, too. So what’s the end game?

Great Post Doc,

I’m still betting that the government will not back off their fanatical support for the banks, which means indefinite stagnation for real estate. But it’s a worried bet. I keep asking myself, how can the financial market sustain this farce with the commercial market crashing harder even than the residential market? What happens when the Fed runs out of leeway to borrow more cash (within a few weeks they will reach the limit set by law). I have no answers, which is why I’m keeping my current house as a rental/fallback residence, even as I plan to buy. Here is south OC, houses still go very quickly once they hit the right price range (typically about 30% – 35% off peak), but prices will drop further if something happens to shatter the pretend and extend farce we are being sold.

***

I still say:

1. If you are under water, stop paying and live payment free as long as possible.

2. Vote all incumbents out of office – break the hold of influence over congress.

3. Vote independent, show no confidence in the crony politics that punish the middle class and reward the rich.

Happy House Hunting All!

@LA-Achitect: did you actually so something to deserve the ticket? Because if you did, all you had to do to not pay those $275 was drive or park properly, as the case may be. I don’t want people living rent-free on my taxes (or getting principal reductions in the future) while they don’t pay their mortgage or property tax, forcing state and local governments to hike all sorts of fines because they’re being irresponsible. But breaking the law while driving/parking is being irresponsible too. I got nailed driving from LA to SF a couple of months ago and fessed up to it. I didn’t contest the ticket because I was actually driving above the speed limit. You can call me gullible, but I can look anyone in the face and demand that they pay what they owe. Accountability and responsibility start at home – one of the things that got us here in the first place is that no one remembers this. Bankers point the finger at the government and at house-owners, politicians point the finger at bankers, and house-owners point the finger at government and bankers, although everyone is responsible. A sense of undeserved entitlement and resentment and a lack of responsibility and accountability do not a great country make.

Claudia, regarding Newport Beach real estate. Newport Beach is one of the most desirable cities in OC to live in. Prices here won’t come down that much just due to desirability…there will always be a line of people who will want to own in that city. Regarding median income and home price…remember Newport has lots of renters (i.e. the peninsula) and this skews the numbers. I would guess home owner income is much higher. Also many of the baby boomers who bought many moons ago made a fortune on real estate and are enjoying insane appreciation and prop 13 benefits (these people aren’t going to move out anytime soon or will leave the property to their children).

You might see some big price reductions in multi million dollar estates in NB, but anything hovering around 1 million…I doubt you’ll see more than 15% drop from here. Face it, there are certain cities in the world where you just can’t own real estate unless you are filthy rich or if you bought before the bubble (think London, Manhattan, SF, and I would lump NB in there too). You and I were born at the wrong time…our generation just needs to get used to it. Good luck.

After the foreclosure the bank is stuck with a liability it can’t sell. It costs the bank money to mothball a house. The bank will have to service it’s debt, pay property taxes, employ security. In colder climates the bank will have to pay a professional to prepare a home for winter or pay for busted plumbing and water damage.

I am not feeling sorry for the bank. It just makes dollars and sense from a bankers perspective to leave the people in the house till the home is resold.

1986. A barrel of oil plummeted from $27 to $8 devastating the Alaskan economy. My neighbor walked away from his mortgage on a duplex leaving his renter wondering where to send her rent. Her landlord left no address or contact number.

I’m just the neighbor, not any sort of professional. I advised her to stay in the duplex. I informed her correctly or incorrectly that she owed rent to only the one she signed a contract with and to none else. To save each month in an account her $425 monthly rent, in case the landlord somehow recovered and came demanding the same at some time in the future. And to stay put till evicted.

She remained there for a year and a half. She kept the heat on , the lights on.

She kept the duplex in good shape, she provided security. She never heard from a banker. The $425 a month became 7K that she used as a down payment on a home. A home that had sold for 90K during the boom she picked up after the bust for 40k.

That is how it went then. And that is how it’s going to go again. I have seen it before. Thankyou.

I live in a major American city as a police officer. In my city, once a house gets boarded up, sometimes, it stays boarded up for good. Other times, squatters will break open the door and move right in, and turn on the utilities in their name and live happily ever after.

The banks usually have a private contractor/third party check up on their houses. Once they do their rounds, they see someone live there and think “oh dear I guess someone did buy that house” and they contact the bank and tell them that “someone is living there”. The banks in their infinite wisdom and long procedures get lost in their own maze until they figure out “hey, we own that house and those people are trespassing on our property”.

They try to get the police involved and we investigate the matter. The bank can not show us a title on hand showing they own the property outright. The people who live their have already established residency. Thus according to us, this is no longer a criminal matter but a civil matter and a judge will have to hear the case and decide the final judgment.

I think the lenders do not have the manpower to deal with all of their foreclosures and when they do it will not be good for their income statements. I am interested in Huntington Beach and hope you do an email on that city. I always read your emails.

Thanks so much for taking the time – putting all of this great information together.

My wife and I kept telling each other “This Rise in Housing Prices cannot continue”, the Math doesn’t add up & numbers ( good numbers ) don’t lie. We live in Ventura County where the Bubble Lives On. Do you have more information reguarding our area of Beautifull Southern California? Your time is Greatly Appreciated, this is an excellent site for outstanding balanced and helpfull advice. We’ve been waiting 5 years to buy a house here… Keep up the Great Work!

I know few weeks back there was a “Cerritos” episode on this site. We all understand these charts but there are large number of people who are in panic mode as Banks are not realeasing any houses in the market and this trick is “WORKING”. House are selling for asking price (or Over).

13112 Droxford St, Cerritos

1110 Sq. feet SOLD $545000

13122 Andy St, Cerritos

1110 Sq. feet SOLD $565000

I have been sitting on the side lines for last 15 months and I am not sure sitting on the side lines for another 15 months is a great idea.

@Gael

I’ve heard the same thing from friends. Neighbors get burglarized…call cops…no one shows up.

Funny how the NY Times just reported that crime is down in LA. I guess it’s like the “If a tree falls in the forest and nobody is around to hear it…”

If a crime happens and the cops don’t respond…was a crime really committed?

LOL

Economy of Southern California is not “I’ll say it again not going to get better next decade”….. Imposing deficit makes California sink to the bottomless pit. Just wait another “not 15” but 18 months and you will see housing tanking…. if not, I will let it happen….. Screw the banking asshole’s and burn in hell ……I hope there are more bank robberies to come…I love when banking guys suffer, then maybe we will march to the wallstreet and wipeout NY from the United Soviet States of America.

“It’s a Mexican stand-off between the buyers, sellers and the banks. No one wants to budge.”

Buyers can’t afford to buy a home.

Think they are going to “budge”?

Wait until LA introduces speed cameras throughout the city….. it will be AWFUL. You theoretically could get three tickets going up and down the same street and not even know about it until they came in the mail!

Thanks “Accountability MASTER” for your points on accountability. I do find it a stretch to find a link between me doing 45 and the bankers fleecing the system. EVERYBODY goes over the speed limit at some stage of their driving career (even you!!!!!). There is a big difference between a minor increase and a reckless driver speeding dangerously, driving erratically and texting. Anyway, stick to the bankers!

My friend worked for JP Morgan / Chase until he was let go last year due to the lending bust.

He was called back last week.

He does the same job, examing mainly commercial / light commercial properties for environmental hazards.as 2 years ago, when he did it as a prelude to someone flipping the property.

He now does it on behalf of JPM who is the new title holder.

They are booked solid for the next year examing the properties they now ..ahem..own. As if they didn’t own them before.

Anyway, the bank is scared shitless about the reports he brings back.

The run down conditions of the properties, motels, strip malls, bankrupt /Hollywood video stores, completely vacant aptartment complexes etc.

The oil changing that has been done in the storm runoff drains.

Out of business dry cleaners who dumped their solvents out back.

The leaky roofs with heavy mold infiltration.

The crazy Indian former hotel owner / squatter, living in the rooms with his family but no tenants.

He told me his bosses get so freaked out, they advise him not to go back to most of the properties. It’s as if they don’t want to document the extreme contaminations and conditions of the properties, lest they have to reveal it to a buyer somewhere, sometime.

So there is almost some value in having some form of people occupying some properties.

These banks are still in a world of hurt. Bailouts or not. They’re sitting on hundreds of billions of almost useless properties.

And these properties get more useless with every hard rain through a leaky roof, or every time someone strips the fixtures out, steals the standby generator, etc.

Good times!

@LA-Architect: “stick to the bankers!”? No, thanks. I’ll stick to everyone doing the right thing. I’m not finding a big link between you doing 45 and the bankers fleecing the system: as far as I’m concerned, you deserve a ticket and they deserve to be in prison – big difference. As for a “big difference between a minor increase and a reckless driver speeding dangerously, driving erratically and texting” – yes, the first one gets a ticket and the second one can end up doing jail time. I’m not saying that there is no difference – I’m saying that people need to be responsible for their own actions and be ready to face the appropriate consequences when they break the law. That doesn’t mean that you shouldn’t get a ticket when driving above the speed limit (never mind that there is already a tolerance buffer above the speed limit and that if you’re within it you won’t get a ticket in the first place) – you should. The goal here is not that you should get away with breaking the law because the bankers do worse things and get away with it – the goal is that the bankers should be put behind bars or lose their jobs, depending on what each of them actually did. Same thing with complaining about speed cameras (I live in LA too, by the way): there’s an easy way NOT to get a ticket: don’t drive too fast. Problem solved. Like I said, responsibility and accountability start at home, with both the little and the big things. I’m not going to stick to the bankers only, because they’re not the only ones who made this mess – government and people who bought stuff they couldn’t afford were also responsible. Without one of the three, none of this would have happened in the first place. Everyone’s pointing fingers because we’ve gotten used to that in this country, and until everyone realizes that people, bankers, and government were all knee-deep in this, we’re just going to keep making the same mistakes over and over in shorter lapses of time.

LA-Architect…the moment those speed cameras go up, I’m going to be taking the plates off my car and throwing them in the trunk. I will much rather pay a hundred $10 fix-a-tickets a year…

Huh, I like those traffic cameras. They have them all over Culver City. Funny thing is people behave there. No running red lights or blocking the intersection during rush hour. Sad that that is what it takes for people to behave while behind the wheel.

I have become an accidental landlord due to the death of my Mother. I have come to a conclusion. As a landlord you can have a good tenant or a bad tenant. The difference is that with a good tenant you pay for a steady stream of repairs, and with a bad tenant you pay for major repairs when they move out.

Without appreciation and depreciation you can’t make a profit on rental real estate. Now there’s a conflicted statement!

At some point all the people making comments on this blog will have to let reality set in at some point. This is a great Housing Blog, but the bigger picture is the ECONOMY/Federal Reserve Note is collapsing. Over $600 Trillion in DERIVATIVE DEBT/CREDIT DEFAULT SWAPS will insure massive unemployment and foreclosures. You can cry about street cameras, bubble housing prices, intelligent people strategically defaulting on their mortgage just like Tishman-Speyer and Blackrock, Inc. Or you can come to the conclusion of REALITY, that this is BABYLON and your watching the fall of ROME!!!! By the way, my neighbor has been living in their home mortgage free for 26 months, paying only home owners insurance. They challenged the banks legal right to foreclose by asking for the “NOTE” and the Mortgage Servicing Agreement (MERS). Judge told the bank “don’t come back to court unless you have both documents or a Modification.” (Pro-Se) $7,000 a month. add it up.

@trey

A few years ago I suggested we may start using the term quadrillion, although that figure is beyond the net worth of the entire planet, and probably the next three, but counting the exponential growth of derivatives, the quad is coming. The only way to keep the bluff going is to raise the stakes–all the players are bluffing so nobody calls. One way or another this game ends and it’s going to be hell on earth. Madoff was just a microcosm of the world economy. At some point CA muni’s default and Sam picks up the tab…that will be the next shoe to drop in my opinion. Of course, it’s like a centipede with shoes dropping every week, but one state leads to 49 more hats in hand. And pensions. This is the real push for health reform, because Sam buys health

I know only one song, so can I sing it again?

Dean Baker, pinko economist, early on, said three things: owners-become-renters, cram-downs, and no-bailout.

Look where we’re at now. What a freakin mess. Should have listened to the pinko.

Leave a Reply