Zoning out the middle class in California because of high home prices – The psychological and demographic impacts of an unaffordable housing market.

The argument that high home prices crush the middle class seems to be gaining solid traction. Something that would appear to be self-evident is actually an under explored topic in academia. A few articles now focus on what we’ve been talking about for many years. Household incomes do not justify home prices in many California cities and the only reason prices were driven so high, was because of speculative investments and high leverage mortgages. A few other fascinating articles even discuss the drain from the tech boom in California because people started shifting resources and attention to speculating on trading homes instead of innovation. They took their eye off the ball. The data does show that the group hardest hit by high home prices are those that fall in the middle class. California actually may be doable with rentals or apartments but once home ownership is thrown into the equation, the numbers get flipped upside down.

Is the high cost of housing driving people out?

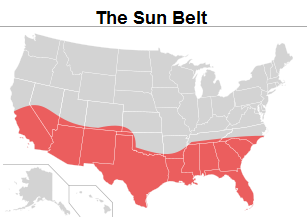

Over the years I have heard and read countless e-mails of people leaving coastal regions in California and New York to other areas in the Sunbelt:

It is hard to quantify this data although we know it is occurring. Those that do choose to leave high cost bubble markets like California presumably have the funds and transferable work skills to pick up and go elsewhere in the country. I came across an interesting article regarding this issue:

“(Pedestrian Observations) The story I started this investigation with is that New York and California predominantly turn away the middle class, which would be seen in middle-class emigration and low-income immigration; my recollection, coming from merely eyeballing the data, had been that immigrants were much poorer. This should be consistent with the breakdown of the cost of living in dense city regions: housing is unaffordable if your ideal of how to live is having a car and a single-family detached house that’s less than an hour away from work; if you’re flexible about car ownership and don’t mind small apartments, then New York and California are quite affordable.â€

This is a very big dilemma for many Californians and probably a large number of readers. Presumably your income is solid enough that you are able to consider buying a house with some kind of stable cash flow. That is a prerequisite. The distinction of “high cost†is also important because I know many people that live near L.A. and OC downtowns and are able to rent rather affordable townhomes or apartments. The issue of course comes to owning a single family home near these locations:

“But what we actually see is that both immigration and emigration between those states and the rest of the world is middle-class. The people moving to the Sunbelt really are being priced out. It’s hard to distinguish pricing out from cashing in on high housing prices, but the lower-income characteristic of this emigration suggests the former. The upshot is that policies reducing the cost of housing could stem this tide while at the same time having no effect on poverty and the need for social services. While it’s heinous to try to price out the poor, as the richer parts of the Bay Area and many other regions do, this is not what is being done here.â€

To sum up the argument, it isn’t the poor or the really rich being priced out but those in the working professional class. Since the notion of owning a home is so powerful many with the job training and skill set to move may actually do so simply to own a home. The horrible economy in California might have also propelled many to take this leap quicker:

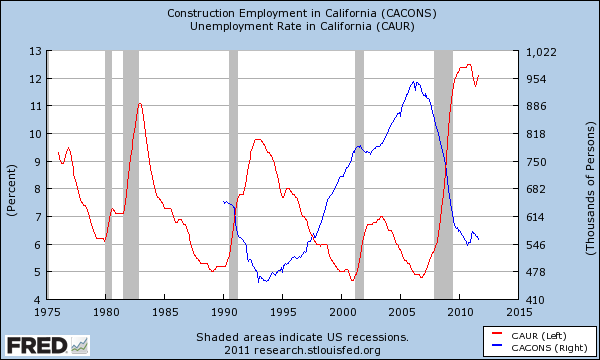

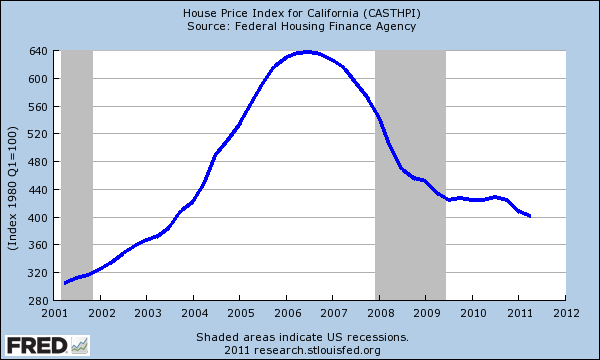

California’s unemployment rate has been in the double-digits since February of 2009. The chart above shows this trend but also highlights the lack of construction going on in a state with supposedly an insatiable demand for housing. Tough zoning regulations and banks hoarding shadow inventory create this odd market disequilibrium. Prices are coming down because that is what occurs when bubbles burst and the slow leaking of REOs in mid-tier markets:

Yet prices may not be going down fast enough for families looking to buy in certain targeted areas. The earlier article which looks at Census and tax data reflects emigration to other states from the middle class. The wealthy stay since housing is a tiny part of their portfolio and their industry may only exist in California (i.e., entertainment, sports, tech, aerospace etc). The poor are restricted by economic constraints just like any other state. Yet it is the middle class that is caught in the middle here. And not everyone leaves of course. I would venture to say that most will lease or end up committing to brutal commutes because they bought into the “drive until you afford†mentality that is pushed by the California housing industry.

Ultimately prices will come back in line to local area incomes and have some semblance of sanity. But this might be three, five, or even ten years out. Can some people hold out this long? Some obviously can’t and are leaving. Some get frustrated and simply buy and become another California debt slave. Some rent but are itching to buy the instant prices fall to meet their mark. And finally, you have those that rent and simply acknowledge that a market this out of whack may have years to go before any sanity is restored because of; the Federal Reserve, bank shadow inventory, strict housing regulations, and delusional sellers. You can enjoy California and not own although this may be blasphemy to many.

Every time an article like this is posted I get very typical responses:

“But we’re planning on having a baby!â€

“We’ve waited too long and are simply jumping in!â€

“No one can predict the market and hey, mortgage rates are low.â€

“We want to own near a good school district.â€

And guess what? You have many people like this willing to jump in and chase the market all the way down. You can go through the archives and see people diving in during 2006, 2007, 2008, 2009, 2010, and even 2011. However keep your common sense grounded. The experts have been wrong over and over. Let us look at what was being said in 2007 by a leading economist here in SoCal:

Dr. Edward Leamer, Director UCLA Anderson Forecast, had this to say in The Economists’ Voice back in 2007:

“My view, announced in December 2005, is that this time will be different. This time the problems in housing will stay in housing. So far, I am feeling very smug. But this keeps me up at night. In this column, first the models, and then the mind. The models say that a recession is coming soon. The mind says otherwise.â€

So this was being said right as we were entering the biggest economic implosion since the Great Depression. He went on to double down with his forecast:

“The models that rely on history suggest that the extreme problems in housing currently being corrected will almost surely infect the rest of the economy, but that history does not take into account two important facts:

-Manufacturing is not poised to contribute much to job loss.

-Real interest rates are very low and there is no evident credit crunch, now or on the horizon.

These facts make the problem in housing less severe than it would be otherwise, and help to confine the pathology to the directly affected real estate sectors: builders, real estate brokers and real estate bankers.

…

The models say “recession;†the mind says “no way.†I’m going with the mind. This time the problems in housing will stay in housing. If you are a builder or a broker, it will feel like a deep depression. The rest of us will hardly notice.â€

What is amazing is that he got the real interest rate part right aside from missing the biggest credit crunch ever. And by the way, credit is abundant if you have the income to back it up! But that is now the problem. People are used to low-down payment mortgages so anything requiring 10 percent down or more seems like a “credit crunch†to them. Plus the verifying income part is difficult when 23 percent of the state is underemployed or without a job.

I’m not picking on one forecast since there were many that came out with even bolder predictions about the grandiose future of housing. Yet this is to reinforce the idea that many times the experts have it utterly wrong. After all, history did give us lessons on what would occur once the bubble burst. Some simply ignored the details and went with the “this time is different†approach. DOW 30,000 anyone?

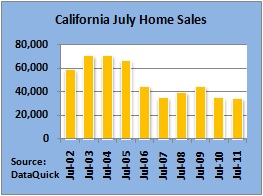

Unfortunately the data that we do see trickling out is negative for the professional class of California and this can’t be useful for the future of the state. This is similar to a mini brain drain. Those that also champion Prop 13 for example fail to realize the drain this places on future new home owners. You have so many issues at hand and few actually are positive for home price growth in the state. Instead, you have archaic laws that benefit older generations and subsidize them with younger workers, yet many of these younger professionals based on the data are moving out. The rich will buy in their tiny enclaves so who will these people in mid-tier markets sell their homes to? Apparently the rush to buy isn’t there anymore as we have seen in the sales data:

Even with historically low mortgage rates and the seasonal sunshine bounce from summer, the California housing market is finding no resurgence this time. I wonder why.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

152 Responses to “Zoning out the middle class in California because of high home prices – The psychological and demographic impacts of an unaffordable housing market.”

Gotta give DrHB credit, he’s 12-24 months ahead of the Mainstream/Lamestream Media news cycles. Be it the student loan bubble, and its effect on housing, the double dip, or even the obvious correlation between income levels and house prices! Look how long the MSM avoided even whispering that basic causality, all the while WISHING house prices higher, in the face of rising unemployment, and declining incomes!

If I remember correctly, in about 06′ as the bubble was unfolding, the Doc predicted the housing slump would to last into 2011, before going flat. Even he underestimated this catastrophy by many, may years. I remember thinking at the time, 2011? Are you kidding me? I think the Doc’s revised forecast would be more in line with a 2015 bottom by now..

There is a good foundation for the conclusion that the slump to have lasted into at least 2011. While a lot of attention has been paid to the pure malignancy of negatively amortizing option loans, relatively little has been said of 5-25 and 5-30 programs that start with an interest-only payment then add in principal payments after the 5 year period is up. Most subscribers to such loans were sold on the concept that they could build equity and then either sell or refinance to collect before the 5 years were up. Those types of loans remained popular well into 2008 and 2009 and even without the unemployment figures and house prices where they are, would have been driving new foreclosures well past that original 2011 prediction. Had the market simply processed the foreclosures and accepted that prices were at least 3x overvalued vis a vis wages, we’d probably be seeing properties in OC and LA trading for the 30-40% of the peak pricing that will be necessary to resume a healthy volume. Of course, we wouldn’t be able to recognize the charred remains of the banking industry at that point (is that really a bad thing?) and until they reach this level, there will be a continual downward slide of prices and growing shadow inventory. Add to that the bad fiscal policy and massive unemployment and it’s no longer a question of whether the pendulum will swing past center but rather how far and for how long. I’d be surprised at this point if we see any appreciable gains until around 2020.

Assuming they qualify, they can actually refinance. Interest rates are pretty low!

This, I think is really much of the point for keeping interest rates extra low. As much as the are good reason to bring them up — it’s going to bankrupt people trying to live off bond interest — they are trying to let the housing slump land as gently as possible and keep as many as possible out of foreclosure.

It also help businesses invest, but I’m not sure businesses want to invest right now.

Truly outstanding analysis and original thought. History does offer some lessons that may or may not point to some future likely event happening. That is, why did the banks build up the shadow? They always could have speeded foreclosure. Were they waiting for some “salvation” by some factor or factors, such as record low fha down payments, fha mortgage rates? By just time going by as inflation motivated the “little people” of the middle and upper middle to buy, or immigration or the dollar’s collapse as traded internationally? Some commenters think Bank of America is surging their foreclosures to catch the spring market; the FED is trying more to drive down the 30 year rate. From that, I think it highly likely the home market will be in doldrums until March (leading to lower long term rates for home loans) and the Fed’s surge to shove down rates artificially will again succeed one level. Expect the possibility, then of even a two and a half percent 30-year fixed rate FHA loan and benchmark, by January. Ridiculous? I think so with my mind, but the models say yes, they are not done using the only major tool they have to save the banks and restore house prices in any means possible. How long they can hold rates down if this succeeds, is unclear. I see support for this likelihood by the insanely low or even zero return on some treasury debt. Will this work to save the banks and re-ignite the market? I think yes, and it solves the middle class affordability problem, if only for now, plus holds property values up in dollar terms and thus supports local property taxes. Intellectually, I can’t believe this will happen, but there are many factors that say this is exactly what will happen. This further will utterly screw savers and the elderly middle class especially.

…and it solves the middle class affordability problem…

Let’s say that Mortgage rates go to zero percent.

Will the middle class now be able to afford a home?

I don’t think so.

Why? Because a house is taxed (property and local), requires insurance (fire, liability, etc)

requires maintenance (painting, new roof) and basic utilities.

All of these items require constant cash flow provided by the “owners”.

In my area (Irvine) I have calculated that the cost of these items is between 3% – 5%

of purchase price/year.

So I ask, how is Joe Sixpack going to come up with $30K – 50K of cash each year

to pay for an inflated $1mm home?

Answer: they won’t.

Unless, of course., we get gov’t subsidies (aka Section 8) and other props for million dollar houses.

The “government” that is keeping Realtor commissions high currently has a law on the books that makes it illegal to have fixed commissions (they’re all negotiated).

That said, the business sense in trying to nickel and dime the Realtor who is helping you find homes rather than incentivize them to find a bargain is pathetically lacking.

But then delusional thinking is seldom persuaded by reason and facts such as you might find, e.g., here: http://michael-hudson.com/2011/09/russian-ripoff/.

Don’t laugh. Section 8 buying homes for the unproductive members of society is already here. My buddy is a real estate agent in the Bay Area who sold a house where the buyer was section 8. The section 8 program is paying the buyer’s mortgage for the first 20 years. So why are we all working so hard?

Regarding subsidies and other props, it would seem that we’re getting a great big new one, if you read what the Fed intends to do today:

http://www.zerohedge.com/contributed/wh-and-fed-sleeping-together

In short, one huge mega refi for the Federally subsidized mortgages. The mother of all refis. The author (Bruce Krasting) has called out how this would work recently. Bernake’s language today sets things up for it.

About the only thing that will do is to buy Obama perhaps a few million votes. But IMO, not even that is certain, unless the economy is really different in a year.

I am exactly that middle class professional guy who is priced out and looking to leave the state.

I make $200k a year but it is not enough to buy a decent SFR anywhere near where I work (I currently live in Foster City and the local average income is about $100k, and average home prices probably around $900k) and a crappy condo is not at all interesting. If the government is going to fight to keep Realtor commissions high and bank losses on NINJA loans low and keep housing unaffordable to people like me indefinitely, it doesn’t make sense for me to stay here.

Regardless of the crony intentions, the net result, if you think about it, is ETHNIC CLEANSING… which brings us back to the concept of Crimes Against Humanity, not just a “recession” that is “nobody’s fault”… 🙄

I can tell you that a number of California practitioners have moved their offices to Arizona. Texas is another.

~Misstrial

You are hardly middle class. There is no reason you couldn’t buy a house in FC or a number of other very nice areas in the Bay Area with that income. If you found a foreclosure, a short sale, or auction you’d save tons. If you lived a 30-45 min drive in San Jose you could buy one for almost a third of that price. Get real. When you move how much is your income going to decrease?

@Dan

Wrong, he is qualified for a $600,000 house. Show me a deal in the Bay area for that price. And, commuting 80 miles a day adds about $600 a month in gasoline alone to your costs. He can move to the Woodlands in just North of Houston (this is just one example of hundreds of places) and buy a very nice house with a pool and large lot for $250,000. This is an exclusive area. I do not think his salary will drop 75%. Most workers do not receive a 300% premium on their salary just to work in the Bary area. I am a university professor, PhD, and working for UC would only increase my salary around 30%, if that. Good luck with California. You will need. Of course, you go just move to Mexico City, Sao Paulo or Buenos Aires and find the same demographics that California and NYC are well on their way to.

About a year or so back curiosity got me to look up average weekly incomes by state. Know what? The difference between Texas and California was about $50. I doubt much has changed since then………..it’s a myth that there’s a huge disparity between wages in California and the rest of the country, use to be, but not anymore.

Oh and add to that, no state income tax in Texas. Don’t get me wrong………..I’m not leaving, can’t stand Texas, but I certainly can see why some people would make the move there and elsewhere.

Jake says “Show me a deal in the Bay area for that price.” Sure. A super quick search on Zillow shows 16 SFH in just FC for less than $750k. The point is it is possible to find a home in the Bay Area for much less than a million these days. Put 150k down and we’re in your “affordability’ index range. So you don’t want a condo, fine, but you can buy a very new 1,500 sq ft condo there in SJ for 250K. You obviously are not THAT familiar with the area. San Jose is only 30 miles from Foster City! FC is at the epicenter of the Bay Area. You could live many places and commute there.

http://www.zillow.com/homedetails/Beach-Park-Blvd-Foster-City-CA-94404/2131778217_zpid/#%7Bscid=hdp-site-map-list-address%7D

And what’s funny here is than Dan stands on the Obama point and disputes the plain facts of housing prices here, obviously without having even looked – being able to barely afford a small house a long commute away from where you live or in a bad neighborhood makes you “rich” (or in his words, “hardly middle class”)? That is an absurd position. Cost of living differences make 200k a number that would make you very comfortable in some places, but in others like NY or SF, not at all (or certainly not “rich”) – going after the actually rich people doesn’t generate enough money because there aren’t enough of them, so we’ll just pretend that everyone pays the cost of living of Iowa… totally disingenuous.

@Dan,

Yes, a $250,000 condo in San Jose with $350 a month real estate taxes and $200 home owner’s fees. Another $1,200 a month in mortgage payments and there you are with $1,750 a month before you get out of bed for 1,200 sq. ft. 25 year old condo in a losy neighborhood. Why would I want a 2,000 sq. ft. home with a large lot and pool in an exclusive area instead for the same price? I know, San Jose is chock full of great culture and beach is only an hour away.

Jake and Jim: You guys aren’t even talking common sense. Jake, I said very new condo, like 2005! Not 25 yrs. old. You want culture? San Jose may not have what you’re interested in but I’d certainly put it up against Texas and Houston. Please. And yes 🙂 It is about an hour away from the beach and San Francisco and not too far from the mountains, etc.

As for Jim you totally went off the deep end. I’m making an Obama point? No, you’re making a Joe the Plumber point. Obama is talking about taxing people who make over $1M the same as people who make $35k to $65K. I really expect people who claim to be lawyers making $200k to be more sophisticated.

I’m sure you are a job creator right? Wrong! Most professionals earning $200k are working for themselves and will never hire an employee or start a “real” company that puts food on the table for tens to hundreds of employees let alone thousands.

I gave you a link to a house in FC that is at least 4 bedrooms for less than $750k. Where’s your head when you state “barely afford a small house a long commute away from where you live or in a bad neighborhood makes you “richâ€. Now a 4 bedroom in FC is a bad neighborhood a long ways away from where you work??? Cost of living in the Bay Area comes down to your house. Food is cheap, entertainment is cheap, medical and insurance is the same, 24 hr. nautilus is $24/mo., there’s tons of public muni golf courses, etc. If you are paying 30% of your $200k income on housing where is the suffering?

Here’s the real problem. Everyone “about to make” or barely making $200k is sure, just sure, they are about to get rich and they are really worried something is going to happen to take it away form them. It’s delusion. No one is looking to tax you out of being rich, including Obama, and yes, when you are in the top 5% of wage earners in America, no matter where you CHOOSE to live, even a place like the Bay Area with its fantastic weather, education, environment, etc. etc. etc, you are rich. Get over it. Move on. Find something else to fascinate about other than what your income “makes” you.

Dan, how can I answer if you aren’t even being honest in your responses? Obama is proposing to tax people making over a million? No, he is also proposing to increase taxes on those making over $200k, and you know it – to answer as though it were only those making over a million is nakedly disingenuous. Likewise to suggest that San Jose is reasonably commutable from here – it would take at least an hour on a good day to drive from San Jose to Foster City in rush hour, the “rich” do not have to spend two hours a day driving from a crappy condo to work. And to suggest that a house priced at almost 4x my income is affordable is a stretch to say the least. You’ve let your class envy or ideology or both get the better of your common sense and honesty.

No ideology or envy, none at all. Just looking at the numbers. You say it costs $900k in FC and surrounding area, I say it doesn’t have to. You say I haven’t looked, yet I live in FC and provided at least one link, you provided none. At $750k with $150k down you would be spending 30% on your housing. Well within very normal parameters. You may not think it’s “comfortable” enough. Fine. Get out 🙂 Please. Also, definitely not a political ideologist, that seems to be your game when in a corner. I stick to the fact that middle class by definition does not include those making the top 5% of incomes in the country. I don’t have to call you rich to say that. I don’t call myself rich either yet I know I am not middle class. You are just not in the middle and you can afford to live near where you work, comfortably, and no, it doesn’t have to be in a shitty condo in San Jose so drop that schtick too. Of course how old you are, your professional and living stability may be influencing your ability to sign up for the long haul. Its not an ideal picture but plenty of people in the past have paid 4x their income for a house. Yes, it grew in value quite significantly compared to how it may perform for you. Honestly my advice to you is to move. You really don’t sound like you are happy there. Good luck.

@Jake

He is qualified for a $600,000 _mortgage_. He could buy that $1M house if he had a balloon down payment. He is really just 1 successful IPO from that house. The steady stream of windfall buyers is what keeps the price up in the nice areas.

In the mean time, you rent, like all the rest and keep pulling the arm of the one armed bandit.

On the other hand, you can “comfortably” purchase a fixer in that area on your income and become well-acquainted with Home Depot. Good exercise, too. Or, learn Spanish.

“Woe is me, I make only 200k a year.” Please. Just hold tight and sock the cash away. When this mess is done, affordability for you may return – even if it doesn’t for others.

Relax Jim. If your household pulls in over $200,000 a year you are up in the top 2.67 percent of households.

Over 97 percent of the population won’t be impacted but keep on spinning the absurd idea that tax cuts help the economy and will benefit many. If that were the case, the last 11 years would have been fantastic with tax rates at historically low levels.

What people don’t want to hear is that we need to tax and cut at the same time. People like Jim want the rest of the population to shed a tear for their paltry $200,000 income. Unlike you with no data, I’ll point you in the right direction:

http://i.imgur.com/N1htI.png

Jim: If you leave the state you will have a much higher standard of living and maybe better quality of life. Buy you are not priced out and this article was not about people like you.

I disagree – I *am* priced out of a reasonable place anywhere near where I work, as unlike you, I’ve been looking for such a place for quite some time now. 750k for the crappiest fixer upper foreclosure in town, is neither affordable nor reasonable, and commuting an hour each way to work neither makes me rich (notwithstanding someone’s absurd assertions about being in the top 3% of an area of millions of square miles, ignoring what incomes of those in the local geographic area are – if you’re going to include incomes in Iowa in the average where rents are 1/8 what they are in SF, you may as well include those in Somalia too), nor makes for a reasonable home buying decision unless you’re thinking like a bubble buyer who’s been told that is your only chance to ever own a home. The Doctor’s point is that people who might otherwise buy and settle here are leaving the state because home prices are still in the stratosphere, and I *AM* an example of someone in that exact predicament.

For me it wasn’t so much feeling priced out, so much as, “You want 1 million dollars for that?!” The sense of value is totally missing in the Bay Area. Even if I had $1M to blow, I wouldn’t have bought any of those homes.

What turned things around for me was when my wife and I went hiking up near Castle Rock State Park, and we saw just off the edge of the park, a 3500 sf house on a couple of acres, tall pines and stables and paddocks for $750,000. That was more like it! I imagined our kids growing up wi a pony, goats and chickens. Room to run and play!

It turned out the house was full of powder post beetles, so we didn’t buy it, but there are very nice properties up there, still $1M, but gorgeous and with 10 acres and a view of Monterrey Bay and excellent schools. That is value! Why anyone would live down in the valley is beyond me.

I live in the Monta Vista section of Cupertino and there are five homes for sale in my neighborhood that range from $725k to about $775k.

3 BR/3BA-3.5BA

Not fixers.

~Misstrial

He obviously doesn’t have the down payment and/or cannot qualify for a mortgage or he doesn’t actually make $200k or his employment situation is dicey. It is a FACT that with that income you should have the down payment and ability to pay for a standard home near where he says he currently lives (we don’t actually know where he works because he hasn’t told us). Whether he *thinks* those homes are not good enough is a personal problem.

The fact that I could, in theory, buy one of those places at 4x my income (and again, Cupertino would involve driving two hours a day, no thanks, but even assuming it was local to where I work), does not make it a reasonable deal or a reasonable decision on my part – people are missing the very basic point that housing prices here are still absurdly inflated and that there are plenty of middle class people who will not buy here either because they can’t or because they won’t and would rather leave the state (or for younger professionals, never come here in the first place). This place has a lot to offer, but not enough to make it worth 3x the cost of other places.

Just one nitpick: the data I’m working with is 2000-9. The pace of emigration actually slowed once the housing bubble crashed, so the emigration can’t really be about California’s weak economy.

Actually that data would be relevant in my opinion. The recession officially hit in 2007 and we were supposedly out of it in the summer of 2009 if we can believe that. So your observation covers this timeframe. The housing market in terms of sales peaked in 2006 and prices peaked in 2007 followed by higher unemployment at this time.

However the bubble is also what pushed people out. Prices were out of kilter in a major way in 2005 through 2007 so people were leaving because of the economy at this time. Those that did not want mega mortgages made the choice much earlier in the process, even years before the official recession hit.

I have a general question. There is a house in our neighborhood that clearly has not had any payments made on it in quite some time. It is falling apart. It is an eyesore. Is there anyway that the citizenry can force a foreclosure on a property? If not, what else can we do about it?

YES, a municipality or county can foreclose on a property, either for non-payment of taxes (the usual reason), OR for code violations. In the latter case, it’s going to take you and your neighbors prodding .gov employess to get off their unionized, you-can’t-fire-me @sses, and actually DO their jobs.

But yes, it can be done. It will take some “squeaky wheels” to get your pet peeve property to the top of the action list. GO.

In the latter case, it’s going to take you and your neighbors prodding .gov employess to get off their unionized, you-can’t-fire-me @sses, and actually DO their jobs.

Yeah! Screw those unions! Who needs healthcare, pensions, a 40 hour working week, weekends, sick leave, maternity pay and all those other fripperies!

They should be grateful they have a job! And a place to live! And children that don’t have to go to work at 12 years old! Or enough money to pay the bills!

Wretched ingrates! How dare they hope to live a better life than their grandparents, the NERVE!

Sorry, GOP-meme is meme-y.

If only unions really were the problem with our economy. But you carry on railing at all the things that make life for the non-millionaires bearable. Just don’t expect me not to roll my eyes at misdirected butthurt.

{/snark}

The problem is the ONLY unions in existence are in the public sector.

Is the planning and code enforcement department unionized?

I thought it was mostly the people providing services who were in unions. You know, the people who pick up the trash and fix the lights.

Something for the anti government righties to think about.

When you calculate all the taxes a person pays, gasoline, payroll, property, FICA, sales and on and on, probably 35% of wages goes to Federal, state and local governments for tax.

So, when a Government employee is paid 100.00 for work, 35% of that goes back to the governments in some fashion, or in other words, Government gets a 35% discount on its work force..

I can already hear, “what about benefits”? Well it is true most benefits are tax free, although with pensions you may or may not pay income tax on it, you are still paying many taxes such as property tax, gas and sales tax.

I thought in California you can file a little beigh card that exempts you from foreclosure but when you eventually do sell the home or pass away, the government’s tax lein is paid (property tax plus interest and penalites), at that time.

My wife and I fit this description perfectly. We are comfortably middle class, I have marketable IT skills and a good income, but we are priced out of our local market. The only way we feel comfortable living in San Diego is renting our small apartment.

It’s somewhat comforting to see that we are not the only family in this situation. We’ve had the discussion before and decided that after my wife finishes her degree (thereby exhausting this states main economic benefit to us: affordable school) we will move unless home prices have come down.

What is happening in S. California is that we have a huge immigrant population that either own businesses that deal in mostly cash or are wage earners who get paid in cash. Incomes are grossly under reported and the rest of the population must pay their taxes and compete with them for housing and social services. Because of the language barriers and lack of state and federal resources to enforce compliance it is virtually impossible to change this trend which in my opinion is growing. In some areas we don’t really know what the average incomes are so how do we know in fact incomes are not in line with wages? When someone under reports their income and pays cash for their home (usually get about 6 family members to put home in their names to keep from looking too suspicious) how does the legit tax payer compete? They either leave the state or they pay higher mortgages because it is difficult to save money when you are paying taxes for other people too. Not to mention the prop 13 crowd that own their homes outright but pay 70% less property tax than the young couple next door who could only afford 3% down payment on their home and are essentially renting.

What is your proof on the under-reporting of income? If you actually know of a case, you should report your suspicions to the IRS for investigation. Your comment reads more like a Tea Party talking point than actual fact. Without empirical evidence, please shut up.

Oh please calm down:

http://www.nolo.com/legal-encyclopedia/negligence-versus-tax-fraud-irs-difference-29962.html

~Misstrial

ChrisNLongBeach, Joe is absolutely right about the tax situation. I also have a Masters in Business Taxation, and am a leading tax expert in the nation. I know what Joe said may not be PC, but nevertheless, facts are facts. I know that Glendale has a problem with Armenians taking government benefits and not paying taxes on their legal and illegal business operations. Your friend, the Obama Administration is not interested in going after these small business people anymore than they are going after the massive Medicaid and Medicare fraud by health care providers. I could really go on about all the fraud, from Wall-Street to main street and the authorities don’t care(they claim they are under funded and we need to pay more tax and etc.) It is the wage slave that keeps this state going.

As you are finding out, people on here are pretty uptight and conservative. Don’t expect much…

I used to practice law in California. What goes on among the lower classes, especially immigrants, is hard to believe unless you have seen it with your own eyes. But if you work off the books, you are “poor” on paper, and entitled to everything from Pell Grants to free school lunches, and from HUD housing (Section 8) to free dentistry and medical care. Once all of the freebies are in place, your off-the-books earnings provide all of life’s little extras, ranging from trips home to the Old Country to nice cars.

I knew one lady who not only was on every possible government program, she had also managed to get her son (an only child) a full scholarship to one of the most expensive schools in Orange County. A male acquaintance of mine, an engineer, told me that after his divorce he was living in one room, and was so broke he couldn’t afford decent Christmas gifts for his children. At the same time, his ne’er-do-well sister-in-law had signed up for several different “Christmas for the poor” programs, and had been inundated with gifts for herself and for all of her children.

As the stigma against illegitimacy has faded, even lower-middle-class whites know that they are better off having children without getting married, as each unmarried parent claims one or more children for tax purposes and gets the Head of Household designation with the IRS. Usually, the unmarried mother can qualify for HUD housing, or an Orange County very low income bond unit, and often other government programs as well. If they got married and combined their incomes, neither would be eligible for much of anything.

The middle classes ARE being squeezed out of California. There are all sorts of programs for the poor, and those who pretend to be poor, and the rich live well with their off-the-books housekeepers and gardeners, but middle-class people are choking to death on sky-high rents for not-so-nice properties.

You are right I am just pulling this out of my rear end. I do not have any stats to back this up. Not really sure what the tea party stands for. My logic is simply this: How many tax auditors in LA or IRS Agents speak fluent Korean, Vietnamese, Thai, farsi, Tagalog, etc… to criminaly prosecute someone who is not a native english speaker? Even a civil investigation of a non native english speaker takes a lot of extra reasources if attorneys and translators are required. Talk to realtors and ask them who is paying cash for homes. Easier for the gov’t to go after the native W2 earners. You need translators in court etc… it goes on and on. Gov’t workers have limited access to non-english agents and are by nature lazy and want to go for the low hanging fruit which is the w-2 wage earner.

you sound like a blind liberal!

I went to the FBI with paper PROOF of government employee embezellment…and never heard anything back. So don’t lose any sleep expecting the IRS to tax the embezzed money. They’ll never hear about it.

“immigrants with cash” “under reported income making wage to home price comarisons impossible”…..

All bubble speak. Pure unsupportable nonsense invented to refute the actual data that shows that local incomes do not support home prices and people are still overextending themselves.

I agree with you 100% that people are over extending themselves. It is W-2 wage earners who are over extending themselves. Drive around LA and look at all of the mom and pop stores. who are they mostly run by? How many are full of customers ? Ask yourself how do they survive? How do they compete with all the efficient chain stores that basically control the whole supply chain? The answer is: They cheat.

if they complied with the laws they could not compete therefore they don’t. These are the people who live in the Grey economy. They buy and sell mostly in cash. Assets are in family member’s names.

The game is rigged and the w-2 middle income wage earner is the sucker. They pay the most taxes in relation to income. They save little or no money. They make most of their largest purchases on credit. They put little or nothing down on their homes cars etc.. They pay outrageous mortgage insurance….Their kids get to compete with the children of illeagals for financial aid and limted space in college. They pay for all the social services that the people in the grey economy enjoy but contribute little or nothing towards.

Ask realtors in LA this question: who are the people buy homes not for investment but for their own use in cash. Just drive around and observe. It doesnt take

It’s not “either/or” the off-the-books immigrants aren’t the cause of the bubble, but these people certainly do exist. They’re not a majority, but they are out there. Armenians and Chinese immigrants have a reputation for not collecting sales taxes.

Joe: You make a very interesting point. Those with cash business seem to be the buyers who are driving pricing in 2 or 3 key areas of town, making it very difficult to quantify the true “purchase power” of the average citizen.

Correction to my previous post: how do we know that incomes are not in line with housing prices if we don’t really know what people are earning? Also when you can afford to pay For the home in cash or mostly cash from non reported income you do not need to earn nearly as much as someone with a huge mortgage and high mortgage insurance premiums.

Under reported, but not totally out of line. Many of these small businesses nowadays are not earning the type of income to buy homes in so cal outright. The economy has slowed down too much for them to save that kind of money. Majority of these businesses are just getting buy and lucky to save some side cash for retirement. Keep in mind that these business owners don’t get a matched 401K, must pay for their own insurance, etc. as well.

I’m sure there are certain thriving businesses today where the owners can buy homes on cash, but there is certainly not enough of these people to maintain upward pressure on the housing market, and the numbers show.

As always I love “Dr. Bubble” articles. However I don’t see how Prop 13 is anything but good for new homeowners by keeping tax levels at 1% of sale price. There are only a small percent of homeowners left who still reside in their homes purchased prior to Prop 13’s passage. Most all sold and moved on and benefit from the 1% cap.

That’s not what California peeps post on this blog. Plus the fact that Prop 13 extends to all manner of COMMERCIAL props, vacation homes, etc.

A decade and a half later, with the benefit of hindsight, Florida came up with a much more sane version, called Save Our Homes, which is NOT inheritable, does NOT cover snowbird/2nd homes, and sure as heck does not cover high-rise office buildings or strip malls. It was recently amended to allow some portability of benefits for in-state moves.

RESULT: FL’s budget is in the black—even with NO INCOME TAX–while CA is in NIGHTMARE territory.

Prop 13 is not the problem – I have no problem with neighbors paying lower taxes, and certainly not with kids being able to inherit their parents homes without suddenly being subject to punitive taxation that effectively forces them to sell the family home. The problem is a state government that in boom times swells the ranks of state programs by billions and unionized state employees by the tens of thousands, and then cries about underfunding and the need for more taxes in the following recession – and since CA voters are by and large too stupid to realize they are taxing and spending the state out of competitiveness, this will pattern seems likely to continue until it’s too late to reverse.

The problem is a state government that in boom times swells the ranks of state programs by billions and unionized state employees by the tens of thousands

Funny, I keep hearing this trope, yet no-one ever has any specifics on which programs “swelled” in size. The state prison system has expanded enormously in both numbers and costs because of right-wing idiocies like Three Strikes and the lock-em-up mentality.

It’s not just the people who still reside in their homes bought by prior to the passage of Prop 13. Anybody who bought in a halfway desirable place 10 years ago or longer is GREATLY benefitting from Prop 13. Many of these areas still have home prices DOUBLE what they were in 2000-2001…and a tax bill about one half of what new buyers pay. The inequity in property taxes is much greater than having a few grandmas still living in their house they bought in 1960.

Won’t this all be a moot point as the Great Recession grinds on, and housing prices revert to mean, and then over correct? In many areas they are down to 2001 prices. Eventually, most of the state will be back to mid-90’s prices, or lower, and that should level the playing field.

It should also put a huge dagger in the heart of big government, as governments from City to State to Federal level will have to downsize. Bernanke may buy a little more time with his ‘Operation Twist’ announced earlier today, but not that much. He’s just rearranging deck chairs on the USS Titanic, as far as I’m concerned. The size of the Federal Govt. needs to be cut in half, including that Section 8 b.s. mentioned above.

Jason, I’m sure you can tell from reading this blog that many people are interested in purchasing in desirable areas of California after all the dust settles. I really don’t think we will see mid 90s prices in any of these areas. Sure you can buy in Riverside, Modesto, Sacramento, etc for super cheap but most people would rather move out of state before living in these areas.

Prop 13 is definitely a factor for keeping many desirable areas inflated. There is little turnover which limits supply and drives prices up. Drive down any street in Manhattan Beach, Hermosa or Redondo and you can pick out the “original” owners pretty quick. These people have no desire to move because they won the housing lottery via appreciation and barely paying any property tax is just icing on the cake. Unfortunately many of these properties will be gifted to heirs or the owners will be literally forcibly removed to go to a nursing home. This is just another unintended consequence of Prop 13!

Prop 13 isn’t about the 1%. It’s 1% of the assessed value, which happens only when the house is sold or modified a lot. The annual increase is limited to 2%.

The problem is that 2% is less than the typical rate of inflation, so the longer you stay, the less you pay relative to the inflated value of the house.

You can request a reassessment when the value of the house declines, so this shrinking pile of money shrinks faster during bubble crashes.

As the property taxes have declined, other taxes have has to be raised to make up the difference. CA has one of the highest sales taxes in the country, and high local taxes. There are communities with 10%+ sales tax rates. We have high fees for many things, like cars. We have relatively high income taxes with a steep progressivity.

At the same time, our per-pupil spending is at the bottom of the nation — and that doesn’t factor in the higher cost of living here.

Symbolically, Prop 13 used to mean “tax revolt” – a revolt against high taxes (and they were high). Today, I think prop 13 increasingly marks the “beginning of the end of the Golden State”. At least as a local, that’s what it feels like to me.

Prop 13 was blamed for all the education cuts I experienced. It’s blamed for a lot of investor griping – new companies don’t want to invest here and compete with old companies that get a advantage by paying almost nothing in property taxes. It’s blamed for cuts to all state services.

John, thanks for explaing Prop 13 in a nutshell. After reading this blog, I still think many people don’t truly understand it.

All Prop 13 does is limit the increase on the taxable value of the house by a maximum of 2% per year. If you bought a house for 100K, the first year taxable value is 100K, the next year max taxable value is 102K, etc, etc. etc . It doesn’t matter if the house went 25% in value during that year. Like you said, California real estate (specially in desirable areas) has far outpaced inflation and whether you want to admit or not, Prop 13 definitely has something to do with it.

@wheresthebeef – thanks for the kudos. The inflation rate from 78 to today has fluctuated from around 1% to 10% or so, but it hasn’t averaged 2%. It’s been more like 3%, so there’s a built-in shrinking proportion that property taxes pay.

(House property values should rise with inflation, more or less. They shouldn’t be rising like they have in the two bubbles that CA real estate have experienced in the past 30 years.)

The problem with this reduced tax isn’t just that the amount of money shrinks – but also that a very stable source of taxes (real estate), is replaced with taxes that respond more quickly to the economic situation: sales taxes and income taxes. So the state budget experiences these crazy fluctuations, where some years you just see huge budget surpluses, and others deficits.

(It’s also led to Mello-Roos, so that communities can levy their own property taxes, mainly so they can afford to fund their schools and provide services to themselves with a steady income.)

During the previous surge in income, the state increased its spending… and cut taxes… and basically balanced the budget. Now they are facing not only many cuts… they can’t balance the budget. And the anti-tax crowd keeps pushing against taxes (which is politically feasible because people feel a squeeze).

The real solution is to undo prop 13 in pieces. First do away with corporate tax breaks, because it distorts the commercial real estate market. Then go after second homes and rental properties (which are more like commercial real estate than “homes”). Then phase it out in general, but retain something to help out seniors and retirees – maybe even reducing their taxes a little bit, or allowing them to defer taxes until after death. Change the annual cap on increases so it rises based on inflation. It may even be possible to add progressivity to the property tax, particularly in areas where you want to increase density for environmental reasons – a condo discount for example.

At the same time, revenue gains in property taxes should be matched with cuts to sales taxes and income taxes. So it’s somewhat tax neutral — though individuals will experience some severe changes in taxes.

Eventually, the higher taxes on property will, hopefully, calm the market down, while it replaces volatile income sources with more stable income sources.

Prop 13 was sold as “saving grandma from losing her house”, but the major funders of that campaign were commercial property owners who knew they would be the major beneficiaries of that law. Through various tricks in corporate law, some major commercial properties have gone decades without triggering a reassessment even though they have been sold — and pay property tax on tiny fractions of their market value.

http://articles.latimes.com/2009/jul/13/business/fi-hiltzik13

I doubt you will see too much movement of middle class folks from CA to the rest of the nation. The overall unemployment rate, nationwide, is 9.1%. Without CA’s 12%, it is still over 8% for the rest of the country.

There are a few pockets of strength, but for the most part, there aren’t any job openings anywhere. If things get bad enough in Greece, they can always pull out of the Euro Zone, and go to their own devalued currency, to spur exports and make tourism affordable. No single state in the USA can do this.

The Fed is going to announce some more interest rate reduction steps today, and maybe some other plans for propping up the economy. But they really are getting low on ammo. I read editorial that thinks they will make a statement on the ’employment’ part of their mandate. However, other than printing money and handing it out to individuals or states, I don’t see what they can do to reduce unemployment.

Operation Twist announced.

As long as the majority of people need to borrow money to buy a house, employment will be the highest correlation of housing prices. CA is above 12% on the U-3, over 20% on the U-6. This means more downward pressure on home prices. And if shadow inventory ever comes into the market….it’s even greater pressure to go south.

You’re “U-6, U-3” abbreviation spurred me to google.

U.S. Bureau of Labor Statistics

Dear Doctor, you are looking at an old model which we called the American dream. Nice middle class blue collar job went along with that nice single family home. Mom stayed home and cooked and dad went to work , all was well. We now have no one working !What single family housing that is around is being tainted by easy gov money section 8 wrecks these neighbor hoods. I see another bubble in zoning these homes into double or and multi dwelling units. In this way its a win for the local gov as well as the investor. I think that given the very large immigrant population from 3rd world counties that find 2nd world living is better than what they came from, looking at the big picture we have to compete with this cheap overseas labor and this is the end game now. The feeding on the aging true middle class has run its gambit , as inflation continues (meat 10.00 a lb gas 5.00ga etc) the squeeze in ca also is that masses are making their ways here from the cold states and states that have undergone the weather disasters simply to get out of winter weather. Look around more campers and people on the streets. We have the most liberal help system of all the states. You may be right the few that are solid will try and stay put for as long as they can take it.

…in zoning these homes into double or and multi dwelling units….

Even without those formal zoning changes, families are doubling or tripling up.

I have lived in Irvine for 32 years in a “high end” location. I noticed this trend

starting about 10 years ago. Recently, it’s gotten much worst.

Side effects? More traffic, Parking on streets, too many people crowding public spaces, a subtle but rising set of tensions.

And Irvine is currently one of the safest cities in the USA.

Pretty scary where this may all go..

What are you talking about? 3/2 stucco boxes in crappy school districts are still selling above $700k to young professional families. Sure, unemployment is sky-high and middle class wages are at mid-90s levels, but all you need to do is ignore those facts and the real estate problems magically disappear! You too could live the dream of buying less house than you want for more than you could realistically afford, and then take comfort in the fact that the senior citizen neighbors on your block pay 15% of your property taxes every year. Just make a game out of it! Pothole dodging when you drive, laughing at how pathetic your children’s eduction is, betting on when your local fire station will be shut down. Everything’s great!

Another great post, Doc! As a Middle-class wage slave that left Cali in 2008, only to return in 2010, I think you hit the nail on the head. A middle-class lifestyle is do-able in coastal California… for RENTERS. I currently rent in a luxury high-rise that is “on the sand” in Long Beach for less than a third of purchasing the equivalent condo. My rent is lower than “buying” a decent condo in OC and way less than trying to swing the debt payments on a SFR within 20 miles of the coast. Still, the news that the foreclosure machine is ramping back up gives me hope that some day I may buy… but for now, RENTING is sensible. It makes no sense to bemoan reality… I choose to live as best I can within REALITY. I am a happy renter! BTW – spent two, very cheap, years in the Tampa Bay area. It may have been cheap, but it was FLORIDA! Californee is the place you wanna be.

I hate prop-13 for the damage it has done to this state. It can not be repealed too soon for me!

However, it has helped keep rents down. If you’ve owned that apartment building for a while, your taxes are nice and (unfairly) low. You can afford to turn around and cut folks a deal on rent. You have a built in cost advantage over your newer competitors!

When prop-13 is repealed for businesses, I bet a bunch of people are going to see their rent go up.

Just wondering. Has anyone else heard or read that the REIT’s are in the market for the SFH REO’s as rental units=income?

That would sure help the banks reduce the shadow inventory and transaction costs, and I bet the FDIC, FHFA, and others would love that. I was wondering if the Financial Accounting Standards Board would help all the entities out here (mark to market magic). Any feedback?

As cash buyers waiting for a simple SFH to grow old in, this wait is getting old in So Ca. I’m tired of these FHA 3.5%ers, and their HUD 203K rehab loans overbidding as the next walk-aways. We’re thinking of moving to a cheaper area. Prop 13 is keeping us in Ca. Property Taxes are a killer in some states. We don’t want to lose our home in our senior years.

I agree with goodneighbor, Section 8 is devastating entire neighborhoods. I had a friend renting a older 3 bdrm 1000 sq ft tract home in Fairfield Ca for $1,000 a month. It went into foreclosure, a property management company managed the rental for the bank, they tried to kick him out with 30 days notice, but he fought and was able to stay 90 days (paying rent the whole time) When his 90 days were up, the property management company told him if he wanted to negotiate a new lease it would be at $1500 because that is what they would get from a section 8 tenant. He moved out (without his deposit, there is no provision for return of it in a foreclosure) He said that in the 6 months since he moved, the area has turned into a section 8 ghetto. It seems that the more section 8 rentals, the more foreclosures (people who were hanging on give up when they realize that they will never sell when their neighbors have cars parked on the lawn and sofas on the porch) When they are foreclosed, the property management company manages the foreclosures for the bank, they then line up investors to buy them, hire their handyman friends to do a $2,000 fix-up so they can rent them, then market them to people with section 8 vouchers which yields a return to the investor of 150-200% of the FMV (of which the property management skims off fees for managing the properties) The sad part is, neighborhoods like that are doomed, they will never recover.

Yes, I know of several investors who have bought homes and are renting them out to section 8 tenants. They pay rent at a competitive level and the money is always there on the 1st of the month. Just for laughs, put a home for rent on craigslist and mention that it’s section 8 available. Droves of people will call you.

the problem is, that at least in some areas of Northern California the rent that HUD pays is not competitive, and the only people who will rent them are people with section 8 vouchers, thus pushing out people who would otherwise be competing for these rentals. In Solano County it ‘was’ the norm that a low wage worker could find a rental for $1,000 or less, but with the trend for more and more houses to be section 8 certified, the options for $1,000 a month rent is becoming limited to areas of Vallejo where people shoot each other in the middle of the day, or an extended stay hotel in Vacaville or Fairfield.

As a renter, I hate Section 8. It drives prices up. I was apartment hunting. They asked if I has S8. I said no, and they lost interest and didn’t want to show me the place. I was looking at a dump, and they were asking for something like $1400. It should have been more like $1000. S8 is a scam that benefits landlords at the expense of taxpayers. It creates ghettos. The landlords claim they’ll fix the places up, but every S8-OK place I looked at was a mess. Floor tiles didn’t match. Screwed up kitchens and bathrooms. Dingy. Smelly. Too much litter on the streets.

At $1k I would have lived there. I’m not fussy. But I was in competition with poor people who get rent paid for by the state.

I know someone who has been on a section 8 waiting list for 13 years and they finally became qualified.

They spent 3 months looking around, as most of the places that accepted section 8 were in bad areas. They settled for an apartment building with 13 units, grease slicks in the parking area and 20 year old punks hanging out in front of the building

shouting “f’in’ this f’in’ that”

Sounds like those section 8 people are living the life of Riley

Sure Section 8 housing is often in shi-hole apartments. But how much is the alleged “market” rent? It’s all distorted. Generally you could pay that “market” rent and get a way nicer place within one mile. The government pays the difference between 1/3 of the tenant’s gross income and the “market” price of the rent, so the tenant is paying very little.

Yet the apartments are poorly maintained. But it can’t be the cost of repairs that’s impeding the landlord’s fixing things – because nearby, there are better-maintained apartments renting at the same price, or sometimes even lower prices. Presumably these competitors are making a profit, even if it’s small.

The real story is that S8 inspectors don’t know the real market prices, or are willfully ignorant. S8 tenants are comparing each apartment to other S8 apartments or unsubsidized apartments that rent for the same amount as 1/3 of their income, but are much smaller. S8 landlords are pocketing big profits because they don’t maintain the properties to be appealing to market-rate renters.

Lynne B

It’s not just the visuals of section 8 tenants. We sold our lovely home a long time ago, and live among them. ESL brings a sub-set of issues in addition to the ones you mentioned. The smell coming out of the two bedroom unit across from us is so awful, when they open their door, the hallway gets a smell that lingers for a long time, and pollutes our unit. We can seldom leave our door open. (6 people live across the way with the manager’s blessing.)The noise level is unreal with young (3-9 yr olds) running around outside until 8:30-9:00PM. No disipline or civilized structure. I hear you loud and clear, Lynne.

But to be fair, a-holes come in all colors, flavors, and from dysfunctional families.

A friends rents out three different homes in the Pittsburg area of CA. 2 are section 8 and 1 is not. She says the biggest issue for her as a landlord is that all three have way more people living in them than just the single families that she originally rented to.

Not that I’m a fan of Section 8, but we better all get used to having poor people around. Incomes are stagnant for many and falling for the lower skilled. The reality is the middle class is disappearing an astonishing rate… recent news articles have laid out the statistics that should scare all that are afraid of creeping blight in middle-class neighborhoods. Check out: http://articles.latimes.com/2011/sep/14/business/la-fi-poverty-census-20110914

Poverty is up 50% and is defined as less than $30k/yr for a family of 4… even the median wage in CA is dropping (Inflation-adjusted median household income — the middle of the populace — fell 2.3% to $49,445 last year from a year ago and 7% from 2000).

These are your neighbors folks. Wishing them away is fruitless. Without middle class wages for the masses, we will all suffer.

SO Lynne, you’re basically saying that section 8 is driving up the cost because section 8 pays more than what was the normal? Interesting. I’ll ask my friends about this.

A voie of reason in the wilderness.

I don’t mind living near section 8 reciepients. What I do mind is the fact that section 8 is inflating rents. They take otherwise difficult-to-rent properties and make them rentable by creating a market for them. If there wasn’t section 8, the investor/absentee landlords would be forced to sell the properties.

Maybe apartments would have to “go condo”, and SFRs would have to revert to being owned, if there was no way to make them profitable as rentals. That would not be bad — it would offload the costs onto owners who could economize on repairs, DIY, and bring the units up to code individually. And it would push down prices to something closer to rents.

I believe Section8 is LARGER price-distorter for market prices than prop-13. Remove it, and market rents will plummet to reflect true ability to pay. This will drive property values further down to affordable levels. Only ones that lose in this scenario are owners who are over-leveraged, and the banks. The poor WIN, the working-man WINs. Housing then would be cheap(er), so that we can spend more energy & time on more productive / enjoyable endeavors. This raises std of living as measured in leisure time = More time to surf or whatever it is you like to do.

If the government gets rid of Section 8, a HUGE number of people would move out of California immediately for places with cheaper rent. Generous welfare in California, with easy qualifying rules, combined with Section 8 housing makes it reasonable for the poor — working and non-working — to remain in California. But without Section 8, lots of them would be better off moving elsewhere, especially if they do NOT work. Increasingly, there are cities in the rust belt where you can get a very solid, but old brick house for under $10,000. If you are disabled, etc., and getting Social Security and food stamps, Medicaid/Medicare, BUT you no longer get Section 8 for housing, and have to pay market rates, then high cost areas like California are no longer possible. It will be interesting to see how things work out in the next few years.

Laura:

Excellent points, however here in Cali, in my experience, most Section 8 funds go to divorced women with children.

This demographic has been largely untouchable being that women’s groups and many non-profits as well as government agencies are set up to help them in one way or another.

Then you have the landlord groups – add that to the above.

There are too many hands in the pot so-to-speak for any meaningful change to be enacted any time soon.

It will take a sea change to get rid of Section 8, and maybe that’s happening now with all of the permanent unemployment.

~Misstrial

rotten game. not as bad as buying up senior trailer parks and uping the pad rental then booting out the fixed incomers who can’t get up the monthly nut. wretched but its business. lots of folks just don’t give a turd about the insidious long term effects their short term profits have on society. hence, credit/RE bubble -crisis.

It has too come to an end, sect 8 should only be used for apartments and for people that are really in need. The only thing we have done is call code enforcement and child services.the combination of the two, when they figure out that the neighbors want them gone has worked. in a two block area we are batting two gone with one new home owner whom is fixing it up to live in and the other one is an eye sore empty. two more places need leveling but in time we’ll get them gone too. I guess the good news is the banker investors wont touch them because of needing serious repair bucks to be sellable. So the little guy that still has a dream and a strong back comes in. The best we can do is help one another to keep our homes clean and safe in these devastating times.

There is a downside to section 8, drama. Section 8 services old people, and single mothers. One thing single mothers attract are boyfriends. Those boyfriends bring drugs, gangs and drama more often than not. Give me a good working married mechanic with a live in grandma for the kids. These people care about their rental homes and their credit. Also, we can kick them out if they start a meth lab or fill the yard with pit bulls. Try kicking out a section 8 renter!

“end up committing to brutal commutes because they bought into the “drive until you afford†mentality that is pushed by the California housing industry.” Not anymore, with the high price of gas. The inland empire is a basket case with Riverside being rated amongst the top cities that are high in unemployment. No wonder the price has collapsed in the inland empire.

IF the banks all rush to the door to unload their REO’s then prices will plummet and there will be great buying opportunities. As Dave Ramsey would say, time to save up your money by a severe cut back on expeditiures.

Just released: “Sales climbed 7.7 percent month over month to an annual rate of 5.03 million units, the NAR said Wednesday. The median price was 5.1 percent lower than a year earlier.

Rising rents are also helping Americans decide to buy homes, the NAR said.

“Favorable affordability conditions and rising rents are underlying motivations,” Lawrence Yun, chief NAR economist, said in a statement. ”

Just released, Operation Twist is in operation. Lower interest rates for mortgages. Break out the beer barrel, good times are coming, just in time for Obama. Well done Ben.

Also, the California Republicans say that the Dems will take over the Legislature with the new districts, that means more taxes and regulations for business, according to the state GOP. How will this affect housing?

The high month over month was due to more days logged in August.

August had 23 business days, as opposed to July, which had only 20. The daily average will show a different picture

I’d still rather rent and live in southern california than be able to buy and live anywhere else in the US.

Who is managing the BofA distressed assets that are starting to move. How does one get the cash price from the bank. Is it an investor group only deal for several properties at a time? Or can a owner/occupant buy a stand alone single family with cash and actually score a deal insulated from another 30% drop? Are all cash buyers undercutting mid tier listing prices by 20-30%?

Still renting in coastal OC and watching the slow decline.

bought last year, short sale all cash. home was remodeled and has a few decent upgrades. payed 22 percent lower than comp. comps were basically junk that needed roofs to plumbing.this was no easy task took over a year to get a deal to fly.

wanted a large lot to grow fruits and veggies to hedge food costs.

moved from la suburb to central coast. no need for air or heat nice micro climate, down side is all the la and ghetto folk rejects like it too. like obama says, we cant control everything. for me my fears of the inflation as the buck is destroyed is what made me buy. age plays into it too, only so many years to try enjoy life somewhat.

My guess is that you bought in Lompoc, Guadalupe, or in a certain section of Paso Robles.

~Misstrial

don’t tell me – Santa Maria? No thanks, that place is no better than eastern LA suburbs

Check out this article from SFGate: 45 yr old doctor and wife buy house in Moraga (contra costa/fortress) for $1.1 million including $729K first and a 401k loan, happy to get 2700ft before the jumbo limit falls

http://www.sfgate.com/cgi-bin/object/article?f=/c/a/2011/08/26/BU931KQR67.DTL&object=%2Fc%2Fpictures%2F2011%2F08%2F25%2Fba-mortgage26_PH_0504000896.jpg&type=business

Carrying cost of tax and interest probably close to $50K, plus taxes, maintenance. For a house that would sell in the philly suburbs where i live for about $400K maybe, with $5000 property taxes . . . .

Go figure.

uh, ignore that plus taxes. figure maybe 36K interest, 14K taxes. 50K. Plus maintenance and utilities …. but taxes already included . . …

Crazy, they maxed out their purchase, and extended themselves as far as they could (borrowed from their 401k) right before the market for these loans is about to shrink.

In 1989 I purchased a home for 310K with 20% down and was making 95K. Using the BLS inflation calculator that same house today should cost 566K and my income without raises 173K. The issue is that incomes have not keep up with inflation and making the 113K downpayment today seems a stretch for most middle class workers or even affording the payments for a 566K home .Back in 89 I was the sole provider as my wife was a stay at home mom also unusual by today’s standards.

Large Down payments along with the move up buyers with equity have become a tiny fraction of the current house buyers due in large measure to both incomes not keeping up with inflation along with bubble home pricing but also cash out refi’s that have removed whatever equity had built up. The low down payment culture today vs the prior years reinvestment into RE is a significant development and will have to be corrected by the government tax policies in order for RE to appreciate.

My husband and I are both from Los Angeles, went to college here, sold our home in Pacific Palisades over two years ago and are leasing in Brentwood. We wanted to buy a home in this area, not going to happen. A 1,000 SF home around the corner is a million, insane so we will continue to rent until we retire out of here. There are no jobs here, there is no quality of life, not to mention the horrific traffic. Most people that live here are not from here, wish they would all go back home, will never buy in Los Angeles.

My work has been expanding and is still hiring here in LA. So it’s not true that there are no jobs. I spent the entire summer off with my kids on the beach or hiking. There is quality of life here. But you’re right there is no reason to buy. Prices are insane. But you don’t have to buy a home. It’s not a prerequisite to a happy life.

JOHN CPA JD has the knowlege and experice to articulate and illustrate better than I how the “wage slave” is the sucker in California compared to those in the Grey economy. He can explain why the housekeeper can afford to own a nicer car than the person making $100k a year who has to pay taxes, numerous types of insurance, unsubsidized rent, no tax breaks, healthcare etc.. The bottom line is the cheaters are winning and no one can stop it. So the “Wage slave” earns just enough to for it to be worthwhile to keep waking up in the morning and going to work. Housing prices are bottoming out becasue there are too many tax cheats who can afford the price and too many idiots who qualify for more debt than they can handle.

1st time i’ve seen mention of the huge under-discussed story of grey market. The “cash” economy is where I’m guessing tons of activity happens, but there is no/little data to quantify or analyze it. Perhaps its out of scope on a Real-Estate board, cuzz property deeds are recorded, and taxed, whereas your gardeners sweet escalade with 24″ wheels isn’t.

“gardeners sweet escalade with 24″ wheels isn’t.”

The energy you put into going after the low hanging fruit is amazing. Where is your indignation for the leather seats of the bankers that raided your future? What about the home in Paris for the ibanker that gambled our economy? Or what about their gold plated rims on the Lambo? Of course you rather spend your time yelling at those at the bottom rung.

The i-banker are throwing this chum and you are gobbling it up like a little servant to their cause. Of course there is indignation around. Yet we have proof with Fed reports, TARP, and other causes of the trillions of dollars in bailouts. Where is your proof?

Maybe you should get the saltwater out of your ears and actually search for some data and put things into a bigger perspective.

They keep moving the bar.

When my dad raised us kids and mom stayed home we had a middle class life.

When prices went up, mom went to work to maintain middle class life.

When maxed out two salaries started using credit to maintain middle class life.

When maxed out credit cards used HELOC to maintain middle class life.

When HELOC maxed, refinanced to maintain middle class life.

Whats next?

CC asked, “What’s next.”

Hard to say, but I wonder what is going to happen to the federal govt. budget deficit. The Republicans are dead set against any tax increases. And they will probably approve the ‘tax cut’ portion of Obama’s recent jobs bill. So that is a factor implying a bigger deficit.

If you follow the stock market, you would know that it will close today near the recent lows, and about 2000 DOW points off the July highs. This means that tax revenue will be dropping, as there won’t be that much in the way of capital gains to report. Another factor implying a bigger deficit.

Spending on defense, unemployment insurance, healthcare, will be very difficult to reduce, especially in an election year, which is almost upon us.

So to answer your question, I think an exploding federal govt. budget deficit will eventually force a reform of our economic and monetary systems. At that point, I think we can address some of your ‘affordability’ issues. At some point, the American people will need to decide whether they want a middle class, with a small military defending our borders only, or a dominant military and no middle class. Or, the American people can continue to vote for this bogus 2-party system, and get the latter outcome, by default.

Our current political system pretty much has us hamstrung. I do like the idea of ‘balanced budget’ amendment, but what is the penalty for failure to comply? California has had a balanced budget rule 4-ever, and what good does it do? I think we need to start over with a 2nd constitutional convention.

California needs a new constitution, that’s for sure.

The US constitution is a model for the world. The only thing I’d change about that is repeal the 2nd amendment and put per capita limits on campaign finance contributions. Organizations (like companies) would be prohibited from making contributions in the name of real people without expressed written consent per donation from each person.