Young and not buying into the American dream: Homeownership among young households is simply not picking up and shifting demographic trends.

If the American dream means owning a home, many younger Americans are opting out of that dream. Part of the reason may be a generational shift in having smaller families and a growing number of dual income no kid (DINK) households. That is part of it but a bigger reason is many younger Americans are financially in poor shape and unable to buy. Many are now part of a growing renter class. The recent Census data shows no reversal in this trend. Why would it? Many young Americans are also carrying high levels of student debt and in high cost areas like California, 2.3 million young adults are living at home with their parents because of financial challenges. This change has also impacted home builders since there is less of a need for large new homes when the demand is more for affordable rentals. Builders are keen to see this and that is why multi-family building permits are way up. What impact will this trend have on the housing landscape of America?

Homeownership down for the young

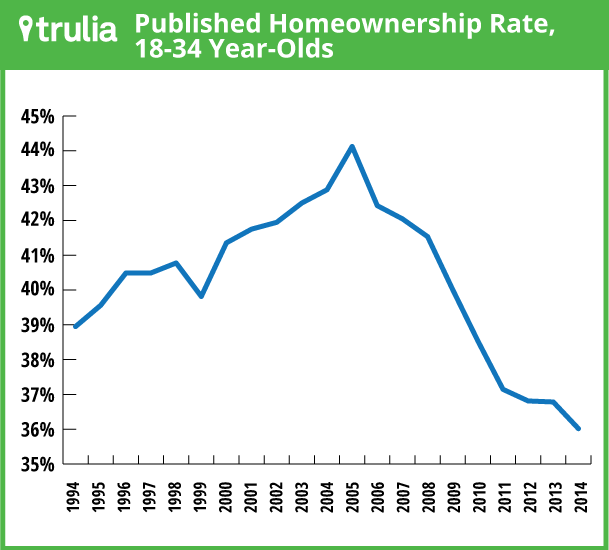

The number of households headed by those 18 to 34 is now at a generational low. These figures merely reflect a less affluent young generation of Americans. So it is no surprise that in some markets, prices are being held up on a razor thin margin of sales from outside buyers (i.e., foreign buyers, investors, etc). Yet as we have seen this year, once the group cools down markets go with it. This is not your typical housing market and we are already seeing what happens when investors pullback ever so slightly. Sales seize up and prices stall out. Of course you have your myopic contingency that merely thinks on the next lemming to purchase their home without stepping back and looking at the larger landscape. It is clear that the next generation of home buyers is simply having a tough go at it:

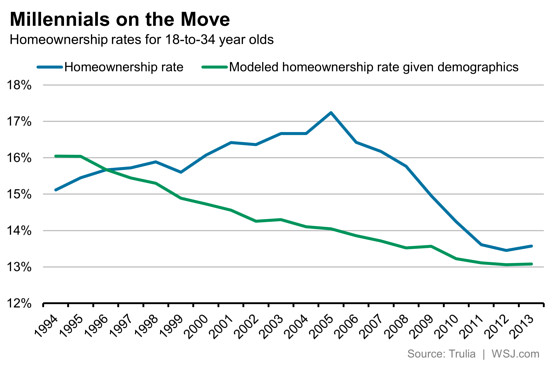

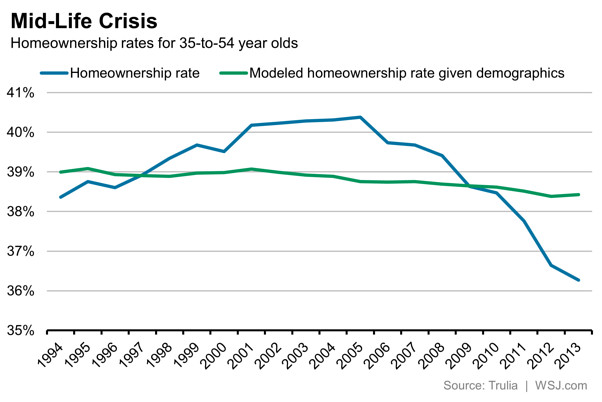

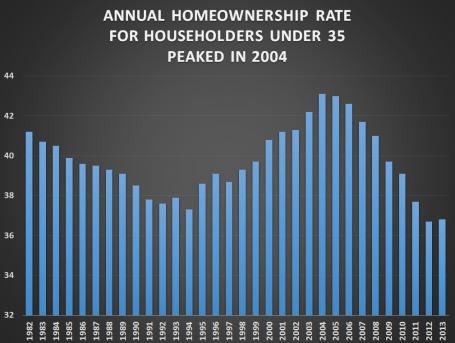

The trend is rather clear in that younger households are simply not buying at a high rate. They are either part of the renting class or living at home with boomer parents. You can see this trend hitting the core group of people that you would expect to be buying in this market based on age:

What is telling is that the homeownership rate only bucked upwards for older Americans in the last decade. Is this a problem? It depends on whether you believe owning a home is a requisite to a healthy economy. In places like San Francisco, arguably the core of tech wealth you have most households renting, including many wealthy tech workers. Los Angeles County, the largest county in California contains a renting majority.

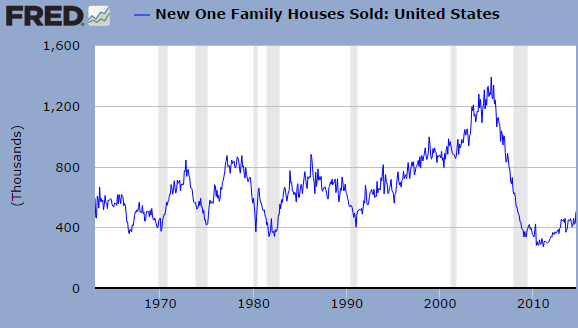

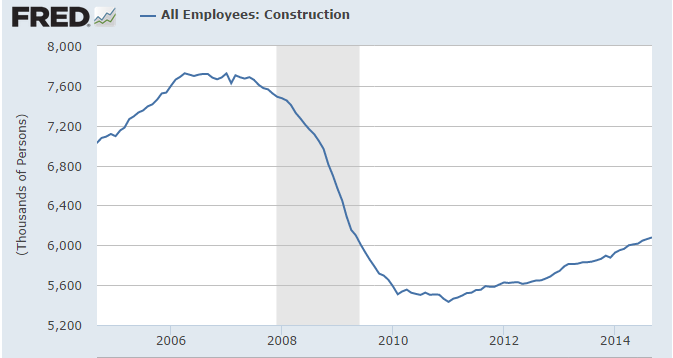

Real estate tends to be a boom for the economy because of high level transactions and heavy construction. Yet that has been lacking:

New home sales are extremely weak. The model of building giant McMansions in an era of cheap energy seems to be pulling back especially when young households are much smaller in size. The era of having three kids or more is simply not in the stars for many and this shift makes the demand for larger homes drop. Plus, many younger households simply do not have the means to buy a newer home since these typically cost more. We had a fairly hot summer here in California and I know some people were paying $300, $400, or more per month simply to cool their larger homes during these months. Owning a home goes beyond the mortgage payment.

Yet people still lust for homes and if we look at the homeownership rate for those 35 and younger, it looks like we hit a peak in 2004:

Basically toxic mortgages provided the leverage for the young to pursue the American dream even though their wages did not justify them purchasing a home. Leverage cuts both ways and millions of Americans were burned. I’m always surprise how some see real estate as a super safe investment yet scoff at the stock market. In the end, you have many Friskies eating baby boomers living in expensive paid off homes but somehow, the cash flow is not coming in. A home does not throw off an income stream. You have taxes, insurance, and maintenance to keep the thing running.

Today, the young are not moving the trend when it comes to home buying. If this were the case, builders would be out in droves pumping out houses left and right. It looks like the American dream is being redefined when it comes to home buying.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

128 Responses to “Young and not buying into the American dream: Homeownership among young households is simply not picking up and shifting demographic trends.”

I’m curious what projections are for Southern California single family home prices 12 to 18 months from now. Sideways? Up? Down?

Can they keep mortgage interest rates down if the Fed pushes up their baseline rates, which they say is coming in about a year?

projections…Interest rates will go up in 2015 fed rate most likely will be 3 to 3.5%. House prices since you are talking Ca. and sunbelt could spike again why you ask?

It is not the American buyer anymore, it is all about the foreign money pouring in. The dollar remains the in play currency, China, Russia, especially love to move away from mounting volatile gov’t issues there. If they come calling American Southwest, South Fla. Ca., NYC, (if anything is left to buy there) will be the winners.

Of course after the gold rush of buying what will be left, you guessed it, maybe another bubble in 2016 late.?

Not saying this I good news for the American buyer, but global world is here, America is in a whole new 21 century of change.

@r “…Interest rates will go up in 2015 fed rate most likely will be 3 to 3.5%…”

You still don’t get it, do you? Not happening in your lifetime, little @r, the bankrupt .GOV cannot afford 3% interest rates (you can have 3% interest, but the inflation will probably be 20% a year). Remember what happened when the 10y note touched 3% mark in the beginning of 2014… any interest rates above 1% will be a disaster for the .GOV, since it is in debt to its ears…

Interest wil not increase in 2015 or 2016 or for years and years to come. Especially with the dollar strength in the international market. Unless the powers to be want to collapse the economy completely and on purpose, the interest will stay low for years and years to come. For those waiting on the interest to increase this is bad news.

Realistically, this is just news – good for some and bad for others. It will stay low for sure – 100% sure.

Like some of the commenters said, rising interest rate will be a disaster for the U.S. In all likelihood, interest rate will remain flat on the strength of the dollar albeit due to international instability (political unrest, Ebola, wars, failing international markets/bubbles).

Most likely, the housing market will move sideways and allow savers a couple more years to save for downpayment and possibly create some sort of increasing demand in the years to come.

There are two interest rates to deal with: short term (i.e. Federal Funds rate) and intermediate term, (i.e. the 10 year U.S. Treasury).

The Fed has already signaled they will keep the overnight rates (Federal Funds rate) at close to zero for a long time. So ZIRP is not going away. This affects adjustable rate mortgages, CD’s, money market, savings accounts, and short term government debt. Granma will be eating cat food thanks to the Fed continuing ZIRP.

The 10 year yield (intermediate term) is the big ????? This affects the 30 year mortgage interest rate.

Seattle said “You still don’t get it, do you? Not happening in your lifetime, little @r, the bankrupt .GOV cannot afford 3% interest rates (you can have 3% interest, but the inflation will probably be 20% a year)….”

This is total BS for several reasons. First, the only way .gov can keep rates below 3% is through QE which is inflationary beyond measure so you contradict yourself immediately. Secondly if you have a stronger dollar you can afford higher taxes without destroying consumer purchasing power. See the relatively blissful economics of the Clinton years. Not that I’m a fan of his, but those high tax rates sure were offset by lower asset prices to the detriment of the Rentier class.

The fact is if you stop turning the dollar into toilet paper you don’t need as much tax revenue. We already owe over a third of the national debt to ourselves (treasuries held by the FED), stop the bleeding now and natural interest rates are a BOON to the economy. The only ones who suffer are the Rentier class who are now unable to get “Money for nothing and the chicks for free”. While the FED serves the Rentiers, they also know if they DON’T raise rates the dollar denominated world as we know it is over. Rates are going up in 2015 because they have to or the system is toast.

Jeez man why can’t you and the other dullards get this. As far back as Jefferson this has been understood. First by inflation, then by deflation…

Hey, wing nuts, there is an economic boom happening. Renting is a healthy option today. Being mobile is the path to the American dream. Globalization and technology have changed everything. Wake up! I bought Apple and Netflix a long time ago.

Flyover…..If we have a change in DC this Nov. elections then you can count on higher rates, if the Dems win all bets are off. There is never 100% of anything in life but death and taxes my friend.

BTW flyover, if taxes do raise in 2015, will you change your screen name to flyover landed?

Seattle… Bank CD’s at 2% for 5 years, what does that tell you about future rates going up or staying at near 0 ?

This is basic fiancial trends, banks want 5 year lock in now at 2%, CD rates going to 4.5% for five years in late 2015, if conservatives get in.

If mortgage rates get up to mid- or high-5%, then watch out for a significant tank. The market is already slipping at 4.25% rates. No way it can hold on with another point or point and a half in interest rates, I don’t care how many jobs are created. They’re mostly low-paying anyway.

Anyway, today they announced Turner Broadcasting is cutting 10% of its work force (1,450 jobs), and a big start-up talent agency is closing (Resolution). More well-paying job cuts in L.A.

@projections wrote: “…projections are for Southern California single family home prices 12 to 18 months from now..”

Irvine: down (the Chinese crackdown on fraud and money laundering is already showing up. 1/2 of the zip codes in Irvine are down (slightly) YoY).

San Marino: down (see Irvine).

Low tier areas: Compton, Paramount, South Gate, Inglewood, Hawthorne, eastern portions of Gardena, Lynwood – current prices do not support income levels. These are not desirable places to live. Prices plunge.

Mid and Upper Tier areas: these will follow the stock markets. Since the houses in these neighborhoods are priced outside the income levels of the people who live there, the only way to buy in is: trust funds, inheritance, stock options. So if the stock markets tank, so does the mid and upper tier home prices.

Does a triple dip qualify as a tank?

Home prices headed for a triple dip

https://homes.yahoo.com/news/home-prices-headed-triple-dip-124200714.html

Rented the movie “The Ivory Tower” on the weekend. Details the student loan debacle, how young people are drowning under student loans.

I personally know many people, my age – in their 40’s, that are still carrying huge student loan balances. The majority of them have run-of-the-mill jobs too which is the irony. Talk about a bad investment.

I read once that Harvard, Princeton and Columbia have so much money tucked away they could all stop charging tuition tomorrow for every student for the next 25 years and still be in the black. Greed…. has seeped into educational institutions not just corporations.

We have an odd, illogical culture in the U.S. about education. We provide every child a free education through the 12th year, a decades-old and outdated standard that is no longer sufficient to create a productive worker in a competitive global marketplace. If 12 years are free, why not 16? Why not 18? Maintaining a financial disincentive (loans at 8%) for higher education only guarantees that the US will fall behind Europe and Asia in science, technology, medicine, etc., and at the same time, puts a drag on the RE market because young people can’t buy homes. Student loans makes for a nation of undereducated renters.

Rick Springfield says “If 12 years are free, why not 16? Why not 18?”

Good point Rick. But, why stop at 18 years “free” education? Why not 25? And for that matter, why doesn’t the government just guarantee a job to every college graduate. For those not in college, let’s hire them all full-time to ‘dig ditches and fill them back in’… that will spur the economy and make us globally competitive.

Tom Jones (“It’s Not That Unusual”) wrote: “Why not 25? And for that matter, why doesn’t the government just guarantee a job…”

The rhetorical device “if the gov’t provides one specific item free, why not make everything free” isn’t really a serious argument. I support personal responsibility and capitalism, but there are some things where collectivism works better. If a free BA/BS or Trade School makes the nation more competitive — and I think it does — while making young people debt free so they can buy homes, it’s a win-win for the nation and the economy all around.

ummm. It’s very disgusting to see this so-called free market fixed on everything for the advantage of the rich people and the insiders…

Government deregulation of “for profit colleges” is ridiculous, they must be getting a lot of lobby money to allow kid to shell out thousands of dollars or online schools eg., University of Phoenix the 101.. more of these type stealing money from kids… Most likely they’d not get a real job in a tough market.

It’s always the people at a disadvantage, like 1st in the family to go to college… that get hosed, with these Micky Mouse colleges!

“I read once that Harvard, Princeton and Columbia have so much money tucked away they could all stop charging tuition tomorrow for every student for the next 25 years and still be in the black. Greed…. has seeped into educational institutions not just corporations.”

Ha, I forget where I read this recently, but the author put forward a pretty good argument that Harvard is a reasonably successful hedge fund with an educational institution attached to it. One really has no need for the other anymore.

As of September, Harvard alone has $36.4 billion endowment fund.

http://en.wikipedia.org/wiki/Harvard_Management_Company

Subprime student loans, subprime car loans, subprime housing loans… all that the middle class has become is subprime…

sad but true …Almost one-third of auto loans are to subprime customers.

http://www.zerohedge.com/news/2014-10-06/what-bubble-record-924-billion-65-million-auto-loans-31-all-new-loans-are-subprime

http://thinkprogress.org/education/2014/10/01/3574551/germany-free-college-tuition/

Harvard, Princeton, and almost all decent Colleges are non-profits. And they do pay full scholarships to kids from families making under a certain income, and minorities, and great students.

The main problem for student loans is not state colleges, or the ivy league. It is for-profit colleges with awful graduation rates, 80% of cost is marketing, awful employment of graduates and taking advantage of Vets.

To be fair….All (I believe) Ivy League schools have ‘needs blind admission’ this means that admission works independently of ability to pay. That’s sort of true. In practice this means that you admit some legacies and some good solid rich kids who keep the endowment coffers full and they support the smart poorer kids who are subsidized. (I was one) That’s how it works. To be sure they have giant endowments, but then again they are private institutions. Of course they do accept govt. vouchers in the form of Pell grants and other stuff…

Most people I know in the Midwest, sans Chicago, are homeowners from a fairly young age. But the cost of living is cheap. I think this article is catering toward the bigger, and perhaps coastal, cities.

That being said, I work in the South Bay. I see a lot of 25 to 35 year olds, I’m only 35 myself. Everyone makes between $25 and $35 and hour depending on their skill set, time in, specific company, etc. So that puts incomes in the $50k to $75k range (not including overtime but that’s not guaranteed so it’s excluded). These are all bachelor or master degree positions.

Some people are just happy living here. Some live home with parents, especially the younger chicks. Some want to move to a cheaper city, and some commute while others refuse.

The problem, hands down, is affordability. I understand this is due to lack of space however, and quite frankly the large number of households with incomes of $100k to $150k or more being quite common. Factor in one generation taking up space, then in comes another with not enough room to build single family residences for all the people. So yes the wealthiest and highest bidders are going to win, although I believe that even after all that housing is still 10% to 15% overvalued right now and will fall soon.

A lot of older higher level engineers and management make $120k to $150k and are usually married to someone similar to them. So a $300k income explains a lot of Torrance and Cerritos, among others. If you think of it like that, the demographics are pretty in line. It’s when you start thinking about all the people struggling, poorer immigrants, unskilled labor, etc that it’s hard to understand how the area is sustainable. Most of those people probably lived multi-generational and/or crammed into small spaces.

That’s why I advocate commuting to the IE. If you don’t make comfortable six figure income, you aren’t going to live to fabulously in L.A. County. You get more bang for the buck in Riverside and Corona and there are a lot of very, very nice areas out there.

The problem with commuting when you have a young family is the additional 2-3 hours a day away from home. You end up paying for child care, and your stress level rises in the car. You get to see your spouse and kids less.

The lack of commute and access to all a major urban center has to offer is why we live with “less” than we could have if we moved far out into an ex-urb.

Within 15 years or so technological change (computer driven cars) should eliminate 90% of stress and 50% of commute time. This will open up vast stretches of places to live, particularly for older folks who cannot drive. I wish Google cars would come tomorrow. If we get rid of drivers we get rid of most if not all traffic problems. At the present time jets taking off and landing on carriers are fully flown by computers with no human intervention permitted. The technology is here. Let’s have it already. The nominal and inflation adjusted housing price drop from 1890 to 1940 caused by the last transport revolution ( roads, cars, telephones) will look small compared to the next one.

Do people pay for childcare living in L.A. too? Do they have to pay for private school due to the lack of performance in more affordable areas?

True time is spent in a car but if you vanpool there is hardly any stress, you’re not driving. Or paying all that much for that matter, usually $100 to $200 depending on the size of the pool and corporate subsidy.

“If we get rid of drivers we get rid of most if not all traffic problems”

So replacing human driver with a robot, while not changing anything else, will solve _all traffic problems_?

How that would exactly happen, I’d like to know?

Thomas, most traffic delays are caused by drivers.

* Drivers going into and out of lanes, for no reason other than they think some other lane is a little bit faster, is a BIG reason for slow traffic.

* A steady stream of drivers waiting till the last second to shove themselves into an exiting lane, so they don’t have to wait on line, is another reason.

* Lookiloos slowing for anything interesting to see create bottlenecks.

Yes, if all cars were run by a master computer, traffic would run faster. I don’t know if it would work if only a some cars were guided by a computer. I don’t even know if robot cars are practical.

It’s not for everyone. When I first moved to the IE, I did a 3 day commute and you’re right that it would take 4 hour r/t on the metrolink (Temecula to Glendale). However, it was well worth it for me at the time because it meant the wife can stay home with the kids and not need to work due to the low cost of living we were able to sell our house in LA and use the proceeds to outright purchase a $300k ~4000sq ft home in cash and then some leftover for a massive solar install. Which means no energy bills, electric cars, stay at home mom and a lot of money leftover monthly for travel and or savings. However, since then I’ve been far more productive on the telecommuting than on the days I travelled into work and my employer noticed. They then made me fulltime telecommuter and that has just been icing on the cake. You never know what your options are until you take the leap. However, even if I didn’t get converted to fulltime work from home, it would’ve still been worth it to have the wife not have to work and no mortgage.

I forgot to add, even though my wife doesn’t work and I wfh fulltime, we still have one of the kids in daycare because we can. First of all, due to low cost of living, and low cost of daycare (high quality) it’s worth it so that we can get a few days break and it’s good for their social skills. The difference is we’re doing it as a luxury and not because we have to.

YoSig…Glad you paid off your house enjoy, even though you wake up in Temecula it is good you have a nest egg.

@The Realist wrote: “…That’s why I advocate commuting to the IE…”

Instead of dealing with a daily 4 hour round trip commute, I would advocate moving to the Midwest or Carolinas.

$500K crap shacks in SoCal would sell for less than $100K in the Midwest. I’ve seen a number of them as low as $50K in major Midwestern cities.

yeah but then you have to live there

ernst, I completely agree with that.

With the commute times and cost my second option is moving to a different state, my third is moving to Valencia (or ie, pick your poison).

My parents suburb in Minnesota is a 15 min drive to downtown, 30 min max during rush hour. My parents house 4 bedroom, 2 bath, with furnished basemengt would sell for $140k, and it is on 3/4 acre with giant oak trees.

Minneapolis is just as exciting as Valencia, Moorpark, and the IE.

Free time is so valuable.

bahahha. Minnesota is ok, they have the MOA and Hennepin Ave. And 93X. Other than that, it just snowed there. In early October.

No way.

The IE is a fabulous place. Downtown Riverside has a lot of nice shops and dining, and Victoria Gardens/Ontario Mills has anything the rest of L.A. has

And Hottinger Meats in Chino can’t be beat. Period.

One answer to high cost of housing is to build density. More sky scrapers and multi-tenant building. Zoning laws prevent this. Catch-22. Current home owners want the value of their property to stay elevated and do not want density.

HOUSING TO TANK HARD IN 2014!!!

Hey, @Jim, is it you?

Remember guys (and gals 🙂 ), we won’t have “correction” in housing without “correction” in the economy. The housing may become moar affordable, but most people will probably be unemployed.

Seattle, you aren’t always right, but i agree with you here. Some people are hoping for a RE crash, while at the same time thinking that their $100k per year job is immune from said downturn.

Everything is relative. Everything is relative. Everything is relative.

If RE crashes, most incomes will go down, just like in the last downturn.

We won’t have a correction in housing without a correction in the the economy?

Are you saying housing drives the economy? You must work for the Federal Reserve!

or you are saying what we have now is sustainable? and we’ll be fine should we just stay the course?

If we had a correction in housing, people would have money to spend!

Please! Bring on the correction. We will be better off.

The housing/banking complex IS the drag on the economy.

Hey, @TJ, I have to be proven wrong yet… 😉 . I have been right on everything so far 😉

Basically you’re saying that an overpriced asset class cannot decline if the economy is doing well. Not sure if I think that’s true.

Nice!

Meanwhile Universities are free in Germany!

Nothing is free, you should’ve been known that already (how old are you 🙂 ). The .GOV doesn’t have money, it doesn’t generate any revenue. The .GOV collects taxes and everything is paid for either with taxes, that you or your employer ultimately pay, or with debt. Think about it this way, if Universities were not “free” in Germany, you could’ve gotten bigger paycheck, how about that? Do you still want the universities to be “free”? The same is with “free” healthcare, etc…

The government never produced a dime of wealth and never will. The private sector produces wealth and the government is a consumer of wealth. The bigger the government the more wealth it is wasted.

Some things the government does are essentials. However, the bigger it grows the more it becomes a millstone around the neck of the taxpayer, especially on the middle class. The very rich have power and loopholes. The poor live off middle class. The very rich and the government bureaucracy live off the middle class, too.

If the middle class would be educated and smart and look for their best interest they would always elect politicians who REALLY fight for small taxes and small government (the current Democrats and RINOs are excluded because both groups are for NWO, big government and big taxes).

Till then, they stay empty pockets on this blog and complain because the government stole everything from them both through inflation (hidden tax) and outright taxes (stealing). Then they complain that they can’t afford a home.

Government taxes and spending is not a zero sum game. Some gov’t programs have a multiplier effect where for every dollar spent the economy grows by more than a dollar. Consider the gov’t spending in Calif on the UC system, LAX, freeways, dams and aqueducts. All of that laid of a foundation that allowed the private sector to establish and grow in California.

“The government never produced a dime of wealth and never will.”

Right. Tell that to a defense contractor.

Another gem from Rick Springfield…”Government taxes and spending is not a zero sum game. Some gov’t programs have a multiplier effect where for every dollar spent the economy grows by more than a dollar. Consider the gov’t spending in Calif on the UC system, LAX, freeways, dams and aqueducts. All of that laid of a foundation that allowed the private sector to establish and grow in California.”

Rick, those infrastructures were all built 50-60+ years ago. Since that time, CA has tripled or quadrupled in population, yet we are still mostly relying on the same infrastructure. Why hasn’t CA invested in more infrastructure over the past several decades? Because all of the money gets diverted to SEIU and Calpers and Calstrs, that is why. So, you are right, it is a multiplier effect…union pensions get multiplied, taxpayer services go down.

This all reminds me of my situation living in and close to Manhattan most of my earlier life. RE prices were so high, and this goes back to the eighties, that normal people with normal jobs at a young age couldn’t even consider owning a home in the city, and the high rents were making saving for one difficult. Now it seems that the entire state of California has become much like NYC was just ten or fifteen years ago. Who’s next?

Hey Mike M,

That still holds true for NYC but it has spread like a cancer into the Tri-State area. Between property taxes and RE cost no new families are taking root (except the Russians, which have hit north east Jersey like a locust swarm). Even the old decrepit urban areas (Jersey City etc) since becoming gentrified are starting to sky rocket. Want to commute to NYC? Well, better start looking in sticks of NJ (Sussex county and surounding areas) .. its probably the last affordable area in the commuter area and its still pretty damn far.

I don’t know why everyone’s always talking about how great public transport in NY is. ONLY if you’re in Manhattan island, otherwise it sucks. I go there every couple months for work and it takes an hour using the train/subway to get from JFK airport to midtown which I believe is 14 miles. And this is a very very often travelled route by thousands of people daily. So that tells you how commutable NYC is outside of 14 miles, you’re looking at over an hour to get to work.

Well, Yosig, first of all, it’s one of the few American cities that have any kind of decent non car transportation system at all. Second, using the link from JFK to Manhattan isn’t quite fair – it’s not as though that’s how millions of New Yorkers get around every day. Try the subways or Metro North someday.

“Now it seems that the entire state of California has become much like NYC was just ten or fifteen years ago. Who’s next?”

Seattle and Portland – not much different than SoCal in both prices and being crowded.

Portland isn’t even close to LA in terms of over crowding or housing costs. We’re actually planning on moving there from LA next year. $400K gets you a beautiful, 2500 sq ft. home in-close in the city in Portland. The same house in an equivalent neighborhood, like Silverlake, would be well over a million bucks here in LA.

In the broader scheme, I don’t think the rate of homeownership is the crux of the problem, even if it may be an interesting indicator. The core problem on the coasts is that housing, renting or buying, eats up far too large a slice of finances. For me (in the Portland market) the options essentially boil down to:

1) Rent at 30-35% take home

2) Buy with PITI at 30% of take home but wipe out bulk of liquid assets and be leveraged for 4-5x net income.

And that’s to be in a lower-performing school district even though we make comfortably above median income. Considering how the labor market has changed, more renting and less buying isn’t inherently a bad thing. The hurt is how much of one’s income gets extracted just for shelter.

Blert – has the Ebola virus been manufactured to depopulate the useless eaters?

Conspiracy theories anyone? Conspiracy – yes, theories – there is nothing theory about it…

“Blert – has the Ebola virus been manufactured to depopulate the useless eaters?”

Of course. Google Agenda 21.

http://www.thecommonsenseshow.com/2013/12/03/depopulation-of-the-masses-has-begun/

cheap real estate for the survivors

https://www.youtube.com/watch?v=M7MSNEbl-hA&feature=youtu.be

the stand stephen king part 1 the plague

A few things need to change before the market revives and younger people can afford to buy. The ratio between household income and house price is waaaaay out of whack. In some areas, house prices need to come down 50% to revert to the mean. Remember, they ALWAYS revert to the mean. Household income is going down and household debt is going up. The unemployment rate is much higher than Washington claims. Ignoring the people whose unemployment benefits have run out does not give an accurate picture of who is not working. It won’t change soon, so don’t hold your breath.

I wonder where this robust loan growth is going to come from.

Perhaps recapitalized banks wanting to lend on crashing value prime real estate?

_____

Why Buffett is always betting big on bank stocks

Thursday, 25 Sep 2014

[..]In a few years, when interest rates are more normal, loan growth is really going to be robust,” U.S. Bancorp CEO Richard Davis told the Barclays conference. “We’re getting close to an inflection point.”

http://www.cnbc.com/id/102028790

I hope housing prices tank hard soon, I’ve been waiting for about 2 years now to get in. Prices here in the more desirable parts of SFV and Burbank are still ridicules. I guess I’ll just continue to rent and be stuck with my landlord’s bad taste in fixtures and flooring.

C’mon, @MoMoBro, if housing tanks hard, I really doubt that lots of people will suddenly start buying because so will the economy. Remember, it doesn’t matter if the housing tanks 50% if you don’t have a job to buy a house. The housing will not tank along, it will take all the rest with it (stock market, bond market, etc) and it won’t be pretty…

Be careful @What? you wish for because you can actually get it… and you might not like it…

“What is telling is that the homeownership rate only bucked upwards for older Americans in the last decade. Is this a problem? It depends on whether you believe owning a home is a requisite to a healthy economy.”

Why would anyone believe that owning a home is a requisite to a healthy economy? The economic ills we have today (for the 90%) began 30 years ago, when home ownership was at record highs.

New home construction (new units to keep up with population growth)…now, that’s a far more relevant metric for relative economic health.

Exactly. Home ownership does not mean a healthy economy. Germany home ownership may be below 50%? I guess they do not think renting is bad.

I have owned a home for 15 years. My expenses over this time (siding, carpet, painting, new roof, replaced windows, yard maintenance, electrical, garbage disposal, sinks, faucets) has totaled over $45k. My home has appreciated about $40k. My home is just a force savings account.

“This is not your typical housing market and we are already seeing what happens when investors pullback ever so slightly.” I was under the impression that investors have really pulled back and are now exiting; and if that’s the case patient buyers will be rewarded.

“I was under the impression that investors have really pulled back and are now exiting; and if that’s the case patient buyers will be rewarded.”

Yes, but not too much. If prices drop to last year level, the same investors who found those prices attractive back then will find them attractive again. If the economy will really go in the gutter to keep the investors on the sidelines, then most of the potential buyers on this blog will be too scared to make a move, or if they will try to buy they will find the banks too scared to lend or find themselves without a job.

That is the real life if you like it or not. That is the reason so many families move out to lower cost of living places in order to have a life. Instead of fighting a system created by the FED for the FED, they decide to actually have a life outside of the matrix.

Most people never stop to think outside the box and for that reason they live the life of a slave, complain that it sucks but never do anything to change it. What is the definition of doing the same thing year after year expecting a different result?????….!!!!

London, the job seeker’s dream: City named the most desirable place to work beating New York and Paris

http://www.dailymail.co.uk/news/article-2781652/London-job-seeker-s-dream-City-named-desirable-place-work-beating-New-York-Paris.html

L.A. doesn’t even make the top ten.

You better get a REALLY high paying job if you plan on moving to London. LA real estate is a bargain compared to that place. How’s the weather come winter time? 🙂

Apparently weather isn’t everything. If it were, L.A. would at least rank in the top ten with those other cities that do experience four seasons. Good try though.

I’m sure if you go to the London housing blog, there are people like yourself bellyaching about how much London sucks and can’t wait for the big tank to happen so they can get a piece of the pie.

Why don’t you just pack your bags and move there since it is the numero uno most desirable place on planet earth…LA haters are gonna hate. 🙂

Next!

No Mexicans in London

is it why it sucks?

Not really, this is a response to the suggestions made here that L.A. is on the global city desirability scale with the likes of London and Paris.

Have lived in LA and London, although from LA and will take L.A. any day. London incredibly overpriced for everything, not just housing and the weather is fing horrible. Job market prob worse there too unless you are a certain type of british person (well connected) or low earning easterner who is sending money home.

Not a bad place to spend maybe a year though especially if on an expat package.

London is crazy mad, caught in a bubble, and all the Vested Interests in denial about it.

This man, below, is Chief Counsel – Litigation and Global Chief Compliance Officer at a global company, and a heavyweight US litigation lawyer of very high standing, with a career background working at top US firms and on many high value cases.

(I’ve just read a book he published.) And below was from late 2012. Values have doubled in prime central London since then in my view, 25%-50%+ reflation in Greater London.

_____

11 Oct 2012

Senior partners at major London law firms can’t afford to live! Well, not quite: But senior partners at many major London law firms can’t afford to live in London itself…

From an American’s perspective, everything in London is nauseatingly expensive (or ‘quite dear,’ as the locals so quaintly put it). But the cost of housing goes far beyond ‘nauseatingly expensive’; it’s eye-poppingly, grab-your-chest-and-drop-to-the-ground, out of sight. It leaves partner pay in the dust.

more at: http://abovethelaw.com/2012/10/inside-straight-london-partners-cant-afford-homes/

LAsucks… The city of Angels is not well define, Ny, Chicago, London, Hong Kong, Rome,Paris,Tokyo etc are recognize by their skylines and business districts.

LA is vast network of ill defined boundries, LA county is huge in land mass. Yes by population it is the second largest city in America, but population does not make a dynamic vibrant town of Skyscrapers, waterfronts, stock markert distric well defined etc.

It is hard to say what it is, but be one thing is for sure, with massive people moving about in a county of such huge land mass lets just say LA gets a different classification, nobody has fiqure out since Mexico foolishly gave it up or did we steal it?

The way it’s going, Southern California might as well be part of Mexico. It’s already like Tiajuana with higher taxes. Maybe US should just give it back to Mexico and wash it’s hands of the whole mess. I liken Los Angeles to a toilet in a bad Mexican restaurant.

@LA_sucks, you are correct. Los Angeles is not an elite city. When friends and family from out of state visit me in SoCal, they are stunned to discover most of SoCal is a ghetto/barrio/slum/garbage dump. One trip to SoCal is all it takes for these people to never ever want to visit this place ever again.

And yet here you live. And yet here you continue to post on a “How I learned to love Southern California..” housing blog.

Interesting choices.

@Blo-Sux,

Although your opinions should be considered very, VERY serioiusly, please consider objective reports before you choose to bloviate further:

LA is indeed a global city (#7, thank you very much):

http://www.atkearney.com/documents/10192/efd4176a-09dd-4ed4-b030-9d94ecc17e8b

And, don’t be jealous, blo, just because you don’t start meme’s on this board like I do. Your posting is solid and bland and inconsequential.

This is LA:

These are the ports of

the global age, the places that both run the global

economy and influence its direction. The cities

where decisions are made, where the world’s

movers and shakers come to exchange the latest

news and information. They are places that boast

both old-fashioned power and new-fashioned

flair. They are where you go to do business, yes,

but also to see the greatest art, hear the greatest

orchestras, learn the latest styles, eat the best food

and study in the finest universities. They have

global corporations — this goes without saying.

But they also have think tanks, jazz bars and

broadband. In a word, they have clout

Dfresh is swallowing a bitter pill and trying to deflect by making things personal as usual. According to a very comprehensive survey, the majority of productive workers in the world don’t view L.A. as even being in the top ten places globally where they’d rather be employed. By that measure, it’s not with the likes of London and Paris, as has often been suggested here. Interesting that Chicago, a U.S. city with cold weather, half the regional population, and a far less bubbly housing market ranks above L.A. in the AT Kearney measurements. Check out the 2014 wealth report rankings, L.A. doesn’t even rank. Bringing this back to how it relates to housing, people are delusional in thinking that these global world class city platitudes somehow portend L.A. is immune to another major swing down in prices.

Ca. locals are leaving for happening lower priced towns in: Texas, Nevada, and Colorado. Some CA folks do not even like the beach or the weather, so why the hell do they live in surf USA towns, and pay the rip off prices.

Yoddle…Life is about choices, if CA. isn’t the place, then folks have 49 other options?

Yep, that’s where we’re at. We probably see the beach once a year, and I’m not a fan of the hot weather. I’m from the Midwest originally, but I’ve been in LA a long time. While I wouldn’t want to go back to the really bad winters, the winters in the Pacific Northwest are barely jacket weather, to me.

I read that Colorado is 10% overpriced right now.

Realist….Good post, many thought fringe living was dead, really it never went away, for those who want more bang for a buck, and let’s face it, just can’t afford to live in certain zip codes then you drive to buy.

My nephew lives in Victoria (IE rancho cucomonga) he prefer to live in Flintridge where he works, they can’t do it so he takes off early to get there. They paid $229 ten years ago today worth about high $400’s. Like he said when he retires in 7 years then they will seek a better situation, for now Rancho is safe and okay living.

Seattle…The USA can’t continue with 0 fed rates. True a fragile ecomony exist under this regime, when the house and Senate are controlled by conservatives you will see tax breaks to Corp America, incentives not to go overseas, energy exploration etc.

Wages will increase because America will not be interested in this society of hand outs,

they either get back to school or work or be left even further behind.

The rich want to invest again just not with this administration, if Clinton gets in move to another country, America will stay broke and lifeless. Take care

A push for higher wages by Government intervention is hand out in another form, and someone has to pay for it.

Better for cost of living to fall, and asset values to normalize – rather than Vested Interests trying to lock in their House Price Inflation wealth, and their over-expanded business positions. Break up the market and let more people have a slice. Push for higher wages without sufficient rebalancing, only creates worse problems.

The rich want better buying value, for the most part, and are wary of overvalued markets. That’s why Citibank’s global wealth study of last year reported such a high percentage of their clients with high-net-worth, sitting in cash, accepting near 0% interest on savings.

Also all the Gov intervention, from QE to minimum wage dreaming hikes (and it’s never enough money as other costs rise to go with it – such as rents for the VI landlords to absorb rises), is also putting great strain and uncertainty on entrepreneurs. Small businesses are the lifeblood of economies.

_____

Fed’s Fisher 2011

“Non monetary factors, not monetary policy, are retarding the willingness and ability of job creators to put to work the liquidity that we have provided… Those with the capacity to hire American workers – small businesses as well as large, publicly traded or private – are immobilised. Not because they lack entrepreneurial zeal or do not wish to grow; not because they can’t access cheap and available credit.

“Rather, they simply cannot budget or manage for the uncertainty of fiscal and regulatory policy… According to my business contacts, the opera buffa of the debt ceiling negotiations compounded this uncertainty, leaving business decision makers frozen in their tracks.”

http://www.bbc.co.uk/news/business-14579710

Brain,

You have a logical view based on the wrong assumption. The reality is that the largest banks through the FED (which have the REAL power in this country) don’t want lower RE prices. If they would want that, why did they come up with zero rate, QE, etc.? They can’t succeed all the time, but as much as it is in their power they will try to keep the RE elevated for better or worse (better for them and worse for us).

I am not saying that they have God like power and they will succeed. All I am saying is that they try. Most likely they will lose (I don’t know when) but they will try to keep RE prices high. They did it so far and they will try to kick the can down the road till the road ends.

The young people live out home with their parents because they like it. The children like their mother because she takes good care of them. This is the way that it is meant to be. The children stay at home until they get married. There is no place like home.

Are you serious? Extrapolate your argument out for 20, 30, 40, 50, 60 years and tell me how society looks. How many generations do you want under one roof?

You couldn’t pay me enough to live under the same roof as my parents. This coming from somebody who moved 1000 miles to live in the same city as his parents, but making sure that I have 15 minute buffer between our homes so I maintain my sanity…

Robert,

Interest will not increase in the years to come regardless of who wins in November. It looks like you still live in a parallel universe of left/right/left/right. They are 2 sides of the same coin. They are representatives of the same banking cabal/NOW.

With taxes, I agree with you. It is not a mater of IF – they will go up. Exactly how I don’t know. They can take the form of Obamacare, or outright increases or inflation (which is a hidden tax) or a combination of all three. You can’t have world domination without taxing the middle class to death. On top of the war “needs” the middle class has to support tens of millions of poor.

The middle class is doomed doesn’t matter who wins in November.

Eisenhower warned about giving too much power to the military industrial complex in his parting speech in 1961.

““The government never produced a dime of wealth and never will.â€

Right. Tell that to a defense contractor.”

That is a good example of wealth transfer. That government bureaucracy uses some of the wealth taxed and what is left is transferred: crumbs to the poor and the bulk to the very well connected rich. It was always the same and it will always be the same. All the wealth transferred is from the middle class.

Not that the lot of the renter class is a safe haven http://www.latimes.com/business/realestate/la-fi-rents-in-southern-california-will-climb-20141006-story.html

Iowa is better than California. I have a wicked 87 Monte Carlo I can’t do anything to in CA thanks to CARB.

Mike W.

Unloaded…Welcome aboard to this site, Iowa compared to CA. I guess beauty is in the eyes of the beholder? Maybe you have cataracts(?) have them removed, I can assure you after surgery you won’t compare Iowa to Ca. Take it easy

I was born and raised in So. Cal. but haven’t lived there for years. It was a great place when I grew up on the beaches there. I stayed well connected having family and owning a home in So. California until just recently. I spent my career in Colorado where I had an easy commute to work, made a comparable salary for my profession, had lower costs of housing, etc. and now have the financial freedom to do as I please. Believe me, I wouldn’t have had a chance if I had stayed in So. Cal. … I would have sunk all that disposable income into housing, transportation, taxes, etc. So, I don’t get it, unless you are making a hefty income, have a lot of money or some combination, you will likely never have financial freedom when all your income goes just to live!

The issue is that many people in southern cal are desperately clinging to the idealized notions of southern cal. For the emigrated, it’s about clinging to the belief that they didn’t escape from some other place for nothing. Who wants to accept that maybe the grass isn’t greener on the side they worked hard and risked to get to? For the ones that never lived anywhere else, they don’t have a comparative perspective and it boils down to ignorant tribalism.

Weather is above all. I wouldn’t trade CA for a free NYC condo

We tried the weather doesn’t matter when we moved to Colorado, after seven years we said Uncle, it does matter to us.

Today we live in climate not weather, after 15 years you couldn’t get us to move to a 4 season climate, or like a friend told us, move to Colorado you have two seasons, July and August and winter.

I always thought if I had to leave CA that Colorado might be the best alternative, with 300 days of sunshine and high elevations so its not too soggy. Certainly beats dreary Pacific Northwest or boiling Texas, or humid North Carolina. Climatalogically speaking, what is the next best alternative to perfect CA weather?

It certainly depends on what you like. Colorado does still have tons of snow, despite being so sunny. For us, we prefer cold and rainy, so the Pacific Northwest is appealing, and you don’t have to deal with much snow. Weather is actually a reason we’d like to move to Portland from LA.

Perfect weather? Is that what you call these heat waves as of late? Does historic drought help define perfect?

10/07/2014

MAIN STREAM MEDIA FINALLY ADMITTING THAT REAL ESTATE

IS “SEEING” AN INDUSTRY WIDE DECLINE — CMBC ARTICLE;

>>>> CNBC: Home prices headed for a triple dip:

http://www.cnbc.com/id/102065857?trknav=homestack:topnews:13

Warren Buffett says … Buy, Buy, Buy! [Bloomberg] “Warren Buffett, the billionaire chairman of Berkshire Hathaway Inc. (BRK/A), said he was puzzled by the sluggish rebound in U.S. home construction amid near record-low interest rates and a broader recovery in the economy.

“You would think that people would be lining up now to get mortgages to buy a home,†Buffett said today… “It’s a good way to go short the dollar, short interest rates. It is a no-brainer…”

This is my prediction For the housing market in the near future. All the distressed homes that was bought for low price and flipped for profit will all dry up by this year if not already. If you look at the price history of these homes, they were mostly bought for in the 400’s and now being back on the market for 600k in a matter of months. The unfortunate flippers that are late to the game is now scrambling to sell and will resort to price reductions bc they are running out of the greater fool to buy and time. I am seeing many homes just sitting bc they are priced too high and seller already priced reduce, anymore would mean a loss. Come next year, home prices will not tank but be at fair market price that will be affordable again for middle class buyers. The flippers will not be in the market bc profit margin will be too risky for the price they can sell. Home owners that wants to sell will realize their homes needs to be priced right or it will just sit. Hopefully the housing market will be based on basic economis fundamentals. Hope I am right as I am saving for the right time to buy.

Hackman …300 days a year is a misnomer because it never stays sunny the whole day? Many a time you wake up in sunshine by 4 in the afternoon either hail, rain, wind, snow you name it, within a 4 hour span, happens all 300 days so called sunshine days, The other 65 days are okay. Many Californians left the state, Nev, AZ, NM, Texas were their choices if they couldn’t go back to CA.

OUR friend who wants to leave DENVER IN THE WORSE WAY PUT IT BEST, “ALWAYS SOMETHING FALLINF FROM THE SKY”

IF you have enough savings try Prescott AZ a mile high ( like Denver) more pine trees and forest and very nice year round 4 season climate to boot.

More on Denver, it is a housing trap and investing nightmare, has been that way since silver rush days.

I made money in CA. LV, and AZ never lost a dime, almost lost my shirt investing in LO DO ( lower downtown), just got out from under the Coors field, every body wants to live there snow job like 300 days of sunshine, with 80 inches of precipitation (snow and rain) I ask the weather man how do you gets this without clouds and all this sunshine (?) he just laughed and said, you figured it out, chamber of commerce is very good in this town.

“Climatalogically speaking, what is the next best alternative to perfect CA weather?”

Eastern Washington. Beautiful sunny weather, very dry and very, very mild winters or no winters. No smog, clean air and no heavy traffic. It is also the new wine country.

@flyover

Amen. I think there’s a future there too. The best meal I had in 2012 was in Walla Walla at Whitehouse and Crawford. Cool historic downtown, great wine, mediterranean climate. CHEAP. Missing the ocean though. Still, pretty damned good. I live in a super high end part of coastal LA. Half of my friends who live here have little to no equity in their homes and are worried about expenses of modest vacations – all the while having MD and creative professional jobs – often 2 incomes. That’s a sucker bet. I rent so that I can pick up and leave when I want, live for 3 months in some place if I want.

But that’s what people in LA do. I used to wonder how the guy who was making $60k was driving around in a new BMW here. Oh yeah. Lease and credit card debt.

Flyover, don’t paint with such a broad brush, (E Wash,) Hackman could end up in Spokane, come winter he will hate you forever.

Reason I was considering Denver/Boulder is it’s a tech hub, as is Austin, SF, Boston, NYC…but most of those are not in consideration. If Walla Walla had a job mkt at all related to my industry I’d be interested..

Yes, it is a big difference between Spokane and Walla Walla weather. Even Richland, one hour away has a different climate than Walla Walla or Spokane.

Walla Walla doesn’t have high tech. It is ideal for College professors, doctors and nurses and entrepreneurs.

For those looking for a RE market that tanked hard, check out Ferguson, MO. Houses selling for dramatically less then last year with 90% of the market in pre-forclosure status. I wonder why?

I like living with my parents. I would not trade it for anything. Gringos just don’t get it.

Carlos…Good for you, love and cherish your parents when they are gone it is very hard, I know I lost mine rather early, I miss them everyday.

LA sucks…. LA is nice when the Santa Anna’s aren’t blowing down your trees, and when it rains it pours, and June overcast where it is very overcast clouds, fog, and very chilly.

In other words overall it is nice but nothing is perfect with mother nature. I live in a great climate with no natural disasters and wake up to to scenery that makes atheist rethink there is a God. My wife and I say everyday, we wonder about the masses who live in cities and suburbs of stucco boxes,traffic,crime high taxes, we are very blessed and very lucky to live in this envviroment

“The consensus among members of the policy-setting Federal Open Markets Committee — as it has been for months — is that rates will start to gradually move higher in mid-2015, according to the minutes.”

WHAT ELSE CAN I SAY KIDS I TOLD YOU IN 2015 RATES GO UP.

you got it backwards, the stock mkt is rallying because the possibility of rates going up sooner than mid-2015 is lower http://online.wsj.com/articles/u-s-stock-futures-edge-higher-after-selloff-1412771533

I have a question. In regards to investors buying up rental properties currently in CA–there is a big boom here currently, what makes housing prices surge? Is it because the demand for housing increases and rental property owners will naturally want to receive more return for their investment so they will raise the prices? Do I have that right?

If so, what makes the demand increase? Does an increase in supply automatically produce an increase in demand?

Leave a Reply