The constraints of rising home values: Housing affordability falls as home prices rise, interest rates spike, and household incomes show weak growth.

One of the consequences of rising home values is that housing affordability has once again fallen dramatically. This might not dampen the unrelenting pace of investor buying but it will certainly impact the typical American family looking to purchase a home. While typical households are feeling the impacts of higher rates and spiking prices through lower housing affordability, investors continue to buy up properties. The impact is dramatically seen in the drop of refinances and also, purchase mortgage applications. Keep in mind that each increase in home values not accompanied by a rise in household income means affordability falls for most Americans. The mainstream press simply assumes that everyone is participating in this housing rally. In reality, most have underestimated how much investor buying has occurred over the last few years. The housing market is actually hitting a few constraints as prices rise in the current.

Housing affordability plunges

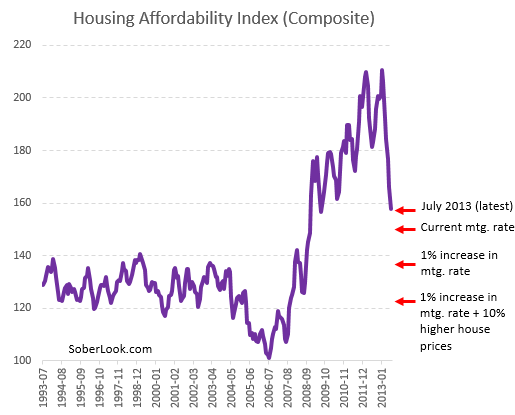

Housing affordability peaked in 2012 and has now been falling dramatically as home prices surge upwards:

This is an interesting chart if you consider the moves in the mortgage market. The housing market is heavily conditioned on low interest rates. Small increases of even one percent are enough to pummel housing affordability even lower. Since it is becoming apparent that wage growth is difficult to come by, the Fed has tried to juice up demand via low rates. It has inspired investors, there is little doubt about that, but what about the benefits for regular households? The above chart seems to suggest that housing affordability is simply falling as home prices surge courtesy of investor buying.

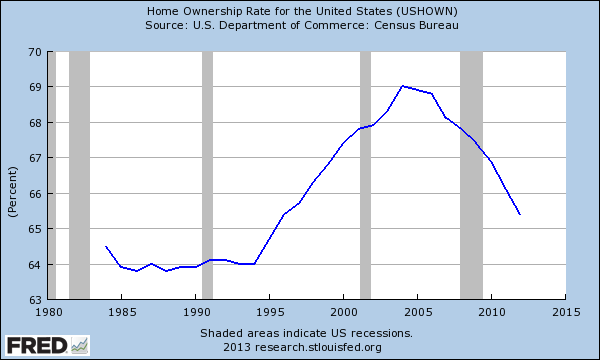

One obvious consequence of this constraint is seen though the massive drop in the homeownership rate:

The homeownership rate is now back to where it was in the mid-1990s. If we considered those in a negative equity position as well, the homeownership rate would be inching closer to generational lows. Does it matter that housing affordability is falling so quickly as home prices rise by the double-digits while income growth is nowhere to be found?

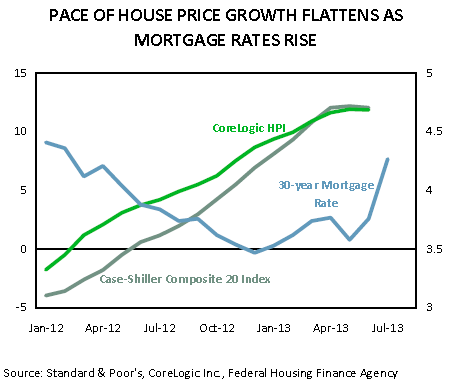

We are starting to see a slowing down in price increases as we reach the upper-bound of these constraints:

Since sales data usually lags 45 to 90 days as home sales close escrow, we are likely to see the impact of higher rates hit in the middle to late fall. Keep in mind with higher rates as well, many investors may be tempted to purchase safer bonds instead of trying to chase 3 to 4 percent yields in some real estate investment markets. Some investors are already showing signs that their investment may not be as lucrative as they once thought.

All of this adds evidence that the Fed is essentially rearranging the furniture in the same house. Most Americans are not benefitting from this real estate appreciation because most of the buying has gone to real estate investors. As incomes go stagnant in a globally hyper-competitive market place, rising prices in home values brought on by investors isn’t necessarily a good thing for most Americans. You want to see slowly rising home values accompanied by solid economic growth and wage growth. That has not happened. Artificially lowering interest rates via QE by ballooning the Fed balance sheet to over $3.5 trillion has been a big windfall to investors and is not exactly what you would call a “free market†system. It isn’t entirely clear that this has helped Americans and dropping housing affordability is not a positive. So the ultimate goal of artificially low rates was to transfer real estate assets from regular families to banks and hedge funds?

The affordability index takes a look at median home prices, median income, and current home rates. There are other factors to look at but it gives us a bottom line on how the housing market is playing out for most Americans. From the looks of it, it is an odd thing to say that rising values are not exactly a positive in how things are panning out.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

45 Responses to “The constraints of rising home values: Housing affordability falls as home prices rise, interest rates spike, and household incomes show weak growth.”

This is why homes are minimum 20% overvalued. 10% of it is from this mini-surge as of the last few months, and the other 10% is from artificially low manipulated interest rates. And to top it off, that 20% doesn’t even factor in when rates go back up toward the historical norm of 7%.

Interest rates have only one way to go — up. As affordability drops, prices will drop.

Of course, real estate agents will tell you now is the best time to buy (when isn’t the best time to buy?). Pop quiz: If you make a 10% down payment and it costs 5% to sell the house after prices remain flat, how much money did you make? Oh, you lost 50% of your equity. If you make a 10% down payment and it costs 5% to sell the house and prices drop 5%, how much money did you make? Ooops, you just got cleaned out again.

Don’t be left holding the bag after the big hedge funds pushed prices up by buying up the inventory. I’ve been a happy home-owner in the past, but who wants to play in this rigged system. Let’s go back to a free market economy. In that event, prices would crash and the market would re-set, just like you read about in economics class.

Agreed, the Fed seems to now realize they are creating asset bubbles, and asset bubbles are far more destructive to the economy than inflation or deflation. Once tapering starts, and starts to impact not only rates, but other asset bubbles like the stock market, there will be spill over effects on housing.

There are other factors that affect home prices than interest rates. In recent times, falling interest rates coincided with falling housing prices.

Recently, interest rates bottomed at 3.31% in Nov 2012.

The C/S index on Nov 2012 for LA was at 175.

Today, interest rates are at 4.57%.

If interest rates were directly correlated to home prices, you’d expect C/S to give you a home price index of about 150.

Instead, we have a C/S index at 200.

C/S is a bit of a lagging indicator since it aggregates 3 months, and the affect of interest rates lags as well since it takes time to close escrows.

However, I think the basic premise is that there’s A LOT more to a home price than interest rates. Interest rates DO affect home prices, but are only one of many many factors.

How about this for a shocker:

Los Angeles’ housing affordability* in 2012 was the LOWEST in the last 20 years by a wide wide margin.

*Inflation adjusted monthly mortgage payment assuming 20% down.

http://www.jchs.harvard.edu/sites/jchs.harvard.edu/files/son2013_appendix_tables.xlsx

(Page W-4)

DG1: that explanation is oversimplified and as such is simply not accurate. If the person wasn’t paying their mortgage, they would have been paying rent, yes? I lived in a rental for 1.5 years and spent $50k over those 18 months. I’m not getting that back either… We haven’t factored in taxes nor the opportunity cost of the down payment money either.

MB, people leveraging themselves to the hilt is a new concept. And income is stagnant. I don’t believe historical data applies this time.

Jeff, if you want to compare rent-paying with mortgage-paying, remember, you’re not getting back all that interest you’re paying either. If you have to sell a house in a flat market, you’re better off renting because in a flat market you’re going to take a significant loss of equity after paying broker commissions (-5%) and other closing costs (-1%).

@MB, thank you for reaffirming that housing was VERY affordable in 2011/2012, the best since the 1990s. So many people were hoping for 1990s nominal pricing, but they missed the fact that the inflation adjusted monthly payment made buying a no brainer. 30 year interest rates in the low 3% range were an absolute gift.

@PapaNow, incomes for the top 10 to 20% are NOT stagnant. And Californians have always used much more leverage than their middle America counterparts. The boom/bust cycles will always be part of CA RE.

Home ownership rates peaked in 2004 at around 69.5%. At 65% today, they have headed south ever since and continue to fall. The “gift” of historically low mortgage rates did not affect this decline. Interest rates are now 50% higher and moving north. In short, all that quantitative easing has done is blow a couple of bubbles in the mist of a worldwide depression. This is especially true for California real estate. Maybe one of the realtors on this blog can explain how house prices will move up when interest rates are taking off AND wages continue to fall. California definitely is la-la land for real estate. Anyone who plays the game without considerable wealth and a very secure, large income stream is out their minds. Of course, this eliminates about 95% of the population. One additional point, along with home ownership rates, labor participation rates are another statistic the government cannot lie about, at least not easily. Take a good, hard look at that number.

@ Lord Blankfein

Your “wealthy” 10% to 20% are not exactly eligible by income to buy anything high-end in California. The average California family income for the top 10% is around $180,000 and has fallen in real terms almost 10% in the last five years. The top 25% income is around $115,000. The article below does an excellent analysis up to 2010 for California wage “growth” and distribution. The 2012 census has the latest figures.

http://www.ppic.org/content/pubs/report/R_1211SBR.pdf

Fulano:

According to your link, from peak to trough (2007-2010), real median income in CA has fallen 10.7% and at the 90th percentile it has fallen 5%. That sounds about right, it was truly a “great recession”

However, in that same time frame, inflation adjusted C/S in Los Angeles has fallen about 40%.

Couple that is exceptionally low interest rates is why affordability has increased so dramatically and explains why 2011 was the most affordable LA homes have been in decades.

Look at Dr. HB’s graph above. According to him, it would take another 10% price hike plus interest rates @ 5.5% to equal affordability of the 1990s.

I’d be interested in the change of income for the 80%+ from 2011 – present.

I’d also be interested in the change of WEALTH for the 80+% from 2011 – present.

What do you expect those numbers would show?

@ Fulano, read MB’s reply. The top 10 to 20% are doing just fine here. They certainly won’t be buying in Malibu, but they will be buying is what most considerable desirable parts of town. As I have preached many times, if you had your act together (20% plus down, great credit, stable income), you were rewarded by buying in 2011/2012 with the super low rates. Affordability based on monthly payment was at a low not seen in decades.

And don’t forget most of the top 10 to 20% already own houses and have boatloads of equity. You probably taking the extreme case, young person gets nice salary starting off. Pay your dues, get a cheap rental and start saving for the next 5 years just like back in the old days.

The current system works only because everyone says it works. The underlying

world economic picture is like a rock, balanced very carefully on another rock.

When some event comes,(Greece defaulting, Iran firing on Navy ships as retaliation for U.S. missle bombardment, spike in oil prices,etc.), this system will crash within weeks. Housing affordability will be the least of our concerns.

The U.S. will be back in full recession.

So two government objectives rising home ownership rate and home affordability as at odds at how we are supposed to “recover” from the great recession-through Fed induced low interest rates that cause home prices to rise!

With household incomes stagnant or decreasing, and interest rates rising…only 2 gimmicky ways to juice housing affordability imo:

1) Loosen lending standards: The banks resuscitate the liar loans, ninja loans, and 90% cash out HELOCs

2) Artificially lower rates once again: The Fed decides to not taper, and continues (or increases) its $85B per month buying spree

Will one of these two things happen? I doubt it, but nothing surprises me anymore.

And 1 non-gimmicky way to increase housing affordability…let the market determine prices instead of central banks (i.e. let prices fall)

TJ,

I think if you ponder #2 and look back at the last 5 years it will become clear exactly what the FED will do.

#1 is well under way. The new QRM rule if implemented allows homebuyers to qualify for loans with zero down and 43% DTI.

No money down, and 43% DTI. Anyone that can fog a mirror can “buy” a home again. We’re being played, folks.

http://www.cbsnews.com/8301-505145_162-57600462/government-relaxes-mortgage-down-payment-rules/

I would add #3 – continue to inflate other asset bubbles (i.e. equities) and hope for spill over effects into the housing market.

In certain high end areas (i.e. the coasts), that is driving a lot of the buying – stock market wealth and/or boomer’s newly revived retirement accounts. Now that the bubble levels have been re-attained, some are taking money off the table and putting it into real estate.

However, as mentioned above, I think the Fed is rightfully getting wary of the asset bubbles they are creating. When they stop supporting them, look out below.

The question at the end of the second-to-last paragraph puzzles me: “So the ultimate goal of artificially low rates was to transfer real estate assets from regular families to banks and hedge funds?”

Can anyone explain why a large bank or a hedge fund would want to keep real estate on their balance sheet? If it is not back on the market collecting interest on the debt, what would be their interest if they were in fact doing this?

Power grab. He who has the money, has the power.

They are genius, they gave bad loans that people took hook line and sinker, got bailed out by the same people’s tax dollars, and now they own the people’s homes. But watch out, Barry O said it’s bad to say the Founding Fathers were right about banks being evil.

Probably not a goal, but rather the unintended consequence of rates below inflation and overpriced real assets.

The hedge fund and banks shouldn’t want what will end up being toxic on the asset side of the balance sheet.

Matt,

I think much of the investment buys have come from hedge funds looking for return. They have billions of dollars that need to be invested in something and the choice, until recently, was 1.5% on a treasury bond or a possible 3-4% return on rent. In my mind, many of these fund managers could not tell their clients that they were just going to sit on cash or buy treasury bonds yielding 1.5%. They had to search for better yield to make it look like they were doing something for their client’s money at the time (although I think these funds will lose a lot of money for said clients). That said, treasury bonds are now yielding around 3%.

Correct, the Blackstone’s of the world need to invest in something to justify their 2/20 fees, and they have been scrambling for places to put their money. It all comes down to excess liquidity – the banks, financial elite, sovereign wealth funds, etc have tons of excess cash to invest, they give it to the likes of Blackstone, and they have to find places to put it.

My guess is these guys are going to figure out being a landlord is a crappy business, they will see better returns elsewhere, and start to realize their capital gains. If you figure they have 20-30% appreciation in their houses, they will be happy to take those returns, or even if prices fall by 10-15%, take low-double-digit returns, they aren’t that picky. I give them a year to start turning to net sellers.

@Matt, Gordon is right on this.

Current real estate investments are yielding +3%. When the 10 year treasury hits 3.5% this will cause the first exodus out of real estate as this means that the 30 year mortgage interest rates will be moving into the 5.5% range. As interest rates go up, real estate selling prices will go down. Hedge funds and all cash investors are fairly liquid so they will start dumping their real estate holdings when this happens.

A hedge on hyperinflation.

Rental income. Also, selling you something you need to finance and they didn’t.

Banks and Hedge Funds have completely different motivations.

1) For banks, they generally already own the impaired debt. They have been allowed extended time to deal with the bad debts so as not to flood the market with homes and drive prices down. Their motivations are to improve recovery value on bad debt (lose less) through whatever means is available as well as take what losses do come very gradually as these “excess reserves” and equity capital are predicated often on a full recovery of the debt (fudged accounting) which is absolutely not going to happen.

2) Hedge Funds aren’t really buying this but funds have been created in an illiquid private partnership structure to buy up houses and then rent them. These investors have gotten access to VERY cheap financing and lucrative terms. Their hope has been to buy properties which can be managed to positive cash flow over the coming years (like a bond) while servicing and paying down the debt to create positive equity and eventually sell to realize equity and a potential profit.

The net result is that the sellers (banks/financials) and non-traditional buyers are helping to keep inventories very low and drive prices up alongside all the other measures being taken (historically low rates, FHA/agency mortgage maximums extended and balance sheets lit on fire).

In any other economic environment you add all this up and housing would be up massively nationwide (think >50% in a couple years). Problem is that if income doesn’t follow you are left with inflated values once again. You may tell everyone you can fly and some may even believe you but whether you have a red cape or not, someday you are going to have to be tested against gravity (real market fundamentals) and it was that gravity which blew this up the first time.

You’re right.

Incomes stagnant; jobs created primarily low wage. People who believe SoCal is filled w/people making $200K+ a year in solid jobs who will continue bidding up million dollar 50’s ranch fixers remind me of folks on Hollywood tour buses thinking they’re going see lots of celebrities. Except for areas like Malibu, Beverly Hills, etc. infused with hot entertainment/foreign money, reality is most of SoCal’s nicer neighborhoods are filled with residents aged 50+, bought decades ago, couldn’t afford to buy/live there at today’s prices…they’re retired/pension/same job for years/never retire, etc. When they “transition” the house will likely pass to their middle class kids who probably couldn’t afford to buy in that neighborhood either. SoCal demographic reality? Rapidly expanding working poor, low/no income, struggling middle class w/little job security, young people with low paying jobs owing thousands on student loans. Unless wacky loans return, who will continue to buy? Rich foreigners w/cash, parents buying a house for adult kid, hedge funds making investments? Hmmm…

Nice to-the-point- 2 minute video on the real cost of a mortgage… reminded me that my mortgage is not only a financial commitment but also a lifestyle commitment.

Enjoy

http://www.youtube.com/watch?v=vHImoGaBD58

Ah, welcome to the new sharecropper society, Comrade.

You can buy a house so long as you please the “collective”

You will be living with 2 other families carefully selected for compatibility.

Don’t want to buy, just rent? We will assign you an apartment Please keep in mind that not every one gets to live in the city that they want to. Please have your NSA clearance papers on the ready.

Bad news for short sellers in California who now must pay taxes on money they never received…

http://www.car.org/newsstand/newsreleases/2013releases/sb30gatto?view=Standard

Rent parity is driving the sales. Not the interest rate. But there will be a point at which the interest rates will start to really kill the sales and then the prices will adjust.

Slow motion train wreck. All the signs are there. Caveat Emptor (buyer beware). Usually the first and last thing learned in real estate. The bust is happening again for those who CHOOSE to see it. Don’t blame anyone but yourself.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Those two “blogs” you post:

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Look to be phony blogs, owned by the same person, with the ulterior motive of hawking gold and silver.

Those two “blogs” have very few posts, similar “content,” and links to buying gold and silver.

Oh, wait. Do those two blogs belong to you?

You’re not spamming, are you?

If you want to comment to the six entities taking comments about the new proposal that the Qualified Residential Mortgage Rule be changed to allow for less than 20% down, thus keeping housing prices unnecessarily high for banksters, you can find who and how to contact here:

http://www.sensiblehousingpolicy.org/uploads/Coalition_for_Sensible_Housing_Policy_-_QRM_White_Paper.pdf

plus read some of the arguments being given

100% financing just allows people to strategically default when the price drops and they save up money while squatting. Even a 5-10% down payment probably helps to deter this behavior because the “savings” from defaulting are less likely to be more than the down payment. QRM appears to open the door to 100% financing again ?

Another signal that we are nearing the peak or have peaked? Sure starting to feel like 2006 all over again.

News Item:

Citigroup (C) plans to lay off an estimated 2,200 workers within its mortgage business by early next year, as rising mortgage rates have hurt mortgage lending and refinancing, executives at the bank tell FOX Business.

The layoffs could come at mortgage units across the country, Citi sources said, adding the bank is closing in on deciding on a final number.

Freddie Mac reports the average for a 30-year fixed-rate home loan is now over 4.6%, versus less than 3.5% before the summer. [The sudden, sharp rise in mortgage rates has caused a drop in consumer demand], and is helping to push bank workers out the door as bank executives fear mortgage lending will continue to dry up.

Read more: http://www.foxbusiness.com/government/2013/09/11/citi-mulls-laying-off-2200-in-mortgage-unit/#ixzz2ee8rrptO

>>Sep 9 2013, 9:33AM

The Mortgage Bankers Association (MBA) reported the first drop in its new Mortgage Credit Availability Index (MCAI) since it became publicly available in June. The index for August decreased 0.7 percent to 11.5, the first decline after four consecutive months of increases. Negative movement in the index signifies that lending standards are tightening.<<

Full story = http://www.mortgagenewsdaily.com/09092013_mba_mcai.asp

Dr. Housing Bubble (and others),

Hi, I’m a long-term reader/lurker, but first time poster. I really enjoy your research and your analysis, and I also like the quality of the group of posters here!

You might have covered this, but how does the ever-tightening standards on the home loans (i.e. increased FHA PMI payments now in effect) and now the possible lowering of the Fannie/Freddie loan caps play into this higher interest rate dynamic?

Do you see an exacerbated move downward? There was just a story on CNBC about reducing the government backed loans and shifting people over to more costly private market loans. I my mind, this will only enhance the coming down swing. Not only are homes overpriced relative to stagnant wages, but now interest rates are rising and the availability of mortgage credit is drying up.

I suppose if this investor/all cash frenzy continues unabated for another quarter or so, this might delay the inevitable, but I simply don’t see (as you have stated repeatedly) how homes can remain inflated with stagnant and/or decreasing wage base.

Thanks in advance for your thoughts and those of your other posters!

A 1.25% increase in interest rates to 4.5% is only significant in an artificial and highly subsidized housing market. For decades the rate on mortgages was around 6.5%.

Housing supply/demand is unlikely to stabilize until interest rates reflect the true market cost of funds. Without the ongoing FED intervention in rates, today’s housing prices would be more representative of current income levels and economic conditions.

It looks like we may be renting for quite a while. We’ve been renting a house in the hills of Studio City for 2 years, and the market around us has gone up so much that, if we were to put 20% down and buy the house we’re renting, our monthly payment would easily be $1000 more than our rent, and our landlord has yet to raise our rent since we moved in. Plus, she remodeled the place before we moved in, too. Our next door neighbors put their 1630 sq. ft. house on the market for $1.2million. I hasn’t sold, but wow, this is crazy.

G, does your calculation of paying $1000 more per month owning vs. renting include:

1. Paying down principal

2. The various tax breaks you get from owning

If it does, continue renting. If it doesn’t, call your agent…it is time to buy!

Leave a Reply to PapaNow