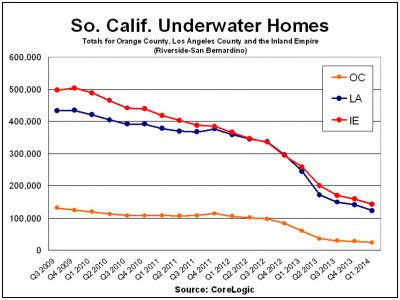

Underwater in Southern California and trend reversals: 10 percent of SoCal homeowners remain underwater despite recent increase in home prices.

You would think that the recent rise in home prices across Southern California would be enough to bring most homeowners into a positive equity position. However, we still have 1 out of 10 homeowners in a negative equity position. The total number of homes underwater in SoCal is estimated to be at 288,000 according to CoreLogic. This is a far cry from the 1.1 million underwater homes going back to 2009. Since that time many foreclosures have occurred and many homes have now shifted into the hands of investors. 288,000 is a large number of homes especially in a market with limited inventory. Now that we are entering into the slower fall selling season, you will likely see inventory pullback and buying demand slow down. Investor demand has pulled back dramatically already. Buying a home is a big deal and running the numbers on a crap shack is important in making sure you are seeing the bigger picture. There still seems to be this amnesia as to what happened only a few years ago. Millions of homeowners lost out in the supposedly safe investment vehicle of housing. Why? Because they took on too much debt and paid too much for a property. As prices soared in the last year, we are starting to see a deeper questioning of current values now that investors are pulling back and foreclosure resales make up a small portion of the market. Regular buyers did not push this market up. It was investors. Many regular households have been pushed into renting.

Trend shift

If we look at a housing market and define “health†via foreclosures, the current market appears to be reaching a new balance. Yet these trend shifts can be deceptive. Keep in mind that in 2007 foreclosure volume was still weak and year-over-year price increases still looked spectacular. Things turn around slowly in housing. Things are good until they aren’t.

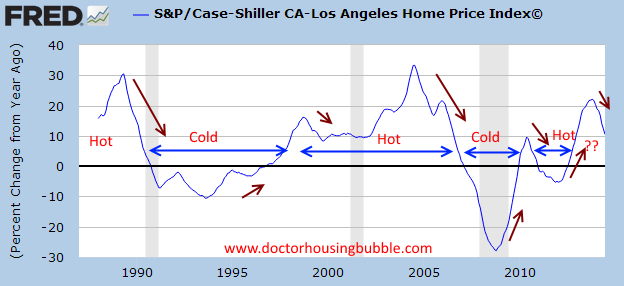

California has been boom and bust for a generation. Take a look at price increases for the LA and OC metro areas:

This is a boom and bust model. Ideally what you would see is a steady year-over-year increase tracking inflation versus these massive peaks and valleys. You can already see that year-over-year increases are reversing and slowing down. Will prices dip? If they do, you will have the same circuitous process that happened in the early 1990s and the bust of the latest housing bubble.

The argument that hits in SoCal is that home prices only go up. That is clearly not the case as the chart above highlights. Also, we still have a large number of current homeowners that owe more on their property than it is currently worth:

It is hard to believe that only in 2009, we had 1.1 million underwater homeowners in SoCal alone. That number has fallen dramatically. Why? Because we had a ton of foreclosures and short sales! In other words people got massively burned in an area that is supposedly immune to all sorts of economic cycles. So much for prices only going up. Keep in mind that many areas are now seeing home prices reaching levels that are very close to the peak that brought down the market the last time. You can take a look at a few of the crap shacks and see if you are willing to make a bid.

What we are seeing in the market today is the following:

-Buyers reluctant to pay current prices

-Some sellers pulling properties off market because of seasonal factors

-Foreclosures making up a small portion of resales

California real estate seems to be destined to booms and busts. We just had a boom. Why are we to expect that for the first time in a generation, that suddenly, people are going to prudent and manage their finances wisely? To the contrary, people will live paycheck to paycheck in good times and in bad times. It is the California way. I continue to be amazed by baby boomers scratching to get by yet live in a million dollar sarcophagus. Given that 2.3 million adults now live with their parents, it does make sense however. Many are tied down with kids that simply cannot buy (or even rent) a property in the current market. So when the next economic hiccup will hit, it will expose those living paycheck to paycheck once again and the amnesia will repeat again. Many Californians have most of their net worth in their home. Yet a home does not throw off income (a rental does and that is the view many investors have taken). In fact, a home even with a paid off mortgage will require taxes, insurance, and maintenance each and every year. The purpose of retirement planning is to have income being sent your way, not out of your checking account. People seem to forget that you need to sell to unlock that equity. Many today cannot because they are underwater, even with a manic 2013.

Some seem to be surprised that the summer was so weak and now we are entering the slower fall season. What do you expect when household fundamentals are simply not improving and the big player investors are now pulling back? Then again, people love being in debt and spending every penny they got. The aspiration for many is to have a granite countertop sarcophagus so they can share Purina Dog Chow with their kids in their 30s and 40s since they are having a tough time affording in this market.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

88 Responses to “Underwater in Southern California and trend reversals: 10 percent of SoCal homeowners remain underwater despite recent increase in home prices.”

Housing market in SoCal reminds me of that one episode of Twilight zone. Seems like everyone else insanity is the norm and if you happen to be the one that digs deep into the data and see all the cracks and stay away, you start to question your own sanity and be ever so tempted to become another lemming in the “buy now..before it’s too late” train just to feel normal. I see this from couple of my friends, one just sold a house and profited couple hundred grand and yet eager to upgrade to a bigger and grander house, so much so he has to sell some of his toys just to come up with the money for the new place. Gotta keep up with the Jones I guess..I just hope that by thinking clearly I will come out on top with the last laugh when this market is upside down again

it’s fun to be on the upside of a bubble, but eventually it crashes

I have been checking out the real estate web sits, specifically So Cal and I have noticed a GINORMOUS amount of foreclosures. At least 95% of the postings are foreclosures (not short sales) The funny thing is I hear no word from the media on the foreclosure problem. My guess is that the real estate lobbyists are buying their way out and may be begging them not to tell the truth on market conditions lest they lose any hope for the “Big pie in the sky payoff” Should it be relayed to the public there goes their goes the start of reduced or no commissions .Last time it was in the news prices were just staring to lower and property taxes had to reconfigured to a lower taxation. Maybe the government does not want word to get out or they will have their money lowered because of lower accessed property value. All I know is that it is mighty fishy!

As usual, the ball is in the Fed’s court. If they continue to wind down QE3, ponzi will crash. If they start QE4, ponzi will continue. It is that simple.

What is not so simple is trying to predict what the Feds actions will be. But based on their track record thus far, I’d say that once asset prices begin to roll over, the Fed will do the exact same thing they did towards the end of QE1 and QE2…keep the ponzi going.

One correction, the FED has never tapered in the first place. Nobody has ever edited the FED, so nobody really knows what their balance shit looks like and how much they are actually buying. We just have to believe whatever comes out of Fellon Yelen mouth.

“One correction, the FED has never tapered in the first place.”

Wrong, the Fed was buying $85B per month of “assets” at the beginning of the year, now they are buying $25B per month. That is called tapering. As for the rest of your comment (nobody has ever “edited” the Fed “balance shit”), it is true, nobody has audited the balance sheet.

For QE, the Federal Reserve pushed a button and “printed” 4 trillion dollars out of thin air. The Federal Reserve can do a reverse QE and make this 4 trillion dollars disappear. QE money printing is backed by nothing except thin air and faith in a fiat currency.

“For QE, the Federal Reserve pushed a button and “printed†4 trillion dollars out of thin air. The Federal Reserve can do a reverse QE and make this 4 trillion dollars disappear. QE money printing is backed by nothing except thin air and faith in a fiat currency.”

Thanks Captain Obvious.

Underwater especially grossly is a major concern throughout the country. I look at proprieties closed and find out many lost a lot of money because of 05′, 06′ hysteria.

English is your second language right “little r”??? Because if not… Sheesh 🙁

little “r” is channeling his inner Yoda.

Sicilian is his first… :-p

Why LA Real Estate is TANKING:

http://la.curbed.com/archives/2014/09/every_single_part_of_la_is_unaffordable_on_1325_an_hour.php

Every Single Part of LA is Unaffordable on $13.25 an Hour? Really? How about Every Single Part of LA is Unaffordable on $50 an Hour. How many households in LA can afford to buy a house on $100K a year salary? $100K a year here, in Seattle, won’t buy anything decent either, but we, supposedly, have lower housing prices than SoCal… BTW, my household income is way above $100K a year, so I know what I am talking about…

Updates on the crap shacks referred to in the article (by clicking to link to another article)

Crap shack Pasadena – did not sell

Crap shack Culver City – sold for 910K

Crap shack Torrance – still for sale

I think we are seeing a housing bubble (rapid price increases and housing prices divorced from value) but a different one from the pre-crash.

In the previous bubble, people were buying homes they couldn’t afford, even on their current paychecks, with liar loans, ARMs, interest-only, 0-downpayment, etc. When the crash came, not only did their homes lose value but many of them lost jobs.

This bubble, if it is a bubble, is different. At least in the Bay Area. In our area, according to Redfin, the average downpayment is 40%, the median house is $1M.

So, let’s say a Googler puts $400K in cash down on a million-dollar, 3/2 home. She gets a mortgage for $600K. And, let’s say, she puts $50K into improvements (painting, flooring, earthquake retrofitting, whatever) so the house is in really good shape. This is not an unreasonable scenario, given the houses we’ve looked at.

And let’s say the housing market crashes next year. Unless the value of her new home drops below $600K, her mortgage won’t be underwater. No, it won’t be worth what she paid for it (1 million) but the mortgage won’t be underwater.

What are her expenses? Utilities, insurance, taxes, mortgage payments of about 4.2% – all of which probably will not total more, or much more, than the rent & utilities in this area for an equivalent apartment (let alone the equivalent home for which rents are generally much higher). [A 3/2 apartment or house in the same general neighborhood as that 1M house can rent for anywhere from about $50K – $80K/yr.]

As long as she doesn’t have to move, as long as she can pay the equivalent of “rent”, she really doesn’t have to worry about the crash. Since she made sure the house was in good shape when she bought, it is unlikely that she will be faced with any insurmountable unexpected costs in the next 10 years (at which time new roofing or painting might be needed). And since housing prices have rebounded to pre-crash levels in about 6 years since the last crash, that 5-10 years to recoup her housing costs is not unreasonable.

So, yes, from my perspective this is a bubble. That million-dollar house she bought is not, to my mind, worth a million. But she liked it enough, for whatever reason, to pay that much and while she could still find herself in trouble in another crash if she lost her job and were unemployed for a year or more, she is most definitely not in the same position as that of the liar-loan buyer during the last bubble.

All of which does not bode well for potential home buyers who do not earn Google-level salaries.

I agree with your analysis. I bought in 2011, did a few basic upgrades and now I’m paying what I would be paying in rent. Zillow says my house has increased by 25% but to me it’s just a paper number. I assume the market will have its up and downs but I’d be very surprised if, after my mortgage is paid off, my house isn’t worth at least what I paid for it.

The problem with this theory is that you assume the economy remains stable and that she does not lose her job. Most people do not willingly default on their mortgages, they are forced to do so by job loss. And when housing crashes it takes the economy with it. Huge swathes of people become unemployed which leads to even more foreclosures resulting in even more price declines – it’s like an avalanche that can’t be stopped.

And when the economy crashes little again, what happens when Ms Google gets downsized? How is she going to make the monthly nut on a 600k mortgage working at Starbucks?

You do realize we not only have another housing bubble, we also have another stock market bubble. Especially in tech stocks where the valuations based on future fairytale like earnings have once again become absurd.

You can thank the Fed for all of this.

“Most people do not willingly default on their mortgages”

this is California bro and during the last bubble I’d say that 80% of the people i talked to about RE prices crashing didn’t care because they would just “walk away”. i personally know a couple that lived in their house without making a payment for 48 months and somehow the property taxes kept getting paid.

Yup, but the difference, with paying the same amount for rent, the Googler could’ve kept $400K and buy the same home at $600K and have $200K mortgage or even better, with fallen home prices so will do the rents, so the Googler will probably end up paying less in rents and she still has her $400K DP…

When is the last time falling housing prices coincided with falling rents? How far did rents fall in the ’07 bubble?

Totally agree, that’s why I just bought my first house. A couple things became evident to me:

1. Rents are sky rocketing, and with low interest rates, payments are the same excluding the property taxes which are tax deductible along with interest.

2. The FED is never going to let the market crash again. Everyone thinks,”oh I can’t wait for the next crash to buy my dream house for nothing” but they can postpone reality for much longer than one thinks. I bet interest rates go negative before this whole thing is over, which could take 20 years.

3. People spent the last 5 years hoarding money or having family hoard money that are more than willing to loan them their mortgage for 3% because money is earning nothing.

4. If the FED ever loses control of the currency, at least you have a big hard asset.

5. As they said in “Wall Street”, time is your biggest commodity and renting steals the joys of home ownership and having something to call yours.

6. The market is zombiefied with low interest rates, people got, in or refied, and got a low cost of living. In other words, no one will be incentivized to sell even if it goes down hard, because owning is now the same as renting. Unless rents start falling…but that won’t happen with so much immigration.

Anyhow, renting vs. owning is a very personal and situational choice. It will make sense for some and not for others. But I got news for all the crash guys, it may go sideways for 10 years or slightly up/down, but won’t crash, at least not the way you think. In the meantime your just wasting your time and money renting (assuming you have the ability to buy).

BTW, this is all coming from a guy who has been NEGATIVE on housing for a while.

The Fed cannot control a crash. When the market gets too slippery too fast, they lose grip. Remember, the FEDs were the same people who didn’t have a grasp of what was really happening (or they intentionally engineered it) and the markets spun out of control in 2008. Never ever think this won’t happen again.

Rob, I agree with most of your points, but you seem to be capitulating (which many people did in 2003-2007.) When former bears turn into bulls, that is historically a sign of a top forming. However, we are at the mercy of the Fed at this point, they are the market, nothing else matters. Anyone can make a case for housing to go up or down from here. But ultimately, the Fed will decide based on THEIR interpretation of THEIR metrics to inflate or deflate.

If their metrics show inflation, they will continue tapering, if their metrics show deflation, they will “untaper.”

Rob, 100% agree with you, and am exactly in the same boat. I was negative on housing for a long time as well. When it started making economic sense to buy and we started really wanting better quality of life than the condo we were renting, we started looking, got super frustrated with what was out there and the crazy behavior by our competition (the “best and final offer” was a total mind-F!), then gave up and looked at renting houses. We actually ended up buying off-market one of the houses we looked to rent. The rent price offered was actually exactly the same what we’re paying in mortgage + tax + interest (with a 20% down payment, which was either going to sit in the stock market – also over-inflated – or… what, really?), and at my tax rate/income level, we get a significant write-off. Even if values “tank” and we go back to what the previous owner paid for our house in 2010, it’s still more than our mortgage right now. When I thought about the outflow in rent even if we stay in the house just two years and compared that to a potential loss if we were forced to sell even with a 20% downturn (though we’re in an area that sustained its values during the last downturn anyway), it actually doesn’t seem that bad.

lost of ‘ifs’ in that post and i find it interesting that you left out the biggest of them all.

EARTHQUAKE!!! we are so overdue it’s going to be a really big one, then what?

Yup, EARTHQUAKE. I’m a worry wart. I worry about The Big One too. But I also worry about DROUGHT and HYPER-INFLATION.

Actually, I am pretty concerned about our next asteroid hit! When was the last time a large asteroid hit the earth?

Right, but the pricing increase has mainly come from the huge # of startup employees rushing into the Bay Area. VC money ultimately comes from the big NY banks in the form or syndicated corporate loans. A $300 million loan from them is huge for the VC’s, but a rounding error for the banks. The rise in startups is partly due to the fact that these big banks need a place to park their money in a low interest rate environment. This a lot of these smaller startups viable as investment opportunities when in higher rate environments, they would not be. When cost of capital is above 10%, how many startups would there be?

Coupled with the above, in a low interest rate environment, housing prices increase. The fundamentals may be there for a small % of Bay Area workers, but for the vast majority in an area of over 7 million, it doesn’t make sense. The entire area housing market is highly coupled to interest rate changes. In the event of even a small change, you’d get a double whammy of housing price falling with higher unemployment in high wage sectors.

Housing To Tank Hard in 2014!!

I thought we agreed it’s going to be “Housing IS Tanking Hard in 2014” JT??? You gotta admit it’s a lot more fun speaking in the language of Realtards LOL! Everything is a certainty and must be stated with conviction 🙂

Anyway the current tank in sales volume is EPIC. Last time sales were this bad there were hundreds of thousands less people and we were in an honest recession without an illusionary stock market pumping confidence. Them numbers don’t lie…

i was a kid in the mid 90’s in SoCal. Despite the recession it wasn’t that bad. Housing was affordable and if you had a job your wages went a long way. Most of those I know who lived through it would take the late 70’s stagflation over today. Of course most of the people I know actually work for a living as opposed to feeding off the ponzi.

“i”…. yes you are the pot calling the kettle Mr. Zero?

Capitalization and grammar are two different things “Little r” 😉

So this black pot is calling you a pink kettle, so to speak… However typing on my phone may impact my accuracy that does not quite compare vis-a-vis to your lack of proper grammar. That being said, if you are new to this country it’s a forgivable sin. Your total lack of understanding in regards to markets and macro economics is far more egregious.

Jim Taylor seems like he’s been consistent. Even though he hasn’t defined “tank” or “housing” I think it’s safe to assume he means median housing prices rather than sales volume.

Sales volume is about what it was before the 2000s run-up and inventory is still a little less than 6 months which is still less than ‘normal’

Jim, 2014 is 67% in the past. Yet I see no “hard” tank, just a plateauing. Some homes with price cuts, but others being bid up.

Those price cuts don’t indicate an incipient crash. More likely, the sellers mistakenly thought that prices would keep rising, so they were asking unrealistically high amounts.

“just a plateauing”

that one always makes me giggle, just like it did when it was said in 2006

Housing NOT To Tank Hard in 2014!!

You’re welcome, @Jim 😉

Actually, what we have been through in the last 6 years, WAS the “Big Tank”. This was a once in a generation thing, it will occur again, but not for a while.

Actually Paul, it was a bubble pop interrupted. So, we are still in the 2002-2006 bubble, just waiting for it to reset.

@Paul A, I’ll agree with @ak on this one. The Federal Reserve did not allow a natural market correction to occur. What we have instead is a variation of a Fibonacci sequence. Ponzi schemes and market bubbles resembles a Fibonacci series, and this is what we have here.

“There still seems to be this amnesia as to what happened only a few years ago.”

Lol, I’ll say. Case in point, there are several tall buildings in Warner Center. The tallest of which had an AIG sign taking up the top three stories, and beckoning to the world of its greatness.

But in the aftermath of their monstrous bailout, their name became shit, an embarrassment to the industry, and the AIG sign came down and stayed down for about four years.

But they knew, like the above sentence, that there is indeed amnesia as to what happened a few years ago. The AIG sign has been back up for the last few years, once again taking up the top three stories. They (the brains at AIG) must have calculated the attention span of the public to be about four years, judging by their actions.

Now, it’s as if nothing had ever happened. AIG? Yeah, I remember them vaguely, something about …. Oh,.. I forgot…

I don’t care about baby boomers. Why so much concern for a group of people that have reaped all the benefits and suffered none of the consequences? Last time I checked you don’t have a lot of boomers complaining while eating Purina Dog Chow on this blog. Boomers eating dog chow is a choice…they have equity, they can sell and move to retirement friendly communities and live out their golden years in style. Its hard to feel sorry for anyone who has choices but complains non the less. Boomers figure out if you want to afford it or not but please stop feeding us dog chow sob stories. Living in California is a choice not a god given right.

California is a luxury item that is not easily afforded by many. It’s an exclusive club. Many will over extend themselves just to fit in.

Renters and homeowners that spend more than a third of their paycheck on living expenses are overextending themselves, it does not matter the size of your paycheck. I find many who rent still pay more than they should. Who cares if you rent or own if all your money is going towards renting or a mortgage. Let’s face it too many people live here who can’t afford it.

I’m a 37 year old with a wife and one child, and I completely agree. Our rent is just under 30% of my income, and it’s not as if I’m living on the ocean and rubbing shoulders with celebrities in my day to day life. We live in the valley, and we don’t even like warm weather! Now that I can run my business from anywhere, we’re counting the days to get out of here. I’ve lived here 15 years, my wife is an L.A. native, and we’ve had enough.

+1 @Christie S

California, exclusive? Explain how so? Weather yes, anything else?

That’s the point. Those of us that don’t live in the exclusive areas of L.A. are still paying premium to live in a place that falls short of many other lesser priced areas of the country.

Christie S: “California is a luxury item that is not easily afforded by many. It’s an exclusive club. Many will over extend themselves just to fit in.”

Well, Malibu and Bel Air, Brentwood and the Palisades, yeah, those are luxury items.

But much of L.A. County is a sun-parched stretch of crapshacks with bars on the windows and gang-graffitied strip malls.

And the Inland Empire is like living in the Nevada/Arizona deserts, but at twice the cost.

California, even the crappy areas are out of reach of the average worker. Exclusive does not mean high end. I was speaking to the affordability. An exclusive club, where people will spend more than they should to live in a crap hole or a mansion.

My trash tv for tonight was “Million dollar listing Los Angeles”. OMG more like the comedy channel.

Poor young sucker FRETS and stresses about LOSING OUT on a duplex in Venice Beach. $2.5million asking, his hot shot agent submits an offer for $2.35 million and poor young sucker goes into a mental meltdown saying “but I can go up, I don’t want to lose this property” “I’ll pay whatever they want, I have to have it, I don’t want to miss out”!!!

Agent assures his client, all his clients actually, that “the longer you wait the more the prices go up”.. and “yes, you may have paid over asking BUT in 2 years its going to be worth a million more”.

Short memories indeed. And clearly zero understanding of income to price ratios and basic economic fundamentals. Suckers and greater fools – seems to be no shortage of them.

On a side note, I found out my workmates husband is a Realtor. She said he hasn’t sold a house for so long he’s now earning a living painting dead lawns green. “In between sales” of course.

One of my neighbors and I had a chat on Saturday morning when I was out on my daily walk. She was saying 4 of her friends are realtors and they all have not had a sale in so long they are on the verge or homelessness. She said 2 of them have had to stop making payments on their homes. I said “they had better start looking for a new career”. She also added that when she bought her house 9 mths ago she had not sold her other home. The Realtor assured her she would be able to sell it in 5 days and convinced this 60 yo divorced woman to give her the listing and collect a buyers commission on the new place. Guess what.., the other place still has not sold, and she is carrying 2 mortgages, she’s on a fixed retirement income, and she just heard last week her retiree health benefits are being cancelled and she has to go buy Obamacare. She looked very worried. I would be too. She’s a sweet lady, clueless in money matters unfortunately. BTW she over paid for the new house…and it has defects that were not disclosed AND she has no money to fix anything. Jeez… what a pickle..

We started to look for a house about a year ago… The inventory was very scares, the prices were outages. During the first six months we were able to find only three decent properties in our price range for which, of course, we submitted offers, all three at the asking price with 20% DP. We were outbid on all three. So, after three months and three “failed” offers we decided it is not worth it. Now, six more months later (six months after we stopped looking) our realtor reached back to me. Here is his email:

Realor:”… Seriously, the market has slowed down a bit now that kids are back in School, and there are actually some pretty good deals with out multiple offers. Let me know your thoughts…”

Me: “… bla-bla-bla… not interested”

Realtor: “… If I see a screaming deal that you might like, I will send it to you…”

Me: “…ok, send them over…”

Next day I receive an email with two overpriced crap shacks that would never consider to buy in my entire life…

I see how homes are not selling in our area, I don’t know who, with common sense, would buy at these prices. The realtors get desperate and I can feel that, but the prices still stay firm, I see no major declines. The picture will start changes when the prices start to decline n Y-o-Y basis, not M-o-M. So, give it two more years, hosing to tank hard in 2016…

2016 is reasonable. It peaked in 05 and dropped in 08. It has peaked again this year. Ton of inventory where I live just sitting there. Nothing but high end stuff is moving where I live in SoCal so 2016 or 2017 could very well be the next housing bubble pop. I think a lot of it depends on when the current stock market bubble pops.

But the question in my mind is when it falls apart, again, will we have a repeat with all the investors big/small/foreign coming in and buy up all of the fallout, again, and locking out the little guy who is just trying to buy a home for his family?

That is the real question for me. I’m sure a decline is in the not too distant future. I’m just wondering what is going to happen after the decline?

The Realtors are not the only ones getting desperate. The property managers are employing used car tactics too.

I’m looking for a rental. I call on 2 homes – both have been EMPTY for 5 weeks. Overpriced rent… I ask “is the rent negotiable? It’s too high for this area”.

The responses I get from both property managers is “no its priced right, and we’ve had incredible interest. And there’s an open house this Saturday”.

BS… so that’s why on both houses they’ve been empty not collecting rent since the last suckers moved out AND they’ve both had rent reductions of $100 a month in the past 3 wks.

@San Diego

I think the investors have shown us where it’s profitable to buy and rent. (2012 prices)

I’d expect many investors to jump back in if housing dips back to those levels.

What area of Seattle do you live in, in which homes are not selling?

What areas of Seattle are you looking to buy in?

I’ve been thinking of moving to Seattle or Portland (as do many Californians).

I lived in Portland for 5 years. By the 5th year I was wondering if life was worth living. Took a huge loss on my house so I could back to LA. Spend a winter there before you move. Mingle with Portlanders (if they’ll let you). The cultural psychology is very different. Portlanders are closed down and closed in compared to LA. Portland was created by people who traveled across the country to get to California and quit. They stopped. They didn’t want to go any further. Not a bad thing but it’s reflective of the psychology. LA very entrepreneurial — Portland not so much. 70% of people on meds. Highest suicide rate. Portlandia doesn’t depict that.

@ San Diego

“But the question in my mind is when it falls apart, again, will we have a repeat with all the investors big/small/foreign coming in and buy up all of the fallout, again, and locking out the little guy who is just trying to buy a home for his family?”

Depends on interest rates…the little guys will want them to be much higher

I am looking for an additional home in Newport Beach. I am looking for an older 50s cottage on a lot of at least 6000 sq ft that is not under the airplanes, next to a busy street, and within 1 mile of PCH. I am willing to spend up to 1.7M. Nothing decent comes up for sale. Two years ago, you could get this stuff for 800K. I just don’t see the market dropping. I have expanded my search to Manhattan Beach. Nothing there either.

The coast is a different story from anywhere in America right now. My friend has owned a home in Venice for 25 years. He tells me with a mix of fear and wonder about the house across the street being sold for 11MM. The bread and butter economy is 300K-600K about. That’s where the prices have stalled or fallen. But don’t think the coast is immune. 2 years ago — was just about the bottom. It can go there again. Tech money is fueling this coast rise and SF rise. The day will come when they will be held accountable. FB is probably selling data for $50 a lead to insurance/medical industries. Snapchat? WhatsApp? Twitter? Show me the money.

If I may pose a question: With a stealth inflation rate of 4.9% rather than the reported 2%, will housing prices continue to rise despite interest rate increases down the road because they are an asset class?

Perhaps this question is dependent on wage inflation but I don’t many people getting hefty raises in So Cal as of rate.

Thank you all for you possible consideration of my question.

If people’s incomes stay flat and everything else goes up in price, how people who earn less and less are supposed to buy moar and moar overpriced crap? Go figure…

By getting moar and moar into debt see student loan, car loan, heloc, credit cards, medical debt etc…At some point it will go bust just like last time and the time before that.

Moar woar is what we need…

Highland Park in LA is one of those neighborhoods that’s gone through the roof over the last several years. It’s an interesting location, but it has a lot of problems: traffic, air quality, schools, crime, all bad. The houses are generally small and 2 or 3 years ago they sold for around $250,000. Then the flippers moved in and prices have basically doubled. But there are signs of trouble.

Here’s a 891 square foot shack in original condition for sale for $548,000. I called the broker just out of curiosity. He said he knows it’s over-priced. He said they’ve had 2 low-ball offers of $400K and $450K, but the owner is holding out. It will take a $75,000 to modernize it with a new kitchen and bathroom, plus new heating, wiring, paint, etc., and it will still be small. Who would sink $600K into this shack?

http://www.zillow.com/homedetails/6260-Church-St-Los-Angeles-CA-90042/20771999_zpid/

Then I was driving home and I saw a for-sale sign around the corner in front of 903 Cresthaven. I called the number and spoke to a person who said the owner bought the house for $530,000 out of foreclosure and started to renovate it but then decided he wanted to get out. It’s not a bad size — about 1,675 square feet. The problem is the kitchen and bathrooms have been removed. The asking price is $569,000 to try to re-coup the original investment plus the extra fees that were paid to get the house out of foreclosure. Good luck.

You know when the flippers are running that things are changing.

Some of my close musician friends live in Highland Park, and, while they have been talking about more and more fun restaurants and whatnot opening up, hearing gunshots in the middle of the night is still a possibility. I’ve spent a lot of time in that area of town, and I can’t believe how desperate people are getting in this city, if it sounds like a good idea to spend $500K or more to live there. Spend 10 minutes in a $500K house in Portland or Seattle, and it puts everything into perspective.

The pros left the party a while ago. When the amateurs start running for the door, the party was already over.

Zero said…”Them( try those) numbers don’t lie” get off the English lessons buddy and post how folks can make money in 2014?

A family member was excited to tell me that his crappy neighbors had a “foreclosed” sign in front of their house in Monrovia. This was almost 4 years ago and they are STILL living in the house! During this time, two members of my husband’s side of the family could not make their mortgage payments. One received notification that her home would be going to auction. In these scenarios mentioned, all remain in their homes to this day.

No joke,

I am here in Monrovia. My apartment complex is being converted for sale. They are very nice. There was a price drop on one of them from $670 to $600K. That’s 10%.

They also “cut” the HOA fees from $500 to $400 on the same complex. I asked the Sales Office what happened with the HOA dropping? She said, “oh we just ‘lowered’ the HOA to make the apartments more affordable.”

How absurd is that? And what a gimmick? You don’t “lower” an HOA, you consciously decide to underfund it. Do buyers not get freaked out with that kind of sh!t?

“You don’t “lower†an HOA, you consciously decide to underfund it.”

Or.. perhaps they are grossly ‘overfunded’, which they keep secret and which I suspect many HOA’s are, and they just decided to drop the price to what it should be in the first place.

The California real estate market is disconnected from reality. I think “Housing to tank hard in 2014” will be just the beginning. I see an increasing number of listings, at inflated prices, that are not selling. This feels like the beginning of 2007.

I’m looking at the Case Schiller Home Price Index Chart the Doctor put up and something jumps out at me. Notice the decreasing cycle depth and duration.

This seems to suggest the manic price excursions are tapering off and we are headed for the “new normal” in pricing – sorry Jim Taylor. That’s if the government doesn’t see fit to start meddling again.

If we look around the globe at large metropolitan areas – I’m thinking New York, London, Singapore, Tokyo, Hong Kong, etc. the housing tends to be expensive and the norm tends to favor renting. We may have been spared for the last many years here because of the space to expand outward other cities don’t have. People will pay more to live near an accommodating business center with nice weather. The pricing of real estate in Southern California is catching up to global norms. Many people will be priced out forever. I lived in a house (I stupidly didn’t buy) in the mid-70’s in “43” that sold for $11,000. How long do you think people sat wishing and waiting in the late 70’s and early 80’s for that price to return? Forgetaboutit! No, I never want to live through that stagflation again. If you haven’t planned how your acquiring your next property by now you might be looking in Lancaster….

Exactly.

Housing prices and rents in LA/SF/NYC are closer to Paris, Hong Kong, and London than it is to Topeka, Tulsa or Cleveland.

The price:income ratio in LA hasn’t been near 3x for decades now, why would it start now?

I don’t think anyone expects a 3x ratio, but the 4x-6x range has been more normal.

I’ll lay it for you, Anon/Tired BS…..

This place is different (sorry ex-pat “locals,” LA has joined the global elite)

This time is different (seismic shift occurred circa 1997…game over)

Median incomes don’t matter (finally put that DHB meme to rest)

The 90% don’t matter

Growing poor doesn’t matter

Declining middle class doesn’t matter

Entry level buyers don’t matter (re: SFR, that is)

Move up buyers don’t matter (rising prices independent of rising median incomes)

Commute times don’t matter (city is evolving…rail, bikes, etc.)

Smog doesn’t matter (worst was the 70’s)

Crime doesn’t matter (always was, always will be…but signs of “pitchforks and torches” just aren’t there)

Earthquakes don’t matter (hiccup is all)

Riots don’t matter (hiccup is all)

Water doesn’t matter (there’s more than enough through conservation and reallocation…and LA can/will flex its muscles in Sacramento if pressed)

What matters?

SoCal’s 10% is a large number…and doing quite well

SoCal has diverse economic inputs

SoCal has joined the elite global metro areas of London, Berlin, New York, etc.

SoCal connected to fastest economically-rising area of the world — Asia

SoCal has largely been built out (we’re not talking outer IE, people)

SoCal attracts disproportionate amount of rising global 1 percenters

SoCal’s Mediterranean climate the envy of the world

SoCal has an unmatched global brand

SoCal’s proximity to Mexico/Central America will always have streams of immigration (legal, illegal, rich, poor, no matter) to add density/bodies that need housing

SoCal, as a metro center, will continue to be impacted by global metro density trend

Hurts, don’t it?

You both are so confident of LA exceptionalism that you repeat it over and over on a non-belivers’ blog.

Looks as if you’re trying hard to convince yourself.

@DFresh, couldn’t have said it better myself!

It is different here, anybody who disagrees is in serious denial. I don’t agree with the policies and actions that have led to this mess, but everybody on this blog is powerless to change any of this. Expecting economic normalcy to return anytime soon is foolish, you will be outlasted plain and simple. The Ponzi world we currently live in IS the new normal, we have long passed the point of no return…

fensterlips sez:

“The pricing of real estate in Southern California is catching up to global norms. Many people will be priced out forever. I lived in a house (I stupidly didn’t buy) in the mid-70′s in “43″ that sold for $11,000. How long do you think people sat wishing and waiting in the late 70′s and early 80′s for that price to return? Forgetaboutit! No, I never want to live through that stagflation again”

You are more right than you know. Welcome to the new normal. And yes, we are in for some serious stagflation, especially post-2016, which will be driven by energy prices and loose monetary policy. I read somewhere, and agree, that the US economy will grow throughout the 2020s, but mainly because of inflation rather than real economic expansion. And it will be on the backs of working people who are increasingly unemployed.

By 2030 the game is up and we can expect WWIII unless the world has developed alternative energy to the point where rising oil prices become a side show.

I used to think that the coming 2016 crash would be as or more catastrophic to average Americans than 2008. It might be. But I am becoming more persuaded that it will be more like 1987.

Nonetheless, my advice to the average American is to prepare for stagflation now, as fully as possible. In addition, move off of fossil fuels to electricity as much as possible. Owning a home is an inflationary hedge. 2016 may bring a correction in home prices but we aren’t going back to 2009, maybe 2011/2012.

…and remember, everything the government touches turns into turd: “…bloated portal, Healthcare.gov… at a price of over $500 million … has been hacked”

http://www.zerohedge.com/news/2014-09-04/healthcaregov-hacked

You can say no it won’t tank or yes its going to tank but here’s the dealbreaker: Our government cannot pay its bills. The USA can’t even pay the interest on the national debt, let alone attack the principal.

We don’t collect enough revenue to even pay the current government operating expenses. If we completely got rid of Medicare, Disability, Social Security and shut down 80% of the military we can’t even afford to run what’s left of the fed government programs or employees.

Every year or so when the debt ceiling is reached, the brilliant idiots running this country just borrow more money to keep it all going. Like a continuous balance transfer on credit cards.

At some stage (I think very soon) we just won’t be able to pay out debts, we will default, and the entire Ponzi scheme will come crashing down. It frightens the living daylights out of me… Hang on everyone, and save every dollar you can.

That’s a very good point. What country comes to mind when you think of printing money as a solution? Argentina. It didn’t work. They became a pariah state for years. Who financed the Iraq war? China. Who is our primary source of financing today? I don’t know. Now the neo-cons proposing a state of perpetual war. Historically why do countries go to war? Something is out of wack with the economy. Too many young people. Too little growth. Poverty. Unreast. Since the beginning of time the solution — got to war — get everyone’s minds off of the real state of things.

@Lottie:

You realize that you are completely full of crap when you write ” here’s the dealbreaker: Our government cannot pay its bills. The USA can’t even pay the interest on the national debt, let alone attack the principal.

We don’t collect enough revenue to even pay the current government operating expenses. If we completely got rid of Medicare, Disability, Social Security and shut down 80% of the military we can’t even afford to run what’s left of the fed government programs or employees.”

Where (cough, Fox News, cough) could you possibly get an idea as mistaken as this?

According to politifact “Federal tax revenue in 2012 was $2.45 trillion. That’s 11 times higher than the $220 billion in net interest payments on the debt and about seven times higher than the $360 billion in total interest payments.”

I would call you an ignoramus, but that would give ignorami everywhere a bad name.

@etherist: I think you’re the one full of crap pal.

We can’t pay the interest on the debts we owe, the govt just rolls those big fat interest payments over every few days/weeks/months. Balance transfers on a massive scale.

In 2011, total Fed govt spent $3.6 trillion. Fed govt revenues were only $2.3 trillion in the same period. The $1.3 TRILLION SHORTFALL was paid for by borrowing more.

In 2011, net interest payments on the debt were $414 billion. Furthermore, By 2024, interest payments alone are projected to reach $880 billion. Sure we can pay it, no problems, we’re just short a few trillion every year, we’ll just keep borrowing.

Maybe you should research a little further than your cable tv remote. From one ignoramus to another (you) buy yourself a calculator, then once you’ve learned how to use it, put your head back up you a@@ where it feels most comfortable. You must be a Realtor!! Excuse me, a Realtard.

Too bad the CBO says that the federal budget deficit has declined sharply in the last couple of years:

“CBO recently released The Budget and Economic Outlook: 2014 to 2024. In that report, CBO projects that if current laws remain in place, the federal budget deficit will total $514 billion in fiscal year 2014. That deficit will be $166 billion smaller than the figure posted in 2013 and down sharply from the shortfalls recorded between 2009 and 2012, which exceeded $1 trillion annually. At 3.0 percent of gross domestic product (GDP), this year’s deficit would be near the average experienced over the past 40 years and about 7 percentage points lower than the figure recorded in 2009.

Lottie, if you have ACTUAL DATA that says different, let’s see it?

Here’s a FLIP GONE BAD: http://www.zillow.com/homedetails/2216-11th-Ave-W-Seattle-WA-98119/49014493_zpid/

A flipper bought this Seattle house at the end of April for $708,000. Then spent money “tastefully restoring” it. (So is the claim.)

Listed it less than 3 months later for $749,000.

Now relisted at $699,000.

I guess since the house didn’t sell during the “hot summer selling season,” the flipper is panicking and wants out.

Can the housing market mimic the auto market. Same tactics used to create greatest sales volume ever.

“MORGAN STANLEY: We Could See The ‘Largest Decline In Used Car Prices In History’

“But Jonas also serves up this insight: “We believe investors who are increasingly aware of today’s sales tactics will find it difficult to justify paying up for earnings beats stemming in large part from future borrowing of demand, precipitating what we fear could be the largest decline in used car prices in history.

It sounds like Jonas is worried that longer financing terms will leave buyers with weaker residual values on their vehicles than expected. This would create an interesting reversal in the used-car market. When the U.S. sales pace fell to 10 million after the financial crisis, prices spiked in the used-car market. Not enough new cars had been built to satisfy demand — and demand was elevated because consumers couldn’t afford a new car.

The used-car market has now returned to normal, but if I read his concerns correctly, Jonas thinks that abundant supply and lower residual values could conspire to undermine used-car values.”

Read more: http://www.businessinsider.com/morgan-stanley-we-could-see-the-largest-decline-in-used-car-prices-in-history-2014-9#ixzz3CSRHBEru

Chinese builder Landsea to invest $1 billion in U.S. housing market

http://www.latimes.com/business/la-fi-chinese-home-builder-20140905-story.html

For anybody driven nuts by the prices, just be patient. Take a vacation to a place you’ve never been and see how others live. Or/also try and find a job in a place that has reasonably priced rentals and just live life. You’ll look back/read about what people are doing in coastal CA and wonder whats in the water there. A good job and good rental is a righteous combination, you just have to be patient, hustle and search. This latest bubble was a result of people seeing some economic opportunities, plus a lot of Social Media bubble money and let’s not forget Chinese Oligarchs trying to launder their ill gotten gains. Does that sound to you like a firm foundation? Get someplace nice and just live – and no, I’m not giving you my location, but it makes coastal CA look like Tijuana!

Leave a Reply to G