What does a Trump administration mean for housing? Examining a few key items for the next year.

With a new administration coming into office in 2017, it might be useful to examine what potential policies will be enacted that may have an impact on housing. The market responded to the election results as if it were a Black Swan event. Most of the comments preceding the election almost assumed it was a foregone conclusion that Hillary Clinton was going to be the next President. Clearly that was not the case. The bond markets had an immediate sizable reaction. We still don’t have the full details on how things will change but there are some changes planned that may have an impact on housing. It is hard to see how rental Armageddon changes because of this. The overall challenges for housing will continue to persist and the Taco Tuesday crowd will continue to imagine that any move is good for housing. So what does a Trump administration mean for housing?

The impact on deductions

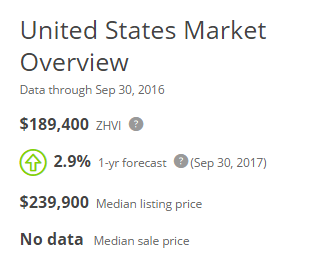

One major benefits of buying a home that is championed by the entire house humping crowd is in regards to the deduction you can take. In particular, the focus is usually around the mortgage interest deduction. While this does help, it is usually oversold since the standard deduction is already $12,600 for married couples. The typical US home is valued at around $189,400:

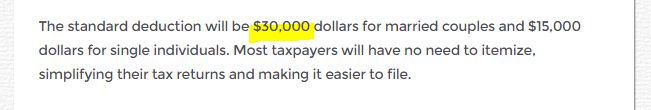

So assume someone bought the typical home with a 20 percent down payment. That means they can write off roughly $5,732 in mortgage interest for the first year (well below the standard deduction). This benefit dwindles as each year passes as more money goes to pay off principal.  The mortgage interest deduction rarely helps the middle class but definitely helps wealthier buyers. However, the Trump tax plan will cut into this benefit:

The tax proposal seeks to raise the standard deduction for married couples up to $30,000 and $15,000 for singles. Many that are buying in more expensive areas are couples, at least based on sales data. Even if you buy a $700,000 crap shack with 20 percent down, the annual mortgage interest comes nowhere close to the new standard deduction whereas today, it does make an impact.

If the tax plan takes effect, this will largely negate the mortgage interest benefit in many overpriced metro areas that is usually pitched by housing cheer leaders. As we noted, the typical US home costs around $200,000 so what you have currently is lower priced states basically subsidizing the mortgage interest deduction for wealthier coastal regions. That may change.

Mortgage rates

Mortgages rates are reacting to the big change in the bond market recently:

“(WSJ) The ultimate problem is the impact of rising rates on home values,†said Stu Feldstein, president at SMR Research Corp., a mortgage-research firm. “We’re back into a bubble condition in part because of low rates that have enabled people to buy houses much more expensive than their incomes could afford.â€

He said his firm expects that by the end of 2017 rising rates will have contributed to home values declining in about one-third of the U.S.â€

The market reacted quickly here pushing mortgage interest rates up. This reaction comes from the expectation of inflation (not necessarily in housing) but also the new administration’s view of the Fed:

September 26, 2016

“(WSJ) Mr. Trump has taken aim at the Fed on several occasions recently, accusing Ms. Yellen of creating a “false economy†by keeping interest rates low to help President Barack Obama.

He also has praised Ms. Yellen, saying just four months ago that he had “great respect†for her and he warned that raising rates “would be a disaster.â€

So we’re in a bubble because of low interest rates and raising rates would be a disaster. A Catch 22. The markets are reacting assuming that rates are going to rise one way or another.

“(Forbes) More than $1 trillion was wiped off the value of bonds around the world this week as U.S. President-elect Donald Trump’s policies are seen boosting spending and quickening inflation.

“We do view the election of Donald Trump as a game changer,†said Adam Donaldson, head of debt research at Sydney-based Commonwealth Bank of Australia. “The strong bias toward fiscal expansion and inflationary policy represents a stark change to the malaise of recent years. This opens the door for the Fed to hike in December, but also more quickly in 2017 and 2018 than previously expected.â€

Much of this reaction is based on big spending plans on infrastructure and tax breaks. While this can be viewed as good for the overall economy, this actually stops the fuel going into the current housing run, that of low interest rates and a Fed that won’t “rock the boat†– if this election taught us anything is that things are going to get shaken up.

Many comments before the election assumed Clinton was going to win and were saying that nothing would change since the policies would simply be an extension of the Obama administration. And this was spun as good for inflated housing values. Yet now, they are spinning higher inflation as good for housing assuming the new incoming administration is highly focused on keeping crap shack values inflated.

What is clear is that you should gear up to expect the unexpected. And most people expect housing values will only continue to go up.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

148 Responses to “What does a Trump administration mean for housing? Examining a few key items for the next year.”

I would expect to see the worst of the last bubble and more. Shady paper, “liar loans”, probably citizenship-for-sale if you put a half mil into real estate, etc.

“Biff” from Back To The Future is President now.

“The typical US home is valued at around $189,400”

that’s slightly more than a down payment in Socal.

Average starter homes are going for $1.5 -$2 on the west side – so that’s not even half

Wuz gonna say: It’s not *much* of one.

This sort of begs the question … what if all that foreign money does dry up and what happens when the monied U.S. citizens are finally tapped out? Who pays millions for a home then? Or, perhaps worse, what happens when those Chinese own everything in SoCal? No one seems to have thought that far!!!!

This danger was anticipated 100 or more years ago; it was called the “yellow peril” and obviously, with a huge population in China and Asia in general, even with a tiny percentage of them rich, it’s always been enough to buy up the whole West Coast and run us out. The reason this has not happened is a bunch of laws that were put into place, that people today would consider awful and illegal and so on, that kept the West Coast from being swallowed up this way.

So let me get this straight. USA has a $20 Trillion debt overhang ( not including massive unfunded liabilities ), 45% of Americans already pay no federal income taxes at all, interest rates on record levels of corporate, municipal and individual debt will soar and taxes will be cut.

This ‘ make America great again ‘ thingy is very confusing.

Taxes will be cut, regardless. Everyone is on the same page on that, and it will be a good thing – leaves more money in the pockets of producers and the middle class.

To balance the tax cuts, you just have to cut spending – across the board. The government is so big that it devours the whole economy.

Except Trump only has a few ways to stimulate the ‘real economy’ and bring jobs back to the people that voted for him. One of those things is massive gov’t spending on infrastructure projects

Military buildup … say build some new highspeed roads, or rail, call ’em the Trumpenbahnen…. and yeah, some kind of “people’s car”…

On my income of about $12k a year, yes, I pay no Federal or state income taxes. I have to pay 13% “tax” into Social Security and Medicare, but yep, no actual income taxes being paid here.

And I’m more fortunate than many around here. This is the Big Dirty Secret – the US has a hell of a lot of poor people.

The Media hates Trump, so the real Trump-plan has not been given the attention it deserves. The meat of the Trump plan relies on a policy once understood and praised by millions of Americans but now forgotten by most: Tariffs.

Import tariffs, combined with lowered business taxes, will ensure that factories and factory-jobs come back to the USA. Even if most are robotic, we still collect the tax off production. Read that last line again. Memorize it. The MSM will not say this. Robert Reich will not say this. Globalists will not say this.

And while that is taking shape over the next 8 years, tariffs will bring in a large revenue pool. The building boom of new infrastructure spending will be dwarfed by the corporate spending to create those factories. Restricting the flow of non-skilled and skilled labour will allow the supply and demand curves to bring higher wages to the US workforce, something unseen for 3 decades now. The Productivity of the US workforce will explode as robotics in factories produce goods and services at the push of a button.

The jobs of the future will be in factory robotics repair and maintenance. If not for narrow minded corporate greed and lobbying, this plan would have been implemented decades ago. Well, better late than never. Things are finally going to be looking up. China? Not so much.

traditionally, as interest rates go down, housing prices go up. A person only has so much money for monthly payments. When interest rates go up, the purchaser has less money to pay the seller. Home prices will go down when interest rates increase. With the standard deduction going up, this is good for the renters, not so good for the property class. Since the renters will have more money, the Landlord(me) gets to charge them more rent.

Not if they are in a Los Angeles rent controlled building, thank god for rent control.

Thank God for rent control? NOT! Rent control eventually causes reduces housing availability and results in reduced maintenance of properties because owner’s can’t raise rents to pay for improvements. Rent control only benefits current tenants who often exploit the program (the rich, families that pass apartments down, subletting that jacks up the price) or just never leave.

Rent control is the reason there are so many ghettos in LA. People living in the same crummy rent controlled apartments for 20+ years paying less then market value while the building crumbles around them. Rent control causes rental-shortages and prevents gentrification. Enjoy your rent control until you get the Ellis Act notice, it will come eventually.

http://www.latimes.com/local/california/la-me-apartments-demolished-20160402-story.html

I appraised an apartment project near the beach in Santa Monica. An ex-professional athlete was living in one of the units and the rent was really low. He turned to me and said – why would I buy a house here?

Rent control or no rent control, something is going to break in SoCal. I think the PNW will see people moving there as well as many other lower cost states. I drive once a week and I am amazed at the traffic. The traffic now from SW Riverside County to SD County is a river of lights on southbound I-15.

Replace the words “rent control” in your argument with the words “prop 13” and you’ll see the other side of the coin. Older generations that retire need to move on from the areas where production happens. Here NOBODY sells their house, they rather turn it into a rental and end we up with neighborhoods full of run down houses with a load of cars in the driveways.

Truthster it’s one big ghetto.

seismic1 must be a landlord if he/she hates rent control so much. I helps the community by encouraging people to stay and not be transients. When you have a transient neighborhood no one cares for the community, no one is there to make it better. They are simply there to eat poop and sleep.

All those tight-knit communities of renters that care about the neighborhood, like that’s a thing in LA.

It is my belief that no one should live in the same rental apartment forever. Turnover allows the owner to refresh, repair, and re-rent for market value. Renters don’t realize that every year taxes, insurance, and maintenance costs increase. I have been in rental apartments in LA where people have lived for 20+ years, and it’s a dirty mess with DIY electrical wiring & renovations, illegal pets, illegal tenants, and numerous other fire and code hazards. These people are scared to death of the landlord finding out what goes on behind their door, while they pay half the rent that their neighbors pay for the same unit model.

“Rent control eventually causes reduces housing availability and results in reduced maintenance of properties because owner’s can’t raise rents to pay for improvements. ”

As if rent was about maintenance, yea. More than half of any rent is about paying the capital to the owner. The other half if maintenance, taxes and profit.

Drop the capital to half and you can drop rent with 25% and still get decent profit.

Isn’t it odd that paying back capital is _always_ more important than maintenance?

And when you don’t maintain, the good renters leave: Short-sighted greedyness and your own doing, from the start. Ghetto is ready but rent control had or has nothing to with it.

So basically you accuse rent control for consequences of absolute greedyness. Nice.

It always falls to choosing profit now or profit in long term and almost always people choose profit now, as they are greedy and don’t care about future.

It is only true that house prices go up when interest rates fall, in cities with inelastic supply of housing. There are dozens of cities where the median multiple has never reached 4, always because of a very efficient greenfields suburban housing-supply sector. Some of these cities also do intensification and apartments best as well.

But the level of understanding of this factor is so poor in the USA, that it is unlikely that the Trump administration will be any better or worse at tackling “housing affordability”.

What the USA does have to its advantage, is that people and businesses can and do relocate out from the unaffordable cities, to the affordable ones. Many countries – the UK and Australia for example – have absolutely no growth-promoting, affordable cities at all.

as long as I get to increase my rent, I am happy. If somebody has a 775000 crap shack, the old 700000 figure has been updated, if the cost of interest goes up, that is less money for the principle, house. If my income does not go up, then the seller will have to lower the price of subject house in Burbank.

a little 1440 sq ft house,3brm 2bth house went for $845k

I can’t wait until all these baby boomer land owners die and are buried six feet deep. Don’t worry, I’ll be at your funeral laughing it up that you died of a heart attack, stroke, alzheimer, or from falling down the stairs and breaking your neck. The baby boomer generation really screwed up America up, wars, poverty, trillions of dollars of American debt; all caused by this retarded generation of old sleazebags.

It’s only a matter of time before you old scum are wiped off the face of the earth, then it’s the millennia’s time to take over this country and make it a great place to live.

Rotation, rotation, rotation.

Out of tech stocks and into gun and marijuana stocks!

I big nope on the dope, that stuff’s just gonna get cheaper, but guns and ammo for sure.

I have $320K down payment sitting in 1.05% savings account and an prequalified up to 1.2M purchase. I am 31 yrs old.

Yet I have been paying $2,800 for a 2+2 4th floor unit in the heart of playa vista phase 1 for the past 2 years to remain flexible and not pay for overpriced west side real estate. Am I stupid? My friends tell me I am and I am being priced out by waiting.

All the random jibber jabbor aside… When the average single family home is at an all time high it does not make sense to buy at that point. The price you buy the house at will effect the next 15 or 30 years of your life (unless you sell it).

ManBearPig – that’s the toughest thing about RE. That you should not buy when everyone’s buying and all your friends are screaming at you to buy. You want to buy when no one wants RE. 5-6 years ago, you could pick up a house on 2-3 acres in Gilroy or Morgan Hill, 40 minutes or a 20-minute train ride from downtown San Jose, add 15 minutes for Palo Alto or Mountain View, for a quarter-mil. They were all over the place, I know, because I was “shopping with someone else’s money” – someone I knew had inherited $400k and I was looking at what I would, if I were in his position, do with it. Instead, he put it into silver coins at $40/oz just in time for silver to drop 30%, and now I think it’s barely holding onto $20/oz., and I believe he’s re-sold his silver at this huge loss and is now “sharecropping” weed, just in time for weed is being legalized and about to become as common as oleander.

Under current interest rates and using conventional rules-of-thumb for homeownership costs, your mortgage payment on an $880,000 loan would be about $4,000/month, property taxes on a 1.2 million place would be $800/month, insurance $1,250/month, and recommended savings for maintenance would be $1,000/month. Grand total $7,050 per month, which means you are saving $4,250/month by renting.

You haven’t provided your income, but to afford a $7,000/month outlay for housing, based on the 30% rule your take-home would need to be above $20,000/month, so your gross would need to be somewhere north of $300,000 for that to be a prudent financial move.

So no I don’t think you’re being “stupid” but there are a couple of alternate paths you might consider:

– If you made a long-term commitment to rent you could move some/all of the $320,000 into more aggressive investments and earn a higher return.

– You could consider more reasonably-priced properties that would probably be more within your means and a better investment.

In the last bubble, people didn’t have to qualify for mortgages, but still found themselves in a ‘my eyes are bigger than my stomach’ situation! Is there a similar analogy today with sky-high prices, even if you have the down payment … taxes, insurance, maintenance … just how many people get that home, only to find that the expenses are far greater than they realized? The other thing that not a soul out there in Cali talks about … how many Prop 13 hanger-oner’s are there living in homes, or inheriting homes, only they haven’t got enough income or savings to do the necessary maintenance or upkeep? How many of those houses will begin to fall down showing their age/wear, and begin to be the blight ‘next door’?

Good points! ‘House poor’ is the term that applies. How many of those homeowners who got in over their heads last time around found out that the cost of homeownership is much more than the mortgage or writing a huge check? And, it is no different this time around, except that tax assessors are having a hey-day with assessments! And, something no one talks about are all those Prop 13 -hanger-oner’s’, the ones who are living in homes on fixed incomes and can’t afford to do any maintenance, or the kid’s who inherit and can’t afford the upgrade or maintenance … there go the neighborhoods as the house next door starts to fall down!

I noticed a possible error while reading your comment. Insurance will be $1200 per year, not per month = $100 per month.

Insurance $1250 a month???

LOL

Don’t take advice from someone who has never owned a home.

$1000 per month in maintenance costs? If anybody ever used that number, it would never make sense to buy. $200/month is a more realistic number.

Friends calling you stupid? That’s kind of harsh and not at all true. If you are going to stay put for 3+ years and get into a place before rates increase you may be better off buying now. If you add the cost and responsibilities of ownership to your rent you will find renting is not such a bad deal.

You are definitely a wise man if you wait, even several years from now, for the inevitable next crash in CA and the bubble States. But there is no problem with stable, median-multiple-3 price cities in Southern and heartland USA; in those cities you might as well just become a homeowner as soon as you can afford it, especially when interest rates are so low and they do not push the house prices up. You can always move to CA in a few years when the crash has happened.

But the problem also is that CA’s bubble and crash cycle does negatively affect the real economy there. If life prospects matter most, then the average person will be better off choosing Texas.

TrumpFTW, you are right where you need to be. I’m going to assume since you live in Playa Vista you work for some Tech company or Defense contractor, your work is very close and you make around 130k. That seems like a comfortable situation. Your friends are dumb, did they buy a house around here in the last few years? If so, let them break down their expense ratio.

As you see in the post reply from blankstate doesn’t add up for you at all even with your over then 20% down payment. Enjoy your short commute which I hope it is and $2800 is a good price for your area, since you got in a new lease recently. Don’t get suckered in, I know too many peers that have bought in the last 3 years that are in hell. If you do not have a kid on the way or family, you have no pressure. Wait it out, invest your money a bit better and you’ll be on the right path. Right now buying a house is not your time.

I’ve watched Playa Vista from my hill adjacent in Playa del Rey. Phase 1 struggled to build (environmental regulations) then sell. Phase 2 is looking to be the same, it was not originally designed to be that dense. If you like that area, bargains are ahead.

Well, the only problem with your comment is that Playa Vista Phase 2 new home prices have increased 40-50% since they were released a little over 2 years ago (and it has spilled over into big price increases in Phase I too) and the first set of for-sale homes completely sold out over that period of time. This new batch of homes is taking longer to sell because the prices are astronomical, but folks would bought two years ago are sitting on a huge cushion of equity now. I don’t think the OP is stupid, and I am by nature also very conservative, but what I do tell people is that if you can afford it, and you find something you like, there’s nothing wrong with buying a home. The problem is when people buy something they can’t afford. All of you here trying to game the housing market are off base, if you think of housing as an expense, then it really doesn’t matter when you buy, only what and how much you buy.

Nothing pays like patience. Nothing.

QBAll,

Proper time beats everything…..

Patience only gets you to your death bed.

NoTankinSight is a realtor

What ever you do, do not get caught up in buying something at the top of your price range. Buy something far below and get it paid off by getting a 15yr loan and paying extra into the principal each month. When that house is paid off, you will have really achieved home ownership and the freedom that comes with it. What freedoms are those you ask? You have the freedom to not work as hard if you would like, or afford to do the things you enjoy far more often, or buy a new house an rent out the one that is paid off and work towards a higher net worth, or sell it and buy that big dream home, or________ (you fill in the blank). Also don’t buy anything if you are not reasonably sure you will be there fore at least five years because that is often a recipe for disaster, especially if buying when prices are high.

This is excellent advice.

While I’m in the don’t buy high camp. Why not consider an investment into real estate but for a passive return on your 300k. I don’t know la market but I know oc a little better. Take your 300k invest in a condo in oc by paying cash. Rent out for your 2-2.4k. After all said and done could be adding 1.5k monthly to your bottom line which would almost pay your rent cost. That also gives you exposure to the upside in home prices. Sounds like a win win to me but what do I know

Well, you’ll find plenty of divergent opinions, particularly on this site. Just ask Jim Taylor. My opinion is that there will be fits and starts as well as small corrections but in general real estate will continue marching up at an average of 3% a year.

If it was me, I would look for the best value in the area you want to be in with a down and payments that don’t leave you strapped. We are all short money right after buying a place. After all, the tide just went out, but you need to make sure you’ll be OK covering your nut year after year.

Appreciation will come naturally. I suspect some inflation will finally arrive in the next two years because of the monetary policy we are expecting from a Trump administration.

The lower taxes will spur a lot of business repatriation of dollars and investment in people and infrastructure. Clinton was given credit for the boom in the ’90s but it was spurred my the fiscal and monetary policy, lower taxes, less regulation from the Reagan years. People have a very near-sighted view of the nations reaction to changed policies so that makes it easy for any incumbent to take credit. That’s fine I really don’t care until people start thinking if we only doubled taxes and handed out more money the economy would rebound. Uh, no. Between 1983 and 2000 houses roughly doubled in price. This includes the housing recession during the mid ’90s so if you can afford to buy in you should be good.

On thing that I don’t think people take into account is that we are now in the information age, for good or bad. The highs and lows of the past were much smaller because people were aware of what was going on but they were smart about it and didn’t take extreme measures.

In 2016 you have extremists on the internet. Maybe even this website is considered “extremist” but I come here for the discussion more than anything. On one side you have extremist shows on HGTV, you have HOUZZ on your phone and tablet. You have friends on Facebook BUYING BUYING BUYING. You have articles “Housing at all time high” “Millenials are priced out of the market forever.” People aren’t very bright and will buy into this narrative.

When the housing market shows the slightest signs of weakness the doomsday articles will arrive en masse. “Unemployment at 15%” “Is housing the right choice to place your assets?” “Buy gold now or be priced out forever.” This will only further any housing weaknesses until you have a full on recession.

I’ll listen to the opinion of anyone here who predicted Trump would win the republican nomination and then the presidency. (crickets) And if you did, you were stupid not to place a wager. Two hundred bucks would have made you $100K.

Please, no more predictions, that means you J.T. Everybody’s wrong, always.

I always said everywhere that Trump will win. I positioned myself for that and I stand to benefit.

It was obvious for everyone that he will win except the propagandists from MSM and those who believe them. It is so much you can rigg the system when you deal with a landslide, unless you are are in North Korea.

Landslide? He lost the popular vote.

“Landslide? He lost the popular vote.”

Not if you subtract millions of illegals who voted and did not have citizenship, dead people who voted and machines changing the vote from Trump to Hilary. All of those voted for Hilary but if you subtract those she lost the popular vote, too.

Also, what about millions who stayed home and did not vote because in some states like CA the republican vote is irrelevant due to electoral college all voting democrat??? you forgot about those, didn’t you?

You can’t lose the NFL and after the game say that you won if you would apply the rules from soccer. The rule of the election game is to get 270 electoral votes not to win the popular vote. Study some US government to learn what are the rules and why they are in place.

@Flyover

Proof?

Can’t win the NFL by imagining touchdowns either.

Stick with reality not Fox News, buddy.

Pretty sweeping generalizations there. I would have bet on Trump if it was legal in this country. Didn’t feel like trying to skirt the law. I did send him a few dollars for the campaign (like he needed it, right?) and did vote for him. I saw it coming. The Clinton shadiness and hubris was hard to miss and the Flyover country and Middle Class ignored for 16 years. We’ll see if he can pull off his promises and create success. He’ll be threading a needle.

Even if Trump is not doing anything, we would end up winners. Just stopping Hilary from doing more damage is still a win – we sink slower.

Don’t overlook China.

Some believe that OC prices are skyer higher in the OC (especially) Irvine, because Chinese have been smuggling money out of China to purchase Irvine real estate.

What happens if Trump even makes a little bit good on his new trade policy (tariffs?) with the Chinese?

What’s your prediction here…elaborate more. i’m looking to buy in Irvine at the moment. Shall i wait for a correction? how much? TIA

SLA…I give the same advice to everyone ( there is no standard deduction in buying a home). Find a house you like and afford, check the history of the home and owners, move forward on a offer that you can afford and your terms. If that doesn’t work move on, tons of homes always for sale, don’t worry about Trump, interest rates and values overall, worry about the home you want and makes sense for you, than don’t turn on the TV and enjoy living.

No matter what era always a concern about something in life, worry only about you and if you have a family them, the guy next door, the 1%, a tornado in Kansas whatever, only worry about buying right, close your door, lend a ear is okay, but don’t fret about things you have no control.

No predictions. Just scenarios.

We live in the age of “unknowable unknowns”

Your could argue:

1) If the Chinese economy falters because of tariffs, then it would seem less money would be available to smuggle out of China and invest in Irvine real estate.

OR (contrary)

2) If the Chinese economy falters because of tariffs, then panic would force even more money out of China and invest in Irvine real estate.

3)…. I am sure other readers can envision many other possibilities.

The bottom line is, nobody really knows. If we did we would all be billionaires.

Something else related to housing – Trump wants education reform like vouchers and “school choice”.

This, as Ed Glaeser points out, would remove one of the perverse incentives for the absurdly large-lot mandates in exclusionary zoning.

Something else related to housing – Trump wants education reform like vouchers and “school choiceâ€.

ooooooo that’s interesting. What would happen to property values in the inner cities if property owners were no longer required to send their kids to the assigned schools? Schools are a big determining value as to where families buy homes. Hypothetically there would be less stigma and more demand in areas with poor schools.

Since we elected Trump president last week, housing has gotten more expensive.

If you didn’t take advantage of the low rates and refi, you missed the boat.

The future is unknown. But the stock market is fleeing bonds causing yields to rise and pouring into industrials and financials with a big focus on banks, defense, construction, & construction materials. Interpret that how you will.

Agreed about the refi. The time was last month. 10 year treasuries are soaring, which means mortgage rates are going up.

As far as current buyers, I think the rising rates are going to finally bring down, or at least stabilize, the ridiculous year over year price increases we’ve been seeing in real estate. It’s not sustainable.

According to Obama’s speech today from the White House, “The housing market has recovered.”

That is partially why the Democrats lost the elections last week. Catering to the rich donors and Wall Street while blinding themselves to the high housing costs that is damaging private ownership and personal finances. Trump may not be better, but he acknowledged the economic challenges facing voters.

Buy a house man

This is a great analysis of the effects of a higher standard deduction and an increase in mortgage rates.

Some other observations.

1) Since mortgage + Property taxes + State Income taxes for some people I know in Ohio surpassed the standard deduction of 12,600.00, they all have been itemizing. For a 200K house in OH, the mortgage interest is about $10K, property taxes at 4% is $8K, and State Income tax was 5% on $100K ($5K) = $23K. Not enough to itemize under Trump unless they have over $7K in charitable deductions.

2) Trump stated he wants to repeal Dodd Frank and the credit criteria that it enforces. Will buyers with poor credit be able to put less down if this is repealed? I would think that this would drive up demand and prices.

3) Trump claims he want to deport 3 million illegal immigrants who are living somewhere. Likely renting. Will this drive down demand for rent?

Seen it all before Bob:

2. Dodd-Frank, should be repeal in a NY minute, like Obama care it is a killer on the economy going forward, another Democratic Socialist failure.

3. He wants to round up and deport maybe 3 million criminals, what don’t you and others understand, these are not upstanding folks who work everyday?

Maybe I should clarify.

1) Dodd-Frank restored some of the restrictions that were removed when the Glass-Steagal was lifted. Dodd-Frank is restricting the growth of sub-prime mortgages for people with poor credit which everyone agrees caused the 2007-2008 housing collapse. Will removing these restrictions cause a repeat of 2008? I think only if banks take more risks with the assumption that they will be bailed out again.

2) 3 Million criminal are still renting somewhere. If you remove 3 million people from the rental market, what will happen?

what you are forgetting is that if the standard deductions went up that much rents would also go up. Rents go up with disposable income.

Property owners either benefit from the current deductions or higher rents…

… Always remember… There is no free lunch.

Did you miss that part where rent hikes have far outpaced wage growth over the past few years? The free lunches have already been served to the specu-vestors courtesy of the Fed and government. Unfortunately for them, many of the markets have become so over-saturated with over-priced inventory that the investors will be eating each other alive for renters.

Oh lord…. The wage growth is there… How do I know?

Try getting approved for a rental below rent to income ratios, the commercial landlords which make up the bulk of the rentals won’t do it. They can only charge what the market incomes can afford.

According to this article, one needed to earn 17% more in 2016 to afford fair market rent in Los Angeles. Highly doubtful that median incomes could go up that quickly in one year.

https://smartasset.com/mortgage/the-income-needed-to-pay-rent-in-the-largest-cities

In 2014, a record high spent more than 30% of their paychecks for rent. Between 2008 and 2015, the share of rents climbed from 25% to 30% of median household incomes nationwide. How could that be if income growth kept up with rents as you claimed?

Oh Lord indeed.

How does a crash happen? I live in Santa Monica and the buyers are all cash that win the ridiculous bidding wars. Dos that mean if prices adjust 20% that less people will jump in the market? That more people will need to sell? Why would that be???

It’s all tied in to REITs, the stock market, the Chinese economy, etc. Once those chips start to fall, and interest rates rise, it will certainly change the complexion of the market.

Plus, “all cash” buyers are often not really cash buyers, but, rather, they use delayed financing just to get in the house.

Housing To Tank Hard Soon!

Can somebody tell me what would be the actual amount of money one could pocket per year when purchasing a 500k home with 20% down? lets say its a 4% loan and standard deduction is 12600 and there is absolutely nothing else to claim.

It really depends do on income.

But let’s say you make $120K.

Your CA taxes and other deductions before housing deductions should be around that $12,600.

Your interest for the year will be $16,000 and your taxes around $6000.

Your tax rate will be around 25%.

($16K + $6K) X 25% = $5500.

So around $5000-6000 yearly benefit.

If the deduction were to go up to $30K… More disposable income for renters means rent will go up dramatically.

$5000-$6000, but this doesn’t reach the standard 12600 so it would mean nothing to me financially right?

Wrong

As I said… You would already hit $12,600 in CA taxes and other deductions… So it is a positive $5000-6000

“Your CA taxes and other deductions before housing deductions should be around that $12,600.”

Not necessarily true. I just reviewed a rather standard 2015 non homeowner tax return for a $120K CA income earner and the CA taxes were around $7,800. “Other” deductions aside from state taxes paid could be anything or nothing.

The CA standard deduction alone is around $4K single / $8K joint. So many tax filers’ situations are unique enough that it’s less than helpful to set assumptions about what anyone’s taxes “should be”.

“More disposable income for renters means rent will go up dramatically.”

Nobody knows what will happen in the future. It could just as well happen that the tax savings get eaten up by price inflation in other life necessities and the supply side of rentals outpaces demand.

Rates will tick up, but how much is unknown. Every percent rise will knock probably 10% off the price. Foreign money is dead for the short term, dollar is very strong. Dot bombs are getting hacked down to size, but domestic energy industry will be strong so we’ll probably see the bubble areas deflate a bit and the non-bubble areas do better, at least relative to the coastal elitist hotspots. Basically a more even distribution of wealth/prosperity will be the result, but we shall see.

Lots of illegals (mostly criminals, some not, some just related) will bail the country before the feds can throw them in a cell, so that will free up more housing. You’ll also have a few whiny libs moving out of the country – dont let the door hit you too hard!

junior_kai…Nice post, if you pay your bills on time and not a illegal felon you have nothing to worry about under TRUMP?

Yeah, I could see Trump setting up some system where they pay back taxes if they owe them and forfeit voting rights. They will have to be verified and they better not have used someone else’s social security number or theyre toast. Just suggesting this policy publicly will probably force a lot more to self deport. This is a win-win for the country – whatever they paid in to the system is ours, much less welfare being expended on non-citizens, and less law enforcement needed to go after them and police those that remain.

Interesting to note that the banks/financials have rocketed up since the Trump win. I dont know if thats a response to rising interest rates, loosening of dodd-frank, or they’re just getting out while the getting is good. I heard more consumer loans are going bad, there has to be a ton of housing loans that will implode over the next several years and Trump will not be bailing the s.o.b.’s out this time.

In my opinion I think a review of the 14th Amendment needs SERIOUS updating. Anchor babies are not a way to claim citizenship for a whole family. If the family is illegal and have to leave why is the kid not going with them as well? Seems cruel to force people out but seeing hospitals give birth to over 300 undocumented kids that the families didn’t pay is absurd.

You are right Homerun.

The liberas try to sell something impossible. On the one hand they promote a safety net for everyone. On the other they promote open borders. However, the 2 are mutual exclusive. No country can have social safety net (welfare) and open borders at the same time – that is a sure recipe to financial collapse. It is just a mater of time; just look at Europe; almost there because of the 2 combined.

The electorate sent a clear message – they want to keep the safety net and close the borders.

It ridiculous but I have seen what appeared to be a gang mom talking to someone complaining about whatever and three kids only wearing diapers are crawling around in the parking lot. What a joke. Enough of our tax money for some of these people.

These blue state cities really need to worry under Trump:

LA, SF, SD, Denver,Portland, Seattle, Chicago. NYC, Boston.

Doesn’t take a rocket scientist to figure out the housing market will boom with liar loans and easy credit. With the few restrictions put on Wall Street will be removed and they will be able to create insanely leveraged assets.

The only real question is at what point will the housing market crash. I figure it will be at least 3 years out, assuming we don’t get mired in multiple conflicts around the globe. Make no mistake – the destruction from the next financial crisis will be Armageddon.

It is unlikely that the new administration will completely dismantle Dodd Frank. More likely that it will be sliced and diced, loosening regulation but still keeping the consumer protection, bank solvency, and common sense policies intact. Even the bankers are not lobbying for a complete repeal, but rather a loosening of the policies they feel are too stringent and/or overreaching which they feel prevent growth. If we do start seeing a resurgence of ARM, NINJA, Liar loans, etc. it will lead to a inevitable crash within a few years, just like last time.

Since we’re going on assumptions….what if Freddie and Fannie were set free and no longer under government conservatorship? You think that financial institutions would be able to sell subprime loans so easily to Freddie and Fannie without the limitless resources of the government behind them? Would the big banks be willing to take on so much risk with a bailout-adverse administration in the White House?

BTW, we are due for a recession considering that a mountain of mal-investments and debt has been accumulating over the past 8 years. A large chunk of commercial loans to real estate firms have a very high risk of going bad due to a glut of apartments in many markets.

The housing market was already softening, so this temporary bump in mortgage rates will only serve to cool it even more. The unfortunate reality is that nothing much has changed. The market just issued a de facto rate hike before the Fed could get around to it. Either way, the economy is heading into choppy waters, and general economic weakness. The pent up demand for big ticket items was already beginning to wane because this “recovery” was extremely weak, non-existent for many.

New home sales are probably vulnerable if D.R. Horton’s latest numbers are any indication. I expect more downward revisions in the months ahead. New administration is looking at higher deficit spending and huge debts in an already weak economy, so tax breaks will only go so far to stimulate growth because to a large extent the parasite (U.S. banking system) has already killed the host.

http://aaronlayman.com/2016/11/new-home-sales-stagnation/

Good points. Trump won in great part because he acknowledged the dire economic conditions experienced by mainstreet during the weakest “recovery” in decades. Meanwhile, Clinton catered to the investor class that benefited from the free Fed and government cheese. Mal-investments by these investors have created a glut of luxury housing of which there is relatively little qualifiable organic demand for.

President Trump may very well surprise all parties involved- on both sides of the spectrum. He ploughed through the conventional GOP candidates like a hot knife through butter in the primaries, and had a surprise win over the favored candidate. Will he break from the past and do something different? Or was “being different” simply a ploy to get elected- and then it’s back to the same old tired out playbook we’ve been experiencing over and over again once he gets into power? The past 40 years of consistent economic policy from both parties (yes, I would include Clinton and Obama in this) has been one of:

1. Historically low taxes for the wealthiest elite (35%, compared to 70-90% under Eisenhower to Nixon presidencies)

2. Rollback of Depression-era financial sector safeguards (particularly under B. Clinton)

3. Cutbacks in social spending (education, infrastructure, healthcare,i.e. the public good)

4. Globalization/outsourcing of native industries.

5. Massive increases in Defense Spending

In parallel with these policies, we’ve seen:

1. Increasing wealth inequality: the gains from greater productivity going to a smaller and smaller elite section of society.

2. Stagnating to Declining wages for average worker.

3. Decreased social mobility.

4. Shrinking Middle Class.

5. Massive Deficits

I believe Trump won the election by positioning himself as a savior of those blue-collar, Rust Belt workers so neglected by economic elites in Washington. Will Trump be a “game changer” and shift the economic paradigm the way Roosevelt and Reagan did before him? Will he remold the Republican Party in new ways as the champion of the hard hat working-class (as he in many ways has hinted)? Or will it just be a zombie-like repeat of the same policies that we’ve seen for the past few decades- polices that have benefited the few at the expense of the majority? Remember, the definition of insanity is repeating the same action over and over again and expecting a different result each time…

donpelon…He won over a lot more than rust belt voters. With 306 votes and over 60 million popular. Matter of fact he won32 states, 8% African-American, 29% Hispanic, 46% college white women, etc.

If you take out the very liberal states of NY,ILL,CA. Hillary gets landslide in the popular vote also. This was a full mandate for Trump and his administration for the next two years at least.

Robert – 80% of the population of the USA lives within 200 miles of the coast. Those rust belt states, due to the way the electoral vote is counted are over-represented in terms of population – California has more people than they do.

This wasn’t a mandate for Trump – it was a popularity poll in that whoever won was the lesser of two evils. My parents would have voted for Sanders, but they instead had to vote for someone who “wasn’t Hillary”.

Get out of here with this mandate nonsense. Trump is down more than a million in the popular vote, and this election had lower voter turnout than the last few elections. He won fair and square, but calling it a mandate is a joke.

Francis and GM,

When you are on the campaign trail with very limited resources, when your own party doesn’t give you cent, you have to deploy your very thin resources where it really matters based on the rules of the game – namely to get the 270 electoral votes.

Now, after the game is finished, the democrats are saying that Hilary would have won based on our imagined rules. Sorry, but the players ALWAYS play by the existing rules. If rules would have been different, namely popular vote, then Trump would have played 24/7 in NY and CA. As it is, he spent his time in states like Michigan, Wisconsin, Iowa, etc.

Also, many voters stayed home in states where their vote did not matter. What about those?

It is the same like in NFL. You can’t say that I would have won if the soccer rules would have applied. Then, the opposite team would have played by the soccer rules not football rules.

GH… Congress is all his, most states are Republican Gov. What does mandate mean to you, Hillary winning the hearts of protestors of which 70% never voted and most her popular vote came from against Trump and not for her???

If he had no backing of the establishment, he who would have won even bigger, he went it almost alone, nobody in US history could have done what he did unbelievable, along with the miracle on ice, did the World take notice and scratch their collective heads?

Flyover,

I’m not arguing the results of the election. Trump won fair and square. I’m just saying that characterizing it as a mandate is over the top, when Trump didn’t even win the popular vote and voter turnout was low (more voter turnout generally equals more democratic votes, as there are more democrats registered.)

It was a mandate. When there is a candidate whose election is being protested in the streets, feared and denounced by the status quo to the degree that Trump has been even prior to the election–the obstacle to being elected is significantly greater than any “normal” candidate would have to overcome. It makes the accomplishment far more meaningful than in a race of two traditional establishment candidates.

The candidate’s opposition cannot claim that on one side the president elect is akin to the second coming of Lucifer and also honestly make a case the candidate’s election in the face of such a dire prediction is not a mandate.

Give me a break, Hotel California. It was simply a matter of low voter turnout, because the Democrats ran a relatively uninspiring candidate who should have focused more on the rust belt. This was the lowest percentage of eligible voters since 1996.

That might explain the how of things, but it doesn’t refute the outcome being an expression of a mandate.

@Hotel and Flyover

Stop with the mandate nonsense. Obama won the electoral college and the popular vote in both 08 and 12. A much greater “mandate.” And we all saw how respectfully the Republicans in the house/senate treated that popular mandate.

You have both been posting on this board for years and your recent comments are just shameful. We’re all now stuck with the same horse in the same race. So keep the discussion on how this mess affects housing.

SoCalRulez: Obama won the electoral college and the popular vote in both 08 and 12. A much greater “mandate.†And we all saw how respectfully the Republicans in the house/senate treated that popular mandate.

About as respectfully as Democrats treated Reagan’s mandate in 1980, i.e., not at all.

I remember the 1980 election. Reagan not only trounced Carter, but the Republicans took control of the Senate. And Democratic youth were as hysterical then as they are now. (I was an undergrad in college at the time.)

When Reagan was shot a few months after his election, the Lefty students I was with were cheering and mocking Reagan, hoping he’d die. I saw this with my own eyes. Other conservatives report seeing similar incidents of Lefty cheering.

Well, what goes around comes around. The Dems haven’t respected Republican presidents since at least Reagan, and probably before that (i.e., before my time).

Good points. Very doubtful that any of Trump’s policies will reverse the low growth new “normal” that over-indebted Western economies are currently experiencing. And neither will they prevent the inevitable recession resulting from the massive mal-investment and debt accumulation under his predecessors.

ABSOLUTELY nobody knows the outcome of Trump presidency. Everyone saying the opposite, it’s just talk. I don’t think that even Trump knows it. There are too many powerful forces at work at the very top with conflicting interests and the system is too complex. What is the outcome of all those interactions???? Nobody knows.

He is very unpredictable and for that reason the MSM fought tooth and nail against him. Actually, that was exactly what helped him with the disfranchised middle class.

I also think that an economic meltdown is already built into the system regardless of who is president and what policies s/he adopt. The economy needs a reset once in a while to eliminate the bubbles/imbalances built in.

I don’t envy anyone who is president in the years ahead.

HISTORY knows the outcome.

1. Impeachment/prison.

2. War.

Not mutually exclusive.

And neither is good for housing.

Mortgage demand down 9.2% in a week, now equal to early 2016 levels.

http://www.wsj.com/articles/mortgage-demand-plummets-as-rates-spike-1479315638

According to reports the majority of the decline was in refinancing apps. Not too many people can benefit from refinancing at current rates. The question is, how many people panic and run out to buy expecting rates rise further?

Truthster…. Most people are procrastinators, they will do what people do, “I should have bought at 3.5%.” Same thing in 2008-09, plenty of foreclosures and my friends and relatives did nothing. I bought twice and unloaded for nice profits in 2010.

I did make a mistake in early 2015, I bought a $1m dollar home for 815k and instead of a quick flip at $899k I feel in love with the property and held out for $925k,

the home stills sits and I’m at 825k and no takers.

I will dump it for $775k before Xmas but for me this is very rare to lose but I missed the market because this home is such a great buy and with fairway views, the location just fell on hard times, foreign buyers dried up, main or second homes in golf areas are no longer in favor.

I remember when I bought my first house and I was so focused on the monthly payment that i missed other places to save money. After a few deals done I think I am older and wiser, but I feel many 1st time buyers are too focused on the monthly payment and end up being penny-wise but pound foolish like I was.

Robert – don’t worry, you’re flipping houses right, just do a lot more and you’ll make it up on quantity.

I don’t think people are going to panic. Even anecdotally here in Portland, I’m hearing more and more people refer to this real estate climate as a bubble…even my friends who bought last year. lol

I think the more the word “Bubble” is publicized the more likely it will slow down the engine. However, for how long is anyone’s guess.

The sell side has been hoping that buyers would panic off the sidelines for the last 7+ years. How many times have I heard they would stampede to their local realtors before the latest rate increase? Why is it it so hard to believe that so many potential organic buyers are priced out?

Hard to understand what? Of course people are priced out.

70% of people in LA are renters.

There is only a small amount of real estate available for sale.

You will always have that ratio… renters out number owners occupied 2 to 1.

@NoTankinSight

There is plenty of real estate for sale. However, that inventory has been severely mis-priced during the current period of over-speculation and mal-investment. The volume rise with exotic mortgages tells me that the market is increasingly desperate for organic buyers.

Before we talk about Trump administration impact on real estate let’s consider that we still have a giant mess on our hands, and the following are 11 very depressing economic realities that Donald Trump will inherit from Barack Obama…

#1 Nearly 7 out of every 10 Americans have less than $1,000 in savings. That means that about two-thirds of the country is essentially living paycheck to paycheck at this moment.

#2 Reuters is reporting that U.S. mall investors are poised to lose “billions†of dollars as the “retail apocalypse†in this nation deepens.

#3 Credit card delinquencies have hit the highest level that we have seen since 2012.

#4 Approximately 35 percent of all Americans have a debt that is at least 180 days past due.

#5 The rate of homeownership has fallen for eight years in a row and is now hovering near a 50 year low.

#6 The total number of government employees now outnumbers the total number of manufacturing employees in this country by almost 10 million.

#7 The number of homeless people in New York City (where Donald Trump is from) has hit a brand new record high.

#8 About 20 percent of all young adults are currently living with their parents.

#9 Total household debt in the United States has now reached a grand total of 12.3 trillion dollars.

#10 The total amount of corporate debt in the U.S. has nearly doubled since the end of 2007.

#11 When Barack Obama entered the White House, the U.S. government was 10.6 trillion dollars in debt. Today, the U.S. national debt is currently sitting at a staggering total of $19,842,173,949,869.58.

Despite nearly doubling the national debt during his eight years in the White House, Barack Obama is going to be the only president in United States history to never have a single year when U.S. GDP grew by at least three percent.

Therefore, short term, I don’t think it is possible to steer a big ship like US economy to make RE desirable again. There will be years till we see better times, if we will see better times….

We consume far more wealth than we produce, and the only way that we are able to do this is by borrowing insane amounts of money.

Either Donald Trump will continue to borrow money recklessly, or we will go into a major league economic downturn.

It really is that simple.

But when our politicians borrow money, they are literally destroying the future of this country. So the choice is pain in the short-term or greater pain in the long-term.

There is a way out, and that would involve shutting down the Federal Reserve and going to a completely debt-free form of money. Unfortunately that is not something that is even on Donald Trump’s radar at this point.

No matter who won the election, the next president was going to be faced with some very harsh economic realities.

There are many out there that have faith that Donald Trump can pull off an unprecedented economic miracle, but there are others that are deeply skeptical. I am in the second group.

Great last two posts!

+2

There is a lot of wealth in untapped natural resources in this country. Oil, minerals, fallow land held by the elites while we pay through the nose. Trump could try and unlock that and the associated prosperity could be bigly. Hopefully rebuilding the military is done by getting out of the many countries it’s deployed in currently and choking the graft from the MIC.

One factor matters much more than any other. Dodd-Frank will be repealed, and that was basically the only thing keeping banks from going right back to issuing lots and lots of unsustainable mortgages. So it will take time for this disaster to percolate. Nothing much will happen for two years– there will be a correction, but it won’t last. So people will be fooled, and will imagine that everything’s going to be okay in the long run. Nothing could be further from the truth. In two to two and a half years, there will be the biggest housing crash in history. It will be a structural crash, and I’m not sure if we will ever come back from it. Basically? If you have the money but don’t NEED to buy a house right now, wait two and a half years.

Oh, now who’s being a Debbie Downer? We all need to run out and buy houses, and right away. Our new leader will make it all good by wiping away all that horrible gov’t regulation and we’ll all be rich!

Every day I see Trump backing off another promise. Obamacare not repealed, Wall becoming a fence oh & taxes will def rise.

Hillary did NOT win the popular vote. Not really.

How many millions of illegal aliens voted? I read one estimate that put it at 3 million.

How many fraudulent votes were there — people voting early and often, dead people voting, ballots that were already filled in, mysteriously “found” baskets of ballots?

Democrats can expect millions of illegal alien and otherwise fraudulent “votes” every election. They far outpace the Republicans in terms of voter fraud.

Take away all of Hillary’s fraudulent votes, and Trump wins the popular vote as well.

Evidence for that little factoid would be nice.

Trump won the election fair and square, but your assertions are pure speculation.

By your thinking someone on the other side would claim:

“Take away all the shady poll closings and voter intimidation in key democratic districts in FL and other key states an Clinton would’ve won!” .. also speculation.

Again, Trump won fair and square, just like Bush when got in on the electorial vote alone. No need to pretend Dems have cornered the market on shady election techniques.

Now you’re drifting into conspiracy mode. The only facts we have is that Trump won the election fair and square via the Electoral College, and Clinton won the popular vote. Also, it looks like the percent of eligible voters was the lowest since 1996.

Really? They went through all of that organizing of election fraud, to stop just short of putting them over the top in key states? I don’t doubt US elections are / have been rigged, but I don’t think its coming from individual voters. More like voter suppression-

https://thinkprogress.org/2016-a-case-study-in-voter-suppression-258b5f90ddcd#.rkvsicutg

Election fraudsters do the best they can. Sometimes the opposition (Trump) is too popular to overcome, even with fraud.

For shame, SOAL.

This type of self serving rumor cut/pasted from your alt right echo chamber sources has no business on Dr H and you know it.

It’s false information and it’s dangerous.

We all dread conversation with “that crazy uncle” at the Thanksgiving dinner table.

I fear he may be you.

In the words of our dear President Elect,

“Stop it. Just stop.”

Stop watching fox news, its bad for your health. Hope you die soon. 🙂

Cash buyers? See that a lot in MFD deals. They cashout refi a couple of other MFD buildings, buy another one cash and then refi to a 75% LTV. Many cash buyers really are not using that much cash. The refi process starts b/f the close of escrow.

On a tangent perhaps, but society embracing consumerism has shifted the decision making process from price to payment.

All those screaming for repeal of Dodd-Frank. You do realize your deposits make you an unsecure creditor, right? Its not your money and the bank is levering up. Doubt it – read up on MF Global.

Not just Cali residences but many businesses too will relocated outta here.

It seems rather clear that deporting 3 million bad illegal aliens immediately, will already loosen up rental supply, deporting the other 9-15 million eventually, which will need to happen, will make a serious dent in lowering rents and therefore house prices. Let’s face it, there’s a significant correlation between where rents are high and where illegals are centered.

Portland has the highest year over year home price increases of any city in America over the last year or so, and illegal immigration certainly isn’t a problem up here.

If it was only that easy. Today the mayor of LA came out and publicly said he would defy any policy targeting the deportation of illegals coming from the new administration. The mayor of Chicago did the same. I assume all “sanctuary” cities will refuse to comply. This sets up a stand-off between local police departments and the fed. Most likely this will get mired in lawsuits and become a political football with both parties making the other out to be the “bad-guy”.

Wouldnt be surprised if the ((regressives)) in CA dont eventually impose housing of illegals on citizens like they do in Europe. Case in point, Italy

https://www.youtube.com/watch?v=MgxvQXunMmU

Also.

Wages would rise. Government food stamp cost would drop which would help lower government spending. There would not be a drop in Federal Income tax as they were not paying income taxes.

Deporting 3 million criminal illegal aliens will have an immediate effect on rent demand.

Since medical costs for supporting aliens is about 1% of the total US budget, it will have little effect.

The largest % of costs are for Social Security and Medicare for the Baby Boomers. I don’t think it would be a good idea to deport them.

Social safety net and open borders are mutually exclusive. You either have one or the other. If you try to have both, one of the 2 things will happen:

1. You collapse the whole financial system (it is just a matter of time) or

2. You eliminate the middle class by making everyone equally poor and enriching the 0.01% from the top. It is no wonder that is pushed aggressively by the 0.01%.

There is no other outcome and you see the disappearing middle class and massive increase in income inequality. You see this also happening in Europe, for the same reason.

On the one hand you hear that the middle class is disappearing because of automation and technological advancement (i.e. robots) and less need for manual labor. Then, why do we promote more immigration legal and illegal of low skill uneducated labor from the south???!!!!….It doesn’t make any sense. That is the reason for the big surprise at the election time when the silent majority went to vote.

The reason is not that they CAN NOT protect the border; they DON’T want to. If Russia would be south, a fly would not cross the border especially with the technology we have today.

Obama deported 2,000,000 people. Did that help the rental market?

When Trump talks about deporting criminals, do you think that refers to heads of households that are working 2 jobs? Or is it the unemployed high school drop out who robs a liquor store?

Jim Taylor, it’s near the end of year, so, you’ll need to update your saved text to reflect 2017… Better luck next year. Maybe the 6th year is the charm.

it is morning in America again. It is our second Independence day.

Interesting article talking about how the current rise in mortgage rates affects current home buyers and the RE market in general:

http://www.cnbc.com/2016/11/21/higher-mortgage-rates-scuttle-some-sales.html

Leave a Reply to Ira