The battle between traditional buyers and cash buyers: Cash buyers still make up over 30 percent of market and purchase applications fall to lowest level since December of 2000.

People adapt very quickly to new circumstances. Today, many are coming to terms that the housing market is dominated by investors. Existing home sales are running at a pathetic pace now that investors are slowly stepping away from the single family home punchbowl. Purchase applications came in at their lowest level since December of 2000. The only difference is that we’ve gone from a population of 281 million to 317 million today. Where is all that pent up demand? A large part of it has moved back home and is too broke even to rent. Home prices went up in 2013 because of Wall Street’s insatiable sudden infatuation with single family homes. It also went up because a cocktail of accounting chicanery, banking trickery, and artificially low rates allowed the foreclosure process to transform into a sideshow. Even though 7,000,000 Americans have had a taste of foreclosure, you still have many benefitting from this delay by squatting or simply dragging out the foreclosure process. The game has worked well for these two groups. Some rationalize that if they buy today, the future will look very similar to the past and maybe they too can benefit from moral hazard. Yet where do we go from here? Purchase applications are a big reflection of what is happening on a larger scale. Lower paying jobs, less long-term employment, and a cash strapped younger class of buyers. Cash buyers still make up a large part of the market today but this group is slowly pulling back.

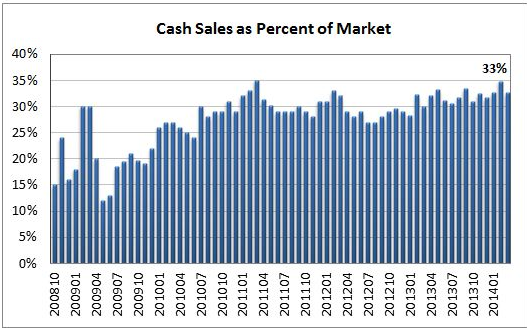

Cash buyers

Cash buyers still make up over 30 percent of all home purchases in today’s market. In more normal markets cash buyers will make up close to 10 percent of all home sales. Keep in mind “cash buyer†simply means people are not using traditional mortgage financing. Most Americans need a mortgage. First, Americans need good work before they can buy a home and that is why we have an unreal number of younger Americans living at home with parents. We’ve also never had a young generation so deep into student loan debt. We also have changing family needs. Why do you need a McMansion when you will have only one or two kids (or none for many DINKs)?

When we look at the percent of all sales going to cash buyers, it is also important to look at overall home sales volume:

Source: NAR

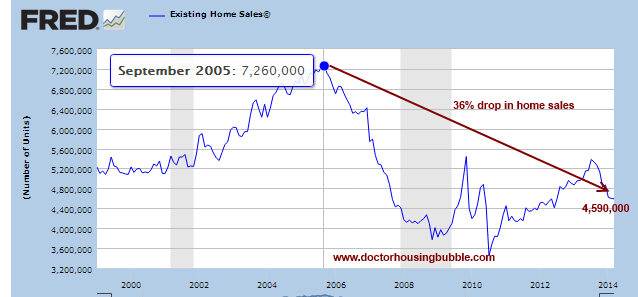

When looking at the above chart, you would think that cash buying is still running at a steady pace. It is not because home sales overall have hit a brick wall in spite of the massive 2013 mania:

Existing home sales are down by 36 percent from their peak. What you have is simply less transactions occurring in the current market. Why? We have a fully stunted housing system. People try to guess as to what the Fed’s next move will be and banks have circumvented accounting standards. Rules that would likely get you into financial trouble (as in not paying your debts) are standard for the banking industry. It is interesting how some people think that once you buy, you suddenly have no additional payments. You have your principal, interest, taxes, insurance, and general upkeep that will go on forever. Housing has traditionally been a good investment for Americans because many are too undisciplined to put money away into a stock index over a consistent period. At least with a home, you are forced to pay the bank each month (and the state gets their nice piece of property taxes as well). Housing, like other investment vehicles, makes sense when the numbers make sense.

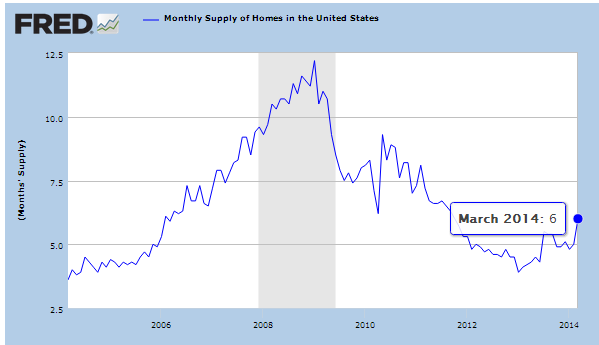

Yet inventory is starting to grow not because of a rush of people starting to sell, but more because homes are not moving:

The market has now reached the break-even supply point of six months of inventory. Yet most of this is coming because most Americans are fully cash strapped and investors have lost their interest in the current market because deals are harder to find. Flippers will continue to flip until the last person is dancing and there are no more musical chairs.

You would think that with home prices surging in 2013, people would be rushing out to buy. Not so:

“(MBA) Both purchase and refinance application activity fell last week, and the market composite index is at its lowest level since December 2000,†said Mike Fratantoni, MBA’s Chief Economist. “Purchase applications decreased 4 percent over the week, and were 21 percent lower than a year ago. Refinance activity also continued to slide despite a 30-year fixed rate that was unchanged from the previous week. The refinance index dropped 7 percent to the lowest level since 2008, continuing the declining trend that we have seen since May 2013.â€

Purchase applications are at their lowest level since December of 2000. Didn’t the public get the memo that if you don’t buy now, you’ll be priced out forever? What suddenly changed in 2013 that saw the market boom? First, investors have created a feeding frenzy and the few buyers that had the means to buy probably started capitulating. Step by step inventory was controlled to a low point where if you wanted to buy, you had to go out and compete with big money investors. Last year, the lemmings in California at open houses were tripping over one another to make offers on beat down shacks. Hot dog stains on wrinkled polos be damned, I want that granite countertop sarcophagus! So a mania ensued. That is not the market of today. Look at many areas around the country and housing is cooling off. Inventory is creeping back in. People are actually running the numbers which is a positive.

If housing is so hot and everyone has gotten the memo, why are purchase applications at levels last seen in December of 2000?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

145 Responses to “The battle between traditional buyers and cash buyers: Cash buyers still make up over 30 percent of market and purchase applications fall to lowest level since December of 2000.”

The market is hotter than ever in prime coastal areas where everybody wants to be. Is this going to cool off soon? It’s hard to imagine when you see so many people at open houses and multiple offers coming in.

Smells like bullshit. But by all means, keep shoveling it.

Tim, you mean like this:

Housing cuts quarterly economic growth again in first back-to-back drop since 2009

http://blogs.marketwatch.com/capitolreport/2014/04/30/housing-cuts-quarterly-economic-growth-again-in-first-back-to-back-drop-since-2009/

Tim,

we all understand the folks in the top few percent have rapidly rising incomes and hot housing markets to live in. Problem is, they are the only group with rising incomes and the divide is getting wider. Bye bye housing ladder.

Tell you what, overlay this chart – http://tinyurl.com/o7j627y – with the housing market and tell us what the future looks like.

Amen! Can I get an amen? How-zing to go up fo-eh-vah!!!!

You talk like Google people I know who have toked the Emerald Triangle stuff. For serious conversation, don’t use the stuff.

I am south of Google. But good guess for an organic sustainable man of the soil. I come from what every floats your boat school of thought. To each his own…

Yes, Mountain Jim, in Felton, told me about you living in Santa Cruz county. When I come down from Mendocino, I stay for cheap in Big Basin or Henry Cowell with Mountain Girl.

Hey Farmer John, Thanks for the Scruz memories. Damn near a lifetime ago (30 years ago during grad school) I lived in La Honda right near Kesey’s old Merry Prankster’s camp. After a couple of winters up there I thought I’d turned into one of them damn Banana Slugs myself…

Then I moved downhill to East Palo Alto and got to experience the gritty end of the nascent Silicon Valley housing boom up close and personal.

Pebble Beach (a rather well know prime piece of CA coastal property) once sold for $840 million, only to be resold for $500 million two years later.

I understand that the market is cooling off in places like the inland empire, but are we going to see places like Santa Barbara cool off? Right now that is not happening. National housing numbers, charts, and trends don’t matter is you aren’t willing to live inland.

Houses are going for WAY over asking in bidding wars in San Francisco as of 2 days ago:

http://sanfrancisco.cbslocal.com/2014/05/03/overbid-madness-strikes-san-francisco-real-estate-market-home-sold-600k-above-asking/

Quote of the week folks!!!! “National housing numbers, charts, and trends don’t matter…”

I sooo agree that numbers charts and trends don’t matter! Math, science, physics are so 2007!!! How-zing to go up fo-eh-vah!!!!

I wasn’t saying data doesn’t matter, I was simply saying that a national trend does not matter if your city isn’t following the trend. It is a fact that the real estate market is not cooling down in prime areas in California. What I was asking was wheter the readers of this website thought they would start to fall soon. Instead of an answer I got a bunch of snarky replies. I know that Jim Taylor said prices would “tank” in March, he has already been proven wrong. So, do the other readers think San Francisco or Santa Barbara real estate will get cheaper in the next few months?

ooooooooooh so you are looking for predictions…. I think you got your pick of predictions here. I say how-zing to go up fo-eh-vah and Jimmy Jim Jim says beware of the ides of march. I still can’t figure out blerts thoughts. And you will find everything in between here. Pick your prediction!

BTW – Still I think “National housing numbers, charts, and trends don’t matter…†is the quote of the week. I think you should try to trade mark it like Paris Hilton tried to trade mark “that’s hot”!

While I think most of us here would especially like to see housing tank in prime areas of California it will take more than overall poor affordability and household formation numbers to make it happen. These are the homes of the 5% (if not the 1%). While the forces of economics apply to these folks as well they have done VERY well financially over the last 5 years and have a pile of money to spend on housing.

I’m hardly a real estate shill, but I see the number of people of millions to spend and it’s both scary and depressing. I think the Doc said it best when he referred to a bifurcating market. Run of the mill homes inland may have indeed peaked and be pulling back. Even semi-nice homes in semi-nice areas (like the ~2500 sqft Eastern Ventura County waters I trawl) seem to have stalled out in price.

But truly high end areas along the coast and within 20 miles of the San Jose – San Francisco axis are a different ball game. There is enough money floating around in these areas to defy gravity for a long time. Short of a black swan type event where the tech economy implodes and all the 1-5% lose their shirts prices could stay unreachably high in prime areas for far longer than any of us would be willing to wait.

I’m certainly not advocating piling on an unsustainable mountain of debt and jumping in to a prime area home right now. But I think that planning around any kind of steep drop in these areas in the near future is a recipe for major disappointment and wasted years of frustrated waiting.

“Prime areas are thriving” is the new “Low Inventory”

Generally, I find there needs to be a something beneath to support something else being elevated. Perhaps this is the Wile E Coyote moment?

So? You cherry pick a showcase house, its not representative of the entire market. SF also has a unique population of tech people in SF and SV who want to live here but don’t think that this market can’t fail.

Hope it wasn’t a TWTR employee…cause they’re down 10% today. Somebody just lost millions in paper $ because of impending lockout when the big boys get to sell. You think this tech bubble 2.0 will never pop? Even if it does, home sales WON’T be affected?

Yes. Everywhere, including your favorite pocket of overpriced sheds (Manhattan Beach?) has prices increases and declines. With very little inventory, there are enough lemmings that will play the bidding war game. Same thing on the freeways – -we can have how many fatal accidents and yet there are still plenty of drivers who will cut you off and drive like they are indestructible. They think they are “winning” something. It’s very childlike behavior for adults to behave this way, yet they do. Will all of them consider the long-term consequences of being underwater on a house? Nope. Full speed ahead, Cap’n. Well, good for them. I don’t think that most posters here assume they will be buying cliff houses in Laguna Beach for under $1.0MM any time soon. But there are plenty of houses in prime areas (“prime” being somewhat subjective) that aren’t the “most desireable” yet they are still there, so most people can stretch and live there during “normal” times (or at least what has been normal). Now, even the most crappy houses put “I’m dreaming” prices on them. A 2 BR house right near me in Marin sold a few weeks ago for $750K and it was in basically 1960s condition. Small 6K lot. If that isn’t an example of mania/bubble/high water mark, then there isn’t anything that will convince you that “this time isn’t different.”

Speaking of full steam ahead what ever happened to Edward John Smith? I hope he is okay… Last I heard he was somewhere in the Mid Atlantic? I hear they are handing out leaky buckets to the passengers and crew. I hope they make it out okay. I do hear the band is still playing so that is a good sign…

Blah blah blah, just more of the same bullshit – this time it’s different, this location is special/unique/magical, it’s a new paradigm etc.

Perhaps you should get a clue and take a look at some previous RE downturns, particularly the late 80’s/early 90’s bubble and subsequent meltdown here in SoCal. Certainly, the least desirable areas boomed and busted hard VERY rapidly, while the so called prime areas resisted, and resisted, and lost value far slower. But in the end, in the mid to late 90s, THOSE PRIME AREAS ENDED UP LOSING THE SAME % FROM PEAK, ALMOST TO THE EXACT PERCENTAGE, AS THE LESS AND LEAST DESIRABLE/GHETTO AREAS DID YEARS BEFORE. This was from a UCLA Anderson School in depth study of the 90s recession and RE meltdown that very thoroughly looked at % changes over time from every LA/SoCal zip code from Newport Coast, Beverly Hills and the Platinum triangle on down to Compton, South Central, East LA, etc.

Those less desirable areas run up in “value” quicker, and lose that “value” quicker. But in the end the most prime areas capitulated as well, years after the ghetto areas bottomed out.

Bay Area Renter, is an old house necessarily bad? This Pasadena house was built in 1895, yet it recently sold for $755,000 – http://www.redfin.com/CA/Pasadena/1046-N-Garfield-Ave-91104/home/7193468

Plenty of houses in Pasadena, and parts of Seattle, are over 100 years old, and they sell for high prices. That being so, why is a 1960s built house necessarily bad? Some people here have written that they’d rather an old house than one built in the past 20-30 years, because they think newer houses are more shoddily built.

Here’s a history lesson to counter your hubris, Tim J.:

It doesn’t get more prime than 2 Rodeo Drive, the iconic mall/plaza across from the (once called Regent) Beverly Wilshire at the base of Rodeo Drive shopping, at Wilshire and Rodeo. Here’s a blast from the past that will hopefully educate you regarding “prime” property, coastal or otherwise. You might learn a thing or two, such as how Stitzel unloaded the property at peak onto the greater fools, a group of Japanese businessmen and investors. And how those suckers, buying in at $200 million in 1990, unloaded for $131 million in 2000 – a 69 MILLION DOLLAR LOSS or OVER ONE THIRD DROP IN VALUE.

http://articles.latimes.com/2007/sep/18/business/fi-rodeo18

“Completed in 1990 at the southern entrance to the Rodeo Drive shopping district, Two Rodeo has entered popular culture as a retail shrine that attracts millions of tourists and other visitors annually.

“This is clearly an icon among cosmopolitan trophy properties,” said Pierre Rolin, chairman of Strategic Real Estate Advisors, the London-based representative of the sellers. He identified them only as a European family trust.

After the complex was finished and occupied by Christian Dior, Valentino and other swanky stores, Stitzel sold majority ownership to Japanese investors for an estimated $200 million. But a deep and prolonged recession swept Southern California in the early 1990s, with even luxury shopping taking a beating.

The Japanese partners bailed out in 2000 after the retail market had improved, but they still took a painful loss when they sold Two Rodeo for $131 million to the family trust. More hard times followed with the collapse of the dot-com bubble and the 2001 recession.”

Look love the stats and chart folks, remember “weapons of mass destruction” they had all the data,charts,maps,photos look where that got us?

Yeah, sure lil bobby. Who needs tangible data, logic, critical thinking, charts etc. when you can just blindly wing it and hope for the best. Try driving a car blindfolded in reverse along Mulholland while you’re at it.

How quickly people forget. I remember lines of cars outside new builder releases and people putting names in a hat for bidding on the houses. 300,000 shitboxes. Even many of the”all cash” is borrowed money or refinanced after the sale and cash is pulled. The banks are hypothicating and rehypothicating the”assets” so real money is taken and the so called asset really doesn’t matter anymore to them since they already got paid. It’s a game of pass the hot potato.

Housing to Tank Hard in 2014!!!

Been saying this for over 4 months. I still have 8 more months left and I am more confident than ever that I will be now.

Fed is doing QE tapering into weakness. .1% gdp growth what a joke. Once interest rates rise you will see all these cash purchasers dump and run with any profits and the slower ones will be forced out with losses. They will trample each other at the exits to get into higher yielding investments with high interest rates. Housing will no longer be worth the headaches for the 5%, when the bank offers the same thing for free.

Housing appears to be tanking hard already.

“But listed prices are still high!”

Ask whatever number you want for the house. All that matters is the number it sells on record for.

And that “record” is extremely unreliable. The MLS is full of crap data. The “selling”price” does not include closing costs paid by the seller or any kind of concession (e.g., the roof is leaky so the seller credits $15K for a new roof for the buyer). The actual sales price could be significantly lower (depending upon what the lender will allow or if the buyer/seller do a “side deal”). Plus, when I bought a house in a rising market back in 1999, the actual sale price was $315K. Yet when the MLS listed the selling price, it said $415K.” Yeah…oops…in a direction that makes it not seem like I got a great deal (which I did). You can’t trust that crap MLS data.

Exactly check the closed price, and houses sell for 96.7% of asking prices, put that in your pipe and smoke it doom and gloom crowd ?

Bay Area Renter…Please tell me you are saying MLS doesn’t post the closed selling price of a home for what is actually closed at?

Maybe you had a typo, I can assure you as a buyer of many properties in my lifetime MLS would have been sued by me many times over if they were rigging the books.

It is not to there advantage, if anything real estate agents rather have then err on the low end this way they can sell more houses faster and not have to work hard to sell higher priced homes listings?

You truly are a Moron among morons, aren’t you, lil bobby socks. Do you even realize that the “sold price % of asking price” stat is one of the most utterly worthless “stats” ever thought up?

You DO know that RE agents and realtors use this meaningless stat as a false metric to tout their performance, but that it is utterly worthless because what they don’t tell you is THEY LOWER THE ASKING PRICES ON THE PROPERTIES THEY ARE SELLING TO MATCH (OR ALMOST MATCH) THE CONTRACT/SOLD PRICE, HENCE RESULTING IN THAT UTTERLY FALSE 96.7% RATE!

Really, you are too stupid for words if you didn’t know that or are trying to pass that one off on us as some sort of statistic that has ANY value or validity at all. It is 100% manipulated for the sole purpose of making agents look good.

“I get my clients 99% of list/asking price!” (But what I don’t tell them is I go into the MLS and lower the list/asking price to 99-100% of the signed purchase price after I’ve found a pair of suckers to make this a transaction)

robert earlier in the thread:

“Look love the stats and chart folks, remember “weapons of mass destruction†they had all the data,charts,maps,photos look where that got us?”

and then robert later in the thread:

Exactly check the closed price, and houses sell for 96.7% of asking prices, put that in your pipe and smoke it doom and gloom crowd ?

I think we are due for a pullback… A few sellers who just want or need to move will agree to a lower price and bring down a few comps.

But what caused prices to collapse last time isn’t happening this time. People that literally couldn’t afford their mortgage were EVERYWHERE. They looked at how cheap rents were compared to owning and WALKED AWAY. People selling now don’t have anywhere cheaper to move to.. so they’ll stay put. No sales, no comps… no drop in prices. A long slow pull back is more likely…

The last round, it was Joe & Mary six-pack buying homes they couldn’t afford with NINJA loans or flippers buying homes with dirt cheap money.

This time around, it’s investors buying and selling homes like baseball cards. When they sense the pain point coming, they’ll divest before going off the cliff.

“Big money always exits a market first. Everyone else will be too late.”

Bubble – I just sold a large amount of stock last week and I am still waiting for it to show as settled. Goldman can buy and sell the same share faster than I can snap my fingers but my etrade account takes days for a trade to complete…

Why would anyone sell if they did not plan to move out of state. Even downsizing is expensive when you factor in your new taxes vs. prop 13 taxes ect. The only sellers are move up buyers and there are not a lot of those to go around. Most people are just hanging on to what they have. This could actually be good. Less people out there trying to stir the pot. Investors will remain dominant and we all know first time buyers are a rare phenomenon that cannot compete with investors. Nothing will tank this year, just a slow down.

“Even downsizing is expensive when you factor in your new taxes vs. prop 13 taxes etc.”

Not necessarily, Christie. Take a look at Props 60 and 90 (and 110 for severely/permanently disabled), which allow elderly (55 and up) property owners to carry over their property tax rate on their primary residence when they sell and purchase a new property more or less for the same or less value as the one they sold, within California counties that participate (includes most Bay Area and SoCal counties):

http://www.boe.ca.gov/proptaxes/faqs/propositions60_90.htm#1

I get it Tim, when somebody presents a positive about housing or sales you discount it, when it is negative you embellish it, yes sir you are truly a objective person?

“I still have 8 more months left and I am more confident than ever…”

You seemed pretty confident before. I guess you’re still not “completely” confident.

You can take it to the bank!

And you’re not quite “completely” braindead, Marco Polo.

Tim Jaylor – which insolvent zombie bank should we take it to?

Jam Tiylor – History and math has already proven your thesis wrong as well as proving math and history wrong…

Aw, come on. Government will do anything…an-y-thing…to prop up housing prices. They will reverse any policy that stands in the way. They will slash defense spending. They will raid Social Security funds. They will cut education and infrastructure spending to the bone and beyond. They will impose price controls on health care. They will permit the outright purchase of American citizenship by foreign millionaires. They will gradually create a nation of 20% homeowners and 80% renters-for-life. They will not let nominal housing prices fall over the long run because that means guaranteed electoral death for whoever lets it happen on his/her/their watch. Never. If there is one lesson to be learned from the last bubble, it is this.

Chris D., please tell me your comment is sarcasm. Quite good if so. Otherwise, nope the government won’t necessarily do a God damn thing to “save housing”. Did they “save housing” the last go round? NOPE – the bailouts were exclusively for the benefit of the “too big to fail” financial entities i.e. the big banks and investment houses that make up the banking cartel. That said bailouts managed to forestall/buffer the collapse of the RE market was a mere side effect.

Saving the housing market was NEVER the Fed and the government’s intention, despite any bullshit P.R. propaganda comments to that effect. It was always and always will be first, foremost, and exclusively, their intention to protect the banking cartel.

“They will gradually create a nation of 20% homeowners and 80% renters-for-life. They will not let nominal housing prices fall over the long run because that means guaranteed electoral death for whoever lets it happen on his/her/their watch.”

Proof that Math has been proven wrong. 80% renters, 20% owners and the 80% renters will be out voted by the “white male property owners” because math no longer applies… Welcome to the new normal!!!

Prices were still falling into the 2012 election…

Chris D. you are very naive if you think that. The Fed is clueless. The more Fed rewards the rich and punish the poor with their current monetary policy, the more the society moves toward a point where the rich will get punished. Inflating housing prices, inflating rents…this will lead to a reaction, and socialism policies will become popular, and the rich will be punished. Monetary stratification of the society through interest rate manipulation is the road to civil war; it is a bad idea, leading to a bad result.

Rents will come down when housing collapses again. Coming soon, as Fed support of higher rents and higher mortgages unwinds. It is odd that the Fed is taking money from US citizens to give to the Landlord Class so that they can keep raising prices on apartments and housing. Very odd indeed. When will American get angry?

Chris, if your gonna troll at least put some effort into it. Sounding like the sociopath love child of Lawrence Yun and Leslie Appleton Young is more pathetic than irritating. Makes me wanna take you to a foster home for the RE shill abused. You and little r Robert must have had it rough as kids…

NihilistZerO – I am very hurt that you did not mention me when you talk about RE shills… I guess I will have to work much harder to become a real RE shill Merican Hero…

You’re totally right about this. They won’t ever let nominal prices drop because it would be a huge kick in the pants to the incumbent homeowners i.e. people with money. All the housing appreciation of the 2000’s was to make people feel rich after they lost $ in the stock market. For these politicians, asset owners rule and wage slaves can go fuck off. If rich people see a loss in their wealth, then you’ll have real political instability. The poor and struggling are too busy trying to find discount groceries to make any real trouble, and they don’t have access to the halls of power to make a big stink. I don’t think the average American is able to comprehend the factors working against them much less rise up and do anything about them.

TLDR Rich people make out, everyone else eats shit

Rates going up? Rates have been forecasting slower growth since January = down.

People forecasted higher rates in Japan for 2 decades as well.

30-90 average days on market in Monstrose/La Canada/La Crescenta/Tujunga area – if priced halfway decently — which in most on this blog would still be considered crazy high numbers. It seems more like purchase apps are lower because there’s not a whole lot of inventory and a proctology exam is required to buy.

Jim,

Love your posts, but perhaps you and others can help me understand something.

How will prices go down? An all cash investor (ACI) buys a home to flip or rent. The ACI is looking for a rate of return that is greater than inflation and or T Bills.

So if interest rates rise (remember getting 5% on your pass book saving?) and housing prices go down, how does the ACI groups out there get out of real estate?

Do they sell at a loss? Do they just stay in place hoping to rent till pricing comes back? What is the effect on the rest of the market while they do that?

If banks won’t sell at a loss (I have never seen a short sale take less then 9 months) why/how would the investors sell?

Just more SFH rental/zombie stock? What effect does that have?

Roll them into REITs and leave the muppets holding the bag?

http://www.bloomberg.com/news/2013-10-29/blackstone-adds-to-biggest-year-for-reit-ipos-since-2004.html

Housing is not an attractive investment for banks because there is too much risk and costs. Think about everything that goes with maintaining a home:

– Insurance (both property and liability)

– Maintenance

– Disasters (flood, tornado, earthquake, etc)

– Management

– Finding buyers/tenants

– Not a liquid investment

Banks would rather hold notes than actual properties because it’s less cost, risk and more profit. They are in the business to lend money, not manage real estate other than their own branch locations.

Cash buyers want quick profits and turnaround times. When they sense the market about to slide, they will sell.

Why keep your money stuck in a losing investment? If investors/banks lose money on the sale, they just write it off their books as a loss and take a tax deduction.

the banks are just using the money that Ben Bernanke gifted to them at billions of dollars per month and they’re just holding that money and then re hypothecating repeatedly the underlying assets over and over again. They’re not loaning money to the public and they don’t have to anymore. They’re making trillions of dollars off of our money via QE.

Investors are getting out now and will continue and be out before retail realizes housing is tanking.

See investors are not going to “wait” as you put it for rents to come back up and make a higher return.

If interest rates go to 8% and inflation is running at 10% their rental yields of 5% are losing already. So yes they will sell the home at a loss if need be to jump into the next assett to make higher yields. Especially if it can be done with licks on a futures or brokerage account rather than managing SFR’s. They have already found SFR’s are a lot of work for the small yielf, but it is better than 0. Wait till inflation takes off and banks have to pay 15% interest rates since inflation is 20%. I don’t see land lording as great prospecting during this time.

I think it is unlikely that Interest rates will go up for a while. All the pressure is deflationary, high debt, low growth. Yves Smith at Naked Capitalism has discussed this at length a few times. We are repeating the path of Japan, which has had low interest rates for over 20 years now. Japan even tried giving out cash vouchers at one point.

Lets see you call people names and a sexist, what else is redeeming about you???

The investors are already getting out, the same way they got out of subprime mortgages – they securitized them. It will be the dummies investing money for the pension funds, the university endowments, the charitable foundations, that will be left holding the bag when this experiment with mass housing investment goes south.

Bingo! You hit the nail on the head! Investment money will keep going as long as safe saving vehicles are not there. Most investors will not opt to let 500,000 sit in a 1% savings account or at high risk in the the stock market. Maybe you are already fully invested in the market and don’t want to put it all in the market. Makes sense, right? Investors will continue to balance risk and real estate is very necessary investment. You are pretty naive to have everything in your 401k and the stock market. When a correction comes it will be brutal. When that money is gone it’s gone…you can at least keep afloat if you are getting rental income if housing crashes again. Buying makes sense for cash buyers.

Christie,

If you believe in future rental income, can I interest you in some rental backed securities? We’ll manage the properties, you just sit back and collect.

How about we pool some cash together?

“Cash buyers still make up over 30 percent of market…”

Should read: “Leveraged knife catching specuvestors still make up over 30 percent of market…”

FIFY 🙂

I was specifically told that these are [wink wink] rich foreign investors (aka rich “Red” Chinese/Russians) with suitcases of “monies”…

I worked the trustee sale in Riverside Co in the glory days. The party peaked at midnight and Big Money Wall Street showed up at 2. I went home at 4. Wall Street stayed till 5. The party rages on!

Also, now is not then. Example, Desert Hot Springs. The old group bought houses with $150 to $300k of debt for less than $90k. Today those houses are selling for $120k ish. There is no bubble. Someone who buys a shack for $120k and it crashes to $90k, he’ll keep paying because he’d pay more in rent for the same box in the same town.

A cash buyer can weather a hell of a storm unlike mortgaged people. Rental income is nothing but net! They can hang on a really long time…as long as they are making enough to pay taxes and upkeep they will not get shaken out even in a dramatic turndown.

I don’t know what school of Economics you went to, but you seem to be thinking about the small mom and pop investors who one 3-4 properties… they can stay put as you say, and collect rent and diversify from the 401K and and stock…

But… the big investors… I can not stay put with million of dollars to collects rents… they are INVESTORS, they move the money around…to the next money maker, if you think they’ll stay put and do hard work to collect rents and do repairs for a long time you are living in la-la land.

They will sell at a loss if they have to but they will re-allocate assets, because that’s what they do…

Most “cash” buyers are beyond leveraged and…

Wait a minute… Why should I or anyone else destroy your RE shill arguments for the umpteenth time??? You add nothing to the conversation and are even more boring and trite than “little r” Robert…

And i sincerely doubt you have the ovaries to stick around and continue the debate after the crash. Stay classy Christie 😉

Christie this is good, they keep posting about our views that means they are interested in what we have to say, of course it will turn to boycott them, but don’t worry this site has gotten more play since I joined.

They look for it now, when my buddy and I played basketball all the coaches and teams hated us because we played old school pic and roll, backdoor layups, they would say I hate those guys, we know what is coming, we can can’t stop it.

This is like housing, they really know you can never collapse housing and have a viable country, we know it has ups and downs but in the long haul most everybody wants a house and yard of their own.

Will somebody tell me how they continue to report low inflation? Housing costs are up, food costs are up, gasoline is up, education is up, clothes are up? Not just by 1% or 3% — they’re up by at least 10% per year. The only thing that’s cheaper is a television. What the f-ck are they talking about no inflation? Life is getting more expensive by the month! Raise interest rates and get this bubble under control!

How-zing and gaz-o-leen don’t count. So what is left? T shirts and T Vees! It’s all good!

Dude, your little z spellings got old a long time ago, and this is from someone who is on your side. Seriously, lose the silly spellings.

Miss Construe – Don’t read my shill commentz if you don’t like my shill spellingz… I am open to debating my shill opinionz with shill responsez. Otherwise don’t waste either your or my time with spelling or grammar correctionz…

gas prices went up here by 50 cents a gallon in the last couple of weeks that’s over $300 per year buying a steak at the grocery store is now like buying a gift for someone at a cost of between 30 and 50 dollars for some beef. Food and gas are not included in the cost of inflation nor is housing so what’s left scraps of cloth that we wear and electronics.

ZeroHedge had a great article about that a few days ago – it’s called hedonics. According to the government, TV prices are down 100% in the past few years, because TVs today are better than TVs from a few years ago, yet prices are roughly the same. Govt inflation statistics are intentionally misleading.

Pay attention, inflation-dingbats:

Inflation-adjusted price of gas – started climbing steadily in 1998, has basically been level over last 7 years except for a huge dip WHEN THE ECONOMY NEARLY CRATERED:

http://inflationdata.com/inflation/images/charts/Oil/Gasoline_inflation_chart.htm

Inflation-adjusted price of meat. Over last 14 years, chicken stable, pork stable, beef up 25-30%.

Sorry, can’t find a graph for “price of clothes”. I don’t think it’s 10% per year.

I do agree that the price of higher education has been going up way faster than inflation: http://inflationdata.com/Inflation/Inflation_Articles/Education_Inflation.asp

Disagree? Bring evidence

“Inflation-adjusted price of gas”

The key word is INFLATION; you admit to it, and it is massive.

What has changed? Consumer confidence, that’s what. The present day RE market, much like the stock market as well as U.S. dollar power, is all a confidence game i.e. a CON GAME. And that confidence is waning as more and more people are realizing the bullshit green shoots and so called good numbers of the past few years since the “great(est) recession” supposedly “ended” are all bullshit and that the recession and downturn never truly ended.

Enjoy the coming shitstorm.

I am fine as long as CNN, CNBC, NPR, etc. tell me we are in recovery…

Simple. They leave their clients or tax payers holding the bag.

Rental Backed Securities, REIT IPOs or whatever other financial instruments they dream up.

^ response to Boca Condo King.

There probably are a few discouraged would be buyers out there…I’m one after wasting a year trying to buy in 2011/2012 and having my offers (all at full price or slightly more) ignored as I was competing with 100% cash flippers and specuvestors. That was NOT fun, would get excited about a place and had my hopes dashed repeatedly. I will not be re-entering the market until the current bubble pops AND I’m convinced that I actually have a chance, will not buy into a bubble or waste my time making offers when my odds of having them be considered are close to zero.

I have bought a house before in a normal market (1997) and it was relatively easy, looked at about 10, made two offers, one of them was accepted…and this was with zero down and a VA/GI Bill loan. By contrast two years ago I had a preapproved conventional loan for way more than I needed and could have put up to 50% down and that did me no good at all.

Definition of “pent up demand” – “will not be re-entering the market until the current bubble pops AND [is] convinced that [one] actually [has] a chance, will not buy into a bubble or waste [ones] time making offers when [ones] odds of having them be considered are close to zero.”

ZZZZZZ

I pay less tax on my $400K CA home purchase than my parents do on their home in Pennsylvania that is valued at $200K. That’s one reason home prices in CA keep pressing higher.. taxes are capped at 2% increases per year maximum. Other states tax laws for real estate keep prices in check.

Good take.. TaxesHousing

Such a true statement. Reason 137 why Prop. 13 was bad policy and continues to be so.

I’ve been arguing for a long time that Prop 13 didn’t solve anything. It only removed a feedback mechanism which tends to put downward pressure on the price level. Instead of higher RE taxes, the loss of revenues are made up for in other areas. Like taxes on other forms of consumption. Everyone else who is consuming only those other things or who bought RE late in the game are subsidising property owners who bought earlier.

It’s absolute fucking bullshit stealth skimming of rents that will not go unanswered forever. Those who benefit from the *current* status quo will respond that such complaints are “whining” or some such self-centered labeling response. We’re well on our way to a critical mass of renters vs owners in this state and that will spell the end of Prop 13. The status quo beneficiaries can call names all they want, there is no free ride – just ask hybrid and electric car owners when the politicians finally get their VMT (vehicle miles traveled) tax scheme implemented.

Yes, I am tired of the bullshit.

Soaring home prices spur a resurgence near USC

The hot housing market and a rail line push young professionals to the West Adams, Leimert Park areas

Priced out of much of Los Angeles, young professionals are zeroing on several neighborhoods around USC and to the west, as the expanding Expo light rail line delivers new residents to the area.

The influx comes as the once-struggling communities now see potential for new investment along major boulevards of South Los Angeles such as West Adams, Jefferson and Crenshaw. Prices are shooting up: In the ZIP Codes covering these neighborhoods, the median home price jumped 40.6%, to $450,000, in the first quarter compared with a year earlier, according to San Diego research firm DataQuick.

After a more recent wave of Latino immigration, only Leimert Park remains majority African American. Many new arrivals are white. The neighborhoods — largely west of USC and south of the 10 Freeway — are distinct.

full story below =discuss

http://www.latimes.com/business/la-fi-property-report-20140501,0,255322.story#ixzz30tmC7Zyj

There is no question that a slow down especially in the $400k to $1m market. It seems like $1m and up is still holding it’s own in prime zip codes.

Of course the banks are now over doing it and even rejecting loans with credit scores at 730 unless the buyer puts up 40% down or makes crazy money in a fortune 500 company, if you own your business better pay cash or they will be you are done with you.

Sellers who are grossly overpriced want to be bailed out, sorry buyers have access to public records it won’t fly.

Who is getting hurt are homes priced right but no takers. Buyers are so disgusted with the over priced underwater home owner they have turned off to everybody.

The question will the Gov’t get creative again to move inventory, and will the grossly overpriced in trouble homeowner fold the tent?

I’m going to hate myself for responding to robert, but the phrase “homes priced right but no takers” really annoys me. There is no such thing. If they priced these houses properly they would sell. If they’re not selling they’re overpriced.

Period. Full stop.

I’ve seen this sort of argument before for holding onto fictional valuations in the face of market realities. It’s nothing more than a lie sellers tell themselves when they can’t face the reality of the marketplace.

“Period. Full stop.” That reminds me of blert. I kinda miss his rambling rants. I hope he is okay…

I see, and what is the low price of anything, so you can afford to buy it then you overprice when the time is right and walk away laughing? You don’t or ever will understand buying and selling, I’ve done it since 22 years old, nobody dictates the price , it is timing, a state of mind, and banks setting locations as prime real estate locations, even though many locations are not close to prime property.

All I can say, if I don’t know what I’m doing why did my wife and I retire at 45, and to this day still lead the very good life?

Your quote: “To me, it seems that it’s not holding up”. Does not ring true. I’m in prime prime LA in Pacific Palisades and have been looking out for the last year or so when everything ran up. Over the last few weeks, it has definitely turned. Slim inventory is nonetheless getting wider and every single house that was on the market has had a price reduction. New listings are definitely cheaper than they were just 2 months ago. I even find myself seeing new listings and thinking “wow, that’s cheap” – but of course that’s just in comparison to the even more ridiculous prices I saw before. My sense is that there are a lot more signs on the streets and being priced cheaper.

sorry…the quote should read IS holding up.

“You don’t or ever will understand buying and selling, I’ve done it since 22 years old, nobody dictates the price , it is timing, a state of mind, and banks setting locations as prime real estate locations,”

Nobody truly understands buying or selling, not even you, robert. Too many variables, too many macro/micro differences, etc. All we can look at are patterns and aggregates. All we can do is predict because it’s human behavior, which is never entirely rational.

All we know is that the right price is the one that the seller and the buyer agree on. Price it too high and people pass on it. Price it too low and people wonder what’s wrong with it.

Thus buying “is a state of mind”?

“You don’t or ever will understand buying and selling, I’ve done it since 22 years old, nobody dictates the price”

Listen to this moron pulling the old pot calling the kettle black, who in the previous comment says “Who is getting hurt are homes priced right but no takers” then follows up with that load of shite.

IT IS ~YOU~, lil bobby, who doesn’t and never will understand buying and selling. You even state, “nobody dictates the price” but previously stated “homes priced right but no takers”. Homes priced “right” according to WHOM – YOU?

Hypocritical idiot. You are only right that NO ONE DICTATES THE PRICE – it is the MARKET that determines the price. And if the MARKET is dictating that prices are NOT RIGHT because transactions are not taking place, then those homes are obviously NOT PRICED RIGHT. Buyers are speaking with their actions, and it is the buyers that set the market. If “right priced homes” are not selling then said homes are NOT “right priced”.

Jam Tiylor – you are breaking the cardinal rule. Even if you win an argument with a r______ you are still r______ed…

Let me give you a lesson, it is free no charge. Most buyers don’t know what they want, they buy emotion, what the news is telling them, impressing other people, very few search public records of sellers and who have to sell, and who doesn’t have to sell?

Thus the sell I reported 6 weeks ago on this site, why would buyers pay more for a production home with 2 car garage and pass on custom homes with 3-4 car garages within 1 mile of each other. I then look at Tour factory guess what the overpriced 2 car garage house has a wine bar, beautiful furniture staging, paver driveway. Bingo

This happens everyday, over priced houses sell, excellent clean houses sit. Now here is the reason and it cost you nothing, women who view clean well appointed homes can’t imagine themselves living there because they are not homemakers so they tell hubby pass on it. Can’t tell you how many times I heard in selling my properties honey can you manage to keep this house like this, the wife blows up and says lets move on.

Most folks are simple lazyboy furniture people, they can’t even fathom buying a nice well appointed home even though they are not buying the darn furnishing’s.

Price is what it is my friend, the marketing of home. the staging of a home for a certain zip code is huge, (my wife was a designer. always marry a woman who can keep a home nice and clean, up to date, it is the key. I sold small homes for large prices and even had the appraiser eating out of my hand, they always say this house something about it, everything is placed right and is has a comfortable feel that is what sells, wine racks and wine refrigerators (find the room in your home that sells house for more money. Thus don’t sell empty houses and stage it well otherwise you are shooting yourself in the pocket book?

There so much total complacency for the home-owning and other housing VI, at these prices. Too many of them have only known a massive long-wave in house price inflation, and can never see it changing. Values are set at the margin, and if and when this market turns, it’s going to be quite something to witness – and it could POP hard. 1 buyer and 1 seller can agree a much lower price to transact at, into a crash, for it to have an immediate effect on values of surrounding homes, when repeated at low volume in an area.

robert earlier in the thread:

“Look love the stats and chart folks, remember “weapons of mass destruction†they had all the data,charts,maps,photos look where that got us?”

and then robert later in the thread:

“There is no question that a slow down especially in the $400k to $1m market. It seems like $1m and up is still holding it’s own in prime zip codes.

Of course the banks are now over doing it and even rejecting loans with credit scores at 730 unless the buyer puts up 40% down or makes crazy money in a fortune 500 company, if you own your business better pay cash or they will be you are done with you.”

i’d like to nominate my condo sell for the real homes of genius award. someone bought my 1brm 1bth 622 sq ft condo at 640 w 4th st #414 long beach ca 90802 for $170,000 all cash as is. i bought it for $39,000 in nov 1996. i close on wed.

The sad thing is that it will be back on the market at $400,000 in a couple of weeks…

hahaha too funny

Excellent Ben, I also sold a 2011 house I bought for $425k and sold it in early March for $646, of course I have no idea what I’m doing and the buyers were stupid, they should have waited till I sold it for $400k and made most everybody on the board happy???

That is why we live in a Forbes top 100 zip code.

You live in a “Forbes Top 100” zip code and your shitbox is only “worth” $645K? Top 100 Best Zip Codes If You’re Impoverished, maybe…

robert earlier in the thread:

“Look love the stats and chart folks, remember “weapons of mass destruction†they had all the data,charts,maps,photos look where that got us?â€

and then robert later in the thread:

“That is why we live in a Forbes top 100 zip code.”

@robert, you are a fool for selling for so little. Didn’t you get the memo? Roving hordes of uber rich Chinese nationals are buying crack shacks in Compton, sight unseen, for $2 million dollars cash!!!!!!! Had you waited a couple of weeks, you could have gotten $10 million cash for your Forbes top 100 zip code starter home.

Soon most SoCal’ers will be living in cardboard boxes since they will be priced out of the market by roving bands of wealthy Chinese I keep reading about on the internets. Buy now or be forever priced out!

robert, why aren’t you in a Forbes top 50 zip code now? Right now is when you should be trading up. You don’t want to get priced out forever now. Then again, I forgot – you dictate the market prices.

Zero Hedge had a post about the current state of the real estate market around the country:

Million-dollar homes in the U.S. are selling at double their historical average while middle-class property demand stumbles, showing that the housing recovery is mirroring America’s wealth divide. As CoreLogic notes, “the real estate market is the ultimate reflection of confidence, wealth and income,” as purchases costing $1 million or more rose 7.8% in March, while sales of homes costing less than $250k plunged 12%, as “the same factors driving the income stagnation in the middle are driving the income momentum at the top.” The luxury markets are indeed on fire as foreign (and domestic) super-wealth floods into real estate but as NewEdge’s van Batenburg notes, echoing ur very words, “The American Dream is dead for everybody but the happy few who have enjoyed the tailwinds of the appreciating stock market.”

http://www.zerohedge.com/news/2014-05-05/american-dream-dead-everyone-happy-few

First of all you know that reading ZH can be detrimental to your health. Second is it not possible that there are very few $200,000 houses left and that is why sales have moved to the higher price point? This time is different and math and history are no longer pertinent…

I think you’re quite right. I was in the market for a 250k home, and wasn’t finding much, so I decided to splurge and spend $2mil.

Tim you are what I thought not to bright, not was a investment, a investment, a investment get it. That is what you don’t want to hear making money in RE geesh?

China’s property bubble has burst:

http://money.cnn.com/2014/05/06/news/economy/china-property-nomura/index.html

Meanwhile, the OECD tells the entire planet to cut rates:

http://www.marketwatch.com/story/oecd-cuts-global-growth-forecast-urges-ecb-to-act-2014-05-06

China is mentioned half way down the article.

I’m beginning to believe that low interest rates may be a permanent thing.

Thanks for that bit of intel…it truly is a race to the bottom with the global economy players chasing each other ever further downward on a death spiral fight against gravity i.e. the necessary deflation and credit/debt destruction.

The cockroaches have come home to roost at Blackstone: http://www.latimes.com/business/la-fi-blackstone-lawsuit-20140506-story.html

BBB Complaints about Blackstone/Invitation Homes:

http://www.bbb.org/dallas/business-reviews/property-management/invitation-homes-in-dallas-tx-90466743/complaints

How about just don’t rent from these crooks. Then they would have no market.

Brilliant! Great idea!

Calgirl …Hope these folks close up shop soon?

Hey Dr, it would be nice if the site had a quote and multi quote function. That said, I agree with A.S. comments.

apolitical scientist

May 5, 2014 at 7:35 pm

“While I think most of us here would especially like to see housing tank in prime areas of California it will take more than overall poor affordability and household formation numbers to make it happen. These are the homes of the 5% (if not the 1%). While the forces of economics apply to these folks as well they have done VERY well financially over the last 5 years and have a pile of money to spend on housing”.

As other mentioned, it IS different this time, as the last blow out in housing values was due to Stated Income loans that went bad. Over the last 6 years, lenders have been making good loans. The only way those loans are going south is if employment implodes.

In San Diego, the market tanked about 30%-40% when Clinton came in and cut defense spending. All the big employers in town left (General Dynamics, Convair, etc, etc) If employment takes a big hit, well then shit will hit the fan in that area/region.

I really do not think interest rates are going up a bunch, as pretty much every democratic country has a huge deficit that needs to be financed. Hence the comment that some organization is calling for lower rates.

Maybe price increases cool off a bit and even go down 10% in out lying areas, but “Housing to Tank in 2014”, I will not hold my breath for that one unless employment craters.

Everybody keeps talking about rates increasing but that is still not happening. Conforming 30 year fixed is at 4.375% today with 0 points. Don’t underestimate the ability of TPTB to hold rates down. They will do whatever is necessary to keep the ponzi rolling.

This current run up in housing doesn’t have the makings of a POP implosion like we saw a few years ago. It is going to be more of a slow deflation of the balloon. Unfortunately, that makes for some pretty dreary viewing from the sideline; it’ll take time, the bottom could take years and even then, may only be clearly visible in the rear view mirror. Put that against an economy and market that is, frankly, quite unpredictable right now — and you have mediocre prospects.

If you want to buy a house and IF you can afford it, buy a house — and live in it.

Timing this wackiness is a losing proposition and one could wind up having spent decades, the majority of their life renting, while waiting and hoping for something that never happens.

And even if you wait five, ten or twenty years and shave 5k, 10k or even 20k off the sale price… was it really worth it?

That’s no way to live your one and only life.

“That’s no way to live your one and only life.”

I was told that I get at least one Mulligan per side!!!

“That’s no way to live your one and only life.”

And there you have it from a forum handle thief. Renting is so horrible, it’s just no way to live your life. No, it’s way better to commit yourself to a loan.

i am seeing and hearing more NAR commericals, which means things are getting skinney and they are looking to place a few more into overpriced assets. same thing ala 2006.heres your realtor: https://www.youtube.com/watch?v=A2_Hmt-MKLA

Ahhhhh, I remember that, when Peter Schiff utterly destroyed that twit. Hilarious.

Here’s my agent, ain’t she good?

https://www.youtube.com/watch?v=hPIxrzmatq0

Brilliant!…Big flashback to see how the insane 2008 Real Estate Market was back then..

Now all we need is to see some big bank commercials from the same time period to remind us all combined with the enormous direct mail marketing and advertising campaigns telling us all to cash in on all that equity your sitting on and we can all feel Rich and wealthy again!! Remember those good old days???

Talking to a big bank rep over the weekend, he says the next big thing coming down the pipeline is Heloc’s resetting, the brunt started in 2004, 2005, 2006 (Huge Year for this) and the tail was in 2007. Your average joe took out anywhere from $50,000-$100,000 and has only been paying the interest up to now….its on a 10 year interest only and it jumps on a $100,000 from $250,00 bare bones payment right now to well over $1100++(Read the small fine print in the signing papers to see for yourselves) and he probably has no clue about it either until they get there new statement in the mail at some point or hear about it all over the 7 o’clock news….

“Hey honey, dont we have one of those”

Sound familiar anyone???

It sure is interesting to hear a “prime” area RE agent referring to national numbers as if they actually matter because all of these wacky charts and numbers are just so gursh durn meaningless for “prime” areas.

Crystal Ball AKA CNBC quote of the week.

” Twitter’s stock plunge created a buying opportunity?”

No comment…

To Bay Area Renter: there’s a major reason why people will pay premium prices for a beautiful old Victorian like the one in Pasadena that you posted a link to, while they want nothing to do with a 60s vintage crapshack.

That house in Pasadena is an absolute beauty. They just don’t build’m like that any more and haven’t since at least 1935. The people who designed, built, and bought that house had posterity in mind, and certainly didn’t think in terms of “starter” or “move up” houses. Architects were classically trained and had a well-developed sense of beauty, while builders and workers had craft and skill. Most of all, people as a rule were not swimming in affluence and the “throwaway” society had not yet been thought of. Whether it was a dress or a house, people made and bought stuff with the idea it would have to last for years and maybe the rest of their lives. A woman would keep the good silk and wool dresses she received as part of her wedding trousseau, over and over again in keeping with changing styles. And a house was forever.

On the other hand, the production houses squeezed out of a giant cookie press in the decades immediately after WW2 are absolute garbage built to last one generation, if even. The 60s was the era of the Throwaway Ethos, and these houses were built to make the builder money, with the idea that the buyers would move up in a decade or so. They were built thousands at a time, according to the latest fad among modern architects, of the cheapest materials the buying public would accept. They were mostly sad and outdated within a decade, and the owners were on to the next fad. You could tear down 95% of the residential and commercial structures built across this country 1945-1980 and not lose a thing. No matter how bad you think construction was in the 80s onward, it was a vast improvement over the construction of the post- war era, and at least is built with minimal energy efficiency in mind, which was not even a thought in the 60s.

Laura, it wasn’t me who posted a link to a Victorian. I referred to the post WW 2 shacks. I agree with everything you said. Someone else questioned me saying that the crap shacks next door to me and indeed the one I’m in are good houses. They aren’t, as you explained. Old can be good but not this type of old.

I see it is 3:15pm, I’m retired have all the time in the world, when do you work? I thought you were a investment manger and stock buyer, anybody who invests this much time on a blog I wouldn’t do business with?

Yeah, suuuuuuuuuuure, lil bobby, spend all day on here commenting is what passes for your retirement. Just living the dream, eh?

Actually a neighbor told me about this blod long tome ago, Dr. puts a lot of effort in it. Then I decided that most you folks can’t rub two quarters together so I want you to educate you to make money in Real Estate, plain enough for you pal???

BTW Mr. Tim…I live the dream alright, staring right now from my den overlooking my negative edge pool to a view that poems are derived from?

Now what view to you have from your digs???

Roses are red, Violets are blue.

My swimming pool has a negative edge, now my mortgage does too.

Look Tim, I don’t do chop sessions at my age anymore do me a favor, join the ranks and don’t post back to me unless you got something to say other then insulting women and others on the board.

I’m on a roll, who is Tim J, Tim Jaylor , Jim Taylor, all of you the same person or do all of you go the same school or same neighborhood, I ant to make sure I stay clear of it the values must be attrious?

I must learn spell check? I type to fast

Why worry about housing anymore kids, Pres. Obama’s administration just proclaim weather will do us in, can’t fight mother nature?

Leave a Reply to Chris D.