Till debt do us part – financial collapse foreshadows second collapse in housing. Million dollar troubles in Beverly Hills. 2 million tax filers disappear in latest tax data.

The crushing reversal of the stock market only reveals the underlying weakness of our economy. Keep in mind the public was warned that if the debt ceiling was not raised, we would essentially experience what is being experienced today. In other words politicians and political pundits have no idea what is really moving the underlying machinery of the banking system. They just take their marching orders from their Wall Street financial backers and assume all is well. The housing market especially in California is likely to experience a deeper blow in the next few years because of dynamic shifts in the composition of home sales but also the underlying wealth of those buying higher priced homes. Many of those buying up relied on favorable government loans that have phased out at the higher end but also the wealth effect is being explored as stock portfolios tank as they did in 2008. Some focus on the historically low interest rates as some kind of saving grace for the market but what use is a low rate if the entire economy is in shambles? Keep in mind that interest rates are only low because of the Federal Reserve artificially buying up over one trillion dollars in mortgage backed securities but also the panic going on all over the world. Global investors are running into Treasuries out of fear even though we just demonstrated the magnitude of our debt with our latest political charade.

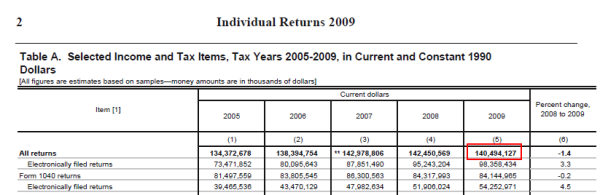

2 million tax filers disappear

Source:Â IRS

It is disturbing to see how deep this recession has hit. From 2008 to 2009 two million tax filers were lost in the economic chaos. This comes from recently released data from the IRS. Now for those of you who have kept pace, California has the second highest unemployment rate in the country and the underemployment rate for the state is an astonishing 23 percent. So again, what use is a low interest rate when job prospects are so poor?

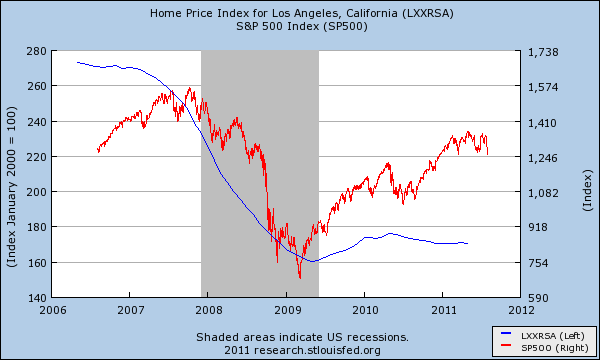

California has a heavy reliance on housing and stock bubbles. During the technology bubble of the 1990s many pocket areas of the state saw wild increases in real estate values. In the 2000s much of the jump in real estate values was chalked up to mania driven delusion brought on by real estate itself. Take a look at the symbiotic relationship between stock values and California home prices:

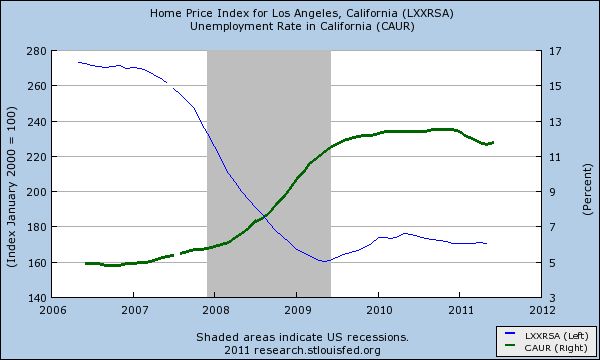

As the stock market imploded in 2007 so did real estate values. When the stock market rebounded in 2009 so did real estate but very little. The relationship is tied but not always one-to-one as it was from 2007 to 2009. Look at 2006 where real estate values peaked while the stock market still had 18 months left before peaking. You start reaching a point where people question what is really going on. The unemployment situation is abysmal:

The current correction is magnified by the budget deficits in California. Many of the California pension programs like CalPERs heavily rely on optimistic stock valuations. The recent budget passing was based on rosy projections that have now fallen by the wayside. So what do we have as choices? Higher taxes and deeper spending cuts. As we have seen with the current debt ceiling talks the world does not deem it optimistic to balance trillion dollar deficits simply by cutting. Something has to give. Most reasonable people realize that a combination of tax hikes and spending cuts are necessary to move forward.

Even the wealthy getting hit

Many of the wealthiest in our country, especially in California derive their net worth from the stock market and not mega mansions on Mulholland Drive. So these corrections cut to the core of their balance sheet but also what they are able to afford. Take a look at this Beverly Hills home for example:

13320 MULHOLLAND DR, Beverly Hills, CA 90210

Listed   08/01/11

Beds     5

Full Baths            7

Partial Baths      0

Property Type  SFR

Sq. Ft.  9,375

$/Sq. Ft.              $448

Lot Size 32,230 Sq. Ft.

Year Built            1990

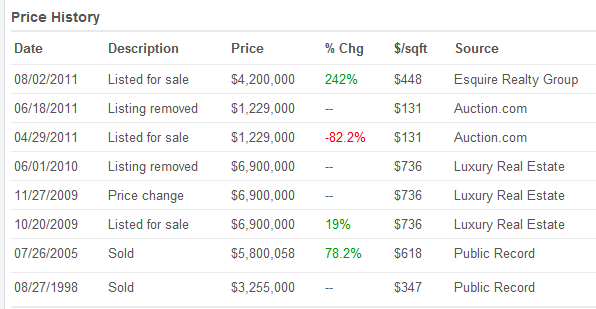

According to Redfin this home is located in the Beverly Hills Post Office area. This home is currently listed for sale at $4,200,000. Looking at Zillow data reveals some interesting information:

It looks like someone tried to sell this place last year in June for $6,900,000. Doesn’t seem like it happened. At a certain point, even a low interest rate is going to do very little for a home like this. People need to come up with real solid income and actually believe that the value of this home will increase. Why would someone purchase a $4 million home if they believed prices were heading south even in Beverly Hills?

This all ties in with what is likely to happen in the next downturn for California. Banks can continue to hide inventory through large amounts of shadow inventory but this will cause a drag on the real economy as it has for the past four years. This game can only go on as long as people allow the system to continue to favor the large banks at the expense of the public and economy.

It is the government that is keeping home prices unaffordable for many by bailing out the big banks. The market is screaming for cheaper priced housing so more disposable income can go to more productive sectors. Yet banks refuse to let this taxpayer bailed out cash cow go. Yet this is no capitalism folks. This is banking welfare and the fact that the market has tanked even after a debt ceiling hike only means people are starting to understand what we have here. The game is rigged but this does not mean home prices will go up. It only means the connected will find a way to land a golden parachute and jump off into another asset to game and siphon off more easy money from the economy. If that sector implodes as well, then it will be taxpayer bailouts again (that is until the public wakes up).

However we can bring this back to a more simplistic point and that is that household incomes are simply not keeping up for current home values in many areas. You pay for your mortgage, taxes, insurance, and other housing expenses from a paycheck. If people find that their paycheck is cut or lost, a mortgage suddenly becomes a heavy burden. Why else would we have some 6,000,000 properties lingering in the shadow inventory? If this setup continues we are likely to face a massive drawn out malaise similar to what Japan is facing. Banks continue to pretend all is well while the government dives deeper and deeper into debt to keep zombie banks running. Yet who wins here?

Most people are disgusted with both political parties because they realize that they only serve the financial elite in this country. The mainstream press hardly does any examination of the issues and you will never hear about the fact that according to the latest IRS data, the average household income fell by $3,500 (a drop of 6 percent) from the previous year. I’ve stopped watching the talking heads because it is pure nonsense and theatre for the most part. Simply flipping through the channels I heard “no one saw this coming†and “is it time for QE3?â€Â Yeah, let us keep buying more mortgages with money we don’t have to save banks we don’t care about and inflating home values because somehow that has worked so well for us.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

42 Responses to “Till debt do us part – financial collapse foreshadows second collapse in housing. Million dollar troubles in Beverly Hills. 2 million tax filers disappear in latest tax data.”

People are all in a kerfluffle about the current stock market correction. I’m not; I’ve seen this coming since May. Back then, it was revealed that the Treasury would have to raise about $600 Billion this quarter (That is about how much was raised during the previous three quarters)!

The only way for that to happen was to tank the Stock Market, and drive people into Treasuries. So I took profits last month, and have been happily sitting on the sidelines awaiting another buying opportunity.

This is also the needed precursor to excuse QE3, which everyone was beating Bernake up about heavily in June. Now they are about to be screaming for him to do it. Europe is a bit of a wild card right now, but I expect Europe to kick the can down the road a little bit longer.

As far as housing goes, the correction should rattle buyers cages, but it will take time to show up in the Case-Shiller numbers, or in local prices. After the 2008 crash, sales still went on where I live. It took about 3-6 months before the general clueless homebuyer figured out that housing might be impacted. We shall see this time; but as long as cheap credit is available, suckers will be buying.

The fed pumped up the stock market, now the pump has stopped and reality has set in, and the stocks, like real estate, are seeking their true FMV. When people feel poorer, they spend less, hence the double dip recession, as well as housing. Bright side is lower oil prices and gasoline.

I am always questioned what I should do with my savings. Keeping it in cash does not seem like a good idea. I feel like I need real assets (I am a renter). At some point, buying overprice realestate may make sense. I agree with all your analysis but nothing has changed but the value of my savings. Everyday the value of the USD vs commodities and other currencies gets weaker – what is somebody to do with their savings?

O thou silly Tim!

Savings? Good heavens, you’re not supposed to have any! Didn’t you get that memo? You were supposed to have lost them at least half a dozen times since Dutch was president. I mean, if you were doing your duty to the economy and speculating on whichever tulip was being waved in front of your nose.

But I am here to say that you have hope! I have been reading consistently in the Bay Area media (both news and business/tech) that we are all about to be saved by “Dot Com 2.0.” Why yes, a new tech bubble is coming our way–the media have been blatting what is obviously a bunch of corporate press releases, dressing them up as news, where tech corporations are demanding “the government” pony up to make their businesses work up front. So that, you know, down the road those on the top of the pyramid scheme can cash out early, pass their ponzishares along…and leaving the last bunch of suckers holding the bag on GourmetNutmegGraters.com.

I thought I was reading The Onion–“US populace demands new bubble to invest in.”

Tim,

Without getting too off-topic for this thread and with the disclaimer that I am NOT a financial advisor (I am just a full-time cash flow investor), you might want to research alternative investments that cash flow, which includes real estate and many other asset classes. I have been a slow and steady cash flow investor for over 9 years and I have learned that cash flow is king. Cash flow saved me from the previous downturn and I’m hoping it will do the same in our upcoming recession. Examples of asset classes you could consider, outside of real estate, include ATM machines, short-term collateralized loans (against real estate or other assets), and many, many others. It’s just a question of education and networking to find the opportunities (actually that is really simplifying things, as it does take a lot of work and education but it really pays off).

Unfortunately leaving your money in a savings account at today’s yields is allowing inflation to erode your capital, which is equates to “financial suicide” for full-time investors like myself. And don’t get me started on today’s “true” 8-10% inflation vs what is reported, as inflation is eating away at everyone’s capital quicker than the government chooses to report these days thanks to changes they made in their inflation formula in the early ’80s.

Good luck to everyone,

Investor J

http://www.meetup.com/FIBICashFlowInvestors/

http://www.meetup.com/investing-363/

Meanwhile, California’s courts continue to legitimize fraud perpetrated by Wall Street banks in the securitization of home loans.

“Gomes appears to acknowledge that California’s nonjudicial foreclosure law does not provide for the filing of a lawsuit to de-termine whether MERS has been authorized by the holder of the Note to initiate a forec-losure. He argues, however, that we should nevertheless interpret the statute to provide for such a right because the “Legislature may not have contemplated or had time to fully respond to the present situation.†That argument should be addressed in the first instance to the Legislature, not the courts. Because California’s nonjudicial foreclosure statute is unambiguously silent on any right to bring the type of action identified by Gomes, there is no basis for the courts to create such a right. ” Gomes v. Countrywide (2011) 192 Cal.App.4th 1149.

Nothing to see here folks. It doesn’t matter if the bank, using MERS as a strawman, can’t really prove it is owed the money on the promissory note, and thus, may be collecting money to which it isn’t entitled, because the borrower agreed to it (even though he would have no way of knowing about the scheme he agreed to).

The second big leg down in real estate has just begun. A “Defaltion Scare” is exactly what the government wants, to scare people out of the stock market and into buying it’s worthless treasuries. How else can we raise the money to pay our trillions of debt? As the stock market tanks and trillions of wealth is destroyed, less and less will be able to buy homes. The result will be a good 20-25% additional drop in home prices for affluent areas, like the Westside of LA.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Patelco Credit Union–one of the largest in CA–sent out an item in its monthly “Financial News” newsletter explaining why this is the best possible time to buy a house. (Think of Claude Rains in Casablanca rounding up the usual suspects.)

One of the items was how there MAY be federal programs coming on line SOMETIME that require lenders to require 20% down payment. And I quote:

“In SF, where an average home price is $642,700 [asterisk–Source: Zillow.com], that could mean you would need a down payment of $128,540. Yikes!”

Note they refer to the average, which is pulled upward by occasional big-ticket sales, while peddling debt to people who clearly are going to be on the lower end of the housing market. The MEDIAN asking price in SF is in fact around $445,000, and 20% is more like $89,000. Still a stiff piece of change, given the unemployment and wage situation.

But many two income families in SF or nearby could save $8K a year, or more, with careful budgeting. And if they can’t, how the bleeding fraque are they going to afford a HOUSE? when $8K a year wouldn’t begin to cover the RE taxes, or sudden repairs, or whatever.

The irony is that Patelco completely stayed out of subprime lending. They’ve got gobs of money to lend. And people are sitting tight, not taking that debt on. Wages won’t support it, employment profile won’t, and people are beginning to wake up, as DHB says and so many of us have seen in our own lives.

I have to wonder how many good institutions like Patelco are going to get destroyed because the sector of society they were created to serve, and do serve–the working middle class and other people of modest income–have absolutely no role in the new world economy model. Except maybe, like commenter Tim, in the role of locked-up savings mother lode to be exploited by any means necessary as a further welfare bailout for the banksters. We’re already seeing massive deflation of our savings through multiple means. Patelco itself? They’re offering 1.85% on 60-month CDs and IRA certificates.

compass rose:

That set off an alarm with me, so I took a look.

I’d get your money out of Patelco very quickly. Take a look at this:

http://banktracker.investigativereportingworkshop.org/credit-unions/california/san-francisco/patelco/

Their TAR value is WAY above the National Median for Credit Unions. At best, they are on shaky grounds. I would not be surprised at all to see them go under during the next down turn.

You can use the banktracker site above to find a good CU. Try to find one which is under the median TAR ratio for CU’s.

If it’s any comfort, CU’s in general are in much, much better shape than Banks.

Questor, you are so very kind.

I pulled my money out of Patelco in ’08. :^)

Bless you, kind stranger.

I am a potential (WestLA) home buyer with cash, sitting on the sidelines for a couple years, thanks to DrHB. I am now thinking more and more of buying a cash-generating apartment building and then living in one of the units… I give up the home-owner-comfort of a front and backyard however, in return I acquire a steady income of +/- $3,500 per month net operating income. My priority is financial security – I can imagine rental prices to drop by much during this fiasco. In addition, I dont think social security will be around in 15 years when I retire. But there will be renters. Any thoughts, I am a newbie at this. And of course will have a management firm handle the apartment for me if and when I buy.

Daniel:

I’m far from an expert on the West LA region, so let me give you an answer in general terms.

I would say that it really depends on where you are talking about. If it’s in the suburbs, I wouldn’t touch it with a ten foot pole. Suburbia will generally be a death trap in the not-so-distant future. Certainly within most retirement time frames.

The next upcoming issue, after the financial meltdown actually does happen (and that’s not an “if”), is energy. Since we’re past peak production of oil, imagine oil at $500 a barrel. Or gas at $20 a gallon in today’s terms. Now imagine what impact that’s going to have on L.A.. Buying in suburbia will be as bad as buying a new place at the peak of the housing bubble.

If it’s along natural transit corridors, near places of businesses which can last, it may be a good idea. In general though, I expect all large cities to increase their population densities, with a large growth of slums at the periphery. So I’d also avoid buying in places that are likely to become slums.

You need to understand that the economic crisis that we’re going through is only the first thing to hit. Next up is energy, and followed by the environment. The best characterization of it that I’ve heard is the E^3 (E cubed; economy, energy, environment) crisis, as the impact of all three is more like a power law, rather than linear.

In any case, I’d make certain that I had a years supply of food first, and learn how to integrate that into daily meals so that it’s constantly recycled. Then I’d consider it.

Daniel,

I’m going to keep this short, only to make it pretty simple: The ROI on your purchase, at today’s West LA apartment building prices, will probably not exceed 5-6%. Of course, I am making a very generalized statement but I am trying to make a point, which is that it’s just not a good investment when you consider the opportunity cost for your funds. Rents tend to be very sticky pretty much everywhere, so it’s not likely that you’ll see huge downside risks on the rent itself, but West LA investment properties in general are too inflated to merit being a good investment at this point, as most people invest in this area for the APPRECIATION – NOT INCOME – and we clearly will not see any for many years to come.

I hope this oversimplication helps. At the very least, I have 1 important piece of advise that applies to anyone who is just starting to consider investing in any area: BE VERY CAREFUL, TAKE IT SLOW, AND BE SURE TO EDUCATE YOURSELF BEFORE INVESTING A DIME! Cash flow is king + slow and steady wins the race in today’s market conditions.

Good luck to everyone,

Investor J

http://www.meetup.com/FIBICashFlowInvestors/

http://www.meetup.com/investing-363/

There are some amazing little 2, 3, and 4 unit properties in the “Orange Drive/Sycamore” area between Beverly and Third in LA. The duplexes are HUGE (2000 to 4000 sq feet per main unit), 3 and 4 bedrooms are not uncommon – built in the 20’s and 30’s and cared for or redone to a fair thee well. These places are almost considered a historic district and rents are VERY high, they run about $3500 – 4500 month for a primo well done duplex with 3/3/and parking for 2 cars. Many people rent here because of the ambiance and it’s close to the studios, close to downtown, and Beverly Hills is a 10 minute drive in morning traffic with no freeway needed! The shops and eateries on La Brea are amazing and within walking distance. The Grove is 4 minutes away. For groceries, there’s Trader Joe’s and Ralph’s on the corner of 3rd and La Brea. GREAT AREA. Go look at the buildings there. They are not cheap but you’ll get a “home” in your own unit and the rental income, too. Owners are realistic in that they understand ROI and TAX savings (because they’ve been dealing with them for years themselves.) When they go on the market, the owners are serious about selling and will adjust to reason because it is a rental/multi-unit neighborhood and they know it. Many of these area sold with a large cash down and an owner carry-back for five years or so. Some at 0 interest! Doesn’t hurt to ask if the owner doesn’t have multiple loans already. Plenty of retiree’s would love to have an income stream for several years vs the whole thing in cash upfront. Other than some of the “flats” of Beverly Hills or certain areas in Santa Monica, this is probably one of the nicest and least known areas for small rental buildings in the entire city. It is city of LA, but ya can’t have everything. At least the power and water is lower because of LADWP vs SO CAL Edison. I owned and lived in one of these amazing old duplexes for 9 years in the late 90’s and early 2000’s and I regret selling it to this day! Best investment and best piece of LA RE I ever owned! (Oh, and the tenants these types of homes tend to attract CAN and DO pay promptly for the most part. You just don’t get many flakes in that area for some reason.) Good Luck and happy RE shopping.

I’ve stopped watching network news as well. Actually, the only show I faithfully watch now is Real Time, Bill Maher’s show. Love the man.

wow, could the person selling the house fix the hanging window shutters, put a new coast of paint on, remove trash from driveway?

$4million dollars and not even the most basic effort made.

whole house is probably rotten if they care that little.

It would be interesting to have a Dr HB.com blog article on what the hedge funds and other big money are doing in the distressed real estate market and what impact that has on things. There are other western U.S. markets of interest, such as Phoenix phalling and such

Don’t worry, everyone. It’s just theatre. Cue panic! Cue QE3!

“I’ve stopped watching the talking heads because it is pure nonsense and theatre for the most part. Simply flipping through the channels I heard “no one saw this coming†and “is it time for QE3?†Yeah, let us keep buying more mortgages with money we don’t have to save banks we don’t care about and inflating home values because somehow that has worked so well for us.”

Reminds of comments one would have heard from citizens of the former USSR about their media and economic systems…..right before the USSR disappeared….and left piles of rusting and useless military bases, fleets and equipment everywhere while splintering into a dozen pieces ….hey, if the shoe fits, America…

The Doc is correct, we have a One Party system disguised as two…and it is properly labeled Fascist.

150 years too late, America starts to realize why our Founding Father’s FIRST founding paper, was The Articles of Confederation.

You are not Free if forced to go along with fascism. Or have you not noticed your freedom has disappeared along with your economic health?

http://www.financialsense.com/contributors/charles-hugh-smith/2011/08/04/you-want-to-create-jobs-here-is-how-part-2

The above article says it way better than I can. corporate socialism must stop now and the only way it will is if the citizenry gets angry enough to take its country back.

Obama Proposes Tax Credits to Spur Companies to Hire Jobless Vets

Washington does not have a clue!!!! Another “targeted” tax joke to try to spur companies to hire people. As a small business owner a targeted tax break will not cause me to hire anyone, never has and never will. It may or may not put extra money in my pocket if I am able to take advantage of the tax break , but the only thing that will cause me to hire more people is (I know this will blow most of you away) …… wait for it…… this is profound…… more business!!!! Yes, if I actually have a need to employ more people because my business is actually expanding.

I may in fact not want to take advantage of the tax credit (up to $4800.00) in this case, because I may have to pay someone $5000.00 to properly fill out the paperwork in order to get my 5K credit!!

Don’t know if you all consider NPR as part of the mass media… but there is a great listen on Left Right and Center I heard today on Double Dip Recession speculation. Have a listen.

On comment I found particularly interesting is about the housing cost and who is going to eat it the most: Home Owners, or Banks. The speaker noted how the current situation is setup in favor of the banks.

Interested to see if the mass media begins to pick up on more stories like this, or “housing is turning around” story spin.

The tax story that DOES matter is the most wealthy group (top individuals and corporations) is of course largely illegally hiding their income overseas in and through tax havens (see UBS as merely one US operationally based provider being caught helping 4000 and then another 15000 inept very wealthy Americans illegally and knowingly duck billions in taxes, get caught, UBS merely fined). US corporations are flush with RECORD cash BUT they stashed it (and hired) overseas, they readily disclose, in tax havens. GE is the prime example of billions in untaxed international profits and yet receiving a US tax refund: GE’s president being appointed and kept on and featured and fussed over as a key Obama advisor.

Look to the food stamp program hunger-driven desperation and growth statistic as telling; 45 MILLION Americans, as what matters now, not to some unsold rich man’s Hollywood four million dollar mansion, for what is the result of these policies on MILLIONS of people. When food stamp use skyrockets by millions of once-proud people, whose concern is having enough to eat or feed a child! while interest rates are near zero now paid to the “little people” by bank and Fed money manipulation and printing, those thrifty and cautious Americans that once were middle class now had no income to speak of, over these last few years. I for one am surprised that there are “only” a few less tax returns filed by these millions pushed down into the lower income group.

Want to know public companies that are offshore: http://www.edgar.gov

The first few pages of their 10K/annual reports show where their parent company is incorporated. Look at all of your big entertainment companies for example. Bank of America has BALCAP for example – offshore they hide gains/losses for 20 years then bring them back to US. Sometimes these are DOUBLE BOOKED in US AND there creating artifical assets/losses – the IRS can’t piece it together.

Yikes! Nice photo. That Mulholland Horror House triggers an instant gag reflex, hardly a bargain at any price. After you assess the lot, divide by two, subtract demolition costs, and add in exorcist fees, you’d be in a very deep hole.

Excellent post DHB! Can you imagine how much better off we would be if the government had stayed out of all this tinkering. Yes we would have tanked initially, but that would have given rise to a robust recovery! Instead propping up the financial industry will lead us to Japan style prolonged pain. Of course the rich would have taken a hit (oh wait, it’s “job creators”), and we can’t have that. Let the working stiff take the bulk of the punishment, they don’t have a lobby in Washington. This thing is so corrupt I want to throw up. Meanwhile they are raising listing prices in Burbank because happy days are here again!

Sigh. I can’t stand either party. The tea party is even more extreme. Perhaps pitch forks and torches it is? With the downgrade of the US , I wonder if our people will finally wake up against the corporate overlords? Back in the depression, they called them robber barons. Today they are called “job creators” and are given trillions of dollars -no questions asked.

It should be obvious to the most casual observer that Manhattan has taken over the country an counts the rest of us as cattle to be milked and slaughtered. Not hard to believe they rigged WT7 to hide all the SEC filings against all the Stock Market fraud. Now the syndicate has so much power they don’t even try to hide what they do–nobody went to jail (Maddoff was not directly related to this). Why try to hide when you own the whole system.

They can keep housing propped up as long as they want to–they just buy and hold at Treasury Auctions and pay with virtual ledger entries. If you’re waiting for San Diego to become affordable, better get a stack of DVD’s and a couple cases of snacks cuz you will be waiting indefinately. There is no real market anymore–just a rigged one to bleed you dry.

Most of us agree that socal real estate is much to high. We have seen prices coming down, but in my opinion not fast enough. I wonder if we will ever see a realistic bottom. But on the other hand there is a reason its high, I mean in those parts of the country with super cheap real estate, well its cheap for a reason. I have lived and visited many other parts of the country and in my opinion socal offers a completely better lifestyle. I to thought of moving to Texas or Down South. But after thinking about the lousy weather and backward people, I said no thank you. Now I am not saying everyone in those states are backward but its a very different lifestyle, I love great weather and being close to the beach and mountains.

So I think those factors will keep real estate a little high in the new future.

It’s “too” as in “too high.” Sorry, bad grammar gets my goat.

My mistake for typing to fast. Ignorant folks on the net with no life, my pet peeve.

We need wholesale change in 2012. Start at the very top and work our way down the list.

@curt

You really think voting in new cronies will fix the problem…we’ve kicked the can down the road for 40 years. We’ve got nothing in the vault but IOU’s. This day had to come. Another Trillion of fiat money down the drain sucked up by our Manhattan Masters. Washington? Looking in the wrong place pal…you’ll never find it there….

I too am sick and tired of watching news on television and they all parade the same lies, half truths and propaganda. There is no real, hard hitting analysis done on the main stream media. For example, with the latest market downturn, all of the “market experts” were on show (i.e. Suzy Orman, Melody Hobson, etc…). They all told the public it’s not the time to panic and now is a great time to buy stocks (when isn’t it a great time to buy stocks, real estate or any other asset class?).

By all fundamental measures the stock market is overvalued. Way overvalued. Yet the experts (salespersons) and main stream media parrot that it’s such a great deal. Thank God for blogs like you Doctor Housing Bubble.

Great post, as always, Doc.

Please be careful in the second half of this year. No doubt, the real economy — jobs, real wages, home sales, real home prices — are doing poorly. But, the money supply is growing — even without QE3 — and will fuel what appears to be a ‘recovery.’ M1 (SA) is growing at 13% and M2 (SA) is growing at 8%:

http://federalreserve.gov/releases/h6/Current/

With that growth in the money supply, we may see some improvement in important economic numbers, including employment. No doubt that the improvement will last only as long as the strong growth in the money supply continues. And, no doubt the strong growth in the money supply will result in price inflation and falling profits, which will kill any embryonic recovery. But, I recommend that you do not try to make money in the short/intermediate-term by betting on a further substantial decline in the stock market. And, do not be surprised by improved economic data as long as money supply continues to grow strongly.

I learned about how money supply drives the economy and the economic data from this blog:

http://www.economicpolicyjournal.com/

Keep up the great work, Doc. I look forward to buying a home here in La Jolla (renting since ’04, after selling the McMansion).

jg: Sorry, I have to respectfully disagree. The broadest measure of the money supply, Z.1, is still collapsing. This includes credit, and the Fed is rather constrained there.

Even M3, as still followed on shadowstats.com, has only recently gone positive a small bit. And that’s after the massive QE and other tricks being used to prop up the economy.

The general trend is down, but with money more focused on the essentials. Such as food. So yes, from the most useful monetary definition, we’re still in deflation.

Dear Dr. Housing Bubble,

Great job as usual. Keep up the great work!

It is a tragedy of epic proportions for the underwater American home owner. Of course no one could possibly have seen this coming! No one! I beg to differ…

DHB wrote: “Most people are disgusted with both political parties because they realize that they only serve the financial elite in this country. The mainstream press hardly does any examination of the issues and you will never hear about the fact that according to the latest IRS data, the average household income fell by $3,500 (a drop of 6 percent) from the previous year. ”

I agree, and would like to add a sidebar. There is a level of arithmetical (including statistical) ignorance in this nation that is right up there (meaning down there) with the level of scientific and technical ignorance.

What this means is that people are elected who truly do represent The People in that they don’t have any more sense of how numbers, trends, and powerful institutions work than a goose, and I’d lay money on the goose having more common sense and less ego.

The missing piece is intelligent, independent commentary that doesn’t hesitate to get down in the mud with the numbers without getting all partisan about it, and of course that’s why we all come and lift a mug here at Doctor Housing Bubble, and are ever grateful to the good doctor for his quant Rx.

I tried through most of my career to get institutions and organizations of various sizes to build more technically, arithmetically, and scientifically competent communications programs. The reason that rarely happened could, I suppose, be that I was incompetent. Another possibility was that the people in the positions of power little understood what they were doing. They followed formulas because it ensured careers. They got jobs because they followed formulas. They had a voice because they got jobs. It was an infinite regress of access and influence that appeared more religious than rational.

So many had no clue what “the man on the street” was living within, and they cared even less. The most recent housing bubble was an outstanding example of this. At some level the problem is that we’ve got too many experts, and not enough common sense about things like that growth is the ideology of the cancer cell, and that wages that don’t rise, or rise only one or two percent, cannot possibly keep pace with a speculation-based global economy that aims to double itself like the Andromeda Strain every 5-7 years.

A few years ago I was pondering what would happen if, for one year, all professional US sports events chose to forego the singing of the US national anthem–that drinking song from the 1700s–and used the two minutes instead to broadcast a simple lesson in math (how to lie with statistics, number freaking, Tuftenomics, even just plain concepts and problems like my parents’ generation got in the fourth to eighth grades during the Depression…). For MLB, NHL, NFL, and NBA alone, it amounted to something like 170 hours per year of Francis Scott Keying.

“Now for those of you who have kept pace, California has the second highest unemployment rate in the country and the underemployment rate for the state is an astonishing 23 percent. So again, what use is a low interest rate when job prospects are so poor?”

Classic signs of a depression; money is cheap but you can no longer get any. Double burn because the cheap money chases yield and drives commodity prices.

We are witnessing the whole ponzi system collapse and crashing to the ground. The rich will be the hardest hit because they are the most leveraged.

Falling incomes, rising unemployment, Fannie/Freddie going off the cliff, reduction in the jumbo loan limits, rising shadow inventory, falling consumer confidence… this is a volatile mix of factors that no one can properly dissect, but what we do know is that this all adds up to enormous uncertainty, which stifles growth and positive forward motion and action. We are in a self-feeding cycle that is going to be hard to break. The banks have their benefactors but you and I do not. The best thing that can happen is to let the bottom come without artificial propups that help only the corporate players, not the public. Let the chips fall where they may so we can all focus on the positive upside. This constant uncertainty of how much further we can fall is helping no one and delaying recovery. Just look at what happened to japan.

An acquaintance is on the board of a small East Coast Bank. 100M in assets. They service their own loans. He says that Sarbanes-Oxley requires his bank to do many things. One of them is to place the full loan value into an escrow account if the loan is 90 days dlinquent.

1. Is this correct?

2. If so, why haven’t the TBTF banks failed.

Leave a Reply to OffTheBooks