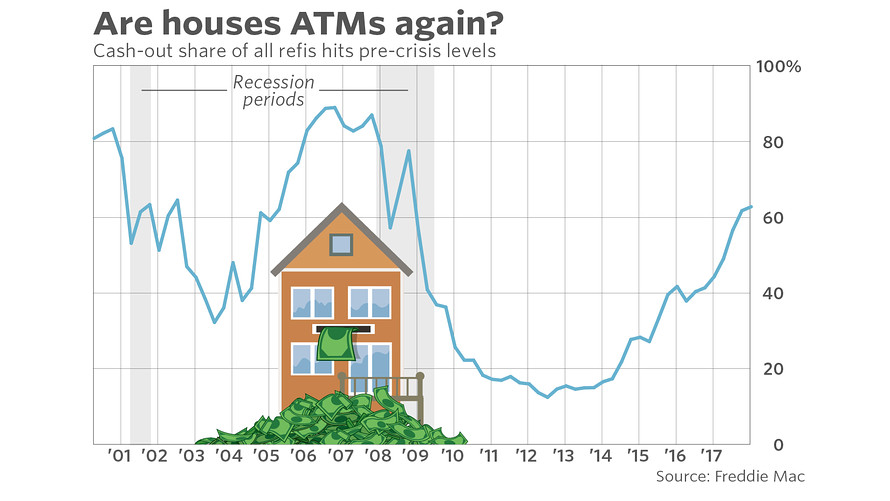

The Housing ATM is back – Cash-out share of all refis hits pre-crisis levels.

It was only a matter of time that people started using their homes as ATMs. It is clear that the housing cheerleaders are drinking a mega dose of housing Kool-Aid and somehow think that people are immune from repeating past mistakes. But here we are seeing cash-out refis hitting pre-crisis levels. And this assumption is based on the underlying mentality that yes, a home is really worth that amount and now people are locking in these high price levels. But guess what? You have to pay that money back on your glorified crap shack. This was one of the many reasons for the last housing bubble where people believed the hyped and went into deeper debt because of this notion that a home was an ATM with a roof on it. The overall tone is incredibly housing positive even though there are major issues in the housing market. For example, the homeownership rate is near generational lows and much of the household formation since the bubble burst has come in the form of rentals. Now homes are being used as ATMs. What can go wrong?

The housing ATM is back

People are once again using their homes like ATM machines. And of course contrary to anecdotal evidence, we have actual data on this:

By doing cash-out refis you are essentially locking in the current valuation of a home and this gives you little buffer should there be a correction (of course this will never happen according to some). Your debt load increases but this trend signifies something deeper. The delusion is running deep. You can look at crypto-currencies, startup companies, and even housing and we are in overvalued territory.

This idea that people are careful with their mortgages and their monthly payments is nonsense. A majority of people max out their lifestyle and are living on the edge when it comes to servicing their payments. They have mega mortgages, big car leases, kids in daycare, and their monthly bill is obscene. All you need is a minor correction and the house of cards will collapse. Tapping equity out of your house simply prolongs your obligations and assumes the good times will go on indefinitely.

This is largely symptomatic of a bigger issue here and that is people are still cash strapped. Even in neighborhoods that I am familiar with you have people living in million dollar homes being incredibly frugal with groceries because they can’t afford to get out of line in their budgets. These are typically your Taco Tuesday baby boomers. A new house hits the market and you have a professional couple or investor buying the place up. The older buyers are living modestly and are house rich, cash poor while their new neighbors are living a life of luxury supported by higher incomes. In many cases, people try to chase their neighbors and since their incomes can’t keep up, they tap their home equity to keep pace with the Joneses.

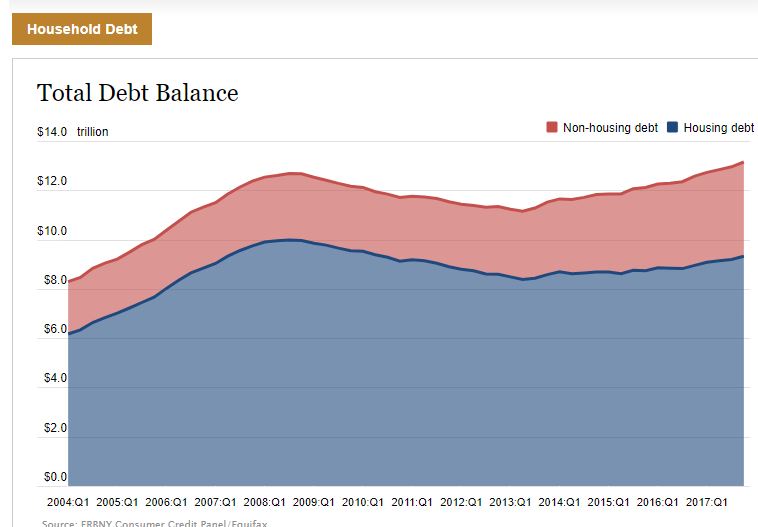

The amount of debt circulating in the economy is relatively high:

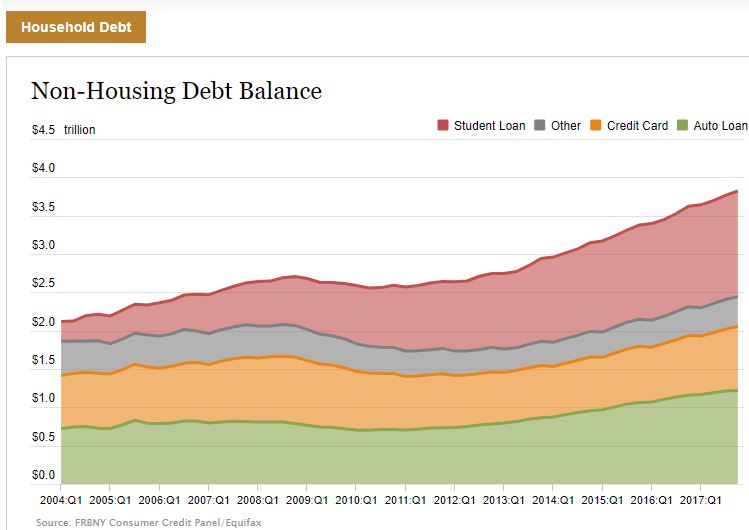

Housing related debt is creeping back up but non-housing debt is in deep record territory:

Many older boomers are now having to face the prospect of financing the college education of their offspring. So either you go into deep student debt for school or you can help finance a college education by your current resources. The housing ATM is an attractive choice.

What this shows is that people truly believe current valuations are solid and that prices will only go higher. The same mentality hit in the last bubble when people were tapping equity out of their homes. Of course this time it is more “sophisticated†and we won’t repeat the past.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

393 Responses to “The Housing ATM is back – Cash-out share of all refis hits pre-crisis levels.”

Well, the article says it all: buy now or be priced out forever

Hello Doc:

I know many homeowners on the Westside (West of LaCienega) who bought in the 70’s, 80’s, 90’s and of course bought at low prices compared to today and their mortgages are low (and low taxes) but have run into a financial squeeze or retired or layed off and are therefore barely able to continue to afford where they are living but …guess what…

They arent going to sell!

they would rather scrape by on the Westside than live large in Funtucky!

And in case AirBnB, VRBO and Craigslist werent enough to give homeowners some extra income by renting rooms, now the City of LA will pay a homeowner some money to place a tiny home in their backyard. More reason you won’t see Westside homeowners selling their homes.

http://www.latimes.com/local/lanow/la-me-ln-homeless-tiny-house-20180411-story.html

It’s different this time. We are at 20 Trillion Dollars National Debt now and the next crash will not allow for any Fed or State funded Real Estate help to kick in to support homeowners. The fall back to earth shall be without a parachute this time. However, the low interest rate loans are low enough to have locked in the homeowners for the rest of their lives. Walking away will not be tolerated this time by the Feds and Banks. Bankruptcy will destroy the property owner and his Job prospects. Let’s hope the economy keeps pumping out new high paying Technology jobs to service that debt for at least another 25 years…//ironie off

excellent rant, A client in Texas in 500 million business said they are making plans for rate hikes and slowing economy, sales….

A perfect storm is brewing, China, Trade, Treasuries, Rate Hikes, inflation, High Debt levels, More treasuries after CBO report….expect a lot of attention to keep bonds from causing crack in armor….thus market and then housing market will have to take a haircut to defend the treasury market…

Most people are oblivious to the trillions of debt created around the world to ward off the greatest depression….no stick saves second time around….230 Trillion per latest report……

good luck and good night

The new technology jobs will go to H1 visa holders willing to work for 100 hours a week for slave wages.

Oh look: boomers passing regs to put themselves first, as always. Screw everyone else, gotta keep the boomer’s low property taxes and give them opportunities to make more $$$. Nothing to see here. Just business as usual.

Replace the word ‘boomer’ with word ‘republican’ and you’re onto something.

Replace the word ‘boomer’ with ‘loonie leftist communists’ and you’re onto something.

It’s not Republicans proposing this stupid idea.

Jeddie,

What did St. Barrack do to make housing cheaper during his 8 year rein?

Jed,

Americans can no longer afford to be this stupid. Liberals want to control every aspect of you life. What you drink and how large that is, how you carry your groceries, how you drive your car, which bathroom you can use, what you say, how you say it……AND IF YOU DON’T COMPLY they will call you racist and destroy your career. The list of those lives destroyed for just telling a joke is too endless to list.

and you have the testicular fortitude to tell us it’s the Republicans fault.

St Barack was just as much a corporate capitalist as any good Republican with couple of exceptions.

Why he was a corporate capitalist.

1) He drove the stock market from 6000 in 2008 to 18000 in 2016. 300%! This was outrageously capitalist since no other President in history has ever seen this rise. This was Socialist since all of the major government pension funds needed to be saved. However, all of us Capitalists like Mr Landlord, saw our net worth triple. I am a nervous Capitalist and wanted to diversify. .01% Savings account rates, nope. Real Estate, 9%… Yep. Take your 500K winning from the stock market and invest in real estate at 9% yearly return. For now.

Why he was a socialist?

1) He implemented Dodd-Frank that should limit the abuses and tremendous transfer of wealth we saw in the last crash. Trump and the Republican Congress are working hard to revoke Dodd- Frank. This time it will be different.

Since Dodd-Frank has not been repealed yet, I think we may have more run up in housing.

Trump’s throwing gasoline on an inflated stock market with tax cuts and another 30% increase in the Dow just makes more people want to diversify to real estate. Though it is highly unlikely his voting base has majority share of the market. Left behind again.

Trump’s recent trade war, deficits, and rising interest rates have put a damper on this.

I have my popcorn, and a mattress stuffed with cash to see where this goes next.

That’s because the “fun” in Funtucky is mostly opoids and cousin-f*ckin’

Welcome back Alex. Where ya been? Are you still homeless?

He’s baaaaaaack…

I have received at least 10 calls in the last month from mortgage companies asking if I would like to refi. When I say no and tell them my current rate, they immediately ask if I need extra cash.

1) Since rates are still low but up from the bottom by over .5%, their focus seems to be primarily to get people to take more money out. When the entire industry is desperate, they are focusing the refi’s on what they can so I can see the percentage of people taking cash out now increasing.

2) HELOCs are no longer tax deductible. I suspect many are switching to a cash-out refi as an alternative since interest is still tax deductible.

Not all cash out’s are equal. While the percentage of cash out refi’s is interesting it’s not useful data. What would be useful is how many people are actually doing a refi and how much cash are they taking out relative to the difference between their mortgage and the home ‘value’.

I took cash out at refi time. I only did that because it was the cheapest/quickest way to do the refi. I took out about $6k in value, which is irrelevant given the mortgage balance and home ‘value’ at the time of the refi.

I understand that story doesn’t fit as well with your blog title though.

I think it’s fine if you wouldn’t notice the difference either way. The more urgently you think you need it, the bigger the mistake to do it (i.e., paying off credit cards). But if it’s a lot – like a new backyard – I’d get the HELOC and eat the interest payments. They’re usually very low the first few years.

You have the most valid point on here and I was thinking the same thing. Of course anyone doing a refi right now is doing it to take cash out since rates are up quite a bit from their lows. People previously were doing a refi to get a lower payment but with rates up that will rarely be the case. I think the argument is somewhat disingenuous if you are just comparing the % of cash out refis. We need the actual numbers and dollar amounts to see if it is really anything like 2006.

Just wait until Treasuries finally become unsellable (again), except there won’t be QE 1-XX to save them!

Pro Tip: People that actually own property after the black hole implodes with be in a position to survive, and those that don’t won’t.

Of course thermal nuclear warfare would completely clear the board, and it’s anyone’s guess what the Brave New World would look like…

:wave

Maybe we should ask the warmonger McStain how the world will look like. Maybe he doesn’t want to die of brain cancer and he wants to take the whole world with him in the grave. People like him and Bolton should be hanged by a lamp post for high treason.

These warmongers will decimate the RE with all their wars for the benefit of MIC.

The ATM cashout is just starting. This party has many years and legs up to go before prices even feel a hint of decline.

SoCal Housing to Tank is wishful thinking. This market is NOT going to drop even if rates go to 6% and HELOC explode. There are NO downward drivers on the housing market in safe clean areas. I went to an open house in San Gabriel Valley this weekend. In 2013 it sold for $800K. With ZERO improvements, it now has 3 offers around $1.2-1.3M – likely all CASH deals.

Before we start calling a panic, let’s see some ACTUAL evidence of defaults on HELOCs. Let’s see a foreclosure or two. Currently – everything is fine and it is more likely than not to continue to be fine for years to come.

Buy what you can afford today and go enjoy your life. You may die waiting for the housing crash.

It depends upon the city. Most of the OC cities are not getting cash buyers anymore. You see little condos in Santa Ana and Anaheim under 300,000. People are leaving OC like flies the past 12 months.

Cynthia,

WHy is that, I wonder?

Hope thats true, we have been wanting to move from the East Coast to OC for over a year, will only pay cash around 1.2m, I’d love to see a correction before we pull the trigger.

“…The ATM cashout is just starting. This party has many years and legs up to go before prices even feel a hint of decline….”

In other words, housing is poised to produce limitless wealth?

No Limitless, but enough to keep the economy rolling. Banks can loan out 9X on 1 dollar, why can’t people borrow 1X the value of a home. Even if the home falls in value, we know the bank will just hold them and rent them out. They don’t need to mark them to market.

No crash or even correction for many years to come. (10+ years)

Sean – how many houses are you going to buy this year? You should get your realtor on the phone asap.

P.S. Why are you on a housing bubble blog?

Good point Sean101,

I do believe there will be a reset, timing and depth is the unknown. Allot of this speculation depends on if/when we enter a recession which most agree we are over due for,,this could trigger a harsh financial environment when a good deal of households are all ready stressed financially.

https://www.nationalmortgagenews.com/news/housing-bubble-or-not-the-real-estate-market-is-in-trouble

Housing has always followed the stock market. If there is any slowdown in the market for a significant length of time you will see a downturn. Not as bad as 2008, more like 2000.

I spent most of my life in Oakland, and ended up buying a house in Alameda 20 years ago. Seven years later, my house was up 2 1/2 times, so I sold it (it went from $285,000 to $$720,000). It dropped to below $500,000 in 2011/2012, but is now worth over a million. This is for a cookie-cutter 3/2 with 1525 square feet, a tiny yard, and pressboard siding that was failing all over the development. After the sale, my sweetie and I ended up renting for the next 10 years, but got kicked out of 2 places because the owners sold the rentals. We’re both engineers, but after we got kicked out of the second place, we couldn’t find anything within our price range that accepted pets that we weren’t competing with dozens of others for. Note that our FICOs are both over 800, and we have what I thought were great incomes (~$250K combined). Of course, I could have rented a 2 BR with 1000 SF across the street from my office on Grand Avenue in Oakland FOR $5300/MONTH (!!!), with an additional $150/month for one parking spot that you could only use overnight because they rented the spaces out during the day. So we said screw it, and moved up to Santa Rosa 3 years ago, where we have watched house prices get as crazy as Oakland and Alameda were when we left.

But here’s the deal. Suddenly, rates are up. And not only that, your standard deduction and personal exemption have been merged into a $12,000 standard deduction, so if we buy a house together, neither one of us will have more than $12,000 to write off, meaning that we cannot get much of a tax benefit for the interest we pay on the mortgage (our Schedule A deductions would each have to be over $12K before we get a benefit). Worse, the write-offs for local taxes (state tax and property taxes included) are limited to $10,000 total. To get a decent-sized house up here (~$750,000), your qualifying income would have to be high enough that you’re paying around $10,000 in state taxes. Your property taxes on this typed of house would be close to $10,000 as well. So there’s another $10,000 or so that you now can’t write off. Which I think is a good thing. Why, you ask? I must be the only person in Sonoma County who is suddenly seeing house prices start to drop. The type of houses that were previously asking well over $750K are now coming in at under $700K. Realtors are telling me that they are seeing bidding frenzies, but when I check back on a house that had over a dozen offers, I see the sale coming in at maybe $10K over asking. And what happened at the last peak, in 2005? A huge debt overhand, just like this article is discussing. In 2005, I called the peak of the market in Alameda, CA as happening in April/May 2005, and I was dead on. I’m calling the peak in Sonoma County as right now, and the rest of the nation will follow. Let’s see if I’m right again.

P.S. The Dataquick/Corelogic numbers for median home prices for February of this year came in a week or so ago, and show that Sonoma County is DOWN 13.1% year over year. This is not my imagination. Something’s going on, and no one’s talking about it.

Karin,

I grew up in Alameda from 1992-2007. I moved to Sacramento in 2007 about 6 months after I graduated. Why you ask? Because I couldn’t imagine living with my parents for 20 years to save up to buy a home. Mind you I wanted to put a big down payment and not jump into a mortgage. My aunt sold her house by Franklin Park for 1.5 million. It’s just absolutely crazy. Over by the base they built condos that were being sold at 900k! Alameda was so beautiful but now it has been taken to the cleaners by developers. I am sad to see what is happening. Oh I have so many friends hat have left due to the increase of cost to live there.

Karin, what is your call for the Burbank housing market?

RR~

Sorry, I can’t call anything but the area I’m in, as I’m doing my own record of asking vs. selling prices in half a dozen towns in Sonoma County, along with visiting open houses and seeing for myself if there’s a buyer’s frenzy for individual listings. When I called Alameda’s peak, the adjacent cities of Oakland and San Francisco peaked at different times, but I wasn’t tracking them because I was only interested in Alameda (since that was where my house was). You really have to do individual legwork for your own area.

K

So you are seeing house prices starting to drop but houses are selling for $10K over asking?

One of these two things can’t be true.

Mr. Landlord~

I wrote:

“Realtors are telling me that they are seeing bidding frenzies, but when I check back on a house that had over a dozen offers, I see the sale coming in at maybe $10K over asking.”

That’s only for houses that are getting bidding frenzies. In the Oakland/Alameda area three years ago, the standard rule was for each additional bidder on a property, add $10-20K to the asking. In San Francisco, it’s much worse than that. I’ve heard of crap shacks going for a million over asking. Not that many houses up here are getting multiple offers.

K

Karin,

You’re too focused on the weeds and missing the forest. You can’t claim housing prices are crashing while houses are still selling for above asking. Multiple bids doesn’t have to mean they are all above asking. Could be some are below asking, some are at asking and the one that wins is $10K above.

Point is as long as there are still homes selling for above asking – as you admit they are – the notion that it’s a buyer’s market is ridiculous.

If asking prices are dropping, then yes sellers can be getting $10k over asking, AND there can be falling prices. Duh.

I’m seeing the same thing in San Diego by the way. I’ve been watching prices of homes relative to what they sold for in 1995 to 2000, and prices are definitely coming down. Whereas the 2000 price was about 40% of asking today, it’s now around 50%. I think the bottom will be 1998-2000 level prices. At least here in San Diego.

Thanks not true. If a house sold for $1MM lats year and listed for $900k this year and closes at $910k, then prices have decreased. I am waiting for prices to drop. Same story as Karen, sold a place I paid $194k for in 1985 for $907k in 2004. Now worth $1.5MM to $1.6MM.

So this is not at anyone in particular, but every over-leveraged speculator from 2006-1007 thinks he/she is a genius b/c the FED stepped in and saved them is well.. an asshat. People that were prudent and not heavily leveraged like myself could have easily have ridden it out. 30x GIM and 1.5% cap rate was enough to hit the sell button. Real estate prices were inflated to save the banks.

Sure- housing prices go down – they list it low to get a bidding war. Only now- the bidding war is only yielding a few percent over (lower) asking. Underpricing is great strategy. People see a deal and want it just like people make a run for tacos on tuesdays.

Landlord- the sellers price it low to inspire a bidding war. Only now, the bidding war isn’t bidding up very much. It’s a strategy. So yes prices can come down and homes can sell for over-asking.

Karin-Great analysis, I live in the bay area as well, specifically the peninsula 🙂 I appreciate your insight.

Karin-Great analysis, I live in the bay area as well, specifically the peninsula 🙂 I appreciate your insight.

Well, our adventure is eerily similar having been in SonomaCounty now 10 years. We lost our house with 5200 other households and I think that’s affecting what you’re seeing. Zillow has offered our home value at $620 last September, then $320 in November and $130 in January for what was a bare lot after October 9th.

Values were inflated on the flip side of this drama because of the increased demand for the remaining housing stock. We thought of buying something acceptable, not fancy, as a place to live in until we’re rebuilt but even a crappy 3/2 was going for $550

I wouldn’t trust any numbers for this area until it becomes rebuilt and stabilized.

I think this is going to take 3 years.

If you’re really seeing a dip, I would take advantage of it and pickup something you like. Long term I’m guessing values will climb. The job market is stable in a pretty area with insufficient housing stock. JMTCW

Fensterlips~

I am so sorry for your loss. We almost bought a house in Berry Creek off of Redwood Highway a year before the fire, but the yard was too small. It burned to the ground in October. I also survived the Oakland Hills fire in 1991, which stopped 4 blocks from my house over Montclair Village. Back then, houses fell in value, but slowly, after the fire. They also fell slowly in Alameda after the peak in 2005. There was a brief frenzy of market activity a few months after the peak, that lasted maybe a week or two, and then it dropped over the next 7 years, bottoming in 2011/2012. So now is not the greatest time to buy. Values go up quickly, but decrease much more slowly, so it’s still a waiting game.

K

Those are interesting observations. We bought and sold during the bubble. But we’re still on the sidelines. Right now I feel like we’re at the tail end of the bubble. People are putting houses on the market for top dollar, despite interest rates going up. Some are selling, but many seem to be gradually dropping their prices. I remember how things were in 2007. Some people said we were in a bubble, but many “experts” said we were in a healthy economy. The stock market looked strong. Realtors were saying “buy now or be priced out forever.” Creative loans like this were propping up the market. I remember reading in the Modesto Bee (around 2006/2007) that some real estate agents were selling multiple Mexican families to one house. The housing market took a few years to peak. And I expected it would deflate at the same rate. In 2008, I was surprised see how sharply and quickly it could tank. BTW no one talks about the TED spread any more. But the TED spread looks the same way it did 2006 and 2007. And people are talking about how strong our economy is –just like they did back in 2006 and 2007.

Hi Karen~

I am having deja vu as well. We just had a bust 6 years ago, but people have short memories. I am seeing the same situation today, with the added burden that the new tax codes are taking away massive write-offs from states with high income and property taxes, like California and New York. This is a bust just waiting to happen. I think the worst will hit by April of next year, when folks see how their deductions will be affected.

Karin

Didn’t Sonoma County just burn down a few months ago? Wouldn’t that possibly have had a negative effect on home prices?

Yes and no. A lot of people were under-insured and couldn’t rebuild, so they’re packing up and moving out of the area. Especially the older folks, who don’t want to spend many of their remaining few years working with contractors and permit departments. On the other hand, you have supply and demand. Before the fire, we had a housing shortage. Santa Rosa alone lost 6% of its housing stock in the fires, so the situation is much worse post-fire.

At open houses, what I’m seeing is a lot of people coming up here from the Bay Area. Good luck to them if they expect to commute there from here. I spent over two years commuting to Oakland, where I left at 5:45 a.m. and didn’t get back home until 8:30 p.m. The commute generally took 4-6 hours a day, RT. Sleep? Maybe 5-6 hours. No life. The weekend was spent making up for lost sleep and running errands.

I’m just over the Napa foothills in Solano County, and our neighborhood is still bonkers. I truly thought we bought at the top in Dec of 2016, but needed a place to live and was not going to rent for my family of four at near parity. Granted we have an income producing inlaw unit on the property so a temporary decrease in housing prices wasn’t as big of a deal as it normally would be, but now smaller houses down the street are selling for $60,000 more than we paid just a year and 4 months ago. So I’d say we have to be nearing a top, but who the hell knows anymore. All I know is that I’m very happy with my purchase, even if it was done near the top.

Most people who buy homes on expensive side tend to be under AMT (alternative minimum tax)

1) They get full mortgage deduction (since there is not standard deduction to compete with).

2) Their state/property tax deduction were already excluded.

So, for them -> tax laws are a moot point.

In California, 250k combined income is very high probability of being under AMT. Plug in hypothetical mortgage into turbo tax and see your tax liability plummet by 35% of the hypothetical mortgage amount.

If your combined income is 250k (and steady), 1mln dollar home should not be a problem.

And Moral of this story: Do not chase the market. You sold a home at a peak (720), only not to buy at bottom and feeling like being priced out at next top(1mil now). You advertise your predictive skills, yet they led you to:

1) Being far behind in equity than you could have been. Lets say you are right again in calling the peak, your former 1m home become $700k again (unlikely). You are back at square 1 at best.

2) You moved to where you did not want to move.

Let’s see if you calling the peak correctly, just not sure how is this going to help you

Surge~

1) No one ever gets a full deduction for their mortgage. In 2017, single taxpayers got

a standard deduction of $6350, and married got $12,700. They got that whether they have write-offs or not. The only advantage write-offs give you is if your Schedule A deductions exceed the standard, because you get the standard no matter what. So if a couple’s mortgage interest + state tax + other Sch. A deductions total $20,000, the only EXTRA write-off they got was the amount over $12,700 ($20,000 – 12,700 = $7,300). In California, your taxes at that level would be 9.3% at the low end, plus 25-28% for federal taxes. So you get a little over a third (~$2500) back of the $7300 over the standard deduction you get anyway, even though you have $20,000 in write-offs. Now, let’s look at the 2018 standard deduction, which is $12,000 for singles and $24,000 for marrieds. This same couple, with $20,000 in deductions, have less than the $24,000 standard, and therefore get NO benefit from their mortgage interest and other deductions. In other words, there is no benefit to your write-offs until you exceed $24,000 in Sch. A deductions under the new tax law.

2) State taxes, and property taxes (for a primary home), were never excluded on the Federal returns before the 2018 tax laws went into effect. You could write it all off unless you got hit with the AMT. Now your total local taxes cannot exceed $10,000. Ouch!

As for your last two comments, I was renting in the East Bay, and did not intend to buy there because I was planning to move out of the area when I retired, which I did less than half a year ago. I knew prices were going up, but did not want to buy a place elsewhere plus pay rent in the East Bay. And as for my house profits, I invested the money wisely two years after I sold the house, and doubled my money within 4 years, without all the hassle and expense of home ownership.

You also state that I moved to where I did not want to move. Not true at all. Sonoma County is what I’d call God’s country, and if I never set foot in the East Bay again, there would only be about half a dozen places I’d miss (like Cat Town in Oakland). We both have relatives in the East Bay, and I have to be dragged down there kicking and screaming. I’ve been smiling like a Cheshire cat since I moved up here. I consider myself a refugee from the East Bay.

Surge, let’s talk again after you do your taxes next year.

K

Maybe so on the demand side, but tax laws are going to impact existing owners of a certain vintage which is way more people than new era buyers of $1MM+

No one knows for sure how that’s going to shake out, not even you.

Dang Surge, have someone take you to the burn unit.

Karin, why did you sell your house in the first place? Were you trying to time the market? And if you weren’t, you made a huge profit from the sale and you have a 250K combined income. So what seems to be the issue, you should easily be able to afford a million dollar home…

Lord Blankfein~

I previously wrote that I felt the market was topped out, and was now turning down. Why in heck would I buy a house now? It would be a very unsound investment. Do I just blow everything I made selling at the peak of the last bubble, by buying in again at the peak of the current bubble? I don’t understand your logic.

Karin

Karin, I read your post again. You did a great job timing the market back in 2005, but completely struck out by not buying again in 2010-2012. In hindsight, you likely should have kept your original house. Like you said, it would have been worth 1M and likely paid off and you wouldn’t had to deal with all the renting headaches and uncertainty of re-entering the market. You may be right, the market may have peaked or it may run another 20 to 30%. The fact is nobody knows. Your guess is as good as anybody’s.

Trying to time any market (stocks, RE, etc) is a fool’s game. The only way to win is by letting time do its magic. Not rocket science here.

I guess I’m stuck in the distant past where a house was the roof-over-your-head (hopefully in a nice neighbourhood), and the only people who took out a home-equity loan were in financial trouble and wanting to do a roll-over debt consolidation. (It was considered shameful.)

Now all you see in housing (and on other all front as well) are weird-ass financial games and foreign hot-money chasing up prices. It is not sustainable.

But we all know that. It only remains to be seen how the bubble will burst. Will Tech go into the toilet again? Shades of the Japanese in the 80’s, will foreign money dry up? (Already happening.) In Southern California, will it be an earthquake that takes out the power, water and gasoline? (Easier than you think.) Will there be a sort of L.A. Riots writ very, very large as the dollar implodes and the various tribes (and have-nots) turn on each other and act out? (Chimp out?)

You’re already seeing a reset on mortgage interest deductions on loans over a certain amount. Will new Government regulations – read market distortions – cause the implosion? Will the Socialist politics do it? (The productive classes are already voting with their feet, Tainter’s Collapse in action.)

L.A. the next Detroit? Hey, it’s possible. (Bum Houses in the backyard? WTF?!)

Look, I’m just free associating here. And thanks for letting me ramble. But when you have sidewalk tent cities and crazy-homeless people everywhere, and all more or less next to (nominally) multi-million dollar houses, you know that it can’t turn out well.

Just a thought.

VicB3

Stop whining and adapt to today’s world.

And you still can have a home as roof over your head.

Buy and hold for long time. Prop13 and no capital gain tax for up to 500k is there to help people who are not buying home as an “investment”.

World always changes. Things will change. Longing for good old days will not make your life better

“The Good Old Days,” as you refer to them, were stable. (Or at least far more stable relative to the present national economy) The present situation is not. Indeed, that’s why you’re even visiting this blog.

And if you or anybody else has to engage in weird ass financial games on a daily basis in order to keep a roof over your head, and if you think that sort of activity is *normal*, then you’re the one with the problem.

If you swim in a cesspool long enough, you learn to think of the smell as normal. I invite you to think about that.

Just a thought.

VicB3

Surge, when it comes to buying RE in California nothing has really changed. Boom and bust cycles. Live frugal and save money. Buy low and you win the game. Get suckered in to buying high or even at the peak and you lose the game. Some Sore losers will hang out on housing bubble blogs telling people that rental parity is paying 200k down plus 1500 dollars more a month than a renter. Sounds familiar?

Surge is right, things change. Prop 13 has a shelf life and therefore cannot be counted on to be around for far longer.

I doubt it will be repealled, but regardless you should not buy based on this. Your purchase and finances are hopefully robust enough

May God bless these people who take out cash when refinancing. They are doing their part keeping the economy going and tax coffers full. When bad times come, they may even lose their home…which is great for people waiting for an opportunity to buy at a discount.

Nobody will lose anything. Both Dems and Reps will borrow another trillion or two and bail the deadbeats out. Plus there are thousands of SJW judges who will side with “poor Mr. and Mrs. Jones (or Garcia)” vs “EEEEEVIL BANK”. That’s why real estate is risk free these days. I know a family who had their house foreclosed on in 2010. They stayed in the house until 2013 when they finally went to court. There was some clerical error somewhere along the line. End result was the judge forced the lender to refinance the loan with a 40% haircut for the lender. All this after they lived 3 years mortgage/rent/property tax free in the home.

That is the legacy of Obama’s America, the rule of law means jack.

Straight-up racist.

Straight-up racist

Hey Dump…keep calling everything racist because that is how we will get more Trump.

I guess I’m stuck in the distant past where a house was the roof-over-your-head (hopefully in a nice neighbourhood), and the only people who took out a home-equity loan were in financial trouble and wanting to do a roll-over debt consolidation. (It was considered shameful.)

Now all you see in housing (and on other all front as well) are weird-ass financial games and foreign hot-money chasing up prices. It is not sustainable.

But we all know that. It only remains to be seen how the bubble will burst. Will Tech go into the toilet again? Shades of the Japanese in the 80’s, will foreign money dry up? (Already happening.) In Southern California, will it be an earthquake that takes out the power, water and gasoline? (Easier than you think.) Will there be a sort of L.A. Riots writ very, very large as the dollar implodes and the various tribes (and have-nots) turn on each other and act out? (Chimp out?)

You’re already seeing a reset on mortgage interest deductions on loans over a certain amount. Will new Government regulations – read market distortions – cause the implosion? Will the Socialist politics do it? (The productive classes are already voting with their feet, Tainter’s Collapse in action.)

L.A. the next Detroit? Hey, it’s possible. (Bum Houses in the backyard? WTF?!)

Look, I’m just free associating here. And thanks for letting me ramble. But when you have sidewalk tent cities and crazy-homeless people everywhere, and all more or less next to (nominally) multi-million dollar houses, you know that it can’t turn out well.

Just a thought.

VicB3

I looked up estimates of 2018 homeless and California populations and found 134000 homeless in a state of 39 million. To 1 significant figure, that’s 0.3%. There are a lot more than 134000 people sharing apartments, or renting rooms in houses or living with Mom & Pop. I’ll bet there were more than that in California’s hobo jungles and migrant camps in the ’30s when California had 15% unemployment (half the national rate) and 6 million people. Homeless people here are like a big horsefly in an auditorium full of people trying to focus on a dull speech.

Oh wow stop the presses you looked up estimates on the homeless. Those numbers are probably less reliable than the polls of the 2016 presidential election. Anyone with their eyes open and a functional brain stem living in Los Angeles knows the homeless problem is out of control and getting worse. Downplaying the problem isn’t going to make it go away.

Nothing to see here … it’s only a horsefly. https://www.bloomberg.com/news/articles/2018-04-16/los-angeles-mayor-eyeing-national-stage-takes-on-homelessness

The condition of people without permanent dwelling is a nothing burger. The inconvenience of having to notice these individuals can easily be avoided by living in a multi million dollar home, gated community and locked in prop13 property taxes. On my visits to clients I don’t have to drive by the dried out river beds that are populated by the these individuals. As long as MY taxes are not going up I see no reason to complain. We have ensured that the next generations will have to deal with tax bills and homelessness.

Just do me a favor and keep interest rates low so that my stocks and house values will remain highly inflated. Thank you. Your happy democrat.

Happy Democrat,

The interest was kept low by the FED not the republicans (the FED is in charge of that not a party). During Obama years, the interest was the lowest ever. As soon as Trump won, the interest was raised repeatedly and they will continue to do so till the economy crashes. Then, they will blame the republicans, Trump and conservatives for the mountain of trillions of dollars accumulated under Obama and the interest rate so high that it takes all the taxes just to pay the bankers from the FED.

Yes, I agree that the low interest rate is the main cause for the vast income inequality, but you can not blame the conservatives for that. They were screaming for a decade about the manipulation in interest rate about QE and recently about the budget passed by RINOs and democrats (no difference between the two). True conservatives were against that.

Homelessness is caused by many causes, and interest is just one of them but not the most important. I believe that personal responsibility and financial discipline are the most important to avoid homelessness. Education and being sober (no booze and drugs) would surely help.

Many of the comments on this board are shortsighted. Many think tax law changes mean the end of the real estate run … as if successful people are going to live with the less advantaged renters in those giant apartment complexes because of a tax law change. Fact is real estate is a global financial asset, and most blue chip cities in most countries are doing very well. US tax law changes has little to do with anything. As this article points out, real estate is the new gold worldwide.

https://www.citylab.com/equity/2018/04/the-global-housing-crisis/557639/

Yep. People think tax laws (or even prop13/capital tax exclusion) will much change anything. They claim housing has turned into a speculative asset, yet they want to repeal those few things that actually protect those who buy home as a long term utility. Because they do not own RE, the think these protections act against them.

I have yet to hear someone who wants to get pre-approved for a home loan recoil or change their mind due to the tax law.

I bet a small % of people may change their mind or at least scale back the amount of house they buy; but, the vast majority will not continue to rent just b/c of the tax change.

Its funny how people complain about the speculation in the market while engaging in the speculative market and driving it.

Say a couple earning $250K a year, is in the 24% tax bracket. And instead of deducting $25K in SALT like they used to, they can only deduct $10K with the new tax law. That means they will may an extra 24% tax on $15K which is an extra $3600 a year or $300 a month.

Does anyone really think that couple will make a life altering decision to rent for the rest of their lives vs buy a home because of a $300 a month change in taxes? It’s beyond ludicrous.

And what makes it even more ludicrous is that the 24% rate they’re in now used to be 28%. So whatever they may lose on the SALT deduction, will be more than made up for with the lower rates. Net effect is break even.

Conclusion: Real estate won’t be affected by any of this.

No one is suggesting people are going to decide to become renters due to the tax law changes.

What is more likely is that in high taxed and COL states like California it will move the needle for people to give consideration of moving to lower taxed and COL states. That will have an outsized effect on RE in both types of places.

And that’s exactly what some of the changes were designed to do.

How so, if everyone is getting a tax break?

Which needle?

Very few move because of taxes

It’s not about whether the increased taxes pencil out for buyers or not, it’s about momentum. Momentum has been up, up, up. Once that pendulum swings the other way, the momentum will be down, down, down. All you need is a catalyst, and the latest tax cuts could be it.

“And that’s exactly what some of the changes were designed to do.”

So Republicans wrote a tax bill to force Democrat Californians to move out of CA and to red states, in order to vote out said Republicans.

Sounds legit.

Surge suggests people don’t care about paying more taxes in the face of a better alternative but we all know money talks the loudest. Most successful wealthy people are very sensitive to taxes and are always stoked by a better deal. This tax plan upped the ante for finding better deals and California got ass rodded on this thing. Yes Sr Landlordt the Republicans passed a tax bill designed to help shift the economic balance of power in this country closer toward conservative states and that will push many more Californians over the edge to move out. Some libbers will be in that mix but I’d bet there’s a surprising amount of more conservative types leaving the state than you might believe.

Mr Landlord,

It is likely the government would like to see less money flow into housing and more into the stock market. They would prefer that since money into the stock market finances expansion and jobs. So, they cut back tax incentives for real estate. That is a possible explanation. The counter to their line of thought is landlords still get all the tax incentives, so even if everyone starts renting, prices still hold because landlording will become even more popular. We will see what happens here …

That Palos Verdes Estates house from the last thread, listed for $1,550,000 and sold within 8 hours, closed for only $1,600,000: https://www.redfin.com/CA/Palos-Verdes-Estates/701-Via-Somonte-90274/home/7723981

Someone got a good deal.

And that 1979 Santa Monica townhouse with the 100% markup, listed at $2 million, has gone pending: https://www.redfin.com/CA/Santa-Monica/829-14th-St-90403/unit-2/home/6772302

SOL, I recently drove by that PV home. Worth every penny and then some. The neighborhood is awesome and the home is very unique. That was a great buy, properties like that will ALWAYS be desirable.

Lord B., as conservative as I am with my money and as convinced as I am that we are in an everything bubble, on that particular property I am on the same page with you. It was worth every penny (I said so from the first time it was posted). I didn’t drive by but I know the area very well. The agreement is with a qualification – if someone buys it to live in it. For me, as an investor, the ROI was not there, but if I wouldn’t have a house and looking for one, that would meet the criteria (again for me personally not as an investment).

When I look for me, I am looking for unique properties in unique locations, and that house met the criteria. The price was decent given these criteria.

Thats surprising. Nice place, nice area and I dont see the price as being a sign of a bubble. I see plenty of junk places on this and other blogs that go for 1M+ that are soulless dogmeat compared to this place which I do consider to be signs of a bubble. Good for the buyers, hope they can actually afford that nut!

Or maybe there’s something wrong with it that doesn’t appear in the ad. There aren’t any good deals.

Burned out house in Silicon Valley listed at $800,000: http://www.sacbee.com/news/state/california/article208596279.html

But it comes with a “generous” 5,850 sq ft lot.

Realtor Holly Barr offers this sales pitch: “They did leave it standing so you can remodel it versus tearing it down so you save a lot of money when you can leave a wall up and do a remodel versus a complete tear-down.â€

My great uncle was a real estate developer in San Francisco.

For context, there are lots of rules that have to be followed when building a new house in San Francisco. The rules change over time. If you leave a wall up, it allows you to build off of the old rules instead of new which can save you a bunch of money. It’s a loophole that everyone accepts.

With regards to that last statement (I know this because my great uncle was a real estate developer in San Francisco):

There are certain rules that have to be followed when constructing a new house in San Francisco. They are different than the rules for remodeling an old house. If you leave a wall up, legally, it counts as remodeling an old house. It’s a loophole that everyone accepts.

https://www.redfin.com/CA/Santa-Monica/829-14th-St-90403/unit-2/home/6772302

A clip from a real estate analyst in a research report:

Home prices across the country are heating up faster than the temperature as the spring market gets underway. According to realtor.com’s March 2018 monthly housing trend report, the U.S. median listing price for a home was $280,000 last month, already outpacing last year’s high of $275,000 — reached in July — and increasing 8 percent year-over-year.

“Our latest inventory data tells us buyers are out in full force this spring,†said Javier Vivas, director of economic research for realtor.com. “Never in history have there been more eyes on fewer homes than today.â€

The housing market has seen a 7 percent decrease in days on the market from last year to 63 days, and total listings decreased 8 percent year-over-year to 1.29 million. Buyers will face competitive conditions this season due to continuing inventory depletion carrying over in March housing trends.

While there has been a slow down at the rate that total listings are staying on the market, 36 of the largest 100 markets in the country are still seeing inventory move at least a week faster than this time last year, according to Vivas.

“March housing trends show the inventory depletion we’ve seen over the last two buying seasons is carrying over to this year,†he said. “It’s going to be a languid search for buyers this season as they face the harshest, most competitive buying conditions yet.â€

I took a cash out refi on my primary home to buy a rental property last year. Reason is my interest rate is a lot lower on my primary residential home than on an investment property. I refied into a 15 year fixed, and paid cash for the investment property. The interest rate would have run over 1.5% higher had I bought the house with a mortgage on it. And refi closing costs were a lot lower than on a purchase. Plus in at that price point, it was then (and still is now) a crazy seller market. 5 offers in the first day for houses priced right. As a cash buyer, my offer went to the top of the list, closed in 22 days vs the typical 45 days.

So instead of my equity sitting there doing nothing, it’s now earning 9-10% annually and saved me thousands of dollars in upfront fees. I realize this isn’t typical, but it’s not that unusual either. Lots of people will take equity out of their home and use it for other investments and/or business opportunities. Primary residential mortgage money is the cheapest money available. Might as well take advantage of it.

I did the same thing many times with my investment properties. I always bought with cash for a better deal and I paid the loan on my house over time.

Cash out refinancing for the right purposes is a great thing. I know several people who have done cash out refis to come up with a rather large down payment for a move up property while renting out their old property. With rock bottom interest rates and sky rocketing rent prices, this was a genius move. And yet we still hear “how can anybody come up with a sizable downpayment in CA?”

Don’t give all the secrets away Mr. Landlord. An unfair playing is a great playing field as long as you are on the correct side.

There’s nothing genius about it. It’s basic strategy.

It’s such basic strategy that everybody should be doing it. For some reason, they’re not? Because it actually requires taking some risks. As with everything if life, those who take risks will see the bigger rewards. Again, not rocket science we are dealing with…

Bob,

You have it backwards amigo. In flyover country, it’s easy to afford a nice home. $250K buys a decent house. $350K buys a McMansion. $500K buys a mansion. “Low” wage is relative. $50K in Topeka is the equivalent of $150K in San Francisco, adjusting for home prices and taxes.

As for Trump, his voters were on average much better off than Hillary’s voters. Trump won every income group above $50K a year. Hillary won evert group BELOW $50K a year. And in the Republican primaries, his voters were also affluent.

https://www.nytimes.com/interactive/2016/11/08/us/politics/election-exit-polls.html

https://www.washingtonpost.com/news/monkey-cage/wp/2017/06/05/its-time-to-bust-the-myth-most-trump-voters-were-not-working-class/?utm_term=.3912786993fe

Mr Landlord,

I agree with you 100%. Taking money out your house is THE cheapest option available.

At a little over 4%, you can’t beat it.

However in order of priority, take the money and

1) Pay off student loan debt which is likely at 7%.

2) Pay off any emergency medical or otherwise loans. Anywhere from 7% – 20%.

3) Start a business. Risky, but a cheap alternative to other loans.

4) Definitely pay off your 25% credit card debt and NEVER run it up again.

5) Take it out to invest in real estate (9%) or the stock market (Trump’s 30%) but be aware that all good things come to an end. You don’t want to be left holding the bag while real estate/rents/stock market decline 70% while you are paying 4%. Risky today IMHO.

Bob,

I have no debt other than mortgage, so that doesn’t apply to me, but good advice.

And yeah the mentality here is so pathetic. Wahh wahh wahh nobody can get money for a downpayment, wahh wahh wahh. Well no, obviously some people can get money for a downpayment otherwise nobody would be buying houses.

This is the defeatist/victim mentality Democrats and the MSM enforce all day every day. If you just vote for Bernie, he’ll buy you a house and all your problems will be solved!!! And it sounds a lot more appealing than forgoing up the iphoneX and $500 jeans in order to save for a downpayment on a home.

Mr Landlord,

I used to wonder where people were coming up with the money to buy houses/crapshacks. Wages have not risen even close to the price of houses.

However, non-wage income has been the key to wealth since 2002..

1) If you bought a house in 2012 for $1M, it is likely worth $2M now. That is nearly $1M in equity that can be borrowed to buy another house.

2) Better yet, if you had $1M and put it in a Dow Index fund in Jan 2009 when it was at 6600, The Dow is now at 24000, so you now have $3.6M. Plenty of money to buy a dream home (or several crapshacks).

3) As I mentioned in previous posts, if you loved Apple and had prescience and put your spare million into Apple stock at $1.00 per share just after the tech bubble popped in 2002, you would now have $180M.

So much money out there to buy with cash as long as you just haven’t been working for a living.

Mr Landlord,

I used to wonder where people were coming up with the money to buy houses/crapshacks. Wages have not risen even close to the price of houses.

However, non-wage income has been the key to wealth since 2002..

1) If you bought a house in 2012 for $1M, it is likely worth $2M now. That is nearly $1M in equity that can be borrowed to buy another house.

2) Better yet, if you had $1M and put it in a Dow Index fund in Jan 2009 when it was at 6600, The Dow is now at 24000, so you now have $3.6M. Plenty of money to buy a dream home (or several crapshacks).

3) As I mentioned in previous posts, if you loved Apple and had prescience and put your spare million into Apple stock at $1.00 per share just after the tech bubble popped in 2002, you would now have $180M.

So much money out there to buy with cash as long as you just haven’t been working for a living.

It used to be in the US, if you worked hard, you could earn enough to afford a house, a car, and a few kids. You can’t do that today in many parts of the US. You had to be a part of the few who had a house when times were good. Or had the foresight and effort to invest in stocks before there was an E-Trade. The saying “Work hard and you will do well” no longer applies for many Americans. You can’t blame the Boomers since some did buy houses and invest in stocks. They are doing very well. Many Boomers rented and never invested in stocks. Most of them are in flyover country or rural central CA by now after being forced out of coastal CA by rising rents and low wages. These are the people both Bernie and Trump targeted. We’ll see how Trump does for these people. If he doesn’t deliver, Bernie and Bernie II will be the next FDR.

Bob,

Damn these replies get all messed up with weird nesting. This is what I wanted to post regarding your views that Trump only won da poors. You’ve fallen into the same trap the MSM fell into, and never got out of. Your entire premise on who the Trump voter is….wrong. While the Hag won the PhD baristas making $11/hr and her BFF with a Masters in Art History making $30K working at the museum, Trump won the construction manager making $150K or the plumber who owns his own business making $250K a year. But in your twisted view, PhD = rich, plumber = living in a double wide. Plus Trump won a majority of white males WITH a college degree. If you want to believe that the only people who voted for Trump live in a double wide by the river…..be my guest. The data says otherwise.

https://www.washingtonpost.com/news/monkey-cage/wp/2017/06/05/its-time-to-bust-the-myth-most-trump-voters-were-not-working-class/?utm_term=.3912786993fe

“To look at it another way, among white people without college degrees who voted for Trump, nearly 60 percent were in the top half of the income distribution. In fact, one in five white Trump voters without a college degree had a household income over $100,000.

Observers have often used the education gap to conjure images of poor people flocking to Trump, but the truth is, many of the people without college degrees who voted for Trump were from middle- and high-income households. That’s the basic problem with using education to measure the working class.

In short, the narrative that attributes Trump’s victory to a “coalition of mostly blue-collar white and working-class voters†just does”n’t square with the 2016 election data. According to the election study, white non-Hispanic voters without college degrees making below the median household income made up only 25 percent of Trump voters. That’s a far cry from the working-class-fueled victory many journalists have imagined.”

Mr Landlord,

To clarify my point. Trump won the middle class working votes. These are the people making 50K-99K (Dual income) and make up 31% of the voters. Trump won these voters 50% to 46%. These are the voters who work hard at jobs and are doing OK but many can’t afford a house in most cities. As you pointed out, 50K is good in a Flyover city, but a 150K house is still on the crapshack side. This is a guess, but I doubt many of these have invested in the stock market or with 300% gain in the Obama stock market, they would be making 100K+

I expected most of the poor to vote for Hillary since they always vote Democrat. If you work at WalMart full-time, even WalMart HR says you should apply for food stamps. Hillary and Bernie had given them the hope of higher wages.

I expected most of the 100K+ earners to vote for businessman/pro-tax-cut Trump.

The race was close, and the disgruntled working middle class swung the vote.

Here is some data to back me up.

http://www.businessinsider.com/exit-polls-who-voted-for-trump-clinton-2016-11#by-income-clinton-led-only-among-voters-with-a-2015-family-income-under-50000-a-group-that-included-36-of-the-voters-in-the-exit-polls-4

Bob,

We’re saying the same thing, but drawing a different conclusion. Yes, The Hag won the poors, Trump won the middle and upper middle class. However, “middle class” ($50-99K) in flyover means a solid middle class life, including a nice home. “Middle class” in CA is border line poverty. A family earning $75K a year, can easily afford a $250K home. And $250K in most of flyover buys a very nice place. The American dream is alive and well in flyover. It’s in CA where you need $250K just to live in a non-ghetto ‘hood, where the American dream is DOA.

And also Bob, the people working at WM full time – most of them anyway – make under $50K a year. Which means that they did NOT vote for Trump. That’s the thing you’re missing. WM full timers voted for The Hag, your own data says so. Yet you insist on believing the opposite.

Mr Landlord,

Both you and I agree the people working at WalMart mostly voted for Hillary. They are likely working full time and are still below the poverty level and qualify for food stamps. Trump has never claimed to support food stamps for the poor so he likely did not get their vote.

The interesting thing is that the middle $50K – $100K voted for Trump. These are likely in the working middle class.

Trump kind of screwed the bottom end of this income range if they have a family. With a family with 3 kids making 50K, , adding up the std deduction and personal exemptions, the total deductions in 2017 were 13K(std) + 20K (personal exemptions) = 33K. That pushed a family with 3 kids into the 10% bracket. In 2018, the personal exemptions are gone so this family will have 24K in deductions which will leave them paying 12% of 9K = $1.1K more in taxes.

Trump just lost the median %50K income voters with families to Bernie next time.

Please correct me if I am wrong.

Seen it All Before Bob you are completely incorrect. A family making 50k with 3 kids has a negative tax rate (they pay no federal income taxes and actually get a credit).

50k-24k std deduction=26k. Of this 26k 19050 is taxable at 10%=1905. 6950 is then taxable at 12%=834. Their tax bill would then be 2739 however the child tax credit was moved from 1k to 2k so they get 6k (then entire amount) for their kids which means they pay nothing. Also 1400 of the child tax credit is refundable (I think per child.) even if you pay nothing (which they do). So they have a negative 3261 dollar tax bill and can get 2800 back.

You might as well take everything you can out of this eaten out husk of a state, California.

What is left of California? The future of California belongs to hispanics and the tide of color. Have you been to Irvine? Try finding a white person there. The only white people in California are in tiny enclaves surrounded by cities full of foreigners. 1 in 4 school kids in California are white. The rest are hispanics and “new Americans”. 20 years from now California will be a collapsed banana republic actually make that a weed republic. There won’t be anything resembling America in California. Boomers will expire in a state that doesn’t resemble the one they were born in any way other than the weather.

Jerry Brown and co play funny games with the state budget claiming California is in the black. Are you a public servant today expecting a nice pension when you retire? Yeah, good luck. Let’s see what the hispanic majority thinks of that in 20 years.

It’s over for California. White Americans never came together and fought for their own interests and so they will be replaced. Demographics is destiny.

This is why you should do everything your power to make #CALEXIT a reality.

That is also the destiny in Western Europe. They have been subjected to the same thing in the last few decades. Good luck with those trying to collect a pension from a population addicted to socialism and welfare. What the people want is irrelevant in these countries where democracy means just selecting between puppet one or puppet two. In the end, they still end up with a puppet who is doing the masters bidding (by carrot or blackmail). Not much of a difference between US and EU these days.

That is also the destiny in Western Europe. They have been subjected to the same thing in the last few decades. Good luck with those trying to collect a pension from a population addicted to socialism and welfare. What the people want is irrelevant in these countries where democracy means just selecting between puppet one or puppet two. In the end, they still end up with a puppet who is doing the masters bidding (by carrot or blackmail). Not much of a difference between US and EU these days.

You can’t keep up with changes and resort to racially-charged whining.

There is nothing in that post that isn’t true. CA is now a 3rd world country for all intents and purposes. It’s basically Brazil. Good weather, a few ultra rich white people surrounded by dirt poor brown people. Maybe they’ll start a cool Carnivale in Santa Monica some day.

It’s no worse than not keeping up with the changes through apathetic acceptance of the unacceptable which is primarily to blame for the problems California faces.

Jonny OK: White Americans never came together and fought for their own interests …

Hollywood, the news media, and academia convinced White Americans that it was racist to fight for your own interests (even though every other ethnic group does it)

Too much drugs/alcohol and estrogen = cultural suicide. Saw it 25 years ago while attending a UC as one of the few white guys studying stem. Most were poly-sci (sorry, nothing scientific about it) and other useless fields. Now the blue state is becoming a brown state – skin to match the s-t covering the streets and average IQs < 90. Very fitting.

My old high school which was an open campus of mostly whites is now overwhelmingly third world filth and they've had to construct massive fencing and gates so it looks like a prison more than a school. Test scores went from top 20% in the state to the bottom.

I hope they secede or get nuked. 1 of 8 places of similar climate? Who cares, its an overpriced, overcrowded dump. So what if youre not cold or sweating like a pig – they probably have climate control in prison or psyche wards too.

This is some of the most racist and xenophobic nonsense I’ve read in a long time. Wow.

If you’re so open-minded why don’t you go live in Mexico, China or Iran?

I don’t want to live in any of those places but California is becoming a blended sh*thole of all of those places as the demographics have shifted from majority white to minority white.

You don’t want to live in any of those non-white countries as a minority so why would you want them to come here to make you a minority in this country?

That’s not racism. It’s common sense. I actually love all cultures and races. I just want to defend the Western (European) world.

The multi-culturalism the left sells today is not multi-culturalism. It is cultural death. When you blend all the cultures together in one place those cultures are destroyed or the most dominant culture takes over. Take a look at Paris or London. They are no longer French or British. Look at California. It looks nothing like the California dream of yesteryear. It’s now a third world sh*thole.

Why anyone would want to buy property in California I don’t know. I don’t even see how it appeals to these new immigrants. At least in their own nations they have their cultures and their people. They come to California to be subsumed into a overcrowded mass of strangers from all over the planet. It’s not a community. I see this every day here in California.

The funniest thing I saw recently was a white female boomer school teacher saying “Happy Thanksgiving” to a muslim parent in a burka. The muslim didn’t even understand what the hell she was saying.

The schools send out correspondence in English and mandarin now. This place is a joke.

Real multi-culturalism is having homogenous nations where cultures can develop and be protected. This fake multi-culturalism is really globalism which leads to the loss of all cultures to be replaced by consumerism and atomization.

Johny OK, excellent explanation on the difference between multiculturalism and globalism (a collectivist ideology from the pit of hell to make everyone equal poor and no identity).

Globalism destroy multiculturalism and is pushed by the larger corporations.

Globalism is against free markets and thrives under fascism/communism (all the power in the hands of few hundred people). It is the use of military and politicians to get an advantage over those who want free markets. Globalism promotes TBTF (too big to fail). Globalism has more in common with fascism and communism and it is anti capitalists (capitalism implies free markets and we ceased to have free markets in 1913).

I agree. So whites are now a disadvantaged underclass, suffering because an insensitive minority-majority is doing what to them…??? What parallel universe is this group of whiteys from?

I’m so happy to say that we are now officially looking for a job somewhere far from California. We are sick and tired of it here. It’s a nice place (sometimes) but the cost of housing has pushed us out and we make 250k combined. There is something wrong when 250k isn’t enough to buy a home without making major sacrifices. Goodbye California! When we leave I can say for certain we will NEVER return.

You can make 250K work. According to Zillow, with 100K down, you can afford 1.05M. You can get into something decent for that. I just looked and I did not see much to pick from in the South Bay … This one is almost decent … it would be better if it was a little further west, but still not bad.

https://www.redfin.com/CA/Torrance/22509-Reynolds-Dr-90505/home/7717096

Two or three years ago, for this money, you could have gotten into the Avenues of South Redondo Beach. Unfortunately, those have jumped about 400K since then, so west Torrance is the best spot for 1M.

He could do way better than just “decent†in other places. Ambitious people don’t stick around in order to settle for less.

Same here. We make 300k combined and have 300k for down pay. We want to live in a house in SGV that has at least 9000+ sqft land plus 2500+ sqft living space that the property is not distress nor still have 70’s decor or smells like an old hag. I guess we are still asking too much coz what I ask will be 1.5M at least in today’s market.

wise decision dont blame you at all you will find nice places to live for a third of cost

I’m so happy to say that we are now officially looking for a job somewhere far from California. We are sick and tired of it here. It’s a nice place (sometimes) but the cost of housing has pushed us out and we make 250k combined. There is something wrong when 250k isn’t enough to buy a home without making major sacrifices. Goodbye California! When we leave I can say for certain we will NEVER return.

Good Lord, Mark – $250k would buy you a hell of a spread in some VERY nice areas of CA. Assuming you could do the work remotely, that is.

Good luck, Mark! I can’t help but be a little envious. Unfortunately, I’m probably stuck here for the time being because of family connections. If it wasn’t for that, we would have already been gone. I am utterly sick of the rat race and expense of living here, though the amenities and climate can be very nice.

Thats a hyperbole. Steady 250k income will get something nice in a good area. Especially if you can work from home.

$250K will go further for him in many other places. Ambitious people like him don’t stay and settle for less.

Scroll down a little and see what he can get for $875K…a 2 bedroom home in an HOA that “barely has any” bars on the windows.

Or he can move to 85% of the country and for $575K buy a great home in a great neighborhood, while paying 1/2 as much in taxes.

California has this desirable Mediterranean climate that only 8 places on the planet enjoy. Meanwhile our government is making it impossible to build new houses while importing millions of subsistence workers that don’t speak English.

An earthquake would only make the prices and availablility far worse. Look what our big fires did to pricing. Here’s a clue from someone in the middle who lost their house. There’s almost nothing available and prices are up 30%

We are competing with people from all manner of crazy places around the planet. With internet connectivity, someone making their fortune in, say, Malaysia, can take their bundle and move somewhere perhaps more stable with a nice climate. Why is the San Gabriel Valley suddenly all Chinese? What do you think happened? They moved from their sweaty hellhole to our not so sweaty hellhole bringing their millions. We are competing with them for houses, space on the freeways and everything else and they have no allegiance to us, our country or our mores. A Miidle Class isn’t normal. You need just right conditions for it to flourish and those conditions are evaporating quickly. We are becoming a 2 class state pretty quickly. A Tale of 2 Cities, or 2 states.

I tend to agree with what you say. I don’t know a whole lot about it but it seems that if foreign money is making it difficult to damn near impossible for locals to own, then shouldn’t there be some sort of law in place to prevent that? I read that Canada had a similar problem with foreign investors and started to put restrictions on foreign ownership into their real estate laws. Australia did that as well. The fact is, I can’t, as well as most of the people I know, compete with foreign cash (or any all cash buy for that matter) and it is absolutely wrecking the housing market here. California is seriously broken and seems to be only getting worse. Again, I am so happy to be leaving.

There was a law until Obama abandoned it….Foreign PE was not allowed to own multiple units but in haste he sold off America to his Manchurian overlords

“…shouldn’t there be some sort of law in place to prevent that?”

Yes, but that would be “xenophobic” or “racist”. Boils my blood.

It is climate and political stability

You cannot compare cash out refi’s today to 2006. Back then you didn’t need INCOME VERIFICATION and could leverage up to 100% of the value of the property (and in some programs MORE than the value) and on “stated income”.

Today here are the maximum loan to value programs for cash out:

80% conventional

85% FHA

80-90% jumbo (with severe restrictions)

100% with VA

Unless you are VA you cannot really leverage the value of the collateral as many of you believe and also, remember, you must qualify from an income standpoint. Debt to income ratio is the magic qualifier.

Banks have just added a middle man between themselves and the poor lending standards. When you dig down through the layers, they are still doing the same lending. They’ve just changed the thin veneer of safety from AAA rated CDOs to loans to nonbank lenders. When those third party lenders collapse, the banks will still be on the hook for the subprime loans that fail.

https://www.cnbc.com/2018/04/10/big-banks-have-found-a-new-way-to-stay-in-the-subprime-lending-business.html

I can concur. When I refied last year it wasn’t simple. Lots of docs were required, tax returns, bank statements, investment account statements, etc. And this was for someone like me with perfect credit and high income. And still they went over everything with a fine toothed comb.

Apparently, we learned nothing from the last financial crisis. Desperate for higher returns, investors are jumping back into bonds made up of sub prime debt.

“…last weekend the Financial Times reported that in the first quarter of 2018 a total of $1.3 billion of bonds backed by sub-prime loans were purchased by investors.”

https://www.marketwatch.com/story/the-striking-similarities-between-mortgage-backed-securities-and-the-17th-century-financial-system-2018-04-04

This time the US Government is backing fully 70% of the total mortgage market through Fannie Mae and Freddie Mac. It might take a few years but when the housing bubble part deux pops – it just might take down the entire system.

“It might take a few years but when the housing bubble part deux pops – it just might take down the entire system.”

The last bubble popped in 2 years. If I had to bet money on it, I’d guess that the next one will take longer (maybe much longer) due to owners being on more solid footing in general, but drop the same percentages. I don’t think the economy will collapse with it, though – at least not this time.

That “solid footing” is likely eroding very rapidly as more owners take cash-out refis. You can bet that most of the people doing this are not using the money to make wise investments such as cash-flow rental properties.

As it is, the people most likely to tap their equity are those who are most likely not on solid ground to begin with, being saddled with the highest CC debt on record, record student loan debt, and monster car loans for vehicles costing $35K-$50K. Add to this the epic corporate debt, and you have the ingredients for another Perfect Storm. Consumer, corporate, and government debt taken together total 250% of our GDP, while consumer and corporate debt alone total 161% of GDP. We passed the sustainable max of about 90% long ago.

Interesting article. Thanks for posting.

I hope Millie’s head doesn’t explode after reading the attached article from the OC Register regarding a ballot measure that will further strengthen Prop 13. There are some things in life not worth fighting…trying to overturn third rails is one of them.

If approved, the Prop. 13 “portability†measure would allow homeowners who are 55 or older to take their low property tax base with them after selling their home and buying a new home anywhere in the state. There would be no limit on how many times they can use the provision and no limit on home prices (although buying a more expensive home would result in a slightly higher “blended†tax assessment).

https://www.ocregister.com/2018/04/12/signatures-filed-for-initiative-to-strike-prop-13-moving-penalty-for-seniors/

Lord b,

Hehe, you would dearly miss me, wouldn’t you?

Regarding the article….come on now. Boomers looking for more handouts is not surprising is it? That’s what they’ve been doing all their life. Why do you think they have such a bad reputation. It’s a pathetic generation but the good news is they are getting older and older. Time is on our side.

Lame attempt at trying to get the retired boomers out of their houses.

Do you think it has a chance to pass? I don’t.

CA is basically a 3rd world socialist country inhabited by brown peasant renters who rely on govt aid to survive. Not sure how you get those brown peasants to vote in a tax cut for old white home owners in Pasadena and Simi Valley. Plus 2018 will a Dem year, making it that much more unlikely.

I predict this doesn’t get more than 45% of the vote.

Not sure how you get those brown peasants to vote in a tax cut for old white home owners in Pasadena and Simi Valley.

Poor, young brown people don’t vote in large numbers. Older, richer, white folks do.

Also, people are more motivated to vote for direct benefits than for indirect benefits.

If teachers’ pay raises were on the ballot, teachers would vote in large numbers. Taxpayers would vote in smaller numbers, because their interest in defeating the measure is indirect.