Stock Market Dissonance: Why the Stock Market no Longer Reflects Main Street Economics. The Dow Jones Industrial Average.

One of the biggest bankruptcies in history occurred on June 1st yet you would not know this by looking at the stock market. In fact, the Dow Jones Industrial Average (DJIA) shot up by 220 points. If we look at total assets, this is the fourth largest bankruptcy in history. The Dow is made up of 30 companies that show a supposedly wide cross section of the American economy. The company that filed for bankruptcy was General Motors and was actually one of the 30 components. A company that dates back to 1908 and survived the Great Depression. So how can it be that a company that employs 250,000 filing for bankruptcy is actually good for the stock market and makes the DJIA rally so strongly? The easy answer is the stock market no longer reflects the economic reality on main street.

The U.S. Treasury and Federal Reserve have created an artificial system and the stock market is reacting to these new conditions. These conditions now assume rock bottom low rates and financial institutions being continuously bailed out. Yet this paradigm is not helping the American public that now has 25,000,000 unemployed or underemployed family, friends, or colleagues. Think of the implication of the GM bankruptcy. Right when the announcement was made there were details of laying off thousands of workers and closing numerous dealers. The market rallies and unemployment this Friday will shoot up by another 500,000. This disconnect is so obvious and shows the priorities of those pushing legislation.

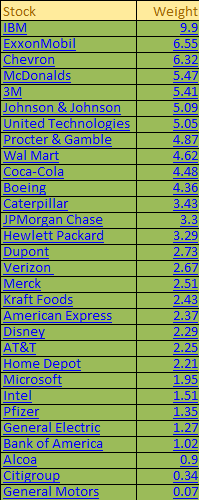

Before we get ahead of ourselves, why would a bankruptcy of GM, a DJIA component lead to a strong rally? First, let us look at the weighting of each of the 30 components:

The above is a reason I take very little stock with the DJIA but it is still widely regarded in the mainstream media as an accurate reflection of the overall stock market performance. A better measure would be the Wilshire 5000 but how many times have you heard that market index in the media? Let us focus on the above list I compiled a little further. You notice that GM and Citigroup are all the way at the bottom? That is why even if GM and Citigroup went straight to zero (GM practically did) it had very little impact on the DJIA. Yet in reality, the bankruptcy impact is gigantic in the real world since it means tens of thousands more Americans out of work and a giant of American manufacturing giant was unable to stand on its own two feet. So what do we hear on June 1st?

“(CNN Money) According to a statement released Monday, General Motors, which filed for bankruptcy on Monday, will be replaced by Cisco Systems (CSCO, Fortune 500); Citigroup (C, Fortune 500) will be replaced by The Travelers Companies (TRV, Fortune 500).”

How convenient. Of course, we have already experienced this with the removal of AIG and having it replaced with Kraft. A government cheese recipient taken out by a true cheese maker. The DJIA is a horrible indicator of longer term prosperity. During the boom times bubbly stocks are put in, keep in mind the index is maintained by humans and as we have now found out, humans make all kind of errors including missing peaks and troughs. Don’t believe me? Let us take a look at some grand timing:

Microsoft added on November 1999

Intel added on November 1999

AT&T added on November 1999

Bank of America added on February 2008

Chevron added on February 2008

These are just a few examples. First, you’ll notice that Microsoft and Intel (big companies no doubt) where added at a bubble point for technology stocks. So when the tech bubble burst, the index took a much bigger hit because of these additions. Next, we have the timely addition of Bank of America on February 2008! When Bank of America was added it was trading around $45 per share. Now it is trading at $11.37 and this is thanks to the crony banking system bailout. Chevron was added right before our massive oil bubble. So as you can see, the addition of companies to the DJIA is not exactly a good reflection of the economy. In fact, some of the additions are indicators of bubbles and late party arrivals.

Now let us examine the list again. First, the recent stock market crash was the deepest and widest since the Great Depression. If we look at the DJIA, you will see why this is true. First, 2 of the top 3 companies on the list were oil companies. Well logically when the oil bubble burst these would get hammered as they did. Next, there are many financial services companies on the list. This during the boom distorted the market and made the DJIA bubble up over 14,000 yet this mark was a reflection of the bubble. Now with the banking industry having Uncle Sam as number 1 on its Fave 5 menu, of course the DJIA tanked because it was heavily weighted on bubble industries. Bank of America? JP Morgan? American Express? Citigroup? This list starts reading like the TARP recipient list.

It should be abundantly clear that the DJIA is not a good indicator of what is occurring on main street. Yet it is something that is always referenced so it is important to understand what is truly reflected here. Let us refer to the list again. If you look at the top 10, three of these companies (Wal-Mart, McDonalds, and Coca-Cola) reflect the massive consumption economy that is the U.S. Where are the major manufacturing companies? In a way, seeing GM literally fall off the list is a testament to what our economy has become. An almost completely consumption based economy. Is it any wonder that Chinese students laughed openly when Timothy Geithner stated: “Chinese assets are very safe,” referring to debt with the U.S. in a recent talk? Politics aside, I’d laugh too. Ben Bernanke and Geithner are busy selling off the U.S. to keep their banking cronies alive. Where are the Pecora Investigations? Why not demand the same stringent requirements of Bank of America, Goldman Sach, JP Morgan, and Citigroup as we do of Chrysler and GM? Because those that operate the levers of power are either bought out or believe the banking oligarchy.

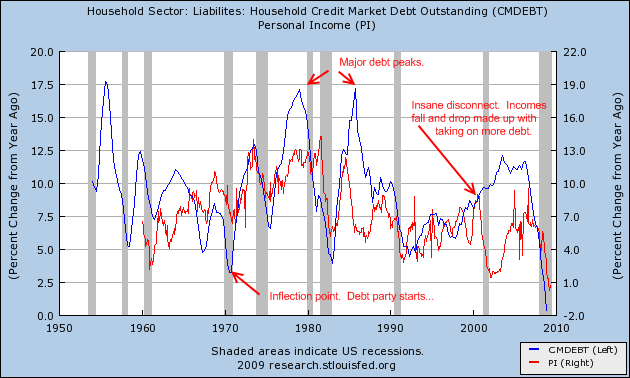

When you look at the Dow, it starts becoming abundantly clear what the U.S. Treasury and Federal Reserve think the country should look like. And before you say that these places are independently operated, just look at former employers of our recent U.S. Treasuries. They like the bubble era. They want Americans to go back and buy cars on a yearly basis, purchase homes over and over, eat fast food, and purchase goods to numb the need to focus on reality. That reality is for nearly 40 years we have spent more than we have earned. Just look at this chart showing personal income growth and household debt:

From the 1950s to the 1970s, growth in income tagged along with growth in debt. Yet this completely became disconnected in the 1970s. From that point on, taking on debt at higher levels seemed okay. In the last few years in this bubble, we just took it to the extreme logical conclusion. Just think for a second how irresponsible it was to give someone making $30,000 a year a $50,000 luxury car simply because they can make the monthly payment for 7 years? Or what about giving the person making $40,000 a year a $500,000 mortgage? Not only did this happen, but it occurred so many times that we are now years later left to deal with the fallout. Yet the notion that we will go back to this world is absurd and that is what the stock market is betting on. Our lives are changed forever. The fact that we have students in China laughing at our U.S. Treasury is one of the many indications that the gig is up. Our biggest lender is laughing. This is not a good sign.

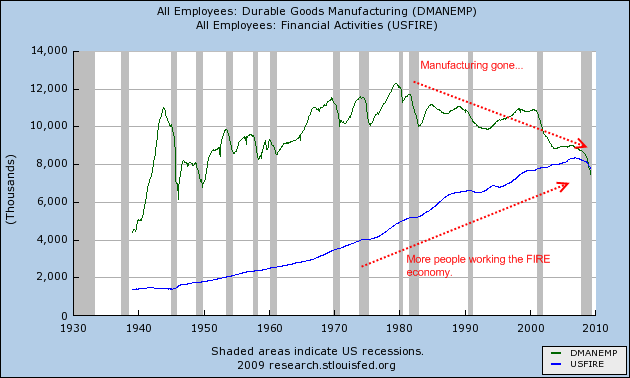

When I look at the Dow, I don’t see a reflection of the U.S. economy but more of a horse race ticket for the gambling casino. AIG doesn’t make sense anymore? Remove it since it is now owned by the U.S. government. Don’t like GM or Citigroup? Out they go. It is a list of convenience. We would be better off tracking the Wilshire 5000 or at a minimum, the S&P 500 but even that list has taken an unusually heavy love to financials. But in this case, you can’t blame the actual index. It is merely reflecting a country that became obsessed with financial services and tossed manufacturing to the wayside:

The chart above is rather telling. It is somewhat ironic that on the same day, it is announced that both GM and Citigroup will be removed from the DJIA. With manufacturing already gone and financial services slimming down, you tell me what emerging field is going to get us out of this recession? Maybe Travelers Companies and Cisco are closer reflections to what is a stable Dow component. Too bad it took this long to realize which companies were simply running on cheap money.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

14 Responses to “Stock Market Dissonance: Why the Stock Market no Longer Reflects Main Street Economics. The Dow Jones Industrial Average.”

Thank you for you excellent work. I’ve read you for over a year and your influence has saved me from making many unwise snap decisions.

“Green” industries may become the next boom, if treated with favorable government incentives. Oil is becoming increasingly scarce, and expensive.In the middle of a horrible recession, gas is approaching $3. What happens when the economy recovers?

Eventually, maybe in 30 or 40 years, it will be GONE, and the gov’t. is not pursuing a viable replacement. What is going to power aircraft in 30 years?

How are farmers going to plow fields?

How will we feed 9 billion people, about 900 million of whom will live in the U.S.by the end of this century.?

Wall Street wants to see high unemployment because it prevents wage inflation, but at the same time those same forces want consumers to keep spending even without a source of income. How do you justify those two aposing points? Oh yeah! go into debt. Then What? That is where we are now.

Robert Cramer – coal. no joke. It can be cracked to a liquid fuel for aircraft and can burn very cleanly for generation of electricity in a properly engineered process. For farming, biofuels might actually be viable (for general consumption, I sincerely doubt it, however). And if coal is too hard to stomach for electricity, there’s always nuclear. It’s not as bad as it’s often made out to be. There’s so much red tape that it can’t currently compete with most other methods but if it’s properly embraced and dweveloped, it will go a long way toward solving many of the “crises” we’re currently facing (in quotes because these crises are largely assmebled and perpetuated through mass ignorance and often not nearly as dire as they are often portrayed to be)

When the housing bubble first showed signs of serious implications to the global economy, many pundits were predicting where the next bubble would occur, and they agreed with you about “green” and “clean alternative energy”.

Unfortunately, many people do not know that the technology (such as hydrogen fuel cells) viable for widespread production is still 20-30 years away. I predict as the economy picks up in a few years and gas hits astronomical prices, a MAJOR bubble will be in alternative energy.

Great article Doc.

When will Americans realize that the “money honeys” and “Mr. Booyaa” and not giving them a true picture of the economy? Only after true unemployment starts to fall, real personal incomes start rising, and debt becomes more manageable does the real estate market have even a hope of finding a bottom. Unfortunately that may not happen for some time.

http://www.totalinvestor.com

Our new economic model ? : The poor lining the streets selling hooked rugs, pots of noodles, and begging for change. The Dow will probably be 15,000 by then and the credability of the US a thing of the past.

Wall Street has been a sore point with me for years. I couldn’t believe that so many Americans got sucked into the Dot.com bubble in the 90’s (how many of those companies with no business plan are still around?) and I watched flabbergasted as the housing bubble grew out of control, all the while realizing that the end would be disastrous. All this while I watched manufacturing (the only source of wealth building) being exported to low-wage countries around the world (one of my MBA professors spewed crap about how America would maintain predominance by being the “R&D” center of the world, as if U.S. companies need R&D if they do not manufacture anything here).

As a regular reader of bloggers on Dollarcollapse.com, I became concerned by the data that showed that sub-prime mortgages and insolvent banks were soon to lead to a massive U.S. crisis. I shifted all of my investments out of stocks and into “safe” U.S. government securities. Unlike many others, I did not lose 30-40% in the ensuing Wallstreet casino carnage. But now, with the possibility of a collapsing dollar due to hugely irresponsible government deficits, I am afraid that there is no place to hide, except gold, if you can find it. I am incredulous that Americans still put their faith in those in Washington D.C. who have put our country at risk of collapsing into a banana republic. You will soon realize that not all Americans are “sheeples” if you ever try to purchase guns, ammunition or reloading supplies. Those may be the 5% that are wiling to sacrifice to restore the Republic.

As a final point that Dr. Housing Bubble did not mention directly. DJIA stands for “Dow Jones Industrial Average” and (used to) represent the average value of Americas’ 30 largest industrial companies. It has gradually become bastardized to include non-industrial companies (companies that do not produce any value added products which create wealth i.e. banks, McDonalds, etc). At last count, and being very generous, I found that the DJIA still contains 9 industrial companies. Not very representative of a meaningfull index. But, that’s all that is left in America.

All is not lost however. My prediction is that when American wages fall to the $1 per hour level (or whatever currency takes over when the dollar fails), we will again be competitive in the world market for labor arbitrage and can again become a major industrial country.

Or, maybe Americans will wake up before then, sharpen their pitchforks, head to D.C. and eliminate the problem that has put their nation on the fast track to failure.

Patience, doc. Stock markets don’t move in a straight and NEVER correlate well with daily news. The technical spring bounce after a fall crash is right out of the 1929 playbook (the 1930 top was in May) and we are about to head down to new lows:

http://goldversuspaper.blogspot.com/2009/06/calling-top-in-stock-market.html

The DJIA is a horrible index just because it contains only 30 companies, regardless of who they are. The first thing you learn in statistics is that you need a large sample for the numbers to mean anything. And the first thing you learn in investing is to diversify. The Wilshire 5000 is indeed the better index.

Wall Street is being manipulated and the numbers are false, I totally agree! It doesn’t look like it will end any time soon either. Where is the money coming from to manipulate the S&P? Taxpayer bailout money! Meanwhile, those of us on Main Street are getting about 6% of the billions of tax money that hasn’t even been earned yet. Go green? I wish. I don’t think Americans are educated enough to understand that the clock is ticking and we cannot afford to keep destroying this planet just to enjoy our materialistic lifestyle. On a brighter note, we aren’t producing goods, therefore, we aren’t currently polluting as we have been. All we need to do is produce things DIFFERENTLY! We overpackage, overprocess and genetically mutate practically everything we use. We have to stop this behavior. Luckily, behaviors can be changed…IF we want to change them. This is a global economy now and there’s no going back. I’m paying close attention to the trends on the West Coast because that’s the leading edge of this country. If California goes under, the whole country will follow…if California goes ‘green’, I expect the same…and Texas can do whatever it wants as far as I’m concerned! (They’re talking about secession!) New York is very conscious of what a green economy can do. Green jobs are hiring, you have to open your eyes and look for them. WAKE UP America! (You’ve overslept, but it’s not to late to get the job done!) 🙂

This is no ordinary bear market rally. Don’t get me wrong, it certainly ain’t no bull market. This is the most highly manipulated, fabricated and orchestrated rally ever. Market makers are putting to work all our government’s printing of liquidity and tax dollars given to them to set the tenor, and the lemmings follow.

The rising 10 yr should have kept this thing in check by now but it is oblivious.

I can’t help but think how badly this thing is going to end. Rising interest rates, collapsing real estate, collapsing stock market and commodity prices remaining firm.

Indeed Doc, that is an amazing chart showing how each recession was ‘resolved’ by increasing consumer debt, like an addict ‘being cured’ from withdrawal by shooting more heroin…I’ve been reading about the Khazars and usury, and seeing the blatant GS-Treasury incest makes that fantastic story seem much more believable. We are obviously being manipulated by forces that have zero concern for our well-being, and this seems plausible. Glad to see Mozilla being questioned. Maybe he’ll fake his death and exile in Bermuda or Indonesia…he caused more damage the Ken Lay ever did.

On the rental side, property managers have gotten paranoid and tightened their restrictions when looking at a person’s credit, and rents have even gone up some (including mere room rentals).

Leave a Reply