Spawning a Mortgage Disaster: The Birth of the Adjustable Rate Mortgage in 1982. California Confidential. A Budget Mess and Massive Cuts. S&P 500 Stock Market Speedway.

After looking at the Alt-A and option ARM disaster, many readers have been asking what in the world created the toxic ecology for these mortgages to spawn. You really have to go back to 1982 when the Garn-St. Germain Depository Institutions Act of 1982 was passed. This bill was sponsored by Congressman Fernand St. Germain, Democrat from Rhode Island and Senator Jake Garn, Republican from Utah. The bill passed with an overwhelming vote of 272-91 in the House. This one act played a large role in the S&L debacle but also laid the foundation for toxic adjustable rate mortgages. Title VIII specifically allowed for adjustable rate mortgages. Here is a part of the remarks from President Ronald Reagan at the time of signing the bill in 1982:

“(University of Texas) Now, this bill also represents the first step in our administration’s comprehensive program of financial deregulation. I particularly want to commend the leadership of the chairman, Senator Garn, and Chairman St Germain, along with Secretary Regan and his fine team at Treasury. They did a remarkable job forging a consensus within the Congress and among affected industries in favor of the bill’s deregulatory provisions. I’d like to also thank Congressmen Stanton, Wylie, and LaFalce for their assistance.

What this legislation does is expand the powers of thrift institutions by permitting the industry to make commercial loans and increase their consumer lending. It reduces their exposure to changes in the housing market and in interest rate levels. This in turn will make the thrift industry a stronger, more effective force in financing housing for millions of Americans in the years to come.”

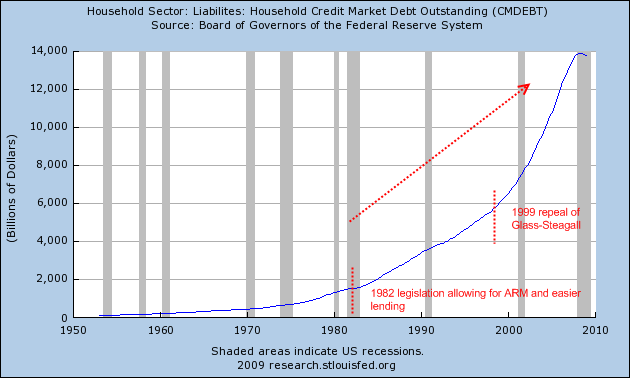

As we all know, the S&L industry became a wild casino and brought the United States economy to its knees. Little did we know that only a few years later we would create an even bigger housing bubble that would bring the world to the verge of a new global recession. I highlight this piece of legislation because this allowed for more creative financing but is really the mother of the Alt-A and option ARM disaster we are now facing. With no adjustable rate mortgages there would be no Alt-A or option ARM problems. That is the bottom line. And without the Gramm-Leach-Bliley Act repealing the Glass-Steagall Act in 1999 there wouldn’t be the behemoth too big to fail institutions. The Gramm-Leach-Bliley Act allowed commercial banks, investment banks, and securities firms to consolidate. Now what could possibly go wrong with all this in place and a corrupt and crony Wall Street using the U.S. Treasury and Fed as their personal loan shark? You can almost mark it on the dot when the U.S. debt market exploded especially for consumers:

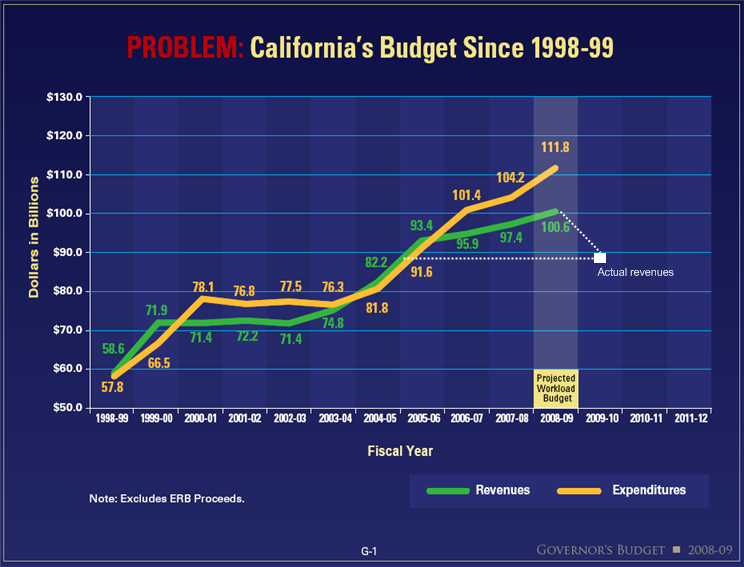

And keep in mind what major debt induced problems occurred during this time. We had the S&L Crisis followed by the technology bubble and finally the epic housing bubble. The historical record shows that when the U.S. government tries to get involved in cahoots with Wall Street bad things happen for the American consumer. From 1945 to 1982 boring 30-year mortgages seemed to do well for our country. Since that time we have bounced from one bubble to another. Here in California some are celebrating because the state government has come to an agreement on how to balance the $26.3 billion deficit. Why are some cheering? They are doing their job and if you look at the agreement, it will mean more pain for the state. More cuts and more borrowing. How does this bode well for a state with 11.6 percent unemployment? The reason California finds itself in such a challenging budget situation is a gigantic portion of the revenues brought in where completely based on a housing bubble.

You look at uber subprime mortgage lenders like New Century Financial that at one point had 7,200 employees and a market cap of $1.75 billion and you come to realize that some companies existed purely to feed the toxic mortgage industry. I wonder how much money the state got in 2005 when New Century had a net income of $417 million? Hundreds of these kinds of operations kicked the state down with funds brought on by financing people with subprime, Alt-A, and option ARM junk. At this point the state has failed to acknowledge that a large portion of those revenues will never come back (unless we have another bubble). California was the hub for toxic mortgage lending. The state pioneered the way for ultra-toxic mortgage all-stars like California based Countrywide Financial.

So when people try to understand the fall in revenues, it is hard to say what the true bottom is. We have been at the center of the last two epic bubbles. Without the technology bubble and the housing bubble it is hard to say where our true equilibrium is. How much of the revenues brought into the state were based on bubble industries? And now, the stock market is on a tear yet the fundamentals are still horrific. We have yet to see the commercial real estate fallout. The Alt-A and option ARM wave will rip into the mid to upper tier of the markets. These are multi-trillion dollar problems. Unemployment is still ticking up. Yet the stock market rallies on like a runaway train.

S&P 500 Not Cheap

The only reason people are diving into the stock market, especially the turbo capitalism based financials is because of the bailout backstop. The S&P 500 has gone up a stunning 41 percent since the March low! This rally is based on Wall Street smoking the bailout crack provided by the taxpayer. Without the taxpayer, they’d be toast. As you can tell, bailing them out did nothing for the real economy. It just allowed them to bet more rounds at their roulette table with your money. At least we know who the U.S. Treasury and Federal Reserve work for.

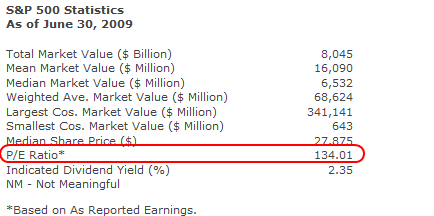

If we look at the fundamentals of the S&P 500 we find a grim reality:

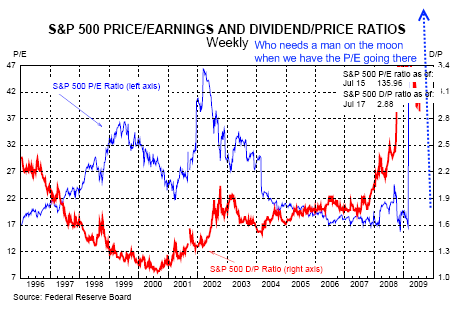

That is right. At the end of last month the P/E ratio for the S&P 500 was 134! That is not cheap by any stretch of the imagination. When you put this on a chart it literally flies off the paper:

We are much higher than the tech bubble peak but hey, this is crony capitalism and who really cares about profits in the real economy. All we care about is whether Goldman Sachs can hedge their bets and short the American people with their own money for the sake of capitalism. This is not capitalism.  This is crony corporate welfare at its worst. The real economy is in the dumps. Those that jump for joy seeing Goldman Sachs rally suffer from a serious case of Stockholm syndrome. Don’t fall in love with your captors.

California Budget Deal

Before jumping for joy, the California budget kicks the can down the road once again. It is a painful budget. The cuts are deep and the state will feel the repercussions. Yet the major thematic problem with how the agreement is proposed is no one is acknowledging reality. And that is, much of the revenues from this past decade were bubble based. They are not coming back. The tone of the budget deal is such that “we’ll be back to happy days in no time.” If you know about therapy you will know that in Gestalt therapy one technique often used is the “empty chair.” The client is asked to pretend someone is in the empty chair (maybe a father or mother) and to speak to the chair.  The therapist will observe the conversation and make notes at times guiding the client. This helps to externalize thoughts that may be repressed and bring dialogue into the open. What we need is to give California some solid Gestalt therapy. If California citizens were asked to tell “California” their thoughts it would definitely reflect a very different reality. They would probably tell the state to get real and create a budget that is based on non-bubble based revenues. The state however isn’t having anything to do with the intervention.

Some deep cuts:

$6 billion to K-12 and community colleges

$3 billion to the UC and CSU systems

$1.3 billion to Medi-Cal

$1.3 billion through 3 day furloughs

$1.2 billion from state prisons

$528 million to CalWORKS

You’ve added it up and only see roughly $14 billion in cuts. Another $4.7 billion will be taken from cities and counties and another $2 billion will be in good old fashion borrowing. So this celebration should be more somber in tone because these cuts will have repercussions in the real economy. Yet what else can you do? You can only balance the budget in two ways. Cuts (which are being taken) and more revenues (taxes). That is it. Borrowing is basically pushing the problems down the road. If you look at the Alt-A and option ARM problems, a gigantic issue that is largely centered with California housing will be in the dumps for many years. Where is the money going to come from?

“The State started the fiscal year with a $1.45 billion cash deficit, which grew to $11.9 billion on June 30, 2009. Borrowed money from special funds provided enough cash to fund State operations through June 30. The Controller faced a large cash shortfall at the end of July, forcing his office to begin issuing registered warrants or “IOUs” to any General Fund payment that was not protected by the State Constitution, federal law, or court decision. Without IOUs, the State would have run out of cash and begun missing those protected payments at the end of July.”

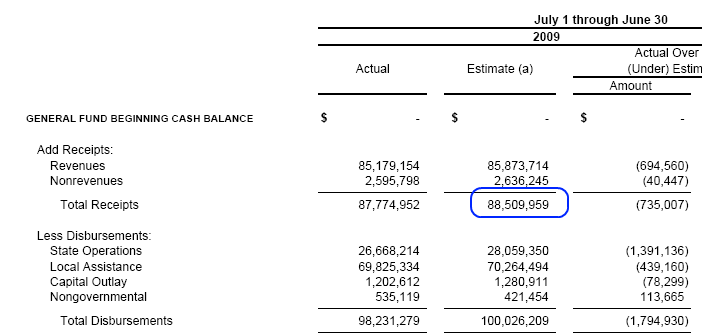

This is a statement from the State Controller’s Office. So we went from $1.45 billion to $11.9 billion in 6 months? That means the state is leaking $2 billion a month. And if we look at even a monthly estimate you will see why:

And a chart that is over 1.5 years old:

If you have a hard time figuring out what you bring in each month how are you going to plan out for one fiscal year? The state is in a really tough bind. All these signs point to a prolonged housing slump. Those jumping in to buy right now simply are choosing to ignore the Alt-A and option ARM reality and the fiscal situation of the state. A good round of fiscal therapy may help.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

33 Responses to “Spawning a Mortgage Disaster: The Birth of the Adjustable Rate Mortgage in 1982. California Confidential. A Budget Mess and Massive Cuts. S&P 500 Stock Market Speedway.”

I know a few people who have recently bought in West LA & Santa Monica. Both were young professional couples who had sat out the bubble and thought they were getting a good deal this spring when prices came down a little and interest rates dropped. They also had substantial help from their families. Everyone else I know (who doesn’t have help) is content waiting another year or two for prices to fall further and continuing to build up large downpayments. This is telling me a few people jumped in this spring, but with them now out of the way we should see a large drop in the high-priced areas as everyone else continues to wait!

The most disgusting part of the budget deal is the state telling the localities to borrow money and give it to the state with a promise to payback in a couple of years.

That’s like maxing out your credit cards then having your kids get new ones and give to you.

If the state is leaking $2 Billion per month then by this time next year the state must find a way to do without an additional $24B ? Those cuts listed above amount to a little over $13B.

With one of the methods used to balance the budget was to “borrow” a couple billion from city and county governments then should the budget be prepared for a $26B shortfall? DOUBLE what was just cut? Am I missing something?

Sorry, I meant a couple billion borrowed.

I’m glad to see some cuts at least, it is a good first step. Waiting is very hard to do, I have been doing that since 2006 and have collected more than enough for a down payment. So I am just gonna rent some more and hope my family does not get too cramped in our tiny apt. Collecting 1.5% in savings is better than losing 20% a year on housing…

@Josh: I know several that decided to buy recently too. It’s funny tho. I don’t know anyone who bought in the past ten years who didn’t have substantial help from family with down payments. We are content to wait longer since we have no such help and can’t see that it is wise to jump in yet. Thank you Dr. Housing Bubble!

Pressure at Mortgage Firm Led To Mass Approval of Bad Loans

Monday, May 7, 2007; A01

Maggie Hardiman cringed as she heard the salesmen knocking the sides of desks with a baseball bat as they walked through her office. Bang! Bang!

” ‘You cut my [expletive] deal!’ ” she recalls one man yelling at her. ” ‘You can’t do that.’ ” Bang! The bat whacked the top of her desk. As an appraiser for a company called New Century Financial, Hardiman was supposed to weed out bad mortgage applications. Most of the mortgage applications Hardiman reviewed had problems, she said.

But “you didn’t want to turn away a loan because all hell would break loose,” she recounted in interviews. When she did, her bosses often overruled her and found another appraiser to sign off on it.

Hardiman’s account is one of several from former employees of New Century that shed fresh light on an unfolding disaster in the mortgage industry, one that could cost as many as 2 million American families their homes and threatens to spill over into the broader economy.

—

Shares in the Irvine, Calif., company rose from $5 in early 2001 to $66 at the end of 2004, cementing its status as a Wall Street favorite. Last year it issued $51.6 billion in loans, more than any other specialized subprime mortgage lender.

As Industry Grew, Standards Loosened

Once a little-used lending tool, subprime loans made up 20 percent, or about $600 billion, of all mortgages issued in the country last year. These loans carry a high risk of default because they generally are made to home buyers with questionable credit. But because they require borrowers to pay high interest rates, they have been a gold mine for lenders in recent years, accounting for 30 percent of all profits made in the mortgage business, according to Mercer Oliver Wyman, a consulting firm.

Lenders also made a fortune selling subprime loans to Wall Street. Investment banks charged huge fees for packaging them into massive bonds called mortgage-backed securities. Investors received high returns for buying and selling these bonds.

But there is growing evidence that along this chain, the filters that were supposed to catch bad loans did not work.

—

I have a relative who was given a Porsche Carrera as a Christmas Bonus!

High End Home Market Still Has Further to Fall

We have been enlightened to a rather public person’s Real Estate dilemma; Timothy Geithner.

He, along with his wife, bought a NY house in 2004 for $1.602 million. Currently, they owe $1.25 million in 2 mortgages on that house.

Now that he works in Washington, in February, he put his NY based home up for sale at $1.635 million.

After dropping the price to $1.575 million hoping to attract a buyer, it still did not sell. They now rent the house for $7,500 a month.

At $7,500 a month, they’ll get $90,000 in rent revenue. The property taxes are $27,000 a year. Hey, the house is in the “Welfare State.”

That leaves $63,000 for interest on the mortgage and any other repair costs to maintain the property they… I mean, the bank owns.

Let’s assume the mortgage has an interest rate of 5.25%. Owing $1.25 million at 5.25%, that equals $65,625 in interest to the bank.

The rent does not even cover the interest and property taxes when the mortgage is $1.25 million. ($65,625 + $27,000 = $92,625 – $90,000 in rent = $2,625 loss)

Am I reading the P/E chart right? It looks like the P/E for the SP was fairly low through the first quarter of this year. What happened? Is it really possible for it to spike like that?

I think we are too far down the road in this fiat nation. There is no going back. We can’t pay our debt, and the rest of the world has no way to stop us, even though they are fully aware of what is going on. Our masters at Goldman will direct our military to crush almost any nation that refuses to give us their oil or other commodities or products for our paper. Unfortunately, that seems to be heading toward the biblical Armageddon. An empire is either growing or dieing–there is no steady-state.

Sad that there was never enough money for environemental improvements such as solar but there were enough granite counter-tops to make a couple more Rushmore’s…mis-directed resources are the unintended consequence of pure capitalism. We need a more advanced civilization to take billions into the future will dwindling resources, but instead we have become information laden and wisdom deficient…too bad. A wasted opportunity.

We should be grateful for this. It’s going to help bring The Won down by making people realize that the consequences of overspending your income are extremely ugly. We used to have morals in this country, and bankruptcy was considered not only a financial but an ethical failure. Those days are long gone. Now the only way to make people realize that disaster is squarely in your path if you overspend is to have them, or people they know personally, be crushed by the debt monster.

You have to wonder about the mental state of people who would pay $500k for a modest house when their income was less than 100k. How did they ever expect they could pay it back? If they thought they could always pass it on to a greater fool, the problem with the greater fool theory is that there comes a time when there are no greater fools than the last person who bought the item. Lots of us who don’t live in Cal and have seen their housing prices screaming out of sight for years always wondered how people could possibly have afforded those prices. Now we know–they couldn’t, and the consequences are now becoming apparent. I don’t know if it comes from living so close to Hollyweird or not, but there has been for years a truly delusional component to California living. Let’s hope, in Kipling’s words, that they eventually realize “we’ve had no end of a lesson, which will do us no end of good.”

One of the good things about the Ca. budget crisis, is that it is bringing to light hundreds of give away programs, that the average taxpayer had no knowledge of.

The Cal. Grants program gives up to $10,000.(not a loan-never has to be repaid) to students who go to PRIVATE colleges. If you can’t afford a private college, WHY should taxpayers give you money for a private college?

What is wrong with public schools?

Where you are wrong is in stating that if Californians were to tell “California” their thoughts they would be stating a different reality. When you have as many people employed by the State and Local governments as California, it is impossible to get the cuts needed. Those Californians that are employed by the state don’t want any cuts at all because private industry is paying for their jobs. The worst abusers are local Public safety, Prisons, Sheriffs, CHP, go on down the list of Unions. They get to enjoy great medical insurance and ridiculous benefits at the expense of every small business owner in the State. Until you control pension reform for Unions you will never get the States fiscal problems solved

Where did you get your data for the P/E ratio? All the sources I checked (searched via google), showed a P/E ratio for the SP500 to be about 14-16.

The S&P 500 PE ratio is 16.39. 134 must be a mistake.

I noticed that teh State controller’s statement was from the beginning of the FISCAL year until June 30th. Doctor, you then inquire, “So we went from $1.45 billion to $11.9 billion in 6 months?” No, that isn’t the case. Fiscal in California starts July 1, so the controller’s statement covers all 12 months. I know, who cares what part of the Titanic you are on, the ship is still going to sink!

I think the problems originated with the establishment of the FHA that allowed the government to subsidize housing by guaranteeing mortgage loans. The FHA removed the element of risk from lending institutions that allowed them to be lax in their lending practices.

The fire chief in Orinda, Ca.(a small town) will get $157,000. a year in retirement.

Unless this issue is addressed, ALL Calif. cities will be bankrupt by 2015.

S&P 500 data from…S&P:

http://tinyurl.com/5zrsfl

@Josh & @ gael. I am fortunate enough to have said downpayment, having saved for years now, but there’s still no way I’d even think of considering the possibility of buying right now. And having just become a parent, I wonder what future state the CA schools will be in given all these brutal cuts.

I am reminded of those celebrities who suddenly find themselves with $30 million dollars but somehow fritter it all away to become completely broke, when all they had to is put a couple of million away in a good savings account (admitedly hard to find these days) to be set for life. Fantastic job, Sacramento.

Amen to Andrew’s comments above. I know. I work for government. The benefits,

salaries and waste are way over the top. Its unbelievable! Yet, the beat goes on…….. California taxpayers must like it.

I’ve got a bit of a problem with blaming Garn-St. Germain/deregulation/Reagan/adjustable mortgages in 1982 for resulting ultimately for the mess we are in and the messes we had. The S & L’s were sitting on a bunch of 30yr 6% fixed mortgage (assets) while paying out 20% interest for deposits (liabilities) due to interest rates going to the moon due to decades of lousy economics coming home to roost. The S&L’s were going broke and deregulation was the attempt to allow them to make enough profits to stay solvent. Let’s put the cart before the horse shall we…

Adjustable Mortgages sprang up in an interest rate environment where fixed loans were impossibly unaffordable. There isn’t anything wrong with plain Jane adjustables. Option Arms and balloons and any “exotics” ought to be banned imho. If one has the money to afford the negative repercussions of one of those exotics one doesn’t need an exotic anyway because they can afford a conventional fixed or adjustable.

The invention of adjustable rate mortgages in 1982 was due to the peak in inflation and interest rates the previous year. I got a 30 month Certificate of Deposit paying 16.5% annually in the fall of 1981.

The Great Inflation made interest rate deregulation inevitable.

In other words if you really look at the big picture much is the fault of the Federal Reserve! The most recent housing bubble would almost certainly not have been possible without the Fed keeping interest rates low for years. But we are ALSO still living with all the terrible policy decisions that were made in response to the inflation of the early 80s! (interest rate deregulation, Prop 13, companies getting in the habit of giving out non-monetary benefits instead of wages, etc. etc.).

There is that evil straw dog Prop 13 again! IF Prop 13 were around today they would be cramming enormous property tax increases down our throats. Instead, the b/tards refuse to budget to the 2% increase MAX that they can normally expect to get in any given year. Any windfalls should 1st be sequestered in a rainy day fund before any new spending…and then only on one time uses or demonstrably sustainable projects.

So what do they do instead? The guys at the top jack up their own wages/pensions and then hit the eject button at their convienence.

@ S&P P/E: Somewhere between 14 and 2000

There are multiple ways of counting the S&P P/E. Some count price (the only consistent parameter here), while earnings are calculated or estimated a number of ways. When counting earnings for the last four quarters (an actual number, albeit dubious) the P/E is over 1000. When you count estimated forward earnings, just like we do toxic paper, you get better numbers. Since so many financials lost money in 2008, it really skews the figures. If you believe that the market shot up 40% based on green shoots and the PE is only 14-16, I’m not surprised. We are largely living in a delusional era where you can search the Internet to find cooraborating evidence to any argument. Financials work in mysterious ways, or if you don’t tell me what I want to hear, I’ll ask someone who will.

The point is, DHB has been telling us here the story we aren’t getting from the MSM and the Goldmen. You have to guess what’s the truth, but we are being played to put all our money in real estate, gold, stocks; and then the big boys haul in the net with all our money. If you luck out and sell in time, good for you. If not, it’s not good. Most of us are losing this game though, because the deck is stacked and the Walls are playing with the house’s money.

I hear unemployment is a lagging indicator, but that’s curious. If businesses truly detected green shoots, would there have been another 1/2 million + first time UE? Try to think this through. The perma-bull chatter is not working anymore. It’s not good and it’s getting worse for the most part, except at GS & JP.

Good luck.

Comment by Economist E

July 22nd, 2009 at 11:42 am

I think the problems originated with the establishment of the FHA that allowed the government to subsidize housing by guaranteeing mortgage loans. The FHA removed the element of risk from lending institutions that allowed them to be lax in their lending practices.

>>>

Snicker…… giggle…..laugh…..fall off chair hodling sides from laughter….

>>>

Reality Check 101 (and park your anti-government pre-conceived theories and try reality)

>>

(1) The FHA was created in the 1930s. (Name changed but the concept stayed the same over the years.)

>>

(2) The FHA worked just fine for over 70 (SEVENTY) years! It did not cause housing bubbles nor have massive loan defaults.

>>

(3) The FHA has far far far lower default rates than those primo lenders like COuntrywide.

>>

(4) The FHA did NOT BUY UP subprime, alt-a or option ARM loans. It did NOT GUARANTEE those kind of loans.

>>

(5) The FHA loan process is too boring for words – appraisals, minimum standards for condition of the property (And if you want to to see a pain in the backside, try to close a propoerty that has to have an FHA inspection), proof of income, proof of the source of the downpayment, requirement of pre-purchase counseling for the prosepective buyer on the costs of owning a home,,,,,,,

>>>

(6) The Too-Scary-For-Words loans (2/28s, option ARMs, hybrid Option ARMS, NINJAs) were CREATED BY private lenders not subject to the Community Reinvestment Act. You know who they are – Countrywide, Option One, New Century, Argent etc etc etc (And if you don’t know who the ones were who created those loans, packaged them and sold them to greater fools through the offices of Wall St, check out the Implod-O-Meter.)

>>

(7) The FHA DID NOT HAVE SOD ALL TO DO WITH THE LENDING PRACTICES OF THE LENDERS WHO MADE THOSE LOANS!

>>

I strongly urge you to learn who made those kind of loans, who packaged and sold them as CDOs and SIVS, and who owns those loans (hint: it is NOT the FHA who has nothing to do with the loans at all – think foreign investors and Wall St banks). If you don’t know who the actors were/are or how it worked or who sold what to whom,…well, the politest way to put it is that you don’t know the subject matter and certainly can’t know what caused what to happen. That post alone proves that your ID is not based upon a real identity or training.

With the recent upswing in the market, it must be over 150 now!

Ha! the thought of somebody telling “doctor housing bubble” that he’s waiting for a couple years for the market to come back. Obviously dude wasn’t aware to whom he was speaking…

Well, I went ahead and manually calculated the P/E ratio for the SP500, and it is indeed high (just over 100, but not as high as 134). However, in doing the calculation, I realized that a few big companies are dragging down the earnings (think auto, banks, etc.). Since these large companies comprise a significant percentage of the SP500, they can bring earnings way down for the whole group. Regardless, with a P/E ratio that high, the S&P500 is a poor investment. Well, I already knew that as my total investments in an SP500 index fund using a dollar cost averaging technique over the last 7 years are worth less than my cost basis (and yes I started investing after the tech bust when prices were “low”). I probably should stop saving and just spend any money I make as all investments (including cash $) seem to be in decline.

I am witnessing the RE implosion from NorCal. One of my friend invested in a rental house in the EastBay back in 2005 and held many 2nd mortgages on houses in Stockton. Needless to day he is now talking about “retiring” in Oregon, instead of cushy, comfy Menlo Park. He is walking away from his rental because the bank told him it would be easier for them to foreclose than to alter his loan. He will declare bankruptcy, and the bank will hold $150K of negative equity. I am waiting for Silicon Valley to drop further, Palo Alto has dropped about 10-15% since ’05. It may drop another 20% before it’s over. Note the VC industry is about to fold– not looking good for startup gold to fund houses anymore!

http://www.mercurynews.com/topstories/ci_12902709

I’m in Silicon Valley too. The VC business has milked about all the easy money it can from its usual business lines.

That’s why they have jumped on energy and supported Obama. They see “green energy” as a huge source of profits due to rent seeking. Al Gore’s partnership at Kleiner Perkins is a highly visible indication of that strategy. Frankly, there is nothing new in the energy field worth VC investment without government-mandated markets.

However, in the low end of decent housing here in San Jose, investors are paying cash for houses that can serve as rental homes for working professionals. These are like bonds with inflation-adjusted cash flows. The underlying asset price may fail but so long as there is reasonable employment in the Valley (a decent bet) then rents will somewhat follow incomes and hence inflation.

Re: 7/21. gael noted that most buyers of her/his acquaintance in the past 10 years have had infusions of family money. That’s another ugly facet of the indirect inflation of housing-via-bubble. Affordability for younger people increasingly hinges on family resources, i.e., yet another form of intergenerational wealth transfer to the banks/financiers. In the 7/24 posting, William notes how new buyers are paying back bubble-inflated “values” with real income/dollars, and these two things are related. Perhaps by design.

~

Doc notes that it’s impossible to know what a sane equilibrium for CA is these days after three decades of funnymoney musical chairs, and I’m sorry to agree. But I’m reasonably sure that equilibrium for California will more resemble something Tom Joad saw, than the tech or housing ‘shroom visions.

~

Whitehall mentions reasonable employment in Silly Valley being a decent bet. Hm, Cisco just slashed 700 jobs at its HQ (remember those plans to turn Watsonville into a sort of Microsoft South company town/campus?)…while creating I think it was 3,000 jobs in Bangladore.

~

Doc, I were looking to throw some money at stuff, I’d be weighing in on the close-down auction at Twentieth Century Props:

http://www.incengine.org/incEngine/?art=hollywood_collections_test_2

~

rose

Leave a Reply to whitehall