The Elusive California Housing Bottom: The Relationship between Unemployment and Housing Prices. Market Conditions point to a 2013 Market Bottom.

On Friday, state unemployment figures highlighted a weak job market. The California numbers moved up again reaching a high for the recession registering an 11.6 percent unemployment rate. This comes at a time when the state is in a $26.3 billion budget deficit. Even though some are getting excited that a budget deal may be in reach, they forget that we still have a revenue problem. What does that mean? We’ll be back in this same spot a few months down the road. Much of these structural problems have to do with how California collects revenues from personal income taxes and other volatile sources of income. Another reason why this will be a prolonged recession for the state is our heavy reliance on real estate.

I happened to catch one of those house-flipping shows this weekend and what I saw simply reaffirms that California still has pockets of denial. A home was bought in a better area of Southern California and the buyers added every tiny detail including a Jacuzzi, stainless steal appliances, hardwood floors, and of course the granite countertops. The home needed work but was in a so-called prime area. The home sat on the market as you would suspect but eventually, someone paid a price that simply did not justify the home and location. From purchase, rehab, to sale it took nearly one year. The realtors gave out price ranges from $500,000 to $910,000. The asking price was over $1 million. It sold for that price.

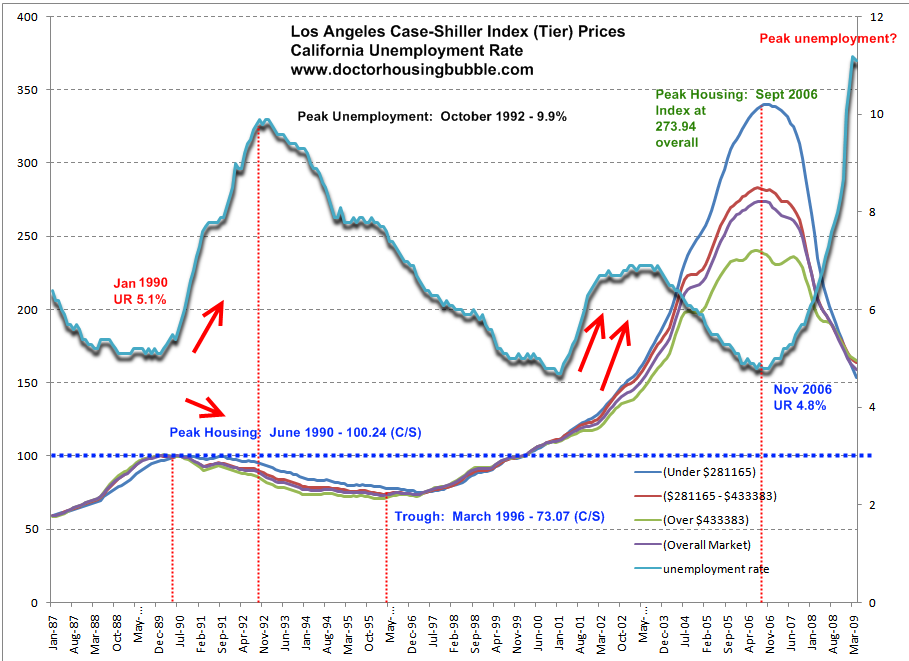

This simply reaffirms what I have been observing and what the data is telling us. The middle to upper range of the market is finding fewer and fewer suckers. The Alt-A and option ARM tsunami will hit these areas like a ton of bricks come late 2009 and into 2010. Some of these areas include Culver City, Palms, and Pasadena. But I know the main question many want answered is “when will we really see a true bottom for the California housing market?” For that answer, I decided to compile an intricate graph looking at tiered housing prices for the Los Angeles area and statewide unemployment:

*Click for sharper image

We should spend some time looking at this chart carefully since it may hold the future of where we are heading. First, in the late 1980s to early 1990s Southern California had a housing bubble. Shocking, I know. The peak was reached in June of 1990 looking at the Case-Shiller data. The unemployment rate hit a trough in January of 1990 at 5.1 percent. This is one of your more typical patterns of housing declines. First, you see unemployment creeping up which burst the housing bubble. Housing prices did not reach a trough until March of 1996 nearly six years later. Unemployment peaked in October of 1992 at 9.9 percent. Even as the employment situation improved, housing prices still continued their downward movement.

That in many respects was a normal boom and bust cycle. It is easy to understand. Yet there is no semblance of logic for what occurred after the 1996 trough. Southern California housing prices increased non-stop until reaching a peak in September of 2006. A decade of massive appreciation. Even the sharp spike in unemployment during the 2001 recession and tech bust did very little to stop the Southern California housing bubble. If you take the 73.07 trough figure reached in 1996 and look at the 273.94 peak figure from September of 2006 housing prices for the region nearly quadrupled! This is pure insanity. This is seeing a $100,000 home selling for $400,000 ten years later. Or a $200,000 home selling for $800,000 a decade later.

California was home to some of the most toxic mortgage producers including IndyMac and Countrywide Financial. These lending institutions not only employed Californians but also allowed them to play into the housing bubble. California turned itself into a snake eating its own tail. When housing was booming, so was the state and those working in the real estate industry. Now that housing is imploding so is the state. The two now share a similar fate.

If we glance at the chart again, you’ll notice that from peak unemployment in 1992 to the trough in housing prices in 1996 there was nearly a 4 year lag. Assuming this pattern, we still do not have the peak unemployment figure since we keep moving up. So assume we hit peak unemployment in 2009 (best-case scenario) then is the housing bottom really in 2013? Most estimates show us reaching peak unemployment in 2010. I would argue that this bubble is much larger than the late 1980s bubble so we will probably have a much deeper impact. And make no mistake, every tier of the market will be hit. It is also the case that we did not have a significant number of Alt-A and option ARM loans back then. It is an interesting note that the highest tier includes homes over $433,383 while the average Alt-A loan is $420,000+. Want to take a wild guess what is going to happen to that highest tier?

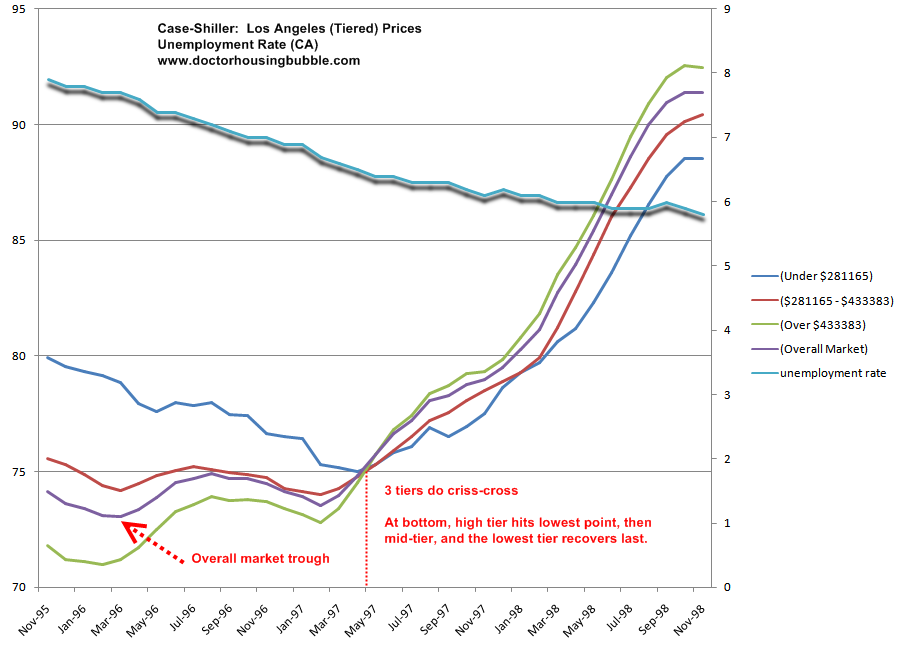

It may be hard to detect what was exactly happening to our current market but the action is unmistakable. First, let us zoom into the trough of the 1990s to see what occurred in various tiers:

This is where you see the real action taking place. What you’ll notice is this. The overall market hit a trough in 1996. At this overall bottom, the high end of the market had the strongest percent fall according to the Case-Shiller data. This would of course make logical sense since the high range of the market has a tiny number of buyers and in a tough economy, sellers will have to lower prices to move inventory. Keep in mind this is market behavior at a true bottom. When the recovery starts, you can see that the high range led the way, followed by the mid tier, and finally the low range. At a certain inflexion point, all three ranges cross. With the Alt-A and option ARM tsunami around the corner you can practically see this pattern playing out again.

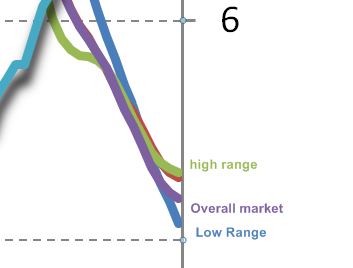

There is very little doubt that this will happen. Let us now zoom in and view our current situation:

The current situation is inverted. That is, the low range is at the bottom, the overall market is next followed by the mid to high range which still have to catch up. And the more troubling fact is the trend for all is still lower. We haven’t reached the bottom yet and unemployment is still spiking.

When you look at this data and look at history, we are still very far away from a bottom here in Southern California. Combine this with the Alt-A and option ARM loans that were made in mass during the boom and you have a recipe for a second phase of this housing bubble. Maybe I was too optimistic saying 2011 was going to be the year we reached a housing bottom.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

39 Responses to “The Elusive California Housing Bottom: The Relationship between Unemployment and Housing Prices. Market Conditions point to a 2013 Market Bottom.”

A 2013 to 2016 housing market “bottom” would be “right around the corner” from the Japanese perspective……

Their home price and stock market “lows” just keep on coming — even nearly 19 to 24 years after their peaks! (Are there yet additional Japanese market “lows” to be “reached” — even now going forward?)

(March 25, 2009) Japan Home Prices Slump to 24-Year Low as Recession Deepens, The carnage continues. Land values now down to 1984 levels

http://forum.globalhousepricecrash.com/index.php?showtopic=49118

27 October 2008 – Tokyo’s Nikkei 225 stock index closed down to 7,162.90 – the lowest since October 1982. [It had previously reached an all-time closing high of 38,915.87 on 29 December,1989 – following an intra-day high of 38,957.44]

ok..we have been reading your data and we are in agreeance. however, we are trying to wrap our hands on when to buy and re-enter the market. we are renting in the OC and paying high rent on top of a month to month fee (thanks to the rip off Irvine Comp capitalizing on the RE situation) so we can opt out and buy but on the fence with should we sign another lease and sit it out another 6 months or with upcoming moratorium lifting in aug/september plan and Act. feedback any thoughts?

Every segment is going to get hammered. The upper-end (not the $5M+ elite end, but the $800K-$3M range) is filled with “working rich” – people or couples with household income in the $150K-$400K range.

Very little savings, Lexus & BMW in the driveway, kids in public school, little or no vacations.

Liar loans, assumptions that home will always appreciate & “we can always cash out (sell)” mentality.

Well, if one of the yuppies loses its job, or even suffers reduced income (royalties / bonuses / etc) – guess what? Can’t make that payment.

Interest rate just shot up 3 points? Can’t make that payment.

Sudden unforeseen costs (home problem, medical problem, etc.)? Can’t make that payment.

We all knew there was something wrong with the picture….

Thanks. Would love to have the “numbers” in regards to the number of Alt-A outstanding and other metrics included. Any way to see how market is absorbing or handling these? What are the banks strategies appear to be with regard to inventory? If they are holding properties what are they waiting for, PPIP or something else, a combination?

Can we revisit Alt A and Option ARM in the context of the new prediction for a 2013 bottom?

What I have seen and read (both here and other sites) is that because of the changes in accounting mark to market rules, the banks are no longer under the same pressure they were previosly to foreclose. Basically, banks are now in a better position to do nothing because if they do nothing they can book the initial value of the loan versus if they foreclose, they now have losses. This is an utter falacy. So we are going to see huge profits for these banks now because they don’t have to reflect their true value. This is Enron 2 in the making and something caused by our very own US government that pressured FASB to change its standards.

So back to Option Arm/Alt A. The way I see it, banks have done nothing thus far because there is no accounting/profit pressure to do so. What happens when the second wave hits? Can the banks continue to do nothing? There will be hundreds of millions of dollars, perhaps billions, in cash flow that are no longer coming in. I’ve read arguments that because banks can essentially borrow from the fed for nothing, this cash flow argument is meritless.

Do the math–we’ve all seen plenty of statements 300,000 “foreclosures–NODs, NOTs, foreclosures” a month. First, those double and triple count (ie. an NOD leads to an NOT which leads to a foreclosure). So to be conservative, divide that number by 3 to get to a 100,000 people defaulting on loans per month.

100,000 “foreclosures” times again, conservatively speaking–1000 a month mortgage (which I think is very low) is 100M a month, the next month that is 200M, then 300M and so on.

This is the current state of affairs for banks–since the mark to market rules have changed, and banks have become squatters. I don’t think the math I set forth above is close to what the real situation is, nor is remotely close to where it would be in 2010. So question–how long can the banks do nothing–or do they just file BK and we have millions of homes auctioned off at the steps of the court house.

Does anyone out there have a real grasp

Seriously, MBAgirl?? You read these posts and STILL want advice on if you should jump in the market and buy? Because your situation is so unique that and that you’re the exception, so maybe it’s the right time to buy just for you??? So, Dr. writes that maybe 2011 was even too optimistic for a housing bottom and you’re worried about whether or not to sign a 6 month lease?? Last I checked it was July 2009. Add 6 months and that’s not anywhere near 2011. I think you may need to find another school to get another MBA from. Yours doesn’t seem to have taught you basic math. Unless, of course, you truly think your ARE the exception. So, yes, go buy NOW!! Hurry, hurry! One less person I have to compete with when the market finally bottoms.

MBAGirl – You might decide that the bubble is bouncing along a bottom right now and you might not, but this blog and most of the commenters here are cheering for a bottom out in 2013 or beyond. Unless you are trolling you aren’t going to get anything you want here but the-sky-is-falling and doom/gloom projections here and on other blogs like this. And probably some mockery from people like mey. blogs like this are great with important numbers / projections / opinions to be aware of in any case, but look at it this way – you won’t “know” there is a bottom until everyone else including Dr.HB can look back and look at facts. It won’t be too late or anything, but you won’t really know until everyone knows. If you buy now you are taking a gamble that could pay off, break even in time, or if most people here have their wishes come true you lose big.

Once again you have hit the nail right on the head. We are in unchartered waters, which means we have to make adjustments once we get new information. Regardless of when the bottom is, the fact remains that real estate will not be an appreciating asset for years to come. With absolutely no hurry to really buy now, and the multitude of headwinds blowing in the face of real estate, we are in for a nasty adjustment back to the true intrinsic “value” of homes as opposed to the “price’ of current homes. Once people adjust to that fact, they will understand. Until then, the Westside will be the last bastion of denial to fall by the wayside.

http://www.westsideremeltdown.blogspot.com

Hey MBA Girl, I almost responded–but then I read Mey’s response. Pay heed. He said what I would have (albeit, a bit more crudely, but who can blame him).

Now, Dr. HB, I’ve been wondering about your “2011” from some time. I’ve been saying 2012 all along. Peak to trough in the early 90s took 6-7 years. If the current market’s peak was 2006, 2012-2013 would be comparable–except that this was a bigger bubble. Which brings to mind an interesting question: how much bigger a bubble was it?

I like to look at my tax preparation/financial planning-office house in Granada Hills for price comparisons, since I know the numbers for this classic 3 bedroom 2 bath 1680 square foot tract home in the Valley. I purchased it in ’85 for $106k. It ballooned to $190k in 1989, when I said it would collapse by 30%. Indeed, it bottomed at $130-135k in ’96. It then grew in fantasyland to almost $600k by the Spring of ’06.

Now, let’s adjust for inflation and interest rates. A little research shows that long-term fixed mortgage rates were about 10% in 1989 and 6.5% in 2006. If one could afford to purchase about one-third more house, then the housing bull would argue that houses were worth a third more (just like a bond). Just for fun, let’s give the bull this one. So, my $190k office-house is worth about $250k in the face of the interest rate drop.

Inflation was (according to unreliable government sources) about 60% in the 17-year period 1989-2006 (amazing how much fiat money drops in value in the blink of an economic eye under a regime of relatively mild inflation, isn’t it?!). Add 60% to the $250k house and we get $400k. Although I’ve been citing its “fair value” in my client newsletter (www.DougThorburn.com; view by “subject” to see earlier issues for now) as $360k, if it was worth $190k in a prior bubble, $360k is probably still too high. MBA girl, pay heed.

Taking this a step further, if “fair value” was $160k in the mid ’90s (and it quickly increased to that and well beyond after the ’96 bottom), it’s worth about $330k today. I happen to think it’ll bottom at $250k, but we’ll only know in the fullness of time.

Getting back to how much bigger this bubble was than the late ’80s version, adjusting for interest rates and inflation my office-house didn’t stop increasing in value at its late ’80s equivalent of $400k. It peaked 50% higher. That is one helacious bubble. And, as we have seen, bubbles do not end well. They end badly. This is what I meant when I wrote my real estate bubble series in ’05.

MBA girl, I hope you’re still paying attention.

Nice article. Very insightful. One argument misrepresents, however. The graph showing that the high-tier index ‘crosses over’ the low-tier and medium-tier indexes in the mid 1990s is not meaningful since all 3 are normalized to 100 in Jan-2000. That is, the price levels themselves are not ‘crossing over’ even though the indexes are. If you want to compare index levels, all three should be converted to year-over-year changes. It still may be that the high-tier index is increasing faster than the low and mid tiers, but they should be compared on this basis.

Still, the main point is right on target: no bottom for a few more years at least.

Whattodo: Your questions are interesting, because it is the pragmatics which will ultimately mark the endgame of this situation. If there are indeed many thousands of mortgages in default where the banks are not foreclosing or doing much of anything (and anecdotal data seems to support that), are the banks taking a big risk by letting an increasing number of people who will likely never be able to pay off their mortgage, just sit in the house, pending future developments?

All it takes is a certain percentage of these people completely giving up as far as keeping up the yards and the outer appearance (they figure, “I’m going to eventually lose this house, anyway; I’ll stay in it rent-free for a time, but I’m sure not going to spend any money on it, since I’ll never get it back,”), to ruin the look of entire neighborhoods. Why would the banks care? Well, not only would the ultimate sales price of these houses continue to decline, but neighboring ones would as well; and who’s to say that this won’t cause more people to default, meaning even less cash intake for the banks. I know that our government is idiotically trying to allow people to stay in “their houses” by every means possible, but making it easier in the short term for banks to do nothing would seem like a recipe for more long-term financial implosion.

How DARE you insinuate that thee GOLDEN state suffers from any blemishes whatsoever- just look at this and be reassured:

http://www.chuckdevore.com/blog.asp?artid=94

Religious thinking requires suspension of one’s critical faculties and exceptionalism born of wish-fulfillment fantasy is the cornerstone of that sometimes desperate self-serving suspension of reason. It is thus not surprising that an “MBA girl” (let’s take that handle literally as it is likely that is how it is meant to be taken) whose self-image in great part may require subscription to the quasi-religious canon of the b-school curriculum would ask the question she does.

The rules of evidence only apply in someone else’s court (“seriously, Jesus really is watching over me every minute of every day…”) and the laws of physics are really just suggestions (“seriously, you just have to see ‘What The (Bleep) Do We Know?'”) And there’s no shortage of snake-oil-salesmen pushing the party line (“seriously, the check is in the mail.”) Moreover, you too may one day get to join the great capitalist country club in the sky (“seriously, Ayn Rand blah blah blah…”)

And the tooth fairy continues to flip houses…

Thanks to DAve. That article is devastating. It’s one thing to feel that CA has turned into a welfare wasteland and another thing to see the numbers that show it’s true.

If you run out of denial in So Cal, come on up to the central coast… tons of denial (and toxic morgages) in Santa Cruz…. after all everyone wants to live in here….

MBA Girl: The succinct answer to your question is this: Now is not the time to buy.

~

Whenever it is that values reach a “bottom,” they will stay there for a very long time. This won’t be a ‘V’ shaped recovery but, sadly, an ‘L’ shaped one. Values will drop to some value and essentially stay there (maybe appreciate very slowly) indefinitely — until wages increase. And the likelihood of wages increasing anytime in the foreseeable future is nil.

MBA Girl:

I also live in OC (not south county – but a nice quaint area). We moved here 3 months ago (to get closer to family) from our appartment in LA (where we rented for 8 years waiting for reasonable prices). We are working professionals for the last 12 years with “I guess” stable careers (hmm…my husband is an architect). We have a good income, no debt, good savings, excellent credit. So why are we still renting (many people ask) – because prices still make no logical since – especially with the new thought that one of us could lose our “stable” job! By the way, we found great rent in OC – in fact the place we are renting was reduced from what the lease was from the last tenant. I would renegotiate your lease or look for a better deal!

One of the nice things about getting older (one of the FEW nice things) is that you have some historical perspective. If you got out of college around 1998 or 1999, at the height of the dot com bubble, you “imprinted” on the fact that jobs were abundant. You could quit a job on Monday, and have multiple offers by Friday.

However, if you got out of college around 1982, you would have spent months pounding the pavement, looking for work. Much different “imprint”.

My guess would be that MBA girl is too young to remember these two different scenerios. Advertisers play on insecurities, in order to sucker you into buying- “You DESERVE this(pick one) house, car, big screen tv.” “Buy today or you will loose out”.

The most successful investors (Buffet, Templeton, Lynch) know that you have to be patient.

MBA girl- wait just 6 months. With what is unfolding, you will no longer have the buyer’s fever to act “NOW”.

I realize this is a housing blog, but take a look at the exerpt from the Tri state Transportation Canpain

. http://www.tstc.org. It reflects what the good doctor has been saying about California’s dependence on sales & other types of taxes

Los Angeles County Metropolitan Transit Authority (Pre-Budget Crisis)

Until recently, operating funds for the Los Angeles MTA came primarily from two sources in addition to fare box revenues: county sales taxes, and money received from the state. Proposition A, approved by LA County voters in 1980, imposes a 1/2 cent sales tax and requires 35% of its revenue to be spent on rail development and 40% for discretionary purposes (such as operating funds for buses). The rest of the revenue is returned to the cities in the county.

A decade later, Los Angeles County voters passed Proposition C, enacting an additional 1/2 cent sales tax and requiring 40% to be spent on bus and rail operations and expansion, 25% for highway and freeway improvements, 10% on commuter rail, 5% on bus and rail security, with the rest to be turned over to cities in the county. Additionally, in 2008 a county wide initiative, Proposition R (yet another 1/2 cent sales tax), was passed which will add additional funding to expand LACMTA service, with particular emphases on the Red Line subway expansion to Santa Monica.

Before this year, the LACMTA also received operating revenue from programs created after the 1972 passage of the state Transportation Development Act. The act dedicated part of the state sales tax to a State Transit Assistance fund, which was distributed to transit agencies based on a formula that included the size and population of the area served by each agency. But this year, with California facing a state budget shortfall of over $40 billion, Gov. Schwarzenegger and the state legislature eliminated the state assistance fund. California still dedicates a portion of the state tax in each county to a Local Transportation Fund for transit and transportation improvements within the county.

.

Even we New Yorkers get it.

Hi MBAgirl. I used to do the financial market research and modeling for one of the best-managed public real estate owners. I beg you not to buy. OC will continue to fall dramatically. How far and for how long it will fall is unknowable, but I expect an additional decline in excess of 25%. Buying real estate now will later be viewed as foolhardy, impatient, and expensive. The market is collapsing at 2% every month! Keep renting.

With the rise in unemployment rates and inability of the helpless borrowers to repay the loans, mortgage delinquencies are on the rise.

The unemployment rate in the nation, which stands at 9.4% currently, may even increase to alarming double digit number making the financial situation even worse for the borrowers to repay. The layoffs of many workers have been permanent and hence, their hopelessness in recovery of the jobs or helplessness to repay mortgage over time looks bleak and they resort to foreclosure than choosing to invest or borrow more money on something that they are not sure whether they would be able to afford in the long run.

I think the situation would deteriorate even further since

* Massive Job losses

* There Is No Demand

* Since May, Mortgage Rates Have Gone Up

* Too Much Supply

* Option ARM – The Next Wave of Default

* Market Psychology

Recently read an article on a similar premise.

http://www.housingnewslive.com/is-the-housing-market-recovering.php

Thanks so much everland-

I wish I had a billboard big enough to show those charts to the whole country-

That’s all money that’s NOT being spent on education for the CHILLDERN!!!

On a related note, thank God for Prop 13 or you can imagine how much higher our numbers would be.

What do you make of this post from Denninger?

Yes We Can (Help Main Street); Text Edition

http://market-ticker.denninger.net/archives/1236-Yes-We-Can-Help-Main-Street;-Text-Edition.html

This is a four-point plan to bring a durable bottom to both the housing market and the economy at large. Let’s go through it point-by-point, and expand on the “why” behind each.

(more at link plus video)

Comment by DAve

July 20th, 2009 at 12:23 pm

Thanks so much everland-

I wish I had a billboard big enough to show those charts to the whole country-

That’s all money that’s NOT being spent on education for the CHILLDERN!!!

__

(1) Define “Welfare” . That blog does not. It is too busy pushing a political view.

>>

(2) TANF (the old Aid to Dependent Children) also known as the ‘welfare check’ goes only to households WITH CHILDREN

.>>

(3) Medicaid – only ones who qualify are (a) CHILDREN (b) pregnant women under a certain income or (b) those who are permanently and completely disabled and have an income below 150% of Federal Poverty Level. In Texas (a cheapskate state that prefers to see people do without housing, food or shelter – including CHILDREN – while paying the lowest possible wages), the standars is (as I recall) only those with incomes of less than 100% FPL or under $10470 for 1; $14470 of 2 and $17800 for 4.

>>

(4) SCHIP or State CHILDREN’S Health Insurance Plan. Covers CHILDREN who aren’t poor enough for Medicaid but whose parents do not have employer paid coverage and/or can not afford private insurance

>>

(5) Childcare subsidies – again spent on CHILDREN so the parents can work or finish school

>>

(6) Subsidized housing – preference goes to households with CHILDREN

>>

About the only type of ‘welfare’ that is NOT tied to having children in the household is Food Stamps and for that the formula is Federal. Only households with with less than 150% FPL qualify for Food Stamps.

>>

So if you are so worried about ‘children’, then you would logically support higher levels of TANF, childcare subsidies etc.

>>

I’m more of the ‘if you can’t feed ’em, don’t breed ’em school” and if they can’t support the rugrats, then the kids should be put in an orphange or up for adoption. Spay and neuter have a lot to recommend themselves as policies.

>>

ANd please stop the endless moaning about CA taxes. The state only ranks around 18th or 20th in the US in terms of state taxes. Its problem is that it wants to spend – mandatory jail terms, universities, mandated spending on schools and extra-curricular activies (LOL! In the state constitution??!! CA has lost its mind in putting how much money goes to after-school activities in the state Constitution), skate parks etc etc etc – like it was the #1 state in taxes.

I’m in Silicon Valley, in NorCal. I’m actively shopping for a ~ $500k house (3/2 with yard) to live in within our decent school district. What I’m seeing at EVERY open house is a horde of orientals. Every offer I make, with FHA financing, is up against all-cash offers, which the banks prefer for the REOs and short sales. There are very few regular sales. A lot of the foreclosures are from people with Hispanic last names, btw.

Yes, there will be further waves of foreclosures coming on market, probably after they get some government coverage against cram-downs.

Prices will fall but…..

What I see is a rush to covert cash into something with an inflation hedge – like California real estate. China has a lot of dollars and is actively trying to find something that is not so dependent on a responsible US government. Stuff like copper and land. With rental real estate, there is some hedge against a crashing dollar. How many of those cash buyers are buying rental property, I don’t know.

From my point of view, getting a house with a 30 year fixed mortgage also offers me considerable inflation hedge. My job is rather countercyclical so my salary should make some adjustment to inflation. plus with the 3.5% down FHA loan and the $8k income tax credit, I have incentives.

Just some observations from the front lines……

The only reason the state ranks low in taxes is property taxes. Being that I can’t afford property (sorry I’m middle class which since I live in CA, means I will always rent and I’ll never own anything), that doesn’t exactly do me any good at all when I’m here in L.A. forking over 9.25% sales taxes whenever I buy anything and paying 9.3% top bracket income taxes. Renters in other states aren’t paying those types of taxes, I know, I talk to them. Only in CA!

Hey MBAgirl. You might want to get a refund on that biz school tuition. It obviously didn’t include any common sense in the curriculum.

UFB

“I know that our government is idiotically trying to allow people to stay in “their houses†by every means possible”

Except the cram down. If you have a giant tumor and do everything but cure the disease the patient will just die a little later, which may be the worse because at least a young couple can cut their losses and start again. There really aren’t that many years a person can be productive and to lose five or six years to people who aren’t rich is huge. It’s bad enough to have your 401k raped and pillaged by the gold men, but to have your home become a losing asset too will be the death knell for the deceased American middle-class (RIP). Gotta go so I can calculate 1/12th of 0.87% so I’ll know how much my money market account will make this month…

Wow whitehall. I really fail to see the point in mentioning that a lot of the foreclosures are from people with Hispanic last names. Also Oriental is used to describe objects and not people. Save your racial generalizations for a different blog. Cash is king, don’t be jealous that you don’t have it.

CalPERS expected to report loss of $56.8 billion

Uh, DAve, if Proposition 13 were not in place, then the housing prices would never have gotten this high. If there were 5% property tax, no normal person could afford a house of more than $400,000, and so demand would decrease. Even if some crazy banks stepped in to screw the dumber buyers by signing them up for option ARMs or subprimes, they would have defaulted much more quickly with higher property taxes. This wouldn’t affect the total cost of ownership, of course, but it would affect home prices.

MBAgirl, if you’re still reading this…… those that are telling you to wait are right.

And don’t get flustered by some of the comments. Even those guys are telling you (in their own unique way) that to buy now or even 6 months from now will mean you’ll lose a lot of money as the housing market must now face the failure of Alt-A and Option Arm loans.

The good Doc has been right about this thing for years. What he reports finally gets coverage in the mainstream media many, MANY months later. He backs up what he says with facts and figures that are available to those who also want to do the research.

2 state pension funds lose almost $100 billion

CalPERS and the State Teachers’ Retirement System report losses amounting to one-quarter of their portfolios.

The tremendous drop in value is expected to have a direct effect on the amount of money that the state and about 2,000 local governments and school districts must contribute in coming years to pay for pensions and healthcare for 1.6 million government workers, retirees and their families.

As income from the pension investments fall, the governments would have to make up the difference to meet the state’s pension obligations.

MBA Girl, in regards to your question, please wait. Wait and don’t buy all of the hoopla about “it’s a great time to buy”, “if you don’t buy now you will miss the bottom before prices start going up again”, etc….

We are still in the third inning of this real estate deflationary cycle. Have patience. That is what the greatest investors have in common (Warren Buffet, Jim Rogers, George Soros, etc….).

We just had the world’s largest credit bubble. Thus it won’t be over in a few months. The hangover will take a long time.

Now, for those who were rude to “MBA Girl”, it is not necessary to be rude to someone. She asked a question and some individuals were very rude to her (i.e. “get a refund from your business school, etc….). Be polite and if have a rude comment, then save it. Your mother was right when she said “if you can’t say something nice, then don’t say it at all”.

Commercial brokers are swimming in empty space

In a distressed market, the stakes are higher and deals are more elusive.

—

Commercial real estate slumps hard in the Southland

Offices and warehouses empty out, even as rents decrease, in L.A., Riverside, Orange and San Bernardino counties. A turnaround might be years away.

—

From the Calpers-Teachers Link:

The fund suffered severe losses across its portfolio, which was hard hit by a 43% decline in its real estate values, a 28.2% drop in stocks and a 27.6% loss in private equity holdings.

Whitehall, I also live in Bay Area. I also hear the same story you are telling from different resource. Folks are crazy to find a safe place for their piles and piles of cash to prevent the lost from inflation. Stock market? No. Bank? No. Real estate, yes. If huge inflation is right on the corner, just like Alta-A foreclosure wave, buying real estate could be good thing to do. The question is whether Fed can pull all the excess liquidity from market without too much side effect so to minimize the inflation.

Without inflation danger down the road, I believe the bottom time (nominally, not adjusted by inflation) given by Dr.HB is right, but with double amount of money in the market, I don’t know.

On further reflection, buying a rental property is something like buying a long bond. Price of the asset varies (like abond) but the actual cash flow vary, unlike a bond. Still rent cash flow is less variable and is somewhat indexed to inflation.

Williams948,

Just reporting the facts before my eyes. Use whatever PC terms you want but China has large dollar inventories and wants them converted to other assets. As to the foreclosures, the subprime loan mess had a political angle to push mortgages to specific ethnicities as political vote buying. Again, just reporting the facts before my eyes. Of course, that seldom has little import to the politically correct.

Norman,

The classic Fed mandate has been to take away the punch bowl just when the party got started. I’m very doubtful that they can bring back all that money gracefully. Besides, there is not enough money to lend on the planet to cover the upcoming deficits from the Obama Administration. The Fed will have to monatize the deficit. That also fits the foreign policy of suckering China. The US has always had the option of reducing the value of China’s dollar reserves by inflating and reducing the real value of those reserves.

S&P at 147. I just read an article about the S&P P/E going to 1900 so perhaps 2000. Frightening since many companies lie about their earnings, so I’ve heard…

MBAgirl…you sure know how to get a conversation going. Good luck…it’s a jungle out there. Be especially careful of the Alt Apes and the Jumbo-loan Elephant in the room. Also the Goldman Asp and BOA constrictor. Some really bloodthirsty predators out there.

Mey,

Harsh, and yet, amusing.

Leave a Reply