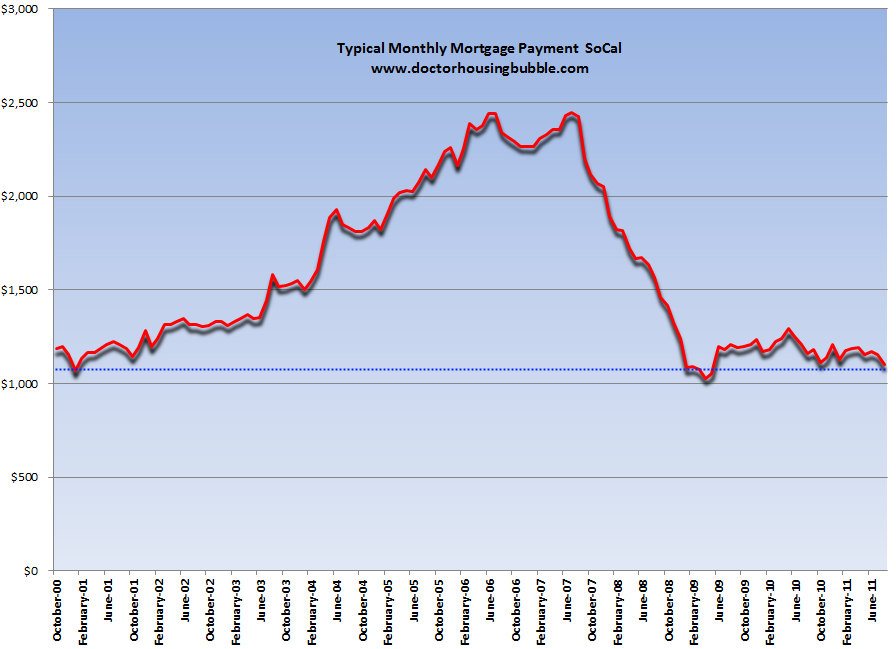

Southern California fondly remembers Y2K by taking prices back to 2000. The typical monthly mortgage payment in California is now the same as it was in 2000. Over 50 percent of all SoCal home sales are distressed properties.

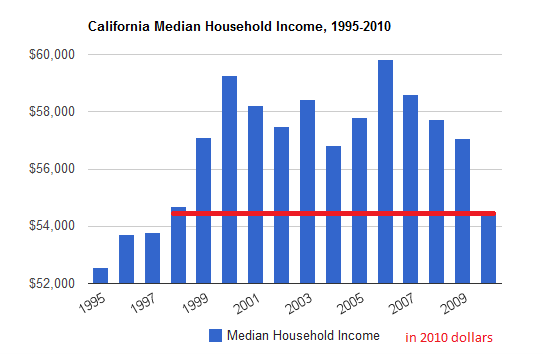

Home prices continue to fall in Southern California during a time of the year when you would normally see a healthy bounce. Clearly low mortgage rates and glossy looking television ads are not enough to inflate home values. You notice how banks have a clear thick glass paneling keeping you away from your money but you are more than welcome to sit face-to-face with a “personal banker†for a gigantic back breaking mortgage? Even with lower priced inventory growing, home sales still remain anemic. The large issue at hand is the lack of household income growth. The reason we still have housing market problems four years later and trillions of dollars in the hole is because we allowed the banking sector to handle the “recovery†which clearly never materialized. This should all be rather obvious to all of you and isn’t some kind of conspiracy theory. It is merely fact. So it is no surprise that even here in September of 2011 we still have over 6,000,000 homes lingering in the shadow inventory. Ironically we know that lower home prices will move inventory and we have seen this in beaten down markets in Florida, Nevada, and even here in our Inland Empire. Make no mistake, simply increasing sales does not mean that prices will somehow run back up as we will highlight. Yet creating a healthier market requires this painful progression, including banking failure. The problem of course is that the entire bailouts were banking-centric and this crisis was banking-centric. I wanted to examine some data on California housing not examined anywhere else.

California inflation versus home price changes – the 11 year review

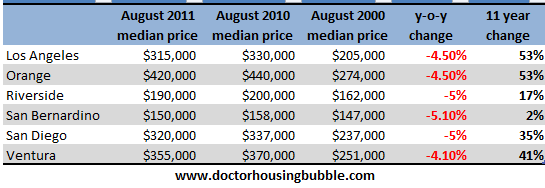

Given the dismal income data released by the Census and the grim reality it paints for California, I wanted to look at what has transpired since 2000. There has been absolutely no income growth over this time so I wanted to look at home prices and also factor in statewide inflation. Let us first look at the largest counties in Southern California:

We’ve already discussed the faux-bounce that occurred in the summer of 2010. The data is already showing that every single county is now negative year-over-year for price. All those folks who bought with 3.5 percent down FHA insured loans are now all fully underwater. Keep in mind sellers pay the commission on selling a home so they are more underwater more than they think. Hope those fancy marketing brochures were worth the tens of thousands that just evaporated over the last 12 months.   Setting that aside for the moment, I also gathered nominal home price information going back to August of 2000. This is where we really can find some interesting trends. As you will notice, both Riverside and San Bernardino are virtually back to the prices they last saw in August of 2000. San Bernardino is up 2 percent from the median price back in 2000! 11 years and a home has only gone up 2 percent in value. The same can be said for Riverside County. Both of these areas have massive lost decades.

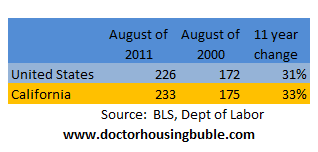

Los Angeles and Orange County both are up 53 percent over this 11 year timeframe. Some will argue that we need to examine and factor in inflation. We can do that:

Over this same 11 year timeframe overall inflation for California has gone up by 33 percent. Since incomes adjusted for inflation are now back to 1990s levels, we should use an inflation adjusted price to see where our new baseline would be:

August 2000 (LA):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $205,000

August 2011 (LA growth with overall inflation):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $272,650

August 2000 (OC):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $274,000

August 2011 (OC growth with overall inflation):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $364,420

Now this is simply assuming that home prices tracked inflation over the last 11 years (which they should). Based on this the median home price in Los Angeles needs to fall by $42,350 and fall by $55,580 in OC. Will this happen? Hard to say. But given the kind of income growth we have seen this isn’t farfetched:

Now some may look at the above and think that we are closer to a bottom. Keep in mind the peak for L.A. County was $550,000 and for Orange County it was $642,250. In other words we have already wiped out $200,000 from the peak price in both counties. With the enormous amount of shadow inventory in these markets I would expect that home prices trickle lower or simply stagnant and have prices get eaten away via inflation. The problem however, because of the economy, is you have people unable to make their payments so foreclosures continue to grow.

Over half the sales last month in SoCal came from distressed inventory:

August 2011

Foreclosure resales:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 34.6

Short sales:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 17.9

Now this is interesting because we are having a large amount of one and done sales. In better days, you will have a non-distressed seller selling their home and moving up in the musical chairs that is the California housing market. In other words, people would upgrade. So virtually every transaction involved two home sales versus one. Today, those foreclosure resales are one and done. I doubt short sale sellers are in the game to purchase another home because of short-term credit issues. Next, you have a large number of people paying all cash for homes. 28.5 percent of all sales last month were for all cash. Another one and done group here. Before people start thinking these are high rolling foreigners the median priced paid by the all cash group was $210,000. Try finding something like that in your prime markets. These folks are likely to be investors going after places in the Inland Empire or lower priced cities in L.A. or OC. And what a shocker that sales are jumping there:

“(LA Times) Among the states with the highest foreclosure rates, California led the pack in new foreclosure proceedings with an increase of 55% over July, according to data from Irvine-based RealtyTrac. Metro areas in the inland parts of California posted big jumps, with Riverside and San Bernardino counties soaring 68%, Bakersfield 44% and Modesto 57%, the real estate information company said.

A separate report found crosscurrents in Southern California’s housing market during August, with sales increasing but prices continuing to fall.

Sales were up 8.6% from July and 6% from August 2010, with a total of 19,654 properties selling across the six-county Southland in August, according to DataQuick of San Diego. The jump in sales was driven partly by a quirk of the calendar that left August with more business days than usual.â€

Foreclosure resales are likely to be cheaper and FHA insured loans made up nearly 32 percent of all sales when typically this figure is in the single digits. In other words, people are stretching their budgets. And we even see this when we look at the monthly nut:

Source:Â DataQuick

This I found fascinating. The typical monthly mortgage payment in SoCal is now the same as it was in 2000. In other words, the low mortgage rates are like a piece of duct tape holding up a dam of toxic assets and banking graft. Clearly people can only afford lower priced homes to reflect lower incomes. This is the larger trend at play here. Some will argue that prices now make sense because of current mortgage rates. Yet mortgage rates are artificial and reflect unreal risks that the market is having. It is unsustainable and Europe is finding out what occurs when you have spendthrift nations attached to thrifty countries. Right now our Greece is the banking system. Bailout after bailout but that doesn’t change the fact that they are insolvent. They also enjoy hiding assets (i.e., shadow inventory).

Sure some want to buy in Bel-Air for a few dollars but come on, that isn’t going to happen. Even if a home goes from $5 million to $2 million this is only a market for big incomes. The big change that we are seeing is we are starting to wash out the posers who were able to use Alt-A or option ARMs and leveraged their way into the good life. Those living in prime markets with large mortgages should have been booted out of their homes years ago. This isn’t a poor grandma in a $75,000 home in Indiana but Real Housewives material in OC and LA. Here is a simple rule of thumb; how about those who have a mortgage below the median national home price get some mortgage assistance while those above it get none? Of course we are now trillions of dollars in the hole and four years into the crisis so any sensible policy would require clawing back bonuses and gains from the bankers who clearly did not help in the recovery aside from lining their own pocketbooks.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

63 Responses to “Southern California fondly remembers Y2K by taking prices back to 2000. The typical monthly mortgage payment in California is now the same as it was in 2000. Over 50 percent of all SoCal home sales are distressed properties.”

When one uses the bls inflation statistic, one gets a rough idea of values. However, in many counties in California, the newer homes are often numerous, usually much larger and more expensive than the older ones, thus the median should be larger ten years later, even inflation adjusted. In other words, net of home size and feature growth, the inflation adjusted home is probably now the same as it was in 2000. Also, if one uses an inflation adjustment that is shall we say, skeptical of the bls methods and raises 1% a year more, just a measley 1%, then in that eleven years that makes 11% “hidden” inflation. So it may be the point so well made by this outstanding post, that the inflated value of homes shows a lost decade…yep, already there. Also, if one differentiates those under 45 (likely in the old days to trade up) from their elders 45 and over (much less likely to trade up in the old days) you will find that the younger folks have the most impact of lost income and especially lost equity (like nearly total) and lost credit if they own a home.

Yet people are still buying. Why? putting aside the social status, there is still no inflation shelter one can buy, well, that “most” people can buy, but they can still buy homes. People still think rigidly that a home is inflation shelter and will still yield a great return soon. Even now, that’s what they think; lots of not too smart people out there, unfortunately. (yep, they still buy time shares at retail too, talk about not learning!)

If you pay off your home, it IS an inflation shelter…literally. So all those “smart” people who put thier wealth in made-up numbers and the faith of the financial community might just end up with a big fat zero. Those who paid off their home will have a place to live, the ones who got defrauded into thinking the 401k was the pinnacle of retirement will be crying.

Swiller said: “Those who paid off their home will have a place to live…”

I really wish that is true but unfortunately, property taxes keep going up and up and up (maybe not in CA because they have prop 13 but definitely in other parts of the country).

Local government, schools, fire departments, … , have an insatiable appetite for more and more property tax dollars, even during a down economy.

If you can’t afford your property tax, the sherrif will be at your door and throw your belongings out on the yard, even if your home is completely paid off.

In addition to Rastum’s points, all of which are valid, there is the question as where you will work to get money for food, entertainment, property taxes, other taxes, utility bills, etc. One of the great advantages of renting, which I don’t currently enjoy, is that you can get up and leave, to search for work or relocate near located work.

Given the weak economy, the fact that gasoline prices haven’t dropped a lot more is a bad sign. What will they do if the economy picks up a little, or a lot? Go through the roof, I would guess. The option of driving a long distance to work, every day, is going to be problematic.

It sure seems like homes in non-ethnic neighborhoods are still in a strong bubble, while ethnic neighborhoods seem to have receded back to pre-bubble prices. The price differences between homes simply a mile or two apart are often times double just because Latinos live there.

A more Caucasian neighborhood certainly makes those living there pay a lot more just to be amongst their own people. Its kinda sad, i mean I have to literally pay $200,000 for for a home just to live around primarily Caucasian people. I never really thought of the real estate market as being “racist” but it certainly is.

I can only provide anecdotal evidence from my own open house hopping, but I know exactly what you’re talking about. I’ve visited neigborhoods eqaul distance from the city of San Diego, some a half hour north, others a half hour south (and thus closer to the border). The recently built homes were nearly identical in both areas, but the prices were not. And looking around at the neighbors shows a trend in ethnic separation.

Homer who is forcing you to pay the extra $200K? Move to one of those “ethnic neighborhoods” save 200K and show everyone how “diverse” you are.

Calling the housing market racist is irrational. People gravitate to where they want to live and obviously people with money are going to gather in certain neighborhoods. It is a socioeconomic issue, not a race issue. It seems to me banks have been more aggressive unloading distressed properties in lower income neighborhoods. In some less desirable areas, there are condo’s 75% off peak. My guess is, banks were more willing to cut their loss on these properties because the dollar loss was relatively limited. Losing 75% on a 200k condo in Sylmar is a lot easier to manage than 35% of a $1.2M home in Newport Beach. The fact is, investment grade properties are available (and have been for years) in lower income neighborhoods. Try to find an investment grade property in Pasadena, Culver City, Santa Monica or Redondo Beach. It’s not going to happen – yet.

Sadly, NumbersNeverLie, history shows that there been racism in the housing market. Read a book called Sundown Towns: A Hidden Dimension of American Racism by James W. Loewen. Here is part of a review. “From Maine to California, thousands of communities kept out African Americans (or sometimes Chinese Americans, Jewish Americans, etc.) by force, law, or custom. Some towns are still all white on purpose. Their chilling stories have been joined more recently by the many elite (and some not so elite) suburbs like Grosse Pointe, MI, or Edina, MN, that have excluded nonwhites by “kinder gentler means.”” Sad, but true.

Grammar Correction…”history shows there “has” been racism” in the housing market.

I’d prefer to label it cultural preference: Some like to live close to temple or church, some like to live close to ocean, or far from crack-slingers, and are therefore willing to pay a premium for the priviledge. I grew up a minority in da hood, but today i pay high price to raise my kids in a neighborhood devoid of nightly gunshots. I always have the option to move back to where i grew up, further from surf, but i choose not to.

What the heck is a “non-ethnic” neighborhood?

Did you know that “White” is not only a race but an ethnicity?

I’m giving you the benefit of the doubt that you didn’t mean that to sound quite as bigoted as it did……I hope I’m correct in doing so.

Homer S:

I agree with your assessment. From what I’ve seen, neighborhoods with good schools and a reputation for safety are tending to be holding values.

I’m thinking of Irvine here. And the Westside of Los Angeles.

btw, I don’t think you comment was racist at all. I think you were merely making an observation.

~Misstrial

This is what is called malinvestment on a gargantuan scale. It will take decades, not years, for it to wash out. Investing most of your capital in junk housing and automobiles is not exactly on the road to prosperity. Wait for peak oil as the real killer of this utterly ignorant system. Our military is the only thing that is keeping the boat afloat. Soon, it too will run out of fiat. Very sad, this could have been a great country.

Well said.

These are the fruits of some bad seed sown over decades of enlightened ignorant give away of the American dream by our “dream team” politicans. It would appear that the so called middle class home needs to price at multiples (2.5 X to 3.5 X) of what an assistant manager in “Jack in the Crack” makes. Oh, yes, I would like to buy a large iced tea and lemonaide, did I forget to ask for my senior discount. Okay here’s $0.54.(for real) Thank you.

I hear more people saying that housing is not a good investment anymore. It’s starting to sink in. It’s only been 4 years since the dive started. But, as unemployment persists and the young are saddled with huge debt, the price of homes will continue to head south and people are starting to understand this is something will not be going away in a year or two…..

These younger people not only have student loans, but they also have lower wages and NO job security. So truthfully they need to have 6 months savings plus a down payment which is difficult to save because they have such high student loan payments.

Perhaps the only saving grace is that these folks are living with their parents and will continue to do so while they pay off debt and save. Then maybe they will be able to buy something.

Excellent observation that typical monthly mortgage payment in SoCal is now the *same* as it was in 2000 !!!

Given that today’s mortgage payment amount is the same as in 2000, if the mortgage rates today are *half* of the 2000 mortgage rates, shouldn’t today’s house prices be *double* the 2000 house prices?

If it weren’t for shadow inventory and foreclosures sales, house prices today would be much higher based on this fact alone (mortgage rate being halved), as shown below.

Here are the facts:

On 2000-08-01, the 30-Year Conventional Mortgage Rate was 8.03%

On 2011-08-01, the 30-Year Conventional Mortgage Rate was 4.27%

http://research.stlouisfed.org/fred2/data/MORTG.txt

Agreed that the super-low mortgage rates of today are artificial and unsustainable.

Given this point, isn’t now a great time to lock up these artificially low rates? Why wait if mortgage rates are likely to rise in future, and make payments less affordable? Shouldn’t every home owner get a fixed-rate mortgage now, and lock up a good interest rate for the next 30 years?

On the other hand, if mortgage rates are likely to fall in future (from the already low rates of today) then no question that it is better to wait. But, how much more artificially lower can mortgage rates be made in future? The Federal Reserve has just one bullet left, operation twist. If today’s balance-sheet recession continues after operation twist, we could end up with eight lean years.

In a word, YES! It is a FANTASTIC time to buy, and lock in these historic low rates!

Please Mr. Realturd, explain to us all the effect of rising interest rates on home values. You mean they are inversely related? So that higher future interest rates will equal lower home prices. Hmmm, think I’ll wait. As the good Dr. has explained countless times, you cannot refinance lower than historic lows, but when interest rates do rise you can buy a home for less – and then even refinance in the future if rates go back down. But hey, if you like being a debt slave by all means, now is a great time to buy (isn’t it always for you).

Let me guess; RE/MAX realtard?

Remember, when rates go up the full doc lending environment will force prices down since home buyers can only afford $x mo. payment. When rates go up without a recovery in personal income those who bought early will be slaughtered. It’s the reduction in rates that has held up prices and made an overhang shelf of future strategic defaulters which will trigger another avalanche of foreclosures when rates rise and prices tumble – again. It’s just math.

Yes lock up that low rate…that the people you are trying to sell to in 10-20 years won’t have and thus force you to sell at a price below what you paid…..No thanks. Better to buy at a low price with a high rate than a high price with a low rate where you will be stuck in debt slavery for a very long time.

Somebody help me understand why do realtors post on this site? Do they hope to change the minds of the small minority who understand that tulip bulbs aren’t recovering any time soon…

Let’s take this opportunity to drive home the point that buying a house now is like buying Real Estate on the Titanic. You’ll be underwater shortly. Even with 20% down.

Just turn away from watching American Idol for a moment, and take a look at what’s going on in the economy.

In certain neighborhoods one can make a very good argument for buying as opposed to renting. When one factors in low mortgage rates and 50% drop in prices, there is not a huge amount of downside risk in purchasing a home. For the last couple of years, cash investors have been huge buyers of distressed housing. These investors make decisions based on economic fundamentals like projectd ROI and do not factor in any of the subjective value of home ownership. A lot of posters praise renting over buying analyzing the financial ramnifications as if buy shares of Apple. It simply aint like that. IMO, if you don’t get in over your head on mortage payments and particulary if you have children, home ownership is far better than renting.

I think you have a very high opinion of these “investors”. I actually know some of these folks and they are working on emotions and seeing the word through the rose colored glasses of the past ten years. Can somebody explain to me what “projected†ROI is in this market? I am assuming ROI is something like (rent + appreciation – expenses – taxes)/purchase price? Well… I am not sure how to “project†appreciation in a depreciating market…. Maybe (rent – depreciation – expenses – taxes)/purchase price. Now… is rent not directly correlated with income in a given area? Are these investments in areas with growing wages? So I guess maybe (rent – depreciation – expenses – taxes – vacancy)/purchase price is a better equation… Almost forgot transaction cost to realize my appreciation!!!! Hmmmmm maybe (rent – depreciation – expenses – taxes – vacancy)/(purchase price + transaction fees (12%)) if you want to sell to realize all that locked up equity!!! Where do I sign up for this investment?

Having money and a stable source of income qualifies as a good reason to buy anytime you want, in good or bad times. But buying in context of cash investors vs buying in context of buying a home to live in and raise your family are different. They have different motives and different timelines.

For example, to the investor, he/she may only need a 6 month window to turn around a cheap investment and make a decent profit off of it. However, to the family, it may end up a nightmare on the premise that the neighborhood is gradually being abandoned due to loss of economic activity in the local area. Perhaps crime increases, schools get closed down or public services are shut down. Families have interests that are not all financial, and what makes sense to the investor doesn’t necessarily translate to a family.

This is not to say there are no opportunities out there, but I don’t agree with generalizing the outlook of home ownership for families because the numbers simply add up for investors.

An investor needs to invest in something, and if buying a house will give a good ROI, then this explains why so many houses are being bought with cash. If I can get 8% on a rental, this beats bonds/CD’s, and the stock market has not been kind to me lately. Of course you have to realize that this is a long term investment that is not liquid, and appreciation/depreciation is not part of the equation.

I am not sure in what world one would not include all costs in ROI. I believe that return is the P&L side of the equation which includes revenue minus expenses. I would think that depreciation would be part of the projected ROI if you are depreciating at 10% a year. As I am sure that appreciation would be part of the calculation if you where appreciating 10% a year. You may have seen this called unrealized gain/loss. I have never seen a ROI calculation that did not include asset depreciation/appreciation included.

On another note, since a home is the average Joe’s largest investment, I would think it would be something that penciled out versus a decision made purely on emotions. Just a thought…

BTW. Are you telling me you do not count stock appreciation/depreciation in your assessment of the stock market? Many stocks do not have dividends and most dividends are quite small compared to the investment. It is my understanding that stock appreciation/depreciation is the major component on return. Correct me if I am wrong.

Gosh, that sounds brilliant! Let’s see, an 8% ROI when the price of the asset is going down 5% YOY.

That’s an absolutely sure fire way to make $1 Million in Real Estate. Of course, you do have to start with $2 Million.

These cash investors sound like idiots to me.

“An investor needs to invest in something, and if buying a house will give a good ROI, then this explains why so many houses are being bought with cash.”

Yep, and smart one buy their tulip bulbs with cash to max ROI too! 😉

Anyone burning through “cash” right now hasn’t been paying attention – Housing for sale is flooding the market, “ca$h” on the other hand is getting more, and MORE, scarce.

Debt-credit is accepted as identical to actual dollar currency by TBTF, and if it wasn’t *GAME OVER* – The extreme measures taken to preserve the issuers of such debt-credit is evidence that the somebody in charge gets the importance of this illusion to the system.

China (and the US’ other sovereign owners) don’t hold dollars…They hold I.O.U.s for dollars.

Everyone is screamin’ about the printing press, but that is an archaic model – What the FED has been creating enmasse is debt, debt that has to be repaid in U$D!

Unless Chairsatan Bernank can pull an instant currency devaluation out of his hat (like FDR did in 1933), things could get interesting VERY fast…

Got dollars?

It all depends on how valuable the dollar remains, in regards to dollar earning potential/ability.

If one pays attention to macro economic data, it would appear that the majority of wage earners (up to 70%) will be working for close to minimum wages, which was definitely NOT the scenario before 2000.

Doesn’t matter how low the interest rate is if you can’t save for a down payment/closing costs; Can’t earn enough to pay the monthly mortgage payment (when taking into account taxes/insurance/non-RE costs of living; And have no job security in the region you chose to live, requiring frequent moves to obtain employment.

Until REAL jobs return to the USofA, and the REAL unemployment rate is below 5%, anyone that buys a “dream” home is more than likely going to have a nightmare later on.

Hope is not a life strategy…

Exactly!!!

Inquisitor-“It all depends on how valuable the dollar remains, in regards to dollar earning potential/ability.”

Im guessing that the dollar will buy less of most things, in other words, the inflation case, except housing. If the USA Congress could have run $1.4 trillion deficits at any time in the past, without serious consequences, don’t you think they would have figured that out long ago?

The reason I think housing will go the other way, down in price, is that people will be squeezed with their other expenses and won’t be able to save a down payment, nor make large monthly housing payments.

Also, it doesn’t look that good for the stock market. Normally falling interest rates are good for the market. But lately rates have dropped and the market is more down than up lately. There’s talk of QE-3 to prop up the stock market, and further drive down 10-year treasury yields, but that will just flatten the yield curve and bring on a recession.

The one thing that has kept the economy off the ropes is the huge amount of deficit spending by the federal govt., but that can’t go on much longer. Maybe one more year, then we’re Greece………

Robin,

You mention that home prices are double and then go on to mention that now would be a great time to buy and lock in the rate. But now I would have twice the debt load as somebody that bought in 2000. I’m not just going to buy based on the monthly payment, I have to consider the impact of the total debt. Somebody that bought in 2000 with half the total mortgage amount, could make a lot of progress every month with extra principal payments, my extra payments would only go half as far. I would much rather have the $200k loan in 2000 vs a $400k loan today.

Normally interest rates rising signals a growing economy, so interest rates don’t necessarily correspond to a drop in prices. But the fed has been keeping rates artificially low for a while, and as you said it’s unsustainable. I have a feeling that once interest rates start to rise we are going to see a drop in prices. If that happens payments won’t be any less affordable, but the home itself will certainly be more affordable. I’m tired of the focus on affordable payments, I want affordable houses.

Michael D,

You make very good points. No question that a $200k loan in 2000 was far better than a $400k loan today. And, any extra principal payment is a great use of savings today: (a) reduce principal, and (b) inherently eliminate future interest otherwise due on the amount of principal reduction.

Although we cannot foresee the future, some economists think our economy may end up going into eight lean years (as in Japan). In the worst case, prepare the family to wait it out for the next few years, until the economy grows fast enough to force interest rates to rise and bring house prices down. Sometimes a growing economy can cause household income to grow sufficiently to support increasing mortgage rates (as capacity to make monthly payments increases).

Still, I don’t disagree with your position: house prices are likely to fall in future for other reasons, e.g. when foreclosed homes are suddenly released into a local market by certain banks in need of capital. In the mean time, waiting for a price drop has another advantage – saving up more for downpayment (the more we pay the less we owe).

You said it.

Reminds me of all the idiots who finance ridiculous prices for cars yet run around and brag about the “low payment”.

When I bought my first new car when I was 20 years old the salesmen was all about the “payment”. My answer to him was, I could care less about the payment, it was actual dollar amount first, interest rate second and payment last that I cared about.

“Given that today’s mortgage payment amount is the same as in 2000, if the mortgage rates today are *half* of the 2000 mortgage rates, shouldn’t today’s house prices be *double* the 2000 house prices?”

That’s faulty logic. The interest rate is almost double, but if you’re going to point out the fact that monthly payments are on the same level as 2000, you could’ve done the math how the rates factor into the bottom line. If you did, you’d realize @ ~8%, your monthly payments will be only 1.5x of your payments at 4.27%. So home prices won’t be double. It would be, at best, 1.5x price of 2000.

“If it weren’t for shadow inventory and foreclosures sales, house prices today would be much higher based on this fact alone (mortgage rate being halved), as shown below.”

Income has gone down since 2000 almost 10% in california (as of 2010, with no sign of improving in 2011), and unemployment has gone up from 5% to 12% (not including those who have dropped from the labor force because they couldn’t find a job, those working part time but looking for full time, etc). This is a ‘no brainer’ factor in home prices as well, and one of the reasons why home prices are still declining.

“Given this point, isn’t now a great time to lock up these artificially low rates? Why wait if mortgage rates are likely to rise in future, and make payments less affordable? Shouldn’t every home owner get a fixed-rate mortgage now, and lock up a good interest rate for the next 30 years?”

No, now is not great time to lock up debt.

1. The economy is unstable, and more jobs will be lost

2. There is still more downside left, and buying now will negate a good chunk (if not all) of your starting equity.. aka your down payment

3. Interest rates will likely stay ‘artificially low’ for a little bit longer. There is more room for rates to go up, but as long as banks are taking this beating, the Fed will act accordingly to keep rates low as long as possible.

“The Federal Reserve has just one bullet left, operation twist. If today’s balance-sheet recession continues after operation twist, we could end up with eight lean years”

The Fed still has multiple options. Some people feel that the Fed has done everything it could to no avail, but they could certainly do a lot of other things that don’t contribute to the bottom line. The only caveat is that for each action, the social consequences get more dire. The Fed is always on the move, but it has become more selective in picking its battles.

ed,

Agreed with almost everything you said – except about the Fed – the Fed is pushing on a string. We could be headed for eight lean years. A rebound in the economy will be not due to any Fed action, but inspite of it.

@Robin: I agree that the Fed is pushing on a string. But the situation strikes me as a lot more complex than that. For example, take the $300 Trillion that is being used via interest rate derivatives. That’s a heck of a lot of power to keep the Bond Market Vigilantes at bay. And this is, in part, why Bernake is so confident that he can keep rates low for the next two years.

That’s just one example. What’s going on behind the curtain is that they have hopped onto the derivative market in order to juice up their power, whereever they see fit. You don’t see much in print about this. But it’s there if you look. Especially if you read between the lines. E.g. the US Banks “helping” out the European ones right now.

My point here is that the situation is much more complex than what is being covered. And that will lead to more complex outcomes.

Unfortunately, the end result is the same. However, the goal seems to be to pass the problem onto the next Administration and Fed President, and not to actually solve it. Towards that end, they may well be successful.

“Given that today’s mortgage payment amount is the same as in 2000, if the mortgage rates today are *half* of the 2000 mortgage rates, shouldn’t today’s house prices be *double* the 2000 house prices?”

You should recheck your math.

e.g. Let’s say a 500k home has a rate of 5%. In order for the payment on a 250K home to equal the payment on the 500K home the rate would be over 12%, not 10%. Play around with any morgage calculator and you will see. This is P&I only.

“e.g. Let’s say a 500k home has a rate of 5%. In order for the payment on a 250K home to equal the payment on the 500K home the rate would be over 12%, not 10%. Play around with any morgage calculator and you will see. This is P&I only.”

Ahhh yes, I get it now. Thanks for clearing that up!

I sold in Simi Valley in 1999, (1800 sq ft, 6600 sq ft lot) 2 blocks from Simi High School for 259 K.

That same neighborhood model sold for 255K in 2001 and then again for 525K in 2004….equity in 3 years…$270 K

This person bought a new McMansion that was built on what once was the beautiful Simi Valley hillside 4 miles away for 845K. They lived there less than 18 months and sold in Oct 2005 for $1,295.000…Equity in 13 months…450K

Do the math and think about that…720 thousand dollars made in real estate by one person in a 4 year period…

There were a lot of WINNERS in the California housing boom and I would bet that they bought their next investments in other states by now. California is DOOMED by this mess and will take decades to come back…just sayin

Yes, Cali was looted by flippers…

But for every Cali flipper that cashed out there RE winnings, there were 3-4 that continued to leverage into the bubble bursting and lost it all.

Sometimes karma is a b!@#h!

I remember people spreading that “leveraging” mentality back then. I wasn’t ready for housing in LA at that time and I had a fairly decent income. At the time, someone at my company who had a not so fairly decent income who bought a home during the bubble climb. I thought to myself, “what is going on here?” I believe she lost her ass after the crash.

zillow zestimate today (09/11) is $722K on the home that sold for 1M295K in 2005.

Doing the math on that, this price is 123 thousand LESS than the original purchase price of said New home in 2004…

With all sorts of people, buying WAY too much house and needing the extra money to keep up with the farce, and the banks coaxing them so easily into the HELOC loans and the endless advertising on the “drug of money”, we are now where we are today. Sad but true and as the State Government runs the businesses away, Hollywood will not be enough to maintain any sort of life for people with families. The problems in Cali and the Country are Endless…

UGH

Thinking like this reminds me of the stock market bubble in 2000. I think the stat was 90% of people lost 90% of their gains during the bubble…so essentially most people made ZERO profit during that period. However, there are always a few people who made a fortune by being lucky. I worked with a guy who bought thousands of shares of AOL back in the mid 90s. He cashed out most of his position in 2000 and bought a really sweet house in Newport Beach for cash. That is pure luck and timing! Sometimes you win and most times you lose.

Interesting… I don’t think I’ll ever buy a house – all the endless maintenance is bad enough without the falling value. It is such a rip-off that lenders charge mostly interest for years on the mortgage before the homeowner starts paying much principal.

Volunteering to be a debt-owner, and thus the sucker enriching multiple banksters, realtards and public employee parasites, is definitively not for those that operate with their full brain capacity, and aren’t emoting their way through life 😉

Got Ag/Au?

Not a huge fan of Ag, but now might be a good time to buy some more Au, and buy into any possible weaknesses we see next week.

@ed and inquisitor, What do you see as the distinguishing features of Ag vs. Au as an investment? Why would one chose one or the other?

Thanks

@glisten:

SInce they didn’t respond, allow me to give you my take. Gold is the ultimate safe haven over the long term. Silver will have the most appreciation, again over the long term. Silver lately has been at a ratio of about 40-50 to the price of gold. Historically, it’s been around 15-16. When it catches up, it will probably overshoot to around 10. This is in line with what Eric Sprott has said.

Note well that this is over the long term. Sprott thinks the next decade, and he could well be right.

Between then and now, you are going to see a crash in price when the House of Cards implodes, like it did in 2008. While both PMs have been much more of a flight to safety than Treasuries have been, you can’t ignore the liquidity of the Treasury market. Thus, during a crash, PMs will be sold to meet margin calls; and the price will go significantly downward.

Over the long term though, both are going way up. All countries have no choice but to devalue their currency, if they want to remain competitive in the export biz. That’s what is going on today. And as such, PMs will appreciate compared to all currencies, especially after the great deleveraging, and crash in the Credit supply.

Gold is more stable and is behaving like a currency. It’s also what central banks like to hold in their reserves. There may be some investment opportunities in silver, but it has been volatile. Also, due to industrial applications that simply use up silver, there is possibility that silver may be phased out from it’s traditional role as a lesser currency (to gold).

In the long run, it’s possible that silver can be a better investment than gold, but I prefer to stay mostly in gold and take up silver only in certain situations.

I’m sure some others here can argue the point that silver is just as good as gold and I’m foolish to not increase my exposure, but in the end, it’s the numbers that matter. Some days you win, some days you lose. goal is to win more than to lose. haha

“It is such a rip-off that lenders charge mostly interest for years on the mortgage before the homeowner starts paying much principal”

Who said “Crime doesn’t pay”? lol

P.S. When housing is once again just a place to LIVE v. An INVESTMENT with TBTF, NAR, .GOV parasite wealth extraction/looting guaranteed, then perhaps, just perhaps, it will be a good time to buy!

Caveat Emptorium indeed :p

I laughed out loud at the realturd post! So funny! Buy now! Lock in those low rates!

Hahahahahahaaaaaaaaaaaaaaaaaaaaaaaaaaaa!!!!!

What an asshole.

I will reiterate again in caps IN CERTAIN NEIGHBORHOODS it may be a good time to consider purchasing a home. I reside in Northern Nevada but follow the blog because will probably be back in SoCa in a few years. Houses in the 100-200K range move very quickly. Many are purchased by cash buyers at an average price per sq ft that is slightly North of $90 – about $25 to $30 below replacement cost. These sales are happening in an economy that is based primarily on hospitality and in which everyone knows is going to take some serious time to improve. Not a lot of Kool aid drinkers left in this area.

Regardless of what one thinks of the current economic environment and it’s future prospects, the fact is that many people feel that the Western World isn’t going to crash and burn and are willing to take some measured risks on the future.

Most of the posters are correct about prices are still too high and are likely to decline in the neigborhood where they reside or are hoping to purchase. But the fact remains that rates are at historical lows and there are now housing markets where buying (even including taxes and upkeep) is a viable option.

I agree dirtbagger, but California has most of the toxic mortgages, and if the shadow inventory is really in the multi millions, this is going to take many, many years, to fix. You have the complete idiot who bought (financed) way too much house, and then you have the other complete idiot who borrowed against their equity in their home, and now that the rates are down, they can not refi. The banks advertised their kool-aid for 3 years and you had lots of people completely intoxicated from it all, and now, here we are, this will not be easy to fix, and the banks today are in way, way more trouble than they are saying.

@dirtbag It is true that although our economic solvency is mathematically insoluble, they can keep playing these same games indefinitely. I would just advise that if you are buying with the prospect of making a sound investment, you are taking a big risk. The future is still a funciton of the mistakes of the past, and this is an unprecedented financial disaster that no one was held accountable for, so if you think this is the end, think again.

In the last 2 weeks, friends have got fha lows under 4%. One is 30 year fixed and the other is 3% for 5 years then adjustable! And just to remind you that the CA housing market is still out of control, the reason they went for 5 years is so they could get the mortgage payments low enough to balance their budget. All it takes is one unplanned life event and they will default, or they’ll be underwater in 5 years and walk away… the cycle continues…

FHA loan to boot. In my idea of a free society, government is not the one handing out house loans, education loans, taking retirement money from you and taking the said money from the future. Government is not the one forcing people to buy a product, taking over education, vilifying growing own vegetables and stock, taxing gravity (a.k.a. property tax), creating secret list that bar people from travel, and much much more.

A society yes. Free, now that there is up for interpretation. Soon there will be some government medical loan agency if not already.

Not to mention that the guy who bought in 2000 is now more than 1/3 done making payments, so he can retire! And with any luck, he can refinance now, provided he’s built up some equity by making extra payments through the good years… right…

Leave a Reply to desmo