The Southern California flipper epidemic: A market in the middle of crosswinds. What a $2+ million flip in Arcadia will get you.

The flippers are out roaming the Southern California freeways in luxurious SUV fashion with Bluetooth fully activated. Funny how quickly things can change. Last week I was browsing the late night talk shows and who shows up? One of those reality show flippers from SoCal! I believe the moratorium on flipping homes is now out the window and now we are back on the housing mania bandwagon. Acceleration in flipping activity is a clear sign of a housing market that is overheating. For flipping to occur on a large scale, you need an overall rising market. Flipping completely depends on selling homes for higher and higher prices. That is the entire point of investing time and energy into a project that you will turn around and sell quickly. This is why it is fascinating to see the kind of prices some flippers are now demanding in the market. Yet the market is now seeing some signs of cooling after a two year run. Today we’ll look at a flip in Arcadia.

The $2 million Arcadia flip

This is an interesting flip in Arcadia:

521 VAQUERO Rd, Arcadia, CA 91007

This is a very nice home in the city of Arcadia. Arcadia is a premium market although nothing like Santa Monica or La Jolla. So to command celebrity like prices is somewhat odd for a 4 bedroom house. It is a big 4 bedroom listed at 3,699 square feet.

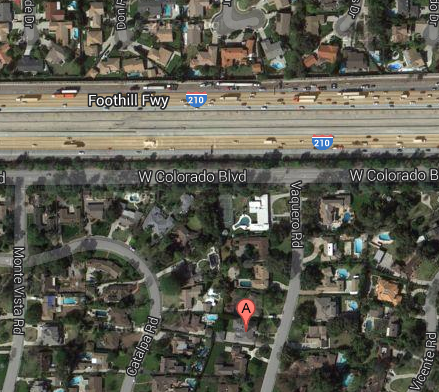

I mapped this place and it is actually very close to the 210:

For $2.2 million you might expect to be further away from a major freeway (at least it isn’t the 405 I suppose).  Another thing that caught my attention is the activity on this property. There have been reports that the average length of time a person will stay in a property is 7 years. So when I hear people whine that “they can’t buy to set roots in California†I have to grimace because these are the people that a few years down the road “need†a move up home since 2,000 square feet is no longer enough for a 10 pound toddler. In other words, people have this nostalgic view that they will sit in their property for 30 years smoking a pipe when the facts fly directly in the face of this (plus, those that are crying that they missed this run-up are essentially saying they are speculators). You don’t make any money until you sell therefore you are contradicting the emotional pleas that you cannot afford a place to settle down. So back to this flip, let us look at the action:

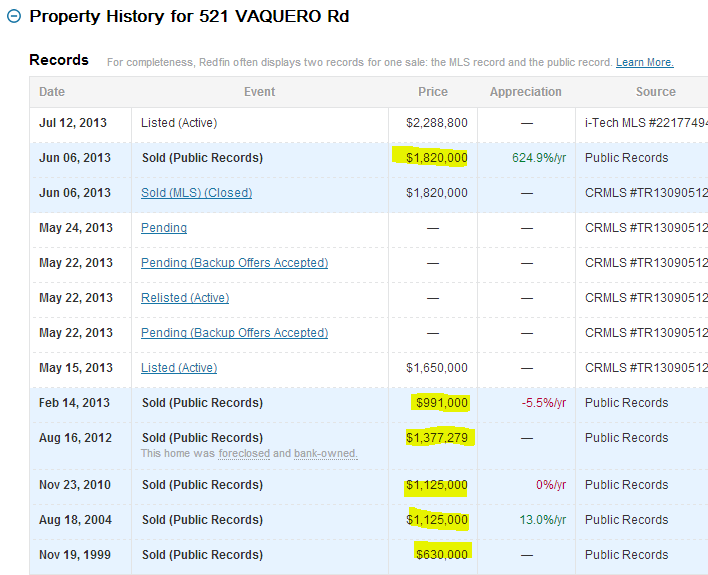

Interesting action here. The place has sold 5 times in the last 14 years and has been foreclosed on once (so not counting the foreclosure, we are looking at an average holding period of 3 years). The big winners here are the person that bought in 1999 and sold in 2004 and the person that bought in 2013 and flipped it in June for nearly double the price (from $991,000 to $1,820,000). I imagine this is where most of the upgrades also came into play.

But look at the current action. Someone that just closed in June is now trying to sell this place for $2.2 million! The place was only “owned†for one month before trying to offload it to the next buyer for $468,000 more. What could have been done in one month to justify this jump? These examples drive at the core of the current mania in California and other high priced metro areas.

In this zip code of Arcadia, the median household income is around $70,000 (however, about 50 percent are renters in this zip code). The median price of homes sold in this zip code is $1.2 million (up 38 percent from last year). Inventory in Arcadia has also doubled since the low reached in Q1 of 2013. Rising prices and rising inventory signal some sort of crosswinds (that is, something will have to give and momentum is slowing down).

Welcome to home flipping California style. This will be an interesting flip to track at a tipping point in the market.

Do you have any other examples of extreme flips in SoCal you would like to share in the comments?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

108 Responses to “The Southern California flipper epidemic: A market in the middle of crosswinds. What a $2+ million flip in Arcadia will get you.”

That house in $220k to $330k in the nice suburbs of St. Louis around St. Charles

Yes, you could get that house for a song in St. Charles or St. Louis. But you would be in Missouri with all that means. Anecdotal observation: My Orange County complex has new neighbors with license plates from Arizona, New Mexico, Florida, Michigan, New York, Ohio, Mississippi, Alabama and -wait for it- Missouri! Like the Beverly Hillbillies taught us: “Californy is (still) the place you wanna be.” High housing cost and all, people still move here (to be renters).

Seems strange to me that people would voluntarily relocate to CA, as the job market for well paying/career jobs is very challenging, plus much higher cost of living usually gobbles up any wage bumps. Weather? Nightclubs? Shopping?

I’m wondering ho would find relocation to CA sound economic idea? Aspiring actors/models? Google/Facebook rockstars? Welfare/Section 8/CalFresh hopefuls? Professional surfer/skateboarder? Graffiti artist? Rapper? Friend renting out rooms?

@We Don’t Make Those Drinks No More

I’ll agree with CaliChris on this.

Housing costs and car insurance are high here, but in the fly-over areas they routinely spend $500 per month on their utility bills and food at the grocery store can be double what we pay here.

In the Culver City/Playa Vista/Marina Del Rey region, I too see a lot of out of state plates. But you need to rethink the SoCal job market.

If you have a technical/science college degree (i.e. a bachelors or masters degree in computer science, any of the engineering majors, biochemistry, microbiology, chemistry, biology, physics, math, physiology, pharmacology, etc.), SoCal is a pretty good place to be compared to most of the fly-over areas of the U.S.

Now, if you are an unskilled worker, SoCal really sucks unless you are a trust fund baby or win the lotto.

Sounds like Park West, off Lincoln by LAX.

I wonder how many of those people will last more than a few years?

The key word in CaliChris’ statement was “complex.” That kinda tells you the demographic immediately. They won’t be buying the $2 million house.

Great place to vacation…. I lived in SoCal around 2000 for a few years…. never again, and it’s dirty anymore….. and broke.

And please don’t move to Arizona…. we love our guns and freedom… that might make you nervous…..

Flyover country is NOwhere near as expensive as SoCal, any way you slice it, unless you live very deep in the IE (San Bern, Hemet, et all).

Food double? What? I was just there and it’s equal at best. Which could be thought of as ‘relatively’ more expensive considering the average wage is lower, but not by that much. Certainly not enough to make up for the “weather tax” we pay in SoCal.

Utilities, yes there are months where they are higher in the Midwest, particularly July and August, and late November through early March. I’ve had heating bills approach $300 in a really bad month, but that’s also an anomaly.

I’ve had a/c bills approach $200 in SoCal, for 4 to 5 months in the summer.

Taxes are lower, car fees and gas are lower, housing is lower, restaurants are lower. What isn’t lower? Not much.

@mlimberg, I’m with ya on AZ buddy! Much better environment both politically and quality of life wise, and COL. I spend a bit of time in Scottsdale and Tempe every year, and if layoffs happen that will be my first metro area of search.

Ernst wrote:

“If you have a technical/science college degree (i.e. a bachelors or masters degree in computer science, any of the engineering majors, biochemistry, microbiology, chemistry, biology, physics, math, physiology, pharmacology, etc.), SoCal is a pretty good place to be compared to most of the fly-over areas of the U.S.”

Are career opportunities in those fields necessarily better in SoCal anymore, even in the fields you list? Will a SoCal salary bump likely be gobbled up quickly with cost of living? What about the quality of life…schools, neighborhood one can afford…

I lived/worked in an affluent Midwestern suburb for two years; never had $500 utility bill, not even close. Food cost same/lower. Pretty much everything else, same/lower.

An example, “young professionals” I knew bought houses. Random example I am familiar with, Leawood KS (affluent, excellent schools, jobs in fields you describe, median household income, 2007-2011 $129,104). Here’s a sub 300k house a young professional might afford/consider…

http://www.zillow.com/homedetails/11912-Canterbury-Rd-Leawood-KS-66209/75685646_zpid/

Here is a random sub 300K house in LA a young professional might afford/consider…

http://www.zillow.com/homedetails/4305-Esmeralda-St-Los-Angeles-CA-90032/20689594_zpid/

Two nice houses. Every person has to make choices, life is subjective.

I hear similar viewpoints frequently from the 50+ crowd, who’ve had the same SoCal job for years, bought a house decades ago, couldn’t imagine life anywhere else, love the weather, lifestyle, etc. However, the decision to relocate to SoCal is very, very different than it was in the 80’s, 90’s, etc.

I live in a small house in Mar Vista, and my utility bill from LADWP is on average over $200 a month. I pay nearly half of that just on the LADWP’s infamous “solid resource fee” ie. garbage pickup – even though I’m currently living in the house alone and my bins are routinely half empty.

I’ve been running a wall a/c unit regularly for the past month. Can’t wait to see my next bill.

@Drinks

I can’t vouch for industries other than my own, but for tech/software, California is your best bet. There are small pockets in NY, Boston, Washington State, etc but anywhere else is pretty much a career buster.

I lived in LA for 3.5 years and now on Lake Travis outside Austin. My first electric bill in Texas this summer was $333, but I have 4000+ sq ft and a pool (for those with high energy bills try ceiling fans in conjunction with AC and invest in a variable speed air conditioner). My electric bill was $100-$120 during the summer a month for an 850 sq ft apt in LA. My rent was $2495 for an 850 sq ft apt in LA and my mortgage on my $688k house is $2471. My first water bill was $78 and that includes having to fill my pool up at times because of evaporation due to the direct sun. Compared to LA, my car insurance is cheaper, my car registration is much cheaper and food at whole foods is approximately 25% cheaper in Texas. With my randalls food card, i paid $3.29 for a gallon of regular gas yesterday. Plus, there is less traffic, so i get more miles per gallon than i did in LA, and don’t waste time in bumper to bumper traffic. Even movies are cheaper at the theatre. I would think most Midwestern cities are closer to what I pay in Texas than what one would pay in Cali. I understand rooting for your home state if you’re from CA, but lets at least be honest when it comes to costs.

So, let’s discuss why people from other states do move here.

My theory is that they don’t know any better and are buying into a narrative long sold in popular media that life is easier here. The smart ones will soon enough recognize it as bullshit after settling into the realities of SoCal life.

Then again, there are plenty of Pollyannas in the form of inexperienced natives and stubborn transplants that will spin almost any suggestion of harsh reality into surfing and skiing on the same day.

Papa is simply pointing out that the grass is not always greener on this side. Just because many have to find out the hard way doesn’t make his point any less valid. I’ll step out on a limb here and suggest that as mean reversion in regard to quality of life to income ratio continues on a downward slope for the majority here in SoCal, some formerly industrial Midwest cities could begin to experience a renaissance.

Nothing lasts forever.

Joe, a lot of people are just chasing the dream. I see kids move here all the time fresh out of school. They are escaping the dreary rust belt and BFE flyover country to experience the dream of California living. Most will wash out and leave, but they can at least claim they lived by the beach for a few years in the prime of their lives. This rotating door will never stop spinning. This sounds like a crappy way to build a state economy, but it works pretty well in the desirable areas. People will pay nosebleed high rent, lease fancy luxury cars and wine and dine until it is time to leave and have their replacements take over for them.

LB wrote “People will pay nosebleed high rent, lease fancy luxury cars and wine and dine until it is time to leave and have their replacements take over for them.”

Sounds cool, but if the CA economy is propped up by a perpetual revolving door of out of state renters, and GenX/Millenials stuck in sub 100K/annual jobs, what demographic will qualify to buy the 700K+ ranch style fixers from the 50+ Reyn Spooner crowd once they sell/pass away in a few years? Chinese nationals? Trust fund babies?

I’m originally from St. Louis. No thanks to St. Louis, especially St. Charles. I would rather live in a shack than St. Charles.

you’re an idiot. Go Cardinals!

Wait til the music stops.

But it’s the best time to buy! Rates may never be this low–ever again!

For the sake of clarity, that’s snark. DRHB’s blog deleted the HTML-like reference.

Housing markets where cash is king:

http://money.cnn.com/2013/07/25/real_estate/cash-home-sales/index.html

Not that difficult to go to all your family members and group together a bunch of cash. After the house is yours you just do a cash out mortgage and pay everyone back. Just one hurdle to buying a house these days. Could like do it with your stockbroker. A margin loan. You are just buying house rather than stocks.

Thank you Dr. HB for doing an article on an area I’m looking at. Definitely bubblelicious with a lot of cash offers.

I’m surprised they didn’t price it at $8,888,888; a full price buyer might offer a down payment of $888,888, with an 8 day escrow. Lucky!

I suspect the $77K median household income is hiding a lot of economic inequality within the zip code. I grew up right next to Arcadia, so I’m quite familiar with the area. The house listed for $2.2 million is in a super exclusive part of town behind the Arboretum. It’s the type of neighborhood where you’d feel poor driving a Toyota around. It’s sort of an enclave, very secluded. No way those people are making anywhere close to $77K per year. Even renting a house in that particular area costs $4000/month and up.

The median income is probably skewed downward by the 50% renter population that lives in the condos a few blocks south of Huntington Drive, where a 2-bedroom place goes for $1200-$1400/month. Arcadia has one of the best school districts in the SGV, second only to San Marino or La Canada Flintridge (which are even pricier). Everyone wants to live there, but it’s too expensive to buy, hence the large renter population.

$1.2 to $1.8 million sounds about right for that area. The $990K price is a steal. The $2.2 million price tag seems a bit high. I would expect 5 bedrooms, 4000-plus square feet, and a pool or guesthouse at that price.

The fact that 2 bedroom rentals in that area are going for 1200-1400 a month means that not everybody wants to live there, otherwise the rent would be more expensive. Think about, the property taxes on a $2.2 million pad is over 2k a month and there in the same neighborhood as slummy $1200/month apartments; yea that makes since.

There are no apartments in that particular area where this house is located. In my original post, I said that the apartments are several blocks south (still in the same zip code and city, but definitely not in the same neighborhood). Renting a house in that exclusive neighborhood would probably cost $4K-$6K, or more, per month.

Checking Craigslist, I see no rentals under $1500. (I put the floor of $1200 in to filter a bunch of spam out)

http://losangeles.craigslist.org/search/apa?query=arcadia&zoomToPosting=&srchType=A&minAsk=1200&maxAsk=&bedrooms=2

This really doesn’t seem like an exclusive neighborhood since there 2 bedroom homes for rent in the same neighborhood (Paloma Drive, north of Huntington Drive) for $1600/month on hotpads.com. With rent that cheap it seems like there should be quite a few toyotas driving through this neighborhood.

I just checked the listing on hotpads.com. There’s something screwy with it, since there’s another identical listing (same address, same photos) for $3200/month and a THIRD listing (again, same address and same photos) also for $1600/month. I have no idea what’s going on, but the $1600/month seems very unlikely. Another 2BD/1BA rental (804sq ft) in the same neighborhood is going for $2500/month.

I’m starting to see more of these wacky flippers: Here’s a good example down the 210:

http://www.redfin.com/CA/La-Verne/840-Lake-Ave-91750/home/8042143

Note the jump: bought for $459k in June, listed for $599k in July after dumping maybe $30k into the property to “groom” it (paint and a new lawn).

Oh, and the median income for that zip is about $74k. Yep, this’ll end well…

That’s a quite wealthy area, I’m sure the median income is also skewed like Arcadia. North of the 210 are affluent homes, and the schools are some of the best in SoCal.

No, it’s solidly middle-class. Take a closer look at the comps in the subdivision. La Verne Heights (to the east) is more up-scale. Bonita USD is very good but San Dimas is in the same USD and the comps throughout that town don’t support the asking price of this property.

I point out this particular property because I believe that it’s the work of your standard “easy money” crowd. The good news (for the flippers) is that there’s plenty of room in the price to come down and still make a nickel.

Under the guise of making sure enough ‘creditworthy’ buyers can get mortgages, too big to jail banks and morons who will buy homes they cant afford win again. Makes me want to vomit, but we all knew it would happen soon enough…

http://www.zerohedge.com/news/2013-07-25/regulators-fold-lift-skin-game-rules-keep-housing-bubble-dreams-alive

This is confirmation that the bubble 2.0 is on its way to burst once again. I wonder what price we will be able to get after the next crash?

My favorite part is that those of us who buy within our means are STILL dragged down by those around us who buy beyond their means. Seriously, the best solution is just to return to 20% down, 20 year mortgage windows, lower conforming loan limits, no FHA, etc… Make the bank have to hold the mortgage.

House hype end date(s)? Really… Keep hyping those homes will yeah! To the stratosphere..

http://www.bloomberg.com/news/2013-06-21/fed-seen-by-economists-trimming-qe-in-september-with-end-in-2014.html

http://www.moneynews.com/StreetTalk/Fed-bonds-quantitative-easing/2013/06/19/id/510804

You hit the nail on the head.

That the government, banking, and real estate lobbying interests push for schemes which encourage folks with little to no financial prudence to over extend themselves, subverts systemic integrity. That is why some of us are here in these discussions. We see it and recognize that in having a system whereby the balance of purchasers who buy-in with sound financial principles versus those whom do not becomes extreme, the system looses footing and honest players get caught up in the wreckage.

The over-extenders, whether through ignorance or will, are like the addicts to the government, financiers, and housing industry’s drug dealers. The drug is financialization run amok. Making money from money and the passing off of risk in a game of musical chairs.

I don’t fully blame the addicts, but they are key to the problem.

Call me crazy or socialist, but perhaps one way to get around this problem is to have an income qualification gap that could be used to weed out buyers who have TOO MUCH income to qualify to buy a specific house. Similar to your FHA or HUD. If some homes are deemed for certain owners based on their income maybe this might put a lid on what homes would be appropriate due to specific market circumstances. In addition, this could grow or contract based on the market. That could put a big peg in selling homes to extreme values and keep it in line with what the city or county can tolerate.

Do you really think a billionaire is going to live in a home in a middle class neighborhood? This Gentrification is good until there is no room for qualified buyers who don’t make the kind of income these flippers are doing. the middle class are an important part of society that has a right to live where they choose. Not by market forces.

This house is in Sand Canyon, an exclusive area in the Santa Clarita Valley. It has been sitting on the market since April at $779K. Today the price jumped to $879K! Prior to April it hadn’t been on the market for a long time, so I don’t think it’s a flipper, but I’m astonished anyway.

http://www.redfin.com/CA/Santa-Clarita/27009-Sand-Canyon-Rd-91387/home/6028991

Here is a before and after of a house in Santa Clarita. Anyone want to hazard a guess at how much the current owners put into the house before flipping it? I’d be curious to know.

Before:

http://debbiepowell818.com/PropertyDetails?pid=SR12128157:SOCAL&ls=CARETS&presented_by=yes&use_close=true&show_address=yes&show_description=yes&show_virtual_tour=yes

After:

http://www.redfin.com/CA/Newhall/21259-Oak-Orchard-Rd-91321/home/8118118

These two condos are not even flips. Both located in Sherman Oaks. The listing pictures are even the same as the last listing and I’ve seen them in person the first time they held open houses. If the pictures are accurate, absolutely nothing has been changed ito the properties.

Sold in June for 270k, listed a month later for +100k and currently on second price reduction.

http://www.redfin.com/CA/Sherman-Oaks/5055-Coldwater-Canyon-Ave-91423/unit-105/home/5217368?from_mobile_app=true

Sold in May for 325k. Up for sale exactly two months after with a 25k markup.

http://www.redfin.com/CA/Sherman-Oaks/4358-Mammoth-Ave-91423/unit-16/home/4859068?from_mobile_app=true

Looks like the individual or group is trying to keep a steady business model going. However, all these homes have a peak, which is probably why this was turned around for sale so quickly.

When I was a kid, flipper was a mammal that lived in the sea. Have things changed for the better?

Here’s a nice flip. Purchased on 7/16/2013 for 1.3 mil. Listed on 7/22/2013 for 1.790 mil.

http://www.redfin.com/CA/Los-Angeles/3373-Deronda-Dr-90068/home/7129867

Interesting price history on this place.

KK

The property was most likely sold back to the lender at the trustee’s sale on Feb 14th, 2013 for 991K. It was then sold on June 6th, 2013 by their REO department. I would look into the MLS listing to confirm this.

I doubt anyone was able to get the property at such a deep discount. And if so, it was one good inside job.

2.3 million for an Arcadia property? LOL!

Wrong. If it sold at trustee sale that means an outsider bought it. The bank did not sell it to itself. The alternative, if indeed it was then sold by the real estate wing of the bank, is that they lied and claimed the bid price was a sale.

In reality it is most likely what I have come to see as the current real estate market – a real property version of car sales where insiders get to purchase wholesale so to speak, one because they have cash to do so (trustee sale) and two because the banks invite them to buy rather than opening the sale to a free market system.

I always wonder where in the world Southern Californians get their money to buy homes. Everything I have is self-earned (i.e. no parental help), and at 40, my biggest priority is to fund retirement. The home I bought is about 2-2.5x annual salary, and the idea of going 5-6x because payments are “affordable” just seems insane to me nowadays. Did I wise up to come to this reality, or is there some dynamic in the market’s mentality/funding that I’m missing?

This is beginning to be like an art expo where people bid on look and feel while looking for a bigger gain. Not much toward the live factor anymore.

The featured house has been an absolute boon to many industries over the last 15 years. It sold five times, that means a constant churn of very expensive realtor commissions. I’m sure it was refinanced almost annually. The local contractors were kept happy with all the renovations and upgrades. And the county tax collector couldn’t be more pleased with the ever increasing property tax they receive.

These are all reasons why having a huge collapse in housing prices likely won’t happen. Too many industries and entities have vested interests in inflated home prices.

Regarding the 77K median income for the city. Don’t pay attention to those stats, they are usually worthless in desirable pockets of California. Remove the renters, people who bought many years ago and focus on today’s buyers and it will be MUCH higher than 77K. I think Arcadia is one of those places where many people work in “cash only” businesses…good luck with that one!

LB, I respect a lot of what you’ve written over the past few months, but I really wonder what “macro” issues outside of the “micro” So-Cal housing market might force a change.

Here’s my list of “what-if’s”:

* Ending federal deduction of state income taxes. (Proposed by Romney)

* The buy-and-holders of the 1960s/70s croak and their kids don’t want to move back.

* Interest rates go up.

* China moves on from Cali. (Already starting.)

* Conforming mortgage loan limits are lowered.

* Mortgage tax deduction capped/ended. (Another Romney issue.)

* Prop. 13 is repealed/”adjusted.”

* Prop. 30 is extended/”adjusted.”

* The job market continues to suck and there aren’t enough $200-$500k households to be buying this stuff.

* Current demographic trends continue, i.e. native-born Americans emigrate California and less-affluent immigrants from central America, etc…, continue to immigrate.

* CalPERS needs more money and unilaterally adds parcel taxes. (They argue already that they have police-like powers where they can make such moves on behalf of the state.)

Trust me, as a native So-Cal’er, I’d love to move back eventually after leaving last year, but the big picture tells me that California is a slow-moving train wreck. Yes, there might be a decade or two between now and then, but I just don’t see the an economic renaissance ahead, and that’s what is ultimately necessary to sustain/improve the housing market.

KR, I highly doubt any of the housing welfare you mentioned will be forever removed, it may be scaled back. The current mortgage interest deduction capped out at 1M is ridiculous in my opinion, this might be slowly lowered yearly. If anything, it should be capped at the conforming loan limit…so I wouldn’t stray too far away from that. And Prop 13, that sucker is here to stay. It’s almost irrelevant if you buy today because you will certainly not see the returns of the lottery winners who bought 30+ years ago.

Just like housing bubble 1, the people who really got hurt are those that massively overextended themselves. Stick to a DTI ratio around 25% for housing a enjoy life!

Don’t forget about the $250 grand gain for single or $500 ground gain for married home deduction when selling? Of course that does not seem to matter for the flipper.

Makes you wonder how these businesses do when the market technically reaches a peak? If housing starts to correct downward I suspect these companies would close up from the lack of momentum or downsize.

The counties should revise their numbers to see if whether the incomes in the area are still justified.

This one is trying to sneak out $100k after only owning 4 months. Think they are not going to do it. Trapped by higher interest rates. These sellers are about 2 months too late in their listing. Too bad, bagholder.

http://www.zillow.com/homedetails/1638-Acacia-Hill-Rd-Diamond-Bar-CA-91765/21493961_zpid?utm_source=Patch&utm_medium=referral&utm_campaign=patch_diamondbar-walnut&cbsubdomain=diamondbar-walnut#Patch

And when zillow loaded up a contact realtor on the right side of the page, it was a Chinese woman who’s name was appended underneath by the phrase “(Chinese Speaking)”.

I’m glad Cali seems to be doing well. I saw a price bump in late Spring/early summer in other parts of the nation but now see price cuts in most areas, even Laguna Niguel. The local Big Bank banker says the mortgage department is pretty quiet since the rate hikes mid-summer and Bernanke’s tapering talk.

He said to watch for more price cuts as winter approaches. Of course, if rates keep rising, house prices will fall accordingly no matter what time of year..

Bloomberg has touted that Arcadia is one of the best places in US to raise kids… furthermore, population is 59% Asian ….

and 7th highest median income in US according to CNN.

seems like the high cost of homes is expected.

http://en.wikipedia.org/wiki/Arcadia,_California

Yep, my friends and I joke that all the rich Asians live in San Marino. All the rich Asians who can’t afford San Marino live in Arcadia. And all the Asians who can’t afford Arcadia live in Temple City. Everyone else lives in San Gabriel, Rosemead, or Monterey Park.

Of course, we’re saying this as Asians who grew up in Temple City, so take that how you will.

Not sure about the 7th highest median income though. That seems highly unlikely. I would believe it for San Marino, but not for Arcadia. San Marino has a higher median household income than Beverly Hills. At any rate, Arcadia definitely is a nice place to raise kids, with low crime, great schools, and nice tree-lined streets.

More evidence the market is frothing. This flipper is going to flip out.

http://Www.westsideremeltdown.blogspot.com

http://Www.santamonicameltdownthe90402.blogspot.com

I’m seeing signs that thigns are cooling as well. There’s flipper in the Inland Empire who I guess has dubbed himself “Rancho Robert.” I’ve toured two of his flips and they are nice but appear to be overpriced, even in today’s market. Both had slick looking fellows in fancy suits showing them off. One mentioned to me that his boss owned something like 80 properties.

Anyway… I looked at both 3 or 4 weeks ago and both are still listed and having open houses every week.

Here’s one of them:

http://www.redfin.com/CA/Alta-Loma/9750-Liberty-Ct-91737/home/4212560

It was purchased for $465k on April 30th and listed again at $629k on June 10th. It’s been on Redfin for 46 days now.

The other one that I looked at has been on Redfin for 37 days now:

http://www.redfin.com/CA/Alta-Loma/10778-Zinfandel-St-91737/home/3276405

I know Rancho well and both those homes are $150k overpriced. Their pre-flip price was fair.

I just noticed that the house next door to the one on Liberty was listed by owner 6 days ago… for $775k. What are these people smoking? I seriously doubt either one will sell for anywhere near their asking prices.

Actually most of “Rancho Roberts” houses never make it to the MLS. He has a pretty big following in the IE and they really do a nice product. They are priced about 15 percent less than a comparable new home in the same market, and his houses already have all the upgrades. Properties in Rancho Cucamonga are still 25-40 percent below peak bubble.

Don’t forget property tax, Association, Meloroos…what else have I forgot?

What annoys me is trying to have an objective conversation with a real estate professional in an atmosphere like this. I commented to a broker-friend that prices are looking high now and he said, “No, no — buy now because these prices will look low in a couple of years.” How’d that work for you in 2005, 2006 and 2007?

Knowledgable Real estate professionals actually do well in up OR down markets. There is still land to builds in the IE, so as current housing stock is nearing replacement cost, there will soon be a significant increase in new construction. Many of the current flippers in the IE, are previous builders, and they will go back to new construction as the distressed properties dry up, and new construction once again becomes feasible.

I don’t have numbers to back me up, but logic says your statement is just not true. Regardless of whats the smart move, psychology dictates that most people will not buy assets as they fall in value as they believe they will continue to fall in value (ie they will be able to get those assets cheaper at a later date (see housing bubble 1.0 for verification)). Therefore, the total number of homes sold is smaller in downturns. Hence real estate agents would do worse on average as the overall housing pie is smaller. Of course there could be random outliers, but that would not be the meat of knowledgeable agents.

PS: regardless of a real estate is ‘knowledgable’ (whatever that means as most have no clue about macro factors), they only make money when they are closing (aka telling buyers its a great time to buy and sellers its a great time to sell).

The central coast (San Luis Obispo County) had been lagging behind the LA/OC/SD markets, but has quickly accelerated. In 2012 and see a single flip. Things totally changed in early 2013.

A few examples of places I walked through:

1610 sq ft: Sold $381k after bidding war in Feb. Renovated and listed in April $625k

1010 sq ft: Sold for $299k cash late April, renovated and listed yesterday for $479k

Some on this blog have defended flippers, claiming they help raise the value of neighborhoods by improving properties.

In a small market like the central coast, the flippers are consistently snatching up any property that the average young family or first time homebuyer would consider purchasing (the market under $400k). This is the market that historically enabled sweat equity and eventual move-up buyers.

The flippers have turned would-be entry level buyers into renters yet again. Or they’re pushing buyers beyond their means.

Is anyone still defending flippers?

These flippers are really getting desperate now. Move into areas of the market where there is little competition and try to be the first to get out. Maybe they are still marketing to people from LA to follow north.

Good flip areas were where you get foreign buyers from asia, india (also asia I know) and the arab countries. They need a place to put up their businesses and rug sales. Sorry, Central Coast is not it. I see the Central Coast always languishing in price due to $5+ gas the the fact that you have to drive long distances to get anywhere.

Having lived in north San Diego county and the central coast, I’d agree about the influence of foreign buyers in select areas of So Cal. What makes the central coast a desirable area for flippers is the fact that price increases weren’t accelerating until early 2013 and during the first bubble San Luis Obispo (and moreso Santa Barbara) out priced all but the most desirable areas of coastal SoCal. I think flippers are hoping prices return to Bubble 1.0 highs, and since prices increases lagged and are now racing to keep pace with the rest of SoCal, there’s greater profits to be made here right now than in the more saturated LA/OC/SD markets. Just my two cents

It is a grim thought that we may very well go back to that 2006-07 peaks again sooner and that may be the new norm. It is lunacy to even think our economy was even running normal back then when those loans were being created yet flippers of all groups were all doing it and look what eventually happened; and this is just a few years after the Dot com bubble. I just don’t buy the argument that the economy everywhere can sustain prices at 06-07 levels that should have not happened in the first place. The FED is probably being force-fed to do this by the banks to create the illusion of growth when it is just small markets in specific states that are being used to justify these growth numbers. The spike is likely a temporary effect of this, but since the interest rates are already coming indicates that perhaps we may see normalcy sooner than later.

Sara, what part of Central Cali do you reside in?

I live in San Luis Obispo county, but sometimes work in Santa Barbara and Monterey counties. I’ve been seeing a market pickup across the whole central coast.

In SLO county, the competition for properties comes from flippers, vacation home purchasers (valley residents), parents of Cal Poly students, and local buyers who were priced out during bubble 1.0 and are now jumping in thinking they missed the boat. Per unclevito’s comment, I haven’t seen many foreign buyers here…yet. But that doesn’t mean the market isn’t hot with flipper activity.

Its true that the central coast is extremely smalltown and remote compared to LA and OC. I lived in both and chose to relocate to this slower pace of life. The most common story here? “I lived in (LA, OC, IE, SD, SF, BA) made my money and chose to relocate myself or my family here.”

There’s a big part of the reason why prices went so high in bubble 1.0. And why flippers are at it again, making huge profits on the sleepy central coast.

I may consider relocation to the Central Coast. Can you share your experiences with me? Just click my name and find my email.

The central coast (San Luis Obispo County) had been lagging behind the LA/OC/SD markets, but has quickly accelerated. In 2012 and see a single flip. Things totally changed in early 2013.

A few examples of places I walked through:

1610 sq ft: Sold $381k after bidding war in Feb. Renovated and listed in April $625k http://www.trulia.com/property/3098005479-321-Surf-Ave-Oceano-CA-93445

1010 sq ft: Sold for $299k cash late April, renovated and listed yesterday for $479k

http://www.trulia.com/property/1000678005-182-Tally-Ho-Rd-Arroyo-Grande-CA-93420

Some on this blog have defended flippers, claiming they help raise the value of neighborhoods by improving properties.

In a small market like the central coast, the flippers are consistently snatching up any property that the average young family or first time homebuyer would consider purchasing (the market under $400k). This is the market that historically enabled sweat equity and eventual move-up buyers.

Overall it feels unsustainable and rather… depressing. Is anyone still defending flippers?

Here are links:

1610 sq ft: Sold $381k after bidding war in Feb. Renovated and listed in April $625k http://www.trulia.com/property/3098005479-321-Surf-Ave-Oceano-CA-93445

1010 sq ft: Sold for $299k cash late April, renovated and listed yesterday for $479k

http://www.trulia.com/property/1000678005-182-Tally-Ho-Rd-Arroyo-Grande-CA-93420

If everyone only owned their one home there would be plenty of property to go around. However, that rental income is too hard to let go.

The buyers dictates the values… Not the sellers. Flippers or not, what is the difference. Some people buy new cars and some people buy used ones. Some people buy fixers and some prefer “turn key” flips., There is clearly a market for both.

Not so fast. If only it were that simple.

What also influences prices (what you refer to as “values”) is available leverage. This wouldn’t matter if the market had only cash buyers (and I do mean cash, not leverage in the name of cash).

The point is that government/banking and financialization interests play a fundamental role in housing prices. So I call bullshit on the idea that buyers alone dictate prices.

Just because VW advertises “0” down for a new car, it doesn’t mean they dictate the market price. Just because a seller advertises a price for a home, there has to buyer willing to pay. If there are multiple offers on a property, I say the advertised price was too low. Have you ever been to an auction? Is the buyers who set the price. In a financed transaction, the lender’s that set the amount they willing to finance the over eager buyers… But it’s the buyer that selects the property and what they are willing to pay.

I agree that the cash “flipper” will probably not pay as much as the financed homeowner, but its still the buyer… Financed or not, that sets value.

Access to cheap capital does Help create more buyers, thereby creating more demand, but I submit that the same FHA capital is available in Detroit.

I think you’re missing the point. There are many inputs that are upstream from the buyer that exhibit an effect on a transaction. Oversimplifying the equation isn’t due diligence and doesn’t properly serve to answer what we’re observing.

Go try to put a bid a hyped house that has 20 bids and see if your bid dictates the value to the seller. This market is a different ball game.

I submit that if there were 20 bids in this instance, the asking price was too low, or set intentionally low to attract multiple bids. Ultimately, the seller accepts the best bid (sometimes the highest bid isn’t the best) made by a BUYER!

You are the avatar of my theorem that flippers are the new used car shills. Sell the ups. Convince the ups. Teach the ups that they are driving the price. One step above psychics. Making the ups think the price of the house is their idea while you feed their brains what you want with your “The market now is…..” Bull shit.

What you are missing in this story about Arcadia is the fact that Chinese speculators are out in force here. There has never been a bigger bunch of bubbleheads and they have nit experienced less than double digit growth in their adult lives. When they saw so cal prices dip from the wildly unsustainable 10x income to the moderately unsustainable 5x income they jumped as fast as they could, esp in las Vegas, sg valley and east.

$2m next to the freeway is an anomaly. Let’s see median income and median house price comparisons. Median prices have been rising primarily because sold inventory shifted from distressed to non distressed. Actual increases for the same properties is not huge and the flippers are flipping to the stupid money, the hgtv crowd that will soon be out of capital.

Food for thought….

If the home is such a nice place to live why sell it so quickly?

A constant whine here is the assumed profit on a transaction. What difference does it make what the seller paid for the property? …Does it really matter how much Von’s purchased the bananas for when making you decision to buy? If Von’s prices bananas at $20 per bunch, guess how many they sell. The buyers will probably stop at Ralph’s to get their banana’s ….cause they are on sale there for $1.50!

If we are to compare apples to bananas, you have a point.

The clever use of weasel words such as “whine” doesn’t negate the effect that rentier profits have on all other users of a currency.

Applying today’s flipper-dominated housing market to your analogy, Ralph’s and all the other supermarkets would raise their banana prices to $20 and pocket those profits. Banana shoppers would have to commute hours to find a supermarket offering more reasonably priced bananas. So banana shoppers would give up and rent.

I don’t think you understand supply chain. Vons and Ralphs will buy their bananas at or very near the same price. Then what the supermarkets mark up is profit, minus costs, of course. If Vons can make more money at $20 they would be doing it.

Reselling bananas is different than reselling real estate because the buy and sell points are different through time. It’s more akin to buying and selling stocks. Buying high and selling at a loss is bad practice so those with control do not purchase through the fear of loss, whereas those with no control or those who need to launder money for small loss will continue to buy at a high. A supermarket will always make a gross profit buying wholesale (an established wholesaler or distributor also works on cost + margin) and selling retail regardless of the what the price is at that time.

RR Fan-curiously, are you Rancho Roberts’ relative/friend, a real estate agent or both? Its odd for someone who writes like you do to want to spend valuable time on a housing bear blog unless there is an agenda. Its one thing to cite reasons why you believe housing will continue to go up or at least not crash as Lord B does (but his comments are at least thought provoking and plausible), but your comments seem a little canned. Just saying…

Thank you for giving a good example of what I said about you in my above post.

No real agenda… But canned comments? …Hmmm that is thought provoking! Canned fruit has a much lounger shelf life than fresh.

I am a contractor and make a living in the industry. Just got tired of reading the negative comments about the “flippers” and felt people might like to hear a counter point. I don’t be-grudge or blame the “Rancho Roberts” of the world for trying to make a buck. The market will dictate whether those types of flippers continue to be successful or not. I’ve seen a lot of horrible remodels, but I’ve seen some really nice ones too.

I have done my share of rehab – resales over the years …this happens in up AND down markets. When the prices go below the cost of new build, it is more prevalent because there aren’t many buyers willing to pay the price for new build.

FTB- in response to your comment to cite reasons why I think prices will at least stabilize and more likely increase at least in the next couple years, here goes:

1. As prices increase homeowners feel more confident and secure in their investments and spend money on deferred maintenance, improvements and upgrades. Pride of ownership creates less default.

2. There are many people who held on to their smaller, “underwater” homes that have been wanting to move up but were unable. Now that prices have increased, they have equity, and are able to sell and make the move.

3. The distressed sales are what hurts the market the most. I submit that over the last five years, we were not just in a typical market correction cycle, we actually went into a reverse bubble! Because of the overwhelming, and historically disproportional number of distressed sales due to the unrestrained financing and subprime fiasco, prices dropped below a normal correction. There were just not enough buyers or investors to keep supply/demand in balance. Over the last five years, the people who purchased, investors or users have much more skin/equity in the game. I venture to say there will be a relatively small number of defaults post 2009 loans. Less distressed sales makes less volatile market.

Would I run out and buy a $2million dollar “flip” in Arcadia? … Not likely, but as it has been pointed out on this blog, low interest rates are is likely here for a while, and it isn’t getting any cheaper to build from the ground up. Therefore I predict no crash anytime soon.

There is a very small market for bananas after they turn brown.

…. Do they sell “canned” bananas?

Quick response as I need to go to work, but:

1-true on its face, but you ignore that more people than not cannot afford to do this as costs of everything else has risen (gas, college tuition, food, etc) and incomes have not.

2-true on its face, but see 1.

3-this I agree with. Skin in the game helps for sure and switching bad buyers for more creditworthy ones helps. However, this is changing already as ARMS, etc are coming back. Also, you ignore the fact that there are more very sophisticated investors in the market who may exit if they can get better returns elsewhere and they can because they paid cash and likely bought at the bottom.

This entire comment is negated by the fact incomes are falling. Less money into the system, not more.

Papa- Have you seen Lowes and Home Depot stock over the last year? …people ARE spending more on home improvements.

FTB- I don’t think the last year of 20-30 percent YOY appreciation is normal or sustainable in SoCal, (just a reverse correction as stated before)…but values in the rest of the country have increased significantly too. Not everyone retires in Newport Beach, the IE is still very affordable. The low interest environment is currently offsetting increases in real wages. Even 4.5 percent is an incredible rate locked for 30 years. I know many people that have done 15 refi’s sub 3 percent and will own free and clear at retirement age. I am curious to see numbers for equity gains not only from appreciation but also from reduced debt in the coming quarters. Also would like to see the numbers for people who are now able to move or refinance old debt as values have s

Adjusted upward over the last year.

Again, this guy spouting on about the “market” as if what we’ve been witnessing over the past few years is more about free market fundamentals than government and finance industry meddling.

It must be really tempting to frame what’s going on as simply the market at work without nary a nod to man behind the curtain when your livelihood depends on said lever operator.

100% you are saying that the bubble prices of 2007 were the norm completely negating the unsustainablity of prices that run 10 to 12 above incomes. You are blind to the fact that you are in a contrived market – where banks were and are allowed to hold properties on the books at the bubble prices and dribble them out so that the market is artificial. Fascinating poster I read years ago. “He who controls the supply controls the price”. That poster was created by an oil company. Your real estate market is akin to the car market where the stock is hidden from the buyer on the back lot and they are told their are no more options to choose from. The dealer steers the buyer toward the car for the profit they want never disclosing the true market value of the car.

A friend was visiting from Dallas last week. We had a BBQ went for a walk and sat outside the rest of the evening. No bugs, no humidity…. He said when he retires, he’s moving to SoCal.

Cool for your friend who must have quite a nest egg saved up and can afford to live anywhere he chooses in his 70s (the new retirement age for most folks under 35), but what does that have to do with trends? How many people will be able to afford CA housing if they buy in at their high home prices (which you believe are going up) in their golden years? Are you predicting incomes to skyrocket as well?

Well, people who come from other states to visit us in Cali, they all dream or California living… “if I get a job I’ll move here”, “when I retire i’ll move here” blah blah… it’s an illusion.

Well, I’ve lived in L.A. for fifteen years, and I can’t wait to get out of here. I can’t imagine buying a home like those listed above for a half million bucks all the way out in Rancho Cucamunga. We’re planning on Denver, and, despite Denver real estate being at its peak, it is still a screaming deal compared to L.A., and it is a generally nicer place to live.

FTB – just read your post regarding “knowledgeable” RE professionals. Who do you think makes commission on the distressed sales? Who do you think makes commission on REO assets? It’s the same as a stock broker. They make money when you buy OR sell … the market up or down.

I agree there are unscrupulous people out there that will say or do anything for a sale, but for the most part it’s the buyers … investors OR users, that ultimately dictate value of a particular property. It doesn’t matter if the market is declining or appreciating. In the case of a financed sale, the obvious caveat would be buyer and property qualifications.

As a contractor, I eek out a living during the up and down markets. After all there is even someone making a living bulldozing houses in Detroit!

I need to report from Ventura County where flippers sales were over 40% during the last year. It definitely started to cool off. Now we experience open houses not only on Sundays but also on Saturdays and Fridays. Every corner has at least 4 signs of ‘Open House’ right now. Agents are getting anxious and more aggressive. When you ask them how long is the house on the market they basically say about a month. It definitely started to turn around in June. Flippers are more and more desperate to unload and they start to lower their prices.

Leave a Reply to Mitesh Damania